Michael Saylor's MicroStrategy Racks Up Over $10B In Unrealized Profit As Bitcoin Blows Past $82K

Bitcoin BTC/USD flew above $82,000 early Monday morning as the blistering rally sparked by Donald Trump’s presidential victory continued to bring riches to investors, particularly those with very large holdings.

What happened: MicroStrategy Inc. MSTR, the company that has pioneered Bitcoin’s corporate adoption, saw the value of its stash swell past $20 billion, according to data from bitcointreasuries.net.

At an average acquisition price of $9.904 billion, the firm was up more than $10 billion in profit on its Bitcoin investments.

| Bitcoin Holdings | Cost Price | Current Market Value | Paper Gains |

| 252,220 | $9.904 billion | $20.703 billion | $10.796 billion |

MicroStrategy adopted Bitcoin as its primary reserve asset on August 10, 2020, becoming the first publicly listed company to pursue this strategy.

Since then, shares of the so-called “Bitcoin development company” have soared 1783%. Interestingly, the stock has outperformed even Bitcoin, with the leading cryptocurrency growing by 592% in the same period.

Why It Matters: MicroStrategy boss Michael Saylor is seen as a Bitcoin evangelist for his unflinching conviction in the asset.

During the company’s third-quarter earnings call recently, he backed the cryptocurrency’s potential in “fixing” the unhealthy balance sheets of both public and private enterprises.

He even dared the Bitcoin doubters to bet against the company’s stock, assuring that he would never sell the acquired holdings.

MicroStrategy announced that it would raise $42 billion over the next three years through equity and debt financing to buy more Bitcoin.

Price Action: At the time of writing, Bitcoin was exchanging hands at $82,015.09. up 3.09% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy were up 12% in pre-market trading.

Read Next:

Image via Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Dow, S&P 500 extend rally as bitcoin tops $82,000, Tesla surges

US stocks climbed on Monday led by a continuation of the ‘Trump trade’ in the roaring post-election rally rally as investors looked ahead to a fresh reading on inflation.

The Dow Jones Industrial Average (^DJI) led the way higher, up 400 points, or about 1%, while the S&P 500 (^GSPC) moved up 0.3%. Both indexes are coming off their best week of the year, capped by record highs. The tech-heavy Nasdaq Composite (^IXIC) dipped below the flatline as Nvidia (NVDA), Apple (AAPL) and Meta (META) lagged.

Markets on Veterans Day were building on all-time highs thanks in large part to expectations for lower corporate taxes and deregulation from President-elect Donald Trump. Spirits are also buoyant after the Federal Reserve’s latest interest-rate cut, though doubts about the rally’s staying power are starting to emerge.

Wall Street is waiting for October consumer inflation data on Wednesday for pointers to the path of rates. Last week, Chair Jerome Powell stayed mum on the Fed’s thinking in the face of Trump policies that could keep price pressures in play.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

One worry is that Trump’s proposed tariffs could feed through into higher inflation, prompting the Fed to scale back on rate cuts. Minneapolis Fed President Neel Kashkari said on Sunday that if there is an escalating “tit-for-tat” reaction by other countries, policymakers will “have to wait and see”.

Traders now see a 65% chance that the Fed lowers rates by another quarter percentage point in December, per the CME FedWatch Tool. A week ago, before the presidential election, the odds stood at almost 80%.

Meanwhile, bitcoin (BTC-USD) soared to top $82,000 for the first time, amid high hopes for a crypto-friendly Trump administration and Congress. Dogecoin (DOGE-USD) and other smaller digital currencies also gained as traders bet on Trump’s promise to make the US a leading light in crypto.

In corporates, Tesla (TSLA) shares — another “Trump trade” hot spot — continued to climb, up over 8%. The EV maker’s stock hit its highest close in over two years on Friday, topping $1 trillion in market value amid optimism over CEO Elon Musk’s relationship with the incoming president.

LIVE 3 updatesDJT stock continues rally after Trump announces 'no intention' to sell shares

Trump Media & Technology Group stock (DJT) rose 6% in early trade Monday after shares surged 15% on Friday following news that Donald Trump would not sell his shares in the company.

Trump, who made the announcement on his Truth Social account Friday afternoon, maintains a roughly 60% interest in DJT, the parent company of Truth Social.

At Monday’s opening levels of around $34 a share, Trump Media boasts a market cap of more than $7.3 billion, giving the president-elect a stake worth more than $4.2 billion.

Shares in the company have been on a wild ride since Trump clinched victory over Kamala Harris in the presidential election, oscillating between highs and lows.

In September, shares in Trump Media traded at their lowest level since the company’s debut following the expiration of its highly publicized lockup period. The stock eventually bounced back from its lows as both domestic and overseas betting markets began to shift in favor of a Trump victory.

Trump founded Truth Social after he was kicked off major social media apps like Facebook (META) and Twitter, now X, following the Jan. 6, 2021, Capitol riots. Trump has since been reinstated on those platforms. He officially returned to posting on X in mid-August after about a year’s hiatus.

As Truth Social attempts to take on social media incumbents, the fundamentals of the company have long been in question.

On Tuesday, just a few hours before the election polls closed, DJT dropped third quarter results that revealed a net loss of $19.25 million for the quarter ending Sept. 30. This was narrower than the $26.03 million the company reported in the year-ago period.

DJT also reported revenue of $1.01 million, a slight year-over-year drop compared to the $1.07 million it reported in the third quarter of 2023. Over the past nine months ending Sept. 30, revenue has fallen 23% from the prior-year period.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance.

Icon Energy Corp. Reports Financial Results for the Nine-Month Period Ended September 30, 2024, and Declares Cash Dividend of $0.085 per Common Share

ATHENS, Greece, Nov. 11, 2024 (GLOBE NEWSWIRE) — Icon Energy Corp. (“Icon” or the “Company“) ICON, an international shipping company that provides worldwide seaborne transportation services for dry bulk cargoes via its fleet of oceangoing vessels, announces its financial results for the nine-month period ended September 30, 2024, (the “Reporting Period“) and declares cash dividend of $0.085 per common share.

