META, UBER, or AMZN: Which “Strong Buy” Tech Stock Could Offer the Highest Upside?

The Q3 earnings season for the tech giants has been a mixed bag. While some managed to impress investors with their performance and outlook, others fell short of expectations on some metrics. Wall Street remains upbeat on several tech giants, thanks to generative AI (artificial intelligence)-led tailwinds. Using TipRanks’ Stock Comparison Tool, we placed Meta Platforms (META), Uber Technologies (UBER), and Amazon (AMZN) against each other to find the “Strong Buy” stock with the highest upside potential, according to Wall Street analysts.

Social media giant Meta Platforms reported better-than-expected Q3 revenue and earnings for the third quarter of 2024. The company’s top line grew 19% year-over-year to $40.5 billion, while EPS (earnings per share) rose 37% to $6.03.

However, shares fell after the earnings report as investors were disappointed with Meta’s subdued user numbers. Daily active people (DAP), which indicates the number of users who visited at least one of the family apps (Facebook, Instagram, Messenger, and/or WhatsApp) on a given day, increased 5% to 3.29 billion but lagged analysts’ consensus of 3.31 billion.

Moreover, the company increased its capital expenditure guidance for 2024, with CEO Mark Zuckerberg cautioning investors about a significant rise in AI infrastructure capex in 2025.

Following the Q3 print, Baird analyst Colin Sebastian reaffirmed a Buy rating on META stock and increased the price target to $630 from $605. The analyst believes that the company’s strong Q3 results reflect a stable macro backdrop, healthy user growth and engagement trends, and the benefits of AI in ad products and content recommendations. He expects AI to drive further growth for Meta Platforms in the days ahead.

Like Sebastian, most analysts are bullish on Meta Platform’s prospects. META stock scores a Strong Buy consensus rating based on 41 Buys, three Holds, and one Sell recommendation. The average META stock price target of $654.23 implies 11% upside potential. Shares have rallied 66.5% year-to-date.

Uber Technologies stock fell 9.3% on October 31, as the company reported slower-than-expected bookings growth and triggered concerns among investors about the impact of macro pressures on the demand in the ride-hailing industry. The company’s gross bookings grew 16% year-over-year to $40.97 billion, falling short of analysts’ estimate of $41.25 billion.

On the positive side, Uber’s Q3 revenue increased 20% to $9.29 billion and surpassed estimates. The company’s earnings per share (EPS) jumped to $1.20 from $0.10 in the prior-year quarter, reflecting the inclusion of a $1.7 billion benefit from unrealized gains related to the reevaluation of its equity investments.

TipRanks’ ‘Perfect 10’ Picks: 2 Top-Scoring Stocks for the Rest of 2024

With the end of 2024 approaching, what could be more natural than to figure out the top stocks for the rest of the year?

