SmartCentres Real Estate Investment Trust Releases Third Quarter Results for 2024

TORONTO, Nov. 13, 2024 (GLOBE NEWSWIRE) — SmartCentres Real Estate Investment Trust (“SmartCentres”, the “Trust” or the “REIT”) SRU is pleased to report its financial and operating results for the quarter ended September 30, 2024.

“Building on a successful first half of the year, retail fundamentals are outperforming, driven by strong momentum in leasing demand and executed lease deals for both existing space and for new build space,” said Mitchell Goldhar, CEO of SmartCentres. “We are seeing it in the higher quality of our income, strong same property NOI and higher spreads on lease extensions. We renewed and extended lease maturities in 2024 at strong rental growth rates of 6.1%, or 8.9%, excluding anchors. In-place and committed occupancy has increased again this quarter to an industry leading 98.5%, with approximately 187,000 square feet of vacant space leased during the quarter. We expect to continue delivering solid rental growth and strong occupancy levels for the balance of the year. The Millway, our new purpose-built rental project in the VMC, continues to experience strong leasing momentum with 93% occupancy at the end of the quarter, which is expected to exceed 95% by year-end, at rental rates above budget. Our mixed-use development pipeline continues to add to the bottom-line with the closing of 47 townhomes at our Vaughan NW project. Finally, we secured and closed on a construction facility of $135.0 million to finance our 224,000 square foot Canadian Tire anchored retail project on Laird Drive in Toronto which will provide additional income once completed in approximately 18 months.”

2024 Third Quarter Highlights

Retail Operations

- Same Properties NOI excluding Anchors(1) for the three months ended September 30, 2024 increased by 8.2% (4.9% including anchors) compared to the same period in 2023.

- Leasing momentum has strengthened further, with approximately 187,000 square feet of vacant space leased during the quarter, resulting in an in-place and executed for future occupancy rate of 98.5%, an improvement of 30 basis points compared to the prior quarter.

- New build retail leasing also reflects strong momentum with over 220,000 square feet executed year-to-date.

- Renewed and extended 88.1% of all leases maturing in 2024, with strong rental growth of 8.9% (excluding anchors).

Development

- A significant development pipeline will provide long-term portfolio expansion and profitable growth from the approximately 58 million square feet (at the Trust’s share) of zoned mixed-use development permissions, including 0.8 million square feet of sites currently under construction. In addition to growth, this on-site development pipeline enhances our operating shopping centres while fulfilling our vision of creating whole communities.

- The Millway, a 458-unit purpose-built rental apartment building located in VMC, was completed in Q4 2023. Leasing activity is on track with 93% of the units leased and committed by quarter-end, at average rental rates above budget. Leased and reserved units are expected to exceed 95% by year-end from continuing strong leasing momentum.

- Siteworks and excavation are now complete at ArtWalk condo Phase I and construction is advancing, with approximately 93% of the 340 units in Tower A pre-sold.

- Construction of Phase I of the Vaughan NW townhomes is progressing well, with 47 units completed and closed in Q3 2024. As at September 30, 2024, approximately 83% of the 120 units in Phase I have been pre-sold.

- Siteworks for the 224,000 square foot Canadian Tire and ancillary retail units project on Laird Drive in Toronto continues, and possession is expected in approximately 18 months.

- Construction of the self-storage facility in Stoney Creek is nearing completion with opening expected in Q4 2024. Three other self-storage facilities are under construction and on schedule to open in 2025.

Financial

- Net rental income and other increased by $11.6 million or 8.9% for the three months ended September 30, 2024 compared to the same period in 2023, primarily due to lease-up activities and increase in residential closing revenue from townhome sales.

- FFO per Unit(1) for the three months ended September 30, 2024, was $0.71 compared to $0.55 for the same period in 2023. This increase was primarily due to an increase in the fair value adjustment on the TRS resulting from fluctuations in the Trust’s Unit price. FFO per Unit with adjustments(1) for the three months ended September 30, 2024, was $0.53 compared to $0.54 for the same period in 2023. The decrease was primarily attributed to higher interest rates and lower interest capitalization following the completion of development projects compared to the prior year period, partially offset by increased net rental income driven by lease-up activities for retail properties, self-storage facilities and apartment rentals.

- Net income and comprehensive income per Unit was $0.23 for the three months ended September 30, 2024 (three months ended September 30, 2023 – $1.19). The decrease was mainly driven by a decrease in fair value adjustments on revaluation of properties due to updated valuation parameters and leasing activities in the prior year period, and a decrease in the fair value adjustment on financial instruments due to mark-to-market adjustments for interest rate swap agreements and a fair value change in units classified as liabilities due to fluctuation in the unit price.

- In August 2024, the Trust issued $350.0 million principal amount of Series AA senior unsecured debentures by way of a private placement (the “Series AA Debentures”). The Series AA Debentures bear interest at a rate of 5.162% per annum, with a maturity date of August 1, 2030. The Trust used the proceeds from the Series AA Debentures primarily to repay the $100.0 million aggregate principal of Series O senior unsecured debentures in full upon their maturity, and the outstanding floating rate debt on its operating lines.

- In September 2024, the Trust entered into a construction facility for the project on Laird Drive, Toronto, totaling $135.0 million. The facility bears interest at Adjusted CORRA plus 1.45%, with a maturity date of September 27, 2027. As at September 30, 2024, the facility was undrawn.

| (1) | Represents a non-GAAP measure. The Trust’s method of calculating non-GAAP measures may differ from other reporting issuers’ methods and, accordingly, may not be comparable. For additional information, please see “Non-GAAP Measures” in this Press Release. |

Selected Consolidated Operational, Mixed-Use Development and Financial Information

| (in thousands of dollars, except per Unit and other non-financial data) | |||||||

| As at | September 30, 2024 | December 31, 2023 | September 30, 2023 | ||||

| Portfolio Information (Number of properties) | |||||||

| Retail properties | 155 | 155 | 155 | ||||

| Office properties | 4 | 4 | 4 | ||||

| Self-storage properties | 10 | 8 | 8 | ||||

| Residential properties | 3 | 3 | 2 | ||||

| Industrial properties | 1 | 1 | 1 | ||||

| Properties under development | 22 | 20 | 20 | ||||

| Total number of properties with an ownership interest | 195 | 191 | 190 | ||||

| Leasing and Operational Information(1) | |||||||

| Gross leasable retail, office and industrial area (in thousands of sq. ft.) | 35,282 | 35,045 | 35,033 | ||||

| In-place and committed occupancy rate | 98.5 % | 98.5 % | 98.5 % | ||||

| Average lease term to maturity (in years) | 4.3 | 4.3 | 4.3 | ||||

| In-place net retail rental rate excluding Anchors (per occupied sq. ft.) | $23.13 | $22.59 | $22.43 | ||||

| Financial Information | |||||||

| Investment properties(2) | 10,606,288 | 10,564,269 | 10,518,429 | ||||

| Total unencumbered assets(3) | 9,366,921 | 9,170,121 | 9,067,121 | ||||

| Debt to Aggregate Assets(3)(4)(5) | 43.6 % | 43.1 % | 43.0 % | ||||

| Adjusted Debt to Adjusted EBITDA(3)(4)(5) | 9.8X | 9.6X | 9.7X | ||||

| Weighted average interest rate(3)(4) | 4.09 % | 4.15 % | 4.13 % | ||||

| Weighted average term of debt (in years) | 3.2 | 3.6 | 3.7 | ||||

| Interest coverage ratio(3)(4) | 2.4X | 2.7X | 2.8X | ||||

| Three Months Ended September 30 | Nine Months Ended September 30 |

||||||

| 2024 | 2023 | 2024 | 2023 | ||||

| Financial Information | |||||||

| Rentals from investment properties and other(2) | 243,326 | 206,016 | 688,616 | 623,560 | |||

| Net income and comprehensive income (2) | 42,479 | 215,175 | 150,220 | 495,938 | |||

| FFO(3)(4)(6) | 128,174 | 98,405 | 305,911 | 294,072 | |||

| AFFO(3)(4)(6) | 109,619 | 85,788 | 274,392 | 262,237 | |||

| Cash flows provided by operating activities(2) | 105,380 | 93,855 | 252,090 | 237,108 | |||

| Net rental income and other(2) | 141,978 | 130,402 | 405,928 | 385,110 | |||

| NOI(3)(4) | 148,785 | 143,834 | 423,922 | 424,407 | |||

| Change in SPNOI(3)(4) | 4.9 % | 1.9 % | 2.4 % | 3.2 % | |||

| Weighted average number of units outstanding – diluted(7) | 180,858,726 | 180,069,508 | 180,602,179 | 180,002,762 | |||

