ADENTRA Announces Third Quarter 2024 Results

Third quarter 2024 sales of US$568.8 million

Earnings per share of US$0.42 and Adjusted EBITDA of US$48.0 million

Quarterly dividend increased by 7% to C$0.15 per share

LANGLEY, BC, Nov. 13, 2024 /CNW/ – ADENTRA Inc. (“ADENTRA” or the “Company”) today announced financial results for the three and nine months ended September 30, 2024. ADENTRA is one of North America’s largest distributors of architectural building products to the residential, repair and remodel, and commercial construction markets. We currently operate a network of 86 facilities in the United States and Canada. All amounts are shown in United States dollars (“US $” or “$”), unless otherwise noted.

Highlights for Q3 2024 (as compared to Q3 2023)

- Generated sales of $568.8 million (C$775.9 million), as compared to $558.7 million (C$749.4 million)

- Gross margin of $121.4 million, up from to $118.3 million

- Gross margin percentage increased to 21.3%, a 10 basis points improvement

- Operating expenses decreased by $4.2 million, or 4.1%

- Net income increased by 28.7% to $10.4 million; Basic earnings per share grew 16.7% to $0.42 (C$0.57)

- Operating cash flow before changes in working capital increased $12.6 million to $38.6 million, from $25.9 million

- Increased the quarterly dividend to C$0.15 per share from C$0.14 per share, payable on January 31, 2025 to shareholders of record as of January 20, 2025

- On July 29, 2024, announced the US$130 million acquisition of Woolf Distributing Company, Inc. (“Woolf”), a US Midwest-based value-added distributor of architectural building and millwork products for residential and commercial markets.

“We achieved a solid third-quarter performance, marked by disciplined execution and steadfast adherence to our strategic roadmap, effectively navigating headwinds in select markets,” stated Rob Brown, President and CEO of ADENTRA. “Notably, affordability constraints and the slower-than-anticipated pace of interest rate reductions in the U.S. contributed to tempered activity levels during the period.”

“Despite these challenges, our third-quarter performance held steady. Organic sales volumes decreased by just 1%, with total sales growing by 1.8% year-over-year, including two months of revenue contribution from our recent acquisition of Woolf.

“We also saw early signs of relief from the prolonged product price deflation that has impacted the past two years. Third-quarter price deflation of 3% represented the lowest rate of decline over the past five quarters, a substantial improvement from the year-to-date rate of 6%. Encouragingly, we achieved a modest increase in average product prices compared to Q2 2024, signaling a potential easing in product price pressures.”

“Our gross margin performance of 21.3%, up 10 basis points year-over-year, further underscores the stability of our operations. Organically, our operating expenses remained consistent with Q2 2024 levels, demonstrating our continued tight control over costs across the business.”

“A key highlight of the quarter was our strong cash flow generation, totaling $66 million. We strategically leveraged this cash flow, along with our credit facility, to complete the acquisition of Woolf, closing the quarter with a solid balance sheet and a pro forma leverage ratio of 2.5x. This places us comfortably within our target leverage range of 2-3x, providing us with the financial agility to advance our strategic priorities.”

“Reflecting on our business’s strength and our positive outlook for the coming year, I am pleased to announce that our Board of Directors has approved a 7% increase in our quarterly dividend to $0.15 per share—our 12th dividend increase in 12 years,” Mr. Brown concluded.

Outlook

Affordability pressures stemming from the cumulative impact of consumer price inflation in the broader economy, alongside continued market challenges related to elevated interest rates, will impact Q4 2024 as compared to Q4 2023. We anticipate that these headwinds will be offset by strong operational execution and the inclusion of Woolf, resulting in fourth quarter Adjusted EBITDA aligning closely with Q4 2023 levels.

Amid the market conditions described above, our 2024 results have remained strong. Year-to-date, we achieved stable volumes, improved our gross profit margin by 110 basis points to 21.7%, and sustained consistent Adjusted EBITDA and Adjusted EPS compared to the same period in 2023. Our results underscore the critical competitive advantages embedded in our business model and strategic approach.

Our size, scale, and operational sophistication enable us to implement impactful initiatives that are challenging for smaller regional competitors to replicate. Core strategies include our global sourcing and vendor management programs, which grant access to branded, exclusive, and semi-exclusive products under favorable terms. We’ve also enhanced our focus on high-value, installation-ready products. Furthermore, we employ advanced data analytics and digital platforms to strengthen asset management, uphold pricing discipline, and expand online sales. Our tight control of operating expenses continues to support profitability.

These strategies are integral to our Destination 2028 plan, which targets $800 million in additional run-rate revenue through acquisitions by 2028, along with achieving a 10%+ EBITDA margin and 12%+ ROIC. Our third quarter acquisition of Woolf has put us on pace to meet these goals, delivering immediate benefits while positioning us for continued growth. As one of North America’s largest distributors of architectural building products, with approximately 6% market share, we are well-positioned to pursue further growth, and we maintain a robust pipeline of acquisition opportunities.

Looking ahead, forecasters indicate a favorable outlook for building market conditions in the second half of 2025 and beyond. This optimism is bolstered by anticipated interest rate reductions and strong end-market fundamentals, including a historic undersupply of housing, favorable demographic trends, solid home equity levels, and an aging housing stock. We are confident in our multi-year growth trajectory across core markets in repair and remodel, residential, and commercial sectors.

Q3 2024 Investor Call

ADENTRA will hold an investor call on Thursday, November 14, 2024 at 8:00 am Pacific (11:00 am Eastern). Participants should dial 1-888-510-2154 or (437) 900-0527 (GTA) at least five minutes before the call begins. A replay will be available through November 27, 2024 by calling toll free 1-888-660-6345 or (289) 819-1450 (GTA), followed by passcode 76588 #.

Summary of Results

|

Three months |

Three months |

Nine months |

Nine months |

|||||

|

ended |

ended |

ended |

ended |

|||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Total sales |

$ 568,819 |

$ 558,673 |

$ 1,653,449 |

$ 1,724,465 |

||||

|

Sales in the US |

524,927 |

516,510 |

1,522,030 |

1,593,682 |

||||

|

Sales in Canada (CAD$) |

59,862 |

56,548 |

178,792 |

175,981 |

||||

|

Gross margin |

121,384 |

118,307 |

358,836 |

354,749 |

||||

|

Gross margin % |

21.3 % |

21.2 % |

21.7 % |

20.6 % |

||||

|

Operating expenses |

(96,687) |

(100,860) |

(282,741) |

(287,707) |

||||

|

Income from operations |

$ 24,697 |

$ 17,447 |

$ 76,095 |

$ 67,042 |

||||

|

Add: Depreciation and amortization |

19,287 |

17,390 |

55,581 |

52,121 |

||||

|

Earnings before interest, taxes, depreciation and |

||||||||

|

amortization (“EBITDA”) |

$ 43,984 |

$ 34,837 |

$ 131,676 |

$ 119,163 |

||||

|

EBITDA as a % of revenue |

7.7 % |

6.2 % |

6.9 % |

11.0 % |

||||

|

Add (deduct): |

||||||||

|

Depreciation and amortization |

(19,287) |

(17,390) |

(55,581) |

(52,121) |

||||

|

Net finance expense |

(11,240) |

(12,662) |

(32,736) |

(36,986) |

||||

|

Income tax recovery (expense) |

(3,054) |

3,301 |

(5,269) |

(3,005) |

||||

|

Net income for the period |

$ 10,403 |

$ 8,086 |

$ 38,090 |

$ 27,051 |

||||

|

Basic earnings per share |

$ 0.42 |

$ 0.36 |

$ 1.62 |

$ 1.21 |

||||

|

Diluted earnings per share |

$ 0.41 |

$ 0.36 |

$ 1.60 |

$ 1.19 |

||||

|

Average US dollar exchange rate for one Canadian dollar |

$ 0.733 |

$ 0.745 |

$ 0.735 |

$ 0.743 |

|

Analysis of Specific Items Affecting Comparability (in thousands of Canadian dollars) |