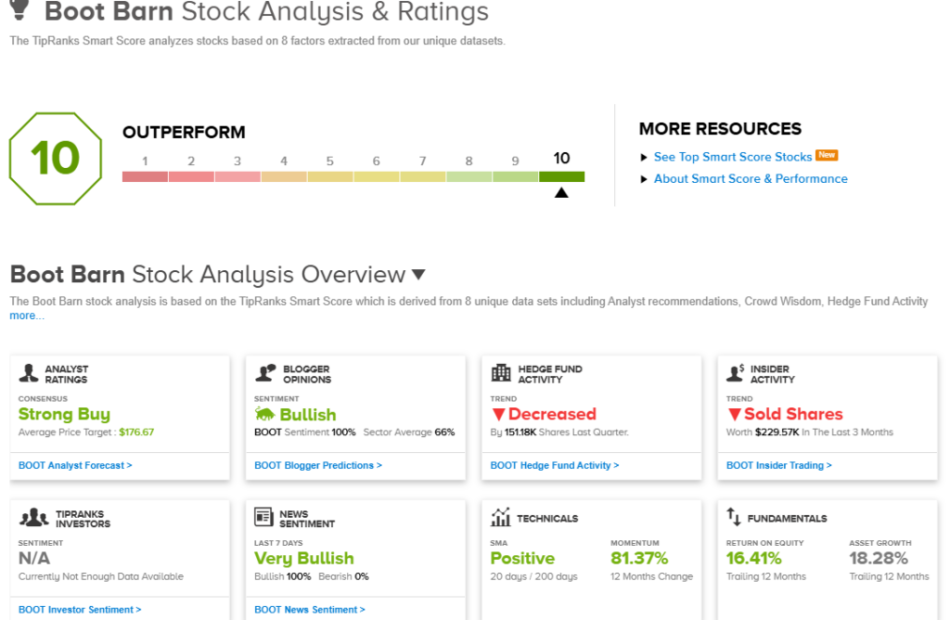

Stock picking of this sort is an essential skill for every investor, and fortunately, the Smart Score make it easier. This data gathering and sorting tool from TipRanks uses a combination of AI tech and natural language algorithms to gather and comb through the aggregated data of the stock market – data derived from thousands of traders dealing in thousands of stocks for tens of millions of daily transactions – and it uses that data to give every stock a simple score, on a scale of 1 to 10 and based on the stock’s standing against a set of factors known to match up with future outperformance.

We’ve opened up the TipRanks databanks to find two of these top-scoring stocks that investors should consider for the rest of 2024. These are ‘Perfect 10’ stocks, stocks that have earned the highest possible Smart Score.

Boot Barn Holdings (BOOT)

We’ll start in the retail world, with Boot Barn. This company operates in the lifestyle niche, offering customers a range of Western-themed apparel, footwear, and accessories. The company is particularly noted for its high-end Western boots and its cold-weather outdoor gear. Boot Barn also deals in hiking shoes and work boots, rugged work clothes, Western-style fashion, and even cowboy hats. The company’s clothing is marketed to men, women, and kids and is complemented by a range of décor and gifts.

The Boot Barn company was founded in 1978 and has grown since then to become the largest Western-themed lifestyle retail firm. The company operates through a network of brick-and-mortar stores, more than 420 of them across 46 states, and through an e-commerce operation that includes three websites: bootbarn.com, sheplers.com, and countryoutfitter.com.

BOOT shares have fallen 16% following the fiscal Q2 report on October 28. Revenue showed year-over-year growth, and earnings were in line with expectations, but investors reacted to the unexpected announcement that CEO Jim Conroy will step down on November 22.

Baird analyst Jonathan Komp sees the drop in share price as an opportunity and writes about the stock: “We were surprised by the stock’s sizable decline following the news CEO Jim Conroy plans to leave for Ross Stores in November, as strong continuity across BOOT’s remaining team reduces near-term disruption risk. Factoring BOOT’s +5% raise to F2025E EPS guidance, the >25% correction in BOOT’s NTM P/E appears overdone given strong comps momentum and near-term visibility. We also view pushback to BOOT’s ending inventory as flimsy, given limited markdown risk.”

Bond Market on Risky Path as Traders Regroup From Wild Week

(Bloomberg) — The bond-market selloff unleashed by Donald Trump’s presidential victory last week ended almost as quickly as it began.

Most Read from Bloomberg

Yet firms like BlackRock Inc., JPMorgan Chase & Co. and TCW Group Inc. have issued a steady drumbeat of warnings that the bumpy ride is likely far from over.

Trump’s coming return to the White House has significantly upended the outlook for the US Treasury market, where October’s losses had already wiped out much of this year’s gains.

Less than two months after the Federal Reserve started pulling interest rates back from a more than two-decade high, the likelihood that Trump will cut taxes and throw up large tariffs is threatening to rekindle inflation by raising import costs and pouring stimulus on an already strong economy.

His fiscal plans — unless offset by massive spending cuts — would also send the federal budget deficit surging. And that, in turn, has renewed doubts about whether bondholders will start demanding higher yields in return for absorbing an ever-rising supply of new Treasuries.

