First Mining Announces 2024 Third Quarter Financial Results and Operating Highlights

VANCOUVER, BC, Nov. 11, 2024 /PRNewswire/ – First Mining Gold Corp. (“First Mining” or the “Company”) FF FFMGF FMG reports its third quarter financial results for the quarter ended September 30, 2024. The financial statements and management’s discussion and analysis (“MD&A”) are available on First Mining’s website at www.firstmininggold.com/investors/reports-filings/financials/ and have been posted under the Company’s profile on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

“We want to thank our new and existing supportive shareholders for a positive third quarter where we were able to successfully add more than $15 million to our balance sheet to continue advancing our projects,” stated Dan Wilton, CEO of First Mining. “We continue to demonstrate strong exploration success at both Duparquet and our Birch-Uchi Greenstone Belt project and we look forward to more exciting results to come. We are tremendously proud in our recent achievement of filing of our Final Environmental Impact Statement / Environmental Assessment at our Springpole Gold Project, which has the potential to deliver tremendous socio-economic and infrastructure benefits to an underserviced region of Northwestern Ontario with a focus on environmental stewardship and sustainable development.”

2024 Q3 Highlights:

- On November 5, 2024, the Company announced that it submitted the final Environmental Impact Statement / Environmental Assessment (“EIS/EA“) for the Springpole Project. The final EIS/EA submission marks a significant procedural milestone in the advance of the Springpole Project and follows over two and a half years of consultation and engagement on the draft EIS/EA submitted in May 2022. The Project is being assessed by the Impact Assessment Agency of Canada in accordance with the Canadian Environmental Assessment Act (CEAA, 2012) and by the Ministry of Environment Conservation and Parks under Ontario’s Environmental Assessment Act.

- On October 31, 2024, the Company announced that it entered into a Process Agreement with Cat Lake First Nation and Lac Seul First Nation which provides important capacity support for the implementation of a community-based Anishinaabe-Led Impact Assessment (“ALIA“).

- As of September 30, 2024, the Company’s cash and current investments balance was $13.8 million and the equity interest in PC Gold Inc. (Pickle Crow Project) was $21.5 million, resulting in a combined carrying value of $35.3 million.

- On September 26, 2024, the Company completed a brokered bought deal public offering raising aggregate gross proceeds of $8,050,023 which consisted of 59,629,800 units of the Company at a price of $0.135 per unit and subsequent to the end of the third quarter, on October 10, 2024, completed a non-brokered private placement for $7,352,600 in aggregate gross proceeds raised through the issuance of 54,463,706 units of the Company at a price of $0.135 per unit. Each unit consisted of one common share and one half of one common share purchase warrant with each full common share purchase warrant being exercisable to acquire one additional common share of the Company at an exercise price of $0.20 for a period of 36 months following the closing date of each offering.

- On September 9, 2024, the Company announced four newly discovered gold mineralization occurrences at the Challenger Target, including channel sample results grading up to 6.53g/t Au over 3 m, and including grab samples grading up to 26.6 g/t, 20.3 g/t and 7.7 g/t Au. The new occurrences were identified during their summer follow up mapping program in the Challenger target area.

- On August 28, 2024, the Company announced further drilling results from the 2024 Phase 3 diamond drilling program at Duparquet. These results further defined resource expansion opportunities at the Valentre target. The Phase 3 program was completed in October 2024, comprising 24 holes over 9,564 m, and assay results are in progress.

About First Mining Gold Corp.

First Mining is a gold developer advancing two of the largest gold projects in Canada, the Springpole Gold Project in northwestern Ontario, where we have commenced a feasibility study and permitting activities are on-going with a final Environmental Impact Statement / Environmental Assessment for the project submitted in November 2024, and the Duparquet Gold Project in Quebec, a PEA-stage development project located on the Destor-Porcupine Fault Zone in the prolific Abitibi region. First Mining also owns the Cameron Gold Project in Ontario and a portfolio of gold project interests including the Pickle Crow Gold Project (being advanced in partnership with Firefly Metals Ltd.) and the Hope Brook Gold Project (being advanced in partnership with Big Ridge Gold Corp.).

First Mining was established in 2015 by Mr. Keith Neumeyer, founding President and CEO of First Majestic Silver Corp.

ON BEHALF OF FIRST MINING GOLD CORP.

Daniel W. Wilton

Chief Executive Officer and Director

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this news release. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “plans”, “projects”, “intends”, “estimates”, “envisages”, “potential”, “possible”, “strategy”, “goals”, “opportunities”, “objectives”, or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions.

Forward-looking statements in this news release relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events. All forward-looking statements are based on First Mining’s or its consultants’ current beliefs as well as various assumptions made by them and information currently available to them. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Such factors include, without limitation the Company’s business, operations and financial condition potentially being materially adversely affected by the outbreak of epidemics, pandemics or other health crises, and by reactions by government and private actors to such outbreaks; risks to employee health and safety as a result of the outbreak of epidemics, pandemics or other health crises, that may result in a slowdown or temporary suspension of operations at some or all of the Company’s mineral properties as well as its head office; fluctuations in the spot and forward price of gold, silver, base metals or certain other commodities; fluctuations in the currency markets (such as the Canadian dollar versus the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities, indigenous populations and other stakeholders; availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development; title to properties.; and the additional risks described in the Company’s Annual Information Form for the year ended December 31, 2023 filed with the Canadian securities regulatory authorities under the Company’s SEDAR+ profile at www.sedarplus.ca, and in the Company’s Annual Report on Form 40-F filed with the SEC on EDGAR.

First Mining cautions that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. First Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on our behalf, except as required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/first-mining-announces-2024-third-quarter-financial-results-and-operating-highlights-302300627.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/first-mining-announces-2024-third-quarter-financial-results-and-operating-highlights-302300627.html

SOURCE First Mining Gold Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

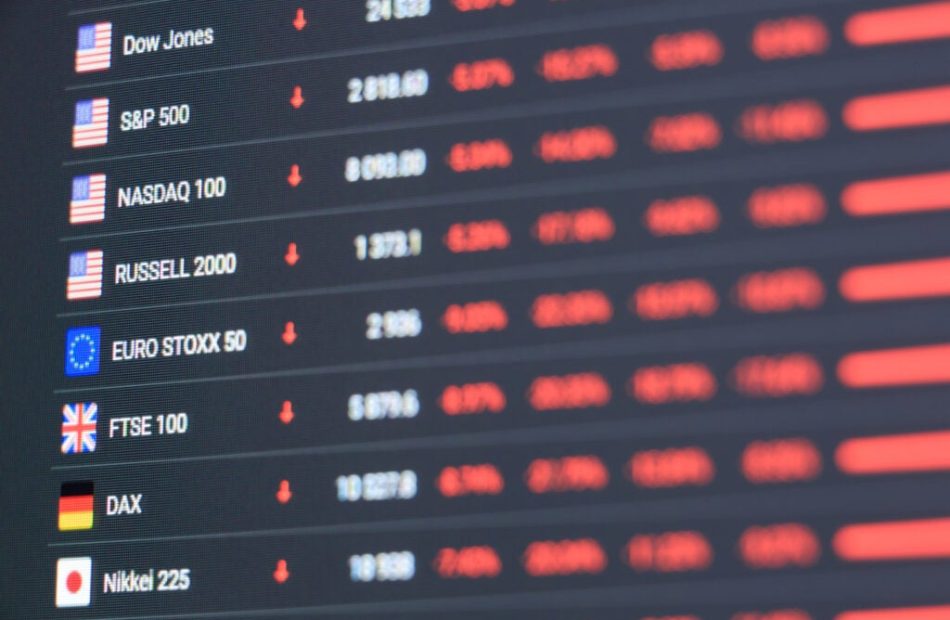

Asia Mixed And Europe Up, Dollar Gains To 3-Month High – Global Markets Today While US Slept

