October Inflation Rate Rises To 2.6% As Expected: December Interest Rate Cut Remains Uncertain (UPDATED)

After six consecutive months of easing, the annual inflation rate, as measured by the Consumer Price Index (CPI), reversed course in October, climbing to 2.6% as expected.

This outcome casts doubt on the disinflationary trend that consumers and policymakers had hoped would persist, underscoring the challenging path ahead for the Federal Reserve’s 2% inflation target.

On Tuesday, Minneapolis Fed President Neel Kashkari cautioned that he might consider pausing a potential December rate cut if inflation data came in higher than anticipated.

Market-implied odds of a 25-basis-point cut in December were at 58% before the report’s release, according to the CME FedWatch tool.

October Inflation Report: A Wake-Up Call For Markets

- The annual CPI inflation rate rose from 2.4% in September to 2.6% in October, in line with economist predictions.

- Month-over-month, CPI increased by 0.2%, holding from both the prior and expected rate of 0.2%.

- The core CPI rate, which excludes volatile energy and food prices to better gauge underlying inflation pressures, held steady at 3.3%, aligning with forecasts.

- On a monthly basis, core CPI rose by 0.3% as expected.

Key Drivers Of October’s Inflation Uptick

The shelter index saw a 0.4% increase, contributing to more than half of the overall monthly rise in all items. The food index also went up, increasing by 0.2%, with the food-at-home index rising 0.1%and the food-away-from-home index climbing 0.2%. The energy index remained steady in October, following a 1.9% decrease in September.

In October, indexes that rose included shelter, used cars and trucks, airline fares, medical care and recreation. Offsetting these rises, apparel, communication and household furnishings and operations were among those that declined.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

End-Use Applications Rising for Uranium as Market Expected to Reach $1.81 Billion in 2028

PALM BEACH, Fla., Nov. 13, 2024 (GLOBE NEWSWIRE) — FN Media Group News Commentary – The uranium ore market is expected to continue substantial growth over the next several years. A report from the Business Research Company said: “The uranium ore market size has grown strongly in recent years. It will grow from $1.11 billion in 2023 to $1.21 billion in 2024 at a compound annual growth rate (CAGR) of 9.5%. It continued: “The uranium ore market size is expected to see strongly grown in the next few years. It will grow to $1.81 billion in 2028 at a compound annual growth rate (CAGR) of 10.5%. The growth in the forecast period can be attributed to government policies and incentives, focus on carbon emission reduction, geopolitical stability, exploration and discovery of new uranium deposits, public perception and social acceptance. Major trends in the forecast period include advancements in nuclear technology, development of in-situ recovery (ISR) technology, focus on uranium enrichment technologies, increased scrutiny on environmental and social impact, and diversification of uranium end-use applications. The growth in the historic period can be attributed to the nuclear power plant construction boom, the cold war and military demand, the Chernobyl and three-mile island incidents, global economic trends, and changes in the regulatory environment.” Active mining/energy companies in the markets this week include: Mustang Energy Corp. MECPF MEC, Denison Mines Corp. DNN DML, Uranium Energy Corp UEC, ATHA Energy Corp. SASKF SASK, Centrus Energy Corp. LEU.

Business Research Company concluded: “Rising electricity consumption is expected to propel the growth of the uranium ore market going forward. Electricity consumption refers to the amount of electrical energy used by individuals, businesses, industries, or other entities over a specified period. Uranium ore plays a fundamental role in electricity consumption as it is the primary fuel source for nuclear power plants, where nuclear fission reactions release heat that is converted into electricity. For instance, in September 2021, according to the Energy Information Administration, a US-based government agency, the United States witnessed a 2.6% increase in total electricity consumption in 2022 compared to the previous year. During the same year, there was a 3.5% rise in retail electricity sales to the residential sector and a 3.4% increase in retail electricity sales to the commercial sector compared to 2021. Therefore, rising electricity consumption is driving the growth of the uranium ore market.”

