FitLife Brands Announces Third Quarter 2024 Results

Omaha, Nov. 14, 2024 (GLOBE NEWSWIRE) — FitLife Brands, Inc. (“FitLife” or the “Company“) FTLF, a provider of innovative and proprietary nutritional supplements and wellness products, today announced financial results for the third quarter ended September 30, 2024.

Highlights for the third quarter ended September 30, 2024 include:

- Total revenue was $16.0 million, an increase of 15% compared to the third quarter of 2023.

- Online sales were $10.8 million, representing 68% of total revenue and an increase of 14% compared to the third quarter of 2023.

- Gross margin was 43.8% compared to 41.0% during the third quarter of 2023.

- Net income was $2.1 million compared to $1.7 million during the third quarter of 2023.

- Basic earnings per share and diluted earnings per share were $0.46 and $0.43, respectively, compared to $0.38 and $0.35 during the third quarter of 2023.

- Adjusted EBITDA was $3.6 million, a 41% increase compared to the third quarter of 2023.

- The Company ended the quarter with $14.3 million outstanding on its term loans and cash of $4.7 million, or total net debt of $9.5 million.

For the third quarter ended September 30, 2024, total revenue was $16.0 million, an increase of 15% compared to $13.9 million during the same period last year. Online revenue for the quarter was $10.8 million, an increase of 14% compared to the quarter ended September 30, 2023. Online revenue accounted for 68% of the Company’s total revenue during the quarters ended September 30, 2024 and 2023.

Wholesale revenue for the quarter ended September 30, 2024 was $5.2 million, an increase of 16% compared to the same period last year. The Company’s recent acquisitions of Mimi’s Rock Corp (“MRC“) and the MusclePharm assets contributed $1.3 million of wholesale revenue during the third quarter of 2024, while Legacy FitLife wholesale revenue was down $0.5 million, or 12%, compared to the same period last year.

Gross margin for the quarter ended September 30, 2024 was 43.8% compared to 41.0% during the same period in the prior year.

Net income for the third quarter of 2024 was $2.1 million compared to $1.7 million during the quarter ended September 30, 2023. Basic and diluted earnings per share were $0.46 and $0.43 respectively, compared to $0.38 and $0.35 during the third quarter of 2023.

Adjusted EBITDA for the quarter ended September 30, 2024 was $3.6 million, an increase of 41% compared to the same period in 2023. Adjusted EBITDA for the last twelve months, which includes four full quarters of MRC’s financial performance but approximately only three and a half quarters of MusclePharm, was $13.4 million.

As of September 30, 2024, the Company had $14.3 million outstanding on its term loans and cash of $4.7 million, or total net debt of approximately $9.5 million. The Company’s $3.5 million revolving line of credit remains undrawn.

Performance of Acquired Brands

Management frequently receives questions from investors regarding the performance of brands subsequent to their acquisition by the Company. In an effort to be responsive to these questions, the Company has provided additional disclosure in this press release and in the Management’s Discussion and Analysis section of the Company’s Form 10-Q filed with the SEC. The Company currently intends to provide this level of disclosure for no more than two years following a transaction, after which the performance of acquired brands will be reported as part of Legacy FitLife results.

One of the primary metrics used by management to evaluate the performance of the Company’s brands is contribution, a non-GAAP financial measure which management defines as gross profit less advertising and marketing expenditures. Other companies may also report contribution as a performance metric, but their definition or calculation of contribution may differ from the Company’s. Management believes that contribution, as defined by the Company, is a particularly relevant performance metric since it incorporates the gross profit associated with a specific brand or collection of brands as well as the advertising and marketing expenditures associated with the same brand or brands. With limited exceptions, other operating expenses incurred by the Company are generally not allocable to a specific brand or collection of brands.

Other than for MusclePharm, the numbers in the contribution tables presented below in the body of the press release represent the performance of a collection of brands. Legacy FitLife consists of nine brands and MRC consists of three brands. These collections of brands do not meet the definition of operating segments and are not managed as such.

| Legacy FitLife | |||||||||||

| (Unaudited) | |||||||||||

| 2023 | 2024 | ||||||||||

| Q3 | Q4 | Q1 | Q2 | Q3 | |||||||

| Wholesale revenue | 4,361 | 4,011 | 4,506 | 4,224 | 3,859 | ||||||

| Online revenue | 2,339 | 2,134 | 2,455 | 2,578 | 2,443 | ||||||

| Total revenue | 6,700 | 6,145 | 6,961 | 6,802 | 6,302 | ||||||

| Gross profit | 2,490 | 2,480 | 2,928 | 3,006 | 2,684 | ||||||

| Gross margin | 37.2 | % | 40.4 | % | 42.1 | % | 44.2 | % | 42.6 | % | |

| Advertising and marketing | 79 | 71 | 80 | 94 | 70 | ||||||

| Contribution | 2,411 | 2,409 | 2,848 | 2,912 | 2,614 | ||||||

| Contribution as a % of revenue | 36.0 | % | 39.2 | % | 40.9 | % | 42.8 | % | 41.5 | % | |

For the third quarter of 2024, Legacy FitLife revenue declined 6% compared to the same period last year, driven by a 12% decline in wholesale revenue partially offset by 4% increase in online revenue.

Despite the revenue decline, gross profit and contribution for Legacy FitLife increased by 8% compared to the same period last year. Gross margin increased from 37.2% during the third quarter of 2023 to 42.6% during the third quarter of 2024. Contribution as a percentage of revenue increased from 36.0% to 41.5% over the same time period.

The Company’s wholesale revenue continues to be challenged by declining customer counts in the brick-and-mortar stores of our wholesale partners. However, at least some of the customers choosing to no longer shop in brick-and-mortar locations continue to purchase Legacy FitLife products online, and when a customer buys online the Company earns higher gross profit and contribution.

| Mimi’s Rock (MRC) | ||||||||||||

| (Unaudited) | ||||||||||||

| 2023 | 2024 | |||||||||||

| Q3 | Q4 | Q1 | Q2 | Q3 | ||||||||

| Wholesale revenue | 85 | 91 | 94 | 90 | 71 | |||||||

| Online revenue | 7,117 | 6,811 | 7,399 | 7,371 | 7,139 | |||||||

| Total revenue | 7,202 | 6,902 | 7,493 | 7,461 | 7,210 | |||||||

| Gross profit | 3,206 | 2,790 | 3,520 | 3,597 | 3,441 | |||||||

| Gross margin | 44.5 | % | 40.4 | % | 47.0 | % | 48.2 | % | 47.7 | % | ||

| Advertising and marketing | 1,196 | 846 | 1,062 | 1,071 | 929 | |||||||

| Contribution | 2,010 | 1,944 | 2,458 | 2,526 | 2,512 | |||||||

| Contribution as % of revenue | 27.9 | % | 28.2 | % | 32.8 | % | 33.9 | % | 34.8 | % | ||

For the third quarter of 2024, MRC revenue was approximately flat compared to the same period in 2023. Over the same time period, despite minimal growth in total revenue, gross profit increased 7% and contribution increased 25%. For the third quarter of 2024, gross margin increased to 47.7% from 44.5% last year.

Revenue for the largest MRC brand—Dr. Tobias—increased 6% while revenue for the skin care brands—Maritime Naturals and All Natural Advice—declined 33% in the third quarter of 2024 compared to the same period in 2023.

At the time of the MRC acquisition in 2023, the skin care brands were sold in a number of countries. Analysis subsequent to the acquisition determined that—in almost all countries other than Canada and the US—the products were being sold at levels resulting in negative contribution. Even worse, in many of those countries, the products were being sold at negative gross margins.

To optimize performance of the skin care brands, management exited a number of countries and raised prices in other countries. As a result of these changes, a substantial amount of unprofitable revenue was eliminated.

The substantial year-over-year increase in contribution for the MRC brands is a function of the optimization of the skin care brands, beneficial product mix within the Dr. Tobias brand, as well as the optimization of advertising spend across all MRC brands.

| MusclePharm | |||||||||||

| (Unaudited) | |||||||||||

| 2023 | 2024 | ||||||||||

| Q3 | Q4 | Q1 | Q2 | Q3 | |||||||

| Wholesale revenue | – | 180 | 1,117 | 1,388 | 1,231 | ||||||

| Online revenue | – | 73 | 978 | 1,279 | 1,234 | ||||||

| Total revenue | – | 253 | 2,095 | 2,667 | 2,465 | ||||||

| Gross profit | – | 93 | 839 | 977 | 876 | ||||||

| Gross margin | – | 36.8 | % | 40.0 | % | 36.6 | % | 35.5 | % | ||

| Advertising and marketing | – | – | 86 | 161 | 94 | ||||||

| Contribution | – | 93 | 753 | 816 | 782 | ||||||

| Contribution as % of revenue | – | 36.8 | % | 35.9 | % | 30.6 | % | 31.7 | % | ||

MusclePharm revenue decreased 8% sequentially from the second quarter of 2024 to the third quarter of 2024, with wholesale revenue decreasing 11% and online revenue decreasing 4%. Lower revenue during the quarter is partially due to the normal seasonality of sales in the second half of the year. In addition, some significant wholesale orders slipped into October and, as a result, monthly revenue for MusclePharm in October was the highest it has been since the Company acquired the MusclePharm assets.

The Company has also made significant progress with new wholesale partners. Subsequent to the end of the third quarter, the Company secured placement for MusclePharm’s Combat Sport protein bars in several regional grocery and convenience chains. The Company also signed an agreement to license the MusclePharm brand to a manufacturer in Israel.

