Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio In Q4

The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

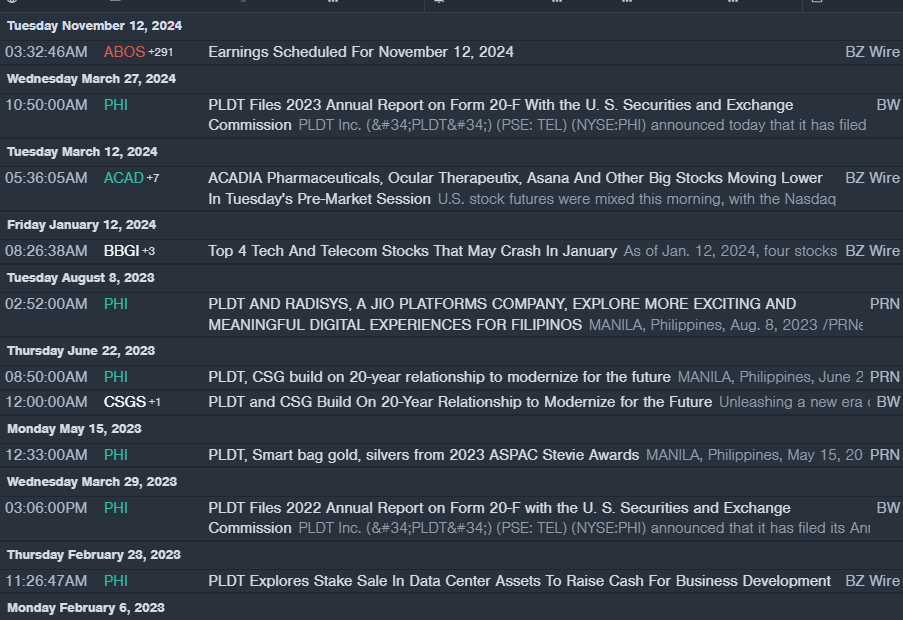

PLDT Inc ADR PHI

- On March 27, PLDT filed 2023 annual report on Form 20-F with the U.S. Securities and Exchange Commission. The company’s stock fell around 12% over the past month and has a 52-week low of $22.01.

- RSI Value: 25.90

- PHI Price Action: Shares of PLDT fell 1.8% to close at $22.90 on Monday.

- Benzinga Pro’s real-time newsfeed alerted to latest PHI news.

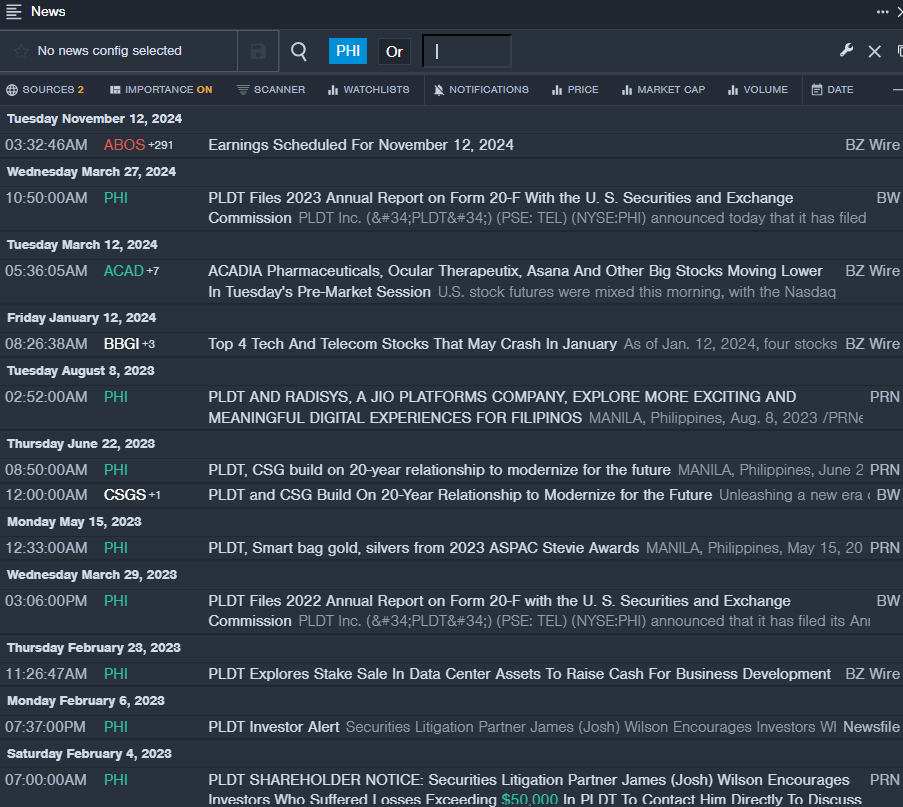

Liberty Latin America Ltd LILA

- On Nov. 6, Liberty Latin America reported worse-than-expected third-quarter revenue results. CEO Balan Nair commented, “We are continuing our strategy to connect communities and drive broadband and postpaid mobile penetration across our markets. We are encouraged by our transformation programs, which are increasingly gaining momentum and enabling us to connect with our customers through their channels of choice.” The company’s stock fell around 24% over the past five days and has a 52-week low of $5.90.

- RSI Value: 24.04

- LILA Price Action: Shares of Liberty Latin America fell 2% to close at $7.46 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in LILA stock.

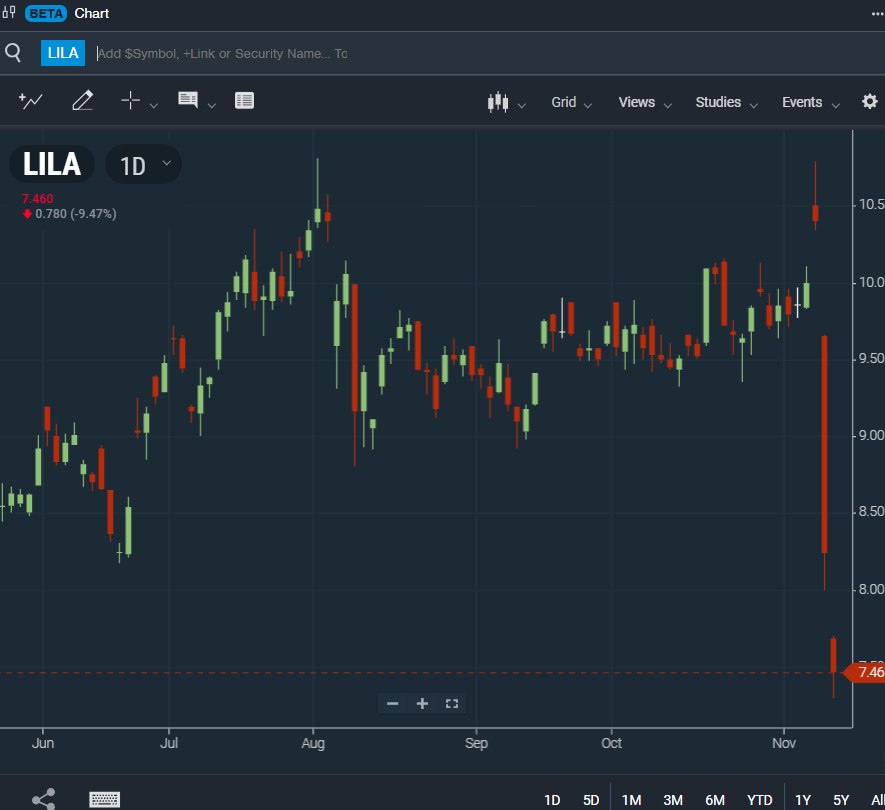

Telefonica SA TEF

- On Nov. 7, Telefonica posted third-quarter sales of $11.02 billion down from $11.23 billion in the year-ago period. The company’s stock fell around 9% over the past month and has a 52-week low of $3.82.

