Entera Bio Reports Q3 2024 Financial Results and Provides Business Updates

JERUSALEM, Nov. 08, 2024 (GLOBE NEWSWIRE) — Entera Bio Ltd. ENTX, (“Entera” or the “Company”) a leader in the development of oral peptides and small therapeutic proteins, today reported financial results and key business updates for the quarter ended September 30, 2024.

“The third quarter of 2024 drew consistent attention to our pivotal-staged clinical asset, EB613, the first oral PTH(1-34) tablet treatment dedicated to post-menopausal women with high risk osteoporosis. Entera’s proprietary N-Tab™ platform consistently delivered across our oral GLP-2 tablet, oral GLP-1/Glucagon tablet and confidential hypoparathyroidism tablet program. Finally, we are humbled by key additions from around the world to our clinical and scientific advisory board which we view as testament to what we are aspiring to build at Entera,” said Miranda Toledano, Chief Executive Officer of Entera.

Ms. Toledano continued, “We are headed into a busy year end across all programs and keenly anticipating FDA’s potential landmark ruling on the ASBMR-FNIH SABRE regulatory endpoint for osteoporosis drugs, expected in January 2025. Current regulatory guidelines requiring fracture outcomes have curtailed innovation in the treatment of this significant disease due to ethical, time and sizing of studies required to evaluate new treatments. The SABRE work is based on a statistical meta-analysis of over 170,000 patients across 53 randomized clinical studies and 7 osteoporosis drug classes correlating total hip Bone Mineral Density (BMD) to fracture outcomes. We believe that our pivotal program for EB613 is first in line to leverage this pathway. Our recent discussions with patients, regulatory agencies, clinicians and fellow industry colleagues acknowledge the need for new treatments for osteoporosis and, especially, oral anabolic therapy. Osteoporosis is one of the foremost underserved women’s health issues globally, where fracture rates continue to rise and where, despite medical guidelines, efficacious injectable anabolics are used in a minority of patients worldwide. We are developing EB613 to help close this treatment gap.”

Q3 2024 Updates:

EB613: First Oral PTH(1-34) Anabolic Tablet Treatment for Women with Osteoporosis

- In September 2024, new comparative pharmacological data for EB613 was presented at the American Society for Bone Mineral Research September 2024 (ASBMR 2024) Annual Meeting in Toronto. The abstract was previewed by Dr. Serge Ferrari of Geneva University Hospital in Switzerland in his sneak-peak highlights of cutting-edge clinical abstracts on osteoporosis therapy at ASBMR2024.

First GLP-1/Glucagon Agonist (Oxyntomodulin) Peptide Tablets for Obesity

- In September 2024, Entera and OPKO Health, Inc. ((“OPKO”, NASDAQ:OPK), jointly announced topline pharmacokinetic/ pharmacodynamic (PK/PD) results for the oral oxyntomodulin (OXM) tablet program. The program is focused on developing the first oral dual agonist GLP-1/glucagon peptide as a potential once-daily treatment for patients with obesity and metabolic disorders using Entera’s proprietary N-Tab™ platform. Oral OXM exhibited significant systemic exposure across two in vivo models, a favorable PK profile and bioavailability. The high plasma concentrations with prolonged systemic exposure were consistent with the reported half-life for semaglutide (Rybelsus®), the only approved oral GLP-1 analog. Oral OXM showed a statistically significant reduction in plasma glucose levels compared with placebo. Entera plans to present this data together with OPKO at an upcoming clinical conference.

First GLP-2 Peptide Tablets for Short Bowel Syndrome

- Entera continues pre-IND validation of its oral GLP-2 tablet in partnership with OPKO. Final in vivo PK/PD data is expected in the second half of 2024. This program is being developed as the first potential tablet GLP-2 replacement therapy for patients suffering with Short Bowel Syndrome, a rare and devastating intestinal failure condition. The program may also provide value to other critical conditions of GI inflammation, which is being explored with external parties.

EB612: First Oral PTH(1-34) Peptide Replacement Therapy Tablets for Hypoparathyroidism

- Entera continues to collaborate productively with a third party on the oral tablet development of another PTH replacement treatment for hypoparathyroidism.

Financial Results for the Quarter Ended September 30, 2024

As of September 30,2024, Entera had cash and cash equivalents of $6.9 million. The Company expects that its existing cash resources are sufficient to meet its projected operating requirements into the third quarter of 2025.

Research and development expenses for the three months ended September 30, 2024 were $1.5 million, as compared to $1.4 million for the three months ended September 30, 2023. The increase of $0.1 million was primarily due to an increase of $0.5 million in materials required in connection with the optimization processes related to the preparation of the EB613 phase 3 study. The increase was partially offset by a decrease of $0.4 million related to a completed Phase 1 PK, which occurred in 2023.

General and administrative expenses for the three months ended September 30, 2024 were $1.5 million, as compared to $1.0 million for the three months ended September 30, 2023. The increase of $0.5 million was mainly attributable to increases in intellectual property expenses, consultancy fees and share-based compensation.

Operating expenses for the period ended September 30, 2024 were $3.0 million, as compared to $2.4 million for the quarter ended September 30, 2023.

Net loss was $3.0 million, or $0.08 per ordinary share (basic and diluted), for the quarter ended September 30, 2024, as compared to $2.4 million, or $0.08 per ordinary share (basic and diluted), for the quarter ended September 30, 2023.

About Entera Bio

Entera is a clinical-stage company focused on developing oral peptide or protein replacement therapies for significant unmet medical needs where an oral tablet form holds the potential to transform the standard of care. The Company leverages a disruptive and proprietary technology platform (N-Tab™) and its pipeline includes five differentiated, first-in-class oral peptide programs, expected to enter the clinic (Phase 1 to Phase 3) by 2025. The Company’s most advanced product candidate, EB613 (oral PTH (1-34)), is being developed as the first oral, osteoanabolic (bone building) once-daily tablet treatment for post-menopausal women with low BMD and high-risk osteoporosis. A placebo controlled, dose ranging Phase 2 study of EB613 tablets (n=161) met primary (PD/bone turnover biomarker) and secondary (BMD) endpoints. Entera is preparing to initiate a Phase 3 registrational study for EB613 pursuant to the FDA’s qualification of a quantitative BMD endpoint, which is expected to occur by January 2025. The EB612 program is being developed as the first oral PTH (1-34) tablet peptide replacement therapy for hypoparathyroidism. In collaboration with OPKO Health, Entera is also developing the first oral oxyntomodulin, a dual targeted GLP-1/glucagon peptide, in tablet form for the treatment of obesity; and the first oral GLP-2 peptide tablet as an injection-free alternative for patients suffering from rare malabsorption conditions such as short bowel syndrome. For more information, visit www.enterabio.com or follow us on LinkedIn, X (formerly Twitter), Facebook and Instagram.

Cautionary Statement Regarding Forward Looking Statements

Various statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements (other than statements of historical facts) in this press release regarding our prospects, plans, financial position, business strategy and expected financial and operational results may constitute forward-looking statements. Words such as, but not limited to, “anticipate,” “believe,” “can,” “could,” “expect,” “estimate,” “design,” “goal,” “intend,” “may,” “might,” “objective,” “plan,” “predict,” “project,” “target,” “likely,” “should,” “will,” and “would,” or the negative of these terms and similar expressions or words, identify forward-looking statements. Forward-looking statements are based upon current expectations that involve risks, changes in circumstances, assumptions and uncertainties. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved.