||||||||

|

Three months |

Three months |

Nine months |

Nine months |

|||||

|

ended September 30 |

ended September 30 |

ended September 30 |

ended September 30 |

|||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Earnings before interest, taxes, depreciation and |

||||||||

|

amortization (“EBITDA”), per table above |

$ 43,984 |

$ 34,837 |

$ 131,676 |

$ 119,163 |

||||

|

LTIP expense |

2,115 |

1,293 |

8,456 |

5,986 |

||||

|

Accrued trade duties |

— |

15,640 |

— |

15,640 |

||||

|

Transaction expense |

1,935 |

— |

1,935 |

— |

||||

|

Adjusted EBITDA |

$ 48,034 |

$ 51,770 |

$ 142,067 |

$ 140,789 |

||||

|

Adjusted EBITDA as a % of revenue |

8.4 % |

9.3 % |

8.6 % |

8.2 % |

||||

|

Net income for the period, as reported |

$ 10,403 |

$ 8,086 |

$ 38,090 |

$ 27,051 |

||||

|

LTIP expense, net of tax |

1,555 |

1,154 |

6,215 |

5,467 |

||||

|

Accrued trade duties, net of tax |

— |

11,495 |

— |

11,495 |

||||

|

Transaction expenses, net of tax |

1,422 |

— |

1,422 |

— |

||||

|

Foreign exchange loss, net of tax |

578 |

370 |

603 |

240 |

||||

|

Amortization of acquired intangible assets, net of tax |

4,653 |

4,062 |

12,777 |

12,186 |

||||

|

Adjusted net income for the period |

$ 18,610 |

$ 25,168 |

$ 59,108 |

$ 56,440 |

||||

|

Basic earnings per share, as reported |

$ 0.42 |

$ 0.36 |

$ 1.62 |

$ 1.21 |

||||

|

Net impact of above items per share |

0.33 |

0.76 |

0.90 |

1.31 |

||||

|

Adjusted basic earnings per share |

$ 0.75 |

$ 1.12 |

$ 2.52 |

$ 2.52 |

||||

|

Diluted earnings per share, as reported |

$ 0.41 |

$ 0.36 |

$ 1.60 |

$ 1.19 |

||||

|

Net impact of above items per share |

0.32 |

0.74 |

0.88 |

1.29 |

||||

|

Adjusted diluted earnings per share |

$ 0.73 |

$ 1.10 |

$ 2.48 |

$ 2.48 |

||||

Results from Operations – Three Months Ended September 30, 2024

For the three months ended September 30, 2024, total sales grew by $10.1 million to $568.8 million, from $558.7 million in Q3 2023. This increase reflects the positive impact of the newly acquired Woolf business which contributed sales of $31.4 million over two months of operations, partially offset by a $20.5 million, or 3.7%, decrease in organic sales. The change in organic sales reflects an approximately 3% decrease in product prices and a 1% decrease in sales volumes as compared to Q3 2023. Third quarter sales results were not significantly impacted by foreign exchange translation of Canadian sales to US dollars for reporting purposes.

In our US operations, third quarter sales grew by $8.4 million to $524.9 million, from $516.5 million in the same period in 2023. The year-over-year improvement reflects the $31.4 million contribution from the acquired Woolf business, partially offset by the $23.0 million, or 4.4% decrease in organic sales. Approximately 3% of the change in organic sales related to product price deflation, with 2% attributable to lower sales volumes.

In Canada, third quarter sales of C$59.9 million increased by C$3.3 million, or 5.9%, from Q3 2023 levels. The year-over-year improvement in Canadian sales reflects an approximate 10% increase in sales volumes, partially offset by a 4% decrease in product prices.

Third quarter gross margin increased to $121.4 million, a $3.1 million, or 2.6%, improvement from Q3 2023, primarily related to the increase in sales. Gross margin percentage of 21.3% was 10 basis points higher than the same period in the prior year.

For the three months ended September 30, 2024, we lowered operating expenses to $96.7 million, from $100.9 million in the same period last year. This $4.2 million, or 4.1%, improvement was primarily driven by $15.6 million of accrued trade duties recognized in Q3 2023, which did not recur in the current period (discussed further in section 7.0). This decrease was partially offset by $2.3 million of expense related to two months’ operation of our new Woolf business, as well as $1.9 million of transaction costs related to the acquisition. Additionally, variable compensation increased by $2.5 million compared to Q3 2023, primarily as a result of the reduction in accruals in Q3 2023. People costs were also $3.5 million higher in the current period, primarily due to inflationary adjustments and an increase in employee benefits expense.

For the three months ended September 30, 2024, depreciation and amortization increased to $19.3 million, from $17.4 million in Q3 2023. The year-over-year increase was primarily driven by higher premise leases. Depreciation and amortization included $6.3 million of amortization on acquired intangible assets, representing an increase of $0.8 million compared to Q3 2023, primarily due to intangible assets acquired from the Woolf acquisition.

For the three months ended September 30, 2024, net finance expense decreased to $11.2 million, from $12.7 million in Q3 2023. The $1.4 million improvement was attributable both to lower bank indebtedness and lower interest rates as compared to Q3 2023.

For the three months ended September 30, 2024, income tax expense was $3.1 million, representing an effective tax rate of approximately 22.7%. The effective tax rate is lower than the U.S. statutory rates, reflecting the benefits of our tax structuring initiatives.

Third quarter Adjusted EBITDA decreased 7.2% to $48.0 million, from $51.8 million during the same period in 2023. This $3.7 million change reflects a $6.8 million increase in operating expenses (before changes in depreciation and amortization, LTIP expense, accrued trade duties, and transaction expense), partially offset by the $3.1 million increase in gross margin.

Net income for the third quarter of 2024 increased 28.7% to $10.4 million (basic earnings per share of $0.42), from $8.1 million (basic earnings per share of $0.36) in Q3 2023. The $2.3 million improvement includes the $9.1 million increase in EBITDA and the $1.4 million decrease in net finance expense, partially offset by the $6.4 million increase in income tax expense and the $1.9 million increase in depreciation and amortization.

Third quarter adjusted net income decreased by 26.1% to $18.6 million, from $25.2 million in Q3 2023. Adjusted basic earnings per share for Q3 2024 were $0.75, compared to $1.12 in the same period of the prior year, a decrease of 33.0%.

