Wall Street's Most Accurate Analysts Spotlight On 3 Utilities Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilites sector.

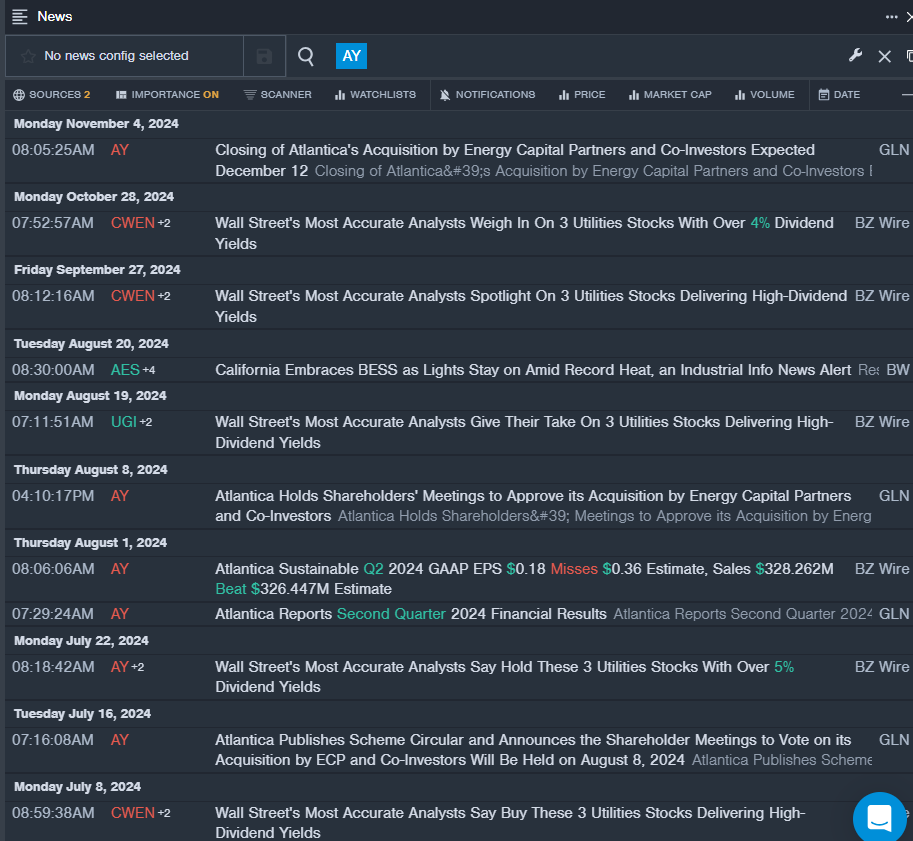

Atlantica Sustainable Infrastructure plc AY

- Dividend Yield: 8.05%

- Seaport Global analyst Angie Storozynski downgraded the stock from Buy to Neutral on May 29. This analyst has an accuracy rate of 76%.

- BMO Capital analyst James Thalacker maintained a Market Perform rating and raised the price target from $20 to $23 on May 10. This analyst has an accuracy rate of 74%.

- Recent News: On Aug. 1, Atlantica Sustainable posted better-than-expected quarterly sales.

