CANADA NOW RANKED 20TH IN THE WORLD FOR WOMEN & CHILDREN'S RIGHTS, WARNS AGENCY CHILDREN BELIEVE

MARKHAM, Ontario, Nov. 14, 2024 (GLOBE NEWSWIRE) — A new report released to mark the 35th anniversary of the Convention of the Rights of the Child on November 20, indicates that Canada’s global ranking on women and children’s rights has fallen to 20th in the world. According to the ChildFund Alliance World Index, which ranks 157 countries according to 30 different criteria, Canada’s ranking has fallen steadily since 2015 due to such factors as the environment, human capital and violence against children. Children Believe, the alliance’s Canadian member, urges Canada to demonstrate greater rights leadership both at home and abroad as it assumes the G7 presidency in 2025.

“This report should be a wake-up call for the Government of Canada,” says Fred Witteveen, President & CEO of Children Believe. “To build on our Feminist International Assistance Policy, Canada must put more money where its mouth is and make fresh commitments to support the rights of women and children here at home and abroad. A critical contributor to global economic growth, safety and security is to ensure the most vulnerable children, especially girls, have access to their right to an education and to include them in decisions that affect their lives. Because education means choices and is the most powerful tool for all children, everywhere, to be able to change their lives for the better.”

Starting in Budget 2025, Children Believe, as part of the Canadian International Education Policy Working Group (CIEPWG) is calling on the Government of Canada to commit $650 million in new and additional resources towards its Official Development Assistance envelope every year for the next four years (2025-2029). The coalition is asking that Canada helps ensure that all girls and boys complete at least 12 years of education because it improves their future incomes, their health, their choice to marry later and ultimately to be more active and productive in their communities.

“Despite Canada’s disappointing ranking on rights, we still enjoy much greater access than other places in the world that need our support. In 2025, Canada must put access to global education firmly back on the G7 leader’s agenda to not only solidify Charlevoix’s legacy – but expand it.”

Children Believe is dedicated to removing the barriers to education, including rights violations. Last year, over 417,000 children, youth, women, parents, and duty-bearers, from 762 community groups across Children Believe’s six countries of operation, benefited from the organization’s work to prevent various forms of violence, neglect, and abuse.

“Children Believe works in some of the world’s toughest places like Ethiopia, Burkina Faso and Mali which all rank in the bottom 10 of the World Index,” says Witteveen. “We look forward to our ongoing partnership with the Government of Canada to improve lives in these places to build a more just and prosperous world for everyone”.

CHILDFUND ALLIANCE WORLD INDEX: KEY FINDINGS

- Canada’s ranking on the index has been declining over the past ten years. In 2015 Canada was ranked #11, in 2020 it was #15 and in 2021 it was #19.

- In 2023, one in three children and more than one in four women lived in countries with minimal implementation of human rights protections. At the current pace, it may take 113 years to fully implement the rights assessed in this Index.

- While access to information and WASH (Water, Sanitation, and Hygiene) services has improved, today’s societies are generally less democratic and secure for women and children. While child health outcomes have improved, educational rights have not progressed since 2020, a stagnation partly due to pandemic impacts.

- Though women’s education levels and participation in decision-making are increasing, they remain among the most vulnerable and marginalized groups, facing the highest likelihood of human rights abuses worldwide.

HOW CANADIANS CAN HELP

This holiday season Canadians can help disrupt rights violations by empowering women and children. Donations to Help Where Most Needed in Children Believe’s gift catalogue will protect them from grave dangers like violence, abuse and exploitation.

CHILDREN BELIEVE

Children Believe works globally to empower children to dream fearlessly, stand up for what they believe in — and be heard. The organization has developed programs in more than 400 communities across six countries in Africa, Asia and the Americas. For 60-plus years, Children Believe has brought together brave young dreamers, caring supporters and partners, and unabashed idealists with a common belief: creating access to education — inside and outside of classrooms — is the most powerful tool children can use to change their world. Children Believe: Until every child grows up to live the life they choose to live.

