Thunes and Papara establish a bilateral partnership to enable cross-border transfers to and from Türkiye

Papara’s over 21 million users can send and receive money to and from five continents, further enhancing its cross-border transfer capabilities.

ISTANBUL and SINGAPORE, Nov. 11, 2024 /PRNewswire/ — Thunes, the Smart Superhighway to move money around the world, today welcomed Papara, Türkiye’s leading fintech company, as a new Member of its Direct Global Network, and allies to facilitate cross-border payments to and from Türkiye. This collaboration empowers Papara users in Türkiye, enabling them to send money into 3 billion mobile wallet accounts, 4 billion bank accounts, and 15 billion cards in over 80 currencies to more than 130 countries. The cooperation also enables fast, simple and affordable international money transfers directly to Papara accounts, marking the first time such a service is available in Türkiye.

With over 21 million users, Papara offers comprehensive digital services facilitating various domestic and international financial transactions. The alliance allows Thunes’ extensive Direct Global Network Members to send money directly to Papara accounts in real-time, providing a faster, more convenient way to transfer money to Türkiye. With Thunes’ in-house SmartX Treasury System and Fortress Compliance Platform, Members of the Network receive unrivaled speed, control, visibility, protection, and cost efficiencies when making real-time payments, globally.

Simon Nelson, Chief Revenue Officer at Thunes said: “It is an honor to welcome Papara to our proprietary Direct Global Network. Papara users in the Republic of Türkiye can send money to Africa, Asia, Europe, the Middle East, and North and South America, supporting Papara in its quest to offer compelling international money transfer services to its users.”

Aik Boon Tan, Chief Network Officer at Thunes added: “We are thrilled to partner with Papara to expand our Network’s reach into Türkiye. By enabling direct transfers to Papara accounts, we are removing traditional barriers and offering a more efficient service for cross-border payments into Türkiye to Members of our Direct Global Network.”

Emre Kenci, CEO at Papara, commented: “Our partnership with Thunes significantly enhances Papara’s cross-border payment capabilities, providing our users with a trusted and secure platform for international transfers. Now, millions of Papara users can receive money from around the world directly into their accounts—a major step forward as they continue to send money using our expanding global money transfer service. This alliance enriches our offerings and reaffirms our commitment to delivering innovative financial solutions for our users.”

About Thunes:

Thunes is the Smart Superhighway to move money around the world. Thunes’ proprietary Direct Global Network allows Members to make payments in real-time in over 130 countries and more than 80 currencies. Thunes’ Network connects directly to over 7 billion mobile wallets and bank accounts worldwide, as well as 15 billion cards via more than 320 different payment methods, such as GCash, M-Pesa, Airtel, MTN, Orange, JazzCash, Easypaisa, AliPay, WeChat Pay and many more. Thunes’ Direct Global Network differentiates itself through its worldwide reach, in-house SmartX Treasury System and Fortress Compliance Platform, ensuring Members of the Network receive unrivaled speed, control, visibility, protection, and cost efficiencies when making real-time payments, globally. Members of Thunes’ Direct Global Network include gig economy giants like Uber and Deliveroo, super-apps like Grab and WeChat, MTOs, fintechs, PSPs and banks. Headquartered in Singapore, Thunes has offices in 15 locations, including Abidjan, Barcelona, Beijing, Dubai, Hong Kong, Johannesburg, London, Manila, Nairobi, Paris, Riyadh, San Francisco, Sao Paulo and Shanghai. For more information, visit: https://www.thunes.com/

About Papara:

Papara is a leading financial technology company based in Turkey. Founded in 2015, Papara is committed to providing fast, simple, affordable, and enjoyable financial services for all. Papara brings an unrivaled range of products and services offering instant and free transfers to users as well as providing a one-stop shop for paying bills, enabling international money transfers, buying insurance, investing in precious metals, and tracking spending habits. In addition, Papara offers Papara Cards that are valid worldwide and online. Papara users who use Papara Cards earn instant cash rewards with the Cashback program for purchases in specific brands and categories. Papara has 21M retail users and 7,000 corporate users, such as Uber and TikTok. Papara has more than 1,000 employees. Papara is listed in the latest KPMG Global Fintech100 and LinkedIn Top Startup Turkey 2022. Papara was awarded “Best Fintech Startup” by VISA and selected the “Best Startups” in the 2022 Finovate Awards organized by Finovate. Papara is listed in CNBC & Statista’s World’s Top FinTechs of 2024 for the second year in a row. Papara is expanding its products, services, and geographic reach to become the leading challenger fintech in the region. For more information, visit: https://www.papara.com/en

Photo – https://stockburger.news/wp-content/uploads/2024/11/Thunes_Papara.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/thunes-and-papara-establish-a-bilateral-partnership-to-enable-cross-border-transfers-to-and-from-turkiye-302300207.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/thunes-and-papara-establish-a-bilateral-partnership-to-enable-cross-border-transfers-to-and-from-turkiye-302300207.html

SOURCE Thunes

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

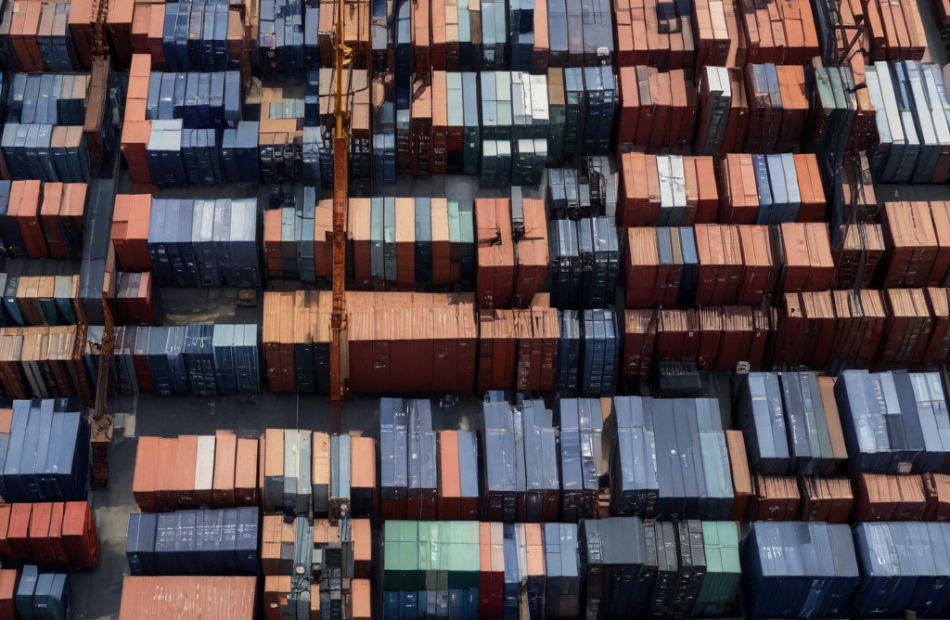

China May Benefit From Trump's Return To White House Despite His Tariff Plans, Says Expert: 'Short-Term pain, But Potentially Long-Term Strategic Gain'

China may view President-elect Donald Trump’s return to the White House as an opportunity for strategic advantage despite immediate economic challenges, according to a leading China expert.

What Happened: Elizabeth Economy, a senior fellow at the Hoover Institution, told Bloomberg TV that while Trump’s proposed 60% tariffs would significantly impact China’s economy, the longer-term implications could favor Beijing’s global ambitions.

“China is probably looking at the return of Donald Trump as short-term pain, but potentially long-term strategic gain,” Economy said. She estimated that China would need to find new markets for approximately $200 billion in exports if Trump’s tariff plans materialize.

The trade restrictions would hit China particularly hard given its current economic struggles, Economy noted. However, she suggested that Trump’s potential impact on America’s global leadership role could ultimately benefit China’s strategic interests.

