Tony Thene Boosts Confidence With $97K Purchase Of Carpenter Tech Stock

On November 19, a substantial insider purchase was made by Tony Thene, President and CEO at Carpenter Tech CRS, as per the latest SEC filing.

What Happened: Thene’s recent move, as outlined in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, involves purchasing 5,500 shares of Carpenter Tech. The total transaction value is $97,460.

At Wednesday morning, Carpenter Tech shares are up by 0.8%, trading at $185.98.

Delving into Carpenter Tech’s Background

Carpenter Technology Corp supplies specialty metals to a variety of end markets, including aerospace and defense, industrial machinery and consumer durables, medical, and energy, among others. The company’s reportable segments include; Specialty Alloys Operations and Performance Engineered Products. It generates maximum revenue from the Specialty Alloys Operations segment. The SAO segment is comprised of the company’s alloy and stainless steel manufacturing operations. This includes operations performed at mills predominantly in Reading and Latrobe, Pennsylvania, and surrounding areas as well as South Carolina and Alabama. Geographically, the company derives its maximum revenue from the United States and the rest from Europe, Asia Pacific, Mexico, Canada, and other regions.

Financial Insights: Carpenter Tech

Positive Revenue Trend: Examining Carpenter Tech’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 10.08% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Materials sector.

Profitability Metrics:

-

Gross Margin: With a high gross margin of 24.57%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Carpenter Tech’s EPS is below the industry average. The company faced challenges with a current EPS of 1.69. This suggests a potential decline in earnings.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.42, caution is advised due to increased financial risk.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: Carpenter Tech’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 41.09.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 3.3 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Carpenter Tech’s EV/EBITDA ratio, surpassing industry averages at 21.14, positions it with an above-average valuation in the market.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Carpenter Tech’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Tel-Aviv Stock Exchange Reports its Results for the Third Quarter of 2024

Quarterly revenue reached NIS 109 million, an increase of 14%;

EBITDA increased by 17% to NIS 45 million;

43% growth in net profit to NIS 26 million

- Revenue in the third quarter of the year reached a record NIS 109 million, compared to NIS 95 million in the corresponding quarter last year, an increase of 14%.

- Adjusted EBITDA in the third quarter of 2024 increased by 17%, totaling NIS 45 million, compared to NIS 38 million in the corresponding quarter last year.

- Net profit in the third quarter of the year totaled NIS 26 million, compared NIS 18 million in the corresponding quarter last year, an increase of 43%.

- Daily trading volumes were significantly higher this quarter, with a 7% increase in shares and 20% in bonds, compared to the average daily trading volumes in the corresponding quarter last year.

Ittai Ben Zeev, TASE CEO, said today:

“We conclude the third quarter with strong results that demonstrate the resilience of the Israeli economy. These results are the fruit of the ongoing implementation of TASE’s strategic plan, which focuses on aligning our operations with international standards, investing in technological advancement, and developing new financial products to enhance accessibility for investors.

Ben Zeev added: “Despite the ongoing war, TASE continues to demonstrate its strength as a crucial platform for raising equity and debt financing for both public companies and the Government of Israel., which is critical to the vitality and strength of the economy in these challenging times. Now, more than ever, it is important to generate growth catalysts that strengthen the local capital market, encourage international investment in the Israeli market and create incentives for local investments to facilitate continued growth and economic resilience.”

TEL AVIV, Israel, Nov. 20, 2024 /PRNewswire/ — The Tel-Aviv Stock Exchange Ltd. TASE today announced its financial results for the third quarter ended September 30, 2024.

Key trends and data in the capital market in the first nine months of 2024

The Israeli capital market continues to exhibit substantial resilience despite the ongoing war and the downgrading of Israel’s sovereign credit rating in recent months.

TASE’s leading indices maintain an upward trend: the TA-125 index increased by 12% from the beginning of the year through the end of September, similar to the increase in the Dow Jones Index and outperforming the 9% increase in the MSCI Europe Index, but less than the 21% increase in the S&P500 Index. Since October to date, TASE’s leading indices have continued to climb.

The market cap of the equity market at the end of September reached NIS 1,184 billion, a 12% increase over year-end 2023, with this resulting from the increase in TASE’s equity indices.

Trading volumes in the main trading channels increased significantly in the first nine months of 2024 compared to 2023. In the equity market, trading volumes were 5% higher than the average daily trading volume for all of 2023, and averaged NIS 2.1 billion a day. The average daily trading volume of bonds totaled NIS 4.4 billion, 12% greater than the average daily trading volume in 2023. The increase in the trading volumes was driven primarily by government shekel bonds, the average daily trading volume of which amounted to NIS 2.3 billion, compared to an average daily trading volume of NIS 1.9 billion in 2023, with this resulting from the surge in bond offerings by the Ministry of Finance.

