Will Trump's Second Term Unlock Housing? 'Lower Rates, More Development' On The Table, Experts Say

Real estate experts anticipate changes to housing policy following Donald Trump’s election victory. His promises of lower interest rates and reduced development regulations have taken center stage in his approach to the market.

The president-elect’s platform focuses heavily on removing barriers to new construction, including eliminating regulations that currently add over $90,000 to new home prices. His administration also plans to open federal lands for housing development.

Don’t Miss:

“Many in the real estate business are elated with a Trump victory and if the administration can live up to its campaign promises, rightfully so,” Alex Beene, financial literacy instructor at the University of Tennessee at Martin, told Newsweek.

“For months, he has been advocating for lower interest rates, which have become one of the most significant barriers to home ownership in the post-pandemic years,” he said.

Trending: During market downturns, investors are learning that unlike equities, these high-yield real estate notes that pay 7.5% – 9% are protected by resilient assets, buffering against losses.

According to Realtor.com Chief Economist Danielle Hale, potential Republican control of Congress could accelerate these policy changes. However, she noted that Trump’s proposals present both opportunities and challenges for the housing market.

While supply-side policies might boost housing inventory, some measures could have unintended consequences.

Proposed immigration restrictions could affect the construction labor force, with Census Bureau data showing that up to one-third of residential construction relies on foreign-born workers.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Industry leaders see potential benefits in Trump’s real estate background. “The fact that Trump is a real estate developer himself also lends to the feeling that he ‘understands’ the market and what drives demand, quality and profits,” said Jeff Holzmann, Chief Operating Officer of RREAF Holdings, to Newsweek.

Ben Allen, cofounder of construction permitting platform GreenLite, predicted increased development activity if interest rates decline.

See Also: Unlock the hidden potential of commercial real estate — This platform allows individuals to invest in commercial real estate offering a 12% target yield with a bonus 1% return boost today!

“A lower cost of capital with better economics for developers should help accelerate development while bringing more housing inventory online faster,” Allen told Newsweek. “The entire market benefits – developers, buyers and sellers alike.”

The housing sector faces a significant supply shortage, with estimates ranging from 2.5 to 7.2 million needed homes over the past decade.

It remains to be seen whether Trump can address the fundamental challenges while managing market dynamics. However, experts do expect relief during the former president’s second term.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Trees don’t grow to the sky': Nelson Peltz says the stock market's Trump 'euphoria' won't last

The stock market has been on a record-setting hot streak since Donald Trump won the White House last week. But billionaire activist investor Nelson Peltz doesn’t think it will last.

“No, trees don’t grow to the sky. Definitely not uninterrupted,” the Trian Partners founder said in an interview at CNBC’s Delivering Alpha conference. “There will be something that might upset it. I think you’ve got euphoria from the election.”

Major stock indexes, including the Dow Jones Industrial Average, the S&P 500, and the Nasdaq, all hit record highs in the days following Trump’s election win. These gains slowed Wednesday, with the Dow ending the day up just 0.11%, or about 47 points, the S&P 500 closing up 0.2%, and the tech-heavy Nasdaq falling roughly 0.26%.

Beyond the election-driven excitement, Peltz pointed to the high concentration of companies that currently drive the market.

“You’ve got the S&P 500, and then you’ve got the S&P 20-25,” he said. “You’ve got two different markets. It’s the wrong name. You’ve got these 20 companies that are swinging the cat around the room. And then you’ve got these other companies.”

That echoed observations from researchers at Goldman Sachs (GS), who have warned that the era of double-digit gains in the stock market may be coming to an end. The strategists estimate that the S&P 500 will deliver an annualized return of 3% over the next decade — well below the 13% returns of the last 10 years and the long-term average of 11%.

While they attributed much of that downward revision to a higher starting point going into the next decade, another major factor fueling uncertainty is an “extremely high level of market concentration,” particularly when it comes to the 10 largest mega-cap tech stocks, the strategists said.

These top 10 companies — which include Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), Google parent Alphabet (GOOGL), and Meta (META) — account for 36% of the overall index and are driving much of the returns. So far this year, these leading firms have returned almost43%, compared with 36% for the index as a whole.

Goldman said its forecast would be roughly 4 percentage points higher (7% instead of 3%) if the market were not so concentrated, with a baseline range of 3% to 11% growth instead of a possible -1% to 7% over the next decade.

