VEON Elevates its Youth Offering Through Banglalink’s AI-Powered Lifestyle App RYZE

Amsterdam, Dubai and Dhaka – 11 November 2024: VEON Ltd. VEONVEON), a global digital operator, announces that Banglalink, its digital operator in Bangladesh, has launched RYZE, a comprehensive digital lifestyle app tailored to engage Bangladesh’s emerging generation featuring AI-powered personalization.

Over 48% of Bangladesh’s 175 million people are under the age of 25, according to the Bangladesh Bureau of Statistics. As a digital operator providing mobile connectivity and a portfolio of connected digital services, Banglalink recognises this untapped potential and has launched RYZE as an all-encompassing package designed to facilitate the digital lifestyles of young Bangladeshis.

RYZE is available to all mobile users across any network. It includes a prepaid package powered by AI recommendation tools that offers resources for skill development, highly personalised entertainment packages and tailored loyalty and rewards packages.

“RYZE exemplifies our commitment to empowering the youthful communities we serve through seamless digital solutions that meet the unique needs of the next generation,” explains Erik Aas, CEO of Banglalink. “By integrating AI-driven features, RYZE delivers a comprehensive lifestyle experience from skill development to entertainment ensuring it resonates with the digital-first generation. At Banglalink we are proud to continually champion digital inclusion and provide the foundations for dynamic, digital led economic growth.”

RYZE’s launch sees it join the growing roster of VEON’s digital-first lifestyle apps. ROX in Pakistan, IZI in Kazakhstan and Kyrgyzstan, as well as OQ in Uzbekistan are all pioneering digital-first brands that supports VEON’s online services strategy across the frontier markets where it operates.

Through its digital operators, VEON Group offers a variety of products and initiatives across entertainment, financial services, digital health and education. VEON’s Digital Operators serve 160 million connectivity customers and a total base of 110 million total monthly active users across its proprietary digital products and services such as Toffee, Tamasha, BeeTV, KyivstarTV, Simosa, myBL, JazzCash, Simply, Izi, BeeCloud and Helsi. In the first half of 2024, direct revenues from digital services represented more than 10% of VEON Group’s total revenues.

About Banglalink:

Banglalink is one of the leading digital communications service providers in Bangladesh. As of August 2024, Banglalink serves 41.3 million mobile subscribers and 20.8 million digital subscribers every month transforming lives through technology. Banglalink’s digital offerings include Toffee, the country’s leading digital entertainment platform and MyBanglalink, a pioneering super app. For more information visit: https://www.banglalink.net

About VEON

VEON is a digital operator that provides converged connectivity and digital services to nearly 160 million customers. Operating across six countries that are home to more than 7% of the world’s population, VEON is transforming lives through technology-driven services that empower individuals and drive economic growth. VEON is listed on NASDAQ and Euronext. For more information visit: www.veon.com

Disclaimer

This release contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical facts, and include statements relating to, among other things, VEON’s digital products, commercial plans and partnerships. Forward-looking statements are inherently subject to risks and uncertainties, many of which VEON cannot predict with accuracy and some of which VEON might not even anticipate. The forward-looking statements contained in this release speak only as of the date of this release. VEON does not undertake to publicly update, except as required by U.S. federal securities laws, any forward-looking statement to reflect events or circumstances after such dates or to reflect the occurrence of unanticipated events.

Contact Information

VEON

Hande Asik

Group Director of Communications

pr@veon.com

MHP Group

Julian Tanner

Julian.tanner@mhpgroup.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Price Tops $80,000 for First Time

Bitcoin traded above $80,000 over the weekend, extending a run for the leading cryptocurrency, which got a lift from last week’s election victory by Donald Trump.

Bitcoin (BTCUSD) recently traded around $79,700, up about 4% over the past 24 hours and still in the neighborhood of record levels. The expectation that a second Trump administration and a new Congress thought to be friendlier to the industry has lifted both bitcoin and other assets in the sector, with investors lately pouring money into instruments like spot bitcoin exchange-traded funds.

The rise has boosted the estimated market cap of crypto broadly, with the figure recently above $2.7 trillion, according to CoinMarketCap.