Financial Highlights for the Reporting Period

- Revenue, net of $3.6 million, up $0.4 million from the first nine months of 2023

- Operating profit of $0.6 million, compared to $0.7 million during the nine-month period ended September 30, 2023

- Net income of $0.6 million, compared to $0.8 million during the nine-month period ended September 30, 2023

- EBITDA(1) of $1.5 million, equal to the same period last year

Operational Highlights

- Delivery of our recently acquired Kamsarmax dry bulk carrier, M/V Bravo, in September 2024, and commencement of her period employment

- Successful closing of a $91.5 million term loan facility, of which $16.5 million was drawn and the balance of $75 million is reserved for future vessel acquisitions

Quarterly Cash Dividend

- Icon’s Board of Directors approved a cash dividend of $0.085 per common share for the third quarter of 2024. The cash dividend will be paid on or around December 27, 2024, to all of its common shareholders of record as of December 16, 2024

- The previously declared cash dividend of $0.08 per common share for the second quarter of 2024 was paid on September 30, 2024

- Icon expects to pay quarterly cash dividends on its common shares during the one-year period following its initial public offering, in an aggregate amount of approximately $500,000 for the year

Ismini Panagiotidi, Chairwoman and Chief Executive Officer of Icon, commented:

“We are pleased to announce our financial results for the first nine months of 2024, reflecting the completion of our initial public offering in July 2024 and the progress we have made in executing our strategic priorities since then.

The successful delivery and commencement of employment of Icon’s second vessel, M/V Bravo, marks our first step toward realizing our growth ambitions, while the recent $91.5 million term loan facility, with $75 million reserved for future vessel acquisitions, provides a strong foundation for expansion. These transactions underscore the strong support we enjoy from charterers and financiers, positioning us well for further growth opportunities.

In addition, staying true to our stated dividend policy and following the $0.08 per common share cash dividend paid for the second quarter of the year, we are pleased to announce a cash dividend of $0.085 per common share for the third quarter, reaffirming our dedication to returning value to our shareholders.”

Financial Performance Summary

| Nine-month period ended September 30, |

||||||

| (in thousands of U.S. dollars, except daily figures) |

| | 2024 (unaudited) |

| | 2023 (unaudited) |

| Income statement data | ||||||

| Revenue, net | | $ | 3,582 | $ | 3,248 | |

| Operating profit | 567 | 710 | ||||

| Net income | | | 562 | 752 | ||

| Non-GAAP financial measures (2) | | | | | ||

| EBITDA | $ | 1,492 | $ | 1,484 | ||

| Daily TCE | | | 13,258 | | | 11,462 |

| Daily OPEX | | | 5,064 | | | 5,136 |

Throughout the first nine months of 2024 and 2023, Icon’s vessels operated under index-linked time charters, benefitting from the year-on-year increase in the dry bulk charter market rates. The resulting increase in revenue, net was partly offset by the fewer Operating Days during the Reporting Period (see “Fleet Employment and Operational Data” section below). Overall, revenue, net increased by 10% to $3.6 million during the Reporting Period, from $3.2 million in the comparable period. Daily TCE increased to $13,258 during the Reporting Period, up 16% from the same period last year.

The increase in revenue, net was primarily offset by costs associated with positioning the M/V Alfa for her scheduled drydocking and with the delivery of the M/V Bravo, which resulted in a $0.2 million increase in voyage expenses. Additionally, Icon’s incremental obligations as a public company since July 2024, translated into a $0.1 million increase in general and administrative expenses, while the costs related to changing ship management company earlier this year contributed to a $0.1 million increase in management fees. Vessel operating expenses were maintained at similar levels, with a slight improvement on a daily basis, as reflected by the decrease in ‘Daily OPEX’ to $5,064 during the Reporting Period, compared to $5,136 during the corresponding period of 2023.

Operating profit during the nine-month period ended September 30, 2024, was $0.6 million, down from $0.7 million in the comparable period, due to the non-cash write-off of the unamortized balance of previously deferred drydocking costs, upon arrival of the M/V Alfa at the shipyard for her scheduled drydocking. Lastly, the decrease in operating profit, coupled with the interest and finance costs associated with Icon’s new term loan facility, resulted to a $0.2 million decrease in net income, from $0.8 million during the first nine months of 2023, to $0.6 million during the Reporting Period.

EBITDA remained consistent between the two periods at $1.5 million.

Fleet Employment and Operational Data

| Nine-month period ended September 30, |

||||||

| | | 2024 | | | 2023 | |

| Fleet operational data (3) | | | | | ||

| Ownership Days | | | 281.8 | 273.0 | ||

| Available Days | | | 250.8 | 273.0 | ||

| Operating Days | | | 250.8 | 273.0 | ||

| Vessel Utilization | | | 100.0% | | | 100.0% |

| Average Number of Vessels | | | 1.0 | | | 1.0 |

Ownership days for the nine-month period ended September 30, 2024, increased to 281.8 from 273.0 the previous year, due to the addition of Icon’s second vessel, the Kamsarmax dry bulk carrier M/V Bravo, delivered on September 23, 2024. Available days decreased from 273.0 to 250.8, primarily because the M/V Alfa was temporarily taken out of service for her scheduled drydocking. Utilization remained consistent at 100%.

| Vessel name | Type | Built | Employment | Earliest charter expiration |

||||

| Alfa | Panamax | Japan, 2006 | Index-linked time charter | October 2025 | ||||

| Bravo | Kamsarmax | Japan, 2007 | Index-linked time charter | August 2025 | ||||

As of September 30, 2024, Icon owned two vessels, both time-chartered by an international commodity trading conglomerate and earning floating daily hire rates linked to the Baltic Panamax Index. The minimum contracted revenue(4) expected, as of September 30, 2024, to be generated by these contracts between September 30, 2024, and their respective earliest expiration dates is $8.8 million.

Key Developments

Initial public offering. On July 15, 2024, Icon successfully closed the initial public offering of 1,250,000 of its common shares, at an offering price of $4.00 per share, for gross proceeds of approximately $5,000,000, before deducting underwriting discounts and offering expenses. Icon’s common shares began trading on the Nasdaq Capital Market on July 12, 2024, under the symbol “ICON.”

