Bitcoin Proxy MicroStrategy Director Sells 40K Company Shares Worth $12M As Stock Hits All-Time High

MicroStrategy Inc. MSTR director Leslie J. Rechan has executed a significant sale of company shares, amounting to approximately $12 million, as per a recent SEC filing. The transactions were disclosed on Wednesday.

What Happened: Rechan exercised stock options to acquire 40,000 shares of MicroStrategy’s Class A common stock on Nov. 7 and Nov. 11, 2024. The adjusted exercise prices were $12.746 and $12.957 per share, following a 10-for-1 stock split in August. Originally, these prices were $127.46 and $129.57.

On Nov. 7, Rechan sold 11,171 shares at an average price of $275.04 and 8,829 shares at $275.80. On Nov. 11, he sold 17,800 shares at $325.23 and 2,200 shares at $326.60. The total value of these transactions reached approximately $12 million.

MicroStrategy stock is considered an alternative to Bitcoin.

Despite these sales, Rechan retains 4,970 shares directly and holds indirect ownership of 20,000 shares through the Meredithe Rechan 2021 Family Trust. The August stock split significantly reduced the exercise price of Rechan’s options, enhancing the profitability of these transactions.

Why It Matters: The timing of the share sale coincides with a period of heightened activity for MicroStrategy. Recently, the company’s shares have been trading higher, driven by the surge in Bitcoin BTC/USD prices, which reached new all-time highs over the weekend. MicroStrategy, known for its substantial Bitcoin holdings, announced raising $2 billion to purchase more Bitcoin, aligning with the cryptocurrency’s rally.

Bitcoin’s price climbed to $80,000 for the first time on Sunday and continued to rise, trading around $81,870 on Monday morning, marking an 18.5% increase over the past week. This surge follows the election of Donald Trump, who is perceived as a pro-crypto candidate, potentially creating a more favorable regulatory environment for cryptocurrencies.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From Helmerich & Payne Stock Ahead Of Q4 Earnings

Analysts expect the Tulsa, Oklahoma-based company to report quarterly earnings at 81 cents per share, up from 69 cents per share in the year-ago period. Helmerich & Payne projects to report revenue of $695.24 million for the recent quarter, compared to $659.61 million a year earlier, according to data from Benzinga Pro.

On Oct. 16, Barclays analyst David Anderson maintained Helmerich & Payne with an Equal-Weight and lowered the price target from $42 to $39.

With the recent buzz around Helmerich & Payne, some investors may be eyeing potential gains from the company’s dividends, too. Currently, Helmerich & Payne offers an annual dividend yield of 2.77%. That’s a quarterly dividend amount of 25 cents per share ($1.00 a year).

So, how can investors exploit its dividend yield to pocket a regular $500 monthly?

To earn $500 per month or $6,000 annually from dividends alone, you would need an investment of approximately $216,540 or around 6,000 shares. For a more modest $100 per month or $1,200 per year, you would need $43,308 or around 1,200 shares.

To calculate: Divide the desired annual income ($6,000 or $1,200) by the dividend ($1.00 in this case). So, $6,000 / $1.00 = 6,000 ($500 per month), and $1,200 / $1.00 = 1,200 shares ($100 per month).

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

How that works: The dividend yield is computed by dividing the annual dividend payment by the stock’s current price.

For example, if a stock pays an annual dividend of $2 and is currently priced at $50, the dividend yield would be 4% ($2/$50). However, if the stock price increases to $60, the dividend yield drops to 3.33% ($2/$60). Conversely, if the stock price falls to $40, the dividend yield rises to 5% ($2/$40).

Similarly, changes in the dividend payment can impact the yield. If a company increases its dividend, the yield will also increase, provided the stock price stays the same. Conversely, if the dividend payment decreases, so will the yield.

HP Price Action: Shares of Helmerich & Payne fell 2% to close at $36.09 on Tuesday.

Read More:

Image: Helmerich & Payne

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Nutanix Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Wednesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Evercore ISI Group analyst Eric Boyes initiated coverage on Axalta Coating Systems Ltd. AXTA with an Outperform rating and announced a price target of $47. Axalta Coating shares closed at $39.60 on Tuesday. See how other analysts view this stock.

- Oppenheimer analyst Param Singh initiated coverage on NetApp, Inc. NTAP with a Perform rating. NetApp shares closed at $120.92 on Tuesday. See how other analysts view this stock.

- Benchmark analyst Josh Sullivan initiated coverage on Airship AI Holdings, Inc. AISP with a Buy rating and announced a price target of $6. Airship AI shares closed at $3.07 on Tuesday. See how other analysts view this stock.

- RBC Capital analyst Brad Erickson initiated coverage on Jumia Technologies AG JMIA with a Sector Perform rating and announced a price target of $5. Jumia Technologies shares closed at $4.01 on Tuesday. See how other analysts view this stock.

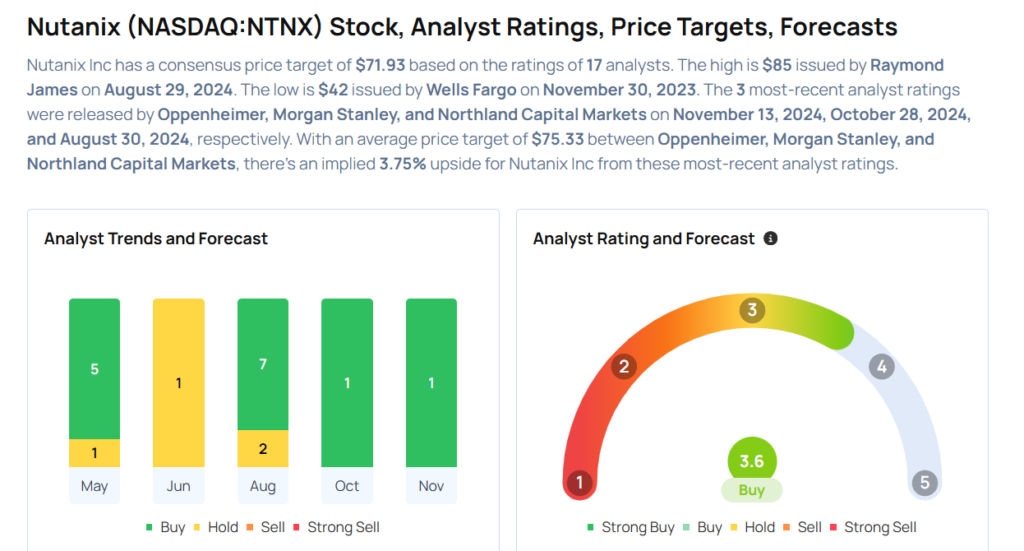

- Oppenheimer analyst Param Singh initiated coverage on Nutanix, Inc. NTNX with an Outperform rating and announced a price target of $80. Nutanix shares closed at $72.24 on Tuesday. See how other analysts view this stock.

Considering buying NTNX stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spirit Airlines Nears Bankruptcy, Creditors May Approve Equity 'Cancellation:' Here's What It Means For Investors As Shares Fall With A Thud

Shares of Spirit Airlines Inc. SAVE plunged by 62.73% in after-hours and closed nearly 5.29% lower at $3.22 apiece on Tuesday after the company failed to file its earnings for the quarter ended September 2024. The discount airline in a filing late Tuesday, said that it is in talks with its creditors to carve out a restructuring plan which could lead to the cancellation of its equity shares.

What Happened: The budget airline is in discussion with its noteholders for potential bankruptcy or out-of-court restructuring that has been underway for months. This comes after Spirit’s effort to merge with Frontier Group Holdings Inc. ULCC and its takeover by JetBlue Airways Corporation JBLU fell out.

Also read: Top Wall Street Forecasters Revamp Tower Semiconductor Price Expectations Ahead Of Q3 Earnings

Why It Matters: As the ultra-discount airline’s efforts to save itself fail, its equity holders may suffer because of the cancellation of shares. However, the company’s statement indicates that the plan that it is trying to negotiate would not hamper general unsecured creditors, employees, customers, vendors, suppliers, aircraft lessors, or the holders of its secured debt backed by aircraft.

The bondholders include the owners of about $1 billion, 8% coupon loyalty bonds which are due 2025 and $500 million in unsecured convertible bonds due 2026. This former debt is backed by claims on elements of the company’s frequent-flyer program.

Also Read: Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio In Q4

Price Action: The shares of Spirit Airlines have underperformed the NYSE Composite on a year-to-date basis as it has fallen by 80.31%, whereas the index gave a 17.88% return in the same period. The relative strength index at 40.79 shows that the stock is neither overbought nor oversold.

