3 Unstoppable Stocks That Can Crush the S&P 500 by 2030

The bull market continued to drive the S&P 500 to new highs this year. It’s still a great time to invest because once a bull market gets going, it tends to go on for several years.

Three Motley Fool contributors believe Dutch Bros (NYSE: BROS), MercadoLibre (NASDAQ: MELI), and Sweetgreen (NYSE: SG) could outperform the S&P 500. The index delivered an average return of 10% over the last several decades, but these companies are growing much faster and could deliver superior returns.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

John Ballard (Dutch Bros): Investing in emerging restaurant brands can be one of the best ways to build wealth in the stock market. Dutch Bros started out as a coffee shop but has expanded its menu to include a range of beverages, including smoothies and energy drinks. It is profitably expanding across the U.S., which could fuel market-thumping returns over the next five years.

Despite a challenging year for consumer spending, Dutch Bros remains on track with its growth strategy. Revenue grew 28% year over year last quarter, with same-shop sales up 2.7%. This is indicative of an offering that is resonating with people and driving repeat purchases similar to other leading beverage chains like Starbucks.

Dutch Bros has consistently posted around 30% or better revenue growth over the last few years. The only reason that explains why the stock is not following that growth is profitability. But here, too, Dutch Bros is performing well for a small restaurant business. Net income jumped 62% year over year to reach $22 million in Q3.

Dutch Bros has tremendous opportunities to keep expanding. It operated just 950 shops in 18 states as of the most recent quarter. The stock bounced sharply following the company’s Q3 earnings results, but it’s not too late to jump on board. The company’s long runway of growth can still support excellent returns over the long term.

Jennifer Saibil (MercadoLibre): MercadoLibre has outperformed the market by a wide margin over the past five years — 267% to 109%, even after a recent pullback — and it has every chance of doing that again over the next five years.

It’s the dominant e-commerce platform in Latin America, serving an area that has more than 500 million people the way Amazon serves the U.S. People rely on it for many of their purchases in increasing numbers and with increasing engagement. For example, customers who shopped in three or more categories increased 468% between 2019 and 2023, and average quarterly products per buyer increased from 4.4 to 7.1.

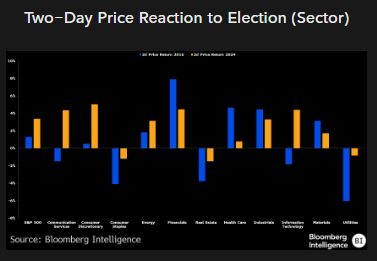

Traders Think It’s 2016, While Stock Market Has to Live in 2024

(Bloomberg) — A sense of déjà vu overwhelmed Wall Street this week, as Donald Trump’s election win gave the stock market a jolt similar to what happened after his victory eight years ago. Small caps soared, banks leaped and the S&P 500 Index had its best Election Day in history and strongest week in 12 months.

Most Read from Bloomberg

The challenge, however, is this is 2024, not 2016. Things have changed a lot since then.

“As Mark Twain once said, ‘History does not repeat itself, but it often rhymes,’” Matt Maley, chief market strategist at Miller Tabak + Co., LLC, said. “So investors should remember the old playbook, but they shouldn’t memorize it.”

When Trump ran for president in early 2016, US equities were on shaky footing, posting their worst start to a year since the financial crisis with a drop of more than 5% in January. By the time of his inauguration, the S&P 500 was coming off a 9.5% gain in 2016 after ending 2015 in the red. The index was trading at 17 times projected earnings. The yield on 10-year Treasuries was around 2.5%, and the fed funds rate sat at 0.75%.

Fast forward eight years and the landscape is very different. Equity valuations are soaring. The S&P 500 is at an all-time high and briefly surpassed 6,000 for the first time ever after rising 56% in the past two years. The tech-heavy Nasdaq 100 Index is also at a record after nearly doubling since the start of 2023. The S&P is trading at just 23 times projected earnings, some 40% above its average since 2000. The yield on 10-year Treasuries is 4.3%, and the fed funds rate is at 4.75%.

In other words, the stock market was pretty well set up to rip at the start of Trump’s first term in office. But this time, the stocks appear to be at a peak or nearing one, and there may not be much more room to go.

“It’s not what you would normally think — that rates go way up, and that the stock market goes up substantially with rates going up — unless inflation’s going up with it,” said David Miller, co-founder and chief investment officer at Catalyst Funds. “Which is, I think, what’s happening.”