- Benzinga Pro’s real-time newsfeed alerted to latest AY news

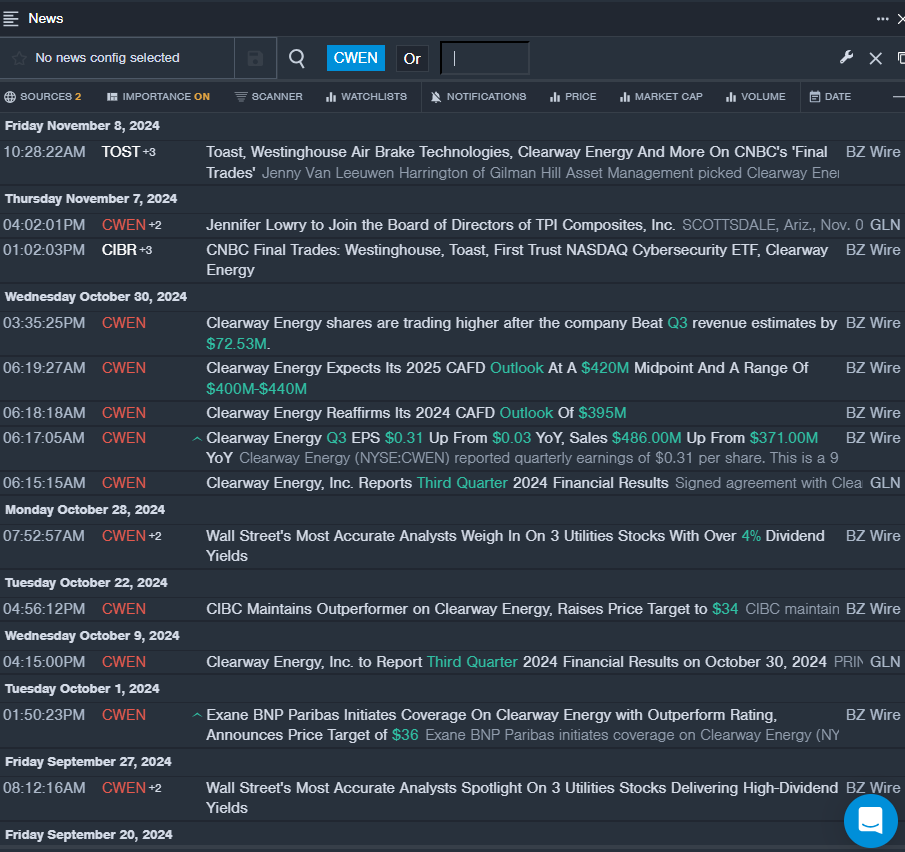

Clearway Energy, Inc. CWEN

- Dividend Yield: 6.37%

- Jefferies analyst Julien Dumoulin-Smith initiated coverage on the stock with a Buy rating and a price target of $35 on Sept. 20. This analyst has an accuracy rate of 68%.

- Morgan Stanley analyst Robert Kad upgraded the stock from Equal-Weight to Overweight and raised the price target from $25 to $36 on July 31. This analyst has an accuracy rate of 77%.

- Recent News: On Oct. 30, Clearway Energy beat third-quarter revenue estimates by $72.53 million.

- Benzinga Pro’s real-time newsfeed alerted to latest CWEN news.

Avista Corporation AVA

- Dividend Yield: 5.04%

- B of A Securities analyst Ross Fowler reinstated an Underperform rating and a price target of $37 on Sept. 12. This analyst has an accuracy rate of 63%.

- Mizuho analyst Anthony Crowdell upgraded the stock from Underperform to Neutral and raised the price target from $32 to $36 on May 3. This analyst has an accuracy rate of 63%.

- Recent News: On Nov. 6, Avista posted better-than-expected quarterly earnings, while sales missed estimates.

- Benzinga Pro’s charting tool helped identify the trend in AVA stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LEEF Brands Cannabis Co. Reports Revenue Growth, Higher Operating Expenses In Q3

Cannabis operator LEEF Brands, Inc. LEEF LEEEF announced its financial results for the three months ended Sept. 30, 2024, with revenue of $6.76 million, compared to $5.67 million for the same period last year.

The British Columbia-based company noted the increase in revenue was primarily due to market pricing changes and a focus on boosting margins and positive operating cash flow. Its customer base has increased with expansion into other verticals as well as the acquisition of The Leaf in January 2023.

“I’m proud of our team for driving positive momentum this quarter, making substantial progress on key initiatives, innovations and infrastructure upgrades, including the completion of Phase 1 construction at Salisbury Canyon Ranch,” stated CEO Micah Anderson. “This 1,900-acre ranch with a 187-acre cultivation permit, positions us for our first planting in spring 2025. Additionally, we’ve invested significantly in our extraction technology, increasing our overall capacity by 32%, which will enable larger product output in the coming year. We’re optimistic about the opportunities ahead and excited about the strong foundation we’re building for 2025.”