| Net income and comprehensive income per Unit(2) | $0.24/$0.23 | $1.21/$1.19 | $0.84/$0.83 | $2.78/$2.76 | |||

| FFO per Unit(3)(4)(6) | $0.72/$0.71 | $0.55/$0.55 | $1.72/$1.69 | $1.65/$1.64 | |||

| FFO with adjustments per Unit(3)(4) | $0.54/$0.53 | $0.54/$0.54 | $1.58/$1.56 | $1.60/$1.59 | |||

| AFFO per Unit(3)(4)(6) | $0.61/$0.61 | $0.48/$0.48 | $1.54/$1.52 | $1.47/$1.46 | |||

| AFFO with adjustments per Unit(3)(4) | $0.44/$0.43 | $0.47/$0.47 | $1.40/$1.39 | $1.42/$1.41 | |||

| Payout Ratio to AFFO(3)(4)(6) | 75.2 % | 96.1 % | 90.1 % | 94.3 % | |||

| Payout Ratio to AFFO with adjustments(3)(4) | 105.9 % | 97.7 % | 98.8 % | 97.6 % | |||

| Payout Ratio to cash flows provided by operating activities | 78.2 % | 87.8 % | 98.1 % | 104.3 % | |||

| (1) | Excluding residential and self-storage area. |

| (2) | Represents a Generally Accepted Accounting Principles (“GAAP”) measure. |

| (3) | Represents a non-GAAP measure. The Trust’s method of calculating non-GAAP measures may differ from other reporting issuers’ methods and, accordingly, may not be comparable. For additional information, please see “Non-GAAP Measures” in this Press Release. |

| (4) | Includes the Trust’s proportionate share of equity accounted investments. |

| (5) | As at September 30, 2024, cash-on-hand of $31.4 million was excluded for the purposes of calculating the applicable ratios (December 31, 2023 – $31.4 million, September 30, 2023 – $45.3 million). |

| (6) | The calculation of the Trust’s FFO and AFFO and related payout ratios, including comparative amounts, are financial metrics that were determined based on the REALpac White Paper on FFO and AFFO issued in January 2022 (“REALpac White Paper”). Comparison with other reporting issuers may not be appropriate. The payout ratio to AFFO is calculated as declared distributions divided by AFFO. |

| (7) | The diluted weighted average includes the vested portion of the deferred issued pursuant to the deferred unit plan and vested EIPs granted pursuant to the equity incentive plan. |

Development and Intensification Summary

The following table provides additional details on the Trust’s 8 development initiatives that are currently under construction or where initial siteworks have begun (in order of estimated initial occupancy/closing date):

| Projects under construction (Location/Project Name) | Type | Trust’s share | Actual / estimated initial occupancy / closing date | % of capital spend | GFA(1) (sq. ft.) |

No. of units |

||||||

| Mixed-use Developments | ||||||||||||

| Vaughan NW | Townhomes | 50 % | Q1 2024 | 59 % | 366,000 | 174 | ||||||

| Stoney Creek Self-Storage | Self-Storage | 50 % | Q4 2024 | 83 % | 138,000 | 973 | ||||||

| Toronto (Gilbert Ave.) Self-Storage | Self-Storage | 50 % | Q1 2025 | 70 % | 177,000 | 1,540 | ||||||

| Dorval (St-Regis Blvd.) Self-Storage | Self-Storage | 50 % | Q2 2025 | 56 % | 164,000 | 1,165 | ||||||

| Toronto (Jane St.) Self-Storage | Self-Storage | 50 % | Q3 2025 | 68 % | 143,000 | 1,404 | ||||||

| Ottawa SW | Residential apartments | 50 % | Q4 2026 | 29 % | 376,000 | 402 | ||||||

| Vaughan / ArtWalk | Condo | 50 % | Q2 2027 | 35 % | 295,000 | 340 | ||||||

| Total Mixed-use Developments | 1,659,000 | 5,998 | ||||||||||

| Retail Development | ||||||||||||

| Toronto (Laird) | Retail | 50 % | Q2 2026 | 31 % | 224,000 | — |

| (1) | GFA represents Gross Floor Area. |

Reconciliations of Non-GAAP Measures

The following tables reconcile the non-GAAP measures to the most comparable GAAP measures for the three and nine months ended September 30, 2024, and the comparable period in 2023. Such measures do not have a standardized meaning prescribed by IFRS and may not be comparable to similar measures disclosed by other issuers.

Net Operating Income (including the Trust’s Interests in Equity Accounted Investments)

| (in thousands of dollars) | Three Months Ended September 30, 2024 | Three Months Ended September 30, 2023 | ||||||||||

| GAAP Basis | Proportionate Share Reconciliation | Total Proportionate Share(1) | GAAP Basis | Proportionate Share Reconciliation | Total Proportionate Share(1) | |||||||

| Net rental income and other | ||||||||||||

| Rentals from investment properties and other | $211,737 | $12,001 | $223,738 | $206,016 | $9,580 | $215,596 | ||||||

| Property operating costs and other | (75,763) | (5,188) | (80,951) | (74,551) | (4,397) | (78,948) | ||||||

| $135,974 | $6,813 | $142,787 | $131,465 | $5,183 | $136,648 | |||||||

| Residential sales revenue and other(2) | 31,589 | 16 | 31,605 | — | 37,934 | 37,934 | ||||||

| Residential cost of sales and other | (25,585) | (22) | (25,607) | (1,063) | (29,685) | (30,748) | ||||||

| $6,004 | $(6) | $5,998 | $(1,063) | $8,249 | $7,186 | |||||||

| NOI | $141,978 | $6,807 | $148,785 | $130,402 | $13,432 | $143,834 | ||||||

| (in thousands of dollars) | Nine Months Ended September 30, 2024 | Nine Months Ended September 30, 2023 | ||||||||||

| GAAP Basis | Proportionate Share Reconciliation | Total Proportionate Share(1) | GAAP Basis | Proportionate Share Reconciliation | Total Proportionate Share(1) | |||||||

| Net rental income and other | ||||||||||||

| Rentals from investment properties and other | $638,755 | $34,195 | $672,950 | $623,560 | $26,105 | $649,665 | ||||||

| Property operating costs and other | (241,384) | (16,073) | (257,457) | (235,074) | (12,680) | (247,754) | ||||||

| $397,371 | $18,122 | $415,493 | $388,486 | $13,425 | $401,911 | |||||||

| Residential sales revenue and other(2) | 49,861 | 82 | 49,943 | — | 125,401 | 125,401 | ||||||

| Residential cost of sales and other | (41,304) | (210) | (41,514) | (3,376) | (99,529) | (102,905) | ||||||

| $8,557 | $(128) | $8,429 | $(3,376) | $25,872 | $22,496 | |||||||

| NOI | $405,928 | $17,994 | $423,922 | $385,110 | $39,297 | $424,407 | ||||||

| (1) | This column contains non-GAAP measures because it includes figures that are recorded in equity accounted investments. The Trust’s method of calculating non-GAAP measures may differ from other reporting issuers’ methods and, accordingly, may not be comparable. For additional information, please see “Non-GAAP Measures” in this Press Release. |

| (2) | Includes additional partnership profit and other revenues. |

Same Properties NOI

| Three Months Ended |

Nine Months Ended | ||||||

| (in thousands of dollars) | September 30, 2024 | September 30, 2023 | September 30, 2024 | September 30, 2023 | |||

| Net rental income and other | $141,978 | $130,402 | $405,928 | $385,110 | |||

| NOI from equity accounted investments(1) | 6,807 | 13,432 | 17,994 | 39,297 | |||

| Total portfolio NOI before adjustments(1) | $148,785 | $143,834 | $423,922 | $424,407 | |||

| Adjustments: | |||||||

| Lease termination | (476) | (230) | (1,068) | (691) | |||

| Net profit on condo and townhome closings | (5,998) | (7,186) | (8,429) | (22,496) | |||

| Non-recurring items and other adjustments(2) | 1,431 | 646 | 4,024 | 2,723 | |||

| Total portfolio NOI after adjustments(1) | $143,742 | $137,064 | $418,449 | $403,943 | |||

| NOI sourced from acquisitions, dispositions, Earnouts and developments | (3,284) | (3,172) | (8,065) | (3,065) | |||

| Same Properties NOI(1) | $140,458 | $133,892 | $410,384 | $400,878 | |||

| (1) | Represents a non-GAAP measure. The Trust’s method of calculating non-GAAP measures may differ from other reporting issuers’ methods and, accordingly, may not be comparable. For additional information, please see “Non-GAAP Measures” in this Press Release. |

| (2) | Includes non-recurring items such as one-time adjustments relating to royalties, straight-line rent and amortization of tenant incentives. |