Vessel Acquisition. On August 2, 2024, Icon entered into an agreement with an unaffiliated third-party to acquire a Kamsarmax dry bulk carrier for a purchase price of $17.57 million. The vessel was successfully delivered to Icon on September 23, 2024, and was renamed M/V Bravo. The acquisition was financed with a combination of cash on hand and borrowings under Icon’s new term loan facility discussed below.

Vessel Charter. On August 29, 2024, Icon entered into an agreement with an international commodity trading conglomerate to time charter the M/V Bravo for a period of 11 to 14 months, at a floating daily hire rate linked to the Baltic Panamax Index. The charter commenced shortly after the vessel’s delivery to Icon.

Vessel Drydocking. On September 2, 2024, the M/V Alfa completed her scheduled drydocking, undergoing routine repairs and maintenance to ensure continued operational efficiency, safety, and compliance with class requirements.

Financing. On September 19, 2024, we borrowed an amount of $16.5 million under a new term loan facility with a leading international financial institution to finance a portion of the purchase price of the M/V Bravo and to leverage the M/V Alfa. The term loan facility contains securities and financial and other covenants customary for transactions of this type. It has a four-year term and outstanding amounts thereunder bear interest at 3.95% over SOFR.

An additional amount of up to $75 million may be made available to us under the same term loan facility, in whole or in parts, to finance future vessel acquisitions. This additional amount remains uncommitted, free of interest or other fees, and we are not obliged to borrow it, or any part thereof. The terms of borrowing the balance amount, or any part thereof, will be determined at the time it is requested.

Dividends. On September 30, 2024, we paid a cash dividend of $0.08 per common share for the second quarter of the year. For the third quarter, Icon declared a cash dividend of $0.085 per common share, payable on or around December 27, 2024, to all of its common shareholders of record as of December 16, 2024.

About Icon

Icon is an international shipping company that provides worldwide seaborne transportation services for dry bulk cargoes via its fleet of oceangoing vessels. Icon maintains its principal executive office in Athens, Greece, and its common shares trade on the Nasdaq Capital Market under the symbol “ICON.”

Forward Looking Statements

This communication contains “forward-looking statements.” Statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions that are other than statements of historical fact are forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant risks, uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, the Company cannot provide assurance that it will achieve or accomplish these expectations, beliefs or projections. The Company’s actual results could differ materially from those anticipated in forward-looking statements for many reasons, including as described in the Company’s filings with the U.S. Securities and Exchange Commission (the “SEC“). As a result, you are cautioned not to unduly rely on any forward-looking statements, which speak only as of the date of this communication.

Factors that could cause actual results to differ materially from those discussed in the forward-looking statements include, among other things: the Company’s future operating or financial results; the Company’s liquidity, including its ability to service any indebtedness; changes in shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, business strategy, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks associated with operations; broader market impacts arising from war (or threatened war) or international hostilities; risks associated with pandemics (including COVID-19); and other factors listed from time to time in the Company’s filings with the SEC. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based. You should, however, review the factors and risks the Company describes in the reports it files and furnishes from time to time with the SEC, which can be obtained free of charge on the SEC’s website at www.sec.gov.

Contact Information

Icon Energy Corp.

Dennis Psachos

Chief Financial Officer

+30 211 88 81 300

ir@icon-nrg.com

www.icon-nrg.com

(Please refer to Exhibit I, attached, for supplementary information)

Exhibit I

Interim Consolidated Statements of Income

| Nine-month period ended September 30, |

||||||

| (in thousands of U.S. dollars, except for share data and earnings per share) |

2024 (unaudited) |

| | 2023 (unaudited) |

||

| Revenue, net | $ | 3,582 | $ | 3,248 | ||

| Voyage expenses, net | (257) | (119) | ||||

| Vessel operating expenses | (1,427) | (1,402) | ||||

| Management fees | (293) | (205) | ||||

| General and administrative expenses | (111) | (37) | ||||

| Depreciation expense | (547) | (508) | ||||

| Amortization of deferred drydocking costs | (380) | (267) | ||||

| Operating Profit | $ | 567 | $ | 710 | ||

| Interest and finance costs | (61) | (2) | ||||

| Interest income | 58 | 45 | ||||

| Other costs, net | (2) | (1) | ||||

| Net Income | $ | 562 | $ | 752 | ||

| Accrued dividends on Series A Preferred Shares | (526) | – | ||||

| Net income attributable to common shareholders | $ | 36 | $ | 752 | ||

| Earnings per common share, basic and diluted | $ | 0.06 | $ | 3.76 | ||

| Weighted average number of shares, basic and diluted | 555,839 | 200,000 | ||||

Condensed Interim Consolidated Balance Sheet Data

| (in thousands of U.S. dollars) | September 30, 2024 (unaudited) |

December 31, 2023(5) |

||||

| Assets | ||||||

| Cash, cash equivalents and restricted cash | $ | 1,823 | $ | 2,702 | ||

| Other current assets | 1,202 | 320 | ||||

| Vessels, net | 26,662 | 9,181 | ||||

| Other non-current assets | 864 | 679 | ||||

| Total assets | $ | 30,551 | $ | 12,882 | ||

| Liabilities and shareholders’ equity | ||||||

| Total long-term debt, net of deferred financing costs | $ | 16,206 | $ | – | ||

| Other liabilities | 1,704 | 3,713 | ||||

| Total shareholders’ equity | 12,641 | 9,169 | ||||

| Total liabilities and shareholders’ equity | $ | 30,551 | $ | 12,882 | ||

Summarized Cash Flow Data

| Nine-month period ended September 30, |

||||||

| (in thousands of U.S. dollars) | | | 2024 (unaudited) |

| | 2023 (unaudited) |

| Cash provided by operating activities | | $ | 588 | $ | 1,533 | |

| Cash used in investing activities | | | (18,006) | – | ||

| Cash provided by/(used in) financing activities | | | 16,539 | (3,307) | ||

| Net decrease in cash, cash equivalents and restricted cash | | $ | (879) | $ | (1,774) | |

| Cash, cash equivalents and restricted cash at the beginning of the period | | | 2,702 | 3,551 | ||

| Cash, cash equivalents and restricted cash at the end of the period | | $ | 1,823 | $ | 1,777 | |

Significant Accounting Policies and Recent Accounting Pronouncements

A discussion of the Company’s significant accounting policies and recent accounting pronouncements can be found in Note 2 of the Company’s Consolidated Financial Statements for the years ended December 31, 2023 and 2022, included in the Company’s most recent registration statement, filed with the SEC on Form F-1 which can be obtained free of charge on the SEC’s website at www.sec.gov. There have been no material changes to these policies in the Reporting Period.