It has also helped shares of crypto-linked companies like MicroStrategy (MSTR), a big bitcoin holder—it said its bitcoin holdings were valued above $16 billion at the end of the third quarter—and exchange Coinbase Global (COIN).

More broadly, investor optimism has lifted markets in recent days. The S&P 500 and Dow Jones Industrial Average last week finished their best weeks of the year.

Dow, S&P 500 Notch Best Week Of Year As Tesla Surges Post Trump Win: Investor Sentiment Improves, Fear & Greed Index Remains In 'Neutral' Zone

The CNN Money Fear and Greed index showed further improvement in the overall market sentiment, while the index remained in the “Neutral” zone on Friday.

U.S. stocks settled higher on Friday, with the Dow Jones and S&P 500 recording their best week in the year following the election of Donald Trump as the 47th U.S. president.

The S&P 500 surged 4.66% last week, while the Dow gained 4.61% during that period, with both indices recording their best week since Nov. 2023. The Nasdaq, meanwhile, jumped 5.74% during the week.

On the economic data front, the University of Michigan consumer sentiment rose to 73 in November, recording the highest reading in seven months, versus a reading of 70.5 in October and also topping market estimates of 71.

Tesla, Inc. TSLA shares jumped 8.2% on Friday, extending gains following the U.S. presidential election. Shares of Applied Optoelectronics, Inc. AAOI surged 55% after the company reported better-than-expected third-quarter revenue results.

Most sectors on the S&P 500 closed on a positive note, with consumer staples, utilities, and real estate stocks recording the biggest gains on Friday. However, materials and communication services stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 260 points to 43,988.99 on Friday. The S&P 500 gained 0.38% to 5,995.54, while the Nasdaq Composite jumped 0.09% to close at 19,286.78 during Friday’s session.

Investors are awaiting earnings results from Aramark ARMK, Live Nation Entertainment, Inc. NYSE: LYV), and monday.com Ltd. MNDY today.

What is CNN Business Fear & Greed Index?

At a current reading of 60.5, the index remained in the “Neutral” zone on Friday, versus a prior reading of 58.6.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Policymakers don't want to tank the stock market

Stocks surged after election results came in and the major news outlets declared former President Donald Trump the winner.

At the same time, the strength of the market response has arguably been at odds with what many economists consider the prospect of worse economic policies under President-elect Trump.

Maybe it’s traders and investors betting that policies bad for the market won’t actually be implemented. After all, what president would want to be affiliated with wealth destruction caused by falling stock prices?

While there are many aspects of the economy (like inflation and employment) that can be tricky to define and measure, stock prices are very unambiguous. People’s investment portfolio values are regularly updated down to the penny.

I’d add that those voters with money in the stock market include the many billionaires with whom the incoming president has gotten cozy. And much of these billionaires’ wealth is tied up in the stock market.

Assuming the president does not want to be associated with destroying the investor class’ wealth, this means his administration will likely think twice about going all-in on policies that could prove costly to the companies in the stock market. More from Joe:

Trump’s presidency carries plenty of market risk, experts warn

Stocks notched their best week of the year as investors cheered President-elect Donald Trump’s economic agenda.

“Tax cuts are behind the rally … and in general, there is the perception that markets like Republican administrations, although certainly the performance for the past few years of the Democratic administration has not exactly been shabby,” Interactive Brokers’ Steve Sosnick explained to me on Yahoo Finance’s special election coverage.

The Dow Jones Industrial Average (^DJI) skyrocketed more than 1,700 points from Wednesday through Friday, closing the week up 4.6%. The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) surged to a record, while the Russell 2000 (^RUT) hit its highest level since November 2021.

But the market should be careful what it wishes for. Experts tell me as clarity emerges, a resurgence in inflation from trade tariffs and additional government spending could pose a risk to the market’s momentum and temper rate cuts from the Fed.

“The sharp spike [in the markets] is, to some extent, a reaction to the expectation of solid growth, deregulation, tax cuts … But the other part of that, of course, is that it can lead to greater inflation and wider fiscal deficits,” Sonal Desai, Franklin Templeton Fixed Income chief investment officer, told me on Catalysts.

