Geokey and Overhead Door Corporation Open New Possibilities for Your Property with Seamless Mobile Entry

Overhead Door Corporation and Geokey Bring Smart Access to Garage Doors and More

OMAHA, Neb., Nov. 12, 2024 /PRNewswire/ — Geokey® today announced its newest partnership with Overhead Door Corporation, a leader in garage door opener technology. This integration enables users to control their Genie® and Overhead Door™ Brand garage door openers directly from their smartphones, using Geokey’s mobile access control software.

“Our goal has always been to simplify property access for on-site staff and residents, and our partnership with Overhead Door Corporation is an important step in allowing users to open any door, anywhere, using a single app,” said Brandon Peterson, CEO of Geokey. “Integrating our software with Overhead Door Corporation’s operators provides added convenience for residents, making access to frequently used doors easier than ever before.”

Residents can now control their garage door openers remotely through the Geokey app. Owners, operators, and property managers can also monitor garage door activity in real-time, monitoring who is accessing and at what time, providing additional security and peace-of-mind for owners, operators, and residents.

“At Overhead Door Corporation, we are thrilled to integrate our comprehensive range of residential and commercial Wi-Fi garage door openers with Geokey’s innovative solution. This partnership not only enhances convenience for multi-family properties but also underscores our commitment to delivering cutting-edge access solutions that meet the evolving needs of our customers. Together, we are redefining how residents interact with their spaces, ensuring seamless and secure access at their fingertips,” said Mike Noyes, President of Genie Company.

The partnership connects Genie’s full line of residential and commercial Wi-Fi garage door openers through Aladdin Connect® as well as Overhead Door™ Brand’s full line of residential and commercial garage door openers through OHD Anywhere®.

About Geokey: Geokey is revolutionizing the way multifamily and student housing owners and operators secure their access points with a cutting-edge mobile access control platform that doesn’t require Wi-Fi. By taking a hardware and software agnostic approach, properties can utilize multiple hardware manufacturers and property technologies controlled under one cloud-based solution to fit their diverse and unique needs. Learn more about how Geokey is revolutionizing the access control industry at www.geokeyaccess.com.

About the Genie Company: The Genie® Company based in Mt. Hope, Ohio, is a leading manufacturer of smart garage door openers and accessories for residential and commercial applications. The Genie Company was built on customer focus and continues to be one of America’s best known and trusted brands. Innovations like Aladdin Connect® and BenchSentry®, deliver safe, secure, and convenient solutions that offer our customers peace of mind to easily fit their lifestyles. More information at www.geniecompany.com. Aladdin Connect, BenchSentry and all related marks are trademarks of The Genie Company.

About The Overhead Door™ Brand: The Overhead Door™ brand, which is recognized by its iconic Red Ribbon logo and “The Genuine. The Original.” slogan, is one of the most trusted residential garage door and commercial door manufacturers in North America. The Overhead Door™ brand products are available through our dedicated network of more than 440 Distributors– operating across the country using the trade name “Overhead Door Company.” For additional information, visit www.overheaddoor.com. The Overhead Door™ brand is a trademark and the Ribbon Logo is a registered trademark of Overhead Door Corporation.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/geokey-and-overhead-door-corporation-open-new-possibilities-for-your-property-with-seamless-mobile-entry-302303023.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/geokey-and-overhead-door-corporation-open-new-possibilities-for-your-property-with-seamless-mobile-entry-302303023.html

SOURCE Geokey

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Futures Show Weakness As Investors Look To Lock In Gains After Strong Post-Election Rally: 'Bull Market Sentiment Remains Intact,' Says Wharton Economist

U.S. stocks could open on a negative note on Tuesday after the averages scaled record highs last week. Futures of all three major indices were slightly down on Tuesday, pointing to a cautious sentiment on Wall Street.

The three major indices surged over 4% last week after the GOP sweep and the Federal Reserve delivered a widely expected 25 basis point rate cut. Investors could be looking to book profits in the meantime even as experts say there’s gas left in the current equity bull run.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.35% |

| S&P 500 | -0.29% |

| Dow Jones | -0.19% |

| R2K | -0.80% |

In premarket trading on Tuesday, the SPDR S&P 500 ETF Trust SPY fell 0.23% to $597.41 and the Invesco QQQ ETF QQQ declined 0.28% to $512.40, according to Benzinga Pro data.

