This Upstart Analyst Is No Longer Bearish; Here Are Top 5 Upgrades For Monday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

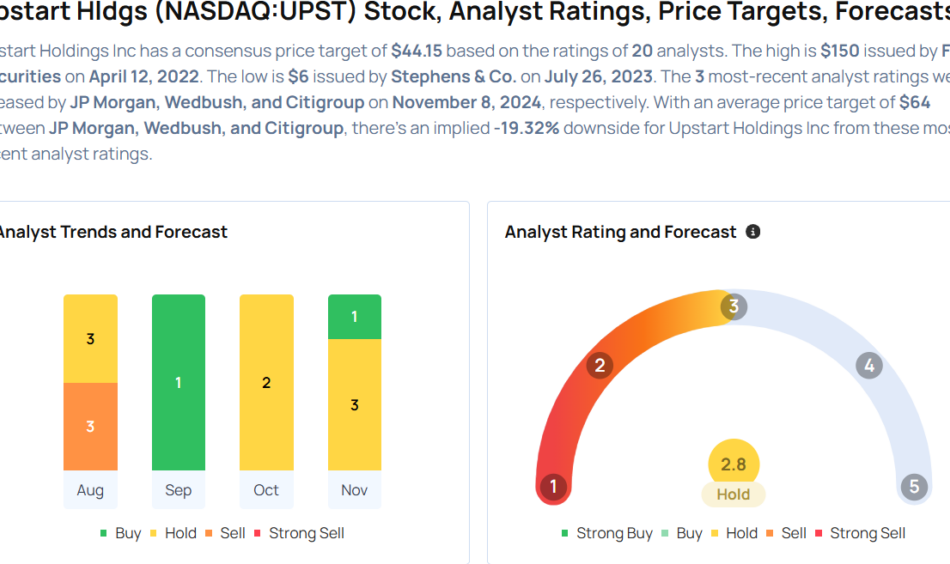

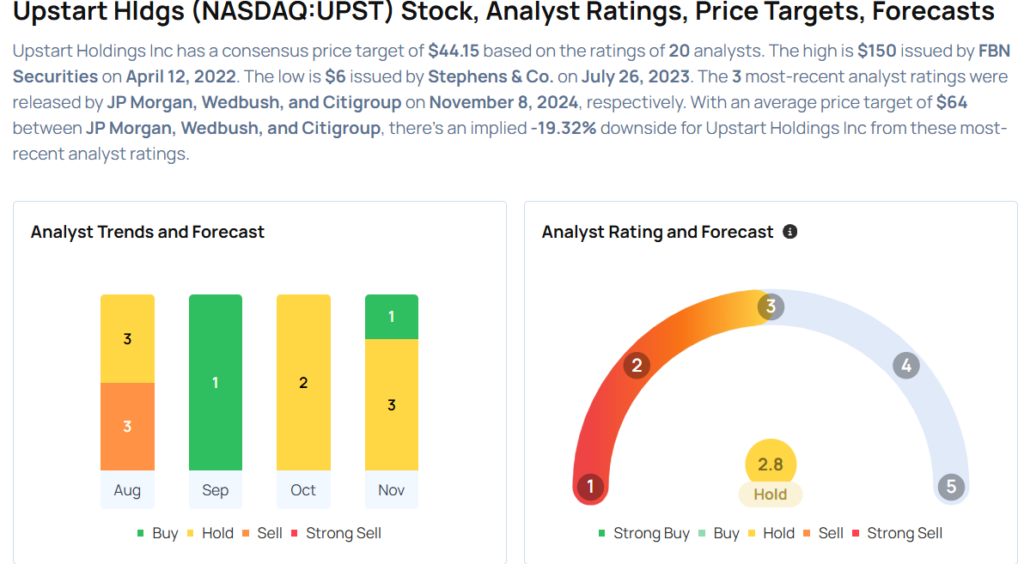

Considering buying UPST stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SpaceX Aims To Launch Starship Once Every 2 Weeks By Late 2025, CEO Elon Musk Says 'We Will Be Much Faster'

SpaceX is aiming to reach a cadence of one Starship launch every two weeks “faster” than late 2025, company CEO and billionaire Elon Musk said on Sunday.

What Happened: Starbase General Manager Kathy Lueders said at the National Congress of Space Activities held in Matamoros late last week that the company is looking to launch one Starship every two weeks by late 2025.

“We will be much faster than that Musk,” wrote on X on Sunday, accelerating the timeline provided by Lueders.

Last week, SpaceX said that it is planning its next and sixth flight test of its ambitious Starship launch vehicle as early as Nov. 18. For the next test flight, the company aims to catch Starship’s booster back at the launch site as on the last flight and splash down the upper stage in the Indian Ocean.

Past Flights: On Starship’s fifth flight test in October, it lifted off from Starbase, and the booster returned to Earth after propelling Starship to space. The booster was subsequently caught by the launch tower at Starbase.

The Starship, meanwhile, went on to space and splashed down on target in the Indian Ocean.

The recovery of the booster was a key objective of the flight test and demonstrated the reusability of the Starship’s design. SpaceX is aiming to make the Starship a completely reusable spacecraft that can fly multiple times, thereby reducing the cost of spaceflight.

The test flights before the one in October accomplished less. Starship flew for the first time in April 2023.

Why It Matters: Starship is key to NASA’s dreams of taking humans back to the surface of the Moon.

NASA’s Artemis 3 mission slated to launch no earlier than September 2026 is expected to enable humans to land back on the surface of the moon with the help of a lunar lander variant of the Starship spacecraft. The last time humans set foot on the Moon was in 1972 with Apollo 17. Since then, no crew has traveled beyond low-Earth orbit.

Musk, meanwhile, is eyeing taking humans to Earth’s neighboring planet Mars aboard the Starship. In September, he said that the first Starship launch to Mars is expected in 2026 and that it will not have a crew on board.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: SpaceX

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lincoln Educational Services Reports Double Digit Growth in Revenue and Student Starts for the Third Quarter 2024 and Raises 2024 Outlook

PARSIPPANY, N.J., Nov. 11, 2024 (GLOBE NEWSWIRE) — Lincoln Educational Services Corporation LINC today announced financial and operating results for the third quarter ended September 30, 2024, as well as recent business developments.

Third Quarter 2024 Financial Highlights & Recent Operating Developments*

- Revenue increased by 15.0% to $114.4 million

- Student starts grew by 21.1%; quarter-end student population rose by 13.3%

- Net income of $4.0 million and adjusted EBITDA of $10.2 million

- Total liquidity in excess of $90 million, no debt outstanding

- Recently opened East Point, Georgia campus outperforming first-year operating plan

- Raised 2024 financial guidance

*Note: The highlighted financial results exclude the Transitional segment results of the prior year. A reconciliation of GAAP / non-GAAP measures is included in this release.

