John B Hess Takes Money Off The Table, Sells $77.84M In Hess Stock

John B Hess, Chief Executive Officer at Hess HES, executed a substantial insider sell on November 7, according to an SEC filing.

What Happened: Hess opted to sell 543,679 shares of Hess, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $77,835,860.

Tracking the Friday’s morning session, Hess shares are trading at $142.75, showing a down of 0.0%.

Get to Know Hess Better

Hess is an independent oil and gas producer with key assets in the Bakken Shale, Guyana, the Gulf of Mexico, and Southeast Asia. At the end of 2023, the company reported net proved reserves of 1.4 billion barrels of oil equivalent. Net production averaged 391 thousand barrels of oil equivalent per day in 2023, at a ratio of 74% oil and natural gas liquids and 26% natural gas.

Key Indicators: Hess’s Financial Health

Revenue Growth: Hess’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 13.96%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company sets a benchmark with a high gross margin of 78.09%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Hess’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 1.62.

Debt Management: Hess’s debt-to-equity ratio surpasses industry norms, standing at 0.88. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 16.64 is lower than the industry average, implying a discounted valuation for Hess’s stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 3.46, Hess’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 7.36, Hess demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Understanding Crucial Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Hess’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At Wayfair's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Wayfair W, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in W usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 16 extraordinary options activities for Wayfair. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 68% leaning bullish and 25% bearish. Among these notable options, 5 are puts, totaling $324,922, and 11 are calls, amounting to $502,588.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $32.5 to $95.0 for Wayfair during the past quarter.

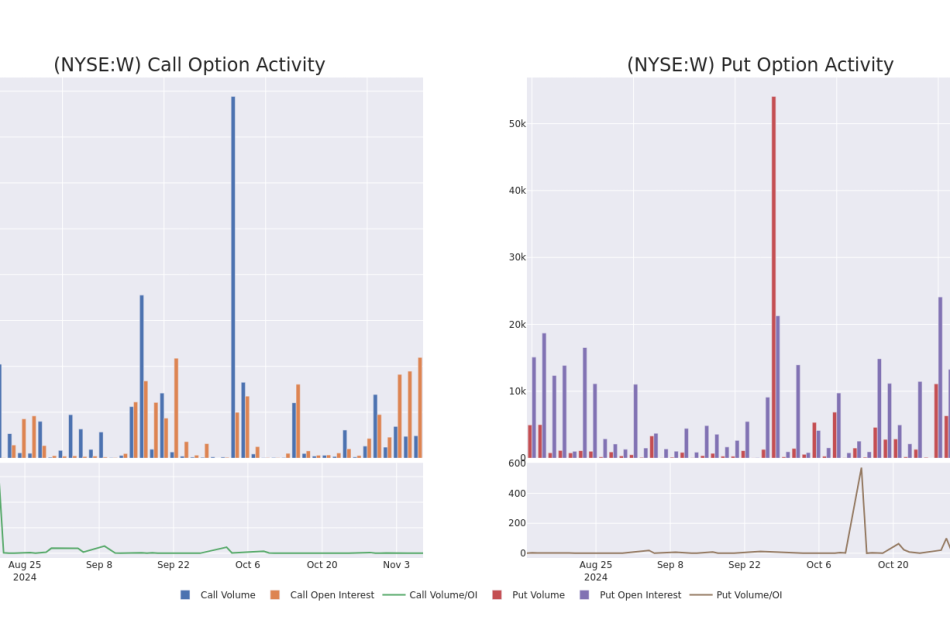

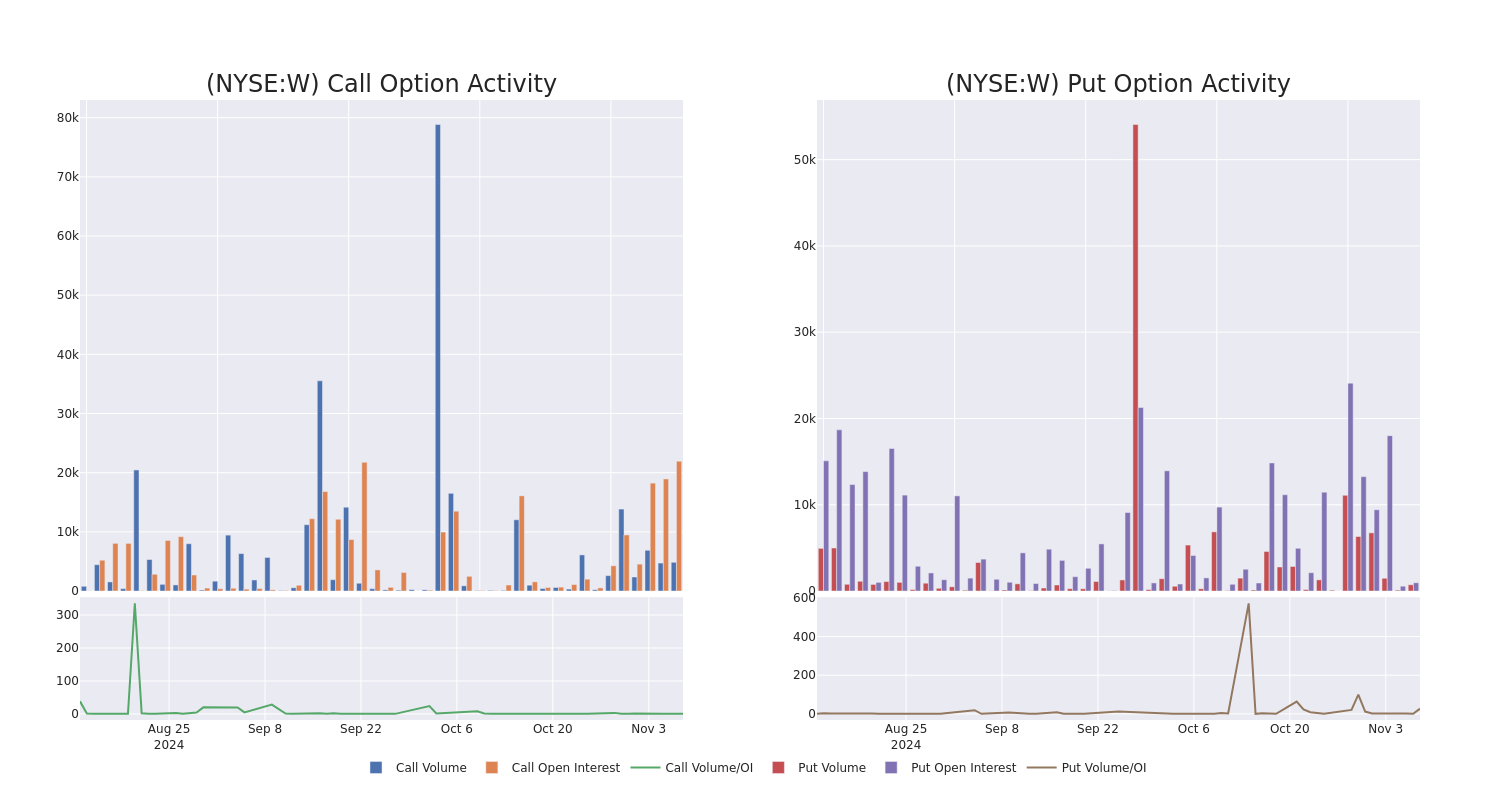

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Wayfair’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wayfair’s whale activity within a strike price range from $32.5 to $95.0 in the last 30 days.

