Advance Auto Parts Q3: Earnings Miss, New Strategy, Outlook & More

Advance Auto Parts Inc. AAP reported third-quarter adjusted loss per share of 4 cents, compared with the street view for EPS of 49 cents. Quarterly sales of $2.15 billion missed the analyst consensus of $2.65 billion. Comparable store sales decreased 2.3%.

On November 1, 2024, the company successfully completed the sale of Worldpac for total cash consideration of approximately $1.5 billion, subject to adjustments for working capital and other items.

The company’s gross profit increased 11.0% to $907.9 million. This represents 42.3% of net sales, compared to 36.9% in the third quarter of the prior year.

The improvement in leverage was mainly due to lapping the one-time inventory reserve adjustment from the previous year. Additionally, stabilizing product costs helped, though this was offset by strategic pricing investments.

The company is implementing a strategic plan to improve business performance, focusing on core retail improvements. It has identified opportunities that could increase adjusted operating income margin by more than 500 basis points by fiscal 2027. The plan is built on three main areas: store operations, merchandising, and supply chain.

For store operations, the company will reduce its U.S. asset footprint by closing 523 Advance corporate stores, exiting 204 independent locations, and shutting down four distribution centers. It will also standardize the store operating model and improve labor productivity. Additionally, the company plans to accelerate new store openings.

In merchandising, the company aims to improve sourcing to lower first costs and bring products to market faster.

For the supply chain, the company plans to consolidate distribution centers and operate 13 large facilities by 2026. It will also open 60 market hub locations by mid-2027 and optimize transportation routes and freight to reduce costs and improve productivity.

The company exited the quarter with cash and equivalents worth $464.49 million.

Outlook: Advance Auto Parts expects FY24 net sales from continuing operations to be approximately $9 billion, with adjusted EPS from continuing operations ranging from $(0.60) to $0.00.

The company aims to achieve over 500 basis points of operating margin growth by fiscal 2027, focusing on core retail improvements.

Advance Auto Parts has provided preliminary guidance for FY25, expecting net sales of $8.40 billion to $8.60 billion and comparable sales growth of 0.50% to 1.50%.

Price Action: AAP shares are trading higher by 2.34% to $41.90 premarket at last check Thursday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kartoon Studios Achieves Second Consecutive Quarter of Sequential Revenue Growth and 57% Year-Over-Year Reduction in Direct Operating Costs for Q3 2024

80% YEAR-OVER-YEAR REDUCTION IN LOSSES; COMPANY POISED FOR CONTINUED REVENUE GROWTH AND REACHING SUSTAINED PROFITABILITY IN 2025 WITH REBOUND IN ANIMATION PRODUCTION PIPELINE AND CONTINUING PROFIT IN CHILDREN’S CHANNEL SYSTEM

LARGEST REVENUE UNIT, MAINFRAME, SURGING WITH 145 EPISODES IN PRODUCTION FOR NETFLIX, DISNEY, SONY, SPINMASTER, AND MULTIPLE GLOBAL BROADCASTERS

HIGHLY ANTICIPATED A.A. MILNE’S WINNIE-THE-POOH, TO RELEASE SNEAK PEEK ANIMATION TRAILER FEATURING TWO NEW FEMALE CHARACTERS

BEVERLY HILLS, Calif., Nov. 14, 2024 (GLOBE NEWSWIRE) — Kartoon Studios TOON today provided a business update for the quarter ended September 30, 2024.

Key Highlights

- Second consecutive quarter of sequential revenue growth

- Significant cost reductions across all operating units resulting in a 57% decrease in direct operating costs vs. Q3 2023

- Significant cuts in general and administrative expenses, reducing them by 40% year-over-year in Q3 and by 25% from Q2 2024

- Loss from operations slashed by 80% in Q3 2024 vs. Q3 2023

- Mainframe Studios, Kartoon Studios’ largest revenue unit, surging amid strong rebound following settlement of the Writers Guild of America (WGA) and Screen Actors Guild (SAG) strikes; has secured series orders for over 145 episodes, and has four series in production for industry giants Disney, Netflix, Sony Kids, Spinmaster, and an as yet unannounced, major broadcaster; Mainframe production pipeline has orders through 2027

- Kartoon Studios’ future growth fueled by ‘Three Pillars’ business strategy; Kartoon Channel/Stan Lee Universe/Winnie-the-Pooh

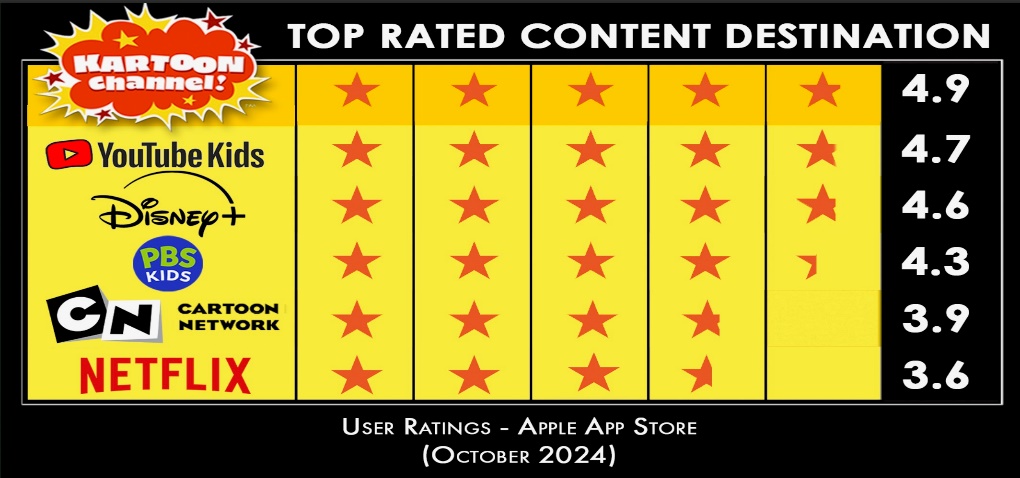

- Kartoon Channel! U.S. distribution now grown to 18 platforms including, Amazon Prime Video, Apple TV, Amazon Fire, Apple iOS, Android Mobile, Android TV, Web, Roku, Pluto TV, Comcast, Cox, Dish, Sling TV, Tubi, Xumo, Samsung, , and LG Smart TVs, while continuing to lead viewer ratings in Apple app store above Netflix, Disney+ You Tube Kids, Max, and PBS Kids