Additionally, the Company is in the process of launching the new MusclePharm Pro Series, a collection of premium sports nutrition products. The Pro Series, consisting initially of 9 SKUs, will be launched in a two-month pilot in high-volume Vitamin Shoppe stores (consisting of approximately 60% of Vitamin Shoppe’s nationwide store base) during the first quarter of 2025. If the pilot effort is successful, the Pro Series is anticipated to be added to the assortment in all Vitamin Shoppe stores and will be exclusive to Vitamin Shoppe for a period of 12 months.

As part of these and other efforts to drive revenue growth, the Company is making targeted investments in advertising and promotion for the MusclePharm brand in both the wholesale and online channels. As a result of these investments, gross margin and contribution margin as a percent of revenue may fluctuate from quarter to quarter.

| FitLife Consolidated | ||||||||||||

| (Unaudited) | ||||||||||||

| 2023 | 2024 | |||||||||||

| Q3 | Q4 | Q1 | Q2 | Q3 | ||||||||

| Wholesale revenue | 4,446 | 4,282 | 5,717 | 5,702 | 5,161 | |||||||

| Online revenue | 9,456 | 9,018 | 10,832 | 11,228 | 10,816 | |||||||

| Total revenue | 13,902 | 13,300 | 16,549 | 16,930 | 15,977 | |||||||

| Gross profit | 5,696 | 5,363 | 7,287 | 7,580 | 7,001 | |||||||

| Gross margin | 41.0 | % | 40.3 | % | 44.0 | % | 44.8 | % | 43.8 | % | ||

| Advertising and marketing | 1,275 | 917 | 1,228 | 1,326 | 1,093 | |||||||

| Contribution | 4,421 | 4,446 | 6,059 | 6,254 | 5,908 | |||||||

| Contribution as % of revenue | 31.8 | % | 33.4 | % | 36.6 | % | 36.9 | % | 37.0 | % | ||

For the Company overall, revenue increased 15%, gross profit increased 23%, and contribution increased 34% compared to the third quarter of 2023. Gross margin increased to 43.8% compared to 41.0% during the third quarter of last year. Contribution as a percentage of revenue increased to 37.0% compared to 31.8% during the third quarter of last year.

Management Commentary

Dayton Judd, the Company’s Chairman and CEO commented, “I am pleased with the Company’s continued strong performance. At MRC, the Dr. Tobias brand—which represents just over 90% of the MRC business—continued to grow despite significant year-over-year reductions in advertising and marketing spend. And although revenue for MRC’s skin care brands has declined significantly due to our decision to exit unprofitable markets and raise prices in others, the brands are substantially more profitable. The MRC brands’ collective contribution of approximately $9.4 million over the last twelve months compares very favorably to the $17.1 million acquisition price the Company paid for MRC.

“For the past couple of years following the COVID pandemic, we have experienced declining sales of our products through brick-and-mortar retailers, primarily due to store closures and declining foot traffic. For the first eight months of 2024, the year-over-year percentage declines in retail sales of FitLife products were in the low double digits. We are encouraged that the rate of decline has improved sequentially in each month over the past four months, with year-over-year declines now in the single digits. Also, as a reminder, the profit impact of wholesale declines for our Legacy FitLife brands are largely offset by the continued growth in high-margin online sales of those products.

“With regard to MusclePharm, we are encouraged by the recent wins we have had for the MusclePharm Combat Sport bars and the new MusclePharm Pro Series, and we remain engaged with a number of other prospective customers as we seek to continue to grow the brand.

“Overall, I am pleased with the strong performance of our brands, which would not be possible without the continued dedication of each FitLife team member. The Company’s balance sheet is strong, with net debt now representing approximately only 0.7x adjusted LTM EBITDA. During 2023, we borrowed $22.5 million to help fund the purchase of MRC and the MusclePharm assets. As of the end of the third quarter of 2024, we had repaid $8.25 million of those borrowings, and on a net debt basis only $9.5 million remains outstanding. The Company continues to evaluate potential M&A opportunities with a specific focus on accretive, non-dilutive transactions.”

Earnings Conference Call

The Company will hold an investor conference call on Thursday, November 14, 2024 at 4:30 pm ET. Investors interested in participating in the live call can dial (833) 492-0064 from the U.S. and provide the conference identification code of 683771. International participants can dial (973) 528-0163 and provide the same code.

About FitLife Brands

FitLife Brands is a developer and marketer of innovative and proprietary nutritional supplements and wellness products for health-conscious consumers. FitLife markets more than 250 different products primarily online, but also through domestic and international GNC® franchise locations as well as through various other retail locations. FitLife is headquartered in Omaha, Nebraska. For more information, please visit our website at www.fitlifebrands.com.

Forward-Looking Statements

Statements in this release that are forward looking involve known and unknown risks and uncertainties, which may cause the Company’s actual results in future periods to be materially different from any future performance that may be suggested in this news release. Such factors may include, but are not limited to, the ability of the Company to continue to grow revenue, and the Company’s ability to continue to achieve positive cash flow given the Company’s existing and anticipated operating and other costs. Many of these risks and uncertainties are beyond the Company’s control. Reference is made to the discussion of risk factors detailed in the Company’s filings with the Securities and Exchange Commission including its reports on Form 10-K and 10-Q. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

FITLIFE BRANDS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

| September 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| ASSETS: | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 4,664 | $ | 1,139 | ||||

| Restricted cash | 56 | 759 | ||||||

| Accounts receivable, net of allowance of doubtful accounts of $19 and $17, respectively | 2,008 | 2,046 | ||||||

| Inventories, net of allowance for obsolescence of $86 and $162, respectively | 10,371 | 9,091 | ||||||

| Sales tax receivable | 58 | 1,019 | ||||||

| Prepaid expense and other current assets | 942 | 639 | ||||||

| Total current assets | 18,099 | 14,693 | ||||||

| Property and equipment, net | 91 | 137 | ||||||

| Right of use asset | 431 | 121 | ||||||

| Intangibles, net of amortization of $143 and $113, respectively | 26,314 | 26,309 | ||||||

| Goodwill | 13,130 | 13,294 | ||||||

| Deferred tax asset | 522 | 792 | ||||||

| TOTAL ASSETS | $ | 58,587 | $ | 55,346 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable | $ | 4,078 | $ | 3,261 | ||||

| Accrued expense and other liabilities | 957 | 1,026 | ||||||

| Income taxes payable | 1,861 | 892 | ||||||

| Product returns | 570 | 571 | ||||||

| Term loan – current portion | 4,500 | 4,500 | ||||||

| Lease liability – current portion | 89 | 87 | ||||||

| Total current liabilities | 12,055 | 10,337 | ||||||

| Term loan, net of current portion and unamortized deferred finance costs | 9,664 | 15,509 | ||||||

| Long-term lease liability, net of current portion | 352 | 51 | ||||||

| Deferred tax liability | 2,358 | 2,413 | ||||||

| TOTAL LIABILITIES | 24,429 | 28,310 | ||||||

| STOCKHOLDERS’ EQUITY: | ||||||||

| Preferred stock, $0.01 par value, 10,000 shares authorized, none outstanding as of September 30, 2024 and December 31, 2023 |

– | – | ||||||

| Common stock, $0.01 par value, 60,000 shares authorized; 4,598 issued and outstanding as of September 30, 2024 and December 31, 2023 | 46 | 46 | ||||||

| Additional paid-in capital | 31,043 | 30,699 | ||||||

| Retained earnings (accumulated deficit) | 3,497 | (3,417 | ) | |||||

| Foreign currency translation adjustment | (428 | ) | (292 | ) | ||||

| TOTAL STOCKHOLDERS’ EQUITY | 34,158 | 27,036 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 58,587 | $ | 55,346 | ||||

FITLIFE BRANDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

(In thousands, except per share data)

(Unaudited)

| Three months ended September 30 | Nine months ended September 30 | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | $ | 15,977 | $ | 13,902 | $ | 49,456 | $ | 39,401 | ||||||||

| Cost of goods sold | 8,976 | 8,206 | 27,588 | 23,332 | ||||||||||||

| Gross profit | 7,001 | 5,696 | 21,868 | 16,069 | ||||||||||||

| OPERATING EXPENSE: | ||||||||||||||||

| Advertising and marketing | 1,093 | 1,275 | 3,647 | 3,359 | ||||||||||||

| Selling, general and administrative | 2,645 | 1,897 | 7,681 | 5,399 | ||||||||||||

| Merger and acquisition related | 59 | 32 | 217 | 1,519 | ||||||||||||

| Depreciation and amortization | 22 | 22 | 85 | 64 | ||||||||||||

| Total operating expense | 3,819 | 3,226 | 11,630 | 10,341 | ||||||||||||

| OPERATING INCOME | 3,182 | 2,470 | 10,238 | 5,728 | ||||||||||||

| OTHER EXPENSE (INCOME) | ||||||||||||||||

| Interest income | (19 | ) | (119 | ) | (41 | ) | (269 | ) | ||||||||

| Interest expense | 326 | 249 | 1,085 | 598 | ||||||||||||

| Foreign exchange (gain) loss | (21 | ) | 210 | (26 | ) | 93 | ||||||||||

| Total other expense (income) | 286 | 340 | 1,018 | 422 | ||||||||||||

| INCOME BEFORE INCOME TAX PROVISION | 2,896 | 2,130 | 9,220 | 5,306 | ||||||||||||

| PROVISION FOR INCOME TAXES | 770 | 434 | 2,306 | 1,490 | ||||||||||||

| NET INCOME | $ | 2,126 | $ | 1,696 | $ | 6,914 | $ | 3,816 | ||||||||

| NET INCOME PER SHARE | ||||||||||||||||

| Basic | $ | 0.46 | $ | 0.38 | $ | 1.50 | $ | 0.86 | ||||||||

| Diluted | $ | 0.43 | $ | 0.35 | $ | 1.40 | $ | 0.78 | ||||||||

| Basic weighted average common shares | 4,598 | 4,446 | 4,598 | 4,458 | ||||||||||||

| Diluted weighted average common shares | 4,965 | 4,891 | 4,943 | 4,901 | ||||||||||||