Wayfair 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| W | CALL | TRADE | BULLISH | 01/16/26 | $11.45 | $11.45 | $11.45 | $40.00 | $114.5K | 280 | 100 |

| W | PUT | TRADE | BULLISH | 01/15/27 | $10.65 | $10.35 | $10.47 | $35.00 | $104.7K | 4 | 100 |

| W | PUT | SWEEP | BULLISH | 06/20/25 | $4.15 | $4.05 | $4.05 | $32.50 | $75.3K | 192 | 187 |

| W | PUT | SWEEP | BULLISH | 06/20/25 | $7.15 | $7.0 | $7.0 | $37.50 | $72.1K | 489 | 373 |

| W | CALL | TRADE | BULLISH | 01/17/25 | $2.0 | $1.97 | $2.0 | $45.00 | $70.0K | 1.4K | 353 |

About Wayfair

Wayfair engages in e-commerce in the United States (87% of 2023 sales), Canada, the United Kingdom, Germany, and Ireland. It’s also embarked on expansion into the brick-and-mortar landscape, with a handful of stores between the AllModern, Birch Lane, Joss & Main, and Wayfair banners. At the end of 2023, the firm offered more than 30 million products from more than 20,000 suppliers under the brands Wayfair, Joss & Main, AllModern, Birch Lane, and Perigold. Its offerings include furniture, everyday and seasonal decor, decorative accents, housewares, and other home goods. Wayfair was founded in 2002 and began trading publicly in 2014.

In light of the recent options history for Wayfair, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Wayfair Standing Right Now?

- Currently trading with a volume of 4,770,975, the W’s price is down by -0.55%, now at $39.57.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 104 days.

What The Experts Say On Wayfair

In the last month, 5 experts released ratings on this stock with an average target price of $50.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wedbush has decided to maintain their Outperform rating on Wayfair, which currently sits at a price target of $45.

* An analyst from Needham downgraded its action to Buy with a price target of $60.

* An analyst from RBC Capital has decided to maintain their Sector Perform rating on Wayfair, which currently sits at a price target of $50.

* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Wayfair, targeting a price of $46.

* An analyst from Baird has decided to maintain their Neutral rating on Wayfair, which currently sits at a price target of $50.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Wayfair, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PINTEC ANNOUNCES UNAUDITED FINANCIAL RESULTS FOR THE FIRST HALF OF 2024

BEIJING, Nov. 8, 2024 /PRNewswire/ — Pintec Technology Holdings Limited PT (“Pintec” or the “Company”), a Nasdaq-listed company providing technology enabled financial and digital services to micro, small and medium enterprises in China, today announced its unaudited financial results for the six months ended June 30, 2024.

First Half 2024 Financial Highlights

- Total revenues decreased by 57.5% or RMB20.17 million to RMB14.92 million (US$2.09 million) for the first half of 2024 compared to total revenues of RMB35.09 million for the same period of 2023.

- Gross profit increased by 111.6% to RMB8.90 million (US$1.25 million) for the first half of 2024 from RMB4.21 million for the same period of 2023. Gross margin was 59.66% for the first half of 2024 compared to 11.99% for the same period of 2023.

- Loss from operations decreased by 37.1% to RMB7.61 million (US$1.07 million) for the first half of 2024 from RMB12.09 million for the same period of 2023.

- Net loss decreased by 82.0% to RMB8.34 million (US$1.17 million) for the first half of 2024 compared to net loss of RMB46.30 million for the same period of 2023.

First Half 2024 Operating Highlights

- Total loans facilitated decreased by 2.4% to RMB46.17 million (US$6.48 million) for the first half of 2024 from RMB47.3 million for the same period of 2023.

- Loan outstanding balance decreased by 9.0% to RMB56.14 million (US$7.88 million) as of June 30, 2024 from RMB61.74 million as of December 31, 2023.

- The following table provides delinquency rates by balance for all loans facilitated by the Company as of the dates indicated:

|

Delinquent for |

||||||||||||

|

16-30 days |

31-60 days |

61-90 days |

||||||||||

|

December 31, 2021 |

1.00 |

% |

1.30 |

% |

1.18 |

% |

||||||

|

December 31, 2022 |

0.23 |

% |

0.58 |

% |

0.18 |

% |

||||||

|

December 31, 2023 |

0.26 |

% |

0.22 |

% |

0.27 |

% |

||||||

|

June 30, 2024 |

0.20 |

% |

0.04 |

% |

0.22 |

% |

||||||

Mr. Zexiong Huang, Chief Executive Officer of Pintec, commented, “During the first half of 2024, despite the unavoidable constraints on our business expansion caused by changes in industry policies, regulations, and slowdown in overall economy in China, we continued to strive for further improvements in our financial position, driven by enhanced operational efficiency, strengthened risk management, and optimized cost structures, all contributing to the resilience of our business. At the same time, even amidst fluctuations in the market risks resulting from the sluggish macroeconomic recovery, we have adhered to a prudent risk management approach, enabling us to maintain stability and healthy asset quality in this challenging environment. We believe that lean financial performance and high-quality assets are fundamental to capturing long-term opportunities.”

“Looking forward, we are committed to focusing on our core strategy, which is to prioritize financial stability and risk management to sustain solid growth in an uncertain macro environment. We remain dedicated to delivering financial digitization solutions to our business partners, financial partners, and end customers. The sustainable and quality-based development will continue to be the path we uphold. To achieve this goal, we will keep solidifying our competencies in overall risk management, attracting customers and strengthening partnerships, expanding our business, and refining operations while implementing cost-effective initiatives.” Mr. Huang concluded.

First Half 2024 Financial Results

Revenues

Total revenues decreased by 57.47% to RMB14.92 million (US$2.09 million) for the first half of 2024 from RMB35.09 million for the same period of 2023.