Results from Operations – Nine Months Ended September 30, 2024

For the nine months ended September 30, 2024, we generated total sales of $1.65 billion, as compared to $1.72 billion in the first nine months of 2023, a decrease of $71.0 million or 4.1%. Organic sales decreased by $100.9 million, or 5.9%, primarily driven by product price deflation of approximately 6%. Sales volumes remained stable year-over-year. The decrease in organic sales was partially offset by the $31.4 million, or 1.8%, acquisition-based revenue growth generated by the acquired Woolf business. Foreign exchange fluctuations in the Canadian dollar also had an unfavorable $1.4 million impact on sales results.

Our US operations generated nine-month sales of $1.52 billion, compared to $1.59 billion in the same period in 2023. The year-to-date results include a $103.0 million, or 6.5%, year-over-year decrease in organic sales driven by product price deflation of approximately 6% and a sales volume decrease of approximately 1%. This was partially offset by revenue contribution from Woolf of $31.4 million.

In Canada, sales for the first nine months increased to C$178.8 million, up C$2.8 million, or 1.6%, from the same period in 2023. The year-over-year improvement reflects an approximate 7% increase in sales volume, partially offset by a 5% decrease in product prices.

Gross margin in the first nine months increased to $358.8 million, up $4.1 million, or 1.2%, from the same period last year. This improvement was driven by an increase in our gross margin percentage to 21.7%, from 20.6% in the same period last year. The organic improvement in gross margin percentage reflects the positive impact of strategic initiatives, including our growing focus on high-value installation-ready products, strong performance from our global sourcing program, and our leveraging of data analytics and digital platforms to maintain strong asset management and pricing discipline.

For the nine months ended September 30, 2024, operating expenses were lower at $282.7 million, as compared to $287.7 million in the same period last year. This $5.0 million, or 1.7%, decrease is primarily attributable to $15.6 million of accrued trade duties recognized in the third quarter of 2023 which did not recur in the current period (discussed further in section 7.0), and $4.0 million of lower premise costs. These decreases were partially offset by $2.3 million of operating expenses and $1.9 million of transaction costs related to the Woolf acquisition, together with inflationary increases in people costs.

For the nine months ended September 30, 2024, depreciation and amortization increased to $55.6 million, from $52.1 million in the prior-year period. The year-over-year increase was attributable to depreciation and amortization related to higher cost of premise leases and additional amortization of intangible assets. Included in the depreciation and amortization was $17.4 million of amortization on acquired intangible assets, an increase of $0.8 million compared to the first nine months of 2023, driven by intangible assets acquired from the Woolf acquisition.

For the nine months ended September 30, 2024, net finance expense decreased $4.3 million to $32.7 million, from $37.0 million in the same period 2023. The primary driver of this improvement was a decrease in our average bank indebtedness balance over the first nine months of the year.

For the nine months ended September 30, 2024, income tax expense was $5.3 million, compared to $3.0 million in the first nine months of 2023. In May 2024, Canada substantively enacted the Excessive Interest and Financing Expenses Limitation (“EIFEL”) legislation which limits our ability to deduct interest and increases our expected taxable income in Canada. During the nine months ended September 30, 2024, we recognized $4.3 million (C$5.8 million) of deferred tax assets based on the expected utilization of operating loss carry forwards.

Excluding this tax recovery, income tax expense was $9.5 million, representing an effective tax rate of 22.1%, compared to 10.0% in the first nine months of 2023. The year-over-year increase in the effective tax rate reflects the benefits of restructuring activities realized in the prior year.

For the nine months ended September 30, 2024, Adjusted EBITDA grew 0.9% to $142.1 million, from $140.8 million during the same period in 2023. This $1.3 million improvement largely reflects the $4.1 million increase in gross margin, partially offset by the $2.8 million increase in operating expenses (before changes in depreciation and amortization, LTIP expense, accrued trade duties, and transaction costs).

Net income for the first nine months of 2024 grew 40.8% to $38.1 million (basic earnings per share of $1.62), from $27.1 million (basic earnings per share of $1.21) in the same period 2023. The $11.0 million increase was driven by $12.5 million higher EBITDA and $4.3 million lower net finance expense, partially offset by an increase in depreciation and amortization of $3.5 million and an increase in income tax expense of $2.3 million.

Adjusted net income for the first nine months of the year grew 4.7% to $59.1 million, from $56.4 million in the same period in 2023. Adjusted basic earnings per share was $2.52, no change from prior-year period.

About ADENTRA

ADENTRA is one of North America’s largest distributors of architectural building products to the residential, repair and remodel, and commercial construction markets. The Company operates a network of 86 facilities in the United States and Canada. ADENTRA’s common shares are listed on the Toronto Stock Exchange under the symbol ADEN.

Non-GAAP and other Financial Measures

In 2024, we revised our calculations of Adjusted net income, Adjusted basic earnings per share, and Adjusted diluted earnings per share to exclude the amortization of acquired intangible assets and foreign exchange gain (loss). The historical presentation of these measures within this news release has also been updated to reflect the revised calculations. We believe that excluding the amortization of acquired intangible assets and foreign exchange gain (loss) from these non-GAAP financial measures helps management and investors in understanding our underlying operating performance.

In this news release, reference is made to the following non-GAAP financial measures:

- “Adjusted EBITDA” is EBITDA before long term incentive plan (“LTIP”) expense, accrued trade duties, and transaction costs. We believe Adjusted EBITDA is a useful supplemental measure for investors, and is used by management, for evaluating our ability to meet debt service requirements and fund organic and inorganic growth, and as an indicator of relative operating performance.

- “Adjusted net income” is net income before LTIP expense, accrued trade duties, transaction costs, foreign exchange gain (loss), and amortization of intangible assets acquired in connection with an acquisition. We believe adjusted net income is a useful supplemental measure for investors, and is used by management to assist in evaluating our profitability, our ability to meet debt service and capital expenditure requirements, our ability to generate cash flow from operations, and as an indicator of relative operating performance.

- “EBITDA” is earnings before interest, income taxes, depreciation and amortization, where interest is defined as net finance income (expense) as per the consolidated statement of comprehensive income. We believe EBITDA is a useful supplemental measure for investors, and is used by management, to assist in evaluating our ability to meet debt service requirements and fund organic and inorganic growth, and as an indicator of relative operating performance.

- “Working capital” is accounts receivable, inventory, and prepaid expenses, partially offset by short-term credit provided by suppliers in the form of accounts payable and accrued liabilities. We believe working capital is a useful indicator for investors, and is used by management, to evaluat the operating liquidity available to us.

In this news release, reference is also made to the following non-GAAP ratios: “adjusted basic earnings per share”, “adjusted diluted earnings per share”, “Adjusted EBITDA margin” and “Leverage Ratio”. For a description of the composition of each non-GAAP ratio and how each non-GAAP ratio provides useful information to investors and is used by management, see “Non-GAAP and Other Financial Measures” in the Company’s management’s discussion and analysis for the quarter ended September 30, 2024 (which is incorporated by reference herein).

Such non-GAAP financial measures and non-GAAP ratios are not standardized financial measures under IFRS and might not be comparable to similar financial measures disclosed by other issuers. For a reconciliation between non-GAAP measures and non-GAAP ratios and the most directly comparable financial measure in our financial statements, please refer to the “Summary of Results”.

Forward-Looking Statements

Certain statements in this press release contain forward-looking information within the meaning of applicable securities laws in Canada (“forward-looking information”). The words “anticipates”, “believes”, “budgets”, “could”, “estimates”, “expects”, “forecasts”, “intends”, “may”, “might”, “plans”, “projects”, “schedule”, “should”, “will”, “would” and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words.