Important factors that could cause actual results to differ materially from those reflected in Entera’s forward-looking statements include, among others: changes in the interpretation of clinical data; results of our clinical trials; the FDA’s interpretation and review of our results from and analysis of our clinical trials; unexpected changes in our ongoing and planned preclinical development and clinical trials, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates; the potential disruption and delay of manufacturing supply chains; loss of available workforce resources, either by Entera or its collaboration and laboratory partners; impacts to research and development or clinical activities that Entera may be contractually obligated to provide; overall regulatory timelines; the size and growth of the potential markets for our product candidates; the scope, progress and costs of developing Entera’s product candidates; Entera’s reliance on third parties to conduct its clinical trials; Entera’s expectations regarding licensing, business transactions and strategic collaborations; Entera’s operation as a development stage company with limited operating history; Entera’s ability to continue as a going concern absent access to sources of liquidity; Entera’s ability to obtain and maintain regulatory approval for any of its product candidates; Entera’s ability to comply with Nasdaq’s minimum listing standards and other matters related to compliance with the requirements of being a public company in the United States; Entera’s intellectual property position and its ability to protect its intellectual property; and other factors that are described in the “Cautionary Statements Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Entera’s most recent Annual Report on Form 10-K filed with the SEC, as well as the company’s subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. There can be no assurance that the actual results or developments anticipated by Entera will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Entera. Therefore, no assurance can be given that the outcomes stated or implied in such forward-looking statements and estimates will be achieved. Entera cautions investors not to rely on the forward-looking statements Entera makes in this press release. The information in this press release is provided only as of the date of this press release, and Entera undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by law.

| ENTERA BIO LTD. | |||

| CONSOLIDATED BALANCE SHEETS | |||

| (U.S. dollars in thousands) | |||

| September 30, | December 31, | ||

| 2024 | 2023 | ||

| (Unaudited) | (Audited) | ||

| Cash and cash equivalents | 6,915 | 11,019 | |

| Accounts receivable and other current assets | 425 | 238 | |

| Property and equipment, net | 65 | 100 | |

| Other assets, net | 336 | 408 | |

| Total assets | 7,741 | 11,765 | |

| Accounts payable and other current liabilities | 1,111 | 1,091 | |

| Total non-current liabilities | 178 | 288 | |

| Total liabilities | 1,289 | 1,379 | |

| Total shareholders’ equity | 6,452 | 10,386 | |

| Total liabilities and shareholders’ equity | 7,741 | 11,765 | |

| ENTERA BIO LTD. CONSOLIDATED STATEMENTS OF OPERATIONS (U.S. dollars in thousands, except share and per share data) (Unaudited) |

|||

| Three Months Ended September 30, |

|||

| 2024 | 2023 | ||

| REVENUES | 42 | – | |

| COST OF REVENUES | 42 | – | |

| GROSS PROFIT | – | – | |

| OPERATING EXPENSES: | |||

| Research and development | 1,477 | 1,370 | |

| General and administrative | 1,544 | 1,028 | |

| Other income | – | (12) | |

| TOTAL OPERATING EXPENSES | 3,021 | 2,386 | |

| OPERATING LOSS | 3,021 | 2,386 | |

| FINANCIAL INCOME, NET | – | (36) | |

| INCOME TAX | – | 29 | |

| NET LOSS | 3,021 | 2,379 | |

| LOSS PER SHARE BASIC AND DILUTED | 0.08 | 0.08 | |

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING USED IN COMPUTATION OF BASIC AND DILUTED LOSS PER SHARE | 37,644,612 | 28,813,952 | |

Contact: Entera Bio: Ms. Miranda Toledano Chief Executive Officer Entera Bio miranda@enterabio.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Netflix: Analyzing the Surge in Options Activity

