Nvidia Supplier TSMC Faces Regulatory Hurdles In Manufacturing 2-Nanometer Chips Abroad, Minister Says 'Core Technology Will Stay In Taiwan'

Taiwan Semiconductor Mfg. Co. Ltd. TSM is unable to manufacture 2-nanometer chips overseas due to Taiwan’s technology protection regulations, as stated by the Minister of Economic Affairs, JW Kuo.

What Happened: A report on Thursday raised concerns that TSMC may be forced to accelerate the production of advanced 2-nanometer chips at its Arizona factories following Donald Trump‘s re-election as U.S. president, according to the Taipei Times.

Kuo clarified that Taiwan’s laws, designed to protect its technologies, currently prohibit TSMC from manufacturing 2-nanometer chips abroad.

“Although TSMC plans to make 2-nanometer chips [abroad] in the future, its core technology will stay in Taiwan,” Kuo said.

Taiwanese law prevents local chipmakers from producing chips abroad that are more advanced than those produced domestically.

See Also: Jeff Bezos-Backed AI Startup Anthropic To Partner With Palantir, AWS For US Defense

Why It Matters: Despite the regulatory restrictions, TSMC’s U.S. expansion plans remain unaffected by Trump’s re-election, as confirmed by the company earlier this week.

The chipmaker, a major supplier to tech giants like Apple Inc. AAPL and Nvidia Corp. NVDA, is proceeding with its $65 billion investment in advanced semiconductor production facilities in Arizona.

However, the U.S. has recently asked TSMC to halt shipments of chips used in AI applications to customers from China, following the discovery of one of its chips in a Huawei AI processor. This move comes amid Trump’s proposed 60% tariffs, which could significantly impact China’s economy.

Despite these challenges, TSMC’s shares have continued to climb, with the company’s October sales showing the slowest growth since February.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sapiens Reports Third Quarter 2024 Financial Results

ROCHELLE PARK, N.J., Nov. 11, 2024 /PRNewswire/ — Sapiens International Corporation, SPNS SPNS, a leading global provider of software solutions for the insurance industry, today announced its financial results for the third quarter ended September 30, 2024.

|

Summary Results for Third Quarter 2024 (USD in millions, except per share data) |

||||||

|

GAAP |

Non-GAAP |

|||||

|

Q3 2024 |

Q3 2023 |

% Change |

Q3 2024 |

Q3 2023 |

% Change |

|

|

Revenue |

$137.0 |

$130.7 |

4.8 % |

$137.0 |

$130.8 |

4.8 % |

|

Gross Profit |

$60.3 |

$56.0 |

7.8 % |

$62.8 |

$59.3 |

6.0 % |

|

Gross Margin |

44.0 % |

42.8 % |

120 bps |

45.8 % |

45.3 % |

50 bps |

|

Operating Income |

$21.7 |

$20.3 |

7.3 % |

$25.1 |

$24.1 |

4.3 % |

|

Operating Margin |

15.9 % |

15.5 % |

40 bps |

18.3 % |

18.4 % |

-10 bps |

|

Net Income (*) |

$18.3 |

$15.9 |

15.5 % |

$21.1 |

$19.1 |

10.5 % |

|

Diluted EPS |

$0.33 |

$0.28 |

17.9 % |

$0.37 |

$0.34 |

8.8 % |

|

(*) Attributable to Sapiens’ shareholders |

||||||

Roni Al-Dor, President and CEO of Sapiens, stated, “This quarter showcased solid performance in our key regions. We are pleased to report that revenue reached $137 million this quarter, reflecting a 4.8% increase over the same period last year. Revenue growth was driven by 7.1% growth in our European region, 1.7% growth in North America and 6.6% growth in ROW regions. This quarter’s non-GAAP operating profit totaled $25 million, representing 18.3% of total revenue.”

Mr. Al-Dor continued, “Revenue fell short of our targets in the third quarter, and the challenges we encountered are expected to impact revenue in the fourth quarter. Today, we are revising our 2024 non-GAAP revenue guidance to a range of $541 million to $546 million, down from the previous range of $550 million to $555 million – a 1.6% reduction at the midpoint. However, we expect our non-GAAP operating margin to be within our guidance range at 18.2%. Looking into 2025, we anticipate a low single-digit revenue growth.”

Quarterly Results Conference Call

Management will host a conference call and webcast on November 11, 2024, at 9:30 a.m. Eastern Time (4:30 p.m. in Israel) to review and discuss Sapiens’ results. Please call the following numbers (at least 10 minutes before the scheduled time) to participate:

North America (toll-free): 1-888-642-5032

International: 972-3-9180644

UK: 0-800-917-5108

The live webcast of the call can be viewed on Sapiens’ website at: https://veidan.activetrail.biz/sapiensq2-2024. A replay of the call will be available one business day following the completion of the event at the same link for 90 days.

Non-GAAP Financial Measures

This press release contains the following non-GAAP financial measures: non-GAAP revenue, ARR, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income attributed to Sapiens shareholders, non-GAAP basic and diluted earnings per share, Adjusted EBITDA and Adjusted Free Cash-Flow.

Sapiens believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Sapiens’ financial condition and results of operations. The Company’s management uses these non-GAAP measures to compare the Company’s performance to that of prior periods for trend analyses, for purposes of determining executive and senior management incentive compensation and for budgeting and planning purposes. These measures are used in financial reports prepared for management and in quarterly financial reports presented to the Company’s board of directors. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends, and in comparing the Company’s financial measures with other software companies, many of which present similar non-GAAP financial measures to investors.

Non-GAAP financial measures consist of GAAP financial measures adjusted to exclude: Valuation adjustment on acquired deferred revenue, amortization of capitalized software development and other intangible assets, capitalization of software development, stock-based compensation, compensation related to acquisition and acquisition-related costs, restructuring and cost reduction costs, and tax adjustments related to non-GAAP adjustments.

Management of the Company does not consider these non-GAAP measures in isolation, or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations, as they reflect the exercise of judgment by management about which expenses and income are excluded or included in determining these non-GAAP financial measures.

To compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. Sapiens urges investors to review the reconciliation of its non-GAAP financial measures to the comparable GAAP financial measures, which it includes in press releases announcing quarterly financial results, including this press release, and not to rely on any single financial measure to evaluate the Company’s business.

Reconciliation tables of the most comparable GAAP financial measures to the non-GAAP financial measures used in this press release are included with the financial tables of this release.

The Company defines Annual Recurring Revenue (“ARR”) as the annualized value of our revenue from customer subscriptions, term licenses, maintenance, application maintenance, and cloud solutions, which may not be the same as the timing and amount of revenue recognized. The ARR run rate is equal to the product of (i) the sum of these revenues in our most recently completed fiscal quarter, multiplied by (ii) four.

The Company defines Adjusted EBITDA as net profit, adjusted to eliminate valuation adjustment on acquired deferred revenue, stock-based compensation expense, depreciation and amortization, capitalization of software development costs, compensation expenses related to acquisition and acquisition-related costs, restructuring and cost reduction costs, financial expense (income), provision for income taxes and other income (expenses). These amounts are often excluded by other companies as well, in order to help investors understand the operational performance of their business.

The Company uses Adjusted EBITDA as a measurement of its operating performance, because it assists in comparing the operating performance on a consistent basis by removing the impact of certain non-cash and non-operating items. Adjusted EBITDA reflects an additional way of viewing aspects of the operations that the Company believes, when viewed with the GAAP results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting its business. The Company uses Adjusted Free Cash-Flow as a measurement of its operating performance, and reconciles cash-flow from operating activities to Adjusted Free Cash-Flow, while reducing the amounts for capitalization of software development costs and capital expenditures. The Company adds back cash payments made for former acquisitions in respect of future performance targets and retention criteria as determined upon acquisition date of the respective acquired company, which were included in the cash-flow from operating activities. We believe that Adjusted Free Cash-Flow is useful in evaluating our business, because Adjusted Free Cash-Flow reflects the cash surplus available to fund the expansion of our business.

About Sapiens

Sapiens International Corporation (NASDAQ and TASE: SPNS) is a global leader in intelligent insurance software solutions. With Sapiens’ robust platform, customer-driven partnerships, and rich ecosystem, insurers are empowered to future-proof their organizations with operational excellence in a rapidly changing marketplace. We help insurers harness the power of AI and advanced automation to support core solutions for property and casualty, workers’ compensation, and life insurance, including reinsurance, financial & compliance, data & analytics, digital, and decision management. Sapiens boasts a longtime global presence, serving over 600 customers in more than 30 countries with its innovative SaaS offerings. Recognized by industry experts and selected for the Microsoft Top 100 Partner program, Sapiens is committed to partnering with our customers for their entire transformation journey and is continuously innovating to ensure their success.

|

Investor and Media Contact

Yaffa Cohen-Ifrah Chief Marketing Officer and Head of Investor Relations, Sapiens +1 917-533-4782 |

Investor Contacts

Brett Maas Managing Partner, Hayden IR +1 646-536-7331

Kimberly Rogers Managing Director, Hayden IR +1 541-904-5075 |

Forward Looking Statements

Certain matters discussed in this press release that are incorporated herein and therein by reference are forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, that are based on our beliefs, assumptions and expectations, as well as information currently available to us. Such forward-looking statements may be identified by the use of the words “anticipate,” “believe,” “estimate,” “expect,” “may,” “will,” “plan” and similar expressions. Such statements reflect our current views with respect to future events and are subject to certain risks and uncertainties. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: the degree of our success in our plans to leverage our global footprint to grow our sales; the degree of our success in integrating the companies that we have acquired through the implementation of our M&A growth strategy; the lengthy development cycles for our solutions, which may frustrate our ability to realize revenues and/or profits from our potential new solutions; our lengthy and complex sales cycles, which do not always result in the realization of revenues; the degree of our success in retaining our existing customers or competing effectively for greater market share; the global macroeconomic environment, including headwinds caused by inflation, relatively high interest rates, potentially unfavorable currency exchange rate movements, and uncertain economic conditions, and their impact on our revenues, profitability and cash flows; difficulties in successfully planning and managing changes in the size of our operations; the frequency of the long-term, large, complex projects that we perform that involve complex estimates of project costs and profit margins, which sometimes change mid-stream; the challenges and potential liability that heightened privacy laws and regulations pose to our business; occasional disputes with clients, which may adversely impact our results of operations and our reputation; various intellectual property issues related to our business; potential unanticipated product vulnerabilities or cybersecurity breaches of our or our customers’ systems; risks related to the insurance industry in which our clients operate; risks associated with our global sales and operations, such as changes in regulatory requirements, wide-spread viruses and epidemics like the coronavirus epidemic, and fluctuations in currency exchange rates; and risks related to our principal location in Israel and our status as a Cayman Islands company.

While we believe such forward-looking statements are based on reasonable assumptions, should one or more of the underlying assumptions prove incorrect, or these risks or uncertainties materialize, our actual results may differ materially from those expressed or implied by the forward-looking statements. Please read the risks discussed under the heading “Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2023, to be filed in the near future, in order to review conditions that we believe could cause actual results to differ materially from those contemplated by the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, to conform these statements to actual results or to changes in our expectations.

|

SAPIENS INTERNATIONAL CORPORATION N.V. AND ITS SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENT OF INCOME U.S. dollars in thousands (except per share amounts) |

|||||||||

|

Three months ended |

Nine months ended |

||||||||

|

September 30, |

September 30, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

(unaudited) |

(unaudited) |

(unaudited) |

(unaudited) |

||||||

|

Revenue |

137,025 |

130,705 |

408,074 |

383,725 |

|||||

|

Cost of revenue |

76,729 |

74,753 |

230,114 |

220,080 |

|||||

|

Gross profit |

60,296 |

55,952 |

177,960 |

163,645 |

|||||

|

Operating expenses: |

|||||||||

|

Research and development, net |

16,449 |

16,028 |

49,779 |

47,391 |

|||||

|

Selling, marketing, general and administrative |

22,101 |

19,659 |

64,030 |

57,475 |

|||||

|

Total operating expenses |

38,550 |

35,687 |

113,809 |

104,866 |

|||||

|

Operating income |

21,746 |

20,265 |

64,151 |

58,779 |

|||||

|

Financial and other (income) expenses, net |

(913) |

551 |

(3,114) |

2,310 |

|||||

|

Taxes on income |

4,324 |

3,710 |

12,812 |

10,627 |

|||||

|

Net income |

18,335 |

16,004 |

54,453 |

45,842 |

|||||

|

Attributable to non-controlling interest |

– |

132 |

141 |

371 |

|||||

|

Net income attributable to Sapiens’ shareholders |

18,335 |

15,872 |

54,312 |

45,471 |

|||||

|

Basic earnings per share |

0.33 |

0.29 |

0.97 |

0.82 |

|||||

|

Diluted earnings per share |

0.33 |

0.28 |

0.97 |

0.82 |

|||||

|

Weighted average number of shares outstanding used to |

55,854 |

55,397 |

55,799 |

55,251 |

|||||

|

Weighted average number of shares outstanding used to |

56,308 |

55,813 |

56,151 |

55,657 |

|||||

|

SAPIENS INTERNATIONAL CORPORATION N.V. AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP RESULTS U.S. dollars in thousands (except per share amounts) |

|||||||||

|

Three months ended |

Nine months ended |

||||||||

|

September 30, |

September 30, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

(unaudited) |

(unaudited) |

(unaudited) |

(unaudited) |

||||||

|

GAAP revenue |

137,025 |

130,705 |

408,074 |

383,725 |

|||||

|

Valuation adjustment on acquired deferred |

– |

55 |

– |

165 |

|||||

|

Non-GAAP revenue |

137,025 |

130,760 |

408,074 |

383,890 |

|||||

|

GAAP gross profit |

60,296 |

55,952 |

177,960 |

163,645 |

|||||

|

Revenue adjustment |

– |

55 |

– |

165 |

|||||

|

Amortization of capitalized software |

1,470 |

1,418 |

4,584 |

4,274 |

|||||

|

Amortization of other intangible assets |

1,043 |

1,835 |

3,630 |

5,531 |

|||||

|

Non-GAAP gross profit |

62,809 |

59,260 |

186,174 |

173,615 |

|||||

|

GAAP operating income |

21,746 |

20,265 |

64,151 |

58,779 |

|||||

|

Gross profit adjustments |

2,513 |

3,308 |

8,214 |

9,970 |

|||||

|

Capitalization of software development |

(1,834) |

(1,638) |

(5,374) |

(4,975) |

|||||

|

Amortization of other intangible assets |

1,276 |

1,074 |

3,732 |

3,234 |

|||||

|

Stock-based compensation |

646 |

1,038 |

2,229 |

2,960 |

|||||

|

Acquisition-related costs *) |

754 |

11 |

1,248 |

21 |

|||||

|

Non-GAAP operating income |

25,101 |

24,058 |

74,200 |

69,989 |

|||||

|

GAAP net income attributable to Sapiens’ |

18,335 |

15,872 |

54,312 |

45,471 |

|||||

|

Operating income adjustments |

3,355 |

3,793 |

10,049 |

11,210 |

|||||

|

Taxes on income |

(599) |

(585) |

(1,808) |

(1,738) |

|||||

|

Non-GAAP net income attributable to Sapiens’ |

21,091 |

19,080 |

62,553 |

54,943 |

|||||

|

(*) Acquisition-related costs pertain to charges on behalf of M&A agreements related to future performance targets and retention criteria, as well as completed or prospective third-party services, such as tax, accounting and legal rendered. |

|||||||||

|

Adjusted EBITDA Calculation U.S. dollars in thousands |

||||||||

|

Three months ended |

Nine months ended |

|||||||

|

September 30, |

September 30, |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

GAAP operating profit |

21,746 |

20,265 |

64,151 |

58,779 |

||||

|

Non-GAAP adjustments: |

||||||||

|

Valuation adjustment on acquired deferred revenue |

– |

55 |

– |

165 |

||||

|

Amortization of capitalized software |

1,470 |

1,418 |

4,584 |

4,274 |

||||

|

Amortization of other intangible assets |

2,319 |

2,909 |

7,362 |

8,765 |

||||

|

Capitalization of software development |

(1,834) |

(1,638) |

(5,374) |

(4,975) |

||||

|

Stock-based compensation |

646 |

1,038 |

2,229 |

2,960 |

||||

|

Compensation related to acquisition and acquisition-related costs |

754 |

11 |

1,248 |

21 |

||||

|

Non-GAAP operating profit |

25,101 |

24,058 |

74,200 |

69,989 |

||||

|

Depreciation |

1,288 |

719 |

3,480 |

2,750 |

||||

|

Adjusted EBITDA |

26,389 |

24,777 |

77,680 |

72,739 |

||||

|

Summary of NON-GAAP Financial Information U.S. dollars in thousands (except per share amounts) |

|||||||||

|

Q3 2024 |

Q2 2024 |

Q1 2024 |

Q4 2023 |

Q3 2023 |

|||||

|

Revenues |

137,025 |

136,800 |

134,249 |

130,914 |

130,760 |

||||

|

Gross profit |

62,809 |

62,481 |

60,884 |

59,370 |

59,260 |

||||

|

Operating income |

25,101 |

24,836 |

24,263 |

24,152 |

24,058 |

||||

|

Adjusted EBITDA |

26,389 |

25,931 |

25,360 |

25,267 |

24,777 |

||||

|

Net income to Sapiens’ shareholders |

21,091 |

21,041 |

20,421 |

20,081 |

19,080 |

||||

|

Diluted earnings per share |

0.37 |

0.37 |

0.36 |

0.36 |

0.34 |

||||

|

Annual Recurring Revenue (“ARR”) U.S. dollars in thousands |

|||||||

|

Three months ended |

|||||||

|

September 30, |

|||||||

|

2024 |

2023 |

||||||

|

Annual Recurring Revenue |

173,414 |

157,589 |

|||||

|

Non-GAAP Revenues by Geographic Breakdown U.S. dollars in thousands |

|||||||||

|

Q3 2024 |

Q2 2024 |

Q1 2024 |

Q4 2023 |

Q3 2023 |

|||||

|

North America |

55,755 |

57,918 |

55,158 |

54,882 |

54,848 |

||||

|

Europe |

69,281 |

66,072 |

68,727 |

65,239 |

64,662 |

||||

|

Rest of the World |

11,989 |

12,810 |

10,364 |

10,793 |

11,250 |

||||

|

Total |

137,025 |

136,800 |

134,249 |

130,914 |

130,760 |

||||

|

Non-GAAP Revenue breakdown |

|||||||||

|

U.S. dollars in thousands

|

|||||||||

|

Three months ended |

Nine months ended |

||||||||

|

September 30, |

September 30, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

Software products and re-occurring post-production services (*) |

100,707 |

87,356 |

292,992 |

251,757 |

|||||

|

Pre-production implementation services (**) |

36,318 |

43,404 |

115,082 |

132,133 |

|||||

|

Total Revenues |

137,025 |

130,760 |

408,074 |

383,890 |

|||||

|

Three months ended |

Nine months ended |

||||||||

|

September 30, |

September 30, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

Software products and re-occurring post-production services (*) |

53,809 |

46,053 |

156,386 |

133,339 |

|||||

|

Pre-production implementation services (**) |

9,000 |

13,207 |

29,788 |

40,276 |

|||||

|

Total Gross profit |

62,809 |

59,260 |

186,174 |

173,615 |

|||||

|

Three months ended |

Nine months ended |

||||||||

|

September 30, |

September 30, |

||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

Software products and re-occurring post-production services (*) |

53.4 % |

52.7 % |

53.4 % |

53.0 % |

|||||

|

Pre-production implementation services (**) |

24.8 % |

30.4 % |

25.9 % |

30.5 % |

|||||

|

Gross Margin |

45.8 % |

45.3 % |

45.6 % |

45.2 % |

|||||

|

(*) Software products and re-occurring post-production services include mainly subscription, term license, maintenance, application maintenance, cloud solutions and post-production services. This revenue stream is a mix of recurring and re-occurring in nature. |

|||||||||

|

Adjusted Free Cash-Flow U.S. dollars in thousands |

|||||||||

|

Q3 2024 |

Q2 2024 |

Q1 2024 |

Q4 2023 |

Q3 2023 |

|||||

|

Cash-flow from operating activities |

13,083 |

8,545 |

18,488 |

38,646 |

3,988 |

||||

|

Increase in capitalized software development costs |

(1,834) |

(1,823) |

(1,717) |

(1,543) |

(1,638) |

||||

|

Capital expenditures |

(1,125) |

(666) |

(466) |

(421) |

(696) |

||||

|

Free cash-flow |

10,124 |

6,056 |

16,305 |

36,682 |

1,654 |

||||

|

Cash payments attributed to acquisition-related costs(*) (**) |

124 |

134 |

751 |

221 |

– |

||||

|

Adjusted free cash-flow |

10,248 |

6,190 |

17,056 |

36,903 |

1,654 |

||||

|

(*) Included in cash-flow from operating activities |

|||||||||

|

SAPIENS INTERNATIONAL CORPORATION N.V. AND ITS SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEET U.S. dollars in thousands |

|||||

|

September 30, |

December 31, |

||||

|

2024 |

2023 |

||||

|

(unaudited) |

(unaudited) |

||||

|

ASSETS |

|||||

|

CURRENT ASSETS |

|||||

|

Cash and cash equivalents |

146,152 |

126,716 |

|||

|

Short-term bank deposit |

39,800 |

75,400 |

|||

|

Trade receivables, net and unbilled receivables |

109,670 |

90,273 |

|||

|

Other receivables and prepaid expenses |

25,769 |

22,514 |

|||

|

Total current assets |

321,391 |

314,903 |

|||

|

LONG-TERM ASSETS |

|||||

|

Property and equipment, net |

11,431 |

12,661 |

|||

|

Severance pay fund |

3,446 |

3,605 |

|||

|

Goodwill and intangible assets, net |

310,533 |

317,352 |

|||

|

Operating lease right-of-use assets |

20,502 |

23,557 |

|||

|

Other long-term assets |

15,993 |

17,546 |

|||

|

Total long-term assets |

361,905 |

374,721 |

|||

|

TOTAL ASSETS |

683,296 |

689,624 |

|||

|

LIABILITIES AND EQUITY |

|||||

|

CURRENT LIABILITIES |

|||||

|

Trade payables |

8,224 |

6,291 |

|||

|

Current maturities of Series B Debentures |

19,796 |

19,796 |

|||

|

Accrued expenses and other liabilities |

80,610 |

77,873 |

|||

|

Current maturities of operating lease liabilities |

5,861 |

6,623 |

|||

|

Deferred revenue |

32,810 |

38,541 |

|||

|

Total current liabilities |

147,301 |

149,124 |

|||

|

LONG-TERM LIABILITIES |

|||||

|

Series B Debentures, net of current maturities |

19,778 |

39,543 |

|||

|

Deferred tax liabilities |

7,938 |

10,820 |

|||

|

Other long-term liabilities |

11,399 |

11,538 |

|||

|

Long-term operating lease liabilities |

17,532 |

21,084 |

|||

|

Accrued severance pay |

8,039 |

7,568 |

|||

|

Total long-term liabilities |

64,686 |

90,553 |

|||

|

EQUITY |

471,309 |

449,947 |

|||

|

TOTAL LIABILITIES AND EQUITY |

683,296 |

689,624 |

|||

|

SAPIENS INTERNATIONAL CORPORATION N.V. AND ITS SUBSIDIARIES CONSOLIDATED STATEMENT OF CASH FLOW U.S. dollars in thousands |

|||

|

For the nine months ended |

|||

|

2024 |

2023 |

||

|

(unaudited) |

(unaudited) |

||

|

Cash flows from operating activities: |

|||

|

Net income |

54,453 |

45,842 |

|

|

Reconciliation of net income to net cash provided by operating activities: |

|||

|

Depreciation |

3,480 |

2,750 |

|

|

Amortization of capitalized software and other intangible assets |

11,946 |

13,039 |

|

|

Accretion of discount on Series B Debentures |

32 |

47 |

|

|

Capital loss from sale of property and equipment |

13 |

83 |

|

|

Stock-based compensation related to options issued to employees |

2,229 |

2,960 |

|

|

Net changes in operating assets and liabilities, net of amount acquired: |

|||

|

Increase in trade receivables, net and unbilled receivables |

(20,640) |

(8,698) |

|

|

Decrease in deferred tax liabilities, net |

(2,280) |

(1,410) |

|

|

Increase in other operating assets |

(908) |

(4,107) |

|

|

Increase (decrease) in trade payables |

1,989 |

(616) |

|

|

Decrease in other operating liabilities |

(5,154) |

(10,110) |

|

|

Increase (decrease) in deferred revenues |

(5,684) |

363 |

|

|

Increase in accrued severance pay, net |

640 |

636 |

|

|

Net cash provided by operating activities |

40,116 |

40,779 |

|

|

Cash flows from investing activities: |

|||

|

Purchase of property and equipment |

(2,306) |

(2,145) |

|

|

Proceeds from (investment in) deposits |

36,360 |

(55,379) |

|

|

Proceeds from sale of property and equipment |

49 |

40 |

|

|

Payments for business acquisitions, net of cash acquired |

(375) |

– |

|

|

Capitalized software development costs |

(5,374) |

(4,975) |

|

|

Acquisition of intellectual property |

– |

(177) |

|

|

Net cash provided by (used in) investing activities |

28,354 |

(62,636) |

|

|

Cash flows from financing activities: |

|||

|

Proceeds from employee stock options exercised |

98 |

4,755 |

|

|

Distribution of dividend |

(29,789) |

(28,144) |

|

|

Repayment of Series B Debenture |

(19,796) |

(19,796) |

|

|

Acquisition of non-controlling interest |

(4,131) |

– |

|

|

Dividend to non-controlling interest |

– |

(47) |

|

|

Net cash used in financing activities |

(53,618) |

(43,232) |

|

|

Effect of exchange rate changes on cash and cash equivalents |

4,584 |

1,865 |

|

|

Increase (decrease) in cash and cash equivalents |

19,436 |

(63,224) |

|

|

Cash and cash equivalents at the beginning of period |

126,716 |

160,285 |

|

|

Cash and cash equivalents at the end of period |

146,152 |

97,061 |

|

Debentures Covenants

As of September 30, 2024, Sapiens was in compliance with all of its financial covenants under the indenture for the Series B Debentures, based on having achieved the following in its consolidated financial results:

Covenant 1

- Target shareholders’ equity (excluding non-controlling interest): above $120 million.

- Actual shareholders’ equity (excluding non-controlling interest) equal to $471.3 million.

Covenant 2

- Target ratio of net financial indebtedness to net capitalization (in each case, as defined under the indenture for the Company’s Series B Debentures) below 65%.

- Actual ratio of net financial indebtedness to net capitalization equal to (44.90)%.

Covenant 3

- Target ratio of net financial indebtedness to EBITDA (accumulated calculation for the four last quarters) is below 5.5.

- Actual ratio of net financial indebtedness to EBITDA (accumulated calculation for the four last quarters) is equal to (1.42).

Logo: https://stockburger.news/wp-content/uploads/2024/11/Sapiens_Logo.jpg

![]() View original content:https://www.prnewswire.com/news-releases/sapiens-reports-third-quarter-2024-financial-results-302301087.html

View original content:https://www.prnewswire.com/news-releases/sapiens-reports-third-quarter-2024-financial-results-302301087.html

SOURCE Sapiens International Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Revelation Biosciences Shares Are Trading Higher By Around 49%; Here Are 20 Stocks Moving Premarket

Shares of Revelation Biosciences, Inc. REVB rose sharply in today’s pre-market trading after the company reported better-than-expected third-quarter EPS results.

Revelation Biosciences a reported quarterly loss of 84 cents per share compared to market estimates of a loss of $2.84 per share.

Revelation Biosciences shares surged 48.8% to $1.22 in the pre-market trading session.

Here are some other stocks moving in pre-market trading.

Gainers

- New Horizon Aircraft Ltd. HOVR gained 68.2% to $0.4879 in pre-market trading.

- Signing Day Sports, Inc. SGN rose 61.1% to $0.2980 in pre-market trading after gaining around 10% on Friday.

- Destiny Tech100 Inc. DXYZ gained 27.1% to $46.01 in pre-market trading after jumping 64% on Friday.

- UTime Limited WTO shares rose 18.8% to $0.3791 in pre-market trading.

- FOXO Technologies Inc. FOXO climbed 17.4% to $0.5824 in pre-market trading after jumping around 35% on Friday.

- Autolus Therapeutics plc AUTL gained 17.1% to $4.37 in pre-market trading after the company reported the FDA approval of AUCATZYL® (obecabtagene autoleucel – obe-cel) for adults with relapsed/refractory B-cell acute lymphoblastic leukemia (r/r B-A.

- Prestige Wealth Inc. PWM gained 16.5% to $0.98 in pre-market trading. Prestige Wealth announced the acquisitions of InnoSphere Tech and closing of acquisition of Wealth AI.

- Coinbase Global, Inc. COIN rose 16% to $314.06 in pre-market trading amid strength in Bitcoin.

- MARA Holdings, Inc. MARA gained 15.3% to $22.25 in pre-market trading amid strength in Bitcoin.

Losers

- Dogwood Therapeutics, Inc. DWTX shares tumbled 29.7% to $2.98 in pre-market trading.

- Jet.AI Inc. JTAI shares fell 13% to $0.0374 in pre-market trading. Jet.AI shares dipped 25% on Friday after the company announced a 1-for-225 reverse stock split.

- Heramba Electric plc PITA shares fell 12.3% to $1.07 in pre-market trading.

- Li-Cycle Holdings Corp. LICY declined 12.1% to $2.9000 in pre-market trading. Li-Cycle shares fell around 9% on Friday after the company reported third-quarter financial results.

- Fresh2 Group Limited FRES dipped 11.8% to $1.1200 in pre-market trading.

- Conduit Pharmaceuticals Inc. CDT fell 9.7% to $0.0980 in pre-market trading after surging over 13% on Friday.

- FutureFuel Corp. FF shares dipped 9.5% to $5.51 in pre-market trading after the company posted a loss for the third quarter.

- Simpple Ltd. SPPL fell 9% to $0.9100 in today’s pre-market trading after surging around 14% on Friday.

- Lifeway Foods, Inc. LWAY fell 8.8% to $21.01 in pre-market trading. Lifeway Foods will report financial results for the third quarter ended Sept. 30, 2024 on Nov. 14, before the opening bell.

- Tempus AI, Inc TEM fell 7.1% to $68.50 in pre-market trading after jumping 30% on Friday.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ispire Technology Inc. Reports Financial Results for Fiscal First Quarter 2025

Gross Profit Increased 13.2% Year-Over-Year to $7.7 Million

Gross Margins increased to 19.5%, up from 16.0% in Fiscal Q1 2024

Expanded Global Reach through 5-Year Master Distributor Agreement with ANDS for MENA and Global Duty-Free Markets

LOS ANGELES, Nov. 11, 2024 /PRNewswire/ — Ispire Technology Inc. ISPR (“Ispire,” the “Company,” “we,” “us,” or “our”), an innovator in vaping technology and precision dosing, today reported results for the fiscal first quarter 2025, which ended on September 30, 2024, and anticipates filing its annual report on Form 10-Q with the U.S. Securities and Exchange Commission (the “SEC”) on November 12, 2024.

Fiscal First Quarter 2025 Financial Results

- Revenue was $39.3 million as compared to $42.9 million in the fiscal first quarter of 2024.

- Gross profit increased 13.2% to $7.7 million compared to $6.8 million in the fiscal first quarter of 2024.

- Gross margin increased to 19.5% as compared to 16.0% in the fiscal first quarter of 2024

- Total operating expenses increased 67.0% to $12.9 million as compared to $7.7 million in the fiscal first quarter of 2024.

- Net loss of ($5.6) million as compared to net loss of ($1.3) million in the fiscal first quarter of 2024.

Michael Wang, Co-Chief Executive Officer of Ispire, commented, “Our results from the fiscal first quarter of 2025 reflect our commitment to our growth strategy of becoming the leading innovative vaping technology and precision dosing solutions company worldwide. While our financial results were slightly impacted due to the strategic shifts we have made in our US business to focus on high quality customers and to improve payment terms and gross profit, I am pleased with our team’s overall performance given the challenging macroeconomic environment and look forward to the remainder of fiscal 2025 and the opportunities that lay ahead.”

Mr. Wang continued, “Additionally, we have continued to make progress with the point-of-use age-gating technology and have begun the initial phase of commercialization worldwide. Also, our recently launched ‘I-80’ is set to revolutionize the cannabis industry given its production efficiency and cost effectiveness and we continue to see increased adoption of our machine from leading players in the industry. Lastly, we are excited to have recently expanded our global reach through a landmark 5-year master distributor agreement with ANDS for the Middle East and North Affrica region and Global Duty-Free markets. This partnership will enable us to bring our Hidden Hills Club nicotine portfolio to new markets, offering adult consumers innovative, harm-reduced alternatives to combustible cigarettes. We believe that the recent advancements we have made, combined with our solid financial performance, positions Ispire for continued growth and success as we proceed with our mission of providing industry-leading vaping technology worldwide.”

Jim McCormick, Chief Financial Officer of Ispire, stated, “The results from our fiscal first quarter were in line with our internal projections as we shifted our U.S. strategy while we also had a few delayed shipments which impacted our quarterly results. Despite the obstacles we’ve faced, our first quarter financial performance was still strong, including our gross profit increasing 13.2% year-over-year and our gross margins improving from 16.0% in the fiscal first quarter of 2024 to 19.5% in the fiscal first quarter of 2025. As we head into the remainder of fiscal 2025, we are confident that we are well-positioned to continue delivering value to our shareholders as we advance our mission of becoming a global leading provider of innovative vaping technology and precision dosing solutions.”

Financial Results for the Fiscal First Quarter Ended September 30, 2024

For the fiscal first quarter ended September 30, 2024, Ispire reported revenue of $39.3 million compared to $42.9 million during the same period last year, a decrease of 8.2%. The decrease in revenue is the combined effect of decreases in product sales in the United States of $8.1 million from $17.8 million for the fiscal first quarter ended September 30, 2023, to $9.7 million for the three months ended September 30, 2024, offset by increases in sales of vaping products in Europe of $2.1 million from $19.9 million for the three months ended September 30, 2023 to approximately $22.0 million for the fiscal first quarter ended September 30, 2024, and increases in sales to other regions of $3.7 million from $0.06 million for the three months ended September 30, 2023 to approximately $3.8 million for the fiscal first quarter ended September 30, 2024, mainly contributed by increase in sales to South Africa of $2.9 million.

Gross profit for the fiscal first quarter ended September 30, 2024, was $7.7 million compared to $6.8 million for the fiscal first quarter 2024 ended September 30, 2023. Over this same period, our gross margin grew to 19.5%, from 16.0%. The increase in gross profit and gross margin was primarily due to changes in product mix with an increase in higher margin products being sold during the fiscal first quarter ended September 30, 2024.

Total operating expenses for the fiscal first quarter ended September 30, 2024 were $12.9 million as compared to $7.7 million for fiscal first quarter ended September 30, 2023. The increase in operating expenses is due to an increase in our marketing activities, marketing campaign and trade shows of $0.7 million, stock-based compensation expense related to selling personnel of $1.0 million for the three months ended September 30, 2024 and headcount and payroll expense for Aspire Science of $0.1 million. The Company also had an increase in stock-based compensation expense of $1.0 million for the three months ended September 30, 2024, as compensation and incentive for management, employees and service providers, and an increase in bad debt expense as an allowance for credit losses of $1.9 million from accounts resulted from management’s assessment on Company’s account receivables balances.

For the fiscal first quarter ended September 30, 2024, net loss was ($5.6) million or ($0.10) per share, compared to a net loss of ($1.3) million, or ($0.02) per share for fiscal first quarter ended September 30, 2023.

As of September 30, 2024, Ispire had $37.7 million in cash and cash equivalents and working capital of $16.6 million.

Conference Call

The Company will conduct a conference call at 8:00 am Eastern Time on Monday, November 11, 2024, to discuss the results. Ispire management will host the conference call, followed by a question-and-answer period.

Please call the conference call dial-in 5-10 minutes prior to the start time and ask for the “Ispire Technology Call.” An operator will register your name and organization.

- Date: Monday, November 11, 2024

- Time: 8:00 am ET

- Dial-In Numbers: United States 844-826-3033 or International +1 412-317-5185

This conference call will be broadcast live on the Internet and can be accessed by all interested parties at https://viavid.webcasts.com/starthere.jsp?ei=1693594&tp_key=0c7f927f41

Please access the link at least fifteen minutes prior to the start of the call to register, download, and install any necessary audio software.

A playback will be available from 11:00 am ET on November 11, 2024 through November 25, 2024. To listen, please dial 1-844-512-2921 or 1-412-317-6671. Use the passcode 10193803 to access the replay.

About Ispire Technology Inc.

Ispire is engaged in the research and development, design, commercialization, sales, marketing, and distribution of branded e-cigarettes and cannabis vaping products. The Company’s operating subsidiaries own or license more than 200 patents received or filed globally. Ispire’s tobacco products are marketed under the Aspire brand name and are sold worldwide (except in the U.S., People’s Republic of China and Russia) primarily through its global distribution network. The Company’s cannabis products are marketed under the Ispire brand name primarily on an original design manufacturer (ODM) basis to other cannabis vapor companies. Ispire sells its cannabis vaping hardware only in the U.S., and it recently commenced its marketing activities in Canada and Europe. For more information, visit www.ispiretechnology.com or follow Ispire on Instagram, LinkedIn, Facebook, Twitter and YouTube. Any information contained on, or that can be accessed through, the Company’s website, any other website or any social media, is not a part of this press release.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”) as well as Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended, that are intended to be covered by the safe harbor created by those sections. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “would,” “could,” “seek,” “intend,” “plan,” “goal,” “project,” “estimate,” “anticipate,” “strategy,” “future,” “likely” or other comparable terms, although not all forward-looking statements contain these identifying words. All statements other than statements of historical facts included in this press release regarding the Company’s strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Important factors that could cause the Company’s actual results and financial condition to differ materially from those indicated in the forward-looking statements. Such forward-looking statements include, but are not limited to, risks and uncertainties including those regarding: whether the Company may be successful in re-entering the U.S. ENDS market; the approval or rejection of any PMTA submitted by the Company; whether the Company’s joint venture with Touch Point Worldwide Inc. d/b/a/ Berify and Chemular Inc. (the “Joint Venture”) may be successful in achieving its goals as currently contemplated, with different terms, or at all, the Joint Venture’s ability to innovate in the e-cigarette technology space or develop age gating or age verification technologies for nicotine vaping devices, the Company’s ability to collect its accounts receivable in a timely manner, the Company’s business strategies, the ability of the Company to market to the Ispire ONE™, Ispire ONE™’s success if meeting its goals, the ability of its customers to derive the anticipated benefits of the Ispire ONE™ and the success of its products on the markets, the Ispire ONE™ proving to be safe, and the risk and uncertainties described in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Cautionary Note on Forward-Looking Statements” and the additional risk described in Ispire’s Annual Report on Form 10-K for the year ended September 30, 2023 and any subsequent filings which Ispire makes with the SEC. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this press release relate only to events or information as of the date on which the statements are made in this press release. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events except as required by applicable law. You should read this press release with the understanding that our actual future results may be materially different from what we expect.

|

ISPIRE TECHNOLOGY INC. |

||||||||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||

|

(In $USD, except share and per share data) |

||||||||

|

September 30, |

June 30, |

|||||||

|

Assets |

||||||||

|

Current assets: |

||||||||

|

Cash |

$ |

37,731,954 |

$ |

35,071,294 |

||||

|

Restricted cash |

24,280 |

– |

||||||

|

Accounts receivable, net |

62,359,322 |

59,734,765 |

||||||

|

Inventories, net |

6,992,025 |

6,365,394 |

||||||

|

Prepaid expenses and other current assets |

1,406,822 |

1,400,152 |

||||||

|

Total current assets |

108,514,403 |

102,571,605 |

||||||

|

Other assets: |

||||||||

|

Property, plant and equipment, net |

2,662,714 |

2,582,457 |

||||||

|

Intangible assets, net |

2,015,805 |

1,375,666 |

||||||

|

Right-of-use assets – operating leases |

3,295,952 |

3,579,140 |

||||||

|

Other investment |

2,000,000 |

2,000,000 |

||||||

|

Equity method investment |

10,172,075 |

10,248,048 |

||||||

|

Other non-current assets |

291,699 |

284,050 |

||||||

|

Total other assets |

20,438,245 |

20,069,361 |

||||||

|

Total assets |

$ |

128,952,648 |

$ |

122,640,966 |

||||

|

Liabilities and stockholders’ equity |

||||||||

|

Current liabilities |

||||||||

|

Accounts payable |

$ |

4,341,642 |

$ |

3,779,723 |

||||

|

Accounts payable – related party |

76,001,622 |

67,046,472 |

||||||

|

Contract liabilities |

2,245,505 |

2,218,166 |

||||||

|

Accrued liabilities and other payables |

12,139,232 |

11,738,339 |

||||||

|

Income tax payable |

399,995 |

– |

||||||

|

Operating lease liabilities – current portion |

1,240,726 |

1,207,832 |

||||||

|

Total current liabilities |

96,368,722 |

85,990,532 |

||||||

|

Other liabilities: |

||||||||

|

Operating lease liabilities – net of current portion |

1,869,951 |

2,194,094 |

||||||

|

Total liabilities |

98,238,673 |

88,184,626 |

||||||

|

Commitments and contingencies |

||||||||

|

Stockholders’ equity: |

||||||||

|

Common stock, par value $0.0001 per share; 140,000,000 shares authorized; |

5,664 |

5,647 |

||||||

|

Preferred stock, par value $0.0001 per share, 10,000,000 shares authorized, no |

– |

– |

||||||

|

Additional paid-in capital |

45,224,962 |

43,217,391 |

||||||

|

Accumulated deficit |

(14,420,057) |

(8,825,041) |

||||||

|

Accumulated other comprehensive (loss) income |

(96,594) |

58,343 |

||||||

|

Total stockholders’ equity |

30,713,975 |

34,456,340 |

||||||

|

Total liabilities and stockholders’ equity |

$ |

128,952,648 |

$ |

122,640,966 |

||||

|

ISPIRE TECHNOLOGY INC. |

||||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

||||||||

|

(In $USD, except share and per share data) |

||||||||

|

Three Months Ended |

||||||||

|

2024 |

2023 |

|||||||

|

Revenue |

$ |

39,338,313 |

$ |

42,864,647 |

||||

|

Cost of revenue |

31,663,935 |

36,019,799 |

||||||

|

Gross profit |

7,674,378 |

6,844,848 |

||||||

|

Operating expenses: |

||||||||

|

Sales and marketing expenses |

2,992,247 |

1,025,219 |

||||||

|

General and administrative expenses |

9,904,539 |

6,697,874 |

||||||

|

Total operating expenses |

12,896,786 |

7,723,093 |

||||||

|

Loss from operations |

(5,222,408) |

(878,245) |

||||||

|

Other income (expense): |

||||||||

|

Interest income |

86 |

72,246 |

||||||

|

Exchange gain, net |

117,585 |

3,661 |

||||||

|

Other income (expenses), net |

6,935 |

(43,204) |

||||||

|

Total other income, net |

124,606 |

32,703 |

||||||

|

Loss before income taxes |

(5,097,802) |

(845,542) |

||||||

|

Income taxes – current |

(497,214) |

(496,045) |

||||||

|

Net loss |

$ |

(5,595,016) |

$ |

(1,341,587) |

||||

|

Other comprehensive (loss) income |

||||||||

|

Foreign currency translation adjustments |

(154,937) |

44,463 |

||||||

|

Comprehensive loss |

(5,749,953) |

(1,297,124) |

||||||

|

Net loss per share |

||||||||

|

Basic and diluted |

$ |

(0.10) |

$ |

(0.02) |

||||

|

Weighted average shares outstanding: |

||||||||

|

Basic and diluted |

56,601,320 |

54,246,212 |

||||||

|

ISPIRE TECHNOLOGY INC. |

||||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||

|

(In $USD, except share and per share data) |

||||||||

|

Three Months ended |

||||||||

|

2024 |

2023 |

|||||||

|

Net loss: |

$ |

(5,595,016) |

$ |

(1,341,587) |

||||

|

Adjustments to reconcile net income from operations to net cash provided by |

||||||||

|

Depreciation and amortization |

204,807 |

29,161 |

||||||

|

Credit loss expenses |

3,102,081 |

225,487 |

||||||

|

Right-of-use assets amortization |

283,188 |

287,481 |

||||||

|

Stock-based compensation expenses |

2,007,588 |

967,560 |

||||||

|

Inventory impairment |

73,692 |

– |

||||||

|

Loss from equity method investment |

75,973 |

– |

||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Accounts receivable, net |

(5,726,638) |

(14,710,476) |

||||||

|

Inventories |

(700,323) |

1,863,080 |

||||||

|

Other current and non-current assets |

(14,319) |

1,603,180 |

||||||

|

Accounts payable |

9,517,069 |

(2,449,276) |

||||||

|

Contract liabilities |

(87,402) |

281,529 |

||||||

|

Accrued liabilities and other payables |

360,697 |

(124,950) |

||||||

|

Income tax payable |

399,995 |

496,138 |

||||||

|

Lease liabilities |

(291,249) |

(249,753) |

||||||

|

Net cash provided by (used in) operating activities |

$ |

3,610,143 |

$ |

(13,122,426) |

||||

|

Cash flows from investing activities: |

||||||||

|

Purchase of property, plant and equipment |

(268,781) |

(533,122) |

||||||

|

Acquisition of intangible assets |

(656,422) |

(255,650) |

||||||

|

Net cash used in investing activities |

$ |

(925,203) |

$ |

(788,772) |

||||

|

Cash flows from financing activities: |

||||||||

|

Repayments of advances from a related party |

– |

(703,323) |

||||||

|

Net cash used in financing activities |

$ |

– |

$ |

(703,323) |

||||

|

Net increase (decrease) in cash and cash equivalents |

2,684,940 |

(14,614,521) |

||||||

|

Cash and cash equivalents – beginning of period |

35,071,294 |

40,300,573 |

||||||

|

Cash and cash equivalents – end of period |

$ |

37,756,234 |

$ |

25,686,052 |

||||

|

Supplemental non-cash investing and financing activities |

||||||||

|

Leased assets obtained in exchange for operating lease liabilities |

– |

537,307 |

||||||

For more information, kindly contact:

IR Contacts:

Investor Relations

Sherry Zheng

718-213-7386

ir@ispiretechnology.com

KCSA Strategic Communications

Phil Carlson

212-896-1233

ispire@kcsa.com

PR Contact:

Ellen Mellody

570-209-2947

EMellody@kcsa.com

![]() View original content:https://www.prnewswire.com/news-releases/ispire-technology-inc-reports-financial-results-for-fiscal-first-quarter-2025-302300568.html

View original content:https://www.prnewswire.com/news-releases/ispire-technology-inc-reports-financial-results-for-fiscal-first-quarter-2025-302300568.html

SOURCE Ispire Technology Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Likely To Open Higher After Registering Best Week Of Year Following Trump Win: Markets Still Have Juice Left As Investors Eye CPI Data, Says Expert

U.S. stocks could get off to a positive start on Monday after the averages registered their best week this year following the reelection of Donald Trump.

After witnessing heightened volatility in the run-up to the high-voltage 2024 presidential elections, and the Federal Open Market Committee’s (FOMC) rate decision, Fed chair Jerome Powell remained cautious in his approach, but delivered the 25 basis point cut that was widely expected by experts and investors.

| Futures | Performance (+/-) |

| Nasdaq 100 | 0.34% |

| S&P 500 | 0.29% |

| Dow Jones | 0.28% |

| R2K | 1.32% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY was up 0.28% to $599.84 and the Invesco QQQ ETF QQQ fell 0.28% to $515.57, according to Benzinga Pro data.

Cues From Last Week:

Dow Jones and S&P 500 registered their best week of the year after the election of Trump as the 47th U.S. president.

The S&P 500 surged 4.66% last week, while the Dow gained 4.61% during that period, with both indices recording their best week since Nov. 2023. The Nasdaq, meanwhile, jumped 5.74% during the week.

Most sectors on the S&P 500 closed on a positive note, with consumer staples, utilities, and real estate stocks recording the biggest gains on Friday.

However, materials and communication services stocks bucked the overall market trend, closing the session lower.

| Index | Week’s Performance (+/-) | Value |

| Nasdaq Composite | 5.74% | 19,286.78 |

| S&P 500 | 4.66% | 5,995.54 |

| Dow Jones | 4.61% | 43,988.99 |

| Russell 2000 | 8.47% | 2,399.64 |

Insights From Analysts:

Ari Wald, head of technical analysis at Oppenheimer & Co., noted that the current rally in U.S. equity markets is based on multiple factors and not just the post-election rush due to Trump’s victory.

“There’s market strength and there’s meaningful market strength. We see last week’s post-election breakout as meaningful market strength based on wide-ranging bullish action.”

Moving past the election, investors will be looking forward to crucial economic data such as the October Consumer Price Index, or CPI. Economists expect a moderate uptick in CPI inflation to 2.6% in October, as compared to 2.4% in September.

The core inflation is expected to remain unchanged at 3.3%.

“The October CPI report will likely support the notion that the last mile of inflation’s journey back to target will be the hardest,” said economists at Wells Fargo, led by Jay Bryson.

Investors will also keep an eye out for crucial retail sales data ahead of the beginning of the holiday season.

Nathan Peterson, Director of Derivatives Analysis at the Schwab Center for Financial Research, laid out the thesis for market movements for the next week.

“If history is any guide, it shouldn’t be a surprise if we get some “back and fill” price action (consolidation of gains) from this week’s surge in stocks, but the timing is difficult if not impossible to predict,” Peterson said.

“Today’s price action suggests to me that the post-election upside momentum is still in play, which bodes well for stocks, at least for the first half of next week.”

Overall, Peterson maintains a cautious stance, saying markets could witness bullish momentum to kick off the week, but bearish sentiments could take over during the second half.

See Also: How To Trade Futures

Upcoming Economic Data

Monday’s economic calendar is light, but crucial economic data is scheduled for the rest of the week.

- On Tuesday, Fed Gov. Christopher Waller will speak at 10 a.m. ET.

- Richmond Fed President Tom Barkin will speak at 10:15 a.m. ET.

- Philadelphia President Patrick Harker will speak at 10 a.m. ET.

- On Wednesday, the Consumer Price Index (CPI) will be released at 8:30 a.m. ET.

- New York Fed President John Williams will speak at 9:30 a.m. ET.

- Dallas Fed President Lorie Logan will speak at 9:45 a.m. ET.

- The monthly U.S. federal budget will be released at 2 p.m. ET.

- On Thursday, Federal Reserve Gov. Adriana Kugler will speak at 7 a.m. ET.

- Initial jobless claims data will be released at 8:30 a.m. ET.

- Federal Reserve Chair Jerome Powell will speak at 3 p.m. ET.

- On Friday, the Import price index will be released at 8:30 a.m. ET.

- Retail sales data will be released at 8:30 a.m. ET

Stocks In Focus:

- Taiwan Semiconductor Manufacturing Co. TSM will be in focus on Monday after it was reportedly ordered to halt shipments of advanced chips to China.

- Investors are awaiting earnings results from Aramark ARMK, Live Nation Entertainment, Inc. NYSE: LYV), and monday.com Ltd. MNDY today.

- Trump Media & Technology Group Corp. DJT shares gain over 5% in premarket trading on Monday.

- Tesla Inc. TSLA shares surged over 7%.

Commodities, Bonds And Global Equity Markets:

Crude oil futures experienced sideways movement in the early New York session, falling by 1.28%.

The 10-year Treasury note yield eased marginally to 4.306%.

Major Asian markets ended mixed on Monday.

Bitcoin BTC/USD hit the $81000 mark first time in history as cryptocurrencies rally after Trump’s win last week.

Read Next:

Photo courtesy: Wikimedia

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GEODRILL REPORTS THIRD QUARTER 2024 FINANCIAL RESULTS

– Long-Term, Multi- Rig Contracts Drive Profitability –

TORONTO, Nov. 11, 2024 /CNW/ – Geodrill Limited (“Geodrill” or the “Company”) GEO, a leading West African based drilling company, reported its financial results for the three month and nine month period ended September 30, 2024. All figures are reported in U.S. dollars ($), unless otherwise indicated. Geodrill’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”).

Financial Highlights Q3-2024:

- Generated revenue of $34.1M, being a 13% increase compared to $30.3M for Q3-2023;

- Delivered EBITDA of $7.6M or 22% of revenue compared to $0.6M or 2% of revenue in Q3-2023;

- Achieved net income of $2.6M or $0.06 per Ordinary Share, compared to a net loss of $(3.0)M or $(0.06) per Ordinary Share in Q3-2023; and

- Ended the quarter with net cash (excluding right of use liabilities) of $3.5M.

Operational Highlights Q3-2024:

- Maintained a strong presence in West Africa in two primary countries, Ghana and Cote d’Ivoire;

- In 2024, the Company secured contracts totaling more than $150M that will continue to strongly contribute to revenue and profitability over the next 3-5 years;

- Subsequent to the quarter end, the Company secured contracts in Chile totaling $49M including two very significant multi-rig, multi-year contracts, and one multi-rig contract;

- Commenced drilling subsequent to the quarter end in Chile and Peru on longer term contracts;

- Grew the Company’s presence in Egypt, supported by its long term underground contract with a tier one client;

- Re-invested and upgraded the Company’s fleet to support two very significant multi-rig contracts; ending the quarter with 95 rigs; and

- Achieved a new milestone of 21M LTI free hours.

Outlook:

- Favorable Market Conditions: The strong gold price continues to provide tailwinds for exploration drilling;

- Geographical Expansion: The Company is actively expanding its geographical reach and diversifying its commodity portfolio.

Financial Summary

|

US$ 000s (except earnings per |

For the three |

For the three |

For the nine |

For the nine |

|

Revenue |

$34,091 |

$30,292 |

$109,935 |

$100,483 |

|

Gross profit |

$8,351 |

$5,804 |

$28,517 |

$25,738 |

|

Gross profit margin |

24 % |

19 % |

26 % |

26 % |

|

EBITDA(1)(2) |

$7,630 |

$646 |

$24,956 |

$17,307 |

|

EBITDA margin |

22 % |

2 % |

23 % |

17 % |

|

Net Income/Loss |

$2,611 |

$(2,950) |

$9,563 |

$5,141 |

|

Earnings/Loss per share – basic |

$0.06 |

$(0.06) |

$0.21 |

$0.11 |

|

Notes: |

||

|

(1) |

EBITDA = earnings before interest, taxes, depreciation and amortization |

|

|

(2) |

Please see “Non-IFRS Measures” below for additional discussion |

|

“This quarter, Geodrill delivered another solid financial performance, which is a testament to our operational success and strategic planning. Our strategic decision to transition our rig fleet to more advantageous jurisdictions has proven to be the right move as demonstrated in our financial results. Additionally, our success in securing multiple rig contracts in new jurisdictions has significantly boosted our revenue visibility and profitability and demonstrates our commitment to operational excellence and financial stability,” said Greg Borsk, Chief Financial Officer.

“Securing multi-rig contracts across both our core and expanded markets enables us to provide shareholders with stable and predictable revenue, while establishing a unique market position to outperform the industry. Following the recent quarter, we have been awarded significant contracts in Chile, including two major multi-rig, multi-year contracts, and one additional multi-rig contract. These contracts are set to boost our revenue starting next quarter and extending through 2027,” stated Dave Harper, President and Chief Executive Officer of Geodrill. “With a strong portfolio of long-term contracts with a tier 1 client base, favorable pricing conditions, and a robust pipeline of opportunities, we are confident in delivering exceptional value to our shareholders and establishing a strong foundation for growth.”

Geodrill’s condensed interim consolidated financial statements and management’s discussion & analysis (“MD&A”), for the three and nine month period ended September 30, 2024, are available via Geodrill’s website at www.geodrill.ltd and will be available on SEDAR+ at www.sedarplus.ca. Management of the Company will host a conference call at 10:00 am ET to discuss the financial results.

Q3 2024 Conference Call Information

|

Date & Time: |

Monday, November 11, 2024 at 10:00 a.m. ET |

|

Telephone: |

Toll Free (North America) 1-888-664-6392 |

|

International 1-416-764-8659 |

|

|

Conference ID: |

45983 |

|

Webcast: |

Conference Call Replay

|

Telephone: |

Toll Free Replay (North America) 1-888-390-0541 |

|

International Replay 1-416-764-8677 |

|

|

Entry Code: |

45983 # |

|

The conference call replay will be available until November 18, 2024 11:59 p.m. ET. |

|

About Geodrill Limited

Geodrill has been successful in establishing a leading market position in Ghana and Cote d’Ivoire. The Company also operates in other African jurisdictions including Egypt and Senegal and is expanding its geographic presence in the South America countries of Chile and Peru. With the large fleet of multi-purpose rigs, Geodrill provides a broad selection of diverse drilling services, including exploration, delineation, underground and grade control drilling, to meet the specific needs of its clients. The Company’s client mix is made up of senior mining, intermediate and junior exploration companies. www.geodrill.ltd

Non-IFRS Measures

EBITDA is defined as Earnings before Interest, Taxes, Depreciation and Amortization and is used as a measure of financial performance. The Company believes EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties to evaluate companies in the industry. However, EBITDA is not a measure recognized by IFRS and does not have a standardized meaning prescribed by IFRS. EBITDA should not be viewed in isolation and does not purport to be an alternative to net income or gross profit as an indicator of operating performance or cash flows from operating activities as a measure of liquidity. EBITDA does not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similarly titled measures presented by other publicly traded companies, and EBITDA should not be construed as an alternative to other financial measures determined in accordance with IFRS.

Additionally, EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not consider certain cash requirements such as capital expenditures, contractual commitments, interest payments, tax payments and debt service requirements. Please see the Company’s MD&A for the three and nine month period ended September 30, 2024 for the EBITDA reconciliation.

Forward Looking Information

This press release may contain “forward-looking information” which may include, but is not limited to the future financial or operating performance of the Company, its subsidiaries, future growth, results of operations, performance, business prospects and opportunities. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “believes”, or variations (including negative variations) of such words and phrases, or by the use of words or phrases that state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions and expected future developments and other factors it believes are appropriate. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company and/or its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements contained in this press release including, without limitation those described in the Management’s Discussion & Analysis for the quarter ended September 30, 2024 and the Company’s Annual Information Form dated March 30, 2024 under the heading “Risk Factors”. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in such forward-looking statements, there may be other factors that may cause actions, events or results to differ from those anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize or should assumptions underlying such forward-looking statements prove incorrect, actual results, performance or achievements may vary materially from those expressed or implied by the forward-looking statements contained in this press release. The forward-looking information and forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update or review such information or statements, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE Geodrill Limited

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/11/c0301.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/11/c0301.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Ethereum ETFs React As BTC Surges Past $82K After Trump's Win

Bitcoin BTC has reached a new milestone, soaring past $82,000, fueled by optimism over a potentially favorable regulatory environment following Donald Trump’s election as U.S. president. The cryptocurrency has more than doubled from its earlier low of $38,505 this year, peaking at $82,368.

What Happened: Bitcoin-linked ETFs have mirrored this upward trend on Monday, as per Benzinga Pro. The Bitwise Bitcoin ETF BITB rose by 6.67%, while the Grayscale Bitcoin Trust ETF GBTC increased by 6.58%. Additionally, the iShares Bitcoin Trust IBIT saw a 7.21% rise.

In contrast, Ethereum ETH/USD experienced a slight decline of 0.61%, yet its associated ETFs showed positive movement.

The ProShares Ether ETF EETH climbed by 8.28%, the Bitwise Ethereum ETF ETHW went up 7.09%, and the iShares Ethereum Trust ETF ETHA increased by 8.42%.

The election of Trump has sparked speculation about a more crypto-friendly regulatory environment, which could pave the way for further adoption and integration of digital currencies.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

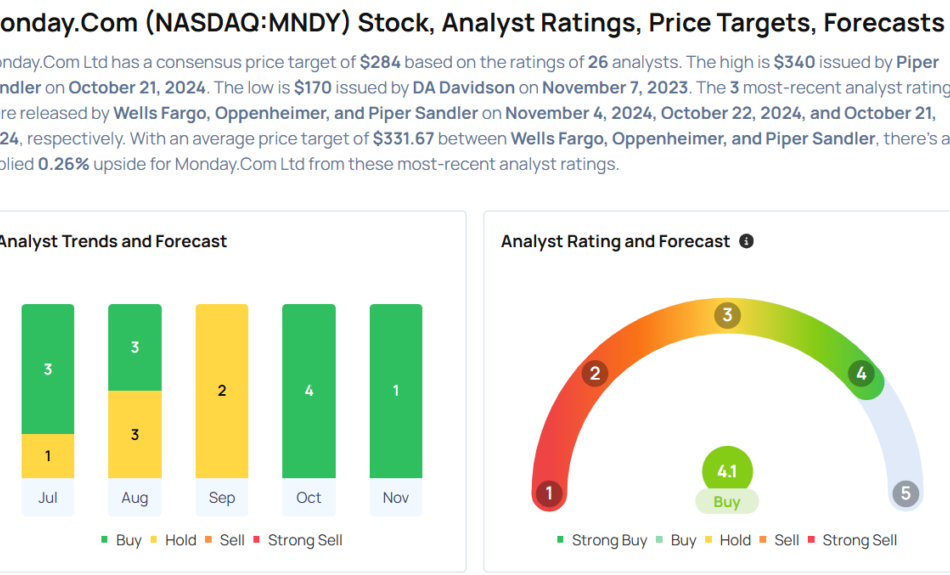

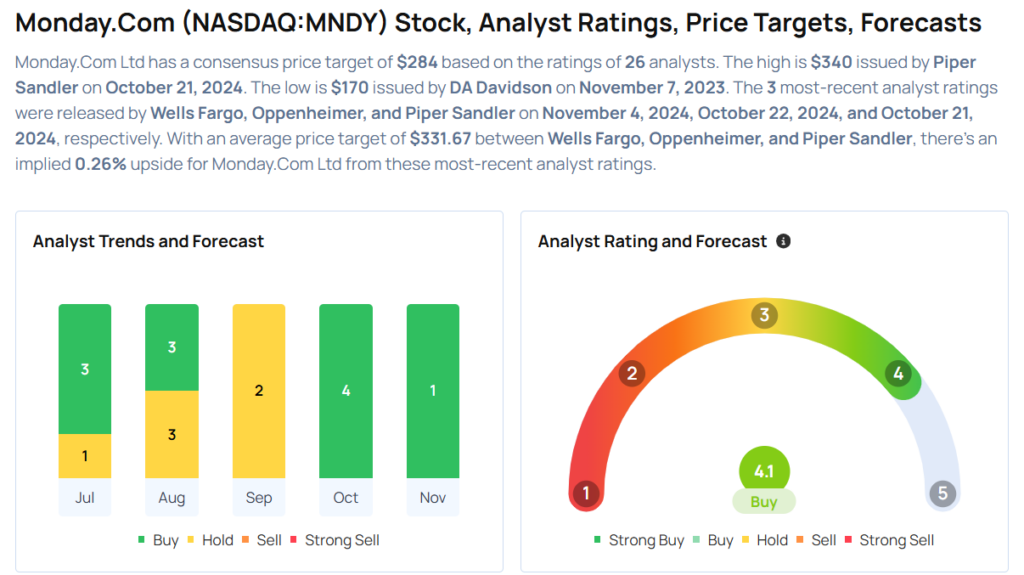

Top Wall Street Forecasters Revamp Monday.com Price Expectations Ahead Of Q3 Earnings

monday.com Ltd. MNDY will release earnings results for its third quarter, before the opening bell on Monday, Nov. 11.