Talos Energy Announces Third Quarter 2024 Operational and Financial Results

HOUSTON, Nov. 11, 2024 /PRNewswire/ — Talos Energy Inc. (“Talos” or the “Company”) TALO today announced its operational and financial results for fiscal quarter ended September 30, 2024.

Recent Key Highlights

- Production of 96.5 thousand barrels of oil equivalent per day (“MBoe/d”) (70% oil, 80% liquids), at the high-end of third quarter 2024 guidance range.

- Reduced debt by $100 million, bringing leverage to 0.9x*.

- Commenced drilling at the high-impact Katmai West #2 well in the Gulf of Mexico to further appraise the field, potentially adding additional proved reserves over the initial discovery well in the west fault block, Katmai West #1 well.

- Discovered commercial quantities of oil and natural gas at the Ewing Bank 953 well, with first production expected in mid-2026.

- Purchased a 21.4% non-operated working interest (“W.I.”) in the Monument discovery located in the Walker Ridge area in the Gulf of Mexico.

- Re-completed the 100% Talos-owned Brutus A3 well yielding a peak production rate of over 30 million cubic feet per day (“MMcf/d”).

- Improved 2024 production guidance with revised estimate of 91.0 – 94.0 Mboe/d and lowered 2024 capital expenditures guidance to $510 – $530 million.

Third Quarter Summary

- Revenue of $509.3 million, driven by realized prices (excluding hedges) of $74.72 per barrel for oil, $19.42 per barrel for natural gas liquids (“NGLs”), and $2.39 per thousand cubic feet (“Mcf”) for natural gas.

- Net Income of $88.2 million, or $0.49 Net Income per diluted share, and Adjusted Net Loss* of $25.6 million, or $0.14 Adjusted Net Loss per diluted share*.

- Adjusted EBITDA* of $324.4 million.

- Capital expenditures of $118.9 million, excluding plugging and abandonment and settled decommissioning obligations.

- Net cash provided by operating activities of $227.0 million.

- Adjusted Free Cash Flow* of $121.5 million.

Talos Interim President and Chief Executive Officer Joseph Mills stated, “For the third quarter 2024, we are proud to report that we achieved another consecutive quarter of record production of 96.5 MBoe/d, along with strong Adjusted EBITDA and Adjusted Free Cash Flow. This is a testament to our team’s focus on delivering results. Our solid cash flow generation enabled us to continue making strides in reducing our debt and attain 0.9x leverage, below our target leverage of 1.0x. We remain focused on paying down the balance of our debt under the Bank Credit Facility by year end 2024. Since closing the QuarterNorth acquisition in March 2024, we have repaid $425 million of debt, demonstrating our focus on maintaining a strong balance sheet and financial flexibility.

“Regarding our drilling and recompletion program, we are pleased with the results of the re-completion at the 100% Talos-owned Brutus A3 well in July 2024, which yielded a peak production rate of over 30 MMcf/d during the third quarter. We are also pleased about the previously announced Ewing Bank 953 well results in September 2024 and the acquired non-operated stake in the Monument deepwater discovery in August 2024. We logged better than expected rock properties at our Ewing Bank 953 well, which we anticipate will be producing by mid-2026. Our participation in the non-operated Monument project, a large deepwater oil and gas discovery in the Wilcox trend, presents an attractive post-FID subsea tie-back opportunity, including a potential drilling opportunity beyond the appraised discovery.

“Additionally, we recently began drilling the first of three consecutive high-impact subsalt wells utilizing the West Vela deepwater drillship, starting with the Katmai West #2 appraisal well in October 2024, to be followed by the Daenerys and Helm’s Deep prospects in 2025. We are placing a strong emphasis on operational execution and capital discipline as we embark on a very important drilling campaign.

“I’m honored to have stepped in as interim CEO of Talos at the beginning of September 2024, allowing me the opportunity to work more closely with our highly skilled and talented employees to achieve these results. The Board, in partnership with an external search firm, is diligently searching for a new CEO who can build on Talos’s strong foundation and lead the Company into its next phase of growth. I have the utmost confidence in our management team, Board, and the future direction and strategy of the Company. Talos’s management team and Board are laser-focused on executing our strategic initiatives and maximizing long-term stockholder value. I’m pleased to be here to ensure a seamless transition until a permanent CEO is named.”

Footnotes:

|

*See “Supplemental Non-GAAP Information” for details and reconciliations of GAAP to non-GAAP financial measures. |

RECENT DEVELOPMENTS AND OPERATIONS UPDATE

Production Updates:

Katmai: In October 2024, the Seadrill-owned drillship West Vela commenced drilling the Katmai West #2 well which will further appraise the field, potentially adding additional proved reserves. The well is expected to reach total depth early in the first quarter 2025. In preparation of the completion of Katmai West #2 well, modifications to the host facility, Tarantula, have been completed between October and November 2024, and has increased capacity from 27 MBoe/d to 35 MBoe/d. Talos projects achieving first production from the Katmai West #2 well in the second quarter 2025. We anticipate the Katmai wells will be rate-constrained under the upgraded capacity allowing for extended flat-to-low decline production from the facility. Talos holds a 50% W.I. and Ridgewood Energy holds a 50% W.I. in Katmai. Talos is the 100% owner and operator of the Tarantula facility.

Sunspear Completion: In October 2024, Talos secured a rig contract for Transocean’s Deepwater Conqueror to complete the Sunspear discovery. The Sunspear well, successfully drilled in July 2023, is expected to commence first production during the second quarter 2025, with production flowing to the Talos operated Prince platform. The initial gross production rate is estimated to be between 8 – 10 Mboe/d. Talos holds a 48.0% W.I., an entity managed by Ridgewood Energy Corporation holds a 47.5% W.I., and Houston Energy holds a 4.5% W.I.

Brutus Re-completion: In July 2024, the 100% Talos-owned Brutus A-3 well was re-completed to the E1/E2 sand, yielding higher rates than expected, and reached a peak production rate of over 30 million cubic feet per day.

Exploitation and Exploration Updates:

Ewing Bank 953: In September 2024, Ewing Bank 953 well encountered approximately 127 feet of net pay in the target sand at approximately 19,000 feet true vertical depth. Preliminary data indicates an estimated gross recoverable resource potential of approximately 15 – 25 million barrels of oil equivalent (“MMBoe”) from a single subsea well with an initial gross production rate of 8 – 10 MBoe/d. First production is expected in mid-2026. Current plans are for the well to be tied back to the South Timbalier 311 Megalodon host platform, which Talos partially owns. Talos holds a 33.3% W.I., with Walter Oil & Gas Corp. as operator holding a 56.7% W.I. and Gordy Oil Company holding a 10.0% W.I.

Monument Discovery: In August 2024, Talos acquired a 21.4% W.I. in Monument, a large Wilcox oil discovery located in Walker Ridge blocks 271, 272, 315, and 316, for a purchase price of $32 million. Monument will be developed as a subsea tie-back to the Shenandoah production facility in Walker Ridge. The Monument discovery is post-FID with appraised proved plus probable gross reserves of approximately 115 million barrels of oil equivalent. First production is expected between 20 – 30 MBoe/d gross by late 2026 under restricted flow due to facility rate-constraints. The proved and probable PV-10 of Monument’s reserves is valued at approximately $265 million(1). There is an additional 25 – 35 MMBoe drilling location adjacent to the discovery that could extend the resource. Talos expects a net investment of approximately $25 million in 2024 and approximately $160 million over 2025 and 2026. Other partners include Beacon as operator with a 30.0% W.I., Navitas Petroleum with a 28.6% W.I., and Repsol E&P USA Inc. with a 20.0% W.I.

Daenerys: Talos expects to utilize the West Vela drillship to drill the Daenerys exploration well following the Katmai West #2 well. The Daenerys well is a high-impact subsalt project that will evaluate the regionally prolific Middle and Lower Miocene section and carries an estimated gross resource potential between 100 – 300 MMBoe. The prospect is part of a broader farm-in transaction executed in 2023 that totals approximately 23,000 gross acres in the Walker Ridge area. The well is expected to spud in the first quarter 2025. Talos holds a 27% W.I. and partners include Red Willow, Houston Energy, and Cathexis.

Helm’s Deep: Talos plans to mobilize the West Vela drillship to Helms Deep after completing drilling operations at Daenerys. The West Vela is expected to commence drilling at Helms Deep, an amplitude-supported, near-infrastructure subsalt Pliocene exploitation well, in the third quarter 2025. The Helms Deep well has a proposed depth of approximately 18,000 feet and an estimated gross resource potential between 17 – 27 MMBoe. Talos is targeting a 50.0% W.I.

Sebastian: Drilling of the Sebastian prospect in the third quarter 2024 encountered non-commercial quantities of hydrocarbons and has been plugged and abandoned. Talos held a 25.0% W.I., with Murphy Oil Corporation as operator holding a 26.8% W.I., Westlawn Americas Offshore a 18.2% W.I, Alta Mar Energy holding a 20.0% W.I., and Houston Energy holding a 10.0% W.I.