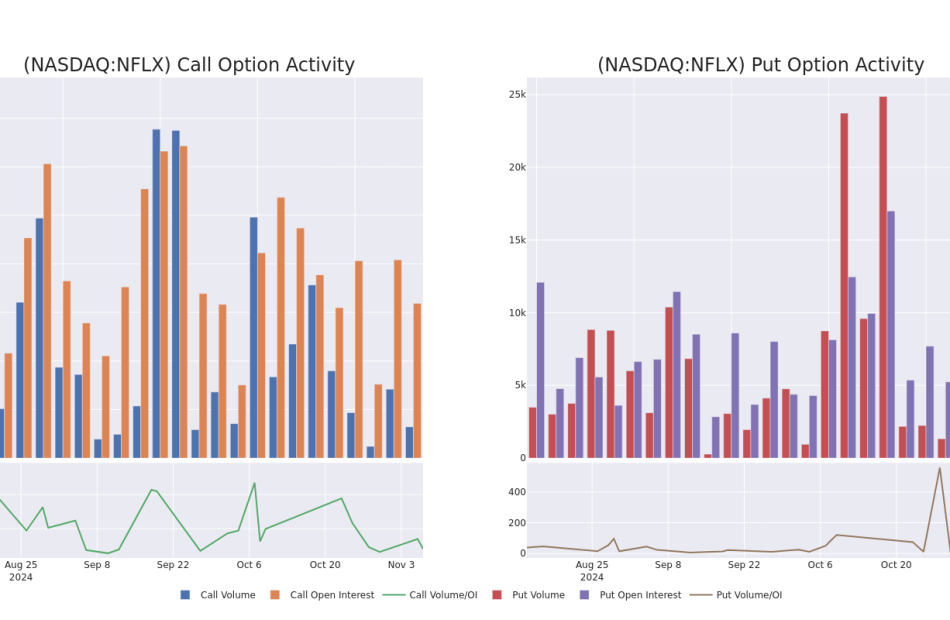

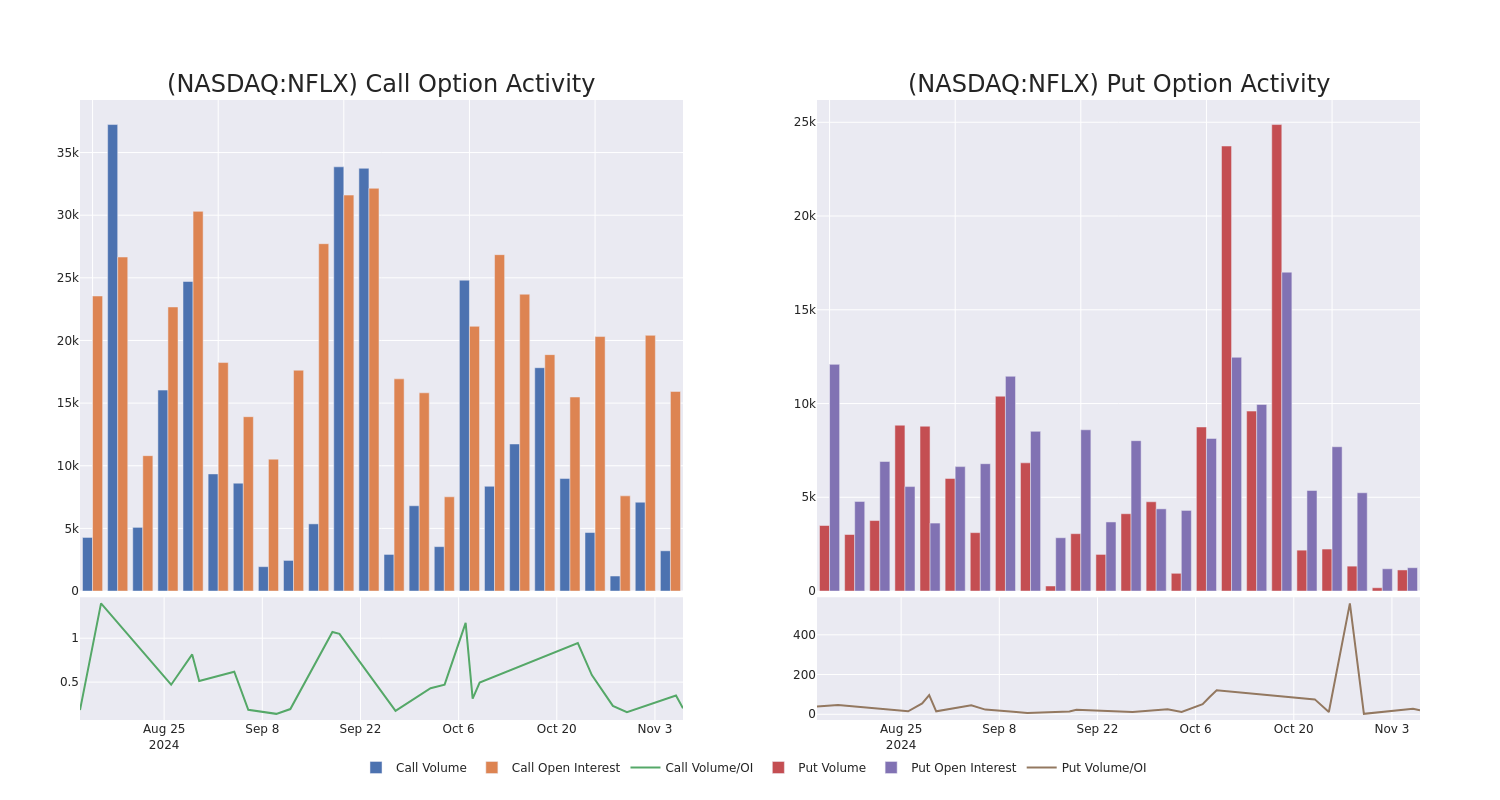

Financial giants have made a conspicuous bullish move on Netflix. Our analysis of options history for Netflix NFLX revealed 93 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $516,789, and 83 were calls, valued at $6,209,128.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $1110.0 for Netflix over the recent three months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Netflix’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Netflix’s substantial trades, within a strike price spectrum from $10.0 to $1110.0 over the preceding 30 days.

Netflix Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NFLX | CALL | TRADE | NEUTRAL | 01/16/26 | $786.8 | $779.0 | $782.88 | $10.00 | $234.8K | 46 | 44 |

| NFLX | CALL | TRADE | NEUTRAL | 01/16/26 | $786.6 | $779.0 | $782.68 | $10.00 | $234.8K | 46 | 38 |

| NFLX | CALL | TRADE | NEUTRAL | 01/16/26 | $786.7 | $779.0 | $782.83 | $10.00 | $156.5K | 46 | 46 |

| NFLX | PUT | SWEEP | BEARISH | 08/15/25 | $170.25 | $169.35 | $170.25 | $945.00 | $153.1K | 18 | 14 |

| NFLX | CALL | SWEEP | BULLISH | 11/08/24 | $4.1 | $3.15 | $3.86 | $790.00 | $138.6K | 1.0K | 820 |

About Netflix

Netflix’s relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 280 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Following our analysis of the options activities associated with Netflix, we pivot to a closer look at the company’s own performance.

Present Market Standing of Netflix

- With a trading volume of 1,222,818, the price of NFLX is down by -0.41%, reaching $793.29.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 74 days from now.

Professional Analyst Ratings for Netflix

5 market experts have recently issued ratings for this stock, with a consensus target price of $764.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Keybanc has decided to maintain their Overweight rating on Netflix, which currently sits at a price target of $785.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Hold rating for Netflix, targeting a price of $760.

* Consistent in their evaluation, an analyst from Rosenblatt keeps a Neutral rating on Netflix with a target price of $680.

* Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Netflix, targeting a price of $800.

* An analyst from Macquarie persists with their Outperform rating on Netflix, maintaining a target price of $795.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Netflix options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FutureFuel Releases Third Quarter 2024 Results

CLAYTON, Mo., Nov. 08, 2024 (GLOBE NEWSWIRE) — FutureFuel Corp. FF (“FutureFuel”), a manufacturer of custom and performance chemicals and biofuels, today announced financial results for the third quarter ended September 30, 2024.

Third quarter 2024 Financial Highlights (all comparisons are with the third quarter of 2023)

- Revenues were $51.1 million, a decrease of 56% or $65.6 million compared to $116.8 million.

- Net loss was $1.2 million, or $0.03 per diluted share, down from a net income of $2.8 million, or $0.06 per diluted share.

- Adjusted EBITDA(1) was $(1.0) million, down from $9.7 million.

Nine months 2024 Financial Highlights (all comparisons are with the first nine months of 2023)

- Revenues were $181.8 million, a decrease of 34% or $94.4 million compared to $276.2 million.

- Net income was $12.7 million, or $0.29 per diluted share, down from $14.0 million, or $0.32 per diluted share.

- Adjusted EBITDA(1) was $13.0 million, down from $18.2 million.

(1) A non-GAAP financial measure. See “Non-GAAP Financial Measures” for a description of the measure and a reconciliation to the applicable GAAP measure.

“In the third quarter we continued to see a market-driven slowdown in our chemical segment with increased margin pressure driven by sluggish demand in our end-use markets. Our biodiesel segment has also experienced increased margin pressure, leading to margin and RIN pricing contraction. We anticipate that some of this pressure and market uncertainty will turn once there is more clarity around the IRA 45Z or Clean Fuel Production Credit, which takes effect January 1, 2025. (See Note 2 to our consolidated financial statements for more detail.)

“Also impacting the latter half of the quarter was an unplanned outage of the infrastructure supporting our biodiesel plant which reduced production. This issue was resolved before the close of the quarter and production has returned to normal rates.

“It is encouraging within the chemical segment, to see robust activities continuing with key customers on future business development programs as we invest to support future growth,” said Roeland Polet, Chief Executive Officer for FutureFuel Corp.

1

2024 Cash Dividends

FutureFuel paid a regular quarterly cash dividend in the third quarter in the amount of $0.06 per share on our common stock. The remaining 2024 quarterly dividend of $0.06 per share will be paid in December.

Financial Overview and Key Operating Metrics

Financial and operating metrics, which include non-GAAP financial measures (see “Non-GAAP Financial Measures” for additional information), include all dollar amounts in thousands, except per share amounts:

| FutureFuel Corp. Certain Financial and Operating Metrics (Unaudited) |

||||||||||||||||

| Three Months Ended September 30, | ||||||||||||||||

| Dollar | % | |||||||||||||||

| 2024 | 2023 | Change | Change | |||||||||||||

| Revenue | $ | 51,140 | $ | 116,752 | $ | (65,612 | ) | (56 | )% | |||||||

| (Loss) income from operations | $ | (2,888 | ) | $ | 297 | $ | (3,185 | ) | na | |||||||

| Net (loss) income | $ | (1,195 | ) | $ | 2,776 | $ | (3,971 | ) | na | |||||||

| (Loss) earnings per common share: | ||||||||||||||||

| Basic | $ | (0.03 | ) | $ | 0.06 | $ | (0.09 | ) | na | |||||||

| Diluted | $ | (0.03 | ) | $ | 0.06 | $ | (0.09 | ) | na | |||||||

| Adjusted EBITDA | $ | (973 | ) | $ | 9,659 | $ | (10,632 | ) | na | |||||||

| Nine Months Ended September 30, | ||||||||||||||||

| Dollar | % | |||||||||||||||

| 2024 | 2023 | Change | Change | |||||||||||||

| Revenue | $ | 181,830 | $ | 276,241 | $ | (94,411 | ) | (34 | )% | |||||||

| Income from operations | $ | 4,761 | $ | 6,965 | $ | (2,204 | ) | (32 | )% | |||||||

| Net income | $ | 12,706 | $ | 13,998 | $ | (1,292 | ) | (9 | )% | |||||||

| Earnings per common share: | ||||||||||||||||

| Basic | $ | 0.29 | $ | 0.32 | $ | (0.03 | ) | (9 | )% | |||||||

| Diluted | $ | 0.29 | $ | 0.32 | $ | (0.03 | ) | (9 | )% | |||||||

| Adjusted EBITDA | $ | 13,042 | $ | 18,230 | $ | (5,188 | ) | (28 | )% | |||||||

Financial and Business Summary

Consolidated revenue in the three months ended September 30, 2024 decreased $65,612 compared to the three months ended September 30, 2023. This decline was driven mostly by lower sales volumes in the biofuel segment of $41,015. Production issues, primarily stemming from delays by equipment suppliers that created an extended service utility downtime, prevented us from building the biodiesel inventories we would typically have available to sell in the three months ended September 30, 2024. Also reducing sales revenue in the three-month period, were lower prices in the biofuel segment of $24,678 due to a decline in renewable fuel and RIN prices with market supply in excess of the Environmental Protection Agency (“EPA”) Renewable Identification Number (“RIN”) mandate. In our chemical segment, sales revenue increased $81 for the three months ended September 30, 2024, compared to the prior-year period, due primarily to stronger sales volumes in the coatings market $1,457, but was mostly offset by reduced chemical sales prices, $1,376, from chemicals sold into the agricultural and energy markets.

