Safehold Announces Pricing of $400 Million of Senior Unsecured Notes Due 2035

NEW YORK, Nov. 12, 2024 /PRNewswire/ — Safehold Inc. (the “Company” or “Safehold”) SAFE today announced that its operating company, Safehold GL Holdings LLC (the “operating company”), has priced a public offering of $400 million aggregate principal amount of its 5.650% senior notes due 2035 (the “Notes”). The Notes will mature on January 15, 2035. The offering is expected to settle on November 14, 2024, subject to the satisfaction of customary closing conditions. The Notes will be fully and unconditionally guaranteed by the Company. The public offering price of the Notes was 98.812% of the principal amount for an effective semi-annual yield to maturity of 5.804%.

The Company has recently terminated hedges and realized a cash settlement gain of approximately $22 million. Giving effect to this gain, the Company expects to recognize an effective semi-annual yield to maturity of approximately 5.09%.

The operating company intends to use the net proceeds from the offering for general corporate purposes, which may include repaying borrowings under its unsecured revolver, making additional investments in ground leases, providing for working capital and funding obligations under existing commitments.

J.P. Morgan Securities LLC, BofA Securities, Goldman Sachs & Co. LLC and Truist Securities, Inc. acted as joint book-running managers and representatives of the underwriters for the offering. Mizuho Securities USA LLC, RBC Capital Markets, LLC, Barclays Capital Inc., Morgan Stanley & Co. LLC, and SMBC Nikko Securities America, Inc. are also acting as joint book-running managers for the offering. BNP Paribas Securities Corp., Raymond James & Associates, Inc. and Citizens JMP Securities, LLC are acting as co-managers for the offering.

This offering is being made pursuant to an effective shelf registration statement and prospectus and related preliminary prospectus supplement filed by the Company and the operating company with the Securities and Exchange Commission. This press release shall not constitute an offer to sell or the solicitation of any offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Copies of the prospectus supplement and related prospectus for this offering can be obtained, when available, from J.P. Morgan Securities LLC, 383 Madison Avenue, New York, NY 10179, Attention: Investment Grade Syndicate Desk, 3rd Floor, telephone collect at (212) 834-4533; or BofA Securities, Inc., 201 North Tryon Street, NC1-022-02-25, Charlotte NC 28255-0001, Attn: Prospectus Department or by email dg.prospectus_requests@bofa.com, telephone (1-800-294-1322); or Goldman Sachs & Co. LLC, Prospectus Department, 200 West Street, New York, NY 10282, telephone at (866) 471-2526 or by emailing prospectus-ny@ny.email.gs.com; or Truist Securities, Inc., Attention: Prospectus Department, 303 Peachtree Street, Atlanta, GA 30308, telephone: 800-685-4786, or e-mail: TSIdocs@Truist.com.

Forward-Looking Statements:

This press release may contain forward-looking statements within the meaning of the federal securities laws, which are based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “may,” “should,” “will,” “would,” “will be,” “seek,” “approximately,” “pro forma,” “contemplate,” “aim,” “continue,” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. While forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, they are not guarantees of future performance. For example, the fact that the offering described above has priced may imply that the offering will close, but the closing is subject to conditions customary in transactions of this type and the closing may be delayed or may not occur at all. For a further discussion of the factors that could cause the Company’s future results to differ materially from any forward-looking statements, see the reports and other filings by the Company with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements). The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.

About Safehold:

Safehold Inc. SAFE is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings. Having created the modern ground lease industry in 2017, Safehold continues to help owners of high quality multifamily, office, industrial, hospitality, student housing, life science and mixed-use properties generate higher returns with less risk. The Company, which is taxed as a real estate investment trust (REIT), seeks to deliver safe, growing income and long-term capital appreciation to its shareholders.

Company Contact:

Pearse Hoffmann

Senior Vice President

Capital Markets & Investor Relations

T 212.930.9400

E investors@safeholdinc.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/safehold-announces-pricing-of-400-million-of-senior-unsecured-notes-due-2035-302303439.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/safehold-announces-pricing-of-400-million-of-senior-unsecured-notes-due-2035-302303439.html

SOURCE Safehold

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tandy Leather Factory Reports Third Quarter 2024 Results

FORT WORTH, Texas, Nov. 12, 2024 (GLOBE NEWSWIRE) — Tandy Leather Factory, Inc. TLF today announced the Company’s financial results for the third fiscal quarter of 2024.

Highlights from Third Quarter 2024:

- Revenues were $17.4 million, down 1.1% from 2023

- Operating loss of $0.3 million

- Net loss of $0.1 million, down from net income of $0.6 million in 2023

- Gross margins of 57.8%, down from 62.4% in 2023

- Operating expenses $10.3 million, up 2.3% from 2023

- Adjusted EBITDA* of $0.2 million

- Ended quarter with $10.1 million of cash and cash equivalents

Tandy Leather Factory’s third quarter sales were $17.4 million in 2024, down from $17.5 million in 2023. Third quarter 2024 gross profit was $10.0 million, down from $10.9 million in 2023. Third quarter saw an operating loss of $0.3 million, down from operating income of $0.9 million in 2023. As of September 30, 2024, the Company held $10.1 million of cash and cash equivalents, up from $8.6 million a year earlier. The Company held inventory of $38.1 million, up from $38.0 million as of December 31, 2023. The Company had a basic and diluted net loss in the quarter of ($0.02) per share, versus income of $0.08 in the prior year.

Janet Carr, Chief Executive Officer of the Company, said, “Sales in the third quarter were consistent with the trend we saw in Q2, down about 1%, and although our September sale was strong, our customers are still spending less on discretionary items and our traffic is down. The biggest impact to our overall financial performance compared to last year is the difference in gross margin rate. Last year’s rate was driven by accounting adjustments; this year was in line with our projection, but also reflected increased promotional activity as we respond to weaker consumer demand. The 2.3% increase in operating expenses was driven primarily by inflationary pressures across all expense categories, especially employment costs. Importantly, cash remains strong, up from this time last year even with a significant increase in capital expenditures compared to last year for store relocations, necessary upgrades of store computer equipment, and a new roof on our headquarters facility.”

Investors are encouraged to send their questions to the Company’s investor relations hotline at investorrelations@tandyleather.com.

* Adjusted EBITDA is a non-GAAP financial measure that the Company believes helps investors to compare its operating performance to that of other companies. The following is a reconciliation of the Company’s net income to Adjusted EBITDA (in millions):

| Three months ended September 30, 2024 |

||||

| Net income | ($0.1 | ) | ||

| Add back: | ||||

| Depreciation and amortization | 0.3 | |||

| Interest income | (0.1 | ) | ||

| Income tax provision | (0.1 | ) | ||

| Stock-based compensation | 0.2 | |||

| Adjusted EBITDA | $0.2 | |||

Tandy Leather Factory, Inc., (http://www.tandyleather.com), headquartered in Fort Worth, Texas, is a specialty retailer of a broad product line, including leather, leatherworking tools, buckles and adornments for belts, leather dyes and finishes, saddle and tack hardware, and do-it-yourself kits. The Company distributes its products through its 99 North American stores (including two temporarily closed for relocation as of September 30, 2024) located in 40 US states and six Canadian provinces, and one store located in Spain. Its common stock trades on the Nasdaq Capital Market under the symbol “TLF”. To be included on Tandy Leather Factory’s email distribution list, go to: http://www.b2i.us/irpass.asp?BzID=1625&to=ea&s=0.

Contact: Janet Carr, Tandy Leather Factory, Inc. (817) 872-3200 or janet.carr@tandyleather.com

This news release may contain statements regarding future events, occurrences, circumstances, activities, performance, outcomes and results that are considered “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Actual results and events may differ from those projected as a result of certain risks and uncertainties. These risks and uncertainties include but are not limited to: changes in general economic conditions, negative trends in general consumer-spending levels, failure to realize the anticipated benefits of opening retail stores; availability of hides and leathers and resultant price fluctuations; change in customer preferences for our product, and other factors disclosed in our filings with the Securities and Exchange Commission. These forward-looking statements are made only as of the date hereof, and except as required by law, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Veteran Predicts S&P 500 To Hit 10,000 By 2029: 'Roaring 2020s'

In a bold projection that’s sure to grab attention, veteran Wall Street strategist Ed Yardeni is calling for the S&P 500 index to soar to 10,000 by the end of the decade due to a “Trump 2.0” boost after Donald Trump‘s recent election victory.

Yardeni, a longtime market analyst, said Tuesday that Trump’s return to the White House — alongside a likely Republican-controlled Congress — will bring in a major regime shift that’s positive for U.S. stocks, the economy and corporate profits.

Why Yardeni Sees Trump 2.0 As Game-Changer For Markets

Yardeni’s optimism stems from his belief that Trump’s policies will accelerate economic growth and improve the fiscal picture.

“We believe Trump 2.0 represents a major regime change that’s bullish for the economy and stocks,” Yardeni said in a note to investors, adding that a business-friendly environment might even help to resolve ongoing geopolitical tensions, as evidenced by recent drops in oil and gold prices.