One scenario is “the bond market instills fiscal discipline with an unpleasant rise in rates,” said Janet Rilling, senior portfolio manager and the head of the Plus Fixed Income team at Allspring Global Investments.

She predicted the 10-year Treasury yield could rise back to the peak of 5% hit in late 2023, about 70 basis points above where it was Friday. That “was the cycle high and it’s a reasonable level if there is a full implementation of the proposed tariffs.”

There remains considerable uncertainty about the precise policies Trump will enact, and some of the potential impact has already been priced in, since speculators started betting on his victory well ahead of the vote. While 10- and 30-year Treasury yields surged Wednesday to the highest in months, they came tumbling back down again over the next two days, ending the week lower than they began.

There’s no cash Treasuries trading on Monday due to a US holiday.

But the prospect that Trump’s policies will spur growth has driven traders to pare back expectations for how deeply the the Fed will cut rates next year, dashing hopes that bonds would rally as it eased policy aggressively.

Economists at Goldman Sachs Group Inc., Barclays Plc and JPMorgan have shifted their Fed forecasts to show fewer reductions. Swaps traders are pricing in that policymakers will reduce its benchmark rate to 4% by mid-2025, a full percentage point higher than they were predicting in September. It’s in a range of 4.5% to 4.75% now.

Chinese Stocks Slide on Disappointing Fiscal Plan, Weak Data

(Bloomberg) — Chinese stocks declined after a high-profile legislative meeting disappointed investors who had been hoping for large-scale stimulus to boost the economy and end a deflationary cycle.

Most Read from Bloomberg

The CSI 300 Index was down 0.4% as of 9:40 a.m. local time, while a gauge of Chinese stocks trading in Hong Kong dropped more than 2%. Both gauges trimmed bigger losses seen at the open. The declines followed a 4.7% tumble in the Nasdaq Golden Dragon China Index in the US on Friday.

Investors had pinned their hopes on the Standing Committee meeting of the National People’s Congress to offer fresh catalysts for the stock market, especially after Donald Trump’s presidential victory injected fresh uncertainty over tariffs. Beijing announced a 10 trillion yuan ($1.4 trillion) program to help local governments tackle their hidden debt on Friday but stopped short of providing new stimulus to bolster consumption.

Chinese data released over the weekend underscored the urgency for more pro-growth efforts, with consumer price growth remaining close to zero and factory-gate prices continuing to fall. UBS lowered its 2025 growth forecast for China following Trump’s election, expecting an “around 4%” expansion for 2025, and a “considerably lower” pace in 2026.

“With perceived emphasis on stabilization rather than stimulus, and no measures to facilitate bank recapitalization and/or boost consumption, we think this will come as a disappointment for stock investors, even though the headline debt-swap numbers were ahead of expectations,” Nomura Holdings Inc. strategists led by Chetan Seth wrote in a note.

