Bitcoin To Peak Between $100K-150K, Solana To Top $600 This Cycle, Say Hedge Funds, VCs

A group of polled venture capital firms and hedge funds expected Bitcoin BTC/USD to peak between $100,000 and $150,000 this bull cycle, down from the astronomical forecasts set by other market researchers.

What happened: According to the “Q4 2024 Crypto Investment Manager Survey” by venture capital firm MV Global, nearly 45% of the respondents projected the top cryptocurrency to stay within the aforementioned range.

These estimates were somewhat modest when compared to global investment bank Standard Chartered’s price target of $200,000 by end-2025 and investment management company VanEck’s prediction of $300,000.

“Our conjecture is the upside sentiment has been reduced because of the last six months of market chop. In other words, the upside-tail is much less priced in,” MV Capital said in the report.

Meanwhile, nearly half of the interviewed investors believed Bitcoin would peak in the second half of 2025, a position consistent with popular opinion.

Most participants anticipated huge upside potential for Solana SOL/USD, with over 30% predicting a peak of over $600 this cycle. This would mean a 172% spike from the current market value.

Just over 23% expected the fourth-largest cryptocurrency to peak between $450,000 and $600,000.

A third of participants expected Ethereum ETH/USD to peak between $3,000 and $5,000, while the other third expected the second-largest cryptocurrency to top in the $5,000-$7,000 range.

“High conviction that both ETH and SOL outperform BTC this cycle, but SOL has much more upside,” MV Capital quoted a liquid fund analyst as stating.

Why It Matters: The prediction markets have been energized amid the cryptocurrency market’s record-breaking rally.

Bitcoin tapped an all-time high of $89,500 on Monday, representing a surge of nearly 30% over the week.

The odds in favor of BTC hitting $100,000 in 2024 on the popular cryptocurrency-based prediction platform Polymarket zoomed to 63% as of this writing.

Price Action: At the time of writing, Bitcoin was exchanging hands at $88,598.31, up 8.81% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Photo courtesy: Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CBAK Energy Reports Third Quarter & First Nine Months of 2024 Unaudited Financial Results

DALIAN, China, Nov. 12, 2024 /PRNewswire/ — CBAK Energy Technology, Inc. CBAT (“CBAK Energy,” or the “Company”) a leading lithium-ion battery manufacturer and electric energy solution provider in China, today reported its unaudited financial results for the third quarter 2024 ended September 30, 2024.

First nine months of 2024 Financial Highlights

- Net revenues from sales of batteries were $113.9 million, an increase of 18.4% from $96.2 million in the same period of 2023.

- Net revenues from batteries used in light electric vehicles were $8.2 million, an increase of 95% from $4.2 million in the same period of 2023.

- Net revenues from batteries used in electric vehicles were $1.0 million, a decrease of 57.1% from $2.4 million in the same period of 2023.

- Net revenues from residential energy supply & uninterruptible supplies were $104.6 million, an increase of 16.8% from $89.5 million in the same period of 2023.

- Gross margin for the battery business was 34.3%, an increase of 15.2 percentage points from 19.1% in the same period of 2023.

- Net income from the battery business was $21.6 million, an increase of 222% from $6.7 million in the same period of 2023.

Zhiguang Hu, Chief Executive Officer of the Company, commented, “We are pleased to report a remarkable 18.4% increase in battery sales revenue during the first nine months of the year, especially given the intense competition within the industry. Our battery business has also delivered an impressive gross margin of 34.6% for the same period, positioning us well ahead of all competitors in the battery manufacturing sector, including internationally recognized industry leaders. Despite broader economic challenges, we have successfully achieved a net income of $21.6 million from our battery operations for the first three quarters of the year. We are proud to present this exceptional performance to our shareholders and investors and remain highly confident in our continued growth for the following quarters in this and next years.”

Jiewei Li, Chief Financial Officer and Secretary of the Board of the Company, added, “As Mr. Hu highlighted, our financial performance for the first three quarters has been exceptionally strong, setting a new benchmark within the industry. While our Dalian facility has continued to generate consistent profits, we are particularly pleased to report that our Nanjing facility—just operating for less than three years with a new battery model—has become profitable as of Q3. The demand and order volumes at the Nanjing plant have far surpassed its current capacity, leading to full-day operations across all production lines. In response to this robust client demand, we have secured procurement agreements with our equipment suppliers and are set to expand the production at our Nanjing Phase II project, adding an additional 2.5 to 3 GWh of capacity by next year.”

Third Quarter of 2024 Financial Results

Net revenues[1] were $44.6 million, representing a decrease of 29.7% compared to $63.4 million in the same period of 2023. This decrease in revenues was due to the fact that the Dalian factory had been operating at full capacity since the beginning of the year, which resulted in a one-month suspension for maintenance in the third quarter. In addition to that, Hitrans is facing suboptimal business performance.

Among these revenues, detailed revenues from our battery business are:

|

Battery Business |

2023 Third Quarter |

2024 Quarter |

% Change |

|||||||||

|

Net Revenues ($) |

44,327,653 |

33,461,793 |

(25) |

|||||||||

|

Gross Profits ($) |

11,698,226 |

7,665,009 |

(31) |

|||||||||

|

Gross Margin |

26.4 |

% |

22.9 |

% |

– |

|||||||

|

Net Income ($) |

7,770,711 |

2,035,338 |

– |

|||||||||

|

Net Revenues from Battery Business on |

||||||||||||

|

Electric Vehicles |

402,863 |

333,216 |

(17) |

|||||||||

|

Light Electric Vehicles |

1,114,107 |

4,913,644 |

341 |

|||||||||

|

Residential Energy Supply & |

42,810,683 |

28,214,934 |

(34) |

|||||||||

|

Total |

63,441,109 |

44,628,241 |

(30) |

|||||||||

|

[1] Net revenues consist of the Company’s self-operated battery business and Hitrans, which was acquired in 2021, an independently managed raw materials business. |

Cost of revenues was $37.7 million, representing a decrease of 26.4% from $51.2 million in the same period of 2023. The decrease in the cost of revenues corresponds to the decrease of net revenues.

Gross profit was $7.0 million, representing a decrease of 43% from $12.2 million in the same period of 2023. Gross margin was 15.6%, compared to 19.3% in the same period of 2023.

Total operating expenses were $7.8 million, representing an increase of 12% from $7.0 million in the same period of 2023.