Rising Profit Expectations: 2025, 2026 EPS Revised Higher

To back up his S&P 500 forecast, Yardeni adjusted his earnings expectations for the index’s constituent companies.

He now expects 2025 earnings per share for the S&P 500 to hit $285, up from his previous estimate of $275. His 2026 EPS projection has similarly risen, from $300 to $320.

While much of the recent growth in S&P 500 earnings has been led by a handful of tech giants — the so-called “Magnificent 7” — Yardeni said he now predicts a broader strength ahead.

“We expect to see a broadening of the companies and industries for which analysts raise their sights in 2025,” he said.

Record Profit Margins: Tax Cuts, Deregulation in Focus

In Yardeni’s view, Trump’s anticipated policies could push corporate profit margins to new heights. He projects the S&P 500 profit margin will rise to 13.9% in 2025 and 14.9% in 2026, levels he attributes to expected tax cuts, deregulation and productivity growth.

One key policy shift Yardeni said he expects is a reduction in the corporate tax rate from 21% to 15%, along with tax breaks for individual income from tips, overtime and Social Security.

He also anticipates a wave of regulatory rollbacks, especially after a recent Supreme Court ruling that empowers businesses to challenge regulatory overreach.

Adjusted Scenario Probabilities: Betting On The ‘Roaring 2020s’

Yardeni has increased the probability of his “Roaring 2020s” scenario, now assigning it a 55% chance, up from 50%. He sees a “1990s-style meltup” as a 25% possibility, while the chance of a “1970s-style geopolitical and/or domestic debt crisis” has dropped from 30% to 20%, he said.

His reasoning? With Trump back in office, Yardeni said “a sooner end to current geopolitical crises” is possible, especially given recent trends in commodity markets, where oil and gold prices have softened.

The S&P 500 Index — as tracked by the SPDR S&P 500 ETF Trust SPY — is up nearly 27% year-to-date, on par with the performance seen in 2021.

Fed Rate Cuts: Fuel For S&P 500 Meltup?

Yardeni is skeptical of recent Federal Reserve rate cuts, which he views as potentially over-stimulative.

Following a 25-basis-point cut Nov. 7 and a 50-basis-point cut in September, Yardeni warns that continued easing could trigger a “meltup” in stocks and potentially rekindle inflation.

“If Fed officials continue to cut the FFR, they risk a rebound in price inflation rates and a meltup in the stock market,” the expert said.

New S&P 500 Targets: 6,100 In 2024, 10,000 By 2029

With these bullish tailwinds in mind, Yardeni revised his S&P 500 price targets sharply upward. He now sees the index reaching 6,100 by the end of 2024, 7,000 in 2025 and 8,000 in 2026.

By 2029, he expects the index to breach the 10,000 mark — a nearly 65% increase from today’s levels.

If these projections hold, investors could be in for a banner decade of stock gains. But as with any market forecasts, only time will tell if “Trump 2.0” truly ushers in Yardeni’s “roaring 2020s.”

Read Next:

Illustration created using artificial intelligence via Midjourney.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotify Stock Climbs Despite Q3 EPS Miss, Revenue Beat (CORRECTED)

Editor’s Note: Quarterly earnings and revenue were corrected and updated.

Spotify Technology S.A. SPOT reported its third-quarter results after Tuesday’s closing bell. Here’s a look at the key figures from the quarter.

The Details: Spotify reported quarterly earnings of $1.59 per share, which missed the analyst consensus estimate of $1.84. The company reported quarterly sales of $4.38 billion, which beat the analyst consensus estimate of $4.31 billion and is an increase over sales of $3.65 billion from the same period last year.

The company reported monthly average user (MAU) net additions of 14 million, surpassing guidance by one million and subscriber net additions of six million were also ahead by one million. Premium subscribers grew 12% year-over-year to 252 million, reflecting year-over-year and quarter-over-quarter growth across all regions.

“The business delivered strong third-quarter results, as all of our KPIs met or exceeded guidance and profitability reached record levels,” the company wrote in a letter to shareholders.

SPOT Price Action: According to Benzinga Pro, Spotify shares are up 7.55% after-hours at $451.04 at the time of publication Tuesday.

Read More:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nu Holdings Options Trading: A Deep Dive into Market Sentiment

Investors with a lot of money to spend have taken a bullish stance on Nu Holdings NU.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with NU, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 14 uncommon options trades for Nu Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 57% bullish and 42%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $123,988, and 10 are calls, for a total amount of $369,648.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $8.0 to $18.0 for Nu Holdings during the past quarter.

