P/E Ratio Insights for Cheesecake Factory

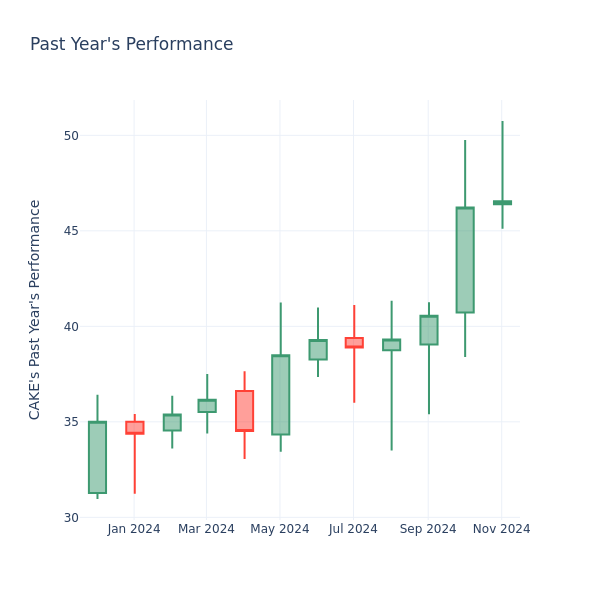

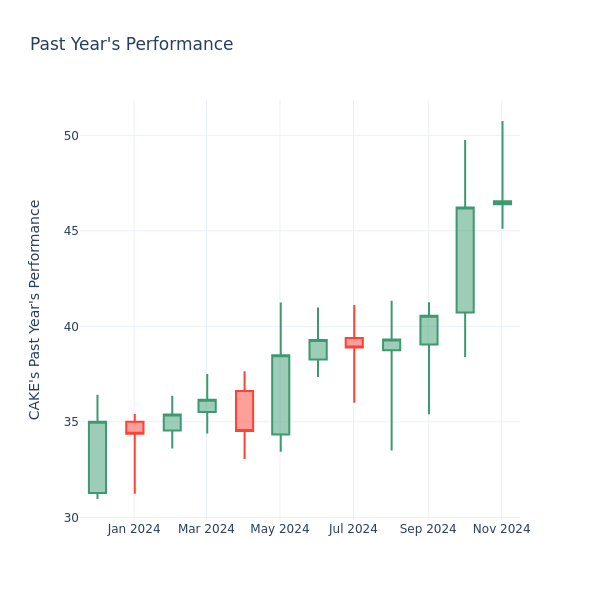

In the current session, the stock is trading at $46.99, after a 0.95% increase. Over the past month, Cheesecake Factory Inc. CAKE stock increased by 14.68%, and in the past year, by 42.92%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Evaluating Cheesecake Factory P/E in Comparison to Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 108.88 in the Hotels, Restaurants & Leisure industry, Cheesecake Factory Inc. has a lower P/E ratio of 17.63. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Monday.com Stock Tanks Despite Q3 Beat, Raised Outlook

Monday.com Ltd MNDY reported fiscal third-quarter 2024 revenue growth of 33% Y/Y to $251.0 million, beating the analyst consensus estimate of $246.1 million.

The project management software company’s adjusted EPS of $0.85 beat the analyst consensus estimate of $0.63, but the stock price plunged after the results.

The net dollar retention rate was 111%, and it was 114% for customers with more than ten users.

The number of paid customers with over $50,000 in annual recurring revenue (ARR) rose 40% year over year to 2,907. The adjusted operating margin was firm year-on-year at 13%.

In the quarter, Monday.com generated an operating cash flow of $86.6 million, with $82.4 million of free cash flow, compared to $66.6 million and $64.9 million, respectively, a year ago. MNDY held $1.4 billion in cash and equivalents as of September.

Monday.com’s co-founders and co-CEOs, Roy Mann and Eran Zinman, attributed the strong third-quarter performance to effective execution and ongoing enhancements to the platform, emphasizing their excitement for future growth after surpassing $1 billion in Annual Recurring Revenue (ARR).

CFO Eliran Glazer highlighted solid revenue growth, improved profitability, and better retention trends, especially as the company expands its focus on larger customers. He expressed confidence in sustaining this momentum through the end of the year and into fiscal 2025, aiming for continued scalable growth.

Outlook: Monday.com expects fourth-quarter revenue of $260 million—$262 million (versus the consensus of $246.1 million) and an adjusted operating margin of 11%–12%.

Monday.com raised 2024 revenue guidance to $964 million–$966 million (prior $956 million–$961 million) against the consensus of $960.2 million and an adjusted operating margin of 12%–13% (prior 10%—11%).