Mustang Energy Corp. MECPF MEC Enters Option Agreement to Acquire Skyharbour’s 914W Uranium Project and Welcomes Jordan Trimble as Strategic Advisor – Mustang Energy Corp. (FRA:92T) (“Mustang” or the “Company”) is excited to announce that it has entered into a strategic option agreement (the “Agreement”) with Skyharbour Resources Ltd. (“Skyharbour”) dated November 12, 2024 to acquire an undivided 75% interest (the “Option”) in Skyharbour’s 914W Uranium Project (the “914W Project”), located in the Athabasca Basin of Northern Saskatchewan. The Option marks an important step for Mustang as it seeks to expand its presence in a promising uranium district. Additionally, Mustang is pleased to welcome Jordan Trimble, President and CEO of Skyharbour, as a Strategic Advisor to the Company, bringing valuable industry insights and expertise to Mustang’s growing portfolio.

“Being granted the Option to acquire a majority interest in the 914W Uranium Project is an exciting milestone for Mustang as we look to expand our footprint in and around the Athabasca Basin, a promising uranium district,” commented Nick Luksha, CEO of Mustang. “With Jordan Trimble joining as a Strategic Advisor, we are gaining invaluable expertise that will strengthen our exploration efforts and help us unlock the potential of the 914W Project. This partnership aligns with our commitment to building a robust portfolio of high-impact assets while supporting sustainable development practices in the region.”

“The 914W Project’s accessible location, combined with promising geological indicators similar to those seen in the nearby uranium occurrences at Scurry Rainbow Zone E1 and the Don Lake Trenches2, underscores the potential for discovery. With much of the 914W Project remaining underexplored, we see an opportunity to unlock further value through targeted exploration,” said Lynde Guillaume, Technical Advisor for Mustang.

Jordan Trimble, President and CEO of Skyharbour stated “As Skyharbour becomes a shareholder and project partner alongside Mustang at the 914W Project under the Agreement, I am looking forward to working with the Mustang team to advance the asset over the coming years. We believe there is a strong discovery upside potential at the early-stage project, and we are optimistic that Mustang will be able to unlock value at the property.”

About the 914W Uranium Project – The 914W Project is situated approximately 48 km southwest of Cameco’s Key Lake Operation, offering excellent logistics and access via Highway 914. The 914W Project is strategically positioned within the Western Wollaston Domain, known for unconformity-related and pegmatite-hosted uranium (or “U”) mineralization.

The project hosts favorable geology with local graphite bearing assemblages. Immediately to the north of the 914W Project is the Scurry Rainbow Zone E1 and the Don Lake Trenches2, where up to 1,288 ppm U was encountered in drill hole ML-11, and surface prospecting revealed up to 0.64% U3O8 in a trench at Don Lake Zone E2.

While historical exploration conducted several geophysical and geological surveys over portions of the property, most of the 914W Project remains underexplored. Mustang sees substantial potential for advancing uranium and rare earth element exploration on the 914W Project. CONTINUED… Read this full press release and more news for Mustang Energy at: https://www.financialnewsmedia.com/news-mec/

Other recent developments in the mining/energy industries of note include:

Denison Mines Corp. DNN DML recently filed its Condensed Consolidated Financial Statements and Management’s Discussion & Analysis (‘MD&A’) for the three and nine months ended September 30, 2024. Both documents will be available on the Company’s website at www.denisonmines.com, SEDAR+ (at www.sedarplus.ca) and EDGAR (at www.sec.gov/edgar.shtml). The highlights provided below are derived from these documents and should be read in conjunction with them. All amounts in this release are in Canadian dollars unless otherwise stated. View PDF version

David Cates, President and CEO of Denison commented, “Our third quarter report includes an update on the positive progress of our engineering and regulatory approval efforts for our planned Phoenix In-Situ Recovery (‘ISR’) uranium mining operation. We continue to rapidly advance detailed design engineering efforts and achieved completion of 45% of total engineering by the end of the third quarter. Long-lead procurement efforts continued to ramp up. Currently, $21 million in milestone payments or commitments have been made for items included in our estimates of initial project capex, with several additional procurement packages in progress.

Uranium Energy Corp UEC recently reported the filing of an initial assessment technical report summary that includes an economic analysis and mineral resource estimate for its 100% owned Roughrider Project, located in Northern Saskatchewan, Canada. All currency references are in United States dollars.

Amir Adnani, President, and CEO stated: “This Initial Economic Assessment marks a pivotal milestone for Roughrider, validating it as a top-tier, high-margin operation with a clear path to development into a world-class mine and mill. With a post-tax estimated net present value of $946 million, today’s results underscore the strength of our 2022 decision to acquire Roughrider from Rio Tinto for $150 million, consistent with our strategy to acquire accretive assets at opportune points in the uranium price cycle.