“Lincoln’s third quarter performance illustrates how well our team is serving America’s growing interest in educational alternatives to a traditional four-year college degree while helping employers fill their workforce skills gap,” said Scott Shaw, President & CEO. “We grew same-campus student starts 16% over the prior year quarter, while our recently opened East Point campus drove overall student start growth to 21%. Third quarter revenue growth reached nearly 15% while adjusted EBITDA grew 67%. The continued successful execution of our transformational growth strategies is driving our performance. Results through the first nine months of the year are enabling us to increase our full year guidance.”

“Our hybrid teaching platform, Lincoln 10.0 continues to improve operating efficiencies while benefiting student experience and outcomes. By the end of the year, Lincoln 10.0 will be used by approximately 65% of our students. During the third quarter, we laid the plans to extend the hybrid teaching platform to our nursing programs over the next 18 months. When the nursing programs are transitioned, Lincoln 10.0 will serve approximately 80% of our student population, further driving operating efficiencies. At the same time, we continue to execute our new campus development efforts in Nashville, TN, Levittown, PA, and Houston, TX.”

“Our goal of creating an additional ten replication programs at existing campuses is still on track to be completed by the first quarter of 2025. During the third quarter, three such programs started and we are on schedule to roll-out an additional three by year-end. We continue to expect each of these programs to generate an additional $1.0 million each in EBITDA by the third year of operation.”

“Corporate partnerships continue to be a key contributor to our growth and during the quarter we announced a partnership with Hyundai Motor America and Genesis Motor America offering their training at no added cost to our students at all of our automotive campuses nationwide. In addition, we signed extensions with several corporate partners that in some cases extend our working relationship for an additional five years. And, as corporate America’s interest in Lincoln and our capabilities builds, our discussions with potential new partners are quite robust.”

“Our recent financial performance, as well as the strong start to our fourth quarter, lead us to increase our guidance for the remainder of the year. Demand for Lincoln’s programs, our impressive graduation and placement rates, our new campus development strategy, and improving efficiencies combine to position Lincoln to achieve our stated longer-term objectives of approximately $550 million in revenue and approximately $90 million in adjusted EBITDA in 2027.”

2024 THIRD QUARTER FINANCIAL RESULTS

(Quarter ended September 30, 2024, compared to September 30, 2023)

- Revenue grew by $14.8 million, or 14.8% to $114.4 million. The increase was primarily due to a 10.6% increase in average student population, driven by four consecutive quarters of double-digit start growth, with the most recent third quarter growing by 21.1%. Contributing to the nearly $15.0 million increase in revenue was the recently opened East Point, Georgia campus, which generated $3.4 million in revenue in the current quarter.

- Educational services and facilities expense increased $4.9 million, or 11.4% to $48.0 million. The increase over the prior year was primarily driven by costs associated with new programs, new campuses and campus relocations. In addition, expenses were up due to the larger student population and depreciation expense driven by expanded capital investments. However, as a percentage of revenue, educational services and facilities costs decreased from the prior year, demonstrating increased operating efficiency.

- Selling, general and administrative expense increased $8.8 million, or 16.3% to $63.3 million. The increase over the prior year was primarily driven by costs associated with new programs, new campuses and campus relocations. Remaining expense increases were driven by several factors including costs associated with a larger student population and increased marketing investments, which helped drive the increase in student starts. While marketing investments were up in the quarter, the costs to obtain new students have decreased, demonstrating increased efficiencies per dollar invested.

RECENT BUSINESS DEVELOPMENTS

East Point, Georgia Campus. The recently opened East Point, Georgia campus has made a strong debut since the initial launch of classes in March 2024. Through September 30, 2024, the campus has enrolled approximately 600 students and generated approximately $5.0 million in revenue.

During the quarter ended September 30, 2024, EBITDA results were positive and we expect to continue to be positive in the fourth quarter exceeding our internal plan for 2024.

THIRD QUARTER SEGMENT RESULTS

Campus Operations Segment

Revenue increased $14.9 million, or 15.0% to $114.4 million. Adjusted EBITDA increased $5.5 million, or 38.6% to $19.9 million, from $14.4 million in the prior year.

Transitional Segment

The Somerville, Massachusetts campus teach-out was completed in the fourth quarter of 2023. In the prior year comparable period, the Somerville campus had revenue of $0.1 million and operating expenses of $0.8 million.

Corporate and Other

This category includes unallocated expenses incurred on behalf of the entire Company.

Corporate and other expense were $9.0 million and $9.1 million for the three months ended September 30, 2024 and 2023, respectively. Included in the current year is a gain of $2.8 million related to insurance proceeds received as a result of hail damage at one of our campuses. Partially offsetting the gain are additional expenses relating to salaries and benefits expense and increased stock-based incentives.

NINE MONTHS FINANCIAL RESULTS

(Period ended September 30, 2024, compared to September 30, 2023)

- Total revenue increased $45.1 million, or 16.4%, to $320.6 million, compared to $275.5 million.

- Campus Operations Segment revenue increased $46.6 million, or 17.0% to $320.7 million, compared to $274.1 million.

- Transitional Segment revenue decreased $1.5 million, or 100% to zero, compared to $1.5 million.

FULL YEAR 2024 OUTLOOK

Based on third quarter operating and financial results, as well as the outlook for the remainder of the year, the Company is raising financial guidance for revenue, adjusted EBITDA, adjusted net income and student starts. Additionally, the Company has increased the low-end range for capital expenditures. Updated guidance for 2024 is outlined below:

| 2024 Guidance | |||||||||||

| (Amounts in millions except for student starts) | Low | High | |||||||||

| Revenue | $ | 430 | – | $ | 435 | ||||||

| Adjusted EBITDA | $ | 41 | – | $ | 43 | 1 | |||||

| Adjusted net income | $ | 16 | – | $ | 18 | 1 | |||||

| Capital expenditures | $ | 50 | – | $ | 55 | ||||||

| Student Starts | 13% | – | 15% | ||||||||

| 1The guidance in this release includes references to non-GAAP operating measures. A reconciliation to the midpoint of our guidance can be reviewed below in the non-GAAP operating measures at the end of this release. | |||||||||||

For reference, the Company’s prior 2024 guidance was revenue of $423 million to $430 million, Adjusted EBITDA of $39 million to $42 million, Adjusted net income of $14 million to $17 million, capital expenditures of $45 to $55 million and student start growth of 9 to 12 percent.

CONFERENCE CALL INFO

Lincoln will host a conference call today at 10:00 a.m. Eastern Standard Time to discuss results. To access the live webcast of the conference call, please go to the Investor Overview section of Lincoln’s website at http://www.lincolntech.edu. Participants may also register via teleconference at: Q3 2024 Lincoln Educational Services Earnings Conference Call. Once registration is completed, participants will be provided with a dial-in number containing a personalized PIN to access the call. Participants are requested to register at least 15 minutes prior to the start of the call. Once registration is completed, participants will be provided with a dial-in number containing a personalized PIN to access the call. Participants are requested to register at least 15 minutes prior to the start of the call.

