Disney, Cisco And 3 Stocks To Watch Heading Into Thursday

With U.S. stock futures trading lower this morning on Thursday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects The Walt Disney Company DIS to report quarterly earnings at $1.10 per share on revenue of $22.35 billion before the opening bell, according to data from Benzinga Pro. Disney shares rose 0.6% to $103.30 in after-hours trading.

- Cisco Systems Inc. CSCO reported better-than-expected results for its first quarter and raised its full-year 2025 guidance. The company reported first-quarter revenue of $13.84 billion, beating the consensus estimate of $13.77 billion. The networking equipment maker reported adjusted earnings of 91 cents per share, beating analyst estimates of 87 cents per share. Cisco shares fell 2.9% to $57.45 in the after-hours trading session.

- Analysts are expecting Advance Auto Parts, Inc. AAP to post quarterly earnings at 49 per share on revenue of $2.65 billion. The company will release earnings before the markets open. Advance Auto Parts shares fell 0.2% to $40.85 in after-hours trading.

Check out our premarket coverage here

- Helmerich & Payne, Inc. HP reported worse-than-expected fourth-quarter earnings and sales results on Wednesday. Helmerich & Payne shares fell 3.3% to $35.00 in the after-hours trading session.

- Analysts expect Applied Materials, Inc. AMAT to report quarterly earnings at $2.19 per share on revenue of $6.95 billion after the closing bell. Applied Materials shares gained 0.2% to $183.22 in after-hours trading.

Check This Out:

Photo courtesy: Unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Advance Auto Parts Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Advance Auto Parts, Inc. AAP will release earnings results for its third quarter, before the opening bell on Thursday, Nov. 14.

Analysts expect the Raleigh, North Carolina-based company to report quarterly earnings at 54 cents per share, versus a year-ago loss of 82 cents per share. Advance Auto Parts projects to report revenue of $2.67 billion for the quarter, compared to $2.72 billion a year earlier, according to data from Benzinga Pro.

On Nov. 4, Advance Auto Parts announced the close of the sale of Worldpac, Inc. to global investment firm Carlyle CG.

Advance Auto Parts shares gained 2.6% to close at $40.94 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

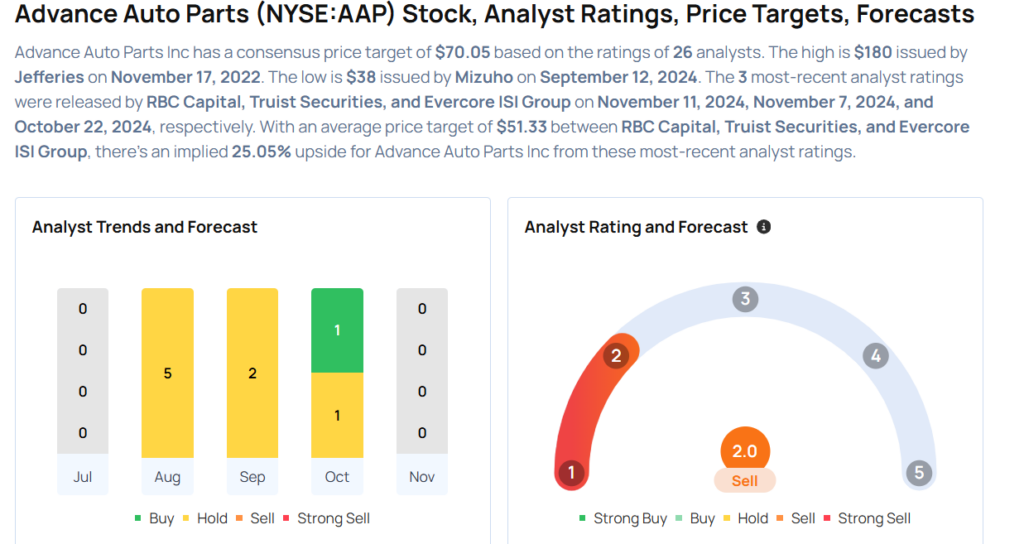

- RBC Capital analyst Steven Shemesh maintained a Sector Perform rating and cut the price target from $52 to $46 on Nov. 11. This analyst has an accuracy rate of 65%.

- Truist Securities analyst Scott Ciccarelli maintained a Hold rating and lowered the price target from $46 to $41 on Nov. 7. This analyst has an accuracy rate of 78%.

- Evercore ISI Group analyst Greg Melich maintained an In-Line rating and decreased the price target from $71 to $67 on Oct. 22. This analyst has an accuracy rate of 80%.

- Wedbush analyst Seth Basham upgraded the stock from Neutral to Outperform on Oct. 15. This analyst has an accuracy rate of 69%.

- Wells Fargo analyst Zachary Fadem maintained an Equal-Weight rating and slashed the price target from $50 to $40 on Sept. 13. This analyst has an accuracy rate of 73%.

Considering buying AAP stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lifevantage Board Member Makes $105K Stock Purchase

It was revealed in a recent SEC filing that Michael Beindorff, Board Member at Lifevantage LFVN made a noteworthy insider purchase on November 12,.