The forward-looking information in this press release is included, but not limited to: Leverage within our target range of 2-3x, providing us with the financial agility to advance our strategic priorities; Our positive outlook for the coming year; Affordability pressures stemming from the cumulative impact of consumer price inflation in the broader economy, alongside continued market challenges related to elevated interest rates, will impact Q4 2024 as compared to Q4 2023; We anticipate that these headwinds will be offset by strong operational execution and the inclusion of Woolf, resulting in fourth quarter Adjusted EBITDA aligning closely with Q4 2023 levels; These strategies are integral to our Destination 2028 plan, which targets $800 million in additional run-rate revenue through acquisitions by 2028, along with achieving a 10%+ EBITDA margin and 12%+ ROIC; our third quarter acquisition of Woolf has put us on pace to meet these goals, delivering immediate benefits while positioning us for continued growth; As one of North America’s largest distributors of architectural building products, with approximately 6% market share, we are well-positioned to pursue further growth, and we maintain a robust pipeline of acquisition opportunities; Looking ahead, forecasters indicate a favorable outlook for building market conditions in the second half of 2025 and beyond; and We are confident in our multi-year growth trajectory across core markets in repair and remodel, residential, and commercial sectors.

The forecasts and projections that make up the forward-looking information are based on assumptions which include, but are not limited to: there are no material exchange rate fluctuations between the Canadian and US dollar that affect our performance; the general state of the economy does not worsen; we do not lose any key personnel; there is no labor shortage across multiple geographic locations; there are no circumstances, of which we are aware that could lead to the Company incurring costs for environmental remediation; there are no decreases in the supply of, demand for, or market values of our products that harm our business; we do not incur material losses related to credit provided to our customers; our products are not subjected to negative trade outcomes; we are able to sustain our level of sales and earnings margins; we are able to grow our business long term and to manage our growth; we are able to integrate acquired businesses; there is no new competition in our markets that leads to reduced revenues and profitability; we can comply with existing regulations and will not become subject to more stringent regulations; no material product liability claims; importation of components or other innovative products does not increase and replace products manufactured in North America; our management information systems upon which we are dependent are not impaired; we are not adversely impacted by disruptive technologies; an outbreak or escalation of a contagious disease does not adversely affect our business; and, our insurance is sufficient to cover losses that may occur as a result of our operations.

The forward-looking information is subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical results or results anticipated by the forward-looking information. The factors which could cause results to differ from current expectations include, but are not limited to: exchange rate fluctuations between the Canadian and US dollar could affect our performance; our results are dependent upon the general state of the economy; the impacts of COVID-19, further mutations thereof or other outbreaks of disease, could have significant impacts on our business; we depend on key personnel, the loss of which could harm our business; a labour shortage across multiple geographic locations could harm our business; decreases in the supply of, demand for, or market values of hardwood lumber or sheet goods could harm our business; we may incur losses related to credit provided to our customers; our products may be subject to negative trade outcomes; we may not be able to sustain our level of sales or earnings margins; we may be unable to grow our business long term or to manage any growth; we are unable to integrate acquired businesses; competition in our markets may lead to reduced revenues and profitability; we may fail to comply with existing regulations or become subject to more stringent regulations; product liability claims could affect our revenues, profitability and reputation; importation of components or other innovative products may increase, and replace products manufactured in North America; disruptive technologies could lead to reduced revenues or a change in our business model; we are dependent upon our management information systems; disruptive technologies could lead to reduced revenues or a change in our business model; our information systems are subject to cyber securities risks; our insurance may be insufficient to cover losses that may occur as a result of our operations; an outbreak or escalation of a contagious disease may adversely affect our business; our credit facility affects our liquidity, contains restrictions on our ability to borrow funds, and impose restrictions on distributions that can be made by us and certain of our subsidiaries; the market price of our Shares will fluctuate; there is a possibility of dilution of existing Shareholders; and, other risks described in our Annual Information Form and in our management’s discussion and analysis for the year December 31, 2023, each of which are available on the Company’s profile at www.sedarplus.ca

This news release contains information that may constitute a “financial outlook” within the meaning of applicable securities laws. The financial outlook has been approved by our management as of the date of this news release. The financial outlook is provided for the purpose of providing readers with an understanding of our anticipated financial performance. Readers are cautioned that the information contained in the financial outlook may not be appropriate for other purposes.

All forward-looking information in this news release is qualified in its entirety by this cautionary statement and, except as may be required by law, we undertake no obligation to revise or update any forward-looking information as a result of new information, future events or otherwise after the date hereof.

Third-Party Information

Certain information contained in this news release includes market and industry data that has been obtained from or is based upon estimates derived from third-party sources, including industry publications, reports and websites. Although the data is believed to be reliable, we have not independently verified the accuracy, currency or completeness of any of the information from third-party sources referred to in this news release or ascertained from the underlying economic assumptions relied upon by such sources. We hereby disclaim any responsibility or liability whatsoever in respect of any third-party sources of market and industry data or information.

SOURCE ADENTRA Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/13/c7800.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/13/c7800.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

YouGov Poll Reveals What Women Want With Weed: Relax, Mindfulness And Great Deals

As cannabis gains traction in the U.S., women are breaking free from social stigma and traditional roles, embracing cannabis. A recent YouGov poll highlights how women are increasingly using cannabis to relax, improve their well-being and practice mindfulness. The data sheds light on key trends shaping female consumer behavior, offering brands and marketers a valuable look into the motivations driving this influential segment.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Health And Wellness Drive Interest

Health benefits top the list of reasons women consider using cannabis. Pain relief ranks first, with 18% of respondents citing it as their primary motivator.

Additionally, 15% express interest in cannabis for improving sleep quality, while 13% would use it to manage anxiety or depression.

Relaxation is another key factor, with 11% seeking stress relief. Enhanced focus appeals to 10% of women. A notable 22% use cannabis to support mindfulness practices, reflecting a broader interest in wellness and mental clarity.

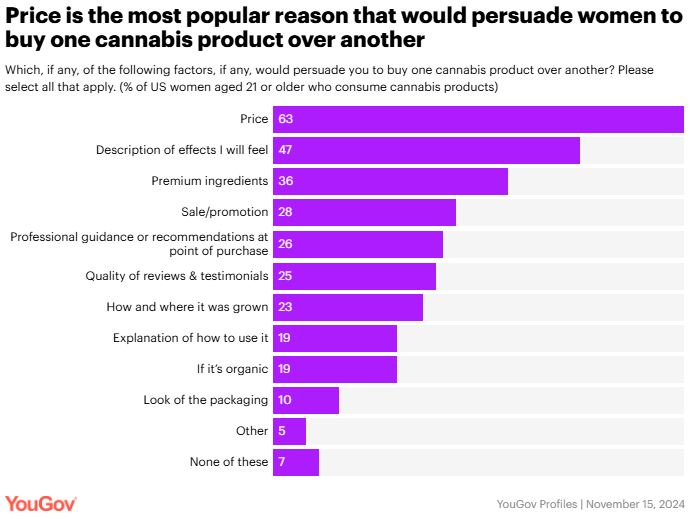

Key Factors Influencing Purchases

For women already consuming cannabis, the cost is a decisive factor, influencing 63% of purchasing decisions.