- Revenues from technical service fees decreased by 86.6% to RMB2.66 million (US$0.37 million) for the first half of 2024 from RMB19.83 million for the same period of 2023. The decrease in revenues from technical service fees was mainly due to the gradual reduction of such business based on our overall operation realignment.

- Revenues from installment service fee decreased by 13.7% to RMB6.49 million (US$0.91 million) for the first half of 2024 from RMB7.53 million for the same period of 2023. The decrease in revenues from installment service fee was mainly due to the decrease in volume of both new and outstanding small and medium enterprises (“SMEs”) loans under current marketing environment in the first half of 2024.

- Revenues from wealth management service fees decreased by 25.3% to RMB5.77 million (US$0.81 million) for the first half of 2024 from RMB7.73 million for the same period of 2023. The decrease in revenue of the wealth management was mainly due to that the new regulation issued by Chinese regulatory authority on insurance brokerage business which led to a scarcity of insurance products that comply with the new regulation and in turn caused the decrease in insurance brokerage business and revenue.

Cost of Revenues

Cost of revenues decreased by 80.51% to RMB6.02 million (US$0.85 million) for the first half of 2024 from RMB30.88 million for the same period of 2023. This decrease was mainly attributable to:

- Funding cost. Funding cost mainly consists of interest expense the Company pays in relation to the funding debts to fund its financing receivables. Funding cost decreased RMB9.31 million to nil compared to funding cost of RMB9.31 million in the same period of 2023. The decrease was due to that we recorded interest expenses of RMB9.31 million during the first half of 2023, which was mainly represents an out-of-period adjustments amount to RMB9.31 million from prior years.

- Reversal/(provision) of credit losses. Provision of credit losses of RMB1.73 million (US$0.24 million) in first half of 2024 compared to reversal of credit losses of RMB0.38 million in the same period of 2023.

- Origination and servicing cost. Origination and servicing cost decreased by 78.8% to RMB5.05 million (US$0.71 million) compared to RMB23.86 million in the same period of 2023, which was mainly due to the decreased in revenue from technical services fees and its corresponding costs.

Gross Profit

Gross profit increased to RMB8.90 million (US$1.25 million) for the first half of 2024 from RMB4.21 million for the same period of 2023. Gross margin was 59.66% in the first half of 2024 compared to 11.99% in the same period of 2023.

Operating Expenses

Total operating expenses increased by 1.3% to RMB16.51 million (US$2.32 million) for the first half of 2024 from RMB16.30 million for the same period of 2023. The Company has been continuously optimizing and refining its organizational structure, marketing strategies and product matrix since the beginning of 2024.

- Sales and marketing expenses in the first half of 2024 increased by 0.3% to RMB8.54 million (US$1.20 million) from RMB8.51 million in the same period of 2023. This increase was primarily due to the addition of sales and marketing personnel to expand our Wealth Management Solutions services and business.

- General and administrative expenses in the first half of 2024 increased by 12.8% to RMB5.71 million (US$0.80 million) from RMB5.06 million in the same period of 2023. This increase was primarily driven by the reversal of share-based compensation in first half of 2023, which was an out-of-period adjustments from prior years and no such adjustments were recorded in first half of 2024.

- Research and development expenses in the first half of 2024 decreased by 17.0% to RMB2.26 million (US$0.32 million) from RMB2.73 million in the same period of 2023, primarily due to personnel structure optimization as part of the business transformation of the Company.

Loss from operations

Loss from operations decreased by 37.1% to RMB7.61 million (US$1.07 million) for the first half of 2024 from RMB12.09 million for the same period of 2023.

Other income and expenses

Other expenses, net decreased by 99.4% to RMB0.28 million (US$0.04 million) for the first half of 2024 from RMB45.59 million for the same period of 2023. The decrease was primarily due to the decrease in impairment loss of long-lived assets of RMB3.74 million, decrease of interest expense of RMB4.41 million and the decrease in loss of RMB38.88 million from disposal of Sky City Holding Limited and eight of its subsidiaries in May 2023.

Income tax (expense)/benefit

Income tax expense was recorded as RMB0.46 million for the first half of 2024 compared to income tax benefit of RMB11.38 million recorded for the first half of 2023.

Net loss

As a result of the foregoing, net loss was recorded RMB8.34 million (US$1.17 million) for the first half of 2024 compared to RMB46.30 million recorded for the same period of 2023.

Net loss attributable to ordinary shareholders was recorded RMB8.43 million (US$1.18 million) for the first half of 2024 compared to net loss attributable to ordinary shareholders of RMB44.86 million recorded for the same period of 2023.

Adjusted net loss was RMB8.34 million (US$1.17 million) for the first half of 2024 compared to RMB65.50 million for the same period of 2023.

Net Loss Per Share

Basic and diluted net loss per ordinary share in the first half of 2024 were both RMB0.02 (US$0.00). Basic and diluted net loss per American Depositary Share (“ADS”) in the first half of 2024 were both RMB0.53 (US$0.07). Each ADS represents thirty-five of the Company’s Class A ordinary shares.

Adjusted basic and diluted net loss per ordinary share in the first half of 2024 were both RMB0.02 (US$0.00). Adjusted basic and diluted net loss per ADS in the first half of 2024 were both RMB0.53 (US$0.07).

Balance Sheet

The Company has combined cash and cash equivalents and long-term restricted cash of RMB53.42 million (US$7.50 million) as of June 30, 2024, compared to RMB45.51 million as of December 31, 2023.

Going Concern

The Company acknowledged that there were recurring losses from operation since year 2019. For the six months ended June 30, 2024, the Company reported a net loss of RMB8.34 million (US$1.17 million). In addition, as of June 30, 2024, the Company reported a negative working capital of RMB388.96 million (US$54.58 million) and had an accumulated deficit of RMB2,520.97 million (US$353.73 million). The Company’s operating results in future periods are subject to numerous uncertainties, and it is uncertain whether the Company will be able to reduce or eliminate its net loss in the foreseeable future. In order to alleviate the pressure on capital turnover, the Company has reached an agreement with a third-party institution to obtain a line of credit facility with an amount up to US$40 million with annual interest rate of 7% if used, which is effective until September 30, 2025.

Due to the unpredictable future of the capital markets and the industry in which we operate, there can be no assurance that the Company will be successful in achieving its budget goals, that the Company’s future capital raising will be sufficient to support its ongoing operations, or that any additional financing will be available in a timely manner or with acceptable terms, if at all. If the Company is unable to raise sufficient financing or events or circumstances occur such that the Company does not meet its budget goals, it may have a material adverse effect on the Company’s financial position, results of operations, cash flows, and ability to achieve its intended business objectives. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The realization of assets and the satisfaction of liabilities in the normal course of business are dependent on, among other things, the Company’s ability to operate profitably, to generate cash flows from operations, and to pursue financing arrangements to support its working capital requirements.