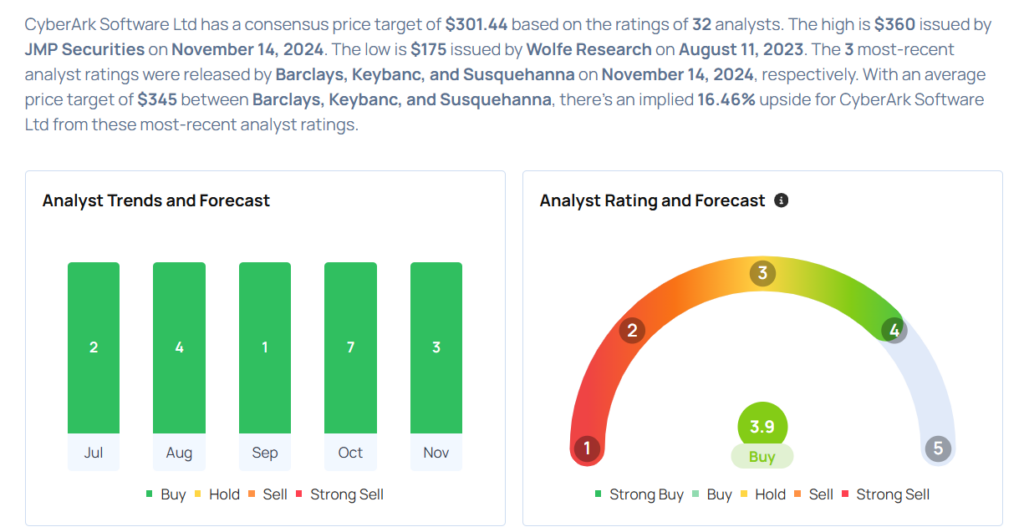

CyberArk Software Analysts Raise Their Forecasts After Upbeat Earnings

CyberArk Software Ltd CYBR reported better-than-expected earnings for its third quarter on Wednesday.

The company posted fiscal third-quarter 2024 revenue growth of 26% year-on-year to $240.1 million, beating the analyst consensus estimate of $234.0 million. The information security company posted an adjusted EPS of 94 cents, which beat the analyst consensus estimate of 46 cents.

CyberArk expects a fiscal fourth-quarter revenue of $297.0 million-$303.0 million, versus the consensus of $234.04 million. It projected an adjusted EPS of $0.65-$0.75 versus the consensus of $0.46.

CyberArk raised the fiscal 2024 revenue outlook to $983.0 million-$989.0 million (prior $932.0 million-$942.0 million) versus the consensus of $941.49 million. CyberArk expects an adjusted EPS outlook of $2.85-$2.96 (prior $2.17–$2.36) versus the consensus of $2.31.

CyberArk shares fell 3% to close at $291.61 on Wednesday.

These analysts made changes to their price targets on CyberArk following earnings announcement.

- JMP Securities analyst Trevor Walsh maintained CyberArk Software with a Market Outperform and raised the price target from $310 to $360.

- Piper Sandler analyst Rob Owens maintained the stock with an Overweight and raised the price target from $300 to $345.

- Susquehanna analyst Shyam Patil maintained CyberArk with a Positive and boosted the price target from $320 to $345.

- Keybanc analyst Eric Heath maintained CyberArk Software with an Overweight and raised the price target from $340 to $355.

- Barclays analyst Saket Kalia maintained the stock with an Overweight and raised the price target from $330 to $335.

Considering buying CYBR stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bilibili's Q3 Earnings: Revenue Surges As Games Lead the Way, Stock Buyback And More

Bilibili Inc BILI reported fiscal third-quarter revenue of $1.04 billion (7.31 billion Chinese yuan), up by 26% year-on-year, beating the analyst consensus estimate of $1.01 billion.

The Chinese video-sharing platform’s adjusted EPADS of $0.08 missed the analyst consensus loss estimate of $0.10.

Also Read: Japan Increases Semiconductor Funding As US Trade Policies Pressure Taiwan Semiconductor

Drivers: Average daily active users (DAUs) climbed 4.4% Y/Y to 107.3 million. Revenues from mobile games were $259.7 million, up by 84% Y/Y, mainly attributable to the strong performance of the company’s exclusively licensed game, San Guo: Mou Ding Tian Xia.

Value-added services (VAS) revenues grew 9% Y/Y to $402.0 million, led by increases in revenues from live broadcasting and other value-added services.

Advertising increased by 28% Y/Y to $298.5 million, mainly attributable to the company’s improved advertising product offerings and enhanced advertising efficiency.

Revenue from IP derivatives and others decreased 2% Y/Y to $80.8 million.

Adjusted net profit was $33.6 million. Bilibili held $2.17 billion in cash and equivalents as of September. It generated $317.1 million in operating cash flow for the quarter.