ATHA Energy Corp. SASKF SASK recently announced, in furtherance to its news release from August 20th, 2024 , the Company and Terra Uranium Ltd. (“T92”) have executed a definitive option agreement for T92 to earn an option to acquire a 70% interest in ATHA’s Spire and Horizon properties (together, the “Spire Horizon Projects”) and a definitive option agreement for ATHA to earn an option to acquire up to a 60% interest in T92’s Pasfield Lake property (the “Pasfield Project”).

ATHA and T92 agree to form a joint venture on the Spire Horizon Projects upon the satisfaction of the First Expenditure, Second Expenditure, and the Third Expenditure, with the initial interest of T92 being a 50% participating interest and ATHA’s being a 50% carried interest (subject to the 5% carried interest in favour of a third party).

Centrus Energy Corp. LEU recently announced the pricing of $350 million aggregate principal amount of 2.25% Convertible Senior Notes due 2030 (the “Notes”) in a private offering (the “Offering”) to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). In connection with the Offering, Centrus has granted the initial purchasers of the Notes an option to purchase, for settlement within the 13-day period beginning on, and including, the date on which the Notes are first issued, up to an additional $52.5 million aggregate principal amount of the Notes on the same terms and conditions. The sale of the Notes to the initial purchasers is expected to settle on November 7, 2024, subject to customary closing conditions.

The Notes will bear interest at a rate of 2.25% per year, payable semiannually in arrears on May 1 and November 1 of each year, beginning on May 1, 2025. The Notes will mature on November 1, 2030, unless earlier repurchased, redeemed or converted in accordance with their terms prior to such date.

About FN Media Group:

At FN Media Group, via our top-rated online news portal at www.financialnewsmedia.com, we are one of the very few select firms providing top tier one syndicated news distribution, targeted ticker tag press releases and stock market news coverage for today’s emerging companies. #tickertagpressreleases #pressreleases

Follow us on Facebook to receive the latest news updates: https://www.facebook.com/financialnewsmedia

Follow us on Twitter for real time Market News: https://twitter.com/FNMgroup

Follow us on Linkedin: https://www.linkedin.com/in/financialnewsmedia/

DISCLAIMER: FN Media Group LLC (FNM), which owns and operates FinancialNewsMedia.com and MarketNewsUpdates.com, is a third party publisher and news dissemination service provider, which disseminates electronic information through multiple online media channels. FNM is NOT affiliated in any manner with any company mentioned herein. FNM and its affiliated companies are a news dissemination solutions provider and are NOT a registered broker/dealer/analyst/adviser, holds no investment licenses and may NOT sell, offer to sell or offer to buy any security. FNM’s market updates, news alerts and corporate profiles are NOT a solicitation or recommendation to buy, sell or hold securities. The material in this release is intended to be strictly informational and is NEVER to be construed or interpreted as research material. All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. All material included herein is republished content and details which were previously disseminated by the companies mentioned in this release. FNM is not liable for any investment decisions by its readers or subscribers. Investors are cautioned that they may lose all or a portion of their investment when investing in stocks. For current services performed FNM was compensated forty five hundred dollars for news coverage of the current press releases issued by Mustang Energy Corp. by a third party non-affiliated company. FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and FNM undertakes no obligation to update such statements.

Contact Information:

Media Contact email: editor@financialnewsmedia.com – +1(561)325-8757

SOURCE: FN Media Group, LLC.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