The consensus estimates of all the 12 analysts tracking the stock as per Nasdaq, is a “sell” with an average price target is $2.13 apiece.

Photo via Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Minto Apartment REIT Reports 2024 Third Quarter Financial Results and Announces Distribution Increase

— Strong revenue and cash flow per unit growth; Distributions increased 3.0% —

OTTAWA, ON, Nov. 12, 2024 /CNW/ – Minto Apartment Real Estate Investment Trust (the “REIT”) MI today announced its financial results for the third quarter and nine months ended September 30, 2024 (“Q3 2024” and “YTD 2024”, respectively). The Condensed Consolidated Interim Financial Statements and Management’s Discussion and Analysis (“MD&A”) for Q3 2024 and YTD 2024 are available on the REIT’s website at www.mintoapartmentreit.com and at www.sedarplus.ca.1

“Our high-quality, well-located portfolio continued to underpin strong operational performance in the third quarter. Average monthly rent increased 5.9% year-over-year for the Same Property Portfolio, average occupancy increased and NOI margins expanded to record levels,” said Jonathan Li, President and Chief Executive Officer of the REIT. “We also had growth in Normalized FFO and AFFO per unit of 8.3% and 9.6%, respectively, due in part to accretive capital allocation strategies that resulted in a 10.8% reduction in interest costs compared to Q3 last year. Our efforts to further strengthen our financial flexibility are ongoing. We will upward finance a total of four properties in Ottawa and Toronto, generating aggregate net proceeds of approximately $91 million, which will be used to pay down the revolving credit facility upon completion of each transaction.”

“Today’s announcement of a 3.0% increase in the monthly distribution underscores our positive outlook for the year ahead. The REIT has now increased distributions in six consecutive years, having done so in every year following its inception in 2018.”

|

_________________________ |

|

1 This news release contains certain non-IFRS and other financial measures. Refer to “Non-IFRS and Other Financial Measures” in this news release for a complete list of these measures and their meaning. |

Q3 2024 Highlights

- Same Property Portfolio (“SPP”) revenue was $39.8 million, an increase of 6.1% compared to the third quarter ended September 30, 2023 (“Q3 2023”) driven primarily by a 6.9% increase in unfurnished suite revenue, partially offset by lower commercial revenue due to the temporary Minto Yorkville retail vacancy;

- Total Portfolio revenue of $39.8 million was flat year over year as the sale of properties in Ottawa and Edmonton offset the increased SPP revenue;

- SPP average monthly rent was $1,969, an increase of 5.9% compared to Q3 2023;

- Average occupancy of unfurnished suites increased to 97.1%, compared to 96.9% in Q3 2023;

- SPP operating expenses increased 2.1% compared to Q3 2023 while Total Portfolio operating expenses decreased by 4.0% over the same period driven by property sales;

- The REIT executed 449 new leases, achieving an average rental rate that was 10.8% higher than the expiring rents. The gain-to-lease potential on sitting rents remains attractive at 14.8% as at September 30, 2024;

- SPP annualized turnover was 26%, slightly lower than Q3 2023;

- SPP Net Operating Income (“NOI”) increased 8.2% compared to Q3 2023 and SPP NOI margin was a record 66.2%, an increase of 130 bps from Q3 2023;

- Normalized Funds from Operations (“Normalized FFO”) were $0.2588 per unit, an increase of 8.3% from $0.2390 per unit in Q3 2023;

- Normalized Adjusted Funds from Operations (“Normalized AFFO”) were $0.2345 per unit, an increase of 9.6% compared to $0.2139 per unit in Q3 2023;

- Normalized AFFO payout ratio was 53.8%, a reduction of 350 bps compared to Q3 2023;

- Interest costs declined by 10.8% compared to Q3 2023, reflecting reduced average variable-rate debt exposure and mortgages associated with sold properties;

- Net loss and comprehensive loss was $41.9 million, compared to net income and comprehensive income of $27.8 million in Q3 2023;

- Debt-to-adjusted earnings before interest, taxes, depreciation and amortization (“Debt-to-Adjusted EBITDA”) ratio decreased to 10.79x from 11.79x at year-end 2023, and Debt-to-Gross Book Value ratio decreased by 80 bps to 42.0%;

- On September 23, 2024, the REIT published its 2023 Environmental, Social and Governance (“ESG”) Report, which highlighted the REIT’s continued progress in addressing issues that are important to its investors, employees and communities; and

- On September 25, 2024, the Toronto Stock Exchange accepted the REIT’s notice to initiate a Normal Course Issuer Bid (“NCIB”). The NCIB is active until September 26, 2025 and enables the REIT to acquire up to 3,283,584 Units, representing 5% of its issued and outstanding units. The REIT’s previous NCIB expired on September 19, 2024. The REIT did not purchase and cancel any Units during the quarter.

Strengthening the Balance Sheet Subsequent to Q3 2024

Subsequent to Q3 2024, the REIT committed to the upward financing of three properties located in Ottawa and is finalizing an upward financing for one property located in Toronto for combined net proceeds of approximately $91 million, which will be used to reduce the outstanding balance on its variable-rate revolving credit facility. The financings are expected to close in December 2024.

