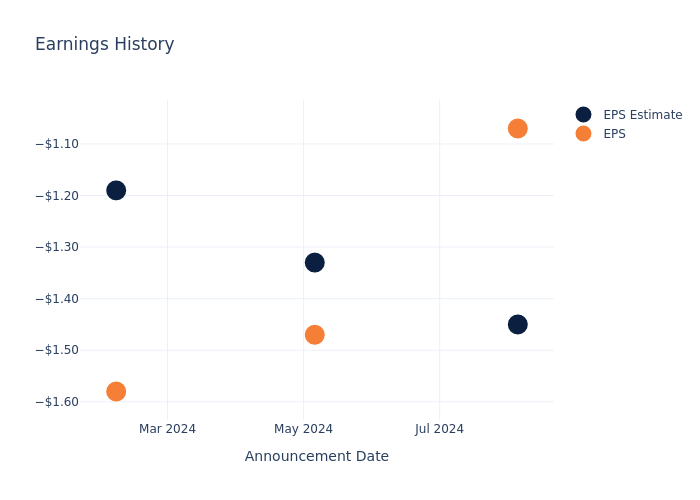

Enanta Pharma's Earnings Outlook

Enanta Pharma ENTA is gearing up to announce its quarterly earnings on Monday, 2024-11-25. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Enanta Pharma will report an earnings per share (EPS) of $-1.16.

The announcement from Enanta Pharma is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

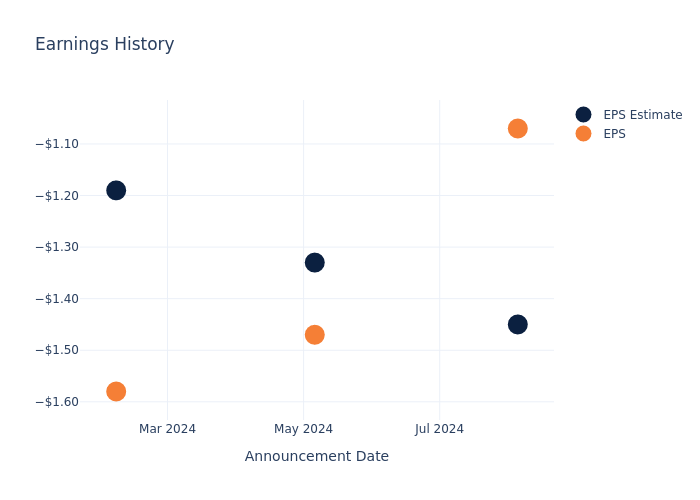

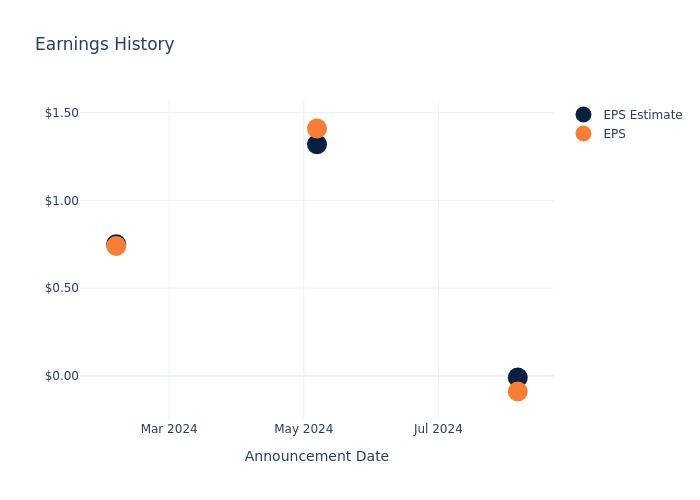

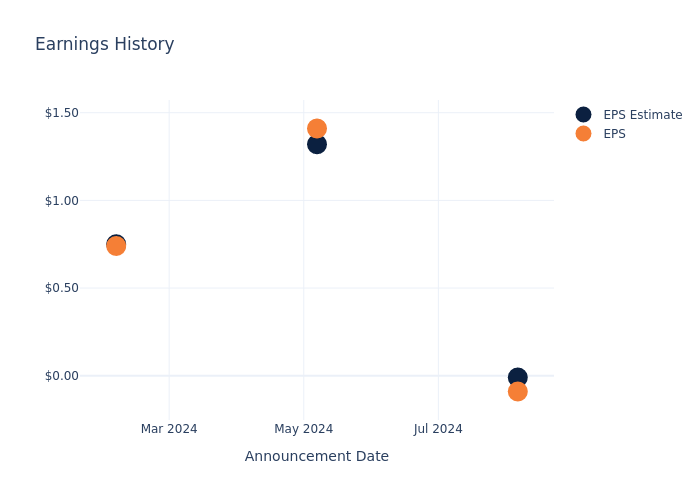

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.38, leading to a 1.17% increase in the share price the following trading session.

