Should You Buy Nvidia Stock Before Nov. 20? Here's What History Suggests

Over the last couple of weeks, investors have been anxiously waiting for various companies to report third-quarter earnings results. Factors including the election and high-profile themes in artificial intelligence (AI) have added an extra layer of ambiguity to this specific earnings season.

For the most part, big tech reports have been pretty solid. But the “Magnificent Seven” member that everyone is most curious about has yet to report: Nvidia (NASDAQ: NVDA). That will change on Nov. 20.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

This particular earnings report could be more meaningful than the usual one. Here’s what investors should be looking for, and my view on whether they should scoop up shares before the highly anticipated data drop takes place.

For the last two years, Wall Street analysts and investors who follow Nvidia have been laser-focused on the growth trends in its compute and networking business. In particular, sales related to the company’s data center services and graphics processing units (GPUs) seem to be all anyone wants to talk about.

The upcoming earnings report will be no different. When CEO Jensen Huang and CFO Colette Kress address investors during the earnings call, I can just about guarantee the executives will be peppered with questions about one specific thing: the upcoming launch of its Blackwell chip line, Nvidia’s most powerful GPUs yet.

While early reports have suggested that Blackwell could generate $10 billion in revenue by the end of the year, there’s a finer detail that I would encourage investors to be on the lookout for.

One of Nvidia’s closest partners is IT infrastructure company Super Micro Computer. Supermicro specializes in providing the storage cluster architectures that house GPUs such as those made by Nvidia. However, over the last few months, Supermicro has been at the center of some drama. Namely, the company delayed filing its annual report, and last week was dropped by its auditor.

In response, Nvidia is reportedly moving some of its supply chain efforts away from Supermicro in favor of other IT architecture specialists. While this seems like a logical move to make, I will be curious to see if this transition impacts Nvidia’s financial guidance related to Blackwell in any way.

The chart below traces Nvidia’s stock price over the last two years, with annotations that show when its quarterly reports arrived.

Evolv Technologies Holdings, Inc. Class Action Alert: Wolf Haldenstein Adler Freeman & Herz LLP reminds investors that a securities class action lawsuit has been filed in the United States District Court for the District of Massachusetts against Evolv Technologies Holdings, Inc.

Upcoming Lead Plaintiff Deadline is December 31, 2024

CLICK HERE TO PROVIDE CONTACT INFORMATION AND JOIN THE CASE

NEW YORK, Nov. 11, 2024 (GLOBE NEWSWIRE) — Wolf Haldenstein Adler Freeman & Herz LLP (“Wolf Haldenstein”) announces that a federal securities class action lawsuit has been filed in the United States District Court for the District of Massachusetts on behalf of persons and entities that purchased or otherwise acquired Evolv Technologies Holdings, Inc. EVLV (“Evolv” or the “Company”) between August 19, 2022, and October 30, 2024.

CLICK HERE TO PROVIDE CONTACT INFORMATION AND JOIN THE CASE

All investors who purchased shares and incurred losses are advised to contact the firm immediately at classmember@whafh.com or (800) 575-0735 or (212) 545-4774. You may obtain additional information concerning the action or join the case on our website, www.whafh.com.

If you have incurred losses, you may, no later than December 31, 2024, request that the Court appoint you as the lead plaintiff of the proposed class. Please contact Wolf Haldenstein to learn more about your rights.

The filed complaint alleges that Evolv’s financial statements for the period from the second quarter of 2022 and the second quarter of 2024 contained material misrepresentations and omissions related to the company’s revenue recognition and other financial metrics.

On October 25, 2024, Evolv issued a press release stating that there were material weaknesses in its internal controls over financial reporting, and further disclosed that certain sales, specifically to a major channel partner, were subject to undisclosed terms and conditions. The company also revealed that certain employees engaged in financial misconduct.

Following this announcement, Evolv’s stock price plummeted approximately 40%, closing at $2.70 per share/

Subsequently, on October 31, 2024, Evolv announced the termination of its Chief Executive Office, Peter George. The company’s stock price declined further, falling approximately 8% to close at $2.16 per share.

Wolf Haldenstein has experience in the prosecution of securities class actions and derivative litigation in state and federal trial and appellate courts across the country. The firm has attorneys in various practice areas, and offices in New York, Chicago, Nashville and San Diego. The reputation and expertise of this firm in shareholder and other class litigation has been repeatedly recognized by the courts, which have appointed it to major positions in complex securities multi-district and consolidated litigation.

If you wish to discuss this action or have any questions regarding your rights and interests in this case, please immediately contact Wolf Haldenstein by telephone at (800) 575-0735 or via e-mail at classmember@whafh.com.

Contact:

Wolf Haldenstein Adler Freeman & Herz LLP

Gregory Stone, Director of Case and Financial Analysis

Email: gstone@whafh.com or classmember@whafh.com

Tel: (800) 575-0735 or (212) 545-4774

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nexus Industrial REIT Announces Third Quarter 2024 Financial Results

Industrial weighting increasing as legacy assets are sold

Net Operating Income grows 11.0% as recent investments yield returns

TORONTO, Nov. 11, 2024 (GLOBE NEWSWIRE) — Nexus Industrial REIT (the “REIT”) NXR announced today its results for the third quarter ended September 30, 2024.

“This quarter we continued to execute against our plan, and I am thrilled with our progress.” said Kelly Hanczyk, CEO of Nexus Industrial REIT.

“We sold our Old Montreal office portfolio and have our legacy retail and non-core industrial properties under firm sales contracts that are expected to close by the end of the year. These dispositions strengthen our balance sheet and also advance our strategy as a Canada-focused, pure-play industrial REIT.

“Industrial assets now contribute 94% of our NOI on a proforma basis, and our concentration will be nearly 100% industrial upon closing the remaining dispositions. Combined, we are targeting asset sales of approximately $110 million in the second half of 2024,” continued Mr. Hanczyk.

“We have also resolved two key vacancies and fully leased our new Titan Park property, exceeding business case. We completed construction at our Hubrey Road and Glover Road development projects, and our St. Thomas project remains on track for completion in the first quarter of 2025. Combined, these four developments will add over $10 million of stabilized NOI annually.”

Third Quarter 2024 Highlights:

- Net loss was $46.0 million driven by net operating income (“NOI”)(1) of $32.6 million, loss on fair value adjustments of Class B LP Units of $47.5 million, loss on fair vale adjustment of derivative financial instruments of $22.2 million and gain on fair value adjustment of investment properties of $11.1 million.

- NOI increased 11.0% year over year to $32.6 million from the acquisition of high-quality, tenanted income-producing industrial properties, and growth in industrial Same Property NOI which totaled $1.4 million or 5.6% compared to a year ago (1).

- Completed the sale of six Old Montreal office properties and contracted for the sale of the legacy retail portfolio, three non-core industrial properties, vacant land, and the remaining Old Montreal office properties.

- Completed construction and tenanted the new 96,000 sq. ft. intensification industrial project in London, ON, and completed construction of the new 115,000 sq. ft. development in Hamilton, ON.

- Completed the lease-up of the newly constructed 325,000 sq. ft. industrial development in Regina, SK. The property will contribute annual stabilized NOI(1) of $3.8 million, exceeding the original investment plan.

- Normalized FFO(1) per unit was $0.188 and Normalized AFFO(1) per unit was $0.158, a reduction of $0.010 and $0.007 versus a year ago.

- NAV(1) per unit of $13.06 grew $0.17 or 1.3% versus a year ago.

Subsequent events:

- Completed the sale of one office property and one mixed-use industrial property in which the REIT held a 50% ownership interest.

(1) Non-IFRS Financial Measure

| Summary of Results | |||||||||

| (In thousands of Canadian dollars, except per unit amounts) | Three months ended September 30, |

Nine months ended September 30, |

|||||||

| 2024 | 2023 | 2024 | 2023 | ||||||

| $ | $ | $ | $ | ||||||

| FINANCIAL INFORMATION | |||||||||

| Operating Results | |||||||||

| Property revenues | 45,529 | 39,752 | 131,036 | 115,647 | |||||

| Net operating income (NOI) (1) | 32,568 | 29,331 | 93,722 | 82,748 | |||||

| Net (loss) Income | (45,991 | ) | 76,954 | 41,205 | 157,893 | ||||

| Funds from operations (FFO) (1) | 17,613 | 18,060 | 48,544 | 51,283 | |||||

| Normalized FFO (1) (2) | 17,717 | 17,887 | 49,602 | 51,604 | |||||

| Adjusted funds from operations (AFFO) (1) | 14,795 | 15,072 | 40,153 | 43,120 | |||||

| Normalized AFFO (1) (2) | 14,899 | 14,899 | 41,211 | 43,441 | |||||

| Distributions declared (3) | 15,063 | 14,477 | 44,973 | 42,711 | |||||

| Same Property NOI (1) | 28,012 | 26,857 | 72,543 | 70,727 | |||||

| Industrial Same Property NOI (1) | 26,262 | 24,858 | 67,312 | 65,028 | |||||

| Weighted average units outstanding (000s): | |||||||||

| Basic (4) | 94,137 | 90,452 | 93,675 | 88,844 | |||||

| Diluted (4) | 94,313 | 90,554 | 93,851 | 88,946 | |||||

| Per unit amounts: | |||||||||

| Distributions per unit – basic (3) (4) | 0.160 | 0.160 | 0.480 | 0.480 | |||||

| Distributions per unit – diluted (3) (4) | 0.160 | 0.160 | 0.480 | 0.480 | |||||