- Research and development expenses was $3.4 million, an increase of 36% from $2.5 million in the same period of 2023.

- Sales and marketing expenses were $1.0 million, a slightly decrease of 8% from $1.1 million in the same period of 2023.

- General and administrative expenses were $2.8 million, a decrease of 14% from $3.2 million in the same period of 2023.

- Recover of doubtful accounts was $0.55 million, compared to a provision of doubtful accounts of $0.25 million in the same period of 2023.

Operating loss amounted to $0.83 million, compared to an operating income of $5.3 million in the same period of 2023.

Finance income, net amounted to $40,350, compared to $0.4 million in the same period of 2023.

Change in fair value of warrants was nil, compared to $15,000 in the same period of 2023.

Net loss attributable to shareholders of CBAK Energy was $0.2 million, compared to net income attributable to shareholders of CBAK Energy of $6.3 million in the same period of 2023.

Net income attributable to shareholders of CBAK Energy (after deducting the change in fair value of warrants) was $17,647, compared to a net income of $6.2 million in the same period of 2023, mainly due to the fact that our acquired raw material manufacturing unit, Hitrans, is in net loss.

Basic and diluted income per share were both nil, compared to basic and diluted loss per share of $0.07 in 2023.

First nine months of 2024 Financial Results

Net revenues[1] were $151.2 million, representing an increase of 2.0% compared to $148.3 million in the same period of 2023. This increase was primarily attributable to an increase in revenue from the Company’s battery business.

Among these revenues, detailed revenues from our battery business are:

|

Battery Business |

2023 First nine months |

2024 nine months |

% Change |

|||||||||

|

Net Revenues ($) |

96,163,040 |

113,897,786 |

18.4 |

|||||||||

|

Gross Profits ($) |

18,336,732 |

39,040,824 |

109.5 |

|||||||||

|

Gross Margin |

19.0 |

% |

34.3 |

% |

– |

|||||||

|

Net (Loss) Income ($) |

6,746,883 |

21,610,408 |

– |

|||||||||

|

Net Revenues from Battery Business on |

||||||||||||

|

Electric Vehicles |

2,358,842 |

1,012,655 |

-57.0 |

|||||||||

|

Light Electric Vehicles |

4,230,066 |

8,249,437 |

95.0 |

|||||||||

|

Residential Energy Supply & |

89,574,132 |

104,635,694 |

16.8 |

|||||||||

|

Total |

96,163,040 |

113,897,786 |

18.4 |

|||||||||

|

[1] Net revenues consist of the Company’s self-operated battery business and Hitrans, which was acquired in 2021, an independently managed raw materials business. |

Cost of revenues was $112.8 million, representing a decrease of 12.7% from $129.2 million in the same period of 2023. The decrease in the cost of revenues corresponds to theCompany’s higher gross profit from the battery business.

Gross profit was $38.5 million, representing an increase of 102.0% from $19.0 million in the same period of 2023. Gross margin was 25.4%, compared to 12.8% in the same period of 2023.

Total operating expenses were $23.1 million, representing an increase of 13.1% from $20.4 million in the same period of 2023.

- Research and development expenses were $9.2 million, an increase of 14.9% from $8.0 million in the same period of 2023.

- Sales and marketing expenses were $4.1 million, an increase of 46.9% from $2.8 million in the same period of 2023.

- General and administrative expenses were $10.0 million, an increase of 7.5% from $9.3 million in the same period of 2023.

- Recovery of doubtful accounts was $0.2 million, compared to a provision for doubtful accounts of $0.3 million in the same period of 2023.

Operating income amounted to $15.4 million, compared to an operating loss of $1.4 million in the same period of 2023.

Finance income, net amounted to $0.6, compared to $0.2 million finance expenses in the same period of 2023.

Change in fair value of warrants was nil, compared to $0.14 million in the same period of 2023.

Net income attributable to shareholders of CBAK Energy was $16.3 million, compared to net income attributable to shareholders of CBAK Energy of $2.3 million in the same period of 2023.

Net income attributable to shareholders of CBAK Energy (after deducting the change in fair value of warrants) was $16.3 million, compared to a net income of $2.1 million in the same period of 2023, mainly due to the strong performance of our battery business.

Basic and diluted income per share were both $0.18, compared to basic and diluted loss per share of $0.03 in 2023.

Conference Call

CBAK Energy’s management will host an earnings conference call at 8:00 AM U.S. Eastern Time on Tuesday, November 12, 2024 (9:00 PM Beijing/Hong Kong Time on November 12, 2024).

For participants who wish to join our call online, please visit:

https://edge.media-server.com/mmc/p/sepoc69g

Participants who plan to ask questions during the call will need to register at least 15 minutes prior to the scheduled call start time using the link provided below. Upon registration, participants will receive the conference call access information, including dial-in numbers, a unique pin, and an email with detailed instructions.

Participant Online Registration:

https://register.vevent.com/register/BI35d99553511e4d63bffc9c7d4409bcec

Once completing the registration, please dial-in at least 10 minutes before the scheduled start time of the conference call and enter the personal pin as instructed to connect to the call.

A replay of the conference call may be accessed within seven days after the conclusion of the live call at the following website: https://edge.media-server.com/mmc/p/sepoc69g

The earnings release and the link for the replay are available at ir.cbak.com.cn.

About CBAK Energy

CBAK Energy Technology, Inc. CBAT is a leading high-tech enterprise in China engaged in the development, manufacturing, and sales of new energy high power lithium and sodium batteries, as well as the production of raw materials for use in manufacturing high power lithium batteries. The applications of the Company’s products and solutions include electric vehicles, light electric vehicles, energy storage and other high-power applications. In January 2006, CBAK Energy became the first lithium battery manufacturer in China listed on the Nasdaq Stock Market. CBAK Energy has multiple operating subsidiaries in Dalian, Nanjing, Shaoxing and Shangqiu, as well as a large-scale R&D and production base in Dalian.

For more information, please visit ir.cbak.com.cn.

Safe Harbor Statement

This press release contains “forward-looking statements” that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this press release, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Our actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these forward-looking statements.

