Toyota aims to ramp up China production in a strategy pivot

By Maki Shiraki

TOKYO (Reuters) – Toyota aims to make at least 2.5 million vehicles a year in China by 2030, three people said, an overhaul that will see it bring its Chinese sales and production operations closer together and allow local executives a freer hand in development,

The plan, which has not been previously reported, represents a strategic pivot by the world’s top selling automaker in the world’s largest car market, underlining its ambition to claw back business lost to BYD and other local players in recent years.

Toyota’s strategy is in contrast to that of other global automakers, including Japanese ones, that are either scaling back or pulling out of China.

It aims to boost production to as much as 3 million vehicles a year by the end of the decade, two of the people said. However, it has stopped short of establishing a formal target, the three people said. All of the people declined to be identified because the matter has not been made public.

The bigger number represents a 63% increase on the record 1.84 million vehicles it produced in China in 2022. Last year it produced 1.75 million vehicles there.

Toyota has informed some suppliers of the intended ramp-up, in the hope of reassuring parts makers of its commitment to China and thereby securing its supply chain, the people said.

In response to questions from Reuters, Toyota said in a statement: “With the intense competition in the Chinese market, we are constantly considering various initiatives”. It said it would continue to work on making “ever-better cars” for the Chinese market.

The Japanese automaker aims to bring the sales and production operations of its two Chinese joint ventures closer together, to improve efficiency, two of the people said.

It also intends transfer as much of the development responsibility as possible to China-based staff who have a better grasp of local market preferences, particularly around electrified and connected car technology, two of the people said.

The moves signal a growing awareness within Toyota that it needs to rely more on local staff to take charge and speed up product development in China, one of the people said, adding that otherwise “it will be too late”.

Legacy automakers, Toyota included, have been outmaneuvered in China as domestic EV makers rapidly roll out affordable, battery-powered cars with advanced technology.

Last year Toyota announced plans to deepen cooperation among its R&D centre in Jiangsu province and its two local joint ventures.

One problem, representative of Toyota’s broader woes, is that vehicles developed independently by joint venture partners are selling better than those produced with Toyota.

Charting the Global Economy: Trump Win Reverberates Around the World

(Bloomberg) — Donald Trump’s decisive win of the US presidential election has world leaders already preparing for how his next administration will shape the global economy.

Most Read from Bloomberg

In China, factories ramped up shipments ahead of Christmas holidays and likely in anticipation of worsening trade tensions. Emerging markets were hit hard as the dollar and US yields soared. And back in the US, economists predict Trump’s proposals — particularly on tariffs — would stoke inflation and depress growth.

Speaking after the Federal Reserve cut interest rates by a quarter point, Chair Jerome Powell said Trump’s re-election will have “no effect” on the central bank’s policy decisions in the near-term. The Bank of England also lowered borrowing costs for the second time this year.