Other Business Developments

Common Stock Repurchase Program: Year-to-date 2024, Talos repurchased approximately 4.0 million shares of common stock for approximately $45.1 million. As of September 30, 2024, there is $157.5 million remaining under the authorized plan. The timing of future repurchases under the share repurchase program will depend on market conditions, contractual limitations, and other considerations. The program may be extended, modified, suspended or discontinued at any time, and does not obligate the Company to repurchase any dollar amount or number of shares.

Limited Duration Stockholder Rights Plan: In October 2024, Talos’s Board adopted a limited duration stockholder rights Plan (the “Rights Plan”). The Board adopted the Rights Plan solely in response to the continued accumulation of approximately 24% of shares of Talos common stock by Control Empresarial De Capitales (“Control Empresarial”). The Rights Plan is similar to those adopted by other publicly traded companies and is intended to enable all Talos stockholders to realize the long-term value of their investment and protect Talos from any future efforts to obtain control of Talos that are inconsistent with the best interests of its stockholders. Control Empresarial has been an important Talos stockholder and Talos will continue to maintain an active and constructive dialogue with Control Empresarial.

Audit Committee Internal Review: In September 2024, the Company received notification from an external third party suggesting a mid-level employee was engaged in inappropriate procurement practices. In response, the Audit Committee of the Company’s board of directors, conducted a review of such alleged practices by engaging independent external legal counsel to assist in reviewing the matter and determining the extent of such activities. Such review with external legal counsel did not identify or implicate other current or former employees and the employee was separated from the Company. The Audit Committee also has not identified any related material errors in the historical financial statements.

Talos plans to file an amended Form 10-K/A to our Annual Report on Form 10-K for the year ended December 31, 2023 (our “Annual Report”), and an amended Form 10-Q/A for each of the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, and June 30, 2024, (together, our “Quarterly Reports”), respectively, to amend and restate certain disclosures. These amended disclosures will address the material weaknesses identified at the end of 2023 in our internal controls over our financial reporting practices and investors can continue to rely on numbers previously disclosed. Notwithstanding the identified material weakness, management has concluded that the financial statements included in our Annual Report and Quarterly reports present fairly, in all material respects, the Company’s financial position, results of operations and cash flows as of the dates, and for the periods presented, in accordance with GAAP. The Company expects to file these amendments and the Quarterly Report on Form 10-Q for the quarter end September 30, 2024, on November 12, 2024.

|

(1) Proved and probable reserves are estimated by Netherland, Sewell & Associates, Inc. (‘NSAI”). PV-10 utilizes SEC pricing of $78.21 / BBL WTI and $2.64 per MCF per MMBTU. |

THIRD QUARTER 2024 RESULTS

Key Financial Highlights:

|

($ thousands, except per share and per Boe amounts) |

Three Months Ended |

||

|

Total revenues |

$ |

509,286 |

|

|

Net Income (Loss) |

$ |

88,173 |

|

|

Net Income (Loss) per diluted share |

$ |

0.49 |

|

|

Adjusted Net Income (Loss)* |

$ |

(25,583) |

|

|

Adjusted Net Income (Loss) per diluted share* |

$ |

(0.14) |

|

|

Adjusted EBITDA* |

$ |

324,359 |

|

|

Adjusted EBITDA excluding hedges* |

$ |

318,288 |

|

|

Capital Expenditures |

$ |

118,922 |

|

Production

Production for the third quarter 2024 was 96.5 MBoe/d and was 70% oil and 80% liquids.

|

Three Months Ended |

|||

|

Oil (MBbl/d) |

68.0 |

||

|

Natural Gas (MMcf/d) |

118.0 |

||

|

NGL (MBbl/d) |

8.8 |

||

|

Total average net daily (MBoe/d) |

96.5 |

||

|

Three Months Ended September 30, 2024 |

||||||||||||

|

Production |

% Oil |

% Liquids |

% Operated |

|||||||||

|

Green Canyon Area |

39.7 |

71 |

% |

81 |

% |

54 |

% |

|||||

|

Mississippi Canyon Area |

44.7 |

75 |

% |

84 |

% |

77 |

% |

|||||

|

Shelf and Gulf Coast |

12.1 |

51 |

% |

60 |

% |

59 |

% |

|||||

|

Total average net daily (MBoe/d) |

96.5 |

70 |

% |

80 |

% |

65 |

% |

|||||

|

Three Months Ended |

|||

|

Average realized prices (excluding hedges) |

|||

|

Oil ($/Bbl) |

$ |

74.72 |

|

|

Natural Gas ($/Mcf) |

$ |

2.39 |

|

|

NGL ($/Bbl) |

$ |

19.42 |

|

|

Average realized price ($/Boe) |

$ |

57.37 |

|

|

Average NYMEX prices |

|||

|

WTI ($/Bbl) |

$ |

75.10 |

|

|

Henry Hub ($/MMBtu) |

$ |

2.23 |

|

Lease Operating & General and Administrative Expenses

Total lease operating expenses for the third quarter 2024, inclusive of workover, maintenance and insurance costs, were $163.3 million, or $18.40 per Boe. Excluding workover expenses, total lease operating expenses were $134.1 million, or $15.10 per Boe. Total lease operating expenses inclusive of workover does not include $14 million of service credit related to workover expenses incurred in the same quarter.

Adjusted General and Administrative expenses for the third quarter, adjusted to exclude one-time transaction-related costs and non-cash equity-based compensation, were $32.9 million, or $3.70 per Boe.

|

($ thousands, except per Boe amounts) |

Three Months Ended |

||

|

Lease Operating Expenses |

$ |

163,347 |

|

|

Lease Operating Expenses per Boe |

$ |

18.40 |

|

|

Lease Operating Expenses excluding workover |

$ |

134,054 |

|

|

Lease Operating Expenses excluding workover per Boe |

$ |

15.10 |

|

|

Adjusted General & Administrative Expenses* |

$ |

32,855 |

|

|

Adjusted General & Administrative Expenses per Boe* |

$ |

3.70 |

|

Capital Expenditures

Capital expenditures for the third quarter 2024, excluding plugging and abandonment and settled decommissioning obligations, totaled $118.9 million.

|

($ thousands) |

Three Months Ended |

||

|

U.S. drilling & completions |

$ |

69,974 |

|

|

Asset management(1) |

34,326 |

||

|

Seismic and G&G, land, capitalized G&A and other |

14,622 |

||

|

Total Capital Expenditures |

$ |

118,922 |

|

|

___________________ |

|

(1) Asset management consists of capital expenditures for development-related activities primarily associated with recompletions and improvements to our facilities and infrastructure. |

Plugging & Abandonment Expenses

Capital expenditures for plugging and abandonment and settled decommissioning obligations for the third quarter 2024 totaled $37.7 million.

|

Three Months Ended |

|||

|

Plugging & Abandonment and Decommissioning Obligations Settled(1) |

$ |

37,713 |

|

|

___________________ |

|

(1) Settlement of decommissioning obligations as a result of working interest partners or counterparties of divestiture transactions that were unable to perform the required abandonment obligations due to bankruptcy or insolvency. |

Liquidity and Leverage

At September 30, 2024, Talos had approximately $842.9 million of liquidity, with $840.0 million undrawn on its credit facility and approximately $45.5 million in cash, less approximately $42.7 million in outstanding letters of credit. On September 30, 2024, Talos had $1,375.0 million in total debt. Net Debt* was $1,329.5 million. Net Debt to Pro Forma Last Twelve Months (“LTM”) Adjusted EBITDA* was 0.9x.

OPERATIONAL & FINANCIAL GUIDANCE UPDATES

Talos provided the following updates to it previously issued 2024 operational and financial guidance:

- Improved average daily production guidance to 91.0 – 94.0 MBoe/d (71% oil) for the full year 2024.

- Cash Operating Expenses and Workovers guidance of $555 – $585 million, inclusive of a $14 million service credit recognized in the third quarter 2024, which was previously held as an asset on Talos’s balance sheet.

- Total General & Administrative expenses, including both expense and capitalized costs, remains in line with prior guidance. Talos increased its G&A Expense range to $120 – $130 million to reflect a higher expense ratio, with offsetting savings recognized in capital expenditures guidance. The increased range also accounts for various other one-time expenses.

- Capital Expenditures guidance was reduced significantly to $510 – $530 million, reflecting updated project timing and capitalized G&A cost reductions.

- P&A, Decommissioning range increased to $100 – $110 to reflect the acceleration of selected non-operated activities into 2024 from previously planned 2025.

- Interest Expense guidance of $175 – $185 million, excluding a $4.9 million one-time fee recognized earlier in 2024 as part of the QuarterNorth transaction financings.

- Talos expects to maintain a long-term leverage ratio below 1.0x.