Any forward-looking statements contained in this press release are only estimates or predictions of future events based on information currently available to our management and management’s current beliefs about the potential outcome of future events. Whether these future events will occur as management anticipates, whether we will achieve our business objectives, and whether our revenues, operating results, or financial condition will improve in future periods are subject to numerous risks. There are a significant number of factors that could cause actual results to differ materially from statements made in this press release, including: significant legal and operational risks associated with having substantially all of our business operations in China, that the Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our securities or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and could cause the value of such securities to significantly decline or be worthless, the effects of the global Covid-19 pandemic or other health epidemics, changes in domestic and foreign laws, regulations and taxes, the volatility of the securities markets; and other risks including, but not limited to, the ability of the Company to meet its contractual obligations, the uncertain markets for the Company’s products and business, macroeconomic, technological, regulatory, or other factors affecting the profitability of our products and solutions that we discussed or referred to in the Company’s disclosure documents filed with the U.S. Securities and Exchange Commission (the “SEC”) available on the SEC’s website at www.sec.gov, including the Company’s most recent Annual Report on Form 10-K as well as in our other reports filed or furnished from time to time with the SEC. You should read these factors and the other cautionary statements made in this press release. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. The forward-looking statements included in this press release are made as of the date of this press release and the Company undertakes no obligation to publicly update or revise any forward-looking statements, other than as required by applicable law.

For further inquiries, please contact:

In China:

CBAK Energy Technology, Inc.

Investor Relations Department

Phone: +86-18675423231

Email: ir@cbak.com.cn

|

CBAK Energy Technology, Inc. and Subsidiaries |

||||||||||||

|

Condensed consolidated Balance Sheets |

||||||||||||

|

As of December 31, 2023 and September 30, 2024 |

||||||||||||

|

(Unaudited) |

||||||||||||

|

(In US$ except for number of shares) |

||||||||||||

|

December 31, |

September 30, |

|||||||||||

|

(Unaudited) |

||||||||||||

|

Assets |

||||||||||||

|

Current assets |

||||||||||||

|

Cash and cash equivalents |

$ |

4,643,267 |

$ |

10,448,362 |

||||||||

|

Pledged deposits |

54,179,549 |

37,415,946 |

||||||||||

|

Short-term deposits |

– |

13,788,170 |

||||||||||

|

Trade and bills receivable, net |

28,653,047 |

34,910,784 |

||||||||||

|

Inventories |

33,413,422 |

23,938,925 |

||||||||||

|

Prepayments and other receivables |

7,459,254 |

9,950,350 |

||||||||||

|

Receivables from a former subsidiary, net |

74,946 |

7,580 |

||||||||||

|

Total current assets |

128,423,485 |

130,460,117 |

||||||||||

|

Property, plant and equipment, net |

91,628,832 |

89,365,457 |

||||||||||

|

Construction in progress |

37,797,862 |

38,993,618 |

||||||||||

|

Long-term investments, net |

2,565,005 |

2,336,537 |

||||||||||

|

Prepaid land use rights |

11,712,704 |

11,601,078 |

||||||||||

|

Intangible assets, net |

841,360 |

507,113 |

||||||||||

|

Deposit paid for acquisition of long-term investments |

7,101,492 |

16,500,192 |

||||||||||

|

Operating lease right-of-use assets, net |

1,084,520 |

3,713,242 |

||||||||||

|

Total assets |

$ |

281,155,260 |

$ |

293,477,354 |

||||||||

|

Liabilities |

||||||||||||

|

Current liabilities |

||||||||||||

|

Trade and bills payable |

$ |

82,429,575 |

$ |

89,773,942 |

||||||||

|

Short-term bank borrowings |

32,587,676 |

25,708,098 |

||||||||||

|

Other short-term loans |

339,552 |

337,147 |

||||||||||

|

Accrued expenses and other payables |

41,992,540 |

35,144,908 |

||||||||||

|

Payables to a former subsidiary, net |

411,111 |

407,560 |

||||||||||

|

Deferred government grants, current |

375,375 |

499,861 |

||||||||||

|

Product warranty provisions |

23,870 |

17,099 |

||||||||||

|

Operating lease liability, current |

691,992 |

1,527,829 |

||||||||||

|

Finance lease liability, current |

1,643,864 |

762,694 |

||||||||||

|

Income tax payable |

– |

343,856 |

||||||||||

|

Total current liabilities |

160,495,555 |

154,522,994 |

||||||||||

|

Deferred government grants, non-current |

6,203,488 |

5,778,875 |

||||||||||

|

Product warranty provisions |

522,574 |

410,350 |

||||||||||

|

Operating lease liability, non-current |

475,302 |

2,683,772 |

||||||||||

|

Total liabilities |

167,696,919 |

163,395,991 |

||||||||||

|

Commitments and contingencies |

||||||||||||

|

Shareholders’ equity |

||||||||||||

|

Common stock $0.001 par value; 500,000,000 authorized; 90,063,396 |

90,063 |

90,083 |

||||||||||

|

Donated shares |

14,101,689 |

14,101,689 |

||||||||||

|

Additional paid-in capital |

247,465,817 |

247,732,612 |

||||||||||

|

Statutory reserves |

1,230,511 |

1,230,511 |

||||||||||

|

Accumulated deficit |

(134,395,762) |

(118,096,203) |

||||||||||

|

Accumulated other comprehensive loss |

(11,601,403) |

(10,127,774) |

||||||||||

|

116,890,915 |

134,930,918 |

|||||||||||

|

Less: Treasury shares |

(4,066,610) |

(4,066,610) |

||||||||||

|

Total shareholders’ equity |

112,824,305 |

130,864,308 |

||||||||||

|

Non-controlling interests |

634,036 |

(782,945) |

||||||||||

|

Total equity |

113,458,341 |

130,081,363 |

||||||||||

|

Total liabilities and shareholder’s equity |

$ |

281,155,260 |

$ |

293,477,354 |

||||||||

|

CBAK Energy Technology, Inc. and Subsidiaries |

||||||||||||||||||||

|

Condensed consolidated Statements of Operations and Comprehensive Income (Loss) |