FITLIFE BRANDS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

(In thousands)

(Unaudited)

| Nine months ended September 30, | ||||||||

| 2024 | 2023 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income | $ | 6,914 | $ | 3,816 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 85 | 64 | ||||||

| Allowance for doubtful accounts | 2 | (17 | ) | |||||

| Allowance for inventory obsolescence | (76 | ) | 35 | |||||

| Stock-based compensation | 344 | 94 | ||||||

| Amortization of deferred financing costs | 31 | 8 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable – trade | 18 | (498 | ) | |||||

| Inventories | (1,223 | ) | 2,534 | |||||

| Deferred tax asset | 270 | 709 | ||||||

| Prepaid expense, other current assets and sales tax receivable | 793 | (471 | ) | |||||

| Right-of-use assets | 72 | 60 | ||||||

| Accounts payable | 827 | (3,570 | ) | |||||

| Lease liability | (82 | ) | (60 | ) | ||||

| Accrued expense, other liabilities and income taxes payable | 680 | 71 | ||||||

| Product returns | (2 | ) | (3 | ) | ||||

| Net cash provided by operating activities | 8,653 | 2,772 | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of property and equipment | (10 | ) | (60 | ) | ||||

| Cash paid for acquisition of Mimi’s Rock Corp. | – | (17,099 | ) | |||||

| Cash deposit paid for the acquisition of MusclePharm assets | – | (1,825 | ) | |||||

| Net cash used in investing activities | (10 | ) | (18,984 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Borrowings on term loans | – | 12,500 | ||||||

| Payments on term loans | (5,875 | ) | (1,250 | ) | ||||

| Net cash provided by (used in) financing activities | (5,875 | ) | 11,250 | |||||

| Foreign currency impact on cash | 54 | (3 | ) | |||||

| CHANGE IN CASH AND RESTRICTED CASH | 2,822 | (4,965 | ) | |||||

| CASH AND RESTRICTED CASH, BEGINNING OF PERIOD | 1,898 | 13,277 | ||||||

| CASH AND RESTRICTED CASH, END OF PERIOD | $ | 4,720 | $ | 8,312 | ||||

| Supplemental cash flow disclosure | $ | 1,105 | $ | 593 | ||||

| Cash paid for income taxes | $ | 1,083 | $ | 475 | ||||

| Cash paid for interest, net of amounts capitalized | ||||||||

Non-GAAP Financial Measures

The financial information included in this release and the presentation below contain certain financial measures defined as “non-GAAP financial measures” by the SEC, including non-GAAP EBITDA and non-GAAP adjusted EBITDA. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP.

As presented below, non-GAAP EBITDA excludes interest, foreign currency gain/loss, income taxes, depreciation and amortization. Adjusted non-GAAP EBITDA excludes, in addition to interest, foreign currency gain/loss, taxes, depreciation and amortization, equity-based compensation, M&A/integration expense, restructuring and non-recurring gains or losses. The Company believes the non-GAAP measures provide useful information to both management and investors by excluding certain expense and other items that may not be indicative of its core operating results and business outlook. The Company believes that the inclusion of non-GAAP measures in the financial presentation below allows investors to compare the Company’s financial results with the Company’s historical financial results and is an important measure of the Company’s comparative financial performance.

The Company’s calculation of Adjusted EBITDA for the three and nine months ended September 30, 2024 and 2023 is as follows:

| For the three months ended September 30, |

For the nine months ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Net income | $ | 2,126 | $ | 1,696 | $ | 6,914 | $ | 3,816 | ||||||||

| Interest expense | 326 | 249 | 1,085 | 598 | ||||||||||||

| Interest income | (19 | ) | (119 | ) | (41 | ) | (269 | ) | ||||||||

| Foreign exchange (gain) loss | (21 | ) | 210 | (26 | ) | 93 | ||||||||||

| Provision for income taxes | 770 | 434 | 2,306 | 1,490 | ||||||||||||

| Depreciation and amortization | 22 | 22 | 85 | 64 | ||||||||||||

| EBITDA | 3,204 | 2,492 | 10,323 | 5,792 | ||||||||||||

| Non-cash and non-recurring adjustments | ||||||||||||||||

| Stock-based compensation | 141 | 21 | 344 | 94 | ||||||||||||

| Merger and acquisition related | 59 | 32 | 217 | 1,519 | ||||||||||||

| Restructuring costs | 184 | – | 184 | – | ||||||||||||

| Amortization of inventory step-up | – | – | – | 323 | ||||||||||||

| Non-recurring loss on foreign currency forward contract | – | – | – | 112 | ||||||||||||

| Adjusted EBITDA | $ | 3,588 | $ | 2,545 | $ | 11,068 | $ | 7,840 | ||||||||

investor@fitlifebrands.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street's Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks With Over 4% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the communication services sector.

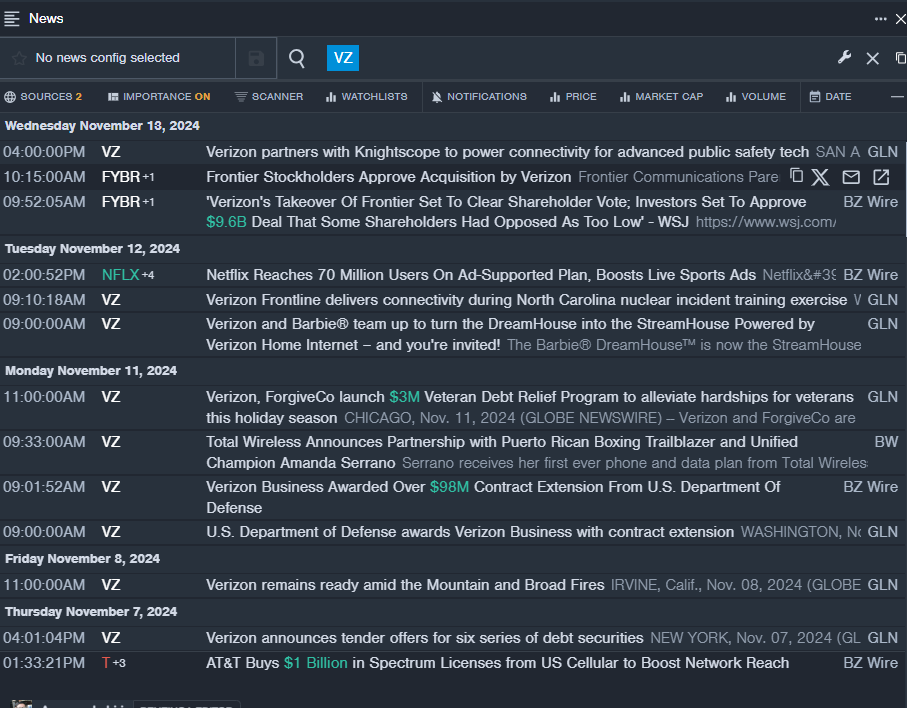

Verizon Communications Inc. VZ

- Dividend Yield: 6.59%

- Scotiabank analyst Maher Yaghi maintained a Sector Perform rating and cut the price target from $47.25 to $47 on Oct. 23. This analyst has an accuracy rate of 71%.

- UBS analyst John Hodulik maintained a Neutral rating and raised the price target from $43 to $44 on Oct. 23. This analyst has an accuracy rate of 73%.

- Recent News: Frontier Communications Parent, Inc. FYBR announced that its stockholders approved the acquisition by Verizon at its special meeting held on Nov. 13.

- Benzinga Pro’s real-time newsfeed alerted to latest VZ news.

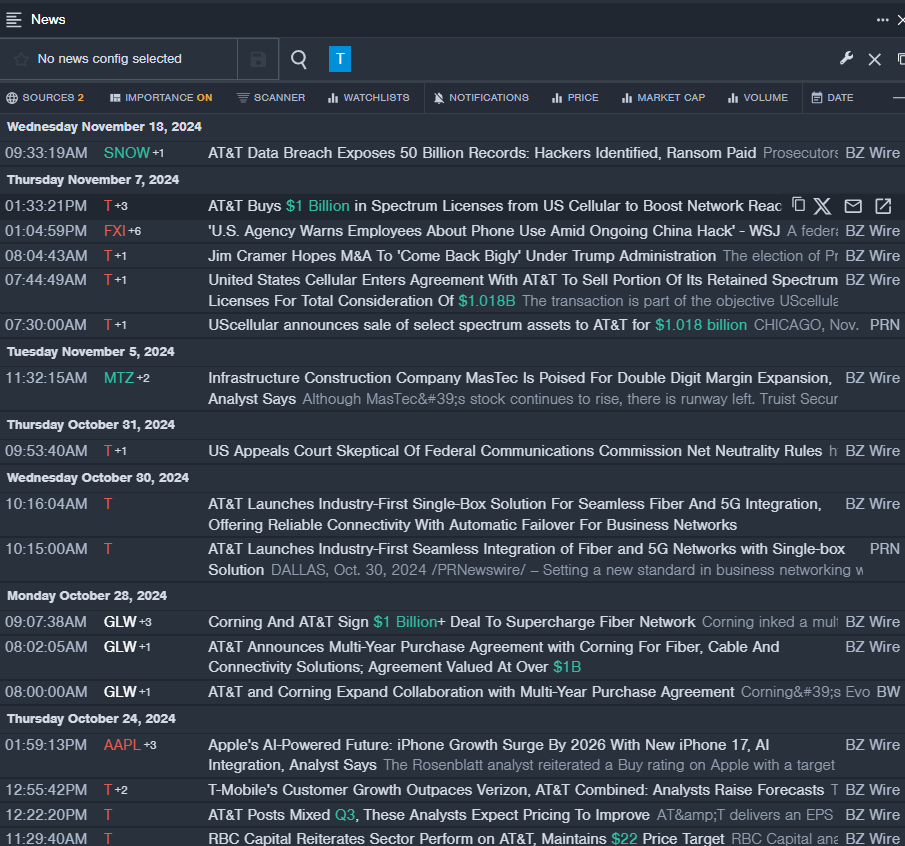

AT&T Inc. T

- Dividend Yield: 4.98%

- Wells Fargo analyst Eric Luebchow maintained an Overweight rating and cut the price target from $25 to $24 on Oct. 24. This analyst has an accuracy rate of 69%.