Analyzing Volume & Open Interest

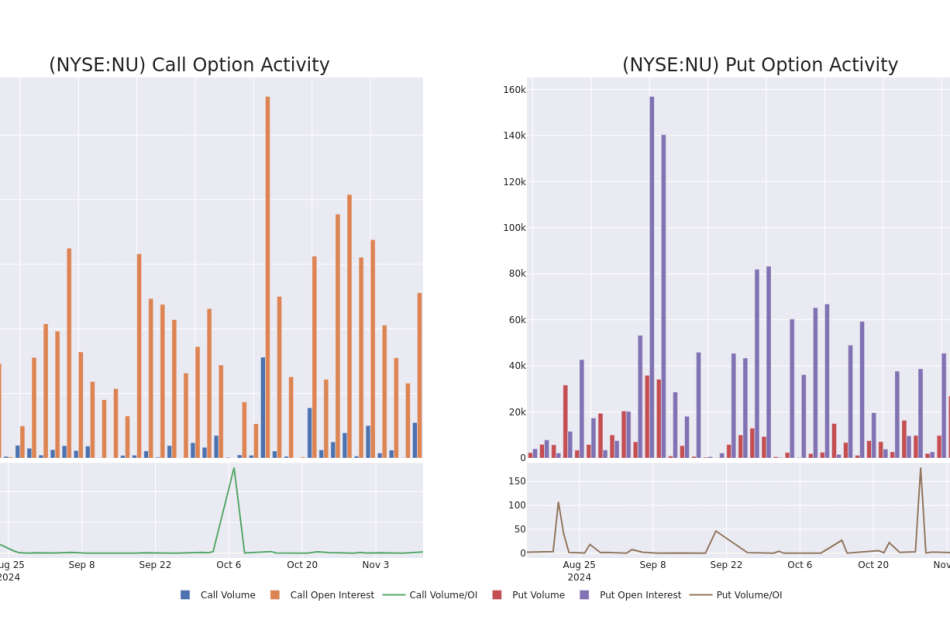

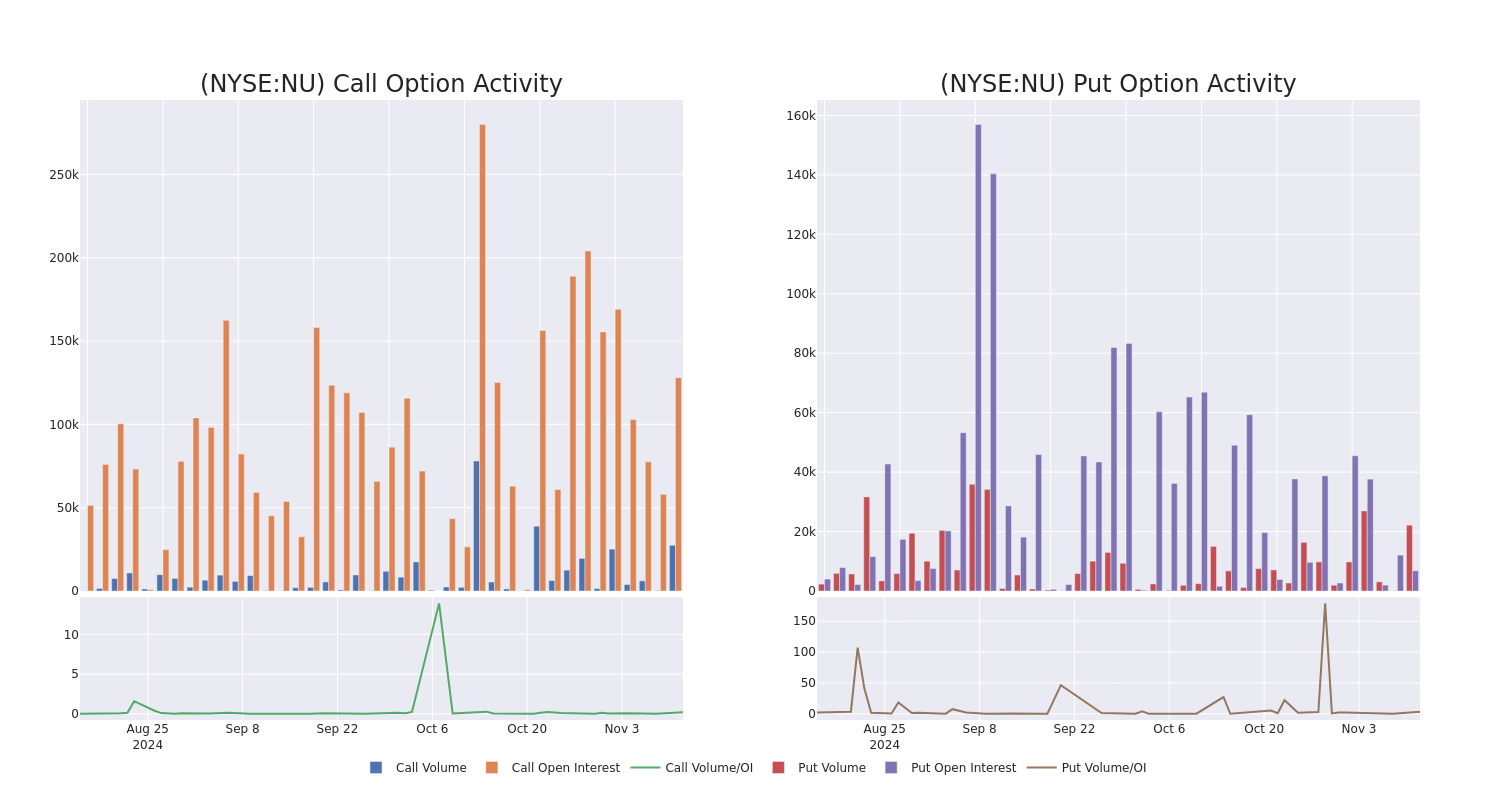

In today’s trading context, the average open interest for options of Nu Holdings stands at 14980.44, with a total volume reaching 49,651.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Nu Holdings, situated within the strike price corridor from $8.0 to $18.0, throughout the last 30 days.

Nu Holdings Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | CALL | SWEEP | BEARISH | 11/15/24 | $1.25 | $1.22 | $1.22 | $15.00 | $61.0K | 26.8K | 749 |

| NU | CALL | SWEEP | BEARISH | 11/15/24 | $0.54 | $0.53 | $0.54 | $16.00 | $42.6K | 65.3K | 17.5K |

| NU | CALL | TRADE | BULLISH | 01/15/27 | $9.2 | $8.9 | $9.1 | $8.00 | $41.8K | 402 | 48 |

| NU | CALL | SWEEP | BULLISH | 11/15/24 | $2.05 | $2.02 | $2.05 | $14.00 | $40.9K | 17.9K | 250 |

| NU | PUT | SWEEP | BULLISH | 11/15/24 | $0.19 | $0.18 | $0.18 | $14.50 | $38.4K | 6.8K | 3.8K |

About Nu Holdings

Nu Holdings Ltd is engaged in providing digital banking services. It offers several financial services such as Credit cards, Personal Account, Investments, Personal Loans, Insurance, Mobile payments, Business Accounts, and Rewards. The company earns the majority of its revenue in Brazil.

Following our analysis of the options activities associated with Nu Holdings, we pivot to a closer look at the company’s own performance.

Present Market Standing of Nu Holdings

- Trading volume stands at 26,423,790, with NU’s price down by -0.03%, positioned at $15.88.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 1 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Nu Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GDI Integrated Facility Services Inc. Releases its Financial Results for the Third Quarter Ended September 30, 2024

- Q3 2024 Revenue of $640 million, an increase of $25 million, or 4%, over Q3 2023.

- Q3 2024 Adjusted EBITDA* of $39 million, in line with Q3 2023.

- Q3 2024 Net income of $7 million or $0.28 per share compared with $8 million or $0.35 per share.

- Q3 2024 Long-term debt, net of cash, reduced by $41 million in Q3 compared to Q2.

- Q3 2024 Net operating working capital reduced by $25 million compared to Q2.

LASALLE, QC, Nov. 12, 2024 /CNW/ – GDI Integrated Facility Services Inc. (“GDI” or the “Company“) GDI is pleased to announce its financial results for the third quarter ended September 30, 2024.

For the third quarter of 2024:

- Revenue reached $640 million, an increase of $25 million, or 4%, over the third quarter of 2023, comprised of 5% growth from acquisitions and partially offset by 2% organic decline mainly attributable to the Technical Services segment.

- Adjusted EBITDA* amounted to $39 million, in line with the third quarter of 2023.

- Net income was $7 million compared to $8 million, a decrease of $1 million.

- The long-term debt, net of cash, stood at $407 million as at September 30, 2024, compared to $448 million as at June 30, 2024, a reduction of $41 million.

- Net operating working capital was $277 million as at September 30, 2024, compared to $302 million as at June 30, 2024, a reduction of $25 million.

For the third quarters of 2024 and 2023, the business segments performed as follows:

|

(in millions of |

Business Services Canada |

Business Services USA |

Technical Services |

Corporate and Other |

Consolidated |

|||||

|

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

|

|

Revenue |

145 |

146 |

222 |

185 |

264 |

269 |

9 |

15 |

640 |

615 |

|

Organic Growth (Decline) |

(1 %) |

3 % |

(1 %) |

0 % |

(6 %) |

15 % |

27 % |

0 % |

(2 %) |

(1 %) |

|

Adjusted EBITDA* |

12 |

14 |

14 |

14 |

20 |

16 |

(7) |

(5) |

39 |

39 |

|

Adjusted EBITDA Margin* |

8 % |

10 % |

6 % |

8 % |

8 % |

6 % |

N/A |

N/A |

6 % |

6 % |

For the nine-month period ended September 30, 2024:

- Revenue reached $1.9 billion, an increase of $108 million, or 6%, over the corresponding period of 2023, coming strictly from growth from acquisitions.

- Adjusted EBITDA* amounted to $100 million, a decrease of $6 million, or 6%, over the corresponding period of 2023.

- Net income was $9 million compared to $13 million, a decrease of $4 million. The decrease is mainly due to lower operating income of $15 million, which is primarily attributable to an increase in amortization and depreciation expense of $10 million, partially offset by lower net finance expense of $7 million and lower income tax expense of $4 million.

- The long-term debt, net of cash, was at $407 million as at September 30, 2024, compared to $417 million as at December 31, 2023, a reduction of $10 million.

- Net operating working capital was $277 million as at September 30, 2024, compared to $273 million as at December 31, 2023, an increase of $4 million.

For the first three quarters of 2024 and 2023, the business segments performed as follows:

|

(in millions of |

Business Services Canada |

Business Services USA |

Technical |

Corporate and Other |

Consolidated |

|||||

|

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

2024 |

2023 |

|

|

Revenue |

435 |

432 |

668 |

541 |

775 |

785 |

45 |

57 |

1,923 |

1,815 |

|

Organic Growth (Decline) |

1 % |

1 % |

3 % |

(1 %) |

(4 %) |

28 % |

14 % |

8 % |

0 % |

11 % |

|

Adjusted EBITDA* |

34 |

41 |

41 |

39 |

42 |

39 |

(17) |

(13) |

100 |

106 |

|

Adjusted EBITDA Margin* |

8 % |

9 % |

6 % |

7 % |

5 % |

5 % |

N/A |

N/A |

5 % |

6 % |

GDI’s Business Services Canada segment recorded $145 million in revenue in the third quarter while generating $12 million in Adjusted EBITDA*, representing an Adjusted EBITDA margin* of 8%. GDI’s Business Services USA segment performed well in Q3 2024, recording revenue of $222 million and Adjusted EBITDA* of $14 million, representing an Adjusted EBITDA margin* of 6%.

The Technical Services segment recorded revenue of $264 million and Adjusted EBITDA* of $20 million, representing an Adjusted EBITDA margin* of 8%. Q3 is typically the Technical Services segment’s seasonally strongest quarter.

Finally, GDI’s Corporate and Other recorded revenue of $9 million compared to revenue of $15 million in Q3 2023, the decrease being attributable to the sale of the Superior janitorial products distribution business on April 1, 2024, which was partially offset by organic growth generated by GDI’s chemical manufacturing business.

“I am very pleased with GDI’s overall performance in Q3 Fiscal 2024,” stated Mr. Claude Bigras, President & CEO of GDI. “Q3 Fiscal 2024 had one extra working day in Canada and the U.S. compared to Q3 Fiscal 2023, which represents approximately $3 million dollars in combined additional costs in our Business Services segments. Our Business Services Canada segment generated an Adjusted EBITDA margin of 8% in Q3 Fiscal 2024 and has successfully managed to maintain a 100-200 basis point improvement in Adjusted EBITDA margin over the pre-COVID period. Slight organic decline was mainly due to the timing of contract wins and losses, however the outlook for organic growth is positive as the business enjoyed a number of contract wins in Q3 that are expected to start up in Q4 Fiscal 2024 and Q1 Fiscal 2025. Our Business Services USA segment also produced a slight organic revenue decline as quarter over quarter organic growth comparisons reflect the loss of the segment’s largest client, the bulk of which occurred in Q1 of this year, which we have almost fully replaced with new business wins. Additionally, we continue to shed low margin business obtained in the Atalian acquisition which had an impact on Adjusted EBITDA margin during the quarter. Our Technical Services segment had a record quarter, with $264 million in revenue and $20 million of Adjusted EBITDA, representing an Adjusted EBITDA margin of 8%, an all-time high for this segment. The business segment has sharply rebounded from the weakness experienced in Q4 Fiscal 2023 and Q1 this year and the margin improvement initiatives that we began implementing in Q3 last year are starting to bear fruit. The Technical Services segment generated organic decline in the quarter as we focused on higher margin projects and growth in services revenues and the prior year’s quarter recorded very strong organic growth. While Q3 is normally the seasonally strongest quarter for this business, we expect continued robust performance in this segment in the coming quarters.

