Expect a ‘huge sucking sound’ of foreign capital flooding in as U.S. dominance of global finance increases, top economist says

Wall Street has been flying high as an expected Republican sweep in the election drives hopes for lower taxes and deregulation, and that makes U.S. financial markets more attractive to the rest of the world, a top economist said.

In an interview on Bloomberg TV on Friday, Allianz chief economic advisor Mohamed El-Erian was asked if investors should expect a positive growth shock that’s accompanied by more inflation.

“The direction of travel is clear: More growth, slightly higher inflation, a higher public sector borrowing requirement, and a huge sucking sound where a lot of foreign capital will end up in the U.S.,” he replied.

The magnitudes of those trends will become more apparent when policies from the incoming Trump administration become clearer—and when the people who will carry them out become known, El-Erian added.

Just days after the presidential election, talk of potential Cabinet appointments is already ramping up. On Friday, the Financial Times reported that Robert Lighthizer, who was U.S. Trade Representative during Trump’s first term, was asked to fill the post again.

Meanwhile, the job of Treasury secretary will likely be offered to a financier, the FT added, with hedge fund managers Scott Bessent and John Paulson seen as possibilities.

Meanwhile, the rest of the world may have more trouble coping with a period of faster growth and hotter inflation, adding to America’s relative edge, El-Erian said.

“This is a period in which U.S. dominance of the global system is going to increase, both for positive reasons and for negative reasons in the short term,” he explained. “The rest of the world simply cannot build enough pipes around the U.S. They’re trying and they’ve been doing it, but these pipes are very small compared to the size of the U.S.”

Indeed, despite fears that Trump’s tax cuts, tariffs, and immigration crackdown will be inflationary and worsen deficits, bonds yields have come back down after soaring in the immediate aftermath of the election.

El-Erian argued that’s because U.S. bonds have become more attractive relative to those from other advanced economies.

Continued demand for Treasuries would help the federal government finance what’s expected to be an explosion of debt under another Trump presidency.

Ahead of the election, the nonpartisan Committee for a Responsible Federal Budget estimated that his policies could add $7.5 trillion to the debt and possibly as much as $15.2 trillion.

But if investors, especially “bond vigilantes,” balk at the enormous volumes of debt the Treasury Department auctions, they could send yields higher and raise borrowing costs across key segments of the economy, like mortgage rates.

