Prime Mining Q3 2024 Financial and Operating Results

VANCOUVER, British Columbia, Nov. 13, 2024 (GLOBE NEWSWIRE) — Prime Mining Corp. (“Prime”, or the “Company”) (TSV: PRYM) PRMNF (Frankfurt: O4V3) is pleased to report its operating and financial results for the quarter ended September 30, 2024. Prime is focused on the exploration and development of its wholly owned high-grade Los Reyes Gold-Silver Project in Sinaloa State, Mexico (“Los Reyes” or the “Project”).

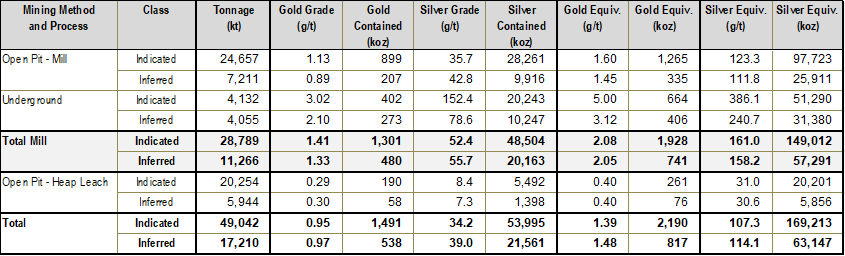

Prime Chief Executive Officer Scott Hicks commented, “Over the course of the quarter and since the quarter end, Prime has made significant progress. In September, we announced outstanding high-grade gold and silver drill results from Tahonitas at the southern end of the Z-T Trend. We also appointed board member Sunny Lowe, who brings a wealth of financial and industry experience to Prime. In October, we announced a major expansion to the resource at Los Reyes, reflecting a 49% increase in Indicated Resources to 2.2 million gold-equivalent ounces and an 11% increase in Inferred Resources to 0.8 million gold-equivalent ounces, compared to the May 2023 Resource1. The resource also included an initial high-grade underground resource, demonstrating significant underground and open pit optionality at Los Reyes. This substantial resource growth from higher-grade open pit and underground zones validates the Company’s strategy of targeting a high-recovery, high-margin milling operation. We are excited to continue advancing Los Reyes through expansion and generative drilling, while de-risking the project through ongoing technical evaluations.”

Corporate Highlights During the Quarter

(Unless otherwise stated, all amounts are presented in Canadian dollars.)

- On September 26th, the Company announced the appointment of Sunny Lowe to its Board of Directors.

Corporate Highlights Subsequent to the Quarter

- On October 15th, the Company announced an updated multi-million-ounce high-grade open pit constrained resource based on exploration drilling up to July 17, 2024.

Exploration Highlights During the Quarter

Prime Intersects 9.4 gpt Gold Equivalent over 10.5 metres at Tahonitas in the Z-T Trend

September 3, 2024

Expansion Drilling Highlights in the Z-T Trend

The Company is reporting 11 core holes at Tahonitas in the Z-T Trend with the following highlights:

- 9.39 grams per tonne (“gpt”) gold-equivalent (“AuEq”) (2.63 gpt Au and 522.1 gpt Ag) over 10.5 metres (“m”) estimated true width (“etw”) in hole 24TA-139, including:

- 10.29 gpt AuEq (2.89 gpt Au and 572.0 gpt Ag) over 8.0 m etw,

- 4.55 gpt AuEq (2.87 gpt Au and 130.0 gpt Ag) over 4.1 m etw in hole 24TA-138, including:

- 8.06 gpt AuEq (5.23 gpt Au and 218.3 gpt Ag) over 2.1 m etw, and,

- 3.56 gpt AuEq (2.92 gpt Au and 49.2 gpt Ag) over 4.6 m etw in hole 24TA-138, including:

- 5.57 gpt AuEq (4.84 gpt Au and 56.8 gpt Ag) over 2.7 m etw,

- 2.95 gpt AuEq (2.88 gpt Au and 5.5 gpt Ag) over 4.1 m etw in hole 24TA-135, including:

- 13.21 gpt AuEq (12.95 gpt Au and 20.3 gpt Ag) over 0.7 m etw, and,

- 4.24 gpt AuEq (4.08 gpt Au and 12.2 gpt Ag) over 2.3 m etw in hole 24TA-135, including:

- 13.92 gpt AuEq (13.40 gpt Au and 40.4 gpt Ag) over 0.6 m etw.

Maintaining Health and Safety Protocols

Prime remains engaged with local stakeholders and is proactive in monitoring employees and contractors concerning general health conditions. The Company continues to closely adhere to the directives of all levels of government and relevant health authorities in Mexico and Canada.

Community Engagement and Environmental Stewardship Strategy

We continued to gather environmental and community data in the quarter in support of our ESG programs, including completion of a materiality assessment, strategic plan, and disclosure matrix. We strive to minimize the environmental footprint of our activities and ensure that Los Reyes has a positive impact on our host communities.

The Company released its second annual sustainability report during May 2024 which establishes a baseline and a new yardstick to measure our progress in meeting our commitments regarding sustainability and stewardship of the environment, relevant social issues, and corporate governance.