On Friday, November 8, U.S. markets rallied, with the S&P 500 briefly surpassing the 6,000 mark and posting its most substantial weekly gain in a year. The surge was driven by Donald Trump’s election win, expectations of pro-business policies, and an anticipated Fed rate cut. Optimism over a potential Republican sweep in Congress boosted investor sentiment, pushing the Nasdaq to record highs and securing the S&P’s 50th record close of the year.

According to economic data, the University of Michigan’s consumer sentiment index increased to 73 in November, marking its highest level in seven months. This figure surpassed both October’s reading of 70.5 and market expectations of 71.

Most S&P 500 sectors gained, led by consumer staples, utilities, and real estate, while materials and communication services lagged.

The Dow Jones Industrial Average was up 0.59% and closed at 43,988.99, the S&P 500 rose 0.38% to 5,995.54, and the Nasdaq Composite gained 0.09% to finish at 19,286.78.

Asia Markets Today

- On Monday, Japan’s Nikkei 225 gained 0.18% and ended the session at 39,539.50, led by gains in the Shipbuilding, Railway & Bus, and Services sectors.

- Australia’s S&P/ASX 200 fell 0.35% and ended the day at 8,266.20, led by losses in the Metals & Mining, Resources and Materials sectors.

- India’s Nifty 50 traded lower by 0.11% at 24,122.10 and Nifty 500 was down 0.32% at 22,572.70.

- China’s Shanghai Composite rose 0.51% to close at 3,470.07, and the Shenzhen CSI 300 gained 0.66%, finishing the day at 4,131.13.

- Hong Kong’s Hang Seng fell 1.45% and closed the session at 20,426.93.

Eurozone at 05:30 AM ET

- The European STOXX 50 index was up 1.24%.

- Germany’s DAX gained 1.37%.

- France’s CAC rose1.20%.

- U.K.’s FTSE 100 index traded higher by 0.90%.

- European markets opened on a positive note, lifted by record highs on Wall Street and a recent Fed rate cut. Gains were seen across major indices, although political uncertainty lingers due to Trump’s reelection and instability within Germany’s coalition government.

Commodities at 05:30 AM ET

- Crude Oil WTI was trading lower by 1.06% at $69.31/bbl, and Brent was down 1.29% at $72.92/bbl.

- Oil prices remained steady as concerns over U.S. storm disruptions eased and China’s stimulus plan disappointed investors. Weak demand growth in China and expectations of increased U.S. output under Trump’s administration further weighed on the market outlook.

- Natural Gas gained 6.18% to $2.834.

- Gold was trading lower by 0.71% at $2,675.60, Silver rose 0.36% to $31.562 and Copper slipped 0.24% to $4.2945

US Futures at 05:30 AM ET

Dow futures gained 0.37%, S&P 500 futures up 0.27%, and Nasdaq 100 futures rose 0.22%.

Forex at 05:30 AM ET

- The U.S. dollar index increased by 0.26% to 105.27, the USD/JPY rose by 0.73% to 153.75, and the USD/AUD rose by 0.01% to 1.5180.

- The U.S. dollar strengthened to three-month high, continuing gains from Trump’s election win, which raised expectations of inflationary policies and slower Fed rate cuts. Despite a recent rate reduction, the dollar retained most of its gains, with the focus shifting to upcoming inflation data.

Photo by Pavel Bobrovskiy via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Moleculin Reports Third Quarter 2024 Financial Results and Provides Corporate Update

– On track to start dosing in pivotal, adaptive Phase 3 clinical trial (the “MIRACLE” trial) designed for possible accelerated approval of Annamycin in combination with cytarabine for the treatment of R/R AML in Q1 2025

– Median durability of CRc in MB-106 Annamycin+ Cytarabine AML clinical trial continues to climb – now past 8 months

– Recent virtual AML KOL event underscores how Annamycin could significantly change the AML treatment landscape; Replay available here

– Company to host conference call and webcast today, Monday, November 11th at 8:30 AM ET

HOUSTON, Nov. 11, 2024 /PRNewswire/ — Moleculin Biotech, Inc., MBRX (“Moleculin” or the “Company”), a late stage pharmaceutical company with a broad portfolio of drug candidates targeting hard-to-treat tumors and viruses, today reported its financial results for the quarter ended September 30, 2024. As previously announced, the Company will host a conference call and live audio webcast to discuss the operational and financial results at 8:30 AM ET on Monday, November 11, 2024 (details below).

“We are thrilled to have emerged as a late stage company. Our focus remains on the ramp up for and execution of our upcoming MIRACLE trial. We have been extremely active and our recent interactions with potential clinical trial sites globally have been overwhelmingly positive as we prepare for the start of enrollment and dosing early next year. We believe with our recent clinical and regulatory ‘wins,’ we have foundationally set the stage for a transformational year ahead and the opportunity to drive significant value for all stakeholders. With that said, we continue to follow our CRc (complete response composite) preliminary data from our MB-106 Phase 1B/2 AML clinical trial. We are also pleased with the median durability continuing to climb – and is now in excess of 8 months,” commented Walter Klemp, Chairman and Chief Executive Officer of Moleculin.

Recent Highlights

- Appointed Daniel D. Von Hoff, M.D., F.A.C.P., FASCO, FAACR, leading expert in Pancreatic Cancer to its Scientific Advisory Board to Support Development of Annamycin;

- Hosted a Virtual Acute Myeloid Leukemia KOL event with internationally renowned Acute Myeloid Leukemia (AML) Key Opinion Leaders to discuss Annamycin, the use of anthracyclines, how Annamycin could significantly change the AML treatment landscape, and the Company’s recently announced global Phase 3 pivotal trial for the treatment of AML patients who are refractory to or relapsed after induction therapy (R/R AML) (the “MIRACLE” trial);

- Presented positive in vivo efficacy data of Annamycin in orthotopic and experimental lung metastatic models of Sarcoma in a poster titled “Annamycin: Opening New Doors for Organotropic Targeting of Primary and Metastatic Lung Cancer,” at the IASLC 2024 World Conference on Lung Cancer;

- Commenced enrollment and treatment of patients in the Investigator-initiated Phase 2 study evaluating WP1066 in combination with radiation therapy for the treatment of adults with glioblastoma; and

- Closed a $5.5 million financing upfront with up to an additional $11.0 million of potential aggregate gross proceeds upon the exercise in full of milestone-linked warrants.