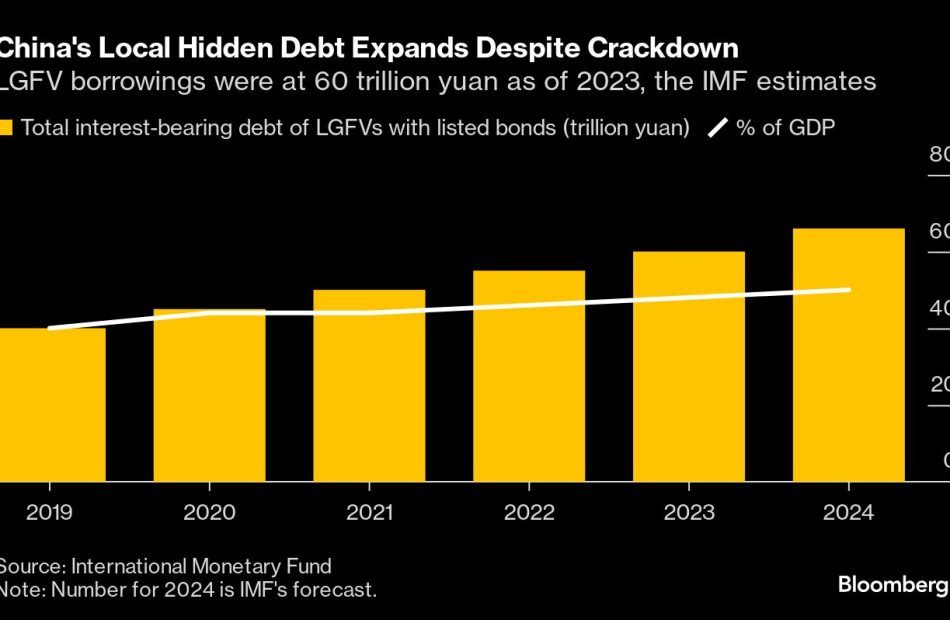

China gave indebted local governments a 10 trillion yuan ($1.4 trillion) lifeline but stopped short of unleashing new stimulus, preserving room to respond to a potential trade war when Trump takes office next year.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

The former and soon-to-be next president has promised an escalation of tariffs on all US imports and the biggest mass deportation of migrants in history. He also wants a say in Federal Reserve policy. Many economists reckon the platform adds up to higher inflation and slower growth ahead.

Trump’s stunning and decisive election victory has already led to a frantic repricing in financial markets around the world. Powell will need to reassure global investors that the Fed can manage the impact of a second Trump term — especially if accompanied with a Republican sweep of Congress — that’s already shifting expectations for the path of monetary policy.

Asia

Chinese officials unveiled details of a program to refinance “hidden” local debt onto public balance sheets at a press briefing in Beijing on Friday. While policymakers didn’t announce measures to directly stimulate domestic demand, Finance Minister Lan Fo’an promised “more forceful” fiscal policy next year, signaling bolder steps could come after Trump’s inauguration in January.

China’s export growth surged in October to the fastest pace since July 2022, extending a months-long boost to the economy that may be jeopardized by Trump’s reelection and his tariff threats. Last year, Chinese companies shipped $500 billion in goods to America, accounting for 15% of the value of all its exports.

Prediction: President-Elect Donald Trump Reclaiming the White House Paves the Way for This Multitrillion-Dollar Investment to Send Stocks Soaring

No event has been more anticipated in 2024 than Election Day. With current President Joe Biden stepping aside, it was a certainty that someone new would lead our great nation forward over the coming four years.

Although not every aspect of the legislative process has relevance to the stock market, elections do, ultimately, determine which elected officials will shape fiscal policy on Capitol Hill. While some aspects of election night are still being determined, as of the time of this writing on Nov. 6, the biggest question of all has been answered: Who will be president?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

In the early morning hours on Wednesday, Nov. 6, the Associated Press called the election for the former president and now President-Elect Donald Trump.

During Trump’s first term as president, which ran from his inauguration on Jan. 20, 2017 through Jan. 19, 2021, the stock market performed exceptionally well. The ageless Dow Jones Industrial Average (DJINDICES: ^DJI), broad-based S&P 500 (SNPINDEX: ^GSPC), and growth stock-propelled Nasdaq Composite (NASDAQINDEX: ^IXIC) respectively rose by 56%, 67%, and 138%.

But the latter half of Trump’s presidency was also characterized by the initial stages of the COVID-19 pandemic, which resulted in historically low interest rates and rounds of fiscal stimulus from the federal government. This is to say that trying to compare what happened in his first term to what may occur in the second is night-and-day different.

While Wall Street’s post-election reaction was resoundingly optimistic, policy questions and concerns do remain.

For example, President-Elect Trump has stated that he’d like to institute tariffs on goods imported into the U.S. Goods imported from China, the world’s No. 2 economy by gross domestic product, would face a 60% tariff under Trump’s proposal, while goods imported from all other countries would endure a tariff of up to 20%.

The purpose of tariffs is to promote domestic production and make American-made products more price-competitive with goods being imported into the United States. However, tariffs can have unintended consequences. Specifically, they can increase costs for consumers and businesses, as well as worsen trade relations with China and our allies.