Stifel’s Barry Bannister, who sees a downside risk of 5,250 for the S&P 500 a year from now, is keeping a close watch for a resurgence in inflation. S&P closed out the week above 6,000.

“If inflation proves resurgent … we suspect Chairman Powell’s last 12 months in office (May 2025 to May 2026) are a significant investor risk, magnified by the repercussions of the approaching 2026 US midterm elections,” Bannister wrote in a note to clients.

Truist co-chief investment officer Keith Lerner echoed the point on a new episode of the Opening Bid podcast (listen in below).

Deutsche Bank anticipates Trump’s fiscal, trade, and immigration policies could result in an upward adjustment to its inflation forecast. The team, led by Matthew Luzzetti, projects inflation could rise by roughly 0.5% in 2026 to about 2.5%, primarily due to the inflationary impact of tariffs.

Reports Friday that Trump asked Robert Lighthizer to return to his administration as US trade Representative could signal a more aggressive approach to tariffs. During Trump’s first term, Lighthizer played a key role in his escalating trade war with China, implemented tariffs on steel and aluminum imports, and helped renegotiate the US’s trade agreement with Mexico and Canada.

TKO INVESTOR UPDATE: Did the TKO Group Holdings Board Breach its Fiduciary Duties to Shareholders? Contact BFA Law about its Investigation (NYSE:TKO)

NEW YORK, Nov. 10, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces an investigation into TKO Group Holdings, Inc. TKO, the board of directors, and the controlling stockholder for potential breaches of fiduciary duty.

If you are a holder of TKO Group Holdings, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/tko-group-holdings-inc.

Investigation Details:

TKO is controlled by Endeavor Group Holdings, Inc. (“Endeavor”) through its ownership of 53.6% of the total voting power of the Company’s voting stock. Endeavor has designated a majority of directors to the board of directors of TKO. As a result of its control, Endeavor can influence TKO to engage in conflicted transactions and control the outcome of TKO’s corporate actions that typically would require shareholder approval.

On October 24, 2024, TKO announced that it had entered into a transaction agreement with Endeavor Operating Company, LLC, a subsidiary of Endeavor, pursuant to which TKO agreed to acquire the Professional Bull Riders, On Location and IMG businesses from Endeavor for $3.25 billion in Company stock (the “Acquisition”). As a result of the Acquisition, Endeavor will increase its ownership stake in TKO from approximately 53% to 59%. Minority shareholders will have no say in the Acquisition, as Endeavor has approved the Acquisition by written consent without a minority vote.

BFA believes that the Acquisition is a conflicted transaction that may have resulted in the Company overpaying for Endeavor’s businesses. Specifically, upon announcement of the Acquisition, TKO’s stock price fell by more than 5% and likely would have fallen further had TKO not simultaneously announced a $2 billion stock repurchase program. Given Endeavor’s control over TKO, BFA believes TKO minority stockholders may possess valid claims for breach of fiduciary duty against the board of directors of TKO and/or Endeavor.

Click here if you are a holder of TKO Group Holdings: https://www.bfalaw.com/cases-investigations/tko-group-holdings-inc.

What Can You Do?

If you are a current holder of TKO Group Holdings stock, you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/tko-group-holdings-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/tko-group-holdings-inc

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mark Cuban Reveals Regrettable Shark Tank Deal That 'Drives Him Crazy' Was A Chocolate Covered Pretzel Company Who Offered Free Shipping

In a 2017 Q&A with Oxford Union students, Mark Cuban opened up about one of his biggest regrets on Shark Tank – and he didn’t hold back. When asked about his commitment to the companies he invests in, Cuban emphasized that he’s there “’til death do us part” as long as the founders keep grinding.

Don’t Miss:

Out of his 71 investments on the show, about 12-15 are thriving, while three have exited (although, as he joked, “none really exciting”). Then he got real: at the bottom of his portfolio, Cuban revealed, “10 out of 71 … three have gone out of business and seven have gone out of business but aren’t smart enough to know it.” The crowd laughed, but Cuban didn’t let the moment slide without giving an example of a deal that “still drives him crazy.”