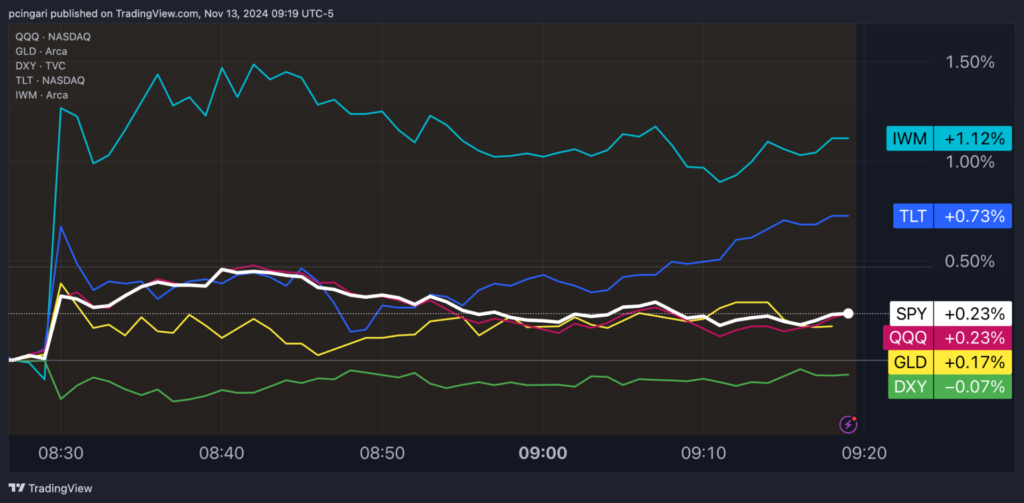

Markets Breathe Sigh Of Relief After In-Line Inflation Data: Stocks Rebound As Small Caps, Bonds Soar

Investors can breathe a sigh of relief as October inflation data met economists’ expectations, though the annual headline rate showed a slight uptick from the previous month.

As anticipated, the Consumer Price Index (CPI) rose 2.6% year-over-year in October, marking an increase from September’s 2.4% but snapping six straight months of declines.

Excluding food and energy, core inflation held steady at 3.3% for the third consecutive month, highlighting some stickiness in underlying price pressures that remain above the Fed’s 2% target.

In response to the data, speculators raised their expectations for an interest-rate cut, with increased bets on a 25-basis-point reduction in December. Market-implied probabilities now indicate a 79% likelihood of a December rate cut, up from 58% before the CPI report, as per the CME FedWatch tool.

Following the release, Minneapolis Fed President Neel Kashkari expressed optimism about inflation’s trajectory, stating on Bloomberg TV, “I have confidence inflation is headed in the right direction.”

On Tuesday, Kashkari had flagged the risk of a rate pause in December if inflation data surprises to the upside.

“I am not yet seeing a lot of upside inflation risks; the bigger risk is getting stuck,” he added on Wednesday.

Markets reacted positively, with U.S. equity futures slightly rising, while Treasury yields and the dollar eased amid increased rate-cut expectations.

Market Reactions

- The S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, was 0.2% higher.

- The Nasdaq 100, followed by the Invesco QQQ Trust, Series 1 QQQ, inched 0.15% higher.

- Small caps outperformed large-cap counterparts, as the iShares Russell 2000 IWM, rallied 1.1% minutes ahead the New York open.

- Top-performing S&P 500 stocks during the premarket trading were Charter Communications Inc. CHTR, GE Vernova Inc. GEV and Albemarle Corp. ALB up 5.7%, 4% and 3.7%, respectively.

- Skyworks Solutions Inc. SWKS, Fair Isaac Corp. FICO and Bio-Techne Corp. TECH were the laggards, down 6.7%, 4.1% and 2.8%, respectively.

- Gold prices rose 0.3%, following three straight sessions of declines.

- The U.S. dollar index (DXY) slightly eased 0.1%.

- Treasury-linked ETFs rose, with the iShares 20+ Year Treasury Bond ETF TLT up by 0.7%.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insulation Materials Market Size to Exceed USD 167.5 billion By 2031, Growing CAGR of 5.5%| States Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Nov. 13, 2024 (GLOBE NEWSWIRE) — The global insulation materials market (Markt für Dämmstoffe) was valued at US$ 104.4 billion in 2022. From 2023 to 2031, the market is projected to expand at a CAGR of 5.5%. The market is expected to reach US$ 167.5 billion by 2031. In the years to come, building materials that are environmentally friendly and sustainable, including insulation, will be in high demand. Developing eco-friendly insulation materials might become easier with the attention given to green building practices and certifications.

Anticipated tougher building codes and energy efficiency legislation may prompt the introduction of improved insulation materials to achieve greater performance. It is expected that governments will continue to advocate for energy-efficient building techniques. Continuous developments in materials science and technology could create more economical and effective insulating materials. Enhancing thermal performance, installation simplicity, and environmental sustainability could be the main areas of innovation.

