Billionaires Are Piling Into an Index Fund That Could Soar Up to 1,207% by 2030, According to Wall Street Experts

Billionaire money managers are some of the savviest minds on Wall Street. However, the moves of hedge funds and family offices don’t always align with the opinions of analysts, whose job is to advise investors. But when the two do agree, it could mean an investment is about to soar higher.

That’s why it’s particularly notable that multiple billionaires are piling into the iShares Bitcoin Trust (NASDAQ: IBIT). The leading spot Bitcoin exchange-traded fund (ETF) has attracted the attention of several notable asset managers, including Israel Englander, David Shaw, and Steven Cohen in the first six months of 2024.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

-

Israel Englander added 10.9 million shares of the ETF to Millenium Management’s portfolio.

-

David Shaw’s D.E. Shaw & Company bought 2.6 million shares of the ETF.

-

Steven Cohen bought 1.7 million shares for Point72 Asset Management.

At the same time, multiple analysts and Wall Street insiders have put a massive long-term price target on Bitcoin (CRYPTO: BTC), the underlying asset behind the iShares Bitcoin Trust. Ark Invest’s Cathie Wood says Bitcoin could reach $1 million or more by 2030. Bernstein analysts suggest it might take until 2033 to reach that milestone. Tech CEOs Michael Saylor and Jack Dorsey also expect Bitcoin to reach $1 million, and they’ve invested heavily in the cryptocurrency through their companies. That price represents an increase of 1,207% over the next six years, as of this writing.

Here’s the bullish case for Bitcoin and the iShares Bitcoin Trust.

The Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs at the start of 2024, and they could unlock a ton of value for Bitcoin. The ETFs make investing in Bitcoin much easier for institutional investors like the billionaires listed above.

So far, over $25 billion have flowed into those ETFs since their launch in January, as of this writing. But the majority of those funds came from retail investors, not the big banks and hedge funds. That said, investment advisors and hedge funds investing in Bitcoin ETFs like the iShares Bitcoin Trust are two of the fastest-growing parties of interest.

Many institutional investors may be waiting for more regulatory clarity on the cryptocurrency. Bitcoin prices surged on the news of Donald Trump winning the U.S. presidential election, as his administration is expected to provide a favorable regulatory environment for Bitcoin. Still, the real value will come from any regulation, regardless of whether it’s tight or loose, that gives institutional investors clear boundaries and guidelines for how to invest in Bitcoin.

Warren Buffett's Favorite Energy Stock Is In Debt Reduction Mode. Earnings Up Next.

Warren Buffett-backed Occidental Petroleum (OXY) reports third-quarter earnings late Tuesday, with analysts expecting a 37% drop in profits as investors focus on how the Permian Basin oil producer plans to reduce debt and clean up its balance sheet.

Ahead of Occidental’s Tuesday report, analysts predict Q3 EPS coming in at 74 cents per share, down 37% compared to $1.18 per share a year ago, with revenue totaling $7.12 billion, running basically flat vs. Q3 2023.

Occidental Petroleum is coming off a big expectations beat in Q2, when it saw a surprise 51% profit increase, breaking a string of five consecutive quarterly earnings declines.

↑

X

How These Technical Indicators Can Show A Change In Market Trend

The Q3 financial report arrives as U.S. oil prices traded around $68 per barrel Tuesday, riding the ebb and flow of concerns over the conflict between Israel and Iran along with weak demand in China. U.S. oil prices since July have traded between $65 and $78.

OXY investors will be looking for details about the company’s plans to reduce the debt associated with its $12 billion acquisition of Permian Basin producer CrownRock. The deal adds 94,000 net Midland Basin acres and production of 170,000 barrels of oil equivalent per day to Occidental’s holdings.

Occidental Petroleum stock advanced 1% to 51.30 during market trade on Tuesday, adding to Monday’s 0.5% gain.

Eying A Clean Balance Sheet

Occidental has already said it is committed to reduce its debt by at least $4.5 billion within 12 months of Aug. 1, when it closed its acquisition of CrownRock.

Occidental Petroleum announced on Aug. 19 that it achieved $3 billion in principal debt reduction, using organic cash flow from “operations and proceeds from divestitures.”

