ALLOS: FFO GROWS 37%

RIO DE JANEIRO, Nov. 13, 2024 /PRNewswire/ — ALLOS (B3: ALOS3), the most complete experience, entertainment, services, lifestyle and shopping platform in Latin America announces its results for the third quarter of 2024 (3Q24).

FFO GROWS 37.2% FFO reached R$307.2 million in 3Q24, a growth of 27.7% compared to the same period of the previous year. FFO per share grew 37.2%, driven by the operational performance and the latest share buyback programs.

SALES GROW 8.0% AND SALES/SQM 9.2% Total sales reached R$9.5 billion, advancing 8.0% YoY. Sales/sqm reached R$1,862/sqm, growing 9.2% YoY, strengthened by mix qualification initiatives and robust portfolio management.

SSR INCREASES BY 4.2% In 3Q24, the inflation index returned to positive levels, which, together with strong sales performance, contributed to the quarter’s 4.2% SSR.

HELLOO/MEDIA GROWS 29.7% Helloo has shown significant growth for another consecutive quarter. In 3Q24, media revenues reached R$46.1 million, up 29.7% compared to 3Q23. Media accounted for 6.7% of the company’s total gross revenue versus 5.2% in the 2Q24.

ADVANCE IN DIVESTMENT PLAN In November, documents were signed for divestments in four of the Company’s malls, three partial and one total, amounting to R$579.2 million. The stakes to be sold are 20% of Carioca Shopping, 10% of Shopping Tijuca, 9.9% of Plaza Sul Shopping, and 50% of Rio Anil Shopping.

MONTHLY DIVIDENDS AND BUYBACK OF R$777 MILLION IN 2024 ALLOS adopted the practice of monthly dividend distribution to shareholders. The Board of Directors will approve the dividend amount every three months, with R$150 million to be paid to shareholders in the 4Q24. Additionally, throughout the year, the Company repurchased R$777 million of its shares, representing 6.3% of the total capital.

ALLOS RAISES R$2.5B AT CDI + 0.87% In August, R$2.5 billion was raised through two series of debentures in the institutional market, with maturities in 2031 and 2034 and a weighted average cost of CDI+0.87%. Most of the funds were used for liability management.

ALLOS RECOGNIZED AS COMPANY OF THE YEAR BY EXAME In a memorable ceremony, ALLOS was awarded the title of Company of the Year 2024 and Best Company in the Real Estate and Construction sector by the renowned magazine EXAME. This recognition celebrates the Company’s commitment to transforming the future of retail, consistently dedicated to providing exceptional experiences, serving, and delighting every day. Additionally, ALLOS was named the best company in the real estate sector by Valor Econômico.

![]() View original content:https://www.prnewswire.com/news-releases/allos-ffo-grows-37-302304876.html

View original content:https://www.prnewswire.com/news-releases/allos-ffo-grows-37-302304876.html

SOURCE ALLOS S.A.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hubbell President Electrical Solutions Trades Company's Stock

Mark E. Mikes, President Electrical Solutions at Hubbell HUBB, executed a substantial insider sell on November 12, according to an SEC filing.

What Happened: Mikes opted to sell 1,144 shares of Hubbell, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The transaction’s total worth stands at $533,328.

As of Wednesday morning, Hubbell shares are up by 0.61%, currently priced at $454.77.

Unveiling the Story Behind Hubbell

Hubbell is a diversified conglomerate industrial company that mostly competes in the electrical components market. Its products and services serve vital portions of the U.S. electrical supply chain, including transmission and distribution as well as the commercial, industrial, and residential end markets. The company organizes its business into two segments: Utility Solutions Segment and the Electrical Solutions Segment. It derives maximum revenue from Utility Solutions Segment.

A Deep Dive into Hubbell’s Financials

Revenue Growth: Hubbell displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 4.86%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Key Profitability Indicators:

-

Gross Margin: The company shows a low gross margin of 34.46%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Hubbell’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 4.08.

Debt Management: Hubbell’s debt-to-equity ratio surpasses industry norms, standing at 0.65. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: Hubbell’s P/E ratio of 32.54 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 4.33 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 20.92, Hubbell demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Navigating the World of Insider Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Hubbell’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EVP & Chief Financial Officer Of CoreCivic Makes $1.21M Sale

DAVID GARFINKLE, EVP & Chief Financial Officer at CoreCivic CXW, disclosed an insider sell on November 12, according to a recent SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, GARFINKLE sold 50,000 shares of CoreCivic. The total transaction value is $1,210,000.

