Seeking at Least 9% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

You can’t really go wrong with dividend stocks. These equities provide a stable, long-term income stream, one that supplements the return from share appreciation. And even if the share price goes down, you can still make bank via the dividend. It’s a solid advantage to add to any stock portfolio – and can be made even better by the high-yield dividends, ones that can provide yields of 9% or better.

For investors seeking out these high-yield dividend payers, the street’s analysts are on the job. They’ve been sorting through the ranks of div stocks, and tagging some of the 9%+ high-yield payers as Buys right now.

We’ve used the TipRanks platform to pull up the details on two of these picks. Let’s dive in.

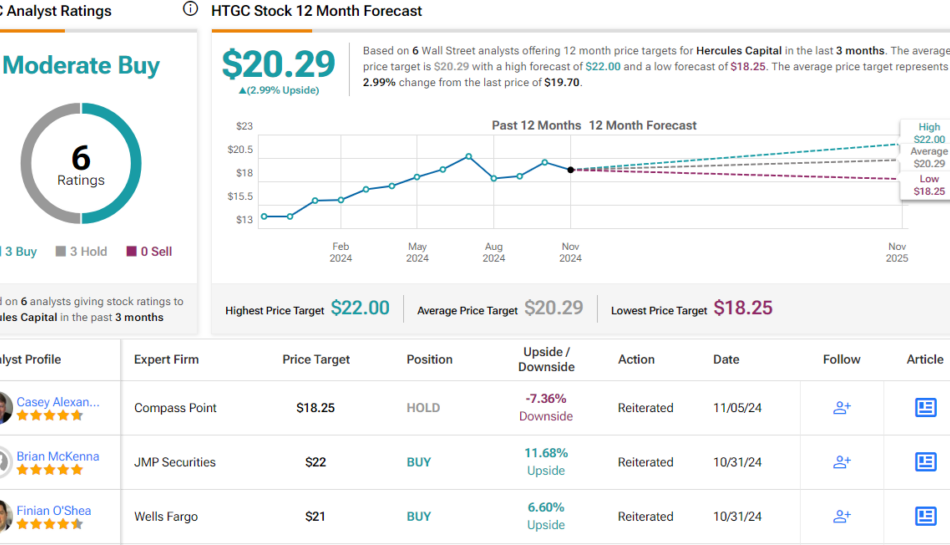

Hercules Capital (HTGC)

We’ll start with Hercules Capital, a BDC, or business development company. Hercules focuses its work on emerging companies, particularly those with a bent toward the sciences and technology – life sciences, sustainable and renewable tech, and SaaS finance tech. Hercules is a leading specialty finance provider in this niche, supporting a venture capital-backed clientele with access to credit services and growth capital financing.

Since its founding in 2003, Hercules has provided funding for over 660 companies, to a total of $21 billion-plus in capital commitments. The company currently has over $4.6 billion in assets under management.

On the dividend side, Hercules has a long-standing commitment to keeping up capital returns to shareholders. The company’s current regular dividend, last declared on October 28 for payment this coming November 20, was set at 40 cents per common share and was supplemented by an 8 cent per share special dividend. The combined dividend payment, of 48 cents per common share, annualizes to $1.92 per share and gives a strong forward yield of 9.75%.

That dividend is supported by Hercules’ financial results, which were reported at the end of October for 3Q24. The company’s total investment income in the quarter was reported as $125.25 million, stated by management to be a company quarterly record. The investment income figure was up 7.3% year-over-year, although it missed expectations by $2.9 million. At the bottom line, Hercules had a quarterly net investment income of 51 cents per share.

This BDC has caught the attention of JMP’s Brian McKenna, an analyst ranked in the top 2% of Wall Street stock experts, who is impressed by Hercules’ business strength. McKenna writes of the firm, “Hercules continues to demonstrate its leading position within the venture lending space, and we are quite pleased again with the strength of quarterly results as well as the trajectory of the business into year-end. Lower base rates and tighter spreads will clearly be somewhat of a headwind within the P&L moving forward, but we also believe the company has demonstrated its ability to consistently deliver ROEs in the mid-to-upper teens through the cycle. So, while the stock trades at a healthy valuation multiple on paper, we believe underlying results and the outlook for the business more than justify this multiple.”

