A Closer Look at Airbnb's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on Airbnb ABNB.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ABNB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 17 uncommon options trades for Airbnb.

This isn’t normal.

The overall sentiment of these big-money traders is split between 47% bullish and 41%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $227,369, and 11 are calls, for a total amount of $558,152.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $160.0 for Airbnb over the last 3 months.

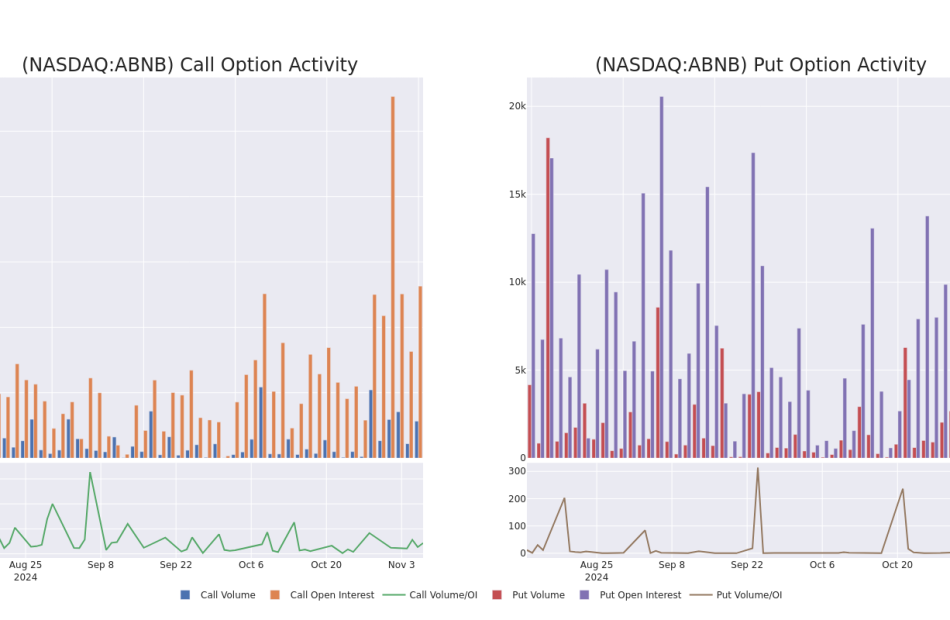

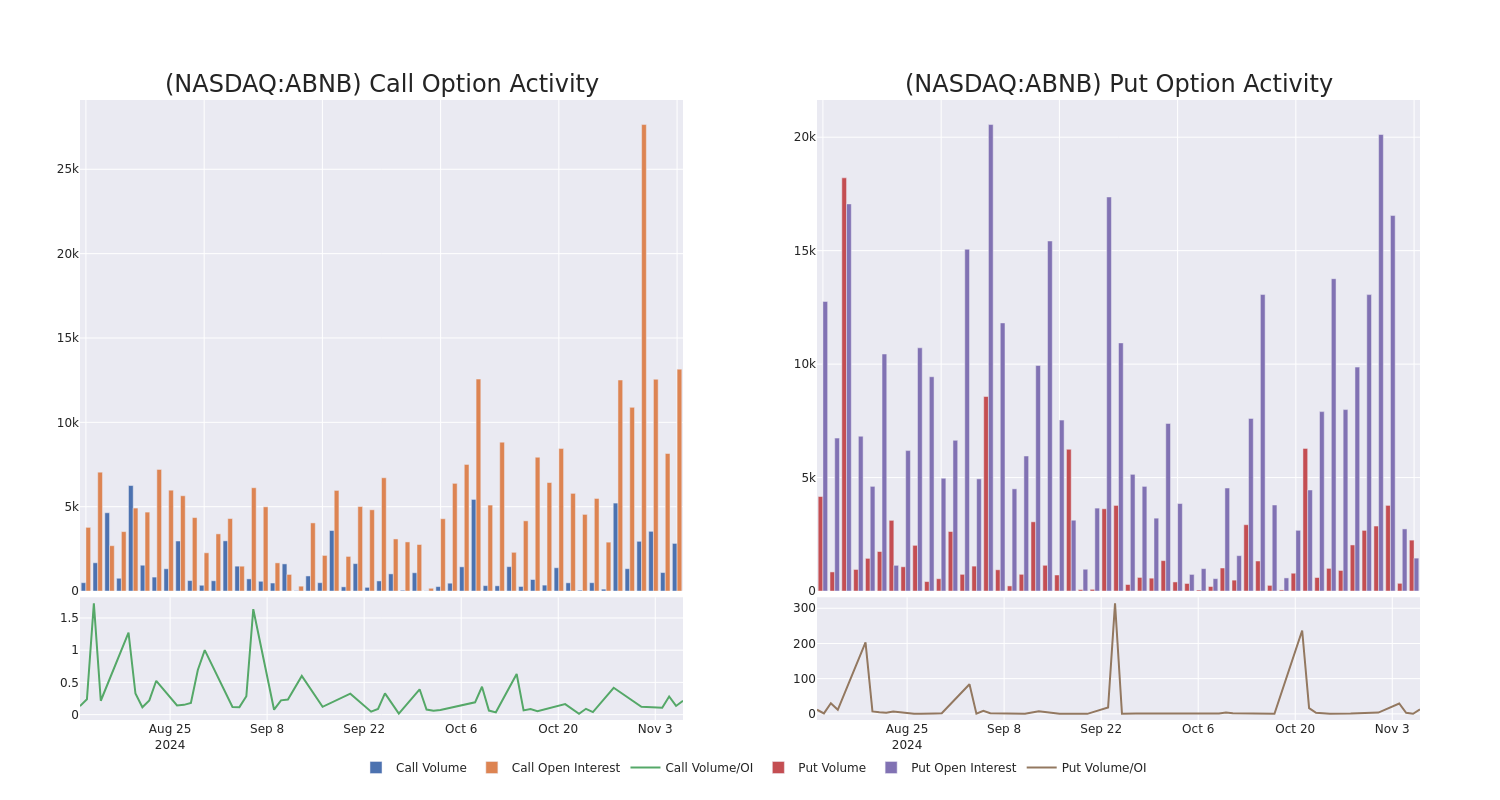

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Airbnb options trades today is 1123.46 with a total volume of 5,067.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Airbnb’s big money trades within a strike price range of $90.0 to $160.0 over the last 30 days.

Airbnb 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABNB | CALL | TRADE | BEARISH | 12/20/24 | $9.05 | $8.9 | $8.9 | $145.00 | $226.0K | 882 | 776 |

| ABNB | PUT | SWEEP | BEARISH | 11/08/24 | $3.9 | $3.85 | $3.85 | $140.00 | $64.6K | 188 | 822 |

| ABNB | PUT | TRADE | BEARISH | 11/08/24 | $5.4 | $5.15 | $5.4 | $143.00 | $54.0K | 28 | 107 |

| ABNB | CALL | SWEEP | NEUTRAL | 11/08/24 | $5.35 | $4.9 | $5.31 | $146.00 | $53.2K | 70 | 144 |

| ABNB | CALL | SWEEP | BEARISH | 11/08/24 | $5.4 | $5.2 | $5.25 | $147.00 | $40.6K | 181 | 82 |

About Airbnb

Started in 2008, Airbnb is the world’s largest online alternative accommodation travel agency, also offering booking services for boutique hotels and experiences. Airbnb’s platform offered over 8 million active accommodation listings as of June 30, 2024. Listings from the company’s over 5 million hosts are spread over almost every country in the world. In 2023, 50% of revenue was from the North American region. Transaction fees for online bookings account for all its revenue.