Use of Non-GAAP Financial Measures

In evaluating its business, the Company considers and uses adjusted net income/loss as a supplemental measure to review and assess its operating performance. The presentation of this non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company defines adjusted net income/loss as net income/loss excluding share-based compensation expenses and income tax benefit recognized due to reversal of uncertain tax position.

The Company believes that this non-GAAP financial measure can help management evaluate the Company’s operating performance and formulate business plans. Adjusted net income/loss enables management to assess operating results without considering the impact of share-based compensation expenses and income tax benefit recognized due to reversal of uncertain tax position. The Company also believes that this non-GAAP financial measure provides useful information about its operating results, enhance the overall understanding of its past performance and future prospects and allows for greater visibility with respect to key metrics used by management in their financial and operational decision-making.

This non-GAAP financial measure is not defined under U.S. GAAP and is not presented in accordance with U.S. GAAP. This non-GAAP financial measure has limitations as an analytical tool. One of the key limitations of using adjusted net income/loss is that it does not reflect all items of income and expenses that affect the Company’s operations. The Company will continue to incur share-based compensation expenses in its business, which are reflected in the presentation of its adjusted net income/loss. Further, this non-GAAP financial measure may differ from non-GAAP financial information used by other companies, including peer companies, and therefore its comparability may be limited.

The Company compensates for these limitations by reconciling this non-GAAP financial measure to the most directly comparable U.S. GAAP financial measure, net income/loss, which should be considered when evaluating the Company’s performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial measure.

Exchange Rate

This announcement contains translations of certain RMB amounts into U.S. dollars (“USD”) at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to USD were made at the rate of RMB7.1268 to US$1.00, the noon buying rate in effect on June 28, 2024, in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred to could be converted into USD or RMB, as the case may be, at any particular rate or at all. For analytical presentation, all percentages are calculated using the numbers presented in the financial statements contained in this earnings release.

Safe Harbor Statement

This press release contains forward-looking statements. These statements constitute “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “target,” “confident” and similar statements. Among other things, the quotations from management in this announcement, as well as Pintec’s strategic and operational plans, contain forward-looking statements. Pintec may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Such statements are based upon management’s current expectations and current market and operating conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control. Forward-looking statements involve inherent risks, uncertainties and other factors that could cause actual results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited to, the Company’s limited operating history, regulatory uncertainties relating to the markets and industries where the Company operates, and the need to further diversify its financial partners, the Company’s reliance on a limited number of business partners, the impact of current or future PRC laws or regulations on wealth management financial products, and the Company’s ability to meet the standards necessary to maintain the listing of its ADSs on the Nasdaq Global Market, including its ability to cure any non-compliance with Nasdaq’s continued listing criteria. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and the Company does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law.

About Pintec

Pintec is a Nasdaq-listed company providing technology enabled financial and digital services to micro, small and medium enterprises in China. It connects business partners and financial partners on its open platform and enables them to provide financial services to end users efficiently and effectively. Pintec empowers its business partners by providing them with the capability to add a financing option to their product offerings. It helps its financial partners adapt to the new digital economy by enabling them to access the online population that they could not otherwise reach efficiently or effectively. Pintec continues to deliver exceptional digitization services, diversified financial products, and best-in-class solutions with innovative technology, to solidify its relationship with its business partners and satisfy its clients’ needs. Pintec currently holds internet micro lending license, fund distribution license, insurance brokerage license and enterprise credit investigation license in China. For more information, please visit ir.pintec.com.

