As Trump's Return To White House, China Plans New Stimulus Package To Protect Economy From US Trade Policies

China is poised to unveil a substantial fiscal stimulus package this Friday, as the National People’s Congress (NPC) Standing Committee wraps up its session. This comes in the wake of Donald Trump’s recent election as U.S. president, which has heightened China’s focus on economic strategies.

What Happened: Finance Minister Lan Foan has proposed a significant increase in the debt ceiling for local governments to address hidden debts. The stimulus package may also include special sovereign bonds for major banks and local government bonds to buy unsold properties, South China Morning Post reported on Friday.

Vice-minister of finance Liao Min has hinted that the package could be substantial, with market estimates ranging from 6 trillion yuan to over 10 trillion yuan. Despite recent economic hurdles, senior officials remain optimistic about meeting a 5% growth target.

Economists like Ding Shuang from Standard Chartered suggest that China “will likely reserve their firepower for next year as growth risks have decreased.” Meanwhile, Larry Hu from Macquarie Group notes that China may wait for clarity on U.S. trade policies under Trump before making additional economic moves.

Why It Matters: The announcement of China’s fiscal stimulus comes amid heightened economic uncertainty following Trump’s election victory. During his campaign, Trump proposed raising tariffs on Chinese imports by up to 60%, potentially reducing Chinese exports to the U.S. by $200 billion and impacting China’s GDP by one percentage point. This has intensified China’s focus on bolstering its economy through fiscal measures.

In October, investor sentiment towards U.S.-listed Chinese stocks was dampened due to the lack of anticipated large-scale stimulus measures. The forthcoming announcement may reignite investor confidence, as Chinese stocks like Alibaba Group Holding BABA, JD.com, Inc JD, and others have shown signs of recovery following Trump’s victory.

Price Action: At the time of writing, chinese stocks were on the red during the pre-market hours on Friday, as per Benzinga Pro. Alibaba was down by 3.85% while its peer JD.com was down by 4.05%. EV makers Li Auto LI and Nio NIO were trading 4.33% and 2.07% lower.

Read Next:

Image via Flickr

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bloomin' Brands Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Bloomin’ Brands, Inc. BLMN will release earnings results for its third quarter, before the opening bell on Friday, Nov. 8.

Analysts expect the Tampa, Florida-based company to report quarterly earnings at 20 cents per share, down from 44 cents per share in the year-ago period. Bloomin’ Brands projects to report revenue of $1.04 billion for the quarter, compared to $1.08 billion a year earlier, according to data from Benzinga Pro.

On Aug. 26, Bloomin’ Brands named Michael L. Spanos as Chief Executive Officer.

Bloomin’ Brands shares fell 1.2% to close at $16.78 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- B of A Securities analyst Justin Post maintained a Neutral rating and cut the price target from $22 to $19 on Oct. 22. This analyst has an accuracy rate of 85%.

- Barclays analyst Jeffrey Bernstein maintained an Overweight rating and slashed the price target from $22 to $20 on Oct. 22. This analyst has an accuracy rate of 64%.

- Citigroup analyst Jon Tower maintained a Neutral rating and cut the price target from $22 to $20 on Aug. 19. This analyst has an accuracy rate of 74%.

- Deutsche Bank analyst Lauren Silberman maintained a Hold rating and slashed the price target from $26 to $19 on Aug. 7. This analyst has an accuracy rate of 76%.

- UBS analyst Dennis Geiger maintained a Neutral rating and cut the price target from $26 to $18 on Aug. 7. This analyst has an accuracy rate of 68%.

Considering buying BLMN stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

George Soros' 1986 Warning On US Debt Resurfaces As Trump Victory And Market Boom Sparks Fears Of Fiscal Instability

George Soros, the renowned hedge-fund manager, issued a warning in the 1980s about the risks of unsustainable U.S. public finances—a caution that has resurfaced amid today’s market boom, stirring concerns among investors and economists alike.

What Happened: In his 1986 investment classic “The Alchemy of Finance,” Soros cautioned about the fundamental deterioration in the U.S.’s financial position. This warning materialized in October of the following year when the U.S. equity market experienced its swiftest crash in history, according to Economist Felix Martin‘s commentary on Reuters Breakingviews.

