Unpacking the Latest Options Trading Trends in Expedia Group

Whales with a lot of money to spend have taken a noticeably bearish stance on Expedia Group.

Looking at options history for Expedia Group EXPE we detected 32 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 53% with bearish.

From the overall spotted trades, 16 are puts, for a total amount of $1,361,552 and 16, calls, for a total amount of $954,831.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $200.0 for Expedia Group during the past quarter.

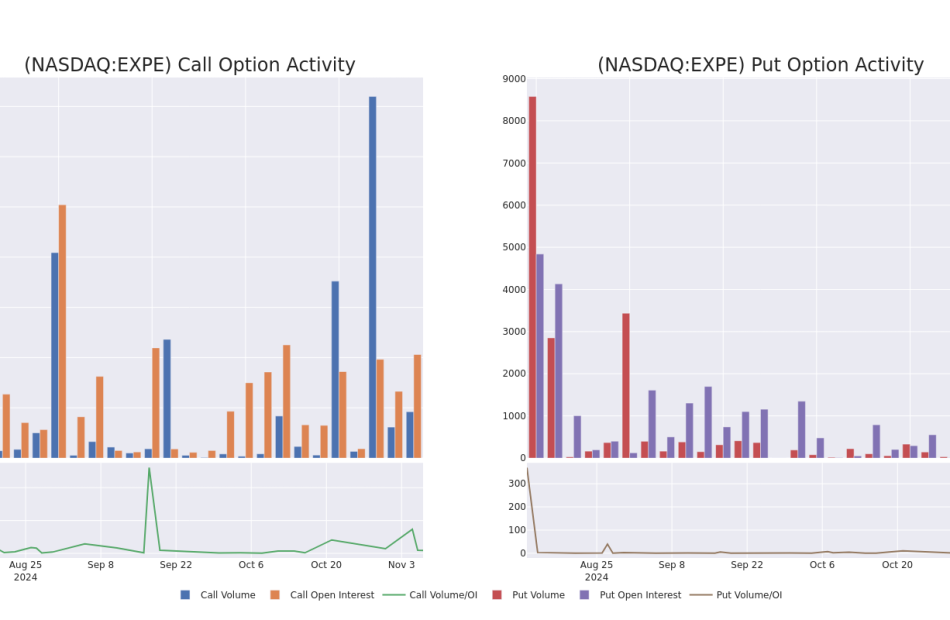

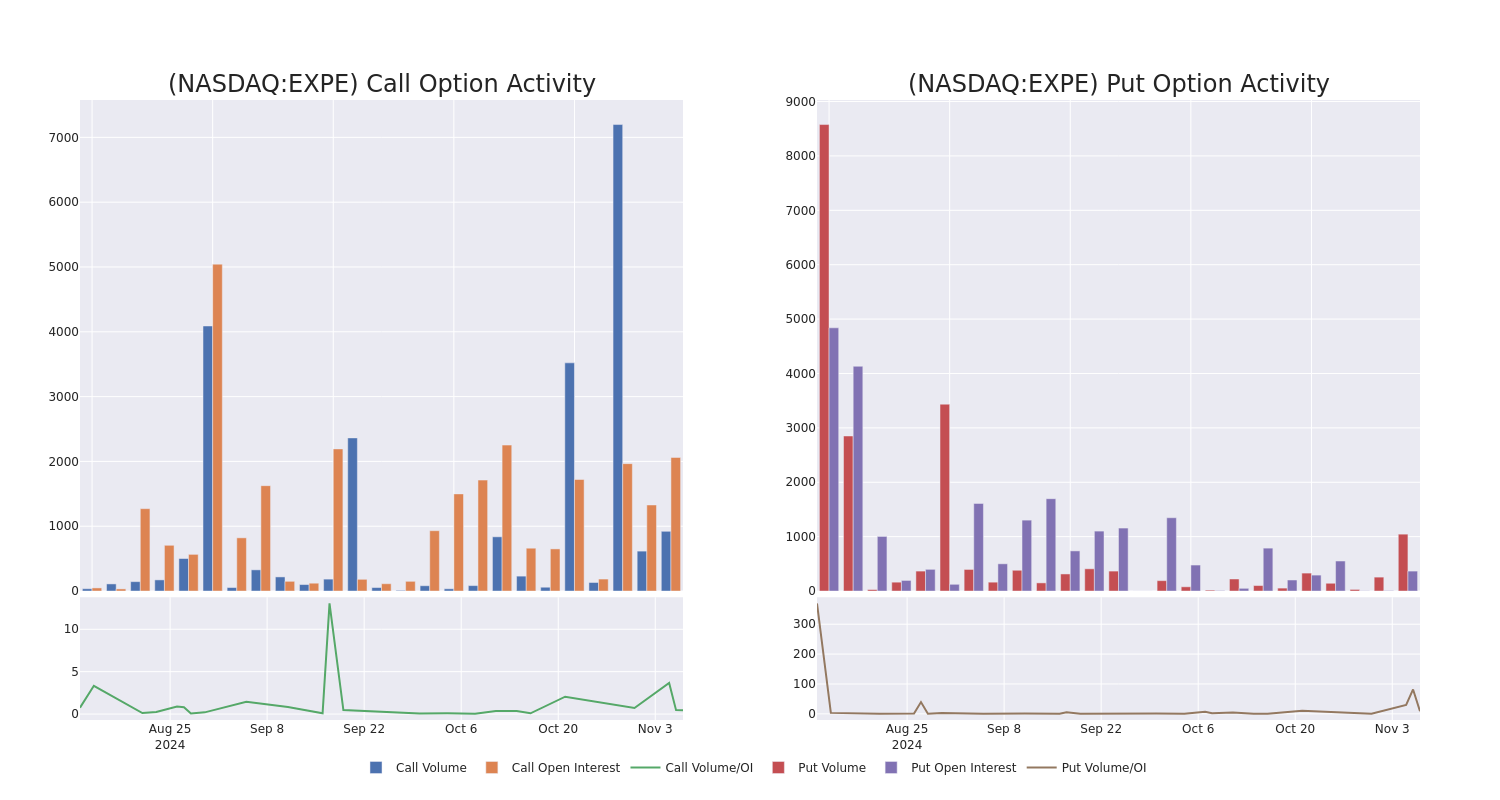

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Expedia Group’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Expedia Group’s substantial trades, within a strike price spectrum from $100.0 to $200.0 over the preceding 30 days.