|

Pintec Technology Holdings Ltd. |

||||||||||||

|

Condensed Consolidated Balance Sheets |

||||||||||||

|

(In thousands, except for share and per share data) |

||||||||||||

|

As of |

As of June 30, |

|||||||||||

|

2023 |

2024 |

2024 |

||||||||||

|

RMB |

RMB |

US$ |

||||||||||

|

(Unaudited) |

(Unaudited) |

|||||||||||

|

ASSETS |

||||||||||||

|

Current assets: |

||||||||||||

|

Cash and cash equivalents |

40,508 |

44,606 |

6,259 |

|||||||||

|

Restricted cash |

– |

3,815 |

535 |

|||||||||

|

Short-term financing receivables, net |

61,467 |

55,941 |

7,849 |

|||||||||

|

Short-term financial guarantee assets, net |

43 |

– |

– |

|||||||||

|

Accounts receivable, net |

1,569 |

2,255 |

316 |

|||||||||

|

Prepayments and other current assets, net |

4,605 |

3,373 |

476 |

|||||||||

|

Amounts due from related parties, net |

5 |

– |

– |

|||||||||

|

Total current assets |

108,197 |

109,990 |

15,435 |

|||||||||

|

Non-current assets: |

||||||||||||

|

Non-current restricted cash |

5,000 |

5,000 |

702 |

|||||||||

|

Total non-current assets |

5,000 |

5,000 |

702 |

|||||||||

|

TOTAL ASSETS |

113,197 |

114,990 |

16,137 |

|||||||||

|

LIABILITIES |

||||||||||||

|

Current liabilities: |

||||||||||||

|

Accounts payable |

4,977 |

4,153 |

583 |

|||||||||

|

Amounts due to related parties, current |

299,346 |

301,398 |

42,291 |

|||||||||

|

Tax payable |

18,857 |

18,561 |

2,604 |

|||||||||

|

Financial guarantee liabilities |

43 |

– |

– |

|||||||||

|

Accrued expenses and other liabilities |

165,072 |

174,834 |

24,532 |

|||||||||

|

Total current liabilities |

488,295 |

498,946 |

70,010 |

|||||||||

|

Non-current liabilities: |

||||||||||||

|

Other non-current liabilities |

4,781 |

4,490 |

630 |

|||||||||

|

Total non-current liabilities |

4,781 |

4,490 |

630 |

|||||||||

|

TOTAL LIABILITIES |

493,076 |

503,436 |

70,640 |

|||||||||

|

DEFICIT |

||||||||||||

|

Class A Ordinary Shares (US$ 0.000125 par value per share; |

454 |

454 |

64 |

|||||||||

|

Class B Ordinary Shares (US$ 0.000125 par value per share; |

42 |

42 |

6 |

|||||||||

|

Additional paid-in capital |

2,036,473 |

2,036,473 |

285,749 |

|||||||||

|

Statutory reserves |

9,006 |

9,006 |

1,264 |

|||||||||

|

Accumulated other comprehensive income |

73,607 |

73,383 |

10,297 |

|||||||||

|

Accumulated deficit |

(2,512,537) |

(2,520,966) |

(353,730) |

|||||||||

|

Total shareholders’ deficit |

(392,955) |

(401,608) |

(56,350) |

|||||||||

|

Non-controlling interests |

13,076 |

13,162 |

1,847 |

|||||||||

|

TOTAL DEFICIT |

(379,879) |

(388,446) |

(54,503) |

|||||||||

|

TOTAL LIABILITIES AND DEFICIT |

113,197 |

114,990 |

16,137 |

|||||||||

|

Pintec Technology Holdings Ltd. |

||||||||||||

|

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss |

||||||||||||

|

(In thousands, except for share and per share data) |

||||||||||||

|

For the six months ended June 30, |

||||||||||||

|

2023 |

2024 |

2024 |

||||||||||

|

RMB |

RMB |

US$ |

||||||||||

|

Revenues: |

||||||||||||

|

Technical service fees |

19,834 |

2,658 |

373 |

|||||||||

|

Installment service fees |

7,527 |

6,493 |

911 |

|||||||||

|

Wealth management service fees and others |

7,727 |

5,771 |

810 |

|||||||||

|

Total revenues |

35,088 |

14,922 |

2,094 |

|||||||||

|

Cost of revenues: |

||||||||||||

|

Funding cost |

(9,305) |

– |

– |

|||||||||

|

Reversal/(Provision) of credit losses |

378 |

(1,730) |

(243) |

|||||||||

|

Origination and servicing cost |

(23,856) |

(5,055) |

(710) |

|||||||||

|

Reversal of guarantee |

1,903 |

765 |

107 |

|||||||||

|

Cost of revenues |

(30,880) |

(6,020) |

(846) |

|||||||||

|

Gross profit |

4,208 |

8,902 |

1,248 |

|||||||||

|

Operating expenses: |

||||||||||||

|

Sales and marketing expenses |

(8,509) |

(8,537) |

(1,198) |

|||||||||

|

General and administrative expenses |

(5,059) |

(5,708) |

(801) |

|||||||||

|

Research and development expenses |

(2,728) |

(2,264) |

(318) |

|||||||||

|

Total operating expenses |

(16,296) |

(16,509) |

(2,317) |

|||||||||

|

Loss from operations |

(12,088) |

(7,607) |

(1,069) |

|||||||||

|

Long-lived assets impairment |

(3,737) |

– |

– |

|||||||||

|

Loss from disposal of subsidiaries |

(38,883) |

– |

– |

|||||||||

|

Financial expenses, net |

(4,273) |

132 |

19 |

|||||||||

|

Other income/(expenses), net |

1,305 |

(409) |

(57) |

|||||||||

|

Loss before income tax (expense)/benefit |

(57,676) |

(7,884) |

(1,107) |

|||||||||

|

Income tax benefit/(expense) |

11,377 |

(459) |

(64) |

|||||||||

|

Net loss |

(46,299) |

(8,343) |

(1,171) |

|||||||||

|

Less: Net (loss)/income attributable to non-controlling interests |

(1,444) |

86 |

12 |

|||||||||

|

Net loss attributable to Pintec Technology Holdings Limited |

(44,855) |

(8,429) |

(1,183) |

|||||||||

|

Other comprehensive (loss)/income: |

||||||||||||

|

Foreign currency translation adjustments, net of nil tax |

46,080 |

(224) |

(31) |

|||||||||

|

Total other comprehensive income/(loss) |

46,080 |

(224) |

(31) |

|||||||||

|

Total comprehensive loss |

(219) |

(8,567) |

(1,202) |

|||||||||

|

Total comprehensive (loss)/income attributable to non-controlling |

(1,444) |

86 |

12 |

|||||||||

|

Total comprehensive income/(loss) attributable to Pintec Technology |

1,225 |

(8,653) |

(1,214) |

|||||||||

|

Net loss per ordinary share |

||||||||||||

|

Basic |

(0.10) |

(0.02) |

(0.00) |

|||||||||

|

Diluted |

(0.10) |

(0.02) |

(0.00) |

|||||||||

|

Weighted average ordinary shares outstanding |

||||||||||||

|

Basic |

433,743,535 |

554,687,200 |

554,687,200 |

|||||||||

|

Diluted |

434,294,424 |

554,687,200 |

554,687,200 |

|||||||||

|

Pintec Technology Holdings Ltd. |

||||||||||||

|

Unaudited Reconciliations of GAAP and Non-GAAP Results |

||||||||||||

|

(In thousands, except for share and per share data) |

||||||||||||

|

For the six months ended June 30, |

||||||||||||

|

2023 |

2024 |

2024 |

||||||||||

|

RMB |

RMB |

US$ |

||||||||||

|

Net loss |

(46,299) |

(8,343) |

(1,171) |

|||||||||

|

Add: Share-based compensation expenses |

(6,884) |

– |

– |

|||||||||

|

Less: Income tax benefit recognized due to reversal of uncertain tax |

12,319 |

– |

– |

|||||||||

|

Adjusted net loss |

(65,502) |

(8,343) |

(1,171) |

|||||||||

|

Less: Adjusted net (loss)/income attributable to non-controlling interests |

(1,444) |

86 |

12 |

|||||||||

|

Adjusted net loss attributable to Pintec Technology Holdings Limited |

(64,058) |

(8,429) |

(1,183) |

|||||||||

|

Adjusted net loss per ordinary share |

||||||||||||

|

Basic and diluted |

(0.15) |

(0.02) |

(0.00) |

|||||||||

|

Weighted average number of ordinary shares outstanding |

||||||||||||

|

Basic and diluted |

433,743,535 |

554,687,200 |

554,687,200 |

|||||||||

![]() View original content:https://www.prnewswire.com/news-releases/pintec-announces-unaudited-financial-results-for-the-first-half-of-2024-302299734.html

View original content:https://www.prnewswire.com/news-releases/pintec-announces-unaudited-financial-results-for-the-first-half-of-2024-302299734.html

SOURCE Pintec Technology Holdings Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Smart Money Is Betting Big In GOOGL Options

Deep-pocketed investors have adopted a bearish approach towards Alphabet GOOGL, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GOOGL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 60 extraordinary options activities for Alphabet. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 43% bearish. Among these notable options, 17 are puts, totaling $838,080, and 43 are calls, amounting to $2,307,217.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $120.0 to $350.0 for Alphabet over the recent three months.

