Extendicare Announces 2024 Third Quarter Results and Early Redemption of 2025 Debentures

MARKHAM, Ontario, Nov. 12, 2024 (GLOBE NEWSWIRE) — Extendicare Inc. (“Extendicare” or the “Company”) EXE today reported results for the three and nine months ended September 30, 2024, and the Company announced that it is exercising its option to redeem all of the outstanding $126.5 million principal amount of 2018-1 5.00% convertible unsecured subordinated debentures EXE (the “2025 Debentures”).

Third Quarter 2024 Highlights

- Adjusted EBITDA(1) excluding out-of-period items increased by $13.5 million or 64.9% to $34.3 million, largely driven by rate increases in long-term care (“LTC”) and home health care and volume growth in home health care and managed services.

- Home health care average daily volume (“ADV”) grew to 30,181, up 10.2% from Q3 2023.

- SGP third-party and joint venture serviced beds increased 11.4% from Q3 2023 to 143,500 beds, driven by continued organic growth.

- Commenced construction of a new 256-bed LTC redevelopment project in St. Catharines, Ontario to replace Extendicare’s 152-bed Class C home in the same city and anticipate commencing construction on two additional homes in Q4.

Subsequent to Q3

- As previously announced, established a new $275 million senior secured credit facility to support growth and redeem the 2025 Debentures, which, as announced today, are being redeemed in full on December 16, 2024.

“Our strategy continues to deliver robust growth across our operating segments and improved operating results. Sequential growth in home health care volumes was especially notable given the third quarter typically experiences a seasonal pullback in service demand,” said Dr. Michael Guerriere, President and Chief Executive Officer.

Dr. Guerriere added, “We are pleased with the continued progress of our redevelopment program. We commenced construction on a new 256-bed home in St. Catharines and we look forward to opening our new Kingston and Stittsville homes in the Axium JV before year end. And the close of our new credit facility gives us the balance sheet flexibility we need to continue to pursue our growth strategy.”

Redevelopment Program Advances with up to Three Additional Projects Starting in 2024

In September 2024, the Company began construction on a new 256-bed LTC home in St. Catharines, under the time-limited enhanced construction funding subsidy provided by the Government of Ontario. The home is anticipated to open in Q1 2027. It will replace the existing Extendicare home which comprises 152 Class C beds in the same city. Extendicare entered into a $72.3 million fixed-price construction contract in connection with the home and estimates the total development costs for the project will be $106.4 million.

The Company anticipates starting two more redevelopment projects under the enhanced construction funding subsidy before it expires at the end of November, subject to receipt of applicable regulatory approvals. The projects, in London and Port Stanley, together consist of 320 total beds to replace 230 Class C beds in the homes they will replace.

These projects, in addition to the St. Catharines development project, are anticipated to be sold to Axium JV in Q1 2025, with Extendicare retaining a 15% managed interest, subject to customary closing conditions, including receipt of regulatory approvals from the Ontario Ministry of Long-Term Care (“MLTC”).

In Q4 2024, the Company plans to open two new Axium JV homes currently under construction. Limestone Ridge is a 192-bed home in Kingston, Ontario, which will replace Extendicare Kingston, a 150-bed Class C home nearby. Following the opening of the new home, the Company will sell Extendicare Kingston for proceeds of approximately $3.7 million. Crossing Bridge is a 256-bed home in Stittsville, Ontario, which will replace Extendicare West End Villa, a home in Ottawa. Once Crossing Bridge is open, the Company intends to list the Class C LTC home for sale.

Enhanced Overall Liquidity with New $275 Million Credit Facility

As announced on November 8, 2024, the Company has entered into a new senior secured credit facility for $275.0 million (the “Senior Secured Credit Facility”) with a syndicate of Canadian chartered banks, for a term of three years. The Senior Secured Credit Facility consists of a revolving credit facility for up to $145.0 million (the “Revolving Facility”), which replaces the Company’s former demand credit facilities of $112.3 million, and a delayed draw term loan facility in an amount up to $130.0 million (the “Delayed Draw Facility”). The Revolving Facility is available for working capital and general corporate purposes, including capital expenditures and acquisitions. The Delayed Draw Facility is available until April 30, 2025, to redeem the 2025 Debentures.

Early Redemption of 2025 Debentures

The Company has exercised its option to redeem all of the outstanding 2025 Debentures on December 16, 2024 (the “Redemption Date”) using funds from the Delayed Draw Facility. The 2025 Debentures will be redeemed at par, plus accrued and unpaid interest up to but excluding the Redemption Date, for a total of $1,006.3013699 per $1,000 principal amount of 2025 Debentures. All interest on the 2025 Debentures will cease from and after the Redemption Date and the 2025 Debentures will be delisted from the facilities of the Toronto Stock Exchange at the close of markets on December 16, 2024.

Q3 2024 Financial Highlights (all comparisons with Q3 2023)

- Revenue increased 11.3%, or $36.5 million, to $359.1 million, driven primarily by LTC funding increases, home health care ADV growth and rate increases, and growth in managed services.

- NOI(1) increased $14.9 million to $50.1 million; excluding out-of-period LTC funding of $1.8 million recognized in Q3 2024, NOI improved by $13.1 million, or 37.1%, to $48.3 million, reflecting revenue growth, partially offset by higher operating costs across all segments.

- Adjusted EBITDA(1) increased $15.3 million to $36.1 million, reflecting the increase in NOI noted above and lower administrative costs.

- Other expense was $1.1 million compared with income of $5.0 million, reflecting a pre-tax gain on the sale of assets of $9.1 million in Q3 2023, partially offset by a $3.0 million decline in strategic transformation costs in connection with the Revera and Axium transactions.

- Net earnings increased $4.5 million to $16.3 million, largely driven by the increase in Adjusted EBITDA, partially offset by the decline in other expense (income).

- AFFO(1) increased to $23.1 million ($0.28 per basic share) from $12.3 million ($0.14 per basic share), largely reflecting the improvement in Adjusted EBITDA and lower maintenance capex, partially offset by increased current taxes. Excluding the out-of-period LTC funding recognized in Q3 2024, AFFO improved by $9.5 million to $21.8 million ($0.26 per basic share).

Nine Months 2024 Financial Highlights (all comparisons with Nine Months 2023)

- Revenue increased 12.6%, or $119.9 million, to $1,074.6 million, driven primarily by LTC funding increases, home health care ADV growth, rate increases and $13.6 million in retroactive funding to support one-time compensation costs incurred in Q1 2024, and growth in managed services, partially offset by lower COVID-19 and out-of-period LTC funding.

- NOI(1) increased $39.4 million to $147.7 million; excluding a net recovery of COVID-19 costs of $12.1 million in 2023 and the increase in out-of-period LTC funding of $7.3 million, NOI improved by $44.2 million, or 49.3%, to $133.7 million, reflecting revenue growth, partially offset by higher operating costs across all segments.

- Adjusted EBITDA(1) increased $38.3 million to $104.9 million, reflecting the increase in NOI noted above, partially offset by higher administrative costs.

- Other income was $2.7 million compared with a nominal amount, reflecting a $4.3 million decline in strategic transformation costs in connection with the Revera and Axium transactions, partially offset by a $1.6 million decrease in pre-tax gains on the sale of assets.