Non-GAAP Financial Measures Definitions and Reconciliation to GAAP

To supplement our financial information presented in accordance with the United States generally accepted accounting principles (“U.S. GAAP“), we may use certain “non-GAAP financial measures” as such term is defined in Regulation G promulgated by the SEC. Generally, a non-GAAP financial measure is a numerical measure of a company’s operating performance, financial position or cash flows that excludes or includes amounts that are included in, or excluded from, the most directly comparable measure calculated and presented in accordance with U.S. GAAP. We believe non-GAAP financial measures provide investors with greater transparency and supplemental data relating to our financial condition and results of operations and, therefore, a more complete understanding of our business and financial performance than the comparable U.S. GAAP measures alone. However, non-GAAP financial measures should only be used in addition to, and not as substitutes for, the financial results presented in accordance with U.S. GAAP. Although we believe the following definitions and calculation methods are consistent with industry standards, our non-GAAP financial measures may not be directly comparable to similarly titled measures of other companies.

Earnings before Interest, Tax, Depreciation and Amortization (“EBITDA”). EBITDA is a financial measure we calculate by deducting interest and finance costs, interest income, taxes, depreciation and amortization, from net income. EBITDA assists our management by carving out the effects that non-operating expenses and non-cash items have on our financial results. We believe this also enhances the comparability of our operating performance between periods and against companies that may have varying capital structures, other depreciation and amortization policies, or that may be subject to different tax regulations. The following table reconciles EBITDA to the most directly comparable U.S. GAAP financial measure:

| Nine-month period ended September 30, |

||||||

| (in thousands of U.S. dollars) | | | 2024 (unaudited) |

| | 2023 (unaudited) |

| Net income | | $ | 562 | $ | 752 | |

| Plus: Depreciation expense | | | 547 | 508 | ||

| Plus: Amortization of deferred drydocking costs | | | 380 | 267 | ||

| Plus: Interest and finance costs | 61 | 2 | ||||

| Less: Interest income | | | (58) | (45) | ||

| EBITDA | | $ | 1,492 | $ | 1,484 | |

Time Charter Equivalent (“TCE”). TCE is a measure of revenue generated over a period that accounts for the effect of the different charter types under which our vessels may be employed. TCE is calculated by deducting voyage expenses from revenue and making any other adjustments that may be required to approximate the revenue that would have been generated, had the vessels been employed under time charters. TCE is typically expressed on a daily basis (“Daily TCE“) by dividing it by Operating Days, to eliminate the effect of changes in fleet composition between periods. The following table reconciles TCE and Daily TCE to the most directly comparable U.S. GAAP financial measure:

| Nine-month period ended September 30, |

||||||

| (in thousands of U.S. dollars, except fleet operational data and daily figures) |

| | 2024 (unaudited) |

| | 2023 (unaudited) |

| Revenue, net | | $ | 3,582 | $ | 3,248 | |

| Less: Voyage expenses | | | (257) | (119) | ||

| TCE | | $ | 3,325 | $ | 3,129 | |

| Divided by: Operating Days | | | 250.8 | 273.0 | ||

| Daily TCE | | $ | 13,258 | $ | 11,462 | |

Daily Vessel Operating Expenses (“Daily OPEX”). Daily OPEX, is a measure of the vessel operating expenses incurred over a period divided by Ownership Days, to eliminate the effect of changes in fleet composition between periods. The following table reconciles Daily OPEX to vessel operating expenses:

| Nine-month period ended September 30, |

||||||

| (in thousands of U.S. dollars, except fleet operational data and daily figures) |

| | 2024 (unaudited) |

| | 2023 (unaudited) |

| Vessel operating expenses | | $ | 1,427 | $ | 1,402 | |

| Divided by: Ownership Days | | | 281.8 | 273.0 | ||

| Daily OPEX | | $ | 5,064 | $ | 5,136 | |

Other Definitions and Methodologies

This press release refers to the terms and methodologies described below. Although we believe the following definitions and calculation methods are consistent with industry standards, these measures may not be directly comparable to similarly titled measures of other companies.

Ownership Days. Ownership Days are the total days we owned our vessels during the relevant period. We use this to measure the size of our fleet over a period.

Available Days. Available Days are the Ownership Days, less any days during which our vessels were unable to be used for their intended purpose as a result of scheduled maintenance, upgrades, modifications, drydockings, special or intermediate surveys, or due to change of ownership logistics, including positioning for and repositioning from such events. We use this to measure the number of days in a period during which our vessels should be capable of generating revenues.

Operating Days. Operating Days are the Available Days, less any days during which our vessels were unable to be used for their intended purpose as a result of unforeseen events and circumstances. We use this to measure the number of days in a period during which our vessels actually generated revenues.

Vessel Utilization. Vessel Utilization is the ratio of Operating Days to Available Days.

Average Number of Vessels. Average Number of Vessels is the ratio of Ownership Days to calendar days in a period.

Minimum contracted revenue. The amount of minimum contracted revenue is estimated by reference to the contracted period and hire rate, net of charterers’ commissions but before reduction for brokerage commissions and assuming no unforeseen off-hire days. For index-linked contracts, minimum contracted revenue is estimated by reference to the average of the relevant index during the 15 days preceding the calculation date.

1 EBITDA is a non-GAAP financial measure. For the definitions of non-GAAP financial measures and their reconciliation to the most directly comparable financial measures calculated and presented in accordance with the United States generally accepted accounting principles, please refer to “Exhibit I—Non-GAAP Financial Measures Definitions and Reconciliation to GAAP.”