- RSI Value: 21.28

- TEF Price Action: Shares of Telefonica fell 2% to close at $4.37 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in TEF shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pactiv Evergreen Reports Third Quarter 2024 Financial Results

Solid execution and cost discipline

Poised for next phase of Transformational Journey

Third Quarter 2024 Financial Highlights:

- Net Revenues of $1,333 million for the third quarter of 2024 were down 3% compared to $1,379 million in the third quarter of 2023 and were approximately flat compared to $1,338 million in the second quarter of 2024.

- Net Loss from continuing operations of $213 million for the third quarter of 2024 compared to net income of $28 million in the third quarter of 2023 and net income of $20 million in the second quarter of 2024.

- Adjusted EBITDA1 of $214 million for the third quarter of 2024 compared to $227 million in the third quarter of 2023 and $183 million in the second quarter of 2024.

- Diluted loss per share from continuing operations of $1.18 for the third quarter of 2024 compared to diluted earnings per share of $0.15 in the third quarter of 2023 and diluted earnings per share of $0.10 in the second quarter of 2024.

- Adjusted EPS1 of $0.36 for the third quarter of 2024 compared to $0.32 in the third quarter of 2023 and $0.17 in the second quarter of 2024.

LAKE FOREST, Ill., Nov. 12, 2024 (GLOBE NEWSWIRE) — Pactiv Evergreen Inc. (“Pactiv Evergreen” or the “Company”) today reported results for the third quarter of 2024. Michael King, President and Chief Executive Officer of Pactiv Evergreen, said, “Our execution during the third quarter was solid and we made meaningful progress on our long-term strategy. We maintained strict cost discipline, optimized enterprise resources and overcame challenges at the Pine Bluff, Arkansas mill during its final quarter under our ownership. As we advance to the next phase of our transformational journey, we intend to leverage our heritage of product innovation and design to foster growth and assist our customers in achieving their sustainability goals.”

King continued, “In late September and early October, some of our teams and communities were significantly impacted by Hurricanes Helene and Milton. The safety and well-being of our team members remain our utmost priority. It’s been truly inspiring to witness our teams swiftly activate contingency plans in response to these severe weather events, showcasing their commitment to serving our customers and supporting the affected communities.”

Jon Baksht, Chief Financial Officer of Pactiv Evergreen, added, “Our third quarter results reflect our efforts to right size our operations and manage resources to align with the broader demand environment. Our team has done an excellent job reducing our cost to serve by implementing various initiatives to set Pactiv Evergreen up for success. Compared to the prior quarter, we reduced our leverage profile and are on track to deliver on the cost savings targets we laid out in August. We are also continuing to invest in areas of the business to drive growth for Pactiv Evergreen and create value for our stockholders.”

___________________

1 Adjusted EBITDA and Adjusted EPS are non-GAAP measures. All references to Adjusted EBITDA and Adjusted EPS are references to Adjusted EBITDA from continuing operations and Adjusted EPS from continuing operations, respectively. Refer to their definitions in the discussion on non-GAAP financial measures and the accompanying reconciliations below.

Third Quarter 2024 Results vs. Third Quarter 2023 Results

Net revenues in the third quarter of 2024 were $1,333 million compared to $1,379 million in the third quarter of 2023. The decrease was primarily due to lower sales volume, partially offset by favorable pricing in the Foodservice segment, mainly due to the pass through of higher material costs, and favorable product mix in the Food and Beverage Merchandising segment. Lower sales volume was mostly due to a focus on value over volume in the Food and Beverage Merchandising segment and the broader demand environment.

Net loss from continuing operations was $213 million, or $1.18 per diluted share, in the third quarter of 2024 compared to net income of $28 million, or $0.15 per diluted share, in the third quarter of 2023. The change was principally due to the $322 million impairment charge resulting from the divestiture of our Pine Bluff, Arkansas mill and our Waynesville, North Carolina extrusion facility (the “Mill Transaction”). The change also reflects a $60 million decrease in tax expense largely as a result of the aforementioned impairment charge.

Adjusted EBITDA1 was $214 million and Adjusted EPS1 was $0.36 in the third quarter of 2024 compared to $227 million and $0.32, respectively, in the third quarter of 2023. The decrease in Adjusted EBITDA1 reflects higher manufacturing costs and lower sales volume, partially offset by lower incentive based compensation costs, favorable product mix in the Food and Beverage Merchandising segment and favorable pricing, net of material costs passed through, in the Foodservice segment. The increase in Adjusted EPS1 is primarily due to impacts of the aforementioned Mill Transaction.

Segment Results

Foodservice

| For the Three Months Ended September 30, | Components of Change in Net Revenues | |||||||||||||||||||||||

| (In millions, except for %) | 2024 | 2023 | Change | Change % | Price/Mix | Volume | ||||||||||||||||||

| Total segment net revenues | $ | 670 | $ | 675 | $ | (5 | ) | (1 | )% | 1 | % | (2 | )% | |||||||||||

| Segment Adjusted EBITDA | $ | 120 | $ | 117 | $ | 3 | 3 | % | ||||||||||||||||

| Segment Adjusted EBITDA margin2 | 18 | % | 17 | % | ||||||||||||||||||||

2 For each segment, segment Adjusted EBITDA margin is calculated as segment Adjusted EBITDA divided by total segment net revenues.

The decrease in net revenues was mostly due to lower sales volume, partially offset by favorable pricing, largely due to the pass through of higher material costs. Lower sales volume was due to the broader demand environment.

The increase in Adjusted EBITDA reflects favorable pricing, net of material costs passed through, and lower incentive based compensation costs, partially offset by higher manufacturing costs.

Food and Beverage Merchandising

| For the Three Months Ended September 30, | Components of Change in Net Revenues | |||||||||||||||||||||||||||

| (In millions, except for %) | 2024 | 2023 | Change | Change % | Price/Mix | Volume | Mill Closure | |||||||||||||||||||||

| Total segment net revenues | $ | 667 | $ | 712 | $ | (45 | ) | (6 | )% | 3 | % | (8 | )% | (1 | )% | |||||||||||||

| Segment Adjusted EBITDA | $ | 111 | $ | 130 | $ | (19 | ) | (15 | )% | |||||||||||||||||||

| Segment Adjusted EBITDA margin | 17 | % | 18 | % | ||||||||||||||||||||||||

The decrease in net revenues was primarily due to lower sales volume, partially offset by favorable product mix. Lower sales volume was due to a focus on value over volume and the broader demand environment.

The decrease in Adjusted EBITDA reflects higher manufacturing costs and lower sales volume, partially offset by favorable product mix and lower incentive based compensation costs.

Third Quarter 2024 Results vs. Second Quarter 2024 Results

Net revenues in the third quarter of 2024 were $1,333 million compared to $1,338 million in the second quarter of 2024. The decrease was mostly due to lower sales volume, partially offset by favorable pricing in the Food and Beverage Merchandising segment and favorable product mix in the Foodservice segment. Lower sales volume was mainly due to seasonal trends in the Food and Beverage Merchandising segment.