Read Also: Weedmaps Net Income Surges 312% YOY, Cash Reserves Up 31%

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Financial Highlights:

- Net loss amounted to $3.19 million, compared to a net loss of $1.99 million in the same period last year.

- Gross profit of $1.5 million, representing a gross margin of 22%, compared to gross profit of $1.86 million, representing a gross margin of 33% for the same period of 2023. The decrease in gross profit margin percentage the company attributed primarily to pricing compression within the market and an inventory impairment of approximately $425,000 recorded in September 2024.

- Adjusted EBITDA was a loss of $1.79 million, compared to adjusted EBITDA gain of $224,495 in the third quarter of 2023.

- Total operating expenses for the three months ended Sept. 30, 2024 were $3.87 million, a 32% increase from $2.93 million in the same period of 2023.

- The company had a cash balance and total assets of $2.16 million and $45.07 million, respectively, as of Sept. 30, 2024.

“We continue to focus on our long-term financial health and strategic growth, which includes the phase 1 completion of Salisbury Canyon Ranch, as well as innovating in how we manage assets and payment systems,” stated CFO Kevin Wilson. “This quarter, the company acquired Bitcoin cryptocurrency in a business-to-business transaction which marks the beginning of a larger strategy of integrating LEEF Brands into the Bitcoin Ecosystem. This is a milestone that reflects our commitment to forward-looking financial strategies. Despite the industry challenges, our focus remains on increasing efficiency and positioning LEEF for success as we move forward.”

LEEF Brands recently announced a 10-for-1 share consolidation of its common shares and a proposed private placement to raise up to CA$2.5 million ($1.8 million). Upon completion of the consolidation, LEEF will have approximately 162,762,651 common shares issued and outstanding, subject to rounding adjustments. The consolidation will take effect Nov. 18, 2024 with trading expected to begin on a consolidated basis on the Canadian Securities Exchange and OTCQB on Nov. 18th, 2024.

Price Action

LEEF Brands shares closed Tuesday’s market session 12% higher at $0.014 per share.

Read Next:

Photo: Courtesy of SD_FlowerPower via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Cummins Analyst Turns Bullish; Here Are Top 5 Upgrades For Wednesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- BTIG analyst Janine Stichter upgraded the rating for On Holding AG ONON from Neutral to Buy and announced a $64 price target. On Holding shares closed at $52.62 on Tuesday. See how other analysts view this stock.

- Evercore ISI Group analyst David Raso upgraded PACCAR Inc PCAR from In-Line to Outperform and raised the price target from $99 to $129. PACCAR shares closed at $116.79 on Tuesday. See how other analysts view this stock.

- Morgan Stanley analyst Josh Baer upgraded CCC Intelligent Solutions Holdings Inc. CCCS from Equal-Weight to Overweight and increased the price target from $14 to $15. CCC Intelligent Solutions shares closed at $11.50 on Tuesday. See how other analysts view this stock.