Share Buyback: The board of directors has authorized a share repurchase program under which the company can repurchase up to $200 million of its publicly traded securities for the next 24 months.

Bilibili Chairman and CEO Rui Chen reported strong growth across community metrics and core business segments this quarter. Daily active users (DAUs) and monthly active users (MAUs) reached record highs of 107 million and 348 million, respectively. The average daily time spent by users increased to 106 minutes, up by 6 minutes from the same period last year. Chen highlighted the company’s success in boosting user engagement and driving value through a variety of commercial offerings. He emphasized that achieving the first adjusted net profit marks a significant milestone, setting the stage for further development of commercialization efforts and continued growth.

CFO Sam Fan noted strong performance in high-margin segments like mobile games and advertising, which accelerated overall revenue growth and improved profitability. Gross profit jumped 76% year-over-year, with the gross margin rising to 34.9% from 25.0% in the same period last year.

Bilibili stock surged over 83% year-to-date.

Price Action: BILI stock is down 5.67% at $20.07 premarket at the last check Thursday.

Also Read:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Notches Another All-Time High, But Is It Still a Buy Today?

In case you missed it, Bitcoin (CRYPTO: BTC) has been on an absolute tear. Following the recent U.S. election that saw pro-crypto candidate Donald Trump win the presidency, Bitcoin has surged over 30% since election night, recently surpassing $90,000.

The cryptocurrency’s performance has undoubtedly caught the attention of seasoned investors and newcomers alike. But with Bitcoin at such highs, it’s only natural to ask: Is it still a good buy today?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Conventional wisdom says that buying at all-time highs is risky business. But there are two compelling reasons — one short-term and one long-term — that suggest Bitcoin could still be a strong buy.

At first glance, Bitcoin’s climb to $90,000 might suggest that the rally has ended, leaving latecomers feeling they’ve missed out. However, this isn’t the case.

An often-overlooked indicator, funding rates for Bitcoin perpetual futures, tells a different story. This may seem like a technical detail, but understanding funding rates can help investors gauge the sustainability of Bitcoin’s current rally.

Funding rates are periodic fees exchanged between traders holding long (buy) and short (sell) positions in futures markets. Their purpose is to keep the futures contract price close to Bitcoin’s actual spot price.

When the funding rate is positive, long positions pay a fee to short positions, indicating a higher demand to bet on price increases. Conversely, a negative rate means short positions pay longs, suggesting bearish sentiment dominates.

Elevated funding rates typically indicate a highly leveraged market, where many traders are taking out long positions with borrowed funds. Historically, Bitcoin’s price has seen local peaks when funding rates surge, as these leveraged positions become susceptible to liquidations during any price correction.

However, as you can see in the chart above, this isn’t the case today. Data shows that even with Bitcoin reaching $90,000, funding rates remain low, suggesting that the recent price increase is not driven by excess leverage. Instead, the rally seems to be fueled by organic buying rather than speculative trading.

Producer Inflation Rises More Than Expected In October: Should Traders Rethink Interest Rate Cut Path?

Producer inflation in October came slightly higher than anticipated Thursday, casting doubts on whether the U.S. economy’s broader disinflationary trend will hold through the year’s final quarter.

Compared to October 2023, the Producer Price Index (PPI) surged to 2.4% last month, up from upwardly revised 1.9% and surpassing projections of 2.3% as tracked by TradingEconomics data. It marks the first increase in the annual PPI inflation rate after three straight months of declines.

On a monthly basis, the PPI for final demand increased by 0.2%, accelerating the previous 0.1% reading and matching economic estimates of 0.2%.

When excluding energy and food items, core PPI was up by 0.3% from a month earlier, accelerating from the previous 0.2% but matching estimates. On an annual basis, core PPI surged from 2.8% to 3.1%, topping expectations of 3%, marking the third straight month of gains.

“Over one-third of the rise in the index for final demand services can be traced to prices for portfolio management, which advanced 3.6%,” the Bureau of Labor Statistics said.

On Wednesday, consumer inflation data also showed an increase in October, matching expectations.

Prior to Thursday’s PPI report, traders assigned a 79% of chance on a 25-basis-point rate cut in December.

Jobless Claims Below Expectations

Concurrently, unemployment claims rose by 217,000 in the week ending Nov. 9, down from the previous 221,000 and below estimates of 223,000.