The latest market snapshot at Wednesday morning reveals CoreCivic shares up by 0.09%, trading at $22.15.

Get to Know CoreCivic Better

CoreCivic Inc is an owner and operator of private prisons and detention centers in the United States. It operates in three segments: Safety, Community, and Properties. The Community segment owns and operates residential reentry centers. The Properties segment owns properties for lease to third parties and government agencies. The vast majority of the company’s revenue comes from the CoreCivic Safety segment which consists of correctional and detention facilities that are owned, or controlled via a long-term lease, and managed by the company, as well as those correctional and detention facilities owned by third parties but managed by CoreCivic.

Financial Insights: CoreCivic

Positive Revenue Trend: Examining CoreCivic’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.62% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company shows a low gross margin of 24.56%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, CoreCivic exhibits below-average bottom-line performance with a current EPS of 0.19.

Debt Management: CoreCivic’s debt-to-equity ratio is below the industry average at 0.67, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 32.54 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.26, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 11.04, CoreCivic presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Unlocking the Meaning of Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of CoreCivic’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Liberty Gold Reports Q3 2024 Financial and Operating Results

VANCOUVER, British Columbia, Nov. 13, 2024 (GLOBE NEWSWIRE) — Liberty Gold Corp. LGDLGDTF (“Liberty Gold” or the “Company”), is pleased to announce its financial and operating results for the three and nine months ended September 30, 2024. All amounts are presented in United States dollars unless otherwise stated.

THIRD QUARTER OF 2024 AND RECENT HIGHLIGHTS

- On October 7, 2024, we announced the close of the sale of the TV Tower project in northwest Türkiye (“TV Tower“), through the sale of our 73.7% owned subsidiary Orta Truva Madencilik Şanayi ve Ticaret A.Ş (“Orta Truva“) to a major Turkish mining and construction company. The first of three staged consideration payments of $3.7 million was received on October 4, 2024. Our share of the remainder of the gross proceeds will be paid in two further stages as follows1:

- $2.2 million on October 4, 2025, and

- $2.6 million on October 4, 2026.

- On October 24, 2024, we published our 2023 Environmental, Social and Governance disclosure update2.

At the Black Pine project in Idaho (“Black Pine“),

- On October 10, 20243, we announced the results of a Black Pine preliminary feasibility study (“Black Pine PFS“), demonstrating the commercial viability of an open pit, run-of-mine heap leach operation with a one-year construction period.

- As part of the Black Pine PFS a first-time mineral reserve for Black Pine was released, and the mineral resource previously published on February 15, 20244, was updated.

- On September 25, 20245 we announced the receipt of the Hardrock Prospector Permit (“HPP“) at Black Pine adding 7.1 square kilometres (“km2“) of key exploration and development ground in the centre and south of the known mineralized area and expanding the Black Pine Project Area by 10% to a total of 69.3 km2

- On July 17, 2024, we announced the commencement of a 20,000-metre drill exploration program at Black Pine targeting seven key areas identified on newly permitted ground6.

- On July 3, 2024, the Company reported on the Black Pine Mine Permitting initiation meeting with federal and states agencies.7

At the Goldstrike project in Utah, we announced the identification of a high-grade antimony mineralizing system that outcrops along the eastern extension of the main gold trend8.

SELECTED FINANCIAL DATA

The following selected financial data is derived from our unaudited condensed interim consolidated financial statements and related notes thereto (the “Interim Financial Statements”) for the three and nine months ended September 30, 2024, as prepared in accordance with IFRS Accounting Standards – IAS 34: Interim Financial Statements.

A copy of the Interim Financial Statements is available on the Company’s website at libertygold.ca or on SEDAR+ at www.sedarplus.ca.

The information in the tables below is presented in $’000s, except ‘per share’ data:

| Three months ended September 30, |

Nine months ended September 30, |

||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||

| Attributable to shareholders: | |||||||||

| Loss for the period | $(5,750) | $(5,430) | $(12,621) | $(15,544) | |||||

| Loss and comprehensive loss for the period | $(5,674) | $(5,485) | $(12,871) | $(15,443) | |||||

| Basic and diluted loss per share from continuing operations | $(0.01) | $(0.02) | $(0.03) | $(0.05) | |||||

| As at September 30, | As at December 31, | |||

| 2024 |

2023 |

|||

| Cash and short-term investments | $9,281 | $9,082 | ||

| Working capital (excluding assets held for sale) | $6,696 | $7,648 | ||

| Total assets | $35,268 | $35,337 | ||

| Current liabilities | $6,020 | $1,750 | ||

| Non-current liabilities | $759 | $3,180 | ||

| Shareholders’ equity | $25,860 | $27,636 | ||

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

info@libertygold.ca

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company’s designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and has reviewed and validated that the information contained in the release is accurate.