- Kartoon Channel! Worldwide broadened its international footprint by launching on Samsung TV Plus in India, UK, and Italy, as well as Indonesia’s Link Net, now operating in 69 countries globally, and has grown total addressable footprint worldwide to over 1.5 billion potential viewers

- Announced development plans for Stan Lee’s The Excelsiors – one of the largest initial superhero ensemble creations by the legendary Stan Lee. Project will launch as a graphic novel through Legible Comics, with concurrent development for television and film adaptations, overseen by industry icon and BATMAN Executive Producer, Michael Uslan

- Kartoon Studios announced a collaboration with LiveOne NASDAQ to produce, publish, and distribute all music for its Winnie-the-Pooh films and series, including original songs, albums, and soundtracks

- Highly anticipated Winnie-The-Pooh based on A.A.Milne classic characters, poised to release animated trailer with two new female characters, and an original music-based approach

Andy Heyward, Kartoon Studios’ Chairman and CEO stated: “In Q3 2024, we continued to build on the positive results achieved in the first half of the year. Revenue for the nine months ending September 30, 2024, reached $23.2 million, reflecting a 4% increase in revenue for Q3 2024 from Q2 2024 and a 38% growth for Q2 2024 from Q1 2024. This growth highlights rising demand for our animated productions through Mainframe, currently our largest revenue-driving unit, as the industry steadily recovers from the disruptions caused by the 2023 Writers Guild of America (WGA) and Screen Actors Guild (SAG) strikes. Our focus on operational efficiency has yielded significant outcomes, with direct operating costs reduced by 54% year-over-year through the first nine months of 2024, thanks to the impact and disciplines of our recently hired CFO, Brian Parisi. Brian was recently recognized by the LA Business Journal as CFO of the Year, and those of us who work closely with him every day know how well deserved that recognition is. In Q3 alone, we achieved a 57% cost reduction compared to the same period in 2023. Brian’s highly disciplined approach has directly impacted our financial results, reducing our loss from operations by 80% for the three-month period compared to 2023 after adjustments for last year’s one-time impairments. Since joining us in late 2023, Brian’s expertise has been instrumental in driving significant cost efficiencies and supporting our mission for sustained growth and building out the premier children’s entertainment company for the 21st century.”

“In Q2 2024, we redefined our business around three core pillars: Kartoon Channel!, which streaming and FAST system, has already turned profitable, Stan Lee Universe, and Winnie-The-Pooh, each providing proven brand equity, and a strong foundation for growth and global brand expansion in 2025 and beyond. In Q3 2024, we achieved meaningful progress across each of the three pillars.

Kartoon Channel! broadened its international footprint by launching first with Samsung Plus across India, UK, and Italy, with a footprint of 1.5 billion potential viewers. Recently, we added Indonesia’s Link Net, giving Kartoon Channel access to nearly 300 million potential viewers in the fourth most populous country in the world. We also unveiled Stan Lee’s The Excelsiors, one of Stan Lee’s most ambitious superhero ensembles, debuting as a graphic novel with concurrent plans for TV and film adaptations led by Michael Uslan, the visionary behind the Batman franchise. Furthermore, we announced a partnership with LiveOne NASDAQ to produce, publish, and distribute all original music for our upcoming Winnie-the-Pooh films and series, leveraging LiveOne’s platform to connect fans with exclusive songs, albums, and soundtracks from the beloved franchise. We believe that these initiatives reinforce our commitment to building a dynamic, diversified, children’s entertainment portfolio that resonates with audiences worldwide, positioning Kartoon Studios for long-term success.”

“In addition, Mainframe Studios, has demonstrated remarkable resilience and adaptability, emerging stronger amid a rebounding industry. With series orders for over 145 episodes and a contracted pipeline secured through 2025 and 2026, Mainframe is positioned for continuing growth. Collaborating with esteemed partners like Sony Kids, Disney, Spin Master, and others, Mainframe attracts clients who demand superior work in animation. Their commitment to technical excellence and innovation, combined with a scalable infrastructure, enables Mainframe to deliver high-quality content at an unprecedented scale. This strength is attracting production orders from across the entertainment industry. We are incredibly proud of what Mainframe has achieved and excited about its future,” concluded Heyward.

Brian Parisi, Chief Financial Officer of Kartoon Studios, commented, “We are highly encouraged by the positive trends we are seeing in 2024 and optimistic that our current initiatives will guide Kartoon Studios toward profitability in 2025, as we create and profit from powerful timeless assets. Alongside reductions in direct operating costs, we achieved significant cuts in general and administrative expenses, lowering them by 40% year-over-year in Q3 and by 25% compared to Q2 2024. Our commitment to operational efficiency and disciplined cost control is yielding strong results, with total operating expenses down 14% from Q2 2024, 50% from Q3 2023, and 53% year-to-date compared to 2023, after adjusting for one-time impairments taken last year. We believe we are now operating at a sustainable expense level for the foreseeable future, whereas revenue will ramp up with Stan Lee Universe and A.A.Milne’s Winnie-The-Pooh, coming to market. Furthermore, our balance sheet remains strong, with no long-term debt. With this solid financial foundation, and strong cost reduction trends, we believe that we are well-positioned to capitalize on future growth opportunities and deliver long-term value for our shareholders, as we focus on becoming the premier children’s entertainment company of the 21st century.”

Kartoon Studios reported revenue of $8.7 million for the quarter ended September 30, 2024. As of that date, the Company had current assets of $37.2 million, working capital of $3.5 million, and total stockholders’ equity of $42.8 million. The Company had no Long-Term Debt as of September 30, 2024.