Cues From Last Session:

The Dow Jones scaled the 44,000 mark on Monday for the first time, closing the day up by over 300 points to end the day at 44,293.13.

Crude oil prices remained under the $70 mark as the risk of Hurricane Rafael receded, providing relief.

Treasury yields continued to rise, signaling concerns that the next administration might struggle with fiscal discipline.

Most sectors on the S&P 500 closed on a positive note, with consumer discretionary, financials, and industrials stocks recording the biggest gains on Monday.

However, information technology and real estate stocks bucked the overall market trend, closing the session lower.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.06% | 19,298.76 |

| S&P 500 | 0.10% | 6,001.35 |

| Dow Jones | 0.69% | 44,293.13 |

| Russell 2000 | 1.47% | 2,434.98 |

Insights From Analysts:

Ryan Detrick, chief market strategist at Carson Group, agreed with FundStrat’s Tom Lee on the potential for small-cap stocks to grow further.

“Good to see @fundstrat sticking with the small caps and cyclical themes. We are right there with him,” Detrick said.

Earlier, Lee said “there’s still a lot of upside” in small-cap stocks, adding, “So I think small-caps could, over the next couple of years, outperform by more than 100%.”

WisdomTree and Wharton School economist Jeremy Siegel continued to stress that the equity markets have enough gas in them to continue the ongoing bull run.

“The ‘bull market’ sentiment remains intact, though valuations remain a watchpoint,” he said, adding that the expectations of “lighter regulations” from President-elect Donald Trump’s administration would benefit equities.

“Corporate earnings have continued to impress, and with no immediate breakdowns in tech’s big players, I do not see a downturn for equities in the near term. With inflation easing on essential items like oil and ongoing global cooling in commodity prices, the environment is favorable for continued economic stability.”

“The bull market in stocks looks set to continue, while bonds face a rougher road,” Siegel said but noted that the gains that equity investors have been seeing this year are unlikely to repeat in 2025.

See Also: How To Trade Futures

Upcoming Economic Data

Tuesday’s economic calendar is fairly light.

- Fed Gov. Christopher Waller will speak at 10 a.m. ET.

- Richmond Fed President Tom Barkin will speak at 10:15 a.m. ET.

- Philadelphia President Patrick Harker will speak at 10 a.m. ET.

Stocks In Focus:

- Tesla Inc. TSLA shares continued to rally, gaining nearly 9% on Monday. However, in premarket trading on Tuesday, the EV giant’s shares were down nearly 2.9%.

- Trump Media & Technology Group Corp. DJT shares were down over 5.6% in premarket trading.

- Live Nation Entertainment Inc. LYV shares were up over 6.6% in premarket trading after the Ticketmaster parent beat market expectations and said it is looking toward an “even bigger 2025.”

- MicroStrategy Inc. MSTR, Coinbase Global Inc. COIN, and Robinhood Markets Inc. HOOD surged between 7% to 26% after Bitcoin BTC/USD continued to set new highs.

- Investors are awaiting earnings results from Tyson Foods, Inc. TSN, The Home Depot, Inc. HD, and Occidental Petroleum Corporation OXY today.

Commodities, Bonds And Global Equity Markets:

Crude oil futures surged in the early New York session, rising by 0.7% to hover around $68.50 per barrel.

The 10-year Treasury note yield surged to 4.355%.

Major Asian markets ended in the red on Tuesday, and European stocks showed weakness as well in early trading.

Read Next:

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shopify Q3 Earnings: Ninth Consecutive Quarter of Revenue Beats, GMV Up 24%, Positive Outlook And More

Shopify Inc (NYSE:SHOP) clocked fiscal third-quarter 2024 revenue growth of 26% year-over-year to $2.16 billion, which beat the analyst consensus estimate of $2.11 billion.

Revenue growth marked its sixth consecutive quarter of greater than 25% revenue growth, excluding logistics.

The stock soared after it reported its quarterly results on Tuesday.

Also Read: Canaan Secures Major Mining Deal With HIVE, Shares Soar On Equipment Order

The e-commerce platform company reported EPS of $0.64, which beat analyst consensus estimate of $0.27. The company reported a net income of $344 million compared to $173 million a year ago.

Gross merchandise volume increased 24% year-over-year to $69.7 billion. Merchant solutions revenue increased 26.4% year-over-year to $1.55 billion.

The gross margin for the quarter was 51.7%, compared to 52.6% a year ago. The gross profit grew by 24.1% year over year to $1.12 billion.