“The outlook for all GDI’s business segments remains positive for the remainder of the year. We have good momentum in our Business Services segments and our Technical Services business is generating excellent results. Our balance sheet is healthy, we reduced long term debt by $41 million during the quarter, we have a leverage ratio of approximately three times and have sufficient financial flexibility to support our growth objectives. Please note that Q4 Fiscal 2024 also has one extra working day as compared to Q4 Fiscal 2023 which should be taken into account when comparing quarters. I look forward to GDI’s performance for the remainder of Fiscal 2024,” concluded Mr. Bigras.

ABOUT GDI

GDI is a leading integrated commercial facility services provider which offers a range of services in Canada and the United States to owners and managers of a variety of facility types including office buildings, educational facilities, distribution centers, industrial facilities, healthcare establishments, stadiums and event venues, hotels, shopping centres, airports and other transportation facilities. GDI’s commercial facility services capabilities include commercial janitorial and building maintenance, energy advisory and system optimization, the installation, maintenance and repair of HVAC-R, mechanical, electrical and building automation systems, as well as other complementary services such as janitorial products manufacturing and distribution. GDI’s subordinate voting shares are listed on the Toronto Stock Exchange GDI. Additional information on GDI can be found on its website at www.gdi.com.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements in this MD&A may constitute forward-looking information within the meaning of securities laws. Forward looking information may relate to GDI’s future outlook and anticipated events, business, operations, financial performance, financial condition or results and, in some cases, can be identified by terminology such as “may”; “will”; “should”; “expect”; “plan”; “anticipate”; “believe”; “intend”; “estimate”; “predict”; “potential”; “continue”; “foresee”; “ensure” or other similar expressions concerning matters that are not historical facts. In particular, statements regarding GDI’s future operating results and economic performance, and its objectives and strategies are forward-looking statements. These statements are based on certain factors and assumptions including expected growth, results of operations, performance and business prospects and opportunities, which GDI believes are reasonable as of the current date. While management considers these assumptions to be reasonable based on information currently available to the Company, they may prove to be incorrect. It is impossible for GDI to predict with certainty the impact that the current economic uncertainties may have on future results. Forward-looking information is also subject to certain factors, including risks and uncertainties (described in the “Risk Factors” section) that could cause actual results to differ materially from what GDI currently expects. Namely, these factors include risks pertaining to unsuccessful implementation of the business strategy, changes to business structure, inherent operating risks from acquisition activity, failure to integrate an acquired company, decline in commercial real estate occupancy levels, increase in costs which cannot be passed on to customers, labour shortages, disruption in information technology systems and execution issues with Strategic IT projects, increases in interest rates, exchange rate fluctuations, deterioration in economic conditions, increase in competition, influence of the principal shareholders, loss of key or long-term customers, public procurement laws and regulations, legal proceedings, reputational damage, labour disputes, disputes with franchisees, environmental, social and governance(“ESG”) considerations, goodwill and long-lived assets impairment charges, tax matters, key employees, participation in multi-employer pension plans, legislation or other governmental action, cybersecurity, data confidentiality and data protection, and public perception of our environmental footprint, many of which are beyond the Company’s control. Therefore, future events and results may vary significantly from what management currently foresees. The reader should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While management may elect to, the Company is under no obligation and does not undertake to update or alter this information at any particular time, except as may be required by law.

|

Analyst Conference Call: |

November 13, 2024 at 9:00 A.M. (ET) Kindly note that Investors and Media representatives may attend as listeners only. |

|

Please use the following dial-in numbers to have access to the conference call by dialing 10 minutes before the beginning of the conference: North America Toll-Free: 1-800-990-4777 Local: 289-819-1299 (Toronto) or 514-400-3794 (Montreal) RapidConnect URL: https://emportal.ink/4eymlOT

|

|

|

A rebroadcast of the conference call will be available November 20, 2024 by dialing: North America Toll-Free: 1-888-660-6345 Local: 289-819-1450 (Toronto) Confirmation Code: 65596 # |

September 30, 2024 unaudited condensed consolidated interim financial statements and accompanied Management & Discussion Analysis are filed on www.sedarplus.ca.

|

__________________________________________________ |

|

* The terms “Adjusted EBITDA” and “Adjusted EBITDA Margin” do not have standardized definitions prescribed by International Financial Reporting Standards and therefore, may not be comparable to similar measures presented by other companies. “Adjusted EBITDA” is defined as operating income before depreciation and amortization, transaction, reorganization and other costs, share-based compensation and strategic information technology projects configuration and customization costs. The Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by revenues. For more details and for a reconciliation of that measure to the most directly comparable IFRS measure, consult the “Segmented Information” tables at the end of this press release. |

GDI INTEGRATED FACILITY SERVICES INC.

Condensed Consolidated Interim Statements of Financial Position

(Unaudited) (In millions of Canadian dollars)

|

As at September 30, 2024 |

As at December 31, 2023 |

|

|

Assets |

||

|

Current assets |

||

|

Cash |

31 |

17 |

|

Trade and other receivables and contract assets |

590 |

571 |

|

Current tax assets |

2 |

11 |

|

Inventories |

34 |

42 |

|

Other financial assets |

15 |

13 |

|

Prepaid expenses and other |

13 |

11 |

|

Derivatives |

− |

1 |

|

Total current assets |

685 |

666 |

|

Non-current assets |

||

|

Property, plant and equipment |

126 |

127 |

|

Intangible assets |

116 |

131 |

|

Goodwill |

370 |

356 |

|

Other assets |

17 |

12 |

|

Total non-current assets |

629 |

626 |

|

Total assets |

1,314 |

1,292 |

|

Liabilities and Shareholders’ Equity |

||

|

Current liabilities |

||

|

Bank indebtedness |

− |

14 |

|

Trade and other payables |

307 |

298 |

|

Provisions |

31 |

32 |

|

Contract liabilities |

37 |

34 |

|

Current tax liabilities |

7 |

2 |

|

Current portion of long-term debt |

22 |

36 |

|

Total current liabilities |

404 |

416 |

|

Non-current liabilities |

||

|

Long-term debt |

416 |

384 |

|

Other payables |

7 |

5 |

|

Deferred tax liabilities |

17 |

32 |

|

Total non-current liabilities |

440 |

421 |

|

Shareholders’ equity |

||

|

Share capital |

382 |

380 |

|

Retained earnings |

77 |

68 |

|

Contributed surplus |

3 |

2 |

|

Accumulated other comprehensive income |

8 |

5 |

|

Total shareholders’ equity |

470 |

455 |

|

Total liabilities and shareholders’ equity |

1,314 |

1,292 |

GDI INTEGRATED FACILITY SERVICES INC.

Condensed Consolidated Interim Statements of Comprehensive Income

(Unaudited) (In millions of Canadian dollars, except for earnings per share)

|

Three-month periods ended September 30, |

Nine-month periods ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

Revenues |

640 |

615 |

1,923 |

1,815 |

|

Cost of services |

520 |

498 |

1,583 |

1,478 |

|

Selling and administrative expenses |

84 |

80 |

247 |

238 |

|

Transaction, reorganization and other costs |

1 |

− |

4 |

2 |

|

Strategic information technology projects configuration and |

− |

2 |

1 |

4 |

|

Amortization of intangible assets |

6 |

6 |

23 |

17 |

|

Depreciation of property, plant and equipment |

14 |

13 |

42 |

38 |

|

Operating income |

15 |

16 |

23 |

38 |

|

Net finance expense |

8 |

5 |

12 |

19 |

|

Income before income taxes |

7 |

11 |

11 |

19 |

|

Income tax expense |

− |

3 |

2 |

6 |

|

Net income |

7 |

8 |

9 |

13 |

|

Other comprehensive income (loss) |

||||

|

(Losses) gains that are or may be reclassified to earnings: |

||||

|

Foreign currency translation differences for foreign operations |

(4) |

6 |

5 |

(1) |

|

Hedge of net investments in foreign operations, net of tax |

8 |

(6) |

(1) |

1 |

|

Cash flow hedges, effective portion of changes in fair value, net |

− |

− |

(1) |

(1) |

|

4 |

− |

3 |

(1) |

|

|

Total comprehensive income |

11 |

8 |

12 |

12 |

|

Earnings per share: |

||||

|

Basic |

0.28 |

0.35 |

0.37 |

0.55 |

|

Diluted |

0.28 |

0.35 |

0.37 |

0.54 |

GDI INTEGRATED FACILITY SERVICES INC.

