Elliott takes more than $5B stake in Honeywell, advises separating automation, aerospace units

Activist investor Elliott Investment Management has taken a more than $5 billion stake in Honeywell International and is calling for the conglomerate to split into two separate companies.

In a letter sent to Honeywell’s board, Elliott said that the Charlotte, North Carolina-based company needs to simplify its structure as it deals with uneven execution, inconsistent financial results and an underperforming stock price.

Elliott is advising Honeywell to separate its automation and aerospace businesses.

“As independent entities, Honeywell Aerospace and Honeywell Automation would benefit from simplified strategies, focused management, improved capital allocation, better operational performance, enhanced oversight, and numerous other benefits now enjoyed by dozens of large businesses that have moved on from the conglomerate structure, including former conglomerates General Electric, United Technologies, and many more,” Elliott wrote.

The activist investor believes splitting up the aerospace and automation businesses would result in share-price gains of 51% to 75% over the next two years.

“Honeywell’s board of directors and management acknowledge and appreciate the perspectives of all our shareholders,” Stacey Jones, Chief Communicator at Honeywell, said in a statement. “Although Elliott had not made us aware of their views prior to today, we look forward to engaging with the firm to obtain their input. Our leadership welcomes investor feedback as we continue to execute a disciplined strategy, which includes pursuing sustainable growth, optimizing the portfolio, and maintaining an accretive capital deployment program.”

Shares of Honeywell rose 5% in early trading Tuesday.

Dow Settles Above 44,000 For The First Time As Tesla Continues To Surge After Trump Win: Investor Sentiment Improves, Fear Index In 'Greed' Zone

The CNN Money Fear and Greed index showed further improvement in the overall market sentiment, while the index remained in the “Greed” zone on Monday.

U.S. stocks settled higher on Monday, with the Dow Jones jumping more than 300 points to settle above the 44,000 level for the first time, extending gains following the election of Donald Trump as the 47th U.S. president.

Wall Street recorded gains last week, with the S&P 500 surging 4.66% last week and the Dow gaining 4.61%. The Nasdaq, meanwhile, jumped 5.74% during the week.

Tesla, Inc. TSLA shares jumped around 9% on Monday, extending gains following the U.S. presidential election. Shares of big banks, including, JPMorgan Chase JPM, Goldman Sachs GS, Bank of America BAC, and Citigroup C all closed higher on Monday.

Most sectors on the S&P 500 closed on a positive note, with consumer discretionary, financials, and industrials stocks recording the biggest gains on Monday. However, information technology and real estate stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 304 points to 44,293.13 on Monday. The S&P 500 gained 0.10% to 6,001.35, while the Nasdaq Composite rose 0.06% to close at 19,298.76 during Monday’s session.

Investors are awaiting earnings results from Tyson Foods, Inc. TSN, The Home Depot, Inc. HD, and Occidental Petroleum Corporation OXY today.

What is CNN Business Fear & Greed Index?

At a current reading of 67.9, the index remained in the “Greed” zone on Monday, versus a prior reading of 62.7.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