Shopify generated $423 million in operating cash flow and $421 million in free cash flow for the quarter.

President Harley Finkelstein highlighted Shopify’s strong Q3 performance, reinforcing its position as a top choice for merchants across all sizes. He emphasized that as the peak shopping season nears, merchants rely on Shopify’s robust platform for tools, speed, and reliability to drive success.

CFO Jeff Hoffmeister pointed out Shopify’s 26% revenue growth and a 19% free cash flow margin for the quarter, marking the sixth consecutive quarter with over 25% revenue growth (excluding logistics).

Q4 Outlook: Shopify expects revenue growth to be at a mid-to-high-twenties percentage rate on a Y/Y basis versus a consensus of $2.11 billion. It projects a free cash flow margin to be similar year-over-year.

In October, Jim Cramer expressed bullishness on Shopify, highlighting the stock’s recent Golden Cross formation, a key technical indicator signaling potential upward momentum. Cramer praised Shopify’s leadership and current valuation, noting its strong market performance.

Shopify stock has surged 22% year-to-date.

SHOP Price Action: Shopify stock is up 20.50% at $108.40 premarket at last check Tuesday.

Also Read:

Photo via Shutterstock

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Shopify Q3 Earnings: Ninth Consecutive Quarter of Revenue Beats, GMV Up 24%, Positive Outlook And More originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Home Depot, Tyson Foods And 3 Stocks To Watch Heading Into Tuesday

With U.S. stock futures trading lower this morning on Tuesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Tyson Foods, Inc. TSN to report quarterly earnings at 69 cents per share on revenue of $13.39 billion before the opening bell, according to data from Benzinga Pro. Tyson shares rose 1.2% to $59.50 in after-hours trading.

- Analysts are expecting The Home Depot, Inc. HD to post quarterly earnings at $3.64 per share on revenue of $39.17 billion. The company will release earnings before the markets open. Home Depot shares fell 0.2% to $407.55 in after-hours trading.

- Grab Holdings Limited GRAB posted better-than-expected results for its third quarter and raised its 2024 outlook. The company reported quarterly earnings of 1 cent per share, compared to consensus estimates of a loss of 1 cent per share. Grab shares climbed 12.3% to $4.92 in the after-hours trading session.

Check out our premarket coverage here

- James River Group Holdings, Ltd. JRVR posted weaker-than-expected earnings for its third quarter. James River shares fell 7.1% to $6.15 in the after-hours trading session.

- Analysts expect Occidental Petroleum Corporation OXY to report quarterly earnings at 74 cents per share on revenue of $7.23 billion after the closing bell. Occidental Petroleum shares gained 0.6% to close at $50.81 on Monday.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street's Most Accurate Analysts Give Their Take On 3 Real Estate Stocks With Over 6% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