Expedia Group Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EXPE | PUT | TRADE | NEUTRAL | 01/16/26 | $11.35 | $9.1 | $10.4 | $150.00 | $520.0K | 45 | 0 |

| EXPE | CALL | SWEEP | BEARISH | 11/08/24 | $47.95 | $45.7 | $45.7 | $140.00 | $182.8K | 93 | 40 |

| EXPE | PUT | SWEEP | BEARISH | 04/17/25 | $13.0 | $11.7 | $12.8 | $185.00 | $95.5K | 4 | 76 |

| EXPE | CALL | SWEEP | BULLISH | 11/22/24 | $39.75 | $38.75 | $38.75 | $150.00 | $93.0K | 38 | 33 |

| EXPE | CALL | TRADE | BULLISH | 06/20/25 | $17.7 | $15.9 | $17.7 | $200.00 | $88.5K | 59 | 60 |

About Expedia Group

Expedia is the world’s second-largest online travel agency by bookings, offering services for lodging (80% of total 2023 sales), air tickets (3%), rental cars, cruises, in-destination, and other (11%), and advertising revenue (6%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

After a thorough review of the options trading surrounding Expedia Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Expedia Group’s Current Market Status

- Currently trading with a volume of 3,695,283, the EXPE’s price is up by 3.48%, now at $180.19.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 90 days.

What The Experts Say On Expedia Group

5 market experts have recently issued ratings for this stock, with a consensus target price of $182.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Expedia Group with a target price of $210.

* An analyst from B of A Securities has decided to maintain their Neutral rating on Expedia Group, which currently sits at a price target of $166.

* An analyst from UBS has decided to maintain their Neutral rating on Expedia Group, which currently sits at a price target of $156.

* Maintaining their stance, an analyst from Wedbush continues to hold a Neutral rating for Expedia Group, targeting a price of $180.

* Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for Expedia Group, targeting a price of $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Expedia Group options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Super Micro Computer Stock a Buy? 3 Things to Watch.

With shares down by 78% from an all-time high reached in March, Super Micro Computer (NASDAQ: SMCI) might be one of the first dominoes to fall as the artificial intelligence (AI) hype cycle reaches a possible conclusion. But so far, this crash has little to do with company fundamentals and seems more related to allegedly shady accounting practices and possible wrongdoing.

Let’s explore three factors to watch before considering a position in this embattled tech stock.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The first recent sign of trouble for Supermicro came in late August when short-seller Hindenburg Research — which would financially benefit from a fall in the stock’s price — released a report alleging the company engaged in accounting manipulation, self-dealing, and evading sanctions related to Russia’s invasion of Ukraine. Last week, some of these accusations gained strength when when Supermicro’s auditor, Ernst & Young, resigned, saying, according to Supermicro that “we are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management…”

To make matters worse, Supermicro is also reportedly being looked at by the Justice Department, which is said to be reaching out to the company’s former employees and others.

These developments won’t necessarily affect Supermicro’s operations. However, they could tank its valuation by creating skepticism about the accuracy of its reporting and potential fines that could come up if management is found guilty of wrongdoing. Unfortunately, that might be the best-case scenario for this increasingly embattled company.

Supermicro’s situation could get much worse. Public companies are required to have auditors and to file their financial statements by certain deadlines. The company has fallen out of compliance with both requirements, putting it at risk of delisting by te Nasdaq.

After failing to file its annual 10-K annual report in August, management has until mid-November to submit a compliance plan, which (if approved) could push the deadline to February 2025. However, Supermicro is still in a catch-22 because it doesn’t have an auditor, and the ongoing issues could make new firms hesitant to take on the role.

Board Member At Stryker Sells $84.49M Of Stock

A substantial insider sell was reported on November 7, by Ronda E Stryker, Board Member at Stryker SYK, based on the recent SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, Stryker sold 230,000 shares of Stryker. The total transaction value is $84,494,989.

As of Friday morning, Stryker shares are up by 0.64%, currently priced at $372.19.

Get to Know Stryker Better

Stryker designs, manufactures, and markets an array of medical equipment, instruments, consumable supplies, and implantable devices. The product portfolio includes hip and knee replacements, extremities, endoscopy systems, operating room equipment, embolic coils, hospital beds and gurneys, and orthopedic robotics. Stryker remains one of the three largest competitors in reconstructive orthopedic implants and holds the leadership position in operating room equipment. Just over one fourth of Stryker’s total revenue currently comes from outside the United States.

Stryker’s Financial Performance

Revenue Growth: Stryker’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 11.92%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Key Profitability Indicators:

-

Gross Margin: The company maintains a high gross margin of 64.02%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 2.18, Stryker showcases strong earnings per share.

Debt Management: Stryker’s debt-to-equity ratio surpasses industry norms, standing at 0.77. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: Stryker’s P/E ratio of 39.64 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 6.48, Stryker’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 28.01, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Exploring Key Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Stryker’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's presidency could help small-cap stocks soar in the coming years, Fundstrat's Tom Lee says

-

Small-cap stocks could be headed for big upside amid Trump’s second term, Tom Lee says.

-

“I think small-caps could, over the next couple of years, outperform by more than 100%,” he said.

-

Lee predicted in July that small-caps had 40% upside through the rest of this year.

Donald Trump’s presidency could drive monster gains in a particular corner of the stock market in the coming years, according to Fundstrat’s head of research Tom Lee.

Speaking to CNBC on Friday, the permeable stock forecaster said he foresaw huge upside for small-cap stocks in the coming years. That’s thanks to Donald Trump’s recent election win, which sent stocks soaring this week as traders anticipated a fresh economic agenda, a looser regulatory environment, and lower taxes.

Small-cap stocks have done well so far this year, with the Russell 2000 up 18%. Still, the index of small-caps is trading at around 10 times forward median earnings, Lee noted, reflecting a lower valuation than the S&P 500, which is trading at around 17 times forward earnings.

“I do think there’s still a lot of upside,” Lee said. “So I think small-caps could, over the next couple of years, outperform by more than 100%,” he added.

Lee, who previously predicted the small-cap Russell 2000 index could rally as much as 40% before the end of the year, also said he sees big gains ahead for other assets lumped into the Trump Trade, a handful of investments thought to benefit under the president-elect’s policies.

Bitcoin, which notched a record-high this week, could climb past $100,000 by the end of the year, Lee predicted. The S&P 500, meanwhile, could rally another 5%-10% through year-end, he said, pointing to the size of previous post-election rallies.

“Part of the reason investors are feeling so optimistic is that President Trump is entering office again, but this time with a lot more knowledge of how to build a cabinet and a team, and so in some ways this end up being more market-friendly,” he added.

Doubts, though, are swirling around some aspects of Trump’s economic agenda, which experts have warned could stoke inflation and keep interest rates higher for longer. Trump’s policies were thought to be more inflationary than Harris’ by 70% of polled economists, according to a survey conducted by the Financial Times and the University of Chicago.

Read the original article on Business Insider

CNL Strategic Capital Announces Operating Results for Third Quarter 2024

Orlando, Fla., Nov. 08, 2024 (GLOBE NEWSWIRE) — CNL Strategic Capital, LLC (CNL Strategic Capital or the Company) seeks to provide current income and long-term appreciation to investors by acquiring controlling equity stakes in combination with loan positions in privately owned middle-market businesses. The Company announced its operating results for the nine months ended Sept. 30, 2024.

Highlights:

- As of Sept. 30, 2024, CNL Strategic Capital’s portfolio consisted of equity and debt investments in 16 portfolio companies and had approximately $1.2 billion in total assets, compared with approximately $1.0 billion as of Dec. 31, 2023.