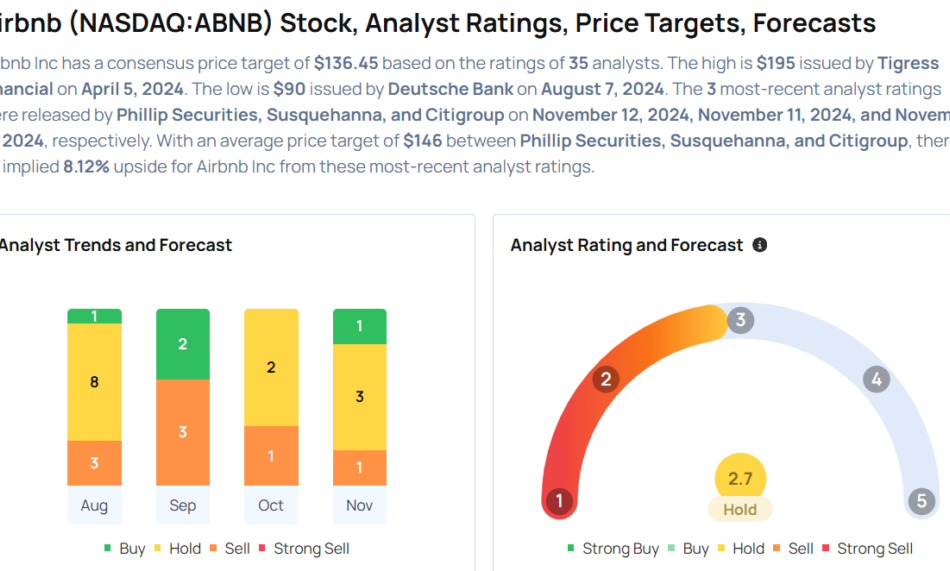

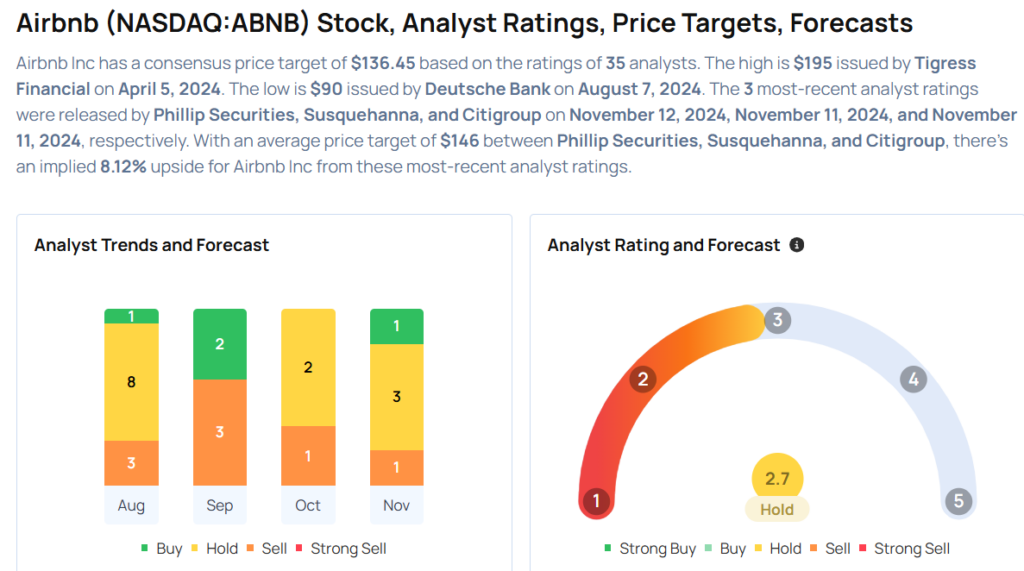

This Airbnb Analyst Turns Bearish; Here Are Top 5 Downgrades For Tuesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Wolfe Research analyst Andy Chen downgraded the rating for Alnylam Pharmaceuticals, Inc. ALNY from Peer Perform to Underperform. Alnylam Pharmaceuticals shares closed at $279.82 on Monday. See how other analysts view this stock.

- Phillip Securities downgraded the rating for Airbnb, Inc. ABNB from Neutral to Reduce and announced a $120 price target. Airbnb shares closed at $137.40 on Monday. See how other analysts view this stock.

- HC Wainwright & Co. analyst Scott Buck downgraded Phunware, Inc. PHUN from Buy to Neutral and lowered the price target from $9 to $6. Phunware shares closed at $5.99 on Monday. See how other analysts view this stock.

- Deutsche Bank analyst Brad Zelnick downgraded Okta, Inc. OKTA from Buy to Hold and lowered the price target from $115 to $85. Okta shares closed at $78.45 on Monday. See how other analysts view this stock.

- Keefe, Bruyette & Woods analyst Meyer Shields downgraded the rating for Horace Mann Educators Corporation HMN from Outperform to Market Perform and raised the price target from $39 to $44. Horace Mann Educators shares closed at $42.31 on Monday. See how other analysts view this stock.