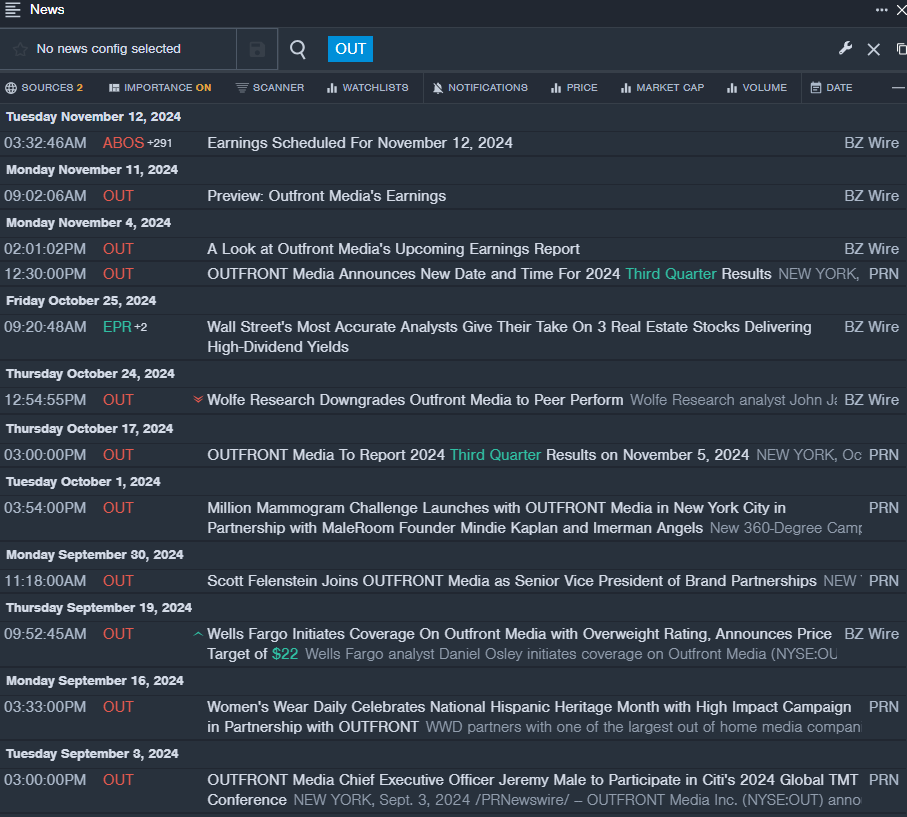

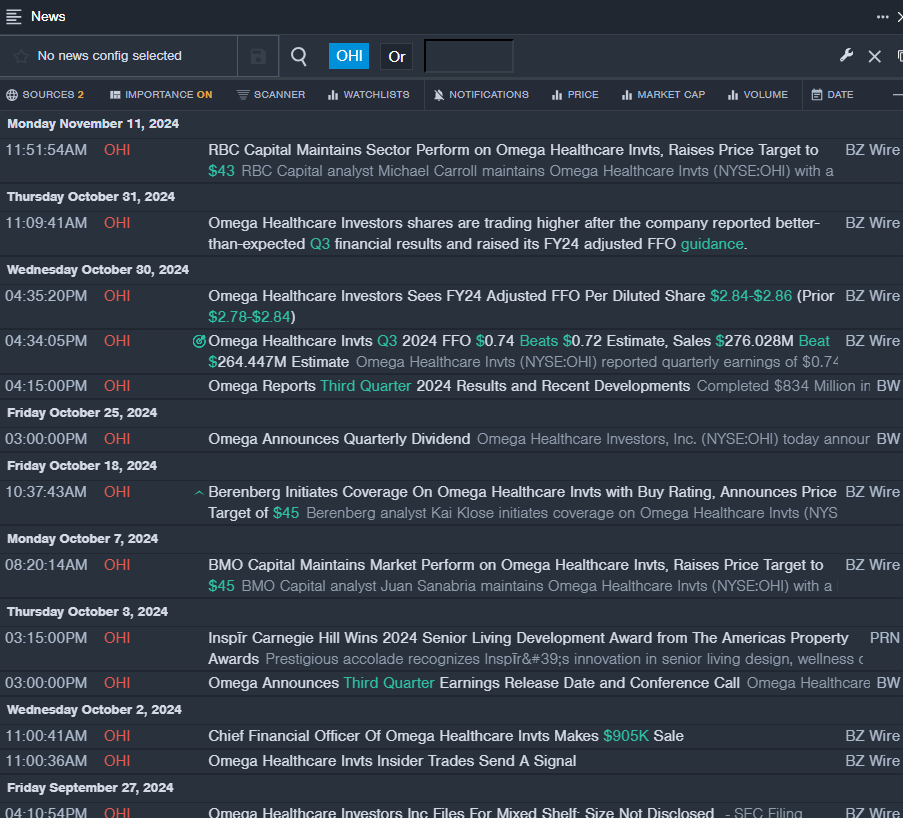

OUTFRONT Media Inc. OUT

- Dividend Yield: 6.65%

- Barrington Research analyst James Goss maintained an Outperform rating and raised the price target from $17 to $18 on Aug. 13. This analyst has an accuracy rate of 66%.

- TD Cowen analyst Lance Vitanza initiated coverage on the stock with a Hold rating and a price target of $16 on July 16. This analyst has an accuracy rate of 80%.

- Recent News: On Sept. 30, Scott Felenstein joined OUTFRONT Media as Senior Vice President of Brand Partnerships.

- Benzinga Pro’s real-time newsfeed alerted to latest OUT news

Omega Healthcare Investors, Inc. OHI

- Dividend Yield: 6.47%

- RBC Capital analyst Michael Carroll maintained a Sector Perform rating and raised the price target from $39 to $43 on Nov. 11. This analyst has an accuracy rate of 61%.

- Wells Fargo analyst Connor Siversky assumed coverage on the stock with an Overweight rating and raised the price target from $40 to $43 on Oct. 1. This analyst has an accuracy rate of 66%.