“We believe our recent financial actions strengthen our balance sheet and accelerate our shareholder return pathway,” Chief Executive Vicki Hollub said in announcement.

Hollub added that OXY expects to achieve nearly 85% of its near-term $4.5 billion debt reduction commitment by the end of Q3.

The Lithium Price Cycle Has Bottomed. What To Expect Next For These Stocks.

On Aug. 1, Occidental Petroleum reported that Colombia-based Ecopetrol (EC) “decided not to acquire any interest in the CrownRock assets,” according to a regulatory filing. There had been speculation that Ecopetrol would take a 30% stake, or $3.6 billion, in CrownRock.

Ecopetrol has a joint venture in the Midland Basin with Occidental Petroleum. It has first right of refusal on participating in OXY projects or deals in the basin.

On July 29, OXY also signed a $818 million deal to sell its Barilla Draw property in the Delaware Basin to Permian Resources (PR).

Occidental Petroleum said on Aug. 19 it plans to apply the proceeds from the $818 million transaction toward debt repayments.

Warren Buffett’s OXY Stock Stake

Occidental Petroleum is pulled back from an April high, trading below both its 50-day moving average and its 200-day line and near its lowest level since early 2022. It has sunk around 29% since the April 12 high. Occidental is down about 15% in 2024.

Occidental’s third-quarter results follow Permian Basin producer Diamondback Energy (FANG), which reported mixed Q3 earnings and revenue on Nov. 5, with EPS down 38%. Exxon Mobil (XOM) and Chevron (CVX) also recently announced third-quarter earnings and revenue, with both U.S. supermajors seeing profits drop significantly compared to a year ago.

Buffett has a 6.5% stake in CVX.

Warren Buffett Stocks: What’s Inside Berkshire Hathaway’s Portfolio?

Buffett’s Berkshire Hathaway (BRKB) holds a 28.2% stake in Houston-based Occidental Petroleum, according to FactSet. Berkshire Hathaway also owns $10 billion of Occidental preferred stock and has warrants to buy another 83.9 million common shares for $5 billion.

In August 2022, the Federal Energy Regulatory Commission granted Berkshire Hathaway approval to purchase up to 50% of available OXY stock. However, Warren Buffett told shareholders in early 2023 he has no intention of taking over the company.

In December 2023, Warren Buffett also spent $588.7 million on more than 10 million shares of OXY stock, following Occidental’s $12 billion acquisition of Permian Basin producer CrownRock. The deal adds 94,000 net Midland Basin acres and production of 170,000 barrels of oil equivalent per day to Occidental’s holdings.

Meanwhile, the Organization of the Petroleum Exporting Countries, or OPEC, on Tuesday lowered its forecast for global oil demand growth in 2024 for the fourth straight month, estimating an increase of 1.82 million barrels per day, down from last month’s 1.93 million. The reason was primarily due to weaker-than-expected data from major consumers like China.

Occidental Petroleum stock has a 30 Composite Rating out of a best-possible 99. Shares also have a 13 Relative Strength Rating and an 85 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Tesla Stock Reclaims $1 Trillion Market Cap. It’s Not The Only One.

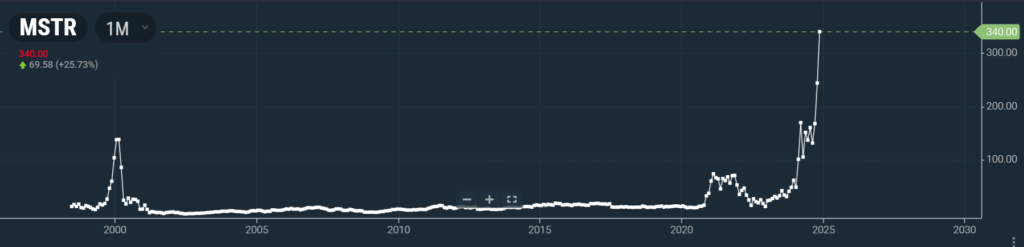

Michael Saylor's MicroStrategy Shares Hit 24-Year High, Jump Most Since Dot-Com Bubble As Bitcoin Nears $90K Mark For The First Time

Shares of Michael Saylor‘s MicroStrategy Inc. MSTR rose as much as 25.73% to hit a record closing high at $340 apiece, as compared to a 0.05% decline in the Nasdaq 100 Index Monday. The shares rose by 5.31% to $358.06 per share during the after-hours trade the same day.