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “planned”, “expect”, “project”, “predict”, “potential”, “targeting”, “intends”, “believe”, “potential”, and similar expressions, or describes a “goal”, or variation of such words and phrases or state that certain actions, events or results “may”, “should”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, timing or results of the publication of any mineral resources, mineral reserves, or pre-feasibility study, the availability of drill rigs, the timing of receipt of future staged payments from the sale of TV Tower, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing or results of the publication of any mineral resources, mineral reserves or pre-feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of receipt of staged payments on the sale of TV Tower or in the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 28, 2024, in the section entitled “Risk Factors”, under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information in this MD&A, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

____________________

1 See news releases dated October 7, 2024 and April 17, 2024.

2 See news release dated October 24, 2024.

3 See news release dated October 10, 2024.

4 See news release dated February 15, 2024.

5 See news release dated September 25, 2024.

6 See news release dated July 17, 2024

7 See news release dated July 3, 2024.

8 See news release dated September 5, 2024.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood Cashes Out On Rocket Lab's 28% Surge in $9M Share Sale But Expands Bet On Flying Cars

On Wednesday, the Cathie Wood-led Ark Invest made substantial trades in Rocket Lab USA Inc RKLB, Amazon.com Inc AMZN, and Archer Aviation ACHR.

The Rocket Lab USA Inc Trade

Ark Invest sold 479,628 shares in Rocket Lab USA. The trades were made through ARK Autonomous Technology & Robotics ETF ARKQ and ARK Space Exploration & Innovation ETF ARKX and were valued at almost $9 million. On Wednesday, Rocket Lab shares shot up over 28% to $18.83.

This sale came after Rocket Lab reported better-than-expected financial results for the third quarter and announced a multi-launch agreement with a confidential customer. The company was also awarded a defense contract worth up to $8 million. Rocket Lab’s shares surged after it reported revenue of $104.81 million, beating the consensus estimate of $102.28 million. The company also reported a loss of 10 cents per share, which was less than the expected loss of 11 cents per share. Rocket Lab expects fourth-quarter revenue in the range of $125 million to $135 million and plans to end the year with more Electron launches. The company has already set an annual launch record with 12 Electron launches to date.

The Amazon.com Trade

Ark Invest also purchased Amazon.com shares. Those transactions were made through ARKQ and ARKX and were valued at $956,812. On Wednesday, Amazon shares ended the day 2.48% higher at $214.10.

Amazon’s stock rose after the company launched an online storefront called “Haul,” designed to compete with Temu. The storefront offers low-cost shopping, with products priced to compete with heavily discounted Chinese products from competitors like Temu and Shein. Chinese e-commerce platforms have built loyal user bases by offering steep discounts on merchandise. Amazon began talking with China-based sellers about offering a similar service earlier this year.

The Archer Aviation Trade

Archer Aviation was another significant trade made by Ark Invest. The firm purchased 57,395 shares of the company for $245,650. The trades were made through ARKQ and ARKX. Archer Aviation shares closed Wednesday 8.15% lower at $4.28.

Archer Aviation, a frontrunner in the electric vertical takeoff and landing (eVTOL) aircraft sector, has seen its stock price soar after signing a major deal with a Japanese aviation giant and reporting solid earnings for the third quarter of fiscal year 2024. Archer Aviation’s strategic alliance with Soracle, a joint venture between Japan Airlines (JAL) and Sumitomo Corporation, has electrified the eVTOL market. Soracle has obtained the right to purchase up to 100 of Archer’s Midnight aircraft, with a potential value reaching $500 million. This agreement marks a significant financial boost for Archer and a calculated entry into a market ripe for urban air mobility disruption.

Importantly, Ark also purchased 55,770 shares of Joby Aviation Inc JOBY. Joby is also an eVTOL company. The transaction amounted to $329,043.

Other Key Trades:

- Ark purchased 1,000 shares of Advanced Micro Devices, Inc. AMD through ARKX. The transaction was valued at $139,300.

- The Wood-led firm purchased shares of Iridium Communications Inc. (IRDM), L3Harris Technologies Inc. (LHX), and Schrodinger Inc. (SDGR).