- Recent News: On Oct. 30, Omega Healthcare Investors reported better-than-expected third-quarter financial results.

- Benzinga Pro’s real-time newsfeed alerted to latest OHI news.

RLJ Lodging Trust RLJ

- Dividend Yield: 6.12%

- Truist Securities analyst Gregory Miller maintained a Buy rating and cut the price target from $14 to $11 on Oct. 28. This analyst has an accuracy rate of 68%.

- Wolfe Research analyst Keegan Carl downgraded the stock from Outperform to Peer Perform on Sept. 26. This analyst has an accuracy rate of 67%.

- Recent News: On Nov. 6, RLJ Lodging posted better-than-expected quarterly sales.

- Benzinga Pro’s charting tool helped identify the trend in RLJ stock.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From Occidental Petroleum Stock Ahead Of Q3 Earnings

Occidental Petroleum Corporation (NYSE:OXY) will release earnings results for the third quarter, after the closing bell, on Tuesday, Nov. 12.

Analysts expect the Houston-based company to report quarterly earnings at 74 cents per share. That’s down from $1.18 per share in the year-ago period. Occidental Petroleum projects to report quarterly revenue of $7.23 billion. Last year, revenue hovered $7.21 billion, according to data from Benzinga Pro.

On Nov. 8, JPMorgan analyst John Royall reinstated Occidental Petroleum with a Neutral and announced a $56 price target.

With the recent buzz around Occidental Petroleum ahead of quarterly earnings, some investors may be eyeing potential gains from the company’s dividends too. As of now, Occidental Petroleum offers an annual dividend yield of 1.73% — a quarterly dividend amount of 22 cents per share (88 cents a year).

To figure out how to earn $500 monthly from Occidental Petroleum, we start with the yearly target of $6,000 ($500 x 12 months).

Next, we take this amount and divide it by Occidental Petroleum’s $0.88 dividend: $6,000 / $0.88 = 6,818 shares.

So, an investor would need to own approximately $346,423 worth of Occidental Petroleum, or 6,818 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $0.88 = 1,364 shares, or $69,305 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

OXY Price Action: Shares of Occidental Petroleum gained by 0.6% to close at $50.81 on Monday.

Read More:

OCI Global Q3 2024 Trading Update

AMSTERDAM, Nov. 12, 2024 /PRNewswire/ — OCI Global reports Q3 2024 trading update.

Hassan Badrawi, CEO of OCI Global:

“During the course of the third quarter and the quarter to date, OCI has achieved significant milestones in its strategic transformation. We announced the sale of OCI Methanol to Methanex for a consideration of USD 2.05 billion, and successively closed the sales of IFCo to Koch Industries for USD 3.6 billion, Fertiglobe to ADNOC for USD 3.62 billion, and Clean Ammonia to Woodside for USD 2.35 billion. These are remarkable achievements for the OCI team, further demonstrating our execution capabilities and our commitment to OCI’s strategic roadmap for value creation. We believe these transactions provide highly valuable liquidity for significant capital returns to shareholders as a priority, alongside future investment capacity.

Following these milestones, OCI will pay an interim extraordinary distribution of EUR 14.50 per share in aggregate (~USD 3.3 billion) on 14 November 2024 to shareholders of record as of the close of business on 29 October 2024. The distribution will be made as a repayment of capital or, at the election of the shareholder, as a payment from the profit reserve. This brings total distributions to OCI shareholders in the past four years to USD 5.4 billion. Looking back at our history as a listed vehicle since 1999, OCI has returned more than USD 20 billion to its shareholders via buybacks, share and cash distributions, representing an IRR of approximately 40%. We will continue to build upon this track record and seek to deliver sustainable value creation for our shareholders, partners and employees.

OCI expects to make an estimated further extraordinary distribution of approximately USD 1 billion through a repayment of capital during H1 2025. This will be subject to continued progress on the execution of the announced transactions and the strategic review.

Finally, we were deeply impacted by the tragic incident in early October at the Beaumont Clean Ammonia site, which resulted in the death of a subcontractor. The safety and well-being of all employees and contractor employees is of paramount importance to OCI, and we are cooperating fully with the local authorities to investigate and understand the circumstances regarding the incident. Our thoughts and deepest condolences remain with our colleague’s family, friends, and local communities.”