- For the nine months ended Sept. 30, 2024, the Company recognized a net change in unrealized appreciation on investments including unrealized foreign currency gain of approximately $50.7 million and had total investment income of approximately $51.8 million. That compares with a net change in unrealized appreciation on investments of $24.6 million and total investment income of approximately $43.7 million during the first nine months of 2023.

- The cumulative total investment return based on net asset value (NAV) since inception and through Sept. 30, 2024, was approximately 98.1% for Class FA shares, 83.1% for Class A shares, 71.5% for Class T shares, 73.8% for Class D shares, 84.9% for Class I shares and 67.3% for Class S shares.1 These returns are prior to any applicable sales load and assume shareholders reinvested their distributions.

- For the nine months ended Sept. 30, 2024, CNL Strategic Capital received approximately $182.2 million in net offering proceeds, including approximately $13.1 million received through the distribution reinvestment plan. Since beginning operations in February 2018 until Sept. 30, 2024, CNL Strategic Capital raised approximately $1.1 billion, including $41.3 million received through the distribution reinvestment plan.

Cash distributions declared net of distributions reinvested were funded from the following sources (in thousands):

| Nine Months Ended Sept. 30, | |||||||||||||

| 2024 | 2023 | ||||||||||||

| Amount | Percentage2 | Amount | Percentage2 | ||||||||||

| Net investment income before Expense Support (reimbursement) | $ | 17,618 | 120.6 | % | $ | 17,918 | 141.2 | % | |||||

| Expense Support (reimbursement) | — | — | (644) | (5.1) | |||||||||

| Net investment income | $ | 17,618 | 120.6 | % | $ | 17,274 | 136.1 | % | |||||

| Cash distributions declared, net of distributions reinvested 3 | $ | 14,604 | 100.0 | % | $ | 12,694 | 100.0 | % | |||||

The sources of declared distributions on a GAAP basis (in thousands):

| Nine Months Ended Sept. 30, | |||||||||||||

| 2024 | 2023 | ||||||||||||

| Amount | % of Distributions Declared |

Amount | % of Distributions Declared |

||||||||||

| Net investment income4 | $ | 17,618 | 63.6 | % | $ | 17,274 | 79.7 | % | |||||

| Distributions in excess of net investment income5 | 10,079 | 36.4 | 4,387 | 20.3 | |||||||||

| Total distributions declared | $ | 27,697 | 100.0 | % | $ | 21,661 | 100.0 | % | |||||

Total investment return based on net asset value (NAV) after incentive fees per share for the nine months ended Sept. 30, 2024:1

| Class FA | Class A | Class T | Class D | Class I | Class S |

| 7.2% | 6.5% | 5.8% | 6.3% | 6.4% | 7.2% |

(These returns are prior to any applicable sales load and assume shareholders reinvested their distributions. These are not actual shareholder returns. Actual returns may vary materially.)

Cumulative total investment return based on NAV after sales fees since inception and through the nine months ended Sept. 30, 2024:1

| Class FA (2/7/18-9/30/24) |

Class A (4/10/18-9/30/24) |

Class T (5/25/18-9/30/24) |

Class D (6/26/18-9/30/24) |

Class I (4/10/18-9/30/24) |

Class S (3/31/20-9/30/24) |

| 98.1% | 83.1% | 71.5% | 73.8% | 84.9% | 67.3% |

(These returns are prior to any applicable sales load and assume shareholders reinvested their distributions. These are not actual shareholder returns. Actual returns may vary materially.)

1This is not shareholder returns. Total investment return is calculated for each share class as the change in the net asset value for such share class during the period and assuming all distributions are reinvested. Amounts are not annualized and are not representative of total return as calculated for purposes of the total return incentive fee. Since there is no public market for the Company’s shares, terminal market value per share is assumed to be equal to net asset value per share on the last day of the period presented. The Company’s performance changes over time and currently may be different than that shown above. Past performance is no guarantee of future results. Investment performance is presented without regard to sales load that may be incurred by shareholders in the purchase of the Company’s shares. For the period from the date the first share was issued for each respective share class through the nine months ended Sept. 30, 2024. 2Represents percentage of cash distribution declared, net of distribution reinvested for the period presented. 3Excludes $13,093 and $8,967 of distributions reinvested pursuant to our distribution reinvestment plan during the nine months ended Sept. 30, 2024, and 2023, respectively. 4Net investment income includes Expense Support (reimbursement), net of $0 and $(644) for the nine months ended Sept. 30, 2024, and 2023, respectively. 5Consists of distributions made from offering proceeds for the periods presented.

About CNL Strategic Capital

CNL Strategic Capital is a publicly registered, non-traded limited liability Company that seeks to provide current income and long-term appreciation to individuals by acquiring controlling equity stakes in combination with loan positions in durable and growing middle-market businesses. The Company is externally managed by CNL Strategic Capital Management, LLC and Levine Leichtman Strategic Capital, LLC (LLSC). For additional information, please visit cnlstrategiccapital.com.

About CNL Financial Group

CNL Financial Group (CNL) is a leading private investment management firm providing alternative investment opportunities. Since inception in 1973, CNL and/or its affiliates have formed or acquired companies with more than $36 billion in assets. CNL is headquartered in Orlando, Florida. For more information, visit cnl.com.

About Levine Leichtman Strategic Capital

LLSC is an affiliate of Levine Leichtman Capital Partners, LLC (LLCP), a middle-market private equity firm with a 40-year track record of investing across various targeted sectors, including Franchising & Multi-unit, Business Services, Education & Training and Engineered Products & Manufacturing. LLCP utilizes a differentiated Structured Private Equity investment strategy, combining debt and equity capital investments in portfolio companies. LLCP believes that by investing in a combination of debt and equity securities, it offers management teams growth capital in a highly tailored, flexible investment structure that can be a more attractive alternative than traditional private equity.

LLCP’s global team of dedicated investment professionals is led by 10 partners who have worked at LLCP for an average of 20 years. Since inception, LLCP has managed approximately $14.8 billion of institutional capital across 15 investment funds and has invested in over 100 portfolio companies. LLCP currently manages $10.2 billion of assets and has offices in Los Angeles, New York, Chicago, Miami, London, Stockholm, Amsterdam and Frankfurt. For additional information, please visit llcp.com.

The information in this press release may include “forward-looking statements.” These statements are based on the beliefs and assumptions of CNL Strategic Capital’s management and on the information currently available to management at the time of such statements. Forward-looking statements generally can be identified by the words “believes,” “expects,” “intends,” “plans,” “estimates” or similar expressions that indicate future events. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond CNL Strategic Capital’s control. Important risks, uncertainties and factors that could cause actual results to differ materially from those in the forward-looking statements include the risks associated with the Company’s ability to pay distributions and the sources of such distribution payments, the Company’s ability to locate and make suitable investments and other risks described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K and the other documents filed by the Company with the Securities and Exchange Commission. This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities.