- Ark Sold shares of Repare Therapeutics Inc. (SNTI) and Adaptive Biotechnologies Corp. (ADPT) along with Exact Sciences Corp. (EXAS).

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Complete Solar Third Quarter Report

OREM, Utah, Nov. 13, 2024 (GLOBE NEWSWIRE) — Complete Solaria, Inc. d/b/a Complete Solar (“Complete Solar” or the “Company”) CSLR, a solar technology, services, and installation company, today will present its Q3’24 results via webcast at 5:00 p.m. EST. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: investors.completesolar.com/news-events/events.

Q3’24 actuals and Q4’24 forecasts (based on non-GAAP results unless noted) are as follows:

- Complete Solar completed the successful acquisition of SunPower’s assets in the New Homes, Blue Raven, Dealer businesses, and rights to the SunPower brand

- The Company also won a Delaware Bankruptcy Court ruling giving it rights to the SunPower brand in the U.S.

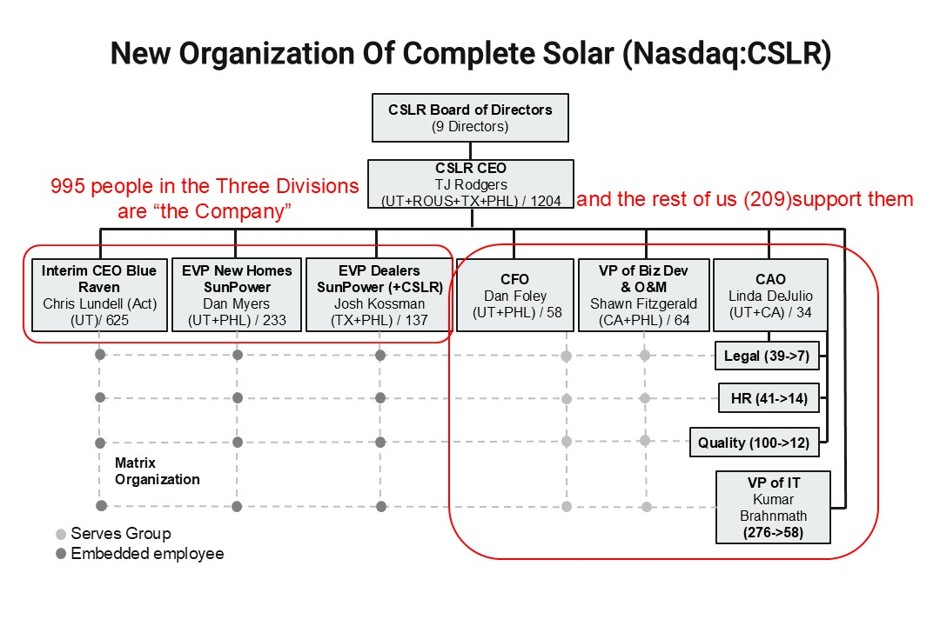

- 1204 SunPower employees have been hired by Complete Solar, which had only 65 employees to form “NewCo”

- In Q3 the Company raised $80 million through convertible debt offerings to provide capital for the $45 million SunPower asset acquisition and working capital, the last $14 million of which will transfer in early December 2024 from a Chinese investor.

Fellow Shareholders:

The revenue, earnings and cashflow for pre-merger Complete Solar Q3’24 are given below, compared with the Q2’24 & Q1’24 prior quarter actual results. This is the last 10Q filing (here) for the “old Complete Solar.”

| ($1000s, except gross margin) | GAAP | Non-GAAP1 | |||||||||||||||

| Q3 2024 | Q2 2024 | Q1 2024 | Q3 2024 | Q2 2024 | Q1 2024 | ||||||||||||

| Revenue | 5,536 | 4,492 | 10,040 | 5,536 | 4,492 | 10,040 | |||||||||||

| Gross Margin | -57 | % | -20 | % | 23 | % | 2 | % | -20 | % | 24 | % | |||||

| Operating Income | (29,768 | ) | (9,494 | ) | (7,544 | ) | (6,546 | ) | (6,624 | ) | (6,179 | ) | |||||

| Cash Balance | 79,502 | 1,839 | 1,786 | 79,502 | 1,839 | 1,889 | |||||||||||

| 1. GAAP/non-GAAP reconciliation attached. | |||||||||||||||||

Acquiring SunPower Assets

In early September ’24 Complete Solar was presented with an opportunity to hire SunPower employees and acquire SPWR assets that would scale Complete Solar and its value at a rate unachievable just weeks before. We needed to raise money ($80 million), to get approval from the SunPower board for our so-called stalking-horse chapter 11 plan in which our small company would acquire over 1,000 employees from solar icon SunPower Corporation that in effect was an IPO for the three divisions acquired from SunPower. The U.S. Bankruptcy Court in Delaware approved our plan, and we began the integration.