An archived version of the webcast will be accessible for 90 days at http://www.lincolntech.edu.

ABOUT LINCOLN EDUCATIONAL SERVICES CORPORATION

Lincoln Educational Services Corporation is a leading provider of diversified career-oriented post-secondary education helping to provide solutions to America’s skills gap. Lincoln offers career-oriented programs to recent high school graduates and working adults in five principal areas of study: automotive technology, health sciences, skilled trades, business and information technology, and hospitality services. Lincoln has provided the workforce with skilled technicians since its inception in 1946 and currently operates 22 campuses in 13 states under Lincoln College of Technology, Lincoln Technical Institute, Lincoln Culinary Institute, Euphoria Institute of Beauty Arts & Sciences and associated brand names. For more information, please go to www.lincolntech.edu.

FORWARD-LOOKING STATEMENTS

Statements in this press release and in oral statements made from time to time by representatives of Lincoln Educational Services Corporation regarding Lincoln’s business that are not historical facts, including those made in a conference call, may be “forward-looking statements” as that term is defined in the federal securities law. The words “may,” “will,” “expect,” “believe,” “anticipate,” “project,” “plan,” “intend,” “estimate,” and “continue,” and their opposites and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all. Generally, these statements relate to business plans or strategies and projections involving anticipated revenues, earnings, or other aspects of the Company’s operating results. Such forward-looking statements include the Company’s current belief that it is taking appropriate steps regarding the pandemic and that student growth will continue. The Company cautions you that these statements concern current expectations about the Company’s future performance or events and are subject to a number of uncertainties, risks, and other influences, many of which are beyond the Company’s control, that may influence the accuracy of the statements and the projects upon which the statements are based including, without limitation, impacts related to epidemics or pandemics; our failure to comply with the extensive regulatory framework applicable to our industry or our failure to obtain timely regulatory approvals in connection with acquisitions or a change of control of our Company; our success in updating and expanding the content of existing programs and developing new programs for our students in a cost-effective manner or on a timely basis; risks associated with cybersecurity; risks associated with changes in applicable federal laws and regulations; uncertainties regarding our ability to comply with federal laws and regulations, such as the 90/10 rule and prescribed cohort default rates; risks associated with the opening of new campuses; risks associated with integration of acquired schools; industry competition; our ability to execute our growth strategies; conditions and trends in our industry; general economic conditions; and other factors discussed in the “Risk Factors” section of our Annual Reports and Quarterly Reports filed with the Securities and Exchange Commission. All forward-looking statements are qualified in their entirety by this cautionary statement, and Lincoln undertakes no obligation to publicly revise or update any forward-looking statements, whether as a result of new information, future events or otherwise after the date hereof.

(Tables to Follow)

(In Thousands)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| REVENUE | $ | 114,410 | $ | 99,618 | $ | 320,691 | $ | 275,548 | ||||||||

| COSTS AND EXPENSES: | ||||||||||||||||

| Educational services and facilities | 48,055 | 43,129 | 136,639 | 121,251 | ||||||||||||

| Selling, general and administrative | 63,339 | 54,485 | 181,697 | 156,603 | ||||||||||||

| (Gain) loss on sale of assets | (12 | ) | 8 | 901 | (30,923 | ) | ||||||||||

| Gain on insuarnce proceeds | (2,794 | ) | – | (2,794 | ) | – | ||||||||||

| Impairment of goodwill and long-lived assets | – | – | – | 4,220 | ||||||||||||

| Total costs & expenses | 108,588 | 97,622 | 316,443 | 251,151 | ||||||||||||

| OPERATING INCOME | 5,822 | 1,996 | 4,248 | 24,397 | ||||||||||||

| OTHER: | ||||||||||||||||

| Interest income | 464 | 878 | 1,800 | 1,891 | ||||||||||||

| Interest expense | (659 | ) | (21 | ) | (1,893 | ) | (74 | ) | ||||||||

| INCOME BEFORE INCOME TAXES | 5,627 | 2,853 | 4,155 | 26,214 | ||||||||||||

| PROVISION FOR INCOME TAXES | 1,674 | 789 | 1,098 | 7,009 | ||||||||||||

| NET INCOME | $ | 3,953 | $ | 2,064 | $ | 3,057 | $ | 19,205 | ||||||||

| Basic | ||||||||||||||||

| Net income per common share | $ | 0.13 | $ | 0.07 | $ | 0.10 | $ | 0.64 | ||||||||

| Diluted | ||||||||||||||||

| Net income per common share | $ | 0.13 | $ | 0.07 | $ | 0.10 | $ | 0.63 | ||||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||

| Basic | 30,682 | 30,164 | 30,547 | 30,115 | ||||||||||||

| Diluted | 31,042 | 30,698 | 30,806 | 30,455 | ||||||||||||

| Other data: | ||||||||||||||||

| Adjusted EBITDA (1) | $ | 10,236 | $ | 6,140 | $ | 23,085 | $ | 10,775 | ||||||||

| Depreciation and amortization | $ | 3,229 | $ | 1,723 | $ | 9,516 | $ | 4,656 | ||||||||

| Number of campuses | 22 | 22 | 22 | 22 | ||||||||||||

| Average enrollment | 14,309 | 12,942 | 13,933 | 12,594 | ||||||||||||

| Net cash provided by (used in) operating activities | $ | 5,606 | $ | (6,791 | ) | $ | (993 | ) | $ | 3,612 | ||||||

| Net cash used in investing activities | $ | (19,192 | ) | $ | (17,784 | ) | $ | (22,199 | ) | $ | (4,961 | ) | ||||

| Net cash provided by (used in) financing activities | $ | 561 | $ | – | $ | (3,115 | ) | $ | (2,945 | ) | ||||||

| Selected Consolidated Balance Sheet Data: | September 30, 2024 | ||

| (Unaudited) | |||

| Cash and cash equivalents | $ | 53,962 | |

| Current assets | 115,438 | ||

| Working capital | 41,983 | ||

| Total assets | 404,022 | ||

| Current liabilities | 73,455 | ||

| Total stockholders’ equity | 169,963 | ||

(1) RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), the Company believes it is useful to present non-GAAP financial measures that exclude certain significant items as a means to understand the performance of its business. EBITDA, adjusted EBITDA, adjusted net income and total liquidity are measures not recognized in financial statements presented in accordance with GAAP.

- We define EBITDA as income (loss) before interest expense (net of interest income), provision (benefit) for income taxes, depreciation and amortization.

- We define adjusted EBITDA as EBITDA plus stock compensation expense and adjustments for items not considered part of the Company’s normal recurring operations.