What Happened: Beindorff demonstrated confidence in Lifevantage by purchasing 7,819 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value of the transaction is $105,009.

The latest market snapshot at Wednesday morning reveals Lifevantage shares up by 0.29%, trading at $13.78.

All You Need to Know About Lifevantage

Lifevantage Corp is engaged in the identification, research, development, and distribution of nutraceutical dietary supplements and skincare products. It offers products such as Protandim, a scientifically-validated dietary supplement; LifeVantage TrueScience, an anti-aging skincare product; Axio energy drink mixes; and PhysIQ, a weight management system and other product Geographically, its products are sold in the regions of the United States, Japan, Hong Kong, Australia, Canada, Philippines, Mexico, Thailand, the United Kingdom, and the Netherlands.

Key Indicators: Lifevantage’s Financial Health

Decline in Revenue: Over the 3 months period, Lifevantage faced challenges, resulting in a decline of approximately -8.08% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Insights into Profitability:

-

Gross Margin: The company maintains a high gross margin of 79.9%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Lifevantage exhibits below-average bottom-line performance with a current EPS of 0.15.

Debt Management: With a below-average debt-to-equity ratio of 0.48, Lifevantage adopts a prudent financial strategy, indicating a balanced approach to debt management.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 42.94 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.91 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Lifevantage’s EV/EBITDA ratio stands at 17.77, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Understanding Crucial Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Lifevantage’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Just Eat Takeaway Sells Grubhub To Wonder For $650M, Marking Strategic Exit From US Market

Just Eat Takeaway.com JTKWY has announced the sale of its U.S. food delivery business, Grubhub, to Wonder Group for an enterprise value of $650 million.

What Happened: This deal follows ongoing efforts to divest Grubhub after pressure from investors. The transaction is expected to generate net proceeds of up to $50 million for Just Eat Takeaway after adjustments.

The completion is set for the first quarter of 2025, pending regulatory approval. The sale is aimed at improving Just Eat’s financial position, supporting investment in key markets, and boosting cash flow.

Wonder, which acquired meal kit company Blue Apron in 2023, plans to integrate Grubhub into its food service platform. Shares of Just Eat rose 20% following the announcement.

Read Next:

Image Via Pixabay

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Asian Stocks Fall as China, Strong Dollar Weigh: Markets Wrap

(Bloomberg) — Asian equities declined Thursday as the dollar’s sustained strength and weakness in China weighed on the region’s risk appetite. Japanese stocks climbed as the yen fell.

Most Read from Bloomberg

Shares in China and Taiwan traded lower while those in South Korea and Australia edged up. Hong Kong shares slid amid thin volumes as the market stayed open despite signs of severe weather. An index of dollar rose nearly 0.2% to its two-year high, while the 10-year US Treasury yield gained for a third day in Asian trading. US stocks futures were little changed.

Assets in the region have slumped since the US election as investors assess the impact of President-elect Donald Trump’s proposed tariff policies on the region’s growth, while the surging dollar pressures the region’s currencies. The MSCI’s Asia stock benchmark is on pace for its worst week since April, while a Bloomberg gauge of Asian currencies has dropped over 1% so far this week.

“The strength in the US dollar will likely be a key overhang” for the region’s stocks, said Jun Rong Yeap, a strategist at IG Asia Pte.

Shares of the region’s chipmakers declined as investors continued to weigh the sector’s outlook after Trump’s win. Taiwan Semiconductor Manufacturing Co., a big component of the MSCI gauge, fell as much as 1%. SK Hynix, a South Korean chipmaker, sank as much as 6.1%.

Chinese equities may remain range-bound given signs from policymakers at last week’s legislative meeting that stimulus measures are probably not going to target a major reacceleration of growth, Kaanhari Singh, head of Asia cross asset strategy for Barclays, said on Bloomberg Television.

“That matters because it looks like China’s fiscal stimulus could be reactive rather than proactive,” Singh said. “The broad dollar higher theme is what has been driving risk in the region across FX and equities.”

US consumer price data was in line with expectations on a headline basis, although the annualized three-month core rate picked up. Overall, the numbers were supportive of a potential Fed cut in mid-December, with swaps traders increasing the likelihood to around 80% from about 56% earlier Wednesday.

The nuanced data led short-end bond yields to fall, with the two-year yield dropping five basis points to 4.29%. Treasury yields were slightly higher across the curve in Asian trading Thursday.

Stock market today: Asian shares meander, tracking Wall Street's mixed finish as dollar surges

BANGKOK (AP) — Shares were mixed in Asia on Thursday after a lackluster finish on Wall Street following a report showing an uptick last month in inflation in the U.S.

The dollar was trading at 156 Japanese yen, up from 155.49 yen, reflecting expectations that the dollar will gain against other currencies under the policies anticipated with the incoming administration of President-elect Donald Trump.

Japan’s Nikkei 225 index edged less than 0.1% higher, to 38,754.50 and the Kospi in South Korea advanced 0.5% to 2,429.23. Australia’s S&P/ASX 200 gained 0.4% to 8,223.20.