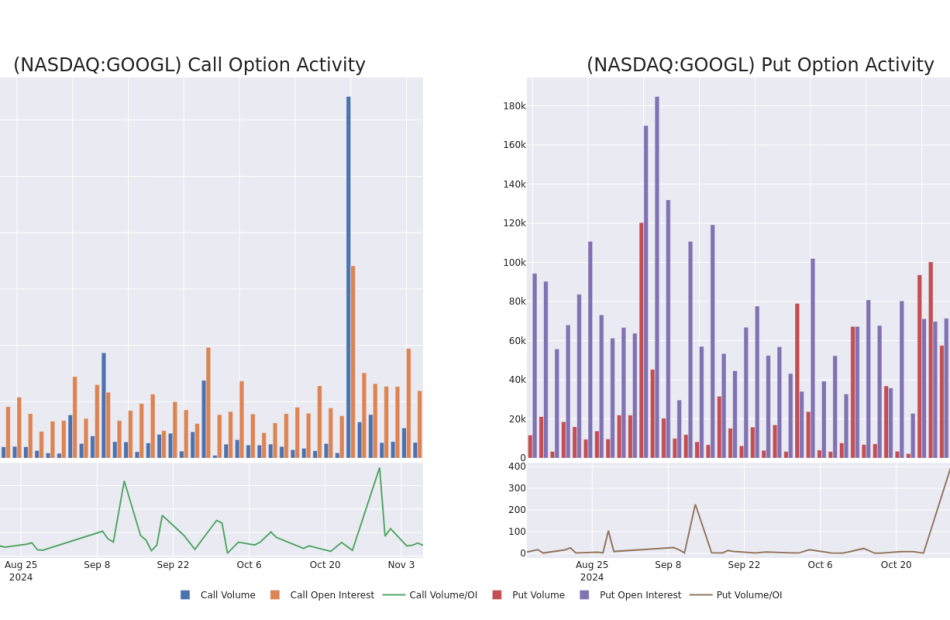

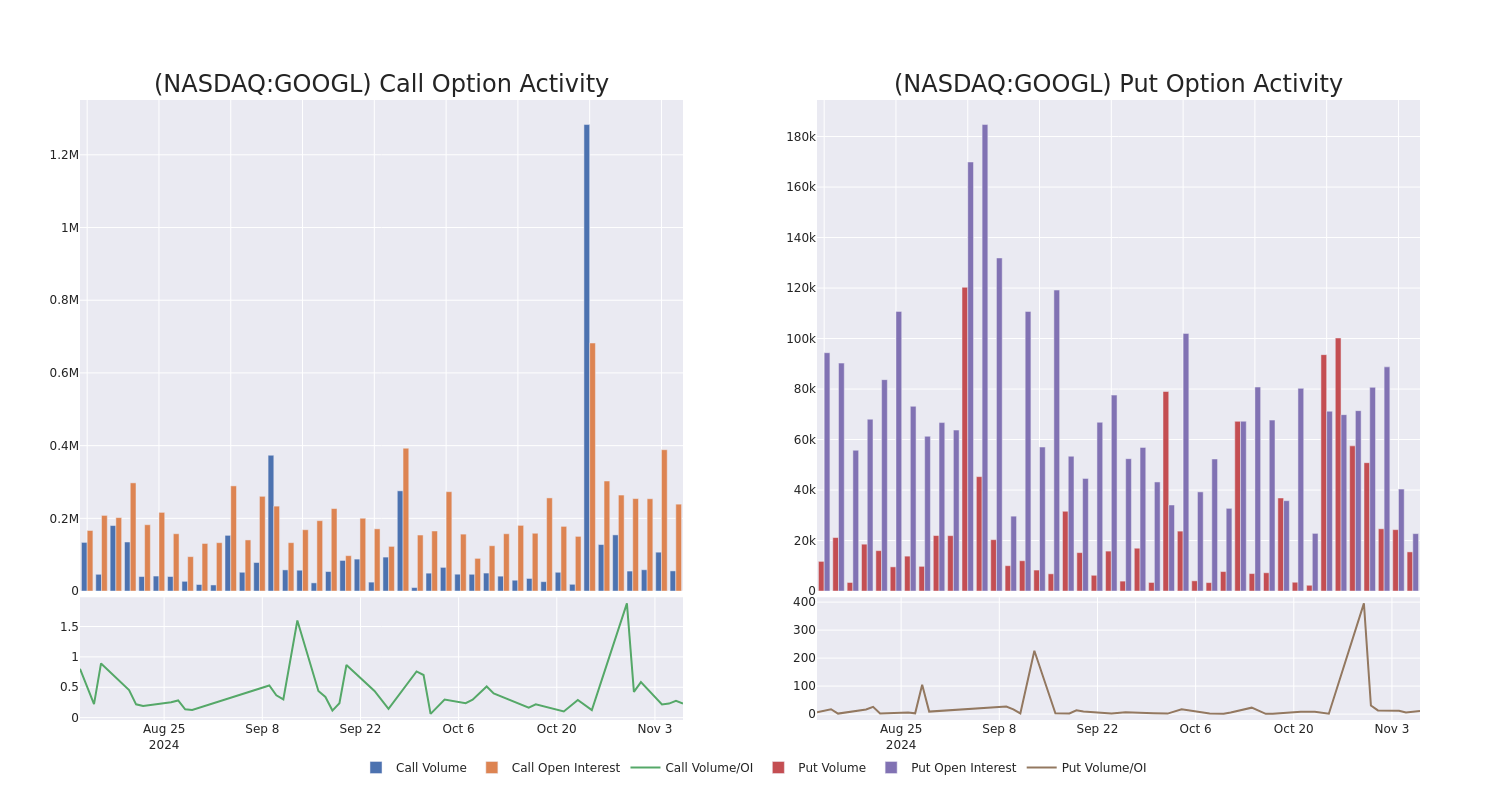

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Alphabet’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Alphabet’s significant trades, within a strike price range of $120.0 to $350.0, over the past month.

Alphabet 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOOGL | CALL | SWEEP | NEUTRAL | 12/13/24 | $7.25 | $7.15 | $7.18 | $175.00 | $272.1K | 806 | 390 |

| GOOGL | CALL | SWEEP | BEARISH | 11/08/24 | $3.45 | $3.4 | $3.4 | $175.00 | $245.2K | 21.4K | 1.6K |

| GOOGL | PUT | SWEEP | BEARISH | 01/16/26 | $171.95 | $168.1 | $170.54 | $350.00 | $136.4K | 0 | 8 |

| GOOGL | CALL | SWEEP | BULLISH | 01/17/25 | $10.5 | $10.4 | $10.45 | $175.00 | $129.5K | 12.9K | 203 |

| GOOGL | CALL | TRADE | BEARISH | 03/21/25 | $11.7 | $11.65 | $11.65 | $180.00 | $116.5K | 4.8K | 403 |

About Alphabet

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google services, the vast majority of which is advertising sales. Alongside online ads, Google services houses sales stemming from Google’s subscription services (YouTube TV, YouTube Music among others), platforms (sales and in-app purchases on Play Store), and devices (Chromebooks, Pixel smartphones, and smart home products such as Chromecast). Google’s cloud computing platform, or GCP, accounts for roughly 10% of Alphabet’s revenue with the firm’s investments in up-and-coming technologies such as self-driving cars (Waymo), health (Verily), and internet access (Google Fiber) making up the rest.