Inflationary Policies

The premise behind traders’ reaction to Trump’s win is that his promises of tax cuts and deregulation will keep propelling equities to new heights. The flip side, however, is that the president-elect’s protectionist trade stance and plans for mass deportations of undocumented workers are seen as inflationary and potentially threatening growth.

Stride, Inc. Announcement: If You Have Suffered Losses in Stride, Inc. (NYSE: LRN), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Nov. 09, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, announces an investigation of potential securities claims on behalf of shareholders of Stride, Inc. LRN resulting from allegations that Stride may have issued materially misleading business information to the investing public.

So What: If you purchased Stride securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=30689 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On October 16, 2024, Fuzzy Panda Research issued a report entitled “Stride Inc (LRN) – The Last Covid Over Earner – Hiding That Est >25% of EBITDA Came from Covid Funds.” In this report, Fuzzy Panda announced that it had a short position in Stride, in part, because Stride was the “last Covid over-earning stock yet to fall. The stock is near its highs [. . .] but investors are clueless about the looming Covid funding cliff. Investors don’t know because Stride management has NOT told them. [. . . ] Former Stride executives told us that management misled investors.”

On this news, the price of Stride stock fell by $6.55 per share, or 9.2%, to close at $64.04 on October 16, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm achieved the largest ever securities class action settlement against a Chinese Company at the time. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Realty Income Announces 653rd Consecutive Common Stock Monthly Dividend

SAN DIEGO, Nov. 8, 2024 /PRNewswire/ — Realty Income Corporation ((Realty Income, NYSE:O), The Monthly Dividend Company®, today announced that it has declared the 653rd consecutive common stock monthly dividend. The dividend amount of $0.2635 per share, representing an annualized amount of $3.162 per share, is payable on December 13, 2024 to stockholders of record as of December 2, 2024.

About Realty Income

Realty Income O, an S&P 500 company, is real estate partner to the world’s leading companies. Founded in 1969, we invest in diversified commercial real estate and have a portfolio of over 15,450 properties in all 50 U.S. states, the U.K., and six other countries in Europe. We are known as “The Monthly Dividend Company®,” and have a mission to invest in people and places to deliver dependable monthly dividends that increase over time. Since our founding, we have declared 653 consecutive monthly dividends and are a member of the S&P 500 Dividend Aristocrats® index for having increased our dividend for the last 30 consecutive years. Additional information about the company can be found at www.realtyincome.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this press release, the words “estimated,” “anticipated,” “expect,” “believe,” “intend,” “continue,” “should,” “may,” “likely,” “plans,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements include discussions of our business and portfolio; cash flows; the intentions of management; and dividends, including the amount, timing and payment of dividends related thereto. Forward-looking statements are subject to risks, uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others, our continued qualification as a real estate investment trust; general domestic and foreign business, economic, or financial conditions; competition; fluctuating interest and currency rates; inflation and its impact on our clients and us; access to debt and equity capital markets and other sources of funding (including the terms and partners of such funding); continued volatility and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients’ solvency, client defaults under leases, increased client bankruptcies, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments in the value of our real estate assets; changes in domestic and foreign income tax laws and rates; property ownership through joint ventures, partnerships and other arrangements which may limit control of the underlying investments; epidemics or pandemics, including measures taken to limit their spread, the impacts on us, our business, our clients, and the economy generally; the loss of key personnel; the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; the anticipated benefits from mergers and acquisitions including from the merger with Spirit Realty Capital, Inc.; and those additional risks and factors discussed in our reports filed with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are not guarantees of future plans and performance and speak only as of the date of this press release. Actual plans and operating results may differ materially from what is expressed or forecasted in this press release. We do not undertake any obligation to update forward-looking statements or publicly release the results of any forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/realty-income-announces-653rd-consecutive-common-stock-monthly-dividend-302300226.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/realty-income-announces-653rd-consecutive-common-stock-monthly-dividend-302300226.html

SOURCE Realty Income Corporation

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Move Over Nvidia and Palantir, This AI Juggernaut Is Up 628% Year to Date. Can the Stock's Momentum Continue?

Move over Nvidia and Palantir Technologies, AppLovin (NASDAQ: APP) took over as the top-performing artificial intelligence (AI) stock in 2024 thanks to the share price surge that followed the release of its third-quarter results. The price jump puts the stock up about 628% year to date as of Nov. 9.