The surge marked the highest level for the shares on Monday since the dot-com bubble in March 2000.

What Happened: The rally in MicroStrategy shares was fueled by the rise in Bitcoin BTC/USD, a crucial asset held by the latter in its portfolio. MicroStrategy is a business intelligence, mobile software, and cloud-based services company, but more than anything else, it serves as a proxy for Bitcoin.

At the time of writing, BTC was trading at $89,768.

The company calls itself the world’s first “Bitcoin Treasury company.” Volatility in MicroStrategy’s stock due to its Bitcoin position allows the company to borrow and raise capital at a low cost in order to turn around and buy more Bitcoin.

MicroStrategy announced that it acquired approximately 27,200 BTC between Oct. 31 and Nov. 10 for approximately $2.03 billion in cash. The company purchased the bitcoin at an average cost of $74,463 per coin and the cryptocurrency hit an all-time high at $89,560.95 on Monday. As of Nov. 11, MicroStrategy held a total of 252,220 bitcoins, purchased at an average price of $39,266, according to Coingecko. Consequently, MicroStrategy holds about 1.201% of the total Bitcoin supply, with its current holding priced at around $22.64 billion.

The top five largest corporate holders of Bitcoin, following MicroStrategy, include Marathon Digital Holdings MARA, Galaxy Digital Holdings GLXY, Tesla Inc. TSLA and Coinbase Global Inc. COIN.

Also Read: What’s Going On With MicroStrategy Stock Monday?

Why It Matters: The dot-com bubble was a stock market bubble that ballooned during the late 1990s and peaked on Friday, March 10, 2000. It was fueled by the rise in investments in Internet-based companies.

Equity markets experienced exponential growth during this period, exemplified by the technology-dominated Nasdaq index, which surged from under 1,000 to over 5,000 between 1995 and 2000. This period of exuberance was followed by a market correction, as the bubble burst between 2001 and 2002, ushering in a bear market.

MicroStrategy shares had hit $313 apiece on March 10, 2000, as per Benzinga Pro data, which was transcended by Monday’s rally.

Price Action: MicroStrategy shares have risen by 396.21% on a year-to-date basis. The total traded volume stood at 37.315 million shares, according to Nasdaq. Benzinga Pro data suggested the relative strength index was at 81.31, implying that the stock may be overbought.

Four analysts tracking the company maintain a ‘buy’ rating of the stock, according to Nasdaq data. The three-month average of the 12-month analyst price targets implies a share price of $302.75, which has already been surpassed by the company.

As per Benzinga Pro, the company’s strategic financial maneuvers, particularly its use of excess cash to acquire additional bitcoins, have boosted its bitcoin-per-share metric, thereby enhancing shareholder value. Furthermore, the potential expansion of market valuation beyond the traditional 3-4x forward revenue, coupled with an accelerating cloud business, innovation through AI initiatives, and forthcoming favorable accounting changes for digital assets, supports a positive outlook for MicroStrategy’s financial future.

Image via Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JLL Income Property Trust Declares 52nd Consecutive Quarterly Dividend

CHICAGO, Nov. 11, 2024 /PRNewswire/ — JLL Income Property Trust, an institutionally managed daily NAV REIT (NASDAQ:ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX) with approximately $6.6 billion in portfolio equity and debt investment assets, announced that on November 5, 2024, its Board of Directors declared a dividend for the fourth quarter of 2024 of $0.1575 per share. This will be the 52nd consecutive dividend paid to its stockholders.

The dividend is payable on or around December 27, 2024 to stockholders of record as of December 23, 2024. On an annualized basis, this gross dividend is equivalent to $0.63 per share and represents a yield of approximately 5.4% on a NAV per share of $11.58 as of September 30, 2024. All stockholders will receive $0.1575 per share less applicable share class specific fees and the annualized yield will differ based on the share class.

“We are proud that JLL Income Property Trust continues to be a reliable and growing source of current income for our stockholders, with this being our 52nd consecutive quarterly dividend payable to stockholders,” said JLL Income Property Trust President and CEO Allan Swaringen. “Over our 12-year history, we have increased the dividend nine times for an average annual increase of 4.1% – providing important inflation-hedging income to our stockholders.”