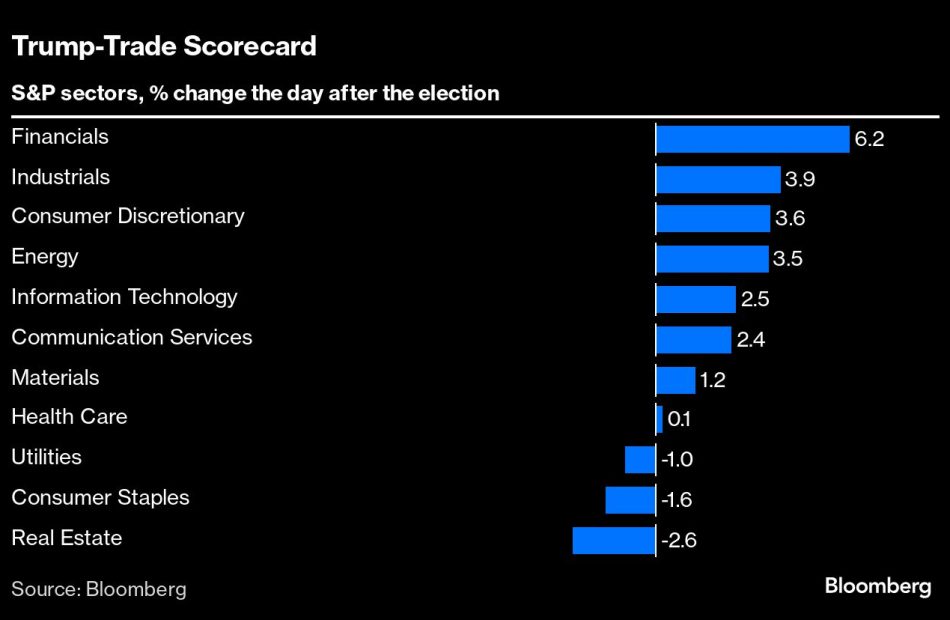

With Trump Win Boosting Stocks, Investors Hunt for Next Winners

(Bloomberg) — For investors looking past the initial risk-on rally in US equities following Donald Trump’s decisive election victory, now comes the hard part.

Most Read from Bloomberg

The Republican president-elect made plenty of campaign promises: steep tariffs, tax cuts, business-friendly deregulation and tighter immigration laws, to name some. For investors who plowed into stocks last week on speculation Trump’s policies will bolster the economy, the challenge is to figure out which sectors will get a lasting boost.

Tariffs, for example, could spark inflation and hurt large multinational firms, while potentially helping domestically oriented small-cap stocks. However, an immigration crackdown risks lifting labor costs, likely squeezing smaller businesses. Meanwhile, a friendly stance toward traditional energy that lifts production might drive down oil prices, and efforts to reverse President Joe Biden’s policies designed to help the clean-energy and electric-vehicle industries could have a hard time getting through Congress.

“I expect active investors to start using a scalpel to sift through at industry levels to see which companies and industries might benefit now,” said Eric Clark, a portfolio manager at Accuvest Global Advisors. “In time we will get more data points on what will actually be implemented and how to play that.”

Clark has already acted on some opportunities. As banks, industrials, energy and big-technology stocks pushed the equities market higher on Wednesday, he sold some tech and financial shares. He also bought stocks in luxury retail and consumer staples — which were in the red amid the surge.

Clearer Picture

Small-cap stocks rallied last week, and they appear to be in a sweet spot as traders assess the potential policy backdrop ahead. These companies, which make most of their revenue at home, stand to benefit from heightened protectionism. A possible corporate-tax cut should also help.

Trump has proposed a 10% to 20% across-the-board levy on imports, and as high as 60% on China-made goods. The prospect that at least some tariffs will come to fruition helped drive the Russell 2000 Index — a benchmark for small-cap stocks — up 8.6% last week. Digital payments company Sezzle Inc., one of the gauge’s top gainers, doubled during that time.

Financial stocks are also seen as being in a strong position, given Trump’s pledge to make changes to regulatory bodies that have pursued tougher banking rules under Biden. As Wells Fargo & Co. bank analyst Mike Mayo sees it, a new era of deregulation could boost Wall Street profitability. Shares of Citigroup Inc., Goldman Sachs Group Inc. and JPMorgan Chase & Co. soared on Trump’s victory.

Shaq Buys Out Delivery Team's Van and Car, Leaving Them To Catch An Uber

Former NBA superstar Shaquille O’Neal made an unexpected addition to his car collection, acquiring a new Mercedes-Benz Sprinter and an S-Class in a spontaneous purchase.

What Happened: O’Neal had a custom Mercedes-Benz Sprinter delivered to his Atlanta estate. The luxury vehicle, customized by Effortless Motors, features a fully decked out cabin in brown leather, ambient lighting, an LCD screen, and a refrigerator.

Upon the delivery of the Sprinter, O’Neal also decided to purchase the S-Class that the Effortless Motors team arrived in, leaving them to return via Uber, reports Autoevolution.

The S-Class, as per the Instagram post, is an S 550 model. According to the outlet Shaq had totally forgotten he’d ordered a Sprinter. “Oh, that’s right, I bought a Sprinter!” he said, surprised, when he saw it parked in his driveway.

Also Read: NBA Legend Shaq Admitted That He ‘Never Voted’ In Presidential Election Until 2020

But his attention was quickly drawn to the stylish S-Class that the tuner’s team drove over in. “I’m getting this one right now!” Shaq excitedly told the owner.