Chinese markets declined, with the Hang Seng in Hong Kong falling 0.9% to 19,649.91. The Shanghai Composite index lost 0.3% to 3,428.37.

Bangkok’s SET lost 0.2% and Taiwan’s Taiex fell 0.5%, while the Sensex in India edged 0.1% higher.

A stronger dollar tends to put strain on other economies, noted Stephen Innes of Capital Economics. The Thai baht has also weakened against the dollar since the U.S. election, as has the Chinese yuan, or renminbi, which now stands at 7.2245 per dollar and was trading at about 7 yuan per dollar in early October.

“For Asia, particularly those economies closely linked to China, the dollar’s dominance is poised to become an economic wrecking ball,” he said in a commentary. “Countries with hefty USD-denominated debt are bracing for impact,” he added.

On Wednesday, U.S. stocks drifted to a mixed finish after the latest inflation update boosted hopes that a cut to interest rates next month will bring more help for the economy.

The S&P 500 was nearly unchanged, gaining 1.39 points to 5,985.38, up less than 0.1%. It was its first loss since a big rally erupted after the Nov. 5 Election Day. The Dow Jones Industrial Average added 0.1% to 43,958.19, and the Nasdaq composite slipped 0.3% to 19,230.74.

U.S. consumer inflation accelerated in October to 2.6% from 2.4%, but an underlying measure called “core inflation” did not rise. Such core inflation can be a better predictor of future trends, economists say, so the figures added to expectations for more help from the Federal Reserve.

The Fed began cutting interest rates from their two-decade high in September to keep the job market hummin g after bringing inflation nearly all the way down to its target of 2%. It cut again earlier this month, and traders now see an improved probability of roughly 80% for a third cut at its meeting next month, according to data from CME Group.

Those expectations sent the yield for the two-year Treasury down to 4.27% from 4.34% late Tuesday. The yield on the 10-year Treasury, which also takes future economic growth more into account, rose to 4.45%, up from 4.43% late Tuesday.

Mark Zuckerberg Teams Up With T-Pain For A Jaw-Dropping 'Get Low' Cover — Prepare For The Z-Pain Experience You Didn't Know You Needed

Meta Platforms, Inc. META CEO co-founder, Mark Zuckerberg, has joined forces with renowned rapper T-Pain to release a cover of Lil Jon’s “Get Low.”

What Happened: On Wednesday, Zuckerberg and T-Pain shared the reimagined high-energy track into a slower tempo song on Instagram, which featured an acoustic guitar.

Zuckerberg’s autotuned voice is prominent, singing the lyrics, with T-Pain making an appearance halfway through the song.

On Instagram, Zuckerberg said, “‘Get Low’ was playing when I first met Priscilla at a college party, so every year we listen to it on our dating anniversary.”

See Also: Amazon Offers Early Black Friday Deals With Up To $350 Off On Apple MacBooks: Here’s More

At the time of writing, the song wasn’t playing on Instagram’s web app, even though Zuckerberg tried to include it in his post. Users can listen to the track on Instagram’s smartphone app. The track is also available on Spotify.

Why It Matters: Zuckerberg’s public image has shifted dramatically from the stereotypical “tech bro” in gray t-shirts to a more polished, fashion-forward CEO, signaling a strategic rebranding.

While the makeover has helped improve his public image, making him seem more approachable and authentic, critics argue it distracts from ongoing concerns about Meta’s societal impact.

Last month, Meta, formerly known as Facebook, reported third-quarter revenue of $40.59 billion, surpassing analyst estimates of $40.29 billion.

The company also reported third-quarter adjusted earnings of $6.03 per share, beating analyst estimates of $5.25 per share.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Positive Signal: Rajendran Anbalagan Shows Faith, Buying $105K In Lifevantage Stock

On November 12, Rajendran Anbalagan, Board Member at Lifevantage LFVN executed a significant insider buy, as disclosed in the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that Anbalagan purchased 7,819 shares of Lifevantage. The total transaction amounted to $105,009.

As of Wednesday morning, Lifevantage shares are up by 0.29%, currently priced at $13.78.

Unveiling the Story Behind Lifevantage

Lifevantage Corp is engaged in the identification, research, development, and distribution of nutraceutical dietary supplements and skincare products. It offers products such as Protandim, a scientifically-validated dietary supplement; LifeVantage TrueScience, an anti-aging skincare product; Axio energy drink mixes; and PhysIQ, a weight management system and other product Geographically, its products are sold in the regions of the United States, Japan, Hong Kong, Australia, Canada, Philippines, Mexico, Thailand, the United Kingdom, and the Netherlands.

Lifevantage: Financial Performance Dissected

Negative Revenue Trend: Examining Lifevantage’s financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -8.08% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Staples sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Insights into Profitability:

-

Gross Margin: The company excels with a remarkable gross margin of 79.9%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Lifevantage exhibits below-average bottom-line performance with a current EPS of 0.15.

Debt Management: Lifevantage’s debt-to-equity ratio is below the industry average at 0.48, reflecting a lower dependency on debt financing and a more conservative financial approach.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 42.94 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.91 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 17.77, Lifevantage demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

The Insider’s Guide to Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Lifevantage’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.