Warren Buffett's AI Bets: 24.1% of Berkshire Hathaway's $287 Billion Stock Portfolio Is Invested in These 2 Artificial Intelligence Stocks

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is one of history’s most successful investors. Under his leadership, Berkshire Hathaway has risen to become the world’s ninth-largest company, with a market capitalization of roughly $959 billion today.

In addition to its dozens of fully and partially owned subsidiary businesses, Buffett’s conglomerate also owns a portfolio of publicly traded stocks worth $287 billion as of this writing. And while the Oracle of Omaha is best known as a value investor, that portfolio actually has significant exposure to the rise of artificial intelligence. With that in mind, read on for a look at two of the most high-profile AI stocks in the Berkshire Hathaway portfolio.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Keith Noonan: Accounting for 23.2% of the value of Berkshire Hathaway’s public equity portfolio, Apple (NASDAQ: AAPL) is the conglomerate’s biggest stock holding, and by default also its biggest AI stock holding. The investment has been an incredible performer for Berkshire Hathaway: Apple shares have delivered a total return of more than 800% since Buffett’s company first bought the stock in the first quarter of 2016.

The tech giant recently rolled out its Apple Intelligence software with its iPhone 16 smartphones, and it’s positioning AI as a key selling point for its next-generation mobile devices. In addition to being a huge sales and profit driver in its own right, Apple’s dominant position in the mobile hardware market gives the company some big advantages in the artificial intelligence race.

Thanks to its large and highly engaged mobile hardware user base, the company has access to troves of valuable data and a loyal customer base to sell add-on services to. Notably, Apple’s software and services business is now on track to generate over $100 billion in annual revenue.

However, while Apple has served up great stock performance and has some big AI opportunities on the horizon, Berkshire Hathaway has made some eye-catching moves with the stock lately. Berkshire Hathaway’s recently published third-quarter report revealed that the conglomerate had once again sold a significant amount of Apple stock during the period. It still owns roughly 296 million shares of Apple stock, but that’s down by more than two-thirds from its peak holding of roughly 907.6 million shares.

Is Dell Technologies (NYSE:DELL) a Buyable Growth Stock?

Growth investing strategies, like looking for buyable growth stocks, are popular for a reason—and Dell Technologies (DELL) might just be one to consider. When done with a focus on quality and a long-term perspective, growth investing has the potential to help investors build life-changing, generational wealth.

What do I mean by quality? I look for businesses that are firmly established within their industries. It’s easier to achieve strong revenue and earnings growth in sectors that consistently expand, which is another factor I prioritize in potential investments. I also insist on investment-grade balance sheets.

This brings me to Dell Technologies. After reviewing the company’s recent earnings report and growth catalysts, I believe it could be a worthwhile growth stock to buy now. Here’s why.

One reason for my bullish sentiment on Dell stock is its Fiscal second quarter financial results for the period ended August 2nd. The company posted $25 billion in net revenue for the quarter, up 9.1% from the prior year. For context, that was $910 million ahead of analysts’ expectations. Strong growth in the company’s Infrastructure Solutions Group segment (e.g., data storage, AI servers, and cloud services) easily offset a slight revenue decline in the Client Solutions Group segment (i.e., workstations, PCs, and monitors).

Dell’s non-GAAP diluted EPS surged 8.6% year-over-year to $1.89 for the Fiscal second quarter, significantly surpassing the analyst consensus of $1.71. CFO Yvonne McGill noted that an AI-optimized server mix and more competitive pricing led to a 230 basis point decline in gross margin to 21.8% of revenue for the quarter. This was partially offset by a nearly 2% reduction in the share count, which led bottom-line growth to roughly match top-line growth for the quarter.

Dell’s outlook further supports my Buy rating on the stock. Each quarter, the company becomes more of an AI play. In the past year, the quickly growing Infrastructure Solutions Group segment rose from nearly 37% of revenue in Q2 2024 to almost 47% in Q2 2025—a nearly 10 percentage point swing. The company envisions its total addressable market expanding from $1.2 trillion in 2019 to $2.1 trillion by 2027, driven by segments like servers and storage.