Complete details of Kartoon Studios’ financial results for the third quarter ended September 30, 2024, are available in the Company’s Form 10-Q, which has been filed with the Securities & Exchange Commission and is available on the Company’s website.

About Kartoon Channel!

Available everywhere and anywhere kids are today, Kartoon Studios’ Kartoon Channel! is a family entertainment destination that delivers 1000s of episodes of carefully curated and safe family-friendly content. The channel features original content, including Stan Lee’s Superhero Kindergarten, starring Arnold Schwarzenegger, Rainbow Rangers, and Shaq’s Garage, starring Shaquille O’Neal and Rob “Gronk” Gronkowski. Kartoon Channel! also delivers animated classics for little kids, such as Peppa Pig Shorts, Mother Goose Club, Barney and Friends, Om Nom Stories, as well as content for bigger kids, like Angry Birds, Talking Tom & Friends and Yu-Gi-Oh!. Kartoon Channel! also offers STEM-based content through its Kartoon Classroom, including Baby Genius and more, as well as a Spanish language collection on the platform, KC En Espanol.

Kartoon Channel! is available across multiple platforms, including iOS, Android Mobile, Web, Amazon Prime Video, Apple TV, Amazon Fire, Roku, Pluto TV, Comcast, Cox, Dish, Sling TV, Android TV, Tubi, Xumo, Samsung and LG Smart TVs.

Internationally, Kartoon Channel! is currently available in key territories around the world, including the UK, Italy, and Spain via Samsung TV Plus, India (Jio via Powerkids Entertainment), Africa and Sub-Sahara Africa (StarTimes), Australia and New Zealand (Samsung TV Plus), Germany (Waipu), Philippines (Tapp Digital), Mongolia (Mobinet Media), Malaysia (Astro), Indonesia (Linknet) and Maldives (Dhiraagu). Additionally, Kartoon Channel! Branded blocks are currently available daily in 69 countries across the Middle East, Africa, Latin America, and Europe.

About Stan Lee

Kartoon Studios owns a controlling interest in Stan Lee Universe and manages all aspects of the Stan Lee brand including his name, likeness, signature, voice, and consumer products licensing, as well as characters created by Stan, post Marvel. Known by his signature phrase “Excelsior!,” Stan Lee is one of the most prolific and legendary creators of all time. As Marvel’s editor-in-chief, Stan “The Man” Lee helped build a universe of interlocking continuity, one where fans felt as if they could turn a street corner and run into a superhero from Spider-Man to the Fantastic Four, Thor, Iron Man, the Hulk, the X-Men, and more. Stan went on to become Marvel’s editorial director and publisher in 1972 and was eventually named chairman emeritus. He was the co-creator of characters appearing in 4 of the top 10 box office movies of all time, which featured Spider-Man, Iron Man, the Hulk, Thor, Guardians of the Galaxy, Black Panther, and of course the Avengers, accounting for billions of dollars of revenue for Marvel and the Walt Disney Company. Among Stan’s many awards are the National Medal of Arts, awarded by President Bush in 2008, and the Disney Legends Award, received in 2017. He was also inducted into the comic industry’s Will Eisner Award Hall of Fame and Jack Kirby Hall of Fame.

About Kartoon Studios’ Winnie-The-Pooh

Kartoon Studios’ “Winnie-the-Pooh” is based on the designs and stories of one of the most successful brands of all time, A.A. Milne’s Winnie-the-Pooh, a property that has generated over $80 billion in sales over the last four decades and is estimated to currently generate $3-$6 billion per year. The total lifetime revenues exceed those of “Barbie,” “Harry Potter,” “Star Wars,” “Mickey Mouse,” “Peanuts,” “Ninja Turtles,” “Power Rangers,” “Marvel,” and almost every major brand in the world.

The company is currently in pre-production on the animated Christmas movie, set to premiere December 24, 2025, on Amazon Prime Video Channels, through Kartoon Channel!’s $3.99/month subscription. Concurrently, the global retail program will kick off with the debut of physical entertainment through Alliance Entertainment Corporation in conjunction with Kartoon Studios rollout of a global consumer products campaign.

Kartoon Studios’ Winnie-the-Pooh animated content is being developed with a unique ‘yarn-based’ design and palette for the characters and backgrounds, along with original modern stories inspired by Milne’s beloved classic books, as well as two new female characters. The beautifully imagined yarn gives the characters depth and warmth. Additionally, the stories will be told in a ‘Seussian style’ rhyme to provide an enriched dimension to the stories.

About Mainframe Studios

Founded in 1993 and headquartered in Vancouver, Canada, Mainframe Studios created the very first entirely CG TV series, ReBoot. Since then, the company produced more than 1,000 half-hour series for TV, over 60 feature-length projects, and two theatrical feature films. We have been innovators and creators since day one and have partnered with some of the biggest names in the business. The company’s creative-driven approach marries seamlessly with our rock-solid production processes, allowing us to deliver great storytelling that’s on time and on budget.

About Kartoon Studios

Kartoon Studios TOON is a global end-to-end creator, producer, distributor, marketer, and licensor of entertainment brands. The Company’s IP portfolio includes original animated content, including the Stan Lee brand, Stan Lee’s Superhero Kindergarten, starring Arnold Schwarzenegger, on Kartoon Channel! and Ameba; Shaq’s Garage, starring Shaquille O’Neal, on Kartoon Channel!; Rainbow Rangers on Kartoon Channel! and Ameba; the Netflix Original, Llama Llama, starring Jennifer Garner, and more.

In 2022, Kartoon Studios acquired Canada’s WOW! Unlimited Media and made a strategic investment becoming the largest shareholder in Germany’s Your Family Entertainment AG RTV, one of Europe’s leading distributors and broadcasters of high-quality programs for children and families.

