VINCI PARTNERS TO HOST VIRTUAL WEBCAST TO DISCUSS COMBINATION WITH COMPASS ON NOVEMBER 25TH AT 8:00AM ET

RIO DE JANEIRO, Nov. 11, 2024 /PRNewswire/ — Vinci Partners Investments Ltd. VINP (“Vinci Partners,” “Vinci,” “the Company,” “we,” “us,” or “our”), the controlling company of a leading alternative investment platform in Brazil, will host a virtual webcast on November 25th, 2024 at 8:00 AM ET to delve deeper into the combination with Compass, provide updates on the ongoing integration and potential synergies, discuss key aspects of its M&A activity and outline its strategic vision for the future growth of the combined platforms across Latin America.

Webcast and Conference Call

To access the webcast please visit the Events section of the Company’s website at: https://ir.vincipartners.com/news-and-events/events. For those unable to listen to the live broadcast, there will be a webcast replay on the same section of the website.

To access the conference call through dial in, please register at Vinci’s Combination with Compass: Virtual Webcast Dial In to obtain the conference number and access code.

About Vinci Partners

Vinci Partners is a leading alternative investment platform in Brazil, established in 2009. Vinci Partners’ business segments include private equity, public equities, real estate, private credit, infrastructure, special situations, investment products and solutions and retirement services, each managed by dedicated investment teams with an independent investment committee and decision-making process. We also have a corporate advisory business, focusing mostly on pre-initial public offering, or pre-IPO, and merger and acquisition, or M&A, advisory services for Brazilian middle-market companies. On October 29, 2024, Vinci announced the closing of the combination with Compass, a leading independent asset management firm in Latin America, creating a full-service Latin American alternative asset manager, that as of September 2024, had more than US$54 billion in assets under management.

Forward-Looking Statements

This press release contains forward-looking statements that can be identified by the use of words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others. By their nature, forward-looking statements are necessarily subject to a high degree of uncertainty and involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside of our control. Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements and there can be no assurance that such forward-looking statements will prove to be correct. The forward-looking statements included herein speak only as at the date of this press release and we do not undertake any obligation to update these forward-looking statements. Past performance does not guarantee or predict future performance. Moreover, neither we nor our affiliates, officers, employees and agents undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release. Further information on these and other factors that could affect our financial results is included in filings we have made and will make with the U.S. Securities and Exchange Commission from time to time.

USA Media Contact

Kate Thompson / Tim Ragones

Joele Frank, Wilkinson Brimmer Katcher

+1 (212) 355-4449

Brazil Media Contact

Danthi Comunicações

Carla Azevedo (carla@danthicomunicacoes.com.br)

+55 (21) 3114-0779

Investor Contact

ShareholderRelations@vincipartners.com

NY: +1 (646) 559-8040

RJ: +55 (21) 2159-6240

![]() View original content:https://www.prnewswire.com/news-releases/vinci-partners-to-host-virtual-webcast-to-discuss-combination-with-compass-on-november-25th-at-800am-et-302301796.html

View original content:https://www.prnewswire.com/news-releases/vinci-partners-to-host-virtual-webcast-to-discuss-combination-with-compass-on-november-25th-at-800am-et-302301796.html

SOURCE Vinci Partners Investments Ltd.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Luminar Technologies Stock Is Rising After Hours: What's Driving The Action?

Luminar Technologies Inc LAZR provided a business update for the third quarter after the bell on Monday. Here’s a look at what you need to know.

What Happened: Luminar said it continues to meet all key deliverables for the Volvo EX90 production ramp. The lidar company said it shipped more product in the third quarter than it did in the past three quarters combined.

Luminar also announced that it was selected as a standard equipment feature on an additional model in the Volvo cars line-up. The company said the selection endorses Luminar’s leadership in lidar and the company’s ability to execute and industrialize at scale.

The lidar company also announced a new advanced decampment contract with a major Japanese automaker.

“This contract marks the next phase in the company’s collaboration on the OEM’s next-generation ADAS system using Luminar’s LiDAR, as well as paid development of new software capabilities,” the company said.

Luminar was scheduled to report third-quarter financial results on Monday, but the company said it plans to file a notification of late filing with the SEC, due to “the complexity of the analysis relating to the previously announced convertible notes exchange transaction consummated in August 2024.”

Luminar said it would be automatically granted a five-day extension. The company expects to file its quarterly report “as soon as practicable” within the five-day extension period.

Luminar did note that third-quarter operating cash flow and free cash flow increased by about $20 million in the quarter. The company said it now expects to see continued improvement in free cash flow in the fourth quarter.

“Today nearly every major automaker has LiDAR planned into their roadmaps, and our commercial growth this quarter is a testament to both our technical leadership and ability to execute to global automaker standards,” said Austin Russell, founder and CEO of Luminar.

“This quarter, we’ve further restructured Luminar to withstand near-term headwinds facing the industry so we are better positioned to capitalize on the long-term value in this trillion-dollar industry.”

Management will hold a conference call to further discuss the business update at 5 p.m. ET.

LAZR Price Action: Luminar shares were up 16.08% in after-hours, trading at $1.09 at the time of publication Monday, according to Benzinga Pro.

Photo: Courtesy of Luminar.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Novavax: Analyzing the Surge in Options Activity

Deep-pocketed investors have adopted a bullish approach towards Novavax NVAX, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NVAX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Novavax. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 77% leaning bullish and 22% bearish. Among these notable options, 7 are puts, totaling $300,278, and 2 are calls, amounting to $146,900.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $9.0 to $40.0 for Novavax during the past quarter.