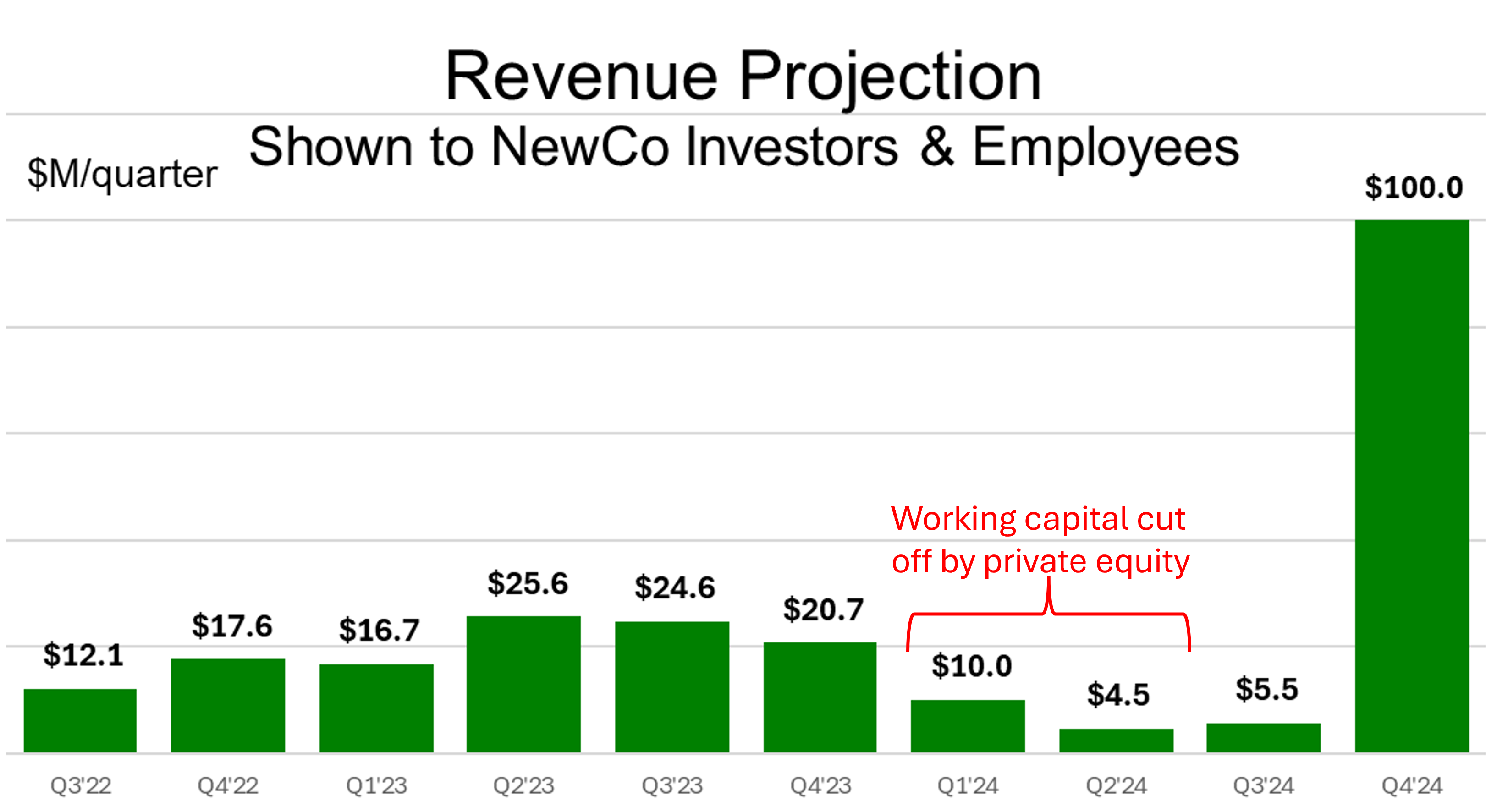

The first five-quarter plan (Q4’24-Q4’25) presented to investors in the $80 million funding presentation called for $100 million in revenue in Q4’24 for the combined company with a sustainable operating income loss of $1.0 million, followed in Q2’25 by its first profitable quarter ($0.4 million).