Toon Media Networks, the Company’s wholly owned digital distribution network, consists of Kartoon Channel!, Frederator Network, and Ameba. Kartoon Channel! is a globally distributed entertainment platform with near full penetration of the U.S. market. Kartoon Channel! and Ameba are available across multiple platforms, including iOS, Android Mobile, Web, Amazon Prime Video, Apple TV, Amazon Fire, Roku, Pluto TV, Comcast, Cox, Dish, Sling TV, Android TV, Tubi, Xumo, and Samsung and LG Smart TVs. Frederator Network owns and operates one of the largest global animation networks on YouTube, with channels featuring over 2000 exclusive creators and influencers, garnering billions of views annually.

For additional information, please visit www.kartoonstudios.com

Forward-Looking Statements: Certain statements in this press release constitute “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “predict,” “forecast,” “project,” “plan,” “intend” or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements and include statements regarding being poised for revenue growth and reaching sustained profitability in 2025 with rebound in animation production pipeline and continuing profit in children’s channel; system; releasing A.A. MILNE’S WINNIE-THE-POOH sneak peek animation trailer featuring two new female characters; development plans for Stan Lee’s The Excelsiors – one of the largest initial superhero ensemble creations by the legendary Stan Lee: launching the project as a graphic novel through Legible Comics, with concurrent development for television and film adaptations, overseen by industry icon and BATMAN Executive Producer, Michael Uslan: the collaboration with LiveOne NASDAQ to produce, publish, and distribute all music for its Winnie-the-Pooh films and series, including original songs, albums, and soundtracks; continuing to build on the positive results achieved in the first half of the year; the Company’s ability to expand its brand globally in 2025 and beyond; the Company’s belief that its initiatives reinforce its commitment to building a dynamic, diversified, children’s entertainment portfolio that resonates with audiences worldwide, positioning the Company for long-term success; the future success of Mainframe Studios; current initiatives guiding Kartoon Studios toward profitability in 2024; operating at a sustainable expense level for the foreseeable future; and being well-positioned to capitalize on future growth opportunities and deliver long-term value for shareholders;. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties, including without limitation, the Company’s ability to sustain growth and profitability in 2025; the Company’s ability to expand its brand globally in 2025 and beyond; the ability of the Company to achieve profitability in 2025; the successful release of the Company’s Winnie-the-Pooh films and series; the successful production and release of the Company’s animated Christmas movie set to premiere December 24, 2025; the Company’s ability to obtain additional financing on acceptable terms, if at all; fluctuations in the results of the Company’s operations from period to period; general economic and financial conditions; the Company’s ability to anticipate changes in popular culture, media and movies, fashion and technology; competitive pressure from other distributors of content and within the retail market; the Company’s reliance on and relationships with third-party production and animation studios; the Company’s ability to market and advertise its products; the Company’s reliance on third-parties to promote its products; the Company’s ability to keep pace with technological advances; the Company’s ability to protect its intellectual property and those other risk factors set forth in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in the Company’s subsequent filings with the Securities and Exchange Commission (the “SEC”). Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements whether as a result of new information, future events or otherwise, except as required by law.

MEDIA CONTACT:

pr@kartoonstudios.com

INVESTOR RELATIONS CONTACT:

ir@kartoonstudios.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d875b59d-289a-4c22-8b10-5aa1b69527e2

https://www.globenewswire.com/NewsRoom/AttachmentNg/9d4e09c8-3a1b-4b58-aa7c-966aac73c798

https://www.globenewswire.com/NewsRoom/AttachmentNg/fb89d98d-fc03-40aa-af95-b3cd21e48daf

https://www.globenewswire.com/NewsRoom/AttachmentNg/60eb6320-f4ef-49ac-b3ea-b6215c245f66

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EVTOL Aircraft Market Analysis: Key Drivers, Market Players, and Future Prospects

Luton, Bedfordshire, United Kingdom, Nov. 14, 2024 (GLOBE NEWSWIRE) — Electric Vertical Takeoff and Landing (eVTOL) aircraft are transforming the landscape of urban air mobility by providing sustainable, efficient, and versatile transportation options for both passengers and cargo. These aircraft, powered by electric propulsion systems, are designed for vertical takeoff and landing, offering quiet, emission-free operations. eVTOLs have the potential to revolutionize urban transportation by bypassing ground traffic and utilizing vertical space for faster, point-to-point travel. With the ability to hover and maneuver in confined spaces, as well as the potential for autonomous flight, these aircraft could serve as air taxis, emergency response units, and logistics platforms, while reducing noise pollution and lowering carbon emissions.

As cities become increasingly congested, the demand for more efficient and eco-friendly transportation solutions is growing, which is propelling innovation within the eVTOL market. Driven by the need for alternatives to traditional urban transport, eVTOLs represent a major step toward cleaner commuting options. Regulatory frameworks, particularly those from aviation authorities like the FAA and EASA, are pivotal in shaping the future of this market. As these bodies develop and implement guidelines for eVTOL operations, they ensure safety, reliability, and public confidence, accelerating market growth.

Access PDF Sample Report (Including Graphs, Charts & Figures) @

https://exactitudeconsultancy.com/reports/37162/evtol-aircraft-market/#request-a-sample

The integration of autonomous technologies is another key factor in the eVTOL market’s expansion. Advances in Artificial Intelligence (AI), Machine Learning (ML), and flight control systems are paving the way for fully autonomous eVTOLs, which can enhance safety, efficiency, and cost-effectiveness by reducing human error and eliminating the need for pilots. Additionally, government policies focused on reducing carbon emissions and promoting sustainable solutions are fueling investments and regulatory support, further driving the market’s development.

With the rising global urban population and increased traffic congestion, eVTOLs offer a timely solution for cities in need of fast, efficient transportation alternatives. By reducing commute times and offering a faster, cleaner way to navigate urban environments, eVTOLs are expected to become a key component of future urban transportation networks. As urban areas continue to grow, so will the demand for innovative, eco-friendly mobility options like eVTOLs, ensuring the continued expansion of this emerging market.