Financial Summary

|

($000’s except per unit and per suite amounts) |

Three months ended September 30, |

Nine months ended September 30, |

|||||

|

2024 |

2023 |

Variance |

2024 |

2023 |

Variance |

||

|

Revenue from investment properties |

$ 39,818 |

$ 39,835 |

— % |

$ 117,654 |

$ 117,639 |

— % |

|

|

Property operating costs |

7,279 |

7,438 |

2.1 % |

21,872 |

22,932 |

4.6 % |

|

|

Property taxes |

3,925 |

4,090 |

4.0 % |

11,844 |

12,015 |

1.4 % |

|

|

Utilities |

2,238 |

2,479 |

9.7 % |

8,223 |

9,556 |

13.9 % |

|

|

NOI |

$ 26,376 |

$ 25,828 |

2.1 % |

$ 75,715 |

$ 73,136 |

3.5 % |

|

|

NOI margin (%) |

66.2 % |

64.8 % |

140 bps |

64.4 % |

62.2 % |

220 bps |

|

|

Normalized NOI |

$ 26,376 |

$ 25,828 |

2.1 % |

$ 75,715 |

$ 73,266 |

3.3 % |

|

|

Normalized NOI margin (%) |

66.2 % |

64.8 % |

140 bps |

64.4 % |

62.3 % |

210 bps |

|

|

Revenue – SPP |

$ 39,818 |

$ 37,541 |

6.1 % |

$ 116,885 |

$ 110,616 |

5.7 % |

|

|

NOI – SPP |

26,376 |

24,380 |

8.2 % |

75,311 |

68,802 |

9.5 % |

|

|

NOI margin (%) – SPP |

66.2 % |

64.9 % |

130 bps |

64.4 % |

62.2 % |

220 bps |

|

|

Normalized NOI – SPP |

$ 26,376 |

$ 24,380 |

8.2 % |

$ 75,311 |

$ 68,932 |

9.3 % |

|

|

Normalized NOI margin (%) – SPP |

66.2 % |

64.9 % |

130 bps |

64.4 % |

62.3 % |

210 bps |

|

|

Interest costs |

$ 9,295 |

$ 10,420 |

10.8 % |

$ 27,736 |

$ 31,798 |

12.8 % |

|

|

Net (loss) income and comprehensive (loss) income |

(41,851) |

27,815 |

nmf2 |

(27,855) |

(39,421) |

29.3 % |

|

|

Funds from Operations (“FFO”) |

17,203 |

15,692 |

9.6 % |

$ 48,891 |

$ 39,246 |

24.6 % |

|

|

FFO per unit |

0.2620 |

0.2390 |

9.6 % |

0.7445 |

0.5978 |

24.5 % |

|

|

Adjusted Funds from Operations (“AFFO”) |

15,607 |

14,041 |

11.2 % |

44,074 |

34,162 |

29.0 % |

|

|

AFFO per unit |

0.2377 |

0.2139 |

11.1 % |

0.6712 |

0.5204 |

29.0 % |

|

|

Distribution rate per unit |

$ 0.1262 |

$ 0.1225 |

3.0 % |

$ 0.3787 |

$ 0.3675 |

3.0 % |

|

|

AFFO payout ratio |

53.1 % |

57.3 % |

420 bps |

56.4 % |

70.6 % |

1,420 bps |

|

|

Normalized FFO |

$ 16,999 |

$ 15,692 |

8.3 % |

$ 48,016 |

$ 41,353 |

16.1 % |

|

|

Normalized FFO per unit |

0.2588 |

0.2390 |

8.3 % |

0.7312 |

0.6299 |

16.1 % |

|

|

Normalized AFFO |

15,403 |

14,041 |

9.7 % |

43,199 |

36,269 |

19.1 % |

|

|

Normalized AFFO per unit |

0.2345 |

0.2139 |

9.6 % |

0.6579 |

0.5525 |

19.1 % |

|

|

Normalized AFFO payout ratio |

53.8 % |

57.3 % |

350 bps |

57.6 % |

66.5 % |

890 bps |

|

|

Average monthly rent |

$ 1,969 |

$ 1,837 |

7.2 % |

$ 1,969 |

$ 1,837 |

7.2 % |

|

|

Average monthly rent – SPP |

$ 1,969 |

$ 1,860 |

5.9 % |

1,969 |

1,860 |

5.9 % |

|

|

Closing occupancy |

97.4 % |

97.8 % |

(40) bps |

97.4 % |

97.8 % |

(40) bps |

|

|

Closing occupancy – SPP |

97.4 % |

97.8 % |

(40) bps |

97.4 % |

97.8 % |

(40) bps |

|

|

Average occupancy |

97.1 % |

96.9 % |

20 bps |

97.0 % |

97.0 % |

— bps |

|

|

Average occupancy – SPP |

97.1 % |

96.9 % |

20 bps |

97.0 % |

97.0 % |

— bps |

|

|

As at |

September 30, 2024 |

December 31, 2023 |

Variance |

|

Debt-to-Gross Book Value ratio |

42.0 % |

42.8 % |

(80) bps |

|

Debt-to-Adjusted EBITDA ratio |

10.79x |

11.79x |

(1.00)x |

|

_______________________________ |

|

2 No meaningful figure. |

Summary of Q3 2024 Operating Results

Continued Solid Growth in SPP Revenue and NOI

The REIT generated SPP NOI growth of 8.2% in Q3 2024 compared to Q3 2023, while SPP NOI margin increased by 130 bps year-over-year to a quarterly record of 66.2%. The increase in SPP NOI reflected SPP revenue growth of 6.1%, partially offset by a 2.1% increase in related property operating expenses. SPP revenue growth in Q3 2024 was driven primarily by 6.9% growth in unfurnished suite revenue due to higher average monthly rent, partially offset by lower commercial revenue due to the temporary retail vacancy at Minto Yorkville.

Normalized FFO and AFFO per unit Driven by NOI Growth and Reduced Interest Costs

Normalized FFO per unit and Normalized AFFO per unit increased by 8.3% and 9.6% in Q3 2024, respectively, compared to Q3 2023. The increases reflected NOI growth and a 10.8% reduction in interest costs compared to Q3 2023. Debt-to-Gross Book Value ratio was 42.0% at September 30, 2024, a reduction of 80 bps from 42.8% as at December 31, 2023, and Debt-to-Adjusted EBITDA ratio decreased to 10.79x from 11.79x over the same period.

NAV per unit and IFRS Net Income and Comprehensive Income

The REIT’s net asset value (“NAV”) per unit as at September 30, 2024 was $22.38, compared to $22.27 as at June 30, 2024. The increase in NAV per unit during Q3 2024 reflected strong operational results, partially offset by a non-cash fair value loss on investment properties of $2.6 million. The fair value loss on investment properties was attributable to increases in capitalization rates for select residential properties in Ottawa and Toronto and an increase to the capital expenditure reserve, partially offset by growth in forecast NOI.

The REIT recorded a non-cash fair value loss on Class B LP Units of $54.3 million in Q3 2024, reflecting an increase in the Unit price during the quarter.

The REIT reported a net loss and comprehensive loss of $41.9 million in Q3 2024, compared to net income and comprehensive income of $27.8 million in Q3 2023. The variance was primarily attributable to the non-cash fair value loss of $54.3 million on Class B LP Units noted above, compared to a gain of $35.8 million in Q3 2023.

Gain-on-Lease, Gain-to-Lease Potential, Suite Repositioning and Commercial

The REIT generated organic growth through 449 new leases signed in Q3 2024, achieving an average gain-on-lease of 10.8%. Approximately 37% of new leases signed in Toronto in Q3 2024 were at Niagara West, which is a non-rent controlled property and therefore has a lower gap between expiring rents and market rents. Excluding Niagara West, realized gain-on-lease in Q3 2024 was 14.2% in Toronto and 11.3% across the portfolio.

The REIT estimates a gain-to-lease potential of 14.8% as at September 30, 2024, representing future annualized potential revenue of $20.5 million. SPP annualized turnover was 26.0% in Q3 2024, which was slightly lower compared to Q3 2023.

The REIT repositioned a total of 16 suites across its portfolio in Q3 2024, generating an average annual unlevered return on investment of 8.8%. Management has reduced its estimate of total suite repositionings in 2024, reflecting lower turnover propensity for these suites and the strategic assessment of each repositioning. Management currently expects to reposition a total of 40 to 60 suites in 2024, compared to 116 suites in 2023. A total of 36 suites were repositioned in YTD 2024.

At Minto Yorkville in Toronto, Management continues to pursue leasing and anticipates lease payments to begin in 2026.

Maintaining a Strong Financial Position

As of September 30, 2024, the REIT had Total Debt outstanding of $1.1 billion, with a weighted average effective interest rate on Term Debt of 3.53% and a weighted average term to maturity on Term Debt of 5.33 years. Debt-to-Gross Book Value ratio was 42.0% and Debt-to-Adjusted EBITDA ratio was 10.79x.

The REIT continues to maintain a strong financial position. Total liquidity was approximately $158.8 million as at September 30, 2024, with a liquidity ratio (Total liquidity/Total Debt) of 14.4%.

Increase to Monthly Distributions

The Board of Trustees approved a $0.015 per unit or 3.0% increase to the REIT’s annual distribution, raising it from $0.5050 to $0.5200 per unit. The new monthly distribution will be $0.04333 per unit, up from the current level of $0.04208 per unit. The increase will be effective for the REIT’s November 2024 cash distribution, to be paid on December 16, 2024.

Conference Call

Management will host a conference call for analysts and investors on Wednesday, November 13, 2024 at 10:00 am ET. To join the conference call without operator assistance, participants can register and enter their phone number at https://emportal.ink/47MkF29 to receive an instant automated call back. Alternatively, they can dial 416-945-7677 or 1-888-699-1199 to reach a live operator who will join them into the call.

In addition, the call will be webcast live at:

Minto Apartment REIT Q3 2024 Earnings Webcast

A replay of the call will be available until Wednesday, November 20, 2024. To access the replay, dial 289-819-1450 or 888-660-6345 (Passcode: 12585 #). A transcript of the call will be archived on the REIT’s website.

About Minto Apartment Real Estate Investment Trust

Minto Apartment Real Estate Investment Trust is an unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario to own income-producing multi-residential properties located in urban markets in Canada. The REIT owns a portfolio of high-quality income-producing multi-residential rental properties located in Toronto, Montreal, Ottawa and Calgary. For more information on Minto Apartment REIT, please visit the REIT’s website at: https://www.mintoapartmentreit.com.

Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) relating to the business of the REIT. Forward-looking statements are identified by words such as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “estimate” and other similar expressions. These statements are based on the REIT’s expectations, estimates, forecasts and projections. The forward-looking statements in this news release are based on certain assumptions. They are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed and referenced under the heading “Risks and Uncertainties” in the REIT’s Q3 2024 management’s discussion and analysis dated November 12, 2024, which is available on SEDAR+ (www.sedarplus.ca). There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, the REIT assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-IFRS and Other Financial Measures

This news release contains certain non-IFRS and other financial measures which are measures commonly used by publicly traded entities in the real estate industry. Management believes that these metrics are useful for measuring different aspects of performance and assessing the underlying operating and financial performance on a consistent basis. However, these measures do not have a standardized meaning prescribed by IFRS Accounting Standards (“IFRS”) and are not necessarily comparable to similar measures presented by other publicly traded entities. These measures should strictly be considered supplemental in nature and not a substitute for financial information prepared in accordance with IFRS. The REIT has adopted the guidance under NI 52-112 Non-GAAP and Other Financial Measures Disclosure for the purpose of this news release. These non-IFRS and other financial measures are defined below:

- “AFFO” is defined as FFO adjusted for items such as maintenance capital expenditures and straight-line rental revenue differences. AFFO should not be construed as an alternative to net income or cash flows provided by or used in operating activities determined in accordance with IFRS. The REIT’s method of calculating AFFO may differ from other issuers’ methods and, accordingly, may not be comparable to AFFO reported by other issuers. The REIT also uses AFFO in assessing its capacity to make distributions.