Economy emphasized that Trump’s presidency could weaken the United States’ traditional position as a major security guarantor, free trade advocate, and democracy supporter on the world stage – areas where China seeks to expand its influence.”It opens up an opportunity for [Chinese Prsident] Xi Jinping to fill the gap to step into the bridge,” Economy said.

Why It Matters: Trump’s return has already prompted reactions from China, as seen in recent moves by Chinese leadership. China is actively engaging U.S. allies in Europe and Asia to mitigate the impact of Trump’s proposed tariffs, which could be as high as 60% on Chinese imports. This strategy includes offering tariff cuts and visa exemptions to these allies.

Additionally, the U.S. has taken steps to curb China’s technological advancements. A report reveals that the U.S. has asked Taiwan Semiconductor Manufacturing Co. TSM to halt shipments of advanced chips to China, further complicating China’s economic landscape.

Furthermore, companies like Steve Madden Ltd. SHOO are already adjusting their strategies to avoid potential tariffs by reducing manufacturing in China and shifting production to other countries.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's Tariffs, Deportations, And Tax Cuts May Push Prices Higher, Experts Say: 'It's Pretty Clear'

President-elect Donald Trump‘s proposed economic policies for a potential second term could trigger higher inflation, according to economic experts, despite his promises to lower prices for American consumers.

What Happened: Three key proposals are raising concerns among economists: a universal tariff of up to 20% on imports (with China facing up to 60%), mass deportation of undocumented immigrants, and tax cuts, reported Business Insider.

Major retailers are already warning about price impacts. “If we get tariffs, we will pass those tariff costs back to the consumer,” AutoZone CEO Philip Daniele said during a recent earnings call. Columbia Sportswear CEO Timothy Boyle echoed similar concerns, stating it would be “very difficult to keep products affordable.”

The proposed deportations could disrupt labor markets, particularly in construction and agriculture, forcing wage increases that companies may offset through higher prices. “It’s pretty clear… you reduce the labor supply very abruptly, and you’re going to get an increase in inflation,” said economist Wendy Edelberg, according to the report.

The bond market is already reacting, with yields surging and market-based inflation expectations reaching their highest level since April. Economist Veneta Dimitrova of Ned Davis Research noted these movements reflect “legitimate worries about the path of government spending.”

Why It Matters: The potential inflationary impact of Trump’s policies is a significant concern for investors and economists. A report highlights the market’s focus on predicting which of Trump’s campaign promises will translate into policy actions. While lower corporate taxes and deregulation are seen as economic positives, immigration clampdowns and high tariffs pose potential challenges.

Furthermore, Obama-era economist Jason Furman has expressed skepticism about the Federal Reserve’s inflation outlook, warning of persistent risks.

Interestingly, China experts suggest that while Trump’s tariffs may initially hurt China’s economy, they could ultimately align with Beijing’s long-term strategic goals.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood Predicts Trump's White House Return Will Ignite Reagan-Era Economic Boom Through Deregulation And Tax Cuts: 'Likely To Turbocharge The US Economy'

Cathie Wood, founder and CEO of ARK Investment Management LLC, predicts President-elect Donald Trump‘s return to the White House will trigger significant economic growth through deregulation and tax cuts, drawing parallels to the economic transformation during former President Ronald Reagan‘s administration in the 1980s.

What Happened: In a post-election analysis video, Wood popularly known for leading ARK Innovation ETF ARKK outlined how Trump’s anticipated policies, including reform of major regulatory bodies such as the Securities and Exchange Commission and the Federal Trade Commission, could catalyze substantial economic expansion.

“President Trump is coming into office when that part of the equivalent administration has been done,” Wood said, comparing the current economic landscape to the early 1980s. She emphasized that Trump’s growth-focused approach, particularly his promised tax cuts, could mirror the economic success seen during Reagan’s presidency.