||||||||||||||||||||

|

For the three and nine months ended September 30, 2023 and 2024 |

||||||||||||||||||||

|

(Unaudited) |

||||||||||||||||||||

|

(In US$ except for number of shares) |

||||||||||||||||||||

|

Three months ended |

Nine months ended |

|||||||||||||||||||

|

2023 |

2024 |

2023 |

2024 |

|||||||||||||||||

|

Net revenues |

$ |

63,441,109 |

$ |

44,628,241 |

$ |

148,258,680 |

$ |

151,243,718 |

||||||||||||

|

Cost of revenues |

(51,192,531) |

(37,673,684) |

(129,219,716) |

(112,780,088) |

||||||||||||||||

|

Gross profit |

12,248,578 |

6,954,557 |

19,038,964 |

38,463,630 |

||||||||||||||||

|

Operating expenses: |

||||||||||||||||||||

|

Research and development expenses |

(2,577,714) |

(3,434,351) |

(8,013,760) |

(9,205,378) |

||||||||||||||||

|

Sales and marketing expenses |

(1,116,377) |

(1,022,549) |

(2,800,969) |

(4,114,954) |

||||||||||||||||

|

General and administrative expenses |

(3,240,770) |

(2,779,519) |

(9,302,798) |

(10,002,040) |

||||||||||||||||

|

(Provision for) recovery of doubtful |

(24,623) |

(546,011) |

(286,283) |

241,332 |

||||||||||||||||

|

Total operating expenses |

(6,959,484) |

(7,782,430) |

(20,403,810) |

(23,081,040) |

||||||||||||||||

|

Operating income (loss) |

5,289,094 |

(827,873) |

(1,364,846) |

15,382,590 |

||||||||||||||||

|

Finance (expense) income, net |

(447,031) |

(40,350) |

(189,248) |

658,034 |

||||||||||||||||

|

Other income, net |

601,654 |

521,916 |

1,022,907 |

1,031,329 |

||||||||||||||||

|

Gain on disposal of equity investee |

– |

55 |

– |

26,967 |

||||||||||||||||

|

Change in fair value of warrants |

15,000 |

– |

136,000 |

– |

||||||||||||||||

|

Income (loss) before income tax |

5,458,717 |

(346,252) |

(395,187) |

17,098,920 |

||||||||||||||||

|

Income tax credit (expenses) |

305,431 |

(339,287) |

1,015,626 |

(2,188,800) |

||||||||||||||||

|

Net income (loss) |

5,764,148 |

(685,539) |

620,439 |

14,910,120 |

||||||||||||||||

|

Less: Net loss attributable to non- |

570,644 |

703,186 |

1,699,008 |

1,389,439 |

||||||||||||||||

|

Net income (loss) attributable to CBAK |

$ |

6,334,792 |

$ |

17,647 |

$ |

2,319,447 |

$ |

16,299,559 |

||||||||||||

|

Net income (loss) |

5,764,148 |

(685,539) |

620,439 |

14,910,120 |

||||||||||||||||

|

Other comprehensive loss |

||||||||||||||||||||

|

– Foreign currency translation adjustment |

(515,279) |

4,181,904 |

(6,405,609) |

1,446,087 |

||||||||||||||||

|

Comprehensive (loss) income |

5,248,869 |

3,496,365 |

(5,785,170) |

16,356,207 |

||||||||||||||||

|

Less: Comprehensive (loss) income |

553,874 |

719,587 |

1,927,515 |

1,416,981 |

||||||||||||||||

|

Comprehensive (loss) income attributable |

$ |

5,802,743 |

$ |

4,215,952 |

$ |

(3,857,655) |

$ |

17,773,188 |

||||||||||||

|

Income (loss) per share |

||||||||||||||||||||

|

– Basic |

$ |

0.07 |

$ |

0.00 |

$ |

0.03 |

$ |

0.18 |

||||||||||||

|

– Diluted |

$ |

0.07 |

$ |

0.00 |

$ |

0.03 |

$ |

0.18 |

||||||||||||

|

Weighted average number of shares of |

||||||||||||||||||||

|

– Basic |

89,473,026 |

89,931,617 |

89,171,988 |

89,929,477 |

||||||||||||||||

|

– Diluted |

89,904,319 |

90,229,849 |

89,582,401 |

90,267,431 |

||||||||||||||||

![]() View original content:https://www.prnewswire.com/news-releases/cbak-energy-reports-third-quarter–first-nine-months-of-2024-unaudited-financial-results-302299753.html

View original content:https://www.prnewswire.com/news-releases/cbak-energy-reports-third-quarter–first-nine-months-of-2024-unaudited-financial-results-302299753.html

SOURCE CBAK Energy Technology, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brent Crude Stumbles As Market Sentiments Turn Cautious

By RoboForex Analytical Department

Brent crude oil prices have continued to slip, touching 71.74 USD a barrel on Tuesday. This marks a downturn influenced by China’s underwhelming stimulus measures. The market’s lack of confidence in China’s rejuvenation efforts, coupled with persistently weak inflation and subdued energy demand within the country, has led to this downturn.

Compounding the downward pressure on oil prices, the US dollar’s strength makes commodity investments less attractive, as a robust USD typically dampens demand for dollar-priced assets like oil. However, the geopolitical landscape, which often serves as a driver for oil price volatility, appears stable for now. With reduced tensions in the Middle East, some risk premiums previously embedded in Brent prices have been alleviated.

Investors eagerly anticipate the monthly OPEC report expected later today, which is set to provide deeper insights into the supply-demand dynamics. This report has the potential to influence market sentiments significantly and is a key focus for investors as they consider global oil demand forecasts for 2025.