| Normalized FFO per unit – basic (1) (2) (4) | 0.188 | 0.198 | 0.530 | 0.581 | |||||

| Normalized FFO per unit – diluted (1) (2) (4) | 0.188 | 0.198 | 0.529 | 0.580 | |||||

| Normalized AFFO per unit – basic (1) (2) (4) | 0.158 | 0.165 | 0.440 | 0.489 | |||||

| Normalized AFFO per unit – diluted (1) (2) (4) | 0.158 | 0.165 | 0.439 | 0.488 | |||||

| AFFO payout ratio – basic (1) (3) | 101.8% | 96.1% | 112.0% | 99.1% | |||||

| Normalized AFFO payout ratio – basic (1) (2) (3) | 101.1% | 97.2% | 109.1% | 98.3% | |||||

| SPNOI Growth % (1) | 4.3% | 2.5% | 2.6% | 4.1% | |||||

| Industrial same Property NOI Growth % (1) | 5.6% | 0.5% | 3.5% | 4.4% | |||||

| As at September 30, 2024 and December 31, 2023 | 2024 | 2023 | |||||||

| $ | $ | ||||||||

| PORTFOLIO INFORMATION | |||||||||

| Total Portfolio | |||||||||

| Number of Investment Properties(5) | 113 | 116 | |||||||

| Number of Properties Under Development | 1 | 4 | |||||||

| Investment Property Fair Value (excludes assets held for sale) | 2,449,960 | 2,364,027 | |||||||

| Gross leasable area (“GLA”) (in millions of sq. ft.) (at the REIT’s ownership interest) | 13.0 | 12.5 | |||||||

| Industrial occupancy rate – in-place and committed (period-end)(6) | 97% | 97% | |||||||

| Weighted average lease term (“WALT”) (years) | 6.8 | 6.9 | |||||||

| Estimated spread between industrial portfolio market and in-place rents | 26.3% | 29.0% | |||||||

| FINANCING AND CAPITAL INFORMATION | |||||||||

| Financing | |||||||||

| Net debt | 1,305,513 | 1,203,432 | |||||||

| Net Indebtedness Ratio | 49.98% | 48.90% | |||||||

| Interest coverage ration (times) | 1.60 | 1.72 | |||||||

| Secured Indebtedness Ratio | 28.6% | 30.4% | |||||||

| Unencumbered investment properties as a percentage of investment properties | 40.8% | 35.6% | |||||||

| Total assets | 2,612,258 | 2,463,067 | |||||||

| Cash and cash equivalents | 7,823 | 5,918 | |||||||

| Capital | |||||||||

| Total equity (per condensed consolidated financial statements) | 1,023,338 | 1,000,329 | |||||||

| Total equity (including Class B LP Units) | 1,229,581 | 1,199,434 | |||||||

| Total number of Units (in thousands) | 94,152 | 93,201 | |||||||

| NAV per Unit | 13.06 | 12,87 | |||||||

| (1) | See Non-IFRS Financial Measures. |

| (2) | See Appendix A – Non-IFRS Financial Measures |

| (3) | Includes distributions payable to holders of Class B LP Units which are accounted for as finance expense in the consolidated financial statements. |

| (4) | Weighted average number of units includes Class B LP Units. |

| (5) | Includes 21 properties (4 properties – December 31, 2023) classified as assets held for sale. |

| (6) | Includes committed new leases for future occupancy. |

Non-IFRS Measures

Included in the tables above and elsewhere in this news release are non-IFRS financial measures that should not be construed as an alternative to net income / loss, cash from operating activities or other measures of financial performance calculated in accordance with IFRS and may not be comparable to similar measures as reported by other issuers. Certain additional disclosures for these non-IFRS financial measures have been incorporated by reference and can be found on page 3 in the REIT’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2024, available on SEDAR at www.sedarplus.ca and on the REIT’s website under Investor Relations. See Appendix A of this earnings release for a reconciliation of the non-IFRS financial measures to the primary financial statement measures.

NOI

Net operating income for the three months ended September 30, 2024 was $32.6 million or $3.2 million higher than Q3 2023, which was primarily due to $2.7 million from acquisitions of industrial income producing property completed subsequent to Q3 2023 and an increase in same property NOI of $1.2 million from lease up of 1751-1771 Savage Rd, Richmond, BC, partially offset by $0.2 million relating to dispositions completed since Q3 2023, $0.2 million relating to straight-line adjustments of rent and $0.2 million relating to tenant incentives and leasing costs amortization.

Net operating income for the nine months ended September 30, 2024 was $93.7 million or $11.0 million higher than the same period in 2023, which was primarily due to $11.1 million from acquisitions of industrial income producing property completed subsequent to Q3 2023 and an increase in same property NOI of $1.8 million, partially offset by $0.6 million relating to development projects, $0.9 million relating to dispositions completed since Q3 2023 and $0.2 million relating to tenant incentives and leasing costs amortization.

Fair value adjustment of investment properties

The fair value adjustment of investment properties for the three months ended September 30, 2024, totalled $11.1 million. The REIT engaged external appraisers to value properties totaling $69.5 million in the quarter, resulting in a net write-up of income producing properties of $2.1 million. Overall, fair value gains recorded for the REIT’s portfolio primarily consists of $6.0 million relating to changes in stabilized NOI and capitalization rates, $1.4 million from the remeasurement of Class B LP Units issued as part of an acquisition in the quarter, $2.4 million relating to fair value gains from the sale of an excess land at Fort St-John, BC and $5.4 million relating to properties held for development based on development progress relative to the as-completed appraisal value. Partially offsetting this is $1.4 million of capital expenditures that were not deemed to increase the fair value of the properties and therefore fair valued to zero, $0.6 million of fair value losses related to transaction costs from an acquisition completed during the quarter and $2.2 million of fair value loss relating to investment property sale price adjustment.

The fair value adjustment of investment properties for the nine months ended September 30, 2024, totalled $39.8 million. The fair value adjustment reflects the net write up of income properties primarily due to $23.0 million relating to changes in stabilized NOI and capitalization rates, $2.4 million relating to fair value gains from the sale of an excess land at Fort St-John, BC, $1.4 million from the remeasurement of Class B LP Units issued as part of an acquisition in Q3 2024, and $22.3 million in respect of properties held for development. Partially offsetting this is $5.2 million of capital expenditures that were not deemed to increase the fair value of the properties and therefore fair valued to zero, $1.7 million of fair value losses related to transaction costs from acquisitions completed during the period, and $2.3 million relating to revaluation adjustments to investment properties prior to disposition.

Outlook

The REIT is focused on delivering total unitholder return through profitable long-term growth, and by pursuing its strategy as a Canada-focused pure-play industrial REIT.

Through the remainder of 2024, the REIT expects to benefit from positive rental fundamentals in the markets in which it has leases expiring. Overall, the REIT anticipates mid-single digit Same Property NOI growth in its industrial portfolio for the full year.

In 2024, the REIT expects to benefit from the completion of four significant development projects. Combined, these properties will add annual stabilized NOI of over $10 million when complete:

- In the second quarter of 2024, the REIT completed the Park Street intensification project in Regina, SK. The primary tenant took occupancy April 1st and the remaining space is tenanted effective February 2025. The property is expected to contribute a yield of 7.9% on total development costs of $48 million.

- In the third quarter of 2024, the REIT completed construction of the 96,000 sq ft Hubrey Rd. expansion project in London, ON. This project was tenanted in July, contributing a yield of 8.4% on total development costs of $14 million.

- In the third quarter of 2024, the REIT completed construction of the 115,000 sq ft Glover Rd. new development in Hamilton, ON. This property will contribute an estimated going-in yield 5.9% on total development costs of $25 million (at the REIT’s 80% interest). The Glover Rd. property is being actively marketed for a tenant.

- The REIT expects to complete its 325,000 sq ft Dennis Rd. expansion project in St. Thomas, ON in the first quarter of 2025. This project is being constructed for an existing tenant. The REIT earns 7.8% on capital expenditures during the construction phase, and will earn a contractual going-in yield of 9.0% on the total development costs of $49 million upon completion.

The REIT will continue to prioritize unitholder distributions. The REIT believes that its normalized AFFO payout ratio peaked in the first quarter of 2024 and will improve to a more sustainable level for the balance of the year.

The REIT is focused on building its industrial portfolio. As a result, the REIT is disposing its legacy retail and office properties and a group of non-core industrial buildings. The REIT is targeting asset sales of approximately $110 million in the second half of 2024, and will use the proceeds to reduce its debt balance.

Earnings Call

Management of the REIT will host a conference call at 10:00 AM Eastern Standard Time on Tuesday November 12, 2024 to review the financial results and operations. To participate in the conference call, please dial 647-484-8814 or 1-844-763-8274 (toll free in Canada and the US) at least five minutes prior to the start time and ask to join the Nexus Industrial REIT conference call.

A recording of the conference call will be available until December 12, 2024. To access the recording, please dial 1-412-317-0088 or 1-855-669-9658 (toll free in Canada and the US) and enter access code 7467865.