There’s also concern about America’s rapidly rising national debt. With Donald Trump favoring low tax rates for corporate America and working Americans, it raises the question of what, if any, progress will be made in reducing the federal deficit during his second term in the Oval Office.

Trump's Victory, Powell's Stand, And Furman's Inflation Warning Stir Markets: This Week In Economics

The past week has been a whirlwind of economic and political events. From the Federal Reserve’s rate cut to the re-election of Donald Trump, the landscape of the U.S. economy has been significantly shaped.

Here’s a quick recap of the top stories that made headlines over the weekend.

Furman’s Inflation Warning

Jason Furman, a key economist from the Obama administration, expressed skepticism about the Federal Reserve’s risk assessment. He pointed out that the core PCE inflation is above the target and warned that it could further rise. This could potentially disrupt the Fed’s planned rate reduction schedule unless there’s a significant weakening in the labor markets.

Powell’s Firm Stand

Amidst speculations about his potential resignation following Trump’s victory, Federal Reserve Chair Jerome Powell firmly dismissed such rumors. He stated that the president cannot legally fire the central banker and made it clear that he has no plans to leave his position.

See Also: Trump’s Historic Return: 7 Ways His Second Term Could Impact The US Economy

Trump’s Tax and Tariff Plans

President-elect Trump has hinted at replacing income taxes with tariffs. His specific plans concerning tariffs and taxes are unclear and have varied greatly. However, he has consistently promoted a 10% worldwide tariff and a 60% tax on imported Chinese goods.

Roaring 2020s Scenario

Trump’s election victory has led to a surge in the U.S. stock market, setting the stage for what some analysts call a new “Roaring 2020s.” Analysts and investors speculate that Trump’s planned corporate tax cuts and deregulation could fuel a prolonged rally in the stock market.

US Services Sector Growth

The U.S. services sector’s economic momentum is firing at all cylinders, with business activity in October reaching its strongest level in over two years. The Services PMI surged to 56% in October 2024, up from 54.9% in September, defying expectations of a dip to 53.8%.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Ananya Gairola

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MINTO COMMUNITY OTTAWA WINS 2024 PRODUCTION BUILDER OF THE YEAR + 3 MORE AWARDS AT THE GOHBA HOUSING DESIGN AWARDS

OTTAWA, ON, Nov. 8, 2024 /CNW/ – Minto Communities Ottawa (“Minto Communities”) took home four awards at the Greater Ottawa Home Builders’ Association’s (GOHBA) 41st annual Housing Design Awards on November 2, 2024. This includes Production Builder of the Year and three individual awards for the 2023 Minto Dream Home (The Equestrian), designed and built for CHEO’s Dream of a Lifetime Lottery.

2024 GOHBA Builder of the Year

Minto Communities’ commitment to the Ottawa community, environmental sustainability, innovation in the industry, unique service offerings and customer-first approach, played a big role in being named Production Builder of the Year. This is the fifth time Minto has won the award in recent years, (2016, 2019, 2021, 2022, 2024). Winning this award is a great honour and a testament to the dedication and value Minto Communities brings to the city, homeowners, and the CHEO Foundation. GOHBA also awarded the developer with:

- Innovation Award: Production Home of the Year with Tanya Collins Design and ASL Agrodrain Limited—received for The Equestrian‘s unique geothermal heating and cooling technology

- Best Production Kitchen (251 square feet or more) with Tanya Collins Design—for The Equestrian

- Best Production Bathroom with Tanya Collins Design—for The Equestrian

ABOUT THE 2023 MINTO DREAM HOME (THE EQUESTRIAN)

Located in Mahogany, a modern and established community in Manotick. Built by Minto Communities’ Product Design team, led by Product Development Manager Karen van der Velden, in partnership with Tanya Collins Design. The 2023 Minto Dream Home is described as “modern equestrian” with Arts & Crafts exterior design elements and a blend of modern and classic interior design. The home sits on a semi-private cul-de-sac lot backing onto protected green space. The four-bedroom floorplan delivers over 4,200 square feet of interior space, plus a 3-season patio with nearly 150 square feet. A network of partners helped contribute décor, furnishings, landscaping and materials.