Reconciliation of FFO

| Three Months Ended September 30 |

Nine Months Ended September 30 | ||||||

| (in thousands of dollars) | 2024 | 2023 | 2024 | 2023 | |||

| Net income and comprehensive income | $42,479 | $215,175 | $150,220 | $495,938 | |||

| Add (deduct): | |||||||

| Fair value adjustment on investment properties and financial instruments(1) | 49,217 | (67,063) | 113,054 | (157,989) | |||

| Gain (loss) on derivative – TRS | 25,815 | (5,482) | 15,672 | (13,519) | |||

| Gain (loss) on sale of investment properties | (22) | — | 120 | 23 | |||

| Amortization of intangible assets and tenant improvement allowance | 2,384 | 2,085 | 6,821 | 6,730 | |||

| Distributions on Units classified as liabilities and vested deferred units and EIP | 4,844 | 2,172 | 14,218 | 6,321 | |||

| Salaries and related costs attributed to leasing activities(2) | 2,562 | 1,776 | 7,270 | 5,810 | |||

| Adjustments relating to equity accounted investments(3) | 895 | (50,258) | (1,464) | (49,242) | |||

| FFO(4) | $128,174 | $98,405 | $305,911 | $294,072 | |||

| Add (deduct) non-recurring adjustments: | |||||||

| Gain (loss) on derivative – TRS | (25,815) | 5,482 | (15,672) | 13,519 | |||

| FFO sourced from condo and townhome closings | (6,004) | (6,918) | (8,557) | (21,354) | |||

| Transactional FFO – loss on sale of land to co-owner | — | — | — | (1,008) | |||

| FFO with adjustments(4) | $96,355 | $96,969 | $281,682 | $285,229 | |||

| (1) | Includes fair value adjustments on investment properties and financial instruments. Fair value adjustment on investment properties is described in “Investment Properties” in the Trust’s MD&A. Fair value adjustment on financial instruments comprises the following financial instruments: units classified as liabilities, Deferred Unit Plan (“DUP”), Equity Incentive Plan (“EIP”), TRS, and interest rate swap agreements. The significant assumptions made in determining the fair value are more thoroughly described in the Trust’s unaudited interim condensed consolidated financial statements for the three and nine months ended September 30, 2024. For details, please see discussion in “Results of Operations” section in the Trust’s MD&A. |

| (2) | Salaries and related costs attributed to leasing activities of $7.3 million were incurred in the nine months ended September 30, 2024 (nine months ended September 30, 2023 – $5.8 million) and were eligible to be added back to FFO based on the definition of FFO, in the REALpac White Paper, which provided for an adjustment to incremental leasing expenses for the cost of salaried staff. This adjustment to FFO results in more comparability between Canadian publicly traded real estate entities that expensed their internal leasing departments and those that capitalized external leasing expenses. |

| (3) | Includes tenant improvement amortization, indirect interest with respect to the development portion, fair value adjustment on investment properties, loss (gain) on sale of investment properties, and adjustment for supplemental costs. |

| (4) | Represents a non-GAAP measure. The Trust’s method of calculating non-GAAP measures may differ from other reporting issuers’ methods and, accordingly, may not be comparable. For definitions and basis of presentation of the Trust’s non-GAAP measures, refer to “Presentation of Certain Terms Including Non-GAAP Measures” and “Non-GAAP Measures” in the Trust’s MD&A. |

Reconciliation of AFFO

| Three Months Ended September 30 |

Nine Months Ended September 30 | ||||||

| (in thousands of dollars) | 2024 | 2023 | 2024 | 2023 | |||

| FFO(1) | $128,174 | $98,405 | $305,911 | $294,072 | |||

| Add (Deduct): | |||||||

| Straight-line rents | (1,154) | (410) | (2,854) | (211) | |||

| Adjusted salaries and related costs attributed to leasing | (2,562) | (1,776) | (7,270) | (5,810) | |||

| Capital expenditures, leasing commissions, and tenant improvements | (14,839) | (10,431) | (21,395) | (25,814) | |||

| AFFO(1) | $109,619 | $85,788 | $274,392 | $262,237 | |||

| Add (deduct) non-recurring adjustments: | |||||||

| Gain (loss) on derivative – TRS | (25,815) | 5,482 | (15,672) | 13,519 | |||

| FFO sourced from condo and townhome closings | (6,004) | (6,918) | (8,557) | (21,354) | |||

| Transactional FFO – loss on sale of land to co-owner | — | — | — | (1,008) | |||

| AFFO with adjustments(1) | $77,800 | $84,352 | $250,163 | $253,394 | |||

| (1) | Represents a non-GAAP measure. The Trust’s method of calculating non-GAAP measures may differ from other reporting issuers’ methods and, accordingly, may not be comparable. For additional information, please see “Non-GAAP Measures” in this Press Release. |

Adjusted EBITDA

The following table presents a reconciliation of net income and comprehensive income to Adjusted EBITDA:

| Rolling 12 Months Ended | |||

| (in thousands of dollars) | September 30, 2024 | September 30, 2023 | |

| Net income and comprehensive income | $164,385 | $596,309 | |

| Add (deduct) the following items: | |||

| Net interest expense | 186,607 | 151,810 | |

| Amortization of equipment, intangible assets and tenant improvements | 12,069 | 11,367 | |

| Fair value adjustments on investment properties and financial instruments | 170,039 | (236,093) | |

| Adjustment for supplemental costs | 3,770 | 5,212 | |

| Loss (gain) on sale of investment properties | 53 | (509) | |

| Adjusted EBITDA(1) | $536,923 | $528,096 | |

| (1) | Represents a non-GAAP measure. The Trust’s method of calculating non-GAAP measures may differ from other reporting issuers’ methods and, accordingly, may not be comparable. For additional information, please see “Non-GAAP Measures” in this Press Release. |

Conference Call

Management will hold a conference call on Thursday, November 14, 2024 at 3:00 p.m. (ET).

Interested parties are invited to access the call by dialing 1-855-353-9183 and then keying in the participant access code 86332#.

A recording of this call will be made available Thursday, November 14, 2024 through to Thursday, November 21, 2024. To access the recording, please call 1-855-201-2300, enter the conference access code 86332# and then key in the playback access code 0114619#.

About SmartCentres

SmartCentres is one of Canada’s largest fully integrated REITs, with a best-in-class and growing mixed-use portfolio featuring 195 strategically located properties in communities across the country. SmartCentres has approximately $11.9 billion in assets and owns 35.3 million square feet of income producing value-oriented retail and first-class office properties with 98.5% in place and committed occupancy, on 3,500 acres of owned land across Canada.

Non-GAAP Measures

The non-GAAP measures used in this Press Release, including but not limited to, AFFO, AFFO with adjustments, AFFO per Unit, AFFO with adjustments per Unit, Payout Ratio to AFFO, Payout Ratio to AFFO with adjustments, Unencumbered Assets, NOI, Debt to Aggregate Assets, Interest Coverage Ratio, Adjusted Debt to Adjusted EBITDA, Unsecured/Secured Debt Ratio, FFO, FFO with adjustments, FFO per Unit, FFO with adjustments per Unit, Same Properties NOI, Same Properties NOI excluding Anchors, Debt to Gross Book Value, Weighted Average Interest Rate, Transactional FFO, and Total Proportionate Share, do not have any standardized meaning prescribed by International Financial Reporting Standards (“IFRS”) and are therefore unlikely to be comparable to similar measures presented by other issuers. Additional information regarding these non-GAAP measures is available in the Management’s Discussion and Analysis of the Trust for the three and nine months ended September 30, 2024, dated November 13, 2024 (the “MD&A), and is incorporated by reference. The information is found in the “Presentation of Certain Terms Including Non-GAAP Measures” and “Non-GAAP Measures” sections of the MD&A, which is available on SEDAR+ at www.sedarplus.ca. Reconciliations of non-GAAP financial measures to the most directly comparable IFRS measures are found in “Reconciliations of Non-GAAP Measures” of this Press Release.