About Nexus Industrial REIT

Nexus is a growth-oriented real estate investment trust focused on increasing unitholder value through the acquisition of industrial properties located in primary and secondary markets in Canada, and the ownership and management of its portfolio of properties. The REIT currently owns a portfolio of 111 properties (including one property held for development in which the REIT has an 80% interest) comprising approximately 13.0 million square feet of gross leasable area. The REIT has approximately 94,159,000 voting units issued and outstanding, including approximately 70,749,000 REIT Units and approximately 23,410,000 Class B LP Units of subsidiary limited partnerships of Nexus, which are convertible to REIT Units on a one-to-one basis.

Forward Looking Statements

Certain statements contained in this news release constitute forward-looking statements which reflect the REIT’s current expectations and projections about future results. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the REIT to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this news release. Such forward-looking statements are based on a number of assumptions that may prove to be incorrect.

While the REIT anticipates that subsequent events and developments may cause its views to change, the REIT specifically disclaims any obligation to update these forward-looking statements except as required by applicable law. These forward-looking statements should not be relied upon as representing the REIT’s views as of any date subsequent to the date of this news release. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The factors identified above are not intended to represent a complete list of the factors that could affect the REIT.

For further information please contact:

For further information please contact:

Kelly C. Hanczyk, CEO at (416) 906-2379 or

Mike Rawle, CFO at (647) 823-1381

| APPENDIX A – NON-IFRS FINANCIAL MEASURES | |||||||||||||

| (In thousands of Canadian dollars, except per unit amounts) | Three months ended | Nine months ended | |||||||||||

| September 30, | September 30, | ||||||||||||

| 2024 | 2023 | Change | 2024 | 2023 | Change | ||||||||

| FFO | $ | $ | $ | $ | $ | $ | |||||||

| Net (loss) income | (45,991 | ) | 76,954 | (122,945 | ) | 41,205 | 157,893 | (116,688 | ) | ||||

| Adjustments: | |||||||||||||

| Loss on disposal of investment properties | 282 | — | 282 | 533 | 807 | (274 | ) | ||||||

| Fair value adjustment of investment properties | (11,081 | ) | (30,112 | ) | 19,031 | (39,824 | ) | (60,428 | ) | 20,604 | |||

| Fair value adjustment of Class B LP Units | 47,477 | (28,663 | ) | 76,140 | 15,592 | (51,184 | ) | 66,776 | |||||

| Fair value adjustment of incentive units | 322 | (131 | ) | 453 | 175 | (252 | ) | 427 | |||||

| Fair value adjustment of derivative financial instruments | 22,243 | (3,766 | ) | 26,009 | 17,794 | (6,337 | ) | 24,131 | |||||

| Adjustments for equity accounted joint venture (1) | 224 | (55 | ) | 279 | 295 | (125 | ) | 420 | |||||

| Distributions on Class B LP Units expensed | 3,745 | 3,555 | 190 | 11,532 | 10,036 | 1,496 | |||||||

| Amortization of tenant incentives and leasing costs | 445 | 272 | 173 | 1,102 | 853 | 249 | |||||||

| Lease principal payments | (25 | ) | (17 | ) | (8 | ) | (45 | ) | (49 | ) | 4 | ||

| Amortization of right-of-use assets | 30 | 23 | 7 | 90 | 69 | 21 | |||||||

| Net effect of unrealized foreign exchange on USD debt and related hedges | (58 | ) | — | (58 | ) | 95 | — | 95 | |||||

| Funds from operations (FFO) | 17,613 | 18,060 | (447 | ) | 48,544 | 51,283 | (2,739 | ) | |||||

| Weighted average units outstanding (000s) Basic (4) | 94,137 | 90,452 | 3,685 | 93,675 | 88,844 | 4,831 | |||||||

| FFO per unit – basic | 0.187 | 0.200 | (0.013 | ) | 0.518 | 0.577 | (0.059 | ) | |||||

| FFO | 17,613 | 18,060 | (447 | ) | 48,544 | 51,283 | (2,739 | ) | |||||

| Add: Vendor rent obligation (2) | — | 628 | (628 | ) | 628 | 1,923 | (1,295 | ) | |||||

| Less: Other income (2) | — | (801 | ) | 801 | — | (1,602 | ) | 1,602 | |||||

| Add: Non-recurring personnel transition costs | 18 | — | 18 | 344 | — | 344 | |||||||

| Add: Non-recurring write-offs associated with dispositions of non-core legacy assets | 86 | — | 86 | 86 | — | 86 | |||||||

| Normalized FFO | 17,717 | 17,887 | (170 | ) | 49,602 | 51,604 | (2,002 | ) | |||||

| Weighted average units outstanding (000s) Basic (4) | 94,137 | 90,452 | 3,685 | 93,675 | 88,844 | 4,831 | |||||||

| Normalized FFO per unit – basic | 0.188 | 0.198 | (0.010 | ) | 0.530 | 0.581 | (0.051 | ) | |||||

| (In thousands of Canadian dollars, except per unit amounts) | Three months ended | Nine months ended | |||||||||||

| September 30, | September 30, | ||||||||||||

| 2024 | 2023 | Change | 2024 | 2023 | Change | ||||||||

| AFFO | $ | $ | $ | $ | $ | $ | |||||||

| FFO | 17,613 | 18,060 | (447 | ) | 48,544 | 51,283 | (2,739 | ) | |||||

| Adjustments: | |||||||||||||

| Straight-line adjustments ground lease and rent | (1,218 | ) | (1,438 | ) | 220 | (3,591 | ) | (3,663 | ) | 72 | |||

| Capital reserve (3) | (1,600 | ) | (1,550 | ) | (50 | ) | (4,800 | ) | (4,500 | ) | (300 | ) | |

| Adjusted funds from operations (AFFO) | 14,795 | 15,072 | (277 | ) | 40,153 | 43,120 | (2,967 | ) | |||||

| Weighted average units outstanding (000s) Basic (4) | 94,137 | 90,452 | 3,685 | 93,675 | 88,844 | 4,831 | |||||||

| AFFO per unit – basic | 0.157 | 0.167 | (0.010 | ) | 0.429 | 0.485 | (0.056 | ) | |||||

| AFFO | 14,795 | 15,072 | (277 | ) | 40,153 | 43,120 | (2,967 | ) | |||||

| Add: Vendor rent obligation (2) | — | 628 | (628 | ) | 628 | 1,923 | (1,295 | ) | |||||

| Less: Other income (2) | — | (801 | ) | 801 | — | (1,602 | ) | 1,602 | |||||

| Add: Non-recurring personnel transition costs | 18 | — | 18 | 344 | — | 344 | |||||||

| Add: Non-recurring balance sheet write-offs associated with dispositions of non-core legacy assets | 86 | — | 86 | 86 | — | 86 | |||||||

| Normalized AFFO | 14,899 | 14,899 | — | 41,211 | 43,441 | (2,230 | ) | ||||||

| Weighted average units outstanding (000s) Basic (4) | 94,137 | 90,452 | 3,685 | 93,675 | 88,844 | 4,831 | |||||||

| Normalized AFFO per unit – basic | 0.158 | 0.165 | (0.007 | ) | 0.440 | 0.489 | (0.049 | ) | |||||

| (1) | Adjustment for equity accounted joint venture relates to a fair value adjustment of swaps in place at the joint venture to swap floating rate bankers’ acceptance rates to a fixed rate and a fair value adjustment of the joint venture investment property. |

| (2) | Until Q1 2024, Normalized FFO and Normalized AFFO included adjustments for vendor rent obligation amounts due from the vendor of the REIT’s Richmond, BC property, until certain conditions were satisfied. During Q2 2024, these conditions were satisfied and the vendor settled all outstanding amounts. |

| (3) | Capital reserve includes maintenance capital expenditures, tenant incentives and leasing costs. Reserve amounts are established with reference to building condition reports, appraisals, and internal estimates of tenant renewal, tenant incentives and leasing costs. The REIT believes that a reserve is more appropriate given the fluctuating nature of these expenditures. |

| (4) | Weighted average number of units includes the Class B LP Units. |

| SAME PROPERTY RESULTS | |||||||||||||

| (In thousands of Canadian dollars) | |||||||||||||

| Three months ended | Nine months ended | ||||||||||||

| September 30, | September 30, | ||||||||||||

| 2024 | 2023 | Change | 2024 | 2023 | Change | ||||||||

| $ | $ | $ | $ | $ | $ | ||||||||

| Property revenues | 45,529 | 39,752 | 5,777 | 131,036 | 115,647 | 15,389 | |||||||

| Property expenses | (12,961 | ) | (10,421 | ) | (2,540 | ) | (37,314 | ) | (32,899 | ) | (4,415 | ) | |

| NOI | 32,568 | 29,331 | 3,237 | 93,722 | 82,748 | 10,974 | |||||||

| Add/(Deduct): | |||||||||||||

| Amortization of tenant incentives and leasing costs | 445 | 273 | 172 | 1,102 | 854 | 248 | |||||||

| Straight-line adjustments of rent | (1,215 | ) | (1,435 | ) | 220 | (3,582 | ) | (3,649 | ) | 67 | |||

| Development and expansion | (264 | ) | (309 | ) | 45 | (290 | ) | (928 | ) | 638 | |||

| Acquisitions | (3,282 | ) | (560 | ) | (2,722 | ) | (17,036 | ) | (5,978 | ) | (11,058 | ) | |

| Disposals | (230 | ) | (443 | ) | 213 | (1,226 | ) | (2,168 | ) | 942 | |||

| Termination fees and other non-recurring items | (10 | ) | — | (10 | ) | (147 | ) | (152 | ) | 5 | |||

| Same Property NOI | 28,012 | 26,857 | 1,155 | 72,543 | 70,727 | 1,816 | |||||||

| Industrial same property NOI | 26,262 | 24,858 | 1,404 | 67,312 | 65,028 | 2,284 | |||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

