Donald Trump Reportedly Eyeing The First Crypto-Focused Role In The White House

President-elect Donald Trump’s transition team is considering creating the first-ever White House role dedicated to cryptocurrency policy, signaling a potential shift in the U.S. government’s approach to digital assets.

What Happened: The Trump transition team is evaluating candidates for a role that would act as a bridge between the White House, Congress, and regulatory agencies like the SEC and CFTC.

Bloomberg reported on Wednesday that while the exact nature of the position remains unclear, industry advocates are pushing for direct access to Trump.

The creation of this position aligns with Trump’s campaign promises to overhaul crypto regulation, including replacing SEC Chair Gary Gensler and forming a new crypto advisory council.

Key industry players are already vying for influence.

Brian Brooks, a former executive at Coinbase and Binance.US, met with Trump at Mar-a-Lago, while Coinbase CEO Brian Armstrong reportedly held discussions with the president-elect this week.

Also Read: A Hedge Fund Hit Big On Trump’s Rumored Crypto Acquisition And Could Be Up $14.15 Million

Why It Matters: Trump’s connection to the crypto industry runs deep.

During his campaign, he promised substantial reforms and frequently engaged with Bitcoin mining firms and exchange executives.

In July, he even addressed a Bitcoin conference, further solidifying his interest in the sector by stating he will U.S. the crypto capital of the planet.

Beyond policy, Trump has made personal forays into the crypto space, including the release of his fourth NFT collection.

His media venture, Trump Media & Technology Group, has also expressed interest in acquiring Bakkt Holdings, a company specializing in crypto custody and trading.

Meanwhile, private equity billionaire Marc Rowan, a potential Treasury Secretary pick, admitted limited expertise in crypto’s role within the U.S. financial system, indicating the potential significance of a dedicated crypto-focused role.

Read Next:

Image: Shuterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DoubleTree by Hilton Greensboro Airport Celebrates Grand Reopening with Ribbon-Cutting Event After Extensive Renovations

GREENSBORO, N.C., Nov. 20, 2024 /PRNewswire/ — DoubleTree by Hilton Greensboro Airport successfully held its grand opening and ribbon-cutting ceremony, celebrating the completion of extensive renovations to the property. The event welcomed local dignitaries, business leaders, members of the Greensboro Chamber of Commerce, Visit Greensboro, and members of the community to experience the revitalized spaces. The hotel is managed by Commonwealth Hotels, a Covington, Kentucky-based hotel management company, and owned by SMP Greensboro LLC which is a part of the Scale My Portfolio group which partners with retail investors to buy Commercial real estate assets such as hotels and Apartment communities around the country.

Located just minutes from Piedmont Triad International Airport, DoubleTree by Hilton Greensboro Airport has served as a prominent hospitality venue in Greensboro. The newly updated property now combines DoubleTree brand’s signature comfort with modern design and enhanced amenities, meeting the needs of today’s travelers.

Renovations included newly designed guestrooms, modernized lobby and public spaces, refreshed dining options, and enhanced meeting and event spaces.

Guests at the event had the opportunity to tour the renovated spaces, meet with the hotel’s management team, and enjoy light refreshments. A memorable photograph was taken as local leaders and hotel representatives participated in the ceremonial ribbon cutting.

“We are thrilled to welcome guests to see our transformed property and experience our commitment to excellence firsthand,” said Jennifer Porter, president of Commonwealth Hotels. “These renovations reflect our dedication to providing the highest quality of service and comfort to all who stay with us.”

With these renovations, DoubleTree by Hilton Greensboro Airport remains a top choice for travelers to Greensboro, offering all the signature touches of the brand, including its iconic warm chocolate chip cookie at check-in.

For more information about the DoubleTree by Hilton Greensboro Airport or to book your stay, please visit DoubleTree by Hilton Greensboro Airport or call 336-668-0421.