Here’s a look at Enanta Pharma’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | -1.45 | -1.33 | -1.19 | -2 |

| EPS Actual | -1.07 | -1.47 | -1.58 | -1.33 |

| Price Change % | 1.0% | -10.0% | 1.0% | 12.0% |

Stock Performance

Shares of Enanta Pharma were trading at $9.31 as of November 21. Over the last 52-week period, shares are down 1.98%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Views on Enanta Pharma

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Enanta Pharma.

A total of 3 analyst ratings have been received for Enanta Pharma, with the consensus rating being Outperform. The average one-year price target stands at $23.67, suggesting a potential 154.24% upside.

Comparing Ratings with Peers

The analysis below examines the analyst ratings and average 1-year price targets of and Macrogenics, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

Overview of Peer Analysis

The peer analysis summary presents essential metrics for and Macrogenics, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Macrogenics | Neutral | 964.81% | $108.84M | 63.31% |

Key Takeaway:

Enanta Pharma ranks in the middle among its peers for Consensus rating. It is at the top for Revenue Growth, indicating strong performance in this area. Enanta Pharma also leads in Gross Profit, showcasing efficient cost management. However, it falls behind in Return on Equity compared to its peers.

Delving into Enanta Pharma’s Background

Enanta Pharmaceuticals Inc is an American biotechnology company focused on the research and development of molecule drugs to cure viral infections and liver diseases. The targeted diseases are hepatitis C, hepatitis B, nonalcoholic steatohepatitis, and the respiratory syncytial virus. The novelty of company research is a specific direct-acting antiviral inhibitor against the hepatitis C virus. The company’s inhibitors have been developed in collaboration with AbbVie. AbbVie markets the protease inhibitor, paritaprevir, while other inhibitors are in the pipeline.

Financial Milestones: Enanta Pharma’s Journey

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Decline in Revenue: Over the 3 months period, Enanta Pharma faced challenges, resulting in a decline of approximately -4.88% in revenue growth as of 30 June, 2024. This signifies a reduction in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Enanta Pharma’s net margin excels beyond industry benchmarks, reaching -126.08%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Enanta Pharma’s ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -14.38%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -5.58%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Enanta Pharma’s debt-to-equity ratio surpasses industry norms, standing at 0.34. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Enanta Pharma visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Closer Look at Booking Holdings's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bearish stance on Booking Holdings.