Considering buying ABNB stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaires Are Piling Into an Index Fund That Could Soar Up to 1,207% by 2030, According to Wall Street Experts

Billionaire money managers are some of the savviest minds on Wall Street. However, the moves of hedge funds and family offices don’t always align with the opinions of analysts, whose job is to advise investors. But when the two do agree, it could mean an investment is about to soar higher.

That’s why it’s particularly notable that multiple billionaires are piling into the iShares Bitcoin Trust (NASDAQ: IBIT). The leading spot Bitcoin exchange-traded fund (ETF) has attracted the attention of several notable asset managers, including Israel Englander, David Shaw, and Steven Cohen in the first six months of 2024.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

-

Israel Englander added 10.9 million shares of the ETF to Millenium Management’s portfolio.

-

David Shaw’s D.E. Shaw & Company bought 2.6 million shares of the ETF.

-

Steven Cohen bought 1.7 million shares for Point72 Asset Management.

At the same time, multiple analysts and Wall Street insiders have put a massive long-term price target on Bitcoin (CRYPTO: BTC), the underlying asset behind the iShares Bitcoin Trust. Ark Invest’s Cathie Wood says Bitcoin could reach $1 million or more by 2030. Bernstein analysts suggest it might take until 2033 to reach that milestone. Tech CEOs Michael Saylor and Jack Dorsey also expect Bitcoin to reach $1 million, and they’ve invested heavily in the cryptocurrency through their companies. That price represents an increase of 1,207% over the next six years, as of this writing.

Here’s the bullish case for Bitcoin and the iShares Bitcoin Trust.

The Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs at the start of 2024, and they could unlock a ton of value for Bitcoin. The ETFs make investing in Bitcoin much easier for institutional investors like the billionaires listed above.

So far, over $25 billion have flowed into those ETFs since their launch in January, as of this writing. But the majority of those funds came from retail investors, not the big banks and hedge funds. That said, investment advisors and hedge funds investing in Bitcoin ETFs like the iShares Bitcoin Trust are two of the fastest-growing parties of interest.

Many institutional investors may be waiting for more regulatory clarity on the cryptocurrency. Bitcoin prices surged on the news of Donald Trump winning the U.S. presidential election, as his administration is expected to provide a favorable regulatory environment for Bitcoin. Still, the real value will come from any regulation, regardless of whether it’s tight or loose, that gives institutional investors clear boundaries and guidelines for how to invest in Bitcoin.

Warren Buffett's Favorite Energy Stock Is In Debt Reduction Mode. Earnings Up Next.

Warren Buffett-backed Occidental Petroleum (OXY) reports third-quarter earnings late Tuesday, with analysts expecting a 37% drop in profits as investors focus on how the Permian Basin oil producer plans to reduce debt and clean up its balance sheet.

Ahead of Occidental’s Tuesday report, analysts predict Q3 EPS coming in at 74 cents per share, down 37% compared to $1.18 per share a year ago, with revenue totaling $7.12 billion, running basically flat vs. Q3 2023.

Occidental Petroleum is coming off a big expectations beat in Q2, when it saw a surprise 51% profit increase, breaking a string of five consecutive quarterly earnings declines.

↑

X

How These Technical Indicators Can Show A Change In Market Trend

The Q3 financial report arrives as U.S. oil prices traded around $68 per barrel Tuesday, riding the ebb and flow of concerns over the conflict between Israel and Iran along with weak demand in China. U.S. oil prices since July have traded between $65 and $78.

OXY investors will be looking for details about the company’s plans to reduce the debt associated with its $12 billion acquisition of Permian Basin producer CrownRock. The deal adds 94,000 net Midland Basin acres and production of 170,000 barrels of oil equivalent per day to Occidental’s holdings.

Occidental Petroleum stock advanced 1% to 51.30 during market trade on Tuesday, adding to Monday’s 0.5% gain.

Eying A Clean Balance Sheet

Occidental has already said it is committed to reduce its debt by at least $4.5 billion within 12 months of Aug. 1, when it closed its acquisition of CrownRock.

Occidental Petroleum announced on Aug. 19 that it achieved $3 billion in principal debt reduction, using organic cash flow from “operations and proceeds from divestitures.”