Airbnb’s Current Market Status

- With a trading volume of 6,380,131, the price of ABNB is up by 5.33%, reaching $148.42.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 0 days from now.

What Analysts Are Saying About Airbnb

3 market experts have recently issued ratings for this stock, with a consensus target price of $140.33333333333334.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities has decided to maintain their Neutral rating on Airbnb, which currently sits at a price target of $142.

* An analyst from UBS persists with their Neutral rating on Airbnb, maintaining a target price of $144.

* Consistent in their evaluation, an analyst from Jefferies keeps a Hold rating on Airbnb with a target price of $135.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Airbnb, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Denison Reports Financial and Operational Results for Q3'2024, Including Positive Progress on Phoenix Engineering and Regulatory Review

TORONTO, Nov. 7, 2024 /PRNewswire/ – Denison Mines Corp. (‘Denison’ or the ‘Company’) DML DNN today filed its Condensed Consolidated Financial Statements and Management’s Discussion & Analysis (‘MD&A’) for the three and nine months ended September 30, 2024. Both documents will be available on the Company’s website at www.denisonmines.com, SEDAR+ (at www.sedarplus.ca) and EDGAR (at www.sec.gov/edgar.shtml). The highlights provided below are derived from these documents and should be read in conjunction with them. All amounts in this release are in Canadian dollars unless otherwise stated. View PDF version

David Cates, President and CEO of Denison commented, “Our third quarter report includes an update on the positive progress of our engineering and regulatory approval efforts for our planned Phoenix In-Situ Recovery (‘ISR’) uranium mining operation. We continue to rapidly advance detailed design engineering efforts and achieved completion of 45% of total engineering by the end of the third quarter. Long-lead procurement efforts continued to ramp up. Currently, $21 million in milestone payments or commitments have been made for items included in our estimates of initial project capex, with several additional procurement packages in progress.

On the regulatory side, we are pleased to report that substantially all outstanding information requests (‘IRs’) from the Canadian Nuclear Safety Commission’s (‘CNSC’) review of the Wheeler River draft Environmental Impact Statement (‘EIS’) have been resolved, and the Federal review process is nearing completion. Given this positive progress with the Federal review, we have opted to submit a final Provincial EIS to the Saskatchewan Ministry of Environment to advance the process of obtaining formal approval from the Province.

Beyond Wheeler River, we are pleased with the progress of the SABRE program at the McClean North deposit, which remains on track for production in 2025. Our team is also active on our portfolio of other development and exploration projects, with study work advancing on both the Midwest project and the Tthe Heldeth Túé (‘THT’) deposit, with the potential to result in updated or new technical studies in the coming months.

Also notable is our recent transaction with Foremost Clean Energy, which involves Denison optioning up to 70% of its interests in a portfolio of 10 exploration properties. The transaction was designed to amplify our exposure to future discovery by encouraging exploration on – and retaining significant ownership of – properties that would otherwise have received little attention from Denison with our current focus on development and mining-stage projects.”

Q3 2024 MD&A Highlights

- Signing of Wheeler River Benefit Agreements with Kineepik Métis Local #9 and the Village of Pinehouse Lake

In July 2024, Denison announced the signing of a Mutual Benefits Agreement (‘MBA’) with Kineepik Métis Local #9 (‘KML’), and a Community Benefit Agreement (‘CBA’) with the northern Village of Pinehouse Lake (‘Pinehouse‘), in support of the development and operation of Denison’s 95% owned Wheeler River Project.

The MBA acknowledges that the project is located within KML’s Land and Occupancy Area in northern Saskatchewan and provides KML’s consent and support to advance the project. Additionally, the MBA recognizes that the development and operation of the project can support KML in advancing its social and economic development aspirations while mitigating the impacts on the local environment and KML members. The MBA provides KML and its Métis members an important role in environmental monitoring and commits to the sharing of benefits from the successful operation of the project – including benefits from community investment, business opportunities, employment and training opportunities, and financial compensation.

The CBA acknowledges that Pinehouse is the closest residential community to the project by road, which relies on much of the same regional infrastructure that Denison will rely on as it advances the project. Pinehouse has provided its consent and support for the project, while Denison, on behalf of the Wheeler River Joint Venture, is committed to helping Pinehouse develop its own capacity to take advantage of economic and other development opportunities in connection with the advancement and operation of the project.

- Continued Advancement of Phoenix Engineering and Federal Regulatory Review of the Draft EIS

During the third quarter, the Company continued to focus its efforts on the advancement of the Phoenix project towards a final investment decision in support of its objective to achieve first production by 2027 / 2028, including:

-

- Phoenix engineering activities are advancing within expected timelines to support a financial investment decision (‘FID’) by mid-2025. Total engineering completion at end of the third quarter was 45%, supported by finalization of process design, piping and instrumentation diagrams (P&ID’s), hazard and operability studies (‘HAZOPs’), as well as the selection of major process equipment and electrical distribution infrastructure.

- The review of the draft EIS continues to advance and Denison has been in regular contact with CNSC staff to support the conclusion of any remaining IRs. In September 2024, Denison received confirmation that the majority of outstanding IRs have been resolved, which suggests that the Federal review process is nearing completion.

- Phoenix engineering activities are advancing within expected timelines to support a financial investment decision (‘FID’) by mid-2025. Total engineering completion at end of the third quarter was 45%, supported by finalization of process design, piping and instrumentation diagrams (P&ID’s), hazard and operability studies (‘HAZOPs’), as well as the selection of major process equipment and electrical distribution infrastructure.

- Option of Non-Core Exploration Projects to Foremost Clean Energy Ltd.

In September 2024, Denison executed an option agreement with Foremost Clean Energy Ltd (‘Foremost’), which grants Foremost an option to acquire up to 70% of Denison’s interests in 10 non-core uranium exploration properties (collectively, the ‘Foremost Transaction’). Pursuant to the Foremost Transaction, Foremost would acquire such total interests upon completion of a combination of direct payments to Denison and funding of exploration expenditures with an aggregate value of up to approximately $30 million. The Foremost Transaction provides the following benefits to Denison:

-

- Collaboration with Foremost is expected to increase exploration activity on a portfolio of non-core Denison properties with the potential to increase the probability of discovery within Denison’s vast Athabasca Basin exploration portfolio.

- In October 2024, Denison received an upfront payment in Foremost common shares (representing a ~19.95% ownership interest in Foremost). If Foremost completes the remaining two phases of the Foremost Transaction Denison will receive further cash and/or common share milestone payments of $4.5 million and Foremost will fund $20 million in project exploration expenditures.

- In addition to becoming Foremost’s largest shareholder, Denison retains direct interests in the optioned exploration properties and also secures certain strategic pre-emptive rights to participate in future exploration success from the optioned properties.

- Collaboration with Foremost is expected to increase exploration activity on a portfolio of non-core Denison properties with the potential to increase the probability of discovery within Denison’s vast Athabasca Basin exploration portfolio.

About Denison

Denison Mines Corp. was formed under the laws of Ontario and is a reporting issuer in all Canadian provinces and territories. Denison’s common shares are listed on the Toronto Stock Exchange (the ‘TSX’) under the symbol ‘DML’ and on the NYSE American exchange under the symbol ‘DNN’.

Denison is a uranium mining, exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. The Company has an effective 95% interest in its flagship Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region of northern Saskatchewan. In mid-2023, the Phoenix FS was completed for the Phoenix deposit as an ISR mining operation, and an update to the previously prepared 2018 Pre-Feasibility Study (‘PFS’) was completed for Wheeler River’s Gryphon deposit as a conventional underground mining operation. Based on the respective studies, both deposits have the potential to be competitive with the lowest cost uranium mining operations in the world. Permitting efforts for the planned Phoenix ISR operation commenced in 2019 and have advanced significantly, with licensing in progress and a draft Environmental Impact Study (‘EIS’) submitted for regulatory and public review in October 2022.

Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake Joint Venture (‘MLJV’), which includes unmined uranium deposits (planned for extraction via the MLJV’s SABRE mining method starting in 2025) and the McClean Lake uranium mill (currently utilizing a portion of its licensed capacity to process the ore from the Cigar Lake mine under a toll milling agreement), plus a 25.17% interest in the Midwest Joint Venture (‘MWJV’)’s Midwest Main and Midwest A deposits, and a 69.44% interest in the Tthe Heldeth Túé (‘THT’) and Huskie deposits on the Waterbury Lake Property (‘Waterbury’). The Midwest Main, Midwest A, THT and Huskie deposits are located within 20 kilometres of the McClean Lake mill. Taken together, the Company has direct ownership interests in properties covering ~384,000 hectares in the Athabasca Basin region.

Additionally, through its 50% ownership of JCU (Canada) Exploration Company, Limited (‘JCU’), Denison holds interests in various uranium project joint ventures in Canada, including the Millennium project (JCU, 30.099%), the Kiggavik project (JCU, 33.8118%) and Christie Lake (JCU, 34.4508%).

Technical Disclosure and Qualified Person

The technical information contained in this press release has been reviewed and approved by Chad Sorba, P.Geo., Denison’s Vice President Technical Services & Project Evaluation, and Andy Yackulic, P.Geo., Denison’s Vice President Exploration, who are both Qualified Persons in accordance with the requirements of NI 43-101.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this press release constitutes ‘forward-looking information’, within the meaning of the applicable United States and Canadian legislation concerning the business, operations and financial performance and condition of Denison. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as ‘plans’, ‘expects’, ‘budget’, ‘scheduled’, ‘estimates’, ‘forecasts’, ‘intends’, ‘anticipates’, or ‘believes’, or the negatives and/or variations of such words and phrases, or state that certain actions, events or results ‘may’, ‘could’, ‘would’, ‘might’ or ‘will be taken’, ‘occur’, ‘be achieved’ or ‘has the potential to’.

In particular, this press release contains forward-looking information pertaining to the following: projections with respect to exploration, development and expansion plans and objectives, including the scope, objectives and interpretations of FS, PFS and the Wheeler River technical de-risking process for the proposed ISR operation for the Phoenix deposit; expectations with respect to the EA, EIS and licensing and permitting for proposed operations at Wheeler River; anticipated benefits of the transaction with Foremost; expectations regarding the restart of mining operations at McClean Lake; expectations regarding the assessment of the amenability of ISR for THT and advancement of technical studies for the Midwest deposit; expectations regarding the performance of the uranium market and global sentiment regarding nuclear energy; expectations regarding Denison’s joint venture ownership interests; and expectations regarding the objectives and continuity of its agreements with third parties. Statements relating to ‘mineral reserves’ or ‘mineral resources’ are deemed to be forward-looking information, as they involve the implied assessment, based on certain estimates and assumptions that the mineral reserves and mineral resources described can be profitably produced in the future.

Forward looking statements are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Denison to be materially different from those expressed or implied by such forward-looking statements. For example, the results and underlying assumptions and interpretations of the FS and PFS may not be maintained after further testing or be representative of actual conditions within the applicable deposits. In addition, Denison may decide or otherwise be required to discontinue testing, evaluation, engineering, and development work if it is unable to maintain or otherwise secure the necessary approvals or resources (such as testing facilities, capital funding, etc.). Denison believes that the expectations reflected in this forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be accurate and results may differ materially from those anticipated in this forward-looking information. For a discussion in respect of risks and other factors that could influence forward-looking events, please refer to the factors discussed in the Company’s Annual Information Form dated March 28, 2024 under the heading ‘Risk Factors’. These factors are not, and should not be, construed as being exhaustive.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking information contained in this press release is expressly qualified by this cautionary statement. Any forward-looking information and the assumptions made with respect thereto speaks only as of the date of this press release. Denison does not undertake any obligation to publicly update or revise any forward-looking information after the date of this press release to conform such information to actual results or to changes in Denison’s expectations except as otherwise required by applicable legislation.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/denison-reports-financial-and-operational-results-for-q32024-including-positive-progress-on-phoenix-engineering-and-regulatory-review-302299445.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/denison-reports-financial-and-operational-results-for-q32024-including-positive-progress-on-phoenix-engineering-and-regulatory-review-302299445.html

SOURCE Denison Mines Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chevron Unusual Options Activity

Benzinga’s options scanner has just identified more than 10 option transactions on Chevron CVX, with a cumulative value of $857,330. Concurrently, our algorithms picked up 2 puts, worth a total of 67,694.

What’s The Price Target?

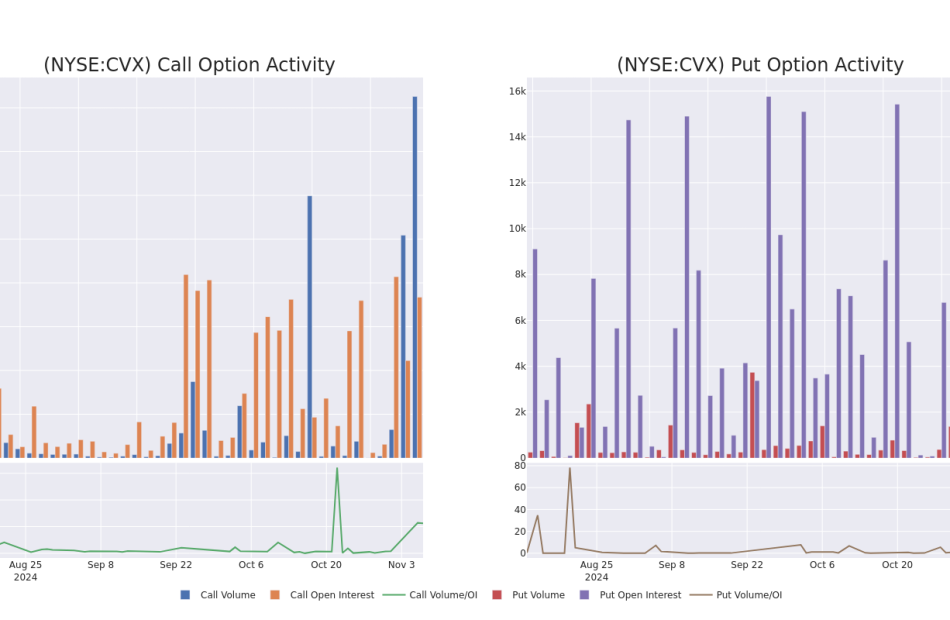

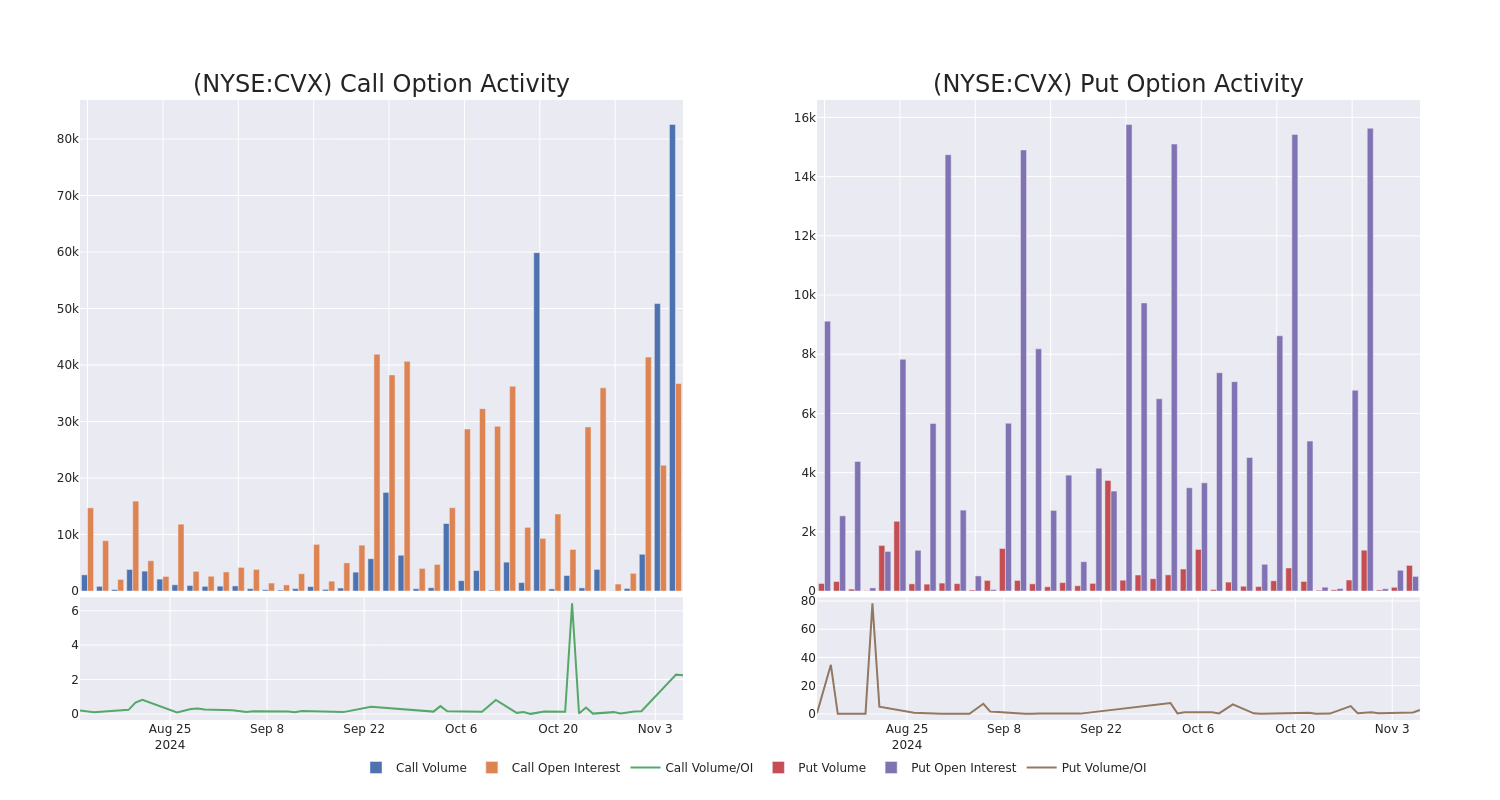

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $148.0 and $175.0 for Chevron, spanning the last three months.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Chevron options trades today is 7446.8 with a total volume of 83,433.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Chevron’s big money trades within a strike price range of $148.0 to $175.0 over the last 30 days.

Chevron Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVX | CALL | SWEEP | BULLISH | 01/17/25 | $2.54 | $2.42 | $2.54 | $165.00 | $254.1K | 10.8K | 1.0K |

| CVX | CALL | SWEEP | BULLISH | 01/17/25 | $1.52 | $1.47 | $1.47 | $170.00 | $181.9K | 23.8K | 18.9K |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.75 | $11.65 | $11.75 | $155.00 | $77.5K | 2.0K | 348 |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.75 | $11.4 | $11.65 | $155.00 | $76.8K | 2.0K | 1.0K |

| CVX | CALL | TRADE | BULLISH | 06/20/25 | $11.65 | $11.55 | $11.65 | $155.00 | $76.8K | 2.0K | 414 |

About Chevron

Chevron is an integrated energy company with exploration, production, and refining operations worldwide. It is the second-largest oil company in the United States with production of 3.1 million of barrels of oil equivalent a day, including 7.7 million cubic feet a day of natural gas and 1.8 million of barrels of liquids a day. Production activities take place in North America, South America, Europe, Africa, Asia, and Australia. Its refineries are in the US and Asia for total refining capacity of 1.8 million barrels of oil a day. Proven reserves at year-end 2023 stood at 11.1 billion barrels of oil equivalent, including 6.0 billion barrels of liquids and 30.4 trillion cubic feet of natural gas.

After a thorough review of the options trading surrounding Chevron, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Chevron

- With a volume of 4,985,443, the price of CVX is up 0.3% at $158.19.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 85 days.

What Analysts Are Saying About Chevron

5 market experts have recently issued ratings for this stock, with a consensus target price of $171.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Truist Securities persists with their Hold rating on Chevron, maintaining a target price of $155.

* Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Outperform rating for Chevron, targeting a price of $163.

* An analyst from RBC Capital persists with their Outperform rating on Chevron, maintaining a target price of $175.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Chevron with a target price of $194.

* An analyst from B of A Securities has revised its rating downward to Buy, adjusting the price target to $168.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chevron, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Asian Stocks Follow US Rally After Fed Rate Cut: Markets Wrap

(Bloomberg) — Asian equities climbed Friday after stocks, bonds and commodities all rallied in the US as the Federal Reserve cut interest rates.

Most Read from Bloomberg

Australian, Japanese, South Korean and Chinese shares all advanced, supporting a second day of gains for a region-wide equity gauge. That was after the S&P 500 rose 0.7% and the Nasdaq 100 climbed 1.5%, both setting fresh peaks. Treasuries ticked lower in Asia while US equity futures were little changed.

Investors are shifting focus from the Fed to China, where lawmakers are expected to approve a fiscal package worth trillions of yuan, potentially offsetting the impact of potential US trade tariffs under Donald Trump.

Such measures may include support for local government debt and consumer spending, according to Michelle Lam, greater China economist for Societe Generale. Any new policies must be balanced against the prospect of potential tariffs, she said, noting that the 60% levies mooted by Trump may fail to emerge.

“We have so much uncertainty coming from the US tariffs,” Lam said. “We might see some smaller increase in tariffs of around 15% to 20% and that is more reasonable” for the Chinese economy to absorb, she said.

Thursday’s cross-asset rally was helped along by comments from Fed Chair Jerome Powell who pointed to the strength of the US economy and said he doesn’t rule “out or in” a December rate cut. Powell added the election will have no effect on policy in the near term, and said he would not step aside if asked by Trump.

“Powell & Co. reminded investors about the solid economic footing the US continues to stand on,” said Bret Kenwell at eToro. “Powell would not tip his hand on whether the Fed would likely cut rates in December, which shouldn’t surprise investors. However, the Fed appears more comfortable with the labor market and the current US economic backdrop than they did a few months ago.”

Bloomberg’s dollar index was little changed in Asia after sliding 0.8% Thursday, its worst day since August, as the greenback trimmed its post election gains. The yen drifted lower Friday after rallying 1.1% the day before to largely erase its declines against the dollar this week.

Local Chinese banks are joining more higher-yielding offshore loans of mainland firms as rates fall at home amid monetary easing measures.

Elsewhere in Asia, Japanese automaker Nissan Motor Co., will dismiss 9,000 workers and cut a fifth of its manufacturing capacity after net income plummeted 94% in the first half. South Korea said it will bolster its monitoring of financial markets and respond “actively” to ease any excessive volatility.

Peter T Heilmann Implements A Sell Strategy: Offloads $877K In Matson Stock

On November 6, a recent SEC filing unveiled that Peter T Heilmann, EVP at Matson MATX made an insider sell.

What Happened: Heilmann’s decision to sell 5,404 shares of Matson was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $877,373.

In the Thursday’s morning session, Matson‘s shares are currently trading at $166.03, experiencing a up of 0.21%.

Discovering Matson: A Closer Look

Matson Inc is engaged in providing ocean transportation and logistics services. The business segments of the company are Ocean Transportation which provides ocean freight transportation services to the domestic non-contiguous economies of Hawaii, Alaska, California, Okinawa, and different islands in the South Pacific, and Logistics segment which offers long haul and regional highway trucking services, warehousing and distribution services, supply chain management, and freight forwarding services. The firm generates the majority of its revenue from Ocean Transportation segment.

Matson: A Financial Overview

Positive Revenue Trend: Examining Matson’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 16.25% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 31.99%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Matson’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 5.98.

Debt Management: Matson’s debt-to-equity ratio is below the industry average at 0.26, reflecting a lower dependency on debt financing and a more conservative financial approach.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 13.96 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 1.73, Matson’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Matson’s EV/EBITDA ratio, surpassing industry averages at 7.19, positions it with an above-average valuation in the market.

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Transaction Codes To Focus On

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Matson’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Co. Jushi Reports Q3 Earnings: Higher Margins Despite Revenue Dip – What's Driving Profitability?

In its latest quarterly earnings report, Jushi Holdings Inc. JUSH JUSHF revealed a mixed financial picture for Q3 2024, showcasing operational resilience despite mounting challenges in competitive markets. The cannabis multi-state operator saw some revenue decline but managed to maintain solid gross margins and an uptick in adjusted EBITDA, signaling a disciplined approach to cost management and operational efficiencies across its cannabis operations.

Revenue And Gross Profit Margins: Resilience In Competitive Markets

For Q3 2024, Jushi recorded revenue of $61.6 million, a 5.8% year-over-year decrease from $65.4 million in Q3 2023 and a slight drop from $64.6 million in Q2 2024. This revenue decline was mainly attributed to intense competition and price compression in Illinois, Pennsylvania and Nevada. Despite these headwinds, Jushi’s gross profit for Q3 2024 remained strong at $28.0 million, with a gross margin of 45.4%—up from 43.6% in Q3 2023, though down from the 50.4% margin achieved in Q2 2024.

“Our organization-wide operational improvement plan is yielding promising results,” said CEO Jim Cacioppo. “We have focused on enhancing efficiencies at our cultivation and processing facilities, allowing us to maintain a competitive gross margin.”

Profitability And Net Loss Trends

One standout figure in Jushi’s report is the year-over-year improvement in net loss. For Q3 2024, the company reported a net loss of $16.0 million, a notable reduction from the $20.6 million loss recorded in Q3 2023, though a significant increase from the Q2 2024 net loss of just $1.9 million. The quarter-over-quarter fluctuation reflects Jushi’s higher operating expenses, partially driven by market competition and expansion efforts in new markets such as Ohio.

Adjusted EBITDA, a key indicator of operational profitability, reached $10.3 million in Q3 2024, up 6.5% from $9.7 million in Q3 2023. However, this figure was down from Q2 2024’s adjusted EBITDA of $14.5 million, as Jushi faced competitive pressures that led to increased promotions and pricing adjustments. The adjusted EBITDA margin for Q3 2024 was 16.8%, an improvement from Q3 2023’s 14.9% margin, but down from Q2 2024’s 22.4%.

Strategic Expansion And Product Innovation

Jushi’s growth strategy in Q3 2024 centered on expanding its footprint and enhancing product offerings. The company increased Jushi-branded product sales, which now account for 55% of total retail revenue, up from 52% in Q3 2023. This boost demonstrates Jushi’s commitment to building brand loyalty and maximizing profitability through higher-margin products.

In addition to brand-driven growth, Jushi launched 278 new SKUs in Q3 2024 across multiple categories, including flower, pre-rolls, edibles and concentrates. This product diversification aims to attract a broader customer base and cater to varying market preferences.

Jushi also focused on expansion in Ohio, where it launched adult-use sales and received a provisional license for a new Beyond Hello dispensary in Springdale, expected to open in early 2025. These moves align with Jushi’s objective of scaling its presence in Ohio, a high-potential market that could counterbalance competitive pressures in other states.

Improved Capital Structure And Debt Reduction

Throughout Q3 2024, Jushi made considerable strides in reducing its debt burden. During the first nine months of the year, the company managed to cut debt by approximately $19.7 million, including refinancing its first lien debt through SunStream Bancorp Inc. with new secured term loans amounting to $48.5 million. As of September 30, 2024, Jushi reported $22.9 million in cash and cash equivalents, indicating strong liquidity amid industry challenges.

“Our focus remains on strengthening our capital structure,” Cacioppo added. “By reducing our debt, we are better positioned to navigate economic fluctuations and pursue strategic growth opportunities in key markets like Ohio, Pennsylvania, and Virginia.”

Forward-Looking Strategies

Looking ahead, Jushi plans to continue leveraging its brand portfolio and expand into high-growth markets. As its cultivation facilities mature, the company expects to enhance product quality and yield, allowing it to remain competitive despite industry headwinds. Additionally, Jushi’s expansion efforts in Ohio and the debut of new product lines such as the Uncommon Kind edibles brand reflect a strategic approach to diversifying revenue streams.

In a rapidly evolving cannabis industry, Jushi’s focus on operational efficiency, brand growth and prudent financial management could position the company to achieve sustained profitability in the long term.

Cover image made with AI

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Powell Dismisses Talk Of Resignation After Trump Victory, Says 'Policy Is Still Restrictive'

Federal Reserve Chair Jerome Powell firmly dismissed speculation Thursday over his potential resignation or removal upon Donald Trump‘s return to the White House, stating the president cannot legally fire the central banker.

At the press conference following the Federal Reserve’s decision to lower the benchmark interest rate by 25 basis points to a target range of 4.5%-4.75%, Powell addressed swirling questions about his future and the Fed reactions after the election results.

When asked “if he asked you to leave, would you go?” Powell responded with a clear “no.”

The president-elect, who has previously criticized Powell for not slashing rates quickly enough, is “not permitted under the law” to fire a central bank governor, stressing the need to preserve Fed’s independence from political will.

The Fed’s approach to setting policy remains reactive to economic data. “We don’t guess, we don’t speculate, and we don’t assume,” he said.

He warned that “U.S. fiscal policy is on an unsustainable path,” though he emphasized that fiscal matters fall outside the Fed’s direct control.

Powell also addressed the recent increase in Treasury yields, asserting that the rise likely reflects expectations for stronger economic growth rather than a significant shift in inflation expectations.

Related Link: Fed Cuts Interest Rates To Lowest Since February 2023, Sticks To Data-Driven Path

Fed Rate Cut: ‘Recalibration’ Amid Restrictive Policy

Powell described Thursday’s rate cut as a “further recalibration of policy stance” to support the economy’s strength while continuing the fight against inflation.

He emphasized that despite the reduction, “policy is still restrictive,” indicating the Fed’s stance is not yet accommodative or neutral.

Powell highlighted the U.S. economy’s “robust” expansion, underscored by steady growth and moderating inflation. Despite signs of cooling, the labor market remains solid, with the unemployment rate at 4.1% in October.

Though the October nonfarm payrolls report showed a sharp drop in the pace of job creation — 12,000 compared to 232,000 in September — Powell attributes this decline to strikes and hurricanes rather than fundamental weakness.

Labor market dynamics have shifted over the last year, with wage growth moderating and job openings declining to levels considered more sustainable.

Labor conditions are no longer a significant source of inflationary pressure and wage gains have aligned with the Fed’s 2% inflation target, Powell said.

The omission of certain phrases in the November statement — such as “further progress” on disinflation and “the committee had gained greater confidence that inflation was progressing towards its 2% goal” — was not intended to signal a pause or suggest concerns about persistent inflation, he said.

The previous language in the September statement was specific to the rationale behind the initial rate cut at that time, the Fed Chair said.

When asked about the possibility of a December rate cut, Powell declined to give any indication, reiterating that the Fed’s decision would be guided by incoming economic data.

Read Next:

Federal Reserve Chair Jerome Powell speaks at a press conference Wednesday, May 1, 2024. Photo courtesy of the Federal Reserve.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cipher Pharmaceuticals Reports Third Quarter 2024 Results

(All figures are presented in U.S. Dollars)

- Successfully closed the acquisition of the U.S. based Natroba™ business on July 26, 2024

- Epuris sales volumes grew 29% compared to Q3 2023, continuing growth trajectory for the fifth consecutive quarter

- Strong product gross margin from the acquired Natroba products of 85%

- Added management depth with appointment of Dr. Hamed Ghanei, Chief Business Officer

MISSISSAUGA, ON, Nov. 7, 2024 /CNW/ – Cipher Pharmaceuticals Inc. CPH CPHRF (“Cipher” or the “Company“) today announced its financial and operating results for the three and nine months ended September 30, 2024.

Third Quarter 2024 Financial Highlights

(All figures in U.S. dollars, compared to Q3 2023, unless otherwise noted)

- Total revenue was $10.4 million in Q3 2024, an increase of 71%

- Total product revenue increased by 213% to $9.3 million in Q3 2024 compared to $3.0 million in Q3 2023

- Epuris product revenue increased by 32% to $3.4 million in Q3 2024 compared to $2.5 million in Q3 2023

- Natroba™ and its authorized generic contributed $5.4 million in product revenue in Q3 2024

- Licensing revenue decreased by 66% to $1.1 million in Q3 2024, compared to $3.1 million in an unusually strong Q3 2023, due to lower product shipments and royalties from the Absorica portfolio

- Gross margin on product revenue increased by 15% to 79% in Q3 2024, compared to 64% in Q3 2023, due to higher gross margin from the acquired Natroba business

- Adjusted EBITDA1 was $4.1 million in Q3 2024, an increase of 13%

Acquisition of Natroba

- On July 29, 2024, Cipher announced the signing of a definitive asset purchase agreement with ParaPRO LLC (“ParaPRO”) and the closing of the acquisition of the global rights of Natroba™ (Spinosad), as well as the commercial sales team in the U.S. for total consideration of $89.5 million (the “Natroba Acquisition”).

- Cipher plans to use the commercial footprint acquired from ParaPRO north of Indianapolis in Carmel, Indiana as its U.S. headquarters and a platform to launch unique dermatology and infectious disease products complementary to Natroba™ across the U.S.

- Cipher paid $80 million in cash (satisfied from $40 million from cash on hand and $40 million from a new credit facility) and issued $9.5 million in common shares of Cipher to ParaPRO (1,474,097 shares at a deemed issue price of CDN$8.91).

- Cipher entered into a new credit agreement and partnership with the National Bank of Canada, with a $65 million revolving credit facility which was partially drawn to fund the Natroba™ transaction and will be available to provide financing to fuel Cipher’s continued future growth plans. Under the terms of the credit agreement, Cipher also has access to an optional $25 million accordion feature. The credit facility matures three years after July 26, 2024 and has an optional annual extension clause. As a result of entering into the new credit facility, Cipher terminated its previous undrawn credit facility with the Royal Bank of Canada.

Management Commentary

Craig Mull, Interim CEO, commented: “During the third quarter, we took great steps forward to close the acquisition of the Natroba business from ParaPRO LLC. We have been diligently integrating the business into the existing Cipher infrastructure, and have established our U.S. based headquarters in Carmel, Indiana. We believe this integration will be complete by the end of the year.

Having now spent in depth time with our U.S. sales team, we are highly impressed with the talent and motivation of our new Cipher employees and are highly confident in our ability to both grow the Natroba business and scale the business in the future with additional complementary products.”

Bryan Jacobs, President, U.S. Operations, commented: “Head lice and scabies greatly impacts families and ensuring parents and physicians have access to the FDA designated complete cure that Natroba offers is our focus. Our main market competitor permethrin is no longer effective due to evolving resistance over time, so we are confident in our ability to grow the Natroba business and market share.

We have recently added new territory managers and sale team members as part of a strategy to insource sales in certain states away from a prior co-promotion partner of ParaPRO LLC. While this transition will take a few months, we believe this strategy will result in a highly trained sales footprint and grow sales while achieving an overall reduction in costs in future periods.”

Ryan Mailling, CFO, commented: “Since my transition to Chief Financial Officer during the third quarter, I have dedicated a large portion of my time executing an efficient financial structuring of our Natroba Acquisition, managing our new bank financing relationship, and supporting the financial and administrative integration of the Natroba business into the existing Cipher infrastructure. I look forward to continuing to progress these activities, while also driving other efficiencies in the business.”

Q3 2024 Corporate Highlights

- Effective August 10, 2024, and as a result of the Natroba Acquisition, the Company’s Chief Financial Officer, Bryan Jacobs, assumed the title of President of the Company. His mandate will be to manage the transition and integration of the U.S. operations and commercial sales team. The Company’s Vice President, Finance, Ryan Mailling, was in turn been appointed as the Chief Financial Officer of the Company, taking over from Mr. Jacobs.

- On September 26, 2024, Cipher presented at the Planet MicroCap Showcase: Vancouver 2024 conference and participated in one-on-one meetings with stakeholders.

- On October 8, 2024, the Company announced the appointment of Dr. Hamed Ghanei as Chief Business Officer. Dr. Ghanei has expertise in business development, including extensive experience with licensing deals and other M&A opportunities in the specialty pharmaceuticals and healthcare industries, which is expected to provide Cipher with further capabilities for its next phase of substantial growth.

Q3 2024 Year-to-Date Financial Review

(All figures in U.S. dollars, compared to the year-to-date Q3 2023, unless otherwise noted)

- Total revenue was $21.5 million in Q3 2024, an increase of 33%

- Product revenue increased by 75% to $16.3 million year-to-date Q3 2024 compared to $9.3 million for the same period in the previous year

- Licensing revenue decreased by 24% to $5.3 million year-to-date Q3 2024 compared to $6.9 million for the same period in the previous year, largely resulting from a decline in revenue from product shipments to Cipher’s commercial partners

- Total gross profit was $17.4 million year-to-date Q3 2024, compared to $13.1 million for the same period in the previous year, due to higher total gross profit from the acquired Natroba business

- Net income and earnings per common share were $8.2 million and $0.34, respectively, year-to-date Q3 2024, compared to net income of $12.7 million and earnings per common share of $0.50 for the same period in the previous year, impacted primarily by transaction costs associated with the acquisition of the Natroba business, increased amortization associated with acquired intangible assets, and a year-over-year reduction in licensing revenue

- EBITDA1 decreased by 14% to $7.4 million year-to-date Q3 2024, compared to $8.6 million for the same period in the previous year

- Adjusted EBITDA1 for the year-to-date Q3 2024 was $10.7 million, an increase of 9% compared $9.9 million for the same period in the previous year

Business Strategy & Outlook

Cipher’s near term business strategy includes the following key focuses:

- Integrating the acquired Natroba business with the existing Cipher business.

- Driving growth of Natroba in the anti-parasitic market in the U.S. where its current market share is approximately 23%2, in a market where market leader “Permethrin” is no longer an effective treatment but still holds 75%2 market share.

- Out-licensing Natroba globally where there is high unmet need, such as warm climate regions.

- Acquiring complementary dermatology products to add to our North American platform to enhance the profitability, size and scale of the business.

- Continue to collaborate with our partner Moberg Pharma on its MOB-015 Phase III clinical trial in the U.S., where results are expected by January 2025.

- Assessing the Canadian market potential for MOB-015 with both the new U.S. Phase III clinical trial data and the existing EU approved MOB-015 product.

Financial Statements and MD&A

Cipher’s Financial Statements for the three and nine months ended September 30, 2024, and Management’s Discussion and Analysis (the “MD&A”) for the three and nine months ended September 30, 2024, are available on the Company’s website at www.cipherpharma.com in the “Investors” section under “Financial Reports” and on SEDAR+ at www.sedarplus.ca.

Notice of Conference Call

Cipher will hold a conference call on November 8, 2024 at 8:30 a.m. (ET) to discuss its financial results and other corporate developments.

- To access the conference call by telephone, dial (416) 945-7677 or (888) 699-1199

- A live audio webcast will be available at https://app.webinar.net/BxoA3Pp3dnP

- An archived replay of the webcast will be available until November 15, 2024 and can be accessed by dialing (289) 819-1450 or (888) 660-6345 and entering conference replay code 02131#

About Cipher Pharmaceuticals Inc.

Cipher Pharmaceuticals CPH CPHRF is a specialty pharmaceutical company with a robust and diversified portfolio of commercial and early to late-stage products, mainly in dermatology. Cipher acquires products that fulfill unmet medical needs, manages the required clinical development and regulatory approval process, and currently markets those products in Canada, the U.S., and South America. For more information, visit www.cipherpharma.com.

Forward-Looking Statements and Non-IFRS Measures

This document includes forward-looking statements within the meaning of applicable securities laws. These forward-looking statements include, among others, statements with respect to the integration of the Natroba business into the Cipher infrastructure, the impact of insourcing sales in certain states, the timing of the receipt of the topline results from MOB-015 Phase III North American study, our plans and intentions with respect to commercializing, out-licensing and marketing Natroba™ in Canada and elsewhere, our plans and intentions with respect to the introduction of additional dermatological and infectious disease products in Canada, the U.S. and elsewhere, the potential for future acquisitions, our objectives and goals and strategies to achieve those objectives and goals, as well as statements with respect to our beliefs, plans, expectations, anticipations, estimates and intentions. The words “may”, “will”, “could”, “should”, “would”, “suspect”, “outlook”, “believe”, “plan”, “anticipate”, “estimate”, “expect”, “intend”, “forecast”, “objective”, “hope” and “continue” (or the negative thereof), and words and expressions of similar import, are intended to identify forward-looking statements.

By their nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, which give rise to the possibility that predictions, forecasts, projections and other forward-looking statements will not be achieved. Certain material factors or assumptions are applied in making forward-looking statements and actual results may differ materially from those expressed or implied in such statements. We caution readers not to place undue reliance on these statements as a number of important factors, many of which are beyond our control, could cause our actual results to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates and intentions expressed in such forward-looking statements. These factors include, but are not limited to, the publication of negative results of clinical trials; our ability to enter into development, manufacturing and marketing and distribution agreements with other pharmaceutical companies and keep such agreements in effect; our dependency on a limited number of products; our dependency on protection from patents that will expire; integration difficulties and other risks if we acquire or in-license technologies or product candidates; reliance on third parties for the marketing of certain products; the product approval process by regulators which can be highly unpredictable; the timing of completion of clinical trials, regulatory submissions and regulatory approvals; reliance on third parties to manufacture our products and events outside of our control that could adversely impact the ability of our manufacturing partners to supply products to meet our demands; we may be subject to future product liability claims; unexpected product safety or efficacy concerns may arise; we generate license revenue from a limited number of distribution and supply agreements; the Company’s performance depends, in part, on the performance of its distributors and suppliers; the pharmaceutical industry is highly competitive with new competing product entrants; requirements for additional capital to fund future operations; products may be subject to pricing regulation; dependence on key managerial personnel and external collaborators; certain of our products are subject to regulation as controlled substances; limitations on reimbursement in the healthcare industry; the extent and impact of health pandemic outbreaks on our business; unpredictable development goals and projected time frames; rising insurance costs; ability to enforce covenants not to compete; we may be unsuccessful in evaluating material risks involved in completed and future acquisitions; we may be unable to identify, acquire or integrate acquisition targets successfully; inability to meet covenants under our long-term debt arrangement; compliance with privacy and security regulation; our policies regarding product returns, allowances and chargebacks may reduce revenues; additional regulatory burden and controls over financial reporting; general commercial litigation, class actions, other litigation claims and regulatory actions; the difficulty for shareholders to realize in the United States upon judgments of U.S. courts predicated upon civil liability of the Company and its directors and officers who are not residents of the United States; the potential violation of intellectual property rights of third parties; our efforts to obtain, protect or enforce our patents and other intellectual property rights related to our products; changes in U.S., Canadian or foreign patent laws; inability to protect our trademarks from infringement; shareholders may be further diluted if we issue securities to raise capital; volatility of our share price; the fact that we have a significant shareholder; our operating results may fluctuate significantly; and our debt obligations will have priority over the common shares of the Company in the event of a liquidation, dissolution or winding up.