Consolidated revenue in the nine months ended September 30, 2024 decreased $94,411 compared to the nine months ended September 30, 2023. As noted above, this decline was driven mostly by lower sales volumes in the biofuel segment of $48,590 as production issues in the first three months of the year related to harsh winter weather and the production issues noted above in the three months ended September 30, 2024, prevented us from building the biodiesel inventories we would typically have available to sell during the current period. Also reducing sales revenue in the nine-month period were lower prices in the biofuel segment of $42,560 due to a decline in renewable fuel and RIN prices with market supply in excess of the EPA RIN mandate. In our chemical segment, sales revenue declined a net $3,261 ($5,382 on reduced prices on chemicals sold into the agricultural and energy markets partially offset by increased volumes in the energy market, $2,121), compared to the prior-year period.

Income from operations in the three months ended September 30, 2024 decreased $3,185 as compared to the same period of 2023, due primarily to lower sales prices in the chemical agricultural and energy markets and reduced throughput of biofuel segment volumes primarily due to the issues noted above.

Income from operations in the nine months ended September 30, 2024 decreased $2,204 as compared to the same period of 2023, primarily due to: (i) a reduction of RIN sales in the current nine-month period and (ii) the change in the adjustment in the carrying value of our inventory as determined utilizing the LIFO method of inventory accounting. This adjustment increased gross profit by $2,885 in the nine months ended September 30, 2024, as compared to an increase of $6,023 in the same period of 2023. Income from operations was negatively impacted by the change in the activity of derivative instruments with a realized loss of $354 and unrealized loss of $1,696 in the nine months ended September 30, 2024, as compared to a realized gain of $9,437 and unrealized gain of $3,259 in the same period of 2023. Gross profit was also negatively impacted in the nine-month period ended September 30, 2024, by higher costs resulting from the impact of extreme winter weather and the production issues noted above.

Capital Expenditures

Capital expenditures were $10,605 in the first nine months of 2024, compared with $4,994 in the same period in 2023.

Cash and Cash Equivalents

Cash and cash equivalents totaled $133,398 as of September 30, 2024, compared with $219,444 as of December 31, 2023. A special cash dividend of $2.50 per common share was paid April 9, 2024 which totaled $109,408.

About FutureFuel

FutureFuel is a leading manufacturer of diversified chemical products and biofuels. FutureFuel’s chemicals segment manufactures specialty chemicals for specific customers (“custom chemicals”) as well as multi-customer specialty chemicals (“performance chemicals”). FutureFuel’s custom manufacturing product portfolio includes proprietary agrochemicals, adhesion promoters, a biocide intermediate, and an antioxidant precursor. FutureFuel’s performance chemicals products include a portfolio of proprietary nylon and polyester polymer modifiers and several small-volume specialty chemicals and solvents for diverse applications. FutureFuel’s biofuels segment primarily produces and sells biodiesel to its customers. Please visit www.futurefuelcorporation.com for more information.

2

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements deal with FutureFuel’s current plans, intentions, beliefs, and expectations, and statements of future economic performance. Statements containing such terms as “believe,” “do not believe,” “plan,” “expect,” “intend,” “estimate,” “anticipate,” and other phrases of similar meaning are considered to contain uncertainty and are forward-looking statements. In addition, from time-to-time FutureFuel or its representatives have made or will make forward-looking statements orally or in writing. Furthermore, such forward-looking statements may be included in various filings that the company makes with United States Securities and Exchange Commission (the “SEC”), in press releases, or in oral statements made by or with the approval of one of FutureFuel’s authorized executive officers.

These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause actual results to differ include, but are not limited to, those set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in FutureFuel’s Form 10-K Annual Report, as amended for the year ended December 31, 2023 and in its future filings made with the SEC. An investor should not place undue reliance on any forward-looking statements contained in this document, which reflect FutureFuel management’s opinions only as of their respective dates. Except as required by law, the company undertakes no obligation to revise or publicly release the results of any revisions to forward-looking statements. The risks and uncertainties described in this document and in current and future filings with the SEC are not the only ones faced by FutureFuel. New factors emerge from time to time, and it is not possible for the company to predict which will arise. There may be additional risks not presently known to the company or that the company currently believes are immaterial to its business. In addition, FutureFuel cannot assess the impact of each factor on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. If any such risks occur, FutureFuel’s business, operating results, liquidity, and financial condition could be materially affected in an adverse manner. An investor should consult any additional disclosures FutureFuel has made or will make in its reports to the SEC on Forms 10-K, 10-Q, and 8-K, and any amendments thereto. All subsequent written and oral forward-looking statements attributable to FutureFuel or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained in this document.

Non-GAAP Financial Measures

In this press release, FutureFuel used adjusted EBITDA as a key operating metric to measure both performance and liquidity. Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA is not a substitute for operating income, net income, or cash flow from operating activities (each as determined in accordance with GAAP), as a measure of performance or liquidity. Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation or as a substitute for analysis of results as reported under GAAP. FutureFuel defines adjusted EBITDA as net income before interest, income taxes, depreciation, and amortization expenses, excluding, when applicable, non-cash share-based compensation expense, public offering expenses, acquisition-related transaction costs, purchase accounting adjustments, loss on disposal of property and equipment, non-cash gains or losses on derivative instruments, and other non-operating income or expense. Information relating to adjusted EBITDA is provided so that investors have the same data that management employs in assessing the overall operation and liquidity of FutureFuel’s business. FutureFuel’s calculation of adjusted EBITDA may be different from similarly titled measures used by other companies; therefore, the results of its calculation are not necessarily comparable to the results of other companies.

Adjusted EBITDA allows FutureFuel’s chief operating decision makers to assess the performance and liquidity of FutureFuel’s business on a consolidated basis to assess the ability of its operating segments to produce operating cash flow to fund working capital needs, to fund capital expenditures, and to pay dividends. In particular, FutureFuel management believes that adjusted EBITDA permits a comparative assessment of FutureFuel’s operating performance and liquidity, relative to a performance and liquidity based on GAAP results, while isolating the effects of depreciation and amortization, which may vary among its operating segments without any correlation to their underlying operating performance, and of non-cash stock-based compensation expense, which is a non-cash expense that varies widely among similar companies, and non-cash gains and losses on derivative instruments, whose immediate recognition can cause net income to be volatile from quarter to quarter due to the timing of the valuation change in the derivative instruments relative to the sale of biofuel.

A table included in this earnings release reconciles adjusted EBITDA with net income, the most directly comparable GAAP performance financial measure, and a table reconciles adjusted EBITDA with cash flows from operations, the most directly comparable GAAP liquidity financial measure.