“We believe our recent financial actions strengthen our balance sheet and accelerate our shareholder return pathway,” Chief Executive Vicki Hollub said in announcement.

Hollub added that OXY expects to achieve nearly 85% of its near-term $4.5 billion debt reduction commitment by the end of Q3.

The Lithium Price Cycle Has Bottomed. What To Expect Next For These Stocks.

On Aug. 1, Occidental Petroleum reported that Colombia-based Ecopetrol (EC) “decided not to acquire any interest in the CrownRock assets,” according to a regulatory filing. There had been speculation that Ecopetrol would take a 30% stake, or $3.6 billion, in CrownRock.

Ecopetrol has a joint venture in the Midland Basin with Occidental Petroleum. It has first right of refusal on participating in OXY projects or deals in the basin.

On July 29, OXY also signed a $818 million deal to sell its Barilla Draw property in the Delaware Basin to Permian Resources (PR).

Occidental Petroleum said on Aug. 19 it plans to apply the proceeds from the $818 million transaction toward debt repayments.

Warren Buffett’s OXY Stock Stake

Occidental Petroleum is pulled back from an April high, trading below both its 50-day moving average and its 200-day line and near its lowest level since early 2022. It has sunk around 29% since the April 12 high. Occidental is down about 15% in 2024.

Occidental’s third-quarter results follow Permian Basin producer Diamondback Energy (FANG), which reported mixed Q3 earnings and revenue on Nov. 5, with EPS down 38%. Exxon Mobil (XOM) and Chevron (CVX) also recently announced third-quarter earnings and revenue, with both U.S. supermajors seeing profits drop significantly compared to a year ago.

Buffett has a 6.5% stake in CVX.

Warren Buffett Stocks: What’s Inside Berkshire Hathaway’s Portfolio?

Buffett’s Berkshire Hathaway (BRKB) holds a 28.2% stake in Houston-based Occidental Petroleum, according to FactSet. Berkshire Hathaway also owns $10 billion of Occidental preferred stock and has warrants to buy another 83.9 million common shares for $5 billion.

In August 2022, the Federal Energy Regulatory Commission granted Berkshire Hathaway approval to purchase up to 50% of available OXY stock. However, Warren Buffett told shareholders in early 2023 he has no intention of taking over the company.

In December 2023, Warren Buffett also spent $588.7 million on more than 10 million shares of OXY stock, following Occidental’s $12 billion acquisition of Permian Basin producer CrownRock. The deal adds 94,000 net Midland Basin acres and production of 170,000 barrels of oil equivalent per day to Occidental’s holdings.

Meanwhile, the Organization of the Petroleum Exporting Countries, or OPEC, on Tuesday lowered its forecast for global oil demand growth in 2024 for the fourth straight month, estimating an increase of 1.82 million barrels per day, down from last month’s 1.93 million. The reason was primarily due to weaker-than-expected data from major consumers like China.

Occidental Petroleum stock has a 30 Composite Rating out of a best-possible 99. Shares also have a 13 Relative Strength Rating and an 85 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Tesla Stock Reclaims $1 Trillion Market Cap. It’s Not The Only One.