The current W223 lineup does not include an S 550 for America, suggesting the vehicle could be either the S 500 4MATIC Sedan or the S 580e 4MATIC with a plug-in hybrid system.

Why It Matters: O’Neal’s love for unique and eye-catching cars is well-known. His collection boasts several Rolls-Royces, a custom TRX Apocalypse truck, and three Tesla Cybertrucks.

The latest purchases not only expand his collection but also highlight his preference for luxury and comfort.

The customization of the Sprinter by Effortless Motors underscores the growing trend of personalized luxury vehicles among celebrities.

Read Next

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Anthony Scaramucci Sued By FTX, Says Bankman-Fried Made Investments In SkyBridge Endeavors That 'Conveyed Little To No Benefit'

FTX, once a leading crypto exchange for Bitcoin BTC/USD, Ethereum ETH/USD and Dogecoin DOGE/USD, has reportedly filed a lawsuit against former White House communications director Anthony Scaramucci as well as his hedge fund SkyBridge Capital.

What Happened: The lawsuit against Scaramucci is one among the 23 filed by FTX in the bankruptcy court of Delaware on Friday in a bid to gather money for the creditors of the now-bankrupt crypto exchange, Bloomberg reported. Plaintiffs of the lawsuit include digital-asset exchange Crypto.com and political groups such as the Mark Zuckerberg-founded FWD.US, the report added.

According to FTX, its founder Sam Bankman-Fried made “lavish and showy ‘investments’” through the crypto winter of 2022 including in Scaramucci for an “established financial, political, and social” network.

FTX claims in the court filings viewed by Bloomberg that the investments “conveyed little to no benefit,” and “instead served only to prop up Bankman-Fried’s standing in the worlds of politics and traditional finance.”

Why It Matters: According to FTX, Bankman-Fried invested $67 million into various SkyBridge endeavors in 2022 when SkyBridge’s assets under management had fallen to about $2.2 billion from a $9 billion high in 2015.

FTX Ventures bought a 30% stake in SkyBridge Capital in September 2022. Scaramucci then said that the firm plans to deploy capital raised from the FTX transaction to purchase more crypto assets.

FTX subsequently collapsed in November 2022.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