Volume & Open Interest Development

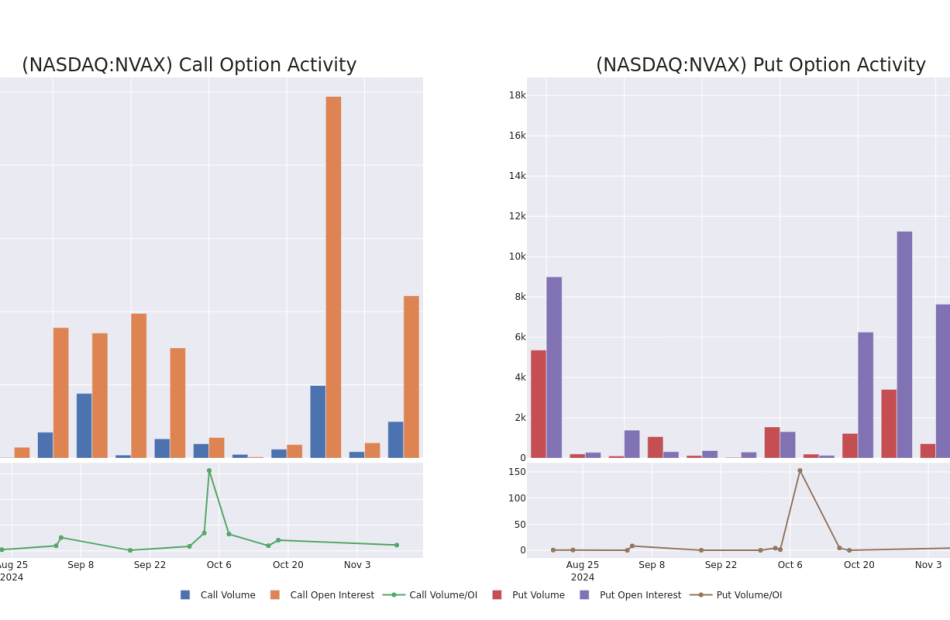

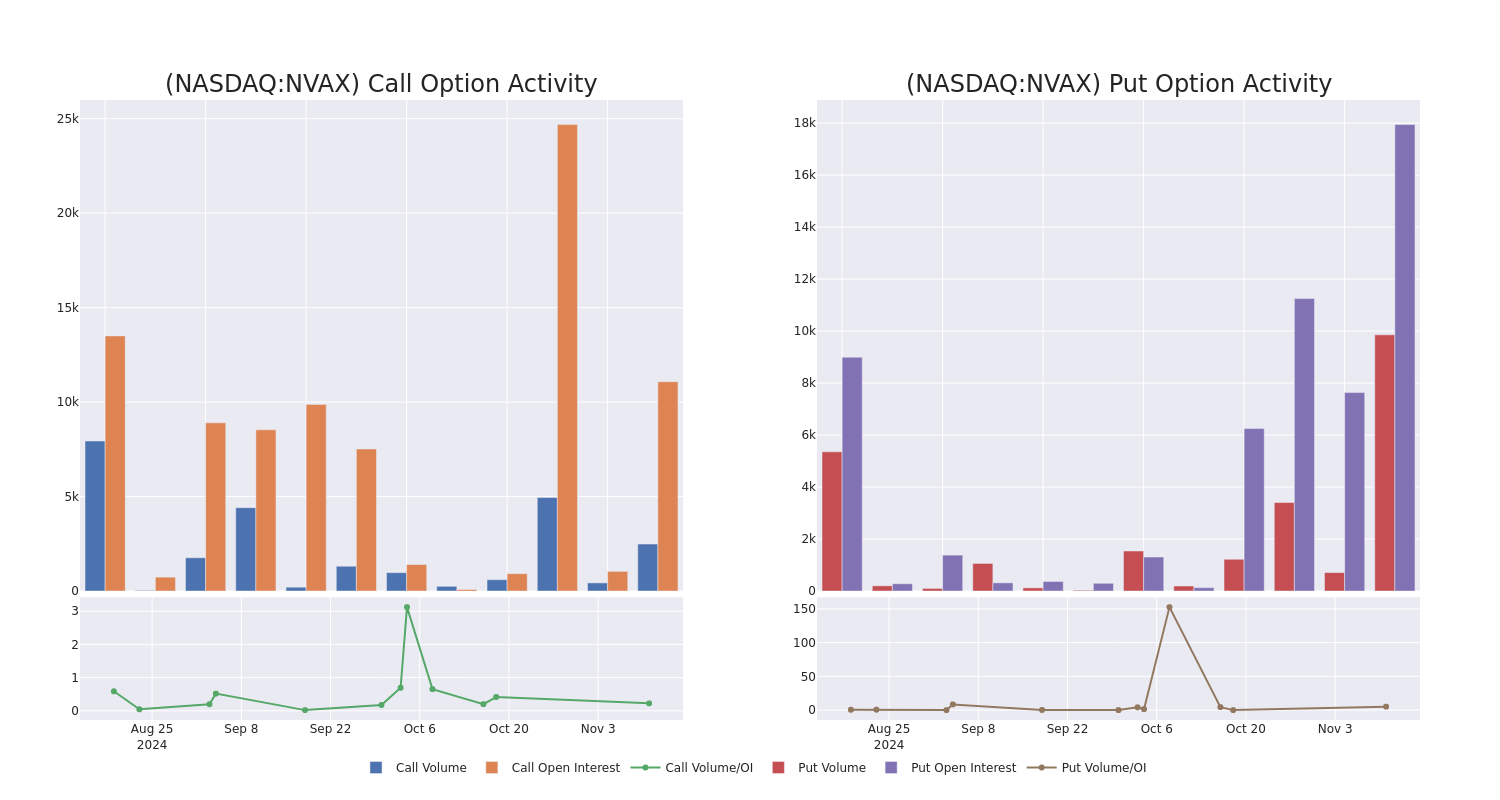

In today’s trading context, the average open interest for options of Novavax stands at 5805.6, with a total volume reaching 12,344.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Novavax, situated within the strike price corridor from $9.0 to $40.0, throughout the last 30 days.

Novavax Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVAX | PUT | SWEEP | BULLISH | 01/16/26 | $4.0 | $3.65 | $3.65 | $10.00 | $84.6K | 17.4K | 1.2K |

| NVAX | CALL | SWEEP | BULLISH | 11/15/24 | $0.77 | $0.66 | $0.78 | $10.00 | $77.9K | 10.0K | 1.0K |

| NVAX | CALL | TRADE | BEARISH | 11/15/24 | $0.7 | $0.69 | $0.69 | $9.50 | $69.0K | 1.0K | 1.4K |

| NVAX | PUT | TRADE | BULLISH | 01/16/26 | $4.0 | $3.6 | $3.6 | $10.00 | $57.6K | 17.4K | 1.9K |

| NVAX | PUT | SWEEP | BULLISH | 01/16/26 | $4.0 | $3.65 | $3.65 | $10.00 | $44.8K | 17.4K | 1.3K |

About Novavax

Novavax Inc is a biotechnology company that develops vaccines. The company works in the clinical stage of development with a focus on delivering novel products that prevent a broad range of diseases. Novavax works together with its wholly owned Swedish subsidiary to produce vaccine candidates to respond to both known and emerging disease threats. The company believes its vaccine technology has the potential to be applied broadly to a wide variety of human infectious diseases. The Company manages its business as one operating segment, the development and commercialization of vaccines. The company generates maximum revenue from Europe.

In light of the recent options history for Novavax, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Novavax

- Currently trading with a volume of 11,712,916, the NVAX’s price is up by 1.42%, now at $9.04.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 1 days.

What Analysts Are Saying About Novavax

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $25.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Jefferies has decided to maintain their Buy rating on Novavax, which currently sits at a price target of $25.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Novavax, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Artificial Intelligence (AI) Software Stock — A 488% Gainer Since its IPO — Still Has Massive Upside, According to 2 Wall Street Analysts

One of the breakout stars of the artificial intelligence (AI) revolution is data analytics software company Palantir Technologies (NYSE: PLTR). Since its initial public offering in late 2020, Palantir shares have generated a 488% return as of market close on Nov. 7.

But to be honest, Palantir’s journey hasn’t been without some challenges and drama along the way. Despite a successful public debut a few years ago, shares of Palantir cratered throughout much of 2022 on the backdrop of a tough macroeconomy. With shares trading for just $6 at the beginning of 2023, Palantir’s outlook didn’t look bright. The company had virtually no presence in the private sector, and growth from its government contracting business was decelerating.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

However, the launch of the Palantir Artificial Intelligence Platform (AIP) in April 2023 sparked a comeback that even Rocky would appreciate.

Two of Palantir’s earliest bulls on Wall Street — Dan Ives of Wedbush Securities and Mariana Perez Mora of Bank of America — have placed price targets of $57 and $55 on Palantir, respectively. AI has become a catalyst of epic proportions for Palantir, and as of the time of this writing, shares are trading at all-time highs of roughly $56.

While Palantir’s current share price doesn’t leave a ton of room for percentage growth relative to targets put forth by Ives and Perez Mora, it’s more important for investors to understand the reasons behind these analyst upgrades and extrapolate what these themes could suggest for Palantir’s future.

Palantir CEO Alex Karp began his third-quarter shareholder letter with a brief statement declaring “this is still only the beginning.”

That’s a pretty bold call when your company just posted 30% revenue growth year over year, closed over 100 deals worth at least $1 million, and is minting positive net income and free cash flow on a consistent basis. At some point, you’d expect the momentum to slow down.

But apparently, Karp, Ives, and Perez Mora are calling for even more growth. Let’s dig into what’s driving these optimistic outlooks and explore how Palantir’s AI journey is unfolding.

One of the ways Palantir has been able to separate itself from the competition since launching AIP is through a unique lead generation strategy. Namely, Palantir hosts immersive seminars called “boot camps,” during which prospective customers can demo the company’s software suites. This hands-on approach helps leads actually identify a use case around AI and understand how Palantir’s software can help ease their pain points.

Archrock Reports Third Quarter 2024 Results and Raises Full Year 2024 Financial Guidance

HOUSTON, Nov. 11, 2024 (GLOBE NEWSWIRE) — Archrock, Inc. AROC (“Archrock”) today reported results for the third quarter 2024.

Third Quarter 2024 Highlights

- Revenue for the third quarter of 2024 was $292.2 million compared to $253.4 million in the third quarter of 2023.

- Net income for the third quarter of 2024 was $37.5 million and earnings per share (“EPS”) was $0.22, compared to $30.9 million and $0.20, respectively, in the third quarter of 2023.

- Adjusted net income (a non-GAAP measure defined below) for the third quarter of 2024 was $47.3 million and adjusted EPS (a non-GAAP measure defined below) was $0.28, compared to $30.9 million and $0.20, respectively, in the third quarter of 2023.

- Adjusted EBITDA (a non-GAAP measure defined below) for the third quarter of 2024 was $150.9 million compared to $120.2 million in the third quarter of 2023.

- Declared a quarterly dividend of $0.175 per share of common stock for the third quarter of 2024, 6% higher compared to the second quarter of 2024 and 13% higher compared to the third quarter of 2023, supported by dividend coverage of 3.0x.

- Closed acquisition of Total Operations and Production Services, LLC (“TOPS”).

- Raised full-year 2024 adjusted EBITDA guidance to a range of $575 million to $585 million.

Management Commentary and Outlook

“Archrock drove tremendous performance during the third quarter, marked by the achievement of several financial and strategic milestones,” said Brad Childers, Archrock’s President and Chief Executive Officer. “Our compression fleet remained fully utilized and our contract operations and aftermarket services segments delivered record-setting adjusted gross margins. In addition, at the end of August, we closed the previously announced acquisition of TOPS, and our teams are doing a great job integrating this high-quality electric motor drive compression operation into Archrock.

“The significant outperformance in our pre-acquisition business, the continued deployment of innovative technology and an expanded electric motor drive fleet result in an increase to our 2024 adjusted EBITDA guidance expectations and set a strong foundation for even higher levels of customer service, operational execution and profitability in 2025.

“We see sustained strength in compression booking demand as our customers plan for continuing production growth to meet increased LNG export capacity and electric generation demand from AI and data centers. I’m particularly excited about our enhanced position in the Permian Basin, which is forecasted to lead the U.S. in oil and gas production growth.

“Against this robust market backdrop, we expect to continue to make high-return investments in large midstream and electric motor drive newbuild horsepower to support our exceptional customer base. Our capital allocation is differentiated and bolstered by the accretive acquisition of TOPS, supporting a 6% sequential increase in our dividend per share and $12 million in share repurchases during the third quarter, as well as our expectation for continued increases to shareholder returns in the future,” concluded Childers.

Third Quarter 2024 Financial Results

Archrock’s third quarter 2024 net income of $37.5 million included a non-cash long-lived and other asset impairment of $2.5 million, a debt extinguishment loss of $3.2 million as well as transaction-related expenses totaling $9.2 million. Archrock’s third quarter 2023 net income of $30.9 million included a non-cash long-lived and other asset impairment of $2.9 million and restructuring charges of $0.6 million.

Adjusted EBITDA for the third quarter of 2024 and 2023 included $2.2 million and $3.2 million, respectively, in net gains related to the sale of compression and other assets.