Full reports of the financial results of the Trust for the three and nine months ended September 30, 2024 are outlined in the unaudited interim condensed consolidated financial statements and the related MD&A of the Trust for the three and nine months ended September 30, 2024, which are available on SEDAR+ at www.sedarplus.ca.

Cautionary Statements Regarding Forward-looking Statements

Certain statements in this Press Release are “forward-looking statements” that reflect management’s expectations regarding the Trust’s future growth, results of operations, performance and business prospects and opportunities. More specifically, certain statements including, but not limited to, statements related to SmartCentres’ expectations relating to cash collections, SmartCentres’ expected or planned development plans and joint venture projects, including the described type, scope, costs and other financial metrics and the expected timing of construction and condo closings and statements that contain words such as “could”, “should”, “can”, “anticipate”, “expect”, “believe”, “will”, “may” and similar expressions and statements relating to matters that are not historical facts, constitute “forward-looking statements”. These forward-looking statements are presented for the purpose of assisting the Trust’s Unitholders and financial analysts in understanding the Trust’s operating environment and may not be appropriate for other purposes. Such forward-looking statements reflect management’s current beliefs and are based on information currently available to management.

However, such forward-looking statements involve significant risks and uncertainties. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including risks associated with potential acquisitions not being completed or not being completed on the contemplated terms, public health crises, real property ownership and development, debt and equity financing for development, interest and financing costs, construction and development risks, and the ability to obtain commercial and municipal consents for development. These risks and others are more fully discussed under the heading “Risks and Uncertainties” and elsewhere in SmartCentres’ most recent Management’s Discussion and Analysis, as well as under the heading “Risk Factors” in SmartCentres’ most recent annual information form. Although the forward-looking statements contained in this Press Release are based on what management believes to be reasonable assumptions, SmartCentres cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. These forward-looking statements are made as at the date of this Press Release and SmartCentres assumes no obligation to update or revise them to reflect new events or circumstances unless otherwise required by applicable securities legislation.

Material factors or assumptions that were applied in drawing a conclusion or making an estimate set out in the forward-looking information may include, but are not limited to: a stable retail environment; a continuing trend toward land use intensification, including residential development in urban markets and continued growth along transportation nodes; access to equity and debt capital markets to fund, at acceptable costs, future capital requirements and to enable our refinancing of debts as they mature; that requisite consents for development will be obtained in the ordinary course, construction and permitting costs consistent with the past year and recent inflation trends.

Contact

For information, visit www.smartcentres.com or please contact:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Proxy MicroStrategy Added More To Its Market Cap In Last 2 Months Than What Ford Is Worth Currently

Bitcoin’s BTC/USD bullish turn since early September has reflected well on MicroStrategy Inc. MSTR, with the proxy firm increasing its valuation by $50 billion in the last two months.

What happened: Widely considered a TradFi alternative to holding Bitcoin, shares of MicroStrategy hit a record closing high, past $350, earlier this week. The surge marked the highest level for the shares since the dot-com bubble in March 2000.

The rally propelled the firm’s market valuation to $72.26 billion, reflecting an increase of $50 billion since Sept. 6, or 225%. Just for context, the gain was higher than the total capitalization of Ford Motor Co. F and Cognizant Technology Solutions Corp. CTSH.

Year-to-date, MicroStrategy has leaped 374%, outperforming some of the hottest stocks on Wall Street, including the “Magnificent Seven.”

The upswing coincided with the record-breaking play of Bitcoin, which was swiftly approaching the $100,000 milestone. Since Sept. 6, Bitcoin has surged more than 60% in value.

Why It Matters: The Bitcoin portfolio of MicroStrategy—a company that has pioneered the leading cryptocurrency’s corporate adoption—has ballooned past a whopping $25 billion, according to data from bitcointreasuries.net.

At an average acquisition price of $11.92 billion, the firm racked up over $13 billion in unrealized profit on its Bitcoin purchases.

In its third-quarter results report, the company announced plans to raise as much as $42 billion in equity and debt funding over the next three years to accumulate more Bitcoin.

Price Action: At the time of writing, Bitcoin was exchanging hands at $89,917.11, up 3.06% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy were up 2.87% in after-hours trading, after pulling back 7.91% during Wednesday’s regular trading session.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ZEEKR Reports Third Quarter 2024 Unaudited Financial Results

HANGZHOU, China, Nov. 14, 2024 /PRNewswire/ — ZEEKR Intelligent Technology Holding Limited (“ZEEKR” or the “Company”) ZK, a global premium electric mobility technology company, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Operating Highlights for the Third Quarter of 2024

- Total vehicle deliveries were 55,003 units for the third quarter of 2024, representing a 51% year-over-year increase.

|

Deliveries |

2024 Q3 |

2024 Q2 |

2024 Q1 |

2023 Q4 |

||||

|

55,003 |

54,811 |

33,059 |

39,657 |

|||||

|

Deliveries |

2023 Q3 |

2023 Q2 |

2023 Q1 |

2022 Q4 |

||||

|

36,395 |

27,399 |

15,234 |

32,467 |

Financial Highlights for the Third Quarter of 2024

- Vehicle sales were RMB14,401.3 million (US$2,052.2 million)[1] for the third quarter of 2024, representing an increase of 42.0% from the third quarter of 2023 and an increase of 7.2% from the second quarter of 2024.

- Vehicle margin[2] was 15.7% for the third quarter of 2024, compared with 18.1% for the third quarter of 2023 and 14.2% for the second quarter of 2024.

- Total revenues were RMB18,358.0 million (US$2,616.0 million) for the third quarter of 2024, representing an increase of 30.7% from the third quarter of 2023 and a decrease of 8.4% from the second quarter of 2024.

- Gross profit was RMB2,941.8 million (US$419.2 million) for the third quarter of 2024, representing an increase of 28.5% from the third quarter of 2023 and a decrease of 14.7% from the second quarter of 2024.

- Gross margin was 16.0% for the third quarter of 2024, compared with 16.3% for the third quarter of 2023 and 17.2% for the second quarter of 2024.

- Loss from operations was RMB1,216.4 million (US$173.3 million) for the third quarter of 2024, representing a decrease of 19.3% from the third quarter of 2023 and a decrease of 29.3% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP)[3] was RMB1,169.8 million (US$166.7 million) for the third quarter of 2024, representing a decrease of 20.8% from the third quarter of 2023 and an increase of 50.5% from the second quarter of 2024.

- Net loss was RMB1,139.1 million (US$162.3 million) for the third quarter of 2024, representing a decrease of 21.7% from the third quarter of 2023 and a decrease of 37.0% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,092.6 million (US$155.7 million) for the third quarter of 2024, representing a decrease of 23.4% from the third quarter of 2023 and an increase of 26.3% from the second quarter of 2024.

|

[1] All conversions from Renminbi(“RMB”) to U.S. dollars (“US$”) are made at an exchange rate of RMB7.0176 to US$1.00, set forth in the H.10 statistical release of the Federal Reserve Board on September 30, 2024. |

|

[2] Vehicle margin is the margin of vehicle sales, which is calculated based on revenues and cost of revenues derived from vehicle sales only. |

|

[3] The Company’s non-GAAP financial measures exclude share-based compensation expenses. See “Unaudited Reconciliation of GAAP and Non-GAAP Results” set forth at the end of this announcement. |

Key Financial Results

(in RMB millions, except for percentages)

|

2024 Q3 |

2024 Q2 |

2023 Q3 |

% Change i |

|||

|

YoY |

QoQ |

|||||

|

Vehicle sales |

14,401.3 |

13,438.2 |

10,143.7 |

42.0 % |

7.2 % |

|

|

Vehicle margin |

15.7 % |

14.2 % |

18.1 % |

(2.4)pts |

1.5pts |

|

|

Total revenues |

18,358.0 |

20,040.1 |

14,044.6 |

30.7 % |

(8.4) % |

|

|

Gross profit |

2,941.8 |

3,449.8 |

2,289.4 |

28.5 % |

(14.7) % |

|

|

Gross margin |

16.0 % |

17.2 % |

16.3 % |

(0.3)pts |

(1.2)pts |

|

|

Loss from operations |

(1,216.4) |

(1,721.0) |

(1,507.8) |

(19.3) % |

(29.3) % |

|

|

Non-GAAP loss from operations |

(1,169.8) |

(777.1) |

(1,477.6) |

(20.8) % |

50.5 % |

|

|

Net loss |

(1,139.1) |

(1,808.8) |

(1,455.7) |

(21.7) % |

(37.0) % |

|

|

Non-GAAP net loss |

(1,092.6) |

(864.9) |

(1,425.6) |

(23.4) % |

26.3 % |

|

|

i |

Except for vehicle margin and gross margin, absolute changes instead of percentage changes are presented. |

Recent Developments

Delivery Update

In October 2024, the Company delivered 25,049 vehicles, representing an increase of 92% from October 2023.