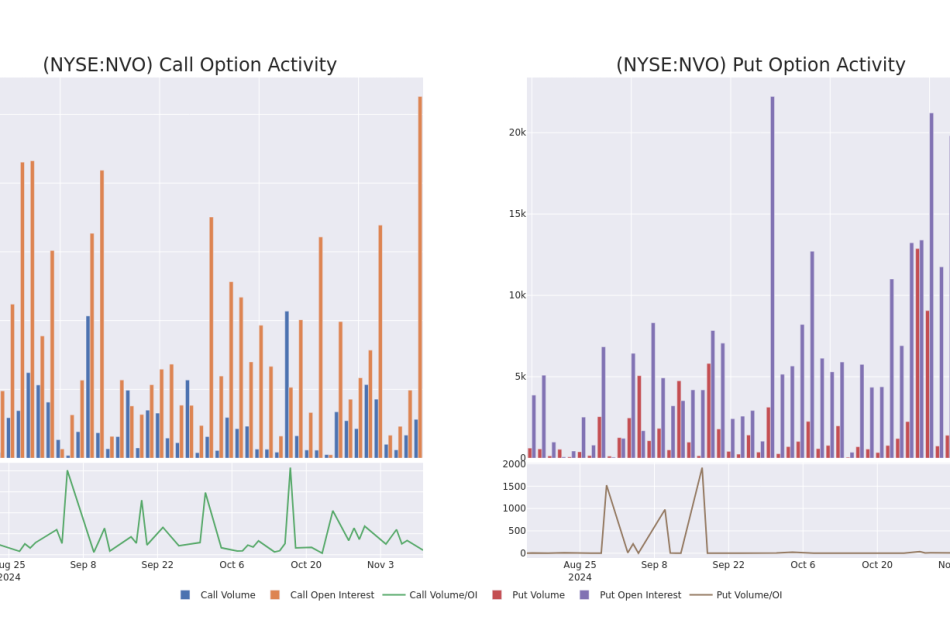

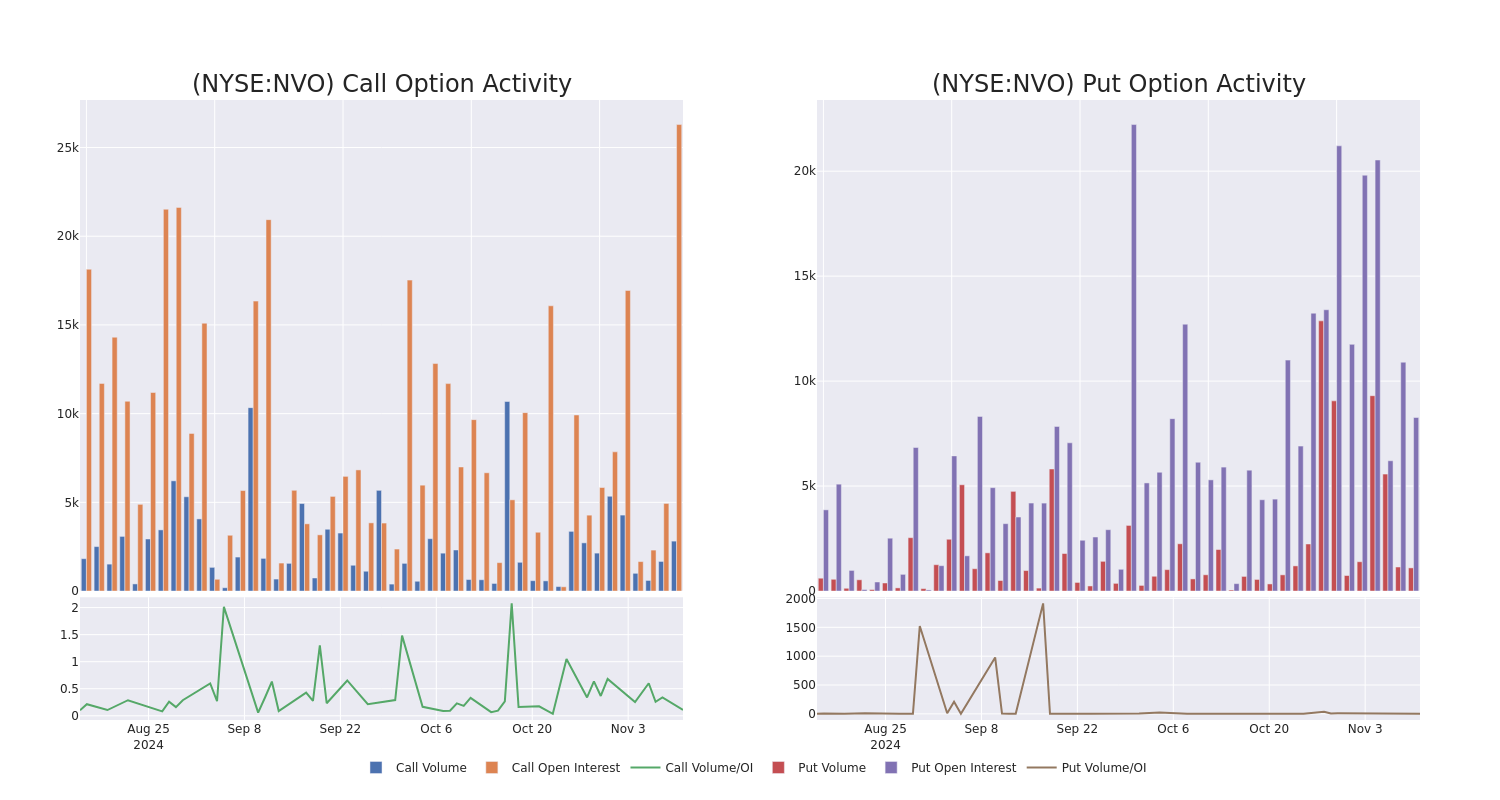

Decoding Novo Nordisk's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Novo Nordisk. Our analysis of options history for Novo Nordisk NVO revealed 23 unusual trades.

Delving into the details, we found 56% of traders were bullish, while 26% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $401,684, and 14 were calls, valued at $675,514.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $200.0 for Novo Nordisk over the recent three months.

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk’s substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.

Novo Nordisk Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | CALL | SWEEP | BULLISH | 01/17/25 | $2.28 | $2.19 | $2.25 | $125.00 | $112.3K | 6.6K | 702 |

| NVO | PUT | SWEEP | BULLISH | 03/21/25 | $10.7 | $10.65 | $10.65 | $115.00 | $93.7K | 1.1K | 100 |

| NVO | CALL | TRADE | BULLISH | 01/17/25 | $13.65 | $13.5 | $13.6 | $100.00 | $85.6K | 1.1K | 78 |

| NVO | PUT | TRADE | BULLISH | 03/21/25 | $36.25 | $35.95 | $35.95 | $145.00 | $71.9K | 11 | 20 |

| NVO | CALL | SWEEP | BULLISH | 12/20/24 | $2.37 | $2.26 | $2.37 | $120.00 | $70.6K | 9.7K | 632 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

Having examined the options trading patterns of Novo Nordisk, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Novo Nordisk

- With a trading volume of 3,829,487, the price of NVO is up by 1.72%, reaching $109.05.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 79 days from now.

What The Experts Say On Novo Nordisk

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $158.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $160.

* An analyst from BMO Capital has decided to maintain their Outperform rating on Novo Nordisk, which currently sits at a price target of $156.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Novo Nordisk with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shopify Q3 Earnings Preview: Stock Hits 52-Week Highs, Analysts Expect Second Best Revenue Quarterly Total In Company History

E-commerce platform company Shopify Inc SHOP is hitting new 52-week highs ahead of third-quarter financial results set for Tuesday, Nov. 12 before the market opens.

Here’s a look at the earnings estimates from analysts and key items for investors and analysts to watch in the financial results.

Earnings Estimates: Analysts expect Shopify to report third-quarter revenue of $2.11 billion, up from $1.71 billion in last year’s third quarter, according to data from Benzinga Pro.

The company has beaten analyst estimates for revenue in seven straight quarters. The $2.11 billion estimate would be the company’s second-largest total ever, trailing only the 2023 fourth-quarter total of $2.14 billion.

Analysts expect the company to report quarterly earnings per share of 27 cents, up from 24 cents per share in last year’s third quarter. The company has beaten analyst estimates for earnings per share in eight straight quarters.