CHILDFUND ALLIANCE

ChildFund Alliance is a global network of 11 child-focused development and humanitarian organizations helping nearly 30 million children and their families in more than 70 countries. We work to end violence and exploitation against children; provide expertise in emergencies and disasters; and engage in partnership with children, families and communities to create lasting change. Our commitment, resources, and expertise are a powerful force to transform the lives of children by using our global voice with and for children to address threats to their lives, safety and well-being.

Dave Stell Children Believe 4168986770 dstell@childrenbelieve.ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Trump Media & Technology

Deep-pocketed investors have adopted a bearish approach towards Trump Media & Technology DJT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DJT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 19 extraordinary options activities for Trump Media & Technology. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 47% bearish. Among these notable options, 10 are puts, totaling $744,800, and 9 are calls, amounting to $5,671,118.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $60.0 for Trump Media & Technology, spanning the last three months.

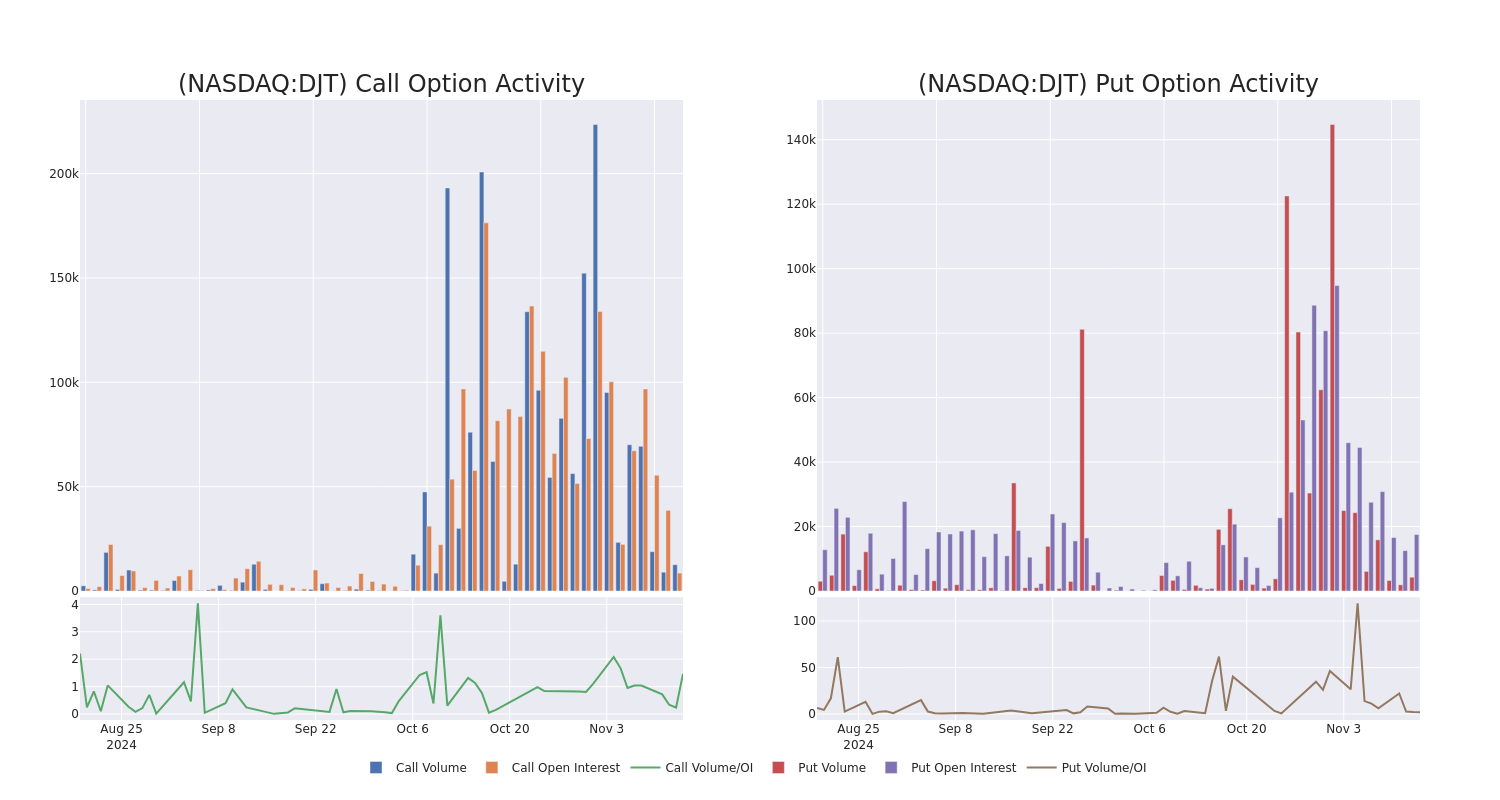

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Trump Media & Technology’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Trump Media & Technology’s significant trades, within a strike price range of $20.0 to $60.0, over the past month.