New Model Launches

On October 23, 2024, ZEEKR officially launched and commenced deliveries of the ZEEKR MIX, a five-seat, family-oriented vehicle. The ZEEKR MIX redefines the concept of an everyday driver, seamlessly combining ample space, outstanding safety, and agile handling. As the first model built on the Company’s SEA-M architecture, the ZEEKR MIX boasts up to 93% in-cabin space utilization, maximizing interior space through innovative packaging and a capsule-style exterior. Two front-row seats that can swivel 270 degrees and a movable central console enhance cabin versatility, enabling “9+N” cabin scenario modes and flexible seating arrangements.

CEO and CFO Comments

“Our performance remained strong and resilient this quarter, marked by record-high deliveries and successful new model launches,” said Mr. Andy An, ZEEKR’s chief executive officer. “In the third quarter, we set a new record with 55,003 vehicle deliveries, representing a 51% year-over-year increase, and reached an additional milestone in October with monthly deliveries of 25,049 units. Notably, the ZEEKR 7X’s deliveries exceeded 20,000 units within 50 days since its launch, marking a robust achievement in the highly competitive mainstream SUV market. As we expand our product lineup and strengthen each model’s position in its respective category, we are delivering ZEEKR’s ultimate driving experience to more users, further cementing ZEEKR’s industry leadership.”

Mr. Jing Yuan, ZEEKR’s chief financial officer, added, “Our disciplined cost control measures, coupled with ongoing optimization of product structure, economies of scale, and technological innovation, drove a 30.7% year-over-year increase in revenue. Vehicle sales for the quarter grew by 42.0% and 7.2% year-over-year and quarter-over-quarter, respectively. Meanwhile, vehicle margin remained on an upward trajectory, rising to 15.7% in the third quarter of 2024, highlighting our consistent progress in profitability enhancement. Looking ahead, we will continue to consolidate resources, strengthen product capabilities, and expand our industry presence to propel our sustainable growth.”

Financial Results for the Third Quarter of 2024

Revenues

- Total revenues were RMB18,358.0 million (US$2,616.0 million) for the third quarter of 2024, representing an increase of 30.7% from RMB14,044.6 million for the third quarter of 2023 and a decrease of 8.4% from RMB20,040.1 million for the second quarter of 2024.

- Revenues from vehicle sales were RMB14,401.3 million (US$2,052.2 million) for the third quarter of 2024, representing an increase of 42.0% from RMB10,143.7 million for the third quarter of 2023, and an increase of 7.2% from RMB13,438.2 million for the second quarter of 2024. The year-over-year increase was due to the increase in new product delivery volume, partially offset by the lower average selling price due to the different product mix and pricing strategy changes between the two quarters. The quarter-over-quarter increase was mainly attributable to the launch of the ZEEKR 7X new model in the third quarter of 2024 and the higher average selling price resulting from changes in product mix.

- Revenues from sales of batteries and other components were RMB3,245.3 million (US$462.5 million) for the third quarter of 2024, representing a decrease of 1.3% from RMB3,288.8 million for the third quarter of 2023 and a decrease of 38.8% from RMB5,299.2 million for the second quarter of 2024. The revenues from sales of batteries and other components remained relatively stable compared with the third quarter of 2023. The quarter-over-quarter decrease was mainly driven by lower sales volume of battery packs in the domestic market.

- Revenues from research and development service and other services were RMB711.4 million (US$101.4 million) for the third quarter of 2024, representing an increase of 16.2% from RMB612.1 million for the third quarter of 2023 and a decrease of 45.4% from RMB1,302.6 million for the second quarter of 2024. The year-over-year increase was mainly due to the increased sales of after-sales vehicle services. The quarter-over-quarter decrease was mainly due to the decreased sales of research and development services to related parties.

Cost of Revenues and Gross Margin

- Cost of revenues was RMB15,416.2 million (US$2,196.8 million) for the third quarter of 2024, representing an increase of 31.1% from RMB11,755.2 million for the third quarter of 2023 and a decrease of 7.1% from RMB16,590.2 million for the second quarter of 2024. The year-over-year increase was mainly attributable to the increase in vehicle delivery volume and the quarter-over-quarter decrease was mainly attributable to the decrease in sales of batteries and other components.

- Gross profit was RMB2,941.8 million (US$419.2 million) for the third quarter of 2024, representing an increase of 28.5% from RMB2,289.4 million for the third quarter of 2023 and a decrease of 14.7% from RMB3,449.8 million for the second quarter of 2024.

- Gross margin was 16.0% for the third quarter of 2024, compared with 16.3% for the third quarter of 2023 and 17.2% for the second quarter of 2024. The gross margin remained relatively stable compared with the third quarter of 2023. The quarter-over-quarter decrease was mainly attributable to the decreased margins on batteries and other components.

- Vehicle margin was 15.7% for the third quarter of 2024, compared with 18.1% for the third quarter of 2023 and 14.2% for the second quarter of 2024. The year-over-year decrease was primarily attributed to the lower average selling price of ZEEKR vehicles due to the different product mix and pricing strategy changes between the two quarters, partially offset by the procurement savings as the cost of auto parts and materials decreased. The quarter-over-quarter increase was mainly due to the change in product mix.

Operating Expenses

- Research and development expenses were RMB1,966.2 million (US$280.2 million) for the third quarter of 2024, representing a decrease of 2.6% from RMB2,018.1 million for the third quarter of 2023 and a decrease of 25.1% from RMB2,623.5 million for the second quarter of 2024. Research and development expenses remained relatively stable compared with the third quarter of 2023. The quarter-over-quarter decrease was mainly due to a one-off, large quantity of share-based compensation expenses in the second quarter, conditioned on the Company’s initial public offering.

- Selling, general and administrative expenses were RMB2,274.8 million (US$324.1 million) for the third quarter of 2024, representing an increase of 25.4% from RMB1,813.9 million for the third quarter of 2023 and a decrease of 12.7% from RMB2,604.7 million for the second quarter of 2024. The year-over-year increase was mainly due to increased expenses related to the expansion of offline channels in China and overseas as well as the marketing activities of the launch of new models. The quarter-over-quarter decrease was mainly due to a one-off, large quantity of share-based compensation expenses in the second quarter, conditioned on the Company’s initial public offering.

Loss from Operations

- Loss from operations was RMB1,216.4 million (US$173.3 million) for the third quarter of 2024, representing a decrease of 19.3% from RMB1.507.8 million for the third quarter of 2023 and a decrease of 29.3% from RMB1,721.0 million for the second quarter of 2024.

- Non-GAAP loss from operations, which excludes share-based compensation expenses from loss from operations, was RMB1,169.8 million (US$166.7 million) for the third quarter of 2024, representing a decrease of 20.8% from RMB1,477.6 million for the third quarter of 2023 and an increase of 50.5% from RMB777.1 million for the second quarter of 2024.

Net Loss and Net Loss Per Share

- Net loss was RMB1,139.1 million (US$162.3 million) for the third quarter of 2024, representing a decrease of 21.7% from RMB1,455.7 million for the third quarter of 2023 and a decrease of 37.0% from RMB1,808.8 million for the second quarter of 2024.

- Non-GAAP net loss, which excludes share-based compensation expenses from net loss, was RMB1,092.6 million (US$155.7 million) for the third quarter of 2024, representing a decrease of 23.4% from RMB1,425.6 million for the third quarter of 2023 and an increase of 26.3% from RMB864.9 million for the second quarter of 2024.

- Net loss attributable to ordinary shareholders of ZEEKR was RMB1,226.3 million (US$174.7 million) for the third quarter of 2024, representing a decrease of 16.9% from RMB1,476.1 million for the third quarter of 2023 and a decrease of 44.0% from RMB2,190.2 million for the second quarter of 2024.

- Non-GAAP net loss attributable to ordinary shareholders of ZEEKR, which excludes share-based compensation expenses from net loss attributable to ordinary shareholders, was RMB1,179.7 million (US$168.1 million) for the third quarter of 2024, representing a decrease of 18.4% from RMB1,445.9 million for the third quarter of 2023 and a decrease of 5.3% from RMB1,246.3 million for the second quarter of 2024.