- Tigress Financial analyst Ivan Feinseth maintained a Buy rating and raised the price target from $29 to $30 on Sept. 27. This analyst has an accuracy rate of 69%.

- Recent News: On Nov. 7, United States Cellular Corp USM agreed with AT&T to sell a portion of its retained spectrum licenses for $1.018 billion.

- Benzinga Pro’s real-time newsfeed alerted to latest T news.

Nexstar Media Group, Inc. NXST

- Dividend Yield: 4.07%

- Barrington Research analyst James Goss maintained an Outperform rating with a price target of $200 on Oct. 12. This analyst has an accuracy rate of 65%.

- Benchmark analyst Daniel Kurnos reiterated a Buy rating with a price target of $215 on Oct. 8. This analyst has an accuracy rate of 76%.

- Recent News: On Nov. 13, the company appointed Bill Sammon as Senior Vice President of Washington, D.C., Editorial Content for The Hill and NewsNation.

- Benzinga Pro’s charting tool helped identify the trend in NXST stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Upper Airway Stimulation Market is Projected to Reach a US$ 2,050.6 Million with 12.3% CAGR by 2034 | Fact.MR Report

Rockville, MD, Nov. 14, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global upper airway stimulation market is estimated to reach a valuation of US$ 642.8 million in 2024 and is expected to grow at a CAGR of 12.3% during the forecast period of (2024 to 2034).

The global upper airway stimulation market is positioned for growth over the next ten years, driven by heightened demand for advanced treatments in managing sleep apnea. UAS therapy in particular is considered for those OSA patients intolerant of CPAP devices and has been gaining momentum as a far safer and more effective alternative. Key market players are leveraging technological advancements, FDA approvals, and partnerships to expand their portfolios and increase market reach.

According to recent market reports, the market was estimated to grow at a CAGR of 12.3% from 2024 to 2034 and thus reach billions of dollars in revenue in the future. Recent market developments have played an important role in this upward trend. Advanced implantable hypoglossal nerve stimulators have given OSA treatment a whole new look. The leading companies, such as Inspire Medical Systems, have been at the leading edge in offering surgically implanted devices for stimulating the hypoglossal nerve.

These improve airway muscle tone and reduce obstruction of the airways during sleep. Results from these devices are remarkable, as evidenced in long-term patient studies aimed at improving the quality of sleep and overall well-being. The invention focuses on patients who have failed CPAP therapy and will, therefore, provide a high unmet need in the OSA treatment space.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10413

Another driver fuelling the market is the increasing number of FDA approvals for next-generation devices to cater to less invasive solutions with improved safety and efficacy profiles. In the recent context, Inspire Medical Systems recently received FDA approval for a new version of its UAS system in July 2023, aimed at advancing treatment flexibility and patient comfort. The further interest from healthcare providers, sleep centers, and other end users leads to greater adoption of UAS devices in hospitals and clinics across the world.

Furthermore, the growing prevalence of sleep apnea among the adult population across the globe is one of the major growth factors. The study by NCOA (The National Council of Ageing), estimates that 936 Mn elder individuals suffer from mild to severe obstructive sleep apnea disorder in the world.

It is expected that this continuously growing patient pool, combined with rising awareness and demand for actual curative treatments, will drive the adoption of the UAS technology. Geographical expansion, particularly toward North America, Europe, and the Asia-Pacific region, is thereby in great focus among the market players, on grounds of an increase in healthcare expenditure and rising diagnosis rates of the disease.

On the other hand, there are certain challenges the market has to confront – represented by the high cost of treatment and the associated strict regulatory approval process. Despite all such barriers, collaborations between medical device companies and healthcare providers are aimed at making such therapies accessible and more affordable to a wider patient demographic.

Key Takeaways from the Market Study:

- The global upper airway stimulation market is projected to grow at 12.3% CAGR and reach US$ 2,050.6 million by 2034

- The market created an opportunity of US$ 192.7 million growing at a CAGR of 10.8% between 2019 to 2023

- North America is a prominent region that is estimated to hold a market share of 38.1% in 2034

- Predominating market players include Inspire Medical Systems, Respicardia, Inc., and Medtronic Plc among others.

- Obstructive sleep apnea (OSA) under indication type is estimated to grow at a CAGR of 11.9% creating an absolute $ opportunity of US$ 1,047.9 million between 2024 and 2034

“Looking ahead, collaboration and partnerships among leading players and service providers will boost product adoption and personalized treatment,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Upper Airway Stimulation Market:

Inspire Medical Systems; Respicardia, Inc.; Medtronic Plc; LinguaFlex LLC; Siesta Medical, Inc.; Pillar Palatal LLC / The Snoring Center; Nyxoah SA; LivaNova/ImThera; Other Prominent Players

Market Development:

Going ahead, key market participants have set ambitious and measurable goals to ensure further growth. The leading players have started to focus on underdeveloped and developing markets where there is a lack of awareness and possible opportunities for the market to grow. Companies are targeting product development and government initiatives in regulatory approvals in these regions, coupled with alliances with local healthcare providers aimed at improving device penetration.

Another measurable goal is the market share acquisition through new product development and launch as well as enhancement of the existing UAS systems. It involves the development and commercialization of minimally invasive therapies that treat a broader patient pool. For example, Inspire Medical Systems develops new generations of its products, which are less invasive, less procedural complications, and less recovery time suitable for patients and physicians.

Further, market-leading companies also focused on strategic partnerships with various hospitals and sleep centers to ensure product adoption rates in end users. It aims to equip additional healthcare providers by offering UAS therapy through a broad-based training and support program, which will further expand hospital adoption rates by 10% by the year 2028. This also covers access to ambulatory surgical centers and home care settings.

There have been several technological advances in the industry that are reordering the competition dynamics. Recently, the FDA approved Inspire Medical System’s next-generation UAS device. The newer version of the UAS device (hypoglossal nerve stimulator) offers flexibility and increased patient control which is therefore much easier for a medical professional to make personalized adjustments for each particular case. With such development, a company would accordingly increase its market share, hence the revenue.

Besides technological innovation, partnerships among manufacturers of the devices and healthcare providers are driving critical roles in increasing adoption rates. Beyond 2023, additional product launches are expected in the UAS market by key players. The development of UAS devices integrated into digital health platforms for real-time monitoring further drives patient engagement and compliance, forming part of the digital transformation trend across healthcare and creating opportunities for growth and innovation within sleep apnea treatment.

The global upper airway stimulation market finds itself at an interesting juncture-one with growing demand for non-CPAP therapies coupled with technological advancement and new product pipelines. The setting of clear, quantifiable goals by the leading players in the market has set the stage for robust growth and expansion, making UAS therapy a cornerstone for the future management of sleep apnea.

Upper Airway Stimulation Industry News:

- The FDA approved LivaNova’s OSA (Obstructive Sleep Apnoea) experimental device in June 2021.

- The FDA approved Inspire Medical Systems’ next-generation Inspire V therapy system, which targets moderate to severe OSA, in August 2024.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10413

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global upper airway stimulation market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of the product type (implantable devices, external stimulation devices), patient demographics (pediatrics, and adults), indication (obstructive sleep apnea (OSA), and central sleep apnea (CSA), end-user (hospitals, sleep centers & clinics, ambulatory surgical centers, and home care settings) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Checkout More Related Studies Published by Fact.MR Research:

Pelvic Floor Electrical Stimulation Devices Market: The global pelvic floor electrical stimulation devices market is reflecting strong growth, particularly due to the widespread prevalence of health issues such as urinary incontinence and sexual dysfunction, coupled with awareness initiatives taken by governments and healthcare organizations towards non-surgical solutions for these issues.

Electrical Stimulation Devices Market: As per a new Fact.MR analysis, the global electrical stimulation devices are anticipated to increase at a noteworthy CAGR of 8% from 2022 to 2027. At present, the global electrical stimulation devices market is valued at US$ 7.5 billion and is projected to reach a market size of US$ 11 billion by 2027.

Continuous Positive Airway Pressure (CPAP) Device Market: The global continuous positive airway pressure (CPAP) device market size is estimated to be US$ 3,969.5 million in 2024. The global demand for CPAP devices is projected to surge at a 6.3% CAGR, reaching a market valuation of US$ 7,286.3 million by 2034.

Implantable Medical Devices Market: The global implantable medical devices market size currently accounts for a valuation of US$ 115 billion and is anticipated to reach US$ 155 billion by the end of 2027. Worldwide sales of implantable medical devices are forecasted to magnify at a CAGR of 6.1% from 2022 to 2027.