Guidance from the company calls for revenue to be up low-to-mid 20s percentage rate on a year-over-year basis, which translates to a range of $2.06 billion to $2.16 billion based on 20% to 26% growth.

Read Also: Jim Cramer Says Shopify ‘At A Great Level To Buy’ As Golden Cross Signals Big Gains Ahead

Key Items to Watch: Among the biggest items investors will be watching is Shopify’s gross merchandise volume (GMV). In the second quarter, the company reported GMV of $67.2 billion, up 22% year-over-year and a company record.

The company also reported several other double-digit year-over-year increases in the second quarter including gross payments volume up 22% to $67.2 billion and merchant solutions revenue up 19% to $1.5 billion.

Analysts and investors will be looking for continued year-over-year growth and GMV to hit or come close to company records.

“We drove strong growth in GMV, revenue and gross profit, all amidst a mixed consumer spend environment, continued to take share and concurrently expanded our free cash flow margin,” Shopify CFO Jeff Hoffmeister said after third-quarter results.

Another item to watch could be margins with Shopify President Harley Finkelstein saying on the company’s second-quarter earnings conference call that Shopify was investing in marketing to help with revenue growth. Finkelstein said the marketing investments could impact profit margins.

“We’ve always been a company that builds for the long term,” Finkelstein said. “We can achieve a seriously meaningful combination of growth and profitability.”

Partnerships could be another area to watch in the earnings report and company commentary on the earnings call.

In September, PayPal Holdings Inc PYPL announced it was expanding its strategic partnership with Shopify. The deal will see PayPal become an additional credit and debit card processor on the Shopify Payments platform.

The partnership could increase the growth opportunities for Shopify merchants.

Analysts have been raising their price targets on Shopify in recent weeks. Here are recent analyst ratings on Shopify and their price target:

- Scotiabank: Maintained Sector Perform rating and raised the price target from $75 to $80

- RBC Capital: Maintained Outperform rating and raised the price target from $85 to $100

- Loop Capital: Maintained Hold rating and raised the price target from $80 to $90

Investors will be closely watching to see if analysts continue raising price targets after the company’s third-quarter financial results.

SHOP Price Action: Shopify stock is up 3.47% to $90.14 on Monday. The stock hit a new 52-week high of $92.16 in early trading and shares have now traded between $48.56 and $92.16 over the past 52 weeks. Shopify stock is up 24.3% year-to-date.

Read Next:

Photo: Piotr Swat via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

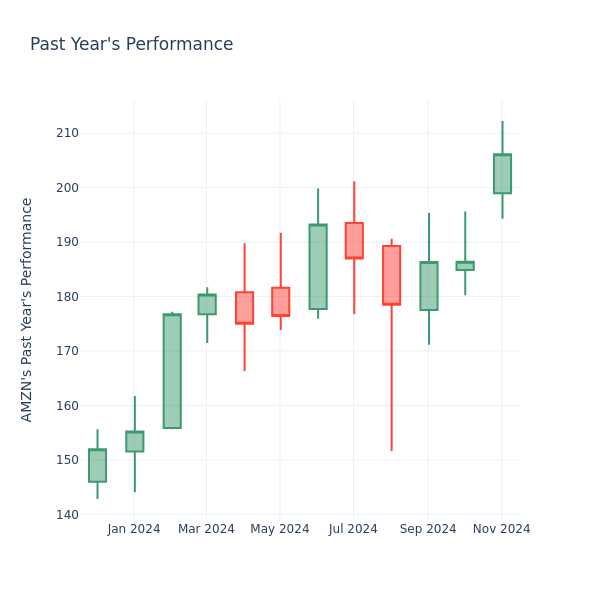

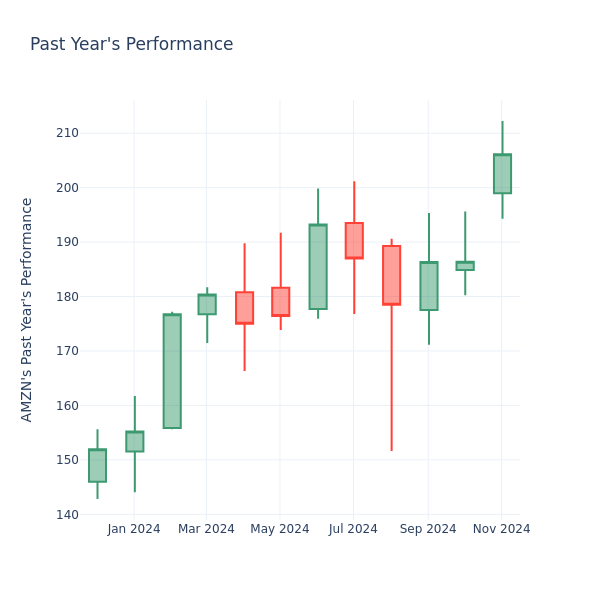

Price Over Earnings Overview: Amazon.com

In the current market session, Amazon.com Inc. AMZN stock price is at $206.13, after a 0.98% drop. However, over the past month, the company’s stock spiked by 9.82%, and in the past year, by 41.38%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

A Look at Amazon.com P/E Relative to Its Competitors

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Amazon.com has a better P/E ratio of 44.48 than the aggregate P/E ratio of 22.29 of the Broadline Retail industry. Ideally, one might believe that Amazon.com Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Grab Reports Third Quarter 2024 Results

- Revenue grew 17% year-over-year, or 20% on a constant currency basis to $716 million

- On-Demand GMV grew 15% year-over-year, or 18% on a constant currency basis to $4.7 billion

- Profit for the quarter was positive at $15 million

- Adjusted EBITDA improved by $62 million year-over-year to an all-time high of $90 million

- Operating Cash Flow of $338 million in the third quarter, and Adjusted Free Cash Flow of $76 million on a trailing 12-month basis

SINGAPORE, Nov. 11, 2024 (GLOBE NEWSWIRE) — Grab Holdings Limited GRAB today announced unaudited financial results for the third quarter ended September 30, 2024.

“Third quarter 2024 was a strong quarter for us as investments we made across the business drove an acceleration of our On-Demand GMV growth. We are serving more users than ever before, with 42 million Monthly Transacting Users on our platform,” said Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab. “We remain bullish on the long-term growth outlook of Southeast Asia, and are firing on all cylinders to capture the strong user demand trends, improve income opportunities for our ecosystem partners, and drive tech-led innovations to enhance the efficiency of our marketplace.”

“We delivered our eleventh consecutive quarter of Adjusted EBITDA improvement, our second positive Profit for the quarter, and the highest quarterly Adjusted Free Cash Flow to date for the business,” said Peter Oey, Chief Financial Officer of Grab. “With the strong momentum we are seeing across the business heading into the end of the year, we expect to deliver sequential On-Demand GMV growth in the fourth quarter and are raising our full year 2024 Group Revenue and Group Adjusted EBITDA outlook.”

Group Third Quarter 2024 Key Operational and Financial Highlights

| ($ in millions, unless otherwise stated) |

Q3 2024 | Q3 2023 | YoY % Change |

YoY % Change |

||||

| (unaudited) | (unaudited) | (constant currency3) | ||||||

| Operating metrics: | ||||||||

| On-Demand GMV1 | 4,659 | 4,063 | 15 | % | 18 | % | ||

| Group MTUs (millions of users) | 41.9 | 36.0 | 16 | % | ||||

| On-Demand MTUs (millions of users) | 37.7 | 31.7 | 19 | % | ||||

| On-Demand GMV per MTU ($) | 124 | 128 | (3 | )% | 0 | % | ||

| Partner incentives | 187 | 165 | 14 | % | ||||

| Consumer incentives | 275 | 216 | 27 | % | ||||

| Loan portfolio2 | 498 | 275 | 81 | % | ||||

| Financial measures: | ||||||||

| Revenue | 716 | 615 | 17 | % | 20 | % | ||

| Operating loss | (38 | ) | (93 | ) | 59 | % | ||

| Profit/(Loss) for the period | 15 | (99 | ) | NM | ||||

| Total Segment Adjusted EBITDA | 178 | 125 | 42 | % | ||||

| Adjusted EBITDA | 90 | 28 | 224 | % | ||||

| Net cash from operating activities (Operating Cash Flow) |

338 | 322 | 5 | % | ||||

| Adjusted Free Cash Flow | 138 | (6 | ) | NM | ||||

- Revenue grew 17% year-over-year (“YoY”) to $716 million in the third quarter of 2024, or 20% on a constant currency basis3, driven by revenue growth across all segments.

- On-Demand GMV grew 15% YoY, or 18% YoY on a constant currency basis, underpinned by 19% YoY growth in On-Demand MTUs and 22% increase in On-Demand transactions.

- Total incentives were $462 million in the third quarter of 2024, while On-Demand incentives as a proportion of On-Demand GMV declined on a quarter-over-quarter (“QoQ”) basis to 9.8% versus 10.1% in the second quarter of 2024 as we optimized incentive spend that was used to support product launches.

- Operating loss in the third quarter was $38 million, representing an improvement of $55 million YoY, primarily attributable to increases in revenue.

- Profit for the quarter was $15 million, an improvement of $114 million YoY, primarily due to improvements in Group Adjusted EBITDA, an increase in net finance income, and lower share-based compensation expenses. This was partially offset by an increase in other expenses and income tax expenses. Share-based compensation expenses for the quarter were $53 million.