- We define adjusted net income as net income plus adjustments for items not considered part of the Company’s normal recurring operations.

- We define total liquidity as the Company’s cash and cash equivalents, short-term investments and restricted cash.

EBITDA, adjusted EBITDA, adjusted net income, and total liquidity are presented because we believe they are useful indicators of the Company’s performance and ability to make strategic investments and meet capital expenditures and debt service requirements. However, they are not intended to represent cash flows from operations as defined by GAAP and should not be used as an alternative to net income (loss) as indicators of operating performance or cash flow as a measure of liquidity. EBITDA, adjusted EBITDA, adjusted net income and total liquidity are not necessarily comparable to similarly titled measures used by other companies.

The following is a reconciliation of net income (loss) to EBITDA, adjusted EBITDA, adjusted net income, and total liquidity:

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

| (Unaudited) | (Unaudited) | ||||||||||||||||

| Consolidated Operations | Consolidated Operations | ||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Net income | $ | 3,953 | $ | 2,064 | $ | 3,057 | $ | 19,205 | |||||||||

| Interest expense (income), net | 195 | (857 | ) | 93 | (1,817 | ) | |||||||||||

| Provision for income taxes | 1,674 | 789 | 1,098 | 7,009 | |||||||||||||

| Depreciation and amortization | 3,229 | 1,723 | 9,516 | 4,656 | |||||||||||||

| EBITDA | 9,051 | 3,719 | 13,764 | 29,053 | |||||||||||||

| Stock compensation expense | 1,250 | 662 | 3,354 | 4,050 | |||||||||||||

| New campus and campus relocation costs | 1,398 | 917 | 6,823 | 1,581 | |||||||||||||

| Severance and other one-time costs | 759 | 100 | 1,066 | 1,399 | |||||||||||||

| Program expansions | 572 | – | 872 | – | |||||||||||||

| Gain on sale of Nashville, Tennessee | – | – | – | (30,939 | ) | ||||||||||||

| Impairment of goodwill and long-lived assets | – | – | – | 4,220 | |||||||||||||

| Transitional segment | – | 742 | – | 1,411 | |||||||||||||

| Gain on insurance proceeds | (2,794 | ) | – | (2,794 | ) | – | |||||||||||

| Adjusted EBITDA | $ | 10,236 | $ | 6,140 | $ | 23,085 | $ | 10,775 | |||||||||

| Three Months Ended September 30, | |||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||

| Campus Operations | Transitional | Corporate | |||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||

| Net income (loss) | $ | 14,297 | $ | 11,890 | $ | – | $ | (745 | ) | $ | (10,344 | ) | $ | (9,081 | ) | ||||||

| Interest expense (income), net | 568 | – | – | – | (373 | ) | (857 | ) | |||||||||||||

| Provision for income taxes | – | – | – | – | 1,674 | 789 | |||||||||||||||

| Depreciation and amortization | 3,060 | 1,552 | – | 3 | 169 | 168 | |||||||||||||||

| EBITDA | 17,925 | 13,442 | – | (742 | ) | (8,874 | ) | (8,981 | ) | ||||||||||||

| Stock compensation expense | – | – | – | – | 1,250 | 662 | |||||||||||||||

| Gain on insurance proceeds | – | – | – | – | (2,794 | ) | – | ||||||||||||||

| New campus and campus relocation costs | 1,398 | 917 | – | – | – | – | |||||||||||||||

| Program expansions | 572 | – | – | – | – | – | |||||||||||||||

| Severance and other one-time costs | – | – | – | – | 759 | 100 | |||||||||||||||

| Transitional segment | – | – | – | 742 | – | – | |||||||||||||||

| Adjusted EBITDA | $ | 19,895 | $ | 14,359 | $ | – | $ | – | $ | (9,659 | ) | $ | (8,219 | ) | |||||||

| Nine Months Ended September 30, | ||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||

| Campus Operations | Transitional | Corporate | ||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Net income (loss) | $ | 35,186 | $ | 26,167 | $ | – | $ | (1,423 | ) | $ | (32,129 | ) | $ | (5,539 | ) | |||||||

| Interest expense (income), net | 1,634 | – | – | – | (1,541 | ) | (1,817 | ) | ||||||||||||||

| Provision for income taxes | – | – | – | – | 1,098 | 7,009 | ||||||||||||||||

| Depreciation and amortization | 8,981 | 4,165 | – | 11 | 535 | 480 | ||||||||||||||||

| EBITDA | 45,801 | 30,332 | – | (1,412 | ) | (32,037 | ) | 133 | ||||||||||||||

| Stock compensation expense | – | – | – | – | 3,354 | 4,050 | ||||||||||||||||

| Gain on insurance proceeds | – | – | – | – | (2,794 | ) | – | |||||||||||||||

| New campus and campus relocation costs | 6,823 | 1,581 | – | – | – | – | ||||||||||||||||

| Program expansions | 872 | – | – | – | – | – | ||||||||||||||||

| Severance and other one-time costs | – | – | – | – | 1,066 | 1,399 | ||||||||||||||||

| Gain on sale of Nashville, Tennessee | – | – | – | – | – | (30,939 | ) | |||||||||||||||

| Impairment of goodwill and long-lived assets | – | 4,220 | – | – | – | – | ||||||||||||||||

| Transitional segment | – | – | – | 1,411 | – | – | ||||||||||||||||

| Adjusted EBITDA | $ | 53,496 | $ | 36,133 | $ | – | $ | (1 | ) | $ | (30,411 | ) | $ | (25,357 | ) | |||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net income | $ | 3,953 | $ | 2,064 | $ | 3,057 | $ | 19,205 | ||||||||

| Adjustments to net income: | ||||||||||||||||

| New campus and campus relocation costs | 1,398 | 917 | 7,334 | 1,581 | ||||||||||||

| Program expansions | 572 | – | 872 | – | ||||||||||||

| Gain on sale of Nashville, Tennessee | – | – | – | (30,939 | ) | |||||||||||

| Gain on insurance proceeds | (2,794 | ) | – | (2,794 | ) | – | ||||||||||

| Impairment of goodwill and long-lived assets | – | – | – | 4,220 | ||||||||||||

| Severance and other one time costs | 1,019 | 178 | 1,326 | 2,249 | ||||||||||||

| Performance based catch-up stock compensation | – | – | – | 1,400 | ||||||||||||

| Transitional segment | – | 742 | – | 1,411 | ||||||||||||

| Total non-recurring adjustments | 195 | 1,837 | 6,738 | (20,078 | ) | |||||||||||

| Income tax effect | (57 | ) | (514 | ) | (1,961 | ) | 5,622 | |||||||||

| Adjusted net income, non-GAAP | $ | 4,091 | $ | 3,387 | $ | 7,834 | $ | 4,749 | ||||||||