A third quarter 2024 dividend of $0.1575 per share, less applicable share class specific fees, was paid according to the table below on September 26, 2024 to stockholders of record as of September 23, 2024. Any future dividends will be approved at the discretion of the Board of Directors.

|

M-I Share |

A-I Share1 |

M Share2 |

A Share3 |

|

|

Q3 Quarterly Gross Dividend per Share |

$0.1575 |

$0.1575 |

$0.1575 |

$0.1575 |

|

Less: Dealer Manager Fee per Share |

– |

($0.00681) |

($0.00799) |

($0.02137) |

|

Q3 Quarterly Net Dividend per Share |

$0.1575 |

$0.15069 |

$0.14951 |

$0.13613 |

|

NAV per Share as of September 30, 2024 |

$11.58 |

$11.60 |

$11.58 |

$11.57 |

|

Annualized Net Dividend Yield Based on NAV as of September 30, 2024 |

5.4 % |

5.2 % |

5.2 % |

4.7 % |

|

1. |

A dealer manager fee equal to 1/365th of 0.30% of NAV is allocated to Class A-I stockholders daily and reduces the quarterly dividend paid. |

|

2. |

A dealer manager fee equal to 1/365th of 0.30% of NAV is allocated to Class M stockholders daily and reduces the quarterly dividend paid. |

|

3. |

A dealer manager fee equal to 1/365th of 0.85% of NAV is allocated to Class A stockholders daily and reduces the quarterly dividend paid. |

JLL Income Property Trust is an institutionally managed, daily NAV REIT that brings to investors a growing portfolio of commercial real estate investments selected by an institutional investment management team and sponsored by one of the world’s leading real estate services firms.

For more information on JLL Income Property Trust, please visit our website at www.jllipt.com.

About JLL Income Property Trust, Inc. (NASDAQ: ZIPTAX; ZIPTMX; ZIPIAX; ZIPIMX), JLL Income Property Trust, Inc. is a daily NAV REIT that owns and manages a diversified portfolio of high quality, income-producing residential, industrial, grocery-anchored retail, healthcare and office properties located in the United States. JLL Income Property Trust expects to further diversify its real estate portfolio over time, including on a global basis. For more information, visit www.jllipt.com.

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

Valuations, Forward Looking Statements and Future Results

This press release may contain forward-looking statements with respect to JLL Income Property Trust. Forward-looking statements are statements that are not descriptions of historical facts and include statements regarding management’s intentions, beliefs, expectations, research, market analysis, plans or predictions of the future. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. Past performance is not indicative of future results and there can be no assurance that future dividends will be paid.

Contacts:

Alissa Schachter

LaSalle Investment Management

Telephone: +1 312 228 2048

Email: alissa.schachter@lasalle.com

Doug Allen

Dukas Linden Public Relations

Telephone: +1 646 722 6530

Email: JLLIPT@DLPR.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-declares-52nd-consecutive-quarterly-dividend-302300809.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-income-property-trust-declares-52nd-consecutive-quarterly-dividend-302300809.html

SOURCE JLL Income Property Trust

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NANOBIOTIX Provides Third Quarter 2024 Update and Progress on Nanotherapeutics Platforms

- Transferred US sponsorship of global Phase 3 NANORAY-312 head and neck cancer study, a key step in the preparation for potential NBTXR3 regulatory submission

- Added expert industry leaders to Supervisory Board, further strengthening support for the Company’s long-term growth strategy

- NBTXR3 program update from pancreatic cancer study and lung cancer study with MD Anderson expected 4Q 2024 and 1H 2025, respectively

- Update on expansion of product portfolio to include disruptive nanotherapeutic platform Curadigm expected 4Q 2024

- €53.2 million in cash and cash equivalents as of September 30, 2024 with cash runway into 4Q 2025

PARIS and CAMBRIDGE, Mass., Nov. 12, 2024 (GLOBE NEWSWIRE) — NANOBIOTIX NBTX, a late-clinical stage biotechnology company pioneering nanoparticle-based approaches to expand treatment possibilities for patients with cancer and other major diseases, provided an update on operational progress and reported financial results for the third quarter of 2024.