MRI Safe Implantable Defibrillator Devices Market: The global MRI safe implantable defibrillator devices market is set to enjoy a valuation of US$ 890 million in 2022 and further expand at a CAGR of 6.7% to reach US$ 1.7 billion by 2032-end.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gold Drops To A Two-Month Low As Investors Turn To Bitcoin After Trump's Victory, But This Economist Remains Confident That 'Gold Will Surge'

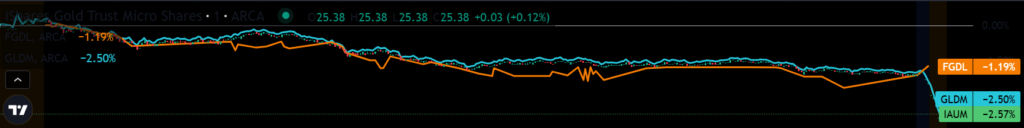

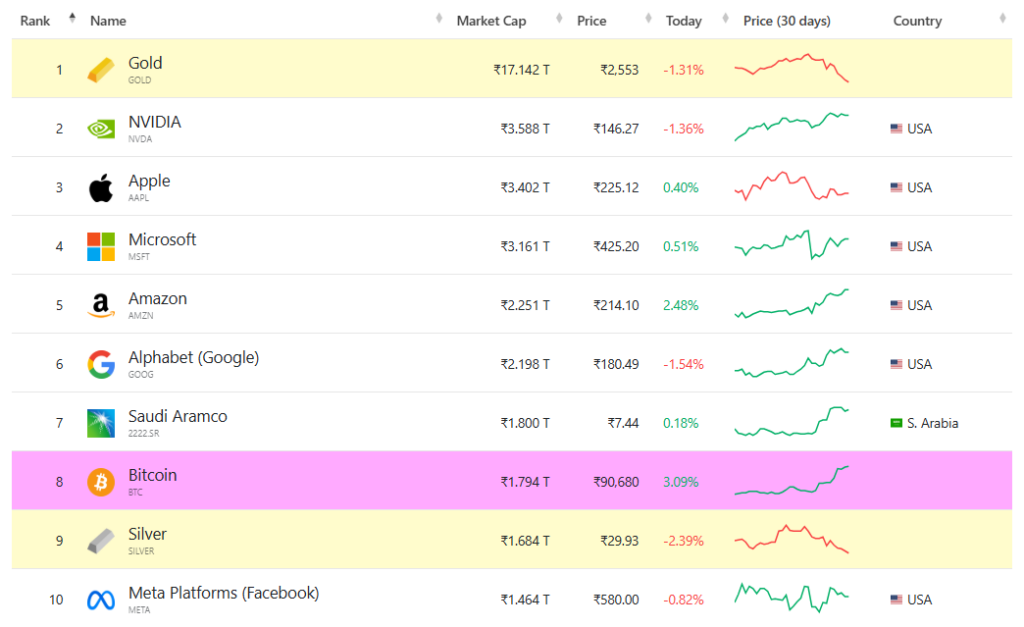

Even after the U.S. headline and core consumer price inflation rose in the month of October, the Gold spot XAU prices fell to a two-month low and have been hovering in the same range. Key ETFs that track gold, have also taken a beating.

This comes amid a rise in Bitcoin‘s BTC/USD prices which is currently trading at above $90,000 a coin after President-elect Donald Trump‘s victory.

Also read: Peter Schiff: US Bitcoin Reserve Could ‘Destroy Dollar,’ Predicts It’s ‘Highly Unlikely’ To Happen

What Happened: Gold spot prices were trading at $2,547.42 per ounce, as of 6:06 a.m. EST, which is the lowest since Sept. 11. Even though bullion is used to hedge inflation the prices of gold hovered around the two-month low levels despite the increase in the U.S. headline and core CPI data. The prices declined nearly 8% from the record high that it scaled on Oct. 31. The surge in the U.S. dollar also weighed on the precious yellow metal.

Prominent Gold ETFs have also declined as the gold spot prices have fallen. According to Benzinga Pro, Franklin Responsibility Sourced Gold ETF FGDL declined by 1.19%, whereas the SPDR Gold MiniShares Trust GLDM was down by 2.5%. Also, iShares Gold Trust Micro Shares IAUM declined by 2.57% as of 6:06 a.m. EST.

Economist Peter Schiff, however, continues to be bullish on gold because he thinks CPI will surge as used car prices in the U.S. will start falling and the Federal Reserve won’t hike rates again.

“Rising bond yields and sticky inflation continue to weigh on gold. Traders believe this combination is bearish for gold as it will sideline future rate cuts. The problem is that CPI numbers will soon surge as used car prices stop falling. The Fed won’t hike. Gold will surge.”

Simultaneously, Bitcoin BTC/USD has been scaling new highs as it surpassed Silver XAG to become the eighth most valuable asset globally, with a market capitalization of $1.79 trillion.

Bitcoin prices have surged dramatically, adding over $300 billion to its market capitalization in just two weeks. This meteoric rise has pushed Bitcoin’s total value above both silver and Meta in terms of market capitalization, according to usagold.com. The rally has been attributed to multiple factors, including Trump’s recent election victory, increased institutional adoption and the evolving regulatory landscape.

Why It Matters: Trump during his pre-election campaign promised the launch of a strategic national crypto stockpile if elected for a second term. He also said that the U.S. government will maintain its Bitcoin holdings that it has amassed from seizing the assets of financial criminals, during a conference that he addressed in Nashville in July. These promises have led to the rise in crypto prices since his victory last week and the cryptocurrency market capitalization has hit a record $3.2 trillion.

Earlier this week on Tuesday, Schiff took to X (formerly Twitter) to encourage traders to invest in silver over bitcoin as gold prices fell.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

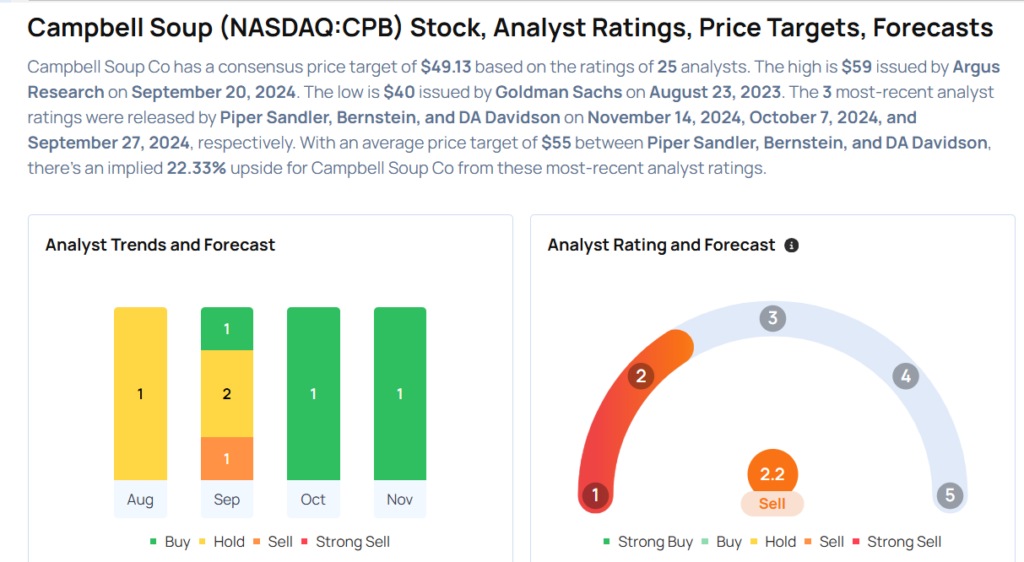

This Campbell Soup Analyst Turns Bullish; Here Are Top 5 Upgrades For Thursday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Piper Sandler analyst Michael Lavery upgraded the rating for Campbell Soup Company CPB from Neutral to Overweight and raised the price target from $47 to $56. Campbell Soup shares closed at $44.27 on Wednesday. See how other analysts view this stock.

- Evercore ISI Group analyst Thomas Gallagher upgraded Prudential Financial, Inc. PRU from Underperform to In-Line and increased the price target from $117 to $140. Prudential Financial shares closed at $125.26 on Wednesday. See how other analysts view this stock.

- Compass Point analyst Floris Van Dijkum upgraded the rating for BXP, Inc. BXP from Neutral to Buy and raised the price target from $80 to $88. BXP shares closed at $79.39 on Wednesday. See how other analysts view this stock.

- Morgan Stanley analyst Ricky Goldwasser upgraded Doximity, Inc. DOCS from Underweight to Equal-Weight and raised the price target from $33 to $53. Doximity shares closed at $52.86 on Wednesday. See how other analysts view this stock.

- Roth MKM analyst Scott Searle upgraded Inseego Corp. INSG from Neutral to Buy and raised the price target from $13 to $15. Inseego shares closed at $10.83 on Wednesday. See how other analysts view this stock.