- Share of profit from joint ventures was up $1.2 million to $1.8 million, including the impact of one-time funding for Ontario LTC homes in Q1 2024, of which $0.7 million related to prior periods.

- Net earnings increased $29.9 million to $55.3 million, largely driven by the increase in Adjusted EBITDA.

- AFFO(1) increased to $63.8 million ($0.76 per basic share) compared with $42.2 million ($0.49 per basic share), largely reflecting the improvement in Adjusted EBITDA, partially offset by increased current taxes and higher maintenance capex. Excluding a $2.8 million year-over-year reduction in AFFO related to a net recovery of COVID-19 costs in 2023, partially offset by out-of-period LTC funding and share of profit from joint ventures, AFFO improved by $24.5 million to $52.9 million ($0.63 per basic share) from $28.4 million ($0.33 per basic share).

Business Updates

The following is a summary of Extendicare’s revenue, NOI(1) and NOI margins(1) by business segment for the three and nine months ended September 30, 2024 and 2023.

| (unaudited) | Three months ended September 30 | Nine months ended September 30 | |||||||||||||||||

| (millions of dollars | 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| unless otherwise noted) | Revenue | NOI | Margin | Revenue | NOI | Margin | Revenue | NOI | Margin | Revenue | NOI | Margin | |||||||

| Long-term care | 201.8 | 24.6 | 12.2 | % | 191.7 | 16.6 | 8.7 | % | 602.5 | 75.6 | 12.5 | % | 581.7 | 64.2 | 11.0 | % | |||

| Home health care | 138.4 | 15.6 | 11.3 | % | 118.1 | 11.6 | 9.8 | % | 418.3 | 43.5 | 10.4 | % | 341.9 | 28.1 | 8.2 | % | |||

| Managed services | 18.8 | 9.9 | 52.6 | % | 12.7 | 7.0 | 55.2 | % | 53.9 | 28.6 | 53.2 | % | 31.2 | 15.9 | 51.1 | % | |||

| 359.1 | 50.1 | 14.0 | % | 322.5 | 35.2 | 10.9 | % | 1,074.6 | 147.7 | 13.7 | % | 954.8 | 108.2 | 11.3 | % | ||||

| Note: Totals may not sum due to rounding. | |||||||||||||||||||

Long-term Care

LTC average occupancy increased to 98.4% in Q3 2024, an increase of 60 bps from 97.8% in Q3 2023.

Revenue increased by $10.1 million or 5.3% to $201.8 million in Q3 2024. During the quarter, LTC funding increases were announced in both Alberta and Manitoba, retroactive to April 1, 2024, resulting in an aggregate annualized revenue increase of $11.1 million. Excluding $1.8 million in out-of-period funding related to these retroactive rate increases, revenue increased by $8.3 million, largely driven by funding increases, timing of spend and improved occupancy.

NOI and NOI margin in Q3 2024 were $24.6 million and 12.2%, compared to $16.6 million and 8.7% in Q3 2023. Excluding $1.8 million in out-of-period funding recognized in the quarter, NOI improved to $22.8 million or 11.4% of revenue, reflecting funding enhancements, timing of spend and increased occupancy, partially offset by higher operating costs.

Home Health Care

Home health care ADV of 30,181 in Q3 2024 increased 10.2% from Q3 2023.

Revenue increased to $138.4 million in Q3 2024, an increase of 17.2% from Q3 2023, driven by growth in ADV and rate increases.

NOI and NOI margin were $15.6 million and 11.3% in Q3 2024, an increase from $11.6 million and 9.8% in Q3 2023, reflecting higher volumes and rates, partially offset by increased wages and benefits.

Managed Services

At the end of Q3 2024, Extendicare Assist had management contracts with 70 homes comprising 9,717 beds. Extendicare Assist also provides a further 52 homes with consulting and other services. The number of third-party and joint venture beds served by SGP increased to approximately 143,500 at the end of Q3 2024, up 11.4% from the prior year period.

Revenue increased by $6.1 million or 48.0% to $18.8 million from Q3 2023. NOI increased by 41.1% to $9.9 million with an NOI margin of 52.6%, an increase from $7.0 million and 55.2% in Q3 2023. These results were largely driven by the Revera and Axium transactions and new SGP clients, partially offset by Extendicare Assist clients that reduced their scope of services.

Financial Position

Extendicare has strong liquidity with cash and cash equivalents on hand of $154.3 million as at September 30, 2024. Subsequent to quarter end, the Company improved its capital flexibility with the new Senior Secured Credit Facility, providing access to additional undrawn credit capacity of $32.7 million under the new $145.0 million Revolving Facility and $130.0 million under the Delayed Draw Facility, which will be used to fund the redemption of the 2025 Debentures on December 16, 2024. Additionally, subsequent to the quarter, the Company used cash on hand to purchase for approximately $30.0 million, 9 Class A Ontario LTC homes that have been under long-term leases. The purchase price represents the balance of the remaining lease payments plus accrued interest and other costs, and fully satisfies the remaining lease liability (carrying interest rates from 6.4% to 7.2%).

Select Financial Information

The following is a summary of the Company’s consolidated financial information for the three and nine months ended September 30, 2024 and 2023.

| (unaudited) | Three months ended September 30 |

Nine months ended September 30 |

|||||||

| (thousands of dollars unless otherwise noted) | 2024 | 2023 | 2024 | 2023 | |||||

| Revenue | 359,061 | 322,529 | 1,074,638 | 954,776 | |||||

| Operating expenses | 308,944 | 287,319 | 926,971 | 846,532 | |||||

| NOI(1) | 50,117 | 35,210 | 147,667 | 108,244 | |||||

| NOI margin(1) | 14.0% | 10.9% | 13.7% | 11.3% | |||||

| Administrative costs | 14,010 | 14,440 | 42,817 | 41,720 | |||||

| Adjusted EBITDA(1) | 36,107 | 20,770 | 104,850 | 66,524 | |||||

| Adjusted EBITDA margin(1) | 10.1% | 6.4% | 9.8% | 7.0% | |||||

| Other (expense) income | (1,082 | ) | 5,048 | 2,704 | 28 | ||||

| Share of profit from investment in joint ventures | 431 | 598 | 1,826 | 598 | |||||

| Net earnings | 16,295 | 11,831 | 55,281 | 25,362 | |||||

| per basic share ($) | 0.20 | 0.14 | 0.66 | 0.30 | |||||

| per diluted share ($) | 0.19 | 0.14 | 0.63 | 0.30 | |||||

| AFFO(1) | 23,125 | 12,290 | 63,828 | 42,166 | |||||

| per basic share ($) | 0.28 | 0.14 | 0.76 | 0.49 | |||||

| per diluted share ($) | 0.25 | 0.14 | 0.70 | 0.47 | |||||

| Maintenance capex | 4,093 | 4,895 | 12,333 | 9,670 | |||||

| Cash dividends declared per share | 0.12 | 0.12 | 0.36 | 0.36 | |||||

| Payout ratio(1) | 43% | 82% | 47% | 72% | |||||

| Weighted average number of shares (000’s) | |||||||||

| Basic | 84,237 | 85,009 | 84,202 | 85,218 | |||||

| Diluted | 95,556 | 95,870 | 95,537 | 96,106 | |||||

Extendicare’s disclosure documents, including its Management’s Discussion and Analysis (“MD&A”), may be found on SEDAR+ at www.sedarplus.ca under the Company’s issuer profile and on the Company’s website at www.extendicare.com under the “Investors/Financial Reports” section.