Condensed Consolidated Interim Statements of Changes in Equity

Nine-month periods ended September 30, 2024 and 2023

(Unaudited) (In millions of Canadian dollars, except for number of shares)

|

Share capital |

Retained |

Contributed |

Accumulated |

Total |

||

|

Number (in thousands |

Amount |

|||||

|

Balance, January 1, 2023 |

23,414 |

379 |

49 |

4 |

7 |

439 |

|

Net income |

– |

– |

13 |

– |

– |

13 |

|

Other comprehensive loss |

– |

– |

– |

– |

(1) |

(1) |

|

Total comprehensive income for the period |

– |

– |

13 |

– |

(1) |

12 |

|

Transactions with owners of the Company: |

||||||

|

Stock options exercised |

94 |

2 |

– |

– |

– |

2 |

|

Share-based compensation |

– |

– |

– |

1 |

– |

1 |

|

Shares repurchased for cancellation |

(98) |

(1) |

– |

(3) |

– |

(4) |

|

Balance, September 30, 2023 |

23,410 |

380 |

62 |

2 |

6 |

450 |

|

Balance, January 1, 2024 |

23,414 |

380 |

68 |

2 |

5 |

455 |

|

Net income |

– |

– |

9 |

– |

– |

9 |

|

Other comprehensive income |

– |

– |

– |

– |

3 |

3 |

|

Total comprehensive income for the period |

– |

– |

9 |

– |

3 |

12 |

|

Transactions with owners of the Company: |

||||||

|

Stock options exercised |

71 |

2 |

– |

– |

– |

2 |

|

Share-based compensation |

– |

– |

– |

1 |

– |

1 |

|

Balance, September 30, 2024 |

23,485 |

382 |

77 |

3 |

8 |

470 |

GDI INTEGRATED FACILITY SERVICES INC.

Condensed Consolidated Interim Statements of Cash Flows

(Unaudited) (In millions of Canadian dollars)

|

Nine-month periods ended September 30, |

||

|

2024 |

2023 |

|

|

Cash flows from (used in) operating activities |

||

|

Net income |

9 |

13 |

|

Adjustments for: |

||

|

Depreciation and amortization |

65 |

55 |

|

Equity portion of share-based compensation |

1 |

1 |

|

Net finance expense |

12 |

19 |

|

Income tax expense |

2 |

6 |

|

Income taxes paid |

2 |

(13) |

|

Net changes in non-cash operating assets and liabilities |

(3) |

(60) |

|

Net cash from operating activities |

88 |

21 |

|

Cash flows from (used in) financing activities |

||

|

Proceeds from issuance of long-term debt |

246 |

319 |

|

Repayment of long-term debt |

(228) |

(269) |

|

Payment of lease liabilities |

(29) |

(24) |

|

Interest paid |

(23) |

(17) |

|

Other |

1 |

(2) |

|

Net cash (used) from financing activities |

(33) |

7 |

|

Cash flows (used in) from investing activities |

||

|

Business acquisitions and disposal, net of cash acquired |

(7) |

(2) |

|

Additions to property, plant and equipment |

(13) |

(15) |

|

Additions to intangible assets |

(2) |

(3) |

|

Acquisition of other investments |

(4) |

– |

|

Proceeds on disposal of property, plant and equipment |

2 |

1 |

|

Net cash used in investing activities |

(24) |

(19) |

|

Foreign exchange loss on cash held in foreign currencies |

(3) |

– |

|

Net change in cash |

28 |

9 |

|

Cash (bank indebtedness), beginning of period: |

||

|

Cash |

17 |

7 |

|

Bank indebtedness |

(14) |

(10) |

|

3 |

(3) |

|

|

Cash, end of period: |

||

|

Cash |

31 |

7 |

|

Bank indebtedness |

– |

(1) |

|

31 |

6 |

|

GDI INTEGRATED FACILITY SERVICES INC.

Segmented information

(Unaudited) (In millions of Canadian dollars)

|

Three-month period ended September 30, 2024 |

|||||

|

Business |

Business USA |

Technical |

Corporate |

Total |

|

|

Recurring/contractual services |

126 |

202 |

25 |

5 |

358 |

|

On-call services |

10 |

20 |

80 |

– |

110 |

|

Project |

– |

– |

159 |

– |

159 |

|

Manufacturing and distribution |

– |

– |

– |

6 |

6 |

|

Other revenues |

6 |

– |

– |

1 |

7 |

|

Total external revenues |

142 |

222 |

264 |

12 |

640 |

|

Inter-segment revenues |

3 |

– |

– |

(3) |

– |

|

Revenues |

145 |

222 |

264 |

9 |

640 |

|

Income (loss) before income taxes |

10 |

11 |

10 |

(24) |

7 |

|

Net finance expense |

– |

(2) |

(1) |

11 |

8 |

|

Operating income (loss) |

10 |

9 |

9 |

(13) |

15 |

|

Depreciation and amortization |

2 |

5 |

10 |

3 |

20 |

|

Transaction, reorganization, and other costs |

– |

– |

1 |

– |

1 |

|

Share-based compensation (1) |

– |

– |

– |

3 |

3 |

|

Strategic information technology projects |

– |

– |

– |

– |

– |

|

Adjusted EBITDA |

12 |

14 |

20 |

(7) |

39 |

|

Total assets |

262 |

365 |

567 |

120 |

1,314 |

|

Total liabilities |

71 |

118 |

259 |

396 |

844 |

|

Additions to property, plant and equipment |

3 |

4 |

9 |

– |

16 |

|

Additions to intangible assets |

– |

– |

– |

1 |

1 |

|

Goodwill recorded on business acquisition (2) |

– |

– |

– |

– |

– |

|

(1) |

Includes stock option, performance share unit and restricted share unit plans. |

|

(2) |

During the three-month period ended September 30, 2024, the goodwill was increased by foreign currency translation of $3. |

GDI INTEGRATED FACILITY SERVICES INC.

Segmented information

(Unaudited) (In millions of Canadian dollars)

|

Three-month period ended September 30, 2023 |

|||||

|

Business |

Business USA |

Technical |

Corporate |

Total |

|

|

Recurring/contractual services |

125 |

177 |

21 |

3 |

326 |

|

On-call services |

11 |

8 |

75 |

1 |

95 |

|

Project |

– |

– |

173 |

– |

173 |

|

Manufacturing and distribution |

– |

– |

– |

14 |

14 |

|

Other revenues |

7 |

– |

– |

– |

7 |

|

Total external revenues |

143 |

185 |

269 |

18 |

615 |

|

Inter-segment revenues |

3 |

– |

– |

(3) |

– |

|

Revenues |

146 |

185 |

269 |

15 |

615 |

|

Income (loss) before income taxes |

11 |

8 |

6 |

(14) |

11 |

|

Net finance expense |

– |

2 |

1 |

2 |

5 |

|

Operating income (loss) |

11 |

10 |

7 |

(12) |

16 |

|

Depreciation and amortization |

3 |

4 |

9 |

3 |

19 |

|

Transaction, reorganization, and other costs |

– |

– |

– |

– |

– |

|

Share-based compensation (1) |

– |

– |

– |

2 |

2 |

|

Strategic information technology projects |

– |

– |

– |

2 |

2 |

|

Adjusted EBITDA |

14 |

14 |

16 |

(5) |

39 |

|

Total assets (2) |

267 |

359 |

544 |

122 |

1,292 |

|

Total liabilities (2) |

69 |

109 |

253 |

406 |

837 |

|

Additions to property, plant and equipment |

2 |

2 |

6 |

1 |

11 |

|

(1) |

Includes stock option, performance share unit and restricted share unit plans. |

|

(2) |

As at December 31, 2023. |

GDI INTEGRATED FACILITY SERVICES INC.

Segmented information

(Unaudited) (In millions of Canadian dollars)

|

Nine-month period ended September 30, 2024 |

|||||

|

Business |

Business USA |

Technical |

Corporate |

Total |

|

|

Recurring/contractual services |

379 |

605 |

87 |

15 |

1,086 |

|

On-call services |

28 |

63 |

220 |

3 |

314 |

|

Project |

– |

– |

468 |

– |

468 |

|

Manufacturing and distribution |

– |

– |

– |

35 |

35 |

|

Other revenues |

19 |

– |

– |

1 |

20 |

|

Total external revenues |

426 |

668 |

775 |

54 |

1,923 |

|

Inter-segment revenues |

9 |

– |

– |

(9) |

– |

|

Revenues |

435 |

668 |

775 |

45 |

1,923 |

|

Income (loss) before income taxes |

26 |

22 |

12 |

(49) |

11 |

|

Net finance expense |

– |

(1) |

– |

13 |

12 |

|

Operating income (loss) |

26 |

21 |

12 |

(36) |

23 |

|

Depreciation and amortization |

8 |

19 |

28 |

10 |

65 |

|

Transaction, reorganization, and other costs |

– |

1 |

2 |

1 |

4 |

|

Share-based compensation (1) |

– |

– |

– |

7 |

7 |

|

Strategic information technology projects |

– |

– |

– |

1 |

1 |

|

Adjusted EBITDA |

34 |

41 |

42 |

(17) |

100 |

|

Total assets |

262 |

365 |

567 |

120 |

1,314 |

|

Total liabilities |

71 |

118 |

259 |

396 |

844 |

|

Additions to property, plant and equipment |

6 |

10 |

25 |

3 |

44 |

|

Additions to intangible assets |

– |

1 |

3 |

2 |

6 |

|

Goodwill recorded on business acquisition (2) |

– |

10 |

2 |

– |

12 |

|

(1) |

Includes stock option, performance share unit and restricted share unit plans. |

|

(2) |

During the nine-month period ended September 30, 2024, the goodwill was also increased by foreign currency translation for $3. |