Key Financial Highlights

- Continuing Operations Adjusted EBITDA for Q3 2024, which now solely includes European Nitrogen and Corporate Entities, showed a similar small loss to Q3 2023:

- Notwithstanding improved sales volumes, margins at European Nitrogen were negatively impacted by higher natural gas pricing, higher EUA provisions and other costs.

- The weaker comparative performance within European Nitrogen was partially offset by lower Group costs and eliminations.

- Notwithstanding improved sales volumes, margins at European Nitrogen were negatively impacted by higher natural gas pricing, higher EUA provisions and other costs.

- Given the recent divestments, the current corporate cost base of Continuing Operations does not yet fully reflect the reduced scope and scale of OCIs continuing business. OCI continues to make substantial progress in right-sizing its corporate cost base to better serve the current structure and scale of the business. OCI expects to beat its previously guided target of USD 30 – 40 million of run-rate corporate costs by 2025.

- Within Discontinued Operations, adjusted EBITDA for OCI’s Methanol business showed a marked improvement year-on-year reflecting increased methanol and ammonia prices, reduced natural gas costs, and robust operational performance.

- Net cash from Continuing Operations stood at USD 1,855 million as of 30 September 2024 compared to a net debt position of USD 2,194 million as of 30 June 2024[1]. The end-Q3 net cash position precedes closing of the Fertiglobe transaction and payment of the announced EUR 14.50 extraordinary distribution.

Key Strategic and Business Highlights

- Effective 15 October 2024, Mr. Hassan Badrawi was appointed Chief Executive Officer (CEO) of OCI, previously OCI’s Chief Financial Officer (CFO) and a 23-year OCI veteran. Mr. Beshoy Guirguis assumed the role of CFO of OCI, formerly OCI’s Vice President of Global Growth and Transformation, and CFO of OCI US Nitrogen, after joining OCI in 2010. Concurrently, Mr. Ahmed El-Hoshy stepped down as CEO of OCI and continues in his full-time role as CEO of Fertiglobe.

- In September 2024, OCI announced that it had entered into a binding equity purchase agreement for the sale of 100% of the equity interests in its global methanol business (“OCI Methanol”) to Methanex Corporation (“Methanex”) for a purchase price consideration of USD 2.05 billion on a cash-free debt-free basis. The transaction is expected to close in H1 2025. Following the announcement of the sale of OCI Methanol, OCI repurchased its 11% and 4% minority stakes in OCI Methanol from Alpha Dhabi Holding PJSC and ADQ, respectively.

- On 5 August 2024, OCI entered into a binding equity purchase agreement for the sale of 100% of its equity interest in the Clean Ammonia project currently under construction in Beaumont, Texas (“OCI Clean Ammonia” or the “Project”) to Woodside Energy Group Ltd (“Woodside”) for a purchase price consideration of USD 2.35 billion on a cash-free debt-free basis, following a competitive process. On 30 September 2024, OCI announced the successful closing of the transaction with the receipt of 80% of the proceeds or approximately USD 1,880 million plus a USD 20 million adjustment for certain pre-paid expenses, and a deferred consideration of 20% or approximately USD 470 million to be received at Project Completion[2], expected in H2 2025. OCI will continue to manage the construction, commissioning, and start-up of the facility through Project Completion and has a financial obligation to pay for the remaining capital expenditure and costs to Project Completion. Construction is well advanced today with USD 799 million cash spent as of 30 September 2024 (including both historical capital expenditure and certain pre-operating expenses). OCI expects a total investment cost through Project Completion of approximately USD 1.55 billion, including contingencies.

- On 29 August 2024, OCI announced the successful completion of the sale of 100% of its equity interests in Iowa Fertilizer Company LLC (“IFCo”) to Koch Ag & Energy Solutions (“KAES”). The transaction was valued at USD 3.6 billion on a cash-free debt-free basis and followed a competitive process. Net proceeds received by OCI amounted to approximately USD 2.6 billion, after adjusting for bond defeasance, mark to market on outstanding hedges, and other transaction related costs.|

- On 15 October 2024, OCI announced the successful completion of the divestment of its majority stake in Fertiglobe to Abu Dhabi National Oil Company P.J.S.C. (“ADNOC”). The gross transaction consideration of USD 3.62 billion on a cash-free debt-free basis was impacted by USD 70 million in various closing adjustments and is further subject to any materialization of certain indemnifications agreed as part of the transaction that will only become quantifiable in due course.