In light of the recent options history for Alphabet, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Alphabet

- With a trading volume of 12,298,312, the price of GOOGL is down by -1.03%, reaching $178.88.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 81 days from now.

What The Experts Say On Alphabet

5 market experts have recently issued ratings for this stock, with a consensus target price of $209.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Piper Sandler downgraded its rating to Overweight, setting a price target of $210.

* An analyst from Roth MKM persists with their Buy rating on Alphabet, maintaining a target price of $212.

* An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $205.

* In a cautious move, an analyst from BMO Capital downgraded its rating to Outperform, setting a price target of $217.

* An analyst from Evercore ISI Group persists with their Outperform rating on Alphabet, maintaining a target price of $205.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Alphabet, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ThreeD Capital Inc. Issues Early Warning Report in Connection with the Acquisition of Securities of AI/ML Innovations Inc.

TORONTO, Nov. 08, 2024 (GLOBE NEWSWIRE) — ThreeD Capital Inc. (“ThreeD”) IDKIDKFF a Canadian based venture capital firm focused on opportunistic investments in companies in the junior resources and disruptive technologies sectors, announces that through the completion of a private placement (the “Acquisition”), ThreeD and Sheldon Inwentash (the “Joint Actor”) acquired ownership and control of an aggregate of 9,000,000 common shares (the “Subject Shares”) and 9,000,000 common share purchase warrants (the “Subject Warrants” and together with the Subject Shares, the “Subject Units”) of AI/ML Innovations Inc. (the “Company” or “AIML”). The Subject Shares represented approximately 6.5% of all issued and outstanding common shares of AIML at the time of the Acquisition. As a result of the Acquisition, the percentage ownership held by ThreeD and the Joint Actor increased by greater than 2% from the last early warning report filed.

Immediately prior to the Acquisition, ThreeD and the Joint Actor owned and controlled an aggregate of 9,514,200 common shares, 14,065,000 common share purchase warrants, and 500,000 stock options of the Company, representing approximately 8.0% of all issued and outstanding common shares of AIML (or approximately 18.1% on a partially diluted basis, assuming exercise of the warrants and options held). Of this total, ThreeD held an aggregate of 8,949,200 common shares and 12,500,000 common share purchase warrants, representing approximately 7.6% of the issued and outstanding common shares of AIML (or approximately 16.4% on a partially diluted basis, assuming exercise of the warrants held). The Joint Actor held an aggregate of 565,000 common shares, 1,565,000 common share purchase warrants, and 500,000 stock options, representing 0.5% of the issued and outstanding common shares of AIML (or approximately 2.2% on a partially diluted basis, assuming exercise of the warrants and options held).

Immediately following the Acquisition, ThreeD and the Joint Actor own and control an aggregate of 18,514,200 common shares, 23,065,000 common share purchase warrants, and 500,000 stock options of the Company, representing approximately 13.4% of all issued and outstanding common shares of AIML (or approximately 26.0% on a partially diluted basis, assuming exercise of the warrants and options held). Of this total, ThreeD held an aggregate of 15,949,200 common shares and 19,500,000 common share purchase warrants, representing approximately 11.6% of the issued and outstanding common shares of AIML (or approximately 22.5% on a partially diluted basis assuming the exercise of the warrants held). The Joint Actor held an aggregate of 2,565,000 common shares, 3,565,000 common share purchase warrants, and 500,000 stock options, representing 1.9% of the issued and outstanding common shares of AIML (or approximately 4.7% on a partially diluted basis, assuming exercise of the warrants and options held).

The Acquisition was conducted through a private placement and not through the facilities of any stock exchange. The holdings of securities of the Company by ThreeD and the Joint Actor are managed for investment purposes. ThreeD and the Joint Actor could increase or decrease its investments in the Company at any time, or continue to maintain its current position, depending on market conditions or any other relevant factor.

The Subject Units were acquired for total consideration of $585,000, or $0.065 per Subject Unit.

About ThreeD Capital Inc.

ThreeD is a publicly-traded Canadian-based venture capital firm focused on opportunistic investments in companies in the junior resources and disruptive technologies sectors. ThreeD’s investment strategy is to invest in multiple private and public companies across a variety of sectors globally. ThreeD seeks to invest in early stage, promising companies where it may be the lead investor and can additionally provide investees with advisory services and access to the Company’s ecosystem.

| For further information: |

| Matthew Davis, CPA |

| Chief Financial Officer and Corporate Secretary davis@threedcap.com |

| Phone: 416-941-8900 |

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Airbnb's Margins Under Pressure Despite Q3 Beat, Analysts Caution

Shares of Airbnb Inc ABNB tumbled in early trading on Friday, after the company reported downbeat third-quarter results.

The company reported its results amid an exciting earnings season. Here are some key analyst takeaways.

Piper Sandler On Airbnb

Analyst Thomas Champion maintained a Neutral, while raising the price target from $125 to $145.

Airbnb reported third-quarter gross bookings and revenues of $20.1 billion and $3.7 billion, up 10% year-on-year and 9% year-on-year, respective, with both coming in higher than estimates, Champion said in a note. The company’s results were “solid” and reflected “firming demand trends,” he added.

Airbnb repurchased shares worth around $1.1 billion, higher than its average of $500 million in the first and second quarters, with remaining authorization of $4.2 billion, the analyst stated. Management indicated expenses in marketing and investment in new businesses “to reignite growth,” he further wrote.

JPMorgan On Airbnb

Analyst Doug Anmuth reiterated a Neutral rating, while lifting the price target from $121 to $142.

Despite the challenges faced in the second quarter, “broad-based strength in demand trends & a normalization of booking lead times” generated growth in GBV (gross booking value) through the third quarter and into the fourth, Anmuth said.

The company’s fourth-quarter guidance of N&E (Nights & Experiences) acceleration “reflects continued healthy travel demand trends, a normalized booking window relative to last quarter, and success across core optimizations and market expansion, despite tougher comps,” the analyst wrote. With investments in marketing and product development expected to continue through 2025, Airbnb’s margins could remain under pressure in the near term, he added.

Goldman Sachs On Airbnb

Analyst Eric Sheridan reiterated a Sell, raising the price target from $103 to $107.