Selected Financial Data

The following selected financial data is summarized from the Company’s consolidated financial statements and related notes thereto (the “Financial Statements”) for the nine months ended September 30, 2024 and 2023. A copy of the Financial Statements and MD&A is available at www.primeminingcorp.ca or on SEDAR+ at www.sedar.ca.

| Nine Months ended September 30, 2024 |

Nine Months ended September 30, 2023 |

|||||

| Loss and comprehensive loss | $(16,245,931 | ) | $(16,945,046 | ) | ||

| Loss per share – basic and diluted | $(0.11 | ) | $(0.12 | ) | ||

| September 30, 2024 |

December 31, 2023 | ||||||

| Cash | $21,239,893 | $33,811,215 | |||||

| Total assets | $35,248,369 | $47,908,403 | |||||

| Total current liabilities | $892,672 | $2,470,659 | |||||

| Total liabilities | $1,700,262 | $3,295,811 | |||||

| Total shareholders’ equity | $33,548,107 | $44,612,592 | |||||

2024 Outlook

Given the results from Prime’s success-based drilling program, the Company is expanding its fiscal 2024 program to 50,000 metres from 40,000 metres. The drill program will continue to evaluate drilling plans using its success-based approach. This evaluation will also include prioritization of targets based on probability of resource development and generative area discovery potential.

Four drill rigs are currently active on site at Los Reyes, with 2024 exploration focused on:

- Extending the high-grade Z-T Area shoots that remain open at depth, as well as along strike, both north and south.

- Expanding the known high-grade mineralization at Guadalupe East.

- Increasing the Central Area resource through additions at Noche Buena and its connection to San Miguel East.

- Generative target drilling of high-grade intercepts at Las Primas, Mariposa, Fresnillo, Mina and others to further develop the resource potential at Los Reyes.

About the Los Reyes Gold and Silver Project

Los Reyes is a high-grade, low-sulphidation epithermal gold-silver project located in Sinaloa State, Mexico. Since acquiring Los Reyes in 2019, Prime has spent $58,839,993 on direct exploration activities and has completed over 208,850 metres of drilling. On October 15, 2024, Prime announced an updated multi-million-ounce high-grade open pit constrained resource based on exploration drilling up to July 17, 2024 (refer to the October 15, 2024 news release for more details).

October 15, 2024 Resource Statement1

(based on a $1950/oz gold price, $25.24/oz silver price, economic-constrained estimate)

1. Refer to the Additional Technical Notes section for the gold equivalent grade (“AuEq”) calculation method.

1. Refer to the Additional Technical Notes section for the gold equivalent grade (“AuEq”) calculation method.

Drilling is ongoing and suggests that the three known main deposit areas (Guadalupe, Central and Z-T) are larger than previously reported. Potential also exists for new discoveries where mineralized trends have been identified outside of the currently defined resource areas. Historic operating results indicate that an estimated 1 million ounces of gold and 60 million ounces of silver were recovered from five separate operations at Los Reyes between 1770 and 1990. Prior to Prime’s acquisition, recent operators of Los Reyes had spent approximately US$20 million on

exploration, engineering, and prefeasibility studies.

QA/QC Protocols and Sampling Procedures

Drill core at the Los Reyes project is drilled in predominately HQ size (63.5 millimetre “mm”), reducing to NQ (47.6 mm) when required. Drill core samples are generally 1.50 m long along the core axis with allowance for shorter or longer intervals if required to suit geological constraints. After logging intervals are identified to be sampled, the core is cut and one half is submitted for assay. RC drilling returns rock chips and fines from a 133.35 mm diameter tricone bit. The returns are homogenized and split into 2 halves, with one half submitted for analysis and the other half stored.

Sample QA/QC measures include unmarked certified reference materials, blanks, and field duplicates as well as preparation duplicates are inserted into the sample sequence and make up approximately 8% of the samples submitted to the laboratory for each drill hole.

Samples are picked up from the Project by the laboratory personnel and transported to their facilities in Durango or Hermosillo Mexico, for sample preparation. Sample analysis is carried out by Bureau Veritas and ALS Labs, with fire assay, including over limits fire assay re-analysis, completed at their respective Hermosillo, Mexico laboratories and multi-element analysis completed in North Vancouver, Canada. Drill core sample preparation includes fine crushing of the sample to at least 70% passing less than 2 mm, sample splitting using a riffle splitter, and pulverizing a 250-gram split to at least 85% passing 75 microns.

Gold in diamond drill core is analyzed by fire assay and atomic absorption spectroscopy of a 30 g sample (code FA430 or Au-AA23). Multi-element chemistry is analyzed by 4-Acid digestion of a 0.25-gram sample split (code MA300 or ME-ICP61) with detection by inductively coupled plasma emission spectrometer for a full suite of elements.

Gold assay techniques FA430 and Au-AA23 have an upper detection limit of 10 ppm. Any sample that produces an over-limit gold value via the initial assay technique is sent for gravimetric finish via method FA-530 or Au-GRA21. Silver analyses by MA300 and ME-ICP61 have an upper limit of 200 ppm and 100 ppm, respectively. Samples with over-limit silver values are re-analyzed by fire assay with gravimetric finish FA530 or Au-GRA21.

Both Bureau Veritas and ALS Labs are ISO/IEC accredited assay laboratories.