3

| FutureFuel Corp. Condensed Consolidated Balance Sheets (Dollars in thousands) (Unaudited) |

||||||||

| September 30, 2024 | December 31, 2023 | |||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 133,398 | $ | 219,444 | ||||

| Accounts receivable, inclusive of the blenders’ tax credit of $3,964 and $11,381, respectively and net of allowances for expected credit losses of $136 and $55, respectively | 15,967 | 28,407 | ||||||

| Inventory, net | 24,878 | 32,978 | ||||||

| Other current assets | 1,994 | 9,717 | ||||||

| Total current assets | 176,237 | 290,546 | ||||||

| Property, plant and equipment, net | 76,815 | 72,711 | ||||||

| Other assets | 3,414 | 3,824 | ||||||

| Total noncurrent assets | 80,229 | 76,535 | ||||||

| Total Assets | $ | 256,466 | $ | 367,081 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Accounts payable, inclusive of the blenders’ tax credit rebates due customers of $890 and $890, respectively | $ | 11,711 | $ | 22,220 | ||||

| Dividends payable | 2,626 | 10,503 | ||||||

| Other current liabilities | 15,314 | 8,621 | ||||||

| Total current liabilities | 29,651 | 41,344 | ||||||

| Deferred revenue – long-term | 9,593 | 12,570 | ||||||

| Other noncurrent liabilities | 3,931 | 3,287 | ||||||

| Total noncurrent liabilities | 13,524 | 15,857 | ||||||

| Total liabilities | 43,175 | 57,201 | ||||||

| Commitments and contingencies | ||||||||

| Preferred stock, $0.0001 par value, 5,000,000 shares authorized, none issued and outstanding | – | – | ||||||

| Common stock, $0.0001 par value, 75,000,000 shares authorized, 43,763,243 shares issued and outstanding as of September 30, 2024 and December 31, 2023 | 4 | 4 | ||||||

| Additional paid in capital | 204,911 | 282,489 | ||||||

| Retained earnings | 8,376 | 27,387 | ||||||

| Total Stockholders’ Equity | 213,291 | 309,880 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 256,466 | $ | 367,081 | ||||

4

| FutureFuel Corp. Condensed Consolidated Statements of Income and Comprehensive Income (Dollars in thousands, except per share amounts) (Unaudited) |

||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | $ | 51,140 | $ | 116,752 | $ | 181,830 | $ | 276,241 | ||||||||

| Cost of goods sold and distribution | 50,757 | 112,882 | 167,783 | 259,340 | ||||||||||||

| Gross profit | 383 | 3,870 | 14,047 | 16,901 | ||||||||||||

| Selling, general, and administrative expenses | 2,290 | 2,410 | 6,483 | 6,694 | ||||||||||||

| Research and development expenses | 981 | 1,163 | 2,803 | 3,242 | ||||||||||||

| Total operating expenses | 3,271 | 3,573 | 9,286 | 9,936 | ||||||||||||

| (Loss) income from operations | (2,888 | ) | 297 | 4,761 | 6,965 | |||||||||||

| Interest and dividend income | 1,830 | 2,527 | 6,151 | 6,595 | ||||||||||||

| Gain on marketable securities | – | – | – | 575 | ||||||||||||

| Other (expense) income, net | (140 | ) | (36 | ) | 2,429 | (103 | ) | |||||||||

| Other income, net | 1,690 | 2,491 | 8,580 | 7,067 | ||||||||||||

| (Loss) income before income taxes | (1,198 | ) | 2,788 | 13,341 | 14,032 | |||||||||||

| Income tax (benefit) provision | (3 | ) | 12 | 635 | 34 | |||||||||||

| Net (loss) income | $ | (1,195 | ) | $ | 2,776 | $ | 12,706 | $ | 13,998 | |||||||

| (Loss) earnings per common share | ||||||||||||||||

| Basic | $ | (0.03 | ) | $ | 0.06 | $ | 0.29 | $ | 0.32 | |||||||

| Diluted | $ | (0.03 | ) | $ | 0.06 | $ | 0.29 | $ | 0.32 | |||||||

| Weighted average shares outstanding | ||||||||||||||||

| Basic | 43,763,243 | 43,763,243 | 43,763,243 | 43,763,243 | ||||||||||||

| Diluted | 43,763,243 | 43,765,709 | 43,763,243 | 43,765,163 | ||||||||||||

| Comprehensive (loss) income | ||||||||||||||||

| Net (loss) income | $ | (1,195 | ) | $ | 2,776 | $ | 12,706 | $ | 13,998 | |||||||

| Other comprehensive income from unrealized net gains on available-for-sale securities | – | – | – | 2 | ||||||||||||

| Income tax effect | – | – | – | (1 | ) | |||||||||||

| Total other comprehensive income, net of tax | – | – | – | 1 | ||||||||||||

| Comprehensive (loss) income | $ | (1,195 | ) | $ | 2,776 | $ | 12,706 | $ | 13,999 | |||||||

5

| FutureFuel Corp. Consolidated Statements of Cash Flows (Dollars in thousands) (Unaudited) |

||||||||

| Nine Months Ended September 30, | ||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 12,706 | $ | 13,998 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 6,923 | 7,736 | ||||||

| Amortization of deferred financing costs | 77 | 75 | ||||||

| Provision for deferred income taxes | 618 | – | ||||||

| Change in fair value of equity securities | – | (3,117 | ) | |||||

| Change in fair value of derivative instruments | 1,439 | 3,523 | ||||||

| Loss on the sale of investments | – | 2,543 | ||||||

| Stock based compensation | 113 | – | ||||||

| Loss on disposal of property, plant, and equipment | 24 | 8 | ||||||

| Noncash interest expense | 26 | 26 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 12,439 | (3,295 | ) | |||||

| Accounts receivable – related parties | 1 | 6 | ||||||

| Inventory | 8,100 | (149 | ) | |||||

| Income tax receivable | 1,940 | 32 | ||||||

| Prepaid expenses | 3,382 | 2,700 | ||||||

| Other assets | 872 | 963 | ||||||

| Accounts payable | (11,043 | ) | (14,910 | ) | ||||

| Accounts payable – related parties | 82 | (800 | ) | |||||

| Income tax payable | 359 | – | ||||||

| Accrued expenses and other current liabilities | 6,062 | (404 | ) | |||||

| Deferred revenue | (2,705 | ) | (2,030 | ) | ||||

| Other noncurrent liabilities | – | 1,553 | ||||||

| Net cash provided by operating activities | 41,415 | 8,458 | ||||||

| Cash flows from investing activities | ||||||||

| Collateralization of derivative instruments | 423 | (2,991 | ) | |||||

| Proceeds from the sale of marketable securities | – | 37,701 | ||||||

| Proceeds from the sale of property and equipment | 6 | – | ||||||

| Capital expenditures | (10,605 | ) | (4,994 | ) | ||||

| Net cash (used in) provided by investing activities | (10,176 | ) | 29,716 | |||||

| Cash flows from financing activities | ||||||||

| Payment of dividends | (117,285 | ) | (7,877 | ) | ||||

| Deferred financing costs | – | (14 | ) | |||||

| Net cash used in financing activities | (117,285 | ) | (7,891 | ) | ||||

| Net change in cash and cash equivalents | (86,046 | ) | 30,283 | |||||

| Cash and cash equivalents at beginning of period | 219,444 | 175,640 | ||||||

| Cash and cash equivalents at end of period | $ | 133,398 | $ | 205,923 | ||||

| Noncash capital expenditures | $ | 452 | $ | 518 | ||||

6

| FutureFuel Corp. Reconciliation of Non-GAAP Financial Measure to Financial Measure (Dollars in thousands) (Unaudited) |

||||||||||||||||

| Reconciliation of Adjusted EBITDA to Net Income | ||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net (loss) income | $ | (1,195 | ) | $ | 2,776 | $ | 12,706 | $ | 13,998 | |||||||

| Depreciation | 2,163 | 2,581 | 6,923 | 7,736 | ||||||||||||

| Non-cash stock-based compensation | 91 | – | 113 | – | ||||||||||||

| Interest and dividend income | (1,830 | ) | (2,527 | ) | (6,151 | ) | (6,595 | ) | ||||||||

| Non-cash interest expense and amortization of deferred financing costs | 34 | 35 | 103 | 102 | ||||||||||||

| Loss on disposal of property and equipment | 24 | – | 24 | 8 | ||||||||||||

| Unrealized (gain) loss on derivative instruments | (257 | ) | 6,782 | 1,439 | 3,523 | |||||||||||

| Gain on marketable securities | – | – | – | (575 | ) | |||||||||||

| Other income | – | – | (2,750 | ) | (1 | ) | ||||||||||

| Income tax (benefit) provision | (3 | ) | 12 | 635 | 34 | |||||||||||

| Adjusted EBITDA | $ | (973 | ) | $ | 9,659 | $ | 13,042 | $ | 18,230 | |||||||

| Reconciliation of Adjusted EBITDA to Net Cash Provided by Operating Activities | ||||||||