Net loss from continuing operations was $213 million, or $1.18 per diluted share, in the third quarter of 2024 compared to net income of $20 million, or $0.10 per diluted share, in the second quarter of 2024. The change was principally due to the $322 million Mill Transaction impairment charge. The change also reflects a $49 million decrease in tax expense largely as a result of the aforementioned impairment charge.

Adjusted EBITDA1 was $214 million and Adjusted EPS1 was $0.36 in the third quarter of 2024 compared to $183 million and $0.17, respectively, in the second quarter of 2024. The increase in Adjusted EBITDA1 and Adjusted EPS1 was mainly due to lower manufacturing costs as a result of a planned mill outage during the second quarter, favorable pricing, net of material costs passed through, and favorable product mix, partially offset by lower sales volume.

Segment Results

Foodservice

| For the Three Months Ended | Components of Change in Net Revenues | |||||||||||||||||||||||

| (In millions, except for %) | September 30, 2024 |

June 30, 2024 |

Change | Change % | Price/Mix | Volume | ||||||||||||||||||

| Total segment net revenues | $ | 670 | $ | 668 | $ | 2 | — | % | 1 | % | (1 | )% | ||||||||||||

| Segment Adjusted EBITDA | $ | 120 | $ | 109 | $ | 11 | 10 | % | ||||||||||||||||

| Segment Adjusted EBITDA margin | 18 | % | 16 | % | ||||||||||||||||||||

The increase in net revenues was mostly due to favorable product mix, largely offset by lower sales volume.

The increase in Adjusted EBITDA was primarily due to favorable product mix, favorable pricing, net of material costs passed through, and lower incentive based costs, partially offset by higher manufacturing costs.

Food and Beverage Merchandising

| For the Three Months Ended | Components of Change in Net Revenues | |||||||||||||||||||||||

| (In millions, except for %) | September 30, 2024 |

June 30, 2024 |

Change | Change % | Price/Mix | Volume | ||||||||||||||||||

| Total segment net revenues | $ | 667 | $ | 674 | $ | (7 | ) | (1 | )% | 1 | % | (2 | )% | |||||||||||

| Segment Adjusted EBITDA | $ | 111 | $ | 93 | $ | 18 | 19 | % | ||||||||||||||||

| Segment Adjusted EBITDA margin | 17 | % | 14 | % | ||||||||||||||||||||

The decrease in net revenues was due to lower sales volume which was attributable to seasonal trends, partially offset by favorable pricing due to pricing actions.

The increase in Adjusted EBITDA reflects lower manufacturing costs, mainly as a result of a planned mill outage during the second quarter, favorable pricing, net of material costs passed through, and lower incentive based costs, partially offset by lower sales volume.

Balance Sheet and Cash Flow Highlights

The Company continues to deliver on its commitment to strengthen its balance sheet. Since December 31, 2022, the Company has reduced its total outstanding debt by $641 million, and Net Debt3 declined by $278 million. The Company’s Board of Directors declared a third quarter 2024 dividend on November 8, 2024 of $0.10 per share of common stock, payable on December 13, 2024 to shareholders of record as of December 2, 2024.

| (In millions) | As of September 30, 2024 |

(In millions) | For the Three Months Ended September 30, 2024 |

|||||||

| Total outstanding debt | $ | 3,495 | Net cash flow provided by operating activities | $ | 244 | |||||

| Cash and cash equivalents | (168 | ) | Capital expenditures | (54 | ) | |||||

| Net Debt3 | $ | 3,327 | Free Cash Flow3 | $ | 190 | |||||

Outlook

“We have made significant progress on our strategy this year, and as we look ahead to 2025, we believe we have established a solid foundation for the next leg of our transformational journey. We are dedicated to carefully overseeing our operations, preserving a strong balance sheet and driving growth, which includes innovation and identifying opportunities to extend our reach beyond the conventional channels we currently serve,” said Mr. King. “The Company is updating its existing guidance range for full year 2024 Adjusted EBITDA1 to a range of $800 million to $810 million in light of the performance of the operations divested in the Mill Transaction prior to closing,” he added.

The Company has not reconciled the non-GAAP measure Adjusted EBITDA1 to the GAAP measure net income (loss) on a forward-looking basis in this release because the Company does not provide guidance for certain of the reconciling items on a consistent basis, including but not limited to items relating to restructuring, asset impairment and other related charges, depreciation and amortization expense, net interest expense and income taxes, which would be required to include a reconciliation of Adjusted EBITDA1 to GAAP net income (loss), as the Company is unable to quantify these amounts without unreasonable efforts.

Conference Call and Webcast Presentation

The Company will host a conference call and webcast presentation to discuss these results on November 12, 2024 at 8:30 a.m. U.S. Eastern Time. Investors interested in participating in the live call may register for the call here. Participants may also access the live webcast and supplemental presentation on the Pactiv Evergreen Investor Relations website at https://investors.pactivevergreen.com/financial-information/sec-filings under “News & Events.” The Company may from time to time use this Investor Relations website as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

About Pactiv Evergreen Inc. Pactiv Evergreen Inc. PTVE is a leading manufacturer and distributor of fresh foodservice and food merchandising products and fresh beverage cartons in North America. The Company produces a broad range of on-trend and feature-rich products that protect, package and display food and beverages for today’s consumers. Its products, many of which are made with recycled, recyclable or renewable materials, are sold to a diversified mix of customers, including restaurants, foodservice distributors, retailers, food and beverage producers, packers and processors. Learn more at www.pactivevergreen.com.

___________________

3 Net Debt and Free Cash Flow are non-GAAP measures. Refer to their definitions in the discussion on non-GAAP financial measures below.

Note to Investors Regarding Forward-Looking Statements

This press release contains forward-looking statements. All statements contained in this press release other than statements of historical fact are forward-looking statements, including statements regarding our guidance as to future financial and operational results, our ability to assist our customers in achieving their sustainability goals, our ability to drive growth and create value for stockholders and our ability to preserve a strong balance sheet, innovate and identify opportunities to extend our reach beyond our conventional channels. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “likely” or “continue,” the negative of these terms and other comparable terminology. These statements are only predictions based on our expectations and projections about future events as of the date of this press release and are subject to a number of risks, uncertainties and assumptions that may prove incorrect, any of which could cause actual results to differ materially from those expressed or implied by such statements, including, among others, those described under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission, or SEC, and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024 filed with the SEC. New risks emerge from time to time, and it is not possible for our management to predict all risks, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement the Company makes. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. Except as otherwise required by law, the Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Use of Non-GAAP Financial Measures

The Company uses the following financial measures that are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”): Adjusted EBITDA from continuing operations, Adjusted EPS from continuing operations, Free Cash Flow and Net Debt.

The Company defines Adjusted EBITDA from continuing operations as net income (loss) from continuing operations calculated in accordance with GAAP plus the sum of income tax expense (benefit), net interest expense, depreciation and amortization and further adjusted to exclude certain items, including but not limited to restructuring, asset impairment and other related charges, gains or losses on the sale of businesses and noncurrent assets, non-cash pension income or expense, unrealized gains or losses on derivatives, foreign exchange gains or losses on cash and gains or losses on certain legal settlements.

The Company defines Adjusted EPS from continuing operations as diluted (loss) earnings per share from continuing operations (“EPS”) calculated in accordance with GAAP adjusted for the after-tax effect of certain items, including but not limited to restructuring, asset impairment and other related charges, gains on the sale of businesses and noncurrent assets, non-cash pension income or expense, unrealized gains or losses on derivatives, foreign exchange losses on cash, gains or losses on certain legal settlements and gains or losses on debt extinguishments.