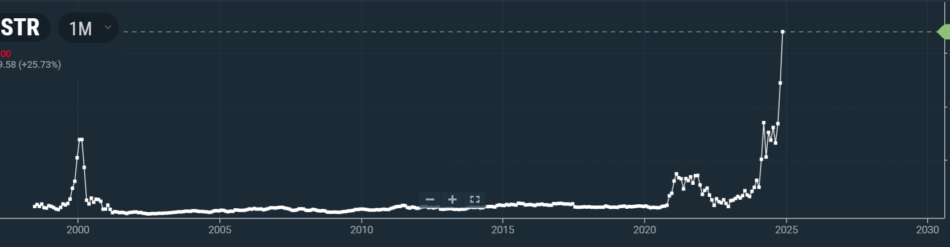

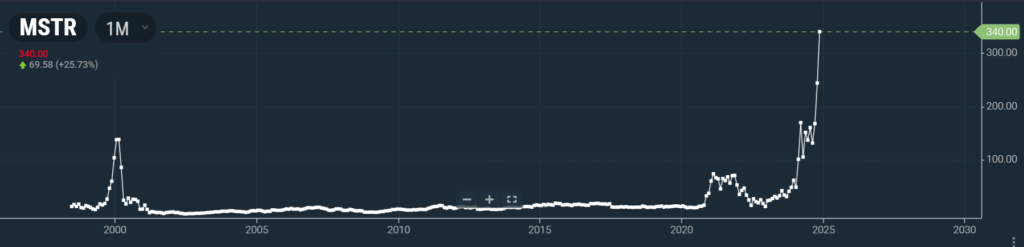

Michael Saylor's MicroStrategy Shares Hit 24-Year High, Jump Most Since Dot-Com Bubble As Bitcoin Nears $90K Mark For The First Time

Shares of Michael Saylor‘s MicroStrategy Inc. MSTR rose as much as 25.73% to hit a record closing high at $340 apiece, as compared to a 0.05% decline in the Nasdaq 100 Index Monday. The shares rose by 5.31% to $358.06 per share during the after-hours trade the same day.

The surge marked the highest level for the shares on Monday since the dot-com bubble in March 2000.

What Happened: The rally in MicroStrategy shares was fueled by the rise in Bitcoin BTC/USD, a crucial asset held by the latter in its portfolio. MicroStrategy is a business intelligence, mobile software, and cloud-based services company, but more than anything else, it serves as a proxy for Bitcoin.

At the time of writing, BTC was trading at $89,768.

The company calls itself the world’s first “Bitcoin Treasury company.” Volatility in MicroStrategy’s stock due to its Bitcoin position allows the company to borrow and raise capital at a low cost in order to turn around and buy more Bitcoin.

MicroStrategy announced that it acquired approximately 27,200 BTC between Oct. 31 and Nov. 10 for approximately $2.03 billion in cash. The company purchased the bitcoin at an average cost of $74,463 per coin and the cryptocurrency hit an all-time high at $89,560.95 on Monday. As of Nov. 11, MicroStrategy held a total of 252,220 bitcoins, purchased at an average price of $39,266, according to Coingecko. Consequently, MicroStrategy holds about 1.201% of the total Bitcoin supply, with its current holding priced at around $22.64 billion.

The top five largest corporate holders of Bitcoin, following MicroStrategy, include Marathon Digital Holdings MARA, Galaxy Digital Holdings GLXY, Tesla Inc. TSLA and Coinbase Global Inc. COIN.

Also Read: What’s Going On With MicroStrategy Stock Monday?

Why It Matters: The dot-com bubble was a stock market bubble that ballooned during the late 1990s and peaked on Friday, March 10, 2000. It was fueled by the rise in investments in Internet-based companies.

Equity markets experienced exponential growth during this period, exemplified by the technology-dominated Nasdaq index, which surged from under 1,000 to over 5,000 between 1995 and 2000. This period of exuberance was followed by a market correction, as the bubble burst between 2001 and 2002, ushering in a bear market.

MicroStrategy shares had hit $313 apiece on March 10, 2000, as per Benzinga Pro data, which was transcended by Monday’s rally.

Price Action: MicroStrategy shares have risen by 396.21% on a year-to-date basis. The total traded volume stood at 37.315 million shares, according to Nasdaq. Benzinga Pro data suggested the relative strength index was at 81.31, implying that the stock may be overbought.

Four analysts tracking the company maintain a ‘buy’ rating of the stock, according to Nasdaq data. The three-month average of the 12-month analyst price targets implies a share price of $302.75, which has already been surpassed by the company.

As per Benzinga Pro, the company’s strategic financial maneuvers, particularly its use of excess cash to acquire additional bitcoins, have boosted its bitcoin-per-share metric, thereby enhancing shareholder value. Furthermore, the potential expansion of market valuation beyond the traditional 3-4x forward revenue, coupled with an accelerating cloud business, innovation through AI initiatives, and forthcoming favorable accounting changes for digital assets, supports a positive outlook for MicroStrategy’s financial future.