GDI INTEGRATED FACILITY SERVICES INC.

|

Nine-month period ended September 30, 2023 |

|||||

|

Business |

Business USA |

Technical |

Corporate |

Total |

|

|

Recurring/contractual services |

370 |

513 |

63 |

14 |

960 |

|

On-call services |

33 |

28 |

222 |

4 |

287 |

|

Project |

– |

– |

500 |

– |

500 |

|

Manufacturing and distribution |

– |

– |

– |

47 |

47 |

|

Other revenues |

20 |

– |

– |

1 |

21 |

|

Total external revenues |

423 |

541 |

785 |

66 |

1,815 |

|

Inter-segment revenues |

9 |

– |

– |

(9) |

– |

|

Revenues |

432 |

541 |

785 |

57 |

1,815 |

|

Income (loss) before income taxes |

33 |

24 |

9 |

(47) |

19 |

|

Net finance expense |

– |

3 |

4 |

12 |

19 |

|

Operating income (loss) |

33 |

27 |

13 |

(35) |

38 |

|

Depreciation and amortization |

8 |

12 |

25 |

10 |

55 |

|

Transaction, reorganization, and other costs |

– |

– |

1 |

1 |

2 |

|

Share-based compensation (1) |

– |

– |

– |

7 |

7 |

|

Strategic information technology projects |

– |

– |

– |

4 |

4 |

|

Adjusted EBITDA |

41 |

39 |

39 |

(13) |

106 |

|

Total assets (2) |

267 |

359 |

544 |

122 |

1,292 |

|

Total liabilities (2) |

69 |

109 |

253 |

406 |

837 |

|

Additions to property, plant and equipment |

6 |

7 |

19 |

6 |

38 |

|

Additions to intangible assets |

– |

– |

1 |

3 |

4 |

|

Goodwill recorded on business acquisition |

– |

– |

2 |

– |

2 |

|

(1) |

Includes stock option, performance share unit and restricted share unit plans. |

|

(2) |

As at December 31, 2023. |

GDI INTEGRATED FACILITY SERVICES INC.

Business acquisition

(Unaudited) (In millions of Canadian dollars, except per share data)

|

Acquisition date |

Company acquired |

Location |

Segment reporting |

Purchase price allocation status |

|

2024 Acquisitions |

||||

|

April 1, 2024 |

(“Hussmann”) |

|

|

Preliminary |

|

May 1, 2024 |

|

Phoenix, Arizona |

Business |

Preliminary |

|

June 1, 2024 |

RYCOM Corporation (“RYCOM“) |

Toronto, Ontario |

Technical |

Preliminary |

|

2023 Acquisitions |

||||

|

June 1, 2023 |

React Technical, Inc. (“React“) |

New York, New York |

Technical |

Completed |

|

November 1, 2023 |

La Financière Atalian (“Atalian“) |

Multi-sites in USA |

Business |

Completed |

GDI INTEGRATED FACILITY SERVICES INC.

Consolidated Financial Position

(Unaudited) (In millions of Canadian dollars, except per share data)

|

(in millions of Canadian dollars) |

September 30, |

December 31, |

|

2024 |

2023 |

|

|

Net operating capital: |

||

|

Trade and other receivables and contract assets |

590 |

571 |

|

Inventories |

34 |

42 |

|

Other financial assets |

15 |

13 |

|

Prepaid expenses and other |

13 |

11 |

|

Trade and other payables and provisions |

(338) |

(330) |

|

Contract liabilities |

(37) |

(34) |

|

Net operating working capital |

277 |

273 |

|

Long-term debt, including current portion, net of Cash (bank indebtedness): |

||

|

Cash, net of bank indebtedness |

31 |

3 |

|

Long-term debt, including current portion |

(438) |

(420) |

|

Long-term debt, including current portion, net of Cash (bank indebtedness) |

(407) |

(417) |

|

Other financial position accounts: |

||

|

Property, plant and equipment |

126 |

127 |

|

Intangible assets |

116 |

131 |

|

Goodwill |

370 |

356 |

|

Other assets |

17 |

12 |

|

Other payables |

(7) |

(5) |

|

Derivatives |

‒ |

1 |

|

Net current tax (liabilities) assets |

(5) |

9 |

|

Net deferred tax liabilities |

(17) |

(32) |

GDI INTEGRATED FACILITY SERVICES INC.

Supplementary Quarterly Financial Information Three-month periods

(Unaudited) (In millions of Canadian dollars, except per share data)

|

Three months ended |

|||||||

|

(in millions of Canadian dollars, except per share data) (1) |

September 2024 |

June 2024 |

March 2024 |

December 2023 |

|||

|

Revenue |

640 |

639 |

644 |

622 |

|||

|

Operating income |

15 |

10 |

(2) |

9 |

|||

|

Depreciation and amortization |

20 |

19 |

26 |

22 |

|||

|

Transaction, reorganization and other costs |

1 |

2 |

1 |

2 |

|||

|

Share-based compensation |

3 |

2 |

2 |

2 |

|||

|

Strategic information technology projects |

‒ |

1 |

1 |

2 |

|||

|

Adjusted EBITDA |

39 |

34 |

28 |

37 |

|||

|

Net income for the period |

7 |

2 |

‒ |

6 |

|||

|

Earnings per share |

|||||||

|

Basic |

0.28 |

0.07 |

0.02 |

0.26 |

|||

|

Diluted |

0.28 |

0.07 |

0.02 |

0.25 |

|

Three months ended |

|||||||

|

(in millions of Canadian dollars, except per share data) (1) |

September 2023 |

June 2023 |

March 2023 |

December 2022 |

|||

|

Revenue |

615 |

609 |

591 |

588 |

|||

|

Operating income |

16 |

10 |

12 |

15 |

|||

|

Depreciation and amortization |

19 |

19 |

17 |

22 |

|||

|

Transaction, reorganization and other costs |

‒ |

1 |

1 |

1 |

|||

|

Share-based compensation |

2 |

3 |

2 |

3 |

|||

|

Strategic information technology projects |

2 |

1 |

1 |

1 |

|||

|

Adjusted EBITDA |

39 |

34 |

33 |

42 |

|||

|

Net income for the period |

8 |

1 |

4 |

10 |

|||

|

Earnings per share |

|||||||

|

Basic |

0.35 |

0.04 |

0.15 |

0.41 |

|||

|

Diluted |

0.35 |

0.04 |

0.15 |

0.40 |

|

(1) |

The differences between the quarters are mainly the results of business acquisitions, as well as seasonality in the Technical Services segment. The quarters from December 2022 to June 2023 were also favorably impacted from COVID-19 related additional services that were rendered by our Business Services business, which continuously decreased each quarter. |

SOURCE GDI Integrated Facility Services Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/12/c3672.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/12/c3672.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Applied Mat

Whales with a lot of money to spend have taken a noticeably bearish stance on Applied Mat.

Looking at options history for Applied Mat AMAT we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 57% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $133,910 and 10, calls, for a total amount of $443,864.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $150.0 and $210.0 for Applied Mat, spanning the last three months.