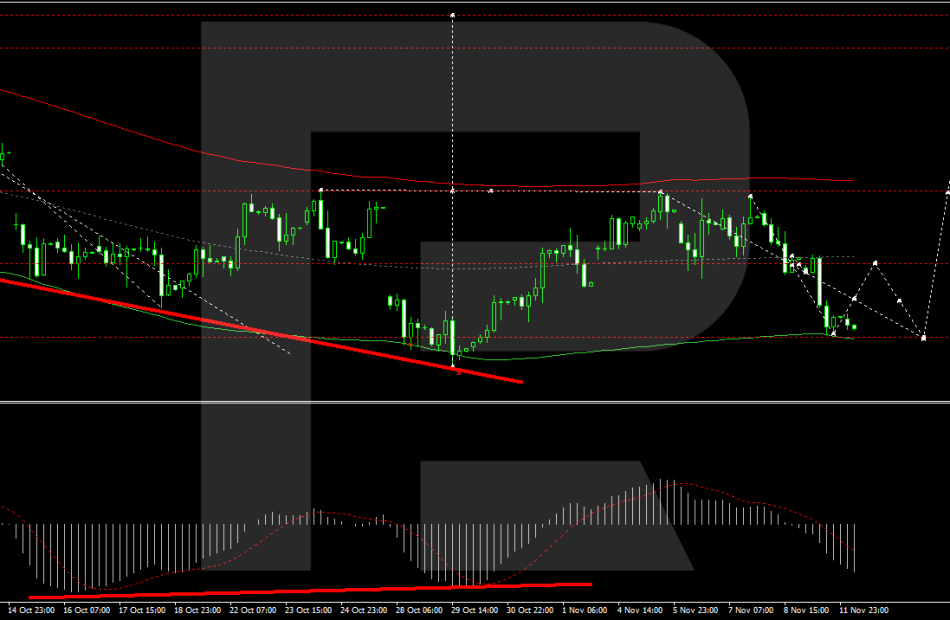

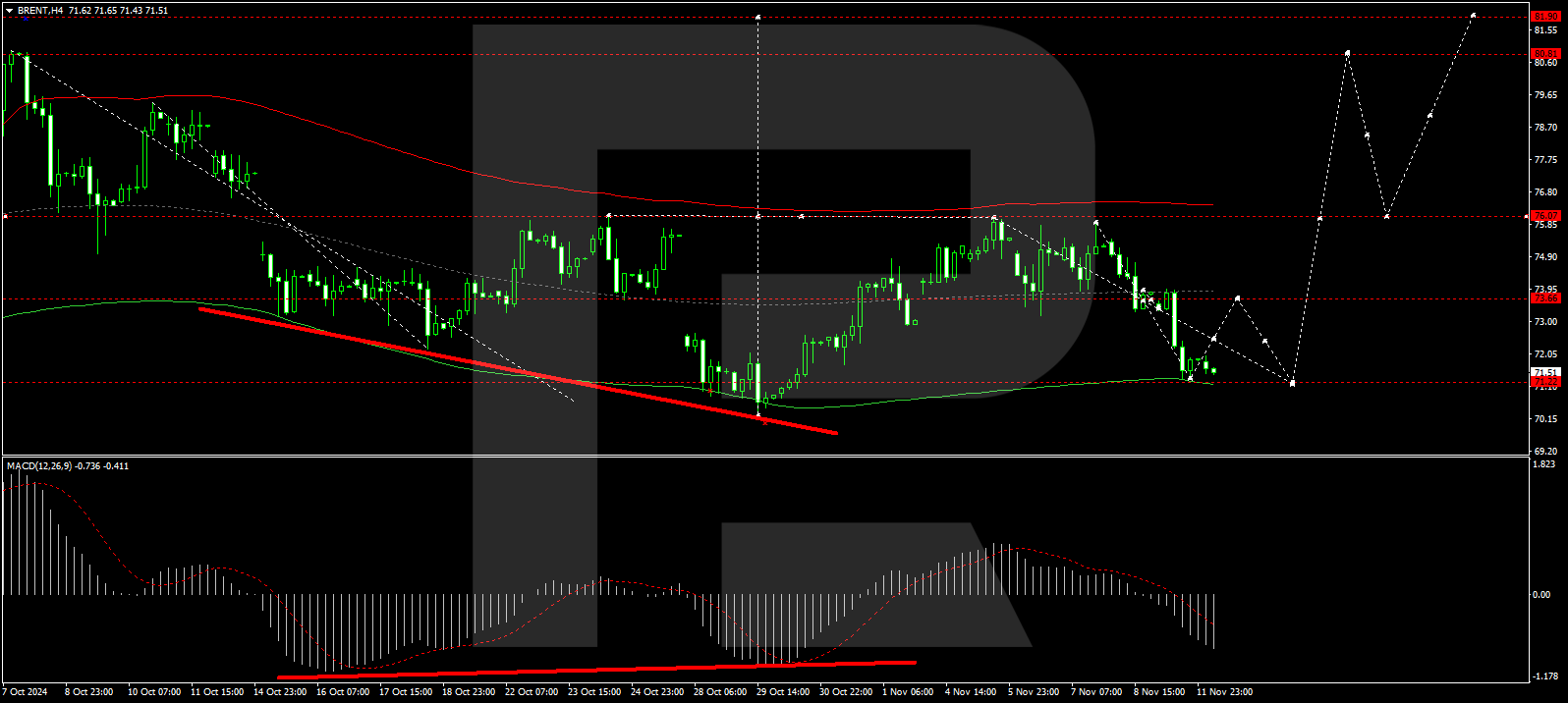

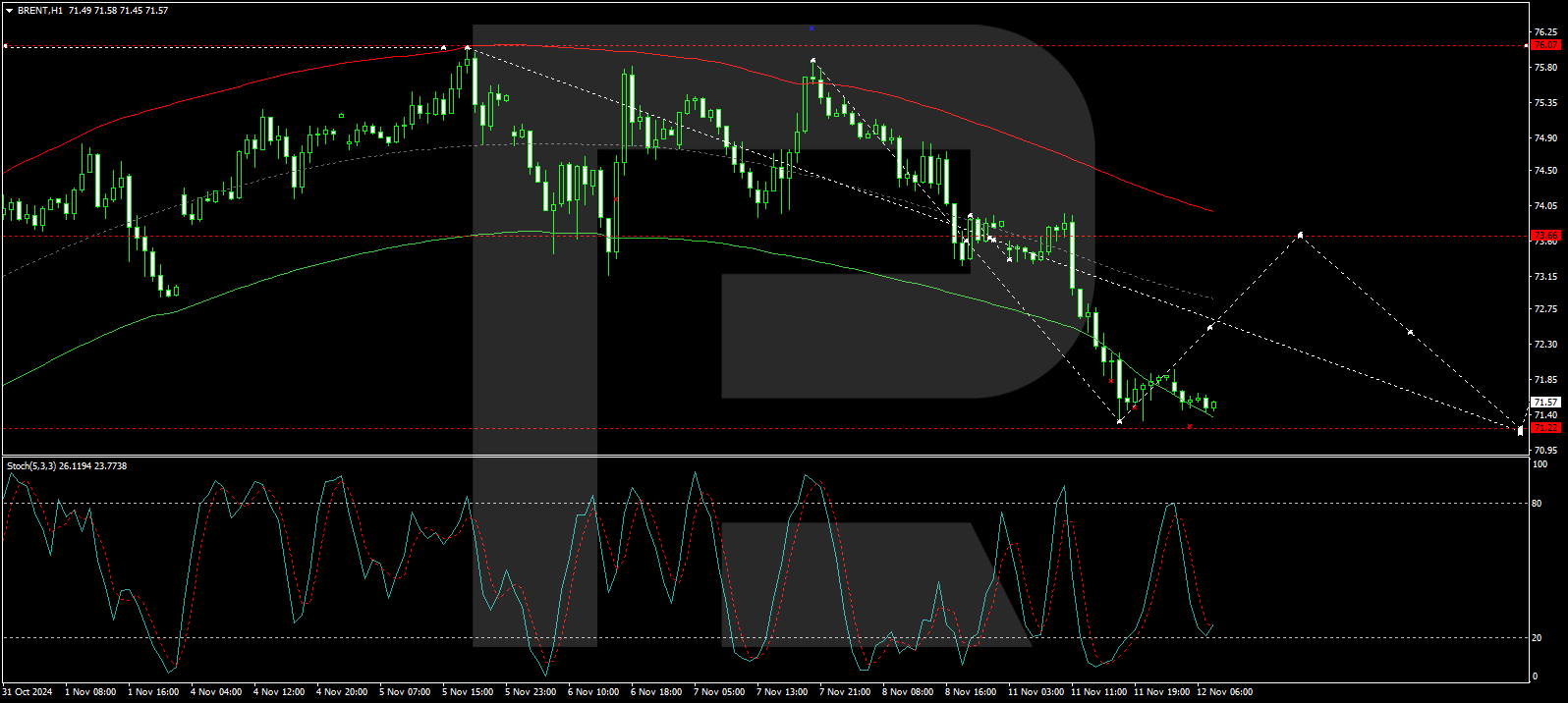

Brent Technical Analysis

On the H4 chart of Brent, the market continues to develop a broad consolidation range around the level of 73.66, extending to the level of 71.33. Today, we expect a growth link to the level of 73.66. After reaching this level, developing another downside structure to 71.22 is possible. Further, we will consider the probability of the beginning of the growth wave development to 76.00, with the prospect of the trend’s continuation to 80.80, the local target. Technically, this scenario is confirmed by the MACD indicator. Its signal line is under the zero level and is directed downwards.

On the H1 Brent chart, the market has formed a consolidation range around 73.66 and worked out a downward wave to 71.33, the local target. Today, a correction link for this downward wave is likely with a target at 73.66, followed by another wave of decline to 71.22. At this point, the potential of the downward wave can be considered exhausted. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under 50 and is directed strictly downwards to 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shell welcomes Dutch Court of Appeal ruling

Shell plc

Shell welcomes Dutch Court of Appeal ruling

November 12, 2024

Today, the Court of Appeal of The Hague overturned the District Court of The Hague’s 2021 ruling in the case brought against Shell plc by Milieudefensie, other NGOs and a group of private individuals.

“We are pleased with the court’s decision, which we believe is the right one for the global energy transition, the Netherlands and our company,” said Shell plc Chief Executive Officer Wael Sawan.

“Our target to become a net-zero emissions energy business by 2050 remains at the heart of Shell’s strategy and is transforming our business. This includes continuing our work to halve emissions from our operations by 20301. We are making good progress in our strategy to deliver more value with less emissions.”

The past few years have highlighted the critical importance of secure and affordable energy for economies and people’s lives. At the same time, the world must meet growing demand for energy while tackling the urgent challenge of climate change. There has been significant progress in the transition to low-carbon energy where governments have introduced policies to encourage investment and drive changes in demand.

As Shell has stated previously, a court ruling would not reduce overall customer demand for products such as petrol and diesel for cars, or for gas to heat and power homes and businesses. It would do little to reduce emissions, as customers would take their business elsewhere. We believe that smart policies from governments, along with investment and action across all sectors, will drive the progress towards net-zero emissions that we all want to see.

Notes to Editors:

- In 2021, the District Court of The Hague ruled that Shell plc must reduce the worldwide aggregate net carbon emissions it reports across Scopes 1, 2 and 3 by net 45% by the end of 2030, compared with 2019 levels, with a “significant best efforts” obligation for Scopes 2 and 3, and a “results-based” obligation for Scope 1. Shell’s appeal did not have the effect of suspending the District Court’s decision.

- Shell is investing $10-15 billion between 2023 and the end of 2025 in low-carbon energy solutions including charging for electric vehicles, biofuels, renewable power, hydrogen, and carbon capture and storage, making Shell a significant investor in the energy transition.

- Shell invested $5.6 billion in low-carbon solutions in 2023, which was 23% of our capital spending.

- By the end of 2023, Shell had achieved more than 60% of its target to reduce Scope 1 and 2 emissions from its operations by 50% by 2030, compared with 2016.

- By the end of 2023, Shell had also achieved its short-term target to reduce the net carbon intensity of the energy products we sell (6.3% reduction against our target of 6-8%) compared with 2016. Our analysis, using data from the International Energy Agency, shows the net carbon intensity of the global energy system fell by around 3% over the same period.

- Shell continues to be one of the industry leaders in reducing emissions of methane. In 2023, we continued to keep our methane emissions intensity well below 0.2% and, by the end of 2023, we had reduced our methane emissions by 70% since 2016.

- To help drive the decarbonisation of transport, Shell set a new ambition in 2024 to reduce customer emissions from the use of our oil products (such as gasoline, diesel and kerosene) by 15-20% by 2030, compared with 2021 (Scope 3, Category 11)2.

1 On a net basis; baseline year 2016.

2 Customer emissions from the use of our oil products (Scope 3, Category 11) were 517 million tonnes carbon dioxide equivalent (CO2e) in 2023 and 569 million tonnes CO2e in 2021.

Enquiries

UK / International Media Relations: +44 207 934 5550

Cautionary Note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries”, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-Looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate”; ‘‘believe”; “commit”; “commitment”; ‘‘could”; ‘‘estimate”; ‘‘expect”; ‘‘goals”; ‘‘intend”; ‘‘may”; “milestones”; ‘‘objectives”; ‘‘outlook”; ‘‘plan”; ‘‘probably”; ‘‘project”; ‘‘risks”; “schedule”; ‘‘seek”; ‘‘should”; ‘‘target”; ‘‘will”; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2023 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, November 12, 2024. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon Intensity” (NCI), which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of energy products produced by others which Shell purchases for resale. Shell only controls its own emissions. The use of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward-Looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov.