Contract Operations

For the third quarter of 2024, contract operations segment revenue totaled $245.4 million, an increase of 18% compared to $207.6 million in the third quarter of 2023. Adjusted gross margin was $165.6 million for the third quarter of 2024, up 25% from $132.3 million in the third quarter of 2023. Adjusted gross margin percentage was 67% for the third quarter of 2024, compared to 64% in the third quarter of 2023. At the end of the third quarter of 2024, total operating horsepower was 4.2 million, up from 3.6 million in the third quarter of 2023, primarily reflecting the acquisition of TOPS. Horsepower utilization at period end remained at 95%.

Aftermarket Services

For the third quarter of 2024, aftermarket services segment revenue totaled $46.7 million, compared to $45.8 million in the third quarter of 2023. Adjusted gross margin was $12.3 million for the third quarter of 2024, compared to $9.1 million in the third quarter of 2023. Adjusted gross margin percentage was 26% for the third quarter of 2024, compared to 20% for the third quarter of 2023.

Balance Sheet

Long-term debt was $2.2 billion at September 30, 2024, which reflects the offering of $700 million aggregate principal amount of 6.625% senior notes due 2032, as well as the tender of $200 million aggregate principal amount of 6.875% senior notes due 2027 (of the $500 million aggregate principal amount outstanding of the notes). Our available liquidity at September 30, 2024 totaled $650 million. Our leverage ratio was 3.57x as of September 30, 2024, compared to 3.84x as of September 30, 2023.

Shareholder Returns

Quarterly Dividend

Our Board of Directors recently declared a quarterly dividend of $0.175 per share of common stock, or $0.70 per share on an annualized basis. Dividend coverage in the third quarter of 2024 was 3.0x. The third quarter 2024 dividend will be paid on November 13, 2024 to stockholders of record at the close of business on November 6, 2024.

Share Repurchase Program

During the quarter ended September 30, 2024, Archrock repurchased 649,854 common shares at an average price of $18.63 per share, for an aggregate of approximately $12.1 million. Approximately $37.9 million remains available for future common share repurchases under Archrock’s current share repurchase program.

Updated 2024 Annual Guidance

Archrock is providing revised guidance for the full year 2024. The full-year 2024 guidance below incorporates four months of the financial impact of the TOPS acquisition that closed on August 30, 2024.

(in thousands, except percentages, per share amounts, and ratios)

| Full Year 2024 Guidance | |||||||||

| Low |

High |

||||||||

| Net income (1) (2) | $ | 157,000 | $ | 167,000 | |||||

| Adjusted EBITDA(3) | 575,000 | 585,000 | |||||||

| Cash available for dividend(4) (5) | 339,000 | 349,000 | |||||||

| Segment | |||||||||

| Contract operations revenue | $ | 970,000 | $ | 980,000 | |||||

| Contract operations adjusted gross margin percentage | 66 | % | 67 | % | |||||

| Aftermarket services revenue | $ | 180,000 | $ | 185,000 | |||||

| Aftermarket services adjusted gross margin percentage | 22 | % | 23 | % | |||||

| Selling, general and administrative | $ | 134,000 | $ | 132,000 | |||||

| Capital expenditures | |||||||||

| Growth capital expenditures (6) | $ | 260,000 | $ | 260,000 | |||||

| Maintenance capital expenditures | 85,000 | 85,000 | |||||||

| Other capital expenditures | 25,000 | 25,000 | |||||||

___________

| (1) | 2024 annual guidance for net income includes $9.5 million of long-lived and other asset impairment as of September 30, 2024, but does not include the impact of any such future costs, because due to its nature, it cannot be accurately forecasted. Long-lived and other asset impairment does not impact adjusted EBITDA or cash available for dividend, however it is a reconciling item between these measures and net income. Long-lived and other asset impairment for the years 2023 and 2022 was $12.0 million and $21.4 million, respectively. |

| (2) | Reflects estimate of expenses incurred to date related to the TOPS acquisition. |

| (3) | Management believes adjusted EBITDA provides useful information to investors because this non-GAAP measure, when viewed with our GAAP results and accompanying reconciliations, provides a more complete understanding of our performance than GAAP results alone. Management uses this non-GAAP measure as a supplemental measure to review current period operating performance, comparability measure and performance measure for period-to-period comparisons. |

| (4) | Management uses cash available for dividend as a supplemental performance measure to compute the coverage ratio of estimated cash flows to planned dividends. |

| (5) | A forward-looking estimate of cash provided by operating activities is not provided because certain items necessary to estimate cash provided by operating activities, including changes in assets and liabilities, are not estimable at this time. Changes in assets and liabilities were $(28.0) million and $(24.5) million for the years 2023 and 2022, respectively. |

| (6) | The $70 million increase from prior annual guidance of $190 million is exclusively related to the addition of horsepower in TOPS’ backlog and payments due at delivery. |

Summary Metrics

(in thousands, except percentages, per share amounts and ratios)

| Three Months Ended | ||||||||||||||

| September 30, | June 30, | September 30, | ||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Net income | $ | 37,516 | $ | 34,425 | $ | 30,858 | ||||||||

| Adjusted net income (1) | $ | 47,313 | $ | 35,793 | $ | 30,858 | ||||||||

| Adjusted EBITDA (1) | $ | 150,854 | $ | 129,712 | $ | 120,150 | ||||||||

| Contract operations revenue | $ | 245,420 | $ | 225,468 | $ | 207,552 | ||||||||

| Contract operations adjusted gross margin (1) | $ | 165,610 | $ | 146,190 | $ | 132,279 | ||||||||

| Contract operations adjusted gross margin percentage | 67 | % | 65 | % | 64 | % | ||||||||

| Aftermarket services revenue | $ | 46,741 | $ | 45,058 | $ | 45,815 | ||||||||

| Aftermarket services adjusted gross margin (1) | $ | 12,346 | $ | 9,900 | $ | 9,127 | ||||||||

| Aftermarket services adjusted gross margin percentage | 26 | % | 22 | % | 20 | % | ||||||||

| Selling, general, and administrative | $ | 34,059 | $ | 31,163 | $ | 28,558 | ||||||||

| Net cash provided by operating activities | $ | 96,900 | $ | 70,651 | $ | 120,070 | ||||||||

| Cash available for dividend | $ | 92,887 | $ | 71,593 | $ | 63,021 | ||||||||

| Cash available for dividend coverage (2) | 3.0 | x | 2.6 | x | 2.6 | x | ||||||||

| Adjusted free cash flow (1) (3) | $ | (834,282 | ) | $ | (16,914 | ) | $ | 62,859 | ||||||

| Adjusted free cash flow after dividend (1) (3) | $ | (862,147 | ) | $ | (42,733 | ) | $ | 38,609 | ||||||

| Total available horsepower (at period end) (4) | 4,418 | 3,806 | 3,773 | |||||||||||

| Total operating horsepower (at period end) (5) | 4,179 | 3,601 | 3,608 | |||||||||||

| Horsepower utilization spot (at period end) | 95 | % | 95 | % | 96 | % | ||||||||

___________

| (1) | Management believes adjusted net income, adjusted gross margin, adjusted EBITDA, adjusted free cash flow and adjusted free cash flow after dividend provide useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review current period operating performance, comparability measures and performance measures for period-to-period comparisons. |

| (2) | Defined as cash available for dividend divided by dividends declared for the period. |

| (3) | Reflects $866.6 million cash paid in TOPS Acquisition, net of cash acquired. |

| (4) | Defined as idle and operating horsepower and includes new compressor units completed by a third-party manufacturer that have been delivered to us. |

| (5) | Defined as horsepower that is operating under contract and horsepower that is idle but under contract and generating revenue such as standby revenue. |

Conference Call Details

Archrock will host a conference call on November 12, 2024, to discuss third quarter 2024 financial results. The call will begin at 9:00 a.m. Eastern Time.

To listen to the call via a live webcast, please visit Archrock’s website at www.archrock.com. The call will also be available by dialing 1 (800) 715-9871 in the United States or 1 (646) 307-1963 for international calls. The access code is 4749623.

A replay of the webcast will be available on Archrock’s website for 90 days following the event.

Adjusted net income, a non-GAAP measure, is defined as net income (loss) excluding transaction-related costs and debt extinguishment loss adjusted for income taxes. A reconciliation of adjusted net income to net income, the most directly comparable GAAP measure, and a reconciliation of adjusted earnings per share to basic and diluted earnings per common share, the most directly comparable GAAP measure, appear below.

Adjusted EBITDA, a non-GAAP measure, is defined as net income (loss) excluding interest expense, income taxes, depreciation and amortization, long-lived and other asset impairment, unrealized change in fair value of investment in unconsolidated affiliate, restructuring charges, debt extinguishment loss, transaction-related costs, non-cash stock-based compensation expense, amortization of capitalized implementation costs and other items. A reconciliation of adjusted EBITDA to net income, the most directly comparable GAAP measure, and a reconciliation of our full year 2024 adjusted EBITDA guidance to net income appear below.

Adjusted gross margin, a non-GAAP measure, is defined as revenue less cost of sales, exclusive of depreciation and amortization. Adjusted gross margin percentage, a non-GAAP measure, is defined as adjusted gross margin divided by revenue. A reconciliation of adjusted gross margin to net income, the most directly comparable GAAP measure, and a reconciliation of adjusted gross margin percentage to gross margin appear below.