On a more company-specific level, Dell is performing reasonably well. AI infrastructure shipments almost doubled quarter-over-quarter, and the company has shipped $6.5 billion in AI infrastructure over the past 12 months. Additionally, Dell’s five-quarter pipeline of prospective shipments is several multiples of its backlog. As these are converted into actual shipments, this should boost growth.

Retirement at 60 with $2.5 Million: Will Your Savings Go the Distance?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

With careful planning, $2.5 million can fund a comfortable retirement starting at age 60. But as with any major life transition, retirees must weigh a complex set of variables from taxes to healthcare to ensure their nest egg lasts decades. Though everyone’s situation differs, this level of savings can provide most the flexibility to retire if desired, especially if paired with even modest Social Security income starting a few years later.

Do you have questions about retirement planning? Speak with a financial advisor today.

Deciding if you have enough saved to retire hinges on estimating future costs and income streams over an expected lifetime. At its simplest, this involves projecting how much income you’ll have from various sources and preparing post-retirement budgets for expenses.

To make an optimal decision, especially if you’re considering retiring earlier than typical, you also have to account for age-related factors. These include healthcare expenses before Medicare eligibility at age 65 and penalties for most retirement account withdrawals before age 59.5.

Social Security timing strategies are also important. These are based on personal circumstances and call for balancing tradeoffs between maximizing monthly benefit amounts and starting benefits earlier. Required minimum distribution (RMD) rules that go into effect after age 73 represent another significant consideration.

Identifying an appropriate withdrawal rate that maintains principal is also key. This will vary depending on your portfolio strategy, asset allocation and investment performance. However, it’s often suggested to use a rate between 4% and 6%, depending on where you look.

Rather than trying to figure out your personal retirement income and expenses in detail, you can use income replacement. For a 60-year-old earning $100,000 annually, the target budget number for income could be, say, $70,000 per year. This is using a 70% income replacement guideline.

The 4% withdrawal rate is another guideline that assumes withdrawing that percentage of a portfolio annually, adjusted for inflation, will allow a nest egg to last as long as a typical retirement. Withdrawing 4% annually from a $2.5 million portfolio would generate $100,000 in retirement income. This covers the $70,000 income replacement target, with a nice cushion of $30,000 per year.

For most people, savings represent only one source of potential income in retirement. Additionally, this individual could start taking Social Security benefits as early as age 62. Alternatively, they could wait to claim their benefits until reaching full retirement age at 67, or even longer at 70. This would qualify them for higher monthly benefit amounts, with the tradeoff of starting them later.

Vanguard Weighs In: When's the Right Time to Start My Roth Conversion?

Deciding between a traditional individual retirement account (IRA) and a Roth IRA can be difficult. Choosing when or if you should convert your IRA funds to a Roth account can be even more daunting. Experts commonly recommend that investors compare their current and future marginal tax rates to decide, but future tax rates can be highly uncertain and many investors are left wondering whether they made the right choice. Now, investment giant Vanguard has a more precise answer. Here’s how calculating your break-even point can pinpoint whether a Roth conversion makes sense for you. A financial advisor could help you save for retirement and select investments that align with your financial goals. Find a qualified advisor today.

Vanguard Finds the Ideal Tipping Point for a Roth Conversion

Typically the rule of thumb is that Roth IRAs are most beneficial if an investor expects to be in a higher tax bracket upon retirement, since Roth contributions are taxed at the current rate and distributions are tax free. As such, Vanguard experts say that “assessing the current tax rate and expected future tax rate is a good first step” in determining whether you should convert your retirement savings to a Roth account.

However, sometimes a Roth conversion can be beneficial even if your future tax rate declines instead of increasing. So rather than a straightforward tax rate comparison, the firm recommends conducting a dynamic Break-Even Tax Rate (BETR) analysis to determine if a conversion is right for you. Calculating a BETR offers investors an approach that simplifies the decision-making process.