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2024 | 2023 | |||||||

| Net cash provided by operating activities | $ | 41,415 | $ | 8,458 | ||||

| Deferred income taxes, net | (618 | ) | – | |||||

| Interest and dividend income | (6,151 | ) | (6,595 | ) | ||||

| Income tax provision | 635 | 34 | ||||||

| Changes in operating assets and liabilities, net | (19,489 | ) | 16,334 | |||||

| Other income | (2,750 | ) | (1 | ) | ||||

| Adjusted EBITDA | $ | 13,042 | $ | 18,230 | ||||

7

| FutureFuel Corp. Condensed Consolidated Segment Income (Dollars in thousands) (Unaudited) |

||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | ||||||||||||||||

| Custom chemicals | $ | 15,323 | $ | 14,454 | $ | 46,333 | $ | 46,650 | ||||||||

| Performance chemicals | 2,605 | 3,393 | 8,890 | 11,834 | ||||||||||||

| Chemical revenue | 17,928 | 17,847 | 55,223 | 58,484 | ||||||||||||

| Biofuel revenue | 33,212 | 98,905 | 126,607 | 217,757 | ||||||||||||

| Total Revenue | $ | 51,140 | $ | 116,752 | $ | 181,830 | $ | 276,241 | ||||||||

| Segment gross profit (loss) | ||||||||||||||||

| Chemical | $ | 3,407 | $ | 6,878 | $ | 12,105 | $ | 21,917 | ||||||||

| Biofuel | (3,024 | ) | (3,008 | ) | 1,942 | (5,016 | ) | |||||||||

| Total gross profit | $ | 383 | $ | 3,870 | $ | 14,047 | $ | 16,901 | ||||||||

As of September 30, 2024, FutureFuel held 5.0 million RINs with a fair market value of $2,556 and no cost. Comparatively, at September 30, 2023, FutureFuel held 4.2 million RINs with a fair market value of $6,971 and no cost.

8

COMPANY CONTACT

FutureFuel Corp.

Roeland Polet

(314) 854-8352

www.futurefuelcorporation.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock Market: Three Top Names In Buy Zones, One With Earnings Due

With the presidential election and November’s Federal Reserve policy decision out of the way, the stock market can begin to look toward the holiday shopping season. Home Depot (HD) anchors the reporting among retailers in the coming week. Cisco Systems (CSCO), Vertex Pharmaceuticals (VRTX) and Costco Wholesale (COST) are all in a buy zone, with Cisco results due Wednesday.

Stocks To Watch: More Ideas For A New Era

The stock market rally is at record highs after a massive week of news, earnings and events. The result has left many leaders even more extended. But Meta Platforms (META), Deckers (DECK), Broadcom (AVGO), Costco Wholesale and Vertex Pharmaceuticals are setting up nicely. Meta ended a four-week slide and now has a new flat base. Deckers has been flirting with a buy point after five months of consolidation, though a key rival reports soon. Broadcom is up 66% this year. Costco has a 45% gain and Vertex has rallied 24%. Broadcom was near a traditional buy point, but already flashing a slightly early entry. Vertex and Costco had broken out, but remained in buy zones.

↑

X

Keep Calm And Trade On: Measuring Post-Election Market Sentiment

Economic Calendar: A Slowed Pace Of Rate Cuts?

The coming week could shift expectations for another rate reduction in December, after Federal Reserve Chairman Jerome Powell said that policymakers were discussing a slower pace of cuts. The consumer price index for October, out Wednesday, is expected to show a second straight 0.3% rise in core prices, excluding food and energy, according to FactSet. The headline inflation rate is expected to rise to 2.6% from 2.4% in October. Thursday’s producer price index will also set expectations for the Fed’s primary inflation gauge released late in the month. Retail sales for October, out Friday, are seen rising a moderate 0.35% on the month, with a 0.4% gain excluding autos and gas.

Fed Cuts Key Rate; Powell Pleases S&P 500, But Maybe Not Trump

Retail Radar: Leveraging ‘Digital Prowess’

Home Depot received an upgrade to outperform on Friday ahead of its Q3 report on Tuesday. Research firm Telsey raised the stock’s price target to 455, up from 360 and 12% above where shares traded on Friday. Telsey expects additional market share gains, given the outfit’s “digital prowess” and strong exposure to the professional market. Analyst consensus is for EPS to retreat 4%, with sales rising 4%. That would mark Home Depot’s seventh consecutive earnings decline. Same-store sales are forecast to fall 3.3%. The last time the Dow retailer recorded a same-store sales increase was Q3 2022. Home Depot stock is up 7% from a September breakout, and rebounding from support.

Stock Market Earnings: Six Of Mag 7 Top EPS Views

More than 400 S&P 500 companies reported recent quarterly results through the end of the week. Earnings outstripped views by 7.9% through Tuesday, according to Yardeni Research. Nvidia (NVDA) is the only Magnificent 7 company yet to report. All of the others have topped earnings expectations, and only Tesla (TSLA) missed the mark in top-line growth.

Entertainment: A Rebounding Disney Reports

Disney (DIS) announces Q4 results early Thursday. FactSet expects the Dow Jones entertainment giant to report a 34% earnings increase on revenue growth of 5.8% — in line with recent results. Total streaming subscribers are seen rising to 232 million, from 224.7 million last year. Disney+ subscribers are expected to hit 155.7 million from 150.2 million in Q4 2023. Analysts forecast parks and experiences revenue will tick up 1%. Piper Sandler has a neutral rating on DIS stock with a 95 price target. Disney shares are up 10% this year after rebounding from an August low, trading above 98 on Friday.

Cava Stock, Shopify, Cisco Systems Rally Bullishly Ahead Of Quarterly Reports

Networking: Cisco Hovers In A Buy Zone

Cisco Systems reports fiscal Q1 2025 earnings late Wednesday. Analysts project adjusted EPS will slip 21%. Revenue is expected to fall 6%. Analysts are expecting a rebound in the computer networking business in the back half of fiscal 2025. Cisco has already forecast AI cloud computing orders of $1 billion in 2025. Investors will focus on whether AI orders and backlog continue to grow. Cisco stock is in a buy zone above a 57.05 buy point.

Energy Stocks: Two Views Of The Oilfields

Occidental Petroleum (OXY) announces third-quarter earnings after Tuesday’s stock market close. Analyst consensus puts Q3 EPS down 37% vs. a year earlier, with sales declining less than 1%. Investors have been paying close attention to how the Warren Buffett-backed Permian Basin oil producer plans to reduce debt and clean up its balance sheet. Top drilling rig maker Helmerich & Payne (HP) reports fiscal fourth-quarter results late Wednesday. Analysts project EPS growing 13% with sales increasing more than 5%. HP stock is flat, Occidental is down 16% in, 2024.

Stock Market Earnings Briefs

Monday

Live Nation Entertainment (LYV) reports Q3 results late Monday. FactSet expects earnings to fall 9.6% to $1.61 per share on a 4.6% decline in revenue to $7.78 billion. LYV stock has rallied more than 33% this year and is approaching its record high of 127.75 from November 2021.

Tuesday

Shopify (SHOP) reports Q3 numbers before the stock market open Tuesday. Analysts predict adjusted EPS of 27 cents, up 14%, with revenue growing 23% to $2.12 billion. Gross merchandise volume is expected to grow 19% to $67.8 billion. The company’s operating margins are one area of investor focus. Shopify sets up e-commerce websites for small businesses, and partners with others to handle digital payments and shipping.