Cash available for dividend, a non-GAAP measure, is defined as net income (loss) excluding interest expense, income taxes, depreciation and amortization, long-lived and other asset impairment, unrealized change in fair value of investment in unconsolidated affiliate, restructuring charges, debt extinguishment loss, transaction-related costs, non-cash stock-based compensation expense, amortization of capitalized implementation costs and other items, less maintenance capital expenditures, other capital expenditures, cash taxes and cash interest expense. Reconciliations of cash available for dividend to net income and net cash provided by operating activities, the most directly comparable GAAP measures, and a reconciliation of our updated full year 2024 cash available for dividend guidance to net income appear below.

Adjusted free cash flow, a non-GAAP measure, is defined as net cash provided by operating activities plus net cash provided by (used in) investing activities. A reconciliation of adjusted free cash flow to net cash provided by operating activities, the most directly comparable GAAP measure, appears below.

Adjusted free cash flow after dividend, a non-GAAP measure, is defined as net cash provided by operating activities plus net cash provided by (used in) investing activities less dividends paid to stockholders. A reconciliation of adjusted free cash flow after dividend to net cash provided by operating activities, the most directly comparable GAAP measure, appears below.

About Archrock

Archrock is an energy infrastructure company with a primary focus on midstream natural gas compression and a commitment to helping its customers produce, compress and transport natural gas in a safe and environmentally responsible way. Headquartered in Houston, Texas, Archrock is a premier provider of natural gas compression services to customers in the energy industry throughout the U.S. and a leading supplier of aftermarket services to customers that own compression equipment. For more information on how Archrock embodies its purpose, WE POWER A CLEANER AMERICA, visit www.archrock.com.

Forward–Looking Statements

All statements in this release (and oral statements made regarding the subjects of this release) other than historical facts are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors that could cause actual results to differ materially from such statements, many of which are outside the control of Archrock. Forward-looking information includes, but is not limited to statements regarding: guidance or estimates related to Archrock’s results of operations or of financial condition; fundamentals of Archrock’s industry, including the attractiveness of returns and valuation, stability of cash flows, demand dynamics and overall outlook, and Archrock’s ability to realize the benefits thereof; Archrock’s expectations regarding future economic, geopolitical and market conditions and trends; Archrock’s operational and financial strategies, including planned growth, coverage and leverage reduction strategies, Archrock’s ability to successfully effect those strategies, and the expected results therefrom; Archrock’s financial and operational outlook; demand and growth opportunities for Archrock’s services; structural and process improvement initiatives, the expected timing thereof, Archrock’s ability to successfully effect those initiatives and the expected results therefrom; the operational and financial synergies provided by Archrock’s size; statements regarding Archrock’s dividend policy; the expected benefits of the TOPS acquisition, including its expected accretion and the expected impact on Archrock’s leverage ratio; and plans and objectives of management for future operations.

While Archrock believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business. The factors that could cause results to differ materially from those indicated by such forward-looking statements include, but are not limited to: inability to achieve the expected benefits of the TOPS acquisition and difficulties in integrating TOPS; risks related to acquisitions, including the TOPS acquisition, which can reduce our ability to make distributions to our common stockholders; risks related to pandemics and other public health crises; an increase in inflation; ongoing international conflicts and tensions; risks related to our operations; competitive pressures; inability to make acquisitions on economically acceptable terms; uncertainty to pay dividends in the future; risks related to a substantial amount of debt and our debt agreements; inability to access the capital and credit markets or borrow on affordable terms to obtain additional capital; inability to fund purchases of additional compression equipment; vulnerability to interest rate increases; uncertainty relating to the phasing out of London Interbank Offered Rate; erosion of the financial condition of our customers; risks related to the loss of our most significant customers; uncertainty of the renewals for our contract operations service agreements; risks related to losing management or operational personnel; dependence on particular suppliers and vulnerability to product shortages and price increases; information technology and cybersecurity risks; tax-related risks; legal and regulatory risks, including climate-related and environmental, social and governance risks.

These forward-looking statements are also affected by the risk factors, forward-looking statements and challenges and uncertainties described in Archrock’s Annual Report on Form 10-K for the year ended December 31, 2023, Archrock’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 and those set forth from time to time in Archrock’s filings with the Securities and Exchange Commission, which are available at www.archrock.com. Except as required by law, Archrock expressly disclaims any intention or obligation to revise or update any forward-looking statements whether as a result of new information, future events or otherwise.

SOURCE: Archrock, Inc.

For information, contact:

| Archrock, Inc. |

| INVESTORS Megan Repine VP of Investor Relations 281-836-8360 investor.relations@archrock.com |

| MEDIA Andrew Siegel / Jed Repko Joele Frank 212-355-4449 |

| Archrock, Inc. Unaudited Condensed Consolidated Statements of Operations (in thousands, except per share amounts) |

||||||||||||||

| Three Months Ended | ||||||||||||||

| September 30, | June 30, | September 30, |

||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Revenue: | ||||||||||||||

| Contract operations | $ | 245,420 | $ | 225,468 | $ | 207,552 | ||||||||

| Aftermarket services | 46,741 | 45,058 | 45,815 | |||||||||||

| Total revenue | 292,161 | 270,526 | 253,367 | |||||||||||

| Cost of sales, exclusive of depreciation and amortization | ||||||||||||||

| Contract operations | 79,810 | 79,278 | 75,273 | |||||||||||

| Aftermarket services | 34,395 | 35,158 | 36,688 | |||||||||||

| Total cost of sales, exclusive of depreciation and amortization | 114,205 | 114,436 | 111,961 | |||||||||||

| Selling, general and administrative | 34,059 | 31,163 | 28,558 | |||||||||||

| Depreciation and amortization | 48,377 | 43,853 | 42,155 | |||||||||||

| Long-lived and other asset impairment | 2,509 | 4,401 | 2,922 | |||||||||||

| Restructuring charges | — | — | 592 | |||||||||||

| Debt extinguishment loss | 3,181 | — | — | |||||||||||

| Interest expense | 30,179 | 27,859 | 28,339 | |||||||||||

| Transaction-related costs | 9,220 | 1,782 | — | |||||||||||

| Gain on sale of assets, net | (2,218 | ) | (576 | ) | (3,237 | ) | ||||||||

| Other income, net | (304 | ) | 128 | (235 | ) | |||||||||

| Income before income taxes | 52,953 | 47,480 | 42,312 | |||||||||||

| Provision for income taxes | 15,437 | 13,055 | 11,454 | |||||||||||

| Net income | $ | 37,516 | $ | 34,425 | $ | 30,858 | ||||||||

| Basic and diluted net income per common share (1) | $ | 0.22 | $ | 0.22 | $ | 0.20 | ||||||||

| Weighted average common shares outstanding: | ||||||||||||||

| Basic | 165,847 | 154,496 | 154,163 | |||||||||||

| Diluted | 166,173 | 154,785 | 154,401 | |||||||||||

___________

| (1) | Basic and diluted net income per common share is computed using the two-class method to determine the net income per share for each class of common stock and participating security (restricted stock and stock-settled restricted stock units that have non-forfeitable rights to receive dividends or dividend equivalents) according to dividends declared and participation rights in undistributed earnings. Accordingly, we have excluded net income attributable to participating securities from our calculation of basic and diluted net income per common share. |

| Archrock, Inc. Unaudited Supplemental Information (in thousands, except percentages, per share amounts and ratios) |

||||||||||||||

| Three Months Ended | ||||||||||||||

| September 30, | June 30, | September 30, | ||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Revenue: | ||||||||||||||

| Contract operations | $ | 245,420 | $ | 225,468 | $ | 207,552 | ||||||||

| Aftermarket services | 46,741 | 45,058 | 45,815 | |||||||||||

| Total revenue | $ | 292,161 | $ | 270,526 | $ | 253,367 | ||||||||

| Adjusted gross margin: | ||||||||||||||

| Contract operations | $ | 165,610 | $ | 146,190 | $ | 132,279 | ||||||||

| Aftermarket services | 12,346 | 9,900 | 9,127 | |||||||||||

| Total adjusted gross margin (1) | $ | 177,956 | $ | 156,090 | $ | 141,406 | ||||||||

| Adjusted gross margin percentage: | ||||||||||||||

| Contract operations | 67 | % | 65 | % | 64 | % | ||||||||

| Aftermarket services | 26 | % | 22 | % | 20 | % | ||||||||

| Total adjusted gross margin percentage (1) | 61 | % | 58 | % | 56 | % | ||||||||

| Selling, general and administrative | $ | 34,059 | $ | 31,163 | $ | 28,558 | ||||||||

| % of revenue | 12 | % | 12 | % | 11 | % | ||||||||

| Adjusted EBITDA (1) | $ | 150,854 | $ | 129,712 | $ | 120,150 | ||||||||

| % of revenue | 52 | % | 48 | % | 47 | % | ||||||||

| Capital expenditures | $ | 70,018 | $ | 91,271 | $ | 74,501 | ||||||||

| Proceeds from sale of property, plant and equipment and other assets | (6,654 | ) | (3,706 | ) | (16,570 | ) | ||||||||

| Net capital expenditures | $ | 63,364 | $ | 87,565 | $ | 57,931 | ||||||||

| Total available horsepower (at period end) (2) | 4,418 | 3,806 | 3,773 | |||||||||||

| Total operating horsepower (at period end) (3) | 4,179 | 3,601 | 3,608 | |||||||||||

| Average operating horsepower | 3,757 | 3,607 | 3,593 | |||||||||||

| Horsepower utilization: | ||||||||||||||

| Spot (at period end) | 95 | % | 95 | % | 96 | % | ||||||||

| Average | 95 | % | 95 | % | 95 | % | ||||||||

| Dividend declared for the period per share | $ | 0.175 | $ | 0.165 | $ | 0.155 | ||||||||

| Dividend declared for the period to all stockholders | $ | 30,656 | $ | 27,977 | $ | 24,282 | ||||||||

| Cash available for dividend coverage (4) | 3.0 | x | 2.6 | x | 2.6 | x | ||||||||

| Adjusted free cash flow (1) (5) | $ | (834,282 | ) | $ | (16,914 | ) | $ | 62,859 | ||||||

| Adjusted free cash flow after dividend (1) (5) | $ | (862,147 | ) | $ | (42,733 | ) | $ | 38,609 | ||||||