- Group Adjusted EBITDA was $90 million for the quarter, an improvement of $62 million YoY compared to $28 million in the prior year period, attributed to On-Demand GMV and revenue growth, improving profitability on a Segment Adjusted EBITDA basis, and lower regional corporate costs4.

- Regional corporate costs4 for the quarter were $88 million, compared to $97 million in the same period in 2023. We remain focused on driving cost efficiencies across our organization, with staff costs within regional corporate costs declining 14% YoY.

- Cash liquidity5 totaled $6.1 billion at the end of the third quarter, compared to $5.6 billion at the end of the prior quarter, with a substantial portion of the cash inflow attributed to the growth in deposits from customers in the banking business, which increased to over $1 billion from $730 million from the prior quarter. Our net cash liquidity6 was $5.8 billion at the end of the third quarter, compared to $5.3 billion at the end of the prior quarter.

- During the third quarter, pursuant to our $500 million share repurchase program, we repurchased an additional 17.7 million shares with an aggregate principal amount of $58.2 million. Cumulatively, we have repurchased and retired 57 million shares with the aggregate principal amount of $189 million as of 30 September 2024.

- Net cash from operating activities was $338 million in the third quarter of 2024, an improvement of $17 million YoY, mainly driven by an increase in deposits from customers in the banking business and an improvement in profit before income tax. Adjusted Free Cash Flow was positive at $138 million in the third quarter of 2024, improving by $144 million YoY. On a trailing 12-month basis, Adjusted Free Cash Flow was $76 million, improving by $348 million YoY.

Business Outlook

| Financial Measure | Guidance |

| FY 2024 | |

| Revenue | $2.76 billion – $2.78 billion 17% – 18% YoY (Previous: $2.70 billion – $2.75 billion 14% – 17% YoY) |

| Adjusted EBITDA | $308 million – $313 million (Previous: $250 million – $270 million) |

| Adjusted Free Cash Flow | Positive for the full year 2024 (Unchanged) |

The guidance represents our expectations as of the date of this press release, and may be subject to change.

Segment Financial and Operational Highlights

Deliveries

| ($ in millions, unless otherwise stated) |

Q3 2024 |

Q3 2023 |

YoY % Change |

YoY % Change |

| (unaudited) | (unaudited) | (constant currency) | ||

| Operating metrics: | ||||

| GMV | 2,965 | 2,656 | 12% | 16% |

| Financial measures: | ||||

| Revenue | 380 | 335 | 13% | 16% |

| Segment Adjusted EBITDA | 55 | 34 | 60% | |

- Deliveries revenue grew 13% YoY, or 16% YoY on a constant currency basis, to $380 million in the third quarter from $335 million in the prior year period, amid strong GMV growth.

- Deliveries GMV grew 12% YoY, or 16% YoY on a constant currency basis, to $2,965 million in the third quarter of 2024. This represents a growth reacceleration compared to the second quarter, driven by increases in transaction volumes and Deliveries MTUs.

- Deliveries segment adjusted EBITDA as a percentage of GMV was 1.8% in the third quarter of 2024, compared to 1.3% in the third quarter of 2023, primarily driven by improved monetization of our Food business and increased contributions from Advertising. Notably, Advertising revenue as a proportion of Deliveries GMV increased to 1.6% in the third quarter from 1.1% in the prior year period.

- Saver Deliveries, which has seen adoption increasing to 32% of Deliveries transactions7 in the third quarter from 14% in the prior year period, continues to drive greater cost efficiencies. During the quarter, 6 in 10 Saver Deliveries transactions were batched.

- Saver Deliveries also continues to be an important strategic initiative to increase user engagement. Saver Deliveries users saw average transaction frequency increase 12% in the 6 months post-Saver adoption, relative to their 6-month average transaction frequency prior to Saver adoption.

Mobility

| ($ in millions, unless otherwise stated) |

Q3 2024 | Q3 2023 | YoY % Change |

YoY % Change |

| (unaudited) | (unaudited) | (constant currency) | ||

| Operating metrics: | ||||

| GMV | 1,694 | 1,407 | 20% | 24% |

| Financial measures: | ||||

| Revenue | 271 | 231 | 17% | 20% |

| Segment Adjusted EBITDA | 149 | 127 | 18% | |

- Mobility revenues continued to grow strongly, rising 17% YoY or 20% YoY on a constant currency basis in the third quarter of 2024, driven by GMV growth.

- Mobility GMV increased 20% YoY, or 24% YoY on a constant currency basis, to $1,694 million during the quarter. The strong growth was driven by Mobility MTUs which grew 23% YoY and average Mobility transactions per MTU which increased 7% YoY.

- Mobility segment adjusted EBITDA as a percentage of Mobility GMV was 8.8% in the third quarter of 2024, expanding by 62 basis points QoQ. The sequential improvement was driven by increased contributions from our High Value Mobility rides8, where GMV from High Value Mobility rides increased 30% YoY.

- During the quarter, total monthly active driver supply grew 13% YoY to largely recover to pre-COVID levels, while quarterly driver-partner retention rates remained stable at 90%. Our continued efforts to improve driver supply resulted in the proportion of surged9 Mobility rides being reduced by 12 percentage points YoY.

Financial Services

| ($ in millions, unless otherwise stated) |

Q3 2024 | Q3 2023 | YoY % Change |

YoY % Change |

| (unaudited) | (unaudited) | (constant currency) | ||

| Operating metrics: | ||||

| Loan portfolio | 498 | 275 | 81% | |

| Financial measures: | ||||

| Revenue | 64 | 48 | 34% | 38% |

| Segment Adjusted EBITDA | (26) | (36) | 27% | |

- Revenue for Financial Services grew 34% YoY, or 38% YoY on a constant currency basis, to $64 million in the third quarter of 2024. The YoY growth was driven by increased contributions from GrabFin’s lending business, new contributions from our digital bank, and optimization of payment incentives.

- Segment adjusted EBITDA for the quarter improved by 27% YoY to negative $26 million, attributed to growth and monetization of our lending products that drove higher revenues and margins, along with reductions in overhead expenses.

- We continued to focus on lending to our ecosystem partners through GrabFin and our digital bank, with total loans disbursed growing by 38% YoY and 13% QoQ to $567 million during the quarter. Our total loan portfolio outstanding at the end of the third quarter grew 81% YoY to $498 million from $275 million in the prior year period.

- Customer deposits in our digital bank business tripled to reach $1.1 billion as of the end of the third quarter from $362 million as of the end of the same period last year, and grew 50% QoQ from $730 million as of the end of the prior quarter. The strong growth was mainly driven by an increased number of deposit customers across our digital banks, and the launch of Boost Pocket in GXS Bank, a term deposit product that boosts the interest rate that customers can earn on their savings.

Others

| ($ in millions, unless otherwise stated) |

Q3 2024 | Q3 2023 | YoY % Change |

YoY % Change |

| (unaudited) | (unaudited) | (constant currency) | ||

| Financial measures: | ||||

| Revenue | 1 | * | NM | NM |

| Segment Adjusted EBITDA | * | * | 7% | |

| * Amount less than $1 million | ||||

- Revenue for Others was $1 million in the third quarter of 2024 while Segment Adjusted EBITDA grew 7% YoY to $0.4 million.

About Grab

Grab is a leading superapp in Southeast Asia, operating across the deliveries, mobility and digital financial services sectors. Serving over 700 cities in eight Southeast Asian countries – Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam – Grab enables millions of people everyday to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending and insurance, all through a single app. Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone. Grab strives to serve a triple bottom line – we aim to simultaneously deliver financial performance for our shareholders and have a positive social impact, which includes economic empowerment for millions of people in the region, while mitigating our environmental footprint.

We use our website as a means of disclosing material non-public information. Such disclosures will be included on our website in the “Investor Relations” section or at investors.grab.com. Accordingly, investors should monitor such sections of our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. Information contained on, or that can be accessed through, our website does not constitute a part of this document and is not incorporated by reference herein.

Forward-Looking Statements

This document and the announced investor webcast contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this document and the webcast, including but not limited to, statements about Grab’s goals, targets, projections, outlooks, beliefs, expectations, strategy, plans, objectives of management for future operations of Grab, and growth opportunities, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors, including macro-economic, industry, business, regulatory and other risks, could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab’s ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of currency exchange fluctuations and inflation; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described under “Item 3. Key Information – D. Risk Factors” and in other sections of Grab’s annual report on Form 20-F for the year ended December 31, 2023, as well as in other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law.

Unaudited Financial Information

Grab’s unaudited selected financial data for the three months and nine months ended September 30, 2024 and 2023 included in this document and the investor webcast is based on financial data derived from Grab’s management accounts that have not been reviewed or audited.

Certain amounts and percentages that appear in this document may not sum due to rounding.