The following summarizes Talos’s updated disclosed full-year 2024 operational and production guidance.

|

Original |

Revised |

||||||||||||

|

FY 2024 |

FY 2024 |

||||||||||||

|

($ Millions, unless highlighted): |

Low |

High |

Low |

High |

|||||||||

|

Production |

Oil (MMBbl) |

23.4 |

24.7 |

23.6 |

24.4 |

||||||||

|

Natural Gas (Mcf) |

40.0 |

44.2 |

40.5 |

41.8 |

|||||||||

|

NGL (MMBbl) |

2.5 |

2.7 |

2.9 |

3.0 |

|||||||||

|

Total Production (MMBoe) |

32.6 |

34.8 |

33.3 |

34.4 |

|||||||||

|

Avg Daily Production (MBoe/d) |

89.0 |

95.0 |

91.0 |

94.0 |

|||||||||

|

Cash Expenses |

Cash Operating Expenses and Workovers(1)(2)(4)* |

$ |

555 |

$ |

585 |

$ |

555 |

$ |

585 |

||||

|

G&A(2)(3)* |

$ |

100 |

$ |

110 |

$ |

120 |

$ |

130 |

|||||

|

Capex |

Capital Expenditures(5) |

$ |

570 |

$ |

600 |

$ |

510 |

$ |

530 |

||||

|

P&A Expenditures |

P&A, Decommissioning |

$ |

90 |

$ |

100 |

$ |

100 |

$ |

110 |

||||

|

Interest |

Interest Expense(6) |

$ |

175 |

$ |

185 |

$ |

175 |

$ |

185 |

||||

|

(1) Includes Lease Operating Expenses and Maintenance. |

|

(2) Includes insurance costs. |

|

(3) Excludes non-cash equity-based compensation and transaction and other expenses. |

|

(4) Includes reimbursements under production handling agreements. |

|

(5) Excludes acquisitions. |

|

(6) Includes cash interest expense on debt and finance lease, surety charges and amortization of deferred financing costs and original issue discounts. |

|

*Due to the forward-looking nature a reconciliation of Cash Operating Expenses and G&A to the most directly comparable GAAP measure could not be reconciled without unreasonable efforts. |

HEDGES

The following table reflects contracted volumes and weighted average prices the Company will receive under the terms of its derivative contracts as of November 6, 2024. The table includes derivative instruments assumed as part of the QuarterNorth acquisition:

|

Instrument Type |

Avg. Daily |

W.A. Swap |

W.A. Sub-Floor |

W.A. Floor |

W.A. Ceiling |

|||||||||||

|

Crude – WTI |

(Bbls) |

(Per Bbl) |

(Per Bbl) |

(Per Bbl) |

(Per Bbl) |

|||||||||||

|

October – December 2024 |

Fixed Swaps |

38,674 |

$ |

76.07 |

— |

— |

— |

|||||||||

|

Collar |

1,000 |

— |

— |

$ |

70.00 |

$ |

75.00 |

|||||||||

|

Long Puts |

4,000 |

— |

— |

$ |

70.00 |

— |

||||||||||

|

Short Puts |

1,000 |

— |

$ |

60.00 |

— |

— |

||||||||||

|

January – March 2025 |

Fixed Swaps |

32,000 |

$ |

72.52 |

— |

— |

— |

|||||||||

|

Collar |

3,000 |

— |

— |

$ |

65.00 |

$ |

84.35 |

|||||||||

|

April – June 2025 |

Fixed Swaps |

33,000 |

$ |

73.53 |

— |

— |

— |

|||||||||

|

July – September 2025 |

Fixed Swaps |

20,685 |

$ |

71.81 |

— |

— |

— |

|||||||||

|

October – December 2025 |

Fixed Swaps |

14,000 |

$ |

73.93 |

— |

— |

— |

|||||||||

|

Natural Gas – HH NYMEX |

(MMBtu) |

(Per MMBtu) |

(Per MMBtu) |

(Per MMBtu) |

(Per MMBtu) |

|||||||||||

|

October – December 2024 |

Fixed Swaps |

35,000 |

$ |

2.85 |

— |

— |

— |

|||||||||

|

Collar |

10,000 |

— |

— |

$ |

4.00 |

$ |

6.90 |

|||||||||

|

Long Puts |

13,660 |

— |

— |

$ |

2.90 |

— |

||||||||||

|

January – March 2025 |

Fixed Swaps |

75,000 |

$ |

3.61 |

— |

— |

— |

|||||||||

|

April – June 2025 |

Fixed Swaps |

65,000 |

$ |

3.38 |

— |

— |

— |

|||||||||

|

July – September 2025 |

Fixed Swaps |

50,000 |

$ |

3.47 |

— |

— |

— |

|||||||||

|

October – December 2025 |

Fixed Swaps |

40,000 |

$ |

3.53 |

— |

— |

— |

|||||||||

|

January – March 2026 |

Fixed Swaps |

20,000 |

$ |

3.65 |

— |

— |

— |

|||||||||

|

April – June 2026 |

Fixed Swaps |

20,000 |

$ |

3.65 |

— |

— |

— |

|||||||||

|

July – September 2026 |

Fixed Swaps |

20,000 |

$ |

3.65 |

— |

— |

— |

|||||||||

|

October – December 2026 |

Fixed Swaps |

20,000 |

$ |

3.65 |

— |

— |

— |

|||||||||

CONFERENCE CALL AND WEBCAST INFORMATION

Talos will host a conference call, which will be broadcast live over the internet, on Tuesday, November 12, 2024 at 8:30 AM Eastern Time (7:30 AM Central Time). Listeners can access the conference call through a webcast link on the Company’s website at: https://www.talosenergy.com/investor-relations/events-calendar/default.aspx. Alternatively, the conference call can be accessed by dialing (800) 836-8184 (North American toll-free) or (646) 357-8785 (international). Please dial in approximately 15 minutes before the teleconference is scheduled to begin and ask to be joined into the Talos Energy call. A replay of the call will be available one hour after the conclusion of the conference until November 19, 2024 and can be accessed by dialing (888) 660-6345 and using access code 05203#. For more information, please refer to the Third Quarter 2024 Earnings Presentation available under Presentations and Filings on the Investor Relations section of Talos’s website.

ABOUT TALOS ENERGY

Talos Energy TALO is a technically driven, innovative, independent energy company focused on maximizing long-term value through its Upstream Exploration & Production business in the United States Gulf of Mexico and offshore Mexico. We leverage decades of technical and offshore operational expertise to acquire, explore, and produce assets in key geological trends while maintaining a focus on safe and efficient operations, environmental responsibility, and community impact. For more information, visit www.talosenergy.com.

INVESTOR RELATIONS CONTACT

Clay Jeansonne

investor@talosenergy.com

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENT

The information in this communication includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact included in this communication regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this communication, the words “will,” “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “forecast,” “may,” “objective,” “plan” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements are based on our current beliefs, based on currently available information, as to the outcome and timing of future events. Forward-looking statements may include statements about: business strategy; recoverable resources and reserves; drilling prospects, inventories, projects and programs; our ability to replace the reserves that we produce through drilling and property acquisitions; financial strategy, liquidity and capital required for our development program and other capital expenditures; realized oil and natural gas prices; risks related to future mergers and acquisitions and/or to realize the expected benefits of any such transaction timing and amount of future production of oil, natural gas and NGLs; our hedging strategy and results; future drilling plans; availability of pipeline connections on economic terms; competition, government regulations, including financial assurance requirements, and legislative and political developments; our ability to obtain permits and governmental approvals, including the potential impact of the revised biological opinion by the National Marine Fisheries Service; pending legal, governmental or environmental matters; our marketing of oil, natural gas and NGLs; our integration of acquisitions and the anticipated performance of the combined company; future leasehold or business acquisitions on desired terms; costs of developing properties; general economic conditions, including the impact of continued inflation and associated changes in monetary policy; political and economic conditions and events in foreign oil, natural gas and NGL producing countries and acts of terrorism or sabotage; credit markets; volatility in the political, legal and regulatory environments in connection with the U.S. Presidential transition and Mexican presidential transition; estimates of future income taxes; our estimates and forecasts of the timing, number, profitability and other results of wells we expect to drill and other exploration activities; our ongoing strategy with respect to our Zama asset; uncertainty regarding our future operating results and our future revenues and expenses; impact of new accounting pronouncements on earnings in future periods; our expectations with regard to the Rights Agreement with Computershare Trust Company, N.A.; and plans, objectives, expectations and intentions contained in this communication that are not historical. These forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, commodity price volatility; global demand for oil and natural gas; the ability or willingness of OPEC and other state-controlled oil companies to set and maintain oil production levels and the impact of any such actions; the lack of a resolution to the war in Ukraine and increasing hostilities in the Middle East, and their impact on commodity markets; the impact of any pandemic, and governmental measures related thereto; lack of transportation and storage capacity as a result of oversupply, government and regulations; lack of availability of drilling and production equipment and services; adverse weather events, including tropical storms, hurricanes, winter storms and loop currents; cybersecurity threats; inflation and the impact of central bank policy in response thereto; environmental risks; failure to find, acquire or gain access to other discoveries and prospects or to successfully develop and produce from our current discoveries and prospects; geologic risk; drilling and other operating risks; well control risk; regulatory changes, including the impact of financial assurance requirements; changes in U.S. labor and trade policies, including the imposition of tariffs and the resulting consequences; the uncertainty inherent in estimating reserves and in projecting future rates of production; cash flow and access to capital; the timing of development expenditures; potential adverse reactions or competitive responses to our acquisitions and other transactions; the possibility that the anticipated benefits of our acquisitions are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of acquired assets and operations; recent and pending management changes, including our search for a new Chief Executive Officer and the other risks discussed in “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2023 and Part II, Item 1A. “Risk Factors” of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, each filed with the SEC. Should one or more of the risks or uncertainties described herein occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this communication.