___________

| (1) | Management believes adjusted gross margin, adjusted EBITDA, adjusted free cash flow and adjusted free cash flow after dividend provide useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review current period operating performance, comparability measures and performance measures for period-to-period comparisons. |

| (2) | Defined as idle and operating horsepower and includes new compressor units completed by a third-party manufacturer that have been delivered to us. |

| (3) | Defined as horsepower that is operating under contract and horsepower that is idle but under contract and generating revenue such as standby revenue. |

| (4) | Defined as cash available for dividend divided by dividends declared for the period. |

| (5) | Reflects $866.6 million cash paid in TOPS Acquisition, net of cash acquired. |

| September 30, | June 30, | September 30, | ||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Balance Sheet | ||||||||||||||

| Long-term debt (1) | $ | 2,236,131 | $ | 1,608,956 | $ | 1,604,554 | ||||||||

| Total equity | 1,290,736 | 894,496 | 861,093 | |||||||||||

___________

| (1) | Carrying values are shown net of unamortized premium and deferred financing costs. |

| Archrock, Inc. Unaudited Supplemental Information Reconciliation of Net Income to Adjusted Net Income and Earnings Per Share to Adjusted Earnings Per Share (in thousands, except per share amounts) |

||||||||||||||

| Three Months Ended |

||||||||||||||

| September 30, | June 30, | September 30, | ||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Net income | $ | 37,516 | $ | 34,425 | $ | 30,858 | ||||||||

| Transaction-related costs | 9,220 | 1,732 | — | |||||||||||

| Debt extinguishment loss | 3,181 | — | — | |||||||||||

| Tax effect of adjustments (1) | (2,604 | ) | (364 | ) | — | |||||||||

| Adjusted net income (2) | $ | 47,313 | $ | 35,793 | $ | 30,858 | ||||||||

| Weighted average common shares outstanding used in diluted earnings per common share | 166,173 | 154,785 | 154,401 | |||||||||||

| Basic and diluted earnings per common share (3) | $ | 0.22 | $ | 0.22 | $ | 0.20 | ||||||||

| Transaction-related costs per share | 0.06 | 0.01 | — | |||||||||||

| Debt extinguishment loss per share | 0.02 | — | — | |||||||||||

| Tax effect of adjustments per share | (0.02 | ) | — | — | ||||||||||

| Adjusted earnings per share (2) | $ | 0.28 | $ | 0.23 | $ | 0.20 | ||||||||

___________

| (1) | Represents tax effect of transaction-related costs and debt extinguishment loss based on statutory tax rate. |

| (2) | Management believes adjusted net income and adjusted earnings per share provides useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review our current period operating performance, comparability measure and performance measure for period-to-period comparisons without burdened earnings and earnings per share for non-recurring transactional costs. |

| (3) | Basic and diluted net income per common share is computed using the two-class method to determine the net income per share for each class of common stock and participating security (restricted stock and stock-settled restricted stock units that have non-forfeitable rights to receive dividends or dividend equivalents) according to dividends declared and participation rights in undistributed earnings. Accordingly, we have excluded net income attributable to participating securities from our calculation of basic and diluted net income per common share. |

| Archrock, Inc. Unaudited Supplemental Information Reconciliation of Net Income to Adjusted EBITDA and Adjusted Gross Margin (in thousands) |

||||||||||||||

| Three Months Ended |

||||||||||||||

| September 30, |

June 30, |

September 30, |

||||||||||||

| 2024 |

2024 |

2023 |

||||||||||||

| Net income | $ | 37,516 | $ | 34,425 | $ | 30,858 | ||||||||

| Depreciation and amortization | 48,377 | 43,853 | 42,155 | |||||||||||

| Long-lived and other asset impairment | 2,509 | 4,401 | 2,922 | |||||||||||

| Restructuring charges | — | — | 592 | |||||||||||

| Debt extinguishment loss | 3,181 | — | — | |||||||||||

| Interest expense | 30,179 | 27,859 | 28,339 | |||||||||||

| Transaction-related costs | 9,220 | 1,782 | — | |||||||||||

| Stock-based compensation expense | 3,738 | 3,513 | 3,191 | |||||||||||

| Amortization of capitalized implementation costs | 697 | 824 | 639 | |||||||||||

| Provision for income taxes | 15,437 | 13,055 | 11,454 | |||||||||||

| Adjusted EBITDA (1) | 150,854 | 129,712 | 120,150 | |||||||||||

| Selling, general and administrative | 34,059 | 31,163 | 28,558 | |||||||||||

| Stock-based compensation expense | (3,738 | ) | (3,513 | ) | (3,191 | ) | ||||||||

| Amortization of capitalized implementation costs | (697 | ) | (824 | ) | (639 | ) | ||||||||

| Gain on sale of assets, net | (2,218 | ) | (576 | ) | (3,237 | ) | ||||||||

| Other income, net | (304 | ) | 128 | (235 | ) | |||||||||

| Adjusted gross margin (1) | $ | 177,956 | $ | 156,090 | $ | 141,406 | ||||||||

___________

| (1) | Management believes adjusted EBITDA and adjusted gross margin provide useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review current period operating performance, comparability measures and performance measures for period-to-period comparisons. |

| Archrock, Inc. Unaudited Supplemental Information Reconciliation of Total Revenue to Adjusted Gross Margin (in thousands) |

|||||||||||||||||

| Three Months Ended | |||||||||||||||||

| September 30, | June 30, | September 30, | |||||||||||||||

| 2024 | 2024 | 2023 | |||||||||||||||

| Total revenues | $ | 292,161 | $ | 270,526 | $ | 253,367 | |||||||||||

| Cost of sales, exclusive of depreciation and amortization | (114,205 | ) | (114,436 | ) | (111,961 | ) | |||||||||||

| Depreciation and amortization | (48,377 | ) | (43,853 | ) | (42,155 | ) | |||||||||||

| Gross margin | 129,579 | 44 | % | 112,237 | 41 | % | 99,251 | 39 | % | ||||||||

| Depreciation and amortization | 48,377 | 43,853 | 42,155 | ||||||||||||||

| Adjusted gross margin (1) | $ | 177,956 | 61 | % | $ | 156,090 | 58 | % | $ | 141,406 | 56 | % | |||||

___________

| (1) | Management believes adjusted gross margin provides useful information to investors because this non-GAAP measure, when viewed with our GAAP results and accompanying reconciliations, provides a more complete understanding of our performance than GAAP results alone. Management uses this non-GAAP measure as a supplemental measure to review current period operating performance, comparability measures and performance measures for period-to-period comparisons. |

| Archrock, Inc. Unaudited Supplemental Information Reconciliation of Net Income to Adjusted EBITDA and Cash Available for Dividend (in thousands) |

||||||||||||||

| Three Months Ended |

||||||||||||||

| September 30, |

June 30, |

September 30, |

||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Net income | $ | 37,516 | $ | 34,425 | $ | 30,858 | ||||||||

| Depreciation and amortization | 48,377 | 43,853 | 42,155 | |||||||||||

| Long-lived and other asset impairment | 2,509 | 4,401 | 2,922 | |||||||||||

| Restructuring charges | — | — | 592 | |||||||||||

| Debt extinguishment loss | 3,181 | — | — | |||||||||||

| Interest expense | 30,179 | 27,859 | 28,339 | |||||||||||

| Transaction-related costs | 9,220 | 1,782 | — | |||||||||||

| Stock-based compensation expense | 3,738 | 3,513 | 3,191 | |||||||||||

| Amortization of capitalized implementation costs | 697 | 824 | 639 | |||||||||||

| Provision for income taxes | 15,437 | 13,055 | 11,454 | |||||||||||

| Adjusted EBITDA (1) | 150,854 | 129,712 | 120,150 | |||||||||||

| Less: Maintenance capital expenditures | (21,190 | ) | (25,415 | ) | (24,103 | ) | ||||||||

| Less: Other capital expenditures | (6,945 | ) | (3,445 | ) | (5,264 | ) | ||||||||

| Less: Cash tax payment | (404 | ) | (2,028 | ) | (53 | ) | ||||||||

| Less: Cash interest expense | (29,428 | ) | (27,231 | ) | (27,709 | ) | ||||||||

| Cash available for dividend (2) | $ | 92,887 | $ | 71,593 | $ | 63,021 | ||||||||