The Company defines Free Cash Flow as net cash provided by operating activities, less capital expenditures.

The Company defines Net Debt as the sum of current and long-term debt, less cash and cash equivalents.

The Company has provided herein a reconciliation of (i) net income (loss) from continuing operations to Adjusted EBITDA from continuing operations, (ii) diluted (loss) EPS from continuing operations to Adjusted EPS from continuing operations, (iii) net cash provided by operating activities to Free Cash Flow and (iv) total debt to Net Debt, in each case representing the most directly comparable GAAP financial measures.

The Company presents Adjusted EBITDA from continuing operations to assist in comparing performance from period to period and as a measure of operational performance. It is a key measure used by its management team to generate future operating plans, make strategic decisions and incentivize and reward its employees. In addition, its management and Chief Operating Decision Maker, who is the President and Chief Executive Officer, use the Adjusted EBITDA from continuing operations of each reportable segment to evaluate its respective operating performance. Accordingly, the Company believes that Adjusted EBITDA from continuing operations provides useful information to investors and others in understanding and evaluating the Company’s operating results in the same manner as its management and board of directors. Like Adjusted EBITDA from continuing operations, management believes Adjusted EPS from continuing operations is useful to investors, analysts and others to facilitate operating performance comparisons on a period-to-period basis because it excludes variations primarily caused by changes in the items noted above.

The Company presents Free Cash Flow to assist in comparing liquidity from period to period and to provide a more comprehensive view of the Company’s core operations and ability to generate cash flow, and also, as with Adjusted EBITDA from continuing operations, to generate future operating plans, make strategic decisions and incentivize and reward its employees. The Company believes that this measure is useful to investors in evaluating cash available to service and repay debt, make other investments and pay dividends. The Company presents Net Debt as a supplemental measure to review the liquidity of its operations and measure the Company’s credit position and progress toward leverage targets. The Company also believes that investors find this measure useful in evaluating its debt levels.

Non-GAAP information should be considered as supplemental in nature and is not meant to be considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition, our non-GAAP metrics may not be the same as or comparable to similar non-GAAP financial measures presented by other companies. Because of these and other limitations, you should consider them alongside other financial performance measures, including our net income and other GAAP results. In addition, in evaluating Adjusted EBITDA from continuing operations, Adjusted EPS from continuing operations and other metrics derived from them, you should be aware that in the future the Company will incur expenses such as those that are the subject of adjustments in deriving Adjusted EBITDA from continuing operations and Adjusted EPS from continuing operations and you should not infer from our presentation of Adjusted EBITDA from continuing operations and Adjusted EPS from continuing operations that our future results will not be affected by these expenses or any unusual or non-recurring items.

Contact:

Curt Worthington

847.482.2040

InvestorRelations@pactivevergreen.com

| Pactiv Evergreen Inc. Condensed Consolidated Statements of (Loss) Income (in millions, except per share amounts) (unaudited) |

||||||||||||

| For the Three Months Ended | ||||||||||||

| September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

||||||||||

| Net revenues | $ | 1,250 | $ | 1,255 | $ | 1,286 | ||||||

| Related party net revenues | 83 | 83 | 93 | |||||||||

| Total net revenues | 1,333 | 1,338 | 1,379 | |||||||||

| Cost of sales | (1,078 | ) | (1,115 | ) | (1,098 | ) | ||||||

| Gross profit | 255 | 223 | 281 | |||||||||

| Selling, general and administrative expenses | (115 | ) | (122 | ) | (137 | ) | ||||||

| Restructuring, asset impairment and other related charges | (338 | ) | (6 | ) | (28 | ) | ||||||

| Other income (expense), net | 2 | 2 | (3 | ) | ||||||||

| Operating (loss) income from continuing operations | (196 | ) | 97 | 113 | ||||||||

| Non-operating income (expense), net | 1 | — | (2 | ) | ||||||||

| Interest expense, net | (56 | ) | (66 | ) | (61 | ) | ||||||

| (Loss) income from continuing operations before tax | (251 | ) | 31 | 50 | ||||||||

| Income tax benefit (expense) | 38 | (11 | ) | (22 | ) | |||||||

| (Loss) income from continuing operations | (213 | ) | 20 | 28 | ||||||||

| Income from discontinued operations, net of income taxes | — | — | 2 | |||||||||

| Net (loss) income | (213 | ) | 20 | 30 | ||||||||

| Income attributable to non-controlling interests | — | (1 | ) | (1 | ) | |||||||

| Net (loss) income attributable to Pactiv Evergreen Inc. common shareholders | $ | (213 | ) | $ | 19 | $ | 29 | |||||

| (Loss) earnings per share attributable to Pactiv Evergreen Inc. common shareholders | ||||||||||||

| From continuing operations | ||||||||||||

| Basic | $ | (1.18 | ) | $ | 0.11 | $ | 0.15 | |||||

| Diluted | $ | (1.18 | ) | $ | 0.10 | $ | 0.15 | |||||

| From discontinued operations | ||||||||||||

| Basic | $ | — | $ | — | $ | 0.01 | ||||||

| Diluted | $ | — | $ | — | $ | 0.01 | ||||||

| Total | ||||||||||||

| Basic | $ | (1.18 | ) | $ | 0.11 | $ | 0.16 | |||||

| Diluted | $ | (1.18 | ) | $ | 0.10 | $ | 0.16 | |||||

| Weighted-average shares outstanding – basic | 179.9 | 179.7 | 178.7 | |||||||||

| Weighted-average shares outstanding – diluted | 179.9 | 181.0 | 179.7 | |||||||||

| Pactiv Evergreen Inc. Condensed Consolidated Balance Sheets (in millions) (unaudited) |

||||||||||||

| As of September 30, 2024 |

As of June 30, 2024 |

As of September 30, 2023 |

||||||||||

| Assets | ||||||||||||

| Cash and cash equivalents | $ | 168 | $ | 95 | $ | 233 | ||||||

| Accounts receivable, net | 463 | 486 | 470 | |||||||||

| Related party receivables | 28 | 37 | 38 | |||||||||

| Inventories | 760 | 881 | 846 | |||||||||

| Other current assets | 126 | 116 | 109 | |||||||||

| Assets held for sale | 99 | — | 7 | |||||||||

| Total current assets | 1,644 | 1,615 | 1,703 | |||||||||

| Property, plant and equipment, net | 1,164 | 1,473 | 1,469 | |||||||||

| Operating lease right-of-use assets, net | 268 | 272 | 276 | |||||||||

| Goodwill | 1,807 | 1,815 | 1,815 | |||||||||

| Intangible assets, net | 959 | 974 | 1,019 | |||||||||

| Other noncurrent assets | 209 | 213 | 164 | |||||||||

| Total assets | $ | 6,051 | $ | 6,362 | $ | 6,446 | ||||||

| Liabilities | ||||||||||||

| Accounts payable | $ | 382 | $ | 367 | $ | 329 | ||||||

| Related party payables | 7 | 7 | 10 | |||||||||

| Current portion of long-term debt | 6 | 20 | 18 | |||||||||

| Current portion of operating lease liabilities | 62 | 66 | 63 | |||||||||

| Income taxes payable | 3 | 12 | 5 | |||||||||

| Accrued and other current liabilities | 372 | 321 | 447 | |||||||||

| Liabilities held for sale | 22 | — | — | |||||||||

| Total current liabilities | 854 | 793 | 872 | |||||||||

| Long-term debt | 3,489 | 3,572 | 3,593 | |||||||||

| Long-term operating lease liabilities | 222 | 223 | 225 | |||||||||

| Deferred income taxes | 185 | 226 | 255 | |||||||||

| Long-term employee benefit obligations | 56 | 57 | 59 | |||||||||

| Other noncurrent liabilities | 156 | 155 | 138 | |||||||||

| Total liabilities | $ | 4,962 | $ | 5,026 | $ | 5,142 | ||||||

| Total equity attributable to Pactiv Evergreen Inc. common shareholders | 1,085 | 1,332 | 1,300 | |||||||||