Driver: Growing Demand for Green Energy and Noise-Free Aircraft

Increasing concerns over CO2 emissions and their impact on the environment are driving the demand for sustainable and noise-reducing transportation solutions, including eVTOL aircraft. With the aviation industry contributing significantly to global CO2 emissions, there is a growing push towards reducing this environmental footprint. eVTOLs, which are powered by electric propulsion systems, produce zero emissions during flight, offering a cleaner alternative to traditional fossil-fuel-powered aircraft. This aligns with global goals to combat climate change, such as the aviation industry’s target to cut CO2 emissions in half by 2050. Additionally, eVTOLs produce considerably less noise compared to traditional airplanes and helicopters, addressing public concerns about noise pollution in urban areas. With these advantages, eVTOL aircraft are poised to become an essential component of sustainable urban transportation. Leading manufacturers like Airbus SE, Bell Textron Inc., EHang Holdings Ltd., and Joby Aviation are actively working to develop quieter, zero-emission eVTOL models, such as Airbus’s CityBus next-gen aircraft, which offers a promising solution to both carbon emissions and noise issues.

Restraint: Battery Failures Due to High Voltage and Thermal Issues

A key challenge for eVTOL aircraft remains the risk of battery failure due to high voltage and thermal issues. eVTOLs require batteries with high energy density to meet power needs during take-off, landing, and flight in crosswinds. This leads to a high power demand that can increase battery size and weight, but also raises the risk of thermal issues. Batteries can heat up quickly under these demands, causing thermal emissions that can lead to battery failure. Such failures may include thermal runaway, where excessive heat cannot be dissipated, resulting in cell degradation or fires.

High power requirements, such as during rapid charging or discharging, can lead to significant heating of the batteries, raising concerns for safety. As seen in some incidents, overcharging or voltage spikes can cause severe thermal runaway or fires. For example, in a reported incident in 2019, a failure in a battery pack of around 4,000 cells caused damages in the range of $2 million to $3 million. Another high-profile incident involved Lilium GmbH’s Phoenix demonstrator, which was destroyed in a fire caused by a non-protected battery system in February 2020, leading to damages of several million dollars. The risk of these failures threatens both the safety of passengers and the credibility of the eVTOL industry, complicating efforts to gain public trust and regulatory approval.

Opportunity: Strategic Developments Driving Market Growth

Strategic partnerships in the eVTOL market present considerable growth potential. Collaboration between aerospace manufacturers, technology providers, and transportation companies is facilitating the pooling of resources, accelerating the development of eVTOL technologies. These partnerships help overcome the barriers to commercializing eVTOLs, driving innovation in aircraft design, regulatory frameworks, and infrastructure.

Moreover, strategic investments in eVTOL start-ups and the development of dedicated testing sites and vertiports are playing a key role in the expansion of the market. Governments are also supporting the sector with favorable policies, grants, and incentives that contribute to market growth. These strategic developments help create a conducive environment for technological and regulatory advancements. With continued collaboration and government backing, the eVTOL market is on track to evolve into a transformative transportation solution, with the potential to revolutionize urban mobility and long-distance travel.

Report Link Click Here: https://exactitudeconsultancy.com/reports/37162/evtol-aircraft-market/

Challenge: Lack of Regulatory Standards for eVTOL Aircraft

A significant barrier to the rapid deployment of eVTOL aircraft is the lack of established regulatory standards. Various standards development organizations, including ASTM International, RTCA, SAE International, and EUROCAE, are working towards the creation of specific standards to support the certification of eVTOLs. However, there are still many gaps in the current regulatory framework, which makes it challenging for manufacturers to meet all necessary criteria for certification.

To bridge these gaps, organizations such as the General Aviation Manufacturers Association (GAMA) are collaborating with regulatory bodies like the FAA and the European Union Aviation Safety Agency (EASA). Despite these efforts, the regulatory landscape remains fragmented, with eVTOL manufacturers needing to propose compliance methods to special conditions that regulators must evaluate individually. This situation makes it time-consuming and complex for manufacturers to navigate the regulatory approval process. As the industry continues to grow, it is expected that the development of comprehensive and standardized regulatory frameworks will be crucial in ensuring safety, reliability, and the successful integration of eVTOLs into the broader aviation ecosystem.

As regulations evolve, it is essential that eVTOL manufacturers remain proactive in their communication with regulatory authorities to ensure that safety standards, airspace integration, and operational guidelines are developed and harmonized globally. This regulatory clarity will be essential for the market’s growth and the widespread adoption of eVTOL technology.

Key Segments in the eVTOL Market:

- Vectored Thrust Dominance: Vectored thrust technology is the leading lift mechanism in the eVTOL market, commanding the largest market share. Its ability to manipulate the direction of propulsive force makes it highly maneuverable, which is ideal for urban air mobility applications. This system offers stability during takeoff, landing, and hovering, making it a popular choice among eVTOL manufacturers. The use of vectored thrust in conventional aircraft also gives manufacturers greater confidence in its viability for eVTOL aircraft.

- Piloted Operation Growth: While autonomous eVTOLs have considerable future potential, piloted eVTOL aircraft are expected to grow at a higher rate during the forecast period. Piloted operations offer a greater level of reassurance to passengers and regulators, especially during the early stages of deployment. The presence of human pilots facilitates regulatory approval and ensures smooth integration with existing air traffic management systems, which contributes to its faster market acceptance.

- >200 km Range Segment Expansion: eVTOL aircraft capable of flying longer distances (>200 km) are poised for rapid growth. These aircraft meet the needs of regional air transportation, connecting cities or covering longer distances more efficiently. With advances in battery efficiency and energy storage, eVTOLs in this segment strike an optimal balance between payload capacity and energy use. The growing demand for longer-range travel within the eVTOL market is expected to fuel its rapid expansion.

- Europe’s Leading Growth: Europe is projected to witness the highest compound annual growth rate (CAGR) in the eVTOL market. Factors contributing to Europe’s growth include its strong economic development, rising demand for air travel, and commitment to sustainable aviation. Countries like France, the UK, and Germany have made significant investments in aerospace, with key aircraft manufacturers and suppliers contributing to the region’s leadership in eVTOL aircraft. Moreover, the emergence of urban air mobility and advanced air mobility solutions further strengthens Europe’s position in this market.

