10% Owner Of Watts Water Technologies Sold $1.07M In Stock

TIMOTHY HORNE, 10% Owner at Watts Water Technologies WTS, disclosed an insider sell on November 6, according to a recent SEC filing.

What Happened: HORNE’s decision to sell 5,000 shares of Watts Water Technologies was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $1,072,600.

During Thursday’s morning session, Watts Water Technologies shares down by 0.0%, currently priced at $212.17.

About Watts Water Technologies

Watts Water Technologies Inc is a U.S.-based company that provides safety, energy efficiency, and water conservation products. Its product portfolio includes residential and commercial flow control products, which are sold for plumbing and hot water applications; HVAC and gas products, including commercial boilers, water heaters, heating solutions, and heating systems; drainage and water reuse products, including drainage products and engineered rainwater-harvesting solutions; and water quality products, including point-of-use and point-of-entry water filtration, conditioning, and scale prevention systems. The company generates the majority of its revenue from markets in the Americas and in Europe, the Middle East, and Africa.

Watts Water Technologies’s Economic Impact: An Analysis

Revenue Growth: Watts Water Technologies displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 7.79%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Evaluating Earnings Performance:

-

Gross Margin: Achieving a high gross margin of 47.3%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Watts Water Technologies’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 2.07.

Debt Management: Watts Water Technologies’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.13.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 25.44, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 3.15 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 15.75, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Exploring Key Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Watts Water Technologies’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Canoe Financial LP Announces Portfolio Management Changes

CALGARY, Alberta, Nov. 07, 2024 (GLOBE NEWSWIRE) — Canoe Financial LP (“Canoe Financial”) announced today that PineStone Asset Management Inc. (“PineStone”) will replace Fiera Capital Corporation (“Fiera”) as sub-advisor for the following funds:

- Canoe Defensive Global Equity Fund

- Canoe Defensive International Equity Fund

- Canoe Defensive U.S. Equity Portfolio Class

- Canoe Global Equity Fund

PineStone, which currently acts as a sub-advisor to Fiera for the funds, will assume direct sub-advisory responsibilities as a result of this change.

Canoe Financial also announced that it will appoint Nalmont Capital Inc. (“Nalmont”) as a sub-advisor, replacing Fiera, to provide risk management advisory for the following funds:

- Canoe Defensive Global Balanced Fund

- Canoe Defensive Global Equity Fund

- Canoe Defensive International Equity Fund

- Canoe Defensive U.S. Equity Portfolio Class

These changes are anticipated to take effect no later than January 10, 2025.

About Canoe Financial

Canoe Financial is one of Canada’s fastest growing independent mutual fund companies managing approximately $18 billion in assets across a diversified range of award-winning investment solutions. Founded in 2008, Canoe Financial is an employee-owned investment management firm focused on building financial wealth for Canadians. Canoe Financial has a significant presence across Canada, including offices in Calgary, Toronto and Montreal.

Contact

Investor Relations

1–877–434–2796

info@canoefinancial.com

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Atlanticus Reports Third Quarter 2024 Financial Results

ATLANTA, Nov. 07, 2024 (GLOBE NEWSWIRE) — Atlanticus Holdings Corporation ATLC (Atlanticus, the Company, we, our or us), a financial technology company that enables its bank, retail and healthcare partners to offer more inclusive financial services to millions of everyday Americans, today announced its financial results for the third quarter ended September 30, 2024. An accompanying earnings presentation is available in the Investors section of the Company’s website at www.atlanticus.com or by clicking here.

Financial and Operating Highlights

Third Quarter 2024 Highlights (all comparisons to the Third Quarter 2023)

- Managed receivables2 increased 14.6% to $2.7 billion

- Total operating revenue increased 19.0% to $351.0 million

- Return on average equity of 21.0%3

- Purchase volume of $819.0 million

- Over 380,000 new accounts served during the quarter, 3.7 million total accounts served1

- Net income attributable to common shareholders of $23.2 million, or $1.27 per diluted common share

1 ) In our calculation of total accounts served, we include all accounts with account activity and accounts that have open lines of credit at the end of the referenced period.

2) Managed receivables is a non-GAAP financial measure and excludes the results of our Auto Finance receivables. See calculation of Non-GAAP Financial Measures for important additional information.

3) Return on average equity is calculated using Net income attributable to common shareholders as the numerator and the average of Total equity as of September 30, 2024 and June 30, 2024 as the denominator, annualized.

Management Commentary

Jeff Howard, President and Chief Executive Officer at Atlanticus stated, “Consistent with prior quarters, we are pleased with our continued growth in revenue, managed receivables, and serviced accounts. Following several quarters of maintaining a conservative credit posture, we are proud of our consistent profitability with another quarter exceeding 20% return on equity.

“For several quarters, the everyday Americans we serve have experienced real wage gains as incomes have risen more than inflation. This has resulted in relatively stable consumer performance, albeit at slightly higher levels of delinquency than existed prior to the pandemic. This consistency allows us to pursue prudent growth across our platform.

“As we look forward, we are excited about the ongoing growth opportunities across our three primary product lines within our Credit as a Service segment. Each product line – general purpose credit card, point of sale of finance, and healthcare payments – represents substantial market opportunities. Our pipeline of new partners, new channels, and new offerings for each of these product lines positions us for an above-market rate of long-term growth.”

| For the Three Months Ended | |||||||||||

| Financial Results | September 30, | ||||||||||

| (Dollars in thousands, except per share data) | 2024 | 2023 | % Change | ||||||||

| Total operating revenue | $350,954 | $294,913 | 19.0% | ||||||||

| Other non-operating revenue | 270 | (6) | nm | ||||||||

| Total revenue | 351,224 | 294,907 | 19.1% | ||||||||

| Interest expense | (42,492) | (28,274) | 50.3% | ||||||||

| Provision for credit losses | (4,633) | (538) | nm | ||||||||

| Changes in fair value of loans | (203,739) | (177,854) | 14.6% | ||||||||

| Net margin | $100,360 | $88,241 | 13.7% | ||||||||

| Total operating expenses | $(63,074) | ($56,483) | 11.7% | ||||||||

| Net income | $29,189 | $24,973 | 16.9% | ||||||||

| Net income attributable to controlling interests | $29,543 | $25,240 | 17.0% | ||||||||

| Preferred stock and preferred unit dividends and discount accretion | (6,316) | (6,341) | nm | ||||||||

| Net income attributable to common shareholders | $23,227 | $18,899 | 22.9% | ||||||||

| Net income attributable to common shareholders per common share—basic | $1.58 | $1.30 | 21.5% | ||||||||

| Net income attributable to common shareholders per common share—diluted | $1.27 | $1.03 | 23.3% | ||||||||