Energy-efficient homes and offices are becoming more popular, creating a greater demand for insulation. Sustainable insulation materials have become increasingly popular since green building certifications such as LEED have become widely accepted (Leadership in Energy and Environmental Design). The industry has adopted insulation materials that adhere to stringent environmental standards and have a low ecological footprint due to growing concerns about environmental impact.

Click to Request Sample PDF Report and Drive Impactful Decisions: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=47280

Key Findings of the Market Report

- In 2022, North America held a share of 22.41% in the insulation materials industry.

- A share of 25.53% of insulation materials industry revenues could be attributed to Europe in 2022.

- As insulation materials industry shares increase, the aerogel segment will hold a prominent position.

- In 2022, Middle East & Africa accounted for 3.89% of global market share.

- Latin America held 4.56% of the market share in 2022.

Global Insulation Materials Market: Growth Drivers

- Building codes and regulations have become more stringent as energy efficiency and sustainability have become increasingly important. Building insulation materials reduce building energy consumption and assist in meeting these requirements. Due to significant growth in the construction industry, particularly in emerging markets, insulation materials have become more in demand. With more buildings being constructed, energy efficiency and comfort are becoming increasingly important.

- As climate change concerns and the need for carbon emissions reductions flourish, insulation materials are becoming increasingly popular to improve buildings’ energy efficiency. Governments and organizations around the world are promoting sustainable construction practices. Innovative insulation materials have been developed based on ongoing research and development work in materials science and technology. As a result, a wide range of industries have adopted this technology.

- Energy-efficient buildings have become more popular with the growing adoption of alternative energy sources, such as solar and wind. Heating and cooling systems are less dependent on insulation materials, maintaining a stable indoor environment. Many governments through tax credits, incentives, and rebates can subsidize energy-efficient materials, including insulation. As a result, insulation materials are in high demand.

Global Insulation Materials Market: Regional Landscape

- North America is expected to dominate the insulation material market. Building codes and regulations in North America have tightened up, especially around energy efficiency. Buildings of all types, including commercial, residential, and industrial, must comply with these regulations that aim to reduce their energy consumption. The market for insulating materials has been significantly influenced by retrofitting and rehabilitation of existing structures. Insulation materials are in higher demand as building owners attempt to improve their structures for energy efficiency.

- The market for insulating materials has benefited greatly from the residential construction industry. The demand for insulating materials in new home building and renovations is rising as the housing market expands and homeowners become more cost-conscious.

- Energy efficiency, a consistent indoor temperature, and compliance with environmental laws are among the reasons commercial and industrial applications use insulation materials. As the commercial and industrial sectors have expanded, the market has benefited.

Unlock Growth Potential in Your Industry! Download PDF Brochure @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=47280

Global Insulation Materials Market: Key Players

Insulation materials are a fragmented market, with several large, medium, and small manufacturers worldwide. Companies merge and acquire, partner, create joint ventures, and collaborate to grow their global market share.

- BASF SE

- Covestro AG

- Dow

- Huntsman International LLC

- John Manville

- CERTAINTEED

- Bayer

- JSP Corporation

- Borealis

- The Woodbridge Group

- Owen Corning

- Knauf Insulation

- Korff Isolmatic GmbH

- Others

Key Developments

- In July 2023, Borouge PLC significantly contributed significantly to the Jiangsu Rudong offshore wind transmission program, the country’s largest HVDC wind transmission program. Borouge has been integral to the safe and efficient transfer of electricity in China’s rapidly growing offshore wind market with its polymeric insulation materials, which use Borealis’ proprietary Borlink technology.

- In January 2023, KNAUF Insulation debuted an online condensation risk assessment tool tailored to the insulation industry. By allowing architects and specifiers to calculate U-values in less than five minutes, the solution will enable them to assess the risk of interstitial condensation.