2 EBITDA, Daily TCE, and Daily OPEX, are non-GAAP financial measures. For the definitions of non-GAAP financial measures and their reconciliation to the most directly comparable financial measures calculated and presented in accordance with the United States generally accepted accounting principles, please refer to “Exhibit I—Non-GAAP Financial Measures Definitions and Reconciliation to GAAP.”

3 For the definitions of fleet operational measures please refer to “Exhibit I—Other Definitions and Methodologies.”

4 For the contracted revenue calculation methodology please refer to “Exhibit I—Other Definitions and Methodologies.”

5 Balance sheet data derives from the audited consolidated financial statements as of that date

![]()

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese EV Maker BYD Edges Closer To Ford's Sales Volume After Beating Tesla In Revenue Race

Chinese EV maker BYD Co Ltd BYDDY is closing in fast on Michigan-based Ford Motor Co‘s F global sales despite the former not manufacturing combustion engine vehicles.

What Happened: BYD has sold over 3.25 million vehicles since the start of this year as of the end of October, marking a growth of about 36% from the corresponding period last year. In October alone, the company sold over half a million vehicles, marking a jump of about 36% from October 2023.

If BYD’s 2024 sales were to increase by 36% through the end of the year, its sales would cross over 4 million. Ford sold just 4.4 million vehicles to dealerships across the world in 2023.

According to a report from Bloomberg, BYD now has the chance to beat Ford in terms of annual sales, thereby cementing its position as a top 10 automaker globally. Ford has been selling nearly 1.1 million vehicles worldwide on average for the past three quarters, the report noted.

Why It Matters: BYD Executive Vice President He Zhiqi said on Weibo earlier this month that the company hired over 200,000 people from August to October for car and components manufacturing and increased production by nearly 200,000 vehicles.

According to BYD, the company made over 1.3 million NEVs in the three months from August to October, compared to nearly 900,000 units that it manufactured in the corresponding period of last year.

For the third quarter between July and September, BYD’s operating revenue rose 24% to 201.12 billion yuan ($28.25 billion), the company said in a filing late last month.

BYD’s American rival Tesla Inc. reported a total revenue of only $25.18 billion in the same quarter, making it the first time since 2022 that BYD has trumped Elon Musk’s EV giant in quarterly revenue. BYD stopped making combustion engine vehicles in March 2022 to focus on electric vehicles.

Despite reporting higher revenue than Tesla in the third quarter, BYD’s net profit continued to trail behind Tesla’s net income of $2.167 billion. The company reported a diluted earnings per share of 4 yuan (56 cents) for the quarter, lower than Tesla’s adjusted earnings per share of 72 cents.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: BYD

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Forget Palantir and Buy These 2 AI Stocks Instead?

Palantir‘s (NYSE: PLTR) stock hit a record high of $51.13 on Nov. 5. Its 223% year-to-date rally was driven by its accelerating revenue growth, soaring profits, and its inclusion in the S&P 500. The buying frenzy in AI stocks, expectations for lower rates, and the market’s post-election rally amplified its gains.

It’s easy to see why the bulls love Palantir. The analytics software company, which helps its government and commercial clients aggregate data from disparate sources to make smarter decisions, expects revenue to rise 26% this year — accelerating from its 17% growth in 2023 — as it stays profitable. Most of that growth will be driven by new government contracts, the robust growth of its U.S. commercial business, and the expansion of its generative AI services.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

From 2023 to 2026, analysts expect Palantir’s revenue and earnings per share (EPS) to grow at compound annual growth rates (CAGR) of 23% and 59%, respectively. But at 186 times forward earnings and 33 times next year’s sales, the company’s frothy valuations might limit its upside potential.

Instead of chasing Palantir’s high-flying stock, should investors buy Nvidia (NASDAQ: NVDA) and TSMC (NYSE: TSM) as their long-term AI plays instead?

Nvidia is the linchpin and bellwether of the AI market because it’s the dominant producer of high-end data center GPUs for processing AI tasks. The world’s leading AI companies — including OpenAI, Microsoft, Alphabet‘s Google, and Meta Platforms — all run their AI applications on Nvidia’s GPUs.

The soaring popularity of OpenAI’s ChatGPT and other generative AI applications drove many companies to upgrade their data centers with Nvidia’s GPUs. As a result, the market’s demand quickly outstripped the company’s available supply, its prices and gross margins soared, and revenue skyrocketed. In fiscal 2024 (which ended this January), Nvidia’s revenue soared 126% as its adjusted EPS jumped 288%.

Nvidia faces some long-term challenges. Many of its top customers are developing first-party AI accelerator chips, its rival AMD is ramping up its production of cheaper data center GPUs, and its sales to China are being throttled by tighter export restrictions. Its major customer Super Micro Computer also faces some tough questions amid its delayed 10-K filing, its auditor’s departure, and a potential regulatory probe.

Nuwellis, Inc. Announces Third Quarter 2024 Financial Results and Recent Highlights

MINNEAPOLIS, Nov. 11, 2024 (GLOBE NEWSWIRE) — Nuwellis, Inc. NUWE, a medical device company focused on transforming the lives of people with fluid overload, today reported financial results for the third quarter ended September 30, 2024.

Recent Highlights:

- Received a 297% CMS reimbursement increase to $1,639 for Aquadex facility fee, effective January 1, 2025.

- Revenue of $2.4 million.

- Pediatrics revenue growth of 28% compared to the prior year quarter.

- Gross margin of 70%, compared to 57.3% in the prior-year quarter.

- Total operating cost reduction of 30% compared to the prior-year quarter.

- New study published in Current Problems in Cardiology highlighted statistically significant reduction in Heart Failure readmissions at 60 days when using Aquadex.

- Added three new pediatric accounts and two new adult accounts.

- Received $5.1 million in gross proceeds through the November exercise of outstanding warrants.