November Dividend Declared

The Board of Directors of Extendicare today declared a cash dividend of $0.04 per share for the month of November 2024, which is payable on December 16, 2024, to shareholders of record at the close of business on November 29, 2024. This dividend is designated as an “eligible dividend” within the meaning of the Income Tax Act (Canada).

Conference Call and Webcast

Extendicare will hold a conference call to discuss its 2024 third quarter results on November 13, 2024, at 11:30 a.m. (ET). The call will be webcast live and archived online at www.extendicare.com under the “Investors/Events & Presentations” section. Alternatively, the call-in number is 1-844-763-8274. A replay of the call will be available approximately two hours after completion of the live call until midnight on November 29, 2024, by dialing 1-855-669-9658 followed by the passcode 2798337#.

About Extendicare

Extendicare is a leading provider of care and services for seniors across Canada, operating under the Extendicare, ParaMed, Extendicare Assist, and SGP Purchasing Network brands. We are committed to delivering quality care to meet the needs of a growing seniors’ population, inspired by our mission to provide people with the care they need, wherever they call home. We operate a network of 122 long-term care homes (52 owned, 70 under management contracts), deliver approximately 10.7 million hours of home health care services annually, and provide group purchasing services to third parties representing approximately 143,500 beds across Canada. Extendicare proudly employs approximately 22,000 qualified, highly trained and dedicated team members who are passionate about providing high-quality care and services to help people live better.

Non-GAAP Measures

Certain measures used in this press release, such as “net operating income”, “NOI”, “NOI margin”, “Adjusted EBITDA”, “Adjusted EBITDA margin”, “AFFO”, and “payout ratio”, including any related per share amounts, are not measures recognized under GAAP and do not have standardized meanings prescribed by GAAP. These measures may differ from similar computations as reported by other issuers and, accordingly, may not be comparable to similarly titled measures as reported by such issuers. These measures are not intended to replace earnings (loss) from continuing operations, net earnings (loss), cash flow, or other measures of financial performance and liquidity reported in accordance with GAAP. Such items are presented in this document because management believes that they are relevant measures of Extendicare’s operating performance and ability to pay cash dividends.

Management uses these measures to exclude the impact of certain items, because it believes doing so provides investors a more effective analysis of underlying operating and financial performance and improves comparability of underlying financial performance between periods. The exclusion of certain items does not imply that they are non-recurring or not useful to investors.

Detailed descriptions of these measures can be found in Extendicare’s Q3 2024 MD&A (refer to “Non-GAAP Measures”), which is available on SEDAR+ at www.sedarplus.ca and on Extendicare’s website at www.extendicare.com.

Reconciliations for certain non-GAAP measures included in this press release are outlined below.

The following table provides a reconciliation of AFFO, which includes discontinued operations, to “net cash from operating activities”, which the Company believes is the most comparable GAAP measure to AFFO.

| (unaudited) | Three months ended September 30 |

Nine months ended September 30 |

|||||||

| (thousands of dollars) | 2024 | 2023 | 2024 | 2023 | |||||

| Net cash from operating activities | 42,518 | 7,223 | 126,089 | 4,244 | |||||

| Add (Deduct): | |||||||||

| Net change in operating assets and liabilities, including interest, and taxes | (16,829 | ) | 5,901 | (56,553 | ) | 39,935 | |||

| Other expense | 1,082 | 4,072 | 4,810 | 9,092 | |||||

| Current income tax on items excluded from AFFO | (287 | ) | (679 | ) | (918 | ) | (2,009 | ) | |

| Depreciation for office leases | (741 | ) | (791 | ) | (2,167 | ) | (2,388 | ) | |

| Depreciation for FFEC (maintenance capex) | (1,959 | ) | (3,455 | ) | (5,872 | ) | (7,945 | ) | |

| Additional maintenance capex | (1,863 | ) | (1,240 | ) | (5,597 | ) | (1,525 | ) | |

| Principal portion of government capital funding | 396 | 534 | 1,255 | 2,037 | |||||

| Adjustments for joint ventures | 808 | 725 | 2,781 | 725 | |||||

| AFFO | 23,125 | 12,290 | 63,828 | 42,166 | |||||

The following table provides a reconciliation of “earnings before income taxes” to Adjusted EBITDA and “net operating income”.

| (unaudited) | Three months ended September 30 |

Nine months ended September 30 |

|||||||

| (thousands of dollars) | 2024 | 2023 | 2024 | 2023 | |||||

| Earnings before income taxes | 22,657 | 13,668 | 73,142 | 32,539 | |||||

| Add (Deduct): | |||||||||

| Depreciation and amortization | 8,635 | 9,023 | 24,839 | 23,547 | |||||

| Net finance costs | 4,164 | 3,725 | 11,399 | 11,064 | |||||

| Other expense (income) | 1,082 | (5,048 | ) | (2,704 | ) | (28 | ) | ||

| Share of profit from investment in joint ventures | (431 | ) | (598 | ) | (1,826 | ) | (598 | ) | |

| Adjusted EBITDA | 36,107 | 20,770 | 104,850 | 66,524 | |||||

| Administrative costs | 14,010 | 14,440 | 42,817 | 41,720 | |||||

| Net operating income | 50,117 | 35,210 | 147,667 | 108,244 | |||||

Forward-looking Statements

This press release contains forward-looking statements concerning anticipated future events, results, circumstances, economic performance or expectations with respect to Extendicare and its subsidiaries, including, without limitation: statements regarding redemption of the 2025 Debentures, its business operations, business strategy, growth strategy, results of operations and financial condition, including anticipated timelines and costs in respect of development projects; and statements relating to the agreements entered into with Revera, Axium and its affiliates, Axium JV and/or Axium JV II in respect of the acquisition, disposition, ownership, operation and redevelopment of LTC homes in Ontario and Manitoba. Forward-looking statements can often be identified by the expressions “anticipate”, “believe”, “estimate”, “expect”, “intend”, “objective”, “plan”, “project”, “will”, “may”, “should” or other similar expressions or the negative thereof. These forward-looking statements reflect the Company’s current expectations regarding future results, performance or achievements and are based upon information currently available to the Company and on assumptions that the Company believes are reasonable. The Company assumes no obligation to update or revise any forward-looking statement, except as required by applicable securities laws. These statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to differ materially from those expressed or implied in the statements. For further information on the risks, uncertainties and assumptions that could cause Extendicare’s actual results to differ from current expectations, refer to “Risks and Uncertainties” and “Forward-looking Statements” in Extendicare’s Q3 2024 MD&A and latest Annual Information Form filed by Extendicare with the securities regulatory authorities, available at www.sedarplus.ca and on Extendicare’s website at www.extendicare.com. Given these risks and uncertainties, readers are cautioned not to place undue reliance on Extendicare’s forward-looking statements. Except as required by applicable securities laws, the Company assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Extendicare contact:

David Bacon, Senior Vice President and Chief Financial Officer

T: (905) 470-4000

E: david.bacon@extendicare.com

www.extendicare.com

| Endnote | ||

| (1 | ) | See the “Non-GAAP Measures” section of this press release and the Company’s Q3 2024 MD&A, which includes the reconciliation of such non-GAAP measures to the most directly comparable GAAP measures. |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lam Research Unusual Options Activity For November 12

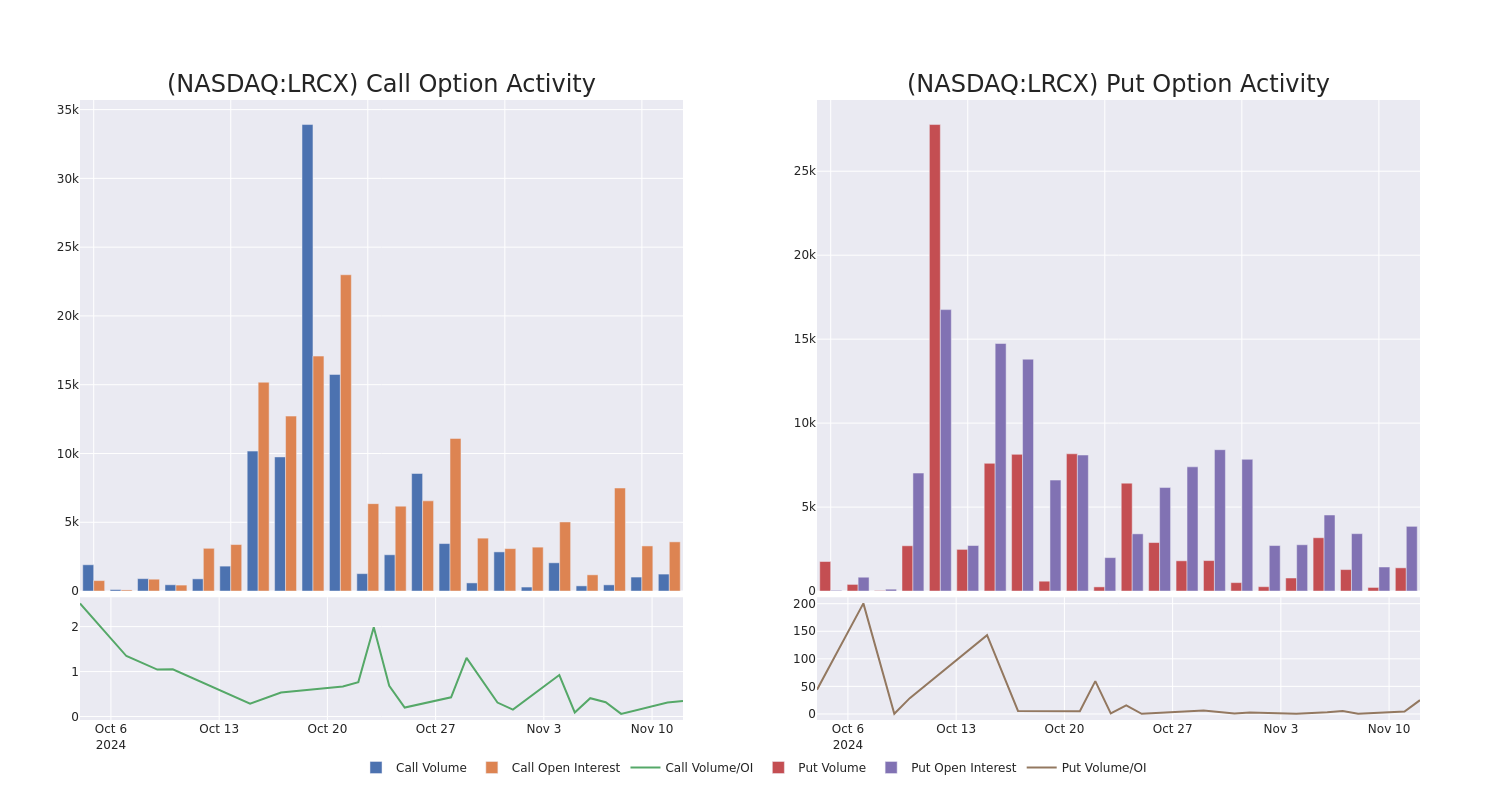

Deep-pocketed investors have adopted a bullish approach towards Lam Research LRCX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LRCX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Lam Research. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 37% bearish. Among these notable options, 2 are puts, totaling $163,980, and 6 are calls, amounting to $383,121.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $80.5 for Lam Research during the past quarter.

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lam Research’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lam Research’s substantial trades, within a strike price spectrum from $60.0 to $80.5 over the preceding 30 days.

Lam Research Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | PUT | TRADE | BEARISH | 12/06/24 | $3.05 | $2.97 | $3.03 | $75.00 | $121.2K | 43 | 1.0K |

| LRCX | CALL | TRADE | BULLISH | 11/15/24 | $16.3 | $15.5 | $16.3 | $60.00 | $97.8K | 226 | 60 |

| LRCX | CALL | SWEEP | BEARISH | 01/17/25 | $5.35 | $5.3 | $5.31 | $75.00 | $95.4K | 822 | 375 |

| LRCX | CALL | SWEEP | BULLISH | 06/20/25 | $10.05 | $10.05 | $10.05 | $75.00 | $75.3K | 1.5K | 383 |

| LRCX | CALL | TRADE | NEUTRAL | 06/20/25 | $10.85 | $10.55 | $10.7 | $75.00 | $53.5K | 1.5K | 50 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment manufacturers in the world. It specializes in deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Following our analysis of the options activities associated with Lam Research, we pivot to a closer look at the company’s own performance.

Where Is Lam Research Standing Right Now?

- Trading volume stands at 5,651,864, with LRCX’s price down by -0.61%, positioned at $75.7.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 71 days.

Professional Analyst Ratings for Lam Research

5 market experts have recently issued ratings for this stock, with a consensus target price of $94.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $100.

* In a cautious move, an analyst from Stifel downgraded its rating to Buy, setting a price target of $100.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Lam Research, targeting a price of $76.

* An analyst from Wells Fargo persists with their Equal-Weight rating on Lam Research, maintaining a target price of $85.

* Reflecting concerns, an analyst from B. Riley Securities lowers its rating to Buy with a new price target of $110.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lam Research with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GTAA REPORTS 2024 THIRD QUARTER RESULTS

TORONTO, Nov. 12, 2024 /CNW/ – The Greater Toronto Airports Authority (“GTAA”) today reported its financial and operating results for the third quarter and the first nine months of 2024. Travel demand continued to show a steady incline. As a result, passenger activity increased by 0.3 million or 3.1 per cent (from 12.5 million to 12.8 million) in the third quarter of 2024 and 1.7 million or 5.1 per cent (from 33.8 million to 35.5 million) during the first nine months of the 2024, when compared to the same periods of 2023. Most of the growth in the first nine months of 2024 was attributable to international travel, which reflected a 9.0 per cent increase in international passengers over 2023.