___________

| (1) | Management believes adjusted EBITDA provides useful information to investors because this non-GAAP measure, when viewed with our GAAP results and accompanying reconciliations, provides a more complete understanding of our performance than GAAP results alone. Management uses this non-GAAP measure as a supplemental measure to review current period operating performance, comparability measure and performance measure for period-to-period comparisons. |

| (2) | Management uses cash available for dividend as a supplemental performance measure to compute the coverage ratio of estimated cash flows to planned dividends. |

| Archrock, Inc. Unaudited Supplemental Information Reconciliation of Net Cash Provided by Operating Activities to Cash Available for Dividend (in thousands) |

||||||||||||||

| Three Months Ended |

||||||||||||||

| September 30, | June 30, | September 30, |

||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Net cash provided by operating activities | $ | 96,900 | $ | 70,651 | $ | 120,070 | ||||||||

| Inventory write-downs | (51 | ) | (318 | ) | (22 | ) | ||||||||

| Provision for (benefit from) credit losses | (90 | ) | (80 | ) | 94 | |||||||||

| Gain on sale of assets, net | 2,218 | 576 | 3,237 | |||||||||||

| Current income tax (benefit) provision | (146 | ) | 615 | 460 | ||||||||||

| Cash tax payment | (404 | ) | (2,028 | ) | (53 | ) | ||||||||

| Amortization of operating lease ROU assets | (962 | ) | (880 | ) | (839 | ) | ||||||||

| Amortization of contract costs | (6,046 | ) | (5,957 | ) | (5,386 | ) | ||||||||

| Deferred revenue recognized in earnings | 4,101 | 2,747 | 2,289 | |||||||||||

| Cash restructuring charges | — | — | 381 | |||||||||||

| Transaction-related costs | 9,220 | 1,782 | — | |||||||||||

| Changes in assets and liabilities | 16,282 | 33,345 | (27,843 | ) | ||||||||||

| Maintenance capital expenditures | (21,190 | ) | (25,415 | ) | (24,103 | ) | ||||||||

| Other capital expenditures | (6,945 | ) | (3,445 | ) | (5,264 | ) | ||||||||

| Cash available for dividend (1) | $ | 92,887 | $ | 71,593 | $ | 63,021 | ||||||||

___________

| (1) | Management uses cash available for dividend as a supplemental performance measure to compute the coverage ratio of estimated cash flows to planned dividends. |

| Archrock, Inc. Unaudited Supplemental Information Reconciliation of Net Cash Provided By Operating Activities to Adjusted Free Cash Flow and Adjusted Free Cash Flow After Dividend (in thousands) |

||||||||||||||

| Three Months Ended |

||||||||||||||

| September 30, |

June 30, |

September 30, |

||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||

| Net cash provided by operating activities | $ | 96,900 | $ | 70,651 | $ | 120,070 | ||||||||

| Net cash used in investing activities (1) | (931,182 | ) | (87,565 | ) | (57,211 | ) | ||||||||

| Adjusted free cash flow (1) (2) | (834,282 | ) | (16,914 | ) | 62,859 | |||||||||

| Dividends paid to stockholders | (27,865 | ) | (25,819 | ) | (24,250 | ) | ||||||||

| Adjusted free cash flow after dividend (1) (2) | $ | (862,147 | ) | $ | (42,733 | ) | $ | 38,609 | ||||||

___________

| (1) | Reflects $866.6 million cash paid in TOPS Acquisition, net of cash acquired. |

| (2) | Management believes adjusted free cash flow and adjusted free cash flow after dividend provide useful information to investors because these non-GAAP measures, when viewed with our GAAP results and accompanying reconciliations, provide a more complete understanding of our performance than GAAP results alone. Management uses these non-GAAP measures as supplemental measures to review current period operating performance, comparability measures and performance measures for period-to-period comparisons. |

| Archrock, Inc. Unaudited Supplemental Information Reconciliation of Net Income to Adjusted EBITDA and Cash Available for Dividend Guidance (in thousands) |

|||||||||

| Annual Guidance Range |

|||||||||

| 2024 | |||||||||

| Low | High |

||||||||

| Net income (1) | $ | 157,000 | $ | 167,000 | |||||

| Interest expense | 126,000 | 126,000 | |||||||

| Provision for income taxes | 61,000 | 61,000 | |||||||

| Depreciation and amortization | 190,000 | 190,000 | |||||||

| Stock-based compensation expense | 15,000 | 15,000 | |||||||

| Long-lived and other asset impairment | 9,000 | 9,000 | |||||||

| Amortization of capitalized implementation costs | 3,000 | 3,000 | |||||||

| Transaction-related costs (2) | 11,000 | 11,000 | |||||||

| Transaction-related debt extinguishment loss | 3,000 | 3,000 | |||||||

| Adjusted EBITDA (3) | 575,000 | 585,000 | |||||||

| Less: Maintenance capital expenditures | (85,000 | ) | (85,000 | ) | |||||

| Less: Other capital expenditures | (25,000 | ) | (25,000 | ) | |||||

| Less: Cash tax expense | (3,000 | ) | (3,000 | ) | |||||

| Less: Cash interest expense | (123,000 | ) | (123,000 | ) | |||||

| Cash available for dividend (4)(5) | $ | 339,000 | $ | 349,000 | |||||

___________

| (1) | 2024 annual guidance for net income includes $9.5 million of long-lived and other asset impairment as of September 30, 2024, but does not include the impact of any such future costs, because due to its nature, it cannot be accurately forecasted. Long-lived and other asset impairment does not impact adjusted EBITDA or cash available for dividend, however it is a reconciling item between these measures and net income. Long-lived and other asset impairment for the years 2023 and 2022 was $12.0 million and $21.4 million, respectively. |

| (2) | Reflects estimate of expenses incurred to date related to the TOPS acquisition and excludes additional costs to be incurred after close. |

| (3) | Management believes adjusted EBITDA provides useful information to investors because this non-GAAP measure, when viewed with our GAAP results and accompanying reconciliations, provides a more complete understanding of our performance than GAAP results alone. Management uses this non-GAAP measure as a supplemental measure to review current period operating performance, comparability measure and performance measure for period-to-period comparisons. |

| (4) | Management uses cash available for dividend as a supplemental performance measure to compute the coverage ratio of estimated cash flows to planned dividends. |

| (5) | A forward-looking estimate of cash provided by operating activities is not provided because certain items necessary to estimate cash provided by operating activities, including changes in assets and liabilities, are not estimable at this time. Changes in assets and liabilities were $(28.0) million and $(24.5) million for the years 2023 and 2022, respectively. |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At GitLab's Recent Unusual Options Activity

High-rolling investors have positioned themselves bearish on GitLab GTLB, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GTLB often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 10 options trades for GitLab. This is not a typical pattern.

The sentiment among these major traders is split, with 30% bullish and 70% bearish. Among all the options we identified, there was one put, amounting to $49,280, and 9 calls, totaling $491,958.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $65.0 for GitLab over the last 3 months.