About Commonwealth Hotels

Commonwealth Hotels was founded in 1986 and is a proven partner in providing hotel management services with superior financial results. The company has extensive experience managing premium branded full-service and select-service hotels. Additional information may be found at commonwealthhotels.com

About Scale My Portfolio

Scale My Portfolio has been involved in over $400mm of Commercial Real Estate transactions across 16 properties over the past 10+ years. The company has over 650 investors who it partners with to invest in assets such as hotels and apartment communities and it offers investors above average returns for investing passively in these assets. Additional Information can be found at www.ScaleMyPortfolio.com

Contact

Barbara E. Willen

Commonwealth Hotels, LLC

bwillen@commonwealthhotels.com

859.392-2254

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/doubletree-by-hilton-greensboro-airport-celebrates-grand-reopening-with-ribbon-cutting-event-after-extensive-renovations-302311974.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/doubletree-by-hilton-greensboro-airport-celebrates-grand-reopening-with-ribbon-cutting-event-after-extensive-renovations-302311974.html

SOURCE Commonwealth Hotels, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Broadcom (AVGO) Stock?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

As NVIDIA Corp prepares to release its highly anticipated earnings report Wednesday evening, investors are watching closely for the potential ripple effects on the broader market—and particularly on peer stocks like Broadcom Inc (NASDAQ:AVGO).

What To Know: Nvidia’s dominance in AI-driven technology and its pivotal role in the S&P 500’s performance make its results a market-moving event, with implications for key players in the semiconductor industry.

Broadcom, like Nvidia, has leveraged the surging demand for AI infrastructure. It supplies high-performance networking chips and custom silicon that power data centers—critical components for Nvidia’s AI-focused operations.

Don’t Miss:

A strong earnings beat from Nvidia could reinforce investor confidence in AI growth prospects, lifting sentiment around Broadcom as a beneficiary of the same demand drivers. Conversely, a disappointing Nvidia report could signal a slowdown in AI investments, weighing on Broadcom’s outlook.

Historically, Broadcom’s stock has moved in tandem with Nvidia’s during major market reactions. Nvidia’s implied one-day move of 12.5% adds volatility to the semiconductor sector, underscoring the high stakes.

By now you’re likely curious about how to participate in the market for Broadcom – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy ‘fractional shares,’ which allows you to own portions of stock without buying an entire share. For example, some stock, like Berkshire Hathaway, can cost thousands of dollars to own just one share. However, if you only want to invest a fraction of that, brokerages will allow you to do so.

If you’re looking to bet against a company, the process is more complex. You’ll need access to an options trading platform, or a broker who will allow you to ‘go short’ a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Smart Money Move: Michael J Roper Grabs $149K Worth Of Sadot Group Stock

A new SEC filing reveals that Michael J Roper, Chief Executive Officer at Sadot Group SDOT, made a notable insider purchase on November 20,.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Roper purchased 44,642 shares of Sadot Group. The total transaction amounted to $149,997.

The latest update on Wednesday morning shows Sadot Group shares up by 5.96%, trading at $3.2.

Delving into Sadot Group’s Background

Sadot Group Inc operates in the food supply chain sector, connecting producers and consumers across the globe, delivering agri-commodities from producing geographies such as the Americas, Africa, and the Black Sea to consumer markets in Southeast Asia, China, and the Middle East/North Africa (MENA) region. Its reportable segment includes Sadot food service and Sadot agri-foods. The key revenue is coming from the Sadot agri-foods segment which engaged in farming, commodity trading, and shipping of food and feed.

Financial Insights: Sadot Group

Revenue Growth: Sadot Group’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 10.74%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 1.22%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Sadot Group’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.25.

Debt Management: Sadot Group’s debt-to-equity ratio is below the industry average. With a ratio of 0.11, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 10.07 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.02 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 3.41, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Unlocking the Meaning of Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Sadot Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bullish Move: Kevin James Mohan Shows Confidence, Acquires $124K In Sadot Group Stock

A new SEC filing reveals that Kevin James Mohan, Chief Investment Officer at Sadot Group SDOT, made a notable insider purchase on November 20,.