- “AFFO per unit” is calculated as AFFO divided by the weighted average number of Units of the REIT and Class B limited partnership units of Minto Apartment Limited Partnership outstanding over the period. The REIT regards AFFO per unit as a key measure of operating performance.

- “AFFO payout ratio” is the proportion of per unit distributions on Units of the REIT and Class B limited partnership units of Minto Apartment Limited Partnership to AFFO per unit. The REIT uses AFFO payout ratio in assessing its capacity to make distributions.

- “annualized turnover” is calculated as the number of move-outs for the period divided by total number of unfurnished suites in the portfolio. This percentage is extrapolated to determine an annual rate.

- “average annual unlevered return” refers to the return on repositioning activities, and is calculated by dividing the average annual rental increase per suite after repositioning by the average repositioning cost per suite, excluding the impact of financing costs.

- “average monthly rent” represents the average monthly rent per suite for occupied unfurnished suites at the end of the period.

- “average occupancy” is defined as the ratio of occupied unfurnished suites to the weighted average of the total unfurnished suites in the portfolio for the period.

- “Debt-to-Adjusted EBITDA ratio” is calculated by dividing interest-bearing debt (net of cash) by Adjusted EBITDA. Adjusted EBITDA is a non-IFRS financial measure and used for evaluation of the REIT’s financial health and liquidity. Adjusted EBITDA is calculated as the trailing twelve-month NOI adjusted for a full year of stabilized earnings including finance income, fees and other income and general and administrative expenses from recently completed acquisitions or dispositions, but excluding fair value adjustments. The REIT regards Debt-to-Adjusted EBITDA ratio as a measure of financial health and liquidity.

- “Debt-to-Gross Book Value ratio” is calculated by dividing total interest-bearing debt consisting of fixed and variable-rate mortgages, credit facilities, construction loans and Class C limited partnership units of Minto Apartment Limited Partnership by Gross Book Value and is used as the REIT’s primary measure of its leverage.

- “FFO” is defined as IFRS consolidated net income adjusted for items such as unrealized changes in the fair value of investment properties, effects of puttable instruments classified as financial liabilities and changes in fair value of financial instruments and derivatives. FFO should not be construed as an alternative to net income or cash flows provided by or used in operating activities determined in accordance with IFRS. The REIT’s method of calculating FFO may differ from other issuers’ methods and, accordingly, may not be comparable to FFO reported by other issuers.

- “FFO per unit” is calculated as FFO divided by the weighted average number of Units of the REIT and Class B limited partnership units of Minto Apartment Limited Partnership outstanding over the period. The REIT regards FFO per unit as a key measure of operating performance.

- “gain-on-lease” refers to the gap between rents achieved on new leases of unfurnished suites as compared to the expiring leases.

- “gain-to-lease potential” refers to the gap between Management’s estimate of monthly market rent and average monthly in-place rent per occupied unfurnished suite.

- “Gross Book Value” is defined as the total assets of the REIT as at the applicable balance sheet date.

- “interest costs” are calculated as the sum of costs incurred on mortgages, credit facility, and Class C limited partnership units of Minto Apartment Limited Partnership and excludes debt retirement costs.

- “NAV” is calculated as the sum of the value of REIT Unitholders’ equity and Class B limited partnership units of Minto Apartment Limited Partnership as at the balance sheet date.

- “NAV per unit” is calculated by dividing NAV by the number of Units of the REIT and Class B limited partnership units of Minto Apartment Limited Partnership outstanding as at the applicable balance sheet date.

- “NOI” is defined as revenue from investment properties less property operating costs, property taxes and utilities (collectively referred to as “property operating expenses” or “operating expenses”) prepared in accordance with IFRS. NOI should not be construed as an alternative to net income determined in accordance with IFRS. The REIT’s method of calculating NOI may differ from other issuers’ methods and, accordingly, may not be comparable to NOI reported by other issuers. It is a key input in determining the value of the REIT’s properties.

- “NOI margin” is defined as NOI divided by revenue from investment properties.

- “Normalized AFFO” is calculated as AFFO net of nonrecurring items that occurred during the period which are not indicative of the REIT’s typical operating results.

- “Normalized AFFO per unit” is calculated as Normalized AFFO divided by the weighted average number of Units of the REIT and Class B limited partnership units of Minto Apartment Limited Partnership outstanding over the period.

- “Normalized AFFO payout ratio” is the proportion of the per unit distributions on Units of the REIT and Class B limited partnership units of Minto Apartment Limited Partnership to normalized AFFO per unit.

- “Normalized FFO per unit” is calculated as Normalized FFO divided by the weighted average number of Units of the REIT and Class B limited partnership units of Minto Apartment Limited Partnership outstanding over the period.

- “Normalized NOI” is calculated as NOI net of nonrecurring items that occurred during the period which are not indicative of the REIT’s typical operating results.

- “Normalized NOI margin” is defined as Normalized NOI divided by revenue from investment properties.

- “Normalized operating expenses” are calculated as operating expenses net of nonrecurring items that occurred during the period which are not indicative of the REIT’s typical operating results.

- “Term Debt” is calculated as the sum of the amortized cost of fixed rate mortgages, a variable-rate mortgage fixed through an interest rate swap and Class C LP Units.

- “Total Debt” is calculated as the sum of the amortized cost of interest-bearing debt consisting of a variable-rate credit facility and fixed rate debt comprised of mortgages, a variable-rate mortgage fixed through an interest rate swap, Class C LP Units, and the construction loan.

- “Total liquidity” is calculated as the sum of the undrawn balance under the revolving credit facility and cash.

- “weighted average effective interest rate on Term Debt” is calculated as the weighted average of the effective interest rates on the outstanding balances of fixed rate mortgages, a variable-rate mortgage fixed through an interest rate swap and Class C limited partnership units of Minto Apartment Limited Partnership.

- “weighted average term to maturity on Term Debt” is calculated as the weighted average of the term to maturity on the outstanding fixed rate mortgages, a variable-rate mortgage fixed through an interest rate swap and Class C limited partnership units of Minto Apartment Limited Partnership.