Detailed product descriptions help 47% select the right fit for their needs, while 36% prioritize premium ingredients, in line with trends in natural and high-quality products.

Promotions sway 28% of buyers and recommendations from professionals influence 26%. Notably, packaging design, in which brands invest heavily is less significant, but it still matters to 10% of respondents.

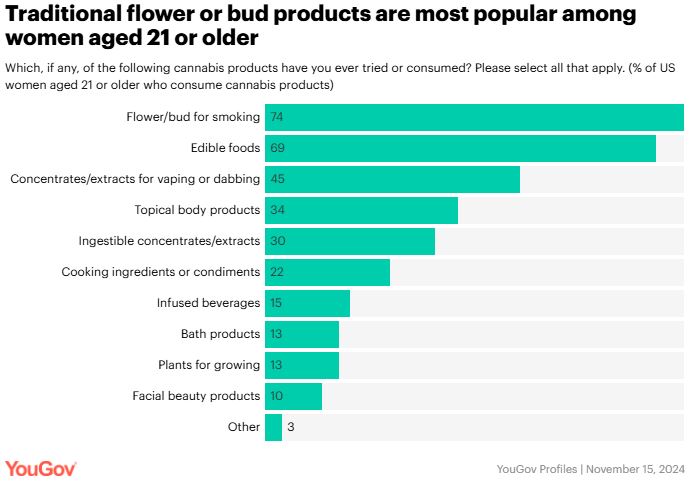

Product Preferences And Usage Trends

Flower products remain the most popular choice, with 74% of women opting for traditional forms like pre-rolls. Edibles follow closely at 69%.

45% use concentrates, such as vape oils, while 34% prefer topicals like creams and lotions. Ingestible products like capsules attract 30%.

Spending And Frequency

Janice Fernandes reported for YouGov that spending varies, with 33% of women spending under $50 monthly and 19% between $50 and $99.

Frequent users make up 35%, consuming cannabis multiple times daily, while 18% use it once daily.

Read Next: Marijuana Legalization Support Hits Record 70% As Republicans Join The Majority, Shows Gallup Poll

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

Dollar Powers To 4-Month Highs Against Yen: Trump Tariff Expectations Spark Carry Trade Frenzy

The U.S. dollar surged past 155.60 yen on Wednesday, hitting levels unseen in nearly four months.

What Happened: Investors piled back into yen-dollar carry trades. The speculation is that the incoming Trump administration will aggressively hike tariffs on imports.

Economists expect the planned tariffs to reshape currency markets and stoke U.S. inflationary pressures.

The greenback’s strength against the yen in six of the past seven weeks reverses early August losses tied to weak U.S. jobs data. Bank of Japan interventions also triggered an abrupt unwind of yen-dollar carry trade positions.

Inflation Data As Expected, Dollar Momentum Unshaken

On Wednesday, the U.S. Consumer Price Index (CPI) report showed inflation accelerating to 2.6% year-over-year in October 2024, meeting economists’ expectations. Core CPI inflation, which excludes volatile food and energy prices, stood at 3.3% for the third straight month, also aligning with forecasts.

This in-line inflation data helped quell concerns that the Federal Reserve might consider an interest-rate pause in December. Instead, speculators are now heavily betting on a 25-basis-point rate cut. Market-implied probabilities are rising to over 80%, as per CME FedWatch.

Yet, even an in-line CPI report fueling rate-cut bets wasn’t enough to hold back the dollar’s momentum.

The Invesco DB USD Index Bullish Fund ETF UUP, a trade-weighted gauge tracking the dollar, soared to its highest point in over a year as investors continued to flock to the greenback.

Tariff Speculation Drives Greenback Surge

Much of the dollar’s recent strength can be attributed to Trump’s proposed tariffs. During his campaign, Trump floated the idea of tariffs as high as 60% on Chinese goods. Additional hikes of 10% to 20% on imports from other countries are also expected.

Tariffs could curb U.S. demand for foreign goods, reducing the need for American companies to buy foreign currencies—a shift that would likely boost the dollar.

Additionally, tariffs might drive up domestic inflation. That could prompt the Fed to rethink its dovish stance on rate cuts, adding even more fuel to the dollar’s rally.

George Vessey, a forex strategist at Convera, said, “Trump’s policies of a trade war in which the U.S. is less exposed and more-fiscally stimulative policies are expected to boost U.S. near-term economic outperformance vs. its G10 peers further. Economic momentum has shifted back in favor of the U.S.”

As global investors recalibrate to the new political environment, expectations for the U.S. dollar have jumped.

In the Bank of America Fund Manager Survey conducted before the election, 31% of respondents expected the dollar to be a top performer in 2025, slightly behind the yen at 32%.

After the election, the dollar shot up to the top spot, with 45% of respondents naming it as their favored currency for 2025, while the yen fell to 20%.

JPMorgan’s pre-election analysis suggested that a “Republican sweep” scenario — a GOP majority in the House and Senate — would lead to substantial dollar gains. In this scenario, the trade-weighted dollar index is projected to gain 7.3%, with some of the biggest moves expected against the Swedish krona (SEK) at +10.8% and the euro (EUR) at +8.4%.

| Election Scenario | USD TWI Change | USD vs. CNY | USD vs. EUR | USD vs. CAD | USD vs. CAD | USD vs. AUD | USD vs. SEK |

|---|---|---|---|---|---|---|---|

| Republican Sweep | +7.3% | +4.4% | +8.4% | +4.7% | +6.1% | +7.9% | +10.8% |

David Morrison, senior market analyst at Trade Nation, highlighted the role of rising U.S. bond yields in supporting the dollar. “The jump in U.S. bond yields has been a major factor in the dollar’s resurgence, as investors bet that the Trump presidency will, thanks to promises of tax cuts and deregulation, lead to increased economic growth. This should continue to surpass anything remotely achievable by the sclerotic economies across Europe and the UK,” he said.

The prospect of new U.S. tariffs has European leaders on edge. French President Emmanuel Macron highlighted on Wednesday escalating risks for global supply chains if the U.S., Europe and China re-enter a trade war.

American tariffs are likely to hit European exports of machinery and pharmaceuticals hard, creating potential economic headwinds for an already weak European economies.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ROSEN, A LEADING LAW FIRM, Encourages Edwards Lifesciences Corporation Investors to Secure Counsel Before Important Deadline in Securities Class Action – EW

NEW YORK, Nov. 13, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Edwards Lifesciences Corporation EW between February 6, 2024 and July 24, 2024, both dates inclusive (the “Class Period”), of the important December 13, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Edwards securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Edwards class action, go to https://rosenlegal.com/submit-form/?case_id=29704 or call Phillip Kim, Esq. at 866-767-3653 or email case@rosenlegal.com for more information. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than December 13, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, during the Class Period, defendants provided investors with material information concerning Edwards’ expected revenue for the fiscal year 2024, particularly as it related to the growth of Edwards’ core product, Transcatheter Aortic Valve Replacement (“TAVR”). Defendants’ statements included, among other things, strong commitment to the TAVR platform, confidence in Edwards’ ability to capitalize on a subset of untreated patients through scaling of its various patient activation activities, and continued claims of significant demand in allegedly lower-penetrated markets. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Edwards class action, go to https://rosenlegal.com/submit-form/?case_id=29704 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

About 20% of NFL Fans Say Their Loyalty Highly Influenced Their Home Search, New Realtor.com® Survey Finds

Football fans say their choice of home features, house layout and specific locations were influenced by their ties to the sport.