AppLovin owns a portfolio of gaming apps but its primary business is an adtech solution to help mobile app developers attract users and better monetize their apps. Since the launch of its Axon 2 AI-based advertising technology in the second quarter of 2023, the company has seen explosive growth.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Let’s take a close look at the company’s Q3 results and whether the stock is still a buy.

Axon 2 has been the source behind nearly all of AppLovin’s growth, with its software platform revenue soaring 66% to $835 million. The company’s legacy apps business, meanwhile, saw revenue increase 1% to $369 million. Overall revenue climbed 39% to $1.2 billion, topping the $1.13 billion consensus as compiled by LSEG.

The company continues to see a ton of operating leverage in its business as sales climb, with gross margin for the quarter improving to 77.5% from 69.3% a year ago. The revenue surge also came despite the company reducing its sales and marketing spend by 3%. That combination is quite remarkable.

Earnings per share (EPS) surged from $0.30 a year ago to $1.25. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), meanwhile, climbed 72% to $722 million. Software platform adjusted EBITDA jumped 78% to $653 million, while its apps business grew adjusted EBITDA by 19% to $68 million as the company optimized the business’s cost structure.

The company produced $551 million in operating cash flow and $545 million in free cash flow. It ended the quarter with $2.9 billion in net debt.

AppLovin guided for fourth-quarter revenue to come in a range of $1.24 billion to $1.26 billion. That would equate to growth of between 30% and 32% and is above the company’s long-term goal to grow revenue by between 20% and 30%. It is projecting Q4 adjusted EBITDA to be between $475 million and $495 million, up from $476 million a year ago.

AppLovin has proven to be one of the biggest AI winners, as its Axon 2 AI adtech platform has led to soaring revenue with its gaming customers. At the same time, it has seen a ton of operating leverage in its business, being able to realize tremendous growth while not increasing its sales and marketing spend and improving its gross margin.

Barrick Falls Behind Rivals as No. 2 Miner Misses Boost From Bullion Boom

(Bloomberg) — Most of the world’s top gold miners have seen their shares surge this year as bullion prices hit repeated record highs. Not Barrick Gold Corp.

Most Read from Bloomberg

Missed production targets, higher operational costs and political turbulence at mines in Africa and Asia have investors turning increasingly sour on the world’s second-biggest gold producer. On Thursday, Barrick posted gold output that missed analysts’ estimates for the 11th straight quarter.

Barrick is one of several miners that have struggled to capitalize on the bullion boom amid higher mining costs and weaker output. But among the largest precious metal producers — Newmont Corp., Agnico Eagle Mines Ltd. and AngloGold Ashanti Ltd. — Barrick has routinely underperformed, with its shares virtually unchanged since the beginning of January. Gold, meanwhile, has soared 30% in the period.

Chief Executive Officer Mark Bristow’s explanation: “We’re rebuilding the business.”

Barrick has spent years working to improve its balance sheet after amassing debt from acquisitions. Bristow, who joined as CEO in 2019 as part of the Canadian company’s takeover of Randgold Resources Ltd., has paid down that debt while exercising restraint in dealmaking. He has also pursued diversification into copper.

Bristow’s explanation doesn’t seem to be winning over investors. Some of Barrick’s top investors have sold off shares while boosting stakes in competitors. Blackrock Inc., one of Barrick’s biggest shareholders, reduced its stake while buying into Agnico Eagle and Newmont, according to regulatory disclosures in November. Other major investors like Van Eck Associates Corp., First Eagle Investment Management LLC and Capital Group Inc. also trimmed their holdings in recent months.

Barrick isn’t alone in drawing scrutiny from shareholders whose expectations have been lifted by gold’s rally. Larger rival Newmont suffered its biggest one-day stock drop since 1997 last month after posting disappointing quarterly earnings.

Bristow said investors are undervaluing Barrick’s stock. “It’s our job as managers to make sure that the market properly understands us,” he said in an interview.

Barrick’s strengths lie in its complex of productive mines in the US, along with huge operations in Papua New Guinea and Mali. It has diversified through expanding in copper just as the global energy transition boosts demand for the wiring metal. The company has relatively little debt.

Why I Sold All of My Palantir Stock

Palantir (NYSE: PLTR) was among my favorite holdings when I bought shares during the bear market of 2022. Its ability to deliver insights by applying artificial intelligence (AI) and machine learning to draw conclusions made the company stand out among SaaS stocks.