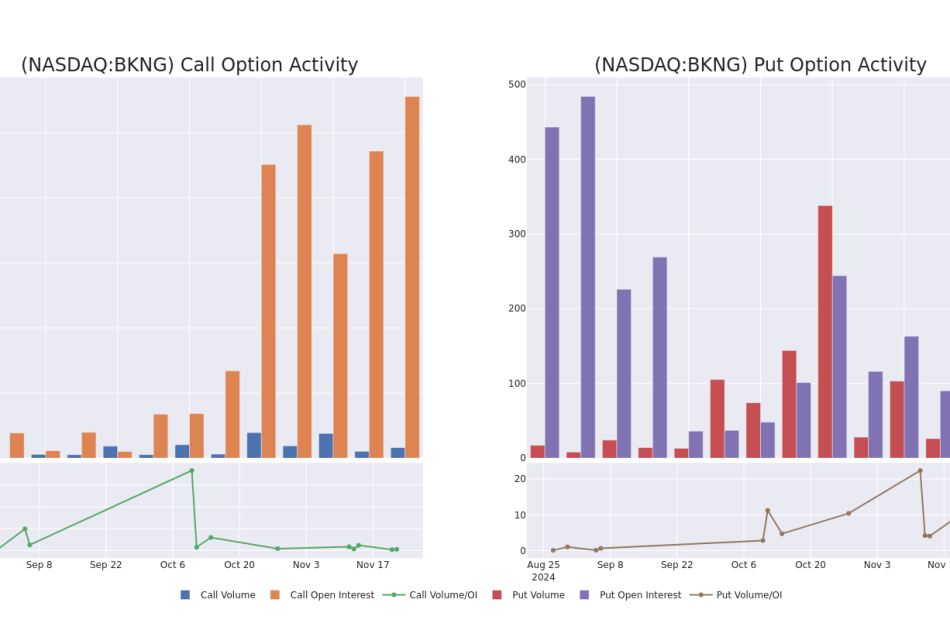

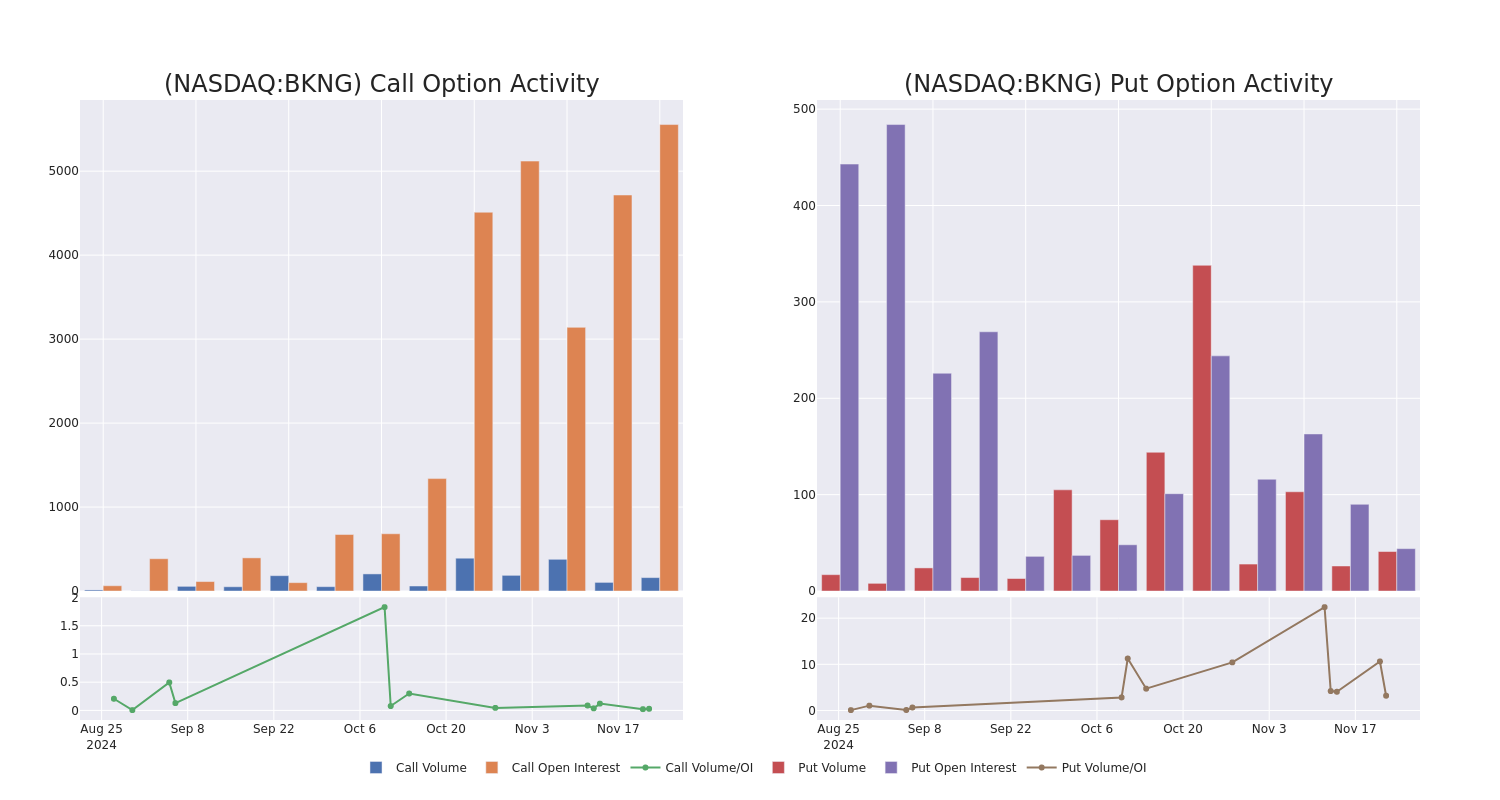

Looking at options history for Booking Holdings BKNG we detected 31 trades.

If we consider the specifics of each trade, it is accurate to state that 29% of the investors opened trades with bullish expectations and 64% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $285,901 and 24, calls, for a total amount of $2,263,422.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $4000.0 and $5800.0 for Booking Holdings, spanning the last three months.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Booking Holdings’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Booking Holdings’s significant trades, within a strike price range of $4000.0 to $5800.0, over the past month.