Insights into Volume & Open Interest

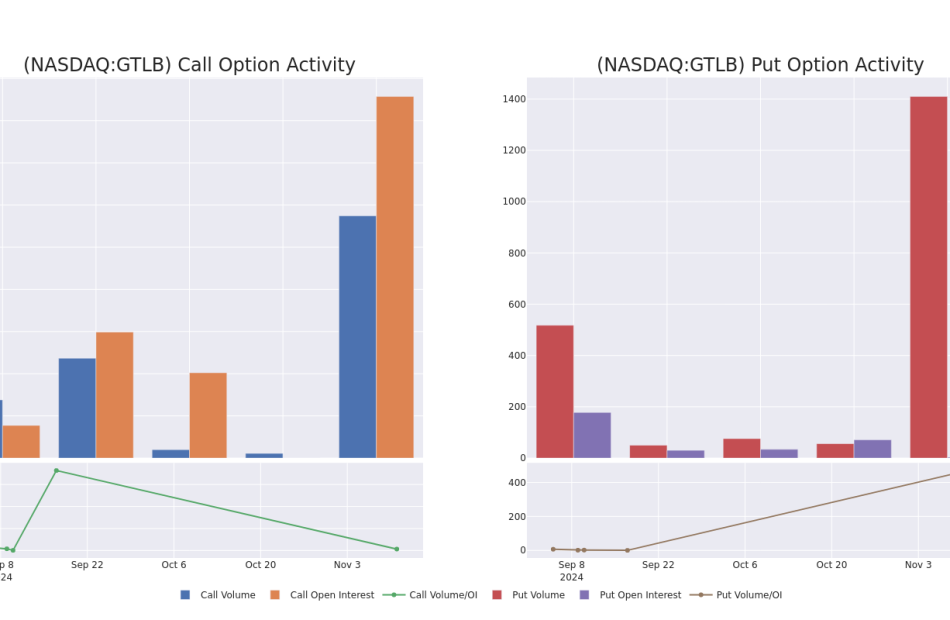

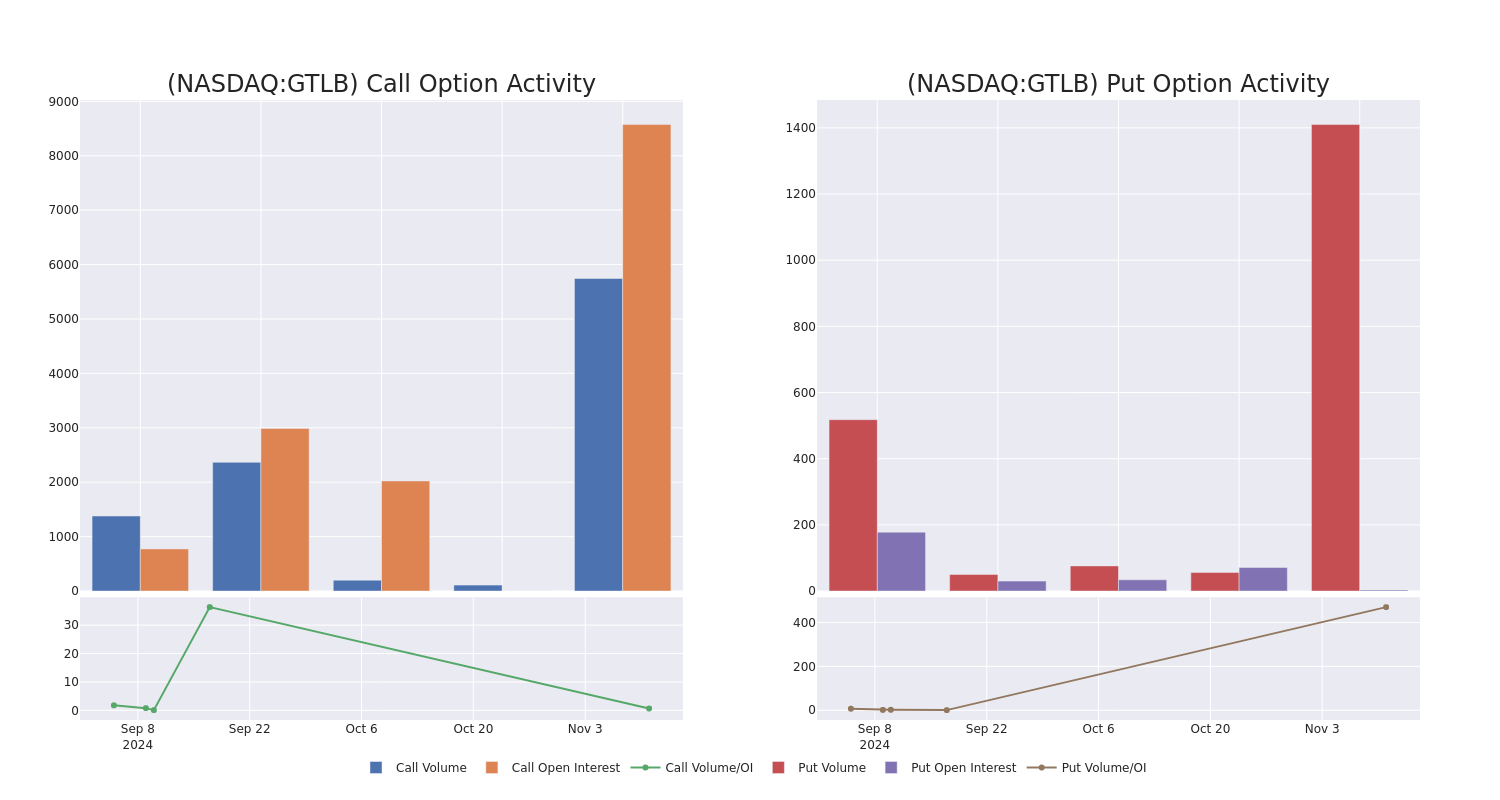

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for GitLab’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across GitLab’s significant trades, within a strike price range of $55.0 to $65.0, over the past month.

GitLab Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GTLB | CALL | SWEEP | BEARISH | 11/15/24 | $7.1 | $6.9 | $6.9 | $55.00 | $165.6K | 2.5K | 758 |

| GTLB | CALL | SWEEP | BULLISH | 11/15/24 | $6.8 | $5.9 | $6.1 | $55.00 | $67.7K | 2.5K | 980 |

| GTLB | PUT | SWEEP | BEARISH | 11/29/24 | $0.7 | $0.3 | $0.35 | $55.00 | $49.2K | 3 | 1.4K |

| GTLB | CALL | SWEEP | BULLISH | 11/15/24 | $6.9 | $6.9 | $6.9 | $55.00 | $46.9K | 2.5K | 853 |

| GTLB | CALL | TRADE | BEARISH | 11/15/24 | $6.1 | $5.4 | $5.4 | $55.00 | $43.7K | 2.5K | 1.1K |

About GitLab

GitLab Inc operates on an all-remote model. GitLab, a complete DevSecOps platform delivered as a single application. It operates in two competitive landscapes: DevOps point solutions and DevOps platforms. In terms of point solutions that are stitched together, GitLab’s offering is substantially different in that it is one platform, one codebase, one interface, and a unified data model that spans the entire DevSecOps lifecycle. DevOps platforms, the principal competitor is Microsoft Corporation following their acquisition of GitHub. GitLab is offered on both self-managed and software-as-a-service (SaaS) models. It is located in the United States, Europe, and Asia Pacific. It focused on accelerating innovation and broadening the distribution of its platform to companies across the world.

Current Position of GitLab

- Currently trading with a volume of 1,195,737, the GTLB’s price is up by 2.07%, now at $61.75.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 21 days.

What Analysts Are Saying About GitLab

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $60.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from DA Davidson continues to hold a Neutral rating for GitLab, targeting a price of $50.

* In a positive move, an analyst from Needham has upgraded their rating to Buy and adjusted the price target to $70.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GitLab with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump could dial back some proposed policies to avoid upsetting a roaring stock market, Wharton professor Jeremy Siegel says

-

Trump could soften his economic agenda to appease investors, Wharton’s Jeremy Siegel said.

-

That’s because Trump is “the most pro-stock market president” in history, Siegel told CNBC.

-

Bond market investors have thrown a fit over some of Trump’s proposals, Siegel added.

Donald Trump might hesitate to carry out some of his sweeping economic agenda to avoid losing the approval of stock and bond investors, Wharton professor Jeremy Siegel said on Monday. .

In an interview with CNBC, Siegel said he believed Trump would adopt a strong pro-market stance over his next term, even at the expense of some of his proposed economic policies. The top economist pointed to Trump’s eagerness to point to the stock market as a measure of success in the past as a reason he might not want to upset the roaring bull market.

“President Trump is the most pro-stock market president we have had in our history,” Siegel added. “It seems to me very unlikely that he’s going to implement policy that will be bad for the stock market.”

A reaction to some of Trump’s proposed policies, which economists believe will add to the federal deficit and stoke higher inflation, was already seen in the bond market last week. Following the election, the yield on the 10-year US Treasury spiked past 4.4%, its highest level since July.

Though yields have pulled back and stabilized since, Siegel said it’s a sign that bond investors could be ready to protest any policies that pile on more government debt or fuel inflation.

It could also be a sign investors are concerned over the potential for higher inflation, and are anticipating higher interest rates from the Federal Reserve.

“I thought what happened on Wednesday after he won when those yields went up was a shot across the bow, saying, ‘Hey, you know, just watch out what you do. We’re there, and all the tax cuts you promised, we’re very skeptical,'” Siegel said. “Both the bond market and the stock market are going to be really big constraints on many of Trump’s programs.”

With a Republican-led Congress, Trump’s proposal to extend his 2017 tax cut package looks like a “slam dunk,” Siegel noted, though he said anticipated challenges to Trump’s other proposed tax cuts. If Trump were to implement all of his proposed cuts, yields could end up rising past 5%, Siegel predicted.

“So I think the trend of higher long-term rates is going to be with us,” he added.

Sigel added that the former president is also unlikely to wrest control from the Federal Reserve. Though Trump was reported to be making plans to exert more influence over the central bank’s policy decisions, the move would probably prove unpopular with markets.

Yalla Group Limited Announces Unaudited Third Quarter 2024 Financial Results

DUBAI, UAE, Nov. 11, 2024 /PRNewswire/ — Yalla Group Limited (“Yalla” or the “Company”) YALA, the largest Middle East and North Africa (MENA)-based online social networking and gaming company, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial and Operating Highlights

- Revenues were US$88.9 million in the third quarter of 2024, representing an increase of 4.4% from the third quarter of 2023.

- Revenues generated from chatting services in the third quarter of 2024 were US$58.5 million.

- Revenues generated from games services in the third quarter of 2024 were US$30.2 million.

- Net income was US$39.2 million in the third quarter of 2024, an 11.2% increase from US$35.2 million in the third quarter of 2023. Net margin[1] was 44.1% in the third quarter of 2024.

- Non-GAAP net income[2] was US$42.6 million in the third quarter of 2024, an 11.3% increase from US$38.3 million in the third quarter of 2023. Non-GAAP net margin[3] was 47.9% in the third quarter of 2024.

- Average MAUs[4] increased by 14.5% to 40.2 million in the third quarter of 2024 from 35.1 million in the third quarter of 2023.

- The number of paying users[5] on our platform increased by 12.0% to 12.6 million in the third quarter of 2024 from 11.2 million in the third quarter of 2023.

|

[1] Net margin is net income as a percentage of revenues. [2] Non-GAAP net income represents net income excluding share-based compensation. Non-GAAP net income is a non-GAAP financial measure. See the sections entitled “Non-GAAP Financial Measures” and “Reconciliations of GAAP and Non-GAAP Results” for more information about the non-GAAP measures referred to in this press release. [3] Non-GAAP net margin is non-GAAP net income as a percentage of revenues. [4] “Average MAUs” refers to the average monthly active users in a given period calculated by dividing (i) the sum of active users for each month of such period, by (ii) the number of months in such period. “Active users” refers to registered users who accessed any of our main mobile applications at least once during a given period. Yalla, Yalla Ludo, Yalla Parchis, YallaChat, 101 Okey Yalla and WeMuslim have been our main mobile applications for the periods presented herein; and Ludo Royal has been our main mobile application since the third quarter of 2023. [5] “Paying users” refers to registered users who played a game or purchased our virtual items or upgrade services using virtual currencies on our main mobile applications at least once in a given period, except for users who received all of their virtual currencies directly or indirectly from us for free; YallaChat does not involve the usage of virtual currencies, and the metrics of “paying users” and “ARPPU” do not reflect user activities on YallaChat. “Registered users” refers to users who have registered accounts on our main mobile applications as of a given time; a registered user is not necessarily a unique user, as an individual may register multiple accounts on our main mobile applications. |

|

Key Operating Data |

For the three months ended |

||||||

|

September 30, 2023 |

September 30, 2024 |

||||||

|

Average MAUs (in thousands) |

35,096 |

40,176 |

|||||

|

Paying users (in thousands) |

11,236 |

12,582 |

|||||

“We are thrilled to report robust third quarter results, marked by record-setting revenues and enhanced profitability,” said Mr. Yang Tao, Founder, Chairman and CEO of Yalla. “Our revenues rose to US$88.9 million, beating the upper end of our guidance, while net income increased by 11.2% year-over-year to US$39.2 million. We also drove a 14.5% year-over-year increase in average MAUs to 40.2 million and a 12% year-over-year increase in our group’s paying users to 12.6 million. This impressive performance was fueled by our dedication to enhancing localization with new gamification features and targeted gaming events, as well as our ongoing efforts to refine operational processes, optimize user acquisition and further develop our product ecosystem.”