Trump Media & Technology Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DJT | CALL | TRADE | BULLISH | 12/20/24 | $8.6 | $8.05 | $8.55 | $23.00 | $4.2M | 401 | 5.0K |

| DJT | CALL | TRADE | BEARISH | 12/20/24 | $9.05 | $8.65 | $8.65 | $21.00 | $653.0K | 406 | 755 |

| DJT | CALL | TRADE | BEARISH | 12/20/24 | $7.25 | $6.85 | $6.93 | $24.00 | $523.2K | 150 | 755 |

| DJT | PUT | SWEEP | BEARISH | 11/15/24 | $6.15 | $5.95 | $6.15 | $33.00 | $305.1K | 1.3K | 595 |

| DJT | PUT | SWEEP | BEARISH | 11/15/24 | $2.7 | $2.62 | $2.7 | $30.00 | $108.0K | 12.1K | 863 |

About Trump Media & Technology

Trump Media & Technology Group Corp is a media and technology company rooted in social media, digital streaming, information technology infrastructure, and more. Its initial product launch will focus on its social media platform, Truth Social, which encourages an open, free, and honest global conversation without discriminating against political ideology.

Having examined the options trading patterns of Trump Media & Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Trump Media & Technology

- With a trading volume of 9,305,086, the price of DJT is down by -6.51%, reaching $27.05.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 81 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Trump Media & Technology with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Edge Lower; Cisco Earnings Top Views

U.S. stocks traded slightly lower this morning, with the Dow Jones index falling by 0.1% on Thursday.

Following the market opening, the Dow traded down 0.09% to 43,917.98 while the NASDAQ fell 0.12% to 19,208.13. The S&P 500 also fell, dropping, 0.15% to 5,976.46.

Check This Out: Jim Cramer Recommends Microsoft, Praises American Water Works For Being ‘Consistent’

Leading and Lagging Sectors

Energy shares rose by 0.1% on Thursday.

In trading on Thursday, real estate shares fell by 0.6%.

Top Headline

Cisco Systems Inc. CSCO reported better-than-expected results for its first quarter and raised its full-year 2025 guidance on Wednesday.

The company reported first-quarter revenue of $13.84 billion, beating the consensus estimate of $13.77 billion. The networking equipment maker reported adjusted earnings of 91 cents per share, beating analyst estimates of 87 cents per share.

Equities Trading UP

- AgEagle Aerial Systems, Inc. UAVS shares shot up 159% to $4.2101 after the company announced 17 new purchase orders for its eBee TAC drones from U.S. defense and security customers.

- Shares of Elevai Labs Inc. ELAB got a boost, surging 58% to $0.0389 after the company announced second-quarter results.

- Gaxos.ai Inc. GXAI shares were also up, gaining 47% to $2.12 after the company’s board approved the purchase of up to $1 million in Bitcoin as a treasury reserve asset.

Equities Trading DOWN

- Nuvectis Pharma, Inc. NVCT shares dropped 48% to $5.55 after the company reported data from its Phase 1b study evaluating NXP800..

- Shares of Sow Good Inc. SOWG were down 41% to $5.82 after the company reported worse-than-expected quarterly financial results.

- Vislink Technologies, Inc. VISL was down, falling 43% to $3.75 after the company reported worse-than-expected third-quarter financial results.

Commodities

In commodity news, oil traded up 0.9% to $69.05 while gold traded down 0.7% at $2,568.70.

Silver traded down 0.9% to $30.400 on Thursday, while copper fell 0.1% to $4.0830.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 gained 1.2%, Germany’s DAX climbed 1.5% and France’s CAC 40 gained 1.4%. Spain’s IBEX 35 Index gained 1.2%, while London’s FTSE 100 rose 0.6%.