| Non-controlling interests | 4 | 4 | 4 | |||||||||

| Total equity | 1,089 | 1,336 | 1,304 | |||||||||

| Total liabilities and equity | $ | 6,051 | $ | 6,362 | $ | 6,446 | ||||||

| Pactiv Evergreen Inc. Condensed Consolidated Statements of Cash Flows (in millions) (unaudited) |

||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||

| September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

||||||||||||||||

| Operating Activities: | ||||||||||||||||||||

| Net (loss) income | $ | (213 | ) | $ | 20 | $ | 10 | $ | 22 | $ | 30 | |||||||||

| Adjustments to reconcile net (loss) income to operating cash flows: | ||||||||||||||||||||

| Depreciation and amortization | 75 | 80 | 79 | 82 | 85 | |||||||||||||||

| Deferred income taxes | (38 | ) | (5 | ) | (11 | ) | (26 | ) | — | |||||||||||

| Asset impairment and restructuring related non-cash charges (net of reversals) | 323 | 1 | 1 | 12 | 3 | |||||||||||||||

| Non-cash portion of operating lease expense | 21 | 21 | 21 | 20 | 20 | |||||||||||||||

| Other non-cash items, net | 8 | 8 | 5 | 12 | 13 | |||||||||||||||

| Change in assets and liabilities: | ||||||||||||||||||||

| Accounts receivable, net | 29 | (17 | ) | (51 | ) | 51 | (3 | ) | ||||||||||||

| Inventories | 16 | 30 | (60 | ) | (7 | ) | 75 | |||||||||||||

| Accounts payable | 13 | 39 | 35 | (28 | ) | (15 | ) | |||||||||||||

| Operating lease payments | (21 | ) | (21 | ) | (21 | ) | (20 | ) | (19 | ) | ||||||||||

| Accrued and other current liabilities | 63 | (35 | ) | (55 | ) | (52 | ) | 43 | ||||||||||||

| Other assets and liabilities | (32 | ) | (27 | ) | 14 | 15 | 6 | |||||||||||||

| Net cash provided by (used in) operating activities | 244 | 94 | (33 | ) | 81 | 238 | ||||||||||||||

| Investing Activities: | ||||||||||||||||||||

| Acquisition of property, plant and equipment | (54 | ) | (57 | ) | (41 | ) | (107 | ) | (62 | ) | ||||||||||

| Purchase of investments | — | — | (23 | ) | — | — | ||||||||||||||

| Receipt of refundable exclusivity payment | — | 10 | — | — | — | |||||||||||||||

| Other investing activities | 1 | 5 | 6 | 2 | 9 | |||||||||||||||

| Net cash used in investing activities | (53 | ) | (42 | ) | (58 | ) | (105 | ) | (53 | ) | ||||||||||

| Financing Activities: | ||||||||||||||||||||

| Term loan debt proceeds | — | 372 | — | — | — | |||||||||||||||

| Term loan debt repayments | (70 | ) | (725 | ) | — | (24 | ) | (229 | ) | |||||||||||

| Revolver proceeds | — | 373 | 18 | — | — | |||||||||||||||

| Revolver repayments | (25 | ) | (18 | ) | (18 | ) | — | — | ||||||||||||

| Deferred financing transaction costs | — | (7 | ) | — | — | — | ||||||||||||||

| Dividends paid to common shareholders | (18 | ) | (18 | ) | (18 | ) | (17 | ) | (18 | ) | ||||||||||

| Other financing activities | (3 | ) | (3 | ) | (8 | ) | (5 | ) | (3 | ) | ||||||||||

| Net cash used in financing activities | (116 | ) | (26 | ) | (26 | ) | (46 | ) | (250 | ) | ||||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (2 | ) | (2 | ) | 1 | — | (4 | ) | ||||||||||||

| Increase (decrease) in cash, cash equivalents and restricted cash | 73 | 24 | (116 | ) | (70 | ) | (69 | ) | ||||||||||||

| Cash, cash equivalents and restricted cash, including amounts classified as held for sale, as of beginning of the period | 95 | 71 | 187 | 257 | 326 | |||||||||||||||

| Cash, cash equivalents and restricted cash as of end of the period | $ | 168 | $ | 95 | $ | 71 | $ | 187 | $ | 257 | ||||||||||

| Cash, cash equivalents and restricted cash are comprised of: | ||||||||||||||||||||

| Cash and cash equivalents | 168 | 95 | 71 | 164 | 233 | |||||||||||||||

| Restricted cash classified as other current assets | — | — | — | 2 | — | |||||||||||||||

| Restricted cash classified as other noncurrent assets | — | — | — | 21 | 24 | |||||||||||||||

| Cash, cash equivalents and restricted cash as of end of the period | $ | 168 | $ | 95 | $ | 71 | $ | 187 | $ | 257 | ||||||||||

| Pactiv Evergreen Inc. Reconciliation of Reportable Segment Net Revenues to Total Net Revenues (in millions) (unaudited) |

||||||||||||

| For the Three Months Ended | ||||||||||||

| September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

||||||||||

| Reportable segment net revenues | ||||||||||||

| Foodservice | $ | 670 | $ | 668 | $ | 675 | ||||||

| Food and Beverage Merchandising | 667 | 674 | 712 | |||||||||

| Intersegment revenues | (4 | ) | (4 | ) | (8 | ) | ||||||

| Total net revenues | $ | 1,333 | $ | 1,338 | $ | 1,379 | ||||||

| Pactiv Evergreen Inc. Reconciliation of Reportable Segment Adjusted EBITDA to Adjusted EBITDA (in millions) (unaudited) |

||||||||||||

| For the Three Months Ended | ||||||||||||

| September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

||||||||||

| Reportable segment Adjusted EBITDA | ||||||||||||

| Foodservice | $ | 120 | $ | 109 | $ | 117 | ||||||

| Food and Beverage Merchandising | 111 | 93 | 130 | |||||||||

| Unallocated | (17 | ) | (19 | ) | (20 | ) | ||||||

| Adjusted EBITDA (Non-GAAP) | $ | 214 | $ | 183 | $ | 227 | ||||||

| Pactiv Evergreen Inc. Reconciliations of Net (Loss) Income from Continuing Operations to Adjusted EBITDA and Diluted EPS from Continuing Operations to Adjusted EPS (in millions, except per share amounts) (unaudited) |

||||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||

| September 30, 2024 | June 30, 2024 | September 30, 2023 | ||||||||||||||||||||||

| Net income to Adjusted EBITDA |

Diluted EPS to Adjusted EPS |

Net income to Adjusted EBITDA |

Diluted EPS to Adjusted EPS |

Net loss to Adjusted EBITDA |

Diluted EPS to Adjusted EPS |

|||||||||||||||||||

| Net (loss) income from continuing operations / Diluted EPS from continuing operations (Reported GAAP Measure) | $ | (213 | ) | $ | (1.18 | ) | $ | 20 | $ | 0.10 | $ | 28 | $ | 0.15 | ||||||||||