“Our strong momentum continues as we further execute across initiatives designed to advance our potentially first-in-class nanoparticle-based therapeutic platforms for millions of patients worldwide. In the NBTXR3 program, we began sponsorship transfer of our global, pivotal NANORAY-312, which is a key step for the potential regulatory submission of NBTXR3 and the promise of our lead candidate to help address the unmet needs of 12 million patients with solid tumors globally who receive radiotherapy each year,” said Laurent Levy, co-founder of Nanobiotix and chairman of the executive board. “We were also pleased to expand our Supervisory Board to include leading experts in both the scientific and financial communities to help foster sustainable long-term growth across our platforms. In the fourth quarter, we expect updated dose escalation data for NBTXR3 in pancreatic cancer from our MD Anderson collaboration, as well as an update to our Curadigm program, which is the next-wave of nanoparticle-based platforms from Nanobiotix.”

Third Quarter 2024 Operational Highlights

In an important step forward for the potential NBTXR3 regulatory pathway, Nanobiotix and Janssen Pharmaceutica NV, a Johnson & Johnson Company (“Janssen”), have initiated the planned sponsorship transfer of NANORAY-312, a global Phase 3 study evaluating radiotherapy-activated NBTXR3 for patients with head and neck cancer ineligible for cisplatin, from Nanobiotix to Janssen. Nanobiotix has transferred the sponsorship of the study in the United States to Janssen as planned. The process of transferring the remaining global regions is ongoing. Nanobiotix estimates this process will require several quarters to complete. Janssen is the global licensee for NBTXR3 co-development and commercialization. Accountability for the NANORAY-312 sponsorship will enable the licensee to submit NBTXR3 for global registration in the event of positive trial results.

The Company strengthened its Supervisory Board with the nominations of Dr. Margaret A. Liu and Ms. Anat Naschitz as board observers, two key additions intended to further equip the Company for sustainable long-term growth. Dr. Liu brings a wealth of experience in US and international academia, pharmaceuticals, biotechnology and public policy, and Ms. Naschitz brings world-class expertise in raising and deploying capital to support disruptive innovation for the benefit of patients, healthcare professionals and investors.

Upcoming Milestones

Janssen License Agreement

- Locally Advanced Head and Neck Squamous Cell Carcinoma (LA-HNSCC): Nanobiotix continues to expect the interim analysis for NANORAY-312 after the required number of events and last patient recruited in 1H 2026

MD Anderson Collaboration

- Pancreatic Cancer: Updated Phase 1b dose escalation data expected 4Q 2024

- NSCLC: Initial Phase 1 dose escalation data in inoperable, recurrent NSCLC amenable to re-irradiation expected 1H 2025

- Esophageal Cancer: Presentation of first Phase 1b/2 data expected in 2025

Preclinical Nanoparticle-Based Platforms

- Curadigm Nanoprimer: Program update on the disruptive potential of Curadigm and the platform’s opportunity to redefine the discovery and design of next-gen therapies expected 4Q 2024

Third Quarter Financial Updates

Nanobiotix reported cash and cash equivalents of €53.2 million (unaudited) as of September 30, 2024.

Based on the current operating plan and financial projections, Nanobiotix anticipates that the cash and cash equivalents of €53.2 million as of September 30, 2024 to fund operations into Q4 2025.

About NBTXR3

NBTXR3 is a novel, potentially first-in-class oncology product composed of functionalized hafnium oxide nanoparticles that is administered via one-time intratumoral injection and activated by radiotherapy. Its proof-of-concept was achieved in soft tissue sarcomas for which the product received a European CE mark in 2019. The product candidate’s physical mechanism of action (MoA) is designed to induce significant tumor cell death in the injected tumor when activated by radiotherapy, subsequently triggering adaptive immune response and long-term anti-cancer memory. Given the physical MoA, Nanobiotix believes that NBTXR3 could be scalable across any solid tumor that can be treated with radiotherapy and across any therapeutic combination, particularly immune checkpoint inhibitors.