Report Link Click Here: https://exactitudeconsultancy.com/reports/37162/evtol-aircraft-market/#request-a-sample

Asia Pacific eVTOL Market Growth

The Asia Pacific region is expected to grow at the second-highest compound annual growth rate (CAGR) during the forecast period for eVTOL aircraft. The region’s rapid growth is driven by urban congestion and accelerated urbanization, particularly in major cities across China, India, Japan, Australia, and South Korea. As emerging economies like China and India continue to experience strong GDP growth, they present significant opportunities for the eVTOL market. China, in particular, is attracting substantial foreign investments due to its stable economic development and government support through favorable legislation, funding, and partnerships.

Additionally, Asia Pacific has a robust technological ecosystem that supports eVTOL development, including advances in artificial intelligence (AI), 5G connectivity, and battery technology. These factors combine to provide an ideal environment for eVTOL market expansion in the region.

Key Players:

- Joby Aviation

- Lilium

- Vertical Aerospace

- EHang

- Volocopter

- Airbus

- Boeing

- Bell Flight

- EmbraerX

- Terrafugia (a subsidiary of Geely)

- AeroMobil

- SkyDrive

- Archer Aviation

- Kitty Hawk

- Urban Aeronautics

- Pipistrel

- Jaunt Air Mobility

- Beta Technologies

- Hyundai Urban Air Mobility

- EVE Urban Air Mobility

Recent Developments

- Jetoptera’s Progress with Turbocompressor Design (August 2024): Jetoptera made significant strides in advancing the turbocompressor design for its J-500 VTOL aircraft, completing the Critical Design Review and preparing for prototype manufacturing.

- UrbanLink’s Seaglider Fleet Expansion (July 2024): UrbanLink placed an order for 27 all-electric seagliders from REGENT Craft, planning operations in South Florida and Puerto Rico by 2027. This expansion reflects the growing demand for electric air mobility solutions.

- PAL-V Liberty Flying Car (June 2024): The PAL-V Liberty successfully passed its first Periodic Technical Inspection (PTI), moving closer to becoming a commercially viable flying car that can operate both on the road and in the air.

- Jetoptera’s J-500 Development (August 2024): Jetoptera continued refining its J-500 VTOL aircraft design, marking a key step in the process toward manufacturing and flight tests.

- Archer Aviation’s Test Flight Milestone (May 2024): Archer Aviation surpassed 400 test flights for its electric aircraft, a major milestone in its development process and a step closer to achieving commercial certification.

- Joby Aviation’s Certification Application (July 2024): Joby Aviation filed for certification to become the first electric air taxi operator, a crucial milestone in the company’s journey toward launching its eVTOL fleet.

Market Segmentation:

By Propulsion Type

- Fully Electric

- Hybrid

- Electric Hydrogen

By System

- Batteries & Cells

- Electric motors/Engines

- Aerostructures

- Avionics

- Software

- Others

By Lift Technology

- Vectored Thrust

- Multirotor

- Lift plus Cruise

By Application

- Air Taxis

- Air Shuttles & Air Metro

- Private Transport

- Cargo Transport

- Air Ambulance & Medical Emergency

- Last Mile Delivery

- Inspection & Monitoring

- Surveying & Mapping

- Surveillance

- Special Mission

- Others

By Mode of Operation

By Range

By Mton

- <100 kg

- 100-1,000 kg

- 1,000-2,000 kg

- >2,000 kg

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Get a Sample PDF Brochure: https://exactitudeconsultancy.com/reports/37162/evtol-aircraft-market/#request-a-sample

Related Reports:

Aircraft Mounts Market

https://exactitudeconsultancy.com/reports/11196/aircraft-mounts-market/

The global aircraft mounts market is expected to grow at an 8.83% CAGR from 2022 to 2029. It is expected to reach above USD 912 million by 2029 from USD 426 million in 2020.

Aircraft Switches Market

https://exactitudeconsultancy.com/reports/4714/aircraft-switches-market/

The global Aircraft switches market is expected to grow at 4.1% CAGR from 2022 to 2029. It is expected to reach above USD 3.45 billion by 2029 from USD 2.40 billion in 2020.

Aircraft Insulation Materials Market

https://exactitudeconsultancy.com/reports/4658/aircraft-insulation-materials-market/

The global aircraft insulation materials market was valued at USD 20.007 billion in 2020 and is projected to reach USD 39.33 billion by 2029, expanding at a CAGR of 7.8% during the forecast period.

Aircraft Sensors Market

https://exactitudeconsultancy.com/reports/4648/aircraft-sensors-market/

The global aircraft sensors market size is expected to grow at 5.5% CAGR from 2022 to 2029. It is expected to reach above USD 6.8 billion by 2029 from USD 4.2 billion in 2020.

Urban Air Mobility Market

https://exactitudeconsultancy.com/reports/19994/urban-air-mobility-market/

The urban air mobility market is expected to grow at 34.3% CAGR from 2023 to 2029. It is expected to reach above USD 27.52 Billion by 2029 from USD 2.6 Billion in 2020.

Electric VTOL (eVTOL) Aircraft Infrastructure Market

https://exactitudeconsultancy.com/reports/27105/electric-vtol-evtol-aircraft-infrastructure-market/

The Electric VTOL (eVTOL) Aircraft Infrastructure Market is expected to grow at 15.58% CAGR from 2022 to 2029. It is expected to reach above USD 57,042.51 million by 2029 from USD 7365.90 million in 2020.

Air Ambulance Market

https://exactitudeconsultancy.com/reports/40709/air-ambulance-services-market/

The global air ambulance market size is projected to grow from USD 21.42 billion in 2023 to USD 43.08 billion by 2030, exhibiting a CAGR of 10.5% during the forecast period.