| As of | ||

| September 30, 2024 | ||

| Cash and cash equivalents | $ | 53,962 |

| Credit facility | 40,000 | |

| Total Liquidity | $ | 93,962 |

| Three Months Ended September 30, | |||||||||||

| 2024 | 2023 | % Change | |||||||||

| Revenue: | |||||||||||

| Campus Operations | $ | 114,410 | $ | 99,527 | 15.0 | % | |||||

| Transitional | – | 91 | -100.0 | % | |||||||

| Total | $ | 114,410 | $ | 99,618 | 14.8 | % | |||||

| Operating Income (loss): | |||||||||||

| Campus Operations | $ | 14,865 | $ | 11,889 | 25.0 | % | |||||

| Transitional | – | (745 | ) | -100.0 | % | ||||||

| Corporate | (9,043 | ) | (9,148 | ) | 1.1 | % | |||||

| Total | $ | 5,822 | $ | 1,996 | 191.7 | % | |||||

| Starts: | |||||||||||

| Campus Operations | 6,243 | 5,157 | 21.1 | % | |||||||

| Total | 6,243 | 5,157 | 21.1 | % | |||||||

| Average Population: | |||||||||||

| Campus Operations | 14,309 | 12,923 | 10.7 | % | |||||||

| Transitional | – | 19 | -100.0 | % | |||||||

| Total | 14,309 | 12,942 | 10.6 | % | |||||||

| End of Period Population: | |||||||||||

| Campus Operations | 15,887 | 14,027 | 13.3 | % | |||||||

| Transitional | – | 4 | -100.0 | % | |||||||

| Total | 15,887 | 14,031 | 13.2 | % | |||||||

| Nine Months Ended September 30, | |||||||||||

| 2024 | 2023 | % Change | |||||||||

| Revenue: | |||||||||||

| Campus Operations | $ | 320,691 | $ | 274,093 | 17.0 | % | |||||

| Transitional | – | 1,455 | -100.0 | % | |||||||

| Total | $ | 320,691 | $ | 275,548 | 16.4 | % | |||||

| Operating Income (loss): | |||||||||||

| Campus Operations | $ | 36,819 | $ | 26,167 | 40.7 | % | |||||

| Transitional | – | (1,423 | ) | -100.0 | % | ||||||

| Corporate | (32,571 | ) | (347 | ) | -9286.5 | % | |||||

| Total | $ | 4,248 | $ | 24,397 | -82.6 | % | |||||

| Starts: | |||||||||||

| Campus Operations | 15,163 | 13,008 | 16.6 | % | |||||||

| Total | 15,163 | 13,008 | 16.6 | % | |||||||

| Average Population: | |||||||||||

| Campus Operations | 13,933 | 12,506 | 11.4 | % | |||||||

| Transitional | – | 88 | -100.0 | % | |||||||

| Total | 13,933 | 12,594 | 10.6 | % | |||||||

| End of Period Population: | |||||||||||

| Campus Operations | 15,887 | 14,027 | 13.3 | % | |||||||

| Transitional | – | 4 | -100.0 | % | |||||||

| Total | 15,887 | 14,031 | 13.2 | % | |||||||

Information included in the table below provides student starts and population under the Campus Operations Segment with a breakdown by Transportation and Skilled Trade programs and Healthcare and Other Professions programs.

| Population by Program (Campus Operations Segment): | |||||||

| Three Months Ended September 30, | |||||||

| 2024 | 2023 | % Change | |||||

| Starts: | |||||||

| Transportation and Skilled Trades | 4,700 | 3,786 | 24.1 | % | |||

| Healthcare and Other Professions | 1,543 | 1,371 | 12.5 | % | |||

| Total | 6,243 | 5,157 | 21.1 | % | |||

| Average Population: | |||||||

| Transportation and Skilled Trades | 10,449 | 9,029 | 15.7 | % | |||

| Healthcare and Other Professions | 3,860 | 3,894 | -0.9 | % | |||

| Total | 14,309 | 12,923 | 10.7 | % | |||

| End of Period Population: | |||||||

| Transportation and Skilled Trades | 11,672 | 9,842 | 18.6 | % | |||

| Healthcare and Other Professions | 4,215 | 4,185 | 0.7 | % | |||

| Total | 15,887 | 14,027 | 13.3 | % | |||

| Population by Program (Campus Operations Segment): | |||||||

| Nine Months Ended September 30, | |||||||

| 2024 | 2023 | % Change | |||||

| Starts: | |||||||

| Transportation and Skilled Trades | 11,030 | 9,064 | 21.7 | % | |||

| Healthcare and Other Professions | 4,133 | 3,944 | 4.8 | % | |||

| Total | 15,163 | 13,008 | 16.6 | % | |||

| Average Population: | |||||||

| Transportation and Skilled Trades | 9,911 | 8,581 | 15.5 | % | |||

| Healthcare and Other Professions | 4,022 | 3,925 | 2.5 | % | |||

| Total | 13,933 | 12,506 | 11.4 | % | |||

| End of Period Population: | |||||||

| Transportation and Skilled Trades | 11,672 | 9,842 | 18.6 | % | |||

| Healthcare and Other Professions | 4,215 | 4,185 | 0.7 | % | |||

| Total | 15,887 | 14,027 | 13.3 | % | |||

The reconciliations provided below represent management’s projections of various components included in our outlook for the full year 2024. These calculations are for illustrative purposes and will be reviewed as the year progresses to reflect actual results, our outlook and continued relevance of specific items. Any revisions or modifications, if necessary, will be disclosed in future 2024 quarterly results announcements. Adjusted EBITDA and adjusted net income have been reconciled to the midpoint of our guidance.

| Reconciliation of Net Income to Adjusted EBITDA and Adjusted Net Income – 2024 Guidance | ||||||||

| (Reconciled to the Mid-Point of 2024 Guidance) | ||||||||

| Adjusted | ||||||||

| EBITDA | Net Income | |||||||

| Net Income | $ | 10,100 | $ | 10,100 | ||||

| Interest expense, net | 600 | – | ||||||

| Provision for taxes | 4,200 | – | ||||||

| Depreciation and amortization1 | 13,400 | 511 | ||||||

| EBITDA | 28,300 | – | ||||||

| New campus and campus relocation costs2 | 8,850 | 8,850 | ||||||

| Program expansions | 1,500 | 1,500 | ||||||

| Other one time items | 1,350 | 1,350 | ||||||

| Gain on insurance proceeds | (2,800 | ) | (2,800 | ) | ||||

| Stock compensation expense | 4,800 | 500 | ||||||

| Tax Effect | – | (3,011 | ) | |||||

| Total | $ | 42,000 | 17,000 | |||||

| 2024 Guidance Range | $41,000 – $43,000 | $16,000 – $18,000 | ||||||

| 1 | Depreciation expense relates to the new East Point, Georgia campus. | |||||||

| 2 | New campus and campus relocation costs relate to the following locations: | |||||||

| East Point, Georgia (relates to Q1 and Q2 of 2024) | ||||||||

| Nashville, Tennessee | ||||||||

| Levittown, Pennsylvania | ||||||||

| Houston, Texas | ||||||||

| New campus adjustment includes pre-opening costs plus EBITDA losses incurred within the first four quarter after opening. | ||||||||

LINCOLN EDUCATIONAL SERVICES CORPORATION

Brian Meyers, CFO

973-736-9340

EVC GROUP LLC

Investor Relations: Michael Polyviou, mpolyviou@evcgroup.com, 732-933-2755

Media Relations: Tom Gibson, 201-476-0322

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer Shares Are Down By Over 4% In Pre-Market: What's Going On?