SANTA CLARA, Calif., Nov. 13, 2024 /PRNewswire/ — About 1 in 5 NFL followers say their loyalty played an extremely significant or highly significant role in their home search process, and a majority (55%) say that supporting a local team helps them feel more connected to their community and neighborhood, according to new research from Realtor.com®.

Among NFL fans surveyed, 18% say their loyalty highly or extremely influenced their search for specific home features, such as a covered porch or built-in bar, 20% say the same about house layout or rooms, such as a basement or theater room, and 18% say the same about specific locations, such as a certain city or neighborhood near a stadium.

The survey found that community plays a large role in football fandom. Among NFL fans, 66% say that having people in their community or neighborhood support the same team makes watching football feel more fun, 61% say supporting a local team was important to them, and 55% say they feel connected to their community and neighborhood because they support the same team.

“When it comes to NFL fans and the teams they support, a connection to their community is a major driving force and influence,” said Charlie Lankston, executive editor and real estate expert at Realtor.com®. “Creating a home is about so much more than buying a physical property—it is also about the community that we build around it. Our new survey shows that football and NFL play a vital role in how we see that community. And that team loyalty is actually less important to most people than their home and the people who surround it. So much so that nearly one-third of NFL fans would actually change teams if they moved to a new city or state.”

Team Loyalty

While good team performance is the reason most cited by NFL fans for supporting a team (44%), personal reasons matter almost as much. Among fans, 40% say the team represents the city or state where they were raised, 39% say their team loyalty was a family tradition, 38% say the team represents the city or state where they currently live, and 29% say their friends or community follow the team.

Where Are They Watching?

The survey found that most NFL fans watch games at home. Of all followers, 67% report watching games in a shared or multipurpose room, such as a family room or living room, while 29% say they have a dedicated space for watching games, such as a finished basement or theater room and just 4% say they don’t watch games at home.

Super Fans

About 1 in 5 who follow the NFL are what’s considered super fans, and their fandom was more influential in their home search. When asked to think back to the last time they searched for a home, 20% of respondents were either extremely or highly influenced to look for a home with a layout or rooms conducive to watching football, like a home theater, basement or multi-purpose room, 18% were extremely or highly influenced to look for a home with specific home viewing features such as covered porch or built in bar, and 18% were extremely or highly influenced to look for a home within a specific location, for example neighborhoods close to stadiums or specific cities.

Generational Loyalty

Gen Z and millennial followers were the most likely to say that their fandom influenced their home search. Some 28% of Gen Z followers say they were highly influenced to search for specific home features, while 29% of millennials say they were highly influenced to look for specific house layouts or rooms.

Methodology

This poll was conducted on August 22-24, 2024, among a national sample of 2,201 adults ages 18+. The survey was conducted online, and the data was weighted to approximate a target sample of adults in the U.S. based on gender, educational attainment, age, race and region.

About Realtor.com®

Realtor.com® is an open real estate marketplace built for everyone. Realtor.com® pioneered the world of digital real estate more than 25 years ago. Today, through its website and mobile apps, Realtor.com® is a trusted guide for consumers, empowering more people to find their way home by breaking down barriers, helping them make the right connections, and creating confidence through expert insights and guidance. For professionals, Realtor.com® is a trusted partner for business growth, offering consumer connections and branding solutions that help them succeed in today’s on-demand world. Realtor.com® is operated by News Corp NWS NWSA]) [ASX: NWS, NWSLV] subsidiary Move, Inc. For more information, visit Realtor.com®.

Media Contact

Mallory Micetich, press@realtor.com

![]() View original content:https://www.prnewswire.com/news-releases/about-20-of-nfl-fans-say-their-loyalty-highly-influenced-their-home-search-new-realtorcom-survey-finds-302303351.html

View original content:https://www.prnewswire.com/news-releases/about-20-of-nfl-fans-say-their-loyalty-highly-influenced-their-home-search-new-realtorcom-survey-finds-302303351.html

SOURCE Realtor.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Timing Cover Market to Surge with 4.2% CAGR, Projected to Hit US$ 30.26 Billion by 2034 | Fact.MR Report

Rockville, MD, Nov. 13, 2024 (GLOBE NEWSWIRE) — The global automotive timing cover market is set to reach a valuation of US$ 20.06 billion in 2024 and further expand at a CAGR of 4.2% between 2024 and 2034.

Automotive timing covers may seem like normal components; however, they play a vital role in ensuring the smooth operation and longevity of internal combustion engines. These covers offer a trifecta of benefits that have seen their demand skyrocket in recent years. First and foremost, timing covers serve as a robust shield, safeguarding critical engine components like timing chains and belts from the relentless assault of debris, dirt, and other contaminants. By maintaining a clean environment around these vital parts, timing covers ensure they can function optimally, contributing to the engine’s overall efficiency and performance.

Timing covers act as staunch guardians of engine fluids, providing a crucial seal that prevents oil and other liquids from leaking out. This not only helps maintain optimal lubrication levels but also safeguards against potential damage that fluid leaks can inflict upon the engine. In addition to their protective functions, timing covers often serve as versatile mounting points for various engine peripherals. From water pumps to crankshaft pulleys, these covers provide a secure anchor for essential components, ensuring they remain firmly in place even under the rigors of engine operation.

As automotive technology advances and engine designs become more intricate, demand for high-quality timing covers continues to rise. Automotive manufacturers and aftermarket suppliers alike are witnessing a steady increase in sales as drivers recognize the indispensable role these covers play in enhancing engine reliability and performance.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9888

Key Takeaways from Market Study

- The global automotive timing cover market is projected to expand at a CAGR of 2% through 2034.

- Global sales of timing cover are estimated at US$ 20.06 billion in 2024.

- The market is forecasted to reach US$ 30.27 billion by 2034-end.

- The North American market is forecasted to expand at a CAGR of 8% through 2034.

- The aftermarket segment is estimated to account for 2% market share in 2024.

- East Asia is projected to account for 1% share of the global market by 2034.

“Growing emphasis on vehicle safety and performance pushing demand for high-quality timing covers. Rising demand for automotive timing covers is being seen, driven by advancing automotive technology and intricate engine designs, enhancing engine reliability and performance,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Automotive Timing Cover Market

Key players in the automotive timing cover market such as Ichiban Engineering, Dialim, Bervina, Jinhua City Liubei Auto Parts, Autozone, Nitto Performance Engineering Pty Ltd, Spectre Performance, Pioneer Automotive Industries, Aisin Group.

Market Competition

In the fiercely competitive landscape of the automotive timing cover market, two key players stand out: Guangzhou Libo Industrial Belts and Jinhua City Liubei Auto Parts.

- Guangzhou Libo Industrial Belts boasts over two decades of expertise, offering top-notch timing belts, pulleys, and covers for various automotive needs. With a stellar reputation for quality and service, the company has expanded its global footprint.

- Jinhua City Liubei Auto Parts, with more than 15 years in the industry, is gaining traction with its innovative designs and reliable products.