Aircraft And Aircraft Parts Market

The global aircraft and aircraft parts manufacturing and repair & maintenance market is anticipated to grow from USD 604.44 Billion in 2023 to USD 828.64 Billion by 2030, at a CAGR of 4.61% during the forecast period.

Aircraft Engine Market

https://exactitudeconsultancy.com/reports/12340/aircraft-engine-market/

The global Aircraft Engine Market is expected to grow at a 2.78% CAGR from 2023 to 2029. It is expected to reach above USD 80.5 by billion 2029 from USD 62.4 billion in 2022.

Automotive Lightweight Materials Market

https://exactitudeconsultancy.com/reports/13055/automotive-lightweight-materials-market/

The automotive lightweight materials market is expected to grow at 7.3 % CAGR from 2023 to 2029. It is expected to reach above USD 131.41 Billion by 2029 from USD 74.79 Billion in 2022.

Connected Aircraft Market

https://exactitudeconsultancy.com/reports/18044/connected-aircraft-market/

The connected aircraft market is expected to grow at 17.4 % CAGR from 2022 to 2029. It is expected to reach above USD 11.18 billion by 2029 from USD 2.64 billion in 2020.

Autonomous Aircraft Market

https://exactitudeconsultancy.com/reports/17899/autonomous-aircraft-market/

The global autonomous aircraft market is expected to grow at 19.8% CAGR from 2020 to 2029. It is expected to reach above USD 23.50 billion by 2029 from USD 6.29 billion in 2020.

Irfan Tamboli (Head of Sales) Phone: + 1704 266 3234 Email: sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Recommends Microsoft, Praises American Water Works For Being 'Consistent'

On CNBC’s “Mad Money Lightning Round,” Jim Cramer recommended buying Microsoft Corporation MSFT.

On Oct. 30, Microsoft reported first-quarter revenue of $65.60 billion, up 16% year-over-year. The total beat a Street consensus estimate of $64.51 billion according to data from Benzinga Pro. The company reported first-quarter earnings per share of $3.30, beating a Street consensus estimate of $3.09 per share.

The “Mad Money” host also praised American Water Works Company, Inc. AWK, calling it “consistent.”

On Oct. 30, American Water Works posted mixed results for the third quarter.

When asked about Amazon.com, Inc. AMZN, he said, “These guys are doing so many things right.”

Amazon.com recently confirmed a vendor data breach exposing employee contact information, linking the company to the widening MOVEit hack.

When asked about FS KKR Capital Corp. FSK, he said, “I do think that overtime you’re going to wish that you did start peeling some.”

On Nov. 13, FSK priced public offering of $600 million 6.125% unsecured notes due 2030.

Broadcom Inc. AVGO is doing “very, very well,” Cramer said.

Broadcom will report its fourth quarter and fiscal year 2024 financial results and business outlook on Thursday, Dec, 12, after the closing bell.

When asked about Trump Media & Technology Group Corp. DJT, he said, “This thing is a very hard stock to value.”

On Nov. 5, Trump Media & Technology reported a quarterly loss of 10 cents per share, versus a year-ago loss of 30 cents per share.

Cramer said that he was surprised that SoundHound AI, Inc. SOUN stock got as “crushed” as it did as the quarter wasn’t “nearly that bad.”

On Nov. 12, SoundHound reported third-quarter revenue of $25.1 million, beating the consensus estimate of $23.02 million. The company reported an adjusted loss of six cents per share, beating analyst estimates for a loss of seven cents per share, according to Benzinga Pro.

Price Action:

- American Water Works shares rose 0.01% to settle at $132.44 on Wednesday.

- Amazon shares gained 2.5% to close at $214.10.

- SoundHound AI shares dipped 17.1% to settle at $6.27 during the session.

- Microsoft shares rose 0.5% to close at $425.20 on Wednesday.

- Broadcom shares fell 1.5% to settle at $173.58 during the session.

- Trump Media shares fell 5.1% to close at $28.93 on Wednesday.

- FS KKR Capital shares gained 0.7% to settle at $21.15.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CBD Pioneer Charlotte's Web Narrows Loss In Q3, Focuses On Long-Term Growth

Charlotte’s Web Holdings, Inc. CWEB CWBHF a producer of hemp-derived CBD and other botanical wellness products, reported its financial results on Thursday for the third quarter ended Sept. 30, 2024.

“Our return to quarter-over-quarter growth in 2024 signals that our strategic direction is paying off,” said Bill Morachnick, CEO of Charlotte’s Web. “We’ve seen positive impacts from our e-commerce platform upgrades, recent product launches, and additional retailers, highlighted by our new partnership with Walmart that brings our CBD topicals to another 827 stores.”

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Q3 Financial Highlights

- Consolidated net revenue totaled $12.6 million, down from $14.3 million in the third quarter, reflecting challenges in the CBD industry such as ambiguity around regulatory advancements and consumer spending trends.

- Gross profit was $6.7 million – accounting for 53% of revenue – compared to $7.9 million in the prior year’s quarter, due to lower revenue and price reductions on tinctures.

- Net loss was $5.8 million, representing an improvement from the net loss of $15.2 million in the prior year’s quarter.

- Adjusted EBITDA came in negative at $3.9 million, improved from a $6 million adjusted EBITDA loss in the third quarter of 2023.

- Selling, general and administrative expenses were $12.7 million, representing a 36.2% decrease from $19.9 million in the third quarter of 2023, due to cost-cutting measures and streamlining operations.

- Net cash used in operations was $7.6 million, with $0.3 million in capital expenditures for manufacturing upgrades.

- On Sept. 30, 2024, the company’s cash and working capital were $24.6 million and $33.5 million, respectively, compared to $47.8 million and $54.5 million, respectively, at Dec. 31, 2023.

Product Innovations And Expansions

The company recently launched:

- Soft Gel Capsules which are full-spectrum CBD capsules with positive consumer feedback.

- Functional Mushroom Gummies – a new line of gummies with three formulations following wellness trends.

In terms of the Walmart Partnership, the company expanded its CBD topicals to 827 Walmart WMT stores.