Booking Holdings Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | CALL | TRADE | BULLISH | 12/18/26 | $1618.6 | $1593.6 | $1615.0 | $4300.00 | $807.5K | 8 | 5 |

| BKNG | CALL | TRADE | BULLISH | 06/20/25 | $1143.9 | $1107.0 | $1129.16 | $4300.00 | $225.8K | 18 | 2 |

| BKNG | CALL | TRADE | BEARISH | 06/20/25 | $1394.7 | $1380.1 | $1380.1 | $4000.00 | $138.0K | 51 | 1 |

| BKNG | CALL | TRADE | NEUTRAL | 12/20/24 | $66.5 | $56.1 | $60.63 | $5350.00 | $121.2K | 363 | 94 |

| BKNG | CALL | SWEEP | BEARISH | 12/20/24 | $321.1 | $320.0 | $320.0 | $4950.00 | $96.0K | 38 | 3 |

About Booking Holdings

Booking is the world’s largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, and Rentalcars.com, and has expanded into travel media with the acquisitions of Kayak and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

After a thorough review of the options trading surrounding Booking Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Booking Holdings’s Current Market Status

- With a volume of 10,693, the price of BKNG is down -0.29% at $5196.0.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 90 days.

Professional Analyst Ratings for Booking Holdings

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $5131.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from RBC Capital has decided to maintain their Outperform rating on Booking Holdings, which currently sits at a price target of $5250.

* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Booking Holdings, targeting a price of $5200.

* Consistent in their evaluation, an analyst from DA Davidson keeps a Buy rating on Booking Holdings with a target price of $5005.

* An analyst from Citigroup persists with their Buy rating on Booking Holdings, maintaining a target price of $5500.

* An analyst from Truist Securities persists with their Hold rating on Booking Holdings, maintaining a target price of $4700.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Booking Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Preview: PennantPark Floating Rate's Earnings

PennantPark Floating Rate PFLT is gearing up to announce its quarterly earnings on Monday, 2024-11-25. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that PennantPark Floating Rate will report an earnings per share (EPS) of $0.32.

The market awaits PennantPark Floating Rate’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

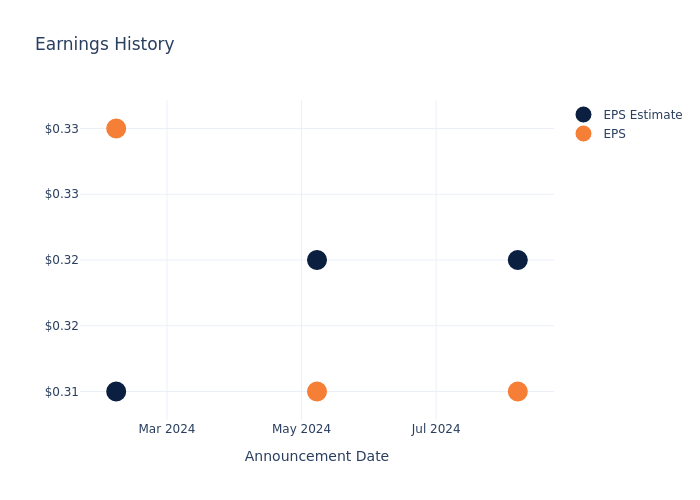

Earnings Track Record

During the last quarter, the company reported an EPS missed by $0.01, leading to a 0.37% increase in the share price on the subsequent day.

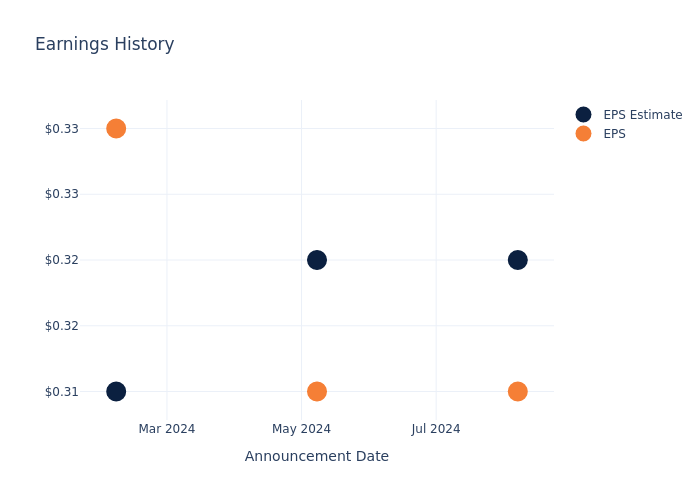

Here’s a look at PennantPark Floating Rate’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.32 | 0.32 | 0.31 | 0.31 |

| EPS Actual | 0.31 | 0.31 | 0.33 | 0.32 |

| Price Change % | 0.0% | -1.0% | 1.0% | 1.0% |

PennantPark Floating Rate Share Price Analysis

Shares of PennantPark Floating Rate were trading at $11.04 as of November 21. Over the last 52-week period, shares are up 0.05%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Jumps 300 Points; Gap Posts Upbeat Earnings

U.S. stocks traded higher this morning, with the Dow Jones index gaining by more than 300 points on Friday.