As these giants vie for market dominance, customers can expect increased product innovation and improved offerings, driving the industry forward with fierce competition and customer-centric solutions.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9888

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global automotive timing cover market for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on vehicle category (two-wheelers, passenger cars, commercial vehicles), material (metal & alloys, polycarbonate, plexiglass, carbon fiber), and sales channel (original equipment manufacturers [OEMs], aftermarket), across six major regions of the world (North America, Latin America, Europe, East Asia, South Asia & Oceania, and MEA).

Check out More Related Studies Published by Fact.MR:

Automotive Engine Cover Market: Size is expected to generate US$1.8 billion in sales by the end of 2033, with a market estimate of US$1.3 billion in 2023. Over the next ten years, the worldwide automobile engine cover market is anticipated to grow at a 3.3% CAGR.

Automotive Shock Absorber Market: Size is estimated at US$ 16.14 billion in 2024 and is projected to reach US$ 22.54 billion by 2034-end, expanding at a CAGR of 3.4% between 2024 and 2034.

Automotive Active Grille Shutter Market: Size is pegged at US$ 5,180.2 million in 2024. The global market is forecast to increase at a 7.7% CAGR and reach a market value of US$ 10,876.9 million by the end of 2034.

Automotive Exhaust Aftertreatment System Market: Size is estimated at US$ 24.1 billion in 2024 and has been calculated to increase at a CAGR of 3.6% to reach US$ 36.02 billion by the end of 2034.

Automotive Gear Market: Size is analyzed to increase from US$ 4.88 billion in 2024 to US$ 8.5 billion by the end of 2034. Sales of automotive gear systems are evaluated to rise at 5.7% CAGR from 2024 to 2034.

Electric Vehicle Sound Generator Market: Size is set to be worth US$ 115.5 million in 2024 and is forecasted to expand at a CAGR of 18.6% to reach US$ 739.3 million by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Monochloroacetic Acid Market Size is projected to Reach USD 1.2 billion, at a CAGR of 3.9% by 2031 – Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Nov. 13, 2024 (GLOBE NEWSWIRE) — The global monochloroacetic acid (MCA) market (モノクロロ酢酸(MCA)市場) is estimated to flourish at a CAGR of 3.9% from 2022 to 2031. Transparency Market Research projects that the overall sales revenue for monochloroacetic acid is estimated to reach US$ 1.2 billion by the end of 2031.

MCA’s potential in manufacturing specialty chemicals for advanced materials like biodegradable polymers and specialty surfactants showcases untapped opportunities. These applications cater to diverse industries, from textiles to electronics, offering innovative solutions beyond traditional segments.

Some prominent manufacturers are as follows:

- AkzoNobel N.V.

- CABB Group GmbH

- Niacet Corporation

- Denak Co. Ltd.

- Shandong Minji Chemical Co. Ltd.

- Jubilant Life Sciences Ltd.

- PCC SE

- Archit Organosys Limited

- Meghmani Organics Ltd

- IOL Chemicals & Pharmaceuticals Limited

- Meridian Chem Bond Pvt. Ltd.

Request Sample PDF Copy of Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2946

Emerging as a viable ingredient in industrial cleaning formulations, MCA demonstrates exceptional efficiency in removing stubborn contaminants across manufacturing and processing industries. Its effectiveness in maintaining equipment cleanliness elevates its significance in various industrial settings.

The role of MCA in water treatment applications remains relatively unexplored. As stringent regulations drive the need for effective water treatment chemicals, MCA’s ability to aid in the removal of impurities and purification processes emerges as a potential growth avenue.

Key Findings of the Market Report

- Liquid form leads the monochloroacetic acid market due to its versatility and ease of application across various industries and processes.

- Glyphosate, a key ingredient in herbicides, dominates the monochloroacetic acid market due to its significant usage in agricultural applications.

- Asia Pacific leads the monochloroacetic acid market due to industrial growth, high agricultural activities, and increasing demand for chemicals.

Monochloroacetic Acid Market Growth Drivers & Trends

- Growing need for herbicides and pesticides, propelling MCA demand in agriculture due to its role in chemical synthesis for agrochemicals.

- Rising pharmaceutical production drives MCA usage in drug synthesis, especially for manufacturing active pharmaceutical ingredients.

- Increasing demand for surfactants and other additives in the cosmetic and personal care industries fuel MCA market growth.

- Shift towards sustainable practices in chemical manufacturing emphasizes MCA’s role in eco-friendly formulations and processes.

- Rapid industrialization and agricultural activities in Asia-Pacific nations amplify MCA demand, contributing significantly to market expansion.

Global Monochloroacetic Acid Market: Regional Profile

- Led by the United States, North America boasts a robust monochloroacetic acid market. Companies like AkzoNobel and Niacet Corporation dominate, catering to diverse industries. Regulatory compliance and technological advancements drive innovation, particularly in agrochemical and pharmaceutical sectors, fostering steady market expansion.

- Europe, spearheaded by Germany and the UK, showcases a mature monochloroacetic acid landscape. Companies such as CABB Group GmbH and Denak Co. Ltd. lead with emphasis on sustainability and technological prowess. Stringent environmental regulations spur innovations in green chemistry applications, positioning the region as a hub for eco-friendly monochloroacetic acid production.

- Rapid industrialization propels the Asia Pacific monochloroacetic acid market, particularly in China and India. Players like Jubilant Life Sciences and Nippon Carbide Industries expand their foothold, catering to diverse end-user industries. Increasing agricultural activities and rising demand in pharmaceuticals stimulate substantial growth, driving the region’s prominence in the global monochloroacetic acid landscape.

Monochloroacetic Acid Market: Competitive Landscape

The monochloroacetic acid market showcases a competitive landscape fueled by key players vying for market dominance. Companies like AkzoNobel, CABB Group GmbH, Niacet Corporation, and Denak Co. Ltd. maintain significant market shares with their broad product portfolios and global reach.

Emerging players such as Jubilant Life Sciences and Daicel Corporation are gaining momentum, leveraging innovation and strategic expansions. Regional players in Asia-Pacific, including China’s Shandong Minji Chemical and Japan’s Nippon Carbide Industries, intensify the market dynamics.

With increasing MCA applications in agrochemicals, pharmaceuticals, and personal care, competition centers on product quality, sustainable practices, and geographical expansion to meet evolving consumer demands.

Product Portfolio

- CABB Group GmbH specializes in fine chemicals and pharmaceutical intermediates. With a global presence, it delivers high-quality custom manufacturing solutions, leveraging expertise in chlorine, sulfur, and various chemical processes to cater to diverse industries with a focus on sustainability and innovation.

- Niacet Corporation is a renowned producer of organic salts and derivatives. Its expertise lies in food, pharmaceutical, and technical markets, providing top-tier solutions. Niacet’s commitment to quality, innovation, and customer-centric approach fuels its global leadership in specialty chemicals.