Non-IFRS Financial Measures

This document and the investor webcast include references to non-IFRS financial measures, which include: Adjusted EBITDA, Segment Adjusted EBITDA, Segment Adjusted EBITDA margin, Total Segment Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Free Cash Flow. Grab uses Adjusted EBITDA, Segment Adjusted EBITDA, Segment Adjusted EBITDA margin, Total Segment Adjusted EBITDA, and Adjusted EBITDA margin for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab’s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab’s management uses Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab’s business segments, as it does not include regional corporate costs. Adjusted Free Cash Flow excludes the effects of the movement in working capital for our lending and digital banking deposit activities. Grab uses Adjusted Free Cash Flow to monitor business performance and assess its cash flow activity other than its lending and digital banking deposit activities, and Grab’s management believes that the additional disclosure serves as a useful indicator for comparison with the cash flow reporting of certain of its peers.

However, there are a number of limitations related to the use of non-IFRS financial measures, and as such, the presentation of these non-IFRS financial measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies. See below for additional explanations about the non-IFRS financial measures, including their definitions and a reconciliation of these measures to the most directly comparable IFRS financial measures. With regard to forward-looking non-IFRS guidance and targets provided in this document and the investor webcast, Grab is unable to provide a reconciliation of these forward-looking non-IFRS measures to the most directly comparable IFRS measures without unreasonable efforts because the information needed to reconcile these measures is dependent on future events, many of which Grab is unable to control or predict.

Explanation of non-IFRS financial measures:

- Adjusted EBITDA is a non-IFRS financial measure calculated as profit (loss) for the period adjusted to exclude: (i) net interest income (expenses), (ii) net other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and amortization, (v) share-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses. Starting from January 2024, realized foreign exchange gain (loss) is additionally excluded from Adjusted EBITDA (as compared to only unrealized foreign exchange gain (loss) in previous reports). Grab’s management believes that this change enhances the comparison of Grab with certain of its peers. Adjusted EBITDA for all periods presented in this earnings release reflect this new definition of Adjusted EBITDA.

- Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

- Segment Adjusted EBITDA margin is a non-IFRS financial measure, calculated as Segment Adjusted EBITDA divided by Gross Merchandise Value. For Financial Services and Others, Segment Adjusted EBITDA margin is calculated as Segment Adjusted EBITDA divided by Revenue.

- Total Segment Adjusted EBITDA is a non-IFRS financial measure, representing the sum of Adjusted EBITDA of our four business segments.

- Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Revenue.

- Adjusted Free Cash Flow is a non-IFRS financial measure, defined as net cash flows from operating activities less capital expenditures, excluding changes in working capital related to loans and advances to customers, and deposits from the digital banking business.

| Three months ended September 30, |

Nine months ended September 30, |

|||||||

| 2024 | 2023 | 2024 | 2023 | |||||

| ($ in millions, unless otherwise stated) | $ | $ | $ | $ | ||||

| Profit/(Loss) for the period | 15 | (99 | ) | (169 | ) | (496 | ) | |

| Income tax expense | 32 | 16 | 63 | 22 | ||||

| Share of loss of equity-accounted investees (net of tax) | 2 | 4 | 5 | 7 | ||||

| Net finance income (including foreign exchange (gain) loss) |

(87 | ) | (14 | ) | (69 | ) | (7 | ) |

| Operating loss | (38 | ) | (93 | ) | (170 | ) | (474 | ) |

| Net other expenses | 33 | 8 | 29 | 10 | ||||

| Depreciation and amortization | 36 | 37 | 111 | 108 | ||||

| Share-based compensation expenses | 53 | 70 | 230 | 238 | ||||

| Impairment losses on goodwill and non-financial assets | – | * | – | 1 | ||||

| Restructuring costs | 3 | 1 | 6 | 52 | ||||

| Legal, tax and regulatory settlement provisions | 3 | 5 | 10 | 8 | ||||

| Adjusted EBITDA | 90 | 28 | 216 | (57 | ) | |||

| Regional corporate costs | 88 | 97 | 263 | 298 | ||||

| Total Segment Adjusted EBITDA | 178 | 125 | 479 | 241 | ||||

| Segment Adjusted EBITDA | ||||||||

| Deliveries | 55 | 34 | 139 | 25 | ||||

| Mobility | 149 | 127 | 416 | 338 | ||||

| Financial services | (26 | ) | (36 | ) | (78 | ) | (121 | ) |

| Others | * | * | 2 | (1 | ) | |||

| Total Segment Adjusted EBITDA | 178 | 125 | 479 | 241 | ||||

| * Amount less than $1 million | ||||||||

| Three months ended September 30, |

Nine months ended September 30, |

|||||||

| 2024 | 2023 | 2024 | 2023 | |||||

| ($ in millions, unless otherwise stated) | $ | $ | $ | $ | ||||

| Net cash from operating activities | 338 | 322 | 599 | 112 | ||||

| Less: Capital expenditures | (46 | ) | (47 | ) | (95 | ) | (107 | ) |

| Free Cash Flow | 292 | 275 | 504 | 5 | ||||

| Changes in: | ||||||||

| – Loan receivables in the financial services segment | 114 | 53 | 206 | 119 | ||||

| – Deposits from customers in the banking business | (268 | ) | (334 | ) | (635 | ) | (364 | ) |

| Adjusted Free Cash Flow | 138 | (6 | ) | 75 | (240 | ) | ||

We compare the percent change in our current period results from the corresponding prior period using constant currency. We present constant currency growth rate information to provide a framework for assessing how our underlying GMV and revenue performed excluding the effect of foreign currency rate fluctuations. We calculate constant currency by translating our current period financial results using the corresponding prior period’s monthly exchange rates for our transacted currencies other than the U.S. dollar.

Operating Metrics

Gross Merchandise Value (GMV) is an operating metric representing the sum of the total dollar value of transactions from Grab’s products and services, including any applicable taxes, tips, tolls, surcharges and fees, over the period of measurement. GMV includes sales made through offline stores. GMV is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business. GMV provides useful information to investors as it represents the amount of customer spend that is being directed through Grab’s platform. This metric enables Grab and investors to understand, evaluate and compare the total amount of customer spending that is being directed through its platform over a period of time. Grab presents GMV as a metric to understand and compare, and to enable investors to understand and compare, Grab’s aggregate operating results, which captures significant trends in its business over time.

Monthly Transacting User (MTUs) is defined as the monthly number of unique users who transact via Grab’s apps (including OVO, GXS Bank, GXBank and MoveIt), where transact means to have successfully paid for or utilized any of Grab’s products or services (including lending and offline Jaya Grocer transactions where users record their Jaya Grocer loyalty points on the Grab app). MTUs over a quarterly or annual period are calculated based on the average of the MTUs for each month in the relevant period. MTUs is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business.

Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners, the effect of which is to reduce revenue. For certain delivery offerings where Grab is contractually responsible for delivery services provided to end-users, incentives granted to driver-partners are recognized in cost of revenue.

Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers, the effect of which is to reduce revenue. Partner incentives and consumer incentives are metrics by which we understand, evaluate and manage our business, and we believe are necessary for investors to understand and evaluate our business. We believe these metrics capture significant trends in our business over time.

Loan portfolio is an operating metric representing the total of current and non-current loan receivables in the financial services segment, net of expected credit loss allowances.

Industry and Market Data

This document may contain information, estimates and other statistical data derived from third party sources , including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations due to the nature of the techniques and methodologies used in market research, and as such neither Grab nor the third-party sources can guarantee the accuracy of such information. You are cautioned not to give undue weight to such estimates. Grab has not independently verified such third-party information, and makes no representation as to the accuracy of such third-party information.

Unaudited Summary of Financial Results

Condensed consolidated statement of profit or loss and other comprehensive income

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| ($ in millions, except for share amounts which are reflected in thousands and per share data) |

$ |

$ |

$ |

$ |

||||||||||||

| Revenue | 716 | 615 | 2,033 | 1,706 | ||||||||||||

| Cost of revenue | (409 | ) | (375 | ) | (1,191 | ) | (1,122 | ) | ||||||||

| Other income | 6 | 6 | 12 | 12 | ||||||||||||

| Sales and marketing expenses | (82 | ) | (76 | ) | (233 | ) | (209 | ) | ||||||||

| General and administrative expenses | (112 | ) | (131 | ) | (368 | ) | (415 | ) | ||||||||

| Research and development expenses | (97 | ) | (99 | ) | (317 | ) | (319 | ) | ||||||||

| Net impairment losses on financial assets | (19 | ) | (18 | ) | (59 | ) | (51 | ) | ||||||||

| Other expenses | (38 | ) | (14 | ) | (41 | ) | (24 | ) | ||||||||

| Restructuring costs | (3 | ) | (1 | ) | (6 | ) | (52 | ) | ||||||||

| Operating loss | (38 | ) | (93 | ) | (170 | ) | (474 | ) | ||||||||

| Finance income | 53 | 54 | 142 | 156 | ||||||||||||

| Finance costs** | 28 | (18 | ) | (55 | ) | (81 | ) | |||||||||

| Net change in fair value of financial assets and liabilities | 6 | (22 | ) | (18 | ) | (68 | ) | |||||||||

| Net finance income | 87 | 14 | 69 | 7 | ||||||||||||

| Share of loss of equity-accounted investees (net of tax) | (2 | ) | (4 | ) | (5 | ) | (7 | ) | ||||||||

| Profit/(Loss) before income tax | 47 | (83 | ) | (106 | ) | (474 | ) | |||||||||

| Income tax expense | (32 | ) | (16 | ) | (63 | ) | (22 | ) | ||||||||

| Profit/(Loss) for the period | 15 | (99 | ) | (169 | ) | (496 | ) | |||||||||

| Items that will not be reclassified to profit or loss: | ||||||||||||||||

| Defined benefit plan remeasurements | * | 1 | * | * | ||||||||||||

| Investments and put liabilities at FVOCI – net change in fair value | (3 | ) | (9 | ) | (2 | ) | (15 | ) | ||||||||

| Items that are or may be reclassified subsequently to profit or loss: |

||||||||||||||||

| Foreign currency translation differences – foreign operations | 134 | (38 | ) | 102 | (52 | ) | ||||||||||

| Other comprehensive income/(loss) for the period, net of tax | 131 | (46 | ) | 100 | (67 | ) | ||||||||||

| Total comprehensive income/(loss) for the period | 146 | (145 | ) | (69 | ) | (563 | ) | |||||||||

| Profit/(Loss) attributable to: | ||||||||||||||||

| Owners of the Company | 26 | (91 | ) | (131 | ) | (469 | ) | |||||||||

| Non-controlling interests | (11 | ) | (8 | ) | (38 | ) | (27 | ) | ||||||||

| Profit/(Loss) for the period | 15 | (99 | ) | (169 | ) | (496 | ) | |||||||||

| Total comprehensive income/(loss) attributable to: | ||||||||||||||||

| Owners of the Company | 130 | (133 | ) | (54 | ) | (526 | ) | |||||||||

| Non-controlling interests | 16 | (12 | ) | (15 | ) | (37 | ) | |||||||||

| Total comprehensive income/(loss) for the period | 146 | (145 | ) | (69 | ) | (563 | ) | |||||||||

| Earnings/(Loss) per share: | ||||||||||||||||

| Basic | $ | 0.01 | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.12 | ) | |||||

| Diluted | $ | 0.01 | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.12 | ) | |||||

| Weighted-average ordinary shares outstanding: | ||||||||||||||||

| Basic | 4,042,521 | 3,907,945 | 3,981,108 | 3,887,446 | ||||||||||||

| Diluted | 4,251,379 | 3,907,945 | 3,981,108 | 3,887,446 | ||||||||||||

| * Amount less than $1 million | ||||||||||||||||

| ** Finance costs include translation gains of foreign currency denominated balance sheet items which result from the appreciation of non-U.S. dollar currencies against the U.S. dollar in the three months ended September 30, 2024. | ||||||||||||||||

The number of outstanding Class A and Class B ordinary shares was 3,909 million and 118 million as of September 30, 2024, and 3,800 million and 112 million, respectively, as of September 30, 2023. 269 million and 354 million potentially dilutive outstanding securities were excluded from the computation of diluted loss per ordinary share because their effects would have been antidilutive for the nine months ended September 30, 2024 and 2023 respectively, or issuance of such shares is contingent upon the satisfaction of certain conditions which were not satisfied by the end of the period.

Condensed consolidated statement of financial position

| September 30, 2024 |

December 31, 2023 |

|||||

| ($ in millions, unless otherwise stated) | $ |

$ |

||||

| Non-current assets | ||||||

| Property, plant, and equipment | 524 | 512 | ||||

| Intangible assets and goodwill | 943 | 916 | ||||

| Associates and joint venture | 144 | 102 | ||||

| Deferred tax assets | 54 | 56 | ||||

| Other investments | 758 | 1,188 | ||||

| Loan receivables in the financial services segment | 104 | 54 | ||||

| Deposits, prepayments and other assets | 113 | 196 | ||||

| 2,640 | 3,024 | |||||

| Current assets | ||||||

| Inventories | 56 | 49 | ||||

| Trade and other receivables | 262 | 196 | ||||

| Deposits, prepayments and other assets | 172 | 208 | ||||

| Loan receivables in the financial services segment | 394 | 272 | ||||

| Other investments | 2,769 | 1,905 | ||||

| Cash and cash equivalents | 2,885 | 3,138 | ||||

| 6,538 | 5,768 | |||||

| Total assets | 9,178 | 8,792 | ||||

| Equity | ||||||

| Share capital and share premium | 23,314 | 22,669 | ||||

| Reserves | 262 | 544 | ||||

| Accumulated losses | (17,217 | ) | (16,764 | ) | ||

| Equity attributable to owners of the Company | 6,359 | 6,449 | ||||

| Non-controlling interests | 73 | 19 | ||||

| Total equity | 6,432 | 6,468 | ||||

| Non-current liabilities | ||||||

| Loans and borrowings | 228 | 668 | ||||

| Provisions | 18 | 18 | ||||

| Other liabilities | 49 | 140 | ||||

| Deferred tax liabilities | 26 | 20 | ||||

| 321 | 846 | |||||

| Current liabilities | ||||||

| Loans and borrowings | 100 | 125 | ||||

| Provisions | 47 | 39 | ||||

| Trade payables and other liabilities | 1,142 | 925 | ||||

| Deposits from customers in the banking business | 1,093 | 374 | ||||

| Current tax liabilities | 43 | 15 | ||||

| 2,425 | 1,478 | |||||

| Total liabilities | 2,746 | 2,324 | ||||

| Total equity and liabilities | 9,178 | 8,792 | ||||

Condensed consolidated statement of cash flows

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| ($ in millions, unless otherwise stated) | $ | $ | $ | $ | ||||||||

| Cash flows from operating activities | ||||||||||||

| Profit/(Loss) before income tax | 47 | (83 | ) | (106 | ) | (474 | ) | |||||

| Adjustments for: | ||||||||||||

| Amortization of intangible assets | 5 | 4 | 18 | 12 | ||||||||

| Depreciation of property, plant and equipment | 31 | 33 | 92 | 96 | ||||||||

| Impairment of property, plant and equipment | – | * | – | 1 | ||||||||

| Equity-settled share-based payments | 53 | 70 | 230 | 238 | ||||||||

| Finance costs | (28 | ) | 18 | 55 | 81 | |||||||

| Net change in fair value of financial assets and liabilities | (6 | ) | 22 | 19 | 68 | |||||||

| Net impairment losses on financial assets | 19 | 18 | 59 | 51 | ||||||||

| Finance income | (53 | ) | (54 | ) | (142 | ) | (156 | ) | ||||

| Gain on disposal of property, plant and equipment | (4 | ) | (4 | ) | (6 | ) | (9 | ) | ||||

| Restructuring costs | – | 1 | – | 52 | ||||||||

| Share of loss of equity-accounted investees (net of tax) | 2 | 4 | 5 | 7 | ||||||||

| Change in provisions | 10 | * | 8 | * | ||||||||

| 76 | 29 | 232 | (33 | ) | ||||||||

| Changes in: | ||||||||||||

| – Inventories | (7 | ) | (2 | ) | (7 | ) | 2 | |||||

| – Deposits pledged | (12 | ) | (6 | ) | (11 | ) | (16 | ) | ||||

| – Trade and other receivables | (38 | ) | 3 | (101 | ) | 23 | ||||||

| – Loan receivables in the financial services segment | (114 | ) | (53 | ) | (206 | ) | (119 | ) | ||||

| – Trade payables and other liabilities | 168 | 23 | 83 | (88 | ) | |||||||

| – Deposits from customers in the banking business | 268 | 334 | 635 | 364 | ||||||||

| Cash from operations | 341 | 328 | 625 | 133 | ||||||||

| Income tax paid | (3 | ) | (6 | ) | (26 | ) | (21 | ) | ||||

| Net cash from operating activities | 338 | 322 | 599 | 112 | ||||||||

| Cash flows from investing activities | ||||||||||||

| Acquisition of property, plant and equipment | (23 | ) | (23 | ) | (48 | ) | (43 | ) | ||||

| Purchase of intangible assets | (13 | ) | (8 | ) | (21 | ) | (26 | ) | ||||

| Proceeds from disposal of property, plant and equipment | 11 | 13 | 18 | 27 | ||||||||

| Acquisition of subsidiary, net of cash acquired | (1 | ) | – | (1 | ) | – | ||||||

| Acquisition of additional interest in associates and joint venture | – | – | (43 | ) | – | |||||||

| Repayment of loan receivable | 92 | – | 92 | – | ||||||||

| (Acquisition of)/ net proceeds from other investments | (47 | ) | 429 | (391 | ) | 1,633 | ||||||

| Interest received | 46 | 57 | 155 | 131 | ||||||||

| Net cash from/ (used in) investing activities | 65 | 468 | (239 | ) | 1,722 | |||||||

| Cash flows from financing activities | ||||||||||||

| Proceeds from share-based payment arrangements | 7 | 7 | 19 | 20 | ||||||||

| Repurchase and retirement of ordinary shares | (58 | ) | – | (189 | ) | – | ||||||

| Proceeds from bank loans | 37 | 38 | 94 | 88 | ||||||||

| Repayment of bank loans | (38 | ) | (50 | ) | (596 | ) | (719 | ) | ||||

| Payment of lease liabilities | (12 | ) | (10 | ) | (33 | ) | (30 | ) | ||||

| Acquisition of non-controlling interests without change in control | (60 | ) | – | (60 | ) | (27 | ) | |||||

| Proceeds from subscription of shares in subsidiaries by non-controlling interests without change in control |