Amid the increase in travel demand this year, Toronto Pearson has maintained both a solid financial performance and high levels of passenger satisfaction, consistent with its current ranking as North America’s best large airport by Airports Council International. With travel demand expected to rise to 65 million annual passengers by the early 2030s, Toronto Pearson is strategically positioning itself for the future with Pearson LIFT, the organization’s plan to transform Pearson into one of the most advanced, sustainable and passenger-friendly airports in the world through cost-effective, value-driven investments. Pearson LIFT is a part of Toronto Pearson’s capital plan spanning more than a decade. It includes three major programs that will address passenger growth demands and prepare the airport for the future of travel.

“The investments we’re making in Toronto Pearson are essential for us to maintain our status as a world-class, international airport that delivers on our vision of bringing joy back to travel,” said Deborah Flint, President and CEO. “As we proceed with LIFT, we are ensuring stakeholders are informed and engaged in the evolution of Toronto Pearson. In a formal planning process, the majority of our airline partners endorsed our LIFT program, signaling confidence in our strategy to grow the airport responsibly and affordably. We appreciate the input we have asked for and received from airlines, government agencies, community groups and other stakeholders. We will continue this approach with our stakeholders as we prepare to select partners to further plan, solution, design and ultimately construct the final project scope.”

Key Passenger and Financial Information

|

For the periods ended September 30 |

||||||||

|

Three months |

Nine-months |

|||||||

|

(millions) |

2024 |

2023 |

Change1 |

2024 |

2023 |

Change1 |

||

|

Passenger Activity |

% |

% |

||||||

|

Domestic |

4.8 |

4.9 |

(0.1) |

(2.7) |

12.4 |

12.6 |

(0.2) |

(1.6) |

|

International |

8.0 |

7.6 |

0.4 |

7.0 |

23.1 |

21.2 |

1.9 |

9.0 |

|

Total |

12.8 |

12.5 |

0.3 |

3.1 |

35.5 |

33.8 |

1.7 |

5.1 |

|

($ millions) |

||||||||

|

Total Revenues |

531.2 |

504.5 |

26.7 |

5.3 |

1,485.0 |

1,393.9 |

91.1 |

6.5 |

|

EBITDA 2 |

237.2 |

279.6 |

(42.4) |

(1.7) |

731.2 |

730.0 |

1.2 |

0.2 |

|

EBITDA Margin |

51.7 % |

55.4 % |

(3.7) pp |

49.2 % |

52.4 % |

(3.2) pp |

||

|

Net Income |

122.3 |

99.7 |

22.6 |

22.6 |

282.4 |

229.7 |

52.7 |

22.9 |

|

Free Cash Flow 2 |

194.2 |

207.5 |

(13.3) |

(6.4) |

351.2 |

476.4 |

(125.2) |

(26.3) |

|

1 % Change” and “%” are based on detailed actual numbers (not rounded as presented). |

||||||||

|

2 Please refer to Non-GAAP Financial Measures at the end of this document for further details. |

||||||||

Revenues increased during the three- and nine-months ended September 30, 2024 by $26.7 million to $531.2 million and $91.1 million to $1,485.0 million, respectively, when compared to the same periods of 2023, primarily due to the rates and charges going up in January 2024.

Earnings before interest and financing costs, and amortization (“EBITDA”) decreased during the three-months ended September 30, 2024 by $42.4 million to $237.2 million due to an increase in operating costs (before amortization), partially offset by the increase in revenues. EBITDA increased during the nine-months ended September 30, 2024 by $1.2 million to $731.2 million, when compared to the same periods of 2023, due to the increase in revenues associated with higher operating activity, and new rates and charges, largely offset by the increase in operating costs (before amortization).

Net income increased during three- and nine-months ended September 30, 2024 by $22.6 million to $122.3 million and $52.7 million to $282.4 million, respectively, when compared to the same period of 2023 due to higher revenues associated with the increase in operating activity and a decrease in interest expense, partially offset by an increase in operating costs during the third quarter and nine months of 2024.

Free cash flow decreased during three- and nine-months ended September 30, 2024 by $13.3 million to $194.2 million and $125.2 million to $351.2 million, respectively, when compared to the same periods of 2023, primarily driven by the decreases in cash flows from operations and less funds received under the Airport Critical Infrastructure Program an increase in capital expenditures, while partially offset by an increase in interest income. Free cash flow is a non-GAAP financial measure. Cash flows from operations are being used to fund increasing capital expenditures to improve facilities and enable growth, while maintaining quality customer experience and moderate debt levels.

The GTAA’s September 30, 2024 financial results are analyzed in more detail in the GTAA’s Condensed Interim Consolidated Financial Statements and Management’s Discussion and Analysis, each for the three- and nine-months ended September 30, 2024, which are available at www.torontopearson.com and on SEDAR at www.sedarplus.ca.

Caution Regarding Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable securities laws. This forward-looking information is based on a variety of assumptions and is subject to risks and uncertainties. These statements reflect GTAA Management’s current beliefs and are based on information currently available to GTAA Management. There is a risk that predictions, forecasts, conclusions and projections that constitute forward-looking information will not prove to be accurate, that the GTAA’s assumptions may not be correct and that actual results may differ materially from such forward-looking information. Additional detailed information about these assumptions, risks and uncertainties is included in the GTAA’s securities regulatory filings, including its most recent Annual Information Form and Management’s Discussion and Analysis, which can be found on SEDAR at www.sedarplus.ca.

NON-GAAP FINANCIAL MEASURES

Throughout this news release, there are references to the following performance measures which in Management’s view are valuable in assessing the economic performance of the GTAA. While these financial measures are not defined by the International Accounting Standards Board and are referred to as non-GAAP measures which may not have any standardized meaning, they are common benchmarks in the industry, and are used by the GTAA in assessing its operating results, including operating profitability, cash flow and investment program.

EBITDA

EBITDA is earnings from operations before interest and financing costs, (reversal)/impairment of investment property, write-down of property and equipment, and amortization. EBITDA is a commonly used measure of a company’s operating performance. This is used to evaluate the GTAA’s performance without having to factor in financing and accounting decisions.

Free Cash Flow

Free Cash Flow (“FCF”) is cash flows from operating activities per the consolidated statements of cash flows, and ACIP grants received less capital expenditures (property and equipment, investment property, and other) and interest and financing costs paid, net of interest income (excluding non-cash items). FCF is used to assess funds available for debt reduction or future investments within Toronto Pearson.

About Toronto Pearson

The Greater Toronto Airports Authority is the operator of Toronto Pearson International Airport, Canada’s largest airport and a vital connector of people, businesses, and goods.

Toronto Pearson was named “Best Airport over 40 million passengers in North America‘” in 2023 by Airports Council International (ACI), the global trade representative of the world’s airports, after winning the award five years running between 2017 and 2021. Toronto Pearson was also recognized in 2024 as one of “Canada’s Best Employers” by Forbes.

For our corporate X channel, please visit @PearsonComms. For operational updates and passenger information, please visit @TorontoPearson/@AeroportPearson on X. You can also follow us on Facebook or Instagram.

SOURCE Toronto Pearson

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/12/c4903.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/12/c4903.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed's Kashkari Warns Of December Interest Rate Pause Risk: 'Surprises To The Upside'

Minneapolis Fed President Neel Kashkari said Tuesday the Federal Reserve could hold off on an interest rate cut in December if inflation data comes in hotter than expected.

In an interview with Yahoo Finance, Kashkari also shared his views on inflation, the labor market and the potential effects of Donald Trump‘s tariffs, throwing in some unexpected perspectives.