Continuing claims fell to 1.873 million, down from 1.892 million and below the predicted 1.88 million.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

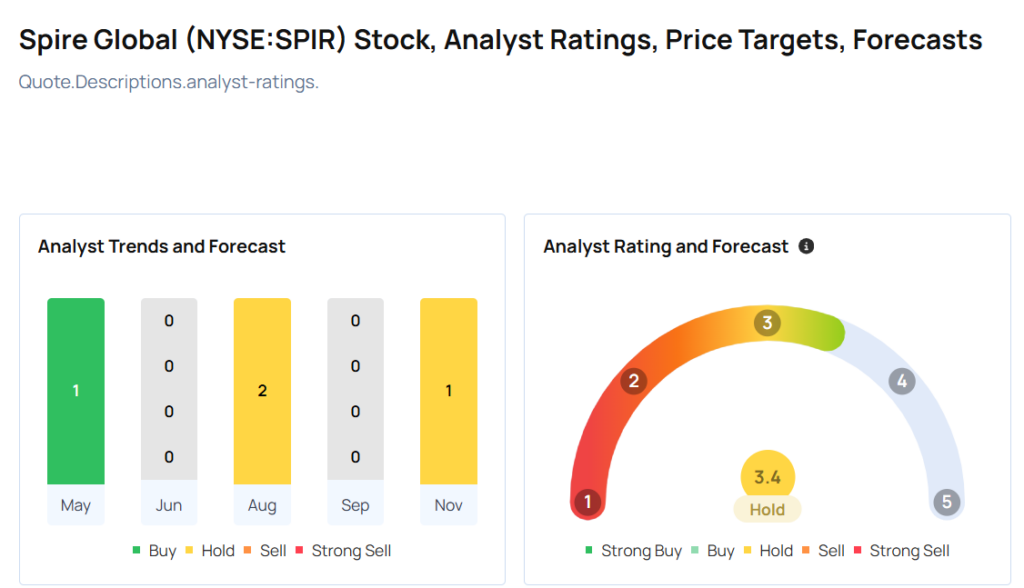

These Analysts Boost Their Forecasts On Spire Global

Spire Global, Inc. SPIR agreed to sell its maritime business to Kpler for roughly $241 million.

The deal includes a $233.5 million purchase price and $7.5 million allocated for services over the next twelve months post-closing. This valuation reflects roughly 5.8 times the revenue generated by the maritime business over the past year.

Peter Platzer, Spire CEO said, “We are now even better equipped with the resources, technology and experience to serve governments and commercial clients to fulfill their missions, whether through our advanced data solutions or empowering them with our sophisticated space services offering…In addition to these benefits for Spire, we expect this sale will benefit our maritime customers and team members by allowing our maritime business to grow even faster within a global organization leading the digitalization of the maritime industry,”

Spire shares gained 14.1% to close at $13.45 on Wednesday.

These analysts made changes to their price targets on Spire following earnings announcement.

Considering buying SPIR stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Futures Waver as PPI Keeps Rate Debate Open: Markets Wrap

(Bloomberg) — US equity futures steadied after a gauge of producer price inflation came in line with expectations, while investors debate the likelihood of an interest rate cut in December.

Most Read from Bloomberg

Contracts for the S&P 500 and Nasdaq 100 gave up a modest gain and Treasury yields rose after the data amid signs that a post-election equity surge is starting to stall.

Investors are trying to balance a picture of easing inflation and falling rates against the possibility that President-elect Donald Trump will implement hardline pledges on taxes and tariffs, reigniting price growth next year. Confirmation of a Republican election clean sweep suggests more policy leeway for Trump and limits potential curbs on his power.

“There is expectation that Trump’s policies will be market friendly, growth friendly, will be impacting higher inflation but not massively, deregulation is going to be good for some sectors,” said Amelie Derambure, senior multi-asset portfolio manager at Amundi. “The assumption is we have good, soft Trump with no big negative impact priced by markets.”

The dollar index extended its rally to hold near two-year highs after the data. Bitcoin traded at about $91,000, holding close to Wednesday’s record high.

The producer price index for final demand increased 0.2% from a month earlier after rising a revised 0.1% in September, Bureau of Labor Statistics data showed Thursday. Separately, applications for US unemployment benefits fell to the lowest level since May last week, indicating the robustness of the labor market.

Several Fed officials Wednesday reiterated their deep uncertainty over how far the central bank will need to lower interest rates with the central bank’s 2% inflation target still elusive. Fed chief Jerome Powell is also due to speak later in the day.

Currently, money markets price around 19 basis points of rate cuts for December and several policymakers have urged a cautious approach. Fed Governor Adriana Kugler, for instance, said on Thursday that rate cuts should be paused if progress on inflation stalls.

Analysts at Brown Brothers Harriman said that with Trump likely to have the wherewithal to carry out his agenda, the scope for rate cuts could be limited going forward. The dollar more than 2% so far this month on the prospect of pro-growth policies and fewer rate cuts.