Following the market opening Friday, the Dow traded up 0.72% to 44,184.62 while the NASDAQ rose 0.07% to 18,985.33. The S&P 500 also rose, gaining, 0.35% to 5,969.29.

Check This Out: Top 3 Materials Stocks That Could Blast Off In November

Leading and Lagging Sectors

Consumer staples shares rose by 1% on Friday.

In trading on Friday, communication services shares fell by 0.4%.

Top Headline

Gap, Inc. GAP reported better-than-expected earnings for its second quarter and raised its outlook for FY24 gross margin.

The company reported quarterly earnings of 54 cents per share, which beat the analyst consensus estimate of 40 cents per share.

Equities Trading UP

- SKK Holdings Limited SKK shares shot up 76% to $1.95 after declining around 75% on Wednesday.

- Shares of DevvStream Corp. DEVS got a boost, surging 77% to $0.8931.

- Replimune Group, Inc. REPL shares were also up, gaining 48% to $16.37 after the company on Thursday announced it received breakthrough therapy designation status for RP1 and will submit an RP1 biologics license application to the FDA under an accelerated approval pathway.

Equities Trading DOWN

- Autonomix Medical, Inc. AMIX shares dropped 52% to $6.53 after the company announced the pricing of a $9 million underwritten public offering.

- Shares of Aptose Biosciences Inc. APTO were down 44% to $0.1374 after the company announced the pricing of an $8 million public offering.

- Cemtrex, Inc. CETX was down, falling 42% to $0.1148 after the company announced its board approved a 1-for-35 reverse stock split.

Commodities

In commodity news, oil traded up 0.8% to $70.67 while gold traded up 0.9% at $2,697.70.

Silver traded up 1.2% to $31.33 on Thursday, while copper fell 0.8% to $4.0910.

Euro zone

European shares were higher today. The eurozone’s STOXX 600 rose 1.2%, Germany’s DAX gained 0.9% and France’s CAC 40 rose 0.7%. Spain’s IBEX 35 Index rose 0.2%, while London’s FTSE 100 gained 1.4%.

The S&P Global UK composite PMI declined to 49.9 in November versus 51.8 in the previous month, while Eurozone composite PMI dipped to 48.1 in November from 50 in the prior month.

Asia Pacific Markets

Asian markets closed mixed on Friday, with Japan’s Nikkei 225 gaining 0.68%, Hong Kong’s Hang Seng Index falling 1.89%, China’s Shanghai Composite Index dipping 3.06% and India’s BSE Sensex gaining 2.54%.

Economics

- The S&P Global US Services PMI climbed to 57 in November versus 55 in the previous month, while manufacturing PMI increased to 48.8 in November from 48.5 in the previous month.

- The University of Michigan consumer sentiment for the US fell to 71.8 in November versus a preliminary reading of 73.

- The year-ahead inflation expectations in the U.S fell to 2.6% in November from 2.7% in October.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pennant Park Investment's Earnings: A Preview

Pennant Park Investment PNNT is gearing up to announce its quarterly earnings on Monday, 2024-11-25. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Pennant Park Investment will report an earnings per share (EPS) of $0.22.

The market awaits Pennant Park Investment’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