Shares of Super Micro Computer Inc. SMCI fell by 4.20% in pre-market trading on Monday, as per Benzinga Pro. The decline follows reports the company has halted the construction of a new factory in Malaysia.

What Happened: As per a Chinese media report on Monday, the decision to halt the factory construction has led Malaysia’s YTL Corp. to shift orders for Nvidia NVDA GB200 NVL72 AI servers to Taiwan’s Wiwynn, marking a significant order transfer to a Taiwanese company.

SMCI has yet to respond to Benzinga’s queries regarding the same.

The report comes at a time when Super Micro is facing potential delisting threats. Their auditor, Ernst & Young, resigned amid allegations of accounting irregularities and possible export control violations. If delisted, Super Micro could be required to repay up to $1.725 billion of its bonds early.

See Also: Bitcoin Surges Past $80,000 Milestone For First Time On Optimism Over Trump

Bondholders have the option for early repayment if Super Micro’s shares are delisted from Nasdaq and not re-listed promptly. The company must submit its annual report to the SEC by mid-November to avoid delisting. On a recent earnings call, CFO David Weigand stated they are working on a compliance plan to extend the deadline to February 2025.

Last Tuesday, the company announced that it expects to report first-quarter revenue of $5.9 billion to $6 billion, which is down from previous guidance of $6 billion to $7 billion.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Food Company Aramark Posts Mixed Q4, Increases Dividend By 11% & More

Aramark ARMK shares are trading higher after the company reported fourth-quarter results and raised quarterly dividend.

Revenue grew 5% year-over-year (Organic revenue: +7%) to $4.42 billion, missing the consensus of $4.46 billion. Revenues were driven by strong volume growth across both segments, with pricing stabilizing due to inflation trends, especially in Education.

FSS United States saw revenue growth of 4%, led by Sports & Entertainment on higher per capita spending and strong stadium attendance, Business & Industry with increased participation and new clients, and retail expansion in Corrections through micro-markets.

FSS International revenue increase of 9% was led by broad-based, especially in the U.K., Germany, Canada, and South America, with top-performing sectors in Business & Industry, Sports & Entertainment, and Extractive Services.

In the fourth quarter, adjusted operating income grew 7% to $271 million, driven by higher revenue, cost discipline, and supply chain efficiencies. Adjusted EPS of $0.54 exceeded the consensus of $0.53.

Operating cash flow increased 42% to $727 million, while Free Cash Flow rose 121% to $323 million in the year. As of fiscal year-end, the company had available cash of over $2.6 billion.

Dividend: Aramark’s Board of Directors approved an 11% increase in the quarterly dividend, raising it to $0.105 per share. The dividend will be payable on December 12, 2024, to stockholders of record as of December 2, 2024.

Repurchase: The Board of Directors approved a new $500 million share repurchase program in early November.

Guidance: Aramark expects FY25 organic revenue growth of 7.5% to 9.5%, with adjusted EPS growth of 23% to 28%.

John Zillmer, Aramark’s Chief Executive Officer, said, “We reached new highs in our financial performance every quarter during fiscal 2024, ultimately achieving record revenue and AOI profitability for any year in Global FSS history.”

Investors can gain exposure to the stock via AdvisorShares Restaurant ETF EATZ and SWP Growth & Income ETF SWP.

Price Action: ARMK shares are up 3.55% at $40.50 premarket at the last check Monday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top 4 Real Estate Stocks That May Rocket Higher In November