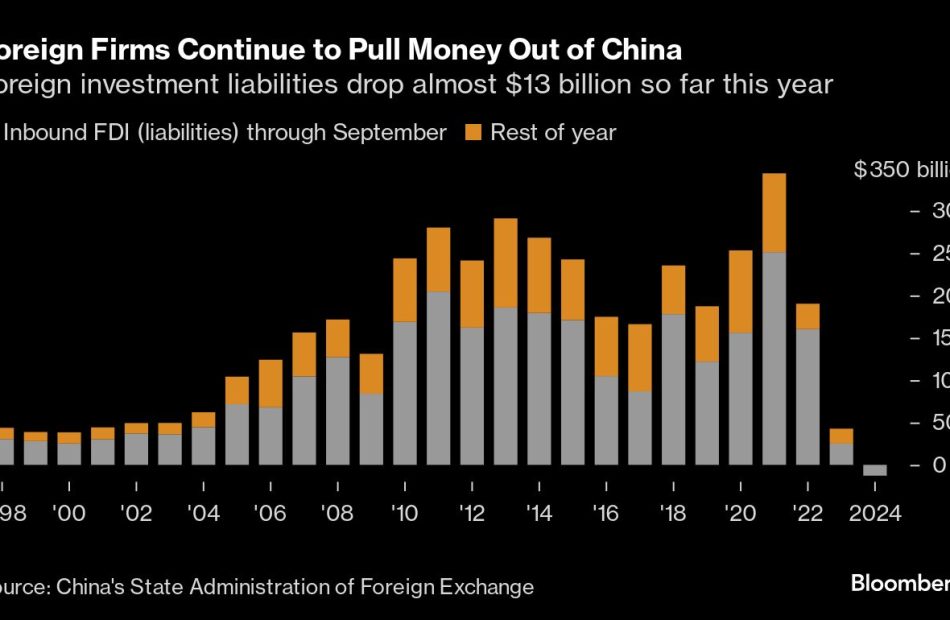

Overseas companies are also pulling their money out of China as the growth outlook turns gloomier. Foreign direct investment slid almost $13 billion in the first nine months of the year, a sign that some investors are still pessimistic even as Beijing rolls out stimulus measures aimed at stabilizing growth.

The CSI 300 Index, a benchmark for onshore shares, fell 1% on Friday as traders grew jittery before the NPC announcement. The gauge rallied nearly 35% from a September low through Oct. 8, but has largely moved sideways since then.

–With assistance from Winnie Hsu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

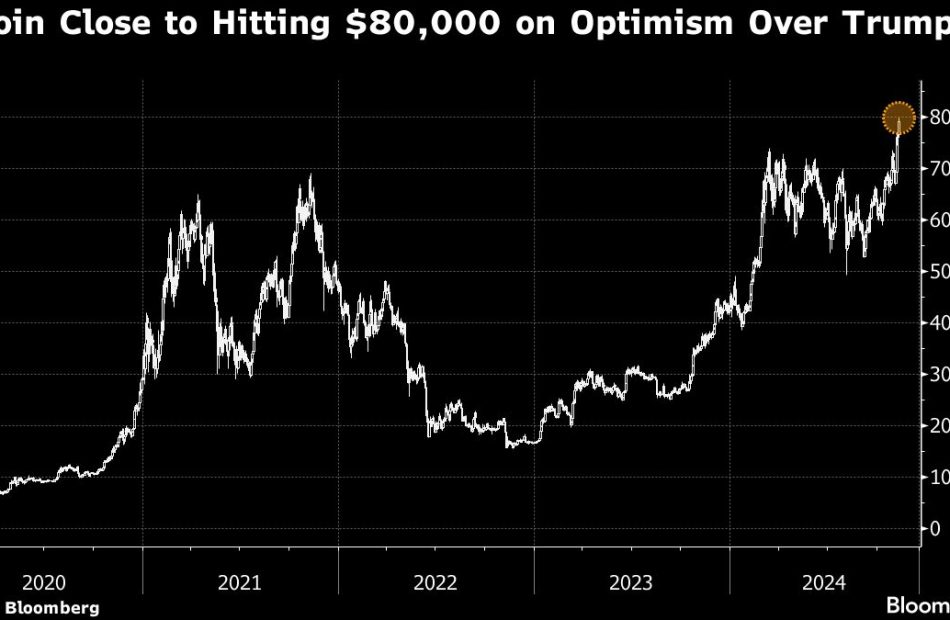

Bitcoin Rises Above $81,000 as Token Becomes Totem for Trump Era

(Bloomberg) — Bitcoin rallied past $81,000 for the first time, boosted by President-elect Donald Trump’s embrace of digital assets and the prospect of a Congress featuring pro-crypto lawmakers.

Most Read from Bloomberg

Trump was declared the winner in Arizona, marking a clean sweep of the seven US battleground states. His decisive victory in the presidential election has prompted celebratory chest-thumping from the digital-asset industry, which spent over $100 million backing a range of crypto-friendly candidates.