Global Insulation Materials Market: Segmentation

By Type

- Fibrous Insulation

- Fiberglass

- Mineral Wool

- Plastic Fibers

- Cellulose

- Others

- Expanded polystyrene (EPS)

- Extruded polystyrene (XPS)

- Polyisocyanurate (Polyiso, ISO)

- Polyurethane (PU)

- Others

By Category

- Blanket Batt Insulation and Roll Insulation

- Foam Board or Rigid Foam

- Insulated Concrete Forms

- Loose-Fill and Blown-In Insulation

- Loose-Fill and Blown-In Insulation

- Spray Foam and Foamed-In-Place Insulation

- Structural Insulated Panels (SIPS)

- Others

By Density

- Up to 100 Kg/m3

- >100 to 200 Kg/m3

- >200 to 500 Kg/m3

- >500 to 700 Kg/m3

- >700 Kg/m3

By End Use

- Residential

- Commercial

- Infrastructure

- Electrical & Electronics

- Packaging

- Food & Beverages

- Automotive

- Oil & Gas

- Consumer Goods

- Aerospace

- Marine

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy Now to Embrace Innovation and Ensure Enduring Success: https://www.transparencymarketresearch.com/checkout.php?rep_id=47280<ype=S

Explore Trending Reports of Chemicals And Materials:

- Ion Exchange Membrane Market – Ion exchange membranes were valued at US$ 1.1 billion in 2022. A CAGR of 3.5% is expected from 2023 to 2031, reaching US$ 1.6 billion.

- Battery Materials Market – It is expected to advance at a CAGR of 13.6% from 2023 to 2031 and reach US$ 171.0 Bn by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After-sun Products Market Size on Track for USD 3.3 Billion by 2031, Rising at a CAGR of 3.7% – Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Nov. 13, 2024 (GLOBE NEWSWIRE) — After-sun products (Produits après-soleil) accounted for a global market value of US$ 2.4 billion in 2022. From 2023 to 2031, it is expected to expand at a CAGR of 3.7%, reaching US$ 3.3 billion by 2031. Beauty and skincare trends are heavily promoted on social media platforms. Consumers often purchase after-sun products based on recommendations from beauty influencers and bloggers.

As people search for effective post-sun exposure care solutions, there is a direct positive impact on after-sun products. The success of after-sun products can be attributed to eye-catching packaging and effective marketing. A broader audience tends to be drawn to brands emphasizing their products’ natural and nourishing qualities.

Sun protection and skin care regulations and guidelines encourage after-sun lotions and creams. Regulations ensure the products are safe and effective so consumers can feel confident. Advances in skincare technology may enable the development of more sophisticated after-sun products.

Request Sample PDF of the Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38219

Enhancing healing properties, improving skin penetration, or extending the effects of products can all be included here. Natural and sustainable products are predicted to grow in popularity over the next few years. Environmental impact is a growing concern for consumers, which helps brands gain an advantage over their competitors by using eco-friendly packaging and ingredients.

Global After-sun Products Market: Key Players

The global after-sun care market is witnessing substantial investments by prominent players trying to develop after-sun lotions and anti-aging products. In the after-sun products industry, leading companies merge and close collaborations with other players.

- L’Oréal S.A.

- Beiersdorf Aktiengesellschaft

- Johnson & Johnson Services, Inc.

- Avon Products, Inc.

- Kao Corporation

- Shiseido Co., Ltd.

- The Procter & Gamble Company

- The Estee Lauder Companies Inc.

- Unilever PLC

- Christian Dior SE

Global After-sun Products Market: Growth Drivers

- Increasing awareness regarding the harmful effects of ultraviolet radiation on the skin leads to greater use of after-sun products to protect the skin from UV damage. Campaigns promoting post-sun care are one factor contributing to the market’s growth. Long-term exposure to the sun can cause skin problems like sunburn, redness, and dehydration. After-sun products are sought after to relieve sunburns and aid in skin recovery.

- Tourism and travel are expanding, and outdoor activities are rising, increasing demand for after-sun products. Vacationers and outdoor enthusiasts often seek after the treatment of sun-damaged skin. The skincare industry is continually researching and developing new formulations for after-sun products. The market will increasingly have products that deliver pain relief, antioxidant protection, hydration, and anti-aging properties.

- Skincare routines are incorporated into consumers’ daily lives as they become more health-conscious. Maintaining healthy skin is one of the main reasons why after-sun products are in such high demand. E-commerce platforms have facilitated global access to skincare products. Due to online availability, consumers can explore and purchase after-sun products.

Key Findings of the Market Report

- Sales of creams and lotions are expected to increase, driving after-sun product demand.

- Based on end-users, the female segment is expected to drive demand for after-sun products.

- Increasing seasonal discounts at online stores are expected to drive after-sun product demand.