Reconciliations of Non-IFRS Financial Measures and Ratios

FFO and AFFO

|

Three months ended September 30, |

Nine months ended September 30, |

||||

|

($000’s except unit and per unit amounts) |

2024 |

2023 |

2024 |

2023 |

|

|

Net (loss) income and comprehensive (loss) income |

$ (41,851) |

$ 27,815 |

$ (27,855) |

$ (39,421) |

|

|

Distributions on Class B LP Units |

377 |

3,155 |

6,880 |

9,464 |

|

|

Disposition costs on investment property |

— |

— |

615 |

348 |

|

|

Fair value loss (gain) on: |

|||||

|

Investment properties |

2,582 |

21,216 |

49,547 |

80,419 |

|

|

Class B LP Units |

54,343 |

(35,799) |

18,286 |

(10,817) |

|

|

Interest rate swap |

766 |

(73) |

1,041 |

(319) |

|

|

Unit-based compensation |

986 |

(622) |

377 |

(428) |

|

|

Funds from operations (FFO) |

17,203 |

15,692 |

48,891 |

39,246 |

|

|

Maintenance capital expenditure reserve |

(1,514) |

(1,510) |

(4,567) |

(4,540) |

|

|

Amortization of mark-to-market adjustments |

(74) |

(141) |

(219) |

(544) |

|

|

Commercial straight-line rent adjustments |

(8) |

— |

(31) |

— |

|

|

Adjusted funds from operations (AFFO) |

15,607 |

14,041 |

44,074 |

34,162 |

|

|

Weighted average number of Units and Class B LP Units issued and outstanding |

65,671,690 |

65,651,608 |

65,666,944 |

65,645,663 |

|

|

FFO per unit |

$ 0.2620 |

$ 0.2390 |

$ 0.7445 |

$ 0.5978 |

|

|

AFFO per unit |

$ 0.2377 |

$ 0.2139 |

$ 0.6712 |

$ 0.5204 |

|

|

Distribution rate per unit |

$ 0.1262 |

$ 0.1225 |

$ 0.3787 |

$ 0.3675 |

|

|

AFFO payout ratio |

53.1 % |

57.3 % |

56.4 % |

70.6 % |

|

Normalized FFO and AFFO

|

Three months ended September 30, |

Nine months ended September 30, |

||||

|

($000’s except unit and per unit amounts) |

2024 |

2023 |

2024 |

2023 |

|

|

FFO |

$ 17,203 |

$ 15,692 |

$ 48,891 |

$ 39,246 |

|

|

AFFO |

15,607 |

14,041 |

44,074 |

34,162 |

|

|

Normalizing items for NOI |

— |

— |

— |

130 |

|

|

Debt retirement costs |

— |

— |

— |

1,779 |

|

|

Property investigation cost write-offs |

— |

— |

— |

417 |

|

|

Insurance recoveries |

(204) |

— |

(875) |

(219) |

|

|

(204) |

— |

(875) |

2,107 |

||

|

Normalized FFO |

$ 16,999 |

$ 15,692 |

48,016 |

41,353 |

|

|

Normalized FFO per unit |

$ 0.2588 |

$ 0.2390 |

0.7312 |

0.6299 |

|

|

Normalized AFFO |

15,403 |

14,041 |

43,199 |

36,269 |

|

|

Normalized AFFO per unit |

$ 0.2345 |

$ 0.2139 |

$ 0.6579 |

$ 0.5525 |

|

|

Normalized AFFO payout ratio |

53.8 % |

57.3 % |

57.6 % |

66.5 % |

|

NOI and NOI Margin

Same Property Portfolio

|

($000’s) |

Three months ended September 30, |

Nine months ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

||

|

Revenue from investment properties |

$ 39,818 |

$ 37,541 |

$ 116,885 |

$ 110,616 |

|

|

Operating expenses |

13,442 |

13,161 |

41,574 |

41,814 |

|

|

NOI |

$ 26,376 |

$ 24,380 |

$ 75,311 |

$ 68,802 |

|

|

NOI margin |

66.2 % |

64.9 % |

64.4 % |

62.2 % |

|

|

Normalizing items for NOI |

|||||

|

Severance costs |

$ — |

$ — |

$ — |

$ 256 |

|

|

Property tax recovery |

— |

— |

— |

(126) |

|

|

— |

— |

— |

130 |

||

|

Normalized NOI |

$ 26,376 |

$ 24,380 |

$ 75,311 |

$ 68,932 |

|

|

Normalized NOI margin |

66.2 % |

64.9 % |

64.4 % |

62.3 % |

|

Total Portfolio

|

($000’s) |

Three months ended September 30, |

Nine months ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

||

|

Revenue from investment properties |

$ 39,818 |

$ 39,835 |

$ 117,654 |

$ 117,639 |

|

|

Operating expenses |

13,442 |

14,007 |

41,939 |

44,503 |

|

|

NOI |

$ 26,376 |

$ 25,828 |

$ 75,715 |

$ 73,136 |

|

|

NOI margin |

66.2 % |

64.8 % |

64.4 % |

62.2 % |

|

|

Normalizing items for NOI |

|||||

|

Severance costs |

$ — |

$ — |

$ — |

$ 256 |

|

|

Property tax recovery |

— |

— |

— |

(126) |

|

|

— |

— |

— |

130 |

||

|

Normalized NOI |

$ 26,376 |

$ 25,828 |

$ 75,715 |

$ 73,266 |

|

|

Normalized NOI margin |

66.2 % |

64.8 % |

64.4 % |

62.3 % |

|

NAV and NAV per unit

|

($000’s except unit and per unit amounts) |

As at |

||

|

September 30, 2024 |

June 30, 2024 |

December 31, 2023 |

|

|

Net assets (Unitholders’ equity) |

$ 1,034,668 |

$ 1,081,559 |

$ 1,077,381 |

|

Add: Class B LP Units |

435,002 |

380,659 |

416,716 |

|

NAV |

$ 1,469,670 |

$ 1,462,218 |

$ 1,494,097 |

|

Number of Units and Class B LP Units |

65,671,690 |

65,671,690 |

65,653,641 |

|

NAV per unit |

$ 22.38 |

$ 22.27 |

$ 22.76 |

SOURCE Minto Apartment Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/12/c4735.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/12/c4735.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Taiwan Design Research Institute (TDRI) Highlights Global Collaborations at San Diego World Design Capital Forum

TAIPEI, Nov. 13, 2024 /PRNewswire/ — Taiwan Design Research Institute (TDRI) participated in the 2024 World Design Capital (WDC) event, held from November 11-15 in San Diego, USA. As WDC’s first cross-border event, San Diego and Tijuana co-hosted under the theme “Beyond Boundaries – Design a Better World,” highlighting human-centered design and international collaboration. TDRI joined global design leaders to explore how design can foster urban and social innovation.

During the event, TDRI hosted “Taipei Night” at the InterContinental San Diego, gathering design experts worldwide in a vibrant evening against California’s skyline to showcase TDRI’s efforts in global design collaboration. TDRI also signed Memorandums of Understanding (MoUs) with the Industrial Designers Society of America (IDSA), UC San Diego, The Design Academy, and Mexico’s CETYS Universidad, underscoring its commitment to cross-disciplinary innovation.

Prominent attendees included New Taipei City’s Deputy Secretary-General Kung, Ya-Wen, Mai Nguyen of UC San Diego’s The Design Lab, designers Patricia Moore and Don Norman, WDO President Thomas Garvey, and officials from Los Angeles’ Economic and Cultural Office. Representatives from WDC 2024, 2026FRM, and institutions including UC San Diego and CETYS Universidad, as well as leaders from the San Diego government, AI industries, and the Philippines official delegation, enriched this gathering. Through these engagements, TDRI fostered a robust platform for sharing insights within the international design community.

A major highlight was TDRI participated in WDC 2024 Beyond Boundaries Design Policy Conference, where Vice president of R&D Shyhnan LIOU presenting its research on the Contextualizing: City Design Power Index Model. The institute engaged in discussions with experts from the United States, the Philippines, the United Kingdom, and Germany, showcasing Taiwan’s design prowess on the global stage.

TDRI also attended the Don Norman Design Award ceremony, recognizing TDRI’s contributions to the global design community and its dedication to showcasing Taiwan’s design excellence.

Representing WDC 2016 Taipei, TDRI and Deputy Secretary-General Kung also participated in the City Network Meeting, sharing Taipei’s achievements in sustainable development, urban regeneration, and quality of life. Highlighting recent TDRI initiatives, they emphasized design’s role in public service and social innovation. New Taipei City shared examples of urban improvements achieved through design, strengthening Taiwan’s position in global urban design.

Through these initiatives, TDRI promotes impactful knowledge exchange, aiming to drive transformative design projects across industries. TDRI will continue exploring new collaborative opportunities to leverage design’s power in making a positive impact on society.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/taiwan-design-research-institute-tdri-highlights-global-collaborations-at-san-diego-world-design-capital-forum-302303921.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/taiwan-design-research-institute-tdri-highlights-global-collaborations-at-san-diego-world-design-capital-forum-302303921.html

SOURCE Taiwan Design Research Institute

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

True North Commercial REIT Reports Q3-2024 Results

Completed 138,900 square feet leased/renewed with a weighted average lease term of 6.9 years, leasing spread of 0.9% and achieved normalized same property NOI growth of 1.5% during Q3-2024

REIT to continue accretive trust units repurchase strategy

/NOT FOR DISTRIBUTION IN THE U.S. OR OVER U.S. NEWSWIRES/

TORONTO, Nov. 12, 2024 /CNW/ – True North Commercial Real Estate Investment Trust TNT (the “REIT”) today announced its financial results for the three months ended September 30, 2024 (“Q3-2024”) and nine months ended September 30, 2024 (“YTD-2024”).

“Q3-2024 saw continued strength in leasing activity by the REIT highlighting its commitment to maintaining strong relationships with tenants which translated into reported occupancy within it’s core portfolio of 93% and normalized same property net operating income growth of 1.5% for the quarter,” stated Daniel Drimmer, the REIT’s Chief Executive Officer. “The REIT continues to focus on maintaining occupancy levels, strengthening its financial position through the sale of non-core assets and also expects to continue the accretive normal course issuer bid repurchase program until the release of the Q4-2024 results in March 2025 at which point the REIT will evaluate the various options for allocation of its capital including the 2024 NCIB and the reinstatement of a distribution as operating and capital market conditions improve.”

On November 24, 2023 the REIT executed a consolidation of its trust units (“Units”), special voting Units of the REIT and the class B Limited Partnership Units of the REIT (“Class B LP Units”) on the basis of 5.75:1 (“Unit Consolidation”). All Unit and per Unit amounts noted within have been retroactively adjusted to reflect the Unit Consolidation. The REIT’s presentation currency is the Canadian dollar. Unless otherwise stated, dollar amounts expressed in this press release are in thousands of dollars.