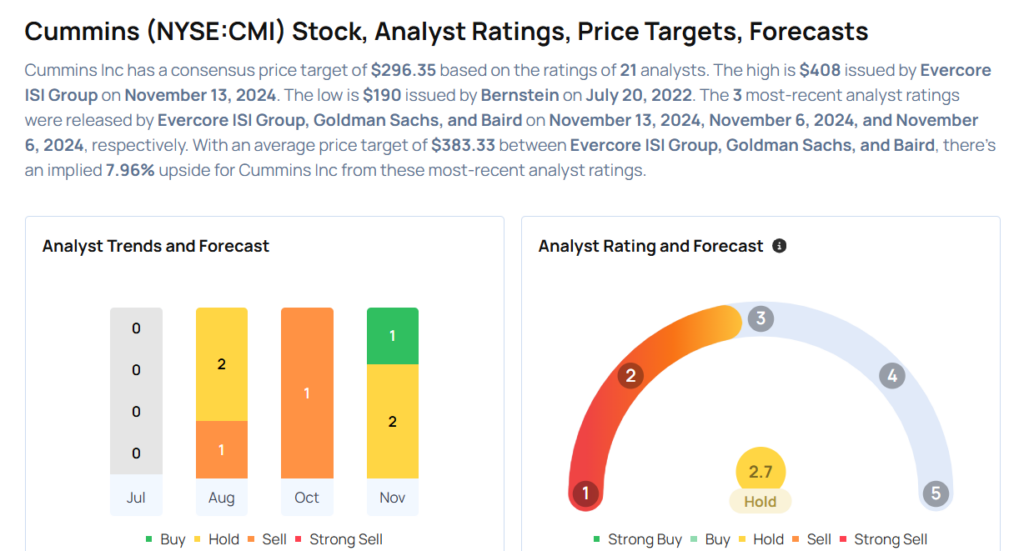

- Evercore ISI Group analyst David Raso upgraded the rating for Cummins Inc. CMI from In-Line to Outperform and raised the price target from $294 to $408. Cummins shares closed at $355.08 on Tuesday. See how other analysts view this stock.

- Canaccord Genuity analyst Maria Ripps upgraded Viant Technology Inc. DSP from Hold to Buy and raised the price target from $13 to $18. Viant Technology shares closed at $13.52 on Tuesday. See how other analysts view this stock.

Considering buying CMI stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spirit Airlines might really go bankrupt this time — and the stock plunges 57%

Spirit Airlines (SAVE) stock was sinking sharply Wednesday, after a report late Tuesday indicated that the ultra-low-cost carrier is preparing to file for bankruptcy.

The Wall Street Journal (NWSA), citing unnamed sources familiar with the matter, reports that the bankruptcy talks come after a potential merger with Frontier Airlines fell apart. A bankruptcy filing could happen within weeks, The Journal reports, as the airline has faced steep losses and looming debt costs.

Spirit Airlines stock was down almost 65% in pre-market trading on Wednesday, to $1.14 per share. It rebounded slightly after markets opened to trade down about 57%, at $1.38 per share. The stock has lost almost 92%so far this year.

The talks between Spirit and Frontier came after Spirit’s failed attempt at merging with JetBlue (JBLU). And it wasn’t the first time that Frontier and Spirit explored a merger. The airlines had been in on-and-off merger talks since 2016. In February 2022, the companies announced a $2.9 billion definitive merger agreement. That deal fell apart in July of that year.

Spirit abandoned that deal for another offer from another low-cost rival: JetBlue. But after a federal judge blocked the merger over concerns that the combination of the two budget airlines would be anti-competitive, Spirit and JetBlue called off their $3.8 billion deal this past March.

Since then, Spirit has struggled to find its footing (and JetBlue isn’t faring much better). Speculation has swirled for months that Spirit might be approaching insolvency.

In a recent regulatory filing, the company said it had pushed back its deadline to refinance roughly $1.1 billion in debt until Dec. 23. Spirit also said it had borrowed the entirety of a $300 million revolving credit facility it had set up in March 2020. Borrowings under that facility are scheduled to mature at the end of September 2026. The company also reiterated at the time that it expects to end 2024 with more than $1 billion in liquidity.

— Rocio Fabbro and Melvin Backman contributed to this article.

CyberArk Q3 Earnings: Subscription Growth Soars, ARR Up, New CFO Announced And More

CyberArk Software Ltd (NASDAQ: CYBR) reported fiscal third-quarter 2024 revenue growth of 26% year-on-year to $240.1 million, beating the analyst consensus estimate of $234.0 million.

The information security company posted an adjusted EPS of $0.94, which beat the analyst consensus estimate of $0.46. The stock price gained after the print.