PRODUCTION ESTIMATES

Estimates for our future production volumes are based on assumptions of capital expenditure levels and the assumption that market demand and prices for oil and gas will continue at levels that allow for economic production of these products. The production, transportation, marketing and storage of oil and gas are subject to disruption due to transportation, processing and storage availability, mechanical failure, human error, adverse weather conditions such as hurricanes, global political and macroeconomic events and numerous other factors. Our estimates are based on certain other assumptions, such as well performance, which may vary significantly from those assumed. Therefore, we can give no assurance that our future production volumes will be as estimated.

RESERVE INFORMATION

Reserve engineering is a process of estimating underground accumulations of oil, natural gas and NGLs that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify upward or downward revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil, natural gas and NGLs that are ultimately recovered. In addition, we use the terms “gross recoverable resource potential,” and “gross reserves,” in this release, which are not measures of “reserves” prepared in accordance with SEC guidelines or permitted to be included in SEC filings. These resource estimates are inherently more uncertain than estimates of proved reserves or other reserves prepared in accordance with SEC guidelines.

USE OF NON-GAAP FINANCIAL MEASURES

This release includes the use of certain measures that have not been calculated in accordance with U.S. generally acceptable accounting principles (GAAP) such as, but not limited to, EBITDA, Adjusted EBITDA, LTM Adjusted EBITDA, Pro Forma LTM Adjusted EBITDA, Net Debt, Net Debt to LTM Adjusted EBITDA, Net Debt to Pro Forma LTM Adjusted EBITDA, Adjusted Free Cash Flow and Leverage, Adjusted EBITDA excluding hedges. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Reconciliations for non-GAAP measure to GAAP measures are included at the end of this release.

|

Talos Energy Inc. Consolidated Balance Sheets (In thousands, except share amounts)

|

||||||

|

September 30, 2024 |

December 31, 2023 |

|||||

|

(Unaudited) |

||||||

|

ASSETS |

||||||

|

Current assets: |

||||||

|

Cash and cash equivalents |

$ |

45,542 |

$ |

33,637 |

||

|

Accounts receivable: |

||||||

|

Trade, net |

210,158 |

178,977 |

||||

|

Joint interest, net |

146,558 |

79,337 |

||||

|

Other, net |

36,420 |

19,296 |

||||

|

Assets from price risk management activities |

82,016 |

36,152 |

||||

|

Prepaid assets |

93,203 |

64,387 |

||||

|

Other current assets |

41,659 |

10,389 |

||||

|

Total current assets |

655,556 |

422,175 |

||||

|

Property and equipment: |

||||||

|

Proved properties |

9,622,726 |

7,906,295 |

||||

|

Unproved properties, not subject to amortization |

668,849 |

268,315 |

||||

|

Other property and equipment |

35,039 |

34,027 |

||||

|

Total property and equipment |

10,326,614 |

8,208,637 |

||||

|

Accumulated depreciation, depletion and amortization |

(4,917,311) |

(4,168,328) |

||||

|

Total property and equipment, net |

5,409,303 |

4,040,309 |

||||

|

Other long-term assets: |

||||||

|

Restricted cash |

105,403 |

102,362 |

||||

|

Assets from price risk management activities |

9,487 |

17,551 |

||||

|

Equity method investments |

109,144 |

146,049 |

||||

|

Other well equipment |

58,795 |

54,277 |

||||

|

Notes receivable, net |

17,305 |

16,207 |

||||

|

Operating lease assets |

11,858 |

11,418 |

||||

|

Other assets |

22,225 |

5,961 |

||||

|

Total assets |

$ |

6,399,076 |

$ |

4,816,309 |

||

|

LIABILITIES AND STOCKHOLDERSʼ EQUITY |

||||||

|

Current liabilities: |

||||||

|

Accounts payable |

$ |

161,506 |

$ |

84,193 |

||

|

Accrued liabilities |

307,781 |

227,690 |

||||

|

Accrued royalties |

76,426 |

55,051 |

||||

|

Current portion of long-term debt |

— |

33,060 |

||||

|

Current portion of asset retirement obligations |

55,730 |

77,581 |

||||

|

Liabilities from price risk management activities |

4,656 |

7,305 |

||||

|

Accrued interest payable |

21,049 |

42,300 |

||||

|

Current portion of operating lease liabilities |

3,933 |

2,666 |

||||

|

Other current liabilities |

46,806 |

48,769 |

||||

|

Total current liabilities |

677,887 |

578,615 |

||||

|

Long-term liabilities: |

||||||

|

Long-term debt |

1,337,745 |

992,614 |

||||

|

Asset retirement obligations |

1,134,145 |

819,645 |

||||

|

Liabilities from price risk management activities |

479 |

795 |

||||

|

Operating lease liabilities |

16,359 |

18,211 |

||||

|

Other long-term liabilities |

414,825 |

251,278 |

||||

|

Total liabilities |

3,581,440 |

2,661,158 |

||||

|

Commitments and contingencies |

||||||

|

Stockholdersʼ equity: |

||||||

|

Preferred stock; $0.01 par value; 30,000,000 shares authorized and zero shares issued or outstanding as of September 30, 2024 and December 31, 2023, respectively |

— |

— |

||||

|

Common stock; $0.01 par value; 270,000,000 shares authorized; 187,378,718 and 127,480,361 shares issued as of September 30, 2024 and December 31, 2023, respectively |

1,874 |

1,275 |

||||

|

Additional paid-in capital |

3,268,049 |

2,549,097 |

||||

|

Accumulated deficit |

(359,602) |

(347,717) |

||||

|

Treasury stock, at cost; 7,417,385 and 3,400,000 shares as of September 30, 2024 and December 31, 2023, respectively |

(92,685) |

(47,504) |

||||

|

Total stockholdersʼ equity |

2,817,636 |

2,155,151 |

||||

|

Total liabilities and stockholdersʼ equity |

$ |

6,399,076 |

$ |

4,816,309 |

||

|

Talos Energy Inc. Consolidated Statements of Operations (In thousands, except per share amounts) (Unaudited)

|

||||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||

|

Revenues: |

||||||||||||

|

Oil |

$ |

467,605 |

$ |

359,404 |

$ |

1,368,234 |

$ |

995,081 |

||||

|

Natural gas |

25,930 |

16,871 |

75,688 |

53,383 |

||||||||

|

NGL |

15,751 |

6,860 |

44,461 |

24,463 |

||||||||

|

Total revenues |

509,286 |

383,135 |

1,488,383 |

1,072,927 |

||||||||

|

Operating expenses: |

||||||||||||

|

Lease operating expense |

163,347 |

103,548 |

455,835 |

286,075 |

||||||||

|

Production taxes |

224 |

600 |

1,244 |

1,813 |

||||||||

|

Depreciation, depletion and amortization |

274,249 |

163,359 |

749,004 |

480,476 |

||||||||

|

Accretion expense |

29,418 |

21,256 |

87,053 |

63,430 |

||||||||

|

General and administrative expense |

41,866 |

24,888 |

159,954 |

121,257 |

||||||||

|

Other operating (income) expense |

(23,363) |

(57,287) |

(110,467) |

(55,172) |

||||||||

|

Total operating expenses |

485,741 |

256,364 |

1,342,623 |

897,879 |

||||||||

|

Operating income (expense) |

23,545 |

126,771 |

145,760 |

175,048 |

||||||||

|

Interest expense |

(46,275) |

(45,637) |

(146,102) |

(128,850) |

||||||||

|

Price risk management activities income (expense) |

126,291 |

(98,802) |

41,531 |

(13,668) |

||||||||

|

Equity method investment income (expense) |

(544) |

(2,493) |

(9,054) |

2,938 |

||||||||

|

Other income (expense) |

3,267 |

2,193 |

(48,465) |

10,450 |

||||||||

|

Net income (loss) before income taxes |

106,284 |

(17,968) |

(16,330) |

45,918 |

||||||||

|

Income tax benefit (expense) |

(18,111) |

15,865 |

4,445 |

55,516 |

||||||||

|

Net income (loss) |

$ |

88,173 |

$ |

(2,103) |

$ |

(11,885) |

$ |

101,434 |

||||

|

Net income (loss) per common share: |

||||||||||||

|

Basic |

$ |

0.49 |

$ |

(0.02) |

$ |

(0.07) |

$ |

0.86 |

||||

|

Diluted |

$ |

0.49 |

$ |

(0.02) |

$ |

(0.07) |

$ |

0.85 |

||||

|

Weighted average common shares outstanding: |

||||||||||||

|

Basic |

180,204 |

124,103 |

174,108 |

118,459 |

||||||||

|

Diluted |

180,561 |

124,103 |

174,108 |

119,262 |

||||||||

|

Talos Energy Inc. Consolidated Statements of Cash Flows (In thousands) (Unaudited)