Additional Technical Notes

Metres is represented by “m”; “etw” is Estimated True Width and is based on drill hole geometry or comparisons with other on-section drill holes; “Au” refers to gold, and “Ag” refers to silver; “gpt” is grams per metric tonne; some figures may not sum due to rounding; Composite assay grades presented in summary tables are calculated using a Au grade minimum average of 0.20 gpt or 1.0 gpt as indicated in “Au Cut-off” column of Summary Tables. Maximum internal waste included in any reported composite interval is 3.00 m. The 1.00 gpt Au cut-off is used to define higher-grade “cores” within the lower-grade halo.

Gold equivalent grades are calculated based on an assumed gold price of US$1,950 per ounce and silver price of $25.24 per ounce, based on the formula AuEq grade (gpt) = Au grade + (Ag grade x $25.24 / $1,950). Metallurgical recoveries are not considered in the in-situ grade estimate but are estimated to be 95.6% and 81% for gold and silver, respectively, when processed in a mill, and 73% and 25% respectively when heap-leached. Additional details will be available in the forthcoming associated Los Reyes Technical Report.

Qualified Person

Scott Smith, P.Geo., Executive Vice President of Exploration, is a qualified person for the purposes of National Instrument 43-101 and has reviewed and approved the technical content in this news release.

About Prime Mining

Prime is managed by an ideal mix of successful mining executives, strong capital markets personnel and experienced local operators all focused on unlocking the full potential of the Los Reyes Project. The Company has a well-planned capital structure with a strong management team and insider ownership. Prime is targeting a material resource expansion at Los Reyes through a combination of new generative area discoveries and growth, while also building on technical de-risking activities to support eventual project development.

For further information, please visit https://www.primeminingcorp.ca/ or direct enquiries to:

Scott Hicks

CEO & Director

Indi Gopinathan

VP Capital Markets & Business Development

Prime Mining Corp.

710 – 1030 West Georgia St.

Vancouver, BC V6E 2Y3 Canada

+1(604) 238-1659

info@primeminingcorp.ca

Cautionary Notes to U.S. Investors Concerning Resource Estimates

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced in this presentation are Canadian mineral disclosure terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines, May 2014 (the “CIM Standards”). The CIM Standards differ from the mineral property disclosure requirements of the U.S. Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the U.S. Securities Act of 1933, as amended (the “Securities Act”). As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multijurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. Accordingly, the Company’s disclosure of mineralization and other technical information may differ significantly from the information that would be disclosed had the Company prepared the information under the standards adopted under the SEC Modernization Rules.

Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities legislation as may be amended from time to time, including, without limitation, statements regarding the perceived merit of the Company’s properties, including additional exploration potential of Los Reyes, potential quantity and/or grade of minerals, the potential size of the mineralized zone, metallurgical recoveries, and the Company’s exploration and development plans in Mexico. Forward-looking statements are statements that are not historical facts which address events, results, outcomes, or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made, and they involve several risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold, silver and copper; the accuracy of mineral resource estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of mineral resource estimates, including but not limited to changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral resources; and risks associated with executing the Company’s objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company’s most recently filed management’s discussion and analysis, as well as its annual information form dated March 25, 2024, available on www.sedarplus.ca. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9d5cee1b-62d2-4987-a4b7-f22ff0329a8b

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AMD Plans To Cut 4% Of Workforce Amid Strategic Shift Toward AI Chip Development To Rival Jensen Huang-Led Nvidia's Dominance: Report

Advanced Micro Devices AMD has reportedly decided to lay off approximately 1,000 employees, representing 4% of its global workforce.

What Happened: AMD is realigning its resources to compete with Nvidia Corporation NVDA in the data center chip market, reported Reuters.

“As a part of aligning our resources with our largest growth opportunities, we are taking a number of targeted steps,” an AMD spokesperson told the publication.

The company has been aggressively investing in the development of AI chips, which command high prices and are in demand among hyperscalers like Microsoft Corporation MSFT.

The company’s data center segment, which includes its AI graphics processors, witnessed a more than two-fold increase in revenue in the September quarter.

Analysts forecast that the data center unit will grow 98% in 2024, outpacing the expected total revenue growth of 13%.

AMD plans to start mass production of its MI325X AI chip in fourth-quarter of 2024, although ramping up production is costly due to limited manufacturing capacity

Why It Matters: Last month, AMD reported third-quarter revenue of $6.8 billion, surpassing analyst expectations of $6.71 billion. The chipmaker also reported earnings of 92 cents per share, matching analysts’ forecasts, according to Benzinga Pro.

Prior to the earnings, analysts highlighted concerns about AMD’s ability to maintain a profitable business model in the face of stiff competition from Nvidia and Intel Corp INTC.

Earlier this month, AMD’s stock saw a 5% increase in the week following the 2024 U.S. presidential election.

Price Action: AMD shares closed Wednesday’s session down by 3.01%, finishing at $139.30. However, in after-hours trading, the stock saw a slight uptick, rising to $139.41 as of the latest update.

Image via Shutterstock

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rubicon Organics Reports Q3 2024 Financial and Operating Results

- Delivered a record net revenue of $13.5 million for Q3 2024, a 34% increase year-over-year, and $34.5 million for the first nine months of 2024, a 15% increase year-over-year.