Also Read: Tencent Q3 Earnings: Gaming And AI Fuel Profit Growth, Pony Ma Eyes E-Commerce Expansion

Segments: Revenues from Subscriptions expanded 43% Y/Y to $175.6 million. Maintenance and professional services were $61.6 million vs. $64.3 million Y/Y.

Key Performance Indicators: Annual Recurring Revenue (ARR) increased 31% Y/Y to $926 million. The subscription portion of ARR was $735 million, implying a 46% year-over-year growth.

The Maintenance portion of ARR was $191 million, compared to $200 million year over year. Recurring revenue grew 29% year over year to $224.2 million.

CyberArk held $1.5 billion in cash and equivalents as of September 30, 2024.

CFO Transition: CFO Josh Siegel will step down on January 1, 2025 and transition into an advisory role after 13 years in the position, making way for Erica Smith, CyberArk’s Deputy CFO.

CyberArk CEO Matt Cohen highlighted the company’s strong performance, exceeding guidance across all key metrics. He credited their success to top-tier execution and leadership in identity security, driving significant growth in net new ARR, record revenue, and improved profitability.

Cohen also celebrated the recent acquisition of Venafi, finalized on October 1, as a strategic expansion of CyberArk’s platform. He stated that Venafi’s cloud-native solution strengthens their leadership in machine identity security, a rapidly growing and complex segment, with positive feedback from customers and partners validating the move.

Outlook: CyberArk expects a fiscal fourth-quarter revenue of $297.0 million-$303.0 million, versus the consensus of $234.04 million.

It projected an adjusted EPS of $0.65-$0.75 versus the consensus of $0.46.

CyberArk raised the fiscal 2024 revenue outlook to $983.0 million-$989.0 million (prior $932.0 million-$942.0 million) versus the consensus of $941.49 million.

CyberArk expects an adjusted EPS outlook of $2.85-$2.96 (prior $2.17–$2.36) versus the consensus of $2.31.

ARR as of December 31, 2024, will likely be $1.153 billion—$1.163 billion (prior $985 million—$995 million), up by 49%- 50%.

Last week, Jim Cramer advised viewers on CNBC’s “Mad Money Lightning Round” to buy CyberArk Software. He praised the company and said he has been a strong supporter for many years.

Cyberark Software stock surged over 39% year-to-date.

Price Action: CYBR stock is up 6.90% at $321.50 premarket at last check Wednesday.

Also Read:

Photo by Igal Vaisman via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top 4 Consumer Stocks That May Explode In November

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

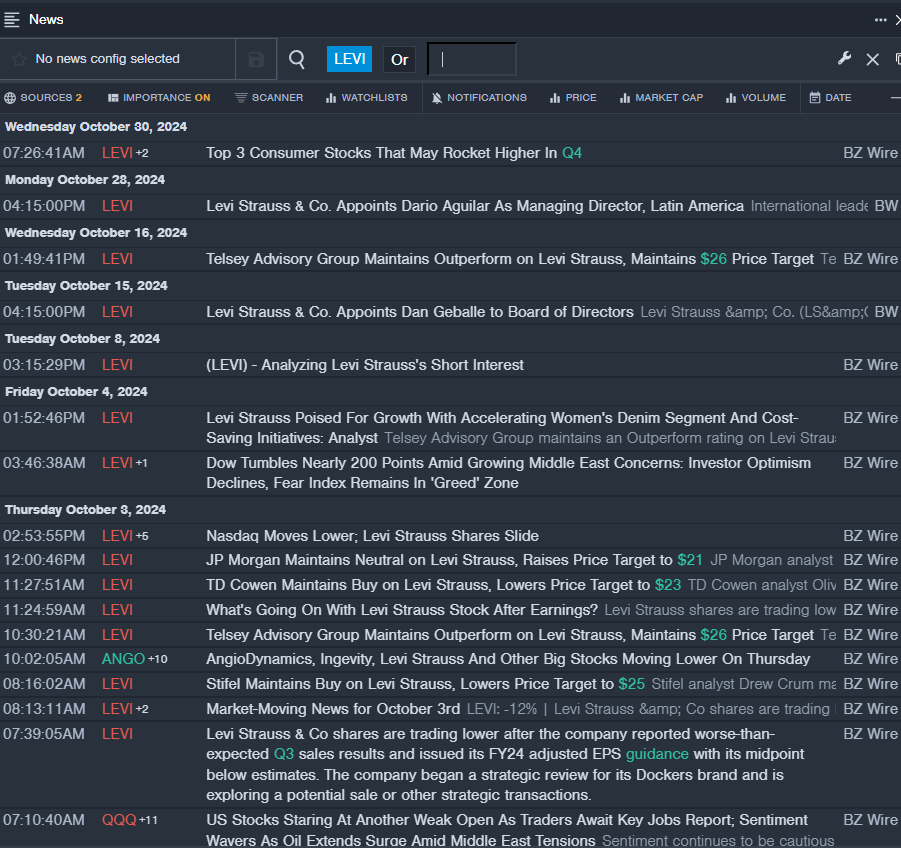

Levi Strauss & Co LEVI

- On Oct. 28, Levi Strauss named Dario Aguilar as Managing Director, Latin America. The company’s stock fell around 11% over the past month and has a 52-week low of $13.94.

- RSI Value: 29.52

- LEVI Price Action: Shares of Levi fell 0.7% to close at $16.86 on Tuesday.

- Benzinga Pro’s real-time newsfeed alerted to latest LEVI news.

Crocs Inc CROX

- On Oct. 29, Crocs reported third-quarter financial results and lowered its revenue guidance related to the HEYDUDE Brand. The company reported adjusted earnings per share of $3.60 (+11%), beating the street view of $3.10. Quarterly revenues of $1.062 billion (+2%) beat the analyst consensus of $1.05 billion. The company’s stock fell around 27% over the past month and has a 52-week low of $77.16.

- RSI Value: 25.13

- CROX Price Action: Shares of Crocs fell 0.9% to close at $101.98 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in CROX stock.

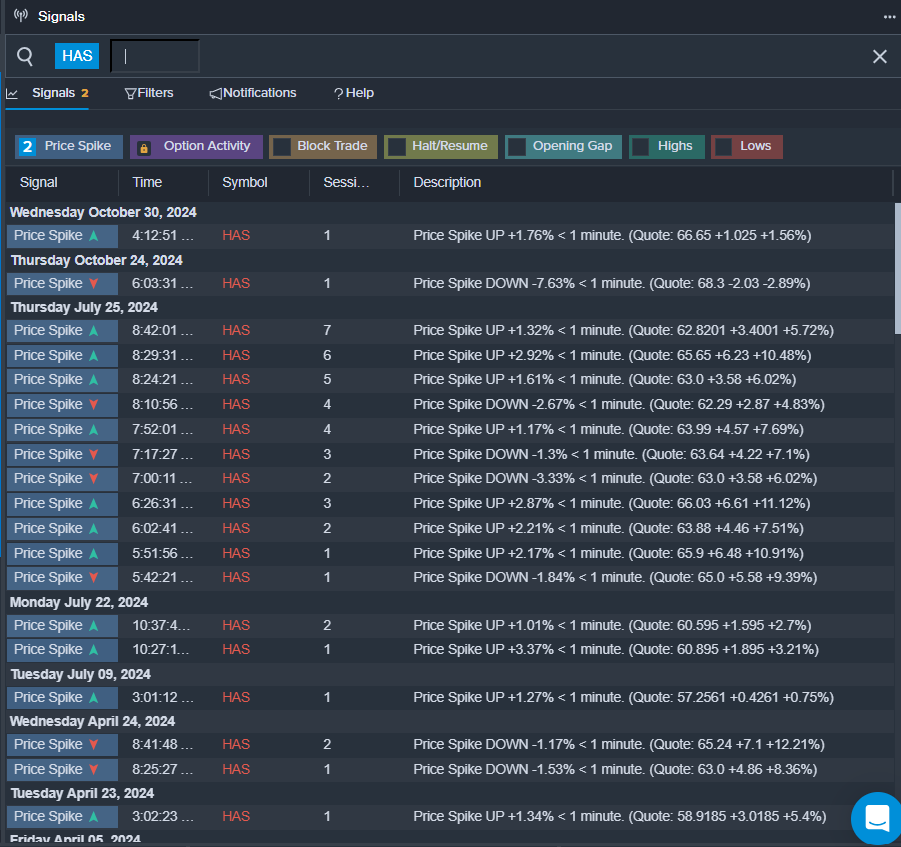

Hasbro Inc HAS

- On Oct. 24, Hasbro reported a third-quarter sales decline of 15% year-on-year to $1.281 billion, marginally missing the analyst consensus estimate of $1.295 billion. “We continue to execute our turnaround efforts and are poised to finish the year with improved profitability, cash flow and operational rigor,” said Gina Goetter, Hasbro’s Chief Financial Officer. The company’s stock fell around 11% over the past month and has a 52-week low of $42.70.

- RSI Value: 29.26

- HAS Price Action: Shares of Hasbro fell 1.1% to close at $63.42 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in HAS shares.

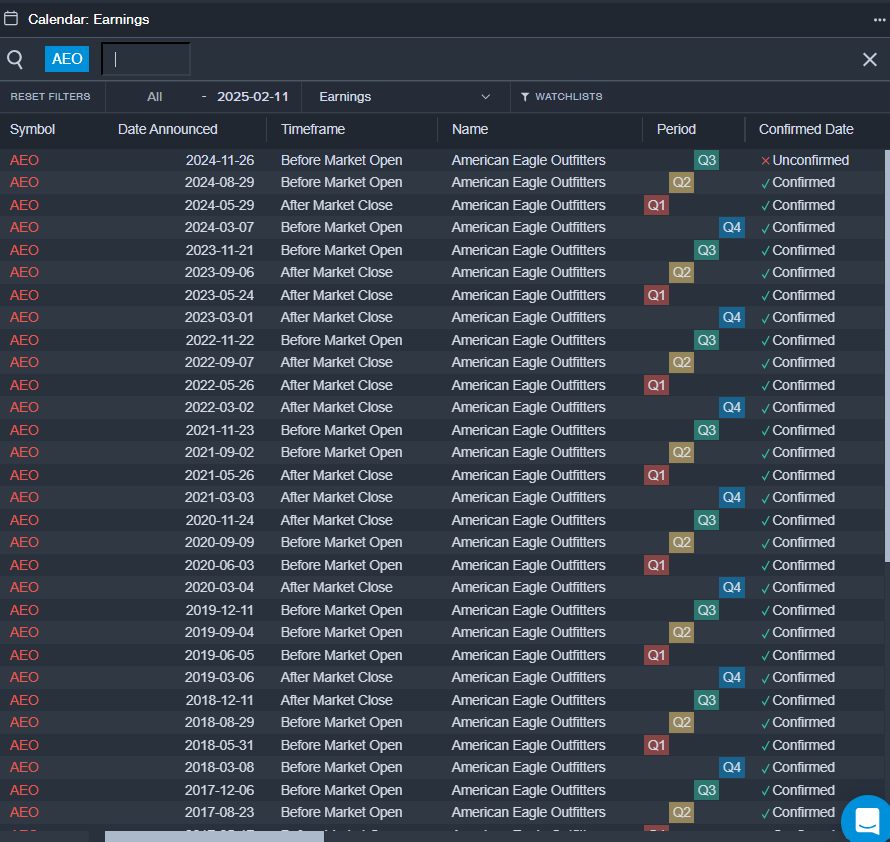

American Eagle Outfitters Inc AEO

- On Nov. 12, Jefferies analyst Corey Tarlowe maintained American Eagle with a Hold and lowered the price target from $22 to $19. The company’s shares lost around 13% over the past month. The company’s 52-week low is $73.04.