Radiotherapy-activated NBTXR3 is being evaluated across multiple solid tumor indications as a single agent or in combination with anti-PD-1 immune checkpoint inhibitors, including in NANORAY-312—a global, randomized Phase 3 study in locally advanced head and neck squamous cell cancers. In February 2020, the United States Food and Drug Administration granted regulatory Fast Track designation for the investigation of NBTXR3 activated by radiation therapy, with or without cetuximab, for the treatment of patients with locally advanced HNSCC who are not eligible for platinum-based chemotherapy—the same population being evaluated in the Phase 3 study.

Given the Company’s focus areas, and balanced against the scalable potential of NBTXR3, Nanobiotix has engaged in a collaboration strategy to expand development of the product candidate in parallel with its priority development pathways. Pursuant to this strategy, in 2019 Nanobiotix entered into a broad, comprehensive clinical research collaboration with The University of Texas MD Anderson Cancer Center to sponsor several Phase 1 and Phase 2 studies evaluating NBTXR3 across tumor types and therapeutic combinations. In 2023, Nanobiotix announced a license agreement for the global co-development and commercialization of NBTXR3 with Janssen Pharmaceutica NV.

About NANOBIOTIX

Nanobiotix is a late-stage clinical biotechnology company pioneering disruptive, physics-based therapeutic approaches to revolutionize treatment outcomes for millions of patients; supported by people committed to making a difference for humanity. The Company’s philosophy is rooted in the concept of pushing past the boundaries of what is known to expand possibilities for human life.

Incorporated in 2003, Nanobiotix is headquartered in Paris, France and is listed on Euronext Paris since 2012 and on the Nasdaq Global Select Market in New York City since December 2020. The Company has subsidiaries in Cambridge, Massachusetts (United States) amongst other locations.

Nanobiotix is the owner of more than 25 patent families associated with three (3) nanotechnology platforms with applications in 1) oncology; 2) bioavailability and biodistribution; and 3) disorders of the central nervous system.

For more information about Nanobiotix, visit us at www.nanobiotix.com or follow us on LinkedIn and Twitter

Disclaimer

This press release contains “forward-looking” statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the use of proceed therefrom, and the period of time through which the Company’s anticipates its financial resources will be adequate to support operations. Words such as “expects”, “intends”, “can”, “could”, “may”, “might”, “plan”, “potential”, “should” and “will” or the negative of these and similar expressions are intended to identify forward-looking statements. These forward-looking statements, which are based on our management’s current expectations and assumptions and on information currently available to management. These forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those implied by the forward-looking statements, including risks related to Nanobiotix’s business and financial performance, which include the risk that assumptions underlying the Company’s cash runway projections are not realized. Further information on the risk factors that may affect company business and financial performance is included in Nanobiotix’s Annual Report on Form 20-F filed with the SEC on April 24, 2024 under “Item 3.D. Risk Factors”, in Nanobiotix’s 2023 universal registration document filed with the AMF on April 24, 2024, in Nanobiotix’ 2024 semi-annual report under the caption “Supplemental Risk Factor” filed with the SEC on Form 6-K and with AMF on September 18 2024, and subsequent filings Nanobiotix makes with the SEC from time to time which are available on the SEC’s website at www.sec.gov. The forward-looking statements included in this press release speak only as of the date of this press release, and except as required by law, Nanobiotix assumes no obligation to update these forward-looking statements publicly.

Contacts

Attachment

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Economist Peter Schiff Sees 'A Silver Lining' As Gold Plummets, While Investors Rush To Snap Up Bitcoin Gains: 'Typically…Silver Would Be Down Twice As Much'

As cryptocurrency prices hover around record levels, investors have been keen on adding them to their portfolios. This is evident by the rise in various Bitcoin BTC/USD ETF levels. However, gold prices have declined by nearly 1% in the morning hours as cryptocurrency prices surged. While silver prices have been down too, Peter Schiff, the chairman of SchiffGold.com and chief economist and global strategist at Europac.com suggests that investors should go for silver over Bitcoin as the precious yellow metal declines.

What Happened: Schiff suggests that “typically” silver prices should drop to about half the rate of gold. However, with silver prices holding steady amid market fluctuations, he views this resilience as a “silver lining.” Schiff believes this unusual performance makes silver an attractive investment alternative to Bitcoin and gold ETFs, given its relative stability in the current market.