###

Colleen Johnson Senior Vice President Marketing and Communications CNL Financial Group 407-650-1223

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

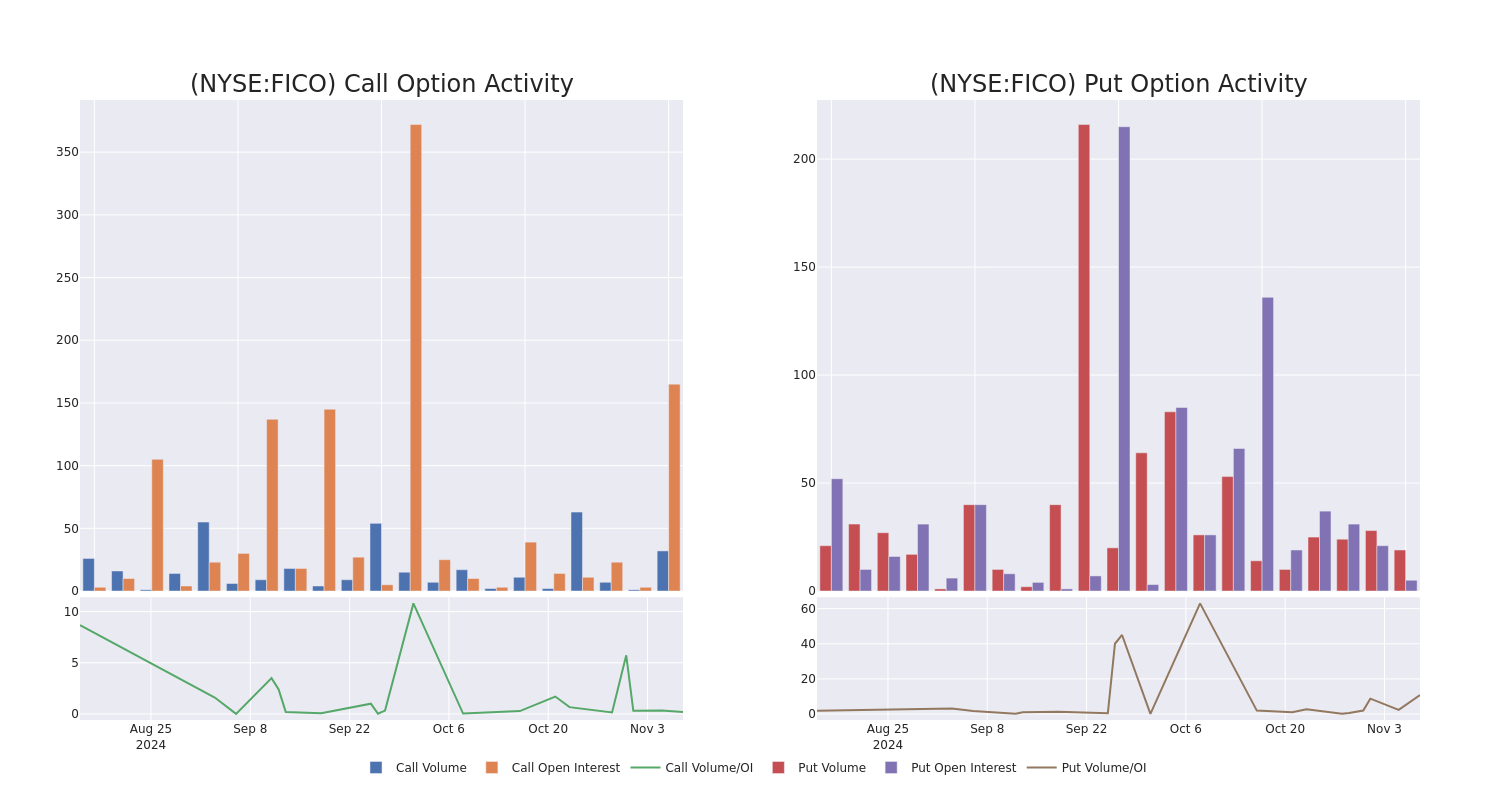

Looking At Fair Isaac's Recent Unusual Options Activity

Deep-pocketed investors have adopted a bearish approach towards Fair Isaac FICO, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in FICO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 14 extraordinary options activities for Fair Isaac. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 50% bearish. Among these notable options, 2 are puts, totaling $71,378, and 12 are calls, amounting to $737,063.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1700.0 to $2500.0 for Fair Isaac over the recent three months.

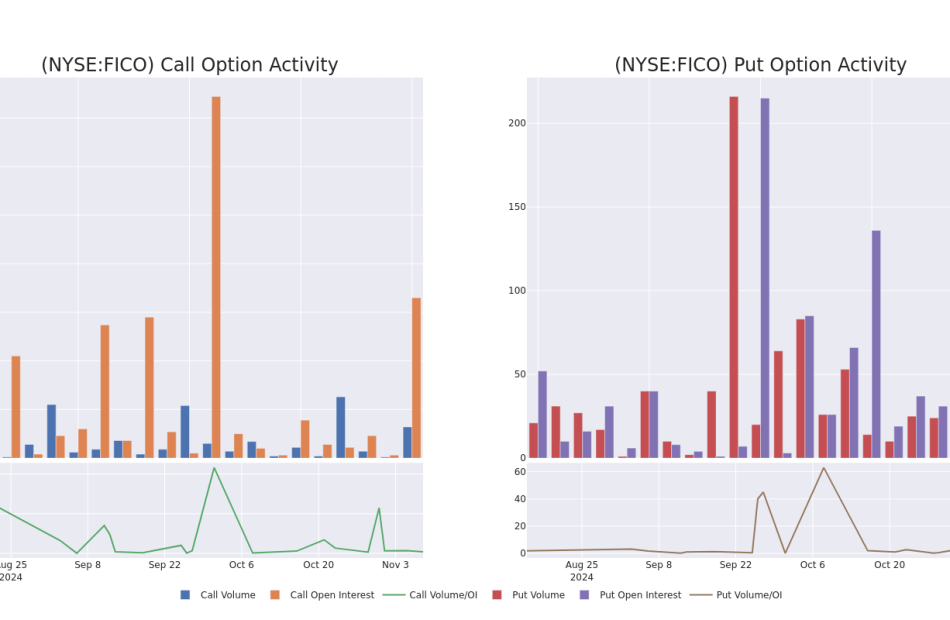

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Fair Isaac options trades today is 16.6 with a total volume of 51.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Fair Isaac’s big money trades within a strike price range of $1700.0 to $2500.0 over the last 30 days.