Asia Pacific Markets

Asian markets closed lower on Thursday, with Japan’s Nikkei 225 falling 0.48%, Hong Kong’s Hang Seng Index falling 1.96%, China’s Shanghai Composite Index dipping 1.73% and India’s BSE Sensex falling 0.14%.

Economics

- U.S. initial jobless claims declined by 4,000 from the previous week to 217,000 in the week ending Nov. 9, compared to market estimates of 223,000.

- U.S. producer prices rose 0.2% month-over-month in October compared to a revised 0.1% gain in September and in-line with market expectations.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Middle East Construction Paints Market Size on Track for USD 16.4 billion Milestone by 2034, Growing at a 4.9% CAGR| Exclusive Report by Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. , Nov. 14, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the Middle East Construction Paints market (سوق دهانات البناء ) size was worth US$ 9.7 Bn in 2023 and is expected to reach US$ 16.4 Bn by the year 2034 at a CAGR of 4.9 % between 2024 and 2034.

Middle East Construction Paints are specialized coatings designed for application on various surfaces in the construction industry. These paints serve multiple purposes, including aesthetic enhancement, protection against environmental factors, and surface durability. Available in a wide range of formulations—such as water-based, solvent-based, and epoxy paints—Middle East Construction Paints can be used on walls, ceilings, floors, and exteriors.

Their diverse properties cater to specific needs, including weather resistance, anti-fungal protection, and fire retardation, making them essential in both – residential and commercial projects.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86355

Prominent Players Operating in Middle East Construction Paints Industry

National Paints, Jotun, Muradli- M LLC, Sobsan Paints, Nasr Paint, Al Tabieaa Paint Producing Co. Ltd., Mena-Kim Group, Nippon Paint Holdings Co., Ltd., Jazeera Paints, Middle East Paints, Global Paints FZC, Caparol Paints, Eagle Paints Factory LLC, The Sherwin-Williams Company, Gulf Paints, Akzo Nobel N.V. and Asian Paints Limited are some of the key players operating in the industry.

Middle East Construction Paints Market Overview

Middle East Construction Paints are essential coatings used to enhance and protect surfaces in various building projects. They are applied to walls, ceilings, exteriors, and the other structural components in both – residential and commercial settings. The primary benefits of Middle East Construction Paints include aesthetic enhancement, surface protection, and improved durability.

These paints can provide a barrier against weather elements, UV radiation, and mold, ensuring that structures remain visually appealing and structurally sound over time. Moreover, advancements in paint formulations have led to the development of low-VOC (volatile organic compounds) options, making them safer for both – the environment and human health.

The Middle East Construction Paints market is currently experiencing robust growth, driven by several key factors. One of the most significant drivers is the rapid expansion of the construction industry, particularly in emerging markets. According to industry reports, the global construction industry is projected to reach approximately US$15 Tn by 2030, with a substantial portion of this growth occurring in the residential and commercial sectors. This surge in construction activities directly translates into an increased demand for high-quality paints and coatings.

Another critical factor is the rising trend of urbanization, which is prompting the development of new residential and commercial properties. As urban population continues to grow, the need for effective and aesthetically pleasing building materials becomes paramount. This urban expansion is also influencing consumer preferences, with a growing demand for decorative paints that enhance the visual appeal of spaces. Market analysts project that the decorative paints segment will grow at a CAGR of around 5% over the next few years, underscoring the increasing focus on aesthetics in construction.

Additionally, the increasing focus on sustainability and energy efficiency is driving the demand for eco-friendly Middle East Construction Paints. As more builders and consumers seek environmentally responsible options, manufacturers are investing in the development of low-VOC and water-based formulations. This trend not only meets regulatory requirements but also caters to a growing consumer base that prioritizes health and environmental considerations.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86355

Middle East Construction Paints Market Regional Insights

The Middle East Construction Paints market in the Middle East is experiencing robust growth, driven by a variety of factors that highlight the region’s unique development landscape. One of the primary drivers is the ongoing boom in construction activities, fueled by ambitious infrastructure projects and urban development initiatives across countries like the UAE, Saudi Arabia, and Qatar.