Volume & Open Interest Development

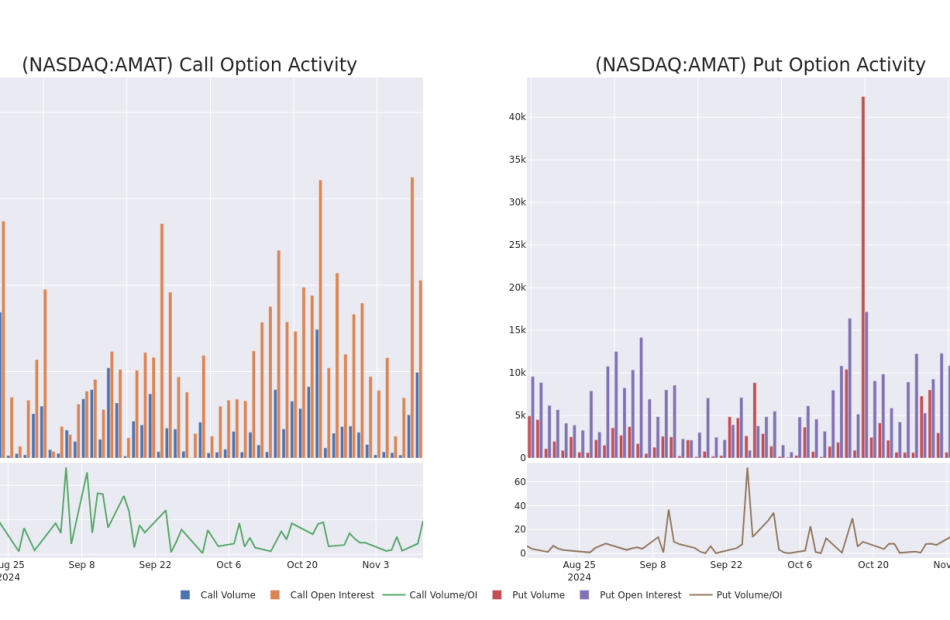

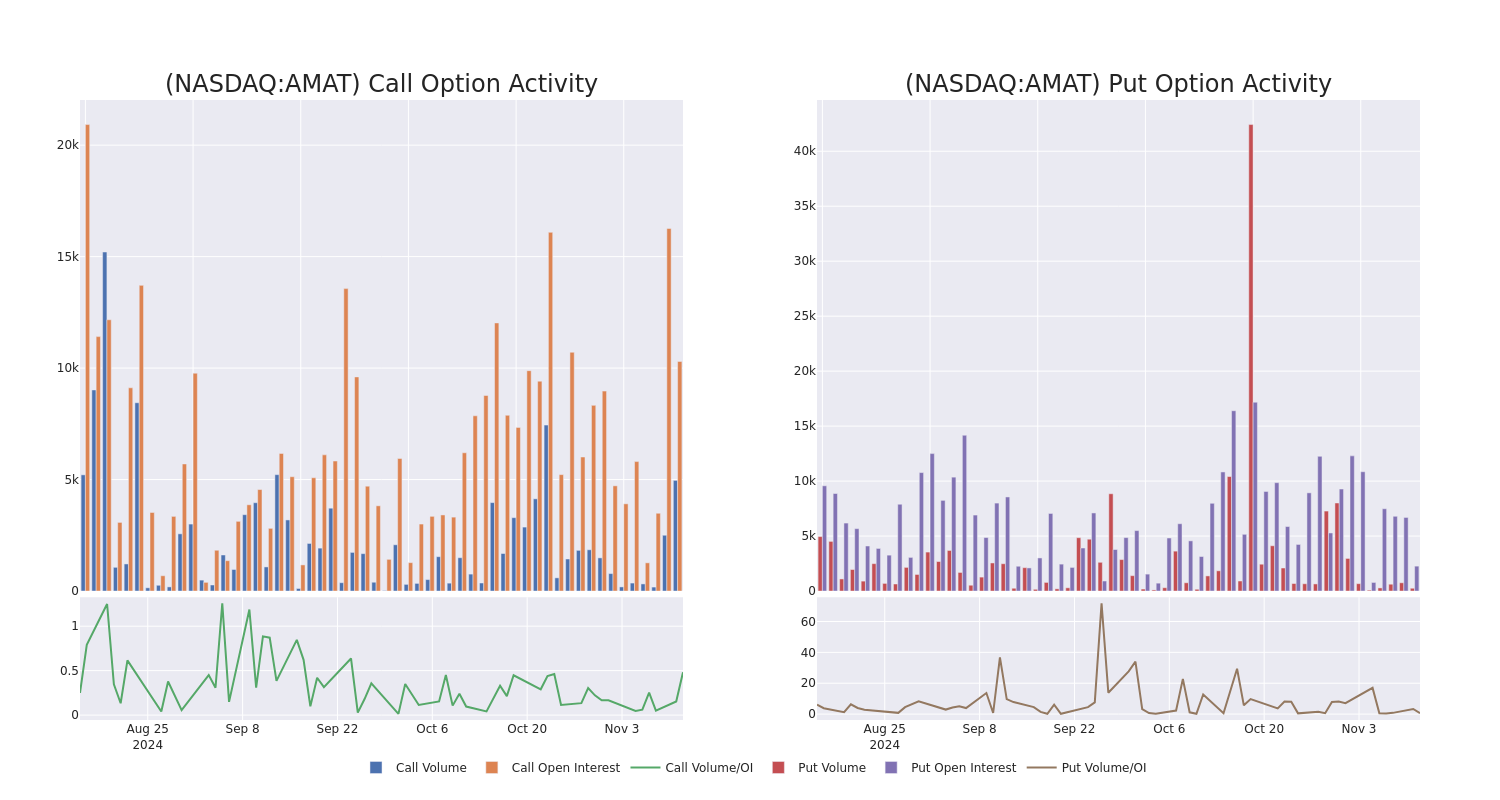

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Applied Mat’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Applied Mat’s whale trades within a strike price range from $150.0 to $210.0 in the last 30 days.

Applied Mat Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | CALL | SWEEP | BEARISH | 11/15/24 | $4.05 | $3.9 | $3.9 | $190.00 | $69.8K | 3.9K | 1.1K |

| AMAT | CALL | TRADE | BEARISH | 11/15/24 | $4.8 | $4.7 | $4.7 | $190.00 | $47.0K | 3.9K | 196 |

| AMAT | CALL | SWEEP | BEARISH | 01/17/25 | $4.65 | $4.55 | $4.55 | $210.00 | $45.5K | 1.8K | 128 |

| AMAT | CALL | TRADE | BULLISH | 11/15/24 | $2.5 | $2.29 | $2.5 | $197.50 | $45.0K | 609 | 236 |

| AMAT | CALL | TRADE | BEARISH | 01/17/25 | $8.5 | $8.3 | $8.38 | $200.00 | $41.9K | 2.4K | 88 |

About Applied Mat

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

Having examined the options trading patterns of Applied Mat, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Applied Mat’s Current Market Status

- Currently trading with a volume of 3,243,432, the AMAT’s price is down by -0.9%, now at $186.87.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 2 days.

What Analysts Are Saying About Applied Mat

2 market experts have recently issued ratings for this stock, with a consensus target price of $210.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Susquehanna has decided to maintain their Neutral rating on Applied Mat, which currently sits at a price target of $170.

* An analyst from Stifel has decided to maintain their Buy rating on Applied Mat, which currently sits at a price target of $250.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Applied Mat with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Extendicare Announces 2024 Third Quarter Results and Early Redemption of 2025 Debentures

MARKHAM, Ontario, Nov. 12, 2024 (GLOBE NEWSWIRE) — Extendicare Inc. (“Extendicare” or the “Company”) EXE today reported results for the three and nine months ended September 30, 2024, and the Company announced that it is exercising its option to redeem all of the outstanding $126.5 million principal amount of 2018-1 5.00% convertible unsecured subordinated debentures EXE (the “2025 Debentures”).

Third Quarter 2024 Highlights

- Adjusted EBITDA(1) excluding out-of-period items increased by $13.5 million or 64.9% to $34.3 million, largely driven by rate increases in long-term care (“LTC”) and home health care and volume growth in home health care and managed services.

- Home health care average daily volume (“ADV”) grew to 30,181, up 10.2% from Q3 2023.

- SGP third-party and joint venture serviced beds increased 11.4% from Q3 2023 to 143,500 beds, driven by continued organic growth.

- Commenced construction of a new 256-bed LTC redevelopment project in St. Catharines, Ontario to replace Extendicare’s 152-bed Class C home in the same city and anticipate commencing construction on two additional homes in Q4.

Subsequent to Q3

- As previously announced, established a new $275 million senior secured credit facility to support growth and redeem the 2025 Debentures, which, as announced today, are being redeemed in full on December 16, 2024.

“Our strategy continues to deliver robust growth across our operating segments and improved operating results. Sequential growth in home health care volumes was especially notable given the third quarter typically experiences a seasonal pullback in service demand,” said Dr. Michael Guerriere, President and Chief Executive Officer.

Dr. Guerriere added, “We are pleased with the continued progress of our redevelopment program. We commenced construction on a new 256-bed home in St. Catharines and we look forward to opening our new Kingston and Stittsville homes in the Axium JV before year end. And the close of our new credit facility gives us the balance sheet flexibility we need to continue to pursue our growth strategy.”

Redevelopment Program Advances with up to Three Additional Projects Starting in 2024

In September 2024, the Company began construction on a new 256-bed LTC home in St. Catharines, under the time-limited enhanced construction funding subsidy provided by the Government of Ontario. The home is anticipated to open in Q1 2027. It will replace the existing Extendicare home which comprises 152 Class C beds in the same city. Extendicare entered into a $72.3 million fixed-price construction contract in connection with the home and estimates the total development costs for the project will be $106.4 million.

The Company anticipates starting two more redevelopment projects under the enhanced construction funding subsidy before it expires at the end of November, subject to receipt of applicable regulatory approvals. The projects, in London and Port Stanley, together consist of 320 total beds to replace 230 Class C beds in the homes they will replace.

These projects, in addition to the St. Catharines development project, are anticipated to be sold to Axium JV in Q1 2025, with Extendicare retaining a 15% managed interest, subject to customary closing conditions, including receipt of regulatory approvals from the Ontario Ministry of Long-Term Care (“MLTC”).

In Q4 2024, the Company plans to open two new Axium JV homes currently under construction. Limestone Ridge is a 192-bed home in Kingston, Ontario, which will replace Extendicare Kingston, a 150-bed Class C home nearby. Following the opening of the new home, the Company will sell Extendicare Kingston for proceeds of approximately $3.7 million. Crossing Bridge is a 256-bed home in Stittsville, Ontario, which will replace Extendicare West End Villa, a home in Ottawa. Once Crossing Bridge is open, the Company intends to list the Class C LTC home for sale.