- The expected cumulative crystallization of approximately USD 11.6 billion of gross transaction proceeds from four transactions affords OCI significant flexibility to deliver on its capital allocation priorities, including deleveraging at a gross level as well as returning a meaningful quantum of capital to shareholders:

- All OCI NV bank debt has now been repaid, including the revolving credit facility and bridge facility utilized during the transition period. Total debt repayment in Q3 2024 amounted to USD 1,019 million. The USD 698 million 2025 Senior Secured Notes were redeemed at par on 15 October. Remaining cash proceeds have been invested whilst OCI NV currently retains gross debt of USD 600 million in the form of its 2033 bonds, which may provide optionality and strategic flexibility as part of a longer-term future capital structure, to be decided.

- Following the successful completion of the Fertiglobe and IFCo transactions, OCI will pay an interim extraordinary distribution of EUR 14.50 per share in aggregate (~USD 3.3 billion) on 14 November 2024 to shareholders of record as of the close of business on 29 October 2024. The distribution will be made as a repayment of capital or, at the election of the shareholder, as a payment from the profit reserve.

- All OCI NV bank debt has now been repaid, including the revolving credit facility and bridge facility utilized during the transition period. Total debt repayment in Q3 2024 amounted to USD 1,019 million. The USD 698 million 2025 Senior Secured Notes were redeemed at par on 15 October. Remaining cash proceeds have been invested whilst OCI NV currently retains gross debt of USD 600 million in the form of its 2033 bonds, which may provide optionality and strategic flexibility as part of a longer-term future capital structure, to be decided.

- OCI expects to make an estimated further extraordinary distribution of approximately USD 1 billion through a repayment of capital during H1 2025. This will be subject to continued progress on the execution of the announced transactions and the strategic review.

- With regards OCI’s strategic review, the Company is actively engaged in the evaluation of strategic alternatives for its continuing businesses. Any future decisions will be made in the best interests of all shareholders.

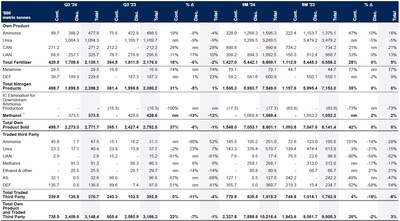

Continuing and Discontinued Operational Highlights

Further to the announcement of the expected divestiture of OCI’s equity holdings in OCI Methanol, this segment is now classified as Discontinued Operations. Discontinued Operations for the third quarter of 2024 also include results for IFCo, Fertiglobe and OCI Clean Ammonia for the period preceding the closing of the respective transactions. Continuing Operations as presented in this trading update reflects costs associated with the Corporate Entities and the operational performance of the European Nitrogen segment.

European Nitrogen

- Own-produced sales were 499 thousand tonnes during the third quarter of 2024, representing a 37% increase over the same period last year and a 14% decline quarter-on-quarter. The year-on-year increase reflects higher ammonia and nitrate volumes in the period, as well as an increase in sales of premium industrial nitrogen products, melamine and diesel-exhaust fluid (DEF). Whilst benchmark prices for nitrates were lower in Q3 2024 compared to Q3 2023, they showed a sequential improvement quarter-on-quarter.

- Despite improved sales performance year-over-year, adjusted EBITDA decreased compared to the same period last year due to higher European natural gas prices, lower product pricing, increased provisions for European emissions allowances, and other costs. The rise in other costs is attributed to higher labor costs and one-off drivers such as elevated maintenance expenses.

- In August 2024, Chivas Brothers, the Pernod Ricard business dedicated to Scotch whisky and makers of Chivas Regal and Ballantine’s, along with its distilling wheat supplier, Simpsons Malt Limited, announced investment in Nutramon® Low Carbon, a low-carbon CAN fertilizer created by OCI. A select number of farmers in the Chivas Brothers Wheat Growers Group are currently trialing Nutramon® Low Carbon, as part of an exclusive agreement. ISCC PLUS certified Nutramon® Low Carbon is produced using certified biogas and is estimated to have a reduced production carbon footprint of up to 50% compared to conventionally produced fertilizers (cradle-to-gate). Through its low-carbon portfolio, OCI aims to reduce the carbon footprint of the global food production chain.