What Happened: Mohan demonstrated confidence in Sadot Group by purchasing 37,202 shares, as reported in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the transaction is $124,998.

During Wednesday’s morning session, Sadot Group shares up by 5.96%, currently priced at $3.2.

Discovering Sadot Group: A Closer Look

Sadot Group Inc operates in the food supply chain sector, connecting producers and consumers across the globe, delivering agri-commodities from producing geographies such as the Americas, Africa, and the Black Sea to consumer markets in Southeast Asia, China, and the Middle East/North Africa (MENA) region. Its reportable segment includes Sadot food service and Sadot agri-foods. The key revenue is coming from the Sadot agri-foods segment which engaged in farming, commodity trading, and shipping of food and feed.

Sadot Group’s Financial Performance

Revenue Growth: Sadot Group’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 10.74%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 1.22%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Sadot Group exhibits below-average bottom-line performance with a current EPS of 0.25.

Debt Management: Sadot Group’s debt-to-equity ratio is below the industry average. With a ratio of 0.11, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 10.07, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.02 is lower than the industry average, implying a discounted valuation for Sadot Group’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 3.41, Sadot Group could be considered undervalued.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Sadot Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

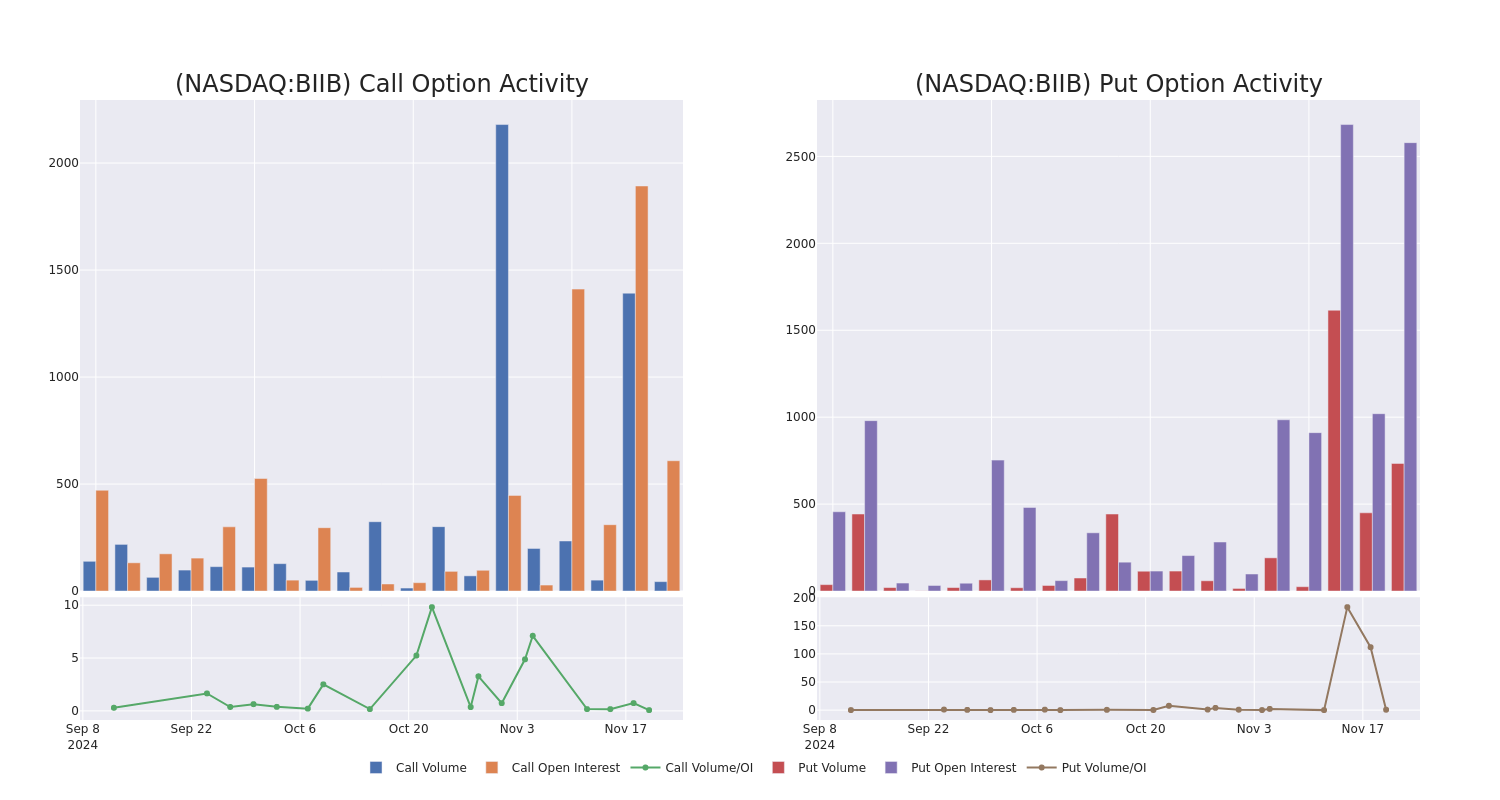

Biogen Unusual Options Activity For November 20

Investors with a lot of money to spend have taken a bearish stance on Biogen BIIB.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with BIIB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Biogen.

This isn’t normal.