Fair Isaac Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FICO | CALL | SWEEP | BULLISH | 04/17/25 | $352.1 | $352.0 | $352.1 | $2000.00 | $352.0K | 29 | 10 |

| FICO | CALL | TRADE | BULLISH | 04/17/25 | $375.6 | $373.0 | $375.6 | $2000.00 | $75.1K | 29 | 12 |

| FICO | CALL | TRADE | BEARISH | 12/20/24 | $548.0 | $538.0 | $539.0 | $1700.00 | $53.9K | 4 | 1 |

| FICO | PUT | SWEEP | BEARISH | 01/17/25 | $55.6 | $51.7 | $55.6 | $2200.00 | $44.4K | 1 | 8 |

| FICO | CALL | TRADE | BULLISH | 01/17/25 | $160.0 | $155.1 | $160.0 | $2180.00 | $32.0K | 3 | 4 |

About Fair Isaac

Founded in 1956, Fair Isaac Corporation is a leading applied analytics company. Fair Isaac is primarily known for its FICO credit scores, which is a widely used industry benchmark to determine the creditworthiness of an individual consumer. The firm’s credit scores business accounts for most of the firm’s profits and consists of business-to-business and business-to-consumer services. In addition to scores, Fair Isaac also sells software primarily to financial institutions for areas such as analytics, decision-making, customer workflows, and fraud.

Having examined the options trading patterns of Fair Isaac, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Fair Isaac Standing Right Now?

- With a volume of 196,525, the price of FICO is down 0.0% at $2176.1.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 76 days.

Expert Opinions on Fair Isaac

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $2252.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Baird has decided to maintain their Neutral rating on Fair Isaac, which currently sits at a price target of $2000.

* In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $2040.

* An analyst from Needham has decided to maintain their Buy rating on Fair Isaac, which currently sits at a price target of $2500.

* An analyst from Goldman Sachs has decided to maintain their Buy rating on Fair Isaac, which currently sits at a price target of $2374.

* An analyst from Barclays has decided to maintain their Overweight rating on Fair Isaac, which currently sits at a price target of $2350.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Fair Isaac with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Planet 13 Announces Q3 2024 Financial Results

- Q3 2024 Revenue of $32.2 million

- Q3 2024 Net loss of $7.4 million

- Q3 2024 Adjusted EBITDA of $1.3 million

All figures are reported in United States dollars ($) unless otherwise indicated

LAS VEGAS, Nov. 08, 2024 (GLOBE NEWSWIRE) — Planet 13 Holdings Inc. PLTH PLNH (“Planet 13” or the “Company“), a leading vertically-integrated multi-state cannabis company, today announced its financial results for the three-month period ended September 30, 2024. Planet 13’s financial statements are prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”).

“Despite Florida not moving forward with adult-use, we see a significant growth runway by expanding our store footprint and enhancing cultivation assets in the state. In addition to our Florida operations, we’re focused on driving growth by scaling our neighborhood store network and broadening the distribution of our HaHa edibles,” said Larry Scheffler, co-CEO of Planet 13. “We’re actively making progress on our growth initiatives while continuing to innovate and elevate the cannabis shopping experience.”

“While we experienced headwinds in Q3 from traditional seasonality in Florida and continued pressure on consumer spending, we are taking strategic steps to set ourselves up for long-term success. Our focus remains on delivering a one-of-a-kind shopping experience for the consumer, making thoughtful investments and most importantly, prioritizing cash flow. With our diversified footprint, multiple growth opportunities, and a strong balance sheet, we are well positioned to drive further growth and profitability in 2025,” said Bob Groesbeck, co-CEO of Planet 13.

Financial Highlights – Q3 – 2024

Operating Results

All comparisons below are to the quarter ended September 30, 2023, unless otherwise noted

- Revenue was $32.2 million as compared to $24.8 million, an increase of 29.7%. The increase in sales was driven by the addition of Florida as well as strong sales at the Illinois neighborhood store.

- Gross profit was $16.7 million or 51.9% as compared to $11.1 million or 44.7%. The improvement in gross margin was driven by a lower cost of cultivation through full utilization of cultivation facilities and better yields, along with the addition of high margin Florida revenue.

- Total expenses were $20.0 million as compared to $55.1 million, a decrease of 63.6%. Lower total expenses were driven by lower impairment loss in the quarter.

- Net loss of $7.4 million as compared to a net loss of $46.3 million.

- Adjusted EBITDA of $1.3 million as compared to Adjusted EBITDA of $0.2 million. Adjusted EBITDA was higher due to the inclusion of Florida, better gross margin performance, and increased operating leverage.

Balance Sheet

All comparisons below are to December 31, 2023, unless otherwise noted

- Cash of $27.4 million as compared to $11.8 million

- Total assets of $243.0 million as compared to $151.7 million

- Total liabilities of $92.3 million as compared to $44.1 million

Q3 Highlights and Recent Developments

For a more comprehensive overview of these highlights and recent developments, please refer to Planet 13’s press releases.

- On July 24, 2024, Planet 13 announced the launch of its new Lifestyles brand company.

- On August 12, 2024, Planet 13 announced the opening of its 27th Florida dispensary, located in Ocala.

- On August 15, 2024, Planet 13 announced the exclusive Nevada launch of Khalifa Kush ‘Products Powered by Planet 13’ at the Las Vegas SuperStore.

- On September 11, 2024, Planet 13 announced the proposed acquisition of a Las Vegas dispensary.

- On October 15, 2024, Planet 13 announced the opening of its 28th Florida dispensary, located in Port Orange near Daytona Beach.

Results of Operations (Summary)

The following tables set forth consolidated statements of financial information for the three-month periods ending September 30, 2024, and September 30, 2023.

Financial Highlights

Results of Operations

| (Figures in millions | For the Three Months Ended | ||||||||||

| and % change based | September 30, | September 30, | |||||||||

| on these figures) | 2024 | 2023 | change | ||||||||

| Total Revenue | $ | 32.2 | $ | 24.8 | 29.7 | % | |||||

| Gross Profit | $ | 16.7 | $ | 11.1 | 50.8 | % | |||||

| Gross Profit % | 51.9 | % | 44.7 | % | 16.2 | % | |||||

| Operating Expenses | $ | 17.6 | $ | 52.5 | -66.4 | % | |||||

| Operating Expenses % | 54.9 | % | 211.8 | % | -74.1 | % | |||||

| Net Loss Before Provision for Income Taxes | $ | (2.9 | ) | $ | (43.9 | ) | -93.3 | % | |||

| Net Loss | $ | (7.4 | ) | $ | (46.3 | ) | -84.0 | % | |||

| Adjusted EBITDA | $ | 1.3 | $ | 0.2 | 509.0 | % | |||||

| Adjusted EBITDA Margin % | 4.2 | % | 0.9 | % | |||||||

The Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, is available on the SEC’s website at www.sec.gov or at https://planet13.com/investors/. The Company’s Management Discussion and Analysis for the period and the accompanying financial statements and notes are available under the Company’s profile on SEDAR+ at https://www.sedarplus.ca/ and on its website at https://planet13.com/investors/.

This news release is not in any way a substitute for reading those financial statements, including the notes to the financial statements.