- Basic and diluted net loss per share attributed to ordinary shareholders were RMB0.48 (US$0.07) each for the third quarter of 2024, compared with RMB0.74 each for the third quarter of 2023 and RMB0.95 each for the second quarter of 2024.

- Non-GAAP basic and diluted net loss per share attributed to ordinary shareholders were both RMB0.46 (US$0.07) each for the third quarter of 2024, compared with RMB0.72 each for the third quarter of 2023 and RMB0.54 each for the second quarter of 2024.

- Basic and diluted net loss per American Depositary Share (“ADS[4]“) attributed to ordinary shareholders were RMB4.80 (US$0.68) each for the third quarter of 2024, compared with RMB9.51 each for the second quarter of 2024.

- Non-GAAP basic and diluted net loss per ADS attributed to ordinary shareholders were RMB4.62 (US$0.66) each for the third quarter of 2024, compared with RMB5.41 each for the second quarter of 2024.

|

[4] Each ADS represents ten ordinary shares. |

Balance Sheets

Cash and cash equivalents and restricted cash was RMB8,297.7 million (US$1,182.4 million) as of September 30, 2024.

Conference Call

The Company’s management will host an earnings conference call on Thursday, November 14, 2024, at 7:00 A.M. U.S. Eastern Time (8:00 P.M. Beijing/Hong Kong Time on the same day).

All participants who wish to join the call are requested to complete the online registration using the link provided below. After registration, each participant will receive by email a set of dial-in numbers, a passcode and a unique access PIN to join the conference call. Participants may pre-register at any time, including up to and after the call start time.

Participant Online Registration: https://dpregister.com/sreg/10194063/fdd5d5735e

A live webcast of the conference call will be available on the Company’s investor relations website at https://ir.zeekrlife.com/.

About ZEEKR

ZEEKR ZK is a global premium electric mobility technology brand from Geely Holding Group. ZEEKR aims to create a fully integrated user ecosystem with innovation as a standard. ZEEKR utilizes Sustainable Experience Architecture (SEA) and develops its own battery technologies, battery management systems, electric motor technologies, and electric vehicle supply chains. ZEEKR’s value is equality, diversity, and sustainability. Its ambition is to become a true mobility solution provider.

ZEEKR operates its R&D centers and design studios in Ningbo, Hangzhou, Gothenburg, and Shanghai and boasts state-of-the-art facilities and world-class expertise. Since ZEEKR began delivering vehicles in October 2021, the brand has developed a diversified product portfolio that primarily includes the ZEEKR 001, a luxury shooting brake; the ZEEKR 001 FR, a hyper-performing electric shooting brake; the ZEEKR 009, a pure electric luxury MPV; the ZEEKR 009 Grand, a four-seat ultra-luxury flagship MPV; the ZEEKR X, a compact SUV; the ZEEKR 7X, a premium electric five-seater SUV; the ZEEKR MIX; and an upscale sedan model. ZEEKR has announced plans to sell vehicles in global markets, and has an ambitious roll-out plan over the next 5 years to satisfy the rapidly expanding global EV demand.

For more information, please visit https://ir.zeekrlife.com/.

Non-GAAP Financial Measures

The Company uses non-GAAP financial measures, such as non-GAAP loss from operations, non-GAAP net loss, non-GAAP net loss attributable to ordinary shareholders, non-GAAP basic and diluted net loss per ordinary share attributed to ordinary shareholders, non-GAAP basic and diluted net loss per ADS attributed to ordinary shareholders, in evaluating its operating results and for financial and operational decision-making purposes. By excluding the impact of share-based compensation expenses, the Company believes that the non-GAAP financial measures help identify underlying trends in its business and enhance the overall understanding of the Company’s past performance and future prospects. The Company also believes that the non-GAAP financial measures allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational decision-making. The non-GAAP financial measures are not presented in accordance with U.S. GAAP and may be different from non-GAAP methods of accounting and reporting used by other companies. The non-GAAP financial measures have limitations as analytical tools and when assessing the Company’s operating performance, investors should not consider them in isolation, or as a substitute for net loss or other consolidated statements of comprehensive loss data prepared in accordance with U.S. GAAP. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure. The Company mitigates these limitations by reconciling the non-GAAP financial measures to the most comparable U.S. GAAP performance measures, all of which should be considered when evaluating the Company’s performance.

For more information on the non-GAAP financial measures, please see the table captioned “Unaudited Reconciliations of GAAP and non-GAAP Results” set forth in this announcement.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars and from U.S. dollars to RMB are made at a rate of RMB7.0176 to US$1.00, the exchange rate on September 30, 2024, set forth in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or U.S. dollar amounts referred to could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause actual results to differ materially from those contained in any forward-looking statement. In some cases, forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “future,” “target,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to,” or other similar expressions. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the SEC. All information provided in this announcement is as of the date of this announcement, and the Company does not undertake any duty to update such information, except as required under applicable law.

For Investor Enquiries

ZEEKR

Investor Relations

Email: ir@zeekrlife.com

For Media Enquiries

ZEEKR

Media Relations

Email: Globalcomms@zeekrlife.com

|

ZEEKR INC. |

|||||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

|||||

|

(Amounts in thousands) |

|||||

|

As of |

|||||

|

December 31 |

September 30 |

September 30 |

|||

|

2023 |

2024 |

2024 |

|||

|

RMB |

RMB |

US$ |

|||

|

ASSETS |

|||||

|

Current assets: |

|||||

|

Cash and cash equivalents |

3,260,670 |

5,640,993 |

803,835 |

||

|

Restricted cash |

844,079 |

2,656,734 |

378,582 |

||

|

Notes receivable |

487,851 |

952,108 |

135,674 |

||

|

Accounts receivable |

1,104,450 |

2,096,355 |

298,728 |

||

|

Inventories |

5,228,689 |

4,745,085 |

676,169 |

||

|

Amounts due from related parties |

7,256,861 |

6,535,623 |

931,319 |

||

|

Prepayments and other current assets |

2,294,508 |

2,711,024 |

386,317 |

||

|

Total current assets |

20,477,108 |

25,337,922 |

3,610,624 |

||

|

Property, plant and equipment, net |

2,914,274 |

3,265,370 |

465,312 |

||

|

Intangible assets, net |

410,912 |

624,404 |

88,977 |

||

|

Land use rights, net |

51,755 |

62,185 |

8,861 |

||

|

Operating lease right-of-use assets |

2,443,545 |

2,225,175 |

317,085 |

||

|

Deferred tax assets |

86,395 |

195,175 |

27,812 |

||

|

Long-term investments |

459,794 |

629,383 |

89,686 |

||

|

Other non-current assets |

273,717 |

367,752 |

52,404 |

||

|

Total non-current assets |

6,640,392 |

7,369,444 |

1,050,137 |

||

|

TOTAL ASSETS |

27,117,500 |

32,707,366 |

4,660,761 |

||

|

ZEEKR INC. |

|||||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (CONTINUED) |

|||||

|

(Amounts in thousands) |

|||||

|

As of |

|||||

|

December 31 |

September 30 |

September 30 |

|||

|

2023 |

2024 |

2024 |

|||

|

RMB |

RMB |

US$ |

|||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|||||

|

Current liabilities: |

|||||

|

Short-term Borrowings |

– |

30,000 |

4,275 |

||

|

Accounts payable |

4,104,717 |

3,589,418 |

511,488 |

||

|

Notes payable |

5,504,945 |

12,474,151 |

1,777,552 |

||

|

Amounts due to related parties |

16,355,902 |

15,008,230 |

2,138,656 |

||

|

Income tax payable |

108,083 |

172,826 |

24,628 |

||

|

Accruals and other current liabilities |

6,243,956 |

8,114,841 |

1,156,354 |

||

|

Total current liabilities |

32,317,603 |

39,389,466 |

5,612,953 |

||

|

Long-term borrowings |

– |

414,630 |

59,084 |

||

|

Operating lease liabilities, non-current |

1,807,159 |

1,577,950 |

224,856 |

||

|

Amounts due to related parties, non-current |

1,100,000 |

– |

– |

||

|

Other non-current liabilities |

563,001 |

540,082 |

76,961 |

||

|

Deferred tax liability |

8,337 |

8,224 |

1,172 |

||

|

Total non-current liabilities |

3,478,497 |

2,540,886 |

362,073 |

||

|

TOTAL LIABILITIES |

35,796,100 |

41,930,352 |

5,975,026 |

||

|

SHAREHOLDERS’ EQUITY |

|||||

|

Ordinary shares |

2,584 |

3,361 |

479 |

||

|

Convertible preferred shares |

362 |

– |

– |

||

|

Shares subscription receivable |

– |

(66) |

(9) |

||

|

Additional paid-in capital |

11,213,798 |

15,683,094 |

2,234,823 |

||

|

Accumulated deficits |

(20,865,686) |

(26,296,475) |

(3,747,218) |

||

|

Accumulated other comprehensive income/(loss) |

17,555 |

(26,402) |

(3,762) |

||

|

Total ZEEKR shareholders’ deficit |

(9,631,387) |

(10,636,488) |

(1,515,687) |

||

|

Non-controlling interest |

952,787 |

1,413,502 |

201,422 |

||

|

TOTAL SHAREHOLDERS’ DEFICIT |

(8,678,600) |

(9,222,986) |

(1,314,265) |

||

|

TOTAL LIABILITIES AND SHAREHOLDERS’ |

27,117,500 |

32,707,366 |

4,660,761 |

||

|

ZEEKR INC. |

|||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE |

|||||||

|

(Amounts in thousands, except share/ADS and per share/ADS data and otherwise noted) |