In view of the ongoing war and the growing cumulative deficit, the Ministry of Finance continued to raise debt in the third quarter, and in the first nine months raised debt in a total amount of NIS 171 billion, compared to NIS 57.8 billion raised in the corresponding period last year. NIS 142.4 billion of said amount was raised on TASE.

The average daily trading volume of corporate bonds totaled NIS 1.1 billion, 6% higher than the average daily trading volume in 2023. T-bills also recorded substantial trading volumes, at a daily average of NIS 1.5 billion, 5% higher than the average daily trading volume in 2023.

Corporate bonds continue to serve as a significant channel for debt raising by public companies – during January-September 2024, the business sector raised debt totaling NIS 87.4 billion, 31% over the total of NIS 66.8 billion raised in the corresponding period last year.

Creations and redemptions of mutual funds reached an average daily volume of NIS 1.8 billion, 29% greater than the average daily volume in 2023. The market cap of the mutual funds at the end of the period reached NIS 405 billion, 23% greater than the market cap at the end of 2023, with this resulting from acquisitions of mutual funds and the appreciation of the mutual funds’ assets on TASE.

Renewed international interest in the local capital market, with foreign investors resuming equity purchases on TASE in July. At the end of the third quarter of 2024, their net purchases totaled NIS 3 billion, with this being in addition to ongoing investments by institutions investors, which have made net equity purchases of NIS 4.3 billion since the beginning of the year.

Enhancement of business operations and promotion of core activities

In the trading sphere, in early November TASE launched a Block Trade Facility for the pre-arranged and protected execution of large-scale transactions, which will be published instantaneously in a transparent and accessible manner, in alignment with global standards. In addition, the second development phase of the new OTC system was completed, improving its compatibility with the needs of foreign investors and with international standards. In August, TASE launched a market-making reform across all securities, with emphasis on shares included in the TA-90 index, which, for the first time, rewards market makers for liquidity, large quantities and tighter spreads.

In September, an agreement was signed for the launch of 6 new exclusive indices with Analyst Mutual Funds, and to date TASE has exclusivity agreements in place with 4 leading manufacturers for the launch of more than 20 new indices in the coming months.

In the derivatives market, in September, TASE launched the futures market on the leading flagship indices, TA-35, TA-90 and TA-Banks5. Within this framework, a first market maker was appointed to ensure liquidity and trade volume, which enable investors to benefit from more competitive prices. In addition, the reduction of the multipliers in the derivatives market for options on the TA-35, TA-Banks5 and TA-125 indices and for foreign currency options, increased the average daily trading volumes by 7% compared to 2023. The average daily trading volume of weekly options increased to 52 thousand units, the highest volume recorded since their launch and 9% greater than the average daily trading volume in 2023. At the same time, the average daily trading volume of the monthly options totaled 65 thousand units, 6% greater than the average daily trading volume in 2023.

In October, TASE launched TASE+, an innovative AI-based tool for monitoring and analyzing capital market investments in Israel and abroad. This free and user-friendly platform, available in English and Hebrew, allows the public to gain capital market experience by managing a virtual data-based investment portfolio. The move is aligned with TASE’s strategy of enhancing its direct engagement with the public, removing trading barriers and improving the public’s access to information. To date, more than 30,000 investment portfolios have been created, and new portfolios are being created daily.

Highlights of the results for the third quarter of 2024:

Revenue in the third quarter of 2024 totaled NIS 109 million, compared to NIS 95.5 million in the corresponding quarter last year, an increase of 14%. The increase in revenue is due mainly to an increase in revenue from data distribution and connectivity services, as a result of the increased volume of activity and the impact of the updated index-usage fees, this in addition to the increase in trading and clearing commissions as a result of the increase in the trading volumes and in the volume of creations/redemptions of mutual fund units.

Costs in the third quarter of 2024 totaled NIS 79 million, compared to NIS 72.1 million in the corresponding quarter last year. The higher costs are due mainly to the increase in payroll expenses, computer and communication expenses, and marketing expenses.

Net financing income in the third quarter of 2024 totaled NIS 4 million, compared to net financing income of NIS 2 million in the corresponding quarter last year, an increase of 103%. Financing income in the quarter increased due to interest income on the deposits and gains on financial assets. The increase in the income in the quarter was partly offset by the increase in financing expenses as a result of a bank loan obtained at the end of 2023.

The profit in the third quarter of 2024 totaled NIS 26 million, compared to NIS 18.2 million in the corresponding quarter last year, an increase of 43%. The increase in profit was due mainly to the increase in revenue, less the increase in costs and in tax expenses.

The adjusted EBITDA in the third quarter of 2024 totaled NIS 45.1 million, compared to NIS 38.4 million in the corresponding quarter last year, an increase of 17%. Most of the increase is due to the NIS 6.5 million increase in profit before financing.

The adjusted profit in the third quarter of 2024 totaled NIS 27.2 million, compared to NIS 20.1 million in the corresponding quarter last year, an increase of 35%. Most of the increase is due to an increase in revenue from services, less the increase in costs and in tax expenses.

Equity as of September 30, 2024 totaled NIS 686.7 million, compared to NIS 401.7 million as of December 31, 2023, an increase of 71%. Most of the increase is due to an increase in a capital reserve as a result of receipts from the sale of shares within the framework of the TASE ownership restructuring, in an amount of NIS 242.5 million.

Seasonality

The revenue of the Company from trading and clearing is affected, inter alia, by the number of trading and clearing days. In the third quarter of 2024, there were 65 trading days, compared to 61 days in the corresponding quarter last year, a 6.6% increase. In the first nine months of 2024 there were 185 trading days, compared to 183 days in the corresponding period last year, a 1.1% increase. Presented below is information on the quarterly breakdown of trading days:

|

Year |

First quarter |

Second quarter |

Third quarter |

Fourth quarter |

Total |

|

2023 |

64 |

58 |

61 |

66 |

249 |

|

2024 |

63 |

57 |

65 |

60 |

245 |

This notification does not supersede that stated in the periodic financial statements of the Company, which contain the full and accurate information.

Click here for the link to the full financial statements for the third quarter of 2024

Contact:

Orna Goren

Head of Communication and Public Relations Unit

Tel: +972 76 8160405

tase.ir@tase.co.il

![]() View original content:https://www.prnewswire.com/news-releases/the-tel-aviv-stock-exchange-reports-its-results-for-the-third-quarter-of-2024-302311893.html

View original content:https://www.prnewswire.com/news-releases/the-tel-aviv-stock-exchange-reports-its-results-for-the-third-quarter-of-2024-302311893.html

SOURCE The Tel Aviv Stock Exchange Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

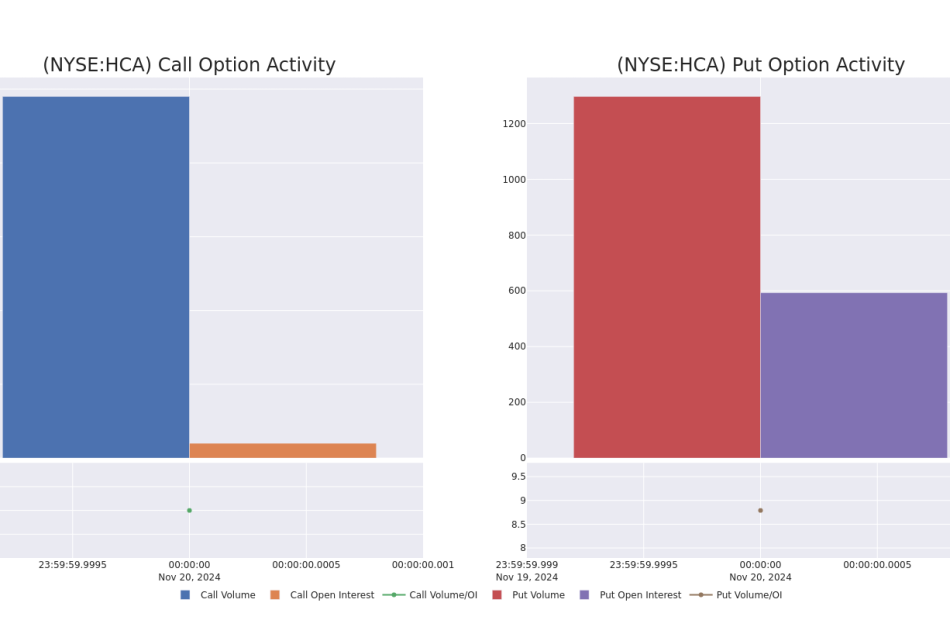

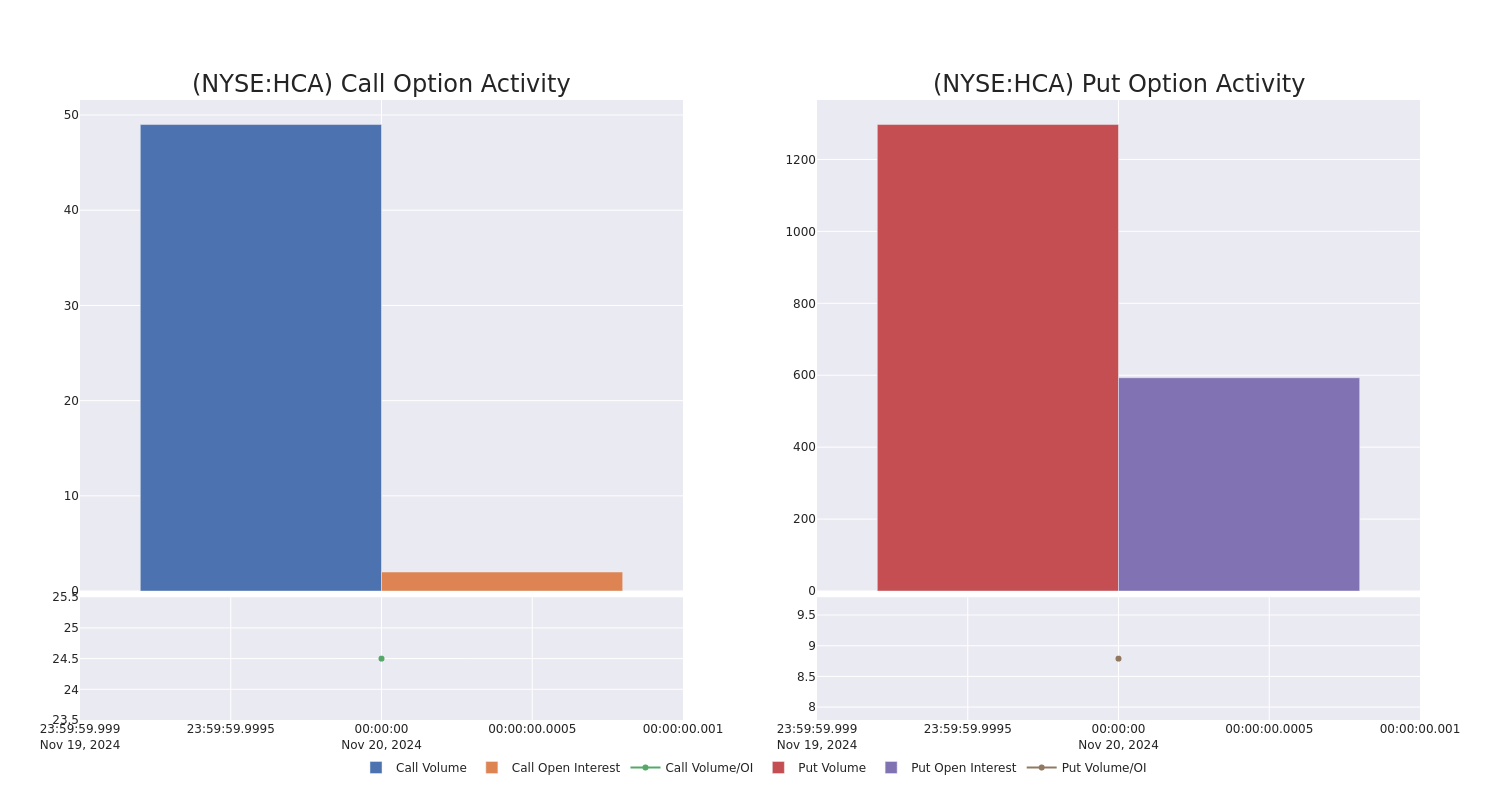

Spotlight on HCA Healthcare: Analyzing the Surge in Options Activity

Benzinga’s options scanner just detected over 8 options trades for HCA Healthcare HCA summing a total amount of $532,222.

At the same time, our algo caught 6 for a total amount of 637,251.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $315.0 to $335.0 for HCA Healthcare over the last 3 months.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for HCA Healthcare’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of HCA Healthcare’s whale trades within a strike price range from $315.0 to $335.0 in the last 30 days.

HCA Healthcare Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HCA | PUT | SWEEP | BEARISH | 12/20/24 | $8.6 | $8.4 | $8.6 | $325.00 | $215.7K | 86 | 262 |

| HCA | PUT | SWEEP | BULLISH | 12/20/24 | $9.6 | $9.5 | $9.5 | $330.00 | $139.7K | 97 | 150 |

| HCA | PUT | SWEEP | BULLISH | 12/20/24 | $9.7 | $9.7 | $9.7 | $330.00 | $95.9K | 97 | 259 |

| HCA | CALL | SWEEP | BULLISH | 02/21/25 | $18.4 | $18.3 | $18.4 | $335.00 | $80.9K | 2 | 36 |

| HCA | PUT | SWEEP | BULLISH | 01/17/25 | $7.8 | $7.2 | $7.2 | $315.00 | $72.7K | 410 | 222 |

About HCA Healthcare

HCA Healthcare is a Nashville-based healthcare provider organization operating the largest collection of acute-care hospitals in the United States. As of June 2024, the firm owned and operated 188 hospitals, 123 freestanding outpatient surgery centers, and a broad network of physician offices, urgent-care clinics, and freestanding emergency rooms across 20 states and a small foothold in England.

Following our analysis of the options activities associated with HCA Healthcare, we pivot to a closer look at the company’s own performance.

Where Is HCA Healthcare Standing Right Now?

- With a volume of 505,703, the price of HCA is down -1.79% at $329.1.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 69 days.

What The Experts Say On HCA Healthcare

In the last month, 5 experts released ratings on this stock with an average target price of $401.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on HCA Healthcare, which currently sits at a price target of $395.

* An analyst from Barclays has decided to maintain their Overweight rating on HCA Healthcare, which currently sits at a price target of $392.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for HCA Healthcare, targeting a price of $420.

* An analyst from Oppenheimer persists with their Outperform rating on HCA Healthcare, maintaining a target price of $400.

* An analyst from Wells Fargo persists with their Equal-Weight rating on HCA Healthcare, maintaining a target price of $400.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest HCA Healthcare options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Look Ahead: Ross Stores's Earnings Forecast

Ross Stores ROST is set to give its latest quarterly earnings report on Thursday, 2024-11-21. Here’s what investors need to know before the announcement.

Analysts estimate that Ross Stores will report an earnings per share (EPS) of $1.40.

The announcement from Ross Stores is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

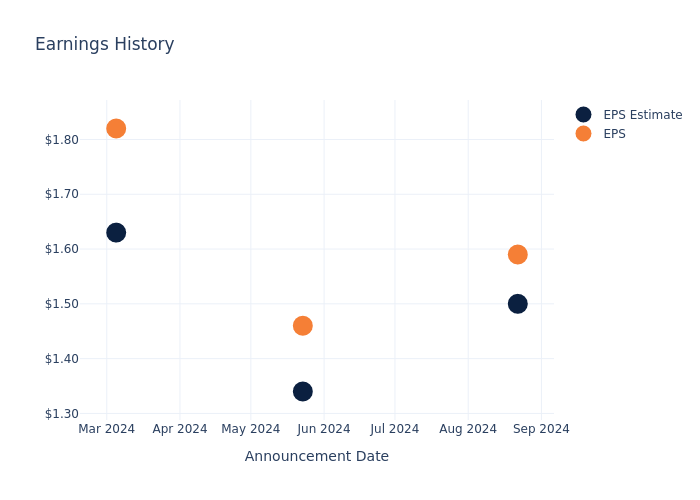

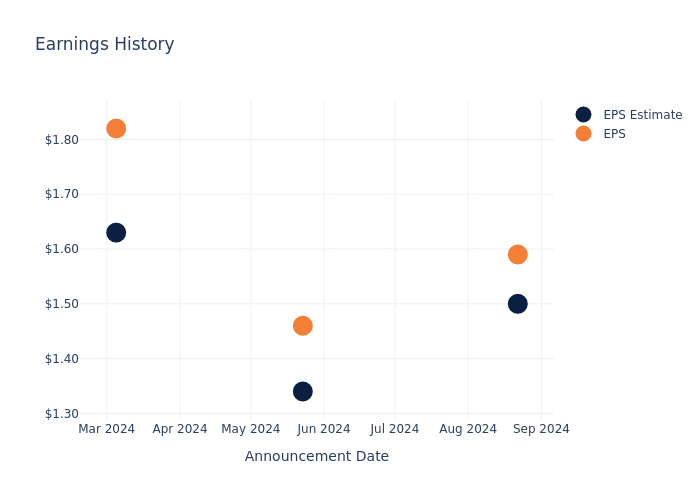

Past Earnings Performance

The company’s EPS beat by $0.09 in the last quarter, leading to a 1.76% increase in the share price on the following day.

Here’s a look at Ross Stores’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.50 | 1.34 | 1.63 | 1.21 |

| EPS Actual | 1.59 | 1.46 | 1.82 | 1.33 |

| Price Change % | 2.0% | 8.0% | -1.0% | 7.000000000000001% |

Performance of Ross Stores Shares

Shares of Ross Stores were trading at $139.26 as of November 19. Over the last 52-week period, shares are up 5.61%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Insights on Ross Stores

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Ross Stores.

Ross Stores has received a total of 14 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $174.93, the consensus suggests a potential 25.61% upside.

Peer Ratings Comparison

The following analysis focuses on the analyst ratings and average 1-year price targets of Burlington Stores, Gap and Abercrombie & Fitch, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Burlington Stores received a Outperform consensus from analysts, with an average 1-year price target of $309.85, implying a potential 122.5% upside.

- Gap received a Neutral consensus from analysts, with an average 1-year price target of $27.17, implying a potential 80.49% downside.

- As per analysts’ assessments, Abercrombie & Fitch is favoring an Neutral trajectory, with an average 1-year price target of $185.62, suggesting a potential 33.29% upside.

Comprehensive Peer Analysis Summary

In the peer analysis summary, key metrics for Burlington Stores, Gap and Abercrombie & Fitch are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ross Stores | Neutral | 7.15% | $1.50B | 10.46% |

| Burlington Stores | Outperform | 13.37% | $1.06B | 7.02% |

| Gap | Neutral | 4.85% | $1.58B | 7.35% |

| Abercrombie & Fitch | Neutral | 21.24% | $736.26M | 11.65% |

Key Takeaway:

Ross Stores ranks in the middle for Consensus rating among its peers. It ranks at the bottom for Revenue Growth. It is at the top for Gross Profit. It is in the middle for Return on Equity.

About Ross Stores

Ross Stores operates as an off-price apparel and accessories retailer with the majority of its sales derived from its Ross Dress for Less banner. The firm opportunistically procures excess brand-name merchandise made available via manufacturing overruns and retail liquidation sales at a 20%-60% discount to full prices. As such, its stores are often filled with a vast array of stock-keeping units, each with minimal product depth that creates a treasure hunt shopping experience. The firm’s more than 1,750 Ross Dress for Less stores are primarily located in densely populated suburban communities and typically serve middle-income consumers. Ross also operates about 350 DD’s Discounts chains targeting lower-income shoppers.

Key Indicators: Ross Stores’s Financial Health

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Ross Stores displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 7.15%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Ross Stores’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 9.97% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Ross Stores’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 10.46% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Ross Stores’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 3.61% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Ross Stores’s debt-to-equity ratio is below the industry average. With a ratio of 1.14, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Ross Stores visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

According To Dave Ramsey, Answering These Two Questions Could Be The Difference Between Living Wealthy Or Struggling Financially

Dave Ramsey, the popular personal finance expert, believes that two simple questions could be a game-changer for anyone hoping to build wealth: “How much does it cost?” and “How much is the down payment?”

Ramsey says those with a healthy financial mindset tend to ask the first question, while others struggling financially often ask the second. He argues that this subtle difference is more important than many realize.

Don’t Miss:

Ramsey’s point hits home, given some eye-opening statistics on American debt and spending habits. According to a recent study by Debt.com, roughly 80% of U.S. workers live paycheck to paycheck, with nearly a quarter unable to save anything month-to-month.

In addition, about 37% of Americans would be unable to cover $400 in emergency expenses. These numbers show the impact of taking on too many high monthly payments without thinking through the long-term consequences, as Ramsey cautions.

As personal debt levels soar, Ramsey’s advice on credit cards resonates with many. Experian research shows that one in three Americans has maxed out their credit cards and the average American carries about $104,215 in total debt across mortgages, credit cards and other loans.

Trending: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

Credit card debt alone has hit record highs, reaching over $1 trillion in the third quarter of 2024. Debt.com also found that 45% of Americans have relied on credit cards for everyday expenses due to inflation, with many unable to pay off their balances fully.

The rise in debt is not just a concern for households but also a boon for credit card companies. Visa and Mastercard stocks have seen considerable gains, with Visa nearing its 52-week high. These companies are thriving partly due to Americans’ increasing dependence on credit.

Ramsey’s advice, while straightforward, has its critics. They argue that worrying about the total cost is not always possible. Many people are just trying to make ends meet. For lower-income families, prioritizing immediate cash flow may sometimes be the only option, despite Ramsey’s call to “think bigger” financially.

See Also: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – You can still get 4,000 of its pre-IPO shares for with $1,000 for just $0.25/share

Ramsey suggests a few practical steps for those determined to break free from debt: creating a weekly budget and being strict about need versus want. A small emergency fund, he adds, can be invaluable in avoiding debt during unexpected expenses.