“If your future tax rate is at the BETR, conversion wouldn’t make a difference,” Vanguard analysts explain. “Simply put, the BETR shows how far your tax rate would have to fall to make conversion undesirable.”

If an investor’s future tax rate is higher than a calculated BETR, generally a Roth conversion would make sense financially. Even if an investor’s future marginal tax rate is lower than it is currently, certain scenarios can lower a BETR and make a conversion far more attractive than it would otherwise seem in a straightforward rate comparison. This could potentially save an investor thousands of dollars.

For instance, if you’re able to pay Roth conversion taxes from a taxable account, such as your standard brokerage account, the full value of your IRA can move to the Roth account. By not paying the conversion taxes from the IRA but with other portfolio funds, you can lower your BETR substantially. Vanguard calculates that, if an investor pays a current 35% marginal tax rate and expects to pay the same in retirement, converting to a Roth and paying taxes from a tax-efficient portfolio could lower the BETR to 29.6%. If taxes were paid from a tax-inefficient portfolio, where the investor has to pay annual taxes on investment returns, the BETR falls even further to 23.5%. As a result, a Roth conversion suddenly becomes rather appealing.

Ask an Advisor: I'm Still Working at 77. Am I Allowed to Skip RMDs?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

I’m 77 years old and I requested my 401(k) fund administrator to prepare my RMD. I was told I do not have to withdraw my money if I am still employed. Please confirm if this in fact an IRS rule or that of the fund management company?

-Bea

That is correct, Bea. If you are still employed, you do not have to take a required minimum distribution (RMD) from your current 401(k) regardless of your age, as long as your employer doesn’t require it. That is in fact an IRS rule.

RMD requirements depend on your age, the account type and whether or not you are still employed. There have been some changes to these rules recently, so let’s review the minimum distribution requirements. (And if you need help with retirement planning, including RMDs, consider speaking with a financial advisor.)

The IRS won’t let you leave your retirement savings in tax-deferred accounts indefinitely. Instead, the government requires you to withdraw a certain amount of money from your accounts each year. How much you’re mandated to withdraw is based on your age and how much money was in your account at the end of the previous year.

Before the SECURE Act of 2019, RMDs started at age 70 ½. However, the law increased the RMD age to 72.

That increase was short-lived, though. The SECURE Act 2.0 raised the RMD age to 73 beginning in 2023 and set it to increase to 75 in 2033.

You are required to take an RMD from most tax-advantaged retirement accounts with the exception of Roth IRAs.

Under prior law, designated Roth accounts within employer-sponsored plans like Roth 401(k)s and Roth 403(b)s were still subject to RMD rules. However, the SECURE Act 2.0 addressed this shortcoming, and beginning in 2024 no Roth accounts will be subject to age-based RMDs. I specify “age-based” here to acknowledge the fact that inherited Roth accounts are still subject to the 10-year rule. (And if you have other retirement-related questions, this tool can help match you with potential financial advisors.)

Here lies the exception that applies to you. If you are still employed then you don’t have to take RMDs from the plan that your current employer sponsors.

However, even if you are still working then you must still take RMDs from:

So, if you have a 401(k) from a former employer, you’ll need to make sure that you’re taking RMDs from that account. A good workaround for avoiding RMDs for an old account is to simply roll those funds over into your current plan if you are allowed. (And if you need help planning your RMDs, consider working with a financial advisor.)

Boeing Just Lost $10 a Share — and It Wasn't All Because of the Strike

It’s finally over. On Monday, by a vote of 59% for and 41% against, the International Association of Machinists (IAM) voted to accept a new four-year contract from Boeing (NYSE: BA).

Under the terms of the new contract, IAM members will see wages rise 38% over the next four years, receive higher 401(k) matching funds (but no reinstatement of the company pension), and pay lower healthcare premiums. Most importantly, after 54 days on the picket line, workers will start returning to work on Wednesday. Boeing can get back to building airplanes (more precisely, the 737, 767, and 777 airplanes on which construction was halted during the strike).