|||||||

|

Three Months Ended |

|||||||

|

September 30 |

June 30 |

September 30 |

September 30 |

||||

|

2023 |

2024 |

2024 |

2024 |

||||

|

RMB |

RMB |

RMB |

US$ |

||||

|

Revenues: |

|||||||

|

Vehicle sales |

10,143,742 |

13,438,241 |

14,401,309 |

2,052,170 |

|||

|

Sales of batteries and other components |

3,288,766 |

5,299,171 |

3,245,331 |

462,456 |

|||

|

Research and development service and |

612,103 |

1,302,639 |

711,362 |

101,368 |

|||

|

Total revenues |

14,044,611 |

20,040,051 |

18,358,002 |

2,615,994 |

|||

|

Cost of revenues: |

|||||||

|

Vehicle sales |

(8,308,327) |

(11,533,020) |

(12,146,781) |

(1,730,902) |

|||

|

Sales of batteries and other components |

(3,050,588) |

(4,223,452) |

(2,808,646) |

(400,229) |

|||

|

Research and development service and |

(396,289) |

(833,756) |

(460,775) |

(65,660) |

|||

|

Total cost of revenues |

(11,755,204) |

(16,590,228) |

(15,416,202) |

(2,196,791) |

|||

|

Gross profit |

2,289,407 |

3,449,823 |

2,941,800 |

419,203 |

|||

|

Operating expenses: |

|||||||

|

Research and development expenses |

(2,018,136) |

(2,623,471) |

(1,966,167) |

(280,177) |

|||

|

Selling, general and administrative |

(1,813,890) |

(2,604,665) |

(2,274,751) |

(324,149) |

|||

|

Other operating income, net |

34,851 |

57,287 |

82,747 |

11,791 |

|||

|

Total operating expenses |

(3,797,175) |

(5,170,849) |

(4,158,171) |

(592,535) |

|||

|

Loss from operations |

(1,507,768) |

(1,721,026) |

(1,216,371) |

(173,332) |

|||

|

Interest expense |

(28,186) |

(23,396) |

(8,088) |

(1,153) |

|||

|

Interest income |

27,614 |

42,537 |

43,255 |

6,163 |

|||

|

Other income/(expense), net |

6,020 |

(7,809) |

54,967 |

7,833 |

|||

|

Loss before income tax expense and |

(1,502,320) |

(1,709,694) |

(1,126,237) |

(160,489) |

|||

|

Share of income in equity method |

33,021 |

85,852 |

81,500 |

11,614 |

|||

|

Income tax benefits/(expense) |

13,605 |

(184,980) |

(94,409) |

(13,453) |

|||

|

Net loss |

(1,455,694) |

(1,808,822) |

(1,139,146) |

(162,328) |

|||

|

Less: income attributable to non- |

20,368 |

381,363 |

87,134 |

12,416 |

|||

|

Net loss attributable to shareholders |

(1,476,062) |

(2,190,185) |

(1,226,280) |

(174,744) |

|||

|

ZEEKR INC. |

|||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE |

|||||||

|

(Amounts in thousands, except share/ADS and per share/ADS data and otherwise noted) |

|||||||

|

Three Months Ended |

|||||||

|

September 30 |

June 30 |

September 30 |

September 30 |

||||

|

2023 |

2024 |

2024 |

2024 |

||||

|

RMB |

RMB |

RMB |

US$ |

||||

|

Net loss per share attributed to |

|||||||

|

Basic and diluted |

(0.74) |

(0.95) |

(0.48) |

(0.07) |

|||

|

Weighted average shares used in |

|||||||

|

Basic and diluted |

2,000,000,000 |

2,301,866,887 |

2,552,901,668 |

2,552,901,668 |

|||

|

Net loss per ADS attributed to |

|||||||

|

Basic and diluted |

– |

(9.51) |

(4.80) |

(0.68) |

|||

|

Weighted average ADS used in |

|||||||

|

Basic and diluted |

– |

230,186,689 |

255,290,167 |

255,290,167 |

|||

|

Net loss |

(1,455,694) |

(1,808,822) |

(1,139,146) |

(162,328) |

|||

|

Other comprehensive income/(loss), |

|||||||

|

Foreign currency translation |

(35,240) |

74,670 |

(75,858) |

(10,810) |

|||

|

Comprehensive loss |

(1,490,934) |

(1,734,152) |

(1,215,004) |

(173,138) |

|||

|

Less: comprehensive income/(loss) |

20,368 |

381,363 |

87,134 |

12,416 |

|||

|

Comprehensive loss attributable to |

(1,511,302) |

(2,115,515) |

(1,302,138) |

(185,554) |

|||

|

ZEEKR INC. |

||||||||

|

UNAUDITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS |

||||||||

|

(Amounts in thousands, except share/ADS and per share/ADS data and otherwise noted) |

||||||||

|

Three Months Ended |

||||||||

|

September 30 |

June 30 |

September 30 |

September 30 |

|||||

|

2023 |

2024 |

2024 |

2024 |

|||||

|

RMB |

RMB |

RMB |

US$ |

|||||

|

Loss from operations |

(1,507,768) |

(1,721,026) |

(1,216,371) |

(173,332) |

||||

|

Share-based compensation expenses |

30,142 |

943,921 |

46,595 |

6,640 |

||||

|

Non-GAAP loss from operations |

(1,477,626) |

(777,105) |

(1,169,776) |

(166,692) |

||||

|

Net loss |

(1,455,694) |

(1,808,822) |

(1,139,146) |

(162,328) |

||||

|

Share-based compensation expenses |

30,142 |

943,921 |

46,595 |

6,640 |

||||

|

Non-GAAP net loss |

(1,425,552) |

(864,901) |

(1,092,551) |

(155,688) |

||||

|

Net loss attributable to ordinary |

(1,476,062) |

(2,190,185) |

(1,226,280) |

(174,744) |

||||

|

Share-based compensation expenses |

30,142 |

943,921 |

46,595 |

6,640 |

||||

|

Non-GAAP net loss attributable to |

(1,445,920) |

(1,246,264) |

(1,179,685) |

(168,104) |

||||

|

Weighted average number of |

||||||||

|

Basic and diluted |

2,000,000,000 |

2,301,866,887 |

2,552,901,668 |

2,552,901,668 |

||||

|

Non-GAAP net loss per ordinary |

||||||||

|

Basic and diluted |

(0.72) |

(0.54) |

(0.46) |

(0.07) |

||||

|

Weighted average number of ADS |

||||||||

|

Basic and diluted |

– |

230,186,689 |

255,290,167 |

255,290,167 |

||||

|

Non-GAAP net loss per ADS |

||||||||

|

Basic and diluted |

– |

(5.41) |

(4.62) |

(0.66) |

||||

![]() View original content:https://www.prnewswire.com/news-releases/zeekr-reports-third-quarter-2024-unaudited-financial-results-302305084.html

View original content:https://www.prnewswire.com/news-releases/zeekr-reports-third-quarter-2024-unaudited-financial-results-302305084.html

SOURCE ZEEKR Intelligent Technology Holding Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ted Cruz Says Running DOGE Won't Be A Cake Walk, Offers Reading Advice To Elon Musk

Senator Ted Cruz (R-Texas) anticipated the newly established Department of Government Efficiency (DOGE) department to yield “good results” but warned that Elon Musk and Vivek Ramaswamy would have their work cut out.