The largest token climbed as much as 6.1% on Sunday and hit an unprecedented $81,497 early in Asia on Monday, before changing hands at $80,835 as of 9:30 a.m. in Singapore. Bullish sentiment lifted smaller coins too, including a surge in Dogecoin, a meme-crowd favorite promoted by Trump supporter Elon Musk.

“With the dust from Trump’s victory still settling down, it was only a matter of time before a run-up of some sort occurred given the perception of Trump being pro-crypto, and that’s what we’re seeing now,” said Le Shi, Hong Kong managing director at market-making firm Auros.

Trump’s Agenda

Trump vowed on the campaign trail to put the US at the center of the digital-asset industry, including creating a strategic Bitcoin stockpile and appointing regulators enamored with digital assets. Jubilant traders for the moment are paying little heed to questions such as the speed of likely implementation or whether a strategic stockpile is a realistic possibility.

His broader agenda of stoking domestic economic growth, tax cuts and reducing red tape has fueled a buying spree across stocks, credit and crypto. The S&P 500 equity index last week hit its 50th record this year.

Bitcoin has added about 93% so far in 2024, helped by robust demand for dedicated US exchange-traded funds and interest-rate cuts by the Federal Reserve. The rise in the token, which scaled fresh records after Tuesday’s US vote, exceeds the returns from investments such as stocks and gold.

The ETFs, powered by BlackRock Inc.’s $35 billion iShares Bitcoin Trust, posted a record daily net inflow of almost $1.4 billion on Thursday, according to data compiled by Bloomberg. A day earlier, the iShares ETF’s trading volume jumped to an all-time peak — all signs of how Trump’s victory is reshaping crypto.

Institutional Demand

Asian Stocks Fall as China Support Disappoints: Markets Wrap

(Bloomberg) — Asian shares slipped after China’s planned debt swap program looked insufficient to some investors and data showed persistent deflationary pressures.

Most Read from Bloomberg

A gauge of the region’s equities dropped over 1% Monday, with Hong Kong and mainland Chinese stocks down in early trade. Benchmarks also declined in South Korea and Australia. US futures edged higher after the S&P 500 rose 0.4% on Friday.

The broad weakness reflects lingering concerns about the prospect of the world’s No. 2 economy, after Beijing unveiled a 10 trillion yuan ($1.4 trillion) program to defuse local governments’ debt risk but stopped short of unleashing new fiscal stimulus. In addition to anemic inflation, sentiment toward China is also faltering as foreign direct investment continues to slump.

Investors had hoped for more potent stimulus measures that would directly boost demand from a key Chinese legislature meeting last week, especially after Donald Trump’s presidential victory injected fresh uncertainty over tariffs. To many economists, Beijing’s stance signals an intention to preserve room to better respond to a potential trade war when Trump takes office next year.

“I do feel that there’s a lot more behind the stimulus and I think that the market at the moment is having a very negative knee-jerk reaction,” Andy Maynard, head of equities at China Renaissance Securities, said on Bloomberg TV. “I still think from a volatility point of view, we are not out of the woods by a long, long stretch yet.”

UBS lowered its 2025 growth forecast for China following Trump’s election, expecting an “around 4%” expansion for 2025, and a “considerably lower” pace in 2026.

Elsewhere, Bitcoin surged past $81,000 for the first time, driven by the incoming president’s support for digital assets and the election of pro-crypto lawmakers.

Oil fell for a second day as a soft outlook for top importer China continued to plague the market, while iron ore declined toward $100 a ton.

The dollar was broadly steady. The yen fell 0.5% against the greenback, ahead of the Japanese parliament’s vote later Monday that’s likely to keep Prime Minister Shigeru Ishiba in the job despite a national election setback.

Federal Reserve Bank of Minneapolis President Neel Kashkari indicated at the weekend the central bank could ease rates less than previously expected amid a strong US economy. Kashkari emphasized, however, that it’s too early to determine the impact of Trump’s policies.

Nvidia's Latest Move Just Gave Supermicro Investors Some Epically Bad News

There has been no other company in the artificial intelligence (AI) realm that’s been watched as closely as Nvidia (NASDAQ: NVDA) over the last couple of years. Nvidia’s role in the AI narrative is so prominent that any announcement the company makes has the power to swing the capital markets at this point.