Charlotte’s Web launched CBD gummies in Canada, through a partnership with Tilray Brands, Inc. TLRY, leveraging local production and distribution.

Outlook

Despite a challenging regulatory environment, the company is positioning itself for long-term growth with new product categories and international expansions.

CWBHF Price Action

Charlotte’s Web’s shares traded 0.72% higher at 14 cents per share after the market close on Wednesday afternoon.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Eterna Therapeutics Regains Compliance with NASDAQ for Continued Listing

CAMBRIDGE, Mass., Nov. 14, 2024 (GLOBE NEWSWIRE) — Eterna Therapeutics Inc. ERNA (“Eterna” or the “Company”) announced today that it has regained compliance with Nasdaq for continued listing and that its stock will continue to trade on The Nasdaq Stock Market. Eterna received formal confirmation on November 12th, 2024 from Nasdaq’s Office of General Counsel, verifying that Eterna has met the market value of listed securities standard of at least $35 million, outlined in Listing Rule 5550(b)(2), and that Eterna is in compliance with all applicable continued listing standards.

“With this achievement and the recent updates we’ve announced, we have transformed our company into a debt-free, low burn rate, fully functional preclinical stage cell therapy company with clear, focused developmental activities and near-term inflection points,” said Sanjeev Luther, President and CEO of Eterna Therapeutics. “With this compliance milestone behind us, we can continue to be laser focused on advancing ERNA-101 for our lead programs in triple-negative breast cancer and platinum-resistant, TP53-mutant ovarian cancer. Our goal remains to bring new treatment options to cancer patients in need, and we are encouraged by the progress we have made thus far,” continued Mr. Luther.

About Eterna Therapeutics Inc.

Eterna Therapeutics is a publicly traded, preclinical-stage company focused on using cutting-edge tools to deliver highly innovative, effective, and safe off-the-shelf cell therapies for the treatment of advanced solid tumors, with an initial emphasis on triple-negative breast cancer (TNBC) and platinum-resistant, TP53-mutant ovarian cancer. The company is currently focused on advancing its lead product ERNA-101, an induced allogenic mesenchymal stem cell (“iMSC”) product, designed to selectively deliver the pro-inflammatory cytokines IL-7 and IL-15 to the tumor microenvironment (TME) in order to drive significant anti-tumor immunity. ERNA-101 is built on the company’s in-licensed core technology, which utilizes a best-in-class approach to engineer allogenic iPSCs to express genes of interest and to efficiently differentiate these cells into iMSCs. For more information, please visit https://www.eternatx.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, in some cases, can be identified by terms such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “could,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” “contemplate,” “project,” “target,” “objective,” or the negative version of these words and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Eterna’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by the forward-looking statements in this press release, including, without limitation, risks and uncertainties related to: Eterna’s ability to execute its business strategy as a preclinical stage company and advance its product candidate; the ability to bring new treatment options to cancer patients in need; progress made on its research programs; and the ability to reduce its operating expenses. Forward-looking statements are based upon Eterna’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. For a detailed description of Eterna’s risks and uncertainties, you are encouraged to review its documents filed with the SEC including its recent filings on Form 8-K, Form 10-K and Form 10-Q. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Eterna does not undertake any obligation to update the forward-looking statements contained herein to reflect events that occur or circumstances that exist after the date hereof, except as required by applicable law.

Investor Relations Contact:

investors@eternatx.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From Spectrum Brands Stock Ahead Of Q4 Earnings

Spectrum Brands Holdings, Inc. SPB will release earnings results for the fiscal fourth quarter, before the opening bell, on Friday, Nov. 15.

The Middleton, Wisconsin-based company projects to report quarterly revenue of $747.51 million, compared to $740.7 million a year earlier, according to data from Benzinga Pro.

On Aug. 8, Spectrum Brands reported better-than-expected third-quarter revenue results. Additionally, the company approved a $500 million share repurchase program.

With the recent buzz around Spectrum Brands ahead of quarterly earnings, some investors may be eyeing potential gains from the company’s dividends, too. Spectrum Brands currently offers an annual dividend yield of 1.79%. That’s a quarterly dividend amount of 42 cents per share ($1.68 a year).

To figure out how to earn $500 monthly from Spectrum Brands, we start with the yearly target of $6,000 ($500 x 12 months).

Next, we take this amount and divide it by Spectrum Brands’ $1.68 dividend: $6,000 / $1.68 = 3,571 shares.

So, an investor would need to own approximately $334,603 worth of Spectrum Brands, or 3,571 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $1.68 = 714 shares, or $66,902 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

Price Action: Shares of Spectrum Brands fell by 1.1% to close at $93.70 on Wednesday.

The company expects to report quarterly earnings at $1.07 per share. That’s down from $1.36 per share in the year-ago period.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Says Super Micro In 'Real Hot Water' As Stock Plunges 10% In Thursday Pre Market After Falling Nearly 60% This Week

Super Micro Computer Inc SMCI experienced a significant 10.33% decline in pre-market trading on Thursday, as per Benzinga Pro. The drop comes after the company announced it could not file its fiscal first-quarter 2025 Form 10-Q for the quarter ending Sep. 30, citing excessive effort and cost.

What Happened: The company is also required to file its 2024 Form 10-K for the fiscal year ending June 30. Concerns from its previous independent accounting firm prompted the Board of Directors to establish a Special Committee to investigate internal controls. Although the committee’s preliminary review is complete, additional time is required to finalize its work.

Jim Cramer commented on X, “SuperMicro is in real hot water with this delay.. [Don’t] know how they get out of this jam…”

Super Micro is in the process of selecting a new independent auditor following the resignation of Ernst & Young. The company needs more time to engage the new auditor and evaluate internal control effectiveness as of June 30, 2024. The quarterly report cannot be finalized until the annual report is completed and filed.

The company faces the risk of being delisted from Nasdaq, which could lead to early repayment of up to $1.72 billion in convertible bonds. Super Micro anticipates first-quarter revenue between $5.9 billion and $6 billion, with adjusted EPS of 75-76 cents.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.