GRILLiT to Rebrand as Primior Holdings Following $30M Merger

Irvine, CA, Nov. 07, 2024 (GLOBE NEWSWIRE) — Irvine, CA – Primior Holdings (GRLT) (formerly GRILLiT Inc.) is pleased to announce the successful completion of its $30 million merger with Primior Inc., a leading real estate development and advisory firm. As part of this strategic realignment, GRILLiT will rebrand as Primior Holdings Inc., signaling its shift toward a broader focus on real estate investment, emerging technologies, and diversified holdings.

GRILLiT to rebrand as Primior Holdings

The merger brings Primior Inc.’s extensive real estate expertise to Primior Holdings Inc. (formerly GRILLiT Inc.), positioning the company to accelerate growth in key sectors. With a proven track record in developing over $3 billion in properties, Primior’s integration will provide the foundation for enhanced value creation and long-term shareholder returns.

Johnney Zhang, CEO and Founder of Primior Inc. commented, “This merger marks a pivotal moment for Primior. By joining forces with GRILLiT, we are well-positioned to expand our real estate portfolio, introduce innovative investment strategies, and capitalize on the benefits of being a public company. With a focus on property development in opportunity zones, tokenization, and emerging technologies to drive superior performance, Primior Holdings is set to lead at the intersection of real estate and innovation.”

Primior Holdings Inc. will strategically evolve from a development company into a premier real estate holding company. The company’s focus will be on acquiring, developing, and adding value to high-potential real estate assets across the U.S., with the goal of holding these properties for long-term cash flow and value appreciation.

“This approach will create consistent income streams while providing a superior appreciation for our shareholders,” Zhang added. “We believe our strategy will attract institutional investors and drive sustainable growth.”

Greg Mitchell, CEO of GRILLiT Inc., noted, “When I took over in 2017, my goal was to create a financially stable company for the benefit of all shareholders. I’ve always had a deep passion for real estate, and Primior Holdings can now deliver on that vision. Together with Johnney and the Primior team, we aim to revolutionize the industry by leveraging emerging technologies and making smart, value-driven investments.”

The rebranding to Primior Holdings Inc. reflects the company’s broader vision and commitment to building a portfolio of quality real estate assets. This transition sets the stage for aggressive growth, driven by strategic acquisitions and cutting-edge real estate innovations.

The merger between GRILLiT Inc. and Primior Inc. pertains solely to Primior’s real estate development and advisory business. Primior’s asset management division, which oversees $2.1 billion in assets under management (AUM), is not included in this merger at this time.

About Primior Inc.

Primior Inc. is a leading real estate development, investment, and advisory firm known for its innovative approach and focus on value creation. With a forward-thinking strategy, Primior integrates technology into its investment and development practices, positioning itself at the forefront of real estate and financial innovation.

About GRILLiT Inc.

GRILLiT Inc. is an OTC-listed holding company that has transitioned toward diversified investments, including real estate and technology. Following the merger with Primior, the company is poised to capitalize on emerging markets and innovative strategies.

Media Contact: Andrew Palacios Primior Holdings andrew@primior.com 8007359973

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cohen & Company Continues Growth Plan, Expands to Denver

DENVER, Nov. 7, 2024 /PRNewswire/ — Cohen & Company, a nationally recognized assurance, tax and business advisory firm, is excited to announce the opening of its Denver, Colorado, location at 8101 East Prentice Avenue in Greenwood Village. The firm’s 13th office adds a physical presence in the western U.S. and offers the opportunity to build upon long-standing client and centers-of-influence relationships in the region.

“Opening an office here is a logical, and pivotal, step in our long-term strategic growth plan,” says Marcy Kempf, Cohen & Company partner in charge of Markets & Industries. “This is yet another way we can support client and other critical business relationships we’ve established in the area over a number of years. In addition to serving the registered and alternative funds markets, which run deep in the Metro Denver area, we are excited about the opportunity to expand our services to key areas such as real estate, private equity and private companies.”

Leasing space in the prime, north end of the Tech Center, the firm is actively building a local team to service the local market and support its client teams nationally. Building new and enhancing existing local business and community relationships is a top priority.

“We are fortunate to be in such a thriving area,” says Stacey Wilson, assurance partner and Denver office lead. “Our location is not only beautiful with its city and mountain backdrops, but is also easily accessible from downtown Denver, the airport and desirable areas like Cherry Creek. As we build our team, we are excited to engage with the local community, creating an office of camaraderie and service Cohen & Company is known for.”

About Cohen & Company

Named one of America’s Most Recommended Tax and Accounting Firms by USA TODAY and one of the Best of the Best Firms by INSIDE Public Accounting, Cohen & Company offers assurance, tax and advisory services to clients throughout the U.S. and worldwide. The firm serves a broad range of clients, from privately held companies and their owners; to public and private funds, advisers and fund service providers within the investment industry; to Fortune 1000 multinational enterprises. Founded in 1977, Cohen & Company has more than 800 dedicated professionals across the U.S. and 13 offices in Colorado, Illinois, Ohio, Maryland, Michigan, New York, Pennsylvania and Wisconsin. Through affiliated entities the firm also has an international presence in the Cayman Islands and Ireland. Learn more at cohencpa.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/cohen–company-continues-growth-plan-expands-to-denver-302298899.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cohen–company-continues-growth-plan-expands-to-denver-302298899.html

SOURCE Cohen & Company

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

T. ROWE PRICE OHA SELECT PRIVATE CREDIT FUND ANNOUNCES SEPTEMBER 30, 2024 FINANCIAL RESULTS AND DECLARED TOTAL DISTRIBUTIONS OF $0.84 PER SHARE IN Q3 2024

NEW YORK, Nov. 7, 2024 /PRNewswire/ — T. Rowe Price OHA Select Private Credit Fund (the “Company” or “OCREDIT”) today announced financial results and declared total distributions of $0.84 per share for the quarter ended September 30, 2024. In addition to the regular monthly distribution, this quarter’s distribution also included a special quarterly distribution of $0.15 per share, representing the fourth consecutive quarter of special distributions.

As borrowers continued to access private credit markets for their financing solutions, OCREDIT was a beneficiary of OHA’s robust investment platform, allowing it to invest in 10 new portfolio companies throughout the third quarter, representing portfolio net growth of $285.3 million. OCREDIT is well diversified across 22 unique sectors with exposure to 103 portfolio companies, and a portfolio yield of 11.6%. “We are satisfied with the overall construct and health of the portfolio and its ability to generate income in an environment where investors are increasingly focused on yield”, said Eric Muller, OCREDIT’s Chief Executive Officer.

Additionally, OCREDIT continues to expand and diversify its borrowing facilities to ensure they are sized appropriately and to ensure appropriate terms and conditions. “Subsequent to quarter-end, in October, OCREDIT continued to demonstrate its access to debt capital by upsizing its JPM Credit Facility to $665 million from $475 million, representing an increase of $190 million. Additionally, we negotiated a reduction in the cost of the BNP Credit Facility to S+225 from S+3001“, said Gerard Waldt, OCREDIT’s Chief Financial Officer. “We are pleased with both the upsize and repricing, as it highlights our banking relationships across multiple lenders and provides us the necessary capacity for our capital pipeline as we head into year end and 2025.”

QUARTERLY HIGHLIGHTS5

- Net investment income per share was $0.77 with weighted average yield on debt and income producing investments, at amortized cost of 11.6%2;

- Earnings per share were $0.69 with inception-to-date3 annualized total return of 14.31%4;

- Net asset value per share as of September 30, 2024 was $27.83, down 0.5% from $27.98 as of June 30, 2024;

- Gross and net investment fundings were $356.5 million and $285.3 million, respectively;

- Ending debt-to-equity was 0.79x, as compared to 0.74x as of June 30, 2024;

- The Company had total net debt outstanding of $850.5 million with a decrease in weighted average interest rate of debt from 7.8% to 7.6% quarter over quarter. Subsequent to quarter end, the Company entered into a Commitment Increase Agreement5 (the “Commitment Increase Agreement”) with JPMorgan Chase Bank (“JPM” or the “JPM Credit Facility”). The Commitment Increase Agreement increased total commitments from $475 million to $665 million.