- Adjusted EBITDA1 of $2.0 million for the three months ended September 30, 2024

- Operating cash flow of $0.9 million for the three months ended September 30, 2024

- #1 premium licenced producer across all categories2

VANCOUVER, British Columbia, Nov. 13, 2024 (GLOBE NEWSWIRE) — Rubicon Organics Inc. ROMJ ROMJF (“Rubicon Organics” or the “Company”), a licensed producer focused on cultivating and selling organic certified and premium cannabis, today reported its financial results for the three and nine months ended September 30, 2024 (“Q3 2024”). All amounts are expressed in Canadian dollars.

“Rubicon Organics record net revenue for both Q3 and year-to-date 2024 reflects our strength and position as Canada’s leading premium House of Brands. Rubicon Organics continues to innovate and expand our product offerings, solidifying a strong market share in premium flower, pre-rolls, edibles, and more. I’m particularly proud of the success of our 2024 vape launch, which has already achieved 55% distribution in just six months. Looking ahead, we expect to drive further growth in Canada and beyond, as we intend for new market entry in 2025.”

“Rubicon Organics’ financial results for Q3 2024 reflect our strong operational execution and strategic focus. With a record-high net revenue of $13.5 million for the quarter and $34.5 million for the nine-month period, we have demonstrated our ability to achieve growth despite the challenges in the market. Our commitment to disciplined financial management has resulted in positive adjusted EBITDA for eight out of the last nine quarters. We also anticipate finalizing our debt re-financing before the end of the year paving the way for the Company’s next five years of growth,” said Janis Risbin, CFO.

________________________

1 Adjusted EBITDA is a non-GAAP measure that is calculated as earnings (losses) from operations before interest, tax, depreciation and amortization, share-based compensation expense, and fair value changes. Included in Adjusted EBITDA in the nine months ended September 30, 2024 is $0.6 million of one-time costs incurred for the ERP implementation project. See Non-GAAP Financial Measures for details on the Adjusted EBITDA calculation.

2 Hifyre data for premium products covering flower, pre-rolled products, concentrates, edibles, topicals, and vapes for the twelve months ended September 30, 2024

Q3 2024 and Subsequent Highlights:

For the three and nine months ended September 30, 2024

- Net revenue of $13.5 million (34% increase from Q3 2023) and $34.5 million (15% increase from Q3 2023) for the three and nine months ended September 30, 2024.

- Gross profit before fair value adjustments of $4.4 million (35% increase from Q3 2023) and $10.2 million (6% decrease from Q3 2023) for the three and nine months ended September 30, 2024.

- Adjusted EBITDA1 gain of $2.0 million and $2.4 million compared to $1.1 million and $3.1 million in Q3 2023, for the three and nine months ended September 30, 2024.

- Cash provided by operating activities of $0.9 million for the three months ended September 30, 2024.

- #1 premium licenced producer across all categories3 with 6.4% market share, up from 5.1%4.

- 2.0%5 national market share of flower and pre-rolls for the three and nine months ended September 30, 2024.

- 5.7%6 and 6.2%7 national market share of premium flower and pre-rolls for the three and nine months ended September 30, 2024.

- Wildflower™ is the #1 topical brand in Canada with market share of 27.8%8 for the nine months ended September 30, 2024.

- 28.5%9 and 27.2%10 national market share of premium edibles for the three and nine months ended September 30, 2024.

- Launch of full spectrum extract vapes in Alberta, BC, and Ontario with four SKUs in market.

________________________

3 Hifyre data for premium products covering flower, pre-rolled products, concentrates, edibles, topicals, and vapes for the twelve months ended September 30, 2024

4 Hifyre data for premium products covering flower, pre-rolled products, concentrates, edibles, topicals, and vapes for the nine months ended September 30, 2023

5 Hifyre data for flower & pre-rolled products covering three and nine months ended September 30, 2024

6 Hifyre data for premium flower & pre-rolled products covering three months ended September 30, 2024

7 Hifyre data for premium flower & pre-rolled products covering nine months ended September 30, 2024

8 Hifyre data for topical products covering nine months ended September 30, 2024

9 Hifyre data for premium edible products covering three months ended September 30, 2024

10 Hifyre data for premium edible products covering nine months ended September 30, 2024

2024 Results of Operations:

| Three months ended | Nine months ended | |||||||

| September 30, 2024 $ |

September 30, 2023 $ |

September 30, 2024 $ |

September 30, 2023 $ |

|||||

| Net revenue | 13,499,282 | 10,041,746 | 34,495,396 | 30,123,479 | ||||

| Production costs | 2,897,890 | 2,797,037 | 8,522,534 | 8,067,975 | ||||

| Inventory expensed to cost of sales | 6,013,707 | 3,806,971 | 14,960,189 | 10,657,979 | ||||

| Inventory written off or provided for | 209,770 | 194,798 | 788,773 | 525,401 | ||||

| Gross profit before fair value adjustments | 4,377,915 | 3,242,940 | 10,223,900 | 10,872,124 | ||||

| Fair value adjustments to cannabis plants, inventory sold, and other charges | (500,324 | ) | (1,309,266 | ) | 62,718 | (1,776,209 | ) | |

| Gross profit | 3,877,591 | 1,933,674 | 10,286,618 | 9,095,915 | ||||

| As at: | September 30, 2024 $ |

December 31, 2023 $ |

||

| Cash and cash equivalents | 9,601,162 | 9,784,190 | ||

| Working capital † | 10,643,402 | 10,132,089 |

† Working capital as at September 30, 2024 includes $10.9 million current portion of loans and borrowings. The Company is currently in discussions with the debenture holder and other lenders to extend the term of the existing agreement or to enter into a new loan agreement anticipated to be finalised before the end of the year.