Governments in these nations are investing heavily in mega-projects such as smart cities, transportation networks, and tourism facilities, which significantly increases the demand for high-quality Middle East Construction Paints. The Middle East’s construction market is projected to grow at a CAGR of around 6% over the next five years, further amplifying the need for reliable and durable paint solutions.

Another significant factor is the rising trend of urbanization in the region. As population grows and urban centers expand, there is an increasing need for residential, commercial, and public buildings. This urban expansion drives the demand for decorative and protective paints that not only enhance the aesthetic appeal of structures but also provide essential protection against the harsh climatic conditions typical of the region. The demand for weather-resistant and UV-stable paints is particularly pronounced, as they ensure longevity and reduce maintenance costs for property owners.

Middle East Construction Paints Market Segmentation

- Resin Type

- Acrylic

- Polyurethane

- Polyester

- Alkyd

- Epoxy

- Others

- Technology

- Water-based

- Solvent-based

- Others

- Application

- Interior

- Exterior

- Wood

- Others

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=86355<ype=S

More Trending Report by Transparency Market Research:

- Metal Fabrication Market (Markt für Metallverarbeitung) – The global market for metal fabrication was estimated to have acquired a market valuation around US$ 20 billion in 2022. The market is likely to grow with a slowly rising 3.3% CAGR from 2022 to 2031 and by 2031, the market is likely to gain US$ 27.74 billion.

- Magnetic Polymer Market (mercado de polímero magnético) – The magnetic polymer market is estimated to expand at a CAGR of 8.1% during the forecast period from 2022 to 2031.

- PVC Emulsion Market (PVCエマルジョン市場) – The industry was valued at US$ 3.5 Bn in 2021. It is estimated to grow at a CAGR of 4.3% from 2022 to 2031 and reach US$ 5.1 Bn by the end of 2031

- Sulfuric Acid Market (سوق حمض الكبريتيك) – The global sulfuric acid market size was valued at US$ 13.9 Bn in 2021. It is estimated to expand at a CAGR of 2.7% from 2022 to 2031 and reach a value of US$ 18.2 Bn by the end of 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Performance Comparison: Apple And Competitors In Technology Hardware, Storage & Peripherals Industry

In the dynamic and cutthroat world of business, conducting thorough company analysis is essential for investors and industry experts. In this article, we will undertake a comprehensive industry comparison, evaluating Apple AAPL and its primary competitors in the Technology Hardware, Storage & Peripherals industry. By closely examining key financial metrics, market position, and growth prospects, our aim is to provide valuable insights for investors and shed light on company’s performance within the industry.

Apple Background

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple’s iPhone makes up a majority of the firm sales, and Apple’s other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple’s sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Apple Inc | 37.03 | 59.75 | 8.87 | 23.83% | $32.5 | $43.88 | 6.07% |

| Hewlett Packard Enterprise Co | 15.50 | 1.29 | 1 | 2.34% | $1.23 | $2.44 | 10.11% |

| NetApp Inc | 23.42 | 26.38 | 3.98 | 23.9% | $0.38 | $1.1 | 7.61% |

| Western Digital Corp | 68.95 | 1.86 | 1.46 | 4.28% | $0.86 | $1.55 | 48.91% |

| Pure Storage Inc | 115.45 | 11.25 | 5.79 | 2.52% | $0.08 | $0.54 | 10.91% |

| Super Micro Computer Inc | 10.12 | 2.18 | 0.82 | 6.68% | $0.4 | $0.6 | 37.87% |

| Eastman Kodak Co | 8.20 | 0.38 | 0.39 | 2.09% | $0.05 | $0.06 | -9.49% |

| Turtle Beach Corp | 50.10 | 3.06 | 0.92 | -6.53% | $0.0 | $0.02 | 59.39% |

| Immersion Corp | 4.72 | 1.19 | 1.68 | 13.41% | $0.03 | $0.06 | 1323.8% |

| AstroNova Inc | 16.96 | 1.17 | 0.72 | -0.34% | $0.0 | $0.01 | 14.12% |

| Average | 34.82 | 5.42 | 1.86 | 5.37% | $0.34 | $0.71 | 167.03% |

Upon a comprehensive analysis of Apple, the following trends can be discerned:

-

The Price to Earnings ratio of 37.03 for this company is 1.06x above the industry average, indicating a premium valuation associated with the stock.