Also read: Bitcoin Blasts Through $88,000 As Market ‘Euphoria,’ Regulatory Optimism Take Hold

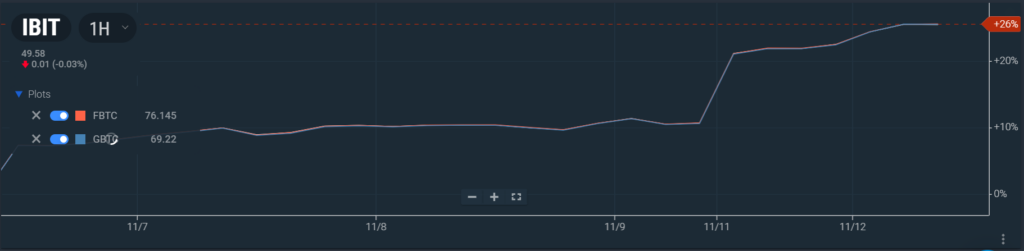

Why It Matters: Comparing the ETFs of all three assets, we see that gold and silver ETFs have underperformed bitcoin ETFs. Gold spot rates XAU were down 1.05% at $2,591.34 per ounce, Silver spot rates XAG were down by 1.25% at $30.30 per ounce and Bitcoin BTC/USD trading at $87,504.28 per coin at the time of publication.

Also read: Here’s How Much $100 In Dogecoin Today Could Be Worth If DOGE Hits New All-Time Highs

The iShares Bitcoin Trust IBIT was up by 13.5% as of Monday’s close. Additionally, the Fidelity Wise Origin Bitcoin Fund FBTC and the Grayscale Bitcoin Trust GBTC ETFs rose by 13.4% on Monday, as per Benzinga Pro data.

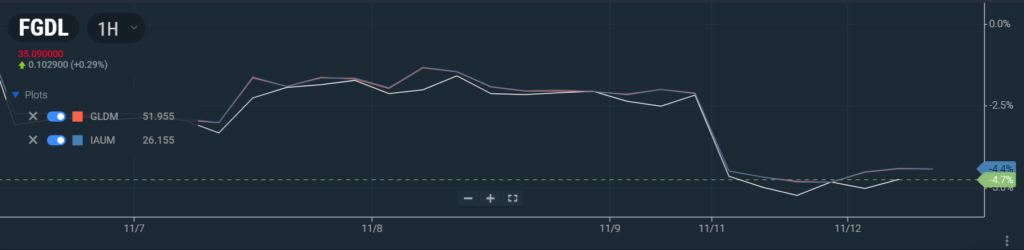

According to Benzinga Pro, Franklin Responsibility Sourced Gold ETF FGDL declined 2.25% as of Monday’s close, whereas the SPDR Gold MiniShares Trust GLDM was down by 2.35% on the same day. iShares Gold Trust Micro Shares IAUM declined by 2.39% on Monday.

Also Read: Gold ETF Hit With $1 Billion Outflow: Investors Dump Safe Haven Asset After Trump Win

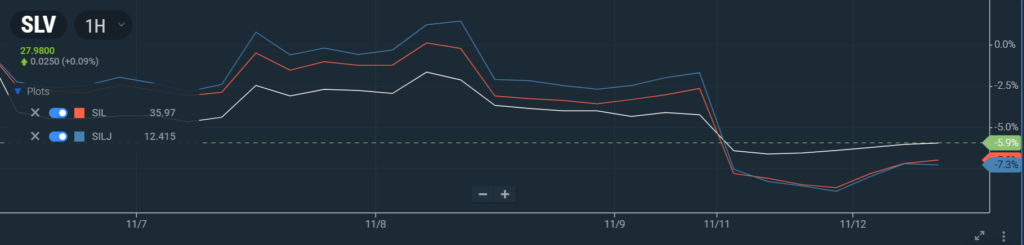

While the gold ETFs fell by over 2% on Monday, silver ETFs were down too. As per Benzinga Pro data, iShares Silver Trust SLV was down 1.79% on Monday. Similarly, Global X Silver Miners ETF SIL and Amplify ETF Trust Amplify Junior Silver Miners ETF SILJ were down by 4.39% and 5.77% as of Monday’s close.

Also read: Why Trump’s Win Has 2 Market Experts Betting On Small Caps, Financials

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Nio About to Shift Into a Higher Gear?