“NewCo” (Complete Solar Plus “Old SunPower” Plus its Blue Raven Solar Subsidiary)

The combined team worked throughout October and early November to reorganize into a new start-up like organization designed to be lean enough to achieve breakeven with $100 million in revenue. That organization is shown below as deployed in order of size in Utah, Rest of US, Texas and the Philippines. Certain administrative functions were centralized to provide great savings in headcount, also shown below:

Complete Solar Announces Preliminary Q3’24 Results

Our companies were not combined until October 1, 2024, so there are no GAAP and non-GAAP results to report for the combined business for Q3’24, but the following chart shows preliminary and unaudited Q3’24 results based on a simple summing of the separate results shown on November 6 to employees and investors.

| Operating Income | ||||||||||

| Division | Charter | Revenue | Prior Report by Division | |||||||

| New Homes | Sales to homebuilders | $53.2 | N/A | ($11.9) | ||||||

| Blue Raven Solar | Sales direct to customer | $43.5 | N/A | ($6.9) | ||||||

| Dealer (+ CSLR) | Sales of jobs from dealers | $ 20.61 | N/A | ($21.3) | ||||||

| $117.34 | ($73.8)2 | ($40.0)3 | ||||||||

1. Contains $5.5M in revenue from the “old CSLR” and $15.1M in revenue from the old SunPower “Dealer” Division now combined as NewCo’s “Dealer” Division. 2. Contains write-offs due to the bankruptcy & acquisition. 3. High costs due to running the pre-layoff employment levels of both companies during the quarter. 4. High revenue due to accumulated backlog at SunPower when it was shut down in Q1’24 and Q2’24.

- Combined revenue in Q3’24 for NewCo was $117.3 million. On a standalone basis, Complete Solar’s Q3’24 revenue was $5.5 million of the $20.6 reported for “Dealer”

- Revenue for Q4’24 is now expected to be $80 million, lower sequentially due to benefits accumulated backlog in Q3 that will not carry over to Q4’24

- The operating income loss is now expected to drop from ($40.0M) in Q3’24 to $2-11 million in Q4’24 due to the significant headcount reduction

Complete Solar CEO, T.J. Rodgers said, “On Wednesday, November 6, 2024 at our Orem, Utah HQ, we presented to over 1,000 employees the details of our Rev. 5 Annual Operating Plan for cutting headcount and other costs to achieve breakeven operating income in 2025.

Rodgers continued, “Our Q3’24 results of $117 million in combined revenue overstates our current revenue rate due to the pileup of SunPower backlog in Q1 & Q2’24. Our current belief is that our revenue will be $80 million in Q4’24, as calculated by extrapolating shipments to known customers from orders in mid-process in our factory.

Rodgers concluded, “Our Q3’24 opex of $43.5 million will shrink to $17.0 million in Q4’24 due to actions already implemented with more to follow in each quarter of 2025.”

About Complete Solar

With its recent acquisition of SunPower assets, Complete Solar has become a leading residential solar services provider in North America. Complete Solar’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.completesolar.com.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America (“GAAP”), Complete Solar provides an additional financial metrics that is not prepared in accordance with GAAP (“non-GAAP”). Management uses non-GAAP financial measures, in addition to GAAP financial measures, as a measure of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of Complete Solar’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect. The non-GAAP financial measures do not replace the presentation of Complete Solar’s GAAP financial results and should only be used as a supplement to, not as a substitute for, Complete Solar’s financial results presented in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our expectations regarding our Q4 ’24 and fiscal 2025 financial performance, including with respect to our Q4 ’24 combined revenues and profit before tax loss, expectations and plans relating to further headcount reduction, cost control efforts, and our expectations with respect to when we achieve breakeven operating income and positive operating income. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with the SunPower assets, our ability to achieve the anticipated benefits of the SunPower acquisition, global market conditions, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the SEC on April 1, 2024, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Complete Solar assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

| Complete Solaria, Inc. | |||||||||||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | |||||||||||||||||

| (In Thousands) | |||||||||||||||||

| COMPLETE SOLARIA, INC. – REPORTED | CSLR + ACQUIRED ASSETS1 | ||||||||||||||||

| 13 weeks ended | 13 weeks ended | 13 weeks ended | 13 weeks ended | 13 weeks ended1 | |||||||||||||

| Note | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 29, 2024 | September 29, 20241 | ||||||||||||

| GAAP operating loss from continuing operations | (16,055 | ) | (7,544 | ) | (9,494 | ) | (29,768 | ) | (73,764 | ) | |||||||