Clinical Development Update

Annamycin is currently being evaluated in ongoing clinical trials for the treatment of relapsed or refractory acute myeloid leukemia (AML) and soft tissue sarcoma (STS) lung metastases. Annamycin currently has Fast Track Status and Orphan Drug Designation from the FDA for the treatment of relapsed or refractory acute myeloid leukemia, in addition to Orphan Drug Designation for the treatment of soft tissue sarcoma. Furthermore, Annamycin has Orphan Drug Designation for the treatment of relapsed or refractory acute myeloid leukemia from the European Medicines Agency (EMA).

AML

The Company recently announced the positive discussion and outcome of its End of Phase 1B/2 (EOP1B/2) meeting with the US Food and Drug Administration (FDA) supporting the advancement of Annamycin in combination with Cytarabine (also known as “Ara-C” and for which the combination of Annamycin and Ara-C is referred to as “AnnAraC”) to a Phase 3 pivotal trial for the treatment of AML patients who are refractory to or relapsed after induction therapy (R/R AML). This Phase 3 “MIRACLE” trial (derived from Moleculin R/R AML AnnAraC Clinical Evaluation) will be a global trial, including sites in the US.

The MIRACLE study, subject to appropriate future filings with and potential additional feedback from the FDA and their foreign equivalents, is expected to initially utilize an adaptive design whereby approximately the first 75 to 90 subjects will be randomized to receive high dose cytarabine (HiDAC) combined with either placebo, 190 mg/m2 of Annamycin, or 230 mg/m2 of Annamycin. At that point, the trial will be unblinded to select the optimum dose for Annamycin. For the second part of the trial, approximately 240 additional subjects will be randomized to receive either HiDAC plus placebo or HiDAC plus the optimum dose of Annamycin. The selection of the optimum dose will be based not only on the overall balance of safety, tolerability, pharmacokinetics and efficacy, consistent with the FDA’s new Project Optimus initiative.

Expected Milestones for Annamycin AML Development Program

- 4Q 2024 – Contracting with MIRACLE trial sites and IRB approval

- 1Q 2025 – First subject treated in MIRACLE trial

- 4Q 2025 – Recruitment and overall efficacy rate update (n=45)

- 2H 2026 – Interim efficacy and safety data (n=90) unblinded and Optimum Dose set for MIRACLE trial

- 2027 – Begin enrollment of 3rd line subjects in MIRACLE2

- 2027 – Enrollment ends in 2nd line subjects

- 2028 – Primary efficacy data for 2nd line subjects in MIRACLE

- 2028 2H – Begin submission of a Rolling New Drug Application (NDA) for the treatment of R/R AML for accelerated approval on primary endpoint of CR from MIRACLE

STS Lung Metastases

As previously announced, the Company completed enrollment in the Phase 2 portion of its U.S. Phase 1B/2 clinical trial evaluating Annamycin as monotherapy for the treatment of soft tissue sarcoma lung metastases. Subjects who had stable disease at the time of study discontinuation were followed for progression free response and overall survival. The study database is locked, and the clinical study report is being written and should be completed in early 2025 and will be released in detail at that time

Expected Milestones for Annamycin STS Lung Mets Development Program

- 2025 – Final MB-107 data readout

- 2025 – Identify next phase of development / pivotal program

Summary of Financial Results for the Third Quarter 2024

Research and development (R&D) expense was $4.9 million and $3.3 million for the three months ended September 30, 2024 and 2023, respectively. The increase over the prior year period is mainly related to costs incurred for clinical trials (clinical research organization and drug production) and sponsored research costs.

General and administrative expense was $2.2 million and $2.6 million for the three months ended September 30, 2024 and 2023, respectively. The decrease of $0.4 million is mainly related to a decrease in regulatory and legal fees.

As of September 30, 2024, the Company had cash and cash equivalents of $9.4 million and believes that the existing cash and cash equivalents as of September 30, 2024, will be sufficient to fund planned operations into the first quarter of 2025.

Conference Call and Webcast

Moleculin management will host its quarterly conference call and webcast for investors, analysts, and other interested parties on Monday, November 11, 2024 at 8:30 AM ET.

Interested participants and investors may access the conference call by dialing (877) 407-0832 (domestic) or (201) 689-8433 (international) and referencing the Moleculin Biotech Conference Call. The live audio webcast will be accessible on the Events page of the Investors section of the Moleculin website, moleculin.com, and will be archived for 90 days.

About Moleculin Biotech, Inc.

Moleculin Biotech, Inc. is a Phase 3 clinical stage pharmaceutical company advancing a pipeline of therapeutic candidates addressing hard-to-treat tumors and viruses. The Company’s lead program, Annamycin, is a next-generation anthracycline designed to avoid multidrug resistance mechanisms and to eliminate the cardiotoxicity common with currently prescribed anthracyclines. Annamycin is currently in development for the treatment of relapsed or refractory acute myeloid leukemia (AML) and soft tissue sarcoma (STS) lung metastases.

The Company is initiating the MIRACLE (Moleculin R/R AML AnnAraC Clinical Evaluation) Trial (MB-108), a pivotal, adaptive design Phase 3 trial evaluating Annamycin in combination with cytarabine, together referred to as AnnAraC, for the treatment of relapsed or refractory acute myeloid leukemia. Following a successful Phase 1B/2 study (MB-106), with input from the FDA, the Company believes it has substantially de-risked the development pathway towards a potential approval for Annamycin for the treatment of AML. This study is subject to appropriate future filings with potential additional feedback from the FDA and their foreign equivalents.

Additionally, the Company is developing WP1066, an Immune/Transcription Modulator capable of inhibiting p-STAT3 and other oncogenic transcription factors while also stimulating a natural immune response, targeting brain tumors, pancreatic and other cancers. Moleculin is also engaged in the development of a portfolio of antimetabolites, including WP1122 for the potential treatment of pathogenic viruses, as well as certain cancer indications.

For more information about the Company, please visit www.moleculin.com and connect on X, LinkedIn and Facebook.

Forward-Looking Statements

Some of the statements in this release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties. Forward-looking statements in this press release include, without limitation, the Company’s forecasted cash burn rate (including its estimate of cash sufficient to meet its projected operating requirements) and the achievement of the expected milestones set forth above. Although Moleculin believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. Moleculin has attempted to identify forward-looking statements by terminology including ‘believes,’ ‘estimates,’ ‘anticipates,’ ‘expects,’ ‘plans,’ ‘projects,’ ‘intends,’ ‘potential,’ ‘may,’ ‘could,’ ‘might,’ ‘will,’ ‘should,’ ‘approximately’ or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including those discussed under Item 1A. “Risk Factors” in our most recently filed Form 10-K filed with the Securities and Exchange Commission (“SEC”) and updated from time to time in our Form 10-Q filings and in our other public filings with the SEC. Any forward-looking statements contained in this release speak only as of its date. We undertake no obligation to update any forward-looking statements contained in this release to reflect events or circumstances occurring after its date or to reflect the occurrence of unanticipated events.