Q3-2024 Highlights

- The REIT’s core portfolio occupancy(1) excluding assets held for sale as at September 30, 2024 was approximately 93% which remained above average occupancy for the markets in which the REIT operates. The REIT also had a weighted average lease term (“WALT”)(1) of 4.3 years excluding investment properties held for sale.

- The REIT contractually leased and renewed approximately 138,900 square feet with a WALT of 6.9 years with positive leasing spreads on renewals reported at 0.9% for the quarter.

- The REIT’s Q3-2024 revenue and net operating income (“NOI”)(1) decreased relative to the same period in 2023 by 7% and 10%, respectively (YTD-2024 – 4% and 9%, respectively), primarily due to the disposition activity in 2023 and 2024 (the “Primary Variance Drivers”), which was partially offset by Q3-2024 normalized same property NOI (“Same Property NOI”)(1) growth of 1.5%. The normalized Same Property NOI growth was primarily due to the REIT maintaining stable occupancy relative to Q3-2023 at approximately 93% (excluding held for sale properties) as well as contractual rent increases.

- Funds from operations (“FFO”)(1) and adjusted funds from operations (“AFFO”)(1) decreased $1,237 and $588, respectively when compared to the same period in 2023 primarily due to the Primary Variance Drivers and reduction in occupancy for the REIT’s held for sale properties, which was partially offset by strong Same Property NOI growth.

- FFO basic and diluted per Unit decreased from $0.63 in Q3-2023 to $0.61, whereas AFFO basic and diluted per Unit increased from $0.61 to $0.64 relative to Q3-2023.

- The REIT had $63.8 million of available funds(1) at the end of Q3-2024 representing an increase of $18,458 from Q4-2023, primarily due to the disposition of non-core assets during YTD-2024 as well as the amendment of the REIT’s credit facility.

|

(1) This is a non-IFRS financial measure, refer to “Non-IFRS Financial Measures”. |

- From the commencement of the normal course issuer bid (“NCIB”) on April 18, 2024 (the “2024 NCIB”) to the date of this filing, the REIT had repurchased and cancelled 595,326 Units for $5,669 at a weighted average price of $9.52 per Unit under the 2024 NCIB which represented an inferred distribution yield of approximately 17.9%(1).

- During Q3-2024, the REIT also completed the refinancing of $15,516 of first mortgages at a weighted average interest rate of 4.95%. The REIT is also focused on renewing the remaining 2024 debt maturities with large Canadian financial institutions with whom the REIT and their asset manager have strong relationships.

YTD Highlights

- Contractually leased and renewed approximately 432,100 square feet with a WALT of 6.3 years and a 1.6% decrease over expiring base rents. The lower leasing spread in YTD-2024 was primarily due to a specific tenant lease entered into at 6925 Century Avenue in Q2-2024. Excluding the impact of one tenant renewal at 6925 Century Avenue, the REIT had positive renewal spreads of 3.2% for YTD-2024.

- Continued the NCIB with YTD-2024 completing the repurchase of 784,420 Units for $7,220 under the 2023 NCIB and 595,326 Units for cash of $5,669 under 2024 NCIB at a weighted average price of $9.52 per Unit and representing a combined inferred distribution yield of 18.4%.

Subsequent Events

- The REIT intends to continue the accretive purchase of Units under the 2024 NCIB until the release of the Q4-2024 results in March of 2025 at which point the REIT will evaluate the various options for allocation of its capital including the 2024 NCIB and the reinstatement of a distribution as operating and capital market conditions improve.

Key Performance Indicators

|

Three months ended |

Nine months ended |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Number of properties(2) |

40 |

44 |

|||

|

Portfolio gross leasable area (“GLA”)(2) |

4,619,600 sf |

4,791,500 sf |

|||

|

Occupancy(2)(3) |

93 % |

93 % |

|||

|

Remaining WALT(2)(3) |

4.3 years |

4.4 years |

|||

|

Revenue from government and credit rated tenants(2) |

76 % |

78 % |

|||

|

Revenue |

$ 30,437 |

$ 32,789 |

$ 95,226 |

$ 99,337 |

|

|

NOI |

16,257 |

18,082 |

50,364 |

55,202 |

|

|

Net loss and comprehensive loss |

(3,383) |

(42,472) |

(5,793) |

(34,684) |

|

|

Same Property NOI |

19,820 |

19,195 |

59,288 |

57,194 |

|

|

FFO |

$ 9,114 |

$ 10,351 |

$ 27,894 |

$ 31,770 |

|

|

FFO per Unit – basic(4) |

0.61 |

0.63 |

1.82 |

1.93 |

|

|

FFO per Unit – diluted(4) |

0.61 |

0.63 |

1.82 |

1.93 |

|

|

AFFO |

$ 9,513 |

$ 10,101 |

$ 28,671 |

$ 31,148 |

|

|

AFFO per Unit – basic(4) |

0.64 |

0.61 |

1.87 |

1.89 |

|

|

AFFO per Unit – diluted(4) |

0.64 |

0.61 |

1.87 |

1.89 |

|

|

AFFO payout ratio – diluted(4) |

— % |

69 % |

— % |

83 % |

|

|

Distributions declared |

$ — |

$ 7,012 |

$ — |

$ 25,731 |

|

|

(1) Estimated using the $1.70775 per Unit distribution prior to reallocating funds used for distributions to the NCIB and the average market price the REIT repurchased Units at under the NCIB up to the date of this filing. |

|

(2) This is presented as at the end of the applicable reporting period, rather than for the quarter. |

|

(3) Excluding assets held for sale. |

|

(4) This is a non-IFRS financial measure, refer to “Non-IFRS Financial Measures”. |

Operating Results

The REIT’s Q3-2024 revenue and NOI decreased relative to the same period in 2023 by 7% and 10%, respectively (YTD-2024 – 4% and 9%, respectively), primarily due to the disposition activity in 2023 and 2024 (the “Primary Variance Drivers”), which was partially offset by Q3-2024 normalized Same Property NOI growth of 1.5%. The normalized Same Property NOI growth was primarily due to the REIT maintaining stable occupancy relative to Q3-2023 at approximately 93% (excluding held for sale properties) as well as contractual rent increases.

Q3-2024 FFO and AFFO decreased by $1,237 and $588, respectively when compared to the same period in 2023 primarily due to the Primary Variance Drivers and the reduction in occupancy for the REIT’s held for sale properties, which was partially offset by strong Same Property NOI growth. YTD-2024 FFO and AFFO decrease was $3,876 and $2,477, respectively due to the same factors as outlined for Q3-2024. Same property interest costs (excluding the impact of properties’ disposed during 2023 and 2024) remained relatively stable with the REIT’s weighted average interest rate declining from approximately 4.03% in Q3-2023 to 3.90% during Q3-2024 primarily as a result of the repayment of first mortgages on the properties disposed during 2023 and 2024 which carried a higher weighted average interest rate. During Q3-2024, the REIT also completed the refinancing of $15,516 of first mortgages at a weighted average interest rate of 4.95%. The REIT is also focused on renewing the remaining 2024 debt maturities with large Canadian financial institutions with whom the REIT and their asset manager have strong relationships.

Q3-2024 FFO basic and diluted per Unit decreased from $0.63 in Q3-2023 to $0.61, whereas AFFO basic and diluted per Unit increased from $0.61 to $0.64 over the comparable period. YTD-2024 FFO and AFFO basic and diluted per Unit decreased $0.11 and $0.02 to $1.82 and $1.87, respectively, compared to YTD-2023, primarily due to the factors described above for FFO and AFFO partially offset by the reduction in the number of Units repurchased under NCIB program.

Same Property NOI

|

As at September 30 |

Three months ended |

|||||||||

|

Occupancy(1) |

2024 |

2023 |

NOI |

2024 |

2023 |

Variance |

Variance % |

|||

|

Alberta |

93.3 % |

93.1 % |

Alberta |

$ 3,216 |

$ 2,976 |

$ 240 |

8.1 % |

|||

|

British Columbia |

100.0 % |

100.0 % |

British Columbia |

795 |

776 |

19 |

2.4 % |

|||

|

New Brunswick |

87.9 % |

85.8 % |

New Brunswick |

1,320 |

1,297 |

23 |

1.8 % |

|||

|

Nova Scotia |

86.1 % |

89.5 % |

Nova Scotia |

1,303 |

1,776 |

(473) |

(26.6) % |

|||

|

Ontario |

94.7 % |

94.1 % |

Ontario |

12,770 |

11,754 |

1,016 |

8.6 % |

|||

|

Total |

93.1 % |

92.8 % |

$ 19,404 |

$ 18,579 |

$ 825 |

4.4 % |

||||

Q3-2024 Same Property NOI increased by 4% (YTD-2024 – 8%) compared to the same period in 2023 which normalized to exclude the impact of termination income and free rent credits in both periods would have been 1.5% primarily as a result of contractual rent increases. Q3-2024 Same Property NOI included termination income of approximately $46 (Q3-2023 – $404) and free rent credits of $76 (Q3-2023 – $981) for certain tenants in the REIT’s Ontario portfolio.