The overall sentiment of these big-money traders is split between 22% bullish and 66%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $198,898, and 4 are calls, for a total amount of $138,060.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $130.0 to $200.0 for Biogen over the last 3 months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Biogen’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Biogen’s substantial trades, within a strike price spectrum from $130.0 to $200.0 over the preceding 30 days.

Biogen Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BIIB | PUT | TRADE | BEARISH | 11/22/24 | $2.35 | $1.35 | $2.0 | $155.00 | $60.0K | 1.5K | 663 |

| BIIB | CALL | TRADE | BEARISH | 04/17/25 | $22.6 | $18.3 | $19.32 | $150.00 | $48.3K | 0 | 25 |

| BIIB | PUT | TRADE | BULLISH | 12/20/24 | $29.6 | $21.7 | $24.0 | $180.00 | $48.0K | 111 | 20 |

| BIIB | CALL | SWEEP | BULLISH | 04/17/25 | $8.6 | $7.8 | $8.6 | $175.00 | $35.2K | 19 | 4 |

| BIIB | PUT | SWEEP | BEARISH | 11/22/24 | $2.1 | $1.55 | $2.09 | $155.00 | $33.5K | 1.5K | 0 |

About Biogen

Biogen and Idec merged in 2003, combining forces to market Biogen’s multiple sclerosis drug Avonex and Idec’s cancer drug Rituxan. Today, Rituxan and next-generation antibody Gazyva (oncology) and Ocrevus (multiple sclerosis) are marketed via a collaboration with Roche. Biogen markets several multiple sclerosis drugs including Plegridy, Tysabri, Tecfidera, and Vumerity. Biogen’s newer products include Spinraza (SMA, with partner Ionis), Leqembi (Alzheimers, with partner Eisai), Skyclarys (Friedreich’s Ataxia, Reata), Zurzuvae (postpartum depression, Sage), and Qalsody (ALS, Ionis). Biogen has several drug candidates in phase 3 trials in neurology, immunology, and rare diseases.

Following our analysis of the options activities associated with Biogen, we pivot to a closer look at the company’s own performance.

Where Is Biogen Standing Right Now?

- Trading volume stands at 839,529, with BIIB’s price down by -0.49%, positioned at $154.67.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 83 days.

Professional Analyst Ratings for Biogen

In the last month, 5 experts released ratings on this stock with an average target price of $261.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Needham downgraded its action to Buy with a price target of $270.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Biogen with a target price of $255.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $270.