Investor Contact:

JTC Team, LLC

Jenene Thomas

(908) 824-0775

MBRX@jtcir.com

|

Moleculin Biotech, Inc. |

||||||||

|

Unaudited Condensed Consolidated Balance Sheets |

||||||||

|

(in thousands) |

September 30, 2024 |

December 31, 2023 |

||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ 9,405 |

$ 23,550 |

||||||

|

Prepaid expenses and other current assets |

2,201 |

2,723 |

||||||

|

Total current assets |

11,606 |

26,273 |

||||||

|

Furniture and equipment, net |

190 |

272 |

||||||

|

Intangible assets |

11,148 |

11,148 |

||||||

|

Operating lease right-of-use asset |

450 |

524 |

||||||

|

Total assets |

$ 23,394 |

$ 38,217 |

||||||

|

Current liabilities: |

||||||||

|

Accounts payable and accrued expenses and other current liabilities |

$ 5,593 |

$ 6,815 |

||||||

|

Total current liabilities |

5,593 |

6,815 |

||||||

|

Operating lease liability – long-term, net of current portion |

390 |

474 |

||||||

|

Warrant liability – long term |

9,932 |

4,855 |

||||||

|

Total liabilities |

15,915 |

12,144 |

||||||

|

Total stockholders’ equity |

7,479 |

26,073 |

||||||

|

Total liabilities and stockholders’ equity |

$ 23,394 |

$ 38,217 |

||||||

|

Unaudited Condensed Consolidated Statements of Operations |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(in thousands, except share and per share amounts) |

2024 |

2023 |

2024 |

2023 |

||||

|

Revenues |

$ – |

$ – |

$ – |

$ – |

||||

|

Operating expenses: |

||||||||

|

Research and development |

4,932 |

3,280 |

13,274 |

12,855 |

||||

|

General and administrative and depreciation and amortization |

2,203 |

2,667 |

6,724 |

7,857 |

||||

|

Total operating expenses |

7,135 |

5,947 |

19,998 |

20,712 |

||||

|

Loss from operations |

(7,135) |

(5,947) |

(19,998) |

(20,712) |

||||

|

Other income: |

||||||||

|

(Loss) gain from change in fair value of warrant liability |

(1,728) |

1 |

1,423 |

76 |

||||

|

Transaction costs allocated to warrant liabilities |

(993) |

– |

(993) |

– |

||||

|

Loss on issuance of warrant liabilities |

(847) |

– |

(847) |

– |

||||

|

Other income, net |

9 |

13 |

31 |

30 |

||||

|

Interest income, net |

102 |

324 |

503 |

1,106 |

||||

|

Net loss |

(10,592) |

(5,609) |

(19,881) |

(19,500) |

||||

|

Net loss per common share – basic and diluted |

$ (2.85) |

$ (2.82) |

$ (6.83) |

$ (9.94) |

||||

|

Weighted average common shares outstanding – basic and diluted |

3,714,278 |

1,987,283 |

2,910,842 |

1,961,327 |

||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/moleculin-reports-third-quarter-2024-financial-results-and-provides-corporate-update-302300667.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/moleculin-reports-third-quarter-2024-financial-results-and-provides-corporate-update-302300667.html

SOURCE Moleculin Biotech, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

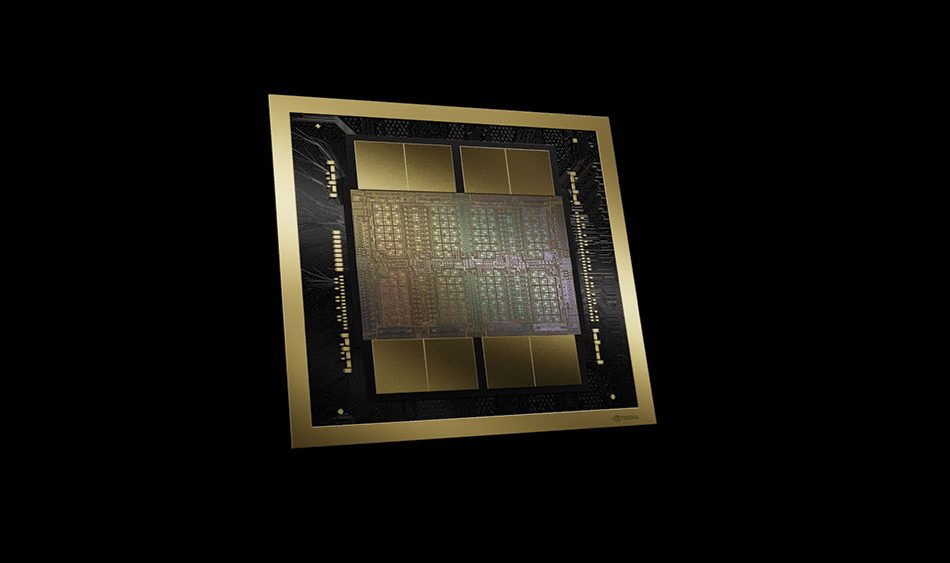

As Nvidia Replaces Intel On S&P Dow Jones Indices, Here's A Comparison Of How Both Stocks Performed Over The Past Year

As the euphoria pertaining to artificial intelligence has increased in recent years, the 128-year-old Dow Jones Industrial Average index replaced the shares of Intel Corp. INTC with Nvidia Corp. NVDA in its index.

The shares of Santa Clara, California-based company, Nvidia Corp have jumped nearly 204% in the past year, whereas Intel Corp (INTC) shares have plummeted nearly 32% in the same period.

What Happened: Nvidia Corp has emerged as the biggest winner in Wall Street’s AI-fueled rally. By Friday’s market close, Nvidia’s market cap reached $3.62 trillion, surpassing Apple Inc.’s AAPL valuation of $3.431 trillion, marking a significant milestone for the chipmaker as it races ahead amid surging demand for AI technologies.

See Also: Google Gemini Rolls Out ‘Utilities’ Extension For Android: Here’s What All You Can Do With It

“Nvidia is a well-run company and joining the Dow demonstrates just how powerful its rally has been in recent years after it was at the right place at the right time when no one else was,” said Scott Colyer, chief executive at Advisors Asset Management, according to Bloomberg.

Some analysts also believe that Intel Corp’s business, which was added to Dow in 1999, has been under pressure. The company has budgeted spending, cut jobs and stopped investor payouts. “Intel has lagged in a huge way,” Adam Sarhan, founder of 50 Park Investments told Bloomberg.