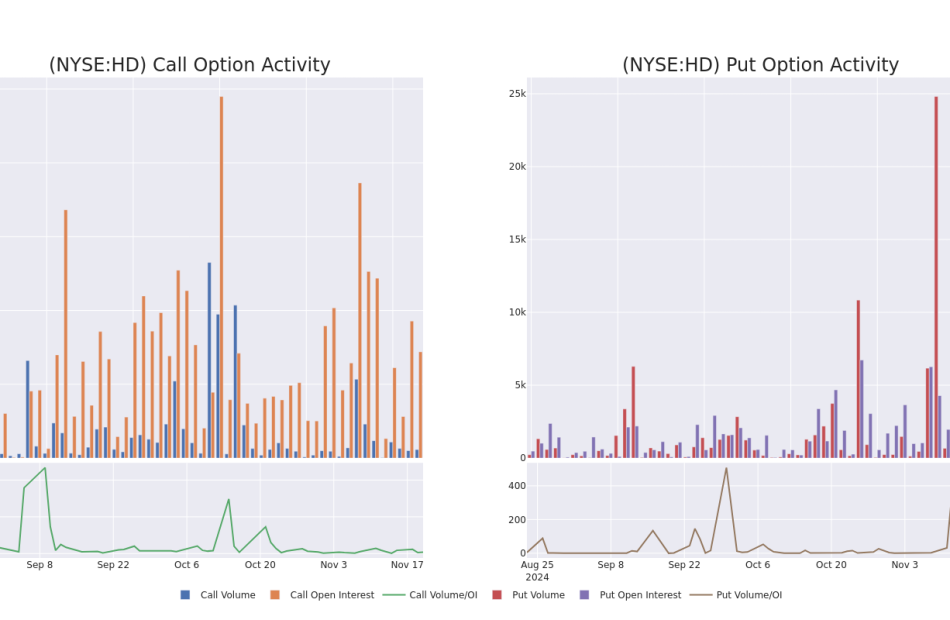

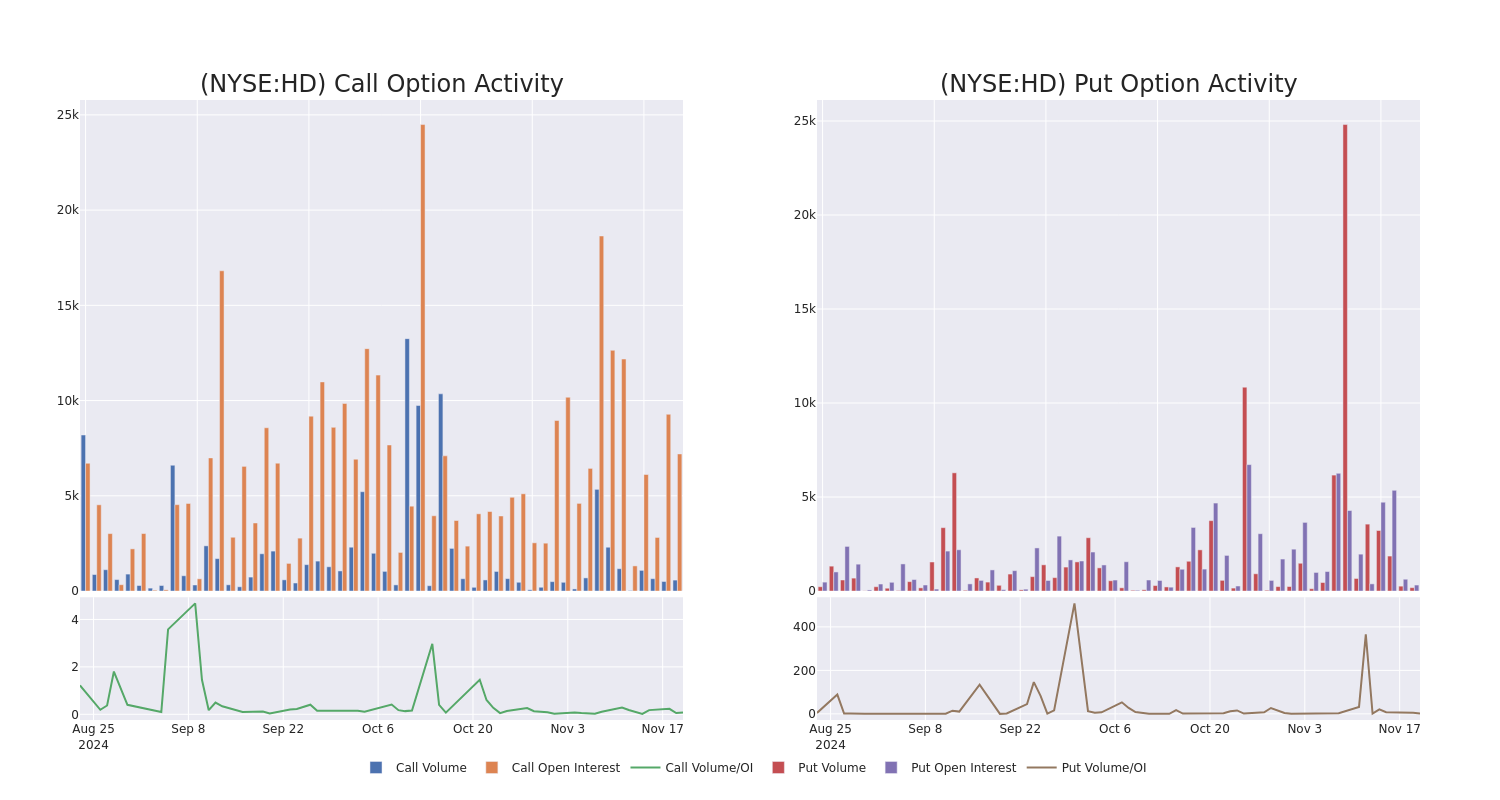

Check Out What Whales Are Doing With Home Depot

Financial giants have made a conspicuous bullish move on Home Depot. Our analysis of options history for Home Depot HD revealed 9 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $69,300, and 7 were calls, valued at $255,371.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $365.0 and $420.0 for Home Depot, spanning the last three months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Home Depot’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Home Depot’s substantial trades, within a strike price spectrum from $365.0 to $420.0 over the preceding 30 days.