Conference Call

Planet 13 will host a conference call on November 8, 2024 at 5:00 p.m. ET to discuss its third quarter financial results and provide investors with key business highlights, strategy, and outlook. The call will be chaired by Robert Groesbeck, Co-CEO, Larry Scheffler, Co-CEO, and Dennis Logan, CFO.

| CONFERENCE CALL DETAILS |

| Date: November 8, 2024 | Time: 5:00 p.m. EST Call registration link – available 15 minutes before call: https://eventmeet.conferencingcenter.com/ExpressAttend/control?u=1 Webcast link: https://events.q4inc.com/attendee/307597500 |

Non-GAAP Financial Measures

There are financial measures included in this press release that are not in accordance with GAAP and therefore may not be comparable to similarly titled measures and metrics presented by other publicly traded companies. These non-GAAP financial measures should be considered as supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP. The Company includes EBITDA and Adjusted EBITDA because it believes certain investors use these measures and metrics as a means of assessing financial performance. EBITDA is calculated as net income (loss) before interest, taxes, depreciation and amortization and Adjusted EBITDA is calculated as EBITDA before share-based compensation, the change in fair value of warrants and one-time non-recurring expenses.

The following table presents a reconciliation of net income (loss) to Adjusted EBITDA for each of the periods presented:

| Reconciliation of Non-GAAP Adjusted EBITDA | |||||||||||

| (Figures in millions | For the Three Months Ended | ||||||||||

| and % change based | September 30, | September 30, | |||||||||

| on these figures) | 2024 | 2023 | change | ||||||||

| Net Income (Loss) | $ | (7.4 | ) | $ | (46.3 | ) | -84.0 | % | |||

| Add impact of: | |||||||||||

| Interest income, net | $ | (0.0 | ) | $ | (0.0 | ) | 179.3 | % | |||

| Provision for income taxes | $ | 4.5 | $ | 2.4 | 89.9 | % | |||||

| Depreciation and amortization | $ | 2.4 | $ | 2.0 | 19.8 | % | |||||

| Depreciation included in cost of goods sold | $ | 1.2 | $ | 1.0 | 23.9 | % | |||||

| EBITDA | $ | 0.6 | $ | (40.9 | ) | -101.5 | % | ||||

| Share-based compensation and related premiums | $ | 0.0 | $ | 0.6 | -95.8 | % | |||||

| Impairment losses | $ | – | $ | 39.6 | -100.0 | % | |||||

| Loss on Sale of Florida License | $ | – | $ | – | 0.0 | % | |||||

| Professional fees expensed related to M&A activities | $ | 0.1 | $ | 0.7 | -81.6 | % | |||||

| Professional fees expensed related to SEC Domestic Issuer Form 10 filing and U.S Domestication from British Columbia to Nevada |

$ | – | $ | 0.19 | -100.0 | % | |||||

| Expenses related to El Capitan Matter | $ | 0.6 | $ | – | 0.0 | % | |||||

| Adjusted EBITDA | $ | 1.3 | $ | 0.2 | 509.0 | % | |||||

For more information on Planet 13, visit the investor website (https://planet13.com/investors/).

About Planet 13

Planet 13 (https://planet13.com) is a vertically integrated cannabis company, with award-winning cultivation, production and dispensary operations across its locations in California, Nevada, Illinois, and Florida. Home to the nation’s largest dispensary, located just off The Strip in Las Vegas, Planet 13 continues to expand its footprint with the recent debut of its first consumption lounge in Las Vegas, DAZED!, the opening of its first Illinois dispensary in Waukegan, bringing unparalleled cannabis experiences to the Chicago metro area. Planet 13’s mission is to build a recognizable global brand known for world-class dispensary operations and innovative cannabis products. Licensed cannabis activity is legal in the states Planet 13 operates in but remains illegal under U.S. federal law. Planet 13’s shares trade on the Canadian Securities Exchange (CSE) under the symbol PLTH and are quoted on the OTCQX under the symbol PLNH. To learn more, visit planet13.com and follow Planet 13 on Instagram @planet13stores.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking information and forward-looking statements within the meaning of applicable securities laws. All statements, other than statements of historical fact, are forward-looking statements and are often, but not always, identified by phrases such as “plans”, “expects”, “proposed”, “may”, “could”, “would”, “intends”, “anticipates”, or “believes”, or variations of such words and phrases. In this news release, forward-looking statements relate to our strategic goals or future performance. Such forward-looking statements reflect what management of the Company believes, or believed at the time, to be reasonable assumptions and accordingly readers are cautioned not to place undue reliance upon such forward-looking statements and that actual results may vary from such forward-looking statements. These assumptions, risks and uncertainties which may cause actual results to differ include, among others: final regulatory and other approvals or consents needed to operate our business; fluctuations in general macroeconomic conditions; inflationary pressures; fluctuations in securities markets; expectations regarding the size of the cannabis market in the states in which we currently operate in or contemplate future operations and changing consumer habits in such states; the ability of the Company to successfully achieve its business objectives; plans for expansion; political and social uncertainties including international conflict; inability to obtain adequate insurance to cover risks and hazards; and the presence of laws and regulations that may impose restrictions on cultivation, production, distribution and sale of cannabis and cannabis related products in the states in which we currently operate in or contemplate future operations; employee relations and other risks and uncertainties discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission at www.sec.gov and on the Company’s issuer profile on SEDAR+ at www.sedarplus.ca and in the Company’s periodic reports subsequently filed with the U.S. Securities and Exchange Commission and on SEDAR+. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

For further inquiries, please contact:

LodeRock Advisors Inc., Planet 13 Investor Relations

mark.kuindersma@loderockadvisors.com

Robert Groesbeck or Larry Scheffler

Co-Chief Executive Officers

ir@planet13lasvegas.com

| PLANET 13 HOLDINGS INC. Interim Condensed Consolidated Balance Sheets (Unaudited, In United States Dollars) |

| September 30, | December 31, | ||||||

| 2024 | 2023 | ||||||

| ASSETS | |||||||

| Current Assets: | |||||||

| Cash | $ | 27,411,087 | $ | 11,831,008 | |||

| Restricted Cash | 2,050,584 | 5,450,584 | |||||

| Accounts Receivable | 1,294,581 | 1,195,927 | |||||

| Inventory | 22,804,161 | 15,760,648 | |||||

| Assets held for sale | – | 9,000,000 | |||||

| Prepaid Expenses and Other Current Assets | 4,619,996 | 4,072,820 | |||||

| Total Current Assets | 58,180,409 | 47,310,987 | |||||

| Plant, Property and Equipment | 73,402,207 | 67,551,697 | |||||

| Intangible Assets | 23,503,797 | 15,253,797 | |||||

| Goodwill | 45,230,595 | – | |||||

| Right of Use Assets – Operating | 40,913,500 | 20,054,369 | |||||

| Long-term Deposits and Other Assets | 998,815 | 869,853 | |||||

| Deferred Tax Asset | 729,435 | 706,038 | |||||

| TOTAL ASSETS | $ | 242,958,758 | $ | 151,746,741 | |||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||

| LIABILITIES | |||||||

| Current: | |||||||

| Accounts Payable | $ | 4,402,574 | $ | 2,850,922 | |||

| Accrued Expenses | 10,554,795 | 6,097,641 | |||||

| Income Taxes Payable | 15,593,678 | 4,782,538 | |||||

| Notes Payable – Current Portion | 10,331,632 | 884,000 | |||||

| Operating Lease Liabilities | 1,733,348 | 674,594 | |||||

| Total Current Liabilities | 42,616,027 | 15,289,695 | |||||

| Long-Term Liabilities: | |||||||

| Operating Lease Liabilities | 45,697,988 | 25,271,706 | |||||

| Other Long-term Liabilities | 33,000 | 33,000 | |||||

| Deferred Tax Liability | 3,937,314 | 3,511,559 | |||||

| Total Liabilities | 92,284,329 | 44,105,960 | |||||

| SHAREHOLDERS’ EQUITY | |||||||

| Common Stock, no par value, 1,500,000,000 shares authorized, 325,163,800 issued and outstanding at September 30, 2024 and 223,317,270 at December 31, 2023 |