|

||||||

|

Nine Months Ended September 30, |

||||||

|

2024 |

2023 |

|||||

|

Cash flows from operating activities: |

||||||

|

Net income (loss) |

$ |

(11,885) |

$ |

101,434 |

||

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

||||||

|

Depreciation, depletion, amortization and accretion expense |

836,057 |

543,906 |

||||

|

Amortization of deferred financing costs and original issue discount |

6,930 |

11,247 |

||||

|

Equity-based compensation expense |

8,859 |

9,080 |

||||

|

Price risk management activities (income) expense |

(41,531) |

13,668 |

||||

|

Net cash received (paid) on settled derivative instruments |

(14,941) |

(10,474) |

||||

|

Equity method investment (income) expense |

9,054 |

(2,938) |

||||

|

Loss (gain) on extinguishment of debt |

60,256 |

— |

||||

|

Settlement of asset retirement obligations |

(86,074) |

(71,097) |

||||

|

Loss (gain) on sale of assets |

(10,069) |

(66,115) |

||||

|

Loss (gain) on sale of business |

(100,482) |

— |

||||

|

Changes in operating assets and liabilities: |

||||||

|

Accounts receivable |

24,183 |

3,821 |

||||

|

Other current assets |

(34,649) |

(12,992) |

||||

|

Accounts payable |

12,624 |

(30,063) |

||||

|

Other current liabilities |

(41,246) |

(89,511) |

||||

|

Other non-current assets and liabilities, net |

(3,830) |

(57,155) |

||||

|

Net cash provided by (used in) operating activities |

613,256 |

342,811 |

||||

|

Cash flows from investing activities: |

||||||

|

Exploration, development and other capital expenditures |

(355,197) |

(438,506) |

||||

|

Cash acquired in excess of payments for acquisitions |

— |

17,617 |

||||

|

Payments for acquisitions, net of cash acquired |

(936,214) |

— |

||||

|

Proceeds from (cash paid for) sale of property and equipment, net |

1,017 |

66,183 |

||||

|

Contributions to equity method investees |

(19,627) |

(29,372) |

||||

|

Investment in intangible assets |

— |

(7,796) |

||||

|

Proceeds from sales of businesses |

141,997 |

— |

||||

|

Net cash provided by (used in) investing activities |

(1,168,024) |

(391,874) |

||||

|

Cash flows from financing activities: |

||||||

|

Issuance of common stock |

387,717 |

— |

||||

|

Issuance of senior notes |

1,250,000 |

— |

||||

|

Redemption of senior notes |

(897,116) |

(15,000) |

||||

|

Proceeds from Bank Credit Facility |

820,000 |

675,000 |

||||

|

Repayment of Bank Credit Facility |

(895,000) |

(460,000) |

||||

|

Deferred financing costs |

(29,886) |

(11,775) |

||||

|

Other deferred payments |

(1,791) |

(841) |

||||

|

Payments of finance lease |

(13,238) |

(12,117) |

||||

|

Purchase of treasury stock |

(45,181) |

(47,504) |

||||

|

Employee stock awards tax withholdings |

(5,791) |

(7,454) |

||||

|

Net cash provided by (used in) financing activities |

569,714 |

120,309 |

||||

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

14,946 |

71,246 |

||||

|

Cash, cash equivalents and restricted cash: |

||||||

|

Balance, beginning of period |

135,999 |

44,145 |

||||

|

Balance, end of period |

$ |

150,945 |

$ |

115,391 |

||

|

Supplemental non-cash transactions: |

||||||

|

Capital expenditures included in accounts payable and accrued liabilities |

$ |

110,201 |

$ |

90,688 |

||

|

Supplemental cash flow information: |

||||||

|

Interest paid, net of amounts capitalized |

$ |

127,367 |

$ |

108,931 |

||

SUPPLEMENTAL NON-GAAP INFORMATION

Certain financial information included in our financial results are not measures of financial performance recognized by accounting principles generally accepted in the United States, or GAAP. These non-GAAP financial measures may not be viewed as a substitute for results determined in accordance with GAAP and are not necessarily comparable to non-GAAP measures which may be reported by other companies.

Reconciliation of General and Administrative Expenses to Adjusted General and Administrative Expenses

We believe the presentation of Adjusted General and Administrative Expenses provides management and investors with (i) important supplemental indicators of the operational performance of our business, (ii) additional criteria for evaluating our performance relative to our peers and (iii) supplemental information to investors about certain material non-cash and/or other items that may not continue at the same level in the future. Adjusted General & Administrative Expenses has limitations as an analytical tool and should not be considered in isolation or as substitutes for analysis of our results as reported under GAAP or as alternatives to net income (loss), operating income (loss) or any other measure of financial performance presented in accordance with GAAP. We define these as the following:

General and Administrative Expenses. General and Administrative Expenses generally consist of costs incurred for overhead, including payroll and benefits for our corporate staff, costs of maintaining our headquarters, costs of managing our production operations, bad debt expense, equity-based compensation expense, audit and other fees for professional services and legal compliance. A portion of these expenses are allocated based on the percentage of employees dedicated to each operating segment.

|

($ thousands) |

Three Months Ended |

||

|

Reconciliation of General & Administrative Expenses to Adjusted General & Administrative Expenses: |

|||

|

Total General and administrative expense |

$ |

41,866 |

|

|

Transaction and other expenses(1) |

(5,696) |

||

|

Non-cash equity-based compensation expense |

(3,315) |

||

|

Adjusted General & Administrative Expenses |

$ |

32,855 |

|

|

________________ |

|

|

(1) |

Transaction expenses includes $4.7 million in severance costs related to the departure of the Company’s former President and Chief Executive Officer on August 29, 2024. |

Reconciliation of Net Income (Loss) to EBITDA and Adjusted EBITDA

“EBITDA” and “Adjusted EBITDA” provide management and investors with (i) additional information to evaluate, with certain adjustments, items required or permitted in calculating covenant compliance under our debt agreements, (ii) important supplemental indicators of the operational performance of our business, (iii) additional criteria for evaluating our performance relative to our peers and (iv) supplemental information to investors about certain material non-cash and/or other items that may not continue at the same level in the future. EBITDA and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of our results as reported under GAAP or as alternatives to net income (loss), operating income (loss) or any other measure of financial performance presented in accordance with GAAP. We define these as the following:

EBITDA. Net income (loss) plus interest expense; income tax expense (benefit); depreciation, depletion and amortization; and accretion expense.

Adjusted EBITDA. EBITDA plus non-cash write-down of oil and natural gas properties, transaction and other (income) expenses, decommissioning obligations, the net change in fair value of derivatives (mark to market effect, net of cash settlements and premiums related to these derivatives), (gain) loss on debt extinguishment, non-cash write-down of other well equipment and non-cash equity-based compensation expense.

Adjusted EBITDA excluding hedges. We have historically provided as a supplement to—rather than in lieu of—Adjusted EBITDA including hedges, provides useful information regarding our results of operations and profitability by illustrating the operating results of our oil and natural gas properties without the benefit or detriment, as applicable, of our financial oil and natural gas hedges. By excluding our oil and natural gas hedges, we are able to convey actual operating results using realized market prices during the period, thereby providing analysts and investors with additional information they can use to evaluate the impacts of our hedging strategies over time.

The following tables present a reconciliation of the GAAP financial measure of Net Income (loss) to EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding hedges for each of the periods indicated (in thousands):