Investing in Chinese electric vehicle (EV) makers such as Nio (NYSE: NIO) is an intriguing option. Heavy government subsidies have led to rapid advancement in battery technology and bringing down costs, which makes for an incredibly competitive EV market in China. In fact, China’s market is so far ahead of the U.S. that over half its new vehicle sales were EVs in July.

The good news for Nio investors is that the company has momentum and could be about to shift into a higher gear. Let’s see what’s ahead.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

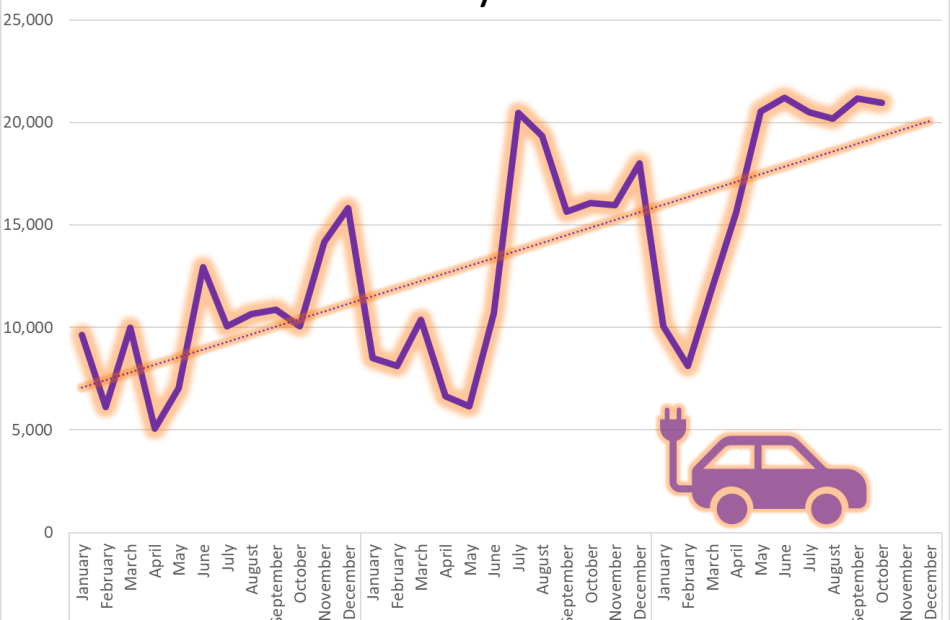

Nio has quietly put together a few months of strong delivery numbers. In fact, for six straight months, Nio has delivered over 20,000 vehicles. Nio delivered 20,976 vehicles in October, which was a 30.5% gain from the prior year.

But the biggest takeaway from the October results was early Onvo deliveries. The Nio brand sold 16,657 vehicles in October, while its “family oriented smart vehicle brand,” Onvo, delivered 4,319 in its first full month of sales. After launching the mid-size Onvo L60 in September, management noted that production and deliveries would steadily ramp up.

At the end of October, Nio had 166 Onvo centers and spaces across 60 cities with plans to expand its network to drive growth. Nio’s Onvo L60 is a good bet for that growth and could shift the company into higher gear. The new electric SUV starts at roughly $21,200 and is aimed directly at competing with rival Tesla‘s Model Y.

Not only will the Onvo L60 help shift Nio’s deliveries into higher gear, it’s just a stepping stone to what could be an even bigger hit among consumers. Nio CEO William Li commented: “If you think the L60 is good, then this new model is a much more competitive product.” Currently, the plans are for Onvo to launch a new EV every year, with the new mid- to large-size electric SUV due next year.

Nio isn’t stopping with Onvo. It has plans to launch another, more affordable, sub-brand named “Firefly” late in 2024. In a Chinese market where EVs represented over 50% of new vehicle sales in July — and which is craving affordable EVs — Nio’s launch of Onvo and Firefly should really kick the company’s deliveries into a higher gear. We’re seeing evidence of that as recently as October production and delivery figures.

The good news is that Nio recently announced a cash injection from a group of investors putting up roughly $1.9 billion to help fund its expansion and growth. The collection of strategic investors will invest roughly $471 million in Nio China, while Nio the parent company has agreed to pour in roughly $1.43 billion in cash to subscribe to the newly issued Nio China shares.