“Now, the Dow is evolving. You don’t want to see stocks that were there 30 years ago. You want to see what’s the strongest that survive today.”

Why It Matters: The Dow Jones Industrial Average is a price-weighted index based on 30 U.S. stocks, which first started as an index of 12 industrial stocks. The index has been subject to criticism for its limited scope, particularly its underrepresentation of technology stocks, a sector that has exhibited substantial growth in recent times.

One disadvantage of a price-weighted index is that a given percentage change in the price of a higher-priced stock has a greater impact on the index’s value than does an equal percentage change in the price of a lower-priced stock. Put another way, higher-priced stocks have more weight in the calculation of a price-weighted index.

Dow’s price-weighted methodology is troublesome for technology companies that abstain from splits and have shares trading above $1,000. Nvidia has split its stock two times in the past four years, the most recent of which was a 10-for-1 swap that took effect in June, which has made it easier for Dow to include the shares in its gauge.

A few analysts are still weary of Nvidia’s rally and believe that the chipmaker lacks a predictable earnings stream. Popularly, dubbed as the Warren Buffet of the U.K., Terry Smith, the founder and chief executive officer of Fundsmith Equity has said in a Nov. 5 interview in Tokyo that “I’m not confident that we know what the future of AI is because there are almost no applications people are paying for. Will they be willing to pay on a sufficient scale and a sufficient price to justify this? Because if not, the suppliers of the chips are going to have a problem,” Smith added.

The $32 billion (GBP 25 billion) Fundsmith Equity portfolio, which prioritizes growth stocks, holds stakes in major U.S. tech companies like Apple Inc, Meta Platforms, Inc., and Microsoft Corp. However, Smith opted out of investing in Nvidia, citing unpredictability in its future outlook.

Smith’s Fundsmith Equity Fund underperformed this year, returning 9% in dollar terms compared to the MSCI World Index’s nearly 20% gain. Smith attributed this to the concentration of performance in a few stocks and the increasing popularity of index funds.

Price Action: Charting back to five-year-old data, Nvidia Corp has surged nearly 2,792% and Intel Corp is down by approximately 55%. Nvidia Corp shares ended the trading day at $147.63 per share, whereas, Intel Corp was at $26.20 per share as of Friday’s close.

Read Next:

Image Credits – Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spectra7 Announces Omar Javaid as the New CEO

Expanding Customer Engagements in Data Center and AI Scale-Up/Scale-Out Backend

Networks for both 112 and 224Gbps Products

Third Quarter 2024 Financial Results

SAN JOSE, Calif., Nov. 11, 2024 /PRNewswire/ – SEV SPVNF Spectra7 Microsystems Inc. (“Spectra7” or the “Company“), a leader in high-performance analog semiconductors for powering the AI revolution in broadband connectivity markets, hyperscale data centers, and Spatial Computing, today announced that its Board of Directors has appointed Omar Javaid, a highly accomplished tech executive, as the Company’s new Chief Executive Officer and a member of the board, effective today. The Company also announced its financial results for the quarter ended September 30, 2024. A copy of the unaudited consolidated financial statements for the three and nine months ended September 30, 2024, and the corresponding management’s discussion and analysis (the “MD&A“) will be available under the Company’s profile on www.sedarplus.ca. Unless otherwise indicated, all dollar amounts in this press release are expressed in US dollars.

With more than 25 years of experience accelerating sales growth and profitability, Mr. Javaid brings to Spectra7 a demonstrated track record in building world class teams, global product launches, executive leadership, and achieving operational excellence. Most recently, Mr. Javaid was Chief Product Officer at Avaya, where he led product development for Avaya’s worldwide portfolio, partnerships, and alliances. Prior to this, he was a Senior Vice-President and GM of Software at Qualcomm, where he led the worldwide software portfolio. He has also held senior positions at Vonage, Hewlett-Packard, Google and Motorola. He was also the CEO and co-founder of Mobilocity, which was sold to Qualcomm. Mr. Javaid holds a Bachelor of Science degree from the University of Michigan, and has completed executive programs at Harvard Business School and Stanford University.

Ron Pasek, Chair of the Board, said, “the Board is delighted to welcome Omar to Spectra7 as our new CEO. His exceptional leadership skills, strategic insights and track record of commercial and financial success make him an ideal choice to lead Spectra7 forward.”

“I am truly honored to join the Spectra7 team as CEO,” said Javaid. “With our unique position and market leading technology in analog semiconductors for powering the AI revolution, I am thrilled to transform our strategy, secure key customer wins and accelerate growth1.”

Data Center Customer Engagements

An expanding base of data center customers recognize the unique benefits of Spectra7’s analog technology, especially for the Scale-Up and Scale-Out Backend AI Networks, and are now evaluating, developing and testing products with Spectra7’s chips. The Company is engaged with an increasing number of hyperscalers, OEMs and interconnect partners with its 112Gbps silicon. Additionally, the Company is engaged with several customers on designs that will use 224Gbps signalling. The Company’s 224Gbps product is expected to be released for fabrication next month and first parts are expected in April 20251. This will be the first product in a family of chips at 224Gbps that will address multiple data center, AI and other rapidly emerging applications.

Third quarter and year-to-date 2024 financial highlights

- Revenue in the third quarter of 2024 was $0.2 million. Revenue for the nine month period was $1.8 million, or approximately 19% of the $9.6 million in the prior year.

- Gross margin2 for the nine month period was 47%, compared to 59% in the prior year.

- Non-IFRS operating expenses3 for the nine month period were $6.9 million, down from $7.1 million in 2023.

- Basic and diluted loss per share for the nine month period was $(0.15), compared with a basic and diluted loss per share of $(0.10) in the prior year.

- EBITDA4 loss for the nine month period was $5.2 million, compared with an EBITDA loss of $1.0 million for the prior year.

RSU Grants

In connection with Mr. Javaid’s appointment as CEO, the Company has granted 7,100,000 restricted share units (“RSUs“) to Mr. Javaid under the Company’s RSU plan. In addition, the Company has granted 300,000 RSUs to the Company’s Interim Chief Financial Officer.

NOTES:

1 This is forward-looking information and is based on a number of assumptions. See “Cautionary Notes” below.

2 Gross margin is a non-GAAP measure which is computed as revenue less cost of sales divided by revenue. Refer to “Revenue and Gross Margin” in the MD&A and the table below for reconciliation to measures reported in the Company’s financial statements.