Enhanced Overall Liquidity with New $275 Million Credit Facility

As announced on November 8, 2024, the Company has entered into a new senior secured credit facility for $275.0 million (the “Senior Secured Credit Facility”) with a syndicate of Canadian chartered banks, for a term of three years. The Senior Secured Credit Facility consists of a revolving credit facility for up to $145.0 million (the “Revolving Facility”), which replaces the Company’s former demand credit facilities of $112.3 million, and a delayed draw term loan facility in an amount up to $130.0 million (the “Delayed Draw Facility”). The Revolving Facility is available for working capital and general corporate purposes, including capital expenditures and acquisitions. The Delayed Draw Facility is available until April 30, 2025, to redeem the 2025 Debentures.

Early Redemption of 2025 Debentures

The Company has exercised its option to redeem all of the outstanding 2025 Debentures on December 16, 2024 (the “Redemption Date”) using funds from the Delayed Draw Facility. The 2025 Debentures will be redeemed at par, plus accrued and unpaid interest up to but excluding the Redemption Date, for a total of $1,006.3013699 per $1,000 principal amount of 2025 Debentures. All interest on the 2025 Debentures will cease from and after the Redemption Date and the 2025 Debentures will be delisted from the facilities of the Toronto Stock Exchange at the close of markets on December 16, 2024.

Q3 2024 Financial Highlights (all comparisons with Q3 2023)

- Revenue increased 11.3%, or $36.5 million, to $359.1 million, driven primarily by LTC funding increases, home health care ADV growth and rate increases, and growth in managed services.

- NOI(1) increased $14.9 million to $50.1 million; excluding out-of-period LTC funding of $1.8 million recognized in Q3 2024, NOI improved by $13.1 million, or 37.1%, to $48.3 million, reflecting revenue growth, partially offset by higher operating costs across all segments.

- Adjusted EBITDA(1) increased $15.3 million to $36.1 million, reflecting the increase in NOI noted above and lower administrative costs.

- Other expense was $1.1 million compared with income of $5.0 million, reflecting a pre-tax gain on the sale of assets of $9.1 million in Q3 2023, partially offset by a $3.0 million decline in strategic transformation costs in connection with the Revera and Axium transactions.

- Net earnings increased $4.5 million to $16.3 million, largely driven by the increase in Adjusted EBITDA, partially offset by the decline in other expense (income).

- AFFO(1) increased to $23.1 million ($0.28 per basic share) from $12.3 million ($0.14 per basic share), largely reflecting the improvement in Adjusted EBITDA and lower maintenance capex, partially offset by increased current taxes. Excluding the out-of-period LTC funding recognized in Q3 2024, AFFO improved by $9.5 million to $21.8 million ($0.26 per basic share).

Nine Months 2024 Financial Highlights (all comparisons with Nine Months 2023)

- Revenue increased 12.6%, or $119.9 million, to $1,074.6 million, driven primarily by LTC funding increases, home health care ADV growth, rate increases and $13.6 million in retroactive funding to support one-time compensation costs incurred in Q1 2024, and growth in managed services, partially offset by lower COVID-19 and out-of-period LTC funding.

- NOI(1) increased $39.4 million to $147.7 million; excluding a net recovery of COVID-19 costs of $12.1 million in 2023 and the increase in out-of-period LTC funding of $7.3 million, NOI improved by $44.2 million, or 49.3%, to $133.7 million, reflecting revenue growth, partially offset by higher operating costs across all segments.

- Adjusted EBITDA(1) increased $38.3 million to $104.9 million, reflecting the increase in NOI noted above, partially offset by higher administrative costs.

- Other income was $2.7 million compared with a nominal amount, reflecting a $4.3 million decline in strategic transformation costs in connection with the Revera and Axium transactions, partially offset by a $1.6 million decrease in pre-tax gains on the sale of assets.

- Share of profit from joint ventures was up $1.2 million to $1.8 million, including the impact of one-time funding for Ontario LTC homes in Q1 2024, of which $0.7 million related to prior periods.

- Net earnings increased $29.9 million to $55.3 million, largely driven by the increase in Adjusted EBITDA.

- AFFO(1) increased to $63.8 million ($0.76 per basic share) compared with $42.2 million ($0.49 per basic share), largely reflecting the improvement in Adjusted EBITDA, partially offset by increased current taxes and higher maintenance capex. Excluding a $2.8 million year-over-year reduction in AFFO related to a net recovery of COVID-19 costs in 2023, partially offset by out-of-period LTC funding and share of profit from joint ventures, AFFO improved by $24.5 million to $52.9 million ($0.63 per basic share) from $28.4 million ($0.33 per basic share).

Business Updates

The following is a summary of Extendicare’s revenue, NOI(1) and NOI margins(1) by business segment for the three and nine months ended September 30, 2024 and 2023.

| (unaudited) | Three months ended September 30 | Nine months ended September 30 | |||||||||||||||||

| (millions of dollars | 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| unless otherwise noted) | Revenue | NOI | Margin | Revenue | NOI | Margin | Revenue | NOI | Margin | Revenue | NOI | Margin | |||||||

| Long-term care | 201.8 | 24.6 | 12.2 | % | 191.7 | 16.6 | 8.7 | % | 602.5 | 75.6 | 12.5 | % | 581.7 | 64.2 | 11.0 | % | |||

| Home health care | 138.4 | 15.6 | 11.3 | % | 118.1 | 11.6 | 9.8 | % | 418.3 | 43.5 | 10.4 | % | 341.9 | 28.1 | 8.2 | % | |||

| Managed services | 18.8 | 9.9 | 52.6 | % | 12.7 | 7.0 | 55.2 | % | 53.9 | 28.6 | 53.2 | % | 31.2 | 15.9 | 51.1 | % | |||

| 359.1 | 50.1 | 14.0 | % | 322.5 | 35.2 | 10.9 | % | 1,074.6 | 147.7 | 13.7 | % | 954.8 | 108.2 | 11.3 | % | ||||

| Note: Totals may not sum due to rounding. | |||||||||||||||||||

Long-term Care

LTC average occupancy increased to 98.4% in Q3 2024, an increase of 60 bps from 97.8% in Q3 2023.

Revenue increased by $10.1 million or 5.3% to $201.8 million in Q3 2024. During the quarter, LTC funding increases were announced in both Alberta and Manitoba, retroactive to April 1, 2024, resulting in an aggregate annualized revenue increase of $11.1 million. Excluding $1.8 million in out-of-period funding related to these retroactive rate increases, revenue increased by $8.3 million, largely driven by funding increases, timing of spend and improved occupancy.

NOI and NOI margin in Q3 2024 were $24.6 million and 12.2%, compared to $16.6 million and 8.7% in Q3 2023. Excluding $1.8 million in out-of-period funding recognized in the quarter, NOI improved to $22.8 million or 11.4% of revenue, reflecting funding enhancements, timing of spend and increased occupancy, partially offset by higher operating costs.

Home Health Care

Home health care ADV of 30,181 in Q3 2024 increased 10.2% from Q3 2023.

Revenue increased to $138.4 million in Q3 2024, an increase of 17.2% from Q3 2023, driven by growth in ADV and rate increases.

NOI and NOI margin were $15.6 million and 11.3% in Q3 2024, an increase from $11.6 million and 9.8% in Q3 2023, reflecting higher volumes and rates, partially offset by increased wages and benefits.

Managed Services

At the end of Q3 2024, Extendicare Assist had management contracts with 70 homes comprising 9,717 beds. Extendicare Assist also provides a further 52 homes with consulting and other services. The number of third-party and joint venture beds served by SGP increased to approximately 143,500 at the end of Q3 2024, up 11.4% from the prior year period.

Revenue increased by $6.1 million or 48.0% to $18.8 million from Q3 2023. NOI increased by 41.1% to $9.9 million with an NOI margin of 52.6%, an increase from $7.0 million and 55.2% in Q3 2023. These results were largely driven by the Revera and Axium transactions and new SGP clients, partially offset by Extendicare Assist clients that reduced their scope of services.

Financial Position

Extendicare has strong liquidity with cash and cash equivalents on hand of $154.3 million as at September 30, 2024. Subsequent to quarter end, the Company improved its capital flexibility with the new Senior Secured Credit Facility, providing access to additional undrawn credit capacity of $32.7 million under the new $145.0 million Revolving Facility and $130.0 million under the Delayed Draw Facility, which will be used to fund the redemption of the 2025 Debentures on December 16, 2024. Additionally, subsequent to the quarter, the Company used cash on hand to purchase for approximately $30.0 million, 9 Class A Ontario LTC homes that have been under long-term leases. The purchase price represents the balance of the remaining lease payments plus accrued interest and other costs, and fully satisfies the remaining lease liability (carrying interest rates from 6.4% to 7.2%).

Select Financial Information

The following is a summary of the Company’s consolidated financial information for the three and nine months ended September 30, 2024 and 2023.

| (unaudited) | Three months ended September 30 |

Nine months ended September 30 |

|||||||

| (thousands of dollars unless otherwise noted) | 2024 | 2023 | 2024 | 2023 | |||||

| Revenue | 359,061 | 322,529 | 1,074,638 | 954,776 | |||||

| Operating expenses | 308,944 | 287,319 | 926,971 | 846,532 | |||||