- During the third quarter of 2024, the Company issued 2,294,172 of Class I common shares for proceeds of $64.2 million and 619,647 of Class S common shares for proceeds of $17.3 million. From October 1, 2024 through November 7, 2024, the Company received total proceeds of $66.7 million from common shareholders in connection with its public offering.6

- Subsequent to quarter end on October 24, 2024, the Company declared a regular distribution of $0.20 per share and a variable supplemental distribution of $0.03 per share for total distributions of $0.23 per share, which is payable on or about November 29, 2024 to common shareholders of record as of October 31, 2024.

DISTRIBUTIONS8

During the third quarter of 2024, the Company declared total distributions of $0.84 per share, of which $0.15 per share was a special distribution. As of September 30, 2024, the Company’s annualized distribution yield (excluding special distributions) was 9.9%.7

From October 1, 2024 through November 7, 2024, the Company declared the following distributions:

|

($ per share) |

October 24, 2024 |

|

Base Distribution |

$0.20 |

|

Variable Distribution |

$0.03 |

|

Total Distribution |

$0.23 |

SELECTED FINANCIAL HIGHLIGHTS

|

($ in thousands, unless otherwise noted) |

Q3 2024 |

Q2 2024 |

|

|

Net investment income per share |

$0.77 |

$0.77 |

|

|

Net investment income |

$29,599 |

$25,065 |

|

|

Earnings per share |

$0.69 |

$0.68 |

|

|

($ in thousands, unless otherwise noted) |

As of September 30, 2024 |

As of June 30, 2024 |

|

|

Total fair value of investments |

$1,937,619 |

$1,649,749 |

|

|

Total assets |

$2,035,072 |

$1,860,020 |

|

|

Total net assets |

$1,079,558 |

$1,002,126 |

|

|

Net asset value per share |

$27.83 |

$27.98 |

|

INVESTMENT ACTIVITY

For the three months ended September 30, 2024, net investment fundings were $285.3 million. The Company invested $356.5 million during the quarter, including $259.3 million in 10 new companies and $97.2 million in existing companies. The Company had $71.2 million of principal repayments and sales during the quarter.

|

($ in millions, unless otherwise noted) |

Q3 2024 |

Q2 2024 |

|

|

Investment Fundings |

$356.5 |

$412.6 |

|

|

Sales and Repayments |

$71.2 |

$119.5 |

|

|

Net Investment Activity |

$285.3 |

$293.1 |

As of September 30, 2024, the Company’s investment portfolio had a fair value of $1,937.6 million, comprised of investments in 103 portfolio companies operating across 22 different industries. The investment portfolio at fair value was comprised of 94.5% first lien loans, 5.2% second lien loans and 0.3% equity investments. In addition, as of September 30, 2024, 99.7% of the Company’s debt investments based on fair value were at floating rates and 0.3% were at fixed rates. There were no investments on non-accrual status.

FORWARD-LOOKING STATEMENTS

Certain information contained in this communication constitutes “forward-looking statements” within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology, such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “can,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction,” “identified” or the negative versions of these words or other comparable words thereof. These may include financial projections and estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, statements regarding future performance, statements regarding economic and market trends and statements regarding identified but not yet closed investments. Such forward-looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. OCREDIT believes these factors also include but are not limited to those described under the section entitled “Risk Factors” in its prospectus, and any such updated factors included in its periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or OCREDIT’s prospectus and other filings). Except as otherwise required by federal securities laws, OCREDIT undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

ABOUT T. ROWE PRICE OHA SELECT PRIVATE CREDIT FUND

T. Rowe Price OHA Select Private Credit Fund (the “Company” or “OCREDIT”) is a non-diversified, closed-end management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The Company also intends to elect to be treated as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”). OHA Private Credit Advisors LLC (the “Adviser”) is the investment adviser of the Company. The Adviser is registered as an investment adviser with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940. OCREDIT’s registration statement became effective on September 29, 2023. From inception through September 30, 2024, the Company has invested approximately $2,244.8 million in aggregate cost of debt investments prior to any subsequent exits or repayments. The Company’s investment objective is to generate attractive risk-adjusted returns, predominately in the form of current income, with select investments capturing long-term capital appreciation, while maintaining a strong focus on risk management. OCREDIT invests primarily in directly originated and customized private financing solutions, including loans and other debt securities with a strong focus on senior secured lending to larger companies.

Please visit www.ocreditfund.com for additional information.

ABOUT OAK HILL ADVISORS

Oak Hill Advisors (“OHA”) is a leading global credit-focused alternative asset manager with over 30 years of investment experience. OHA works with institutions and individuals and seeks to deliver a consistent track record of risk-adjusted returns with downside focus. The firm manages approximately $70 billion of capital across credit strategies, including private credit, high yield bonds, leveraged loans, stressed and distressed debt and collateralized loan obligations as of September 30, 2024. OHA’s emphasis on long-term partnerships with companies, sponsors and other partners provides access to a proprietary opportunity set allowing for customized credit solutions with strength across market cycles.

With over 410 experienced professionals across six global offices, OHA brings a collaborative approach to offering investors a single platform to meet their diverse credit needs. OHA is the private markets platform of T. Rowe Price Group, Inc. (NASDAQ – GS: TROW). For more information, please visit oakhilladvisors.com.

ABOUT T. ROWE PRICE

Founded in 1937, T. Rowe Price (NASDAQ – GS: TROW) helps individuals and institutions around the world achieve their long-term investment goals. As a large global asset management company known for investment excellence, retirement leadership, and independent proprietary research, the firm is built on a culture of integrity that puts client interests first. Clients rely on the award-winning firm for its retirement expertise and active management of equity, fixed income, alternatives, and multi-asset investment capabilities. T. Rowe Price has $1.63 trillion in assets under management as of September 30, 2024, and serves millions of clients globally. News and other updates can be found on Facebook, Instagram, LinkedIn, X, YouTube, and troweprice.com/newsroom.

|

T. Rowe Price OHA Select Private Credit Fund |

||

|

Consolidated Statements of Assets and Liabilities |

||

|

(in thousands, except per share amounts) |

||

|

As of |

As of |

|

|

September 30, 2024 |

December 31, 2023 |

|

|

ASSETS |

(unaudited) |

|

|

Investments at fair value: |

||

|

Non-controlled/non-affiliated investments (cost of $1,927,465 |

$ 1,937,619

|

$ 1,148,412 |

|

Cash, cash equivalents and restricted cash |

37,087 |

105,456 |

|

Interest receivable |

21,392 |

15,498 |

|

Deferred financing costs |

5,184 |

6,021 |

|

Deferred offering costs |

520 |

1,705 |

|

Receivable for investments sold |

33,246 |

9,044 |

|

Unrealized appreciation on foreign currency contracts |

24 |

– |

|

Total assets |

$ 2,035,072 |

$ 1,286,136 |

|

LIABILITIES |

||

|

Debt (net of unamortized debt issuance costs of $3,118 and |

$ 850,528 |

$ 558,630 |

|

Payable for investments purchased |

63,600 |

151 |

|

Interest and debt fee payable |

16,047 |

4,846 |

|

Distribution payable |

14,725 |

11,573 |

|

Management fee payable |

3,254 |

– |

|

Income incentive fee payable |

4,306 |

– |

|

Distribution and/or shareholder servicing fees payable |

17 |

– |

|

Unrealized depreciation on foreign currency forward contracts |

– |

1,048 |

|

Accrued expenses and other liabilities |

3,037 |

5,457 |

|

Total liabilities |

$ 955,514 |

$ 581,705 |

|

Commitments and contingencies (Note 8) |

||

|

NET ASSETS |

||

|

Class I shares, $0.01 par value (38,796,477 and 25,158,870 |

$ 388 |

$ 252 |

|

Additional paid in capital |

1,069,860 |

687,139 |

|

Distributable earnings (loss) |

9,310 |

17,040 |

|

Total net assets |

$ 1,079,558 |

$ 704,431 |

|

Total liabilities and net assets |

$ 2,035,072 |

$ 1,286,136 |

|

Net asset value per share |

$ 27.83 |

$ 28.00 |

|

See accompanying notes to consolidated financial statements. |

||

|

T. Rowe Price OHA Select Private Credit Fund |

||||

|

Consolidated Statements of Operations |

||||

|

(in thousands, except per share amounts) |

||||

|

(unaudited) |

||||

|

For the Three Months Ended |

For the Nine Months Ended |

|||

|

September 30, 2024 |

September 30, |

September 30, |

September 30, |

|

|

Investment income from non-controlled / |

||||

|

Interest income |

$ 53,285 |

$ 20,285 |

$ 137,033 |

$ 24,730 |

|

Other income |

3,195 |

664 |

9,672 |

796 |

|

Total investment income |

56,480 |

20,949 |

146,705 |

25,526 |

|

Expenses: |

||||

|

Interest and debt fee expense |

16,363 |

7,273 |

41,049 |

8,402 |

|

Management fees |

3,254 |

962 |

8,299 |

962 |

|

Income incentive fees |

4,306 |

1,543 |

11,155 |

1,543 |

|

Distribution and shareholder servicing fees |

||||

|

Class S |

39 |

– |

45 |

– |

|

Professional fees |

888 |

504 |

1,704 |

1,051 |

|

Board of Trustees fees |

98 |

97 |

292 |

291 |

|

Administrative service expenses |

359 |

225 |

1,109 |

310 |

|

Organizational costs |

– |

– |

– |

94 |

|

Other general & administrative expenses |

1,223 |

396 |

3,705 |

694 |

|

Amortization of deferred offering costs |

429 |

486 |

2,040 |

486 |

|

Total expenses before fee waivers and |

26,959 |

11,486 |

69,398 |

13,833 |

|

Expense support |

(78) |

(324) |

(1,306) |

(324) |

|

Management fees waiver |

– |

(962) |

(2,344) |

(962) |

|

Income incentive fee waiver |

– |

(1,543) |

(3,363) |

(1,543) |

|

Total expenses net of fee waivers and |

26,881 |

8,657 |

62,385 |

11,004 |

|

Net investment income |

29,599 |

12,292 |

84,320 |

14,522 |

|

Realized and unrealized gain (loss): |

||||

|

Realized gain (loss): |

||||

|

Non-controlled/non-affiliated investments |

285 |

159 |

(34) |

181 |

|

Foreign currency transactions |

172 |

(69) |

438 |

(69) |

|

Foreign currency forward contracts |

(2,558) |

325 |

(2,078) |

325 |

|

Net realized gain (loss) |

(2,101) |

415 |

(1,674) |

437 |

|

Net change in unrealized appreciation (depreciation): |

||||

|

Non-controlled/non-affiliated investments |

(1,272) |

7,251 |

(6,532) |

7,960 |

|

Foreign currency translation |

27 |

– |

27 |

– |

|

Foreign currency forward contracts |

30 |

132 |

1,072 |

141 |

|

Net change in unrealized appreciation (depreciation) |

(1,215) |

7,383 |

(5,433) |

8,101 |

|

Net realized and unrealized gain (loss) |

(3,316) |

7,798 |

(7,107) |

8,538 |

|

Net increase (decrease) in net assets |

$ 26,283 |

$ 20,090 |

$ 77,213 |

$ 23,060 |

|

See accompanying notes to consolidated financial statements. |

||||

For a more detailed description of OCREDIT’s investment guidelines and risk factors, please refer to the prospectus. Consider the investment objectives, risks, and charges and expenses carefully before investing or sending money. For a free prospectus containing this and other information, call 1-855-405-6488 or visit www.ocreditfund.com. Read it carefully.

OCREDIT is a non-exchange traded business development company (“BDC”) that expects to invest at least 80% of its total assets (net assets plus borrowings for investment purposes) in private credit investments. An investment in OCREDIT involves a high degree of risk. An investor should purchase securities of OCREDIT only if they can afford the complete loss of the investment.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Securities regulators have also not passed upon whether this offering can be sold in compliance with existing or future suitability or Regulation Best Interest standard to any or all purchasers.

As of March 26, 2024, OCREDIT is available in 54 states and territories.

As of March 26, 2024, OCREDIT is not registered for offer or sale outside of the United States.

BDCs may charge management fees, incentive fees, as well as other fees associated with servicing loans. These fees will detract from the total return.

OCREDIT may in certain circumstances invest in companies experiencing distress increasing the risk of default or failure. OCREDIT is not listed on an exchange which heightens liquidity risk for an investor. OCREDIT has limited prior operating history and there is no assurance that it will achieve its investment objectives. The Company’s public offering is a “blind pool” offering and thus investors will not have the opportunity to evaluate the Company’s investments before they are made. Investors should not expect to be able to sell shares regardless of performance and should consider that they may not have access to the money invested for an extended period of time and may be unable to reduce their exposure in a market downturn.

OCREDIT employs leverage, which increases the volatility of OCREDIT’s investments and will magnify the potential for loss. Fixed-income securities are subject to credit risk, call risk, and interest rate risk. As interest rates rise, bond prices fall. Investments in high-yield bonds involve greater risk. International investments can be riskier than U.S. investments and subject to foreign exchange risk.

OCREDIT is “non-diversified,” meaning it may invest a greater portion of its assets in a single company. OCREDIT’s share price can be expected to fluctuate more than that of a comparable diversified fund. OCREDIT may invest in derivatives, which may be riskier or more volatile than other types of investments because they are generally more sensitive to changes in market or economic conditions.

Account opening and closing fees may apply depending on the amount invested and the timing of the account closure. There may be costs associated with the investments in the account such as periodic management fees, incentive fees, loads, other expenses or brokerage commissions. Fees for optional services may also apply.

Opinions and estimates offered herein constitute the judgment of Oak Hill Advisors, L.P. as of the date this document is provided to an investor and are subject to change as are statements about market trends. All opinions and estimates are based on assumptions, all of which are difficult to predict and many of which are beyond the control of Oak Hill Advisors, L.P. In preparing this document, Oak Hill Advisors, L.P. has relied upon and assumed, without independent verification, the accuracy and completeness of all information. Oak Hill Advisors, L.P. believes that the information provided herein is reliable; however, it does not warrant its accuracy or completeness. Certain information contained in the press release discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

Diversification cannot assure a profit or protect against loss in a declining market. Potential investors are urged to consult a tax professional regarding the possible economic, tax, legal, or other consequences of investing in OCREDIT in light of their particular circumstances.

In the United States, the Company’s securities are offered through T. Rowe Price Investment Services Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission and a member of FINRA. OHA is a T. Rowe Price company.

© 2024 Oak Hill Advisors. All Rights Reserved. OHA is a trademark of Oak Hill Advisors, L.P. T. ROWE PRICE is a trademark of T. Rowe Price Group, Inc. All other trademarks shown are the property of their respective owners. Use does not imply endorsement, sponsorship, or affiliation of Oak Hill Advisors with any of the trademark owners.

202411-3892273

|

__________________________________ |

|

1 Figures represent borrowings that bear interest at a rate of SOFR + a determined amount. SOFR = Secured Overnight Financing Rate. |

|

2 Computed as (a) the annual stated interest rate or yield plus the annual accretion of discounts or less the annual amortization of premiums, as applicable, on income producing securities, divided by (b) the total relevant investments at amortized cost or fair value, as applicable. |

|

3 Inception is November 14, 2022. |

|

4 Annualized total return based on net asset value calculated as the change in net asset value per share during the respective period, assuming distributions that have been declared are reinvested on the effects of the performance of the Company during the period. Past performance is no guarantee of future results. |

|

5 The Commitment Increase Agreement provides for, among other things, an increase in the total aggregate commitments from lenders under the revolving credit facility governed by the Credit Agreement. |

|

6 Does not include common shares sold through the Company’s distribution reinvestment plan. |

|

7 Performance and share activity shown is indicative of Class I only, unless otherwise indicated. |

|

8 Future distribution payments are not guaranteed. |

SOURCE OHA; T. Rowe Price Group, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decoding Arista Networks's Options Activity: What's the Big Picture?

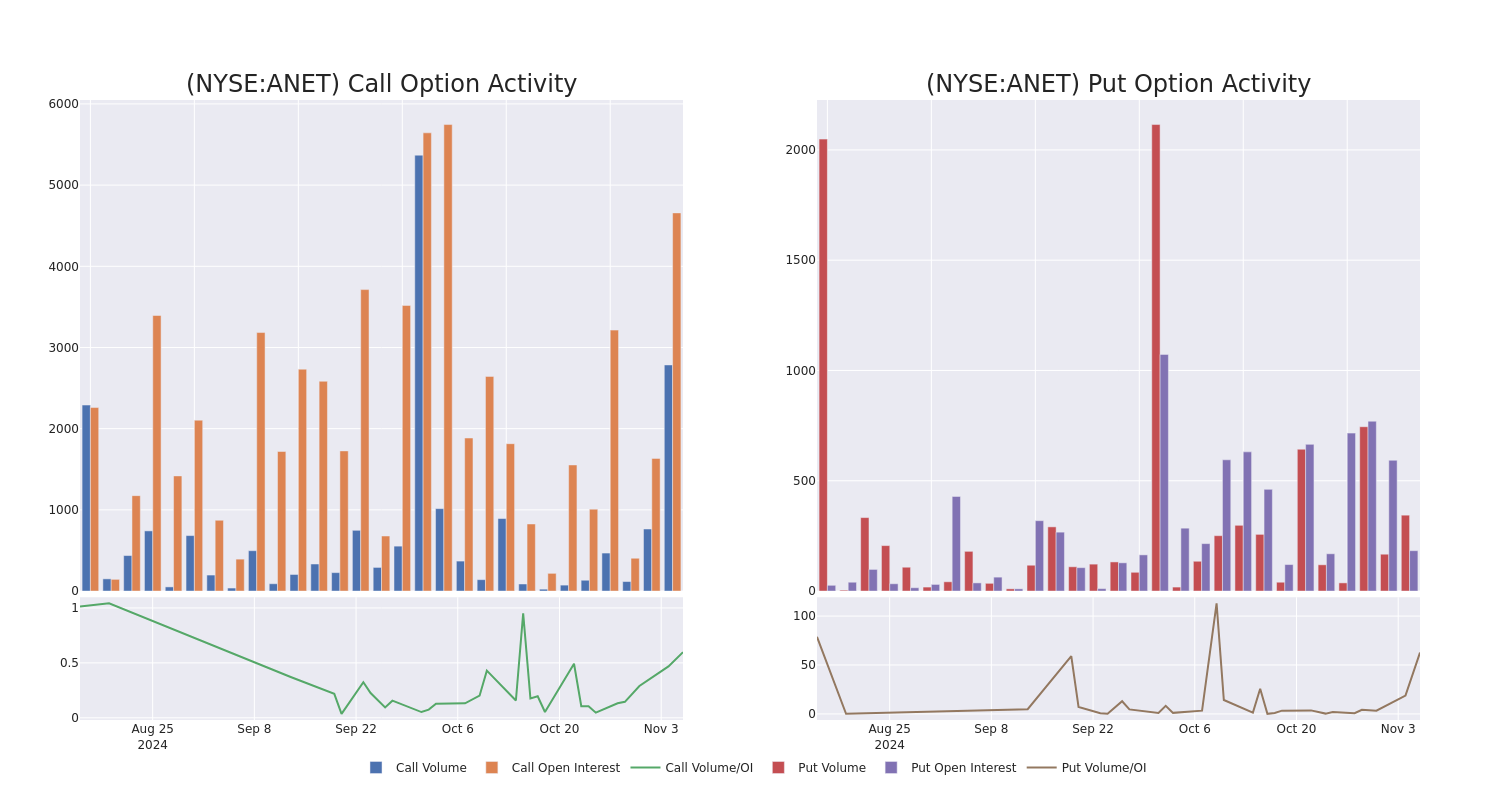

Whales with a lot of money to spend have taken a noticeably bullish stance on Arista Networks.

Looking at options history for Arista Networks ANET we detected 26 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 23% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $522,189 and 21, calls, for a total amount of $964,976.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $370.0 to $600.0 for Arista Networks during the past quarter.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Arista Networks’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Arista Networks’s whale activity within a strike price range from $370.0 to $600.0 in the last 30 days.

Arista Networks Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | PUT | SWEEP | NEUTRAL | 01/17/25 | $9.5 | $9.2 | $9.36 | $370.00 | $362.4K | 115 | 392 |

| ANET | CALL | TRADE | NEUTRAL | 01/16/26 | $88.5 | $86.2 | $87.3 | $430.00 | $87.3K | 60 | 49 |

| ANET | CALL | TRADE | NEUTRAL | 01/16/26 | $88.3 | $84.9 | $86.65 | $430.00 | $86.6K | 60 | 24 |

| ANET | CALL | SWEEP | BULLISH | 01/16/26 | $88.4 | $88.0 | $88.0 | $430.00 | $70.4K | 60 | 115 |

| ANET | CALL | TRADE | BULLISH | 11/08/24 | $14.0 | $14.0 | $14.0 | $440.00 | $70.0K | 692 | 51 |

About Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

In light of the recent options history for Arista Networks, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Arista Networks Standing Right Now?

- Trading volume stands at 1,293,445, with ANET’s price up by 1.21%, positioned at $428.26.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 0 days.

What Analysts Are Saying About Arista Networks

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $460.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Arista Networks with a target price of $460.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Arista Networks, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ACT Energy Technologies Reports 2024 Q3 Interim Results

/NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA/

CALGARY, AB, Nov. 7, 2024 /CNW/ – ACX ACT Energy Technologies Ltd, formerly Cathedral Energy Services Ltd., (the “Company” or “ACT”) news release contains “forward-looking statements” within the meaning of applicable Canadian securities laws. For a full disclosure of forward-looking statements and the risks to which they are subject, see the “Forward-Looking Statements” section in this news release. This news release contains references to Adjusted gross margin, Adjusted gross margin %, Adjusted EBITDAS, Adjusted EBITDAS margin %, Free cash flow, Working capital and Net capital expenditures. These terms do not have standardized meanings prescribed under International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”) and may not be comparable to similar measures used by other companies. See the “Non-GAAP Measures” section in this news release for definitions and tabular calculations.

2024 Q3 KEY HIGHLIGHTS

The Company achieved the following 2024 Q3 results and highlights:

- Revenues of $148.4 million in 2024 Q3, were the highest for any third quarter in the Company’s history and increased 2%, compared to $145.6 million in 2023 Q3.

- Adjusted EBITDAS (1) of $30.2 million in 2024 Q3 was comparable to $30.1 million in 2023 Q3. Lost-in-hole equipment net reimbursements were lower in 2024 Q3, compared to 2023 Q3.

- Canadian operating days increased 34% in 2024 Q3, compared to 2023 Q3, which was favourable to a 12% increase in the Western Canadian rig count (2). ACT remains extremely active in oil plays where wells have a high multilateral count.

- U.S. operating days decreased 22% in 2024 Q3, compared to 2023 Q3, mainly due to a 10% decline in the U.S. land rig count (2).

- An increase in the Canadian average revenue per operating day of 2% in 2024 Q3, compared to 2023 Q3.

- An increase in the U.S. average revenue per operating day of 11% in 2024 Q3, compared to 2023 Q3.

- Net income of $26.2 million in 2024 Q3, compared to $5.7 million in 2023 Q3. The increase is mainly due to the recognition of previously unrecorded Canadian tax pools, resulting in a deferred income tax recovery of $11.1 million. Refer to the ‘Income tax’ section of this news release.

- Cash flow – operating activities of $19.4 million in 2024 Q3, compared to $9.1 million in 2023 Q3, mainly attributable to the change in non-cash working capital.

- Free cash flow (1) of $8.7 million in 2024 Q3, compared to Free cash flow (1) of $6.1 million in 2023 Q3.

- The Company purchased 506,800 common shares of ACT under its Normal Course Issuer Bid (“NCIB”) for a total amount of $3.0 million, at an average price of $5.91 per common share. As at September 30, 2024, the Company recognized $1.1 million as an accrued liability for the maximum common shares to be purchased under the plan. Subsequent to September 30, 2024, the Company purchased 179,800 common shares for a total purchase amount of $1.1 million, at an average purchase price of $6.04 per common share.

- Loans and borrowings less cash was $49.9 million as at September 30, 2024, compared to $67.9 million as at December 31, 2023. The Company will remain focused on reducing its loans and borrowings and generating Free cash flow (1) for the remainder of 2024.

- The Company continues to see a significant opportunity for margin expansion in its U.S. directional business by using Rime Downhole Technologies (“Rime”) supplied Measurement-While-Drilling (“MWD”) systems to reduce its third-party rental costs. To date, ten Rime MWD systems have been deployed with an additional forty MWD systems expected to be deployed by the first half of 2025.

- The Company purchased five additional Rotary Steerable Systems (“RSS”) Orbit tools, expanding its U.S. fleet to twenty-six RSS tools.

|

(1) |

As defined in the “Non-GAAP measures” section of this news release. |

|

(2) |

Per Baker Hughes and Rig Locator. |

PRESIDENT’S MESSAGE

Comments from President & CEO Tom Connors:

“Despite a more challenging market for drilling activity in the U.S., ACT delivered another quarter with solid and consistent results. Consolidated revenues were the second highest for any quarter in the Company’s history with Adjusted EBITDA of $30.2 million being among the highest of any quarter to date. Low natural gas prices and market uncertainty provided some headwinds in the quarter, particularly in the U.S. where the land rig count declined 10% (source: Baker Hughes) on a year-over-year basis. The quarter was also impacted by significantly lower lost-in-hole revenue or reimbursements versus historical averages. We believe our positioning and focus on the higher value, high-performance rotary steerable market in the U.S. and the multi-lateral drilling market in Canada helped propel the company to strong and consistent financial performance in the quarter despite these challenges. The benefits of ACT’s size and scale strategy continues to produce sound results by leveraging leading technology and exceptional service delivery in the North American directional drilling industry.

“We were one of the most active service providers in the directional market in Canada in the third quarter, resulting in record quarterly revenues of $61.5 million, also a 36% increase from 2023 Q3. Third quarter Canadian revenues also exceeded the $58.4 million generated in 2024 Q1, which is a rare achievement in the seasonal Canadian energy services sector. ACT’s activity and performance in the quarter was further buoyed with technology that is ideally suited for multilateral drilling combined with vast field experience that has grown from the onset of this burgeoning method of drilling.

“Due to higher levels of demand and utilization we increased the size of our RSS fleet by five additional tools to a total of twenty-six in our U.S. division in the third quarter. The addition of ten incremental tools this year has allowed us to increase our revenue per operating day by roughly 11% versus the same quarter last year, despite a 22% decrease in operating days year-over-year.

“The successful deployment of a sizable MWD fleet remains the top priority and focus for management in 2024 and 2025, with the potential to further expand our business, improve our margins and EBITDA profile, while generating very attractive returns on our investment. The MWD buildout is expected to provide increased resiliency through expanded margins in a weaker macro environment and position the Company with more flexibility to further pay down debt and potentially initiate return of capital strategy in 2025. The execution of the plan remains on track with delivery of completed MWD tools beginning in 2024 Q4 and continuing into the first half of 2025. With a significant portion of our revenue in our U.S. business going to third-parties to rent essential technology, there is a substantial opportunity to recapture margins even if we are only able to achieve relatively moderate levels of operational success in 2025.

“We continued with our NCIB program in the quarter to return capital back to shareholders at a relatively low purchase price. In 2024, we purchased approximately 0.7 million common shares at an average purchase price of $5.94 per common share as of the date of this news release. Management believes that buying shares at current share price levels represents good value and a sensible use of capital. In addition, we strengthened our balance sheet with reduced debt levels and increased our cash balance which will continue to be a focus into 2025.

“With a constructive outlook in our Canadian business, improving outlook in the longer-term for the U.S., market, improving EBITDA and cash flow profiles, and a clear strategy, I am confident we can deliver higher returns for our shareholders and increasing value for our customers as we go forward. I would like to thank our team for their continued focus, dedication, and exceptional operational execution,” stated Tom Connors, ACT President and Chief Executive Officer.

FINANCIAL HIGHLIGHTS

(unaudited)

Canadian dollars in 000’s (except for otherwise noted)

|

Three months ended September 30, |

Nine months ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

Revenues |

$ 148,449 |

$ 145,591 |

$ 443,702 |

$ 399,878 |

|

Gross margin % |

25 % |

23 % |

23 % |

19 % |

|

Adjusted gross margin % (1) |

30 % |

31 % |

28 % |

27 % |

|

Adjusted EBITDAS (1) |

$ 30,169 |

$ 30,106 |

$ 76,223 |

$ 63,515 |

|

Per share – basic (2) |

$ 0.86 |

$ 0.86 |

$ 2.19 |

$ 1.88 |

|

Per share – diluted (2) |

$ 0.78 |

$ 0.79 |

$ 1.98 |

$ 1.81 |

|

Adjusted EBITDAS margin % (1) |

20 % |

21 % |

17 % |

16 % |

|

Cash flow – operating activities |

$ 19,377 |

$ 9,128 |

$ 69,243 |

$ 53,395 |

|

Free cash flow (1) |

$ 8,654 |

$ 6,085 |

$ 9,107 |

$ 10,372 |

|

Net income |

$ 26,175 |

$ 5,650 |

$ 43,015 |

$ 8,861 |

|

Per share – basic (2) |

$ 0.75 |

$ 0.16 |

$ 1.24 |

$ 0.26 |

|

Per share – diluted (2) |

$ 0.68 |

$ 0.15 |

$ 1.12 |

$ 0.25 |

|

Weighted average shares outstanding: |

||||

|

Basic (000s) (2) |

34,965 |

34,939 |

34,770 |

33,711 |

|

Diluted (000s) (2) |

38,772 |

38,207 |

38,559 |

35,137 |

|

Balance, |

September 30, |

December 31, |

|

Working capital, excluding current portion of loans and borrowings (1) |

$ 78,766 |

$ 74,865 |

|

Total assets |

$ 442,592 |

$ 403,733 |

|

Loans and borrowings |

$ 67,343 |

$ 78,598 |

|

Shareholders’ equity |

$ 225,825 |

$ 179,468 |

|

(1) |

Refer to the “Non-GAAP Measures” section in this news release. |

|

(2) |

Restated to reflect the 7:1 share consolidation on July 3, 2024. Refer to the “Share Consolidation” section in this news release. |

OUTLOOK

The outlook for global energy demand remains robust in the coming years due to rising intensity of energy use in developing countries and the prospect of a soft landing for economic growth among industrialized nations as central banks co-ordinate to bring interest rates down. The rising prominence of natural gas as the transition fuel for power generation in the decades to come is also supportive even before any additional demand caused by growth in AI-driven datacenters.

In the short term, oil markets continue to be impacted by a number of factors. Bearish factors include a relatively weak Chinese economy and the possibility of OPEC adding more oil production to the market in 2025. Bullish factors include continued solid global gross domestic product growth as noted, low U.S. oil and product inventories in relation to five-year averages and ongoing Middle Eastern tensions that could affect oil supply. The U.S. election is also adding uncertainty as it relates to possible changes to U.S. energy policy. On the whole, WTI oil prices have trended lower by roughly U.S. $10 per barrel since the release of our second quarter results in August 2024, which has caused a slow drift downward in U.S. land drilling levels. By contrast, U.S. natural gas prices have improved over the last three months as the market awaits the beginning of the North American winter heating season as well as the start-up of exports from a number of new U.S. liquified natural gas (“LNG”) projects in 2025 and 2026.

Owing to higher levels of uncertainty in both oil and natural gas markets, ACT is seeing varying impact on its job counts in Canada and the U.S. in the fourth quarter of 2024. In Canada, ACT continues to run at levels close to those achieved in the record-setting third quarter. ACT’s Canadian exploration and production (“E&P”) clients have done an excellent job at repairing balance sheets to withstand oil and gas price volatility and have also been helped by a continued weakening of the Canadian dollar, which increases their realized pricing. We remain very constructive on Canada in the years to come and are encouraged by reports that testing continues with respect to bringing the major LNG Canada project online sometime in 2025. With relatively steady levels of activity forecasted for the Canadian market it is also important to note the fourth quarter is likely to be impacted by budget exhaustion and holiday seasonality in early-to-mid- December.

ACT’s U.S. job count has softened modestly in the fourth quarter, in keeping with the continued softness in underlying U.S. rig activity. ACT continues to increase its presence in the premium part of the directional drilling market by way of adding RSS systems to its fleet. Maximizing available revenue per operating day is our immediate focus as well as beginning the margin recapture process as we introduce our new MWD systems to clients. Holiday seasonality also starts to become a factor in late November with the U.S. Thanksgiving holiday. Lower benchmark U.S. oil and gas prices to date in the fourth quarter may also accelerate the timing of the typical end-of-year budget exhaustion process.

2023 ACQUISITION

On July 11, 2023, ACT, through a wholly-owned subsidiary, acquired Rime, a privately-held, Texas-based, engineering business that specializes in building products for the downhole MWD industry (the “Rime acquisition”) in exchange for approximately USD $41.0 million (approximately CAD $54.1 million) comprised of: i) the payment of USD $21.0 million in cash (approximately CAD $28.0 million); and ii) the issuance of principal amount of USD $20.0 million (approximately CAD $26.4 million) of subordinated exchangeable promissory notes (“EP Notes”) that are exchangeable into a maximum of 3,510,000 common shares of ACT at an issue price of CAD $7.70 per common share. The EP notes have a three-year term and accrue interest quarterly at a rate of 5% per annum. In accordance with International Accounting Standards (“IAS”) 32 and IFRS 13, the EP Notes were determined to be a compound instrument and, accordingly, recognized at the fair value of their respective debt component of $23.4 million and equity component of $1.2 million totaling $24.6 million.

RESULTS OF OPERATIONS

|

Three months ended September 30, |

Nine months ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

Revenues |

||||

|

United States |

$ 86,948 |

$ 100,338 |

$ 292,579 |

$ 283,798 |

|

Canada |

61,501 |

45,253 |

151,123 |

116,080 |

|

Total revenues |

148,449 |

145,591 |

443,702 |

399,878 |

|

Cost of sales |

||||

|

Direct costs |

(104,359) |

(101,629) |

(318,723) |

(293,815) |

|

Depreciation and amortization |

(6,432) |

(10,508) |

(24,247) |

(29,848) |

|

Share-based compensation |

(73) |

(429) |

(465) |

(669) |

|

Cost of sales |

(110,864) |

(112,566) |

(343,435) |

(324,332) |

|

Gross margin |

$ 37,585 |

$ 33,025 |

$ 100,267 |

$ 75,546 |

|

Gross margin % |

25 % |

23 % |

23 % |

19 % |

|

Adjusted gross margin % (1) |

30 % |

31 % |

28 % |

27 % |

|

(1) |

Refer to the “Non-GAAP Measures” section in this news release. |

SEGMENTED INFORMATION

United States

Revenues

U.S. revenues were $86.9 million in 2024 Q3, a decrease of $13.4 million or 13%, compared to $100.3 million in 2023 Q3. The Company realized a 22% decrease in operating days to 3,080 days in 2024 Q3, compared to 3,953 days in 2023 Q3. The decrease in operating days was due to a declining market in 2024 Q3. The average revenue per operating day increased 11% to $28,230 per day in 2024 Q3, compared to $25,383 per day in 2023 Q3, mainly due to job mix.

U.S. revenues were $292.6 million in the nine months ended September 30, 2024, an increase of $8.8 million or 3%, compared to $283.8 million for the same period in 2023. The Company realized a 7% decrease in operating days to 10,496 days in the nine months ended September 30, 2024, compared to 11,233 days for the same period in 2023. The decrease is mainly related to a declining market in the nine months ended September 30, 2024. The average revenue per operating day increased 10% to $27,875 per day in the nine months ended September 30, 2024, compared to $25,265 per day for the same period in 2023, mainly due to a change in job mix.

Direct costs

U.S. direct costs included in cost of sales were $64.9 million in 2024 Q3, a decrease of $9.8 million or 13%, compared to $74.7 million in 2023 Q3. The decrease is mainly due to lower third-party rental and labour costs. As a percentage of revenues, direct costs increased to 75% in 2024 Q3, compared to 74% in 2023 Q3 mainly due to higher labour and repair costs as a percentage of revenues.

U.S. direct costs included in cost of sales were $221.3 million in the nine months ended September 30, 2024, an increase of $5.1 million or 2%, compared to $216.2 million for the same period in 2023. The increase is mainly due to higher repairs and manufacturing costs, offset by third-party rental costs. The manufacturing costs are attributable to the Rime acquisition (acquired in July 2023). As a percentage of revenues, direct costs were 76% in both the nine months ended September 30, 2024 and 2023 as a result of higher repair costs, offset by lower labour and rental costs as a percentage of revenues.

Canadian

Revenues

Canadian revenues were $61.5 million in 2024 Q3, an increase of $16.2 million or 36%, compared to $45.3 million in 2023 Q3. The Company realized a 34% increase in operating days to 4,527 days in 2024 Q3, compared to 3,388 days in 2023 Q3. The increase in operating days is mainly attributable to higher market demand in 2024 Q3. The average revenue per operating day increased 2% to $13,585 per day in 2024 Q3, compared to $13,357 per day in 2023 Q3. The increase in the average revenue per operating day is mainly attributed to higher proceeds from lost-in-hole reimbursements from customers and a change in job mix, including higher charges for premium tools.

Canadian revenues were $151.1 million in the nine months ended September 30, 2024, an increase of $35.0 million or 30%, compared to $116.1 million for the same period in 2023. The Company realized a 27% increase in operating days to 11,031 days in the nine months ended September 30, 2024, compared to 8,709 days for the same period in 2023. The increase in operating days is mainly attributable to higher market demand in the nine months ended September 30, 2024. The average revenue per operating day increased 3% to $13,700 per day in the nine months ended September 30, 2024, compared to $13,329 per day for the same period in 2023. The increase in the average revenue per operating day is mainly attributed to higher proceeds from lost-in-hole reimbursements from customers and a change in job mix, including higher charges for premium tools.

Direct costs

Canadian direct costs included in cost of sales were $39.5 million in 2024 Q3, an increase of $12.5 million or 46%, compared to $27.0 million in 2023 Q3. The increase is mainly due to higher labour, repair, and third-party rental costs in 2024 Q3. As a percentage of revenues, direct costs were 64% in 2024 Q3, compared to 60% in 2023 Q3 mainly due to higher rental costs as a percentage of revenues.

Canadian direct costs included in cost of sales were $97.4 million in the nine months ended September 30, 2024, an increase of $19.8 million or 26%, compared to $77.6 million for the same period in 2023. The increase is mainly due to higher labour, repair, and third-party rental costs in the nine months ended September 30, 2024. As a percentage of revenues, direct costs were 64% in the nine months ended September 30, 2024, compared to 67% for the same period in 2023 mainly due to lower labour and repair costs as a percentage of revenues.

CONSOLIDATED

Revenues

The Company recognized $148.4 million of revenues in 2024 Q3, an increase of $2.8 million or 2%, compared to $145.6 million in 2023 Q3. The increase is due to a 4% increase in operating days (2024 – 7,607 days; 2023 – 7,341 days), offset by a decrease of 2% in the average revenue per operating day (2024 – $19,515; 2023 – $19,833). The decrease in the average revenue per operating day is mainly due to lower lost-in-hole reimbursements from the Company’s customers.

The Company recognized $443.7 million of revenues in the nine months ended September 30, 2024, an increase of $43.8 million or 11%, compared to $399.9 million for the same period in 2023. The increase is due to an 8% increase in operating days (2024 – 21,527 days; 2023 – 19,942 days) and an increase of 3% in the average revenue per operating day (2024 – $20,611; 2023 – $20,052).

Direct costs

The Company recognized $104.4 million of direct costs in 2024 Q3, an increase of $2.8 million or 3%, compared to $101.6 million in 2023 Q3. The increase is mainly due to higher repair and labour costs related to an increase in operating days, offset by lower third-party rental costs.

The Company recognized $318.7 million of direct costs in the nine months ended September 30, 2024, an increase of $24.9 million or 8%, compared to $293.8 million for the same period in 2023. The increase is mainly due to higher repairs and labour costs related to the increase in operating days, and the inclusion of manufacturing costs related to Rime (acquired in July 2023), offset by lower third-party rental costs.

Direct costs as a percentage of revenues was 70% in 2024 Q3, which is comparable to 2023 Q3. Direct costs as a percentage of revenue decreased to 72% in the nine months ended September 30, 2024, from 73% for the same period in 2023, mainly due to decreased labour and third-party rental costs as a percentage of revenues.

Gross margin and adjusted gross margin

The Gross margin % increased to 25% in 2024 Q3, compared to 23% in 2023 Q3. The Gross margin % increased to 23% in the nine months ended September 30, 2024, compared to 19% for the same period in 2023.

The Adjusted gross margin % decreased to 30% in 2024 Q3, compared to 31% in 2023 Q3. The Adjusted gross margin % increased to 28% in the nine months ended September 30, 2024, compared to 27% for the same period in 2023.

Depreciation and amortization expense

Depreciation and amortization expense included in cost of sales decreased to $6.4 million and $24.2 million in 2024 Q3 and the nine months ended September 30, 2024, compared to $10.5 million and $29.8 million for the same periods in 2023, respectively. The decrease is mainly due to a change in depreciation methodology, as described below.

In 2024 Q1, the Company assessed its depreciation methodology related to its property, plant and equipment. As a result, the Company determined that using a straight-line method of depreciation, rather than the declining balance method, more accurately reflects the future economic benefits of the related assets. The depreciation expense included in cost of sales decreased due to the change in methodology.

Depreciation and amortization expense included in cost of sales as a percentage of revenues was 4% and 5% in 2024 Q3 and the nine months ended September 30, 2024, compared to 7% for the same periods in 2023, respectively.

Selling, general and administrative (“SG&A”) expenses

|

Three months ended September 30, |

Nine months ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

Selling, general and administrative expenses: |

||||

|

Direct costs |

$ 13,147 |

$ 11,611 |

$ 43,981 |

$ 37,701 |

|

Depreciation and amortization |

2,630 |

2,299 |

7,439 |

5,307 |

|

Share-based compensation |

311 |

1,731 |

1,960 |

3,179 |

|

Selling, general and administrative expenses |

$ 16,088 |

$ 15,641 |

$ 53,380 |

$ 46,187 |

The Company recognized direct costs included in SG&A expenses of $13.1 million and $44.0 million in 2024 Q3 and the nine months ended September 30, 2024, an increase of $1.5 million and $6.3 million, compared to $11.6 million and $37.7 million for the same periods in 2023, respectively. The increase is mainly related to higher professional services and promotional costs in 2024. In addition, a portion of the increased direct costs included in SG&A for the nine months ended September 30, 2024 is attributable to the acquisition of Rime.

Direct costs included in SG&A expenses as a percentage of revenues were 9% and 10% in 2024 Q3 and the nine months ended September 30, 2024, compared to 8% and 9% for the same periods in 2023, respectively.

Depreciation and amortization included in SG&A expenses were $2.6 million and $7.4 million in 2024 Q3 and the nine months ended September 30, 2024, compared to $2.3 million and $5.3 million for the same periods in 2023, respectively, mainly due to amortization expense related to the intangible assets acquired in the Rime transaction.

Stock-based compensation included in SG&A expenses were $0.3 million and $2.0 million in 2024 Q3 and the nine months ended September 30, 2024, compared to $1.7 million and $3.2 million for the same periods in 2023, respectively. The decrease is mainly due to certain stock options being fully vested in 2024.

Research and development (“R&D”) costs

The Company recognized R&D costs of $0.8 million and $2.4 million in 2024 Q3 and the nine months ended September 30, 2024, compared to $0.4 million and $1.4 million for the same periods in 2023, respectively. R&D costs are salaries, benefits, purchased materials and shop supply costs related to new product development and technology.

Write-off of property, plant and equipment

The Company recognized a write-off of property, plant and equipment of $0.6 million and $2.9 million in 2024 Q3 and the nine months ended September 30, 2024, compared to $1.6 million and $3.9 million for the same periods in 2023, respectively. The write-offs related to equipment lost-in-hole and damaged beyond repair. Reimbursements on lost-in-hole equipment and damaged beyond repair are based on service agreements held with clients and are recognized as revenues.

Finance costs

Finance costs – loans and borrowings and EP Notes were $1.9 million in 2024 Q3, a decrease of $0.4 million, compared to $2.3 million in 2023 Q3. The decrease is mainly due to a lower outstanding balance of loans and borrowings in 2024 Q3 compared to 2023 Q3. Finance costs – loans and borrowings and EP Notes were $6.8 million in the nine months ended September 30, 2024, an increase of $1.3 million, compared to $5.5 million for the same period in 2023. The increase is mainly due to higher interest rates in 2024 and finance costs related to the Company’s EP notes issued as part of the Rime transaction in July 2023.

In addition, the Company had finance costs of $0.2 million and $0.6 million in 2024 Q3 and the nine months ended September 30, 2024 related to lease liabilities, which is consistent with the same periods in 2023, respectively.

Foreign exchange

The Company recognized a foreign exchange loss of $1.3 million in 2024 Q3, compared to a foreign exchange loss of $0.8 million in 2023 Q3. The Company recognized a foreign exchange gain of $1.8 million in the nine months ended September 30, 2024, compared to a foreign exchange gain of $0.1 million for the same period in 2023. The impact of foreign exchange is due to fluctuations of the Canadian dollar relative to the USD related to foreign currency transactions recognized in net income.

The Company recognized a foreign currency translation loss on foreign operations of $0.9 million in 2024 Q3, compared to a gain of $4.8 million in 2023 Q3. The Company recognized a foreign currency translation gain on foreign operations of $1.3 million in the nine months ended September 30, 2024, compared to a gain of $0.6 million for the same period in 2023. The Company’s foreign operations are denominated in USD and differences due to fluctuations in the foreign currency exchange rates are recorded in other comprehensive income.

Income tax

The Company recognized an income tax expense of $9.5 million and $6.6 million in 2024 Q3 and the nine months ended September 30, 2024, compared to an income tax expense of $1.4 million and $3.9 million for the same periods in 2023, respectively. Income tax expense is booked based upon expected annualized rates using the statutory rates of 23% for both Canada and the U.S.

The Company recognized a portion of its Canadian tax pools in 2024 Q3 due to management’s assessment and estimates that they will likely be utilized within the next twelve to eighteen months. The tax effected amount recognized was $11.1 million. The remaining tax pools remain unrecognized as at September 30, 2024.

LIQUIDITY AND CAPITAL RESOURCES

Annually, the Company’s principal source of liquidity is cash generated from its operations. In addition, the Company has the ability to fund liquidity requirements through its credit facility and the issuance of additional debt and/or equity, if available.

In order to facilitate the management of its liquidity, the Company prepares an annual budget, which is updated, as necessary, depending on varying factors, including changes in capital structure, execution of the Company’s business plan and general industry conditions. The annual budget is approved by the Board of Directors and updated forecasts are prepared as the fiscal year progresses with changes reviewed by the Board of Directors.

Cash flow – operating activities was $19.4 million and $69.2 million in 2024 Q3 and the nine months ended September 30, 2024, compared to $9.1 million and $53.4 million for the same periods in 2023, respectively. ACT remains focused on reducing its loans and borrowings and generating Free cash flow, as defined in the ‘Non-GAAP measures’ section of this news release. In addition, the Company will remain opportunistic in executing its NCIB and making strategic and accretive acquisitions.

At September 30, 2024, the Company had working capital, excluding current portion of loans and borrowings of $78.8 million (December 31, 2023 – $74.9 million).

Normal course issuer bid

During the nine months ended September 30, 2024, 506,800 (2023 – 347,843) common shares were purchased under the NCIB for a total purchase amount of $3.0 million (2023 – $2.2 million) at an average price of $5.91 (2023 – $5.74) per common share. A portion of the purchase amount reduced share capital by $2.9 million (2023 – $2.0 million), and the residual purchase amount of $0.1 million (2023 – $0.2 million) was recorded to the deficit.

In connection with the NCIB, the Company established an automatic securities purchase plan (“the Plan”). Accordingly, the Company may repurchase its common shares under the Plan on any trading day during the NCIB, including during regulatory restrictions or self-imposed trading blackout periods. The Plan commenced on July 29, 2024 and will terminate on July 28, 2025. As at September 30, 2024, the Company recognized $1.1 million as an accrued liability ($1.0 million reduced share capital, and $0.1 million was recorded to the deficit) for the maximum common shares to be purchased under the Plan. Subsequent to September 30, 2024, the Company purchased 179,800 common shares for a total purchase amount o $1.1 million, at an average purchase price of $6.04 per common share.

Syndicated and revolving credit facilities

On May 30, 2024, LTD and Holdco entered into a Fourth Amended and Restated Credit Agreement with its lenders (“Credit Agreement”) which provided for various administrative changes and the addition of a U.S. domiciled USD Revolving Operating Facility in the amount of $10.0 million. The terms of the Credit Agreement, including payment terms, interest rate and financial covenants remained unchanged. At September 30, 2024, the USD Revolving Operating Facility was undrawn.

During the nine months ended September 30, 2024, the Company withdrew $10.0 million of its Syndicated Operating Facility and repaid $5.0 million, resulting in an outstanding balance of $5.0 million as at September 30, 2024. As at September 30, 2024, $30.0 million of the $35.0 million Syndicated Operating Facility remained undrawn.

During the nine months ended September 30, 2024, the Company repaid $1.6 million of its CAD Revolving Operating Facility. As at September 30, 2024, the $15.0 million CAD Revolving Operating Facility remained undrawn.

In addition, the Company held its Highly Affected Sectors Credit Availability Program (“HASCAP”) loan with a balance of $0.7 million.

At September 30, 2024, the Company was in compliance with all covenants, including its financial covenants, which were as follows:

- Consolidated Funded Debt to Consolidated Credit Agreement EBITDA ratio shall not exceed 2.5:1; and

- Consolidated Fixed Charge Coverage ratio shall not be less than 1.25:1.

Contractual obligations and contingencies

As at September 30, 2024, the Company’s commitment to purchase property, plant and equipment is approximately $4.0 million, which is expected to be incurred in the remainder of 2024.

The Company also holds six letters of credit totaling $1.7 million related to rent payments, corporate credit cards and a utilities deposit.

The Company is involved in various other legal claims associated with the normal course of operations. The Company believes that any liabilities that may arise pertaining to such matters would not have a material impact on its financial position.

The following table outlines the anticipated payments related to contractual commitments subsequent to September 30, 2024:

|

Carrying amount |

One year |

1-2 years |

3-5 years |

Thereafter |

|

|

Loans and borrowings – principal |

$ 67,743 |

$ 21,141 |

$ 46,602 |

$ — |

$ — |

|

EP Notes – principal |

27,050 |

— |

27,050 |

— |

— |

|

Interest payments on loans and borrowings and EP Notes |

12,320 |

5,924 |

6,396 |

— |

— |

|

Lease liabilities – undiscounted |

13,734 |

3,955 |

2,922 |

6,443 |

414 |

|

Trade and other payables |

97,698 |

97,698 |

— |

— |

— |

|

Total |

$ 218,545 |

$ 128,718 |

$ 82,970 |

$ 6,443 |

$ 414 |

Capital structure

As at November 7, 2024, the Company has 34,876,425 common shares, 3,010,817 stock options and EP Notes that are exchangeable into a maximum of 3,510,000 common shares outstanding.

Share Consolidation

On May 9, 2024, the shareholders of the Company approved the consolidation of the issued and outstanding common shares of the Company, on the basis of one post-consolidation common share for a range of five to ten pre-consolidation common shares. On June 10, 2024, the Board of Directors approved a consolidation ratio of one post-consolidation share for seven pre-consolidation common shares (the “Consolidation”). As a result, on July 3, 2024, 243,383,392 common shares issued and outstanding prior to the Consolidation were reduced to 34,769,056 common shares. No fractional common shares were issued in connection with the Consolidation, and all fractional common shares that otherwise would have been issued was rounded to the nearest whole common share. The share units and per share amounts in this news release were restated to reflect the Consolidation.

NET CAPITAL EXPENDITURES

The following table details the Company’s Net capital expenditures:

|

Three months ended September 30, |

Nine months ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

Motors and related equipment |

$ 2,465 |

$ 8,005 |

$ 16,409 |

$ 22,786 |

|

MWD and related equipment |

5,159 |

6,581 |

19,378 |

9,854 |

|

Shop and automotive equipment |

98 |

335 |

480 |

2,084 |

|

Other |

1,386 |

481 |

2,824 |

3,126 |

|

Gross capital expenditures |

9,108 |

15,402 |

39,091 |

37,850 |

|

Less: net lost-in-hole equipment reimbursements |

(4,827) |

(7,399) |

(20,215) |

(19,288) |

|

Net capital expenditures (1) |

$ 4,281 |

$ 8,003 |

$ 18,876 |

$ 18,562 |

|

(1) |

Refer to the ‘Non-GAAP Measures’ section in this news release. |

In 2024 Q3 and the nine months ended September 30, 2024, the Company had capitalized costs recognized as intangible assets related to RSS licenses of $7.4 million and $13.5 million (2023 – $nil), respectively.

As at September 30, 2024, property, plant and equipment included $13.6 million (December 31, 2023 – $4.6 million) of directional drilling equipment not yet being depreciated as they are currently being manufactured and tested. Depreciation of the assets will commence upon the assets being fully operational.

The Company’s 2024 Net capital expenditure budget, including capital costs related to RSS licenses, is expected to be approximately $30 million to $35 million (2023 – $27 million to $32 million), excluding any potential acquisitions. The Net capital expenditure budget is targeted at growing ACT’s high-performance mud motors, MWD in both Canada and the U.S., and RSS in the U.S. ACT intends to fund its 2024 capital plan from cash flow – operating activities.

NON-GAAP MEASURES

ACT uses certain performance measures throughout this news release that are not defined under IFRS Accounting Standards or Generally Accepted Accounting Principles (“GAAP”). These non-GAAP measures do not have a standardized meaning and may differ from that of other organizations, and accordingly, may not be comparable. Investors should be cautioned that these measures should not be construed as alternatives to IFRS Accounting Standards measures as an indicator of ACT’s performance.

These measures include the Adjusted gross margin, Adjusted gross margin %, Adjusted EBITDAS, Adjusted EBITDAS margin %, Adjusted EBITDAS per diluted share, Free cash flow, Working capital and Net capital expenditures. Management believes these measures provide supplemental financial information that is useful in the evaluation of ACT’s operations.

These non-GAAP measures are defined as follows:

i) “Adjusted gross margin” – calculated as gross margin before non-cash costs (write-down of inventory, depreciation, amortization and share-based compensation); is considered a primary indicator of operating performance (see tabular calculation);

ii) “Adjusted gross margin %” – calculated as Adjusted gross margin divided by revenues; is considered a primary indicator of operating performance (see tabular calculation);

iii) “Adjusted EBITDAS” – calculated as net income before finance costs, unrealized foreign exchange on intercompany balances, income tax expense, depreciation, amortization, gain on settlement of lease liabilities, non-recurring costs, write-down of inventory and share-based compensation; provides supplemental information to net income that is useful in evaluating the results and financing of the Company’s business activities before considering certain charges (see tabular calculation);

iv) “Adjusted EBITDAS margin %” – calculated as Adjusted EBITDAS divided by revenues; provides supplemental information to net income that is useful in evaluating the results and financing of the Company’s business activities before considering certain charges as a percentage of revenues (see tabular calculation);

v) “Adjusted EBITDAS per basic and diluted share” – calculated as Adjusted EBITDAS divided by the basic and diluted weighted average common shares outstanding; provides supplemental information to net income that is useful in evaluating the results and financing of the Company’s business activities before considering certain charges on a per basic and diluted common share basis;

vi) “Free cash flow” – calculated as cash flow – operating activities prior to: i) changes in non-cash working capital, ii) income tax paid (refund) and iii) non-recurring costs less: i) PP&E and intangible asset additions, excluding assets acquired in business combinations, ii) required repayments on loans and borrowings, in accordance with the Company’s credit facility agreement, and iii) repayments of lease liabilities, net of finance costs, offset by proceeds on disposal of PP&E. Management uses this measure as an indication of the Company’s ability to generate funds from its operations to support future capital expenditures, additional repayments of loans and borrowings or other initiatives (see tabular calculation).

The Company has deducted intangible asset additions from its Free cash flow calculation in 2024 Q1, compared to being excluded in prior periods. The change of the calculation is mainly due to more significant additions in the period as the Company expanded its RSS tool fleet and the related licenses, as well as expected cash outflows in the future related to intangible assets as the Company expands its technology offerings.

vii) “Working capital” – calculated as current assets less current liabilities, excluding the current portion of loans and borrowings. Management uses this measure as an indication of the Company’s financial and cash liquidity position.

viii) “Net capital expenditures” – calculated as the gross capital expenditures less reimbursements from customers and insurance proceeds related to equipment lost-in-hole and damaged beyond repair, net of payments to vendors for insurance coverage and third-party rental equipment lost-in-hole or damaged beyond repair – refer to the “Capital expenditures” section of this news release.

The following tables provide reconciliations from the IFRS Accounting Standards to non-GAAP measures.

Adjusted gross margin

|

Three months ended September 30, |

Nine months ended September 30, |

|||

|

2024 |

2023 |

2024 |

2023 |

|

|

Gross margin |

$ 37,585 |

$ 33,025 |

$ 100,267 |

$ 75,546 |

|