OCI Methanol

- Own-produced methanol sales were 374 thousand tonnes in Q3 2024, 13% lower than Q3 2023. Methanol asset utilization at OCI Beaumont and Natgasoline averaged 85% and 80% in the quarter, respectively. Own-produced ammonia sales were 77 thousand tonnes in Q3 2024, a similarly robust performance to the 75 thousand tonnes of own-produced ammonia sales achieved during Q3 2023.

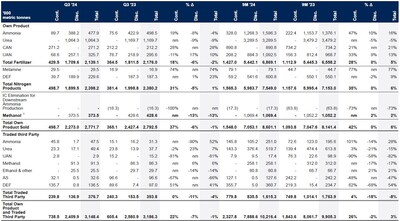

- Benchmark prices for methanol were materially improved in the quarter compared to the same period last year. Spot US Gulf Coast methanol prices averaged USD 347/t in Q3 2024, 46% higher than the USD 238/t averaged in Q3 2023.

- As a result of strong own-produced sales and higher pricing, adjusted EBITDA for the business in Q3 2024 was materially higher than Q3 2023.

- The Natgasoline methanol plant in Beaumont, Texas has been down since 29 September and is expected to resume operations in Q4.

Product sales volumes (‘000 metric tonnes)

Benchmark Prices

Source: CRU, Bloomberg

Notes

This report contains unaudited third quarter highlights of OCI Global (‘OCI,’ ‘the Group’ or ‘the Company’), a public limited liability company incorporated under Dutch law, with its head office located at Honthorststraat 19, 1071 DC Amsterdam, the Netherlands.

OCI Global is registered in the Dutch commercial register under No. 56821166 dated 2 January 2013. The Group is primarily involved in the production of nitrogen-based fertilizers and industrial chemicals.

Auditor

The reported data in this report have not been audited by an external auditor.

Investor and Analyst Conference Call

On 12 November 2024 at 15:00 CET (14:00 GMT), OCI will host a conference call for investors and analysts. Investors can find the details of the call on the Company’s website at www.oci-global.com.

Market Abuse Regulation

This press release contains inside information as meant in clause 7(1) of the Market Abuse Regulation.

About OCI Global

Learn more about OCI at www.oci-global.com. You can also follow OCI on LinkedIn.

Contact

OCI Global Investor Relations: Sarah Rajani, CFA

Email: sarah.rajani@oci-global.com

OCI stock symbols: OCI / OCI.NA / OCI.AS

[1] Continuing Operations net debt of USD 2,194 million as of 30 June 2024 has been restated for the deconsolidation of OCI’s Methanol business

[2] Production of lower carbon ammonia is conditional on supply of carbon abated hydrogen and ExxonMobil’s CCS facility becoming operational

[3] Including OCI’s 50% share of Natgasoline volumes

Photo – https://stockburger.news/wp-content/uploads/2024/11/Volumes.jpg

Photo – https://stockburger.news/wp-content/uploads/2024/11/Benchmark_prices.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/oci-global-q3-2024-trading-update-302302218.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/oci-global-q3-2024-trading-update-302302218.html

SOURCE OCI Global

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nancy Pelosi's Stock Picks Broadcom And Nvidia Among Key AI Stocks Poised For Chip Boom, Says Analyst

Analyst Blayne Curtis highlighted that Nvidia NVDA, Marvell MRVL, and Broadcom AVGO are strategically positioned to capitalize on the AI chip market surge. Curtis has assigned Buy ratings to each of these companies.

Jensen Huang-led Nvidia is experiencing extraordinary demand that surpasses its rapidly growing capacity, Curtis noted. Major tech firms are increasing their investments in GPUs and internal ASIC programs, he added. Despite this, Nvidia is expected to maintain its dominant market share, with room for ASICs to expand, Barron’s reported on Tuesday.

Curtis projects the AI accelerator market to expand by 58% annually, growing from $47 billion in 2023 to $287 billion by 2027. He sees no slowdown in capital expenditure from tech giants like Microsoft, Alphabet, and Meta.

Marvell and Nvidia are expected to see the most immediate gains, with Broadcom likely to outperform later in 2025. Currently, Broadcom’s AI chip business is largely driven by Google by Alphabet Inc. GOOGL GOOG, but Curtis anticipates broader adoption in the coming years. Rep. Nancy Pelosi (D-Calif.) also disclosed in late June the purchase of 20 call options in Broadcom.

Price Action: At the time of writing on Tuesday, Nvidia was down by 1.09%, Marvell was trading 0.90% lower while Broadcom was down by 0.067%, as per Benzinga Pro.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.