Housing Inflation: ‘Elephant’ In The Room

Kashkari outlined his view of inflation as a multipart beast, with goods prices normalizing but housing inflation still causing headaches.

“Housing inflation is the big elephant that is still out there,” he said, noting that new lease prices have dropped but will take time to impact broader housing costs.

“I’m not ready to declare victory yet,” he said, adding that the trend in housing inflation is “encouraging.” He said he expects overall inflation to reach the Fed’s 2% target, though it might take another year or two due to the slow-moving nature of housing data.

The Fed official stressed that if inflation “surprises to the upside” between now and December, it might prompt the Fed to pause its anticipated rate cut in the last meeting of the year.

Kashkari’s remarks come ahead of the October inflation report slated for release Wednesday at 8:30 a.m. ET. Economists predict headline inflation could tick up from 2.4% to 2.6% year-over-year, marking the first increase after six consecutive months of declines.

Read also: Trump-Led Market Honeymoon Faces Crucial Test With Wednesday’s Inflation Data

Tariffs Are Only ‘Inflationary’ If Trade Wars Escalate

Kashkari dismissed concerns that Trump’s proposed tariffs would automatically fuel inflation.

“People will pay higher prices, but that doesn’t mean inflation is higher going forward,” he said.

A one-off increase in the price of goods is not enough to trigger a structural inflationary spiral, Kashkari said.

The real risk, according to Kashkari, lies in how other countries respond to U.S. tariffs. If retaliatory tariffs lead to a prolonged trade war, that could create a dangerous inflationary outcome.

“If there’s a tit-for-tat… that could lead to a longer-term inflationary impact,” he said.

US Labor Market: ‘Cautious Optimism’ From Businesses, Workers

The labor market remains a bright spot, according to Kashkari, who described it as “surprisingly resilient.”

With unemployment at a solid 4.1%, businesses and labor groups are showing “cautious optimism,” he said. Some labor unions are preparing for strikes, a sign that workers feel they’re in a strong negotiating position.

“Most of the dimensions we look at, the labor market is still strong,” Kashkari said, adding that consumer spending has also held up despite high rates. The revised savings rate is another encouraging indicator, suggesting that households aren’t overextending themselves even as interest rates remain elevated.

Kashkari Sticks To Fed Independence, Pushes Back Political Pressures

When asked how the Fed might respond if Trump were to pressure the Fed to lower interest rates, Kashkari was unequivocal.

“My colleagues and I are totally committed to achieving the goals that Congress has assigned us — maximum employment and 2% inflation — and we’re going to conduct monetary policy to achieve that,” he said.

Kashkari also addressed questions on the hypothetical scenario of Trump attempting to push out Fed Chair Jerome Powell if he disagrees with the Fed’s interest rate policy.

Kashkari declined to comment directly on this, referring to Powell’s own statements on the matter. “The chairman answered this question last week in his press conference.”

Read also: Powell Dismisses Talk Of Resignation After Trump Victory, Says ‘Policy Is Still Restrictive’

Market Reactions: Rate-Cut Bets Narrow, Treasury Yields Rise

Market expectations for a 25-basis-point rate cut in December dwindled further on Tuesday, reflecting growing uncertainty over the Fed’s rate-cut path.

Fed futures now imply a 56% chance of a December rate cut, with the remaining 44% odds leaning toward rates staying unchanged, according to the CME FedWatch Tool.

Equities were slightly down for the day. The S&P 500 index, tracked by the SPDR S&P 500 ETF Trust SPY, slipped 0.2% before the close in New York.

Treasury yields saw a notable increase, with the yield on the 10-year Treasury note rising by 10 basis points to 4.44%, marking its highest close since early July.

Read Next:

Neel Kashkari photo via the Federal Reserve.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Calidi Biotherapeutics Reports Third Quarter 2024 Operating and Financial Results

- Announced FDA Clearance of the Northwestern University IND Application for NeuroNova (CLD-101) Clinical Trial in High-Grade Glioma.

- Presented data supporting RTNova (CLD-400), the company’s systemic antitumor virotherapy platform, at the International Oncolytic Virotherapy Conference (IOVC) in Rotterdam, Netherlands, the Society for Immunotherapy of Cancer (SITC) Annual Meeting, and at Immuno US 2024 in San Diego, California.

- Raised $2 million in a registered direct offering and concurrent private placement.

SAN DIEGO, Nov. 12, 2024 (GLOBE NEWSWIRE) — Calidi Biotherapeutics Inc. CLDI (“Calidi”), a clinical-stage biotechnology company developing a new generation of targeted antitumor virotherapies, today reported its operating and financial results for the third quarter ended September 30, 2024, and reviewed recent business highlights.

“Calidi continues to advance our development programs while expanding our industry-leading position in targeted antitumor virotherapies,” said Allan Camaisa, CEO and Chairman of the Board of Calidi Biotherapeutics. “In addition, we are pleased that Northwestern University has received U.S. FDA clearance to advance our CLD-101 program in the clinic for newly diagnosed high-grade glioma.”

Third Quarter 2024 and Recent Corporate Developments

- The U.S. Food and Drug Administration (FDA) has cleared Northwestern University’s Investigational New Drug (IND) application for Calidi’s NeuroNova (CLD-101). CLD-101 is a novel stem-cell based platform designed to deliver oncolytic viruses to tumors, enhancing their antitumor effects. The Phase 1b/2 clinical trial in newly diagnosed high-grade glioma is expected to commence in early 2025 at Northwestern University.

- Data was presented on RTNova (CLD-400), Calidi’s systemic antitumor virotherapy platform, at the International Oncolytic Virotherapy Conference (IOVC) in Rotterdam, Netherlands, at Immuno US 2024 in San Diego, California and the Society for Immunotherapy of Cancer (SITC) annual meeting. RTNova is a systemic treatment designed for reduced elimination by the humoral immune system. It targets multiple tumor sites, killing tumor cells while altering the tumor immune microenvironment. This novel systemic therapeutic approach not only facilitates easier administration but also broadens the potential patient population who can benefit from this treatment.

- Calidi announced in October the completion of a definitive securities purchase agreement with certain institutional investors, raising $2 million in a registered direct offering and concurrent private placement.

Third Quarter 2024 Financial Results

The Company reported a net loss of $5.1 million, or $0.65 per share, for the three months ended September 30, 2024, compared to a net loss of $2.0 million, or $1.41 per share, for the same period in 2023.

Research and development expenses were $2.2 million for the three months ended September 30, 2024, compared to $3.3 million for the comparable period in 2023, respectively.

General and administrative expenses were $3.1 million for the three months ended September 30, 2024, compared to $4.0 million for the comparable period in 2023, respectively.

The Company had approximately $1.9 million in cash and $0.2 million in restricted cash as of both September 30, 2024 and December 31, 2023.

About Calidi Biotherapeutics:

Calidi Biotherapeutics CLDI is a clinical-stage immuno-oncology company with proprietary technology designed to arm the immune system to fight cancer. Calidi’s novel stem cell-based platforms are utilizing potent allogeneic stem cells capable of carrying payloads of oncolytic viruses for use in multiple oncology indications, including high-grade gliomas and solid tumors. Calidi’s clinical stage off-the-shelf, universal cell-based delivery platforms are designed to protect, amplify, and potentiate oncolytic viruses leading to enhanced efficacy and improved patient safety. Calidi’s preclinical off-the-shelf enveloped virotherapies are designed to target disseminated solid tumors. This dual approach can potentially treat, or even prevent, metastatic disease. Calidi Biotherapeutics is headquartered in San Diego, California. For more information, please visit www.calidibio.com.