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||

|

(In thousands) |

(In thousands) |

||||||||||||

|

2024 |

2023 |

Change |

2024 |

2023 |

Change |

||||||||

|

$ |

$ |

$ |

% |

$ |

$ |

$ |

% |

||||||

|

Revenue |

152 |

3,154 |

(3,002) |

(95 %) |

1,830 |

9,555 |

(7,725) |

(81 %) |

|||||

|

Cost of sales |

169 |

1,568 |

(1,399) |

(89 %) |

966 |

3,950 |

(2,984) |

(76 %) |

|||||

|

Gross profit |

(17) |

1,586 |

(1,603) |

(101 %) |

864 |

5,605 |

(4,741) |

(85 %) |

|||||

|

Gross margin % |

(11 %) |

50 % |

(61 %) |

47 % |

59 % |

(12 %) |

|||||||

3 Non-IFRS operating expenses is a non-GAAP measure which includes research and development, sales and marketing, general and administrative expenses and depreciation and amortization for capital equipment and right-of-use assets and excludes share-based compensation expense, non-recurring termination costs, interest and related financing costs, change in fair value of warrant liabilities, foreign exchange gain/loss and gain/loss from property and equipment disposal. Refer to “Non-GAAP Measures” in the MD&A and the table below for reconciliation to measures reported in the Company’s financial statements.

|

in thousands |

|||||||||||

|

2022 |

2023 |

2024 |

|||||||||

|

Dec 31 |

Mar 31 |

Jun 30 |

Sep 30 |

Dec 31 |

Mar 31 |

Jun 30 |

Sep 30 |

||||

|

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

||||

|

Total expenses – IFRS |

3,210 |

3,053 |

3,330 |

3,086 |

4,479 |

2,575 |

9,866 |

2,461 |

|||

|

Share‑based compensation |

469 |

541 |

486 |

288 |

334 |

182 |

270 |

143 |

|||

|

Interest on lease obligation of right-of-use assets |

3 |

1 |

4 |

4 |

3 |

1 |

3 |

4 |

|||

|

Accretion expense |

425 |

370 |

389 |

411 |

493 |

538 |

142 |

– |

|||

|

Other income |

– |

– |

(12) |

(30) |

(9) |

– |

10 |

– |

|||

|

Foreign exchange gain |

354 |

(72) |

57 |

(110) |

143 |

(211) |

27 |

(1) |

|||

|

Extingushment of convertible debt |

– |

– |

– |

– |

– |

– |

6,922 |

– |

|||

|

Non-IFRS operating expenses |

1,959 |

2,212 |

2,407 |

2,523 |

3,515 |

2,065 |

2,491 |

2,315 |

|||

|

in thousands |

|||||||||||

|

2022 |

2023 |

2024 |

|||||||||

|

Dec 31 |

Mar 31 |

Jun 30 |

Sep 30 |

Dec 31 |

Mar 31 |

Jun 30 |

Sep 30 |

||||

|

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

||||

|

Research and development, net of investment tax |

928 |

995 |

1,195 |

1,409 |

1,154 |

1,040 |

1,123 |

1,033 |

|||

|

Sales and marketing |

280 |

269 |

252 |

271 |

325 |

279 |

270 |

236 |

|||

|

General and administrative |

684 |

881 |

891 |

762 |

1,947 |

657 |

1,014 |

963 |

|||

|

Depreciation of right-of-use assets |

60 |

60 |

60 |

60 |

60 |

60 |

57 |

56 |

|||

|

Depreciation of property and equipment |

8 |

8 |

8 |

21 |

28 |

28 |

28 |

27 |

|||

|

Non-IFRS operating expenses |

1,959 |

2,212 |

2,407 |

2,523 |

3,515 |

2,065 |

2,491 |

2,315 |

|||

4 EBITDA or earnings before interest, tax, depreciation, and amortization is a non-GAAP measure. EBITDA excludes share-based compensation, amortization, depreciation, interest, and tax expenses. Refer to “Non-GAAP Measures” in the MD&A and the table below for reconciliation to measures reported in the Company’s annual financial statements.

|

in thousands |

|||||||||||

|

2022 |

2023 |

2024 |

|||||||||

|

Dec 31 |

Mar 31 |

Jun 30 |

Sep 30 |

Dec 31 |

Mar 31 |

Jun 30 |

Sep 30 |

||||

|

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

||||

|

Net loss |

(1,231) |

(1,090) |

(1,275) |

(1,500) |

(4,315) |

(2,242) |

(9,318) |

(2,477) |

|||

|

Depreciation of right-of-use assets |

60 |

60 |

60 |

60 |

60 |

60 |

57 |

56 |

|||

|

Depreciation of property and equipment |

8 |

8 |

8 |

21 |

28 |

28 |

28 |

27 |

|||

|

Depreciation expense – COGS |

35 |

35 |

30 |

31 |

31 |

32 |

32 |

25 |

|||

|

Amortization – intangible assets |

55 |

76 |

105 |

90 |

179 |

167 |

167 |

167 |

|||

|

Share-based compensation |

469 |

541 |

486 |

288 |

334 |

182 |

270 |

143 |

|||

|

Interest on lease obligation of right-of-use assets |

3 |

1 |

4 |

4 |

3 |

1 |

3 |

4 |

|||

|

Accretion expense |

425 |

370 |

389 |

411 |

493 |

538 |

142 |

– |

|||

|

Other income |

– |

– |

(12) |

(30) |

(9) |

– |

10 |

– |

|||

|

Foreign Tax |

(216) |

– |

– |

– |

(119) |

– |

– |

– |

|||

|

Foreign exchange gain |

354 |

(72) |

57 |

(110) |

143 |

(211) |

27 |

(1) |

|||

|

Extingushment of convertible debt |

– |

– |

– |

– |

– |

– |

6,922 |

– |

|||

|

EBITDA |

(38) |

(70) |

(148) |

(734) |

(3,172) |

(1,445) |

(1,659) |

(2,056) |

|||

ABOUT SPECTRA7 MICROSYSTEMS INC.

Spectra7 Microsystems Inc. is a leader in high-performance analog semiconductors for powering the AI revolution in broadband connectivity markets, hyperscale data centers, and Spatial Computing. Spectra7 is based in San Jose, California with a design center in Cork, Ireland and a technical support location in Dongguan, China. For more information, please visit www.spectra7.com.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTES

Certain statements contained in this press release constitute “forward-looking statements”. All statements other than statements of historical fact contained in this press release, including, without limitation, the Company’s timeline for its 224Gbps product, the new CEO’s ability to transform the Company’s strategy, secure key customer wins, and accelerate growth, the Company’s strategy, plans, objectives, goals and targets, and any statements preceded by, followed by or that include the words “believe”, “expect”, “aim”, “intend”, “plan”, “continue”, “will”, “may”, “would”, “anticipate”, “estimate”, “forecast”, “predict”, “project”, “seek”, “should” or similar expressions or the negative thereof, are forward-looking statements. These statements are not historical facts but instead represent only the Company’s expectations, estimates and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied or forecasted in such forward-looking statements. Additional factors that could cause actual results, performance or achievements to differ materially include, but are not limited to, the risk factors discussed in the Company’s management’s discussion and analysis for the year ended December 31, 2023.. Management provides forward-looking statements because it believes they provide useful information to investors when considering their investment objectives and cautions investors not to place undue reliance on forward-looking information. Consequently, all of the forward-looking statements made in this press release are qualified by these cautionary statements and other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company. These forward-looking statements are made as of the date of this press release and the Company assumes no obligation to update or revise them to reflect subsequent information, events or circumstances or otherwise, except as required by law.