Spotify Technology (SPOT) will report its Q3 results late Tuesday. Analysts expect the streaming music leader to earn $1.81 a share, up 417% year over year, on sales of $4.32 billion, up 21%. Spotify is seen adding 5 million premium subscribers in Q3 for a total of 251 million worldwide. The stock sits on a nine-week advance.

Wednesday

CyberArk (CYBR) reports Q3 earnings on Wednesday. Analysts model adjusted EPS of 46 cents, up 9% for the cybersecurity play, with revenue growing 22% to $234.1 million. CyberArk sells privileged access management, also known as PAM, products. Also, it has built a broad identity security platform.

Beazer Homes (BZH) announces fiscal fourth-quarter results after the stock market closes Wednesday. Analysts expect Q3 EPS of $1.35, down 25% vs. a year ago, with sales increasing 20% to $775 million. BZH stock is less than 3% below a buy point in a tight, double-bottom base.

Thursday

Applied Materials (AMAT) will post its fiscal fourth-quarter results late Thursday. Wall Street expects the chip-gear maker to earn $2.19 a share, up 3% year over year, on sales of $6.96 billion, up 3%.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Looking For Market Insights? Check Out Our IBD Live Daily Segment

Market Roars, Tesla Tops $1 Trillion; Five Stocks Still In Range

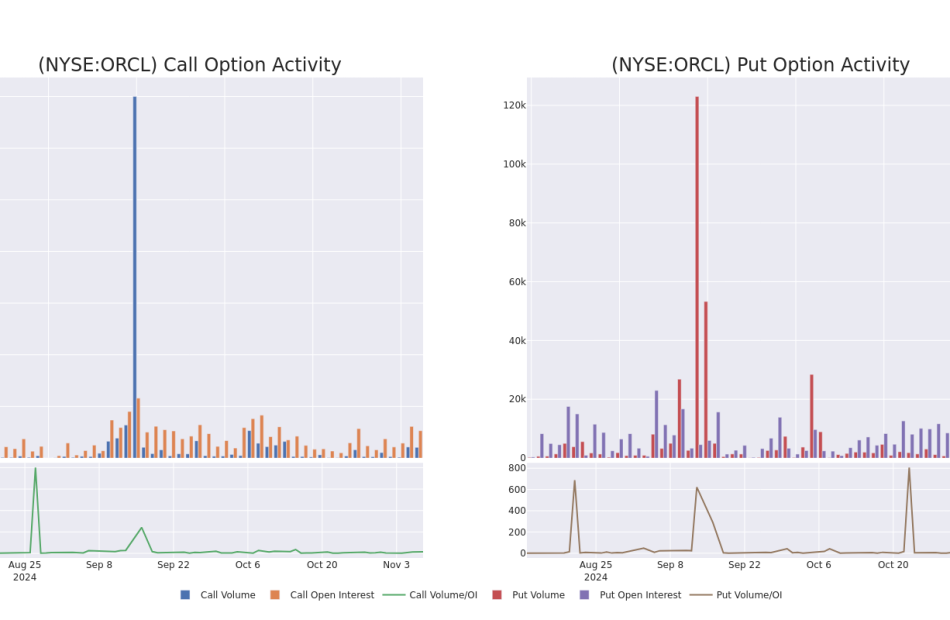

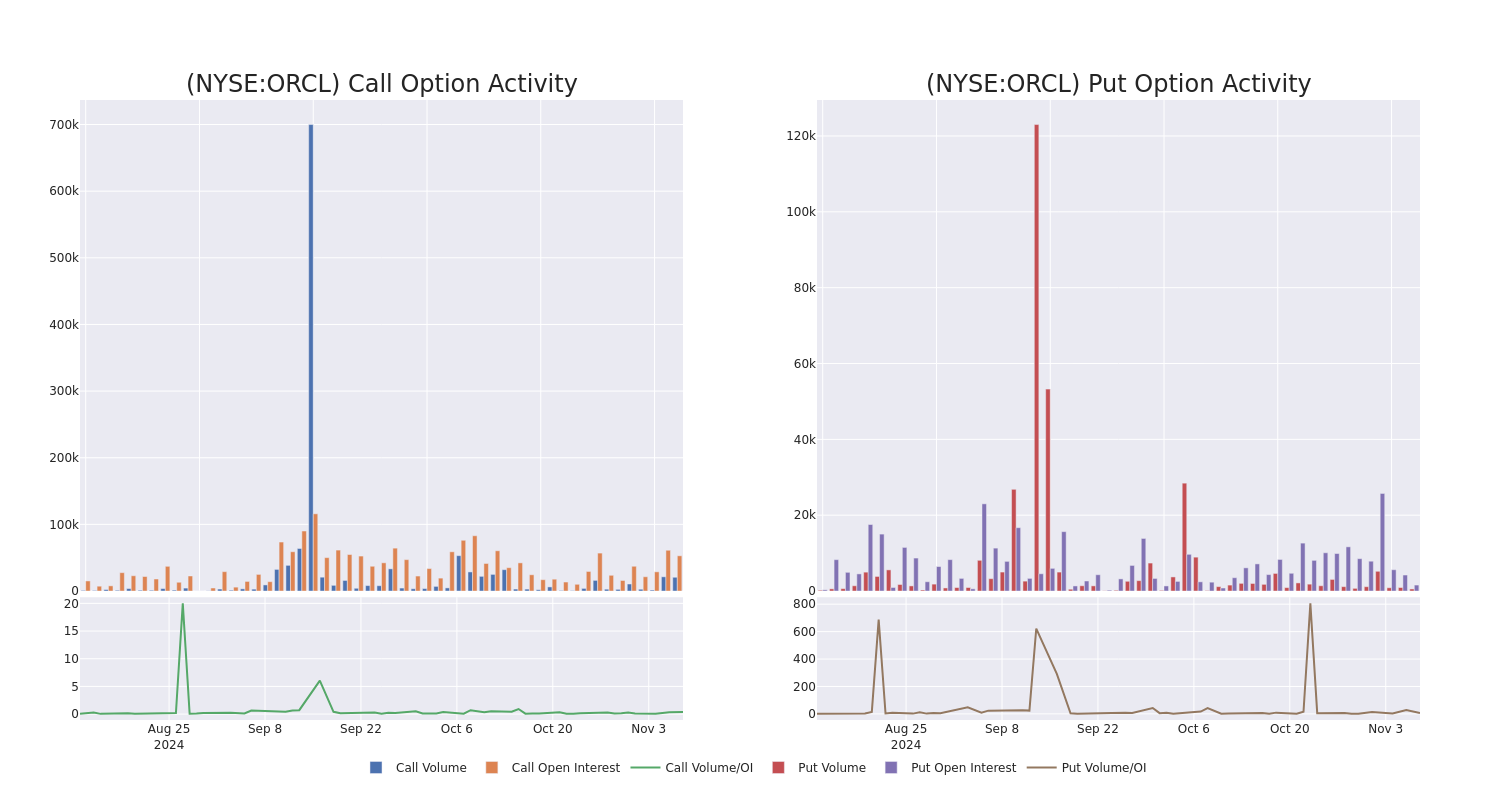

Unpacking the Latest Options Trading Trends in Oracle

Financial giants have made a conspicuous bullish move on Oracle. Our analysis of options history for Oracle ORCL revealed 35 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $292,307, and 30 were calls, valued at $3,141,583.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $100.0 and $240.0 for Oracle, spanning the last three months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Oracle options trades today is 1815.6 with a total volume of 21,239.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Oracle’s big money trades within a strike price range of $100.0 to $240.0 over the last 30 days.