Wood highlighted several key initiatives expected under Trump’s second term:

- Reduced government oversight through regulatory reform

- Decreased federal spending

- Lower tax rates for businesses and consumers

- Increased focus on technological innovation

Addressing Trump’s trade policies, Wood expressed qualified support for his targeted tariff approach. “If Trump makes good on tariff promises… if we counter them at home with lower tax rates for consumers and businesses, that’s a trade-off. That’s a good trade,” she said, adding, “I think the President is very growth-oriented and he’s not going to do anything to harm growth.”

Why It Matters: On monetary policy, Wood noted current federal funds rates near 5% could decrease further under Trump’s administration, contrasting with the 15% rates seen in the early 1980s. She predicted businesses might delay certain activities in anticipation of Trump’s promised tax cuts, similar to the behavior observed during his first term.

In a post on X, formerly known as Twitter, Wood wrote that Trump’s approach to “deregulation (defanging the SEC, FTC, and others), government spending cuts (making room for the private sector), tax cuts, and a focus on technologically enabled innovation are likely to turbocharge the U.S. economy more powerfully than during the Reagan Revolution.”

Wood emphasized that emerging technologies, particularly artificial intelligence, robotics, blockchain, and advanced healthcare genomics, combined with Trump’s projected policies, could drive unprecedented productivity growth while helping to control inflation.

The ARK Invest CEO suggests this confluence of technological innovation and Trump’s proposed economic policies could usher in a new era of active equity investing, similar to the market dynamics of the 1980s and 1990s.

Read Next:

Image via Ark Invest

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

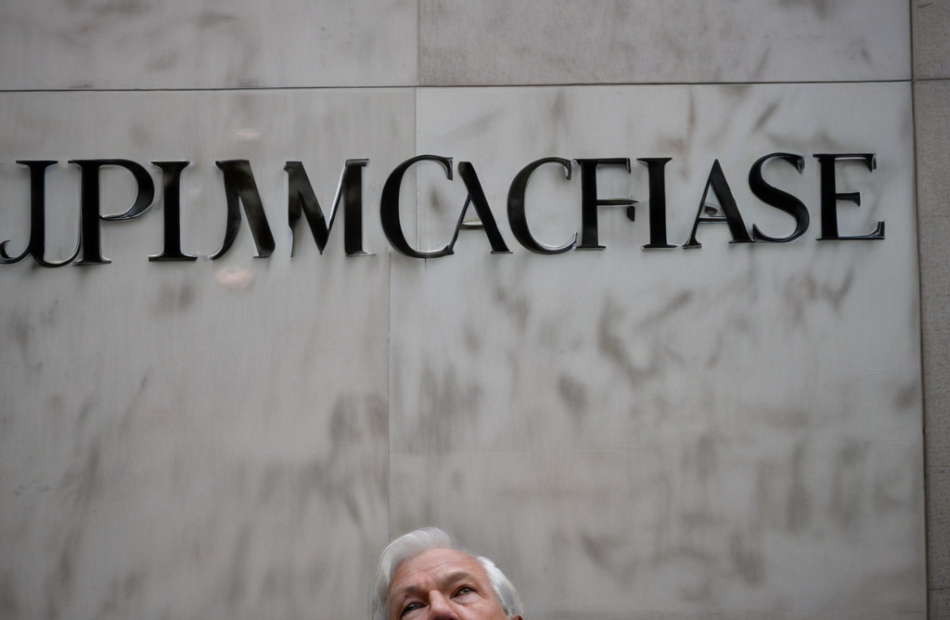

For 36 Years, JPMorgan Chase Has Denied A $331 Monthly Pension To An Employee's Widow. The Sum In Question? 'Only' $53,000

For over three decades, one of America’s largest banks, JPMorgan Chase (NYSE:JPM), has refused to pay out a $331 monthly pension to Elaine Silverberg, widow of one of their former longtime employees, according to The New York Post. The publisher recently reported on the ordeal that has left the widow fighting for what should be hers – a battle she has been waging for over 13 years.