For more information, please contact:

Matt Kreps, Managing Director

Darrow Associates Investor Relations

mkreps@darrowir.com

214-597-8200

Spectra7 Microsystems Inc.

Dave Mier

Interim Chief Financial Officer

925-858-7011

ir@spectra7.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/spectra7-announces-omar-javaid-as-the-new-ceo-302300914.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/spectra7-announces-omar-javaid-as-the-new-ceo-302300914.html

SOURCE Spectra7 Microsystems Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top 4 Health Care Stocks That May Plunge This Quarter

As of Nov. 11, 2024, four stocks in the health care sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Airsculpt Technologies Inc AIRS

- On Nov. 8, AirSculpt Technologies posted better-than-expected quarterly results. “Our revenue and Adjusted EBITDA for the quarter were in line with our expectations with the period including progress on our strategy despite continued challenges in the consumer environment,” said Dennis Dean, Interim Chief Executive Officer and Chief Financial Officer of AirSculpt Technologies, Inc. The company’s stock gained around 42% over the past five days and has a 52-week high of $8.88.

- RSI Value: 81.89

- AIRS Price Action: Shares of Airsculpt Technologies gained 20.7% to close at $8.68 on Friday.

Quidelortho Corp QDEL

- On Nov. 7, QuidelOrtho reported better-than-expected third-quarter financial results and issued FY24 revenue above estimates. “We delivered solid third quarter results, giving us confidence that our strategic priorities and focus on our customers, business growth and margin improvement are gaining traction,” said Brian J. Blaser, President and Chief Executive Officer, QuidelOrtho. The company’s stock gained around 11% over the past five days and has a 52-week high of $75.86.

- RSI Value: 74.63

- QDEL Price Action: Shares of Quidelortho gained 12.6% to close at $43.75 on Friday.

Nuvation Bio Inc NUVB

- On Nov. 6, Nuvation Bio reported financial results for the third quarter ended Sept, 30, and provided a business update. David Hung, M.D., Founder, President, and Chief Executive Officer of Nuvation Bio stated: “In the third quarter, we continued to execute on our goal of bringing taletrectinib to people living with ROS1-positive NSCLC as quickly as possible, which has been our focus since we closed the acquisition of AnHeart Therapeutics earlier this year. In October, we completed the rolling submission of our NDA for line agnostic full approval of taletrectinib in advanced ROS1-positive NSCLC, which was supported by the pooled data from the pivotal Phase 2 TRUST-I and TRUST-II studies that we presented at ESMO. We believe that these data – a confirmed objective response rate of 89% and median duration of response approaching four years in the TKI-naïve setting – are the strongest data seen to date in the ROS1 space and increase taletrectinib’s potential to become a best-in-class treatment option.” The company’s stock gained around 25% over the past five days and has a 52-week high of $4.16.

- RSI Value: 71.61

- NUVB Price Action: Shares of Nuvation Bio gained 9.9% to close at $2.88 on Friday.

Insulet Corp PODD

- On Nov. 7, Insulet reported better-than-expected third-quarter financial results. “We continue to achieve significant milestones and robust revenue growth,” said Jim Hollingshead, President and Chief Executive Officer. The company’s stock jumped around 14% over the past five days and has a 52-week high is $275.52.

- RSI Value: 87.19

- PODD Price Action: Shares of Insulet gained 9.4% to close at $268.00 on Friday.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Stock Called 'Must-Own,' 'Once-In-A-Lifetime Opportunity'

Nvidia (NVDA) stock received price-target increases Monday from two Wall Street analysts who gushed about the chipmaker’s opportunity in artificial intelligence.

Melius Research analyst Ben Reitzes reiterated his buy rating on Nvidia stock and raised his price target to 185 from 165.

↑

X

How Nvidia Is Injecting AI Into The Health Care Industry

In premarket trades on the stock market today, Nvidia stock climbed a fraction to 148.57.

Reitzes called Nvidia stock a “once-in-a-lifetime opportunity,” thanks to its exposure to the AI megatrend. And that trend is still in its early days as Nvidia ramps production of its next-generation AI chip, Blackwell, Reitzes said in a client note.

“Giving up on Nvidia here after its hit — Hopper — is like giving up on Apple at iPhone 1 or 2,” Reitzes said. “AI is still on the come with compute-intensive catalysts/use cases like text-to-video, autonomous agents, self-driving cars and visual intelligence in their infancy.”

Capital expenditure plans are “very solid” at the five biggest AI infrastructure spenders: Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), Alphabet‘s (GOOGL) Google and Oracle (ORCL), he said.

Reitzes forecasts data center capex at those companies to rise 24% in 2025 to $282 billion.

Nvidia Stock Is On Five IBD Stock Lists

Elsewhere, Piper Sandler analyst Harsh Kumar kept his overweight rating on Nvidia stock and upped his price target to 175 from 140.

“We are making Nvidia our top large-cap pick given the company’s dominant positioning in AI accelerators and the upcoming launch of the Blackwell architecture,” Kumar said in a client note.

He called Nvidia stock “a must-own” stock ahead of the Blackwell ramp.

Kumar said the total addressable market for AI accelerators will continue to rise in 2025 and Nvidia is “well positioned” to capture a lion’s share of the market.

The next potential catalyst for Nvidia stock will be the company’s fiscal third-quarter report on Nov. 20.

Nvidia stock is on five IBD lists: Leaderboard, SwingTrader, IBD 50, Sector Leaders and Tech Leaders.

On Oct. 17, Nvidia stock hit a buy point of 140.76 out of a 17-week consolidation pattern, according to IBD MarketSurge charts. The 5% buy zone extends to 147.80, based on IBD trading principles.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Macom Technology Solutions Joins AI Data Center Chip Parade

SiTime Surges 19%, Latest Chip Stock To Catch AI Wave

See Stocks On The List Of Leaders Near A Buy Point

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens

The Cigna Group Affirming Its Capital Priorities

- Reaffirming Previously Provided Outlook for Full-Year 2024, and adjusted EPS growth of at least 10% in 2025

- Confirming it is not Pursuing a Combination with Humana Inc.

- Confirming Continuing to Use Capital to Drive Shareholder Value, including Share Repurchase and Dividends

BLOOMFIELD, Conn., Nov. 11, 2024 /PRNewswire/ — Global health company The Cigna Group CI officials expect to participate in meetings with investors and analysts over the next several weeks. During these meetings, The Cigna Group expects to reaffirm projected full year 2024 consolidated adjusted income from operations of at least $28.40 per share and adjusted EPS growth of at least 10% in 2025. Additionally, in light of recent and persistent speculation, The Cigna Group expects to communicate that the company is not pursuing a combination with Humana Inc. The Cigna Group remains committed to its established M&A criteria and would only consider acquisitions that are strategically aligned, financially attractive, and have a high probability to close.