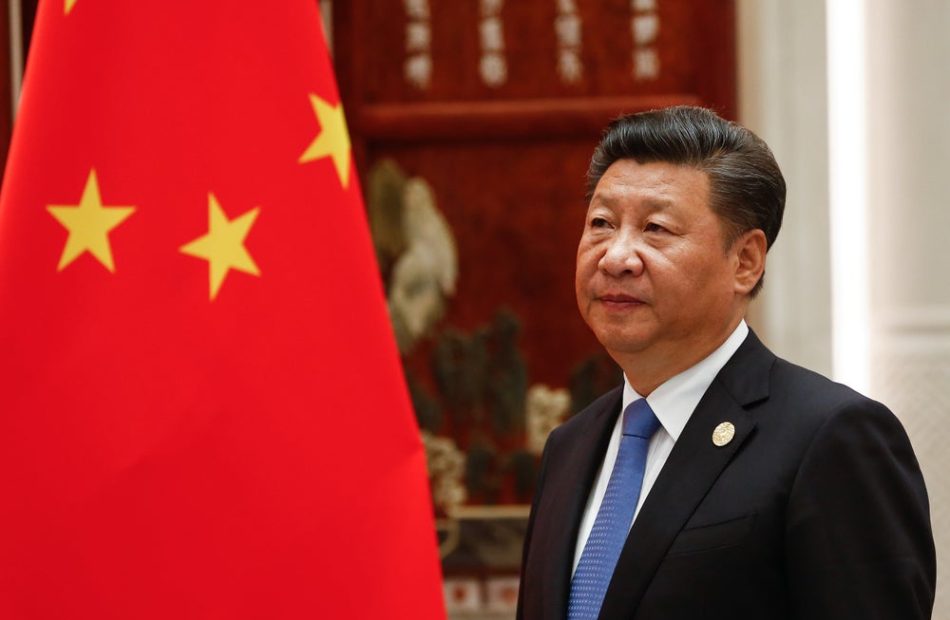

Xi Jinping Courts US Allies To Counter Trump's Trade Threats: Report

In response to President-elect Donald Trump’s threats to isolate Chinese goods from the U.S. market, China is reportedly seeking to engage U.S. allies in Europe and Asia to mitigate the potential impact on its economy.

What Happened: Trump’s campaign promise to impose tariffs of up to 60% on Chinese imports poses a significant threat to Xi Jinping‘s economic model, which is heavily reliant on manufacturing and exports, reported The Wall Street Journal on Thursday.

To counter this, the Chinese leadership is reportedly considering offering tariff cuts, visa exemptions, and other incentives to U.S. allies in Europe and Asia. This strategy, termed “unilateral opening,” represents a shift from China’s traditional quid-pro-quo approach to economic and diplomatic deals.

See Also: Kentucky Gov. Beshear: ‘The Jury Is No Longer Out,’ Kentuckians Want Medical Cannabis

Despite this, China faces resistance from U.S. allies, with the European Union (EU) expressing discontent over China’s support for Russia’s actions in Ukraine. Meanwhile, U.S. allies in Asia, such as Japan, South Korea, and the Philippines, are growing increasingly wary of China’s assertive behavior.

China has already lifted visa restrictions for travelers from over 20 nations, including Australia, New Zealand, Denmark, Finland, and South Korea. Additionally, the country is contemplating significant tariff reductions in various industries, including electrical and telecommunications equipment, seafood, and agricultural products. These moves are seen as part of China’s broader strategy to stimulate economic growth and strengthen its trade relations.

Chinese Premier Li Qiang stated at a trade fair in Shanghai that China would continue to pursue unilateral opening to provide opportunities for foreigners to access the Chinese market.

Why It Matters: Through this new strategy, Beijing aims to capitalize on fears in Europe and Asia that Trump will revive his often hostile rhetoric against U.S. allies. By taking the initiative, China hopes to increase pressure on the U.S. and attempt to divide its allies.

Trump’s victory in the U.S. presidential election has also led to a decline in U.S.-listed Chinese stocks, with analysts warning of a potential escalation in U.S.-China tensions and its impact on trade policies. Major U.S.-listed Chinese stocks Alibaba Group Holding BABA, JD.com, Inc. (NASDAQ: JD), Baidu, Inc. BIDU, NIO Inc. NIO, Li Auto Inc. LI, and XPeng Inc. (NYSE: XPEV) were trading lower in the U.S. after Trump’s victory.

Read Next: How To Earn $500 A Month From Nvidia Stock After Trump Win

Photo by Gil Corzo on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Asks Nvidia, Apple Supplier TSMC To Halt Shipments To China After Its Chip Was Found In Huawei AI Processor: Report

The U.S. has reportedly asked Nvidia, Apple’s key supplier Taiwan Semiconductor Manufacturing Co TSM to halt shipments of chips used in AI applications to customers from China.

What Happened: The U.S. asked TSMC to not ship the advanced chips starting Monday in a letter from the Department of Commerce, Reuters reported, citing a person familiar with the matter. The order pertains to certain chips, of 7 nanometers or more advanced designs, that power AI accelerator and graphics processing units, the report said.

The U.S. Department of Commerce reportedly sent the letter to TSMC weeks after the company informed the department that one of its chips had been found in a Huawei AI processor.

Huawei is on the U.S.’ restricted trade list, mandating suppliers to get licenses for any goods or technology shipped to the company.