Don’t Miss:

Elaine’s late husband, Melvyn Silverberg, worked for Chase Manhattan Bank as a systems analyst until 1979. Tragically, he passed away at just 43 years old in 1988 due to multiple organ failure, leaving Elaine, who was just 37, to raise their three children alone. Since then, Melvyn’s $53,000 pension from his 10 years at the bank has been in limbo for more than 36 years as Elaine has battled to collect it upon her retirement.

In a statement to the New York Post, JPMorgan Chase admitted that Melvyn had earned a vested retirement package but claimed that he had failed to complete the necessary paperwork to elect his wife as a beneficiary. Unfortunately, Mel passed away before the 1984 Retirement Equity Act, which automatically granted pension benefits to spouses, came into effect. Because Mel’s employment ended before this law was passed, the bank has used this technicality to argue that Elaine is not entitled to any payments.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

Elaine, now 73, said that the company has treated her like “an insignificant cockroach just to be stepped on.” The bank has not backed down despite her repeated pleas and even enlisting the help of Sen. Cory Booker of New Jersey and former New York congressman Eliot Engel.

According to the Social Security Administration, the pension should payout $331 monthly, which isn’t exactly a life-altering amount for a bank that made almost $13 billion in profits in the third quarter alone this year.

JPMorgan Chase says they sympathize with Elaine but cannot make an exception without the required paperwork. To add insult to injury, correspondence reviewed by the paper shows that the bank allegedly contacted Melvyn multiple times after his death, including once in 1990, asking him to elect for spousal coverage – two years after he had already passed away.

VEON Elevates its Youth Offering Through Banglalink’s AI-Powered Lifestyle App RYZE

Amsterdam, Dubai and Dhaka – 11 November 2024: VEON Ltd. VEONVEON), a global digital operator, announces that Banglalink, its digital operator in Bangladesh, has launched RYZE, a comprehensive digital lifestyle app tailored to engage Bangladesh’s emerging generation featuring AI-powered personalization.

Over 48% of Bangladesh’s 175 million people are under the age of 25, according to the Bangladesh Bureau of Statistics. As a digital operator providing mobile connectivity and a portfolio of connected digital services, Banglalink recognises this untapped potential and has launched RYZE as an all-encompassing package designed to facilitate the digital lifestyles of young Bangladeshis.

RYZE is available to all mobile users across any network. It includes a prepaid package powered by AI recommendation tools that offers resources for skill development, highly personalised entertainment packages and tailored loyalty and rewards packages.

“RYZE exemplifies our commitment to empowering the youthful communities we serve through seamless digital solutions that meet the unique needs of the next generation,” explains Erik Aas, CEO of Banglalink. “By integrating AI-driven features, RYZE delivers a comprehensive lifestyle experience from skill development to entertainment ensuring it resonates with the digital-first generation. At Banglalink we are proud to continually champion digital inclusion and provide the foundations for dynamic, digital led economic growth.”

RYZE’s launch sees it join the growing roster of VEON’s digital-first lifestyle apps. ROX in Pakistan, IZI in Kazakhstan and Kyrgyzstan, as well as OQ in Uzbekistan are all pioneering digital-first brands that supports VEON’s online services strategy across the frontier markets where it operates.

Through its digital operators, VEON Group offers a variety of products and initiatives across entertainment, financial services, digital health and education. VEON’s Digital Operators serve 160 million connectivity customers and a total base of 110 million total monthly active users across its proprietary digital products and services such as Toffee, Tamasha, BeeTV, KyivstarTV, Simosa, myBL, JazzCash, Simply, Izi, BeeCloud and Helsi. In the first half of 2024, direct revenues from digital services represented more than 10% of VEON Group’s total revenues.