- In terms of source, organic and natural products will create a market in the future.

- In 2022, Europe accounted for the largest share of the global market.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=38219

Global After-sun Products Market: Regional Landscape

- Europe is expected to drive after-sun product demand in the market. Since sun exposure increases during summer, after-sun products are in high demand in European countries. Seasonally high demand is also attributed to tourists arriving at sun-filled European destinations. The sun protection culture is well-established in many European countries. Sun-damaged skin is often soothed and repaired with products designed for after-sun care.

- Health and wellness are rising in Europe, resulting in a growing demand for skincare products. With health-conscious consumers, skincare routines are becoming more important. Consumers in Europe tend to prefer products that use natural and sustainable ingredients. After-sun formulations that use innovative and environmentally friendly ingredients may be successful in Europe.

- After-sun products, including skincare products, have become more accessible due to the rise of e-commerce in Europe. The convenience of online platforms makes it easier for consumers to explore and buy skincare products. Cosmetics and skin care products in Europe are subject to strict regulations. For companies operating in the market, compliance with these regulations is essential. Customers will likely trust products that comply with European safety and effectiveness standards.

Global After-sun Products Market: Segmentation

By Product Type

- Creams and Lotions

- Cleansers and Foaming Cleansers

- Essential Oils

- Gels and Scrubs

- Other Products

By End User

By Sales Channel

- Modern Trade

- Convenience Stores

- Departmental Stores

- Drug Stores

- Online Stores

- Other Sales Channels

By Source

- Conventional

- Natural

- Organic

By Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

Get Exclusive Discount on After-sun Products Market at @ https://www.transparencymarketresearch.com/checkout.php?rep_id=38219<ype=S

More Trending Report by Transparency Market Research:

- Cosmetic Skin Care Market – The global market stood at US$ 101.34 Bn in 2021 and is projected to reach US$ 154.7 Bn by 2031.

- Swimwear Market – The industry was valued at US$ 19.1 Mn in 2021. It is estimated to grow at a CAGR of 6.0 % from 2022 to 2031 and reach US$ 34.2 Bn by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Inflation On Track, But Fed May 'Go Slowly' On Interest Rate Cuts, Experts Say

October’s Consumer Price Index rose from 2.4% in September to 2.6% in October, in line with economist predictions. Here’s a look at what experts expect from the Federal Reserve in the months ahead.

Experts Weigh In: Minneapolis Fed President Neel Kaskari appeared on Bloomberg TV following the CPI data release and said that he has been surprised at the resilience of the U.S. economy in the face of high interest rates. However, he noted that the labor market has been softening.

“I have confidence that inflation is headed in the right direction. Is it headed there fast enough? Do we want it to get there more quickly? We will see,” Kashkari said.

Kashkari cautioned on Tuesday that the Federal Reserve could hold off on an interest rate cut in December if inflation data comes in hotter than expected between now and then.

Tiffany Wilding, economist from Pimco, appeared on CNBC’s Squawk Box and noted that a December rate cut is “still an open question” following the first increase in the annual inflation rate in six months.

“You could get a Fed that just decides to skip and go slowly,” Wilding said.

Joe Brusuelas, chief economist at RSM, noted that the primary catalysts for October’s higher figure were a 2.7% increase in the cost of used auto, a 3.2% increase airline fares and sustained stickiness in housing and service inflation. He sees the Fed moving forward with a 25 basis point cut in December, which would take the rate to a range between 4.25% and 4.5%.

However, Brusuelas cautioned that his previous forecast for four 25-point cuts, one at each meeting in 2025, may be in jeopardy. The Fed may need to pause at some point next year due to the “arrival of expansionary fiscal policy in 2025,” he said.

“Elections have consequences and the immediate consensus is that the economy, which is already strong, may accelerate amidst higher import taxes and inflation,” Brusuelas wrote.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alphabet's Waymo Opens Robotaxi Rides For All In Los Angeles After San Francisco, Says 'More Cities On The Way'

Alphabet Inc‘s GOOG GOOGL Waymo said on Tuesday that it has opened autonomous rides to everyone in Los Angeles.

What Happened: Waymo commenced commercial operations in Los Angeles earlier this year. However, rides then were limited to the nearly 300,000 riders who signed up to join the company’s waitlist. The company was adding new riders to the service incrementally. However, it has now scrapped the waitlist altogether.