Considering buying CPB stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

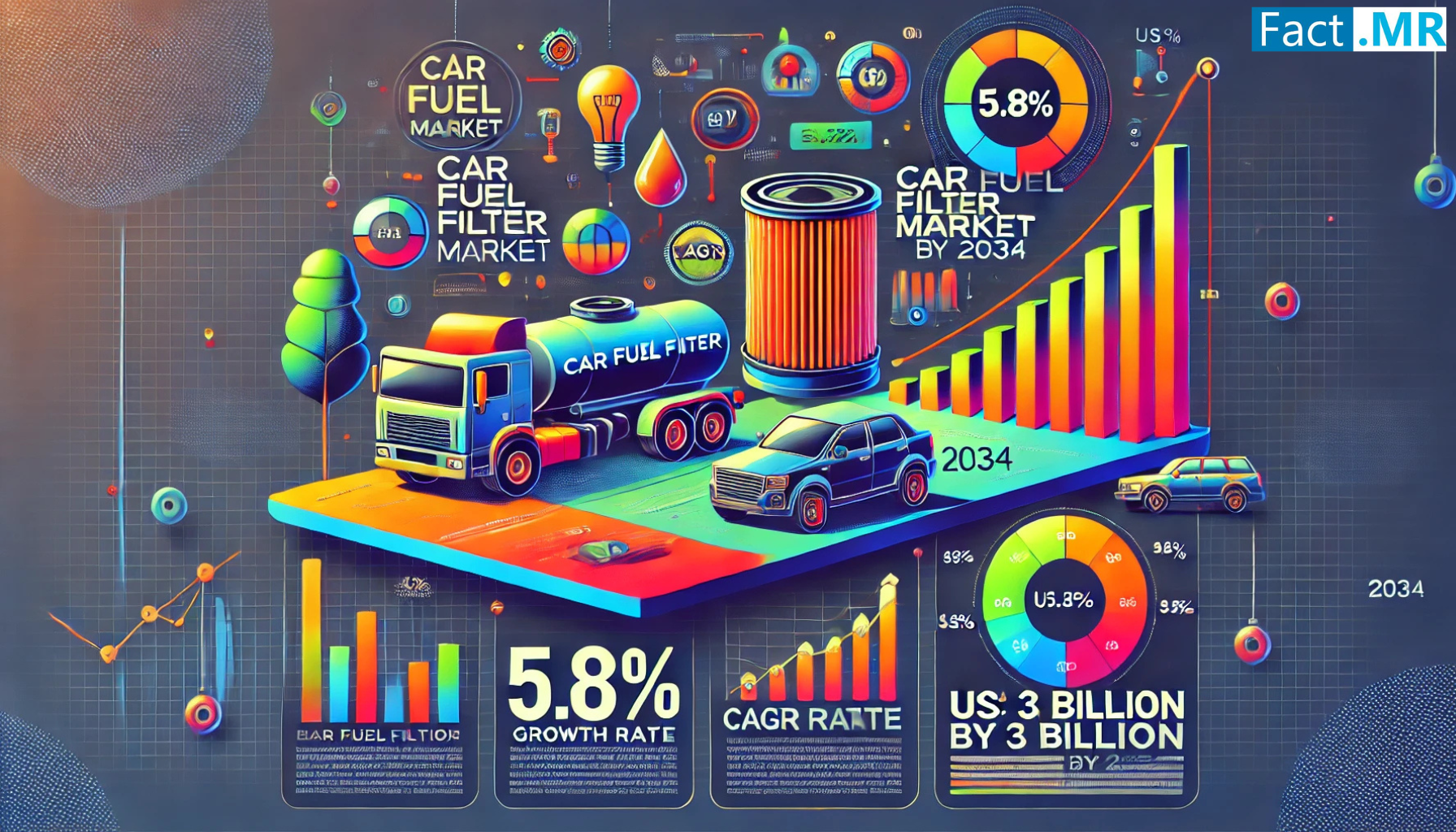

Car Fuel Filter Market is Predicted to Reach US$ 3.05 Billion with Expanding at a CAGR of 5.8% by 2034 | Fact.MR Report

Rockville, MD, Nov. 14, 2024 (GLOBE NEWSWIRE) — According to a recently revised study published by seasoned analysts at Fact.MR, worldwide revenue from the sales of car fuel filters is set to reach US$ 1.74 billion in 2024. The global car fuel filter market has been analyzed to increase steadily at a CAGR of 5.8% from 2024 to 2034.

Ever-increasing sales of vehicles worldwide are contributing to the growing demand for car fuel filters. Since clean fuel delivery is necessary for efficient combustion and reduced emissions, fuel filters are important to maintain engine health and performance. Even though electric vehicles (EVs) don’t require fuel filters, their sales are extremely less as compared to gasoline cars. Hybrid cars, which combine internal combustion engines with electric propulsion systems, still need high-quality gasoline filters to ensure a clean fuel supply and efficient engine functioning. Because people want higher fuel efficiency from their automobiles, the hybrid vehicles industry is growing substantially, which is contributing to car fuel filter market growth.

Japan is at the center of automotive technology progress, being one of the top automakers in the world. High-performance fuel filters are increasing in demand as modern cars with advanced engines become more complicated.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=136

Key Takeaways from Market Study

- The global car fuel filter market is evaluated to reach a size of US$ 3.05 billion by the end of 2034.

- North America is expected to hold 1% of the global market share in 2024.

- Demand for fuel filters for use in SUVs is forecasted to increase at 2% CAGR through 2034.

- The East Asia market is forecasted to reach US$ 740.3 million by the end of 2034.

- In 2024, China is poised to account for 75% of the market share in the East Asia region.

- Based on fuel type, the CNG/gasoline segment is forecasted to generate revenue worth US$ 2.37 billion by 2034.

- The market in China is projected to rise at a CAGR of 9% between 2024 and 2034.

“Car fuel filter manufacturers will do well to partner with automotive part retailers and service centers as well as expand their e-Commerce presence to drive D2C sales,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Car Fuel Filter Market

Key players in the car fuel filter market are Denso Corp, MAHLE GmbH, Parker Hannifin Corp., Cummins Inc., Mann+Hummel Group, Sogefi S.p.A, UFI Filters Group, ACDelco, FRAM Group IP LLC, Hengst SE & Co. KG, Robert Bosch GmbH, Valeo SA.

Compact & Mid-Sized Cars Account for Higher Product Deployment

Car fuel filters are increasing in demand due to rapidly rising sales of small- and medium-sized cars globally. These cars are budget-friendly compared to SUVs and premium vehicles. Due to this, use of fuel filters is high in compact and medium-sized cars. To maintain the long life and performance of any type of vehicle, fuel filters are necessary. More people now prefer compact and medium-sized cars due to fuel efficiency and less cost.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=136

Car Fuel Filter Industry News:

- The largest car filter manufacturer in Latin America, Tecfil, of Brazil, unveiled The EcoLigna, the first sustainable lignin-based vehicle filter, to the North American market in October 2023.

- Uno Minda introduced a comprehensive range of fuel filters for commercial vehicles in October 2023 that enhance engine performance and lifetime. In order to address the evolving needs of commercial vehicle owners and operators, these new filters were developed to ensure optimal fuel filtering and adhere to stringent emission laws.

- Uno Minda unveiled a wide selection of commercial vehicle fuel filters in August 2023 that improve engine performance and lifetime. These new filters were created to meet the changing demands of operators and owners of commercial vehicles while maintaining the highest standards of gasoline filtration and complying with strict emission regulations.

- On the 58th Founder’s Day in March 2022, TVS Auto Bangladesh and Steelbird International, a well-known auto component maker and an industry pioneer in India, formally formed a joint venture to manufacture premium, best-in-class automobile filters.

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the car fuel filter market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (spin-on fuel filters, inline fuel filters, cartridge fuel filters, nylon fuel filters, in-tank fuel filters, universal fuel filters), fuel type (diesel fuel filters, CNG/gasoline fuel filters), vehicle type (compact & mid-sized passenger cars, premium passenger cars, SUVs), and sales channel (OEM, OES, IAM), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR:

Automotive Filter Market: Size was valued at US$ 17.0 billion and is projected to increase at a 4.0% annual rate in 2022, reaching a closing value of US$ 17.77 billion. Additionally, growth is anticipated to rise at a staggering 4.5% CAGR during the 2022–2032 assessment period, reaching US$ 27.59 billion.

Automotive Fuel Filter Market: Size at a value of US$ 2.77 billion in 2024. Worldwide sales of automotive fuel filters are projected to increase to US$ 5.09 billion by the end of 2034, rising at 6.3% CAGR between 2024 and 2034.

Motorcycle Filter Market: Sales are estimated to touch US$ 3.86 billion in 2024. The global motorcycle filter market is forecasted to expand at a CAGR of 5.1% to reach a valuation of US$ 6.36 billion by the end of 2034.

Car Oil Filter Market: Size is expected to grow at a consistent compound annual growth rate (CAGR) of 4.1% over the next ten years, from its 2023 size of US$ 2.32 billion to US$ 3.47 billion by the end of 2033, according to this comprehensive industry study by market research and competitive intelligence provider Fact.MR.

Motorcycle Market: Size was valued at $110 billion in 2023 and is expected to grow at a 4% CAGR, reaching $163 billion by 2033.

Motorcycle Accessory Market: Size is poised to reach US$ 8.81 billion in 2024. The market has been projected to expand at a CAGR of 3.6% and reach a valuation of US$ 21.05 billion by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Down More Than 30%: 2 ‘Strong Buy’ Stocks at Steep Discounts

Looking for a market bargain? Most investors are. The real challenge, however, lies in recognizing what’s a bargain and what’s just cheap.

Stock prices can fall for all sorts of reasons, ranging from a fundamental unsoundness in the shares to overarching market conditions. The key to success in bargain hunting is learning how to spot the stocks that are trading low for the wrong reasons, to avoid them, and to do your homework on the rest.

Against this backdrop, we used the TipRanks database to find two stocks that feature an unbeatable combination of attributes to attract bargain-hungry investors: Strong Buy consensus ratings from the Street along with steep discounts. These are stocks that are down more than 30% from the peaks they hit earlier this year – but that also show solid upside potential for the coming year.