* An analyst from Baird has decided to maintain their Outperform rating on Biogen, which currently sits at a price target of $300.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Biogen, targeting a price of $210.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Biogen with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brazilian Fintech Nubank Considers Domicile Move to UK

(Bloomberg) — Brazilian financial-technology company Nu Holdings Ltd. is considering plans to shift its legal base to the UK, in a move that would mark a major win in Britain’s push to encourage more tech companies to move to the country.

Most Read from Bloomberg

The digital challenger bank has been working with the British government on the plans, which were discussed as part of a broader set of agreements between Brazil and the UK on Tuesday on the sidelines of the Group of 20 leaders’ summit in Rio de Janeiro, according to people familiar with the talks.

The change in domicile was not included in a joint announcement by the two governments penned on Tuesday since it was still pending approval from the UK’s HM Revenue & Customs authority, according to two of the people, who asked not to be named discussing private information.

“Nubank continuously reviews its corporate legal structure to align with the footprint of its operations,” a spokesperson for the company said in a statement. “At this time, no decision has been made regarding the redomiciliation of Nu Holdings Ltd. or any other legal entities within our group. As a publicly traded company, we are committed to transparency and will follow standard communication protocols if and when any such decisions are made.”

Nubank — whose holding company is currently based in the Cayman Islands and is listed on the New York Stock Exchange — recently became the most valuable bank in all of Latin America. While its corporate headquarters would remain in Sao Paulo, Brazil, the change in legal domicile to the UK would be seen as a big achievement in efforts by British Prime Minister Keir Starmer’s government to attract more technology firms and investment to the country.

Last month, the UK Department for Science, Innovation and Technology said it was opening an office to speed up approvals of novel technologies. The new body, called the Regulatory Innovation Office, is designed to reduce the time entrepreneurs wait to get inventions to market and streamline the regulatory hurdles they must deal with.

The Labour government has been courting tech companies and investors as it faces a broad decline in sentiment among businesses, after Chancellor of the Exchequer Rachel Reeves unveiled £40 billion ($50.5 billion) of tax increases in its first budget. Measures included raising the national insurance payroll tax for businesses to 15% and reducing the threshold at which companies start paying the tax. The government also raised capital gains tax and scrapped the value-added-tax exemption on public-school fees.