Home Depot 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HD | CALL | TRADE | BULLISH | 01/17/25 | $41.2 | $39.9 | $41.2 | $365.00 | $53.5K | 30 | 13 |

| HD | PUT | TRADE | BEARISH | 12/27/24 | $4.35 | $2.55 | $4.35 | $385.00 | $43.4K | 122 | 100 |

| HD | CALL | TRADE | NEUTRAL | 02/21/25 | $10.7 | $10.25 | $10.49 | $420.00 | $41.9K | 482 | 46 |

| HD | CALL | TRADE | BULLISH | 06/20/25 | $26.2 | $26.2 | $26.2 | $410.00 | $39.3K | 1.7K | 2 |

| HD | CALL | SWEEP | BEARISH | 11/22/24 | $2.38 | $2.37 | $2.37 | $405.00 | $35.5K | 205 | 337 |

About Home Depot

Home Depot is the world’s largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the US, Canada, and Mexico. Its stores offer numerous building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of Interline Brands in 2015 allowed Home Depot to enter the MRO business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textiles to the lineup, and the recent tie-up with SRS will help grow professional demand in roofing, pool and landscaping projects.

Current Position of Home Depot

- With a trading volume of 901,415, the price of HD is down by -1.28%, reaching $401.61.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 90 days from now.

Professional Analyst Ratings for Home Depot

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $445.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Home Depot, targeting a price of $430.

* An analyst from Truist Securities persists with their Buy rating on Home Depot, maintaining a target price of $459.

* An analyst from Telsey Advisory Group persists with their Outperform rating on Home Depot, maintaining a target price of $455.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Home Depot, targeting a price of $465.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Home Depot, targeting a price of $420.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Home Depot with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Powell Industries Faces Seasonally Slow Q1 Start After Mixed Q4; Stock Tanks

Powell Industries, Inc. POWL shares are trading lower on Wednesday after the company reported fourth-quarter results after the markets closed on Tuesday.

Revenues surged 32% year over year to $275 million, which missed the consensus of $286.49 million.

The revenue growth was led by the Petrochemical sector (+112% Y/Y), Oil & Gas sector (+23% Y/Y), and Commercial & Other Industrial sector (+66% Y/Y).

New orders rose to $267 million from $171 million a year ago, driven by strong demand in the Oil & Gas, Petrochemical, and Electric Utility sectors.

Gross profit increased 55% Y/Y to $80 million, with a margin of 29.2% vs. 24.9% a year ago quarter. EPS of $3.77 surpassed the consensus of $3.55.

Brett A. Cope, Powell’s Chairman and Chief Executive Officer, said, “We experienced tremendous growth in our largest markets, with our top line growing by 45% in fiscal 2024. We continue to execute at a high standard for both our customers and our shareholders as reflected by our gross margin, which improved 590 basis points compared to the prior year.”

”Having recorded our second consecutive year of more than $1.0 billion in new orders, we continue to grow in our traditional markets of oil & gas, petrochemical and electrical utilities, while further diversifying in markets such as data centers, hydrogen, carbon capture and other alternative fuels.”

As of September 30, 2024, cash and short-term investments totaled $358 million. Backlog remained steady at $1.3 billion as of September 30, 2024, consistent with levels at both June 30, 2024, and September 30, 2023.

Michael Metcalf, Chief Financial Officer, said, “As we look ahead to fiscal 2025, we expect continued strength across most of our end markets spanning across all of the geographies that we compete in.”

”We are pleased with our fiscal 2024 results and remain focused on carrying forward the strong operational execution and commercial momentum that we have experienced this year, into fiscal 2025.”

”Notwithstanding our seasonally slower fiscal first quarter, considering the healthy backdrop, robust backlog, strong liquidity, and a solid balance sheet, we anticipate that fiscal 2025 will be another successful year for Powell.“

Investors can gain exposure to the stock via Innovator IBD 50 ETF FFTY and Tidal ETF Trust Aztlan Global Stock Selection DM SMID ETF AZTD.

Price Action: POWL shares are down 15% at $265.63 at the last check Wednesday.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.