We caution that the foregoing list of important factors that may affect future results is not exhaustive. When reviewing our forward-looking statements, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Additional information about factors that may cause actual results to differ materially from expectations, and about material factors or assumptions applied in making forward-looking statements, may be found in the “Risk Factors” section of our MD&A for the year ended December 31, 2023 and the Company’s Annual Information Form, and elsewhere in our filings with Canadian securities regulators. Except as required by Canadian securities law, we do not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf; such statements speak only as of the date made. The forward-looking statements included herein are expressly qualified in their entirety by this cautionary language.

1) EBITDA and adjusted EBITDA are non-IFRS financial measures. These non-IFRS measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are unlikely to be comparable to similar measures presented by other companies. Management uses non-IFRS measures such as Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) and Adjusted EBITDA to provide investors with supplemental measures of the Company’s operating performance and thus highlight trends in the Company’s core business that may not otherwise be apparent when relying solely on IFRS financial measures. The Company defines Adjusted EBITDA as earnings before interest expense, income taxes, depreciation of property and equipment, amortization of intangible assets, non-cash share-based compensation, changes in fair value of derivative financial instruments, provision for legal settlement, loss on disposal of assets and loss on extinguishment of lease, impairment of intangible assets, acquisition costs, restructuring costs and unrealized foreign exchange gains and losses.

2) IQVIA market data as at September 30, 2024.

The following is a summary of how EBITDA and Adjusted EBITDA are calculated:

|

(IN THOUSANDS OF U.S. DOLLARS, |

Three months |

Three months |

Nine months |

Nine months |

|

$ |

$ |

$ |

$ |

|

|

Net income and comprehensive income |

283 |

7,031 |

8,201 |

12,728 |

|

Add back: |

||||

|

Depreciation and amortization |

1,925 |

269 |

2,506 |

954 |

|

Interest expense (income) |

292 |

(533) |

(874) |

(1,315) |

|

Income taxes |

43 |

(3,909) |

(2,392) |

(3,728) |

|

EBITDA |

2,543 |

2,858 |

7,441 |

8,639 |

|

Unrealized foreign exchange (gain) loss |

(325) |

434 |

718 |

(21) |

|

Acquisition, restructuring and other costs |

1,577 |

— |

1,861 |

269 |

|

Share-based compensation |

291 |

315 |

698 |

968 |

|

Adjusted EBITDA |

4,086 |

3,607 |

10,718 |

9,855 |

|

Adjusted EBITDA per share – basic |

0.16 |

0.14 |

0.44 |

0.39 |

|

Adjusted EBITDA per share – dilutive |

0.16 |

0.14 |

0.43 |

0.38 |

Consolidated statements of income and comprehensive income

|

Three months ended September 30, |

Nine months ended September 30, |

|||

|

(IN THOUSANDS OF U.S. DOLLARS, |

2024 |

2023 |

2024 |

2023 |

|

except for per share amounts) |

$ |

$ |

$ |

$ |

|

Revenue |

||||

|

Licensing revenue |

1,055 |

3,090 |

5,273 |

6,936 |

|

Product revenue |

9,315 |

2,978 |

16,268 |

9,306 |

|

Net revenue |

10,370 |

6,068 |

21,541 |

16,242 |

|

Operating expenses |

||||

|

Cost of products sold |

1,970 |

1,076 |

4,131 |

3,114 |

|

Research and development |

— |

10 |

— |

110 |

|

Depreciation and amortization |

1,925 |

269 |

2,506 |

954 |

|

Selling, general and administrative |

6,182 |

1,690 |

9,251 |

4,400 |

|

Total operating expenses |

10,077 |

3,045 |

15,888 |

8,578 |

|

Other (income) expenses |

||||

|

Interest expense (income) |

292 |

(533) |

(874) |

(1,315) |

|

Unrealized foreign exchange (gain) loss |

(325) |

434 |

718 |

(21) |

|

Total other (income) expenses |

(33) |

(99) |

(156) |

(1,336) |

|

Income before income taxes |

326 |

3,122 |

5,809 |

9,000 |

|

Current income tax expense |

— |

116 |

— |

328 |

|

Deferred income tax expense (recovery) |

43 |

(4,025) |

(2,392) |

(4,056) |

|

Total income tax expense (recovery) |

43 |

(3,909) |

(2,392) |

(3,728) |

|

Net income and comprehensive income for the period |

283 |

7,031 |

8,201 |

12,728 |

|

Income per share |

||||

|

Basic |

0.01 |

0.28 |

0.34 |

0.50 |

|

Diluted |

0.01 |

0.27 |

0.33 |

0.50 |

Consolidated statements of financial position

|

As at September 30, |

As at December 31, |

|

|

2024 |

2023 |

|

|

(IN THOUSANDS OF U.S. DOLLARS) |

$ |

$ |

|

Assets |

||

|

Current assets |

||

|

Cash and cash equivalents |

9,524 |

39,825 |

|

Accounts receivable |

13,215 |

5,088 |

|

Inventory |

5,271 |

2,982 |

|

Prepaid expenses and other assets |

1,048 |

378 |

|

Total current assets |

29,058 |

48,273 |

|

Property and equipment, net |

853 |

402 |

|

Intangible assets, net |

85,972 |

1,763 |

|

Deferred financing costs |

376 |

— |

|

Goodwill |

15,706 |

15,706 |

|

Deferred tax assets |

21,890 |

19,887 |

|

Total assets |

153,855 |

86,031 |

|

Liabilities and shareholders’ equity |

||

|

Current liabilities |

||

|

Accounts payable and accrued liabilities |

5,464 |

4,596 |

|

Interest payable |

401 |

— |

|

Contract liability |

8,380 |

562 |

|

Current portion of lease obligation |

263 |

94 |

|

Total current liabilities |

14,508 |

5,252 |

|

Lease obligation |

489 |

259 |

|

Long-term debt |

40,000 |

— |

|

Total liabilities |

54,997 |

5,511 |

|

Shareholders’ equity |

||

|

Share capital |

27,911 |

18,012 |

|

Contributed surplus |

6,153 |

5,755 |

|

Accumulated other comprehensive loss |

(9,514) |

(9,514) |

|

Retained earnings |

74,308 |

66,267 |

|

Total shareholders’ equity |

98,858 |

80,520 |

|

Total liabilities and shareholders’ equity |

153,855 |

86,031 |

SOURCE Cipher Pharmaceuticals Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/07/c7956.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/07/c7956.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.