“We commend the hard work and dedication of the Nuwellis team, fueling steady market adoption of our Aquadex ultrafiltration therapy, with revenue in the third quarter 2024 led by console sales and new account wins in our Pediatric customer category, which posted 28% annual growth,” said Nestor Jaramillo, President and CEO of Nuwellis. “We continue to see momentum with new accounts steadily opening on increasing awareness of the efficacy and supporting clinical evidence for Aquadex ultrafiltration therapy in the adult and pediatric customer categories. We believe these newly published clinical results will have a positive impact in growing our business and supporting Aquadex in becoming the standard of care for fluid removal when diuretics are ineffective. Following the closing of the quarter, we received notice of a 297% increase to $1,639 per day in reimbursement from the Centers for Medicare and Medicaid Services (CMS) which greatly expands the outpatient marketplace for fluid removal. This reimbursement increase is effective January 1, 2025.”

Third Quarter 2024 Financial Results

Revenue for the third quarter of 2024 was $2.4 million, a 2% decrease compared to the prior-year quarter. The year-over-year decrease is attributable to a decrease in consumables utilization, a decrease in US console sales offset by a one-time increase in SeaStar Medical Quelimmune sales.

Gross margin was 70% for the third quarter of 2024, compared to 57.3% in the prior-year quarter. The increase was primarily driven by higher manufacturing volumes of consumables and lower fixed overhead manufacturing expenses.

Selling, general and administrative expenses (SG&A) for the third quarter of 2024 decreased to $2.7 million, compared to $3.4 million in the prior-year quarter. The decrease in SG&A expense was primarily realized through efficiency initiatives enacted in the second half of 2023.

Third quarter research and development (R&D) expenses were $486 thousand, compared to $1.1 million in the prior-year quarter. The decrease in R&D expense was primarily due to reduced consulting fees and compensation related expenses.

Total operating expenses for the third quarter of 2024 were $3.2 million, a 30% decrease compared to $4.5 million in the prior-year quarter as we continue to realize savings from operating efficiency initiatives enacted in the second half of 2023.

Operating loss for the third quarter of 2024 decreased to $1.5 million compared to an operating loss of $3.2 million in the prior-year quarter.

Net income attributable to common shareholders for the third quarter of 2024 was $2.4 million, or a gain of $1.74 per basic and diluted common share, compared to a net loss attributable to common shareholders of $3.4 million, or a loss of $63.27 per basic and diluted common share in the prior-year quarter. Third quarter net income improvement was primarily the result of the revaluation of a prior period warrant liability, resulting in a $3.9 million dollar benefit.

As of September 30, 2024, the Company had no debt, cash and cash equivalents of approximately $1.9 million, and approximately 1.9 million common shares outstanding. Shareholder equity was $3.2 million, which we intend to submit to Nasdaq in support of our continued listing on the Nasdaq Stock Market.

Webcast and Conference Call Information

The Company will host a conference call and webcast at 9:00 AM ET today to discuss its financial results and provide an update on the Company’s performance.

To access the live webcast, please visit the Investors page of the Nuwellis website at https://ir.nuwellis.com. Alternatively, you may access the live conference call by dialing 1-800-445-7795 (U.S) or 1-785-424-1789 (international) and using the conference ID: NUWEQ3. An audio archive of the webcast will be available following the call on the Investors page at https://ir.nuwellis.com.

About Nuwellis

Nuwellis, Inc. NUWE is a medical device company dedicated to transforming the lives of patients suffering from fluid overload through science, collaboration, and innovation. The company is focused on commercializing the Aquadex SmartFlow® system for ultrafiltration therapy. Nuwellis is headquartered in Minneapolis, with a wholly owned subsidiary in Ireland. For more information visit ir.nuwellis.com or visit us on LinkedIn or X.

About the Aquadex SmartFlow® System

The Aquadex SmartFlow system delivers clinically proven therapy using a simple, flexible and smart method of removing excess fluid from patients suffering from hypervolemia (fluid overload). The Aquadex SmartFlow system is indicated for temporary (up to 8 hours) or extended (longer than 8 hours in patients who require hospitalization) use in adult and pediatric patients weighing 20 kg or more whose fluid overload is unresponsive to medical management, including diuretics. All treatments must be administered by a health care provider, within an outpatient or inpatient clinical setting, under physician prescription, both having received training in extracorporeal therapies.

Forward-Looking Statements

Certain statements in this release may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, statements regarding the new market opportunities and anticipated growth in 2024 and beyond. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this release, including, without limitation, those risks associated with our ability to execute on our commercialization strategy, the possibility that we may be unable to raise sufficient funds necessary for our anticipated operations, our post-market clinical data collection activities, benefits of our products to patients, our expectations with respect to product development and commercialization efforts, our ability to increase market and physician acceptance of our products, potentially competitive product offerings, intellectual property protection, our ability to integrate acquired businesses, our expectations regarding anticipated synergies with and benefits from acquired businesses, and other risks and uncertainties described in our filings with the SEC. Forward-looking statements speak only as of the date when made. Nuwellis does not assume any obligation to publicly update or revise any forward-looking statements, whether due to new information, future events or otherwise.

CONTACTS

INVESTORS:

Vivian Cervantes

Gilmartin Group

ir@nuwellis.com

| NUWELLIS, INC. AND SUBSIDIARY | |||||||||||||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||||||||||||

| (in thousands, except share and per share amounts) | |||||||||||||||||||||

| September 30, 2024 |

December 31, 2023 |

||||||||||||||||||||

| ASSETS | (Unaudited) | ||||||||||||||||||||

| Current assets | |||||||||||||||||||||

| Cash and cash equivalents | $ | 1,907 | $ | 3,800 | |||||||||||||||||

| Accounts receivable | 1,293 | 1,951 | |||||||||||||||||||

| Inventories, net | 1,864 | 1,997 | |||||||||||||||||||

| Other current assets | 430 | 461 | |||||||||||||||||||

| Total current assets | 5,494 | 8,209 | |||||||||||||||||||

| Property, plant and equipment, net | 551 | 728 | |||||||||||||||||||

| Operating lease right-of-use asset | 563 | 713 | |||||||||||||||||||

| Other assets | 120 | 120 | |||||||||||||||||||

| TOTAL ASSETS | $ | 6,728 | $ | 9,770 | |||||||||||||||||

| LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY | |||||||||||||||||||||

| Current liabilities | |||||||||||||||||||||

| Accounts payable and accrued liabilities | $ | 1,822 | $ | 2,380 | |||||||||||||||||