Last week, Wells Fargo analyst Michael Berg maintained Monday.Com with an Overweight rating and raised the price target from $315 to $330.

Monday.Com stock gained over 82% year-to-date.

Price Action: MNDY stock is down 13.10% at $282.00 premarket at the last check Monday.

Also Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia To Rally More Than 18%? Here Are 10 Top Analyst Forecasts For Monday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- JP Morgan boosted Cisco Systems, Inc. CSCO price target from $55 to $66. JP Morgan analyst Samik Chatterjee upgraded the stock from Neutral to Overweight. Cisco shares closed at $58.06 on Friday. See how other analysts view this stock.

- Morgan Stanley cut the price target for Madison Square Garden Entertainment Corp. MSGE from $45 to $44. Morgan Stanley analyst Benjamin Swinburne maintained an Equal-Weight rating. Madison Square Garden shares closed at $39.15 on Friday. See how other analysts view this stock.

- Morgan Stanley raised the price target for Dell Technologies Inc. DELL from $136 to $154. Morgan Stanley analyst Erik Woodring maintained an Overweight rating. Dell shares closed at $134.23 on Friday. See how other analysts view this stock.

- Jefferies increased Mercury Systems, Inc. MRCY price target from $30 to $42. Jefferies analyst Sheila Kahyaoglu upgraded the stock from Underperform to Hold. Mercury shares settled at $42.70 on Friday. See how other analysts view this stock.

- Stifel raised Tempus AI, Inc TEM price target from $45 to $65. Stifel analyst Daniel Arias downgraded the stock from Buy to Hold. Tempus AI shares closed at $73.77 on Friday. See how other analysts view this stock.

- Piper Sandler boosted NVIDIA Corporation NVDA price target from $140 to $175. Piper Sandler analyst Harsh Kumar maintained an Overweight rating. NVIDIA shares closed at $147.63 on Friday. See how other analysts view this stock.

- Oppenheimer cut the price target for WhiteHorse Finance, Inc. WHF from $14 to $12. Oppenheimer analyst Mitchel Penn downgraded the stock from Outperform to Perform. WhiteHorse Finance shares settled at $11.07 on Friday. See how other analysts view this stock.

- Needham slashed Solid Power, Inc. SLDP price target from $3 to $2. Needham analyst Chris Pierce maintained a Buy rating. Solid Power shares closed at $1.16 on Friday. See how other analysts view this stock.

- Piper Sandler raised the price target for Toast, Inc. TOST from $25 to $35. Piper Sandler analyst Clarke Jeffries maintained a Neutral rating. Toast shares closed at $37.48 on Friday. See how other analysts view this stock.

- Stephens & Co. increased PAR Technology Corporation PAR price target from $70 to $83 Stephens & Co. analyst Charles Nabhan maintained an Overweight rating. PAR Technology shares closed at $74.24 on Friday. See how other analysts view this stock.

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From Home Depot Stock Ahead Of Q3 Earnings

Home Depot, Inc. HD will release earnings results for the third quarter, before the opening bell, on Tuesday, Nov. 12.

Analysts expect the Atlanta-based retailer to report quarterly earnings at $3.64 per share. That’s down from $3.81 per share in the year-ago period. Home Depot projects to report quarterly revenue of $39.17 billion, according to data from Benzinga Pro.

On Friday, Telsey Advisory Group analyst Joseph Feldman upgraded the rating for Home Depot from Market Perform to Outperform and raised the price target from $360 to $455.

With the recent buzz around Home Depot ahead of quarterly earnings, some investors may be eyeing potential gains from the company’s dividends too. Home Depot currently offers an annual dividend yield of 2.22%. That’s a quarterly dividend amount of $2.25 per share ($9.00 a year).

To figure out how to earn $500 monthly from Home Depot, we start with the yearly target of $6,000 ($500 x 12 months).

Next, we take this amount and divide it by Home Depot’s $9.00 dividend: $6,000 / $9.00 = 667 shares.

So, an investor would need to own approximately $270,735 worth of Home Depot, or 667 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $9.00 = 133 shares, or $53,985 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

HD Price Action: Shares of Home Depot gained by 1.6% to close at $405.90 on Friday.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sapiens International Posts Downbeat Results, Joins Sky Harbour And Other Big Stocks Moving Lower In Monday's Pre-Market Session

U.S. stock futures were higher this morning, with the Dow futures gaining around 150 points on Monday.

Shares of Sapiens International Corporation N.V. SPNS fell sharply in today’s pre-market trading after the company reported worse-than-expected third-quarter financial results.