Q3-2024 Alberta Same Property NOI increased by 8% primarily attributable to the slight increase in occupancy from Q3-2023 to Q3-2024 as well as the impact of contractual rent increases at certain properties. Q3-2024 British Columbia Same Property NOI increased by 2% primarily as a result of stable occupancy and contractual rent increases.

Q3-2024 New Brunswick Same Property NOI increased by 2% relative to Q3-2023 as a result of the increase in occupancy resulting from strong leasing activity in late 2023. Same Property NOI in Nova Scotia decreased due to lower occupancy from certain tenants not renewing upon lease maturity in Q4-2023 which was partially offset by contractual rent increases and new lease commencements.

Q3-2024 Ontario Same Property NOI increased by 9% relative to Q3-2023 primarily due to new leases that commenced throughout 2023 and 2024 on previously vacant space in the GTA, higher rental revenue from a property in the Ottawa portfolio due to the free rent provided to the tenant in 2023 as part of the new lease term that commenced in 2023, partially offset by lower income in the rest of Ontario from the early termination of a tenant in 2023. Normalized Q3-2024 Ontario Same Property NOI growth (excluding the impact of termination income and free rent amounts in both periods) would have been 3.3%.

|

(1) Excluding assets held for sale. |

Debt and Liquidity

|

September 30, |

December 31, |

||

|

Indebtedness to GBV ratio(1) |

61.0 % |

61.9 % |

|

|

Interest coverage ratio(1) |

2.20 x |

2.30 x |

|

|

Indebtedness(1) – weighted average fixed interest rate |

3.94 % |

3.90 % |

|

|

Indebtedness(1) – weighted average term to maturity |

2.39 years |

3.01 years |

At the end of Q3-2024, the REIT had access to available funds of approximately $63,804, and a weighted average term to maturity of 2.39 years in its mortgage portfolio with a weighted average fixed interest rate of 3.94%.

About the REIT

The REIT is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario. The REIT currently owns and operates a portfolio of 40 commercial properties consisting of approximately 4.6 million square feet in urban and select strategic secondary markets across Canada focusing on long term leases with government and credit rated tenants.

The REIT is focused on growing its portfolio principally through acquisitions across Canada and such other jurisdictions where opportunities exist. Additional information concerning the REIT is available at www.sedarplus.ca or the REIT’s website at www.truenorthreit.com.

Non-IFRS measures

Certain terms used in this press release such as FFO, AFFO, FFO and AFFO payout ratios, NOI, Same Property NOI, indebtedness (“Indebtedness”), gross book value (“GBV”), Indebtedness to GBV ratio, net earnings before interest, tax, depreciation and amortization and fair value gain (loss) on financial instruments and investment properties (“Adjusted EBITDA”), interest coverage ratio, net asset value (“NAV”) per Unit, Available Funds, occupancy and WALT are not measures defined by International Financial Reporting Standards (“IFRS”) as prescribed by the International Accounting Standards Board, do not have standardized meanings prescribed by IFRS and should not be compared to or construed as alternatives to profit/loss, cash flow from operating activities or other measures of financial performance calculated in accordance with IFRS. FFO, AFFO, FFO and AFFO payout ratios, NOI, Same Property NOI, Indebtedness, GBV, Indebtedness to GBV ratio, Adjusted EBITDA, interest coverage ratio, adjusted cash provided by operating activities, Available Funds, occupancy and WALT as computed by the REIT may not be comparable to similar measures presented by other issuers. The REIT uses these measures to better assess the REIT’s underlying performance and provides these additional measures so that investors may do the same. Details on non-IFRS measures are set out in the REIT’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2024 and the Annual Information Form are available on the REIT’s profile at www.sedarplus.ca.

Reconciliation of Non-IFRS financial measures

The following tables reconcile the non-IFRS financial measures to the comparable IFRS measures for the three and nine months ended September 30, 2024 and 2023. These non-IFRS financial measures do not have any standardized meanings prescribed by IFRS and may not be comparable to similar measures presented by other issuers.

NOI

The following table calculates the REIT’s NOI, a non-IFRS financial measure:

|

Three months ended |

Nine months ended |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Revenue |

$ 30,437 |

$ 32,789 |

$ 95,226 |

$ 99,337 |

|

|

Expenses: |

|||||

|

Property operating |

(9,363) |

(9,699) |

(30,041) |

(28,800) |

|

|

Realty taxes |

(4,817) |

(5,008) |

(14,821) |

(15,335) |

|

|

NOI |

$ 16,257 |

$ 18,082 |

$ 50,364 |

$ 55,202 |

|

|

(1) This is a non-IFRS financial measure, refer to “Non-IFRS Financial Measures”. |

Same Property NOI

Same Property NOI is measured as the NOI for the properties owned and operated by the REIT for the current and comparative period. The following table reconciles the REIT’s Same Property NOI to NOI:

|

Three months ended |

Nine months ended |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Number of properties |

40 |

40 |

40 |

40 |

|

|

Revenue |

$ 30,415 |

$ 31,000 |

$ 92,761 |

$ 92,731 |

|

|

Expenses: |

|||||

|

Property operating |

(9,303) |

(9,113) |

(29,212) |

(26,942) |

|

|

Realty taxes |

(4,817) |

(4,843) |

(14,523) |

(14,409) |

|

|

$ 16,295 |

$ 17,044 |

$ 49,026 |

$ 51,380 |

||

|

Add: |

|||||

|

Amortization of leasing costs and tenant inducements |

2,521 |

2,393 |

7,385 |

6,588 |

|

|

Straight-line rent |

1,004 |

(242) |

2,877 |

(774) |

|

|

Same Property NOI |

$ 19,820 |

$ 19,195 |

$ 59,288 |

$ 57,194 |

|

|

Less: properties held for sale included in the above |

416 |

616 |

1,154 |

3,358 |

|

|

Same Property NOI excluding investment properties held for sale |

$ 19,404 |

$ 18,579 |

$ 58,134 |

$ 53,836 |

|

|

Reconciliation to condensed consolidated interim financial statements: |

|||||

|

Acquisition, dispositions and investment properties held for sale |

379 |

1,705 |

2,536 |

7,391 |

|

|

Amortization of leasing costs and tenant inducements |

(2,521) |

(2,428) |

(7,402) |

(6,735) |

|

|

Straight-line rent |

(1,005) |

226 |

(2,904) |

710 |

|

|

NOI |

$ 16,257 |

$ 18,082 |

$ 50,364 |

$ 55,202 |

|

FFO and AFFO

The following table reconciles the REIT’s FFO and AFFO to net loss and comprehensive loss, for the three and nine months ended September 30, 2024 and 2023:

|

Three months ended |

Nine months ended |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Net loss and comprehensive loss |

$ (3,383) |

$ (42,472) |

$ (5,793) |

$ (34,684) |

|

|

Add (deduct): |

|||||

|

Fair value adjustment of Unit-based compensation |

192 |

(54) |

300 |

(486) |

|

|

Fair value adjustment of investment properties and investment properties held for sale |