What happened: During a podcast with Ben Ferguson, Cruz said he was upbeat about Musk’s new role in the administration but emphasized the fundamental differences between working for a private company and a government department.

Cruz said he had a phone conversation with Musk and urged the tech tycoon to read the book “Bureaucracy” by Austrian economist Ludwig von Mises, who argued why private players may find it difficult to administer a government agency.

The senator emphasized that the incentives in the government department were opposite to the profit motive seen in private companies.

Cruz added he asked Musk to take note of the fact that unlike private institutions, one cannot fire government employees because of civil service protections in place.

“I pointed out to Elon. Look, when you went into Twitter, you fired 60% of the employees. That’s the flexibility you have.”

On the DOGE connection, Cruz said that the nomenclature was not accidental as everyone knows that Musk is a vocal supporter of Dogecoin DOGE/USD.

Why It Matters: Cruz and Musk have a friendly relationship, and the senator previously lauded the SpaceX CEO for maintaining the U.S.’s leadership in space technology.

A known cryptocurrency advocate, Cruz has invested in Bitcoin BTC/USD and believes in the upside potential of the leading digital asset.

Price Action: At the time of writing, DOGE was exchanging hands at $0.3853, up 0.92% in the last 24 hours, according to data from Benzinga Pro.

Photo by Consolidated News Photos on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rocket Lab CEO Touts SpaceX Rival Status, Trump Impact On Space As Stock Surges Almost 30%

Rocket Lab USA Inc‘s RKLB stock surged nearly 30% in trading on Wednesday following strong third-quarter results, with CEO Peter Beck highlighting the company’s expanding presence across multiple space sectors during an interview.

What Happened: The space company reported third-quarter revenue of $104.81 million, exceeding analyst expectations and marking a 55% year-over-year increase. Beck emphasized the company’s growing $1.05 billion backlog for their small Electron rocket and confirmed the larger Neutron rocket remains on schedule for its debut launch next year.

“Launch is super important; it’s literally the key to space,” Beck told CNBC’s Morgan Brennan. “But the Space Systems group is what enables us to build infrastructure in orbit.” He noted the division currently has over 40 spacecraft in backlog, ranging from Mars missions to telecommunications and national security projects.

Addressing potential political implications, Beck expressed optimism about space policy under President-elect Donald Trump‘s administration, citing its focus on space, national defense, and efficient contracting. “When space does well, Rocket Lab does well,” he stated.

See Also: SoftBank Is In Profit Once Again Thanks To Indian IPOs: What’s Next For Masayoshi Son?

Why It Matters: The company’s recent performance has been remarkable, with shares up more than 350% over six months. Beck attributed this partly to investors’ growing understanding of Rocket Lab’s position as the second-largest space company behind Elon Musk-led SpaceX, which is valued at over $200 billion compared to Rocket Lab’s sub-5% relative valuation.

Looking ahead, Rocket Lab projects fourth-quarter revenue between $125 million and $135 million, anticipating continued growth through year-end. The company has also secured new contracts, including a multi-launch agreement with a commercial satellite constellation operator and an $8 million award from the U.S. Air Force Research Laboratory.

Price Action: Rocket Lab stock closed at $18.83 on Wednesday, up 28.44% for the day. In after-hours trading, the stock dipped 0.58. Year-to-date, Rocket Lab has surged 254.61%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

10% Owner Of St. Joe Sold $2.42M In Stock

Making a noteworthy insider sell on November 12, BRUCE BERKOWITZ, 10% Owner at St. Joe JOE, is reported in the latest SEC filing.

What Happened: BERKOWITZ’s decision to sell 45,400 shares of St. Joe was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value of the sale is $2,418,458.

St. Joe‘s shares are actively trading at $51.03, experiencing a down of 0.0% during Wednesday’s morning session.

Delving into St. Joe’s Background

The St. Joe Co is a real estate development, asset management, and operating company and it has three operating segments; the Residential segment plans and develops residential communities and sells homesites to homebuilders or retail consumers, the Hospitality segment features a private membership club (the Watersound Club), hotel operations, food and beverage operations, golf courses, beach clubs, retail outlets, gulf-front vacation rentals, management services, marinas, and other entertainment assets, and Commercial segment include leasing of commercial property, multi-family, senior living, self-storage, and other assets and it also oversees the planning, development, entitlement, management, and sale of commercial and rural land holdings.

Financial Insights: St. Joe

Revenue Growth: St. Joe’s revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -2.35%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Interpreting Earnings Metrics:

-

Gross Margin: The company shows a low gross margin of 38.03%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): St. Joe’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 0.29.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.88, caution is advised due to increased financial risk.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: St. Joe’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 43.62.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 7.73 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 20.76 reflects market recognition of St. Joe’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of St. Joe’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prime Mining Q3 2024 Financial and Operating Results

VANCOUVER, British Columbia, Nov. 13, 2024 (GLOBE NEWSWIRE) — Prime Mining Corp. (“Prime”, or the “Company”) (TSV: PRYM) PRMNF (Frankfurt: O4V3) is pleased to report its operating and financial results for the quarter ended September 30, 2024. Prime is focused on the exploration and development of its wholly owned high-grade Los Reyes Gold-Silver Project in Sinaloa State, Mexico (“Los Reyes” or the “Project”).

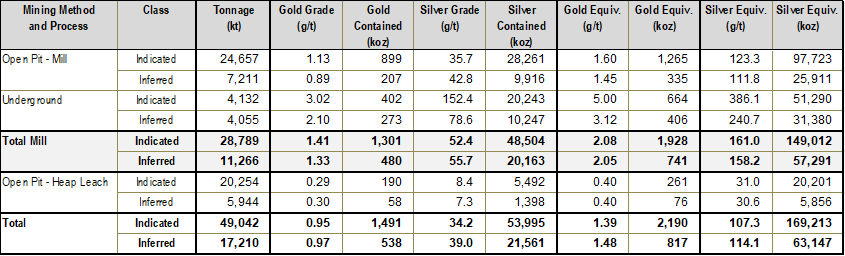

Prime Chief Executive Officer Scott Hicks commented, “Over the course of the quarter and since the quarter end, Prime has made significant progress. In September, we announced outstanding high-grade gold and silver drill results from Tahonitas at the southern end of the Z-T Trend. We also appointed board member Sunny Lowe, who brings a wealth of financial and industry experience to Prime. In October, we announced a major expansion to the resource at Los Reyes, reflecting a 49% increase in Indicated Resources to 2.2 million gold-equivalent ounces and an 11% increase in Inferred Resources to 0.8 million gold-equivalent ounces, compared to the May 2023 Resource1. The resource also included an initial high-grade underground resource, demonstrating significant underground and open pit optionality at Los Reyes. This substantial resource growth from higher-grade open pit and underground zones validates the Company’s strategy of targeting a high-recovery, high-margin milling operation. We are excited to continue advancing Los Reyes through expansion and generative drilling, while de-risking the project through ongoing technical evaluations.”

Corporate Highlights During the Quarter

(Unless otherwise stated, all amounts are presented in Canadian dollars.)

- On September 26th, the Company announced the appointment of Sunny Lowe to its Board of Directors.

Corporate Highlights Subsequent to the Quarter

- On October 15th, the Company announced an updated multi-million-ounce high-grade open pit constrained resource based on exploration drilling up to July 17, 2024.

Exploration Highlights During the Quarter

Prime Intersects 9.4 gpt Gold Equivalent over 10.5 metres at Tahonitas in the Z-T Trend

September 3, 2024

Expansion Drilling Highlights in the Z-T Trend

The Company is reporting 11 core holes at Tahonitas in the Z-T Trend with the following highlights:

- 9.39 grams per tonne (“gpt”) gold-equivalent (“AuEq”) (2.63 gpt Au and 522.1 gpt Ag) over 10.5 metres (“m”) estimated true width (“etw”) in hole 24TA-139, including:

- 10.29 gpt AuEq (2.89 gpt Au and 572.0 gpt Ag) over 8.0 m etw,

- 4.55 gpt AuEq (2.87 gpt Au and 130.0 gpt Ag) over 4.1 m etw in hole 24TA-138, including:

- 8.06 gpt AuEq (5.23 gpt Au and 218.3 gpt Ag) over 2.1 m etw, and,

- 3.56 gpt AuEq (2.92 gpt Au and 49.2 gpt Ag) over 4.6 m etw in hole 24TA-138, including: