Top 3 Financials Stocks That May Fall Off A Cliff This Month

As of Nov. 8, 2024, three stocks in the financials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

Upstart Holdings Inc UPST

- On Nov. 7, Upstart reported quarterly losses of seven cents per share which beat the analyst consensus estimate for losses of 15 cents. Quarterly revenue came in at $162.14 million which beat the analyst consensus estimate of $150.22 million and is an increase over sales of $134.55 million from the same period last year. “With 43% sequential growth in lending volume and a return to positive adjusted EBITDA, we continue to strengthen Upstart’s position as the fintech leader in artificial intelligence,” said Dave Girouard, CEO of Upstart. “Even without a significant boost from the macroeconomy, we’re back in growth mode.” The company’s stock gained around 29% over the past month and has a 52-week high of $57.31.

- RSI Value: 79.08

- UPST Price Action: Shares of Upstart gained 2.8% to close at $55.47 on Thursday.

Toast Inc TOST

- On Nov. 7, Toast reported better-than-expected third-quarter financial results. “Toast delivered a strong third quarter, adding approximately 7,000 net new locations, growing our recurring gross profit streams1 35%, and achieving Adjusted EBITDA of $113 million. We are well positioned to finish out the year strong and carry this momentum into 2025,” said Toast CEO and Co-Founder Aman Narang. The company’s stock gained around 13% over the past month and has a 52-week high of $33.00.

- RSI Value: 85.15

- TOST Price Action: Shares of Toast gained 1.7% to close at $32.67 on Thursday.

Flywire Corp FLYW

- On Nov. 7, Flywire reported better-than-expected third-quarter financial results and issued FY24 revenue guidance above estimates. “Our third quarter results highlight our ability to capture higher payment volumes with new and existing clients, signaling the growth potential within our accounts and verticals.” said Mike Massaro, CEO of Flywire The company’s stock gained around 11% over the past month and has a 52-week high of $31.54.

- RSI Value: 77.08

- FLYW Price Action: Shares of Flywire gained 2% to close at $18.30 on Thursday.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LanzaTech Reports Third-Quarter 2024 Financial Results, Updates 2024 Outlook, and Expands Business Model to Accelerate Revenue Growth

CHICAGO, Nov. 08, 2024 (GLOBE NEWSWIRE) — LanzaTech Global, Inc. LNZA (“LanzaTech” or the “Company”), the carbon recycling company transforming waste carbon into sustainable fuels, chemicals, materials, and protein, today reported its financial and operating results for third-quarter 2024, updated its outlook for 2024, and discussed the expansion of its business model beyond licensing its biorefining technology to include more ethanol product sales and increased involvement in the ownership of the Company’s biorefining value chain.

Key Takeaways:

- Announced a two-stage ethanol off-take agreement with ArcelorMittal S.A. (“ArcelorMittal”), a biorefining licensee of the Company, including off-take contracts for one-year and five-year terms

- Announced Project Drake, a 30 million gallon per year, EU-based, ethanol-to-sustainable aviation fuel project in tandem with the payment of a non-refundable fee in consideration for the Company’s grant of exclusivity to a new aviation infrastructure-focused financial partner with the intent of finalizing a financing commitment by the end of 2024

- Reported revenue of $9.9 million for third-quarter 2024 as compared to revenue of $17.4 million and $19.6 million for second-quarter 2024 and third-quarter 2023, respectively. Sequential decrease driven by timing delay in anticipated LanzaJet, Inc. (“LanzaJet”) sublicensing event that was expected to result in approximately $8.0 million of licensing revenue. Year-over-year decrease driven primarily by higher engineering services revenue related to a specific project being completed in third-quarter 2023

- Provided details on wide-range of potential financial outcomes for fourth-quarter 2024 based on several sizeable initiatives underway with varying degrees of timing uncertainty

- Expanding business model to complement licensing business by developing and financing more of LanzaTech’s own projects with infrastructure capital partners, which enables LanzaTech to potentially own more of the biorefining value chain, including greater involvement with produced ethanol

- Actively evaluating material cost reduction opportunities as well as opportunities to reallocate resources to focus on and accelerate commercial activities

“From a financial point of view, third-quarter 2024 ended on a disappointing note, with LanzaTech missing our financial targets due primarily to a timing delay related to a LanzaJet sublicensing event we were expecting, and to a lesser degree, softer ethanol pricing in a key fuel trading market of ours,” said Dr. Jennifer Holmgren, Board Chair and Chief Executive Officer of LanzaTech. “That aside, we have steadily made commercial progress during the second half of this year, and have much to accomplish during the remainder of the fourth quarter, and beyond. Today, we are announcing our first long-term committed off-take agreement with a licensee, ArcelorMittal, and the advancement of Project Drake, a sizeable sustainable aviation fuel opportunity that we believe positions us for greater upside as compared to a pure licensing arrangement. As we work to increase our ethanol sales business and widen our project ownership and operating scope, so too are we working to expand our business model’s revenue drivers. By controlling more feedstock, operations, and off-take in our business portfolio, we are building multiple pathways to cash flow generation and are working to accelerate our timeline to profitability.”

Third-Quarter 2024 Financial Results

The table below outlines key reported third-quarter 2024 results:

| $ millions, unless noted | 3Q24 | 3Q23 | |||||

| Revenue | 9.9 | 19.6 | |||||

| Cost of revenue | 8.1 | 14.4 | |||||

| Gross Profit | 1.8 | 5.2 | |||||

| Operating expenses | 34.8 | 29.8 | |||||

| Net loss | (57.4 | ) | (25.3 | ) | |||

| Adjusted EBITDA loss (1) | (27.1 | ) | (19.1 | ) | |||

(1) See “Non-GAAP Financial Measures” and “Reconciliations of GAAP Net Income (Loss) to Adjusted EBITDA” sections herein for an explanation and reconciliations of non-GAAP measures used throughout this release.

Revenue

- Third-quarter 2024 revenue was $9.9 million as compared to $17.4 million and $19.6 million for second-quarter 2024 and third-quarter 2023, respectively. The sequential decrease was driven by a timing delay in LanzaJet signing its next sublicensing agreement, which we had forecasted would have resulted in approximately $8.0 million of licensing revenue during third-quarter 2024. The year-over-year decrease was predominantly related to particularly high third-quarter 2023 engineering services revenue reported for a specific project, Project Dragon, that was completed during third-quarter 2023. Going forward, LanzaTech expects to monetize previous work completed for Project Drake as well as execute further engineering work needed for Project Drake, Project SECURE, and other projects in the biorefining pipeline.

- Joint Development Agreement (“JDA”) & Contract Research revenue for third-quarter 2024 was $1.8 million as compared to $2.8 million and $4.9 million for second-quarter 2024 and third-quarter 2023, respectively. The sequential and year-over-year decline was attributable to a few government projects being completed and a period of downtime being experienced prior to new projects commencing. LanzaTech announced Project ADAPT government funding in October 2024, and the Company expects to receive at least one other contract prior to the end of fourth-quarter 2024.

- CarbonSmart™ revenue for third-quarter 2024 was $2.2 million as compared to $0.9 million and $2.3 million for second-quarter 2024 and third-quarter 2023, respectively. Third-quarter 2024 was flat year-over-year, and the quarter-over-quarter increase as compared to second-quarter 2024 was driven by incremental direct fuel sales as a result of establishing licensing arrangements, partners, and supply chain infrastructure during second-quarter 2024.

Cost of Revenue

- Third-quarter 2024 cost of revenue was $8.1 million as compared to $5.5 million and $14.4 million for second-quarter 2024 and third-quarter 2023, respectively. Cost of revenue for third-quarter 2024 was largely comprised of cost of CarbonSmart product sold and headcount allocations related to the delivery of our biorefining services and JDA work. Gross margin for third-quarter 2024 was 18% largely as a function of revenue mix, including additional lower margin CarbonSmart sales and excluded the improvement related to the LanzaJet sublicense transaction that benefited our results in second-quarter 2024.

Operating Expenses

- Third-quarter 2024 operating expenses were $34.8 million as compared to $34.7 million and $29.8 million for second-quarter 2024 and third-quarter 2023. Sequentially, operating costs were flat, but the increase year-over-year was driven primarily by project-related expenses, like those incurred for LanzaTech’s project in Norway, that are expected to be recovered once the projects advance to Final Investment Decision (“FID”).

Net Loss

- Third-quarter 2024 net loss was $(57.4) million as compared to second-quarter 2024 and third-quarter 2023 net loss of $(27.8) million and $(25.3) million, respectively. The sequential and year-over-year increase was attributable to a non-cash expense on financial instruments, as well as the same factors that drove the reduction in revenue as compared to prior periods.

Adjusted EBITDA Loss

- Third-quarter 2024 adjusted EBITDA loss was $(27.1) million as compared to adjusted EBITDA loss of $(17.8) million and $(19.1) million for second-quarter 2024 and third-quarter 2023, respectively. The increase in loss both sequentially and year-over-year is mainly attributable to the same factors that drove the reduction in revenue for the comparative periods.

Recent Commercial Highlights

LanzaTech continues to steadily execute on its commercial strategy, with a number of noteworthy achievements announced recently:

- Entered into a two-stage ethanol off-take agreement with ArcelorMittal, a biorefining licensee of the Company, which includes a one-year contract with potential revenue contribution of $6.0 million, and a five-year contract with annual volume commitments of 5,000 to 10,000 tons, with the potential to generate $10.0 million to $20.0 million in annual revenue. This is LanzaTech’s first long-term ethanol purchase agreement, which the Company expects will enhance access to product and will permit our CarbonSmart customers to make longer, larger commitments.

- Advanced Project Drake, a 30 million gallon per year, EU-based, ethanol-to-sustainable aviation fuel project that LanzaTech has been developing over the last three years. The facility is designed to utilize ethanol from LanzaTech’s waste-to-ethanol technology platform and convert it to SAF via the LanzaJet platform. The front-end engineering and design work for inside the battery limits of this project has been completed and it is expected to reach FID during 2025. LanzaTech has entered into an exclusivity agreement with a new financial partner whereby the partner intends to acquire certain rights in the development of this project, fund the remaining capital needed to reach FID, and enter into a development services agreement with LanzaTech for the remaining work. LanzaTech expects to maintain significant upside participation in this project, and is receiving the first $5 million in fees associated with this agreement.

- Progressed a sizeable project in Norway, in collaboration with Eramet, which is expected to reach FID within the next six months, and which is expected to be the first project to be developed with infrastructure capital partner, Brookfield Asset Management (“Brookfield”). Brookfield, as part of a framework agreement signed in October of 2022, has committed to invest $500 million in such LanzaTech projects that meet its investment criteria.

- Announced the expansion of the Company’s biorefining capabilities to produce a single-cell protein called LanzaTech Nutritional Protein. The estimated $1 trillion alternative protein market is expected to grow significantly, and the Company’s nutrient-rich product is designed to be a suitable ingredient for animal feed, pet food, and human nutrition that can be produced from CO2, oxygen and hydrogen anywhere in the world. LanzaTech’s bioreactors have been producing protein as a co-product to ethanol for years, and now the Company has developed the capability to produce protein as the primary product.

- Added eight projects to the early-stage engineering phase of the Company’s project development pipeline. In September 2024, LanzaTech announced the signing of a master licensing agreement with SEKISUI which resulted in a related project being moved out of the advanced engineering stage and into the stage where an FID evaluation package is being prepared. Additionally, LanzaTech advanced its project with NTPC in India into the post-FID and construction phase, and continues to expect that several additional projects currently in advanced engineering will achieve FID and move into the construction phase over the next 12 months.

Balance Sheet and Liquidity

As of September 30, 2024, LanzaTech had $89.1 million in total cash, restricted cash, and investments, compared to total cash of $75.8 million at the end of second-quarter 2024. The sequential increase in cash is attributable to the $40 million capital raise LanzaTech closed in August 2024, net of cash used during the quarter.

Post September 30, 2024, LanzaTech made a $10.0 million settlement payment to one of the two parties involved in the Forward Purchase Agreement (“FPA”) that was put in place in 2023. It was the Company’s decision to fully satisfy our obligations to this party under the FPA in cash in order to: (1) reduce the number of outstanding common shares, and (2) limit future downward pressure on the stock price in the event that this party were to sell its equity position in LanzaTech on the open market. LanzaTech had the option to settle part of the payment in shares, but as of the date of the settlement, a settlement in common shares per the terms of the FPA would have valued the shares at a discount to the market price.

Fourth-quarter and Full-year 2024 Financial Outlook

Given several large initiatives in various stages of development and finalization, outcomes for fourth-quarter and full-year 2024 financial results create a wide range of potential outcomes. Potential revenue drivers for fourth-quarter 2024 are comprised of the following key components that have varying degrees of associated timing uncertainty:

- The current base business has generated approximately $10.0 million per quarter for the first three quarters of 2024, and the expectation is that fourth quarter results will be similar

- Project Drake is advancing, and assuming the agreements are finalized, the positive impact is forecasted to be material in terms of potential cash flow and income for the fourth quarter

- LanzaTech’s project package for the site under development in Norway is expected to be submitted to Brookfield for FID evaluation in the coming weeks, and it is estimated that the project transfer, in the event of a positive FID, could represent approximately $20.0 million of revenue or income for the Company

- Assuming progress advances as expected, LanzaTech is anticipating that the award contracting process for Project SECURE will be finalized by the end of 2024, which is forecasted to generate approximately $4.0 million of revenue during fourth-quarter 2024

- LanzaJet’s development pipeline related to the deployment of Alcohol-to-Jet sublicenses continues to mature, and the successful signing of another agreement could result in additional share consideration and incremental revenue estimated to be approximately $8.0 million during fourth-quarter 2024

Conference Call Information

LanzaTech will host a conference call today, November 8, 2024, at 8:30 A.M. EST to review the Company’s financial results, discuss recent events, and conduct a question-and-answer session.

The conference call may be accessed via a live webcast on a listen-only basis through the Events and Presentations section of LanzaTech’s Investor Relations website pages. An archive of the webcast will be available for twelve months.

To attend the live conference call via telephone, domestic callers can access by dialing 1-800-274-8461 and international callers can access by dialing 1-203-518-9814, and entering the conference identification code: LANZA

A replay of the conference call will be available shortly after the call ends and can be accessed by domestic callers by dialing 1-844-512-2921 and by international callers by dialing 1-412-317-6671, and entering the access identification code: 11157335. The replay will be available until 11:59 pm Eastern Time November 22, 2024.

About LanzaTech

LanzaTech Global, Inc. LNZA is the carbon recycling company transforming waste carbon into sustainable fuels, chemicals, materials, and protein. Using its biorecycling technology, LanzaTech captures carbon generated by energy-intensive industries at the source, preventing it from being emitted into the air. LanzaTech then gives that captured carbon a new life as a clean replacement for virgin fossil carbon in everything from household cleaners and clothing fibers to packaging and fuels. By partnering with companies across the global supply chain like ArcelorMittal, Zara, H&M Move, Coty, and On, LanzaTech is paving the way for a circular carbon economy. For more information about LanzaTech, visit https://lanzatech.com.

Forward Looking Statements

This press release includes forward-looking statements regarding, among other things, the plans, strategies and prospects, both business and financial, of LanzaTech. These statements are based on the beliefs and assumptions of LanzaTech’s management. Although LanzaTech believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, LanzaTech cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends” or similar expressions. The forward-looking statements are based on projections prepared by, and are the responsibility of, LanzaTech’s management. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside LanzaTech’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. LanzaTech may be adversely affected by other economic, business, or competitive factors, and other risks and uncertainties, including those described under the header “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2023 and its Quarterly Reports on Form 10-Q filed by LanzaTech with the SEC, and in future SEC filings. New risk factors that may affect actual results or outcomes emerge from time to time and it is not possible to predict all such risk factors, nor can LanzaTech assess the impact of all such risk factors on its business, or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements, which speak only as of the date hereof. All forward-looking statements attributable to LanzaTech or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. LanzaTech undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Financial Measures

To supplement our financial statements presented in accordance with US GAAP and to provide investors with additional information regarding our financial results, we have presented adjusted EBITDA, a non-GAAP financial measure. Adjusted EBITDA is not based on any standardized methodology prescribed by US GAAP and is not necessarily comparable to similarly titled measures presented by other companies.

We define adjusted EBITDA as our net loss, excluding the impact of depreciation, interest income, net, stock-based compensation, change in fair value of warrant liabilities, change in fair value of SAFE liabilities, change in fair value of the FPA Put Option liability and Fixed Maturity Consideration, change in fair value of our outstanding convertible note, transaction costs on issuance of Forward Purchase Agreement, (loss) gain from equity method investees and other one-time costs related to the Business Combination and securities registration on Form S-4 and our registration statement on Form S-1. We monitor adjusted EBITDA because it is a key measure used by our management and Board of Directors to understand and evaluate our operating performance, to establish budgets, and to develop operational goals for managing our business. We believe adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of certain expenses that we include in net loss. Accordingly, we believe adjusted EBITDA provides useful information to investors, analysts, and others in understanding and evaluating our operating results and enhancing the overall understanding of our past performance and future prospects.

Adjusted EBITDA is not prepared in accordance with US GAAP and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with US GAAP. There are a number of limitations related to the use of adjusted EBITDA rather than net loss, which is the most directly comparable financial measure calculated and presented in accordance with US GAAP. For example, adjusted EBITDA: (i) excludes stock-based compensation expense because it is a significant non-cash expense that is not directly related to our operating performance; (ii) excludes depreciation expense and, although this is a non-cash expense, the assets being depreciated and amortized may have to be replaced in the future; (iii) excludes gain or losses on equity method investee; and (iv) excludes certain income or expense items that do not provide a comparable measure of our business performance. In addition, the expenses and other items that we exclude in our calculations of adjusted EBITDA may differ from the expenses and other items, if any, that other companies may exclude from adjusted EBITDA when they report their operating results. In addition, other companies may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison.

| LANZATECH GLOBAL INC. CONSOLIDATED BALANCE SHEETS (In thousands of U.S. dollars, except share and per share data) |

|||||||

| As of | |||||||

| September 30, 2024 | December 31, 2023 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 58,741 | $ | 75,585 | |||

| Held-to-maturity investment securities | 28,121 | 45,159 | |||||

| Trade and other receivables, net of allowance | 14,628 | 11,157 | |||||

| Contract assets | 19,136 | 28,238 | |||||

| Other current assets | 15,981 | 12,561 | |||||

| Total current assets | 136,607 | 172,700 | |||||

| Property, plant and equipment, net | 21,849 | 22,823 | |||||

| Right-of-use assets | 25,912 | 18,309 | |||||

| Equity method investment | 10,859 | 7,066 | |||||

| Equity security investment | 14,990 | 14,990 | |||||

| Other non-current assets | 5,999 | 5,736 | |||||

| Total assets | 216,216 | 241,624 | |||||

| Liabilities and Shareholders’ Equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 3,121 | $ | 4,060 | |||

| Other accrued liabilities | 7,929 | 7,316 | |||||

| Warrants | 2,605 | 7,614 | |||||

| Fixed Maturity Consideration and current FPA Put Option liability | 20,080 | — | |||||

| Contract liabilities | 6,449 | 3,198 | |||||

| Accrued salaries and wages | 6,575 | 5,468 | |||||

| Current lease liabilities | 158 | 126 | |||||

| Total current liabilities | 46,917 | 27,782 | |||||

| Non-current lease liabilities | 28,811 | 19,816 | |||||

| Non-current contract liabilities | 6,966 | 8,233 | |||||

| Fixed Maturity Consideration | — | 7,228 | |||||

| FPA Put Option liability | 48,182 | 37,523 | |||||

| Brookfield SAFE liability | 9,550 | 25,150 | |||||

| Convertible Note | 61,577 | — | |||||

| Other long-term liabilities | 608 | 1,421 | |||||

| Total liabilities | 202,611 | 127,153 | |||||

| Shareholders’ Equity | |||||||

| Common stock, $0.0001 par value; 400,000,000 and 400,000,000 shares authorized, 197,782,055 and 196,642,451 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | 19 | 19 | |||||

| Additional paid-in capital | 954,035 | 943,960 | |||||

| Accumulated other comprehensive income | 2,161 | 2,364 | |||||

| Accumulated deficit | (942,610 | ) | (831,872 | ) | |||

| Total shareholders’ equity | $ | 13,605 | $ | 114,471 | |||

| Total liabilities and shareholders’ equity | $ | 216,216 | $ | 241,624 | |||

| LANZATECH GLOBAL INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands of U.S. dollars, except share and per share data) |

|||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue: | |||||||||||||||

| Revenue from contracts with customers and grants | $ | 5,199 | $ | 14,162 | $ | 17,684 | $ | 32,119 | |||||||

| Revenue from sales of CarbonSmart products | 2,209 | 2,258 | 4,010 | 3,265 | |||||||||||

| Revenue from collaborative arrangements | 917 | 1,566 | 4,469 | 3,116 | |||||||||||

| Revenue from related party transactions | 1,618 | 1,619 | 11,399 | 3,668 | |||||||||||

| Total revenue | 9,943 | 19,605 | 37,562 | 42,168 | |||||||||||

| Cost and operating expenses: | |||||||||||||||

| Cost of revenue from contracts with customers and grants (exclusive of depreciation shown below) | (5,339 | ) | (11,862 | ) | (14,356 | ) | (28,835 | ) | |||||||

| Cost of revenue from sales of CarbonSmart products (exclusive of depreciation shown below) | (2,116 | ) | (1,772 | ) | (3,649 | ) | (2,499 | ) | |||||||

| Cost of revenue from collaborative arrangements (exclusive of depreciation shown below) | (479 | ) | (678 | ) | (2,034 | ) | (1,504 | ) | |||||||

| Cost of revenue from related party transactions (exclusive of depreciation shown below) | (207 | ) | (59 | ) | (363 | ) | (150 | ) | |||||||

| Research and development expense | (22,006 | ) | (16,645 | ) | (60,548 | ) | (51,839 | ) | |||||||

| Depreciation expense | (1,301 | ) | (1,376 | ) | (4,289 | ) | (3,981 | ) | |||||||

| Selling, general and administrative expense | (11,452 | ) | (11,808 | ) | (34,236 | ) | (41,095 | ) | |||||||

| Total cost and operating expenses | (42,900 | ) | (44,200 | ) | (119,475 | ) | (129,903 | ) | |||||||

| Loss from operations | (32,957 | ) | (24,595 | ) | (81,913 | ) | (87,735 | ) | |||||||

| Other income (expense): | |||||||||||||||

| Interest income, net | 791 | 1,249 | 2,452 | 3,164 | |||||||||||

| Other expense, net | (19,730 | ) | (1,517 | ) | (23,342 | ) | (29,912 | ) | |||||||

| Total other expense, net | (18,939 | ) | (268 | ) | (20,890 | ) | (26,748 | ) | |||||||

| Loss before income taxes | (51,896 | ) | (24,863 | ) | (102,803 | ) | (114,483 | ) | |||||||

| Loss from equity method investees, net | (5,535 | ) | (463 | ) | (7,935 | ) | (941 | ) | |||||||

| Net loss | $ | (57,431 | ) | $ | (25,326 | ) | $ | (110,738 | ) | $ | (115,424 | ) | |||

| Other comprehensive loss: | |||||||||||||||

| Foreign currency translation adjustments | (48 | ) | (1,001 | ) | (198 | ) | (954 | ) | |||||||

| Comprehensive loss | $ | (57,479 | ) | $ | (26,327 | ) | $ | (110,936 | ) | $ | (116,378 | ) | |||

| Unpaid cumulative dividends on preferred stock | — | — | — | (4,117 | ) | ||||||||||

| Net loss allocated to common shareholders | $ | (57,431 | ) | $ | (25,326 | ) | $ | (110,738 | ) | $ | (119,541 | ) | |||

| Net loss per common share – basic and diluted | $ | (0.29 | ) | $ | (0.13 | ) | $ | (0.56 | ) | $ | (0.70 | ) | |||

| Weighted-average number of common shares outstanding – basic and diluted | 197,773,376 | 195,869,537 | 197,499,156 | 169,797,443 | |||||||||||

| LANZATECH GLOBAL INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands of U.S. dollars) |

|||||||

| Nine Months Ended September 30, | |||||||

| 2024 | 2023 | ||||||

| Cash Flows From Operating Activities: | |||||||

| Net loss | $ | (110,738 | ) | $ | (115,424 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

| Share-based compensation expense | 9,739 | 11,933 | |||||

| Gain on change in fair value of SAFE and warrant liabilities | (20,609 | ) | (14,249 | ) | |||

| Loss on change in fair value of the FPA Put Option and the Fixed Maturity | 23,511 | 44,661 | |||||

| Loss on change in fair value of Convertible Notes | 21,572 | — | |||||

| Recoveries and provisions for losses on trade and other receivables | (700 | ) | 700 | ||||

| Depreciation of property, plant and equipment | 4,289 | 3,981 | |||||

| Amortization of discount on debt security investment | (649 | ) | (933 | ) | |||

| Non-cash lease expense | 1,411 | 946 | |||||

| Non-cash recognition of licensing revenue | (10,385 | ) | (1,700 | ) | |||

| Loss from equity method investees, net | 7,935 | 941 | |||||

| Net foreign exchange gain | 1,060 | 423 | |||||

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable, net | (2,902 | ) | 1,088 | ||||

| Contract assets | 9,269 | (6,488 | ) | ||||

| Accrued interest on debt investment | 131 | (178 | ) | ||||

| Other assets | (2,156 | ) | (6,723 | ) | |||

| Accounts payable and accrued salaries and wages | 409 | (1,484 | ) | ||||

| Contract liabilities | 564 | 29 | |||||

| Operating lease liabilities | 13 | (212 | ) | ||||

| Other liabilities | (1,148 | ) | 1,124 | ||||

| Net cash used in operating activities | $ | (69,384 | ) | $ | (81,565 | ) | |

| Cash Flows From Investing Activities: | |||||||

| Purchase of property, plant and equipment | (3,557 | ) | (7,137 | ) | |||

| Purchase of debt securities | (27,083 | ) | (93,858 | ) | |||

| Proceeds from maturity of debt securities | 44,770 | 50,000 | |||||

| Purchase of additional interest in equity method investment | — | (288 | ) | ||||

| Origination of related party loan | — | (5,212 | ) | ||||

| Net cash provided by/(used in) investing activities | $ | 14,130 | $ | (56,495 | ) | ||

| Cash Flows From Financing Activities: | |||||||

| Proceeds from issue of equity instruments of the Company | 272 | — | |||||

| Proceeds from the Business Combination and PIPE, net of transaction expenses (Note 3) | — | 213,381 | |||||

| FPA prepayment | — | (60,096 | ) | ||||

| Proceeds from exercise of options | — | 1,637 | |||||

| Repurchase of equity instruments of the Company | (48 | ) | (7,650 | ) | |||

| Proceeds from issuance of Convertible Note, net | 40,000 | — | |||||

| Net cash provided by financing activities | $ | 40,224 | $ | 147,272 | |||

| Net (decrease)/increase in cash, cash equivalents and restricted cash | (15,030 | ) | 9,212 | ||||

| Cash, cash equivalents and restricted cash at beginning of period | 76,284 | 83,710 | |||||

| Effects of currency translation on cash, cash equivalents and restricted cash | (287 | ) | (852 | ) | |||

| Cash, cash equivalents and restricted cash at end of period | $ | 60,967 | $ | 92,070 | |||

| Supplemental disclosure of non-cash investing and financing activities: | |||||||

| Acquisition of property, plant and equipment under accounts payable | 40 | 219 | |||||

| Right-of-use asset additions | 9,014 | — | |||||

| Reclassification of capitalized costs related to the business combination to equity | — | 1,514 | |||||

| Cashless conversion of warrants on preferred shares | — | 5,890 | |||||

| Recognition of public and private warrant liabilities in the Business Combination | — | 4,624 | |||||

| Reclassification of AM SAFE warrant to equity | — | 1,800 | |||||

| Conversion of AM SAFE liability into common stock | — | 29,730 | |||||

| Conversion of Legacy LanzaTech NZ, Inc. preferred stock and in-kind dividend into | — | 722,160 | |||||

| Reclassification of Shortfall warrant to equity | — | 3,063 | |||||

| Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (In thousands of U.S. dollars) |

||||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||

| (In thousands) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Net Loss | $ | (57,431 | ) | $ | (25,326 | ) | $ | (110,738 | ) | $ | (115,424 | ) | ||||||

| Depreciation | 1,301 | 1,376 | 4,289 | 3,981 | ||||||||||||||

| Interest income, net | (791 | ) | (1,249 | ) | (2,452 | ) | (3,164 | ) | ||||||||||

| Stock-based compensation expense and change in fair value of SAFE and warrant liabilities(1) | 3,221 | (6,368 | ) | (10,870 | ) | (2,316 | ) | |||||||||||

| Change in fair value of the FPA Put Option and Fixed Maturity Consideration liabilities (net of interest accretion reversal) | (488 | ) | 11,632 | 23,283 | 44,661 | |||||||||||||

| Change in fair value of convertible note and related transaction costs | 21,572 | — | 21,572 | — | ||||||||||||||

| Transaction costs on issuance of FPA | — | — | — | 451 | ||||||||||||||

| Loss from equity method investees, net | 5,535 | 463 | 7,935 | 941 | ||||||||||||||

| One-time costs related to the Business Combination, initial securities registration and non-recurring regulatory matters(2) | — | 410 | — | 4,472 | ||||||||||||||

| Adjusted EBITDA | $ | (27,081 | ) | $ | (19,062 | ) | $ | (66,981 | ) | $ | (66,398 | ) | ||||||

| (1) Stock-based compensation expense represents expense related to equity compensation plans. | ||||||||||||||||||

| (2) Represents costs incurred related to the Business Combination that do not meet the direct and incremental criteria per SEC Staff Accounting Bulletin Topic 5.A to be charged against the gross proceeds of the transaction, but are not expected to recur in the future, as well as costs incurred subsequent to deal close related to our securities registration on Form S-4 and our registration statement on Form S-1. Regulatory matters includes fees related to non-recurring items during the year ended December 31, 2023. | ||||||||||||||||||

Investor Relations Contact – LanzaTech

Kate Walsh

VP, Investor Relations & Tax

Investor.Relations@lanzatech.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walmart Offers New Holiday Bonuses To Independent Drivers As Competition With Jeff Bezos' Amazon Heats Up

In a move to enhance its delivery capabilities during the holiday season, Walmart WMT is rolling out new financial incentives for its independent delivery drivers. This initiative is part of Walmart’s broader strategy to improve the efficiency of online order deliveries from its U.S. stores to customers’ homes.

What Happened: Josh Havens, a spokesperson for Walmart, confirmed that the company is offering incentives and increased earning opportunities for its current drivers. However, specific details regarding these incentives were not disclosed, Reuters reported on Friday.

Walmart’s strategy aims to attract upper-income households and compete with Jeff Bezos‘ Amazon.com AMZN. The retailer leverages the Spark Driver app, enabling freelance drivers to deliver goods directly from stores, thereby boosting e-commerce sales and Walmart Plus subscriptions.

In addition, Walmart has slashed the Walmart Plus membership fee by 50% for the holiday season, offering it for $49 until Dec. 2. This move is anticipated to increase membership to 32 million by year-end, according to Emarketer. Meanwhile, Amazon offers a $99.99 fast grocery delivery service for its Prime members, who pay $139 annually.

Why It Matters: The competition between Walmart and Amazon has intensified, with both companies vying for a larger share of the grocery market. In September, Amazon expanded its Prime member benefits, offering significant discounts at Amazon Fresh stores. This move made grocery shopping more affordable and convenient for Prime members.

In October, Amazon further enhanced its Prime membership by offering gas savings and EV charging discounts, intensifying the battle for subscribers against Walmart.

Earlier in June, Walmart announced enhancements to its Walmart+ membership program, offering perks like free shipping, store delivery, and fuel savings, positioning it as a competitive alternative to Amazon Prime.

Read Next:

Image courtesy of Walmart, Inc.

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AirSculpt Technologies Reports Third Quarter Fiscal 2024 Results

MIAMI BEACH, Fla., Nov. 08, 2024 (GLOBE NEWSWIRE) — AirSculpt Technologies, Inc. AIRS(“AirSculpt” or the “Company”), a national provider of premium body contouring procedures, today announced results for the third quarter and nine months ended September 30, 2024.

“Our revenue and Adjusted EBITDA for the quarter were in line with our expectations with the period including progress on our strategy despite continued challenges in the consumer environment,” said Dennis Dean, Interim Chief Executive Officer and Chief Financial Officer of AirSculpt Technologies, Inc. “We are pleased with our four new center openings during the quarter and our 2023 de novo class continues to surpass our expectations. While our same center sales remain down, we are focused on improving the conversion of leads to consults and cases and believe this, combined with our new center openings and our cost reduction efforts, has us on the right track to return to positive revenue growth while also improving our margins over time.”

Third Quarter 2024 Results

- Case volume was 3,277 for the third quarter of 2024, representing a 4.3% decline from the fiscal year 2023 third quarter case volume of 3,426;

- Revenue declined 9.1% to $42.5 million from $46.8 million in the fiscal 2023 third quarter;

- Net loss for the quarter was $6.0 million compared to net loss of $1.7 million in the fiscal 2023 third quarter; and

- Adjusted EBITDA was $4.7 million compared to $9.1 million for the fiscal 2023 third quarter.

First Nine Months 2024 Results

- Case volume was 10,972, a decline of 2.5% from the first nine months of fiscal 2023 case volume of 11,252;

- Revenue declined 4.8% to $141.2 million from $148.3 million in the first nine months of fiscal 2023;

- Net loss was $3.2 million compared to net income of $0.1 million in the prior year period; and

- Adjusted EBITDA was $18.9 million compared to $33.1 million for the prior year period.

2024 Outlook

The Company affirms the guidance provided on October 24, 2024 for revenue in the range of $183 million to $189 million as compared to its previous guidance provided with second quarter fiscal 2024 earnings of revenue in the range of $180 million to $190 million. The Company is also maintaining its full year 2024 adjusted EBITDA guidance as follows:

- Adjusted EBITDA of approximately $23 to $28 million

- Adjusted EBITDA to cash flow from operations conversion ratio of approximately 50% (1)

- Five new centers to open in 2024

For additional information on forward-looking statements, see the section titled “Forward-Looking Statements” below.

(1) Calculated as cash flow from operating activities divided by Adjusted EBITDA.

Liquidity

As of September 30, 2024, the Company had $6.0 million in cash and cash equivalents and $5.0 million of borrowing capacity under its revolving credit facility. The Company generated $8.6 million in operating cash flow for the nine months ended September 30, 2024, compared to $19.1 million for the same period of 2023.

Conference Call Information

AirSculpt will hold a conference call today, November 8, 2024 at 8:00 am (Eastern Time). The conference call can be accessed by dialing 1-877-407-9716 (toll-free domestic) or 1-201-493-6779 (international) using the conference ID 13749064 or by visiting the link below to request a return call for instant telephone access to the event.

https://callme.viavid.com/viavid/?callme=true&passcode=13725116&h=true&info=company&r=true&B=6

The live webcast may be accessed via the investor relations section of the AirSculpt Technologies website at https://investors.airsculpt.com. A replay of the webcast will be available for approximately 90 days following the call.

To learn more about AirSculpt Technologies, please visit the Company’s website at https://investors.airsculpt.com. AirSculpt Technologies uses its website as a channel of distribution for material Company information. Financial and other material information regarding AirSculpt Technologies is routinely posted on the Company’s website and is readily accessible.

About AirSculpt

AirSculpt is a next-generation body contouring treatment designed to optimize both comfort and precision, available exclusively at AirSculpt offices. The minimally invasive procedure removes fat and tightens skin, while sculpting targeted areas of the body, allowing for quick healing with minimal bruising, tighter skin, and precise results.

Forward-Looking Statements

This press release contains forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements, which are subject to risks, uncertainties, and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies, and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. You are cautioned that there are important risks and uncertainties, many of which are beyond our control, that could cause our actual results, level of activity, performance, or achievements to differ materially from the projected results, level of activity, performance or achievements that are expressed or implied by such forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements, including those factors discussed in the section titled “Risk Factors” in our Annual Report on Form 10-K.

Our future results could be affected by a variety of other factors, including, but not limited to, failure to open and operate new centers in a timely and cost-effective manner; inability to open new centers due to rising interest rates and increased operating expenses due to rising inflation; increased competition in the weight loss and obesity solutions market, including as a result of the recent regulatory approval, increased market acceptance, availability and customer awareness of weight-loss drugs; shortages or quality control issues with third-party manufacturers or suppliers; competition for surgeons; litigation or medical malpractice claims; inability to protect the confidentiality of our proprietary information; changes in the laws governing the corporate practice of medicine or fee-splitting; changes in the regulatory, macroeconomic conditions, including inflation and the threat of recession, economic and other conditions of the states and jurisdictions where our facilities are located; and business disruption or other losses from war, pandemic, terrorist acts or political unrest.

The risk factors discussed in “Item 1A. Risk Factors” in our Annual Report on Form 10-K and in other filings we make from time to time with the U.S. Securities and Exchange Commission could cause our results to differ materially from those expressed in the forward-looking statements made in this press release.

There also may be other risks and uncertainties that are currently unknown to us or that we are unable to predict at this time.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Forward-looking statements represent our estimates and assumptions only as of the date they were made, which are inherently subject to change, and we are under no duty and we assume no obligation to update any of these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated after the date of this press release to conform our prior statements to actual results or revised expectations, except as required by law. Given these uncertainties, investors should not place undue reliance on these forward-looking statements.

Use of Non-GAAP Financial Measures

The Company reports financial results in accordance with generally accepted accounting principles in the United States (“GAAP”), however, the Company believes the evaluation of ongoing operating results may be enhanced by a presentation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Net Income per Share, which are non-GAAP financial measures. Although the Company provides guidance for Adjusted EBITDA, it is not able to provide guidance for net income, the most directly comparable GAAP measure. Certain elements of the composition of net income, including equity-based compensation, are not predictable, making it impractical for us to provide guidance on net income or to reconcile our Adjusted EBITDA guidance to net income without unreasonable efforts. For the same reasons, the Company is unable to address the probable significance of the unavailable information regarding net income, which could be material to future results.

These non-GAAP financial measures are not intended to replace financial performance measures determined in accordance with GAAP. Rather, they are presented as supplemental measures of the Company’s performance that management believes may enhance the evaluation of the Company’s ongoing operating results. These non-GAAP financial measures are not presented in accordance with GAAP, and the Company’s computation of these non-GAAP financial measures may vary from similar measures used by other companies. These measures have limitations as an analytical tool and should not be considered in isolation or as a substitute or alternative to revenue, net income, operating income, cash flows from operating activities, total indebtedness or any other measures of operating performance, liquidity or indebtedness derived in accordance with GAAP.

| AirSculpt Technologies, Inc. and Subsidiaries Selected Consolidated Financial Data (Dollars in thousands, except shares and per share amounts) |

|||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Revenue | $ | 42,548 | $ | 46,793 | $ | 141,172 | $ | 148,309 | |||||||

| Operating expenses: | |||||||||||||||

| Cost of service | 17,766 | 18,175 | 54,635 | 56,144 | |||||||||||

| Selling, general and administrative(1) | 25,495 | 25,030 | 75,525 | 76,805 | |||||||||||

| Depreciation and amortization | 3,003 | 2,629 | 8,693 | 7,479 | |||||||||||

| Loss/(gain) on disposal of long-lived assets | — | 4 | 4 | (198 | ) | ||||||||||

| Total operating expenses | 46,264 | 45,838 | 138,857 | 140,230 | |||||||||||

| (Loss)/income from operations | (3,716 | ) | 955 | 2,315 | 8,079 | ||||||||||

| Interest expense, net | 1,591 | 1,836 | 4,638 | 5,462 | |||||||||||

| Pre-tax net (loss)/income | (5,307 | ) | (881 | ) | (2,323 | ) | 2,617 | ||||||||

| Income tax expense | 733 | 786 | 894 | 2,522 | |||||||||||

| Net (loss)/income | $ | (6,040 | ) | $ | (1,667 | ) | $ | (3,217 | ) | $ | 95 | ||||

| (Loss)/income per share of common stock | |||||||||||||||

| Basic | $ | (0.10 | ) | $ | (0.03 | ) | $ | (0.06 | ) | $ | 0.00 | ||||

| Diluted | $ | (0.10 | ) | $ | (0.03 | ) | $ | (0.06 | ) | $ | 0.00 | ||||

| Weighted average shares outstanding | |||||||||||||||

| Basic | 57,650,923 | 56,785,087 | 57,543,678 | 56,661,903 | |||||||||||

| Diluted | 57,650,923 | 56,785,087 | 57,543,678 | 58,329,685 | |||||||||||

| (1) | During the first quarter of fiscal year 2024, the Company recorded a cumulative reversal of stock compensation expense of $10.4 million related to reassessing the probability of achieving the performance target on certain of the Company’s performance-based stock units. For further discussion, see Note 6 to the condensed consolidated financial statements of the Company’s Quarterly Report on Form 10-Q for the Quarterly Period ended September 30, 2024. |

| AirSculpt Technologies, Inc. and Subsidiaries Selected Financial and Operating Data (Dollars in thousands, except per case amounts) |

|||||||

| September 30, 2024 |

December 31, 2023 |

||||||

| Balance Sheet Data (at period end): | |||||||

| Cash and cash equivalents | $ | 5,972 | $ | 10,262 | |||

| Total current assets | 12,892 | 15,961 | |||||

| Total assets | $ | 208,245 | $ | 204,019 | |||

| Current portion of long-term debt | $ | 3,719 | $ | 2,125 | |||

| Deferred revenue and patient deposits | 2,343 | 1,463 | |||||

| Total current liabilities | 25,347 | 20,315 | |||||

| Long-term debt, net | 66,423 | 69,503 | |||||

| Total liabilities | $ | 125,708 | $ | 120,027 | |||

| Total stockholders’ equity | $ | 82,537 | $ | 83,992 | |||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Cash Flow Data: | |||||||||||||||

| Net cash provided by (used in): | |||||||||||||||

| Operating activities | $ | 1,830 | $ | 635 | $ | 8,637 | $ | 19,090 | |||||||

| Investing activities | (4,899 | ) | (2,116 | ) | (10,479 | ) | (8,092 | ) | |||||||

| Financing activities | (825 | ) | (10,638 | ) | (2,448 | ) | (11,954 | ) | |||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Other Data: | |||||||||||||||

| Number of facilities | 31 | 27 | 31 | 27 | |||||||||||

| Number of total procedure rooms | 65 | 57 | 65 | 57 | |||||||||||

| Cases | 3,277 | 3,426 | 10,972 | 11,252 | |||||||||||

| Revenue per case | $ | 12,984 | $ | 13,658 | $ | 12,867 | $ | 13,181 | |||||||

| Adjusted EBITDA (1) (3) | $ | 4,666 | $ | 9,075 | $ | 18,871 | $ | 33,143 | |||||||

| Adjusted EBITDA margin (2) | 11.0 | % | 19.4 | % | 13.4 | % | 22.3 | % | |||||||

| (1) A reconciliation of this non-GAAP financial measure appears below. |

| (2) Defined as Adjusted EBITDA as a percentage of revenue. |

| (3) For the three months ended September 30, 2024 and 2023, pre-opening de novo and relocation costs were $0.7 million and $0.5 million, respectively. For the nine months ended September 30, 2024 and 2023, pre-opening de novo and relocation costs were $0.8 million and $3.3 million, respectively. |

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Same-center Information(1): | |||||||||||||||

| Cases | 3,147 | 3,426 | 10,013 | 11,252 | |||||||||||

| Case growth | (8.1) % | N/A | (11.0) % | N/A | |||||||||||

| Revenue per case | $ | 12,949 | $ | 13,658 | $ | 12,805 | $ | 13,181 | |||||||

| Revenue per case growth | (5.2) % | N/A | (2.9) % | N/A | |||||||||||

| Number of facilities | 27 | 27 | 27 | 27 | |||||||||||

| Number of total procedure rooms | 57 | 57 | 57 | 57 | |||||||||||

| (1) | For the three months ended September 30, 2024 and 2023, we define same-center case and revenue growth as the growth in each of our cases and revenue at facilities that were owned and operated during the three month period ended September 30, 2024 and 2023, respectively. At facilities that were not owned or operated for the entirety of the prior year period, the current year period has been pro-rated to reflect only growth experienced during the portion of the three months ended September 30, 2024 in which such facilities were owned and operated during the three months ended September 30, 2023. We define same-center facilities and procedure rooms based on if a facility was owned or operated as of September 30, 2023. |

| For the nine months ended September 30, 2024 and 2023, we define same-center case and revenue growth as the growth in each of our cases and revenue at facilities that were owned and operated during the nine month period ended September 30, 2024 and 2023, respectively. At facilities that were not owned or operated for the entirety of the prior year period, the current year period has been pro-rated to reflect only growth experienced during the portion of the nine months ended September 30, 2024 in which such facilities were owned and operated during the nine months ended September 30, 2023. We define same-center facilities and procedure rooms based on if a facility was owned or operated as of September 30, 2023. |

AirSculpt Technologies, Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures

(Dollars in thousands)

We report our financial results in accordance with GAAP, however, management believes the evaluation of our ongoing operating results may be enhanced by a presentation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted Net Income per Share, which are non-GAAP financial measures.

We define Adjusted EBITDA as net (loss)/income excluding depreciation and amortization, net interest expense, income tax expense, restructuring and related severance costs, loss/(gain) on disposal of long-lived assets, settlement costs for non-recurring litigation, and equity-based compensation.

We define Adjusted Net Income as net (loss)/income excluding restructuring and related severance costs, loss/(gain) on disposal of long-lived assets, settlement costs for non-recurring litigation, equity-based compensation and the tax effect of these adjustments.

We include Adjusted EBITDA and Adjusted Net Income because they are important measures on which our management assesses and believes investors should assess our operating performance. We consider Adjusted EBITDA and Adjusted Net Income each to be an important measure because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis. Adjusted EBITDA has limitations as an analytical tool including: (i) Adjusted EBITDA does not include results from equity-based compensation and (ii) Adjusted EBITDA does not reflect interest expense on our debt or the cash requirements necessary to service interest or principal payments. Adjusted Net Income has limitations as an analytical tool because it does not include results from equity-based compensation.

We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue. We define Adjusted Net Income per Share as Adjusted Net Income divided by weighted average basic and diluted shares. We included Adjusted EBITDA Margin and Adjusted Net Income per Share because they are important measures on which our management assesses and believes investors should assess our operating performance. We consider Adjusted EBITDA Margin and Adjusted Net Income per Share to be important measures because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis.

The following table reconciles Adjusted EBITDA and Adjusted EBITDA Margin to net (loss)/income, the most directly comparable GAAP financial measure:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net (loss)/income | $ | (6,040 | ) | $ | (1,667 | ) | $ | (3,217 | ) | $ | 95 | ||||

| Plus | | ||||||||||||||

| Equity-based compensation(1) | 3,430 | 4,492 | 1,522 | 13,483 | |||||||||||

| Restructuring and related severance costs | 1,099 | 995 | 5,487 | 4,300 | |||||||||||

| Depreciation and amortization | 3,003 | 2,629 | 8,693 | 7,479 | |||||||||||

| Loss/(gain) on disposal of long-lived assets | — | 4 | 4 | (198 | ) | ||||||||||

| Litigation settlements(2) | 850 | — | 850 | — | |||||||||||

| Interest expense, net | 1,591 | 1,836 | 4,638 | 5,462 | |||||||||||

| Income tax expense | 733 | 786 | 894 | 2,522 | |||||||||||

| Adjusted EBITDA | $ | 4,666 | $ | 9,075 | $ | 18,871 | $ | 33,143 | |||||||

| Adjusted EBITDA Margin | 11.0 | % | 19.4 | % | 13.4 | % | 22.3 | % | |||||||

| (1) | As of the nine months ended September 30, 2024, this amount contains a cumulative reversal of stock compensation expense of $10.4 million related to reassessing the probability of achieving the performance target on certain of the Company’s performance-based stock units. For further discussion, see Note 6 to the condensed consolidated financial statements of the Company’s Quarterly Report on Form 10-Q for the Quarterly Period ended September 30, 2024. |

| (2) | This amount relates to settlement costs for non-recurring litigation of $0.9 million for the three and nine months ended September 30, 2024. This amount is accrued in “Accrued and other current liabilities” as of September 30, 2024. See Note 9 to the condensed consolidated financial statements included in this Quarterly Report on Form 10-Q for further discussion. |

For the three months ended September 30, 2024 and 2023, pre-opening de novo and relocation costs were $0.7 million and $0.5 million, respectively. For the six months ended September 30, 2024 and 2023, pre-opening de novo and relocation costs were $0.8 million and $3.3 million, respectively.

The following table reconciles Adjusted Net Income and Adjusted Net Income per Share to net income/(loss), the most directly comparable GAAP financial measure:

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net (loss)/income | $ | (6,040 | ) | $ | (1,667 | ) | $ | (3,217 | ) | $ | 95 | ||||

| Plus | |||||||||||||||

| Equity-based compensation(1) | 3,430 | 4,492 | 1,522 | 13,483 | |||||||||||

| Restructuring and related severance costs | 1,099 | 995 | 5,487 | 4,300 | |||||||||||

| Loss/(gain) on disposal of long-lived assets | — | 4 | 4 | (198 | ) | ||||||||||

| Litigation settlements(2) | 850 | — | 850 | — | |||||||||||

| Tax effect of adjustments | (717 | ) | (751 | ) | 996 | (2,079 | ) | ||||||||

| Adjusted net (loss)/income | $ | (1,378 | ) | $ | 3,073 | $ | 5,642 | $ | 15,601 | ||||||

| Adjusted net (loss)/income per share of common stock (3) | |||||||||||||||

| Basic | $ | (0.02 | ) | $ | 0.05 | $ | 0.10 | $ | 0.28 | ||||||

| Diluted | $ | (0.02 | ) | $ | 0.05 | $ | 0.10 | $ | 0.27 | ||||||

| Weighted average shares outstanding | |||||||||||||||

| Basic | 57,650,923 | 56,785,087 | 57,543,678 | 56,661,903 | |||||||||||

| Diluted | 57,650,923 | 58,954,829 | 58,289,022 | 58,329,685 | |||||||||||

| (1) | During the first quarter of fiscal year 2024, the Company recorded a cumulative reversal of stock compensation expense of $10.4 million related to reassessing the probability of achieving the performance target on certain of the Company’s performance-based stock units. For further discussion, see Note 6 to the condensed consolidated financial statements of the Company’s Quarterly Report on Form 10-Q for the Quarterly Period ended September 30, 2024. |

| (2) | This amount relates to settlement costs for non-recurring litigation of $0.9 million for the three and nine months ended September 30, 2024. This amount is accrued in “Accrued and other current liabilities” as of September 30, 2024. See Note 9 to the condensed consolidated financial statements included in this Quarterly Report on Form 10-Q for further discussion. |

| (3) | Diluted Adjusted Net Income Per Share is computed by dividing adjusted net income by the weighted-average number of shares of common stock outstanding adjusted for the dilutive effect of all potential shares of common stock. |

Investor Contact

Allison Malkin

ICR, Inc.

airsculpt@icrinc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Power Play: QuantumScape's Bold Battery Vision and the Roadblocks Ahead

- In September 2020, QuantumScape set high expectations with claims about its solid-state batteries, including rapid charging and extended lifespans.

- By December 2021, these promises had driven its stock to an all-time high, fueled by strong investor excitement over the potential of this breakthrough technology.

- On January 4, 2021, an article titled “QuantumScape’s Solid State Batteries Have Significant Technical Hurdles To Overcome” highlighted that the company’s technology was still in the early stages, far from mass production — causing a 40% drop in stock price.

- In response, QuantumScape’s Chief Technology Officer Tim Holme acknowledged the challenges, stating, “We still have much work ahead.”

- In January 2021, shareholders sued the company, claiming it hid important technical risks related to its technology.

- QuantumScape has agreed to a $47.5 million settlement with shareholders to resolve the lawsuit. Affected investors can now file a claim to receive their payment.

Overview

QuantumScape Corp. QS went public in November 2020 through a merger with Kensington Capital Acquisition, aiming to transform the EV industry with its innovative solid-state battery technology. However, an article published on January 4, 2021, raised serious doubts about the company’s claims regarding charging speed, performance in cold conditions, and cost-effectiveness, which resulted in a 40% drop in stock price and a lawsuit from investors. Recently, QuantumScape ultimately reached a $47.5 million settlement with the affected shareholders to resolve this scandal.

Bold Promises: QuantumScape’s Ambition To Change The EV Landscape

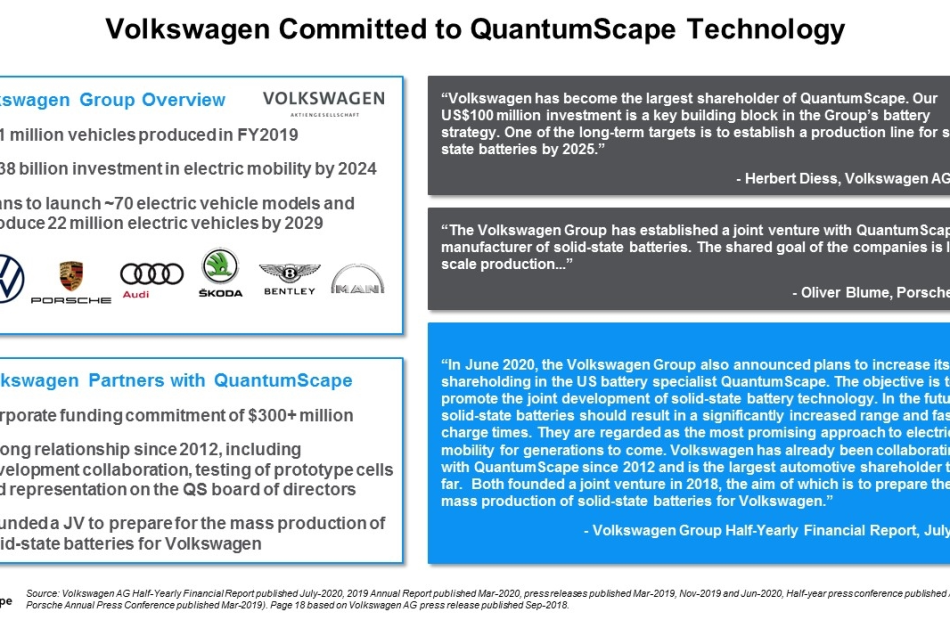

In 2020, QuantumScape caught the attention of prominent investors like Volkswagen, Bill Gates, and Fidelity.

Bill Gates highlighted the critical need for battery innovation, saying, “To replace all existing cars, we need batteries that charge quickly, take up less space, cost less, and match the range of gas-powered vehicles. QuantumScape has a promising battery that is part of the solution.”

That same year, Volkswagen reinforced its confidence in QuantumScape by investing an additional $200 million, further solidifying its support for the company’s technology.

In its September 2020 investor presentation, QuantumScape outlined a major global market opportunity, projecting $450 billion in battery sales fueled by the annual production of over 90 million vehicles.

Moreover, in January 2021 investor presentations, the company presented an ambitious vision for safer, faster-charging batteries that could redefine electric vehicle performance.

The presentation pointed out that previous attempts at EV commercialization had faltered due to technical challenges such as slow charging speeds, inadequate cathode loading, and unreliable separators, which limited battery life to under 800 cycles.

Additionally, these lithium batteries operated within a narrow temperature range, often requiring extra lithium, were costly, and had low energy density, all of which hindered their efficiency and prevented widespread adoption.

QuantumScape positioned itself as a compelling alternative by focusing on solid-state batteries instead of conventional lithium ones. Key benefits included faster charging — reaching 80% in just 15 minutes compared to lithium’s sub-50% in the same timeframe — longer lifespan, retaining 80% capacity after 1,000 charges, reliable performance in cold conditions (effective down to -30°C), and overall greater power output.

CEO Jagdeep Singh expressed optimism about the disruptive potential of this technology:

“We believe the performance data we’ve unveiled today shows that solid-state batteries have the potential to narrow the gap between electric vehicles and internal combustion vehicles, helping EVs become the world’s dominant form of transportation.”

Behind the Hype: Questions Arise Around QuantumScape’s Tech

On January 4, 2021, an article published on Seeking Alpha raised questions about QuantumScape’s battery technology, pointing out potential issues with capacity, range, and real-world performance.

The report suggested the battery might only last 260 charge cycles — far below the 800 cycles initially promised — and flagged high production costs due to complex materials.

Under low temperatures, specifically -10°C, the battery was said to reach just 5% charge in 15 minutes, falling short of the projected 80%.

The author highlighted these challenges, noting the hurdles QuantumScape faces in scaling its technology for the mass market.

In an interview, QuantumScape founder and CEO Jagdeep Singh defended the company, saying, “The Seeking Alpha story had no merit. It read like it was written by someone who didn’t know anything about batteries.”

After the article’s publication, QuantumScape clarified that its batteries were still in development, with test results based on small prototypes rather than full battery packs.

However, the article’s findings significantly affected investors, resulting in a 40% drop in share price and a lawsuit against QuantumScape and CEO Jagdeep Singh.

Resolving The Case

To resolve the lawsuit from investors, QuantumScape has agreed to a cash settlement of $47.5 million. If you invested in QuantumScape, you may be eligible to claim a portion of this settlement to recover your losses.

This year, QuantumScape made significant progress by delivering its new battery samples to automakers, achieving an important milestone for 2024 and moving closer to widespread use. The batteries promise faster charging and longer range, though mass production will take time. To accelerate this process, QuantumScape recently partnered with Volkswagen’s PowerCo, which plans to manufacture the batteries at facilities in Europe and Canada. With a focus on reducing costs and energy consumption, PowerCo aims to start production by 2026-2027, setting the stage for a new era in electric vehicle performance.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SANUWAVE Announces Record Quarterly Revenues: Q3 FY2024 Financial Results

Q3 2024 revenues were $9.4 million, up 89% from Q3 2023. This was an all-time quarterly record for the Company.

Q3 2024 gross margin was 75.5%, vs 71.5% in Q3 2023

GAAP Operating Income was $2.0 million

Company provides guidance for revenue growth of 40-50% for Q4 2024 versus Q4 2023

EDEN PRAIRIE, Minn., Nov. 08, 2024 (GLOBE NEWSWIRE) — SANUWAVE Health, Inc. (the “Company” or “SANUWAVE”) SNWV, a leading provider of next-generation FDA-approved wound care products, is pleased to provide its financial results for the three months ended September 30, 2024.

Q3 2024 ended September 30, 2024

- Revenue for the three months ended September 30, 2024, totaled $9.4 million, an increase of 89%, as compared to $5.0 million for the same period of 2023. This growth is greater than the previously provided guidance for a 65 – 75% increase.

- 124 UltraMist® systems were sold in Q3 2024 up from 55 in Q3 2023 and from 72 in Q2 2024.

- UltraMist® consumables revenue increased by 75% to $5.4 million (58% of revenues) in Q3 2024, versus $3.1 million for the same quarter last year. UltraMIST systems and consumables remained the primary revenue growth driver and continued to represent over 97% of SANUWAVE’s overall revenues in Q3 2024.

- Gross margin as a percentage of revenue amounted to 75.5% for the three months ended September 30, 2024, versus 71.5% for the same period last year.

- For the three months ended September 30, 2024, operating income totaled $2.0 million, an increase of $2.5 million compared to Q3 2023 as a result of the Company’s continued efforts to drive profitable growth and manage expenses.

- Net loss for the third quarter of 2024 was $20.7 million, driven predominantly by the change in the fair value of derivative liabilities. This compares to a net loss of $23.7 million in the third quarter of 2023. Net loss year to date was $18.6 million versus a net loss of $44.0 million in the nine months ended September 30, 2023.

- Adjusted EBITDA [1] for the three months ended September 30, 2024, was $2.1 million versus Adjusted EBITDA of $(0.3) million for the same period last year, an improvement of $2.4 million. Year to date Adjusted EBITDA was $3.5 million versus a loss of $1.8 million in the prior year period.

“The third quarter showed acceleration in revenue growth rate from the first half of the year with growth of 89% year on year (and 31% sequentially) leading the company to a growth rate of 68% for the first nine months of 2024 as compared to the same period in 2023,” said Morgan Frank, CEO. “Obviously, we’re very pleased with these results, especially to have achieved operating income and Adjusted EBITDA positivity again this quarter and, for the first time, became cash generative from operations even after cash interest expense. We have begun to gain traction with some larger customers and our sales funnel remains the most promising it has ever been. As we look to the fourth quarter, we will seek to build on this progress as we continue to hire additional sales and commercial staff. We expect to experience a bit of a ‘pigs through a python’ scenario for us over the coming months and quarters, as large orders move the needle on revenues in significant and variable fashion, but we anticipate finishing 2024 strongly as a breakout year for SANUWAVE.”

Financial Outlook

The Company forecasts Q4 2024 revenue of $9.7 to $10.5 million (40-50% increase from Q4 2023) and therefore for revenues for 2024 as a whole to be in excess of $32 million (an increase of 57% vs full year 2023). The Company forecasts Q4 gross margin as a percentage of revenue to remain in the mid-70s.

Subsequent to quarter end, the Company effected a 1-for-375 reverse stock split on October 18, 2024, completed its note and warrant exchange, and raised $10.3 million in a private placement, simplifying the Company’s capital structure and leaving it with approximately 8.5 million shares outstanding. Details of this transaction can be found on the SANUWAVE website https://sanuwave.com/investors/press-release-details?newsId=OxzYFl0t620enXp1VyUG or in its filings with the SEC.

As previously announced, a business update will occur via conference call on November 8, 2024 at 8:30 a.m. EST. Materials for the conference call are included on the Company’s website at http://www.sanuwave.com/investors

Telephone access to the call will be available by dialing the following numbers:

Toll Free: 1-800-267-6316

Toll/International: 1-203-518-9783

Conference ID: SANUWAVE

OR click the link for instant telephone access to the event.

https://viavid.webcasts.com/starthere.jsp?ei=1692398&tp_key=e3cff43c54

A replay will be made available through November 29, 2024:

Toll-Free: 1-844-512-2921

Toll/International: 1-412-317-6671

Replay Access ID: 11157276

[1] This is a non-GAAP financial measure. Refer to “Non-GAAP Financial Measures” and the reconciliations in this release for further information.

About SANUWAVE

SANUWAVE Health is focused on the research, development, and commercialization of its patented, non-invasive and biological response-activating medical systems for the repair and regeneration of skin, musculoskeletal tissue, and vascular structures.

SANUWAVE’s end-to-end wound care portfolio of regenerative medicine products and product candidates helps restore the body’s normal healing processes. SANUWAVE applies and researches its patented energy transfer technologies in wound healing, orthopedic/spine, aesthetic/cosmetic, and cardiac/endovascular conditions.

Non-GAAP Financial Measures

This press release includes certain financial measures that are not presented in our financial statements prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). These financial measures are considered “non-GAAP financial measures” and are intended to supplement, and should not be considered as superior to, or a replacement for, financial measures presented in accordance with U.S. GAAP.

The Company uses Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) and Adjusted EBITDA to assess its operating performance. Adjusted EBITDA is Earnings before Interest, Taxes, Depreciation and Amortization adjusted for the change in fair value of derivatives and any significant non-cash or infrequent charges. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) as a measure of financial performance or any other performance measure derived in accordance with U.S. GAAP, and they should not be construed as an inference that the Company’s future results will be unaffected by unusual or infrequent items. These non-GAAP financial measures are presented in a consistent manner for each period, unless otherwise disclosed. The Company uses these measures for the purpose of evaluating its historical and prospective financial performance, as well as its performance relative to competitors. These measures also help the Company to make operational and strategic decisions. The Company believes that providing this information to investors, in addition to U.S. GAAP measures, allows them to see the Company’s results through the eyes of management, and to better understand its historical and future financial performance. These non-GAAP financial measures are also frequently used by analysts, investors, and other interested parties to evaluate companies in our industry, when considered alongside other U.S. GAAP measures.

EBITDA and Adjusted EBITDA have their limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under U.S. GAAP. Some of these limitations are that EBITDA and Adjusted EBITDA:

• Do not reflect every expenditure, future requirements for capital expenditures or contractual commitments.

• Do not reflect all changes in our working capital needs.

• Do not reflect interest expense, or the amount necessary to service our outstanding debt.

As presented in the U.S. GAAP to Non-GAAP Reconciliations section below, the Company’s non-GAAP financial measures exclude the impact of certain charges that contribute to our net income (loss).

Forward-Looking Statements