|

Three Months Ended |

||||||||||||

|

($ thousands) |

September 30, |

June 30, |

March 31, |

December 31, |

||||||||

|

Reconciliation of Net Income (Loss) to Adjusted EBITDA: |

||||||||||||

|

Net Income (loss) |

$ |

88,173 |

$ |

12,381 |

$ |

(112,439) |

$ |

85,898 |

||||

|

Interest expense |

46,275 |

48,982 |

50,845 |

44,295 |

||||||||

|

Income tax expense (benefit) |

18,111 |

(983) |

(21,573) |

(5,081) |

||||||||

|

Depreciation, depletion and amortization |

274,249 |

259,091 |

215,664 |

183,058 |

||||||||

|

Accretion expense |

29,418 |

30,732 |

26,903 |

22,722 |

||||||||

|

EBITDA |

456,226 |

350,203 |

159,400 |

330,892 |

||||||||

|

Transaction and other (income) expenses(1) |

(17,687) |

6,629 |

(49,157) |

5,504 |

||||||||

|

Decommissioning obligations(2) |

2,725 |

4,182 |

855 |

2,425 |

||||||||

|

Derivative fair value (gain) loss(3) |

(126,291) |

(2,302) |

87,062 |

(94,596) |

||||||||

|

Net cash received (paid) on settled derivative instruments(3) |

6,071 |

(17,518) |

(3,494) |

1,017 |

||||||||

|

Loss on extinguishment of debt |

— |

— |

60,256 |

— |

||||||||

|

Non-cash equity-based compensation expense |

3,315 |

2,790 |

2,754 |

3,873 |

||||||||

|

Adjusted EBITDA |

324,359 |

343,984 |

257,676 |

249,115 |

||||||||

|

Add: Net cash (received) paid on settled derivative instruments(3) |

(6,071) |

17,518 |

3,494 |

(1,017) |

||||||||

|

Adjusted EBITDA excluding hedges |

$ |

318,288 |

$ |

361,502 |

$ |

261,170 |

$ |

248,098 |

||||

|

________________ |

|

|

(1) |

For the three months ended September 30, 2024, transaction expenses includes $4.7 million in severance costs related to the departure of the Company’s former President and Chief Executive Officer on August 29, 2024; $9.3 million in costs related to the QuarterNorth Acquisition, inclusive of $8.1 million in severance expense for the three months ended June 30, 2024; $28.1 million in costs related to the QuarterNorth acquisition, inclusive of $14.2 million in severance expense and $9.8 million in costs related to the divestiture of TLCS, inclusive of $3.7 million in severance expense for the three months ended March 31, 2024; and $0.9 million in costs related to the EnVen Energy Corporation (“EnVen”) Acquisition, inclusive of $0.5 million in severance expense for the three months ended December 31, 2023. Other income (expense) includes restructuring expenses, cost saving initiatives and other miscellaneous income and expenses that we do not view as a meaningful indicator of our operating performance. For the three months ended September 30, 2024, it includes an incremental $13.5 million gain on the TLCS Divestiture due to the recognition of contingent consideration as well as a $7.0 million increase in fair value of a service credit acquired via the QuarterNorth Acquisition. For the three months ended March 31, 2024, the amount includes a gain of $86.9 million related to the divestiture of TLCS. |

|

(2) |

Estimated decommissioning obligations were a result of working interest partners or counterparties of divestiture transactions that were unable to perform the required abandonment obligations due to bankruptcy or insolvency and are included in “Other operating (income) expense” on our consolidated statements of operations. |

|

(3) |

The adjustments for the derivative fair value (gain) loss and net cash receipts (payments) on settled derivative instruments have the effect of adjusting net income (loss) for changes in the fair value of derivative instruments, which are recognized at the end of each accounting period because we do not designate commodity derivative instruments as accounting hedges. This results in reflecting commodity derivative gains and losses within Adjusted EBITDA on an unrealized basis during the period the derivatives settled. |

|

(4) |

Reporting period includes Carbon Capture & Sequestration (“CCS”) business. |

Reconciliation of Adjusted EBITDA to Adjusted Free Cash Flow and Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow

“Adjusted Free Cash Flow” before changes in working capital provides management and investors with (i) important supplemental indicators of the operational performance of our business, (ii) additional criteria for evaluating our performance relative to our peers and (iii) supplemental information to investors about certain material non-cash and/or other items that may not continue at the same level in the future. Adjusted Free Cash Flow has limitations as an analytical tool and should not be considered in isolation or as substitutes for analysis of our results as reported under GAAP or as alternatives to net income (loss), operating income (loss) or any other measure of financial performance presented in accordance with GAAP. We define these as the following:

Capital Expenditures and Plugging & Abandonment. Actual capital expenditures and plugging & abandonment recognized in the quarter, inclusive of accruals.

Interest Expense. Actual interest expense per the income statement.

Talos did not pay any cash income taxes in the period, therefore cash income taxes have no impact to the reported Adjusted Free Cash Flow before changes in working capital number.

|

($ thousands) |

Three Months Ended |

||

|

Reconciliation of Adjusted EBITDA to Adjusted Free Cash Flow (before changes in working capital): |

|||

|

Adjusted EBITDA |

$ |

324,359 |

|

|

Capital expenditures |

(118,922) |

||

|

Plugging & abandonment |

(35,946) |

||

|

Decommissioning obligations settled |

(1,766) |

||

|

Interest expense |

(46,275) |

||

|

Adjusted Free Cash Flow (before changes in working capital) |

121,450 |

||

|

($ thousands) |

Three Months Ended |

||

|

Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow (before changes in working capital): |

|||

|

Net cash provided by operating activities(1) |

$ |

227,466 |

|

|

(Increase) decrease in operating assets and liabilities |

(7,198) |

||

|

Capital expenditures(2) |

(118,923) |

||

|

Decommissioning obligations settled |

(1,766) |

||

|

Transaction and other (income) expenses(3) |

6,425 |

||

|

Decommissioning obligations(4) |

2,725 |

||

|

Amortization of deferred financing costs and original issue discount |

(1,846) |

||

|

Income tax benefit |

18,111 |

||

|

Other adjustments |

(3,544) |

||

|

Adjusted Free Cash Flow (before changes in working capital) |

121,450 |

||

|

________________ |

|

|

(1) |

Includes settlement of asset retirement obligations. |

|

(2) |

Includes accruals and excludes acquisitions. |

|

(3) |

Transaction expenses includes $1.4 million in costs related to the QuarterNorth acquisition, inclusive of nil in severance expense for the three months ended September 30, 2024. Other income (expense) includes restructuring expenses, cost saving initiatives and other miscellaneous income and expenses that we do not view as a meaningful indicator of our operating performance. |

|

(4) |

Estimated decommissioning obligations were a result of working interest partners or counterparties of divestiture transactions that were unable to perform the required abandonment obligations due to bankruptcy or insolvency. |

Reconciliation of Net Income to Adjusted Net Income (Loss) and Adjusted Earnings per Share

“Adjusted Net Income (Loss)” and “Adjusted Earnings per Share” are to provide management and investors with (i) important supplemental indicators of the operational performance of our business, (ii) additional criteria for evaluating our performance relative to our peers and (iii) supplemental information to investors about certain material non-cash and/or other items that may not continue at the same level in the future. Adjusted Net Income (Loss) and Adjusted Earnings per Share have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP or as an alternative to net income (loss), operating income (loss), earnings per share or any other measure of financial performance presented in accordance with GAAP.

Adjusted Net Income (Loss). Net income (loss) plus accretion expense, transaction related costs, derivative fair value (gain) loss, net cash receipts (payments) on settled derivative instruments and non-cash equity-based compensation expense.

Adjusted Earnings per Share. Adjusted Net Income (Loss) divided by the number of common shares.

|

Three Months Ended September 30, 2024 |

|||||||||

|

($ thousands, except per share amounts) |

Basic per Share |

Diluted per Share |

|||||||

|

Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss): |

|||||||||

|

Net Income (loss) |

$ |

88,173 |

$ |

0.49 |

$ |

0.49 |

|||

|

Transaction and other (income) expenses(1) |

(17,687) |

$ |

(0.10) |

$ |

(0.10) |

||||

|

Decommissioning obligations(2) |

2,725 |

$ |

0.02 |

$ |

0.02 |

||||

|

Derivative fair value (gain) loss(3) |

(126,291) |

$ |

(0.70) |

$ |

(0.70) |

||||

|

Net cash received on paid derivative instruments(3) |

6,071 |

$ |

0.03 |

$ |

0.03 |

||||

|

Non-cash income tax benefit |

18,111 |

$ |

0.10 |

$ |

0.10 |

||||

|

Non-cash equity-based compensation expense |

3,315 |

$ |

0.02 |

$ |

0.02 |

||||

|

Adjusted Net Income (Loss)(4) |

$ |

(25,583) |

$ |

(0.14) |

$ |

(0.14) |

|||

|

Weighted average common shares outstanding at September 30, 2024: |

|||||||||

|

Basic |

180,204 |

||||||||

|

Diluted |

180,561 |

||||||||

|

________________ |

|

|

(1) |

Transaction expenses includes $1.4 million in costs related to the QuarterNorth acquisition, inclusive of nil in severance expense for the three months ended September 30, 2024. |

|

(2) |

Estimated decommissioning obligations were a result of working interest partners or counterparties of divestiture transactions that were unable to perform the required abandonment obligations due to bankruptcy or insolvency. |

|

(3) |

The adjustments for the derivative fair value (gain) loss and net cash receipts (payments) on settled derivative instruments have the effect of adjusting net income (loss) for changes in the fair value of derivative instruments, which are recognized at the end of each accounting period because we do not designate commodity derivative instruments as accounting hedges. This results in reflecting commodity derivative gains and losses within Adjusted Net Income (Loss) on an unrealized basis during the period the derivatives settled. |

|

(4) |

The per share impacts reflected in this table were calculated independently and may not sum to total adjusted basic and diluted EPS due to rounding. |

Reconciliation of Total Debt to Net Debt and Net Debt to LTM Adjusted EBITDA

We believe the presentation of Net Debt, LTM Adjusted EBITDA, Net Debt to LTM Adjusted EBITDA and Net Debt to Pro Forma LTM Adjusted EBITDA is important to provide management and investors with additional important information to evaluate our business. These measures are widely used by investors and ratings agencies in the valuation, comparison, rating and investment recommendations of companies.

Net Debt. Total Debt principal minus cash and cash equivalents.