| Accrued compensation | 597 | 525 | |||||||||||||||||||

| Current portion of operating lease liability | 232 | 216 | |||||||||||||||||||

| Other current liabilities | 50 | 51 | |||||||||||||||||||

| Total current liabilities | 2,701 | 3,172 | |||||||||||||||||||

| Common stock warrant liability | 480 | 2,843 | |||||||||||||||||||

| Operating lease liability | 368 | 544 | |||||||||||||||||||

| Total liabilities | 3,549 | 6,559 | |||||||||||||||||||

| Commitments and contingencies | |||||||||||||||||||||

| Mezzanine Equity | |||||||||||||||||||||

| Series J Convertible Preferred Stock as of September 30, 2024 and December 31, 2023, par value $0.0001 per share; authorized 600,000 shares, issued and outstanding 95 and 11,950, respectively | 2 | 221 | |||||||||||||||||||

| Stockholders’ equity | |||||||||||||||||||||

| Series A junior participating preferred stock as of September 30, 2024 and December 31, 2023, par value $0.0001 per share; authorized 30,000 shares, none outstanding | — | — | |||||||||||||||||||

| Series F convertible preferred stock as of September 30, 2024 and December 31, 2023, par value $0.0001 per share; authorized 18,000 shares, issued and outstanding 127 shares | — | — | |||||||||||||||||||

| Preferred stock as of September 30, 2024 and December 31, 2023, par value $0.0001 per share; authorized 39,352,000 shares, none outstanding | — | — | |||||||||||||||||||

| Common stock as of September 30, 2024 and December 31, 2023, par value $0.0001 per share; authorized 100,000,000 shares, issued and outstanding 1,866,890 and 162,356, respectively | — | — | |||||||||||||||||||

| Additional paid-in capital | 300,546 | 290,647 | |||||||||||||||||||

| Accumulated other comprehensive income: Foreign currency translation adjustment | (46 | ) | (31 | ) | |||||||||||||||||

| Accumulated deficit | (297,323 | ) | (287,626 | ) | |||||||||||||||||

| Total stockholders’ equity | 3,177 | 2,990 | |||||||||||||||||||

| TOTAL LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY | $ | 6,728 | $ | 9,770 | |||||||||||||||||

| NUWELLIS, INC. AND SUBSIDIARY | |||||||||||||||||||||||||||

| Condensed Consolidated Statements of Operations and Comprehensive Loss | |||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||

| (in thousands, except per share amounts and weighted average shares outstanding) | |||||||||||||||||||||||||||

| Three months ended September 30 |

Nine months ended September 30 |

||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||

| Net sales | $ | 2,367 | $ | 2,412 | $ | 6,418 | $ | 6,313 | |||||||||||||||||||

| Cost of goods sold | 711 | 1,031 | 2,097 | 2,718 | |||||||||||||||||||||||

| Gross profit | 1,656 | 1,381 | 4,321 | 3,595 | |||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||

| Selling, general and administrative | 2,702 | 3,428 | 10,544 | 13,582 | |||||||||||||||||||||||

| Research and development | 486 | 1,117 | 2,378 | 4,050 | |||||||||||||||||||||||

| Total operating expenses | 3,188 | 4,545 | 12,922 | 17,632 | |||||||||||||||||||||||

| Loss from operations | (1,532 | ) | (3,164 | ) | (8,601 | ) | (14,037 | ) | |||||||||||||||||||

| Other income (expense), net | 8 | (204 | ) | (87 | ) | 98 | |||||||||||||||||||||

| Financing Expense | — | — | (5,607 | ) | — | ||||||||||||||||||||||

| Change in fair value of warrant liability | 3,882 | — | 4,602 | (755 | ) | ||||||||||||||||||||||

| Income (loss) before income taxes | 2,358 | (3,368 | ) | (9,693 | ) | (14,694 | ) | ||||||||||||||||||||

| Income tax expense | — | (2 | ) | (4 | ) | (6 | ) | ||||||||||||||||||||

| Net income (loss) | $ | 2,358 | $ | (3,370 | ) | $ | (9,697 | ) | $ | (14,700 | ) | ||||||||||||||||

| Deemed dividend attributable to Series J Convertible Preferred Stock | — | — | 541 | — | |||||||||||||||||||||||

| Net income (loss) attributable to common shareholders | $ | 2,358 | ) | $ | (3,370 | ) | $ | (9,156 | ) | $ | (14,700 | ) | |||||||||||||||

| Basic and diluted net income (loss) per share | $ | 1.74 | $ | (63.27 | ) | $ | (14.99 | ) | $ | (357.42 | ) | ||||||||||||||||

| Weighted average shares outstanding – basic and diluted | 1,351,939 | 53,265 | 647,079 | 41,128 | |||||||||||||||||||||||

| Other comprehensive loss: | |||||||||||||||||||||||||||

| Foreign currency translation adjustments | $ | (4 | ) | $ | — | $ | (15 | ) | $ | (6 | ) | ||||||||||||||||

| Total comprehensive income (loss) | $ | 2,354 | $ | (3,370 | ) | $ | (9,171 | ) | $ | (14,706 | ) | ||||||||||||||||

| NUWELLIS, INC. AND SUBSIDIARY | |||||||||||||||||||||||||||||||

| Condensed Consolidated Statements of Cash Flows | |||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||||

| Nine months ended September 30 |

|||||||||||||||||||||||||||||||

| 2024 |

2023 |

||||||||||||||||||||||||||||||

| Operating Activities: | |||||||||||||||||||||||||||||||

| Net loss | $ | (9,697 | ) | $ | (14,700 | ) | |||||||||||||||||||||||||

| Adjustments to reconcile net loss to cash flows used in operating activities: | |||||||||||||||||||||||||||||||

| Depreciation and amortization | 227 | 253 | |||||||||||||||||||||||||||||

| Stock-based compensation expense | 374 | 513 | |||||||||||||||||||||||||||||

| Change in fair value of warrant liability | (4,602 | ) | 755 | ||||||||||||||||||||||||||||

| Warrant financing costs | 5,607 | — | |||||||||||||||||||||||||||||

| Net realized gain on marketable securities | — | (65 | ) | ||||||||||||||||||||||||||||