| Income tax (benefit) expense | (38 | ) | 11 | 22 | ||||||||||||||||||||

| Interest expense, net (excluding loss on extinguishment of debt) | 56 | 60 | 61 | |||||||||||||||||||||

| Loss on extinguishment of debt | — | — | 6 | 0.02 | — | — | ||||||||||||||||||

| Depreciation and amortization (excluding restructuring-related charges) | 70 | 75 | 81 | |||||||||||||||||||||

| Beverage Merchandising Restructuring charges(1) | 336 | 1.51 | 7 | 0.03 | 32 | 0.15 | ||||||||||||||||||

| Footprint Optimization charges(2) | 4 | 0.02 | 3 | 0.01 | — | — | ||||||||||||||||||

| Other restructuring and asset impairment charges | 2 | 0.01 | 2 | 0.01 | — | — | ||||||||||||||||||

| Loss on sale of businesses and noncurrent assets | — | — | 1 | — | — | — | ||||||||||||||||||

| Non-cash pension (income) expense(3) | (1 | ) | — | — | — | 2 | 0.01 | |||||||||||||||||

| Unrealized gains on commodity derivatives | (1 | ) | — | (1 | ) | — | (1 | ) | — | |||||||||||||||

| Foreign exchange (gains) losses on cash | (1 | ) | — | (1 | ) | — | 2 | 0.01 | ||||||||||||||||

| Adjusted EBITDA / Adjusted EPS(4) (Non-GAAP Measure) | $ | 214 | $ | 0.36 | $ | 183 | $ | 0.17 | $ | 227 | $ | 0.32 | ||||||||||||

| (1) | Reflects charges related to the Beverage Merchandising Restructuring, including $322 million of non-cash Mill Transaction impairment charges recorded during the three months ended September 30, 2024. Also includes $3 million, $3 million and $4 million of accelerated depreciation expense for the three months ended September 30, 2024, June 30, 2024 and September 30, 2023, respectively. | |

| (2) | Reflects charges related to the Footprint Optimization, including $2 million and $3 million of accelerated depreciation expense for the three months ended September 30, 2024 and June 30, 2024, respectively. | |

| (3) | Reflects the non-cash pension (income) expense related to our employee benefit plans. | |

| (4) | Income tax (benefit) expense, interest expense, net (excluding loss on extinguishment of debt) and depreciation and amortization (excluding restructuring-related charges) are not adjustments from diluted EPS to calculate Adjusted EPS. Adjustments were tax effected using the applicable effective income tax rate for each period. For the three months ended September 30, 2024, June 30, 2024 and September 30, 2023, the tax effect of the adjustments were income of $0.34 per diluted share, income of $0.02 per diluted share and income of $0.03 per diluted share, respectively. |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

OPEC Cuts 2024 Oil Demand Forecast For Fourth Straight Month Amid China's Economic Slowdown

The Organization of Petroleum Exporting Countries (OPEC) has once again revised its oil demand growth forecasts for 2024, marking the fourth consecutive month of downward adjustments. This move reflects the ongoing economic slowdown in China, a key player in the global oil market.

What Happened: OPEC now projects global oil consumption to increase by 1.8 million barrels per day in 2024, a reduction of 107,000 barrels from its previous estimate. This adjustment follows disappointing data from major Asian markets, including China and India, as well as African countries, Bloomberg reported on Tuesday.

Since July, OPEC has cut its demand growth forecasts by nearly 20%, mirroring a notable decline in crude oil prices. Despite these reductions, OPEC’s outlook remains more optimistic compared to other forecasts, such as those from Wall Street banks and Saudi Aramco.

OPEC members, led by Saudi Arabia, have twice delayed the resumption of production that was halted since 2022. They plan to implement modest monthly production increases starting early next year, with a review set for December 1.

Meanwhile, international crude futures have fallen approximately 18% since early July, with prices hovering around $72 per barrel. Traders are closely monitoring China’s economic challenges, which have resulted in consecutive months of demand contraction.

Why It Matters: The reduction in OPEC’s oil demand growth forecasts comes amid a broader context of cautious market sentiment. Brent crude oil prices have continued to decline, reaching $71.74 per barrel. This downturn is attributed to China’s lackluster stimulus measures and weak inflation, which have dampened energy demand.

Additionally, the strength of the U.S. dollar has made commodity investments less appealing, further impacting oil prices. The geopolitical landscape, which often influences oil price volatility, remains stable, with reduced tensions in the Middle East alleviating some risk premiums previously embedded in Brent prices.

Furthermore, OPEC’s decision to delay production increases, as reported earlier this month, has contributed to fluctuations in oil prices. The oil cartel and its allies, including Russia, postponed plans to ramp up output, citing ongoing market weakness and sluggish demand.

Price Action: On Tuesday, ahead of pre-market hours, the United States Oil Fund LP USO which tracks the West Texas Intermediate (WTI) crude was up by 0.51% at $71.30 per barrel, as per Benzinga Pro.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Edge Lower, Await Trump Cabinet Details: Markets Wrap

(Bloomberg) — A five-day rally in the S&P 500 looked set to stall amid unease over expensive equity valuations and the composition of President-elect Donald Trump’s incoming cabinet.

Most Read from Bloomberg

Contracts on the S&P 500 and Nasdaq 100 indexes slipped about 0.2%, while Europe’s Stoxx 600 gauge lost 1%. Tesla Inc., the EV maker seen as a prime beneficiary of a Trump presidency, dropped in premarket trading after a post-election surge that lifted its valuation past $1 trillion. Other so-called Trump trades remained in play, however, with Treasuries falling, the dollar hitting a one-year high and Bitcoin hovering just below $90,000.

The election outcome has taken investors’ US equity exposure to the highest in three years, suggesting the rally could run out of steam, according to Citigroup Inc. analysts. Traders are also pondering the potential for Trump’s economic policies, including trade tariffs and immigration crackdowns, to spur inflation and affect the path for Federal Reserve monetary policy.

“If we have those tariffs kicking in, if we have those so-called deportations, those would have an outright inflationary impact, and so would result in higher bond yields,” said Kevin Thozet, a member of the investment committee at Carmignac. “Higher bond yields across the curve may start to bite at some point,” especially at a time of lofty stock-market valuations, he said.

Ten-year Treasury yields rose as much as six basis points as the market reopened after Monday’s holiday.

Read: Trump Is Set to Elevate China Hawks, Deepening Beijing Rift

Markets are now focusing on the make-up of the incoming Trump adminstration. Fears for the future of China’s relationship with the US played out in Hong Kong’s Hang Seng Index, which shed more than 3%. US-listed Chinese stocks, such as Alibaba Group Holding Ltd. and PDD Holdings Inc. also fell.

Bloomberg News reported that Senator Marco Rubio — known for his aggressive stance on China — is expected to be named secretary of state. Representative Mike Waltz, who views China as a “greater threat” to the US than any other nation, is in line to be national security advisor. Tom Homan, named as “border czar,” was criticized for harsh immigration policies implemented during Trump’s first term.

“Up until Trump’s inauguration in January, we will be in a period where there will be some form of uncertainty regarding the implementation of his policy measures,” Thozet said.