“La La Land is now our third city open to all riders, with waitlists removed and more cities on the way,” the company’s Chief Product Officer Saswat Panigrahi said in a post on X.

Riders in Los Angeles can now download the Waymo One app and avail a ride around nearly 80 square miles of LA County.

“We intend to grow our service area to cover more of the city in the future,” Waymo said in a statement.

Why It Matters: Los Angeles has now joined San Francisco and Phoenix as the cities where Waymo One rides are available to everyone.

Waymo currently operates a fleet of all-electric vehicles that have been customized to enable autonomous driving in these cities. The company is delivering over 150,000 paid rides every week to the public, it said in October.

Late last month, Waymo closed an oversubscribed investment round of $5.6 billion led by its parent Alphabet to expand its robotaxi service.

Waymo is currently the frontrunner in the field of autonomous vehicles in the U.S. While General Motors’ Cruise was at par with Waymo until last year, it suspended all of its operations in the U.S. late last year following the involvement of one of its robotaxis in an accident in San Francisco, leading to heightened regulatory scrutiny and the exit of its co-founder and then CEO Kyle Vogt.

Amazon.com’s Zoox, meanwhile, is testing its custom-built robotaxi with no pedals or steering wheel in San Francisco by giving rides to company employees.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Waymo

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Splitero Expands its Innovative Home Equity Solutions into Arizona

Arizona homeowners now have better options to access their home equity amid actively growing real estate market

SAN DIEGO, Nov. 13, 2024 /PRNewswire/ — Splitero, the financial technology company that provides homeowners better options to access home equity, announced today that it has expanded into Arizona. This expansion is driven by Arizona’s robust home equity and housing market. Fifty percent of mortgage holders are equity-rich in Arizona, and there is a growing need for better home equity solutions.

“Arizona is a dynamic real estate market, and homeowners need better solutions to leverage their home equity without selling or moving,” said CEO and Founder Michael Gifford. “Splitero addresses this need and perfectly aligns with the financial goals of Arizona homeowners. Expanding into Arizona marks an exciting new chapter for Splitero!”

There is now a record-breaking $11.5 trillion of accessible home equity in the US. In 2024 lenders originated about 671,000 new HELOCs, totaling almost $105 billion, according to National Mortgage Professional. These traditional financial products have burdensome qualification requirements and monthly payments that are subject to interest rates. Splitero makes it easier for homeowners to access their home equity through Home Equity Investments with no income requirements to pre-qualify, no monthly payments, and no new debt.

“Over half of homeowners in Arizona are equity-rich, meaning the total outstanding loan balances on their properties are no more than half of their market value,” said Gifford. “By providing homeowners with a lump-sum of cash in exchange for a share of their home’s future value, Splitero enables homeowners to use their home equity to better their lives.”

Splitero currently operates in California, Colorado, Oregon, Utah, Washington, and now Arizona with plans to expand into additional states in 2025. Splitero recently secured a $300 million strategic investment from funds managed by Antarctica Capital to provide even more homeowners access to their home equity.

Home Equity Investments (HEIs) allow homeowners to use their home equity to better their lives by paying off debt, renovating a home, or using their equity to achieve financial goals without selling their home or refinancing a low-interest rate mortgage. Splitero’s innovative Maturity Match™ aligns homeowners’ HEI term length with their remaining senior mortgage timeline so they don’t have to repurchase their HEI option before paying off their mortgage. Homeowners can repurchase anytime within their term without penalty, giving them the flexibility to repurchase at their convenience.

About Splitero

Splitero is a financial technology company that provides homeowners better options to access their home equity. Founded by real estate veterans, Splitero provides a lump sum of cash in exchange for a share of the home’s future value. Splitero can help homeowners in Arizona, California, Colorado, Oregon, Utah, and Washington access their equity with no additional monthly payments or new debt. For more information, visit www.splitero.com.

Media Contact:

Kirstin Robison, Senior Account Manager

Pitch Public Relations

Cell: (480)-363-5371

krobison@pitchpublicrelations.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/splitero-expands-its-innovative-home-equity-solutions-into-arizona-302303419.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/splitero-expands-its-innovative-home-equity-solutions-into-arizona-302303419.html

SOURCE Splitero

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.