Why It Matters: It is not evident how the TSMC chip ended up on Huawei’s Ascend 910B “multi-chiplet” processor. However, TSMC has notified its affected clients from China that it is suspending shipments of the chips starting Monday, the report said.

The Commerce Department sent similar letters to Nvidia and AMD restricting their ability to export AI chips to China in 2022.

The restrictions imposed in those letters were later turned into rules, Reuters noted.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Faces NHTSA Scrutiny Over Social Media Promotion Of FSD Technology That Shows 'Disengaged Driver Behavior'

The National Highway Traffic Safety Administration (NHTSA) flagged concerns about Tesla Inc‘s TSLA projection of its Full Self Driving (FSD) driver assistance software on social media platform X in a letter to the EV giant.

What Happened: Tesla’s FSD technology is a driver assistance technology that requires active driver supervision. While vehicle owner manuals and YouTube videos clarify that the technology does not make the vehicle autonomous, Tesla’s X account has reported or endorsed postings that “exhibit disengaged driver behavior,” the auto safety regulator wrote in a letter to Tesla dated May 14. The letter was made public on Friday.

“We believe that Tesla’s postings conflict with its stated messaging that the driver is to maintain continued control over the dynamic driving task. We similarly observe that these postings may encourage viewers to see FSD-Supervised as a Chauffer or “Robotaxi” rather than a partial automation / driver assist system that requires persistent attention and intermittent intervention by the driver,” the regulator said while requesting the EV giant to revisit its communications. The regulator also noted that social media posts communicate better with the public than vehicle owners’ manuals.

Why It Matters: In October, NHTSA opened an investigation into nearly 2.4 million Tesla vehicles on the heels of reports of four crashes where FSD was engaged.

The regulator said that it has identified four crash reports in which a Tesla experienced a crash after entering an area of “reduced roadway visibility” with FSD engaged. The reduced visibility, the regulator said, was caused by sun glare, fog, or airborne dust. In one of the crashes, the vehicle struck and killed a pedestrian, the regulator added.

The regulator has now given Tesla time till Dec. 18 to answer its questions as part of the investigation and to furbish details of crashes that the company is aware of.

Tesla issued a recall for over 2 million vehicles in the U.S. in December equipped with all versions of Autosteer (part of Tesla’s suite of advanced driver assistance features called autopilot) after deeming the feature’s controls to be insufficient to prevent misuse. The company said it would enhance its safeguards but NHTSA opened a probe in April to gauge the adequacy of the fix provided by the carmaker.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Made Big Gains Among Latino, Working Class, and Younger Voters

President-elect Donald Trump achieved a decisive victory over Vice President Kamala Harris, making significant gains with key voter groups, including white working-class voters, Latino voters, and younger Americans.

His support among Latinos surged by 14 percentage points compared to 2020, particularly in battleground states like Pennsylvania, Michigan, and Wisconsin, reported BBC.

In Pennsylvania, Trump’s appeal to the growing Latino population was evident, with 42% of Latino voters backing him, a significant jump from 27% in 2020.

Trump gained support in Pennsylvania’s “Latino belt” due to a strong economic message, particularly about inflation. Many Latinos felt their family values aligned more with the Republican Party. Trump’s stance on social issues also resonated with voters in the area. Additionally, his strict immigration policies, including border control, appealed to many in the Latino community.

Also Read: CIA Could Be Politicized Under Trump, With Loyalists Eyeing Key Intel Roles

Trump also made unexpected inroads among younger voters, especially men, and doubled his support from Black voters in Wisconsin, where his share rose from 8% in 2020 to 22% in this election.

In Michigan, Trump gained ground in rural areas and working-class suburbs of Detroit, particularly Macomb County, by emphasizing economic issues like inflation and high interest rates.

Trump’s coalition, which includes a broad range of demographics, proved decisive, while Harris struggled to maintain Biden’s 2020 support among working-class voters and in key swing states.

Also Read:

Photo: Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.