Sapiens Intl posted third-quarter adjusted earnings of 37 cents per share, missing market estimates of 38 cents per share. The company’s quarterly sales came in at $137.03 million versus expectations of $140.07 million.

Sapiens International shares dipped 21.5% to $30.98 in the pre-market trading session.

Here are some other stocks moving lower in pre-market trading.

- Sky Harbour Group Corporation SKYH shares fell 9% to $10.55 in pre-market trading. Sky Harbour will report its third-quarter financial results on Tuesday, Nov. 12.

- NuScale Power Corporation SMR shares dipped 5.7% to $23.05 in pre-market trading after gaining 13% on Friday.

- Tempus AI, Inc TEM fell 5.2% to $69.85 in pre-market trading after jumping 30% on Friday.

- Xeris Biopharma Holdings, Inc. XERS dipped 4.9% to $3.30 in pre-market trading. Xeris Biopharma Holdings posted upbeat quarterly results on Friday.

- Gold Fields Limited GFI declined 4.7% to $15.06 in pre-market trading.

- Lifeway Foods, Inc. LWAY declined 4.2% to $22.10 in pre-market trading after falling 8% on Friday.

- Butterfly Network, Inc. BFLY fell 3.4% to $2.53 in pre-market trading.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VEON Elevates its Youth Offering Through Banglalink's AI-Powered Lifestyle App RYZE

Amsterdam, Dubai and Dhaka – 11 November 2024: VEON Ltd. VEONVEON), a global digital operator, announces that Banglalink, its digital operator in Bangladesh, has launched RYZE, a comprehensive digital lifestyle app tailored to engage Bangladesh’s emerging generation featuring AI-powered personalization.

Over 48% of Bangladesh’s 175 million people are under the age of 25, according to the Bangladesh Bureau of Statistics. As a digital operator providing mobile connectivity and a portfolio of connected digital services, Banglalink recognises this untapped potential and has launched RYZE as an all-encompassing package designed to facilitate the digital lifestyles of young Bangladeshis.

RYZE is available to all mobile users across any network. It includes a prepaid package powered by AI recommendation tools that offers resources for skill development, highly personalised entertainment packages and tailored loyalty and rewards packages.

“RYZE exemplifies our commitment to empowering the youthful communities we serve through seamless digital solutions that meet the unique needs of the next generation,” explains Erik Aas, CEO of Banglalink. “By integrating AI-driven features, RYZE delivers a comprehensive lifestyle experience from skill development to entertainment ensuring it resonates with the digital-first generation. At Banglalink we are proud to continually champion digital inclusion and provide the foundations for dynamic, digital led economic growth.”

RYZE’s launch sees it join the growing roster of VEON’s digital-first lifestyle apps. ROX in Pakistan, IZI in Kazakhstan and Kyrgyzstan, as well as OQ in Uzbekistan are all pioneering digital-first brands that supports VEON’s online services strategy across the frontier markets where it operates.

Through its digital operators, VEON Group offers a variety of products and initiatives across entertainment, financial services, digital health and education. VEON’s Digital Operators serve 160 million connectivity customers and a total base of 110 million total monthly active users across its proprietary digital products and services such as Toffee, Tamasha, BeeTV, KyivstarTV, Simosa, myBL, JazzCash, Simply, Izi, BeeCloud and Helsi. In the first half of 2024, direct revenues from digital services represented more than 10% of VEON Group’s total revenues.

About Banglalink:

Banglalink is one of the leading digital communications service providers in Bangladesh. As of August 2024, Banglalink serves 41.3 million mobile subscribers and 20.8 million digital subscribers every month transforming lives through technology. Banglalink’s digital offerings include Toffee, the country’s leading digital entertainment platform and MyBanglalink, a pioneering super app. For more information visit: https://www.banglalink.net

About VEON

VEON is a digital operator that provides converged connectivity and digital services to nearly 160 million customers. Operating across six countries that are home to more than 7% of the world’s population, VEON is transforming lives through technology-driven services that empower individuals and drive economic growth. VEON is listed on NASDAQ and Euronext. For more information visit: www.veon.com

Disclaimer

This release contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical facts, and include statements relating to, among other things, VEON’s digital products, commercial plans and partnerships. Forward-looking statements are inherently subject to risks and uncertainties, many of which VEON cannot predict with accuracy and some of which VEON might not even anticipate. The forward-looking statements contained in this release speak only as of the date of this release. VEON does not undertake to publicly update, except as required by U.S. federal securities laws, any forward-looking statement to reflect events or circumstances after such dates or to reflect the occurrence of unanticipated events.