2024 Outlook

Brand and Product Development

Our strategy is founded on a strong premium house of brands, highly regarded by both budtenders and consumers alike. Guided by consumer research, we continually innovate our products to anticipate market trends. Our commitment to quality and excellence is evident throughout all areas of our business, seeking to deliver products and services that consistently meet the highest quality standards.

Launch into Vape Category

Rubicon launched into the vape category with our 1964 Supply Co™ brand. The introduction of vapes strategically aligns with our market expansion strategy and offers substantial growth prospects. The vape market has demonstrated robust growth over recent years and trends in Canada and the US support the vape category’s increasing prominence, rivaling or surpassing traditional flower products.

Using our Delta grown genetics and supplementing with biomass of the same genetics grown at partners, we launched Comatose and Blue Dream Full Spectrum Extract (“FSE”) resin vapes in Ontario, BC, and Alberta in May 2024. Following strong demand, we launched new cultivars, with GLTO #41 in late July 2024 and White Rainbow in October 2024. We anticipate launching a fifth vape SKU in market by the end of 2024.

In line with our approach to the live rosin edibles we launched under the brand in 2023, we are focused on delivering products that maintain a competitive edge through superior quality, right price to value ratio leveraging our established and reputable brands. We are confident that by capitalizing on this opportunity, over time we can achieve comparable financial success with our vape offerings as we have with our flower business.

Wildflower™‘s Leadership in Cannabis Wellness

Wildflower™‘s prominence in the cannabis wellness sector is driven by its notable topical products. The Company has expanded the brand to adjacent categories, including edibles, oils, and capsules designed to address specific wellness needs such as sleep, pain relief, and anxiety reduction. While we expect more competition to enter the topical and wellness category, we are expanding the brand into other categories and anticipate steady growth and momentum behind the daily wellness consumer.

Launch of New Genetics

Rubicon plans to continue to launch new and novel genetics into its Simply Bare™ Organic and 1964 Supply Co™ brands to continue leadership in the premium cannabis market. Launches in 2024 include BC Organic Zookies, BC Organic Power Mintz, BC Organic Fruit Loopz, and BC Organic Pineapple Sour under the Simply Bare™ Organic brand. Blue Dream, Stinky Pinky and LA Kush Cake have been launched under the 1964 Supply Co™ brand in 2024 with Sour Tangie expected to launch before the end of the year.

Growth from Solid Business Fundamentals

Consistent quality and systematic delivery to our customers, including the provincial distributors and retailers, and consumers to meet their needs is imperative to be successful in the Canadian cannabis industry. In 2024 we are investing in an Enterprise Resource Planning (“ERP”) system which is necessary for our business to deliver more growth in future and reduce reliance on key people within our internal systems. Project costs are estimated to reach $1 million, with $0.6 million incurred in the first nine months of 2024. While a resource intensive process, this ERP implementation readies our business for growth in the future.

Financial

We believe that our commitment to cannabis quality, strategic brand positioning, diverse product portfolio, and committed team will position us as one of the premier cannabis companies in Canada. For 2024, we continue to anticipate year over year growth in net revenue, supported by modest increases in our cost base, excluding the impact of the ERP implementation occurring across 2024, thereby enhancing our operating leverage. While we expect growth in 2024, we also anticipate that much of the growth will come from our branded products that are produced using external capacity and thereby deliver lower gross margin than our current mix. Furthermore, we anticipate continued fierce competition in the distressed Canadian cannabis industry, leading to the maintenance or growth of value and standard pricing tiers, rather than premium price tiers. Notwithstanding these pressures, we expect to deliver continued operating positive cash flow in the year ahead and plan to refinance our debt to a longer-term mortgage facility before the end of 2024.

Conference Call

The Company will be hosting a conference call to discuss Q3 2024 results on Thursday, November 14, 2024. Conference call details are as follows:

ABOUT RUBICON ORGANICS INC.

Rubicon Organics Inc. is the global brand leader in premium organic cannabis products. The Company is vertically integrated through its wholly owned subsidiary Rubicon Holdings Corp, a licensed producer. Rubicon Organics is focused on achieving industry leading profitability through its premium cannabis flower, product innovation and brand portfolio management, including three flagship brands: its super-premium brand Simply Bare™ Organic, its premium brand 1964 Supply Co™, and its cannabis wellness brand Wildflower™ in addition to the Company’s mainstream brand Homestead Cannabis Supply™.

The Company ensures the quality of its supply chain by cultivating, processing, branding and selling organic certified, sustainably produced, super-premium cannabis products from its state-of-the-art glass roofed facility located in Delta, BC, Canada.

CONTACT INFORMATION

Margaret Brodie

CEO

Phone: +1 (437) 929-1964

Email: ir@rubiconorganics.com

The TSX Venture Exchange or its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) does not accept responsibility for the adequacy or accuracy of this press release.

Non-GAAP Financial Measures

This press release contains certain financial performance measures that are not recognized or defined under IFRS (“Non-GAAP Measures”) including, but not limited to, “Adjusted EBITDA”. As a result, this data may not be comparable to data presented by other companies.