Oracle Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | SWEEP | BULLISH | 12/20/24 | $12.5 | $12.45 | $12.5 | $185.00 | $672.6K | 8.2K | 2.3K |

| ORCL | CALL | SWEEP | BEARISH | 01/17/25 | $13.95 | $13.7 | $13.78 | $185.00 | $452.7K | 4.1K | 335 |

| ORCL | CALL | SWEEP | BULLISH | 11/15/24 | $3.7 | $3.6 | $3.7 | $187.50 | $368.1K | 2.9K | 1.2K |

| ORCL | CALL | TRADE | BULLISH | 01/16/26 | $38.25 | $38.25 | $38.25 | $170.00 | $351.9K | 1.0K | 92 |

| ORCL | CALL | TRADE | BEARISH | 11/15/24 | $1.43 | $1.4 | $1.4 | $192.50 | $210.0K | 183 | 1.6K |

About Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Following our analysis of the options activities associated with Oracle, we pivot to a closer look at the company’s own performance.

Where Is Oracle Standing Right Now?

- Currently trading with a volume of 5,537,782, the ORCL’s price is up by 1.76%, now at $189.65.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 31 days.

Expert Opinions on Oracle

In the last month, 2 experts released ratings on this stock with an average target price of $185.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $165.

* An analyst from JMP Securities has decided to maintain their Market Outperform rating on Oracle, which currently sits at a price target of $205.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oracle options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CEO Jensen Huang Just Delivered Fantastic News for Nvidia Investors

As the market eagerly awaits earnings from artificial intelligence (AI) powerhouse Nvidia (NASDAQ: NVDA), investors will be happy to hear that the company’s CEO, Jensen Huang, has announced a new partnership with Lenovo that will accelerate sales in a key area: enterprise.

The lion’s share of Nvidia’s revenue is derived from companies like Microsoft, Meta Platforms, and Amazon. The tech giants use its hardware to build gargantuan server farms that run their consumer-facing AI products like Gemini and Meta AI. These companies have poured billions of dollars into Nvidia’s coffers and have no plans to stop in the near future. While they are great customers to have, there is always risk in relying on a relatively small customer base. Any one of them could decide to switch to another provider, like AMD, or develop their own chips in-house, as many are reported to be doing. Nvidia would be smart to greatly expand its reach beyond them.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

That seems to be the aim of Nvidia’s partnership with Lenovo. The two companies are teaming up to create a new platform called “Lenovo Hybrid AI Advantage with Nvidia,” aimed at enterprise clients of all sizes, large and small. It is essentially a custom AI solution tailored to each individual business. If Huang’s promise holds true, it will help businesses vastly improve their efficiency and, most importantly, their profitability.

Given that this platform will be comprised of Nvidia products at every level — from its flagship Blackwell chips to its networking hardware to its custom software — the platform could be a boon to Nvidia’s bottom line if it takes off.

A key component here is what is known as “agentic AI.” Up to this point, the generative AI we’ve seen is great at creating content, analyzing content, and relies heavily on direct human guidance. Agentic AI, on the other hand, can reason in more complex environments, and, critically, it can actually do things. Think of an AI marketing tool that could not only craft a whole marketing plan and the creative materials involved, but also deploy it across the company’s media channels. It could continue to monitor the campaign, adjusting it in real time to be more effective.

The platform Nvidia and Lenovo are launching will focus on providing this sort of agentic AI. The possibilities for increased efficiency and cost-cutting are pretty profound, making it an extremely valuable product and a real potential moneymaker for Nvidia.

Bitcoin To $200,000, Ethereum To $10,000 And Crypto Market Cap To 4X By End Of 2025, Says Standard Chartered

Standard Chartered projects a fourfold increase in the digital assets market cap, reaching $10 trillion by the U.S. mid-term elections in late 2026.

What Happened: According to a new note from Geoffrey Kendrick, Head of Research at Standard Chartered, this growth forecast is based on anticipated regulatory shifts following a projected Republican sweep in the recent election cycle, which could lead to mainstream adoption and real-world use cases for digital assets.

Don’t Miss:

“For me, the Trump-ublican sweep means Digital Assets are finally going to come of age,” Kendrick commented, expressing confidence that favorable regulatory policies will drive adoption across the asset class. He added, “I look for the entire asset class to 4X by the time of the US mid-terms in late 2026.”

Standard Chartered highlight several factors contributing to this growth projection.

These include potential regulatory changes, such as a repeal of SAB 121 and favorable stablecoin regulations, which the bank anticipates could be enacted shortly after the new administration takes office in January 2025.

Additionally, Standard Chartered expects the SEC to adopt a softer regulatory stance on digital assets, further opening pathways for mainstream use.

Trending: Over the last five years, the price of gold has increased by approximately 83% — Investors like Bill O’Reilly and Rudy Giuliani are using this platform to create customized gold IRAs to help shield their savings from inflation and economic turbulence.

The report also suggests that assets closely linked to practical, end-use cases—like Solana (CRYPTO: SOL), which the bank expects to outperform Bitcoin (CRYPTO: BTC), and Ethereum (CRYPTO: ETH)—are likely to see the most significant growth.

Kendrick sees strong growth potential for sectors like gaming, tokenization, and emerging areas such as decentralized physical infrastructure (DePIN) and consumer social, which he notes are still in early stages of development.

Furthermore, while Standard Chartered considers a U.S. Bitcoin reserve a low-probability event, it notes this move could have a significant impact on the digital assets market if implemented.

Also Read: Dogecoin millionaires are increasing – investors with $1M+ in DOGE revealed!

Kendrick emphasizes that the regulatory clarity and adoption policies expected from a Trump administration could lift the entire asset class, providing an environment conducive to digital assets going mainstream.

Biglari Holdings Inc. News Release

San Antonio, TX, Nov. 8, 2024 /PRNewswire/ — Biglari Holdings Inc. BH BH)) announces its results for the third quarter and first nine months of 2024.

Biglari Holdings Inc.’s earnings for the third quarter and first nine months of 2024 and 2023 are summarized below. To become fully apprised of our results, shareholders should carefully study our 10-Q, which has been posted at www.biglariholdings.com.

|

(dollars in thousands) |

|||||||

|

Third Quarter |

First Nine Months |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Pre-tax operating earnings………………………………………………………………………. |

$ 3,272 |

$ 20,298 |

$ 28,673 |

$ 39,384 |

|||

|

Investment gains (losses)……………………………………………………………………….. |

40,054 |

(94,314) |

(18,867) |

(25,231) |

|||

|

Income taxes and income attributable to noncontrolling interest……………………….. |

(11,201) |

17,502 |

(3,292) |

(3,845) |

|||

|

Net earnings (loss) attributable to Biglari Holdings shareholders……………………….. |

$ 32,125 |

$ (56,514) |

$ 6,514 |

$ 10,308 |

|||

Analysis of Results:

Investments affect our reported quarterly earnings based on their carrying value. We do not regard the quarterly or annual fluctuations in our investments to be meaningful. Therefore, our operating businesses are best analyzed before the impact of investment gains. As a consequence, in the preceding table we separate earnings of our operating businesses from our investment gains.

About Biglari Holdings Inc.

Biglari Holdings Inc. is a holding company owning subsidiaries engaged in a number of diverse business activities, including property and casualty insurance, licensing and media, restaurants, and oil and gas.

Comment on Regulation G

This press release contains certain non-GAAP financial measures. In addition to the GAAP presentations of net earnings, Biglari Holdings defines pre-tax operating earnings outside of the investment gains/losses of the Company.

Risks Associated with Forward-Looking Statements

This news release may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These statements are based on current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ markedly from those projected or discussed here. Biglari Holdings cautions readers not to place undue reliance upon any such forward-looking statements, for actual results may differ materially from expectations. Biglari Holdings does not update publicly or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. Further information on the types of factors that could affect Biglari Holdings and its business can be found in the Company’s filings with the SEC.

![]() View original content:https://www.prnewswire.com/news-releases/biglari-holdings-inc-news-release-302300368.html

View original content:https://www.prnewswire.com/news-releases/biglari-holdings-inc-news-release-302300368.html

SOURCE Biglari Holdings Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.