*nm = not meaningful

Managed Receivables

Managed receivables increased 14.6% to $2.7 billion with over $338.9 million in net receivables growth from September 30, 2023, driven by growth both in the private label credit and general purpose credit card products offered by our bank partners. Total accounts served increased 5.9% to 3.7 million. Ongoing purchases by customers of our existing retail partners and new private label credit retail partners helped grow our private label credit receivables by $261.5 million in the twelve months ended September 30, 2024. Our general purpose credit card receivables grew by $77.6 million during the twelve months ended September 30, 2024. While some of our merchant partners continue to face year-over-year growth challenges, others are benefiting from continued consumer spending and a growing economy. Our general purpose credit card portfolio continues to grow in terms of total customers served and therefore we continue to experience growth in total managed receivables. We expect continued growth in our managed receivables when compared to prior periods in 2023.

Total Operating Revenue

Total operating revenue consists of: 1) interest income, finance charges and late fees on consumer loans, 2) other fees on credit products including annual and merchant fees and 3) ancillary, interchange and servicing income on loan portfolios.

We are currently experiencing continued period-over-period growth in private label credit and general purpose credit card receivables — growth that we expect to result in net period-over-period growth in our total interest income and related fees for these operations for 2024. Future periods’ growth is also dependent on the addition of new retail partners to expand the reach of private label credit operations as well as growth within existing partnerships and the level of marketing investment for the general purpose credit card operations.

During the quarter ended September 30, 2024, total operating revenue increased 19.0% to $351.0 million. General purpose credit card receivables tend to have higher total yields than private label credit receivables (and corresponding higher charge off rates). As a result, in periods where we have declines in rates of growth of these general purpose credit card receivables, as was noted in 2024 (relative to growth in private label credit card receivables), we expect to have slightly lower total managed yield ratios. We currently expect increases in the acquisition of receivables, and correspondingly higher period-over-period operating revenue for the remainder of 2024. This growth includes an expected seasonal shift in our mix of acquired private label receivables to higher FICO receivables that have lower gross yields (and correspondingly lower charge-off expectations) in the third quarter each year, which may result in marginally lower managed yield ratios when compared to the corresponding periods in 2023.

Interest Expense

Interest expense was $42.5 million for the quarter ended September 30, 2024, compared to $28.3 million for the quarter ended September 30, 2023. The higher expenses were primarily driven by the increases in outstanding debt in proportion to growth in our receivables coupled with increases in the cost of borrowing.

Outstanding notes payable, net of unamortized debt issuance costs and discounts, associated with our private label credit and general purpose credit card platform increased to $1,976.8 million as of September 30, 2024 from $1,719.7 million as of September 30, 2023. The majority of this increase in outstanding debt relates to the addition of multiple credit facilities in 2023 and 2024. Recent increases in the effective interest rates on debt have increased our interest expense as we have raised additional capital (or replaced existing facilities) over the last two years. We anticipate additional debt financing over the next few quarters as we continue to grow coupled with higher effective interest rates on new debt compared to rates on maturing debt. As such, we expect our quarterly interest expense for these operations to increase compared to prior periods.

Changes in Fair Value of Loans

Changes in fair value of loans, interest and fees receivable recorded at fair value increased to $203.7 million for the quarter ended September 30, 2024, respectively, compared to $177.9 million for the quarter ended September 30, 2023, respectively. This increase was largely driven by growth in underlying receivables as well as changes in assumptions due to recent rules enacted by the CFPB, which, if implemented, would further limit the late fee charged to consumers in most instances.

We include asset performance degradation in our forecasts to reflect both changes in assumed asset level economics and the possibility of delinquency rates increasing in the near term (and the corresponding increase in charge-offs and decrease in payments) above the level that current trends would suggest. Based on observed asset performance, implementation of mitigants to a potential change in late fee billings and general improvements in U.S. economic expectations due to the improved inflation environment, some expected degradation has been removed in recent periods. Additionally, as receivables associated with both 1) assets acquired prior to our tightened underwriting standards and 2) those assets negatively impacted by inflation, gradually become a smaller percentage of the portfolio, we expect to see overall improvements in the measured fair value of our portfolios of acquired receivables.

Total Operating Expenses

Total operating expenses increased 11.7% in the quarter when compared to the same period in 2023, driven primarily by increases in variable servicing costs associated with growth in our receivables and costs associated with the implementation of product, policy and pricing changes. In addition, we experienced growth in both the number of employees and inflationary compensation pressure. Certain other nonrecurring accounting and legal expenditures also contributed to increases for the quarter.

We expect some continued increase in both servicing costs and salaries and benefits in 2024 compared to corresponding periods in 2023 as we expect our receivables to continue to grow.

We expect increased levels of expenditures associated with anticipated growth in private label credit and general purpose credit card operations. These expenses will primarily relate to the variable costs of marketing efforts and card and loan servicing expenses associated with new receivable acquisitions.

In addition, as we continue to adjust our underwriting standards to reflect changes in fee and finance assumptions on new receivables, we expect period over period marketing costs for 2024 to increase relative to those experienced in 2023, although the frequency and timing of increased marketing efforts could vary and are dependent on macroeconomic factors such as national unemployment rates and federal funds rates.

Net Income Attributable to Common Shareholders

Net income attributable to common shareholders increased 22.9% to $23.2 million, or $1.27 per diluted share for the quarter ended September 30, 2024.