-

With a Price to Book ratio of 59.75, which is 11.02x the industry average, Apple might be considered overvalued in terms of its book value, as it is trading at a higher multiple compared to its industry peers.

-

With a relatively high Price to Sales ratio of 8.87, which is 4.77x the industry average, the stock might be considered overvalued based on sales performance.

-

With a Return on Equity (ROE) of 23.83% that is 18.46% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

-

The company has higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $32.5 Billion, which is 95.59x above the industry average, indicating stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $43.88 Billion, which indicates 61.8x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 6.07% is significantly lower compared to the industry average of 167.03%. This indicates a potential fall in the company’s sales performance.

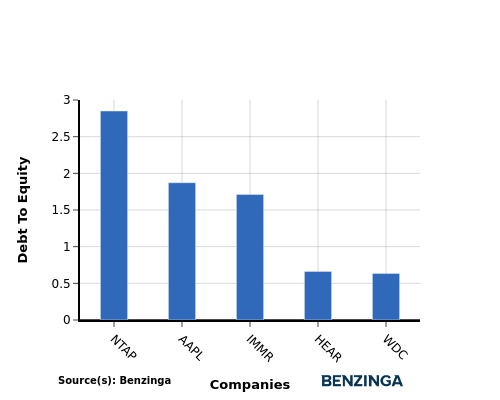

Debt To Equity Ratio

The debt-to-equity (D/E) ratio helps evaluate the capital structure and financial leverage of a company.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

When examining Apple in comparison to its top 4 peers with respect to the Debt-to-Equity ratio, the following information becomes apparent:

-

Apple falls in the middle of the list when considering the debt-to-equity ratio.

-

This indicates that the company has a moderate level of debt relative to its equity with a debt-to-equity ratio of 1.87, suggesting a balanced financial structure with a reasonable debt-equitymix.

Key Takeaways

For Apple, the PE, PB, and PS ratios are all high compared to its peers in the Technology Hardware, Storage & Peripherals industry, indicating that the stock may be overvalued based on these metrics. On the other hand, Apple’s high ROE, EBITDA, gross profit, and low revenue growth suggest that the company is efficiently utilizing its resources and generating strong profits, despite slower revenue growth compared to industry peers.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intuitive Machines Stock Volatile On Q3 Earnings: What You Need To Know

Intuitive Machines Inc LUNR shares are volatile Thursday on the heels of the company’s third-quarter financial results. Here’s a rundown of the report.

What To Know: Intuitive Machines reported third-quarter revenue of $58.48 million, beating analyst estimates of $50.89 million, according to Benzinga Pro. Total revenue was up 359% on a year-over-year basis.

The company reported a net loss of $80.44 million, versus net income of $14.31 million in the prior year’s quarter. Backlog grew to $316.2 million in the quarter, the highest in company history. Intuitive Machines ended the quarter with $89.6 million in cash.

“Intuitive Machines had a very strong third quarter highlighted by key wins, revenue growth, and the largest cash balance in Company history,” said Steve Altemus, CEO of Intuitive Machines.

“We made progress across all three pillars by first securing another south pole lunar delivery mission, then winning the Near Space Network Services contract, and finally, continuing to mature both our LTV design in conjunction with our heavy cargo class lander. These strategic revenue streams bring our business thesis clearly into view, allowing us to focus on capturing more operational services, which we believe will provide long-tail revenues with higher margins.”

Intuitive Machines’ moon lander Odysseus made history in February when it touched down on the surface of the moon, making Intuitive Machines the first private company to land on the moon and bringing the U.S. back to the moon for the first time since 1972.

Intuitive Machines said it completed a vehicle propulsion system hot fire for its second lunar mission during the third quarter. The company said it’s targeting the launch of its second lunar mission in the first quarter.