Image via Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JLL Income Property Trust Declares 52nd Consecutive Quarterly Dividend

CHICAGO, Nov. 11, 2024 /PRNewswire/ — JLL Income Property Trust, an institutionally managed daily NAV REIT (NASDAQ:ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX) with approximately $6.6 billion in portfolio equity and debt investment assets, announced that on November 5, 2024, its Board of Directors declared a dividend for the fourth quarter of 2024 of $0.1575 per share. This will be the 52nd consecutive dividend paid to its stockholders.

The dividend is payable on or around December 27, 2024 to stockholders of record as of December 23, 2024. On an annualized basis, this gross dividend is equivalent to $0.63 per share and represents a yield of approximately 5.4% on a NAV per share of $11.58 as of September 30, 2024. All stockholders will receive $0.1575 per share less applicable share class specific fees and the annualized yield will differ based on the share class.

“We are proud that JLL Income Property Trust continues to be a reliable and growing source of current income for our stockholders, with this being our 52nd consecutive quarterly dividend payable to stockholders,” said JLL Income Property Trust President and CEO Allan Swaringen. “Over our 12-year history, we have increased the dividend nine times for an average annual increase of 4.1% – providing important inflation-hedging income to our stockholders.”

A third quarter 2024 dividend of $0.1575 per share, less applicable share class specific fees, was paid according to the table below on September 26, 2024 to stockholders of record as of September 23, 2024. Any future dividends will be approved at the discretion of the Board of Directors.

|

M-I Share |

A-I Share1 |

M Share2 |

A Share3 |

|

|

Q3 Quarterly Gross Dividend per Share |

$0.1575 |

$0.1575 |

$0.1575 |

$0.1575 |

|

Less: Dealer Manager Fee per Share |

– |

($0.00681) |

($0.00799) |

($0.02137) |

|

Q3 Quarterly Net Dividend per Share |

$0.1575 |

$0.15069 |

$0.14951 |

$0.13613 |

|

NAV per Share as of September 30, 2024 |

$11.58 |

$11.60 |

$11.58 |

$11.57 |

|

Annualized Net Dividend Yield Based on NAV as of September 30, 2024 |

5.4 % |

5.2 % |

5.2 % |

4.7 % |

|

1. |

A dealer manager fee equal to 1/365th of 0.30% of NAV is allocated to Class A-I stockholders daily and reduces the quarterly dividend paid. |

|

2. |

A dealer manager fee equal to 1/365th of 0.30% of NAV is allocated to Class M stockholders daily and reduces the quarterly dividend paid. |

|

3. |

A dealer manager fee equal to 1/365th of 0.85% of NAV is allocated to Class A stockholders daily and reduces the quarterly dividend paid. |

JLL Income Property Trust is an institutionally managed, daily NAV REIT that brings to investors a growing portfolio of commercial real estate investments selected by an institutional investment management team and sponsored by one of the world’s leading real estate services firms.

For more information on JLL Income Property Trust, please visit our website at www.jllipt.com.

About JLL Income Property Trust, Inc. (NASDAQ: ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX), JLL Income Property Trust, Inc. is a daily NAV REIT that owns and manages a diversified portfolio of high quality, income-producing residential, industrial, grocery-anchored retail, healthcare and office properties located in the United States. JLL Income Property Trust expects to further diversify its real estate portfolio over time, including on a global basis. For more information, visit www.jllipt.com.

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

Valuations, Forward Looking Statements and Future Results

This press release may contain forward-looking statements with respect to JLL Income Property Trust. Forward-looking statements are statements that are not descriptions of historical facts and include statements regarding management’s intentions, beliefs, expectations, research, market analysis, plans or predictions of the future. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. Past performance is not indicative of future results and there can be no assurance that future dividends will be paid.

Contacts:

Alissa Schachter

LaSalle Investment Management

Telephone: +1 312 228 2048

Email: alissa.schachter@lasalle.com

Doug Allen

Dukas Linden Public Relations

Telephone: +1 646 722 6530

Email: JLLIPT@DLPR.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-declares-52nd-consecutive-quarterly-dividend-302300809.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-declares-52nd-consecutive-quarterly-dividend-302300809.html

SOURCE JLL Income Property Trust

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.