Share Repurchases

We repurchased and retired 11,193 shares of our common stock at an aggregate cost of $0.3 million, in the quarter ended September 30, 2024.

We will continue to evaluate the best use of our capital to increase shareholder value over time.

About Atlanticus Holdings Corporation

Empowering Better Financial Outcomes for Everyday Americans

Atlanticus™ technology enables bank, retail, and healthcare partners to offer more inclusive financial services to everyday Americans through the use of proprietary technology and analytics. We apply the experience gained and infrastructure built from servicing over 20 million customers and over $40 billion in consumer loans over more than 25 years of operating history to support lenders that originate a range of consumer loan products. These products include retail and healthcare private label credit and general purpose credit cards marketed through our omnichannel platform, including retail point-of-sale, healthcare point-of-care, direct mail solicitation, internet-based marketing, and partnerships with third parties. Additionally, through our Auto Finance subsidiary, Atlanticus serves the individual needs of automotive dealers and automotive non-prime financial organizations with multiple financing and service programs.

Forward-Looking Statements

This press release contains forward-looking statements that reflect the Company’s current views with respect to, among other things, its business, long-term growth plans and opportunities, operations, financial performance, revenue, amount and pace of growth of managed receivables, mix of receivables, underwriting approach, total interest income and related fees and charges, the new CFPB late fee rules and our response thereto, debt financing, liquidity, interest rates, interest expense, operating expense, fair value of receivables, consumer spending, and the economy. You generally can identify these statements by the use of words such as outlook, potential, continue, may, seek, approximately, predict, believe, expect, plan, intend, estimate or anticipate and similar expressions or the negative versions of these words or comparable words, as well as future or conditional verbs such as will, should, would, likely and could. These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those included in the forward-looking statements. These risks and uncertainties include those risks described in the Company’s filings with the Securities and Exchange Commission and include, but are not limited to, bank partners, merchant partners, consumers, loan demand, the capital markets, labor availability, supply chains and the economy in general; the Company’s ability to retain existing, and attract new, merchant partners and funding sources; changes in market interest rates; increases in loan delinquencies; its ability to operate successfully in a highly regulated industry; the outcome of litigation and regulatory matters; the effect of management changes; cyberattacks and security vulnerabilities in its products and services; and the Company’s ability to compete successfully in highly competitive markets. The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, the Company disclaims any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

Contact:

Investor Relations

(770) 828-2000

investors@atlanticus.com

| Atlanticus Holdings Corporation and Subsidiaries | |||||||||

| Condensed Consolidated Balance Sheets (Unaudited) | |||||||||

| (Dollars in thousands) | |||||||||

| September 30, | December 31, | ||||||||

| 2024 | 2023 | ||||||||

| Assets | |||||||||

| Unrestricted cash and cash equivalents (including $147.3 million and $158.0 million associated with variable interest entities at September 30, 2024 and December 31, 2023, respectively) | $308,651 | $339,338 | |||||||

| Restricted cash and cash equivalents (including $22.0 million and $20.5 million associated with variable interest entities at September 30, 2024 and December 31, 2023, respectively) | 76,058 | 44,315 | |||||||

| Loans at fair value (including $2,189.4 million and $2,128.6 million associated with variable interest entities at September 30, 2024 and December 31, 2023, respectively) | 2,511,619 | 2,173,759 | |||||||

| Loans at amortized cost, net (including $4.6 million and $1.8 million of allowance for credit losses at September 30, 2024 and December 31, 2023, respectively; and $16.9 million and $17.9 million of deferred revenue at September 30, 2024 and December 31, 2023, respectively) |

89,109 | 98,425 | |||||||

| Property at cost, net of depreciation | 9,676 | 11,445 | |||||||

| Operating lease right-of-use assets | 11,040 | 11,310 | |||||||

| Prepaid expenses and other assets | 33,811 | 27,853 | |||||||

| Total assets | $3,039,964 | $2,706,445 | |||||||

| Liabilities | |||||||||

| Accounts payable and accrued expenses | $59,563 | $61,634 | |||||||

| Operating lease liabilities | 19,446 | 20,180 | |||||||

| Notes payable, net (including $1,802.6 million and $1,795.9 million associated with variable interest entities at September 30, 2024 and December 31, 2023, respectively) | 2,016,655 | 1,861,685 | |||||||

| Senior notes, net | 269,649 | 144,453 | |||||||

| Income tax liability | 105,214 | 85,826 | |||||||

| Total liabilities | 2,470,527 | 2,173,778 | |||||||

| Commitments and contingencies | |||||||||

| Preferred stock, no par value, 10,000,000 shares authorized: | |||||||||

| Series A preferred stock, 400,000 shares issued and outstanding (liquidation preference – $40.0 million) at September 30, 2024 and December 31, 2023 (1) | 40,000 | 40,000 | |||||||

| Class B preferred units issued to noncontrolling interests | 74,975 | 100,250 | |||||||

| Shareholders’ Equity | |||||||||

| Series B preferred stock, no par value, 3,300,704 shares issued and outstanding at September 30, 2024 (liquidation preference – $82.5 million); 3,256,561 shares issued and outstanding at December 31, 2023 (liquidation preference – $81.4 million) (1) | – | – | |||||||

| Common stock, no par value, 150,000,000 shares authorized: 14,738,862 and 14,603,563 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | – | – | |||||||

| Paid-in capital | 89,386 | 87,415 | |||||||

| Retained earnings | 368,337 | 307,260 | |||||||

| Total shareholders’ equity attributable to Atlanticus Holdings Corporation | 457,723 | 394,675 | |||||||

| Noncontrolling interests | (3,261) | (2,258 | ) | ||||||

| Total equity | 454,462 | 392,417 | |||||||

| Total liabilities, shareholders’ equity and temporary equity | $3,039,964 | $2,706,445 | |||||||

| (1) Both the Series A preferred stock and the Series B preferred stock have no par value and are part of the same aggregate 10,000,000 shares authorized. | |||||||||

| Atlanticus Holdings Corporation and Subsidiaries | |||||||||||||||||

| Condensed Consolidated Statements of Income (Unaudited) | |||||||||||||||||

| (Dollars in thousands, except per share data) | |||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||

| September 30, | September 30, | ||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Revenue: | |||||||||||||||||

| Consumer loans, including past due fees | $255,389 | $224,682 | $728,112 | $654,425 | |||||||||||||

| Fees and related income on earning assets | 78,572 | 59,853 | 185,983 | 167,084 | |||||||||||||

| Other revenue | 16,993 | 10,378 | 42,674 | 25,137 | |||||||||||||

| Total operating revenue | 350,954 | 294,913 | 956,769 | 846,646 | |||||||||||||

| Other non-operating revenue | 270 | (6) | 1,184 | 140 | |||||||||||||

| Total revenue | 351,224 | 294,907 | 957,953 | 846,786 | |||||||||||||

| Interest expense | (42,492) | (28,274) | (115,503) | (76,723) | |||||||||||||

| Provision for credit losses | (4,633) | (538) | (9,323) | (1,551) | |||||||||||||

| Changes in fair value of loans | (203,739) | (177,854) | (549,161) | (505,505) | |||||||||||||

| Net margin | 100,360 | 88,241 | 283,966 | 263,007 | |||||||||||||

| Operating expenses: | |||||||||||||||||

| Salaries and benefits | (12,299) | (11,360) | (37,584) | (32,593) | |||||||||||||

| Card and loan servicing | (28,069) | (25,864) | (82,589) | (74,013) | |||||||||||||

| Marketing and solicitation | (14,848) | (12,599) | (38,848) | (37,491) | |||||||||||||

| Depreciation | (656) | (647) | (1,963) | (1,908) | |||||||||||||

| Other | (7,202) | (6,013) | (24,272) | (19,149) | |||||||||||||

| Total operating expenses | (63,074) | (56,483) | (185,256) | (165,154) | |||||||||||||

| Income before income taxes | 37,286 | 31,758 | 98,710 | 97,853 | |||||||||||||

| Income tax expense | (8,097) | (6,785) | (19,575) | (22,172) | |||||||||||||

| Net income | 29,189 | 24,973 | 79,135 | 75,681 | |||||||||||||

| Net loss attributable to noncontrolling interests | 354 | 267 | 858 | 860 | |||||||||||||

| Net income attributable to controlling interests | 29,543 | 25,240 | 79,993 | 76,541 | |||||||||||||

| Preferred stock and preferred unit dividends and discount accretion | (6,316) | (6,341) | (18,916) | (18,857) | |||||||||||||

| Net income attributable to common shareholders | $23,227 | $18,899 | $61,077 | $57,684 | |||||||||||||

| Net income attributable to common shareholders per common share—basic | $1.58 | $1.30 | $4.15 | $3.99 | |||||||||||||

| Net income attributable to common shareholders per common share—diluted | $1.27 | $1.03 | $3.35 | $3.14 | |||||||||||||

Additional Information

Additional trends and data with respect to our private label credit and general purpose credit card receivables can be found in our latest Form 10-K filing with the Securities and Exchange Commission under Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Calculation of Non-GAAP Financial Measures

This press release presents information about managed receivables, which is a non-GAAP financial measure provided as a supplement to the results provided in accordance with accounting principles generally accepted in the United States of America (GAAP). In addition to financial measures presented in accordance with GAAP, we present managed receivables, total managed yield, combined principal net charge-offs, and fair value to total managed receivables ratio, all of which are non-GAAP financial measures. These non-GAAP financial measures aid in the evaluation of the performance of our credit portfolios, including our risk management, servicing and collection activities and our valuation of purchased receivables. The credit performance of our managed receivables provides information concerning the quality of loan originations and the related credit risks inherent with the portfolios. Management relies heavily upon financial data and results prepared on the managed basis in order to manage our business, make planning decisions, evaluate our performance and allocate resources.

These non-GAAP financial measures are presented for supplemental informational purposes only. These non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, or as a substitute for, GAAP financial measures. These non-GAAP financial measures may differ from the non-GAAP financial measures used by other companies. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures or the calculation of the non-GAAP financial measures are provided below for each of the fiscal periods indicated.

These non-GAAP financial measures include only the performance of those receivables underlying consolidated subsidiaries (for receivables carried at amortized cost basis and fair value) and exclude the performance of receivables held by our former equity method investee. As the receivables underlying our former equity method investee reflect a small and diminishing portion of our overall receivables base, we do not believe their inclusion or exclusion in the overall results is material. Additionally, we calculate average managed receivables based on the quarter-end balances.

The comparison of non-GAAP managed receivables to our GAAP financial statements requires an understanding that managed receivables reflect the face value of loans, interest and fees receivable without any consideration for potential loan losses or other adjustments to reflect fair value.

A reconciliation of Loans at fair value to Total managed receivables is as follows:

| At or for the Three Months Ended | ||||||||||||||||||||||||||

| 2024 | 2023 | 2022 | ||||||||||||||||||||||||

| (in Millions) | Sep. 30 | Jun. 30 | Mar. 31 | Dec. 31 | Sep. 30 | Jun. 30 | Mar. 31 | Dec. 31 | ||||||||||||||||||

| Loans at fair value | $2,511.6 | $2,277.4 | $2,150.6 | $2,173.8 | $2,050.0 | $1,916.1 | $1,795.6 | $1,818.0 | ||||||||||||||||||

| Fair value mark against receivable (1) | 142.5 | 137.7 | 167.5 | 237.5 | 265.2 | 257.9 | 260.1 | 302.1 | ||||||||||||||||||

| Total managed receivables (2) | $2,654.1 | $2,415.1 | $2,318.1 | $2,411.3 | $2,315.2 | $2,174.0 | $2,055.7 | $2,120.1 | ||||||||||||||||||

| Fair value to Total managed receivables ratio (3) | 94.6% | 94.3% | 92.8% | 90.2% | 88.5% | 88.1% | 87.3% | 85.8% | ||||||||||||||||||

| (1) The fair value mark against receivables reflects the difference between the face value of a receivable and the net present value of the expected cash flows associated with that receivable. |

| (2) Total managed receivables are equal to the aggregate unpaid gross balance of loans at fair value. |

| (3) The Fair value to Total managed receivables ratio is calculated using Loans at fair value as the numerator, and Total managed receivables as the denominator. |

A reconciliation of our operating revenues, net of finance and fee charge-offs, to comparable amounts used in our calculation of Total managed yield is as follows:

| At or for the Three Months Ended | |||||||||||||||||||||||||

| 2024 | 2023 | 2022 | |||||||||||||||||||||||

| (in Millions) | Sep. 30 | Jun. 30 | Mar. 31 | Dec. 31 | Sep. 30 | Jun. 30 | Mar. 31 | Dec. 31 | |||||||||||||||||

| Consumer loans, including past due fees | $245.3 | $232.1 | $220.0 | $214.6 | $214.6 | $210.3 | $200.5 | $202.9 | |||||||||||||||||

| Fees and related income on earning assets | 78.5 | 59.5 | 47.9 | 71.7 | 59.8 | 62.9 | 44.3 | 48.0 | |||||||||||||||||

| Other revenue | 16.8 | 13.6 | 11.7 | 12.0 | 10.2 | 7.6 | 6.7 | 8.5 | |||||||||||||||||

| Total operating revenue – CaaS Segment | 340.6 | 305.2 | 279.6 | 298.3 | 284.6 | 280.8 | 251.5 | 259.4 | |||||||||||||||||

| Adjustments due to acceleration of merchant fee discount amortization under fair value accounting |

(15.1) | (12.6) | 4.0 | 6.5 | (6.8) | (10.6) | (0.5) | 3.4 | |||||||||||||||||

| Adjustments due to acceleration of annual fees recognition under fair value accounting |

(8.0) | 1.1 | 10.1 | (12.6) | (3.1) | (9.8) | 7.3 | 7.9 | |||||||||||||||||

| Removal of finance charge-offs | (60.6) | (62.9) | (63.7) | (59.5) | (47.1) | (54.2) | (61.7) | (58.3) | |||||||||||||||||

| Total managed yield | $256.9 | $230.8 | $230.0 | $232.7 | $227.6 | $206.2 | $196.6 | $212.4 | |||||||||||||||||

The calculation of Combined principal net charge-offs is as follows:

| At or for the Three Months Ended | |||||||||||||||||||||||||

| 2024 | 2023 | 2022 | |||||||||||||||||||||||

| (in Millions) | Sep. 30 | Jun. 30 | Mar. 31 | Dec. 31 | Sep. 30 | Jun. 30 | Mar. 31 | Dec. 31 | |||||||||||||||||

| Charge-offs on loans at fair value | $ | 201.5 | $ | 217.0 | $ | 231.7 | $ | 215.2 | $ | 173.5 | $ | 180.0 | $ | 191.9 | $ | 182.3 | |||||||||

| Finance charge-offs (1) | (60.6) | (62.9) | (63.7) | (59.5) | (47.1) | (54.2) | (61.7) | (58.3) | |||||||||||||||||

| Combined principal net charge-offs | $ | 140.9 | $ | 154.1 | $ | 168.0 | $ | 155.7 | $ | 126.4 | $ | 125.8 | $ | 130.2 | $ | 124.0 | |||||||||

(1) Finance charge-offs are included as a component of our Changes in fair value of loans in the condensed consolidated statements of income.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Moody's Downgrades The Toronto-Dominion Bank (TD) and Subsidiary After Guilty Plea – Hagens Berman

SAN FRANCISCO, Nov. 07, 2024 (GLOBE NEWSWIRE) — On October 23, 2024, Moody’s downgraded the long-term ratings of The Toronto-Dominion Bank TD and its U.S. subsidiaries in response to the company’s guilty plea earlier in the month to having engaged in a conspiracy to commit money laundering and agreement to pay a $3 billion fine.

The ratings downgrade comes on the heels of a recently filed federal securities class action lawsuit against The Toronto-Dominion Bank and several of its most senior executives and alleges that they misled investors about the extent of the bank’s anti-money laundering (AML) program deficiencies.

Hagens Berman urges only investors who purchased The Toronto-Dominion Bank TD shares on the New York Stock Exchange and who suffered substantial losses to submit your losses now.

Class Period: Feb. 29, 2024 – Oct. 9, 2024

Lead Plaintiff Deadline: Dec. 23, 2024

Visit: www.hbsslaw.com/investor-fraud/td

Contact the Firm Now: TD@hbsslaw.com

844-916-0895

The Toronto-Dominion Bank Securities Class Action (TD):

The truth about TD’s malfeasance emerged on October 10, 2024, when the U.S. Department of Justice announced that TD’s U.S. subsidiaries had pleaded guilty to violating the Bank Secrecy Act and conspiracy to commit money laundering. The resolution included a $3.09 billion fine, an asset cap, and increased regulatory oversight.

The DOJ found that TD Bank intentionally did not automatically monitor a staggering 92% of transactions, or $18.3 trillion, from January 1, 2018 to April 12, 2024. The DOJ also said that the company’s internal audit “repeatedly identified concerns about its transaction monitoring program, a key element of an appropriate AML program necessary to properly detect and report suspicious activities.”

Deputy Attorney General Lisa Monaco said “[f]or years, TD Bank starved its compliance program of the resources needed to obey the law.”

Attorney General Merrick Garland said “[b]y making its services available for criminals, TD Bank became one[,]” adding “[t]oday, TD Bank also became the largest bank in U.S history to plead guilty to conspiracy to commit money laundering[]” and “TD Bank chose profits over compliance with the law.”

Following the announcement, TD Bank’s stock price plummeted, losing over 10% in the two days after the news broke.

“TD Bank’s alleged misconduct represents a serious breach of trust with its investors. We believe that investors deserve to be compensated for the losses they suffered as a result of the bank’s alleged misleading statements,” said Reed Kathrein, the Hagens Berman partner leading the investigation.

If you invested in Toronto-Dominion and have substantial losses, or have knowledge that may assist the firm’s investigation, submit your losses now »

If you’d like more information and answers to frequently asked questions about the Toronto-Dominion case and our investigation, read more »

Whistleblowers: Persons with non-public information regarding Toronto-Dominion should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email TD@hbsslaw.com.

About Hagens Berman

Hagens Berman is a global plaintiffs’ rights complex litigation firm focusing on corporate accountability. The firm is home to a robust practice and represents investors as well as whistleblowers, workers, consumers and others in cases achieving real results for those harmed by corporate negligence and other wrongdoings. Hagens Berman’s team has secured more than $2.9 billion in this area of law. More about the firm and its successes can be found at hbsslaw.com. Follow the firm for updates and news at @ClassActionLaw.

Contact:

Reed Kathrein, 844-916-0895

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

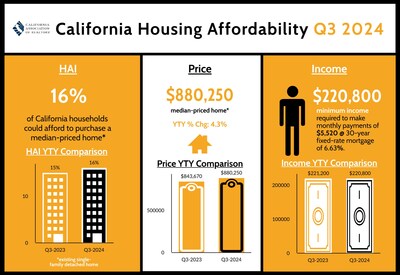

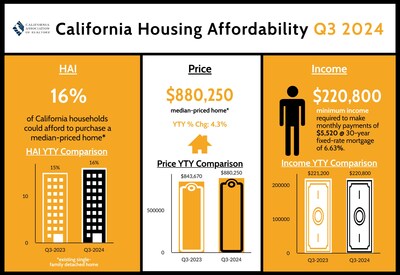

California housing affordability improves from previous quarter and year as price growth ebbs and rates dip, C.A.R. reports

- Sixteen percent of California households could afford to purchase the $880,250 median-priced home in the third quarter of 2024, up from 14 percent in second-quarter 2024 and up from 15 percent in third-quarter 2023.

- A minimum annual income of $220,800 was needed to make monthly payments of $5,520, including principal, interest and taxes on a 30-year fixed-rate mortgage at a 6.63 percent interest rate.

- Twenty-five percent of home buyers were able to purchase the $670,000 median-priced condo or townhome. A minimum annual income of $168,000 was required to make a monthly payment of $4,200.

LOS ANGELES, Nov. 7, 2024 /PRNewswire/ — Slower home price growth and more favorable interest rates in third-quarter 2024 buoyed California’s housing affordability from both the previous quarter and a year ago, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Infographic: https://www.car.org/Global/Infographics/HAI-2024-Q3

Sixteen percent of the state’s homebuyers could afford to purchase a median-priced, existing single-family home in California in third-quarter 2024, up from 14 percent in the second quarter of 2024 and 15 percent in the third quarter of 2023, according to C.A.R.’s Traditional Housing Affordability Index (HAI).

The third-quarter 2024 figure is less than a third of the affordability index peak of 56 percent in the third quarter of 2012. Rates started the third quarter on a downward trend but have climbed since bottoming out in early September. With the dwindling chance of another sizable Fed rate cut in 2024 due to a stronger-than-expected economy, mortgage rates shot back up above 7 percent in recent weeks, reaching their highest levels since early July. Rates could still come down before the end of the year, but the odds of a meaningful decline in the next couple months have reduced sharply from where they were three months ago.

C.A.R.’s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The index is considered the most fundamental measure of housing well-being for home buyers in the state.

A minimum annual income of $220,800 was needed to qualify for the purchase of an $880,250 statewide median-priced, existing single-family home in the third quarter of 2024. The monthly payment, including taxes and insurance (PITI) on a 30-year, fixed-rate loan, would be $5,520, assuming a 20 percent down payment and an effective composite interest rate of 6.63 percent. The effective composite interest rate was 7.10 percent in second-quarter 2024 and 7.14 percent in third-quarter 2023. The monthly PITI for a typical single-family home in California dipped from both the previous quarter and the same quarter of last year.

The statewide median price of existing single-family homes in California declined 2.9 percent quarter-to-quarter, due partly to seasonal factors but also a change in the mix of sales. On a year-over-year basis, California continued to record price increases for the fifth consecutive quarter, although at a more moderate pace of 4.3 percent in third-quarter 2024 – the slowest since the third quarter of 2023. With the market entering the off-season, home prices will soften further as inventory rises and competition cools. While slower price growth will ease the affordability crunch facing buyers, recent mortgage rate spikes will continue to be a challenge for many in the remainder of the year.

The share of California households that could afford a typical condo/townhome in third-quarter 2024 rose to 25 percent, up from 22 percent recorded in the previous quarter and up from the 23 percent recorded in the third quarter of 2023. An annual income of $168,000 was required to make the monthly payment of $4,200 on the $670,000 median-priced condo/townhome in the third quarter of 2024.

Compared with California, more than one-third of the nation’s households could afford to purchase a $418,700 median-priced home, which required a minimum annual income of $105,200 to make monthly payments of $2,630. Nationwide affordability inched up from 34 percent a year ago. In the third quarter of 2024, the nationwide minimum required annual income was less than half that of California’s for the sixth consecutive quarter.

Key points from the third-quarter 2024 Housing Affordability report include:

- On a quarter-to-quarter basis, housing affordability declined in only three counties and remained unchanged in another three. Forty-seven counties showed an improvement in affordability from second-quarter 2024 as a result of moderate price declines in those counties along with lower mortgage rates during the same time period. Compared to a year ago, 40 counties were more affordable, while six counties were less affordable, and seven remained unchanged.

- Lassen (52 percent) remained the most affordable county in California, followed by a two-way tie between Glenn and Tuolumne at 40 percent, and another two-way tie for the next rank between Amador and Tehama at 38 percent. Of all counties in California, Lassen continued to require the lowest minimum qualifying annual income ($66,000) to purchase a median-priced home in the third quarter of 2024.

- Mono (7 percent), Monterey (10 percent), and a two-way tie between Los Angeles and San Luis Obispo counties at 11 percent were the least affordable counties in the state, with each of them requiring a minimum annual income of at least $218,000 to purchase a median-priced home in the respective counties. San Mateo continued to require the highest minimum annual qualifying income ($514,400) to buy a median-priced home in third-quarter 2024 and was the only county in requiring a minimum qualifying annual income of more than $500,000. Santa Clara and San Francisco ranked second and third with a minimum required annual income of $476,800 and $396,400, respectively.

- While housing affordability improved in the majority of counties throughout the state due to higher household income and lower mortgage rates, home prices remained elevated throughout much of California despite softening from the previous quarter. As a result, housing affordability in one-fourth of the counties tracked by C.A.R. either remained unchanged or declined from the same quarter last year. Plumas (23 percent) experienced the biggest affordability drop, falling eight points from the third quarter of 2023. Lassen (52 percent) recorded the second biggest affordability drop, moving six points below the same quarter of last year. Merced (27 percent) and Sutter (28 percent) posted the third worst drop in affordability, with each decreasing three percentage points from a year ago. Housing affordability in California remained near its all-time low across the state and continued to be a challenge for both buyers and sellers.

See C.A.R.’s historical housing affordability data.

See first-time buyer housing affordability data.

Leading the way…® in California real estate for nearly 120 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with 200,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