“The stock market boom has diverted our attention from the fundamental deterioration in the financial position of the United States,” Soros wrote.

As the S&P 500 Index traded at 25 times earnings on the eve of the recent presidential election, the Congressional Budget Office projected that the U.S. public debt would surpass the post-World War Two record in 2027. With a potential Republican majority in Congress, this estimate could be conservative.

According to the Committee for a Responsible Federal Budget, President-elect Donald Trump‘s campaign plans could add a further $15.6 trillion to the U.S. public debt by 2035. This has led to a significant rise in U.S. Treasury yields, making Soros’ decades-old warning alarmingly relevant once again.

However, the issue isn’t confined to the U.S. alone. The International Monetary Fund projects that global public debt will surpass $100 trillion, or 93% of world GDP, this year and could reach 100% by 2030. The IMF notes that past projections have consistently underestimated debt levels.

Following Trump’s election victory on Wednesday, the S&P 500, tracked by the SPDR S&P 500 ETF Trust SPY, rallied 2.85%. Meanwhile, the Nasdaq 100, tracked by the Invesco QQQ Trust QQQ, soared 4.12% on Thursday.

See Also: Trump White House Could Unlock Trillion-Dollar AI Potential For Tesla, Says Dan Ives

Why It Matters: The recent economic developments in the U.S. have significant implications. Goldman Sachs recently reduced the likelihood of a U.S. recession to 15% following strong job growth.

However, the fiscal policies under a potential Republican administration could counteract these positive signs. Economists have warned that a Republican sweep could lead to increased inflationary pressures due to higher tariffs and a growing budget deficit. This scenario could prompt a more hawkish stance from the Federal Reserve.

Additionally, rising U.S. Treasury yields and a stronger dollar, following Trump’s return to the White House, might undermine the Federal Reserve’s efforts to lower interest rates. The bond market is reacting more to the fiscal and inflationary implications of Trump’s victory than to the Fed’s dovish policy.

Read Next:

Image via Wikimedia Commons

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: S&P 500, Nasdaq waver near records as Trump trade fizzles

US stocks hovered near record highs on Friday, with the Nasdaq slipping as post-election euphoria ebbed and China’s latest stimulus plan fell flat.

The S&P 500 (^GSPC) rose 0.3%, while the tech-heavy Nasdaq Composite (^IXIC) dropped roughly 0.1%. The Dow Jones Industrial Average (^DJI) rose slightly.

Stocks are trending toward a downbeat end to a stellar week of gains driven by optimism that President-elect Donald Trump’s policies will boost the economy. But the initial “Trump trade” rush appears to be fizzling out as Wall Street questions whether Trump will be able to push through his ambitions policies. The dollar (DX=F) and Treasury yields, for instance, have given up many of their post-election gains.

Disappointment over China’s new fiscal stimulus also dampened market spirits, putting pressure on oil prices, the yuan and local stocks. The $1.4 trillion plan to refinance local government debt left investors unconvinced of its potential to spur a faltering economy.

Even so, Wall Street major gauges are still on track for strong weekly wins after racking up more records on Thursday as the Federal Reserve delivered the expected interest-rate cut. The S&P 500 is closing in on crossing the 6,000 level for the first time.

On the corporate front, Sony (SONY) shares popped in premarket trading after the PlayStation maker posted a 73% jump in quarterly profit. Meanwhile, Nissan (NSANY) stock sank as investors absorbed the automaker’s plans to slash 9,000 jobs.

Meanwhile Paramount Global (PARA) reported third quarter earnings on Friday that showed further improvement in its streaming business it gets ready to combine with Skydance Media.

LIVE 2 updatesTop Wall Street Forecasters Revamp NRG Energy Price Expectations Ahead Of Q3 Earnings

NRG Energy, Inc. NRG will release earnings results for its third quarter, before the opening bell on Friday, Nov. 8.

Analysts expect the Houston, Texas-based bank to report quarterly earnings at $2 per share, up from $1.41 per share in the year-ago period. NRG Energy projects to report revenue of $9.38 billion for the recent quarter, compared to $7.95 billion a year earlier, according to data from Benzinga Pro.