“Furthermore, we continued to explore and invest in Yalla Game, with a strategic focus on new game development. We are on track to test our self-developed mid-core games by year-end. We are confident that our experience in casual games and commitment to user experience and product excellence will enable us to deliver high-quality games and grow our presence in this thriving market. As MENA’s leader in online social networking and gaming, we will continue providing high-quality products and services to our users while playing an active role in the region’s digital transformation.” Mr. Yang concluded.

Ms. Karen Hu, CFO of Yalla, commented, “During the third quarter of 2024, strong execution of our high-quality growth strategies led to record-high revenues. We also continued to boost efficiency and operating leverage. As a result, we enhanced our profitability with expanded net margin of 44.1%, and excluding share-based compensation, non-GAAP net margin of 47.9%. Our fundamentals remain solid, strongly supporting our current business operations as well as our investments in future development. Looking ahead, we will continue to pursue healthy, sustainable growth, creating long-term value for our stakeholders.”

Third Quarter 2024 Financial Results

Revenues

Our revenues were US$88.9 million in the third quarter of 2024, a 4.4% increase from US$85.2 million in the third quarter of 2023. The increase was primarily driven by our broadening user base and enhanced monetization capability. Our average MAUs increased by 14.5% to 40.2 million in the third quarter of 2024 from 35.1 million in the third quarter of 2023. Our solid revenue growth was also partially attributable to the significant increase in the number of paying users, which grew to 12.6 million in the third quarter of 2024 from 11.2 million in the third quarter of 2023.

In the third quarter of 2024, our revenues generated from chatting services were US$58.5 million, and revenues from games services were US$30.2 million.

Costs and expenses

Our total costs and expenses were US$56.4 million in the third quarter of 2024, a 6.9 % increase from US$52.8 million in the third quarter of 2023.

Our cost of revenues was US$31.8 million in the third quarter of 2024, a 14.6 % increase from US$27.8 million in the same period last year, primarily due to higher commission fees paid to third-party payment platforms as a result of increasing revenues generated. Cost of revenues as a percentage of our total revenues increased to 35.8% in the third quarter of 2024 from 32.6% in the third quarter of 2023.

Our selling and marketing expenses were US$7.4 million in the third quarter of 2024, a 34.9% decrease from US$11.3 million in the same period last year, primarily driven by our more disciplined advertising and promotion approach. Selling and marketing expenses as a percentage of our total revenues decreased to 8.3% in the third quarter of 2024 from 13.3% in the third quarter of 2023.

Our general and administrative expenses were US$10.1 million in the third quarter of 2024, a 38.3% increase from US$7.3 million in the same period last year, primarily due to an increase in incentive compensation. General and administrative expenses as a percentage of our total revenues increased to 11.4% in the third quarter of 2024 from 8.6% in the third quarter of 2023.

Our technology and product development expenses were US$7.1 million in the third quarter of 2024, an 11.1% increase from US$6.4 million in the same period of last year, primarily due to an increase in salaries and benefits for our technology and product development staff. Technology and product development expenses as a percentage of our total revenues increased to 8.0% in the third quarter of 2024 from 7.5% in the third quarter of 2023.

Operating income

Operating income remained relatively stable at US$32.5 million in the third quarter of 2024.

Non-GAAP operating income[6]

Non-GAAP operating income in the third quarter of 2024 was US$35.9 million, a 1.4% increase from US$35.4 million in the same period last year.

Interest income

Interest income was US$7.8 million in the third quarter of 2024, compared with US$5.6 million in the third quarter of 2023, primarily due to an increase in interest rates applicable to the Company’s bank deposits.

Income tax expense

Income tax expense was US$1.29 million in the third quarter of 2024, compared with US$0.71 million in the third quarter of 2023. The increase was primarily due to the introduction and implementation of the UAE Corporate Tax Law, which is effective for the financial years starting on or after June 1, 2023.

Net income

As a result of the foregoing, our net income was US$39.2 million in the third quarter of 2024, an 11.2% increase from US$35.2 million in the third quarter of 2023.

Non-GAAP net income

Non-GAAP net income in the third quarter of 2024 was US$42.6 million, an 11.3% increase from US$38.3 million in the same period last year.

Earnings per ordinary share

Basic and diluted earnings per ordinary share were US$0.25 and US$0.22, respectively, in the third quarter of 2024, while basic and diluted earnings per ordinary share were US$0.23 and US$0.20, respectively, in the same period of 2023.

Non-GAAP earnings per ordinary share[7]

Non-GAAP basic and diluted earnings per ordinary share were US$0.27 and US$0.24, respectively, in the third quarter of 2024, compared with US$0.24 and US$0.21, respectively, in the same period of 2023.

Cash and cash equivalents, restricted cash, term deposits and short-term investments

As of September 30, 2024, we had cash and cash equivalents, restricted cash, term deposits and short-term investments of US$570.1 million, compared with US$535.7 million as of December 31, 2023.

Share Repurchase Program

Pursuant to the Company’s share repurchase program beginning on May 21, 2021, with an extended expiration date of May 21, 2025, in the third quarter of 2024, the Company repurchased 1,736,383 American depositary shares (“ADSs”), representing 1,736,383 Class A ordinary shares from the open market with cash for an aggregate amount of approximately US$7.0 million. Cumulatively, the Company had completed cash repurchases in the open market of 5,709,259 ADSs, representing 5,709,259 Class A ordinary shares, for an aggregate amount of approximately US$42.5 million, as of September 30, 2024. The aggregate value of ADSs and/or Class A ordinary shares that remain available for purchase under the current share repurchase program was US$107.5 million as of September 30, 2024.

Outlook

For the fourth quarter of 2024, Yalla currently expects revenues to be between US$77.0 million and US$84.0 million.

The above outlook is based on current market conditions and reflects the Company management’s current and preliminary estimates of market and operating conditions and customer demand, which are all subject to change.

|

[6] Non-GAAP operating income represents operating income excluding share-based compensation. Non-GAAP operating income is a non-GAAP financial measure. See the sections entitled “Non-GAAP Financial Measures” and “Reconciliations of GAAP and Non-GAAP Results” for more information about the non-GAAP measures referred to in this press release. [7] Non-GAAP earnings per ordinary share is non-GAAP net income attributable to Yalla Group Limited’s shareholders, divided by weighted average number of basic and diluted shares outstanding. Non-GAAP net income attributable to Yalla Group Limited’s shareholders represents net income attributable to Yalla Group Limited’s shareholders, excluding share-based compensation. Non-GAAP earnings per ordinary share and non-GAAP net income attributable to Yalla Group Limited’s shareholders are non-GAAP financial measures. See the sections entitled “Non-GAAP Financial Measures” and “Reconciliations of GAAP and Non-GAAP Results” for more information about the non-GAAP measures referred to in this press release. |

Conference Call

The Company’s management will host an earnings conference call on Monday, November 11, 2024, at 8:00 PM U.S. Eastern Time, Tuesday, November 12, 2024, at 5:00 AM Dubai Time, or Tuesday, November 12, 2024, at 9:00 AM Beijing/Hong Kong time.

Dial-in details for the earnings conference call are as follows:

|

United States Toll Free: |

+1-888-317-6003 |

|

International: |

+1-412-317-6061 |

|

United Arab Emirates Toll Free: |

80-003-570-3589 |

|

Mainland China Toll Free: |

400-120-6115 |

|

Hong Kong, China Toll Free: |

800-963-976 |

|

Access Code: |

5810867 |

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.yalla.com.

A replay of the conference call will be accessible until November 18, 2024, by dialing the following telephone numbers:

|

United States Toll Free: |

+1-877-344-7529 |

|

International: |

+1-412-317-0088 |

|

Access Code: |

5806791 |

Non-GAAP Financial Measures

To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States, or GAAP, this press release presents non-GAAP financial measures, namely non-GAAP operating income, non-GAAP net income, non-GAAP net margin and non-GAAP basic and diluted earnings per ordinary share, as supplemental measures to review and assess the Company’s operating performance. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We define non-GAAP operating income as operating income excluding share-based compensation. We define non-GAAP net income as net income excluding share-based compensation. We define non-GAAP net margin as non-GAAP net income as a percentage of revenues. We define non-GAAP net income attributable to Yalla Group Limited’s shareholders as net income attributable to Yalla Group Limited’s shareholders, excluding share-based compensation. We define non-GAAP earnings per ordinary share as non-GAAP net income attributable to Yalla Group Limited’s shareholders, divided by the weighted average number of basic and diluted shares outstanding.