Airbnb indicated demand strength into the fourth quarter across its core and expansion markets, which build on “demand accelerating every month since July,” Sheridan said. The company’s revenue guidance for the fourth quarter reflects “an acceleration in room nights/experiences booked compared to Q3,” he stated.

“Lead times have now normalized globally exiting Q3 and mgmt. pointed to factors like the Olympics contributing to softness in long lead time bookings at the start of the quarter,” the analyst wrote. He added, however, that investments in long-term platform expansion efforts “created upward pressure on expenses (esp. marketing and product) into Q4,” resulting in uncertainty around the company’s margins in 2025.

Wedbush On Airbnb

Analyst Scott Devitt maintained an Outperform rating, while upping the price target from $135 to $155.

While reporting better-than-expected third-quarter results, Airbnb provided “a mixed outlook,” Devitt said. The company’s 2024 adjusted EBITDA margin guidance of approximately 35.5% implies fourth-quarter margins of about 27%, below the consensus of 29.7%, he added.

Margins will come under pressure as the company “continues to invest in marketing as well as product teams in advance of upcoming launches next year,” the analyst stated. There are several potential catalysts in 2025, including mix shift to higher growth expansion markets, “take rate expansion supported by monetization improvements and new host/guest services, and growth beyond the core,” he further wrote.

Check out other analyst stock ratings.

Truist Securities On Airbnb

Analyst Patrick Scholes reiterated a Hold rating and price target of $124.

Better-than-expected margins drove Airbnb’s EBITDA to $100 million, higher than Street estimates, Scholes said. He added, however, that the situation is likely to reverse in the fourth quarter, as the guidance implies margins around 300 basis points (bps) lower than consensus.

Nonetheless, the third-quarter results and fourth-quarter earnings guidance indicate full-year adjusted EBITDA above the consensus, the analyst stated. Booking lead times normalized as the year progressed and the company did not mention signs of slowing demand in the U.S. like it had during its second-quarter release, he said.

Benchmark On Airbnb

Analyst Daniel Kurnos reaffirmed a Buy rating and price target of $155.

Airbnb delivered “a solid, all-around quarter,” with every metric modestly beating consensus expectations, Kurnos said. The company’s third-quarter “bodes well for our previously non-consensus, almost double-digit nights and experiences call for 4Q,” he added.

The analyst stated, however, that Airbnb remains in “the sentiment penalty box after a couple of tough prints,” which is why its stock declined when the fourth-quarter margin guidance came in below Street expectations.

The company’s plans to launch several new “billion dollar standalone” businesses, investments in non-core market growth, and commentary on adding hotels on the platform “probably spooked the cash flow crowd a bit as well,” he further wrote.

Needham On Airbnb

Analyst Bernie McTernan maintained a Hold rating on the stock.

Nights booked grew by 8.5% year-on-year in the third quarter, slowing by 20 bps sequentially, McTernan said. Despite a slow start to the quarter, “demand grew each month of 3Q, accelerating every month and into October,” he added.

“The company attributed this to more normalized lead times, app bookings growth (58% of nights booked vs 53% YoY), and new first time bookers,” the analyst wrote. Comps will get easier in September and October relative to November and December, and year-on-year trends are likely to stabilize, he stated.

Oppenheimer On Airbnb

Analyst Jed Kelly reaffirmed a Perform rating on the stock.

Although Airbnb’s nights-booked decelerated sequentially by around 20 bps in the third quarter, this was better than Street’s expectations of 150 bps, Kelly said. The better-than-anticipated performance was due to strength in the Latin America and Asia Pacific regions, he added.

The company guided to fourth-quarter revenue of $2.39-$2.44 billion, which implies an acceleration in nights booked and bookings growth of 10%-12% year-on-year, the analyst stated. The full-year EBITDA margin guide of 35.5% implies “4Q EBITDA $642M, 26.6% margins contracting 670bps-y/y driven by S&M/ Product deleverage and lower take-rates from gift cards,” he further wrote.

ABNB Price Action: Shares of Airbnb were down 8% to $135.56 at the time of publication on Friday.

Read More:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Unloading: Marcelo Cardoso Sells $221K Worth Of Laureate Education Shares

Marcelo Cardoso, Chief Operating Officer at Laureate Education LAUR, disclosed an insider sell on November 7, according to a recent SEC filing.

What Happened: Cardoso’s decision to sell 12,775 shares of Laureate Education was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $221,876.

During Friday’s morning session, Laureate Education shares down by 0.0%, currently priced at $18.74.

Discovering Laureate Education: A Closer Look

Laureate Education Inc is an international community of universities. The company provides higher education programs and services to students through an international network of licensed universities and higher education institutions. Its geographical segments include Peru and Mexico.

Laureate Education: Financial Performance Dissected

Revenue Growth: Laureate Education’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 1.96%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Exploring Profitability:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 22.43%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Laureate Education’s EPS is below the industry average. The company faced challenges with a current EPS of 0.56. This suggests a potential decline in earnings.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.56, caution is advised due to increased financial risk.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 11.64, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.88, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Laureate Education’s EV/EBITDA ratio at 6.58 suggests potential undervaluation, falling below industry averages.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

The Insider’s Guide to Important Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Laureate Education’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sell Alert: Eric Scroggins Cashes Out $302K In Allison Transmission Stock

Eric Scroggins, VP at Allison Transmission ALSN, disclosed an insider sell on November 7, according to a recent SEC filing.

What Happened: Scroggins’s decision to sell 2,762 shares of Allison Transmission was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $302,812.

Tracking the Friday’s morning session, Allison Transmission shares are trading at $118.02, showing a down of 0.0%.

Get to Know Allison Transmission Better

Allison Transmission is the largest manufacturer of fully automatic transmissions for commercial vehicles. The company’s automatic transmissions allow customers to achieve better fuel and operator efficiency than less expensive manual and automated manual transmissions. Allison serves several end markets, including on- and off-highway equipment and military vehicles. Its on-highway business has about 60% global market share. The company’s transmissions can be found in Class 4-8 trucks, buses, and a limited number of large passenger vehicles (heavy-duty pickup trucks and motor homes). Allison also produces electric hybrid propulsion systems and is developing e-powertrains.

A Deep Dive into Allison Transmission’s Financials

Revenue Growth: Over the 3 months period, Allison Transmission showcased positive performance, achieving a revenue growth rate of 11.96% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company maintains a high gross margin of 48.06%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Allison Transmission’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 2.3.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.48, caution is advised due to increased financial risk.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 14.41 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 3.27 is above industry norms, reflecting an elevated valuation for Allison Transmission’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 10.62, Allison Transmission demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Important Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Allison Transmission’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.