NRG Energy announced it is partnering with Renew Home, a leading virtual power plant (VPP) company to boost its residential VPP capabilities.

NRG Energy shares gained 4.3% to close at $96.40 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Citigroup analyst Ryan Levine maintained a Buy rating and raised the price target from $84 to $100 on Oct. 31. This analyst has an accuracy rate of 67%.

- Wells Fargo analyst Neil Kalton maintained an Overweight rating and raised the price target from $120 to $130 on Oct. 30. This analyst has an accuracy rate of 66%.

- BMO Capital analyst James Thalacker maintained a Market Perform rating and increased the price target from $90 to $94 on Oct. 29. This analyst has an accuracy rate of 69%.

- Guggenheim analyst Shahriar Pourezza maintained a Buy rating and raised the price target from $77 to $118 on Oct. 8. This analyst has an accuracy rate of 66%.

- Jefferies analyst Julien Dumoulin-Smith initiated coverage on the stock with a Hold rating and a price target of $78 on Sept. 13. This analyst has an accuracy rate of 68%.

Considering buying NRG stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Polymarket CEO Hints At US Comeback After Betting Market's Accurate Trump Victory Prediction: 'It's Part Of The Plan'

In the wake of successful predictions for the presidential election, cryptocurrency-based betting platform Polymarket disclosed its intentions to reestablish its prediction markets for U.S. users.

What Happened: While talking about the company’s growth strategy in a CNBC interview on Thursday, CEO Shayne Coplan said that having a presence in the U.S. market was “part of the plan” and that they were in a position to be “aggressive around expansion.”

“I want to give a lot of credit to the people who fought the battle to go in and legalize political prediction markets in America,” Coplan stated.

Polymarket has remained offshore since the CFTC penalized it $1.4 million and issued a cease-and-desist order for regulatory violations in January 2022. As such, U.S. residents can’t use the platform.

Kalshi, a rival firm, resumed taking bets on the outcome of congressional elections after an appeals court lifted a ban on the platform’s operations by the CFTC last month.

Since then, other players have thrown their hats in the ring, with Robinhood launching its presidential election event contracts just ahead of the Nov. 5 elections.

See Also: Will MicroStrategy’s $42 Billion Bitcoin Bet Boost MSTR Stock Further?

Why It Matters: Polymarket’s re-entry into the US market comes on the heels of its successful prediction of election outcomes, which, according to Coplan, offered a more accurate view than traditional media.

About $3.6 billion was wagered on the outcome of the presidential race on Polymarket, making it the biggest election prediction market. A fraction of it—about $440 million—was invested in Kalshi for the presidential contract.

One notable bettor, a French ‘Trump Whale’ known as Theo, netted almost $50 million on Polymarket following Trump’s victory.

There were widespread concerns over his significantly larger bets in favor of Trump leading to the election, with many pointing to foreign influence and market manipulation.

However, Theo said that his bets were essentially a challenge to conventional polling methods, and he employed what is known as “the neighbor method” to get his predictions right.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Coway Announces Financial Results for Q3 FY2024

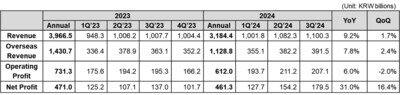

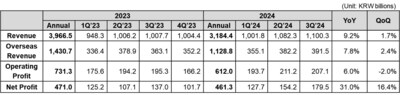

SEOUL, South Korea, Nov. 8, 2024 /PRNewswire/ — Coway Co., Ltd., the “Best Life Solution Company,” has announced its financial results for the third quarter of 2024.

“We continue to secure new customers, having seen our rental accounts exceed 10 million by merit of strong sales growth both domestically and internationally, and are also maintaining stable contract retention,” said Soon Tae Kim, Coway’s Chief Financial Officer. “For the remainder of this year and beyond, we will continue to prioritize research and development that drives product innovation and digitalization, and will also strive to maintain our robust performance growth.”