– | – | |||||

| Preferred Stock, no par value, 50,000,000 shares authorized, 0 issued and outstanding at September 30, 2024 and 0 at December 31, 2023 |

– | – | |||||

| Additional Paid-In Capital | 380,343,096 | 315,951,343 | |||||

| Deficit | (229,668,667 | ) | (208,310,562 | ) | |||

| Total Shareholders’ Equity | 150,674,429 | 107,640,781 | |||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 242,958,758 | $ | 151,746,741 | |||

| PLANET 13 HOLDINGS INC. Interim Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited, In United States Dollars) |

| Three Months Ended | |||||||

| September 30, | September 30, | ||||||

| 2024 | 2023 | ||||||

| Revenues, net of discounts | $ | 32,159,070 | $ | 24,788,239 | |||

| Cost of Goods Sold | (15,463,050 | ) | (13,715,307 | ) | |||

| Gross Profit | 16,696,020 | 11,072,932 | |||||

| Expenses: | |||||||

| General and Administrative | 14,772,846 | 11,340,678 | |||||

| Sales and Marketing | 1,572,549 | 1,348,266 | |||||

| Lease Expense | 1,320,018 | 767,860 | |||||

| Impairment Loss | – | 39,649,448 | |||||

| Depreciation | 2,355,052 | 1,965,607 | |||||

| Total Expenses | 20,020,465 | 55,071,859 | |||||

| Loss From Operations | (3,324,445 | ) | (43,998,927 | ) | |||

| Other Income (Expense): | |||||||

| Interest income, net | 30,263 | 10,834 | |||||

| Foreign exchange gain (loss) | (3,066 | ) | 203 | ||||

| Change in fair value of warrant liability | – | – | |||||

| Provision for misappropriated funds | – | – | |||||

| Other income (expense), net | 376,717 | 98,861 | |||||

| Total Other Income (Loss) | 403,914 | 109,898 | |||||

| Loss Before Provision for Income Taxes | (2,920,531 | ) | (43,889,029 | ) | |||

| Provision For Income Taxes | |||||||

| Current Tax Expense | (4,220,945 | ) | (2,401,672 | ) | |||

| Deferred Tax Recovery | (269,714 | ) | 36,465 | ||||

| (4,490,659 | ) | (2,365,207 | ) | ||||

| Net Loss and Comprehensive Loss | $ | (7,411,190 | ) | $ | (46,254,236 | ) | |

| Loss per Share | |||||||

| Basic and diluted loss per share | $ | (0.02 | ) | $ | (0.21 | ) | |

| Weighted Average Number of Shares of Common Stock | |||||||

| Basic and diluted | 325,163,800 | 222,080,513 | |||||

| PLANET 13 HOLDINGS INC. Interim Condensed Consolidated Statements of Cash Flows (Unaudited, In United States Dollars) |

| Nine Months Ended | |||||||

| September 30, | September 30, | ||||||

| 2024 | 2023 | ||||||

| CASH USED IN OPERATING ACTIVITIES | |||||||

| Net loss | $ | (21,358,105 | ) | $ | (59,350,477 | ) | |

| Adjustments for items not involving cash: | |||||||

| Shared based compensation | 154,893 | 1,926,595 | |||||

| Non-cash lease expense | 1,264,904 | 3,840,610 | |||||

| Depreciation | 9,829,358 | 9,184,602 | |||||

| Change in fair value of warrant liability | – | (18,127 | ) | ||||

| Deferred Tax Recovery | – | (6,509 | ) | ||||

| Lease incentive amortization | 81,832 | (78,347 | ) | ||||

| Loss on impairment of fixed assets | 2,393,087 | – | |||||

| Loss on impairment of intangible assets | – | 39,649,448 | |||||

| Loss on disposal of Intangible assets | 762,091 | – | |||||

| Loss (gain) on disposal of fixed assets | 88,849 | 153 | |||||

| (6,783,091 | ) | (4,852,052 | ) | ||||

| Net Changes in Non-cash Working Capital Items | 14,146,701 | (3,256,283 | ) | ||||

| Repayment of lease liabilities | (720,831 | ) | (3,078,748 | ) | |||

| Total Operating | 6,642,779 | (11,187,083 | ) | ||||

| FINANCING ACTIVITIES | |||||||

| RSU withholding taxes paid in lieu of share issuance | – | (267,526 | ) | ||||

| Proceeds from public share issuance | 9,862,208 | – | |||||

| Net Cash From VidaCann Acquisition | 911,715 | – | |||||

| VidaCann Acquisition-Cash Component | (4,000,000 | ) | – | ||||

| Total Financing | 6,773,923 | (267,526 | ) | ||||

| INVESTING ACTIVITIES | |||||||

| Purchase of property and equipment | (9,481,532 | ) | (6,043,180 | ) | |||

| Proceeds from sales of fixed assets | 7,000 | 64,876 | |||||

| Purchase of 51% interest in Planet 13 Illinois | – | (866,250 | ) | ||||

| Proceeds from sale of Florida License, net of transaction costs | 8,237,909 | – | |||||

| Total Investing | (1,236,623 | ) | (6,844,554 | ) | |||

| NET CHANGE IN CASH DURING THE PERIOD | 12,180,079 | (18,299,163 | ) | ||||

| CASH | |||||||

| Beginning of Period | 17,281,592 | 38,789,604 | |||||

| End of Period | $ | 29,461,671 | $ | 20,490,441 | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