Net Debt to LTM Adjusted EBITDA. Net Debt divided by the LTM Adjusted EBITDA.

|

($ thousands) |

September 30, 2024 |

||

|

Reconciliation of Net Debt: |

|||

|

9.000% Second-Priority Senior Secured Notes – due February 2029 |

$ |

625,000 |

|

|

9.375% Second-Priority Senior Secured Notes – due February 2031 |

625,000 |

||

|

Bank Credit Facility – matures March 2027 |

125,000 |

||

|

Total Debt |

1,375,000 |

||

|

Less: Cash and cash equivalents |

(45,542) |

||

|

Net Debt |

$ |

1,329,458 |

|

|

Calculation of LTM Adjusted EBITDA: |

|||

|

Adjusted EBITDA for three months period ended September 30, 2023 |

$ |

249,115 |

|

|

Adjusted EBITDA for three months period ended December 31, 2023 |

257,676 |

||

|

Adjusted EBITDA for three months period ended March 31, 2024 |

343,984 |

||

|

Adjusted EBITDA for three months period ended June 30, 2024 |

324,359 |

||

|

LTM Adjusted EBITDA |

$ |

1,175,134 |

|

|

Acquired Assets Adjusted EBITDA: |

|||

|

Adjusted EBITDA for three months period ended December 31, 2023 |

129,063 |

||

|

Adjusted EBITDA for period January 1, 2024 to March 4, 2024 |

99,490 |

||

|

LTM Adjusted EBITDA from Acquired Assets |

$ |

228,553 |

|

|

Pro Forma LTM Adjusted EBITDA |

$ |

1,403,687 |

|

|

Reconciliation of Net Debt to Pro Forma LTM Adjusted EBITDA: |

|||

|

Net Debt / Pro Forma LTM Adjusted EBITDA(1) |

0.9x |

||

|

________________ |

|

|

(1) |

Net Debt / Pro Forma LTM Adjusted EBITDA figure excludes the Finance Lease. Had the Finance Lease been included, Net Debt / Pro Forma LTM Adjusted EBITDA would have been 1.0x. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/talos-energy-announces-third-quarter-2024-operational-and-financial-results-302301778.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/talos-energy-announces-third-quarter-2024-operational-and-financial-results-302301778.html

SOURCE Talos Energy

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

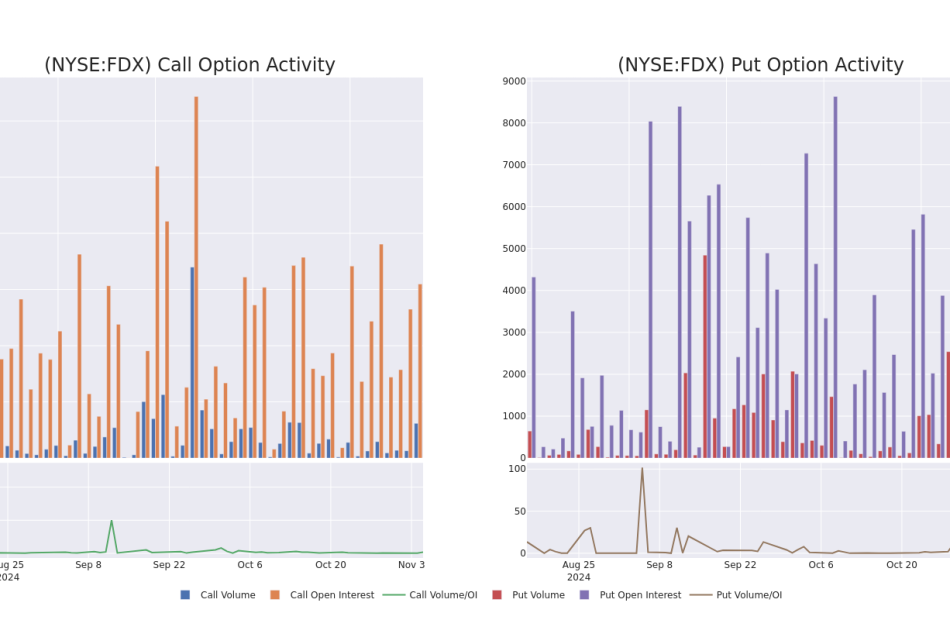

Check Out What Whales Are Doing With FDX

Whales with a lot of money to spend have taken a noticeably bearish stance on FedEx.

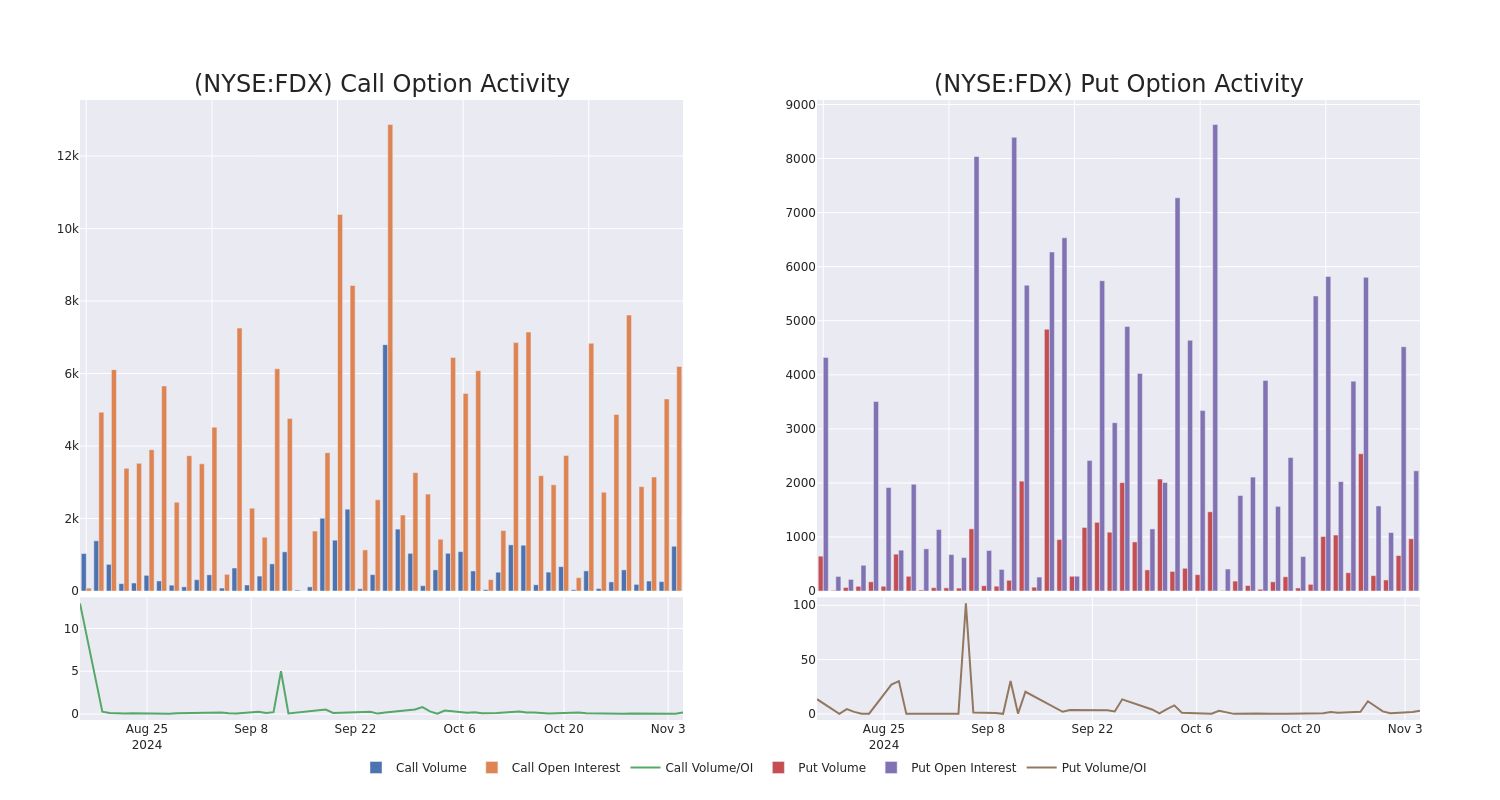

Looking at options history for FedEx FDX we detected 28 trades.

If we consider the specifics of each trade, it is accurate to state that 35% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $440,496 and 17, calls, for a total amount of $1,294,820.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $195.0 to $450.0 for FedEx during the past quarter.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for FedEx options trades today is 844.13 with a total volume of 2,591.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for FedEx’s big money trades within a strike price range of $195.0 to $450.0 over the last 30 days.

FedEx Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | CALL | SWEEP | BULLISH | 01/17/25 | $8.8 | $8.6 | $8.85 | $310.00 | $450.0K | 1.2K | 43 |

| FDX | CALL | TRADE | BULLISH | 01/15/27 | $70.25 | $69.05 | $70.25 | $260.00 | $133.4K | 53 | 19 |

| FDX | CALL | SWEEP | NEUTRAL | 12/19/25 | $27.8 | $25.15 | $26.66 | $320.00 | $130.7K | 142 | 49 |

| FDX | CALL | TRADE | NEUTRAL | 01/16/26 | $77.55 | $76.4 | $76.9 | $230.00 | $76.9K | 76 | 10 |

| FDX | CALL | TRADE | BULLISH | 01/15/27 | $77.35 | $74.6 | $76.65 | $250.00 | $76.6K | 26 | 10 |

About FedEx

FedEx pioneered overnight delivery in 1973 and remains the world’s largest express package provider. In its fiscal 2024, which ended in May, FedEx derived 47% of revenue from its express division, 37% from ground, and 10% from freight, its asset-based less-than-truckload shipping segment. The remainder came from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016, boosting its presence across Europe. TNT was previously the fourth-largest global parcel delivery provider.