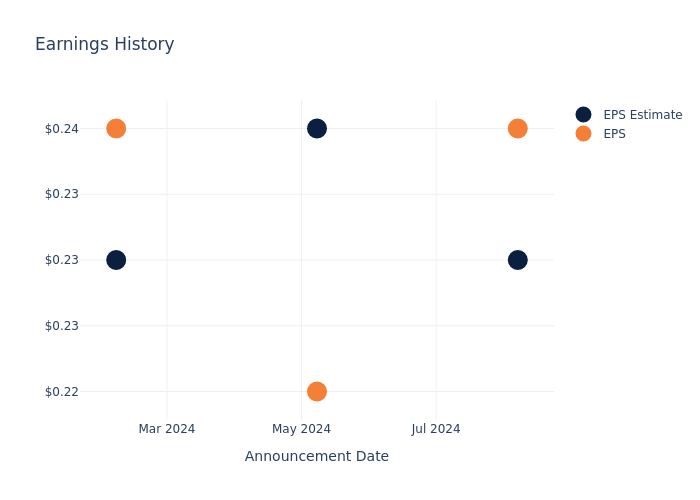

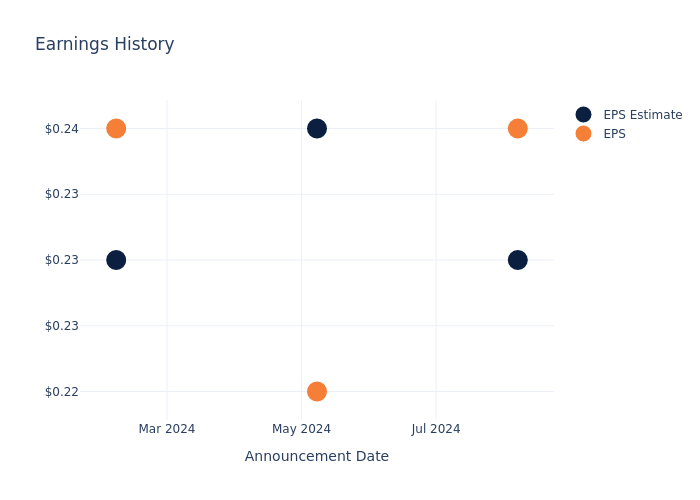

Past Earnings Performance

Last quarter the company beat EPS by $0.01, which was followed by a 1.03% increase in the share price the next day.

Here’s a look at Pennant Park Investment’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.23 | 0.24 | 0.23 | 0.22 |

| EPS Actual | 0.24 | 0.22 | 0.24 | 0.24 |

| Price Change % | 1.0% | 2.0% | -1.0% | -0.0% |

Pennant Park Investment Share Price Analysis

Shares of Pennant Park Investment were trading at $6.94 as of November 21. Over the last 52-week period, shares are up 7.73%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analysts’ Take on Pennant Park Investment

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Pennant Park Investment.

The consensus rating for Pennant Park Investment is Neutral, based on 1 analyst ratings. With an average one-year price target of $6.0, there’s a potential 13.54% downside.

Peer Ratings Comparison

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Bridge Investment Group, three key industry players, offering insights into their relative performance expectations and market positioning.

Summary of Peers Analysis

The peer analysis summary offers a detailed examination of key metrics for and Bridge Investment Group, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Bridge Investment Group | Outperform | -4.48% | $41.07M | 5.58% |

Key Takeaway:

Pennant Park Investment ranks in the middle for Consensus rating among its peers. It is at the bottom for Revenue Growth. It is at the top for Gross Profit. It is at the bottom for Return on Equity.

Discovering Pennant Park Investment: A Closer Look

Pennant Park Investment Corp is a closed-end, non-diversified investment company. Its investment objective is to generate current income and capital appreciation also seeking to preserve capital through debt and equity investments. The company focuses on investing in United States middle-market companies that offer attractive risk-reward to investors and to create a diversified portfolio that includes senior secured debt, mezzanine debt, and equity investments. It generates majority of its revenue from interest and dividends received from investments made.

Financial Milestones: Pennant Park Investment’s Journey

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Pennant Park Investment faced challenges, resulting in a decline of approximately -76.81% in revenue growth as of 30 June, 2024. This signifies a reduction in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Pennant Park Investment’s net margin excels beyond industry benchmarks, reaching 62.84%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Pennant Park Investment’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.75%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Pennant Park Investment’s ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.29%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Pennant Park Investment’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.54. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