LEI number of Shell plc: 21380068P1DRHMJ8KU70

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JBM Exclusively Lists Casa Bella on Westshore Apartments in South Tampa, FL

ST. PETERSBURG, Fla., Nov. 11, 2024 /PRNewswire/ — JBM® Institutional Multifamily Advisors has exclusively listed Casa Bella on Westshore. Initially designed as a luxury condominium community, these apartments feature unique, luxurious finishes and floorplans not typically seen in rentals today. The Property is comprised of two, three, and four-story, elevator serviced buildings with 250 units averaging 1,041 square feet. The Offer Deadline is set for December 5th, 2024.

Product

Casa Bella showcases an ultra-modern amenity package including two resort-style pools, expansive sun decks, jetted hot tub, and poolside grilling stations. The 24-hour state-of-the-art fitness center has recently been renovated with brand new equipment, paint, and flooring. The grand, 2-story resident clubhouse features entertainment and seating areas, coffee station, business center, and resident lounge with TV and poker table. Additional amenities include a fenced-in dog park, putting green, and Italian countryside-inspired landscaping and aesthetic.

Units

The Property includes a diverse mix of one, two, and three-bedroom units featuring open-concept floorplans with loft units having 20′ +/- ceilings. 23% of units feature an attached garage, den, or loft, and 76% of units include an additional half-bathroom. The chef-inspired kitchens feature granite countertops, stainless steel appliances with double door refrigerator with water/ice dispensers, mosaic glass tile backsplash, and shaker-style cabinetry. The luxury spa-inspired bathrooms have granite vanities, extra-large garden-style soaking tubs, modern lightning fixtures, and frameless glass showers in select units. Other features include additional storage space, large balconies, and LVT flooring in select living rooms.

Location

Casa Bella features an irreplaceable, South Tampa waterfront location, providing residents with magnificent views of Tampa Bay. The Property has exceptional connectivity located less than 2 miles from Selmon Expressway (100,000+ ADT) and Gandy Boulevard (41,000+ ADT) which provides access throughout Pinellas and Hillsborough Counties. MacDill Airforce Base is 1.5 miles away and employs 31,000+ people and has an economic impact of over $4 billion. Tampa ranked #1 for Time Magazine’s World’s Greatest Places (2023).

About JBM®

JBM® is the #1 ranked boutique brokerage firm in the U.S.A. despite only transacting in Florida. Green Street’s 2023 national multifamily broker rankings ranks JBM® as the #1 highest average sold price per transaction throughout the entire U.S.A. and #1 highest average sales price per unit throughout Florida. JBM® has a lifetime transactions volume over $19.4 billion and 170,000+ units.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jbm-exclusively-lists-casa-bella-on-westshore-apartments-in-south-tampa-fl-302301322.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jbm-exclusively-lists-casa-bella-on-westshore-apartments-in-south-tampa-fl-302301322.html

SOURCE JBM Institutional Multifamily Advisors

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trend Micro Reports Earnings Results for Q3 2024

- Increase of 42% in operating income to drive 24% operating margin*

- Increase of 6% globally in net sales growth at actual currency

- Increase of 6% total enterprise annual recurring revenue (ARR) to US $1.26 Billion** driven by double digit growth in next-gen security operations center (SOC)

TOKYO, Nov. 12, 2024 /PRNewswire/ — Trend Micro Incorporated ((4704, TSE: 4704)), a global cybersecurity leader, today announced earnings results for the third quarter of fiscal year 2024, ending, September 30, 2024, by reporting 6% year-over-year (YoY) growth.

Industry tool consolidation and demand for AI-powered solutions with better security outcomes continued to dominant buying trends this quarter, increasing demand for the Trend platform with over 780 new customers year-to-date and 10k+ customers in total.

Trend’s accelerated platform adoption was powered by better visibility, prioritization, and mitigation capabilities, resulting in a 21% increase in next-gen SOC ARR. A 37% platform attach rate this quarter was achieved through diligent focus of platform adoption and module expansion across enterprise customers in all regions.

“Cybersecurity has always been reactive because critical asset mapping of specific customer environments and dynamic attacker tactics make it hard to predict and prevent attacks in a proactive way,” said Trend Micro CEO and co-founder Eva Chen. “But thanks to AI innovations, proactive cybersecurity is possible through risk management, opening us up for growth.”

“We have exceeded goals on reducing operating expenses and are focused on our top line targets,” said Trend Micro COO Kevin Simzer. “We will continue to manage operating expenses with vigor, while driving sustainable results from our platform advancements.”

Margin growth continued as the company optimized operating expenses, realizing a 42% increase in operating income and an improved operating margin of 24%*.

Trend will host its annual investor update at 10:00 a.m. (GMT+9) on Wednesday, November 20, 2024, as an online event format for invited industrial investors. More information will be found at: https://www.trendmicro.com/en_us/about/investor-relations/ir-day-event.html

For this quarter, Trend Micro posted consolidated net sales of 68,124 million Yen (or US $456 million, 149.37 JPY = 1USD). The company posted operating income of 14,801 million Yen (or US $99 million) and net income attributable to owners of the parent of 8,523 million Yen (or US $57 million) for the quarter.

The company will not revise expected consolidated results for the full fiscal year ending December 31, 2024 (released on February 15, 2024). Based on information currently available to the company, consolidated net sales for the year ending December 31, 2024 are expected to be 271,000 million Yen (or US $1,843 million, based on an exchange rate of 147 JPY = 1 USD). Operating income and net income attributable to owners of the parent company are expected to be 52,900 million Yen (or US $359 million) and 34,600 million Yen (or US $235 million), respectively.

Key business updates in Q3 2024

Innovative: Trend nurtures a culture of innovation to drive advancements across its cybersecurity platform.

- Extended its platform strategy to enhance AI security and protect sensitive data in high-performance computing environments along with Nvidia and GMI Cloud.

- Joined the Coalition for Secure AI (COSAI) alongside partners including Amazon, Google, NVIDIA, Microsoft, IBM and others.

- Enabled small businesses with the power of the Vision One platform in a format they can manage to maximize the potential of AI while maintaining business resilience by ensuring that any team can securely innovate without elevating risk.

Trusted: Trend is a trusted partner to the customers and communities that it serves.