The Company believes that these Non-GAAP Measures are useful indicators of operating performance and are specifically used by management to assess the financial and operational performance of the Company as well as its liquidity. Accordingly, they should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. For more information, please refer to the “Selected Financial Information” section in the MD&A for the year ended December 31, 2023, which is available on SEDAR+ at www.sedarplus.ca.

Adjusted EBITDA

Below is the Company’s quantitative reconciliation of Adjusted EBITDA calculated as earnings (losses) from operations before interest, tax, depreciation and amortization, share-based compensation expense, and fair value changes. The following table presents the Company’s reconciliation of Adjusted EBITDA to the most comparable IFRS financial measure for the three and nine months ended September 30, 2024.

| Three months ended | Nine months ended | |||||||

| September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

|||||

| $ |

$ | $ | $ | |||||

| Profit / (Loss) from operations | 157,675 | (1,507,718 | ) | (1,462,244 | ) | (1,972,611 | ) | |

| IFRS fair value accounting related to cannabis plants and inventory | 500,324 | (1,309,266 | ) | (62,718 | ) | (1,776,209 | ) | |

| Depreciation and amortization | 809,602 | 810,633 | 2,418,231 | 2,330,643 | ||||

| Share-based compensation expense | 495,994 | 529,742 | 1,506,274 | 944,268 | ||||

| Adjusted EBITDA | 1,963,595 | 1,141,923 | 2,399,543 | 3,078,509 | ||||

‡ Included in Adjusted EBITDA in the nine months ended September 30, 2024 is $0.6 million of one-time costs incurred for the ERP implementation project.

Cautionary Statement Regarding Forward Looking Information

This press release contains forward-looking information within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, statements regarding Rubicon Organics’ goal of achieving industry leading profitability are “forward-looking statements”. Forward-looking information can be identified by the use of words such as “will” or variations of such word or statements that certain actions, events or results “will” be taken, occur or be achieved.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be materially different from any future results, events or developments expressed or implied by such forward looking statements. The forward-looking information in this press release is based upon certain assumptions that management considers reasonable in the circumstances, including the impact on revenue of new products and brands entering the market, and the timing of achieve Adjusted EBITDA1 profitability and cashflow positive. Risks and uncertainties associated with the forward looking information in this press release include, among others, dependence on obtaining and maintaining regulatory approvals, including acquiring and renewing federal, provincial, local or other licenses and any inability to obtain all necessary governmental approvals licenses and permits for construction at its facilities in a timely manner; regulatory or political change such as changes in applicable laws and regulations, including bureaucratic delays or inefficiencies or any other reasons; any other factors or developments which may hinder market growth; Rubicon Organics’ limited operating history and lack of historical profits; reliance on management; and the effect of capital market conditions and other factors on capital availability; competition, including from more established or better financed competitors; and the need to secure and maintain corporate alliances and partnerships, including with customers and suppliers; and those factors identified under the heading “Risk Factors” in Rubicon Organic’s annual information form dated March 27, 2024 filed with Canadian provincial securities regulatory authorities.

These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. Although Rubicon Organics has attempted to identify important risk factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other risk factors that cause actions, events or results to differ from those anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in forward-looking statements. Rubicon Organics assumes no obligation to update any forward-looking statement, even if new information becomes available as a result of future events, new information or for any other reason except as required by law.

We have made numerous assumptions about the forward-looking statements and information contained herein, including among other things, assumptions about: optimizing yield, achieving revenue growth, increasing gross profit, operating cashflow and Adjusted EBITDA1 profitability. Even though the management of Rubicon Organics believes that the assumptions made, and the expectations represented by such statements or information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in forward-looking statements. Investors are cautioned against undue reliance on forward-looking statements or information. Forward-looking statements and information are designed to help readers understand management’s current views of our near and longer term prospects and may not be appropriate for other purposes. Rubicon Organics assumes no obligation to update any forward-looking statement, even if new information becomes available as a result of future events, changes in assumptions, new information or for any other reason except as required by law.

![]()

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SoftBank Is In Profit Once Again Thanks To Indian IPOs: What's Next For Masayoshi Son?

SoftBank Group SFTBF SFTBY has made a significant financial turnaround, reporting a profit of $7.8 billion in its latest quarter, largely attributed to successful Indian IPOs and improved tech valuations.

What Happened: The Japanese conglomerate’s profit in the quarter ending September starkly contrasts the $6.05 billion loss in the same period last year, reported the Financial Times.

The Vision Fund, known for its high-risk, tech-heavy investments, contributed to this turnaround with a $3.95 billion profit. This is the first time in nine quarters that the Vision Fund’s cumulative investment gains have turned positive.

Notable IPOs in India, including those of Ola Electric and FirstCry, have significantly boosted SoftBank’s valuations. The company’s CFO, Yoshimitsu Goto, highlighted the positive impact of these IPOs, which lifted valuations by $1.7 billion.

Other factors contributing to SoftBank’s improved financial position include valuation gains at Coupang in South Korea and DiDi in China, as well as a favorable impact on net income from the weak yen.

Why It Matters: SoftBank’s interest in AI has been a recurring theme, with CEO Masayoshi Son predicting the advent of artificial superintelligence within a decade.