ABOUT MINTO COMMUNITIES CANADA

For almost 70 years, Minto Communities has crafted homes with beautiful designs enjoyed by more than 100,000 happy homeowners. Minto Communities constantly looks for ways to adapt its new homes and communities to provide customers with greater sustainability, lifestyle and design without compromising affordability for today’s families. These innovations support our homeowners’ needs and overall well-being in every detail.

Minto Communities is recognized by the Canadian real estate industry as four-time winner of Building Industry and Land Development Association’s Green Builder of the Year, four-time winner of EnerQuality’s Ontario Green Builder of the Year award and four-time winner of the Ontario Home Builder Association’s Home Builder of the Year award. The company was named one of Canada’s Greenest Employers in 2019.

ABOUT THE MINTO GROUP

The Minto Group is a fully integrated real estate company that provides new homes, condos, apartment rentals, furnished suites, commercial space, property and investment management. After almost 70 years in operation, we have built over 100,000 homes across Canada and the Southern U.S. We own and operate high-quality, multi-residential rental properties in Toronto, Ottawa, Montreal, Calgary, Greater Vancouver, and Greater Victoria areas. Together, with over 1,500 employees in Canada and the U.S., we are committed to doing more to help people live better—building better places for people to live, work, and play, one home and one relationship at a time.

SOURCE Minto Communities Management Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/08/c9732.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/08/c9732.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks soared on news of Trump's election. Bonds sank. Here's why.

As Donald Trump emerged victorious in the presidential election Wednesday, stock prices soared.

As the stock market rose, the bond market fell.

Stocks roared to record highs Wednesday in the wake of news of Trump’s triumph, signaling an end to the uncertainty of the election cycle and, perhaps, a vote of confidence in his plans for the national economy, some economists said.

On the same day, the yield on 10-year Treasury bonds rose to 4.479%, a four-month high. A higher bond yield means a declining bond market: Bond prices fall as yields rise.

While stock traders rejoiced, bond traders voiced unease with Trump’s fiscal plans.

Trump campaigned on a promise to keep taxes low. He also proposed sweeping tariffs on imported goods.

Economists warn that Trump’s plans to preserve and extend tax cuts will widen the federal budget deficit, which stands at $1.8 trillion. Tariffs, meanwhile, could reignite inflation, which the Federal Reserve has battled to cool.

For bond investors, those worries translate to rising yields. The yield is the interest rate, the amount investors expect to receive in exchange for lending money: in this case, to the federal government.

In the current economic cycle, bond investors “might perceive there to be more risk of holding U.S. debt if there’s not an eye on a plan for reducing spending. Which there isn’t,” said Jonathan Lee, senior portfolio manager at U.S. Bank.

The 10-year Treasury bond is considered a benchmark in the bond market. The yield on those bonds “began to climb weeks ago, as investors anticipated a Trump win,” The New York Times reported, “and on Wednesday, the yield on 10-year Treasury notes jumped as much 0.2 percentage points, a huge move in that market.”

It was an ironic moment for bond yields to rise. Bond yields generally move in the same direction as other interest rates.

But the Federal Reserve cut interest rates on Thursday, trimming the benchmark federal funds rate by a quarter point. The cut was widely forecast and, in any case, the Fed’s interest rate decisions matter more for the short-term bond market.

Long-term bond yields are rising because “many investors expect that the federal government under Trump will maintain high deficit spending,” according to Bankrate, the personal finance site.

Many forecasters expect Trump and a Republican-led Congress to renew the 2017 Tax Cuts and Jobs Act, which trimmed tax rates across the board and fed the federal deficit during Trump’s first term.

3 Soaring Stocks to Hold for the Next 20 Years

It’s natural for investors to feel a mix of happiness and worry when a stock they own surges higher. The happiness stems from the large unrealized gain that they are sitting on while the worry comes from losing these gains should the share price fall back to where it used to be. Hence, stocks that have shot up in value are normally given a wide berth as investors are afraid that these gains cannot be sustained.