Coway’s reported earnings are as follows:

- Third quarter revenue: KRW 1,100.3 billion (+9.2% YoY)

- Third quarter operating profit: KRW 207.1 billion (+6.0% YoY)

* The reported figures are taken from the consolidated K-IFRS (International Financial Reporting Standards) statement.

Cumulative revenue for 2024 now stands at KRW 3,184.4 billion (+7.5% YoY) with an operating profit of KRW 612.0 billion (+8.3% YoY).

In South Korea, domestic business generated KRW 660.8 billion in revenue for the third quarter, up 9.9% from last year. This increase has been attributed to steady sales of the ‘Icon Ice Water Purifier’ during the summer months, as well as the ongoing popularity of the BEREX lineup of mattresses and massage chairs. The net increase in domestic rental accounts during the third quarter, totaling 102,000 accounts, more than doubled compared to the same period last year. Furthermore, the cumulative net increase for the first three quarters of this year amounts to 245,000 accounts, a figure that has already surpassed last year’s total net increase of 193,000 accounts.

Coway’s overseas subsidiaries also showcased strong growth in the third quarter, with a revenue report of KRW 391.5 billion, a 7.8% year-on-year increase. Of note among these were the Malaysia subsidiary, which achieved a revenue of KRW 293.4 billion with an 8.8% year-on-year increase, and the Thailand subsidiary, which continued to expand its growth trajectory with revenue of KRW 32.5 billion and an 8.9% year-on-year increase.

For additional details about Coway’s financial performance, please visit the company’s Investor Relations page.

About Coway Co., Ltd.

Established in Korea in 1989, Coway, the “Best Life Solution Company,” is a leading environmental home appliances company making people’s lives healthy and comfortable with innovative home appliances such as water purifiers, air purifiers, bidets, and mattresses. The company’s most recent venture, the BEREX brand, aims to improve sleep and wellness through cutting-edge mattresses and massage chairs. Since being founded, Coway has become a leader in the environmental home appliances industry, with intensive research, engineering, development, and customer service. The company has proven dedication to innovation with award-winning products, home health expertise, unrivaled market share, customer satisfaction, and brand recognition. Coway continues to innovate by diversifying product lines and accelerating overseas business in Malaysia, USA, Thailand, China, Indonesia, Vietnam, Japan, and Europe, based on the business success in Korea. For more information, please visit http://www.coway.com/ or http://newsroom.coway.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/coway-announces-financial-results-for-q3-fy2024-302299796.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/coway-announces-financial-results-for-q3-fy2024-302299796.html

SOURCE Coway Co., Ltd.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Surge Predicted To Reach 10% By Year-End As Trump Victory Fuels Stock Rally, Says Fundstrat's Tom Lee

Wall Street strategist Tom Lee forecasts a significant market rally through year-end, citing renewed investor confidence following President-elect Donald Trump‘s victory and strong market performance.

What Happened: Lee, head of research at Fundstrat, told CNBC’s Halftime Report that markets could surge between 5% and 10% by year-end, following what he called “the best move in the history of any post-election rally.”

“This historic rally needs to be respected,” Lee said, noting unprecedented pre-election derisking and potential “animal spirits” being unleashed by expectations of deregulation and a more business-friendly environment.

Despite positive indicators, Lee acknowledged potential headwinds in the coming months, suggesting market dynamics could shift as fiscal policies take effect or expectations adjust.

The prediction follows strong market performance, with the S&P 500, tracked by the SPDR S&P 500 ETF Trust SPY, rallied 2.85%. Meanwhile, the Nasdaq 100, tracked by the Invesco QQQ Trust QQQ, soared 4.12% on Thursday.

Why It Matters: Supporting the bullish outlook, Goldman Sachs recently lowered its U.S. recession probability to 15%, citing robust job growth.

However, economists warn that a Republican administration could present new challenges, including increased inflationary pressures from higher tariffs and growing budget deficits.

Market observers note that rising U.S. Treasury yields and a strengthening dollar could complicate the Federal Reserve’s interest rate strategy. The bond market appears more focused on the fiscal and inflationary implications of Trump’s victory than the Fed’s dovish stance.

Read Next:

Image Via Unsplash

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.