| Depreciation and amortization | A | – | 321 | – | – | 3,686 | |||||||||||

| Stock based compensation | B | 901 | 638 | 1,965 | 5,406 | 5,579 | |||||||||||

| Restructuring charges | C | 2,971 | 406 | 905 | 17,816 | 23,037 | |||||||||||

| Total of Non-GAAP adjustments | 3,872 | 1,365 | 2,870 | 23,222 | 32,302 | ||||||||||||

| Non-GAAP net loss | (12,183 | ) | (6,179 | ) | (6,624 | ) | (6,546 | ) | (41,462 | ) | |||||||

| Notes: | |||||||||||||||||

| (1) | Complete Solaria acquired SunPower assets (as described in the asset purchase agreement) on October 1, 2024. GAAP and Non-GAAP figures in this column reflect unaudited results as if Complete Solaria owned these assets as of July 1, 2024. | ||||||||||||||||

| (A) | Depreciation and amortization: Depreciation and amortization related to capital expenditures. | ||||||||||||||||

| (B) | Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense. | ||||||||||||||||

| (C) | Restructuring charges: Costs primarily related to acquisition, headcount reductions, severance and other non-recurring charges. | ||||||||||||||||

Source: Complete Solar, Inc.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/69f8526f-2992-4a95-8d35-2c44e198d9e8

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f16f41b-cd7e-428a-bbd3-d29f935d74cc

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Oncology Bet Is Already Paying Off For Pfizer

With the downfall of Covid-19, pharmaceutical companies turned to oncology in search for their next growth story. Earlier in October, Pfizer Inc PFE reported its third quarter revenue grew 14% on an operational basis due to approved cancer products from Seagen it acquired last December. On the other hand, Moderna Inc MRNA posted a surprise profit and higher than expected revenue following the launch of its updated Covid-19 vaccine earlier this year as focused on slashing costs. But, even with Covid-19 still lingering in the air, Moderna has also focused on harnessing the power of mRNA to make biotech history by revolutionizing cancer treatment. However, there is also a significant advancement in early screening and even possible prevention when it comes to the cancer front. For example, their much smaller peer, Mainz Biomed MYNZ just announced a new collaboration agreement aimed at developing and potentially commercializing its next generation colorectal cancer screening product.

Mainz Biomed’s next generation CRC screening product is coming to redefine standards.

Mainz Biomed is a molecular genetics diagnostic company specialized in the early detection of cancer. This week, it announced it entered into a collaborative agreement with Thermo Fisher Scientific Inc. TMO, through its subsidiary Life Technologies Corporation, a leading provider of life sciences solutions and services.

With the power of Thermo Fisher’s powerful technologies, instrumentation and information translation systems, Mainz Biomed will be empowered to develop the proprietary assays for its mRNA-based next-generation CRC screening tests which are raising the bar when it comes to early cancer detection. With U.S. and European clinical trials of its flagship non-invasive test, Mainz Biomed promises to redefine standards in cancer screening. With ColoAlert, Mainz Biomed not only offers the early detection of colorectal cancer but also detects advanced adenomas which are a known cancer precursor, therefore, opening the doors its peers didn’t dare to tackle, the ones of cancer prevention.

Pfizer topped estimates and hiked its full year guidance.

Cancer drugs brought in $854 million to Pfizer’s revenue table, including $409 million from a targeted treatment for bladder cancer called Padcev and $268 million from lymphoma-targeting Adectris. Good results provided some much-needed good news for Pfizer CEO Albert Bourla, who is facing new pressure from activist investor Starboard Value.

For the third quarter, Pfizer reported overall revenue of $17.7 billion.

Moderna continues to focus on developing cancer treatment along with lowering costs.

Back in September, Moderna revealed its plan to cut its research and development budget by $1.1 billion over the next three years while it aims to get FDA approval for 10 products like cancer treatments and vaccines. During the latest earnings call, Moderna CEO Stéphane Bancel was pleased with the cost efficiency achieved during the quarter, with the progress being even better than planned. For the third quarter, Moderna reported revenue of $1.86 billion, smashing LSEG’s consensus estimate of $1.25 billion. While Pfizer already counts on oncology for boosting sales, Moderna’s sales are still made by the Covid shot, along with RSV one that brought $10 million in U.S. sales after gaining approval in May. However, with 45 products in development powered by its messenger RNA platform, Moderna expects to bring 10 of them to the market over the next three years.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Georgian Election Plunges Nation Into EU-Russian Deadlock

The Georgian elections plunged the Caucasus country into political uncertainty after the pro-Russian ruling party won amid allegations of Russian meddling.