- Revealed new research to measure and mitigate risk across their digital attack surface, and insights for organizations lacking sufficient resources and leadership buy-in.

- Published a series of tools uncovering security risks worldwide posed by rogue AI, providing the industry with guidance and best practices.

- Urged network defenders to gain greater visibility to attack surface risk, after releasing a study uncovering weak configurations that could lead to compromise.

Global: Trend has the most geographically diverse customers in the industry, with millions of sensors powering the Trend Vision One platform for superior attack surface risk management.

- Retained #1 ranking in IDC’s Worldwide Cloud-Native Application Protection Platform Market Shares, 2023: A Bull Marketi report.

- Positioned for the 19th consecutive year in the Leader’s Quadrant in the 2024 Gartner® Magic Quadrant™: Endpoint Protection Platforms (EPP)ii.

- Named a Leader in The Forrester Wave™: Attack Surface Management Solutions, Q3 2024.

Trend Micro was awarded the following patents in Q3 2024:

|

Patent No. |

Issue Date |

Title |

|

12032705 |

07/09/2024 |

Detecting an Operational State of Antivirus Software |

|

12063244 |

08/13/2024 |

Protecting computers from malicious distributed configuration profiles |

|

12074898 |

08/27/2024 |

Adaptive actions for responding to security risks in computer networks |

*Excluding Q3 stock price increase impacts.

** Converted at Company Plan Rates, 1USD= 147 yen, 1EUR =157 yen. Non-GAAP and Reference for Internal management.

Notice Regarding Forward-Looking Statements

Certain statements included in this press release that are not historical facts are forward-looking statements. Forward-looking statements are sometimes accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements are based on our current expectations and beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

About Trend Micro

Trend Micro, a global cybersecurity leader, helps make the world safe for exchanging digital information. Fueled by decades of security expertise, global threat research, and continuous innovation, Trend Micro’s AI-powered cybersecurity platform protects hundreds of thousands of organizations and millions of individuals across clouds, networks, devices, and endpoints. As a leader in cloud and enterprise cybersecurity, Trend’s platform delivers a powerful range of advanced threat defense techniques optimized for environments like AWS, Microsoft, and Google, and central visibility for better, faster detection and response. With 7,000 employees across 70 countries, Trend Micro enables organizations to simplify and secure their connected world. www.TrendMicro.com.

i (doc # US52472324, September 2024).

ii Gartner, “Gartner® Magic Quadrant™: Endpoint Protection Platforms (EPP),” Evgeny Mirolyubov, Franz Stefan Hinner, Chris Silva, Deepak Mishra, Satarupa Patnaik, September 23, 2024.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/trend-micro-reports-earnings-results-for-q3-2024-302302265.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/trend-micro-reports-earnings-results-for-q3-2024-302302265.html

SOURCE Trend Micro Incorporated

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

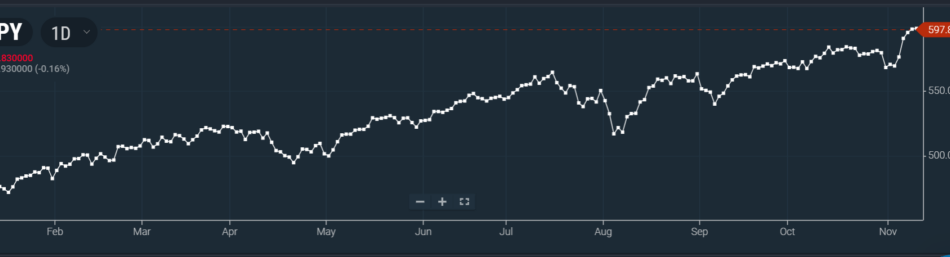

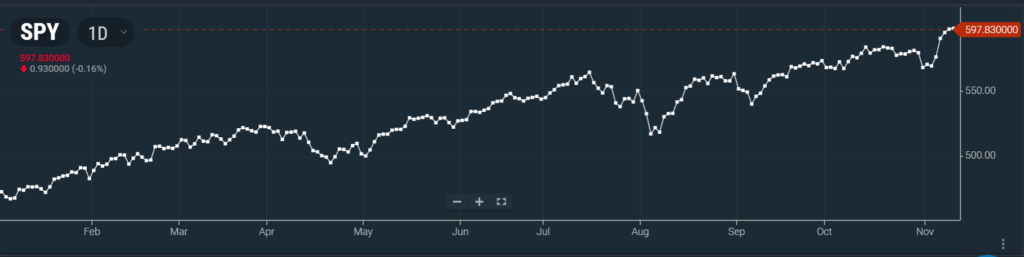

US Stocks May Cool As Trump Win-Fueled Rally Nears Potential Pause Amid Profit-Taking, Says Investment Bank: '…May Limit Further Upside'

Citigroup Inc. forecasts a blip in the ongoing stock market rally, which has been unfolding since the U.S. presidential elections. As per the strategists at Citigroup, the rally fueled by Donald Trump‘s return to the White House will lose steam as investors start to book profits.

What happened: The markets have been upbeat since last week as the S&P 500 Index hit its 51st record high this year. Citigroup strategists led by Chris Montagu said that the long positions in the technology-heavy Nasdaq 100 Index and the small-cap Russell 2000 reflect “an extremely bullish outlook,” according to a Bloomberg report.

The strategists also added that the bullish investors have pushed the exposure to the S&P 500 Index to the highest level in three years.

Why It Matters: “Profits are elevated for both S&P and Russell and this could lead to near-term profit-taking, which may limit further upside,” Chris Montagu, managing director and global head of quantitative research at Citigroup, wrote in a note dated Nov. 11.

Price Action: The S&P 500 Index closed at 6,008.86 points on Monday, it has yielded 25.82% on a year-to-date basis and 37.84% over the last year. The SPDR S&P 500 ETF SPY which tracks the S&P 500 Index has had a similar momentum in 2024.

On Tuesday morning, the Nasdaq 100 futures dipped by 0.35%, while the S&P 500 futures saw a slight decline of 0.29%. The Dow Jones futures were also down, albeit to a lesser extent, at 0.19%. Meanwhile, the Russell 2000 index (R2K) experienced the largest drop among the indices, falling by 0.80%.

In premarket trading, the SPDR S&P 500 ETF Trust fell 0.23% to $597.41 and the Invesco QQQ ETF QQQ declined 0.28% to $512.40, according to Benzinga Pro data.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.