See Also: Rocket Lab CEO Touts SpaceX Rival Status, Trump Impact On Space As Stock Surges Almost 30%

Outlook: Intuitive Machines narrowed its full-year revenue outlook to a range of $215 million to $235 million. The company also said it expects continued backlog expansion driven by potential upcoming awards including Near Space Network 1.2 / 1.3 Direct to Earth and LTVS Phase 2, as well as task orders for OMES and Near Space Network 2.2.

Management is currently discussing the quarter on a conference call with investors that kicked off at 8:30 a.m. ET.

LUNR Price Action: Intuitive Machines shares were down 7.36% at $10.90 at the time of publication, according to Benzinga Pro.

Photo: courtesy of Intuitive Machines.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hillenbrand Posts Better-Than-Expected Earnings, Joins Beazer Homes, Tapestry, Walt Disney And Other Big Stocks Moving Higher On Thursday

U.S. stocks were slightly lower, with the Dow Jones index falling around 0.1% on Thursday.

Shares of Hillenbrand, Inc. HI rose sharply in today’s session following upbeat quarterly results.

Hillenbrand reported quarterly earnings of $1.01 per share which beat the analyst consensus estimate of 92 cents per share. The company reported quarterly sales of $837.60 million which beat the analyst consensus estimate of $792.98 million.

Hillenbrand shares surged 14.7% to $34.60 on Thursday.

Here are some other big stocks recording gains in today’s session.

- AC Immune SA ACIU gained 18% to $3.6844 after the company announced interim safety and immunogenicity data from the Phase 2 VacSYn clinical trial evaluating ACI-7104.056 for the treatment of patients with early Parkinson’s disease.

- NextNav Inc. NN gained 16.8% to $15.85 after the company reported better-than-expected quarterly financial results.

- DLocal Limited DLO shares jumped 16.1% to $10.50 after the company reported better-than-expected third-quarter revenue results.

- Oscar Health, Inc. OSCR rose 14.6% to $15.44.

- Taysha Gene Therapies, Inc. TSHA gained 14.4% to $2.5300 following third-quarter results.

- Beazer Homes USA, Inc. BZH shares rose 13.9% to $36.41 after the company reported better-than-expected quarterly financial results.

- Tapestry, Inc. TPR gained 11.2% to $57.00 after the company announced plans for an additional $2 billion share repurchase program.

- Spire Global, Inc. SPIR rose 10.9% to $14.91. Spire Global agreed to sell its maritime business to Kpler for roughly $241 million.

- Wynn Resorts, Limited WYNN gained 9.2% to $93.69.

- ZIM Integrated Shipping Services Ltd. ZIM climbed 9.1% to $27.28.

- Advance Auto Parts, Inc. AAP gained 8.9% to $44.60 following third-quarter results.

- The Walt Disney Company DIS rose 8.8% to $111.75 following upbeat earnings.

- JetBlue Airways Corporation JBLU gained 6.3% to $7.38.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Selling: Blake Denton Unloads $1.07M Of Noble Corp Stock

Blake Denton, SVP at Noble Corp NE, reported an insider sell on November 13, according to a new SEC filing.

What Happened: Denton’s decision to sell 30,000 shares of Noble Corp was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $1,071,600.

During Thursday’s morning session, Noble Corp shares up by 0.69%, currently priced at $34.85.

Discovering Noble Corp: A Closer Look

Noble Corp PLC is an offshore drilling contractor for the oil and gas industry that provides contract drilling services to the international oil and gas industry with its fleet of mobile offshore drilling units. The company focuses on a high-specification fleet of floating and jackup rigs and the deployment of its drilling rigs in oil and gas basins around the world.

Key Indicators: Noble Corp’s Financial Health

Revenue Growth: Over the 3 months period, Noble Corp showcased positive performance, achieving a revenue growth rate of 14.78% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Navigating Financial Profits:

-

Gross Margin: The company faces challenges with a low gross margin of 28.52%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Noble Corp’s EPS is below the industry average. The company faced challenges with a current EPS of 0.41. This suggests a potential decline in earnings.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.42.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Noble Corp’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 10.18.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.84 is above industry norms, reflecting an elevated valuation for Noble Corp’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Noble Corp’s EV/EBITDA ratio, surpassing industry averages at 7.89, positions it with an above-average valuation in the market.

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Deciphering Transaction Codes in Insider Filings

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Noble Corp’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.