Contact Information

VEON

Hande Asik

Group Director of Communications

pr@veon.com

MHP Group

Julian Tanner

Julian.tanner@mhpgroup.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Futures Signal Wall Street Rally to Extend: Markets Wrap

(Bloomberg) — US stocks looked set to build on their recent advance to record highs as Donald Trump’s victory in the US presidential race stoked investors’ appetite for US assets.

Most Read from Bloomberg

Futures pointed to gains of about 0.3% for the S&P 500, which hit its 50th record high of the year on Friday, while Nasdaq 100 looked set to rise by a similar amount. The biggest premarket gainer of the day was EV maker Tesla Inc, which rose as much as 7.3%. Its valuation surpassed $1 trillion on Friday, on a view that a Trump presidency will be a positive for Elon Musk’s company.

Crypto-linked stocks also gained in premarket trading as Bitcoin rallied past $81,000 for the first time on the prospect of a Republican-led Congress with pro-crypto lawmakers. While US bond markets were shut for a holiday, the dollar rallied 0.3% against a basket of currencies, adding to a six-week winning streak.

“Between now and the end of the year, I can easily see how the US market particularly will continue to be strong on hopes that everything Trump has said will come to pass, particularly when it gets confirmed that he got a clean sweep,” said Nick Clay, portfolio manager at Redwheel.

While Trump’s pledge to impose hefty tariffs on trade partners has weighed heavily on European shares, the Stoxx 600 index rebounded after three weeks of declines. The gauge added 0.9%, with all industry groups in the index climbing, as the mood was lifted by a slew of robust company earnings, including German tiremaker Continental AG and insurance firm Hannover Re.

The wait is on for the next slug of inflation data due Wednesday for clues on the Federal Reserve’s interest-rate trajectory, with annual price growth seen to have quickened slightly to 2.6% in October. Traders will also listen out for Fed policymakers’ speeches after Minneapolis Fed President Neel Kashkari indicated on weekend that rates could ease less than previously expected due to the strong economy.

Earlier, China’s CSI 300 benchmark fell as much as 1.4%, before erasing losses to close with modest gains. Oil pared losses to trade flat after China’s latest efforts disappointed markets. Iron ore declined toward $100 a ton.

Key events this week:

-

Japan current account, Monday

-

Denmark CPI, Monday

-

Norway CPI, Monday

-

United Nations climate change conference, COP29 begins, Monday

-

Germany CPI, Tuesday

-

UK jobless claims, unemployment, Tuesday

-

Fed speakers including Christopher Waller, Tuesday

-

Japan PPI, Wednesday

-

Eurozone industrial production, Wednesday

-

US CPI, Wednesday

-

Australia unemployment, Thursday

-

Eurozone GDP, Thursday

-

US PPI, jobless claims, Thursday

-

Reserve Bank of Australia Governor Michele Bullock speaks, Thursday

-

Fed Chair Jerome Powell speaks, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

BOE Governor Andrew Bailey speaks, Thursday

-

Japan GDP, industrial production, Friday

-

China retail sales, industrial production, fixed-asset investment, Friday

-

UK GDP, industrial production, trade balance, Friday

-

US retail sales, Friday

-

Alibaba earnings, Friday

Aramark, Live Nation Entertainment And 3 Stocks To Watch Heading Into Monday

With U.S. stock futures trading higher this morning on Monday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Aramark ARMK to report quarterly earnings at 53 cents per share on revenue of $4.46 billion before the opening bell, according to data from Benzinga Pro. Aramark shares rose 2.3% to $39.99 in after-hours trading.

- Analysts are expecting Live Nation Entertainment, Inc. NYSE: LYV) to post quarterly earnings at $1.60 per share on revenue of $7.77 billion. The company will release earnings after the markets close. Live Nation Entertainment shares rose 0.5% to $123.60 in after-hours trading.

- Hawaiian Electric Industries, Inc. HE posted downbeat earnings for its third quarter on Friday. The company reported $938.40 million in sales, up from $901.87 million in the year-ago period. Hawaiian Electric shares fell 2.1% to $10.42 in the after-hours trading session.

Check out our premarket coverage here

- After the markets close, IAC Inc. IAC is projected to post a quarterly loss at 22 cents per share on revenue of $922.21 million. IAC shares gained 0.5% to $53.71 in after-hours trading.

- Analysts expect monday.com Ltd. MNDY to report quarterly earnings at 63 cents per share on revenue of $246.1 million before the opening bell. monday.com shares gained 2% to $330.80 in after-hours trading.

Check This Out:

Photo courtesy: Aramark

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.