As the company’s upcoming launch of its new Blackwell graphics processing unit architecture (GPU) looms, all eyes are on Nvidia and its partner network. Super Micro Computer (NASDAQ: SMCI) is one player that’s been a direct beneficiary of Nvidia’s booming GPU business over the last two years.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

However, some recent reporting suggests that Nvidia may be migrating away from its reliance on Supermicro’s IT infrastructure and looking for partnerships elsewhere.

Let’s break down the situation and assess what could be influencing Nvidia’s decisions. Moreover, I’ll explore how this news has been impacting Supermicro stock and what it could mean for investors in both the near and long term.

The launch of the Blackwell chips may be the most hyped-up AI event of 2024. Nvidia CEO Jensen Huang has boasted that demand for the new chipsets is “insane.” Meanwhile, Morgan Stanley‘s research team is forecasting $10 billion in sales from Blackwell just in the fourth quarter. While all of this is good news on the surface, there are some wrinkles unfolding in the background that smart investors should be keen on watching.

According to an article posted on Digitimes, Nvidia is said to be routing Blackwell orders away from Supermicro in favor of other IT architecture specialists.

The last couple of months have been brutal for Supermicro.

Back in August, Supermicro became the subject of a short report published by Hindenburg Research. Hindenburg alleges that Supermicro’s accounting controls are weak — essentially implying that something fishy could be going on with its bookkeeping and potentially the financial outlook of the company.

To be honest, I didn’t think much of Hindenburg’s allegations at the time. After all, short-sellers have a vested interest in seeing a stock price decline — which is exactly what happened following the short report.

However, Supermicro ended up delaying its annual report following the Hindenburg report. While this wasn’t the best look, I remained cautiously optimistic about Supermicro. But then, in late October, Supermicro filed an 8-K to notify investors that its auditor, big four accounting firm Ernst & Young, had resigned.

New Head Strap For Apple Vision Pro, Election Tracking, AI Magic, And More: This Week In Appleverse

The past week was a busy one for Apple Inc. AAPL, with a flurry of announcements and updates that have left tech enthusiasts buzzing. From the unveiling of a new head strap for the Vision Pro to the transformation of Dynamic Island for election tracking, Apple has been making waves. Let’s dive into the weekend’s top stories.

Apple’s Vision Pro Gets a New Belkin Head Strap:

Apple is set to launch a new Belkin Head Strap for its first-generation mixed-reality headset, the Vision Pro’s Solo Knit band. Priced at $49.95, the strap promises superior comfort and stability with its secure locking mechanism and additional stabilization points. This new head strap is similar to the one Apple showcased at WWDC last year.

Apple Transforms Dynamic Island for Election Tracking:

Apple has revolutionized the way users can track election results by providing live updates directly on the lock screens of iPhones and iPads. On U.S. election day, Apple News rolled out a feature that allowed users to monitor the electoral count in realtime on their Dynamic Island.

iOS 18.2 Beta Brings AI Magic to iPhones:

Apple has released the first public beta version of iOS 18.2, introducing powerful new AI-driven features. Users can now register their iPhones in the Apple Beta Program to access the 18.2 beta update. The new iOS 18.2 has Image Playground, which creates images from text prompts.

Mastering iOS 18’s Control Center:

With Apple’s latest iOS 18 update, the Control Center on your iPhone has become more customizable than ever. Users can now effortlessly add, remove, or rearrange icons, create swipeable screens, and more—all without needing to dive into Settings.

Apple Bridges iOS-Android Messaging Gap:

Apple has updated its messaging system to accurately display Android user reactions on iOS, marking a major step forward in iPhone–Android messaging. Apple has addressed the long-standing issue of Android reactions appearing as separate lines on iOS. Now, when an Android user reacts to an RCS message from an iOS user, the chosen emoji will be displayed in line with the message bubble.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Rounak Jain

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.