6,236 |

50,087 |

20,837 |

68,391 |

|

|

Fair value adjustment of Class B LP Units |

2,006 |

(584) |

1,358 |

(9,179) |

|

|

Transaction costs on sale of investment properties |

— |

1,131 |

1,969 |

1,375 |

|

|

Distributions on Class B LP Units |

— |

181 |

— |

679 |

|

|

Unrealized loss (gain) on change in fair value of derivative instruments |

1,542 |

(366) |

1,821 |

(1,061) |

|

|

Amortization of leasing costs and tenant inducements |

2,521 |

2,428 |

7,402 |

6,735 |

|

|

FFO |

$ 9,114 |

$ 10,351 |

$ 27,894 |

$ 31,770 |

|

|

Add (deduct): |

|||||

|

Unit-based compensation expense |

129 |

114 |

124 |

446 |

|

|

Amortization of financing costs |

421 |

329 |

1,266 |

1,071 |

|

|

Rent supplement |

— |

743 |

— |

2,228 |

|

|

Amortization of mortgage discounts |

(7) |

(8) |

(23) |

(25) |

|

|

Instalment note receipts |

12 |

13 |

36 |

41 |

|

|

Straight-line rent |

1,005 |

(226) |

2,904 |

(710) |

|

|

Capital reserve |

(1,161) |

(1,215) |

(3,530) |

(3,673) |

|

|

AFFO |

$ 9,513 |

$ 10,101 |

$ 28,671 |

$ 31,148 |

|

|

FFO per Unit: |

|||||

|

Basic |

$0.61 |

$0.63 |

$1.82 |

$1.93 |

|

|

Diluted |

0.61 |

0.63 |

1.82 |

1.93 |

|

|

AFFO per Unit: |

|||||

|

Basic |

$ 0.64 |

$ 0.61 |

$ 1.87 |

$ 1.89 |

|

|

Diluted |

0.64 |

0.61 |

1.87 |

1.89 |

|

|

AFFO payout ratio: |

|||||

|

Basic |

— % |

69 % |

— % |

83 % |

|

|

Diluted |

— % |

69 % |

— % |

83 % |

|

|

Distributions declared |

$ — |

$ 7,012 |

$ — |

$ 25,731 |

|

|

Weighted average Units outstanding (000s): |

|||||

|

Basic |

14,880 |

16,429 |

15,350 |

16,439 |

|

|

Add: |

|||||

|

Unit options and incentive Units |

15 |

6 |

13 |

5 |

|

|

Diluted |

14,895 |

16,463 |

15,363 |

16,467 |

|

Indebtedness to GBV Ratio

The table below calculates the REIT’s Indebtedness to GBV ratio as at September 30, 2024 and December 31, 2023. The Indebtedness to GBV ratio is calculated by dividing the Indebtedness by GBV:

|

September 30, |

December 31, |

||

|

Total assets |

$ 1,254,456 |

$ 1,323,672 |

|

|

Deferred financing costs |

6,826 |

6,976 |

|

|

GBV(1) |

1,261,282 |

1,330,648 |

|

|

Mortgages payable |

745,545 |

797,393 |

|

|

Credit Facility |

20,870 |

23,600 |

|

|

Unamortized financing costs and mark to market mortgage adjustments |

2,382 |

3,289 |

|

|

Indebtedness |

$ 768,797 |

$ 824,282 |

|

|

Indebtedness to GBV ratio |

61.0 % |

61.9 % |

|

(1) This is a non-IFRS financial measure, refer to “Non-IFRS Financial Measures”. |

Adjusted EBITDA

The table below reconciles the REIT’s Adjusted EBITDA(1) to net loss and comprehensive loss for twelve month period ended September 30, 2024 and 2023:

|

Twelve months ended |

|||

|

2024 |

2023 |

||

|

Net loss and comprehensive loss |

$ (11,730) |

$ (56,589) |

|

|

Add (deduct): |

|||

|

Interest expense |

32,620 |

32,055 |

|

|

Fair value adjustment of Unit-based compensation |

215 |

(479) |

|

|

Transaction costs on sale of investment properties |

1,970 |

1,375 |

|

|

Fair value adjustment of investment properties and investment properties held for sale |

32,651 |

100,194 |

|

|

Fair value adjustment of Class B LP Units |

402 |

(8,724) |

|

|

Distributions on Class B LP Units |

60 |

1,054 |

|

|

Unrealized loss (gain) on change in fair value of derivative instruments |

4,040 |

(1,143) |

|

|

Amortization of leasing costs, tenant inducements, mortgage premium and financing costs |

11,488 |

10,175 |

|

|

Adjusted EBITDA |

$ 71,716 |

$ 77,918 |

|

Interest Coverage Ratio

The table below calculates the REIT’s interest coverage ratio for the twelve month period ended September 30, 2024 and 2023. The interest coverage ratio is calculated by dividing Adjusted EBITDA by interest expense.

|

Twelve months ended |

|||

|

2024 |

2023 |

||

|

Adjusted EBITDA |

$ 71,716 |

$ 77,918 |

|

|

Interest expense |

32,620 |

32,055 |

|

|

Interest coverage ratio |

2.20 x |

2.43 x |

|

Available Funds

The table below calculates the REIT’s Available Funds as at September 30, 2024 and December 31, 2023:

|

September 30, |

December 31, |

||

|

Cash |

$ 9,674 |

$ 8,946 |

|

|

Undrawn Credit Facility |

54,130 |

36,400 |

|

|

Available Funds |

$ 63,804 |

$ 45,346 |

Forward-looking Statements

Certain statements contained in this press release constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking statements are provided for the purposes of assisting the reader in understanding the REIT’s financial performance, financial position and cash flows as at and for the periods ended on certain dates and to present information about management’s current expectations and plans relating to the future. Readers are cautioned that such statements may not be appropriate for other purposes. Forward-looking information may relate to future results, performance, debt financing, achievements, events, prospects or opportunities for the REIT or the real estate industry and may include statements regarding the financial position, business strategy, budgets, projected costs, capital expenditures, financial results, taxes, distributions, plans, the benefits and renewal of the NCIB, or through other capital programs, the impact of the Unit Consolidation and objectives of or involving the REIT. In some cases, forward-looking information can be identified by such terms as “may”, “might”, “will”, “could”, “should”, “would”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “seek”, “aim”, “estimate”, “target”, “goal”, “project”, “predict”, “forecast”, “potential”, “continue”, “likely”, or the negative thereof or other similar expressions suggesting future outcomes or events.

|

(1) This is a non-IFRS financial measure, refer to “Non-IFRS Financial Measures”. |

Forward-looking statements involve known and unknown risks and uncertainties, which may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, assumptions may not be correct and objectives, strategic goals and priorities may not be achieved. A variety of factors, many of which are beyond the REIT’s control, affect the operations, performance and results of the REIT and its business, and could cause actual results to differ materially from current expectations of estimated or anticipated events or results. These factors include, but are not limited to: risks and uncertainties related to the Units and trading value of the Units; risks related to the REIT and its business; fluctuating interest rates and general economic conditions, including fluctuating levels of inflation; credit, market, operational and liquidity risks generally; occupancy levels and defaults, including the failure to fulfill contractual obligations by tenants; lease renewals and rental increases; the ability to re-lease and secure new tenants for vacant space; the timing and ability of the REIT to acquire or sell certain properties; work-from-home flexibility initiatives on the business, operations and financial condition of the REIT and its tenants, as well as on consumer behavior and the economy in general; the ability to enforce leases, perform capital expenditure work, increase rents or raise capital through the issuance of Units or other securities of the REIT; the benefits of the NCIB, or through other capital programs; the impact of the Unit Consolidation; the ability of the REIT to resume distributions in future periods; and obtain mortgage financing on the REIT’s properties and for potential acquisitions or to refinance debt at maturity on similar terms. The foregoing is not an exhaustive list of factors that may affect the REIT’s forward-looking statements. Other risks and uncertainties not presently known to the REIT could also cause actual results or events to differ materially from those expressed in its forward-looking statements. The reader is cautioned to consider these and other factors, uncertainties and potential events carefully and not to put undue reliance on forward-looking statements as there can be no assurance actual results will be consistent with such forward-looking statements.

Information contained in forward-looking statements is based upon certain material assumptions applied in drawing a conclusion or making a forecast or projection, including management’s perception of historical trends, current conditions and expected future developments, as well as other considerations believed to be appropriate in the circumstances. There can be no assurance regarding: (a) work-from-home initiatives on the REIT’s business, operations and performance, including the performance of its Units; (b) the REIT’s ability to mitigate any impacts related to fluctuating interest rates, inflation and the shift to hybrid working; (c) the factors, risks and uncertainties expressed above in regards to the hybrid work environment on the commercial real estate industry and property occupancy levels; (d) credit, market, operational, and liquidity risks generally; (e) the availability of investment opportunities for growth in Canada and the timing and ability of the REIT to acquire or sell certain properties; (f) repurchasing Units under the NCIB; (g) Starlight Group Property Holdings Inc., or any of its affiliates, continuing as asset manager of the REIT in accordance with its current asset management agreement; (h) the benefits of the NCIB, or through other capital programs; (i) the impact of the Unit Consolidation; (j) the availability of debt financing for potential acquisitions or refinancing loans at maturity on similar terms; (k) the ability of the REIT to resume distributions in future periods; and (l) other risks inherent to the REIT’s business and/or factors beyond its control which could have a material adverse effect on the REIT.

The forward-looking statements made relate only to events or information as of the date on which the statements are made. Except as specifically required by applicable Canadian law, the REIT undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

SOURCE True North Commercial Real Estate Investment Trust

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/12/c7869.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/12/c7869.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.