Silicon Motion (SIMO)

We’ll start with Silicon Motion, one of the small players in the semiconductor chip industry. Silicon Motion is a specialist in memory chips, and is an important designer and producer of NAND flash controllers in the solid state storage market. The company is also a leading supplier of SSD controllers for servers, PCs, and client devices. In addition, Silicon Motion has its hands in the supply chain for the eMMC and UFS embedded storage controllers that are vital components of smartphones and IoT devices. In short, even though Silicon Motion is a relatively small chip company – it has a market cap of $1.70 billion – it has an important role in an essential industry.

Silicon Motion’s most recent financial report, released last month for 3Q24, showed sound results. The company’s top line hit $212.4 million, for an impressive 23% year-over-year gain and beating the forecast by $1.6 million. At the bottom line, the company’s EPS, by non-GAAP measures, came in at 92 cents per share, or 7 cents better than had been anticipated.

However, the outlook failed to meet Street expectations, and the stock has been trending south since. In fact, since peaking in June, the shares are down by 39%.

Nevertheless, B. Riley’s Craig Ellis, rated by TipRanks among the top 3% of the Street’s stock experts, sees plenty to like here. He writes of this chip maker, “We really like SIMO’s confident ongoing PC and smartphone CY25 controller share gain expression, its first-ever high-end PC controller market entry/SAM expansion for high-value C2H25 growth plus increased confidence now-brewing enterprise and auto SSD ramps can jump to 10% of CY26/7 sales to compliment growth… While not precisely quantifying CY25’s growth potential until 4Q24’s results post in late-Jan/early Feb, we believe mid-to-high single+ is a solid base case, with high single digits possible with any material macro help long-absent in consumer applications, albeit in more back-end fashion given new SIMO and downstream customer product release timing…”

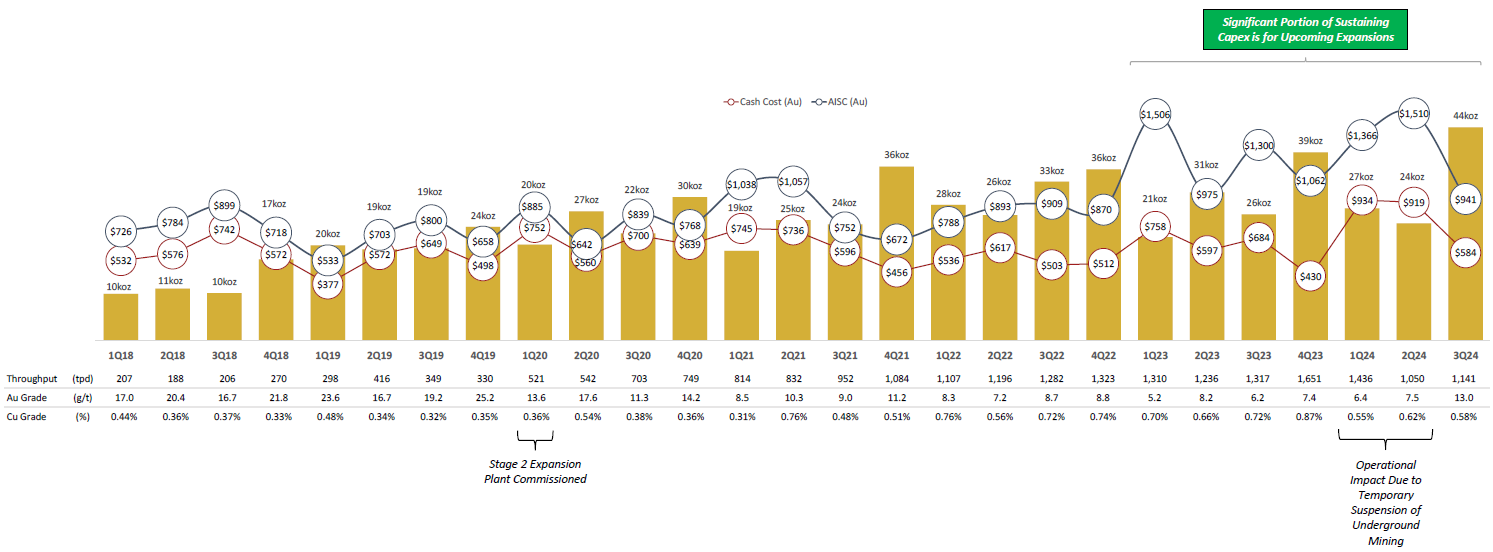

K92 Mining Announces 2024 Q3 Financial Results – Record Revenue, Net Income and Operating Cash Flow with a Significant Increase in Net Cash

VANCOUVER, British Columbia, Nov. 14, 2024 (GLOBE NEWSWIRE) — K92 Mining Inc. (“K92” or the “Company“) (TSX: KNT; OTCQX: KNTNF) is pleased to announce financial results for the three and nine months ended September 30, 2024.

Production

- Record quarterly production of 44,304 ounces gold equivalent (“AuEq“) or 41,702 oz gold, 1,278,492 lbs copper and 37,613 oz silver (1). With over 80% of AuEq production for the lower end of annual guidance delivered in the first 9 months of the year, the Company is well positioned to meet its 2024 operational production guidance.

- Cash costs of $584/oz gold and all-in sustaining costs (“AISC“) of $941/oz gold(3), significantly better than our 2024 operating guidance of $820/oz to $880/oz cash costs and $1,440/oz to $1,540/oz gold all-in sustaining costs.

- Record metallurgical recoveries in Q3 of 95.3% for gold and near-record recoveries of 95.1% copper, with September achieving record monthly gold recoveries of 96.5% and copper recoveries of 95.9%, both exceeding the recovery parameters from the Updated Integrated Development Plan, of 93% and 94%, respectively (see October 16, 2024 press release).

- Quarterly ore processed of 104,992 tonnes and total ore mined of 112,333 tonnes, with long hole open stoping performing to design, and 2,190 metres of total mine development.

- Head grade of 13.8 grams per tonne (“g/t“) AuEq or 13.0 g/t gold, 0.58% copper and 13.0 g/t silver. AuEq head grade in Q3 was the highest since Q4 2020 and above budget, benefiting from higher grade stopes in Q2 reporting to Q3, in addition to a moderate positive gold grade reconciliation versus the latest independent mineral resource estimate (effective date of September 12, 2023 for Kora and Judd) for both gold and copper.

Financials

- Strong cash and cash equivalent position of $120.3 million, which excludes restricted cash of $20.3 million(4). Under the terms of the Trafigura loan, the Company has the ability to convert restricted cash to cash and cash equivalents on January 1, 2025. During the quarter, the Company completed a drawdown of $20 million of unrestricted cash and has $60 million of unrestricted cash available to draw anytime. Unrestricted cash and cash equivalents during the quarter increased by $49.5 million.

- Subsequent to quarter end, K92 purchased put contracts for $2.2 million covering, 12,500 oz Au per month for 9 months at $2,400/oz, to protect against commodity price risk during the Stage 3 Expansion construction. K92 maintains full exposure to commodity price upside.

- Record quarterly revenue of $122.7 million.

- Record quarterly net income of $46.5 million or $0.20 per share.

- Record operating cash flow (before working capital adjustments) for the three months ended September 30, 2024, of $61.0 million or $0.26 per share, and record earnings before interest, taxes, depreciation and amortization (“EBITDA“) (3) of $78.9 million or $0.33 per share.

- Sales of 45,248 oz gold, 1,615,185 lbs copper and 46,062 oz silver. Gold concentrate and doré inventory of 1,887 oz as of September 30, 2024, a decrease of 3,082 oz over the prior quarter.

Growth

- On the Stage 3 and 4 Expansions, 63% of growth capital has been either spent or committed as of September 30, 2024. K92 has completed handover to GR Engineering Services (GRES) for the construction of the 1.2 million tpa (“tonnes per annum“) Stage 3 Expansion Process Plant, with commissioning of the Stage 3 Expansion Process Plant targeting the second half of Q2 2025. Majority of the long-lead time items have arrived on site for the process plant with construction most advanced at the grinding circuit (SAG + Ball), which is the critical path for the mill construction schedule. Underground, the two raise bore rigs are operational, with reaming of the first raise (5 m diameter) completed to upgrade ventilation to the main mine. The first waste/ore pass is currently being developed. Subsequent to quarter end, K92 awarded the river crossing construction contract. This contract was awarded largely on a lump sum fixed price basis and as of October 31, 2024, 69% of growth capital has been either spent or committed.

- Subsequent to quarter end, K92 announced results of its Updated Integrated Development Plan (“Updated IDP“) for the Kainantu Gold Mine, with an effective date of January 1, 2024, that comprises two scenarios: 1) Kainantu Stage 3 Expansion Definitive Feasibility Study Case (“DFS” or “DFS Case“); and 2) Kainantu Stage 4 Expansion Preliminary Economic Assessment Case (“PEA” or “PEA Case“).

- Stage 3 Expansion DFS Case Highlights:

- Evaluates the Stage 3 Expansion to 1.2 million tpa, representing a 100% throughput increase from the 600,000 tpa Stage 2A Expansion throughput

- Involves a new standalone 1.2 mtpa process plant, which is currently under construction

- After-tax NPV5% of $680 million at $1,900 per ounce gold, rising to an after-tax NPV5% of $1.2 billion at $2,600 per ounce gold

- Average annual run-rate production of 303,288 ounces AuEq per annum and a peak annual production of 319,360 ounces AuEq in 2027

- Life of Mine average cash costs of $380 per gold ounce or $694 per AuEq ounce and AISC of $665 per gold ounce or $920 per AuEq ounce over a 7-year mine life

- Growth capital of $194 million and life of mine sustaining capital of $337 million

- Stage 4 Expansion PEA Case Highlights:

- Evaluates two-stages of expansions to a run-rate throughput of 1.8 mtpa, a 200% increase from the 600,000 tpa Stage 2A Expansion throughput

- Involves running the new 1.2 Mtpa process plant in conjunction with the current 600,000 tpa Stage 2A process plant

- After-tax NPV5% of $2.3 billion at $1,900 per ounce gold, rising to an after-tax NPV5% of $3.5 billion at $2,600 per ounce gold

- Average annual run-rate production of 413,593 ounces AuEq per annum and a peak annual production of 484,692 ounces AuEq in 2034

- Life of Mine average cash costs of $174 per gold ounce or $633 per AuEq ounce and AISC $432 per gold ounce or $822 per AuEq ounce over a 14-year mine life

- Growth capital of $201 million and life of mine sustaining capital of $900 million

- Stage 3 Expansion DFS Case Highlights:

See the Company’s new release dated October 16, 2024 for additional details.