Current Position of FedEx

- With a volume of 1,030,501, the price of FDX is up 1.22% at $289.78.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 38 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for FedEx, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Occidental Petroleum Earnings Preview: What Investors Are Watching, Including Debt Levels

Occidental Petroleum Corp. OXY is set to report its third-quarter results on Tuesday after the closing bell. Here’s a preview of what to expect.

What To Know: Last quarter, Occidental Petroleum beat analyst estimates on the top and bottom lines, with earnings of $1.03 per share on revenue of $6.82 billion. The company has beat analysts’ expectations in the past four consecutive quarters.

According to data from Benzinga Pro, the Street expects Occidental Petroleum to report earnings of 74 cents and quarterly revenue of $7.232 billion.

Debt Levels: In August, the company disclosed a $3 billion reduction in principal debt driven by strong organic cash flow and proceeds from divestitures.

“We are pleased with the rapid and significant progress of our deleveraging program along with enhancements made to our already premier portfolio. By the end of the third quarter, we expect to achieve nearly 85% of our near-term $4.5 billion debt reduction commitment,” said Vicki Hollub, president and CEO.

Occidental Petroleum completed or announced divestments of approximately $1.7 billion in 2024, and investors will be looking closely at the company’s debt levels in its third-quarter report.

What Analysts Say: Last quarter, Scotiabank analyst Paul Cheng noted the performance of the company’s OxyChem and Upstream divisions were in line with Wall Street expectations, while its Midstream division reported a significant beat. The Street will be watching these divisions again closely.

The three most-recent analyst ratings have an average price target of $63.33 representing an implied 24.4% upside for Occidental Petroleum from the most recent analyst ratings.

Last Friday, ahead of the company’s earnings release, JPMorgan analyst John Royall gave Occidental Petroleum a Neutral rating and a $56 price target.

OXY Price Action: According to Benzinga Pro, Occidental Petroleum shares ended Monday’s session 0.57% higher at $50.81.

Read More:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

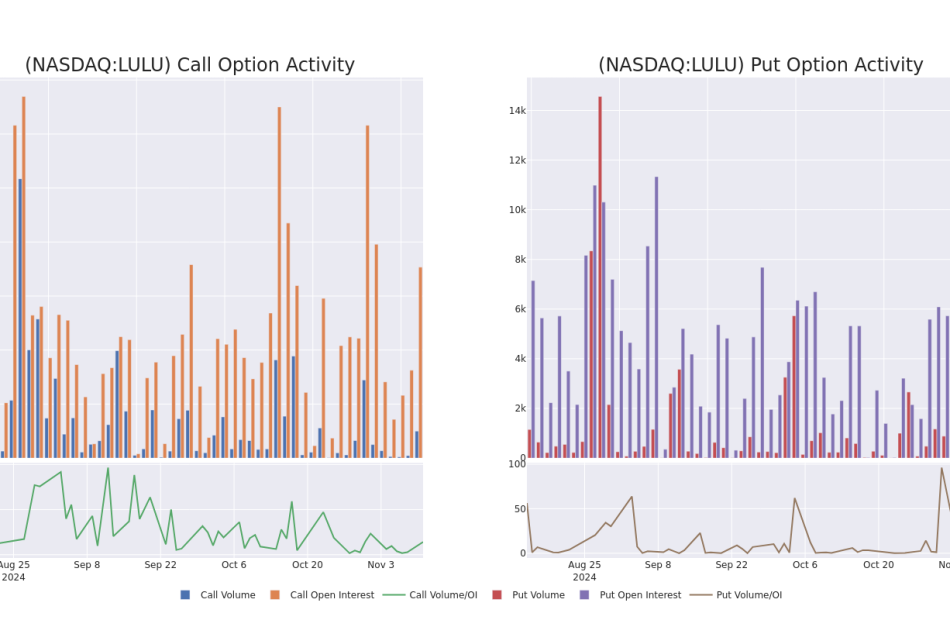

Lululemon Athletica's Options: A Look at What the Big Money is Thinking

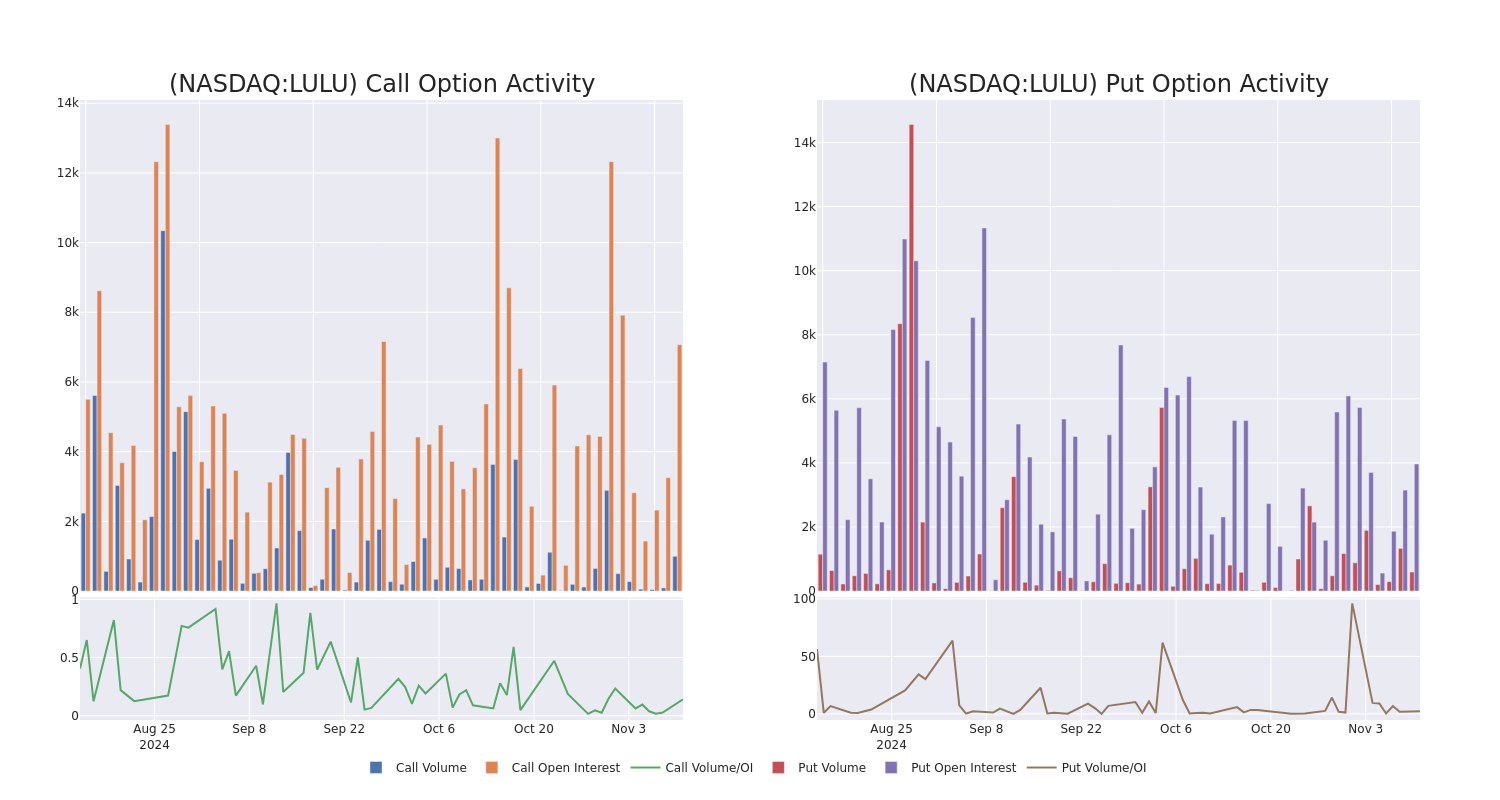

Deep-pocketed investors have adopted a bullish approach towards Lululemon Athletica LULU, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LULU usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 45 extraordinary options activities for Lululemon Athletica. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 31% bearish. Among these notable options, 9 are puts, totaling $477,603, and 36 are calls, amounting to $5,376,516.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $125.0 to $340.0 for Lululemon Athletica during the past quarter.

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lululemon Athletica’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lululemon Athletica’s substantial trades, within a strike price spectrum from $125.0 to $340.0 over the preceding 30 days.

Lululemon Athletica Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LULU | CALL | SWEEP | NEUTRAL | 09/19/25 | $148.25 | $145.15 | $148.25 | $180.00 | $593.2K | 12 | 40 |