- Denak Co. Ltd. stands as a distinguished manufacturer of industrial chemicals and functional materials. Renowned for its diverse product range, including specialty solvents and intermediates, Denak excels in delivering tailored solutions, meeting stringent quality standards and client-specific requirements worldwide.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2946

Monochloroacetic Acid Market: Key Segments

By Product

By Application

- Carboxymethyl Cellulose

- Surfactants

- Thioglycolic Acid

- Glyphosate

- Glycine

- Herbicides

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=2946<ype=S

More Trending Reports by Transparency Market Research –

Hydroelectric Cells Market (수력전지 시장) – The global industry was valued at US$ 1.7 Bn in 2021 and it is estimated to grow at a CAGR of 6.1% from 2022 to 2031 and reach US$ 3.0 Bn by the end of 2031

Biocompatible 3D Printing Materials Market (نطاق سوق مواد الطباعة ثلاثية الأبعاد المتوافقة حيويًا) – The global biocompatible 3D printing materials market is expected to reach US$ 19.7 Bn by the end of 2031 and it is estimated to rise at a CAGR of 18.4% from 2022 to 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gene Therapy for SCID Market is Expected to Reach at a US$ 2.0 Billion by 2034 | Fact.MR Report

Rockville, MD, Nov. 13, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global gene therapy for SCID market is projected to grow at a robust CAGR and could reach US$ 2.0 billion by 2034.

The idea of gene therapy was proposed more than 50 years ago at the time molecular biology principles had been defined and the first disease−inducing genetic mutations were identified. However, it was not until nearly 30 years and several associated advances that it turned into a reality.

European regulatory bodies have given a nod to one gene therapy product of primary immunodeficiency (PID) to cure ADA SCID, essentially, Strimvelis. Interestingly, SCID was the first disease known to be successfully treated through gene therapy even as it was the first and only indication of allogeneic HSC transplantation. SCIDs are inherited immuno-deficiency diseases that lead to an early block in T-cell development with variable abnormalities of other lymphoid (or occasionally myeloid) lineages.

γRV vector-based gene therapy for SCID X1 solely resulted in long-term T cell defect correction. Therefore, the enhancement of mild myeloablation such as that done for gene therapy of ADA deficiency might favor the engraftment of the transduced HSCs, so that the differentiation of B-cells as well as NK cells would be enhanced. So far, fourteen kinds of SCID have been found. Most of the SCID types are inherited in a recessive manner. To name a few, are X-linked SCID, Adenosine Deaminase Deficiency SCID, IL7R Deficiency SCID, and RAG-1 AND RAG-2 Deficiency SCID among others.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10414

Moreover, the LV vectors developed from HIV are tenfold more effective than γRV in transducing the HSCs. Therefore, the LV vectors, usage was anticipated to enhance the transduction of more HSCs as compared to the previous trials. This aforementioned understanding of the diseases and treatment modalities will show robust growth in the future.

Key Takeaways from the Market Study:

- The global gene therapy for SCID market is projected to grow at a robust CAGR and could reach US$ 2.0 billion by 2034

- Europe will hold the majority of market share in the future.

- Predominating market players include Orchard Therapeutics plc, Boston Children’s Hospital, and the University of California Los Angeles.

“Partnership and Collaboration in Developing Disease Specific Gene Therapy to Gain Traction in the forecast period,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Gene Therapy for SCID Market:

Key players in the gene therapy for SCID market are Orchard Therapeutics plc., OSR and Telethon, Jasper Therapeutics, Inc., Graphite Bio, Inc., Mustang Bio Inc., University of California San Francisco, Genethon SA, Boston Children’s Hospital, Shenzhen Geno-Immune Medical Institute, University College London, University of California Los Angeles, and The National Institute of Allergy and Infectious Diseases.

Market Development:

An efficient and safe gene therapy approach has been identified for two SCIDs and WAS after 20 years. Gene therapy has shown very positive effects in the cure of SCID patients. This process includes introducing a viral vector into the patient’s HSCs where the faulty gene is inserted and further becomes part of the person’s DNA and subsequently, the corrected cells are brought back into the body. It has been applied successfully for the cure of X-linked SCID individuals and ADA-deficient SCID.

However, some of the initial (first) attempts were not without problems like graft failures and other side effects that accompanied insertions of vectors including lymphoproliferation, and leukemias, particularly in X-SCID cases. To minimize these risks, some modifications have been implemented in the construction of retroviral vectors.

Pharmaceutical companies and non-profit agencies/organizations have been working together for gene editing therapy or cure of diseases. These collaborations and partnerships illustrate mutual commitment towards developing innovative therapeutic interventions that hold great promise in enhancing an individual’s quality of life with suitable treatment and screening modalities that are likely to benefit from gene replacement therapies.

- For instance, the San Raffaele Telethon Institute for Gene Therapy (SR-Tiget) where Telethon and Ospedale San Raffaele joined hands to develop Strimvelis gene therapy. It was then further advanced by GSK through the partnership that was initiated in the year 2010 between GSK, OSR, and Telethon. These collaborative strategies have further resulted in the approval of Strimvelis as well as a pipeline of more ex vivo gene therapies for treating diseases like MLD and WAS. That is why in the case of Libmeldy, a treatment option for the management of MLD in development, could be a telling example for looking for a practically applicable solution to the primary problem.

FDA has been supporting manufacturers to produce or gain interest in orphan drugs like OTL-101 which is an investigational autologous ex vivo lentiviral hematopoietic stem cell-based gene therapy for AD-SCID. OTL-101 has been designated with breakthrough therapy in the rare disease field which is FDA and EMA regulated and has received a Rare Pediatric Disease Designation from the FDA.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10414

Gene Therapy for SCID Industry News:

- The successful transfer of the marketing authorisation for Strimvelis, the gene therapy approved by the European Medicine Agency in 2016 for the treatment of adenosine deaminase severe combined immunodeficiency (ADA-SCID), was announced today in September 2023 by Orchard Therapeutics, a global gene therapy company, and Fondazione Telethon, a significant Italian biomedical charity organisation.

- A research and clinical partnership for the treatment of X-SCID was announced in February 2021 by Graphite Bio, Inc., a biotechnology company that develops gene-editing therapies to treat or cure serious diseases, and Jasper Therapeutics, Inc., a biotechnology company that develops blood stem cell therapies to cure a variety of diseases.

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global gene therapy for the SCID market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

Checkout More Related Studies Published by Fact.MR Research:

Gene Therapy Market: The global gene therapy market size is calculated at a value of US$ 10.34 billion in 2024. Increasing cases of rare diseases is contributing to the rising need for cell and gene therapies. Expanding at a CAGR of 14.1%, the market is forecasted to reach US$ 38.52 billion by the end of 2034.

Hemophilia Gene Therapy Market: The global market for hemophilia therapy is at present valued at USD 330.9 Million in 2022. The market is anticipated to reach a market size of USD 12,337 Million by end of the forecast period i.e. by 2032. The market is likely to grow with a CAGR of 43.6% in the forecast period.

Bio-identical Hormones Replacement Therapy Market: The global bio-identical hormones replacement market value accounts for USD 36,059.24 million in 2022. This market is expected to grow at a CAGR of 5.1% from 2022 to 2032. The valuation of the bio-identical hormones replacement segment is expected to surpass the value of USD 59,298.50 Million by 2032.

Hormone Replacement Therapy Market: The global hormone replacement therapy market size is projected to increase from a value of US$ 22.5 billion in 2023 to US$ 43.7 billion by the end of 2033, expanding at a CAGR of 6.8% through the study period of 2023 to 2033.

MRI-guided Radiation Therapy Systems Market: The global MRI-guided radiation therapy systems market stands at a valuation of US$ 545.1 million in 2023 and is expected to secure a revenue of US$ 2.89 billion by the end of 2033. This Fact.MR study predicts that worldwide sales of MRI-guided radiation therapy systems will rise at a prolific 18.1% CAGR over the next ten years.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.