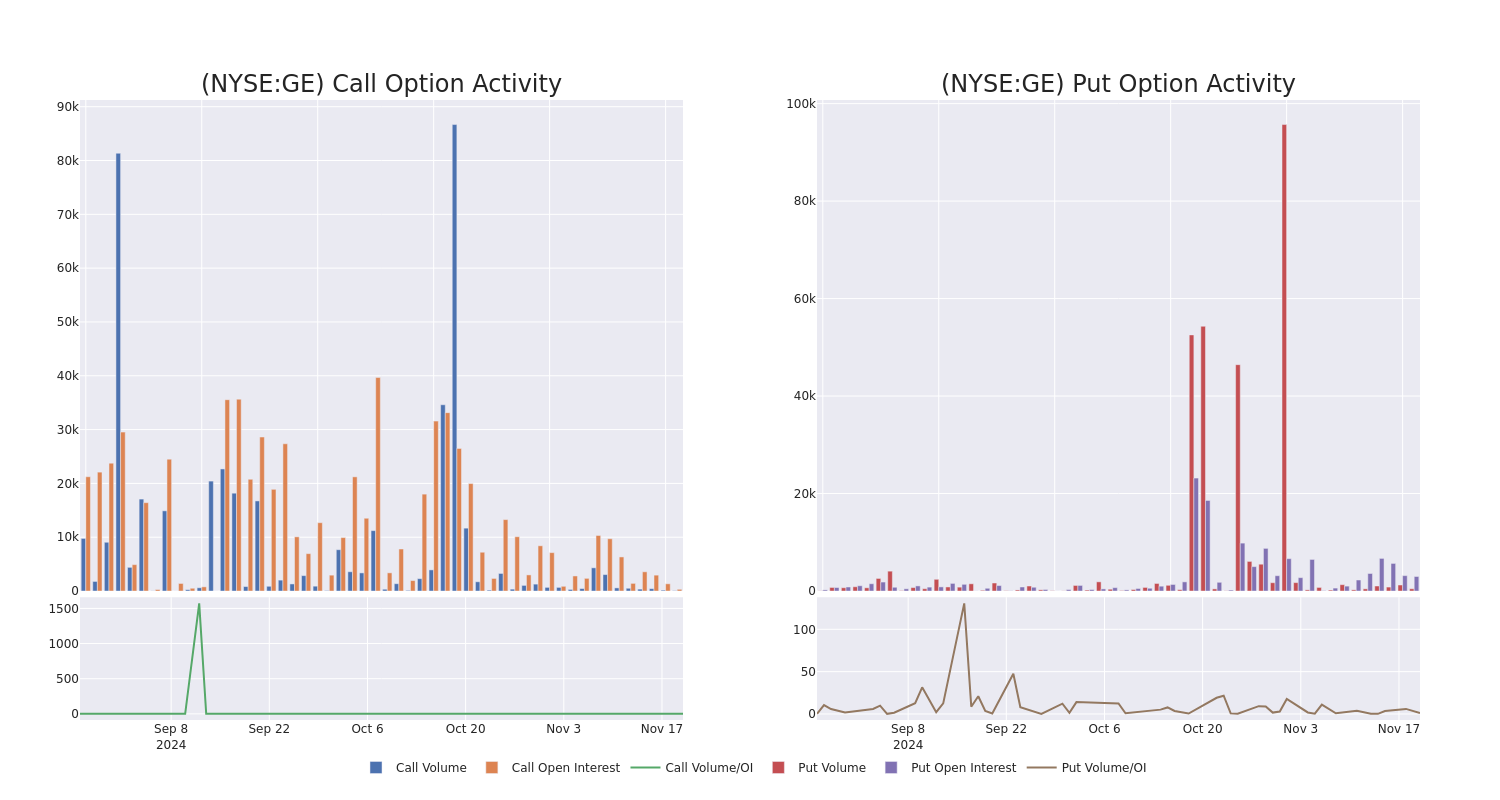

This Is What Whales Are Betting On GE Aero

Whales with a lot of money to spend have taken a noticeably bullish stance on GE Aero.

Looking at options history for GE Aero GE we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 12% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $298,514 and 2, calls, for a total amount of $70,600.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $175.0 to $200.0 for GE Aero over the recent three months.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for GE Aero’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across GE Aero’s significant trades, within a strike price range of $175.0 to $200.0, over the past month.

GE Aero Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | PUT | SWEEP | NEUTRAL | 02/21/25 | $11.55 | $11.5 | $11.55 | $180.00 | $51.9K | 172 | 48 |

| GE | PUT | SWEEP | BULLISH | 01/17/25 | $24.25 | $23.25 | $23.34 | $200.00 | $51.3K | 1.3K | 44 |

| GE | PUT | TRADE | BULLISH | 01/17/25 | $9.55 | $9.4 | $9.44 | $180.00 | $50.0K | 972 | 66 |

| GE | PUT | SWEEP | BULLISH | 01/17/25 | $9.45 | $9.25 | $9.26 | $180.00 | $49.0K | 972 | 197 |

| GE | PUT | SWEEP | BULLISH | 02/21/25 | $18.25 | $17.75 | $17.91 | $190.00 | $48.3K | 79 | 27 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

GE Aero’s Current Market Status

- With a trading volume of 1,683,143, the price of GE is down by -0.11%, reaching $177.37.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 62 days from now.

What Analysts Are Saying About GE Aero

4 market experts have recently issued ratings for this stock, with a consensus target price of $210.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on GE Aero, which currently sits at a price target of $210.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for GE Aero, targeting a price of $200.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on GE Aero with a target price of $230.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for GE Aero, targeting a price of $200.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for GE Aero with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.