| Changes in operating assets and liabilities: | |||||||||||||||||||||||||||||||

| Accounts receivable | 658 | (19 | ) | ||||||||||||||||||||||||||||

| Inventory, net | 120 | 325 | |||||||||||||||||||||||||||||

| Other current assets | (275 | ) | (551 | ) | |||||||||||||||||||||||||||

| Other assets and liabilities | (13 | ) | (16 | ) | |||||||||||||||||||||||||||

| Accounts payable and accrued expenses | (486 | ) | (1,678 | ) | |||||||||||||||||||||||||||

| Net cash used in operating activities | (8,087 | ) | (15,183 |

) | |||||||||||||||||||||||||||

| Investing Activities: | |||||||||||||||||||||||||||||||

| Proceeds from sale of marketable securities | — | 578 | |||||||||||||||||||||||||||||

| Additions to intangible assets | — | (99 | ) | ||||||||||||||||||||||||||||

| Purchases of property and equipment | (37 | ) | (185 | ) | |||||||||||||||||||||||||||

| Net cash provided by (used in) investing activities | (37 | ) | 294 |

||||||||||||||||||||||||||||

| Financing Activities: | |||||||||||||||||||||||||||||||

| Issuance of common stock from offering | 2,403 | — | |||||||||||||||||||||||||||||

| Proceeds from the exercise of Series J Convertible Preferred Warrants | 501 | — | |||||||||||||||||||||||||||||

| Proceeds from the exercise of April 2024 Warrants | 1,182 | — | |||||||||||||||||||||||||||||

| Issuance of July and August 2024 Common Stock and Warrants | 2,160 | — | |||||||||||||||||||||||||||||

| Proceeds from ATM stock offerings, net | — | 2,108 | |||||||||||||||||||||||||||||

| Payments on finance lease liability | — | (20 | ) | ||||||||||||||||||||||||||||

| Net cash provided by financing activities | 6,246 | 2,088 |

|||||||||||||||||||||||||||||

| Effect of exchange rate changes on cash | (15 | ) | (6 | ) | |||||||||||||||||||||||||||

| Net decrease in cash and cash equivalents | (1,893 | ) | (12,807 | ) | |||||||||||||||||||||||||||

| Cash and cash equivalents – beginning of period | 3,800 | 17,737 | |||||||||||||||||||||||||||||

| Cash and cash equivalents – end of period | $ | 1,907 | $ | 4,930 | |||||||||||||||||||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Celanese Analyst Turns Bearish; Here Are Top 5 Downgrades For Monday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

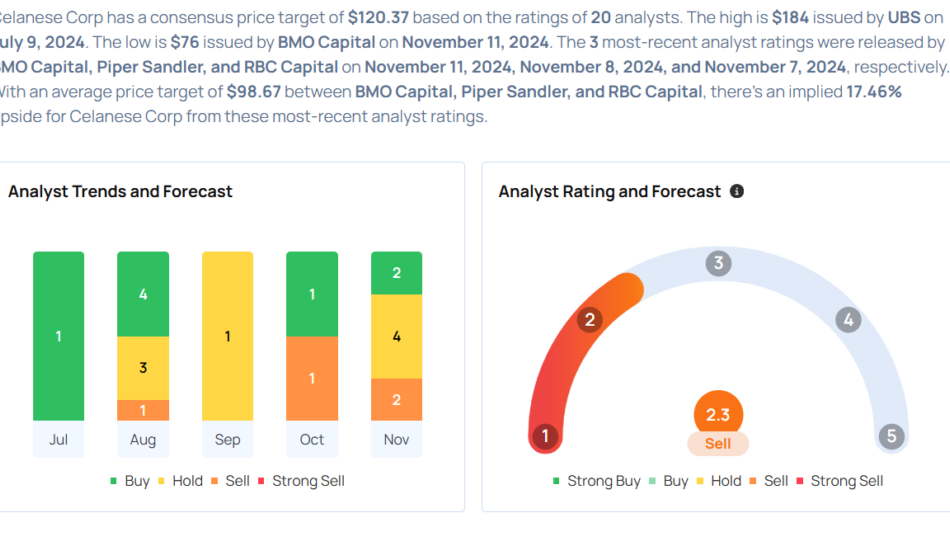

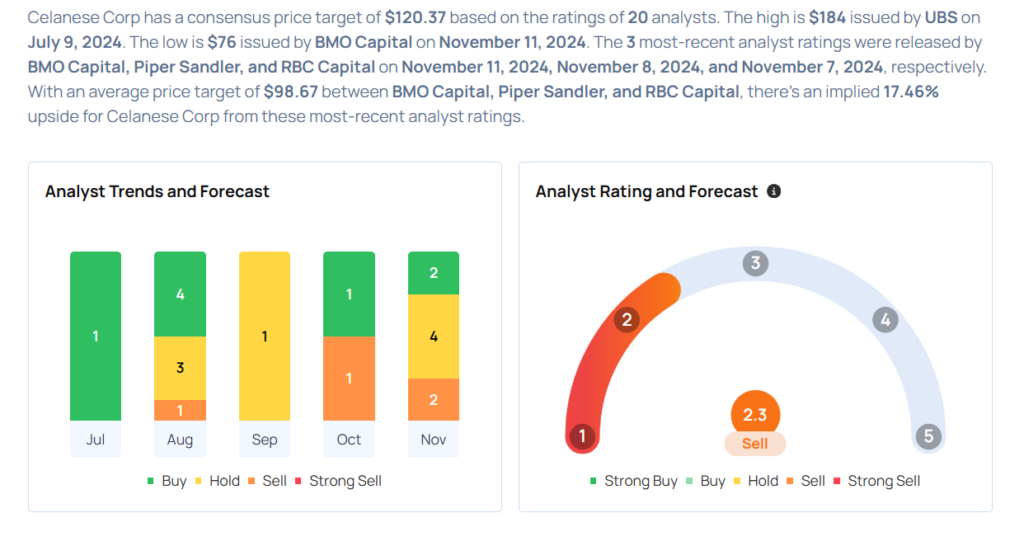

Considering buying CE stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.