Forward-Looking Statements

This press release may contain forward-looking statements for purposes of the “safe harbor” provisions under the United States Private Securities Litigation Reform Act of 1995. Terms such as “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “towards,” “would” as well as similar terms, are forward-looking in nature, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements concerning upcoming key milestones (including the reporting of interim clinical results and the dosing of patients), planned clinical trials, and statements relating to the safety and efficacy of Calidi’s therapeutic candidates in development. Any forward-looking statements contained in this discussion are based on Calidi’s current expectations and beliefs concerning future developments and their potential effects and are subject to multiple risks and uncertainties that could cause actual results to differ materially and adversely from those set forth or implied in such forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that Calidi is not able to raise sufficient capital to support its current and anticipated clinical trials, the risk that early results of clinical trials do not necessarily predict final results and that one or more of the clinical outcomes may materially change following more comprehensive review of the data, and as more patient data becomes available, the risk that Calidi may not receive FDA approval for some or all of its therapeutic candidates. Other risks and uncertainties are set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Registration Statements filed with the SEC on (i) Form S-4 filed on August 2, 2023 and the corresponding prospectus filed on August 4, 2023, and (ii) on Form S-1 filed on April 15, 2024, and the Company’s periodic reports filed with the SEC on (i) Form 10-K filed on March 15, 2024, (ii) Form 10-Q filed on May 14, 2024, and (iii) Form 10-Q filed on August 13, 2024. These reports may be amended or supplemented by other reports we file with the SEC from time to time.

For Investors:

Dave Gentry, CEO

RedChip Companies, Inc.

1-407-644-4256

CLDI@redchip.com

| CALIDI BIOTHERAPEUTICS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands except for par value data) |

||||||||

| September 30, 2024 |

December 31, 2023 | |||||||

| (Unaudited) |

||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 1,897 | $ | 1,949 | ||||

| Prepaid expenses and other current assets | 324 | 2,354 | ||||||

| Total current assets | 2,221 | 4,303 | ||||||

| NONCURRENT ASSETS | ||||||||

| Machinery and equipment, net | 982 | 1,270 | ||||||

| Operating lease right-of-use assets, net | 3,237 | 4,073 | ||||||

| Other noncurrent assets | 217 | 373 | ||||||

| TOTAL ASSETS | $ | 6,657 | $ | 10,019 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 3,574 | $ | 2,796 | ||||

| Related party accounts payable | — | 81 | ||||||

| Accrued expenses and other current liabilities | 2,567 | 4,896 | ||||||

| Related party accrued expenses and other current liabilities | 496 | 536 | ||||||

| Term notes payable, net of discount, including accrued interest | 242 | 529 | ||||||

| Related party term notes payable, net of discount, including accrued interest | 2,631 | 278 | ||||||

| Related party bridge loan payable, including accrued interest | 217 | — | ||||||

| Related party other current liability | 620 | — | ||||||

| Finance lease liability, current | 69 | 81 | ||||||

| Operating lease right-of-use liability, current | 1,163 | 1,035 | ||||||

| Total current liabilities | 11,579 | 10,232 | ||||||

| NONCURRENT LIABILITIES | ||||||||

| Operating lease right-of-use liability, noncurrent | 2,161 | 3,037 | ||||||

| Finance lease liability, noncurrent | 166 | 216 | ||||||

| Warrant liability | 163 | 623 | ||||||

| Related party warrant liability | 13 | 48 | ||||||

| Convertible notes payable, including accrued interest | 1,773 | — | ||||||

| Related party term notes payable, net of discount, including accrued interest | — | 2,060 | ||||||

| Promissory note | 600 | — | ||||||

| Other noncurrent liabilities | — | 1,500 | ||||||

| Related party other noncurrent liabilities | — | 538 | ||||||

| TOTAL LIABILITIES | 16,455 | 18,254 | ||||||

| Commitments and contingencies (Note 11) | ||||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Common stock, $0.0001 par value, 330,000 shares authorized; 9,311 and 3,552 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 1 | 1 | ||||||

| Additional paid-in capital | 107,408 | 91,383 | ||||||

| Non-controlling interest | 485 | — | ||||||

| Accumulated other comprehensive loss, net of tax | (74 | ) | (47 | ) | ||||

| Accumulated deficit | (117,618 | ) | (99,572 | ) | ||||

| Total stockholders’ deficit | (9,798 | ) | (8,235 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 6,657 | $ | 10,019 | ||||

| CALIDI BIOTHERAPEUTICS, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) |

|||||||||||||

| Three Months Ended September 30, |

|||||||||||||

| 2024 | 2023 | ||||||||||||

| (Unaudited) | |||||||||||||

| OPERATING EXPENSES | |||||||||||||

| Research and development | $ | (2,153 | ) | $ | (3,251 | ) | |||||||

| General and administrative | (3,073 | ) | (3,970 | ) | |||||||||

| Total operating expense | (5,226 | ) | (7,221 | ) | |||||||||

| Loss from operations | (5,226 | ) | (7,221 | ) | |||||||||

| OTHER INCOME (EXPENSES), NET | |||||||||||||

| Interest expense | (98 | ) | (101 | ) | |||||||||

| Interest expense – related party | (134 | ) | (223 | ) | |||||||||

| Change in fair value of debt, other liabilities, and derivatives | 352 | 845 | |||||||||||

| Change in fair value of debt, other liabilities, and derivatives – related party | 28 | 4,473 | |||||||||||

| Debt extinguishment | — | (139 | ) | ||||||||||

| Debt extinguishment – related party | — | (332 | ) | ||||||||||

| Grant income | — | 693 | |||||||||||

| Other income (expense), net | 8 | (8 | ) | ||||||||||

| Total other income (expenses), net | 156 | 5,208 | |||||||||||

| LOSS BEFORE INCOME TAXES | (5,070 | ) | (2,013 | ) | |||||||||

| Income tax credit (provision) | 1 | (11 | ) | ||||||||||

| NET LOSS | $ | (5,069 | ) | $ | (2,024 | ) | |||||||

| Net loss attributable to noncontrolling interest | (15 | ) | — | ||||||||||

| NET LOSS ATTRIBUTABLE TO CONTROLLING INTEREST | $ | (5,054 | ) | $ | (2,024 | ) | |||||||

| Deemed dividend on warrants | — | — | |||||||||||

| NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | (5,054 | ) | $ | (2,024 | ) | |||||||

| Net loss per share; basic and diluted | $ | (0.65 | ) | $ | (1.41 | ) | |||||||

| Weighted average common shares outstanding; basic and diluted | 7,824 | 1,431 | |||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Neuronetics Reports Inducement Grant Under Nasdaq Listing Rule 5635(c)(4)

MALVERN, Pa., Nov. 12, 2024 (GLOBE NEWSWIRE) — Neuronetics, Inc. STIM, a commercial stage medical technology company focused on designing, developing, and marketing products that improve the quality of life for patients who suffer from neurohealth disorders, today announced the granting of inducement awards of Restricted Stock Units representing a total of 13,500 shares of the Company’s common stock (RSUs) to seven new non-executive employees. In accordance with NASDAQ Listing Rule 5635(c)(4), these awards were approved by Neuronetics’ Compensation Committee and made as material inducements to their respective employment with the Company.