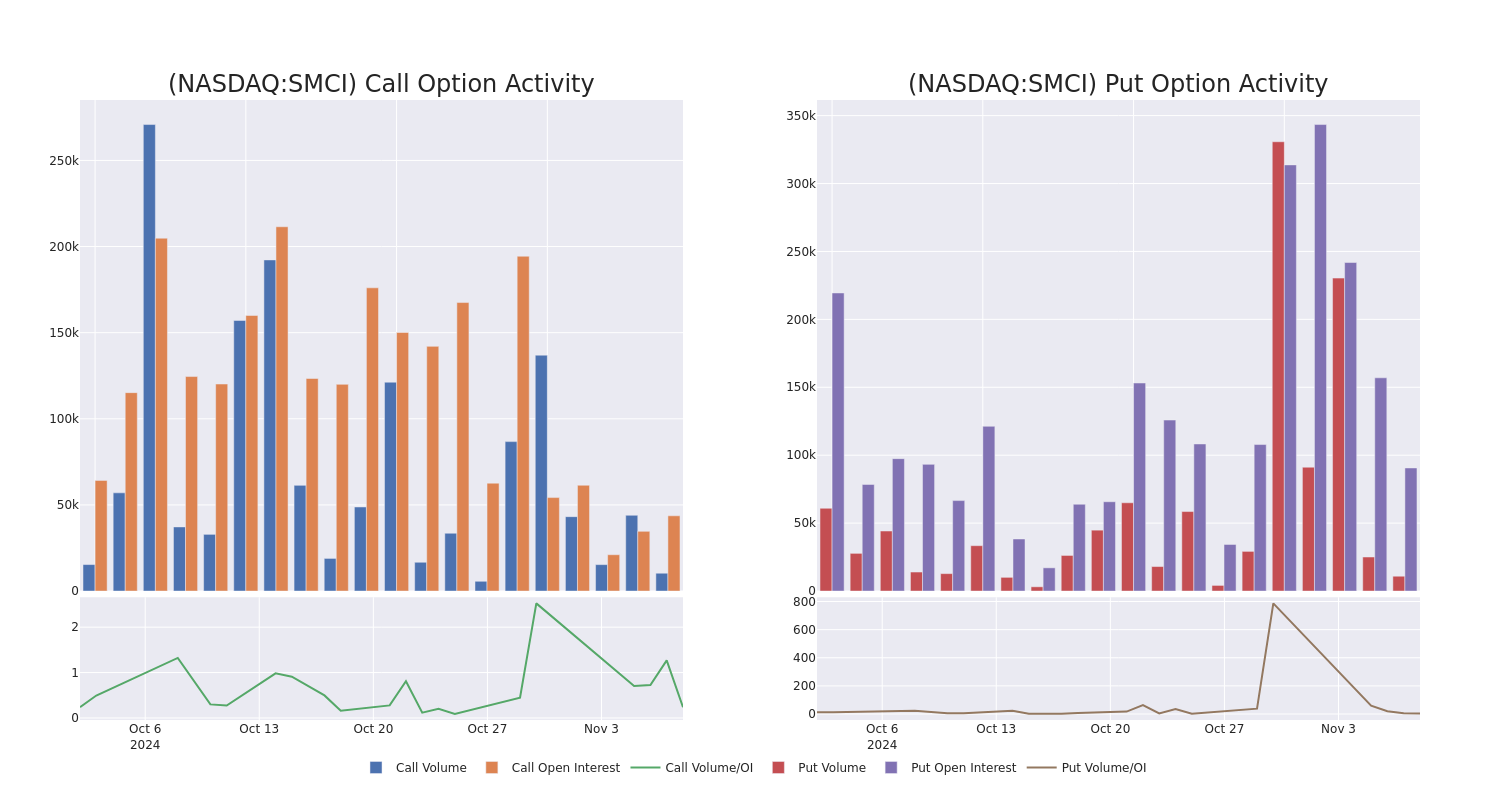

What the Options Market Tells Us About Super Micro Computer

Financial giants have made a conspicuous bearish move on Super Micro Computer. Our analysis of options history for Super Micro Computer SMCI revealed 39 unusual trades.

Delving into the details, we found 43% of traders were bullish, while 51% showed bearish tendencies. Out of all the trades we spotted, 23 were puts, with a value of $1,781,693, and 16 were calls, valued at $804,721.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $13.0 and $87.0 for Super Micro Computer, spanning the last three months.

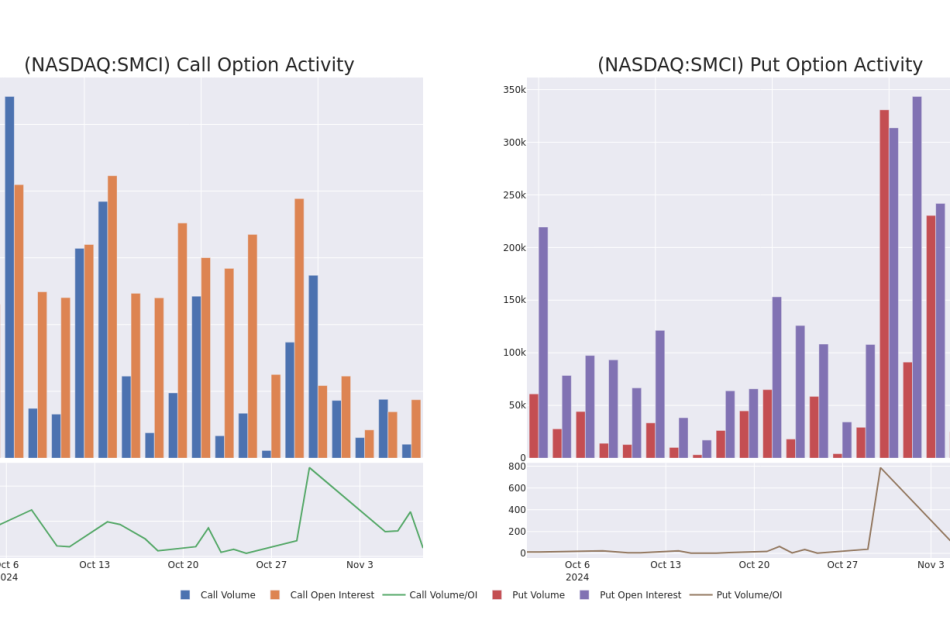

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Super Micro Computer’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Super Micro Computer’s significant trades, within a strike price range of $13.0 to $87.0, over the past month.

Super Micro Computer 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | PUT | SWEEP | NEUTRAL | 06/20/25 | $12.3 | $12.25 | $12.27 | $33.00 | $576.5K | 2.1K | 753 |

| SMCI | PUT | TRADE | BULLISH | 11/15/24 | $13.55 | $13.5 | $13.5 | $38.00 | $135.0K | 5.0K | 115 |

| SMCI | CALL | SWEEP | BULLISH | 02/21/25 | $6.65 | $6.6 | $6.65 | $24.00 | $129.0K | 100 | 350 |

| SMCI | PUT | SWEEP | BEARISH | 11/08/24 | $0.58 | $0.54 | $0.61 | $25.00 | $88.8K | 9.9K | 6.2K |

| SMCI | CALL | TRADE | BEARISH | 01/15/27 | $17.85 | $17.7 | $17.7 | $13.00 | $88.5K | 512 | 72 |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and “Internet of Things” embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm’s revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

After a thorough review of the options trading surrounding Super Micro Computer, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Super Micro Computer’s Current Market Status

- With a volume of 53,554,019, the price of SMCI is down -3.89% at $24.49.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 17 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Super Micro Computer options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.