Thousands of pro-European Union (EU) supporters have protested in the capital Tbilisi since the vote on October 26. The opposition has refused to recognize the results after a controversial partial recount confirmed that the ruling Georgian Dream party won.

Pro-European President Salome Zurabishvili declared the election results “illegitimate,” alleging there was a “Russian special operation” to undermine the vote. Prime Minister Irakli Kobachidze, who supports closer ties with Moscow, said that “any attempts to talk about election manipulation are doomed to failure.”

Similar to Moldova, where voting occurred last month, the Georgian election sparked a geopolitical battle between the West and Russia. The country’s Moscow-friendly authorities have pushed a pro-Russia agenda, while the opposition wants to improve ties with the West.

“The opposition presented the vote as a referendum on the country’s future: whether Georgia would be an EU democracy or an authoritarian country under Russia’s sway,” Alexander Atasuntsev, an independent journalist specializing in post-Soviet affairs, wrote for Carnegie Politika. “The ruling Georgian Dream party, on the other hand, portrayed it as a fateful choice between war and peace.”

The country’s election commission declared that Georgian Dream won its fourth consecutive term with 54% of the votes. The pro-European opposition parties won 37.8% of the vote.

EU, US Call For Georgian Election Investigation

Washington and Brussels have called for a full investigation into the Georgian elections. State Department spokesman Matthew Miller said that the US expects “further consequences if the Georgian government does not change course.”

The European Commission (EC) said a “divisive” atmosphere marked the election with “instances of bribery, double voting and physical violence.” Antonio-Lopez-Isturiz White, the head of the European Parliament’s delegation to the Organization for Security and Co-operation in Europe mission, accused Georgian Dream of promoting “Russian disinformation.”

In response, Moscow accused Western nations of trying to “destabilize” Georgia. “The naked eye can also see attempts to interfere, but not by Russia,” Russian presidential spokesman Dmitry Peskov said. “A huge number of forces from European countries tried to influence the outcome of this vote.”

Ahead of the elections, polls showed more than 80% of the country’s population in favor of European integration. In addition, the Russian invasion of Ukraine in 2022 has raised concern about Moscow’s intentions in Georgia, given its history of intervention.

Europe Wary Of Russian Intentions In Georgia

Moscow has considered Georgia a key part of its effort to reassert authority across the post-Soviet space. Russia currently endorses the pro-Russian de facto regimes in Abkhazia and South Ossetia after invading Georgia in 2008.

The breakaway regions of Abkhazia and the Republic of South Ossetia claimed independence from Georgia in the early 1990s, which Moscow recognized after its invasion. Russian troops have been deployed in central Abkhazia at the Black Sea and in Tskhinvali, the capital of South Ossetia.

Georgian authorities consider the Russian troop deployments illegal, occupying 20% of Georgian territory. Russia is also constructing a naval base in Ochamchire to strengthen its military presence in southern Abkhazia and the Black Sea.

Map Russian military offensive, 2008, source: Reddit

The US and the EU worry that Georgia may follow the path of Belarus, where Russia has based nuclear weapons.

“Critics of Georgia’s governing party fear the country may now follow the geopolitical trajectory of Belarus,” Nicholas Chkhaidze, a research fellow at the Baku-based Topchubashov Centerm, wrote for the Atlantic Council.

In recent years, it “has become increasingly subject to creeping Russian control in every sphere of national life from the economy to defense,” he wrote.

Georgia Moved Close To Moscow Under Ruling Party

The Georgian Dream party has grown increasingly close to Moscow despite European efforts to gain influence. The founder of Georgian Dream, Bidzina Ivanishvili, who has made his fortune in Russia, has warm ties with the Kremlin. Ivanishvili said he would ban opposition parties, holding them “fully accountable under the full force of the law.”

Georgian Dream has clashed with the EU before the election. The EU criticized a law labeling NGOs as foreign agents if they receive 20% or more of funding from abroad. The government has implemented laws that target the country’s LGBTQ+ communities, following a Russian blueprint.

After the Georgian elections, the ruling party snubbed members of the foreign relations committees from the parliaments of France, Germany, Poland, Sweden, Finland and the Baltic states. The opposition party met with the European delegation that traveled on Monday to Tbilisi for talks about the elections.

Kakha Kaladze, secretary general of Georgian Dream and mayor of Tbilisi, described the visiting EU politicians as “ordinary pests” and accused them of “propagating lies.”

Disclaimer:

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.