The investment he was talking about? A chocolate-covered pretzel company. Although he didn’t name it in the Q&A, the company was The Painted Pretzel, founded by Raven Thomas. Cuban had put $100,000 into the company for 25% equity after being impressed by Thomas’s passion and the product’s potential. With the huge PR boost from Shark Tank, sales skyrocketed by 1,500% post-episode – you’d think it was the beginning of something big. But behind the scenes, things unraveled fast.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

The issue? Free shipping. Cuban explained that while the pretzels cost around $14, they sold for $29.95, which should’ve left a decent $15 profit margin. But shipping? It was $16 a pop. That “free shipping” perk that was supposed to attract more customers devoured the profit. Cuban described it like watching cash “just disappear,” adding, “Cash is going like this,” motioning to show how fast it bled out. And it wasn’t just shipping. The company reportedly faced complaints about delays, adding customer service issues to the pile.

Reflecting on the deal, Cuban admitted, “I probably shouldn’t have [invested],” hinting that it was partly to prove a point to his fellow sharks, especially Kevin O’Leary, when he was new to the show. “No lie, to this day, I still get emails …” he trailed off, looking visibly frustrated.

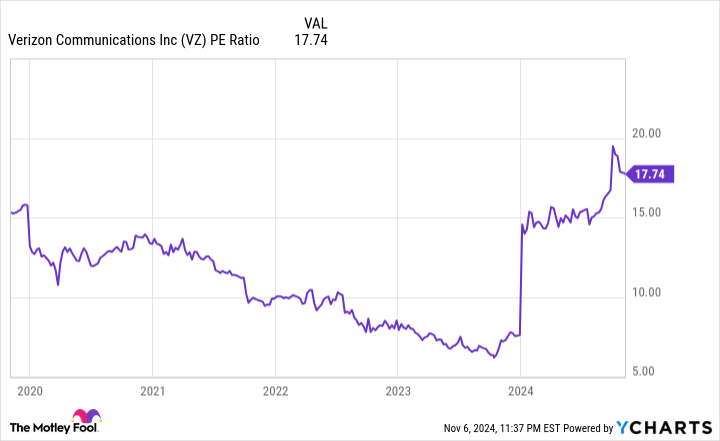

Is Verizon Stock a Buy Now?

Shares of telecom giant Verizon (NYSE: VZ) have been on an upswing. The stock is up about 14% over the past 12 months at the time of this writing. While a rising share price is welcome, perhaps the stock’s most appealing aspect is as an income investment.

Verizon’s dividend serves as a reliable source of passive income, given its 18 straight years of increases. It also sports an impressive forward-dividend yield of 6.5% as of Nov. 7.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Given these positives, it seems like Verizon’s stock is worth buying for the long haul. But there’s a wrinkle to consider. In September, Verizon announced the impending acquisition of Frontier Communications Parent. Here’s a look into how the Frontier purchase may affect whether to buy Verizon stock.

Verizon’s desire to acquire Frontier is part of its gambit to capture customers in the expanding fiber-optic internet market. Demand for high-speed internet is increasing due to data-intensive online activities such as video calls and streaming media.

A key benefit of the deal is that it would expand Verizon’s fiber network. Frontier provides fiber-optic internet service across 25 states, which would raise Verizon’s fiber footprint to 31 states.

In terms of revenue, Frontier generated $1.5 billion in the third quarter, up 4% year over year thanks to rising adoption of its fiber offering. Meanwhile, Verizon’s Fios-branded fiber product produced $3.2 billion in Q3 sales, which was essentially flat from the previous year.

Once the Frontier acquisition closes, which is expected to take 18 months, Verizon’s Fios revenue will be boosted by Frontier’s addition. The acquisition makes sense in terms of strengthening Verizon’s broadband business, but downsides exist.

The Frontier purchase will be an all-cash transaction valued at $20 billion. According to media reports, Verizon looks to take on debt to finance the deal. The telecom already shoulders a hefty $126.4 billion in unsecured debt as of Q3.

Moreover, Frontier has amassed its own debt in excess of $11 billion. The company has stated, “We have a significant amount of indebtedness, and we may incur substantially more debt in the future. Such debt and debt service obligations may adversely affect us.”

Adding to this, Verizon will incur further capital expenditures as it continues to expand its fiber network. Frontier alone plans to reach 10 million homes by 2026, up from about seven million today.