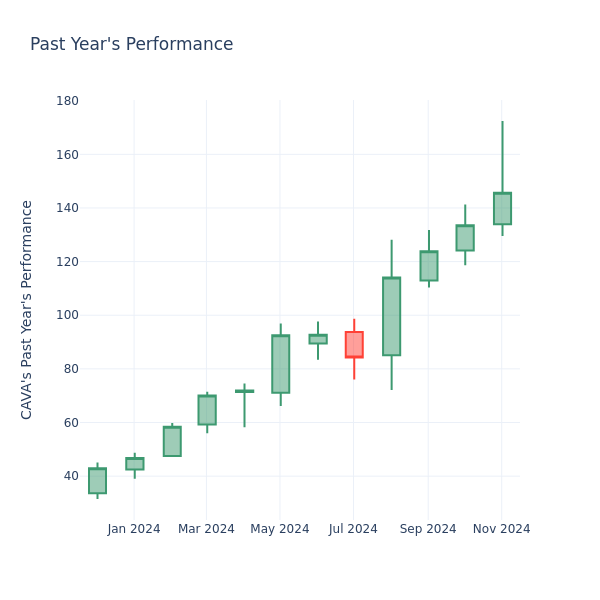

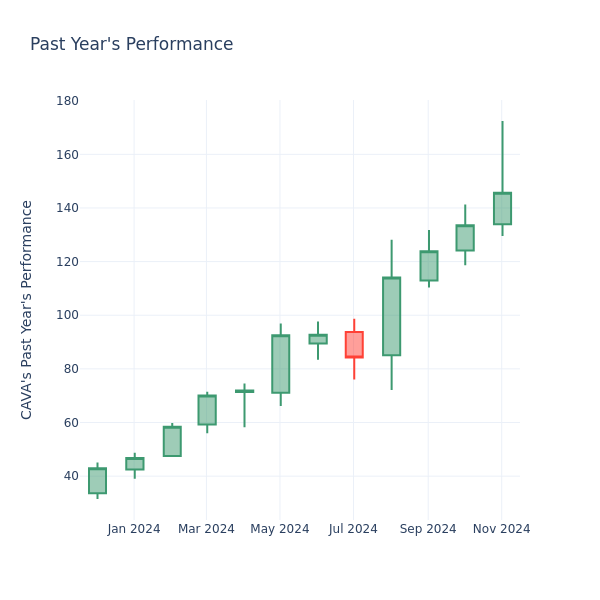

Price Over Earnings Overview: Cava Group

In the current session, the stock is trading at $145.85, after a 0.73% spike. Over the past month, Cava Group Inc. CAVA stock increased by 7.08%, and in the past year, by 333.82%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Cava Group P/E Compared to Competitors

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Cava Group has a better P/E ratio of 353.17 than the aggregate P/E ratio of 69.6 of the Hotels, Restaurants & Leisure industry. Ideally, one might believe that Cava Group Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Jersey Resources's Earnings: A Preview

New Jersey Resources NJR is gearing up to announce its quarterly earnings on Monday, 2024-11-25. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that New Jersey Resources will report an earnings per share (EPS) of $0.88.

The market awaits New Jersey Resources’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.08, leading to a 2.0% increase in the share price the following trading session.

Here’s a look at New Jersey Resources’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.01 | 1.32 | 0.75 | 0.32 |

| EPS Actual | -0.09 | 1.41 | 0.74 | 0.30 |

| Price Change % | 2.0% | -1.0% | -1.0% | 2.0% |

Tracking New Jersey Resources’s Stock Performance

Shares of New Jersey Resources were trading at $49.85 as of November 21. Over the last 52-week period, shares are up 18.98%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about New Jersey Resources

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on New Jersey Resources.

A total of 2 analyst ratings have been received for New Jersey Resources, with the consensus rating being Neutral. The average one-year price target stands at $49.0, suggesting a potential 1.71% downside.

Analyzing Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of UGI, ONE Gas and Southwest Gas Hldgs, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for UGI, with an average 1-year price target of $27.0, indicating a potential 45.84% downside.

- As per analysts’ assessments, ONE Gas is favoring an Outperform trajectory, with an average 1-year price target of $78.0, suggesting a potential 56.47% upside.

- Southwest Gas Hldgs received a Neutral consensus from analysts, with an average 1-year price target of $78.0, implying a potential 56.47% upside.

Insights: Peer Analysis

The peer analysis summary presents essential metrics for UGI, ONE Gas and Southwest Gas Hldgs, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| New Jersey Resources | Neutral | 4.38% | $55.19M | -0.54% |

| UGI | Neutral | -16.82% | $741M | -1.03% |

| ONE Gas | Outperform | 1.36% | $150.02M | 0.68% |

| Southwest Gas Hldgs | Neutral | -7.72% | $191.13M | 0.01% |

Key Takeaway:

New Jersey Resources ranks in the middle among its peers for revenue growth. It is at the bottom for gross profit and return on equity.

Unveiling the Story Behind New Jersey Resources

New Jersey Resources is an energy services holding company with regulated and nonregulated operations. Its regulated utility, New Jersey Natural Gas, delivers natural gas to nearly 600,000 customers in the state. NJR’s nonregulated businesses include solar investments primarily in New Jersey and investments in several large midstream natural gas projects.

Understanding the Numbers: New Jersey Resources’s Finances

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: New Jersey Resources’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 4.38%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Utilities sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: New Jersey Resources’s net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -4.2%, the company may face hurdles in effective cost management.

Return on Equity (ROE): New Jersey Resources’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive -0.54% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): New Jersey Resources’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of -0.17%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.59, caution is advised due to increased financial risk.