More recently, SoftBank has been in the news for its plans to rival Nvidia with its own AI chip production. However, these plans hit a roadblock as negotiations with Intel reportedly fell through. This latest financial success may provide SoftBank with the resources to further pursue its AI ambitions.

In August, SoftBank announced a $3.4 billion share buyback program, following pressure from concerned shareholders.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ALLOS: FFO GROWS 37%

RIO DE JANEIRO, Nov. 13, 2024 /PRNewswire/ — ALLOS (B3: ALOS3), the most complete experience, entertainment, services, lifestyle and shopping platform in Latin America announces its results for the third quarter of 2024 (3Q24).

FFO GROWS 37.2% FFO reached R$307.2 million in 3Q24, a growth of 27.7% compared to the same period of the previous year. FFO per share grew 37.2%, driven by the operational performance and the latest share buyback programs.

SALES GROW 8.0% AND SALES/SQM 9.2% Total sales reached R$9.5 billion, advancing 8.0% YoY. Sales/sqm reached R$1,862/sqm, growing 9.2% YoY, strengthened by mix qualification initiatives and robust portfolio management.

SSR INCREASES BY 4.2% In 3Q24, the inflation index returned to positive levels, which, together with strong sales performance, contributed to the quarter’s 4.2% SSR.

HELLOO/MEDIA GROWS 29.7% Helloo has shown significant growth for another consecutive quarter. In 3Q24, media revenues reached R$46.1 million, up 29.7% compared to 3Q23. Media accounted for 6.7% of the company’s total gross revenue versus 5.2% in the 2Q24.

ADVANCE IN DIVESTMENT PLAN In November, documents were signed for divestments in four of the Company’s malls, three partial and one total, amounting to R$579.2 million. The stakes to be sold are 20% of Carioca Shopping, 10% of Shopping Tijuca, 9.9% of Plaza Sul Shopping, and 50% of Rio Anil Shopping.

MONTHLY DIVIDENDS AND BUYBACK OF R$777 MILLION IN 2024 ALLOS adopted the practice of monthly dividend distribution to shareholders. The Board of Directors will approve the dividend amount every three months, with R$150 million to be paid to shareholders in the 4Q24. Additionally, throughout the year, the Company repurchased R$777 million of its shares, representing 6.3% of the total capital.

ALLOS RAISES R$2.5B AT CDI + 0.87% In August, R$2.5 billion was raised through two series of debentures in the institutional market, with maturities in 2031 and 2034 and a weighted average cost of CDI+0.87%. Most of the funds were used for liability management.

ALLOS RECOGNIZED AS COMPANY OF THE YEAR BY EXAME In a memorable ceremony, ALLOS was awarded the title of Company of the Year 2024 and Best Company in the Real Estate and Construction sector by the renowned magazine EXAME. This recognition celebrates the Company’s commitment to transforming the future of retail, consistently dedicated to providing exceptional experiences, serving, and delighting every day. Additionally, ALLOS was named the best company in the real estate sector by Valor Econômico.

![]() View original content:https://www.prnewswire.com/news-releases/allos-ffo-grows-37-302304876.html

View original content:https://www.prnewswire.com/news-releases/allos-ffo-grows-37-302304876.html

SOURCE ALLOS S.A.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hubbell President Electrical Solutions Trades Company's Stock

Mark E. Mikes, President Electrical Solutions at Hubbell HUBB, executed a substantial insider sell on November 12, according to an SEC filing.

What Happened: Mikes opted to sell 1,144 shares of Hubbell, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The transaction’s total worth stands at $533,328.

As of Wednesday morning, Hubbell shares are up by 0.61%, currently priced at $454.77.

Unveiling the Story Behind Hubbell

Hubbell is a diversified conglomerate industrial company that mostly competes in the electrical components market. Its products and services serve vital portions of the U.S. electrical supply chain, including transmission and distribution as well as the commercial, industrial, and residential end markets. The company organizes its business into two segments: Utility Solutions Segment and the Electrical Solutions Segment. It derives maximum revenue from Utility Solutions Segment.

A Deep Dive into Hubbell’s Financials

Revenue Growth: Hubbell displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 4.86%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Key Profitability Indicators:

-

Gross Margin: The company shows a low gross margin of 34.46%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Hubbell’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 4.08.

Debt Management: Hubbell’s debt-to-equity ratio surpasses industry norms, standing at 0.65. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: Hubbell’s P/E ratio of 32.54 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 4.33 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 20.92, Hubbell demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Navigating the World of Insider Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Hubbell’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EVP & Chief Financial Officer Of CoreCivic Makes $1.21M Sale

DAVID GARFINKLE, EVP & Chief Financial Officer at CoreCivic CXW, disclosed an insider sell on November 12, according to a recent SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, GARFINKLE sold 50,000 shares of CoreCivic. The total transaction value is $1,210,000.

The latest market snapshot at Wednesday morning reveals CoreCivic shares up by 0.09%, trading at $22.15.

Get to Know CoreCivic Better

CoreCivic Inc is an owner and operator of private prisons and detention centers in the United States. It operates in three segments: Safety, Community, and Properties. The Community segment owns and operates residential reentry centers. The Properties segment owns properties for lease to third parties and government agencies. The vast majority of the company’s revenue comes from the CoreCivic Safety segment which consists of correctional and detention facilities that are owned, or controlled via a long-term lease, and managed by the company, as well as those correctional and detention facilities owned by third parties but managed by CoreCivic.