Northwind Group Provides a $77.2 Million First-Mortgage Loan Secured by 167 Residential Condominiums at Vesper in Austin, TX

NEW YORK, Nov. 11, 2024 /PRNewswire/ — Northwind Group, a Manhattan-based real estate private equity firm and debt fund manager announced today that it has provided a $77.2 million first mortgage condo inventory loan through its closed-end debt fund. The loan is collateralized by 167 remaining units at Vesper, a recently completed, 41-story residential condominium tower with a full suite of amenities, located in Austin’s Rainey Street District.

Completed in 2024, Vesper was developed through a joint venture between Pearlstone Partners, one of Austin’s leading condominium developers, and ATCO, a New York-based real estate investment and ownership platform led by the Hemmerdinger Family.

Northwind structured the loan with flexible terms, enabling the sponsorship to effectively manage the sales process for the remaining units. With a strong reputation as one of the nation’s foremost condo inventory lenders, the firm continues to expand its footprint by providing well-structured capital solutions that support high-caliber borrowers and quality real estate properties.

“This financing demonstrates Northwind’s commitment to providing customized capital solutions for sponsors and assets in key gateway cities across the U.S.,” said Ran Eliasaf, founder and managing partner of Northwind Group. “Loans backed by high-quality condominiums are our core focus, and we have strong confidence in Vesper given that 40% of its units have already been sold and it stands as the only new inventory available in the Rainey Street submarket. Austin’s ongoing growth and the rising demand for premium residences, driven by an influx of relocating professionals, further reinforce our confidence. This transaction—our second in Texas this year, following the $111 million condo inventory loan for The Hawthorne in Houston—exemplify our positive outlook on the Texas market. We look forward to partnering with Pearlstone and ATCO to support the success of this project.”

Year to date, Northwind has closed over $1.1 billion in loans secured by real estate assets in major markets such as New York, Houston, Miami, and the San Francisco Bay area.

Ryan Huber, Managing Director of Investments, who represented ATCO in the transaction, commented, “We are proud to have partnered with Pearlstone once again to bring such an exceptional product to market. Northwind’s financing is further validation of the quality of Vesper’s resident experience as well as its prime location in one of Austin’s most vibrant and desirable neighborhoods.”

Bill Knauss, President of Pearlstone Partners, remarked, “We’re excited to embark on this new partnership with Northwind, a move that provides us with the flexibility to execute our business strategy with precision and care. This transaction allows us to approach each phase thoughtfully, ensuring the best possible outcomes for all stakeholders involved in the Vesper project.”

Northwind Group was represented by John Vavas of Polsinelli Law Firm in this transaction.

About Northwind Group

Northwind Group, founded in 2008 by Ran Eliasaf, is a Manhattan-based real estate private equity firm with $2 billion in AUM that invests primarily in debt instruments through its discretionary closed-ended debt funds. For further information, go to www.northwind-group.com.

About Pearlstone Partners

Austin-based Pearlstone Partners is a full-service real estate development firm founded in 2017 by Robert Lee and Bill Knauss. The company has been responsible for $600+ million in locally developed real estate and has $700+ million actively invested in its growing portfolio and pipeline. It has developed a broad range of commercial projects, including office buildings, condos, multi-family, and mixed-use projects in some of Austin’s most desirable areas, with an emphasis on urban properties in pedestrian-oriented locations. Pearlstone Partners engages in the economic development of Central Texas by creating high-quality, profitable real estate development projects. With experience managing every stage of the property development life cycle, Pearlstone is uniquely qualified to execute projects from concept through completion. For more information, visit www.pearlstonepartners.com.

About ATCO

ATCO is a real estate investment and ownership platform deploying capital in select cities across the United States, with a particular emphasis on creating value through placemaking and other strategies in urban locations. ATCO seeks to improve people’s lives by creating places where they genuinely want to work, play, or live, and by doing our work with a long-term perspective.

Through eight decades and four generations, ATCO has owned, managed, and developed a diverse real estate portfolio, primarily in and around New York City and also in select markets we target. ATCO presently owns and manages more than 25 buildings ranging from high-rise office and residential towers to retail properties, from one-story industrial structures to a mixed-use former military base. The portfolio of New York City properties includes 555 Fifth Avenue, 40 Central Park South, 41 West 58th Street, 630 Third Avenue, 381 and 373 Park Avenue South, 515 Madison Avenue, and the Atlas Terminals. Nationally, the company owns properties in Charlotte and Chapel Hill, NC; Austin, Texas; Indianapolis, Indiana; Darien, Stamford and Westport, Connecticut. Internationally, ATCO has investments in seven European countries.

Contact:

jleibrock@5wpr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/northwind-group-provides-a-77-2-million-first-mortgage-loan-secured-by-167-residential-condominiums-at-vesper-in-austin-tx-302301658.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/northwind-group-provides-a-77-2-million-first-mortgage-loan-secured-by-167-residential-condominiums-at-vesper-in-austin-tx-302301658.html

SOURCE Northwind Group

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leidos and the University of Edinburgh Partner to Drive AI and Data Science Innovation

LONDON, Nov. 12, 2024 /PRNewswire/ — Leidos LDOS has announced a partnership with the University of Edinburgh in the United Kingdom to advance AI and data science solutions. The partnership will leverage the university’s Bayes Centre, an innovation hub for data science and AI, to address critical challenges in areas such as environmental, civil, healthcare, and national security.

Charles Newhouse, chief technology officer for Leidos UK & Europe, said: “We are excited to partner with the University of Edinburgh, a leading centre for AI research in Europe. With its research excellence, interdisciplinary approach, and innovation hubs like the Bayes Centre, the university provides an ideal environment for groundbreaking advancements in AI.”

The partnership underscores Leidos’ commitment to build AI that delivers high-quality outcomes while scaling efficiently. By integrating the university’s cutting-edge research with Leidos’ Trusted Mission AI solutions, the collaboration will drive innovation, improve operational efficiency, and deliver AI that meets the highest standards of trust and reliability.

Ron Keesing, chief AI officer at Leidos, said: “Our University Alliance Program connects Leidos with communities of innovation at top universities, and we are excited to welcome the University of Edinburgh to our global network. Universities are key partners in researching, testing, and bringing solutions to market for the nation’s most challenging problems.”

The collaboration will also focus on generating positive social impact, allowing Leidos to engage with the university’s highly skilled, diverse talent pool of over 45,000 students. Through internships and joint projects, the partnership will help attract new talent and drive innovation across the organization.

Professor Ruth King, director of the Bayes Centre, said: “We are delighted to welcome Leidos to the Bayes Centre. The University of Edinburgh recognises the expertise Leidos has in innovating and delivering science and technology solutions across key sectors globally, and we are excited at this opportunity to build a collaborative partnership to advance technology and contribute to scientific development.”

About Leidos

Leidos is a Fortune 500® innovation company rapidly addressing the world’s most vexing challenges in national security and health. The company’s global workforce of 48,000 collaborates to create smarter technology solutions for customers in heavily regulated industries. Headquartered in Reston, Virginia, Leidos reported annual revenues of approximately $15.4 billion for the fiscal year ended December 29, 2023. For more information, visit www.leidos.com.

About the University of Edinburgh

The University of Edinburgh is one of the world’s top research-intensive universities and the birthplace of European AI. Our advanced computing capacity and world-leading informatics enable us to harness data and computational methods across disciplines to address key challenges in a responsible and ethical way.