- Subsequent to quarter end, results from the third set of holes were reported from K92’s maiden drill program at the Arakompa project. Between the high-grade lodes, the tonalite to dioritic host rock is overprinted with porphyry style mineralization increasing the potential for bulk mining. The target size of Arakompa is very large, with mineralization demonstrated from drill holes, rock samples and surface workings for at least 1.7 km of strike, hosted within a ~150-225 m wide mineralized intense phyllic altered package, and exhibits a vertical extent of +500 m. Arakompa is sparsely drilled, with K92’s maiden drill results representing the first drilling on the project completed in 32 years. Exploration has ramped up from 1 rig in Q1 2024 to 4 rigs currently operating. K92 is targeting a maiden mineral resource estimate for Arakompa by Q1 2025. Highlights from the third set of drill results include:

- Potential thick high-grade zone discovered from two holes stepping out 250 metres along strike to the south, encountering both high-grade and bulk mineralized zones:

- KARDD0029: 20.60 m at 9.87 g/t AuEq, including 10.70 m at 14.97 g/t AuEq

- Located ~60 metres up-dip, KARDD0025 recording 23.60 m at 6.57 g/t AuEq, including 12.00 m at 11.16 g/t AuEq

- Significant extension of bulk tonnage strike by ~250 metres to the south to a total interpreted strike now exceeding 750 metres, with bulk tonnage intersections reported to date recording an average true thickness of 56 meters and mineralization reaching a vertical depth of up to 350 meters, with highlights including:

- KARDD0025 (~250 m southern step-out along strike): 100.80 m at 1.92 g/t AuEq

- KARDD0030 (~125 m southern step-out along strike): 111.62 m at 1.53 g/t AuEq

- KARDD0018: 57.0 m at 1.58 g/t AuEq

- KARDD0028: 45.9 m at 1.88 g/t AuEq

- Other high-grade intersections include:

- KARDD0018: 1.30 m at 35.72 g/t AuEq and 4.00 m at 6.59 g/t AuEq

- KARDD0030: 5.40 m at 5.88 g/t AuEq and 1.62 m at 33.52 g/t AuEq

- KARDD0013: 7.10 m at 5.69 g/t AuEq

- KARDD0023: 2.00 m at 14.60 g/t AuEq

- Potential thick high-grade zone discovered from two holes stepping out 250 metres along strike to the south, encountering both high-grade and bulk mineralized zones:

See the Company’s news release dated October 22, 2024 for additional details.

The Company’s interim consolidated financial statements and associated management’s discussion and analysis for the three and nine months ended September 30, 2024 are available for download on the Company’s website and under the Company’s profile on SEDAR+ (www.sedarplus.ca). All amounts are in U.S. dollars unless otherwise indicated.

See Figure 1: Quarterly Production, Cash Cost and AISC Chart

John Lewins, K92 Chief Executive Officer and Director, stated, “The third quarter delivered our strongest quarter to date, achieving multiple records and importantly, a significant strengthening to our net cash position while concurrently progressing construction and development for the Stage 3 and 4 Expansions. Our financial position is strong – at quarter end, the cash balance has grown to $120 million, plus multiple other liquidity sources including $20 million of restricted cash that K92 has the ability to convert to cash and equivalents on January 1, 2025; $60 million in undrawn credit facilities; another $30 million of credit available through an accordion feature, and; cash flow from operations with $2,400/oz put contracts in place until June 2025 to protect commodity price downside while retaining full upside exposure to the record gold price environment.

As at October 31, 2024, 69% of growth capital has been either spent or committed, several major contracts have been awarded on a majority lump sum / fixed price basis de-risking capital costs, and with less than 7 months to the planned commissioning of our Stage 3 Process Plant, there is a tremendous amount of excitement within the organization, as it will mark the transition of K92 to a Tier 1 Mid-Tier Producer.”

| Mine Operating Activities | ||

| Three months ended September 30, 2024 |

Three months ended September 30, 2023 |

|

| Operating data | ||

| Gold head grade (Au g/t) | 13.0 | 6.2 |

| Copper grade (%) | 0.58% | 0.72% |

| Gold equivalent head grade (AuEq g/t) | 13.8 | 7.3 |

| Gold recovery (%) | 95.3% | 92.0% |

| Copper recovery (%) | 95.1% | 93.0% |

| Gold ounces produced | 41,702 | 22,227 |

| Gold ounces equivalent produced (1) (3) | 44,304 | 26,225 |

| Tonnes of copper produced | 580 | 809 |

| Silver ounces produced | 37,613 | 40,233 |

| Financial data (in thousands of dollars) | ||

| Gold ounces sold | 45,248 | 18,339 |

| Revenues from concentrate and doré sales | US$122,749 | US$32,814 |

| Mine operating expenses | US$13,133 | US$9,811 |

| Other mine expenses | US$17,761 | US$5,280 |

| Depreciation and depletion | US$10,130 | US$7,422 |

| Statistics (in dollars) | ||

| Average realized selling price per ounce, net (2) | US$2,388 | US$1,848 |

| Cash cost per ounce (3) | US$584 | US$684 |

| All-in sustaining cost per ounce (3) | US$941 | US$1,300 |

| Notes: | ||

| (1) AuEq in Q3 2024 is calculated based on: gold $2,474 per ounce; silver $29.43 per ounce; and copper $4.17 per pound. AuEq in Q3 2023 is calculated based on: gold $1,928 per ounce; silver $23.57 per ounce; and copper $3.79 per pound. | ||

| (2) The average realized selling price per ounce is net of metal payabilities for both concentrate and doré. | ||

| (3) The Company provides some non-international financial reporting standard measures as supplementary information that management believes may be useful to investors to explain the Company’s financial results. Please refer to non-IFRS financial performance measures in the Company’s management’s discussion and analysis dated November 13, 2024, available on SEDAR+ and on the Company’s website, for reconciliation of these measures. | ||

| (4) AuEq exploration results are calculated using longer-term commodity prices with a copper price of US$4.00/lb, a silver price of US$22.50/oz and a gold price of US$1,750/oz. | ||

| (5) The restricted cash is in relation to a condition precedent in the Loan with Trafigura. All conditions precedent for the advance of US$120 million have been satisfied. Restricted cash can become unrestricted beginning January 1, 2025. | ||

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Conference Call and Webcast to Present Results

K92 will host a conference call and webcast to present the 2024 third quarter financial results at 8:30 am (EDT) on Thursday, November 14, 2024.

- Listeners may access the conference call by dialing toll-free to 1-844-763-8274 within North America or +1-647-484-8814 from international locations.

The conference call will also be broadcast live (webcast) and may be accessed via the following link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=bBRYFhsh

Qualified Person

K92 Mine Geology Manager and Mine Exploration Manager, Mr. Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018, is in a strong financial position and is working to become a Tier 1, mid-tier producer through ongoing expansions. A maiden resource estimate on the Blue Lake copper-gold porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and Director

For further information, please contact David Medilek, P.Eng., CFA, President and Chief Operating Officer at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Such forward-looking statements include, without limitation: (i) the results of the Kainantu Mine Definitive Feasibility Study, and the Kainantu 2022 Preliminary Economic Assessment, including the Stage 3 Expansion, a new standalone 1.2 mtpa process plant and supporting infrastructure; (ii) statements regarding the expansion of the mine and development of any of the deposits; (iii) the Kainantu Stage 4 Expansion, operating two standalone process plants, larger surface infrastructure and mining throughputs; and (iv) the potential extended life of the Kainantu Mine.

All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, Public Health Crises, including the COVID-19 virus; changes in the price of gold, silver, copper and other metals in the world markets; fluctuations in the price and availability of infrastructure and energy and other commodities; fluctuations in foreign currency exchange rates; volatility in price of our common shares; inherent risks associated with the mining industry, including problems related to weather and climate in remote areas in which certain of the Company’s operations are located; failure to achieve production, cost and other estimates; risks and uncertainties associated with exploration and development; uncertainties relating to estimates of mineral resources including uncertainty that mineral resources may never be converted into mineral reserves; the Company’s ability to carry on current and future operations, including development and exploration activities at the Arakompa, Kora, Judd and other projects; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the availability and costs of achieving the Stage 3 Expansion or the Stage 4 Expansion; the ability of the Company to achieve the inputs the price and market for outputs, including gold, silver and copper; failures of information systems or information security threats; political, economic and other risks associated with the Company’s foreign operations; geopolitical events and other uncertainties, such as the conflicts in Ukraine, Israel and Palestine; compliance with various laws and regulatory requirements to which the Company is subject to, including taxation; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions, including relationship with the communities in Papua New Guinea and other jurisdictions it operates; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in the Company’s Annual Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. The estimation of mineral resources and mineral reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those that are anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Figure 1: Quarterly Production, Cash Cost and AISC Chart

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9df62338-d9a1-40ad-9596-67552fca4c14

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.