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Investors aren’t quite so lucky. We still have some work to do in calculating the damage done to Boeing stock over the past 52 days that this strike lasted, and we need to consider the damage that will be further done to Boeing’s financials over the coming years.

We’ll begin with what we know for certain, as reflected in Boeing’s Q3 earnings report, issued late last month.

The good news is that although Boeing’s labor strike slowed down sales in the quarter, the slowdown affected only the last 17 days, from Sept. 13 through 30. While commercial airplane revenue declined 5%, in terms of commercial aircraft delivered, Boeing actually delivered more airplanes in Q3 2024 than in Q3 2023 (116 versus 105). Boeing was also helped by recording small percentage increases in revenue at its global services unit (revenue up 2%) and at Boeing defense (up 1%).

Thus, while total Q3 revenue declined compared to last year’s Q3, the decline was only 1%, to $17.8 billion.

The bad news is that Boeing’s profits didn’t get off so easily. Operating margins at the aerospace giant, already running negative for years, got even worse in Q3, falling to negative 32.3%.

The blame here was shared unevenly. Global services profits actually climbed 6% year over year to $834 million. But, hurt by charges on its T-7A training jet, MQ-25 naval drone, and KC-46A refueling tanker contracts, as well as on its Starliner spacecraft, Boeing recorded a $2.4 billion operating loss from its defense division (BDS). Commercial airplane losses, meanwhile, exceeded $4 billion.

On the bottom line, Boeing lost $6.2 billion, or $9.97 per share.

As explained above, not all of this loss was due to the strike. The losses at BDS, for example, had little to do with striking commercial airplane workers. Still, Boeing highlighted the “impacts of the IAM work stoppage” as the No. 1 factor causing its big loss. More than just sales delayed by the work stoppage, Boeing also took $3 billion worth of charges to account for both the cost of a year-long delay in introducing its new 777X and the shuttering of its 767 Freighter line — both measures taken to cut costs and conserve cash because of the strike.

3 Unstoppable Stocks That Can Crush the S&P 500 by 2030

The bull market continued to drive the S&P 500 to new highs this year. It’s still a great time to invest because once a bull market gets going, it tends to go on for several years.

Three Motley Fool contributors believe Dutch Bros (NYSE: BROS), MercadoLibre (NASDAQ: MELI), and Sweetgreen (NYSE: SG) could outperform the S&P 500. The index delivered an average return of 10% over the last several decades, but these companies are growing much faster and could deliver superior returns.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

John Ballard (Dutch Bros): Investing in emerging restaurant brands can be one of the best ways to build wealth in the stock market. Dutch Bros started out as a coffee shop but has expanded its menu to include a range of beverages, including smoothies and energy drinks. It is profitably expanding across the U.S., which could fuel market-thumping returns over the next five years.

Despite a challenging year for consumer spending, Dutch Bros remains on track with its growth strategy. Revenue grew 28% year over year last quarter, with same-shop sales up 2.7%. This is indicative of an offering that is resonating with people and driving repeat purchases similar to other leading beverage chains like Starbucks.

Dutch Bros has consistently posted around 30% or better revenue growth over the last few years. The only reason that explains why the stock is not following that growth is profitability. But here, too, Dutch Bros is performing well for a small restaurant business. Net income jumped 62% year over year to reach $22 million in Q3.

Dutch Bros has tremendous opportunities to keep expanding. It operated just 950 shops in 18 states as of the most recent quarter. The stock bounced sharply following the company’s Q3 earnings results, but it’s not too late to jump on board. The company’s long runway of growth can still support excellent returns over the long term.

Jennifer Saibil (MercadoLibre): MercadoLibre has outperformed the market by a wide margin over the past five years — 267% to 109%, even after a recent pullback — and it has every chance of doing that again over the next five years.

It’s the dominant e-commerce platform in Latin America, serving an area that has more than 500 million people the way Amazon serves the U.S. People rely on it for many of their purchases in increasing numbers and with increasing engagement. For example, customers who shopped in three or more categories increased 468% between 2019 and 2023, and average quarterly products per buyer increased from 4.4 to 7.1.