That became even more true upon the release of its Artificial Intelligence Platform (AIP). That product delivers productivity gains that were game-changing for its clients.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Despite such benefits, I decided to part with my entire Palantir position right before the Nov. 4 earnings announcement. Admittedly, that decision may baffle many growth investors since the stock surged following the earnings release for the third quarter of 2024. Nonetheless, the real question is whether I stick with this decision over time. Here’s why.

The decision to sell did not come easy. My most painful investing lesson involved my sale of Booking Holdings (NASDAQ: BKNG) during the dot-com bust after I had made a quick profit. While the sale looked like the right decision for several years, it has since risen almost 100-fold from where I sold it. By not holding (or at least repurchasing the shares), I missed out on what could have been a life-changing gain.

Consequently, I now have to ask myself whether I made the same mistake with Palantir. I purchased the stock at an average of $9 per share, giving me a gain of approximately 370% as I sold at $42 per share.

The most crucial factor in my decision to sell was valuation. When I sold, the forward P/E ratio was at 115, and the price-to-sales (P/S) ratio was 40, and both signify a very expensive stock by nearly any measure. Despite both ratios rising from that point, the valuation led me to question whether Palantir shares still offered significant upside over the near term.

With enough growth, I could have forgiven the high multiples, especially with the results reported in the AIP boot camps. Palantir claimed in the second quarter of 2024 that one convenience store chain went from prototype to paid pilot in 25 days, converting its inventory management and price optimization case after the pilot.

Another attendee reported achieving more in one day with AIP than a hyperscaler had in four months. Such eye-popping productivity gains should accrue to Palantir’s top line. Still, I felt the portion of that growth accruing to Palantir was not enough to justify its stock price.

In the first three quarters of 2024, revenue increased by 26% to just over $2 billion. Also, the slow growth in operating expenses allowed net income in the first nine months of 2024 to spike to $383 million, up from $116 million in the same period in 2023.

Warren Buffett's favorite book, 'The Intelligent Investor,' is still the 'best book about investing' 75 years later

When anyone asks me to recommend one book on investing, the answer is simple: Benjamin Graham’s venerated “The Intelligent Investor.”

The classic written by Graham, the father of financial analysis and value investing, was first published in 1949.

One superstar devotee of Graham is Warren Buffett, who was one of his students at Columbia University. After graduation, Buffett worked for Graham’s company, Graham-Newman Corporation, until Graham retired.

The revised edition has now landed. In the preface, Buffett weighs in: “I read the first edition of this book early in 1950, when I was nineteen. I thought then that it was by far the best book about investing ever written. I still think it is.”

The original text is untouched and features commentary on each chapter from Wall Street Journal writer Jason Zweig, who writes The Intelligent Investor column.

Here’s what Zweig had to say in a conversation with Yahoo Finance. Edited excerpts:

Kerry Hannon: For our readers who don’t know much about Benjamin Graham, can you tell us a little about him?

Jason Zweig: You can make a good case that Graham was one of the most brilliant people of the 20th century. His intelligence, had it ever been measured, would’ve been off the charts.

He was admitted to Columbia when he was 17. He worked a full-time job at night for much of the time that he was in college. He graduated in two-and-a-half years, second in his class. He was offered professorships in three different departments before graduation day. He held two US patents.

He wrote an article in the American Mathematical Society Journal when he was 23, about how people were teaching calculus all wrong. He wrote two books on international trade. He was fluent in ancient Greek and Latin. He could speak and read at least six different languages.

And he was a brilliant writer. We bold-faced quite a bit of his original text in this new edition because I wanted to highlight the best passages in the book and how beautifully written they are — to help people learn from this master.

Even though it’s many years after his death, his words still have incredible power and beauty. And I hope this edition will help people appreciate not just the practicality of the advice, but how magnificently written it is.

Read more: How to start investing: A step-by-step guide

Can you define “intelligent investor” for us?

Benjamin Graham was very clear when he wrote this book what he meant by the word intelligent in the title. He says, “I don’t mean somebody with a high IQ. I don’t mean somebody with a PhD or a master’s in economics or finance. I don’t mean a professional financial analyst or a financial planner or a CPA. All I mean is that you should have good judgment and that it’s much more like being wise than being smart.”