To track all earnings releases for New Jersey Resources visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

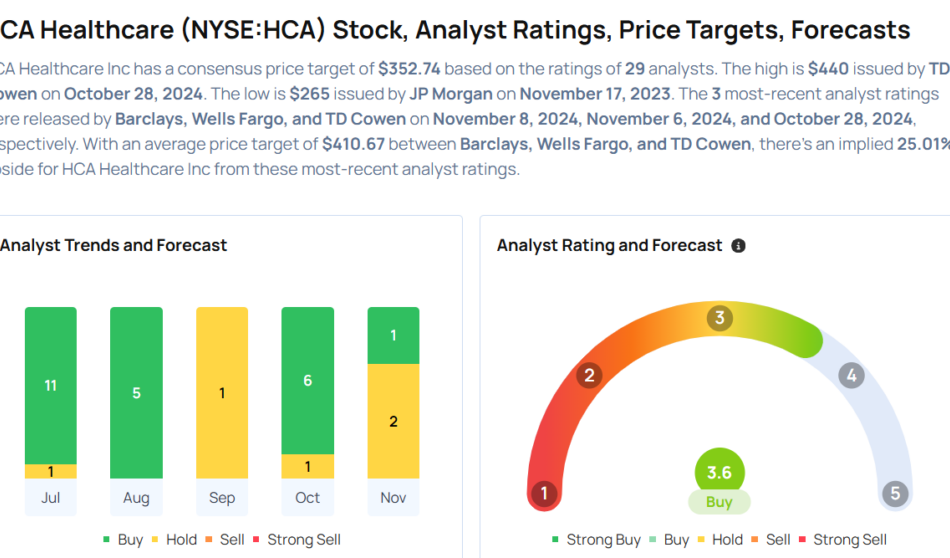

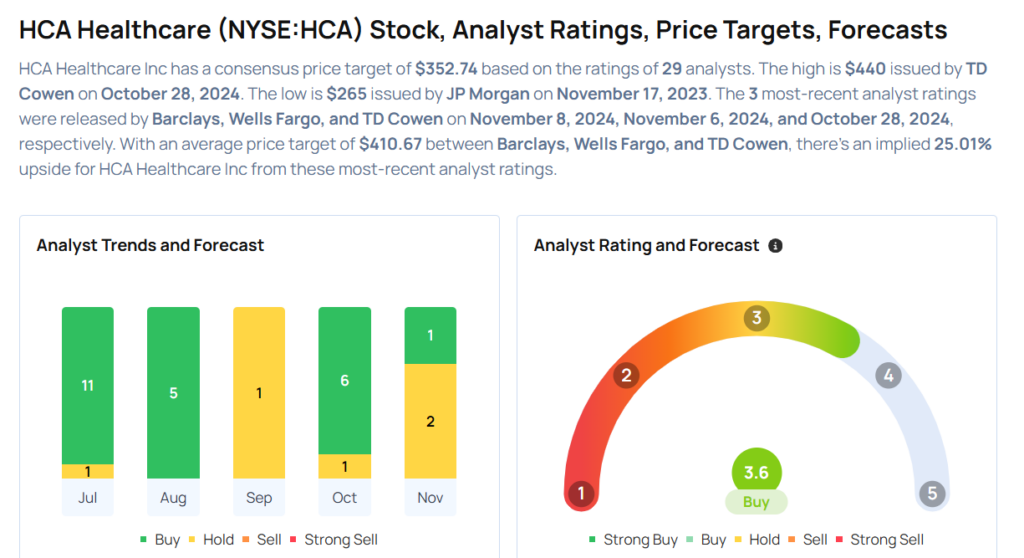

This HCA Healthcare Analyst Is No Longer Bullish; Here Are Top 5 Downgrades For Friday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Raymond James analyst John Ransom downgraded the rating for HCA Healthcare, Inc. HCA from Outperform to Market Perform. HCA Healthcare shares closed at $332.24 on Thursday. See how other analysts view this stock.

- JMP Securities analyst Matthew Carletti downgraded the rating for Root, Inc. ROOT from Market Outperform to Market Perform. Root shares closed at $109.40 on Thursday. See how other analysts view this stock.

- Needham analyst Mike Matson downgraded TransMedics Group, Inc TMDX from Buy to Hold and maintained the price target of $109. TransMedics shares closed at $79.34 on Thursday. See how other analysts view this stock.

- Keybanc analyst Steve Barger downgraded the rating for The Timken Company TKR from Overweight to Sector Weight. Timken shares closed at $75.22 on Thursday. See how other analysts view this stock.

- B. Riley Securities analyst Alex Rygiel downgraded Atkore Inc. ATKR from Buy to Neutral and lowered the price target from $135 to $84. Atkore shares closed at $85.14 on Thursday. See how other analysts view this stock.

Considering buying HCA stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.