The Bayes Centre, our flagship innovation hub for Data Science and AI, is housed at the heart of the University’s campus in a purpose-built £45M facility where around 500 academics, students, and industry partners work side by side to create value from the use of AI and data, unlocking solutions and innovation.

www.ed.ac.uk/research-innovation

www.ed.ac.uk/bayes

Contact:

Alyssa Pettus

Director, External Communications, Leidos

(571) 992-5499

alyssa.t.pettus@leidos.com

Charlotta Cederqvist

Business Development Manager, University of Edinburgh

Charlotta.Cederqvist@ei.ed.ac.uk

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/leidos-and-the-university-of-edinburgh-partner-to-drive-ai-and-data-science-innovation-302302208.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/leidos-and-the-university-of-edinburgh-partner-to-drive-ai-and-data-science-innovation-302302208.html

SOURCE Leidos

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

African Mahogany, Cumaru, and Ipé Added to CITES List Appendix II: a Significant Step for Sustainable Trade and Conservation

Salt Lake City, UT November 11, 2024 –(PR.com)– In an impactful move for global forestry and conservation, African Mahogany, Cumaru, and Ipé have been officially listed under Appendix II of the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES), effective November 25, 2024. This decision, reached at the 19th Conference of Parties (CoP19) in November 2022, marks a critical milestone in ensuring the responsible international trade of these species. Ipe Woods USA, a leader in the sustainable lumber industry, supports this move wholeheartedly, reinforcing its dedication to the preservation and careful management of forest resources.

Ipe Woods USA has been deeply involved in the import and sale of premium lumber from sustainable sources around the globe, prioritizing conservation as a key component of its business. We are fully committed to maintaining reliable access to stock to meet customer demand and prevent any delays due to the certification process. By aligning with CITES, Ipe Woods USA is proud to take part in an international community focused on sustainable forestry and the protection of valuable species.

What CITES Listing Means for Ipe Woods USA Customers

With the new Appendix II listing, every international shipment of African Mahogany, Cumaru, and Ipé will now require a CITES certificate, a process that may introduce some delays as origin documentation undergoes verification. Ipe Woods USA has always employed rigorous methods of origin verification and ensures consistent access to stock, minimizing potential disruptions for our customers. Special order sizes not regularly available may require additional lead time, but with access to some of the largest manufacturing capabilities in the industry, we can often produce custom sizes from existing supplies, offering a reliable solution for customer needs.

Understanding CITES and Its Role in Conservation

CITES, established in 1973, provides a framework for international cooperation in the protection of endangered species. While it doesn’t impose direct laws, CITES guidance allows member countries to implement protective legislation, promoting sustainable trade in both flora and fauna. The listing of species like African Mahogany, Cumaru, and Ipé ensures that these trees, which may be abundant in some areas but sparse in others, are preserved for future generations through controlled trade practices.

Ipe Woods USA is committed to sourcing only from countries with sustainable forestry practices and avoiding regions where these species are endangered. This dedication aligns with our mission of promoting sustainable use while meeting the needs of our customers.

For more information on Ipe Woods USA’s commitment to sustainability, visit our website. To learn more about CITES and its conservation efforts, you can find additional details here.

About Ipe Woods USA

Ipe Woods USA is a trusted name in sustainable lumber, providing quality wood products sourced responsibly from around the world. We remain dedicated to supporting environmental conservation through sustainable sourcing practices and maintaining an ongoing commitment to customer satisfaction.

Contact Information:

Ipe Woods USA

Steven Rossi

844-674-4455

Contact via Email

https://ipewoods.com

Read the full story here: https://www.pr.com/press-release/924964

Press Release Distributed by PR.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Allegro MicroSystems Introduces Advanced Magnetic and Inductive Position Sensing Solutions at Electronica 2024

MANCHESTER, N.H., Nov. 12, 2024 (GLOBE NEWSWIRE) — Allegro MicroSystems, Inc. (“Allegro”) ALGM, a global leader in power and sensing solutions for motion control and energy efficient systems, today at Electronica 2024, introduced its new inductive position sensors and a series of micropower magnetic switches and latches. These advanced sensing products lower system costs, extend battery life and offer reliable performance across a variety of automotive, industrial and consumer applications.

The new micropower magnetic switches and latches, APS11753 and APS12753, redefine position sensing with higher sensitivity options for enhanced air gap tolerance, and ultra-low power consumption using 50% less power than our existing micropower products. This makes them perfectly suited for challenging battery-powered applications in medical, consumer and industrial markets.

“We are excited to announce our latest inductive position sensors as we continue to drive innovation in sensing technology,” said Ram Sathappan, Sr. Director, Global Marketing & Applications at Allegro MicroSystems. “Our inductive sensors deliver high accuracy, advanced diagnostics and connectivity options essential for safety-critical traction motors in electric vehicles, while the magnetic switches and latches enable designers to achieve reliable and energy-efficient position sensing in a variety of applications. We’re anticipating a lot of interest in our solutions and look forward to showcasing these innovations at Electronica.”

Key Features and Benefits of the New Inductive Position Sensors (A17802 and A17803):

- Precise Contactless Angle and Motor Position Sensing: Enables dynamic speed and torque control for smoother motion, reduced vibration and energy savings.

- Wide Temperature Range: Maintains consistent performance and stability in extreme temperatures, ensuring reliability in harsh conditions.

- Integrated Digital Compensation and Programmable Linearity: Enhances accuracy and resolution while offering design flexibility.

Key Features and Benefits of the New Micropower Magnetic Switches and Latches (APS11753 and APS12753):

- Ultra-low Power Consumption: Extends battery life, making them ideal for portable and wireless devices.

- Design flexibility: Wide offering of Magnetic sensitivity options provides design flexibility over a broad set of application needs ranging from stray field rejection to high sensitivity low magnetic field use cases.

- Lower Total Solution Cost: Greater magnetic sensitivity options compensate for mechanical misalignments and variations in magnetic field strength allowing for wider airgap variation and total cost savings

Allegro’s latest solutions highlight its commitment to sensing innovation throughout 2024. Earlier this year, Allegro introduced the industry’s highest bandwidth current sensors (ACS37030 and ACS37032) designed for rapid response and minimal power loss in high-power density Silicon Carbine (SiC) and Gallium Nitride (GaN) systems. These solutions are widely used in electric vehicles, clean energy equipment, and data centers. Allegro also introduced shunt replacement current sensors (ACS37220 and ACS37041) that reduce both energy loss and component count compared to traditional shunt-based solutions.

Additionally, Allegro expanded its portfolio with the new XtremeSense™ TMR sensors (CT455 and CT456), providing space and cost savings while improving energy efficiency. Representatives from Allegro will be present at Electronica in Munich, Germany from November 12 – 15, 2024 at booth # C5.479 to showcase the company’s latest advancements in power and sensing technology. Attendees interested in discovering how Allegro’s innovations deliver performance, efficiency and cost benefits are encouraged to visit.

About Allegro MicroSystems

Allegro MicroSystems, Inc. is leveraging more than three decades of expertise in magnetic sensing and power ICs, to propel automotive, clean energy and industrial automation forward with solutions that enhance efficiency, performance and sustainability. Allegro’s commitment to quality drives transformation across industries, reinforcing our status as a pioneer in “automotive grade” technology and a partner in our customers’ success. For additional information, please visit https://www.allegromicro.com/en/.

Media Contact:

Tyler Weiland

Corporate Communications

(972) 571-7834

tweiland.cw@allegromicro.com

Allegro Contact:

Laura Kozikowski

Sr. Director of Global Marketing

lkozikowski@allegromicro.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.