Each of the RSU grants vests ratably in equal installments on the first, second, and third anniversaries of the grant date, subject to the recipient’s continued service with the Company through the applicable vesting date. The RSUs are subject to the terms of the Neuronetics 2020 Inducement Plan.

About Neuronetics

Neuronetics, Inc. believes that mental health is as important as physical health. As a global leader in neuroscience and the largest TMS company in the industry, Neuronetics is redefining patient and physician expectations by designing and developing products that improve the quality of life for people suffering from psychiatric disorders. An FDA-cleared, non-drug, noninvasive treatment for people with depression, Neuronetics’ NeuroStar® Advanced Therapy system is today’s leading transcranial magnetic stimulation (TMS) treatment for major depressive disorder with over 6.9 million treatments delivered. NeuroStar is widely researched and backed by the largest clinical data set of any TMS system for depression, including the world’s largest depression Outcomes Registry. Our NeuroStar® Advanced Therapy system is also FDA-cleared to treat people suffering from obsessive-compulsive disorder, as well as for the treatment of comorbid anxiety symptoms (“anxious depression”) for adults with MDD suffering from anxiety symptoms. Neuronetics is committed to transforming lives by offering an exceptional treatment option that produces extraordinary results. For safety information and indications for use, visit NeuroStar.com.

“Safe harbor” statement under the Private Securities Litigation Reform Act of 1995:

Statements in the press release regarding Neuronetics, Inc. (the “Company”) that are not historical facts constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by terms such as “outlook,” “potential,” “believe,” “expect,” “plan,” “anticipate,” “predict,” “may,” “will,” “could,” “would” and “should” as well as the negative of these terms and similar expressions. These statements are subject to significant risks and uncertainties and actual results could differ materially from those projected. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this release. These risks and uncertainties include, without limitation, risks and uncertainties related to: the impact of COVID-19 on the Company’s operational and budget plans as well as general political and economic conditions, including as a result of efforts by governmental authorities to mitigate COVID-19, such as travel bans, shelter in place orders and third-party business closures and the related impact on resource allocations, manufacturing and supply chains and patient access to commercial products; the Company’s ability to execute its business continuity; the Company’s ability to achieve or sustain profitable operations due to its history of losses; the Company’s reliance on the sale and usage of its NeuroStar Advanced Therapy for Mental Health System to generate revenues; the scale and efficacy of the Company’s salesforce as well as the Company’s ability to retain talent; availability of coverage and reimbursement from third-party payors for treatments using the Company’s products; physician and patient demand for treatments using the Company’s products; developments in respect of competing technologies and therapies for the indications that the Company’s products treat; product defects; the Company’s ability to obtain and maintain intellectual property protection for its technology; developments in clinical trials or regulatory review of NeuroStar Advanced Therapy for Mental Health System for additional indications; and developments in regulation in the United States and other applicable jurisdictions. For a discussion of these and other related risks, please refer to the Company’s recent SEC filings which are available on the SEC’s website at www.sec.gov. These forward-looking statements are based on the Company’s expectations and assumptions as of the date of this press release. Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this press release as a result of new information, future events, or changes in the Company’s expectations.

Investor Contact:

Mike Vallie or Mark Klausner

ICR Westwicke

443-213-0499

ir@neuronetics.com

Media Contact:

EvolveMKD

646-517-4220

NeuroStar@evolvemkd.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Surya N Mohapatra Exercises Options, Realizes $565K

A significant insider transaction involving the exercise of company stock options was reported on November 12, by Surya N Mohapatra, Board Member at Leidos Holdings LDOS, as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that Mohapatra, Board Member at Leidos Holdings, a company in the Industrials sector, just exercised stock options worth 4,070 shares of LDOS stock with an exercise price of $63.08.

As of Tuesday morning, Leidos Holdings shares are up by 0.37%, with a current price of $202.14. This implies that Mohapatra’s 4,070 shares have a value of $565,954.

About Leidos Holdings

Leidos Holdings Inc is a technology, engineering, and science company that provides services and solutions in the defense, intelligence, civil, and health markets, both domestically and internationally. Company customer includes the U.S. Department of Defense (“DoD”), the U.S. Intelligence Community, the U.S. Department of Homeland Security (“DHS”), the Federal Aviation Administration (“FAA”), the Department of Veterans Affairs (“VA”), and many other U.S. civilian, state and local government agencies, etc. The company is engaged in three reportable segments; Defense Solutions, Civil, and Health. Defense Solutions provides technologically latest services, solutions, and products to a broad customer base. It generates key revenue from Defense Solutions.

Understanding the Numbers: Leidos Holdings’s Finances

Revenue Growth: Leidos Holdings displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 6.86%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Key Profitability Indicators:

-

Gross Margin: The company shows a low gross margin of 18.19%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Leidos Holdings’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 2.72.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.11.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 22.91 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 1.7, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 14.94, Leidos Holdings presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Leidos Holdings’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TeraWulf Stock Tumbles After Worse-Than-Expected Q3 Results

TeraWulf Inc. WULF reported its third-quarter results after Tuesday’s closing bell. Here’s a look at the details from the report.

The Details: TeraWulf reported quarterly GAAP losses of six cents per share, which missed the analyst consensus estimate for losses of three cents. Quarterly revenue came in at $27.05 million, which missed the analyst consensus estimate of $34.27 million and is an increase over sales of $18.95 million from the same period last year.

- TeraWulf self-mined 555 Bitcoin BTC/USD across the Lake Mariner and Nautilus Cryptomine facilities, which represented a 43.4% decrease relative to the same quarter last year.

- Total value of Bitcoin self-mined was $33.9 million compared to $27.6 million in the prior year’s quarter.

- Power cost per Bitcoin self-mined increased year-over-year, to $30,448 per Bitcoin, up from $9,322 per Bitcoin in the third-quarter of 2023 due to an approximate doubling in network difficulty and the Bitcoin reward halving in April 2024.

- Total self-mining hashrate capacity of 10.0 EH/s as of Sept. 30, 2024, represents an increase of 100% relative to the same prior year period.

“The third quarter and the beginning of the fourth quarter marked a pivotal turning point for TeraWulf, as we delivered strong results across our strategic, financial, and operational objectives,” said Paul Prager, chairman and CEO of TeraWulf.

“The sale of our interest in the Nautilus joint venture not only generated a substantial return but also sharpened our focus on scaling high-performance computing at Lake Mariner. Securing an expanded ground lease with exclusive rights to 750 MW of infrastructure capacity is a significant milestone in our growth strategy. Combined with the success of our $500 million capital raise, we are exceptionally well-positioned to seize new opportunities in both Bitcoin mining and HPC hosting as we enter 2025,” Prager added.

WULF Price Action: According to Benzinga Pro, TeraWulf shares are down 3.51% after-hours at $8.23 at the time of publication Tuesday.

Read More:

Photo: Pete Linforth from Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.