The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

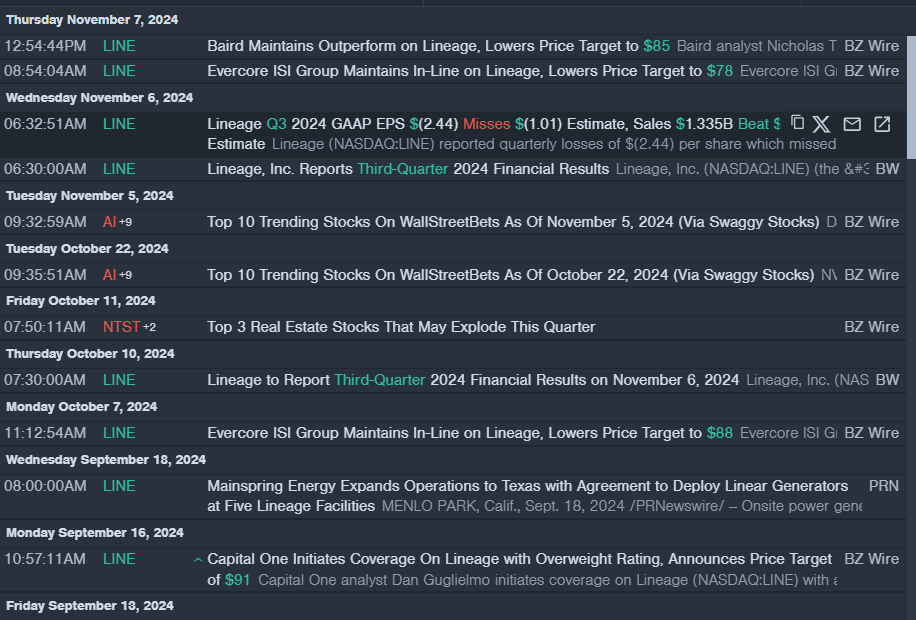

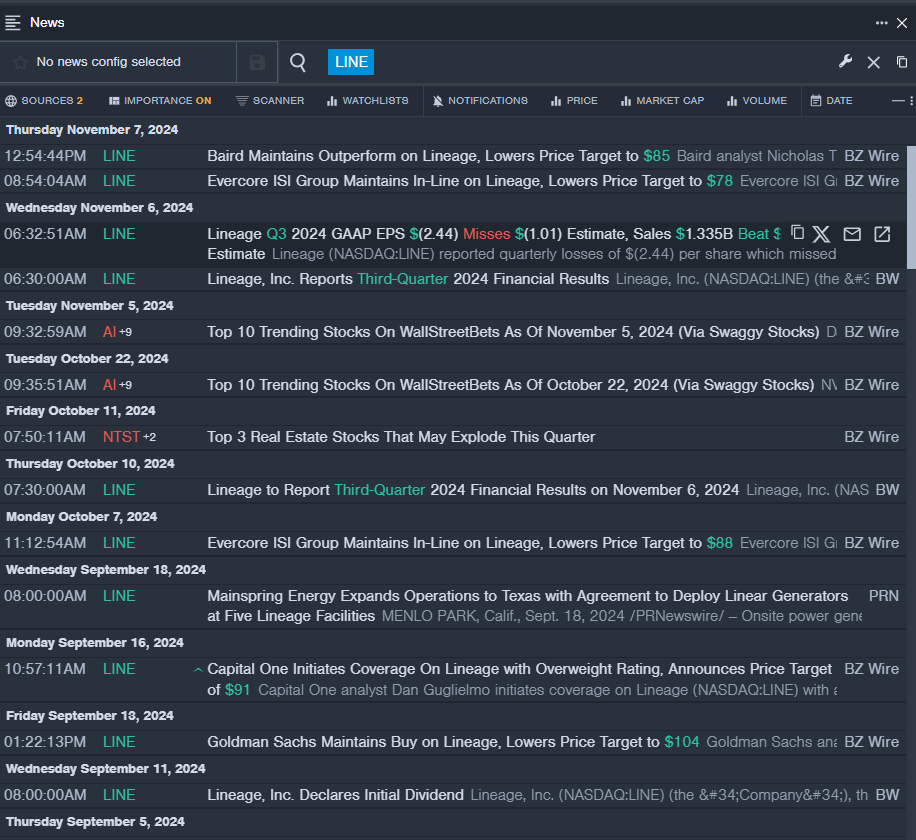

Lineage Inc LINE

- On Nov. 6, Lineage reported a quarterly loss of $2.44 per share which missed the analyst consensus estimate of a loss of $1.01 per share. The company reported quarterly sales of $1.335 billion which beat the analyst consensus estimate of $1.329 billion by 0.44 percent. The company’s stock fell around 11% over the past month and has a 52-week low of $66.94.

- RSI Value: 22.05

- LINE Price Action: Shares of Lineage fell 1.1% to close at $67.32 on Friday.

- Benzinga Pro’s real-time newsfeed alerted to latest LINE news.

Americold Realty Trust Inc COLD

- On Nov, 7, Americold Realty Trust reported worse-than-expected third-quarter financial results. George Chappelle, Chief Executive Officer of Americold Realty Trust, stated, “We are pleased with our third quarter results where we delivered AFFO per share of $0.35, an increase of 11% versus prior year’s quarter. This performance was again driven by organic growth as we produced double digit year-over-year growth in the Global Warehouse Same Store NOI of approximately 11% on a constant currency basis.” The company’s stock fell around 15% over the past month and has a 52-week low of $21.87.

- RSI Value: 18.80

- COLD Price Action: Shares of Americold Realty Trust fell 1.8% to close at $22.76 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in COLD stock.

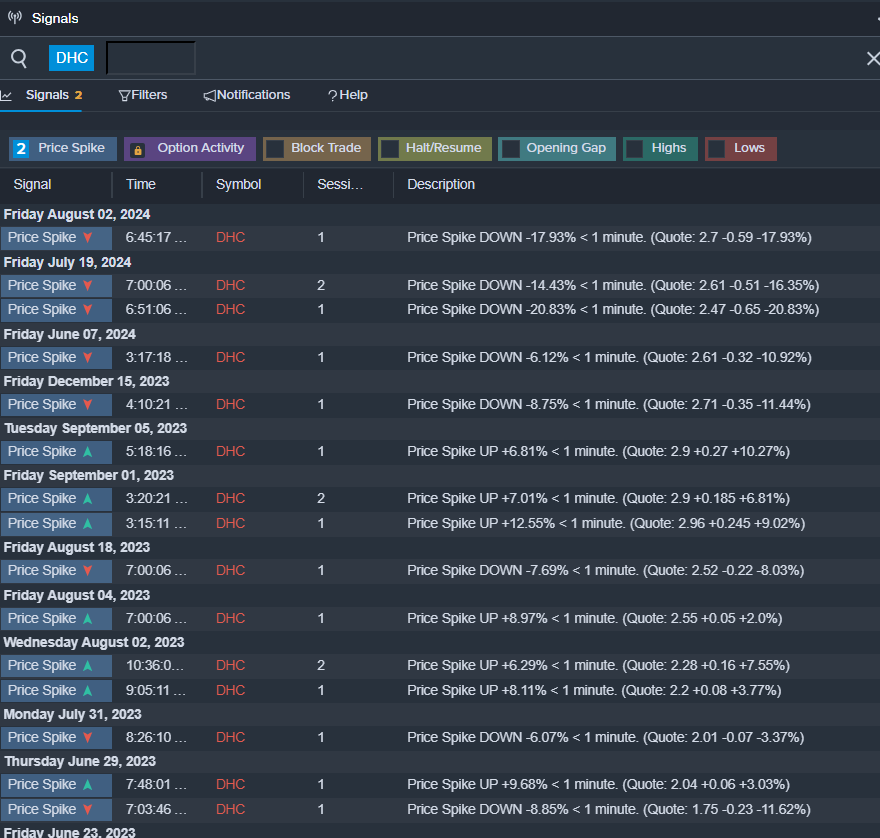

Diversified Healthcare Trust DHC

- On Nov. 4, Diversified Healthcare Trust shares are trading lower after the company reported worse-than-expected third-quarter financial results. The company’s stock fell around 25% over the past five days and has a 52-week low of $1.94.

- RSI Value: 25.68

- DHC Price Action: Shares of Diversified Healthcare Trust fell 1.9% to close at $2.63 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in DHC shares.