Financial Insights: CoreCivic

Positive Revenue Trend: Examining CoreCivic’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.62% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company shows a low gross margin of 24.56%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, CoreCivic exhibits below-average bottom-line performance with a current EPS of 0.19.

Debt Management: CoreCivic’s debt-to-equity ratio is below the industry average at 0.67, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 32.54 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.26, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 11.04, CoreCivic presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Unlocking the Meaning of Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of CoreCivic’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Liberty Gold Reports Q3 2024 Financial and Operating Results

VANCOUVER, British Columbia, Nov. 13, 2024 (GLOBE NEWSWIRE) — Liberty Gold Corp. LGDLGDTF (“Liberty Gold” or the “Company”), is pleased to announce its financial and operating results for the three and nine months ended September 30, 2024. All amounts are presented in United States dollars unless otherwise stated.

THIRD QUARTER OF 2024 AND RECENT HIGHLIGHTS

- On October 7, 2024, we announced the close of the sale of the TV Tower project in northwest Türkiye (“TV Tower“), through the sale of our 73.7% owned subsidiary Orta Truva Madencilik Şanayi ve Ticaret A.Ş (“Orta Truva“) to a major Turkish mining and construction company. The first of three staged consideration payments of $3.7 million was received on October 4, 2024. Our share of the remainder of the gross proceeds will be paid in two further stages as follows1:

- $2.2 million on October 4, 2025, and

- $2.6 million on October 4, 2026.

- On October 24, 2024, we published our 2023 Environmental, Social and Governance disclosure update2.

At the Black Pine project in Idaho (“Black Pine“),

- On October 10, 20243, we announced the results of a Black Pine preliminary feasibility study (“Black Pine PFS“), demonstrating the commercial viability of an open pit, run-of-mine heap leach operation with a one-year construction period.

- As part of the Black Pine PFS a first-time mineral reserve for Black Pine was released, and the mineral resource previously published on February 15, 20244, was updated.

- On September 25, 20245 we announced the receipt of the Hardrock Prospector Permit (“HPP“) at Black Pine adding 7.1 square kilometres (“km2“) of key exploration and development ground in the centre and south of the known mineralized area and expanding the Black Pine Project Area by 10% to a total of 69.3 km2

- On July 17, 2024, we announced the commencement of a 20,000-metre drill exploration program at Black Pine targeting seven key areas identified on newly permitted ground6.

- On July 3, 2024, the Company reported on the Black Pine Mine Permitting initiation meeting with federal and states agencies.7

At the Goldstrike project in Utah, we announced the identification of a high-grade antimony mineralizing system that outcrops along the eastern extension of the main gold trend8.

SELECTED FINANCIAL DATA

The following selected financial data is derived from our unaudited condensed interim consolidated financial statements and related notes thereto (the “Interim Financial Statements”) for the three and nine months ended September 30, 2024, as prepared in accordance with IFRS Accounting Standards – IAS 34: Interim Financial Statements.

A copy of the Interim Financial Statements is available on the Company’s website at libertygold.ca or on SEDAR+ at www.sedarplus.ca.

The information in the tables below is presented in $’000s, except ‘per share’ data:

| Three months ended September 30, |

Nine months ended September 30, |

||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||

| Attributable to shareholders: | |||||||||

| Loss for the period | $(5,750) | $(5,430) | $(12,621) | $(15,544) | |||||

| Loss and comprehensive loss for the period | $(5,674) | $(5,485) | $(12,871) | $(15,443) | |||||

| Basic and diluted loss per share from continuing operations | $(0.01) | $(0.02) | $(0.03) | $(0.05) | |||||

| As at September 30, | As at December 31, | |||

| 2024 |

2023 |

|||

| Cash and short-term investments | $9,281 | $9,082 | ||

| Working capital (excluding assets held for sale) | $6,696 | $7,648 | ||

| Total assets | $35,268 | $35,337 | ||

| Current liabilities | $6,020 | $1,750 | ||

| Non-current liabilities | $759 | $3,180 | ||

| Shareholders’ equity | $25,860 | $27,636 | ||

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

info@libertygold.ca

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company’s designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and has reviewed and validated that the information contained in the release is accurate.

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “planned”, “expect”, “project”, “predict”, “potential”, “targeting”, “intends”, “believe”, “potential”, and similar expressions, or describes a “goal”, or variation of such words and phrases or state that certain actions, events or results “may”, “should”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, timing or results of the publication of any mineral resources, mineral reserves, or pre-feasibility study, the availability of drill rigs, the timing of receipt of future staged payments from the sale of TV Tower, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing or results of the publication of any mineral resources, mineral reserves or pre-feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of receipt of staged payments on the sale of TV Tower or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2024, in the section entitled “Risk Factors”, under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information in this MD&A, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

____________________

1 See news releases dated October 7, 2024 and April 17, 2024.

2 See news release dated October 24, 2024.

3 See news release dated October 10, 2024.

4 See news release dated February 15, 2024.

5 See news release dated September 25, 2024.

6 See news release dated July 17, 2024

7 See news release dated July 3, 2024.

8 See news release dated September 5, 2024.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.