The Cigna Group continues to deliver shareholder value through focused execution against stated operational and financial targets, and via disciplined capital deployment including dividends and share repurchase. Specific to share repurchase, year-to-date the company has repurchased $6 billion of stock, including $1 billion thus far in the fourth quarter. The company expects to continue actively repurchasing its shares in the fourth quarter and in 2025. It will use the majority of proceeds from the sale of its Medicare businesses expected to close in the first quarter of 2025 for share repurchase and has $5.3 billion remaining on its share repurchase authorization.

About The Cigna Group

The Cigna Group CI is a global health company committed to creating a better future built on the vitality of every individual and every community. We relentlessly challenge ourselves to partner and innovate solutions for better health. The Cigna Group includes products and services marketed under Evernorth Health Services, Cigna Healthcare, or its subsidiaries. The Cigna Group maintains sales capabilities in more than 30 markets and jurisdictions, and has approximately 184 million customer relationships around the world. Learn more at thecignagroup.com.

Disclosures

Adjusted income (loss) from operations is a principal financial measure of profitability used by The Cigna Group’s management because it presents the underlying results of operations of the Company’s businesses and permits analysis of trends in underlying revenue, expenses and shareholders’ net income (loss). Adjusted income (loss) from operations is defined as shareholders’ net income (loss) (or income (loss) before income taxes less pre-tax income (loss) attributable to noncontrolling interests for the segment metric) excluding net realized investment results, amortization of acquired intangible assets and special items. The Cigna Group’s share of certain realized investment results of its joint ventures reported in the Cigna Healthcare segment using the equity method of accounting are also excluded. Special items are matters that management believes are not representative of the underlying results of operations due to their nature or size. Adjusted income (loss) from operations is measured on an after-tax basis for consolidated results and on a pre-tax basis for segment results. Consolidated adjusted income (loss) from operations is not determined in accordance with GAAP and should not be viewed as a substitute for the most directly comparable GAAP measure, shareholders’ net income (loss).

Management is not able to provide a reconciliation of adjusted income from operations to shareholders’ net income (loss) (including on a per share basis) on a forward-looking basis because it is unable to predict, without unreasonable effort, certain components thereof including (i) future net realized investment results (from equity method investments with respect to adjusted revenues) and (ii) future special items. These items are inherently uncertain and depend on various factors, many of which are beyond our control. As such, any associated estimate and its impact on shareholders’ net income could vary materially.

The Company’s outlook excludes the potential effects of any other business combinations that may occur after the date of this press release. The Company’s outlook includes the potential effects of expected future share repurchases and anticipated 2024 dividends.

The timing and actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternate uses of capital. The share repurchase program may be effected through open market purchases in compliance with Rule 10b-18 under the Securities Exchange Act of 1934, as amended, including through Rule 10b5-1 trading plans, or privately negotiated transactions. The program may be suspended or discontinued at any time.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release and oral statements made with respect to information contained in this Report, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on The Cigna Group’s current expectations and projections about future trends, events and uncertainties. These statements are not historical facts. Forward-looking statements may include, among others, statements concerning our projected adjusted income from operations outlook for 2024 on a consolidated, per share, and segment basis; projected weighted average shares outstanding; future dividends; future financial or operating performance, including our ability to improve the health and vitality of those we serve; future growth, business strategy, and strategic or operational initiatives; economic, regulatory or competitive environments, particularly with respect to the pace and extent of change in these areas and the impact of developing inflationary and interest rate pressures; capital deployment plans and amounts available for future deployment; our prospects for growth in the coming years; strategic transactions; the anticipated closing of the sale of the Medicare business; expectations related to our Medicare Advantage Capitation Rates; and other statements regarding The Cigna Group’s future beliefs, expectations, plans, intentions, liquidity, cash flows, financial condition or performance. You may identify forward-looking statements by the use of words such as “believe,” “expect,” “project,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “may,” “should,” “will” or other words or expressions of similar meaning, although not all forward-looking statements contain such terms.

Forward-looking statements are subject to risks and uncertainties, both known and unknown, that could cause actual results to differ materially from those expressed or implied in forward-looking statements. Such risks and uncertainties include, but are not limited to: our ability to achieve our strategic and operational initiatives; our ability to adapt to changes in an evolving and rapidly changing industry; our ability to compete effectively, differentiate our products and services from those of our competitors and maintain or increase market share; price competition, inflation and other pressures that could compress our margins or result in premiums that are insufficient to cover the cost of services delivered to our customers; the potential for actual claims to exceed our estimates related to expected medical claims; our ability to develop and maintain satisfactory relationships with physicians, hospitals, other health service providers and with producers and consultants; our ability to maintain relationships with one or more key pharmaceutical manufacturers or if payments made or discounts provided decline; changes in the pharmacy provider marketplace or pharmacy networks; changes in drug pricing or industry pricing benchmarks; our ability to invest in and properly maintain our information technology and other business systems; our ability to prevent or contain effects of a potential cyberattack or other privacy or data security incidents; risks related to our use of artificial intelligence and machine learning; political, legal, operational, regulatory, economic and other risks that could affect our multinational operations, including currency exchange rates; risks related to an impairment of goodwill, intangible assets and/or investments (including as a result of the failure to realize the expected benefits of strategic transactions, as well as integration or separation difficulties or underperformance of such transactions relative to expectations; dependence on success of relationships with third parties; risk of significant disruption within our operations or among key suppliers or third parties; potential liability in connection with managing medical practices and operating pharmacies, onsite clinics and other types of medical facilities; the substantial level of government regulation over our business and the potential effects of new laws or regulations or changes in existing laws or regulations; uncertainties surrounding participation in government-sponsored programs such as Medicare; the outcome of litigation, regulatory audits and investigations; compliance with applicable privacy, security and data laws, regulations and standards; potential failure of our prevention, detection and control systems; unfavorable economic and market conditions, the risk of a recession or other economic downturn and resulting impact on employment metrics, stock market or changes in interest rates and risks related to a downgrade in financial strength ratings of our insurance subsidiaries; the impact of our significant indebtedness and the potential for further indebtedness in the future; credit risk related to our reinsurers; as well as more specific risks and uncertainties discussed in our most recent report on Form 10-K and subsequent reports on Forms 10-Q and 8-K available through the Investor Relations section of www.thecignagroup.com. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. The Cigna Group undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by law.

INVESTOR RELATIONS CONTACT:

Ralph Giacobbe

860-787-7968

Ralph.Giacobbe@TheCignaGroup.com

MEDIA CONTACT:

Justine Sessions

860-810-6523

Justine.Sessions@Evernorth.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/the-cigna-group-affirming-its-capital-priorities-302301139.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-cigna-group-affirming-its-capital-priorities-302301139.html

SOURCE The Cigna Group

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.