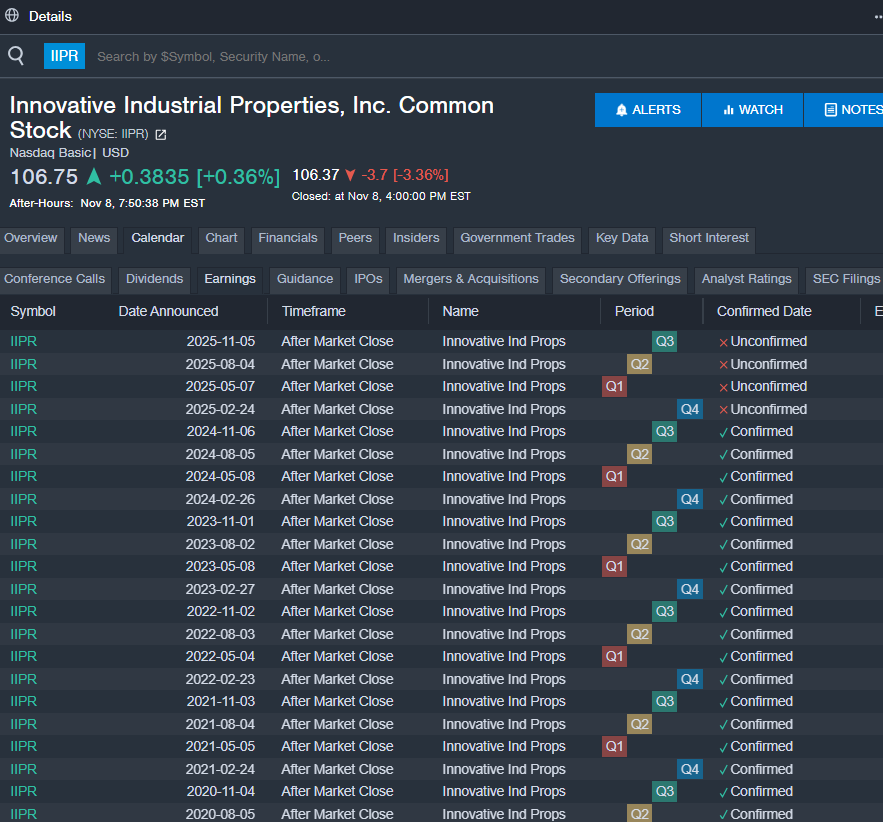

Innovative Industrial Properties Inc IIPR

- On Nov. 6, Innovative Industrial Properties reported worse-than-expected third-quarter financial results. The company’s shares lost around 16% over the past five days. The company’s 52-week low is $73.04.

- RSI Value: 20.87

- IIPR Price Action: Shares of IIPR fell 3.4% to close at $106.37 on Friday.

- Benzinga Pro’s earnings calendar was used to track upcoming IIPR earnings reports.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Imaging Centers Operator RadNet Q3 Earnings: Strong Q3 Performance On Positive Trends, Raises Annual Outlook

On Sunday, RadNet, Inc. RDNT reported revenue of $461.1 million for the third quarter of 2024, beating the consensus of $437.88 million.

Revenue from the Digital Health reportable segment increased 34.3% to $16.4 million, partly due to a $2.2 million increase in AI Revenue, which climbed to $5.1 million during the third quarter. The increase was mainly due to the continuing success of the rollout of the Enhanced Breast Cancer Detection DeepHealth AI-powered screening mammography program.

Aggregate procedural volumes in the third quarter of 2024 increased 9%, and same-center procedural volumes increased 5.5% compared with the third quarter of 2023.

Howard Berger, President and CEO of RadNet, commented, “We continue to demonstrate strong growth and record results in each of our Imaging Center and Digital Health reportable operating segments.”

The outpatient imaging centers network reported an adjusted EBITDA of $73.7 million, an increase of 27.2%.

“Despite continued inflation in staffing costs, improved reimbursement from commercial and capitated payors, strong demand for advanced imaging modalities, the growth of the Digital Health businesses and effective cost controls resulted in an increase to Adjusted EBITDA margins,” Berger added.

The company reported adjusted EPS of $0.18, up from $0.13 a year ago and beating the consensus of $0.15.

Guidance: RadNet raised its previously announced guidance levels.

The company expects Imaging Center Segment 2024 sales of $1.71 billion—$1.76 billion, up from prior guidance of $1.685 billion—$1.735 billion.

The company maintains its 2024 revenue guidance for the Digital Health Segment at $60 million—$70 million.

“Given the positive trends we continue to experience in virtually all aspects of our business and the strong financial performance of the third quarter, we are revising upwards certain guidance levels in anticipation of financial results that we believe will exceed both our original expectations and the adjustments we made to the guidance ranges upon releasing our first and second quarter 2024 results,” added Berger.

Furthermore, the company adds that it has 15 centers in various stages of construction and development that it intends to open in 2025.

Price Action: At last check on Monday, RDNT stock was up 17.20% at $85 during the premarket session.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

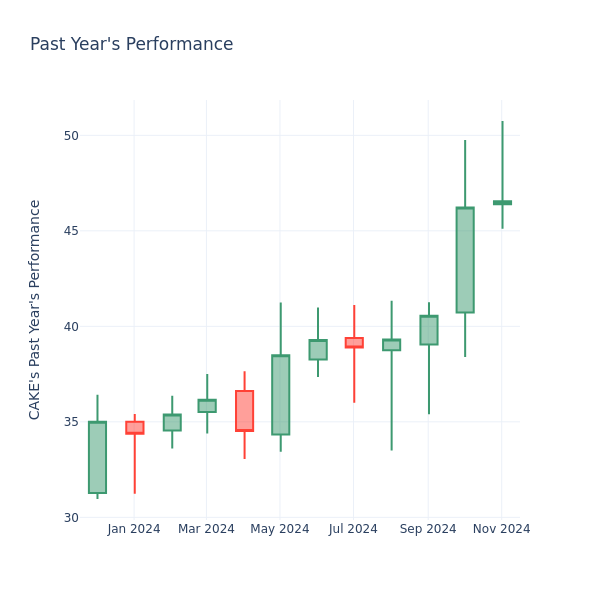

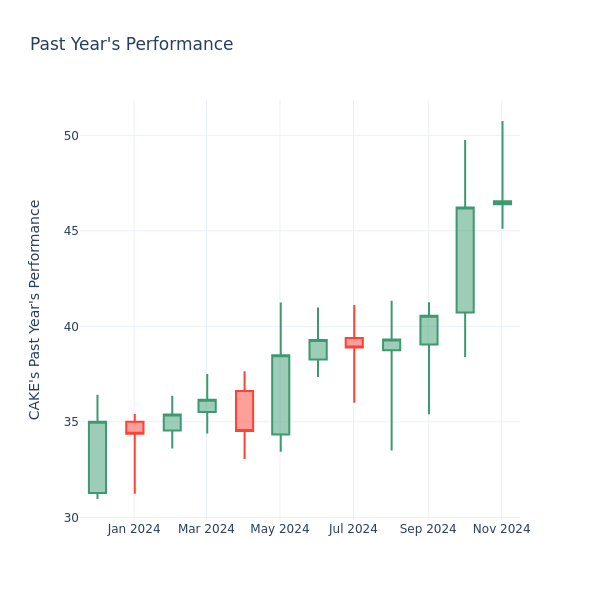

P/E Ratio Insights for Cheesecake Factory

In the current session, the stock is trading at $46.99, after a 0.95% increase. Over the past month, Cheesecake Factory Inc. CAKE stock increased by 14.68%, and in the past year, by 42.92%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Evaluating Cheesecake Factory P/E in Comparison to Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 108.88 in the Hotels, Restaurants & Leisure industry, Cheesecake Factory Inc. has a lower P/E ratio of 17.63. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.