- RSI Value: 15.92

- AEO Price Action: Shares of American Eagle fell 1.5% to close at $17.94 on Tuesday.

- Benzinga Pro’s earnings calendar was used to track upcoming AEO earnings reports.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chipotle's New CEO Scott Boatwright Will Make Millions, But It Will Still Be Half Of Ex-CEO Brian Niccol's Pay

Chipotle Mexican Grill, Inc. CMG announced Monday that Scott Boatwright, who served as interim CEO since August, will permanently lead the fast-casual restaurant chain with a compensation package valued less than half of his predecessor’s pay.

What Happened: Boatwright, 52, who served as interim CEO since August, will receive a total package valued at approximately $11 million – a significant increase from his previous $6.3 million compensation as chief operating officer but substantially lower than his predecessor’s earnings, according to Fottune’s valuation.

The package includes a $1 million base salary, a potential cash bonus of $1.2 million, an $8 million retention grant, and a $3.5 million restricted stock award, plus a $200,000 aircraft allowance.

In contrast, former CEO Brian Niccol‘s 2023 compensation reached $22.5 million before his departure to Starbucks. Niccol’s new position came with a lucrative $113 million package, including a $10 million sign-on bonus and $75 million in equity grants.

“We conducted a thorough and rigorous external search process that confirmed Scott is absolutely the best person to lead the next stage of growth at Chipotle,” board chair Scott Maw said in a statement.

See Also: Greg Brockman Returns To Work At ChatGPT’s Parent Company: ‘Back To Building OpenAI’

Why It Matters: When asked about the compensation details, a Chipotle spokesperson told Fortune: “The bulk of Scott’s compensation will be received through his equity awards, and the actual value Scott will receive is entirely dependent on achievement of the performance goals for the awards and the stock price at the time of vesting.”

The appointment comes amid broader leadership changes at Chipotle, including the elevation of Jack Hartung to president of strategy, finance, and supply chain. The company issued retention grants totaling $34.5 million to key executives to ensure stability during the transition, according to Fortune.

Price Action: Chipotle’s stock has risen nearly 35% year to date, currently trading at $60.49. Under Niccol’s tenure, the company’s share price grew 800%, according to Benziga Pro data.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Skyworks Beats Q4 EPS Estimates, Projects AI-Driven Smartphone Surge Despite Modest Q1 Outlook

Skyworks Solutions Inc SWKS shares are trading lower premarket on Wednesday after it reported fourth-quarter results on Tuesday.

The company reported adjusted EPS of $1.55, which beat the analyst consensus estimate of $1.52. Quarterly sales of $1.025 million were in line with the analyst consensus estimate.

The company declared its quarterly dividend of 70 cents per share, payable on December 24, to stockholders of record at the close of business on December 3.

The company generated an annual operating cash flow of $1.825 billion and free cash flow of $1.668 billion.

Liam K. Griffin, chairman, chief executive officer and president of Skyworks, said, “For the second year in a row, we generated over $1.6 billion of free cash flow and ended fiscal 2024 with a record 40% free cash flow margin. Looking ahead, we believe AI is poised to ignite a transformative smartphone upgrade cycle, propelling the demand for higher levels of RF complexity.”

Outlook: Skyworks Solutions projects first-quarter of 2025 revenue to be $1.05 billion – $1.08 billion ($1.096 billion estimate) with adjusted earnings per share of $1.57 at the mid-point of the revenue range, vs. the estimate of $1.72.

Kris Sennesael, senior vice president and chief financial officer of Skyworks, stated, “We expect our mobile business to be up mid-single digits sequentially, driven by seasonal product ramps. In broad markets, despite excess inventory in select segments, we anticipate further modest sequential growth, and a return to year-over-year growth.”

Investors can gain exposure to the stock via Global X Internet of Things ETF SNSR and First Trust Nasdaq Semiconductor ETF FTXL.

Price Action: SWKS shares are down 6.65% at $81.25 premarket at the last check Wednesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.