Such fears may be unfounded as stocks that have done well may demonstrate the ability to continue growing. These growth stocks usually possess catalysts that can take their business to the next level and enjoy a strong competitive position that enables them to fend off the competition. Stocks like these are ideal candidates to own for the long term, as they can help to compound your wealth and enable you to retire comfortably.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Here are three stocks that have recently surged but also qualify as great long-term buy-and-hold candidates.

Netflix (NASDAQ: NFLX) is a market leader in the streaming television space, boasting 282 million paying members as of Sept. 30. Shares of Netflix have soared around 61% year to date but the company has the potential to continue growing its membership base and earnings in the future. Its solid track record speaks for itself — Netflix’s revenue increased from $29.7 billion in 2021 to $33.7 billion in 2023 while its net income climbed from $5.1 billion to $5.4 billion over the same period. Its free-cash-flow generation has also improved massively, going from a negative free cash flow of $132 million in 2021 to a positive free cash flow of $6.9 billion by 2023.

The streaming giant’s earnings momentum has carried into the first nine months of this year. Revenue rose 15.5% year over year to $28.8 billion while operating income surged 49% year over year to $8.1 billion. Net income stood at $6.8 billion, 53% higher than it was a year ago. Netflix continued to churn out copious amounts of free cash flow, coming in at $5.5 billion, up 4% year over year for the first three quarters of 2024. Paid memberships stood at a record high of 282.7 million, logging a 14.4% year-over-year jump after the company added close to 35 million new subscribers in just one year.

More growth is in store for Netflix as the service takes up just under 10% of TV time in some of the world’s biggest countries. Management sees a huge opportunity to snag more members as it continues to invest in its broad content slate with a steady stream of new movies and TV series. As of June 2024, 40% of U.S. TV screen time is taken up by streaming TV, of which Netflix has an 8.4% share. This is much higher than competitors such as Disney‘s Disney+ (2%) and Amazon‘s Prime Video (3.1%) and implies that the business has a strong competitive moat that can help it to garner more members.

My Favorite Dividend King to Buy in November

Certifications such as the Good Housekeeping Seal help consumers know which products are safe and perform well. Unfortunately, no Good Housekeeping Seal exists for dividend stocks.

However, arguably the next best thing is for a company to belong to the elite group known as Dividend Kings. To qualify, a company must increase its dividend for at least 50 consecutive years. Most income investors will sleep better at night knowing that a stock has such an impressive dividend track record.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But some Dividend Kings are better than others. Which is the best pick right now? Here’s my favorite Dividend King to buy in November.

Technically, AbbVie (NYSE: ABBV) has only been around since 2013. That doesn’t mean the big pharmaceutical company can’t be a Dividend King, though. AbbVie’s business operated for decades as part of Abbott Laboratories before being spun off as a separate publicly traded entity 11 years ago.

AbbVie, therefore, inherits the rich dividend history of its parent. In September, Abbott announced its 52nd consecutive annual dividend increase. Last week, AbbVie followed suit with its latest dividend increase.

Plenty of Dividend Kings have longer streaks of dividend hikes than AbbVie. Few, if any, though, can match the drugmaker’s level of dividend increases in recent years. Since its spinoff from Abbott, AbbVie has raised its dividend payout by a whopping 310%.

Some Dividend Kings don’t offer princely dividend yields. However, AbbVie’s forward dividend yield is 3.26% — nearly 2.7 times higher than the yield of the S&P 500 (SNPINDEX: ^GSPC). The big pharma stock’s yield would be even higher, except AbbVie’s share price has soared 30% this year.

I think AbbVie’s momentum will continue. Some investors have worried about the negative impact of declining sales of Humira, the company’s top-selling drug, with its loss of patent exclusivity last year. Not me. I’ve been confident in AbbVie’s strategy to navigate these challenges, and my confidence appears to be paying off.

In the third quarter of 2024, Humira’s sales fell 36.5% year over year on an operational basis due to biosimilar competition. Yet AbbVie’s overall revenue increased, with the company delivering sales that were $260 million above its expectations. How did the drugmaker manage this feat? By investing in research and development and making smart acquisitions.