About Banglalink:

Banglalink is one of the leading digital communications service providers in Bangladesh. As of August 2024, Banglalink serves 41.3 million mobile subscribers and 20.8 million digital subscribers every month transforming lives through technology. Banglalink’s digital offerings include Toffee, the country’s leading digital entertainment platform and MyBanglalink, a pioneering super app. For more information visit: https://www.banglalink.net

About VEON

VEON is a digital operator that provides converged connectivity and digital services to nearly 160 million customers. Operating across six countries that are home to more than 7% of the world’s population, VEON is transforming lives through technology-driven services that empower individuals and drive economic growth. VEON is listed on NASDAQ and Euronext. For more information visit: www.veon.com

Disclaimer

This release contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical facts, and include statements relating to, among other things, VEON’s digital products, commercial plans and partnerships. Forward-looking statements are inherently subject to risks and uncertainties, many of which VEON cannot predict with accuracy and some of which VEON might not even anticipate. The forward-looking statements contained in this release speak only as of the date of this release. VEON does not undertake to publicly update, except as required by U.S. federal securities laws, any forward-looking statement to reflect events or circumstances after such dates or to reflect the occurrence of unanticipated events.

Contact Information

VEON

Hande Asik

Group Director of Communications

pr@veon.com

MHP Group

Julian Tanner

Julian.tanner@mhpgroup.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Price Tops $80,000 for First Time

Bitcoin traded above $80,000 over the weekend, extending a run for the leading cryptocurrency, which got a lift from last week’s election victory by Donald Trump.

Bitcoin (BTCUSD) recently traded around $79,700, up about 4% over the past 24 hours and still in the neighborhood of record levels. The expectation that a second Trump administration and a new Congress thought to be friendlier to the industry has lifted both bitcoin and other assets in the sector, with investors lately pouring money into instruments like spot bitcoin exchange-traded funds.

The rise has boosted the estimated market cap of crypto broadly, with the figure recently above $2.7 trillion, according to CoinMarketCap.

It has also helped shares of crypto-linked companies like MicroStrategy (MSTR), a big bitcoin holder—it said its bitcoin holdings were valued above $16 billion at the end of the third quarter—and exchange Coinbase Global (COIN).

More broadly, investor optimism has lifted markets in recent days. The S&P 500 and Dow Jones Industrial Average last week finished their best weeks of the year.

Dow, S&P 500 Notch Best Week Of Year As Tesla Surges Post Trump Win: Investor Sentiment Improves, Fear & Greed Index Remains In 'Neutral' Zone

The CNN Money Fear and Greed index showed further improvement in the overall market sentiment, while the index remained in the “Neutral” zone on Friday.

U.S. stocks settled higher on Friday, with the Dow Jones and S&P 500 recording their best week in the year following the election of Donald Trump as the 47th U.S. president.

The S&P 500 surged 4.66% last week, while the Dow gained 4.61% during that period, with both indices recording their best week since Nov. 2023. The Nasdaq, meanwhile, jumped 5.74% during the week.

On the economic data front, the University of Michigan consumer sentiment rose to 73 in November, recording the highest reading in seven months, versus a reading of 70.5 in October and also topping market estimates of 71.

Tesla, Inc. TSLA shares jumped 8.2% on Friday, extending gains following the U.S. presidential election. Shares of Applied Optoelectronics, Inc. AAOI surged 55% after the company reported better-than-expected third-quarter revenue results.

Most sectors on the S&P 500 closed on a positive note, with consumer staples, utilities, and real estate stocks recording the biggest gains on Friday. However, materials and communication services stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 260 points to 43,988.99 on Friday. The S&P 500 gained 0.38% to 5,995.54, while the Nasdaq Composite jumped 0.09% to close at 19,286.78 during Friday’s session.

Investors are awaiting earnings results from Aramark ARMK, Live Nation Entertainment, Inc. NYSE: LYV), and monday.com Ltd. MNDY today.

What is CNN Business Fear & Greed Index?

At a current reading of 60.5, the index remained in the “Neutral” zone on Friday, versus a prior reading of 58.6.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.