|

CALIFORNIA ASSOCIATION OF REALTORS®

|

||||||||

|

Qtr. 3 2024 |

C.A.R. Traditional Housing Affordability Index |

|||||||

|

STATE/REGION/COUNTY |

Qtr. 3 |

Qtr. 2 |

Qtr. 3 |

Median |

Monthly |

Minimum |

||

|

Calif. Single-family home |

16 |

14 |

15 |

$880,250 |

$5,520 |

$220,800 |

||

|

Calif. Condo/Townhome |

25 |

22 |

23 |

$670,000 |

$4,200 |

$168,000 |

||

|

Los Angeles Metro Area |

15 |

13 |

14 |

$827,000 |

$5,190 |

$207,600 |

||

|

Inland Empire |

22 |

20 |

20 |

$590,000 |

$3,700 |

$148,000 |

||

|

San Francisco Bay Area |

21 |

18 |

19 |

$1,275,000 |

$8,000 |

$320,000 |

||

|

United States |

35 |

33 |

34 |

$418,700 |

$2,630 |

$105,200 |

||

|

San Francisco Bay Area |

||||||||

|

Alameda |

18 |

16 |

16 |

$1,275,000 |

$8,000 |

$320,000 |

||

|

Contra Costa |

25 |

21 |

22 |

$875,000 |

$5,490 |

$219,600 |

||

|

Marin |

20 |

16 |

18 |

$1,575,000 |

$9,880 |

$395,200 |

||

|

Napa |

15 |

14 |

15 |

$975,000 |

$6,120 |

$244,800 |

||

|

San Francisco |

21 |

19 |

21 |

$1,580,000 |

$9,910 |

$396,400 |

||

|

San Mateo |

17 |

16 |

17 |

$2,050,000 |

$12,860 |

$514,400 |

||

|

Santa Clara |

19 |

16 |

17 |

$1,900,000 |

$11,920 |

$476,800 |

||

|

Solano |

26 |

24 |

24 |

$600,000 |

$3,760 |

$150,400 |

||

|

Sonoma |

18 |

16 |

15 |

$835,000 |

$5,240 |

$209,600 |

||

|

Southern California |

||||||||

|

Imperial |

28 |

26 |

27 |

$395,000 |

$2,480 |

$99,200 |

||

|

Los Angeles |

11 |

13 |

11 |

$947,480 |

$5,940 |

$237,600 |

||

|

Orange |

12 |

11 |

11 |

$1,398,500 |

$8,770 |

$350,800 |

||

|

Riverside |

21 |

18 |

19 |

$635,000 |

$3,980 |

$159,200 |

||

|

San Bernardino |

27 |

25 |

25 |

$510,000 |

$3,200 |

$128,000 |

||

|

San Diego |

12 |

11 |

11 |

$1,010,000 |

$6,340 |

$253,600 |

||

|

Ventura |

13 |

12 |

13 |

$950,000 |

$5,960 |

$238,400 |

||

|

Central Coast |

||||||||

|

Monterey |

10 |

8 |

9 |

$950,000 |

$5,960 |

$238,400 |

||

|

San Luis Obispo |

11 |

11 |

10 |

$940,500 |

$5,900 |

$236,000 |

||

|

Santa Barbara |

13 |

9 |

10 |

$950,000 |

$5,960 |

$238,400 |

||

|

Santa Cruz |

14 |

13 |

13 |

$1,319,000 |

$8,280 |

$331,200 |

||

|

Central Valley |

||||||||

|

Fresno |

30 |

28 |

27 |

$430,000 |

$2,700 |

$108,000 |

||

|

Glenn |

40 |

35 |

30 |

$327,000 |

$2,050 |

$82,000 |

||

|

Kern |

30 |

30 |

28 |

$405,000 |

$2,540 |

$101,600 |

||

|

Kings |

33 |

29 |

27 |

$375,000 |

$2,350 |

$94,000 |

||

|

Madera |

31 |

29 |

29 |

$426,940 |

$2,680 |

$107,200 |

||

|

Merced |

27 |

25 |

30 |

$413,000 |

$2,590 |

$103,600 |

||

|

Placer |

30 |

28 |

27 |

$670,000 |

$4,200 |

$168,000 |

||

|

Sacramento |

26 |

24 |

23 |

$560,000 |

$3,510 |

$140,400 |

||

|

San Benito |

21 |

18 |

16 |

$800,000 |

$5,020 |

$200,800 |

||

|

San Joaquin |

25 |

24 |

23 |

$572,950 |

$3,590 |

$143,600 |

||

|

Stanislaus |

29 |

25 |

24 |

$480,000 |

$3,010 |

$120,400 |

||

|

Tulare |

31 |

30 |

30 |

$380,000 |

$2,380 |

$95,200 |

||

|

Far North |

||||||||

|

Butte |

29 |

27 |

28 |

$450,000 |

$2,820 |

$112,800 |

||

|

Lassen |

52 |

52 |

58 |

$262,500 |

$1,650 |

$66,000 |

||

|

Plumas |

23 |

29 |

31 |

$520,000 |

$3,260 |

$130,400 |

||

|

Shasta |

34 |

33 |

35 |

$385,000 |

$2,420 |

$96,800 |

||

|

Siskiyou |

36 |

31 |

34 |

$312,500 |

$1,960 |

$78,400 |

||

|

Tehama |

38 |

34 |

39 |

$325,000 |

$2,040 |

$81,600 |

||

|

Trinity |

34 |

28 |

30 |

$275,000 |

$1,730 |

$69,200 |

||

|

Other Calif. Counties |

||||||||

|

Amador |

38 |

32 |

26 |

$416,000 |

$2,610 |

$104,400 |

||

|

Calaveras |

31 |

29 |

27 |

$485,000 |

$3,040 |

$121,600 |

||

|

Del Norte |

28 |

34 |

28 |

$420,000 |

$2,630 |

$105,200 |

||

|

El Dorado |

27 |

22 |

23 |

$665,000 |

$4,170 |

$166,800 |

||

|

Humboldt |

23 |

22 |

23 |

$439,900 |

$2,760 |

$110,400 |

||

|

Lake |

35 |

31 |

30 |

$343,000 |

$2,150 |

$86,000 |

||

|

Mariposa |

27 |

25 |

16 |

$409,000 |

$2,570 |

$102,800 |

||

|

Mendocino |

18 |

17 |

15 |

$549,000 |

$3,440 |

$137,600 |

||

|

Mono |

7 |

5 |

5 |

$869,000 |

$5,450 |

$218,000 |

||

|

Nevada |

26 |

24 |

23 |

$577,000 |

$3,620 |

$144,800 |

||

|

Sutter |

28 |

27 |

31 |

$430,000 |

$2,700 |

$108,000 |

||

|

Tuolumne |

40 |

31 |

31 |

$385,000 |

$2,420 |

$96,800 |

||

|

Yolo |

24 |

22 |

23 |

$615,000 |

$3,860 |

$154,400 |

||

|

Yuba |

27 |

25 |

26 |

$440,000 |

$2,760 |

$110,400 |

||

|

r = revised

Traditional Housing Affordability Indices (HAI) were calculated based on the following effective composite interest rates: 6.63% (3Qtr. 2024), 7.10% (2Qtr. 2024) and 7.14% (3Qtr. 2023). |

||||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/california-housing-affordability-improves-from-previous-quarter-and-year-as-price-growth-ebbs-and-rates-dip-car-reports-302298926.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/california-housing-affordability-improves-from-previous-quarter-and-year-as-price-growth-ebbs-and-rates-dip-car-reports-302298926.html

SOURCE CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EVP At Royal Caribbean Gr Sells $4.06M Of Stock

Revealing a significant insider sell on November 6, Harri U Kulovaara, EVP at Royal Caribbean Gr RCL, as per the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, Kulovaara sold 19,385 shares of Royal Caribbean Gr. The total transaction value is $4,062,661.

The latest update on Thursday morning shows Royal Caribbean Gr shares down by 1.08%, trading at $224.2.

All You Need to Know About Royal Caribbean Gr

Royal Caribbean is the world’s second-largest cruise company, operating 68 ships across five global and partner brands in the cruise vacation industry. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in 2021.

Unraveling the Financial Story of Royal Caribbean Gr

Revenue Growth: Royal Caribbean Gr’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 17.45%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Exploring Profitability:

-

Gross Margin: The company shows a low gross margin of 51.06%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Royal Caribbean Gr’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 4.22.

Debt Management: Royal Caribbean Gr’s debt-to-equity ratio stands notably higher than the industry average, reaching 3.06. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 22.71 is lower than the industry average, implying a discounted valuation for Royal Caribbean Gr’s stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 3.95, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 14.04 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Royal Caribbean Gr’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prakash Bedapudi Implements A Sell Strategy: Offloads $1.94M In Lennox Intl Stock

Disclosed on November 6, Prakash Bedapudi, EVP at Lennox Intl LII, executed a substantial insider sell as per the latest SEC filing.

What Happened: Bedapudi opted to sell 3,142 shares of Lennox Intl, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The transaction’s total worth stands at $1,940,732.

As of Thursday morning, Lennox Intl shares are down by 0.0%, currently priced at $604.78.

Unveiling the Story Behind Lennox Intl

Lennox International manufactures and distributes heating, ventilating, air conditioning, and refrigeration products to replacement (75% of sales) and new construction (25% of sales) markets. In fiscal 2023, residential HVAC was 68% of sales and commercial HVAC and Heatcraft refrigeration was 32% of sales. The company goes to market with multiple brands, but Lennox is the company’s flagship HVAC brand. The Texas-based company is focused on North America after the sale of its European HVAC and refrigeration businesses in late 2023.

Lennox Intl’s Economic Impact: An Analysis

Revenue Growth: Lennox Intl displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 9.65%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Insights into Profitability:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 32.6%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 6.71, Lennox Intl showcases strong earnings per share.

Debt Management: Lennox Intl’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.89, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: Lennox Intl’s P/E ratio of 28.73 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 4.21, Lennox Intl’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio of 21.21, the company’s market valuation exceeds industry averages.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Transaction Codes To Focus On

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Lennox Intl’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Casella Waste Sys Chief Executive Officer Trades Company's Stock

John W Casella, Chief Executive Officer at Casella Waste Sys CWST, disclosed an insider sell on November 6, according to a recent SEC filing.

What Happened: Casella’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday unveiled the sale of 23,509 shares of Casella Waste Sys. The total transaction value is $2,369,563.

Casella Waste Sys‘s shares are actively trading at $106.91, experiencing a down of 0.0% during Thursday’s morning session.

All You Need to Know About Casella Waste Sys

Casella Waste Systems Inc is a solid waste removal company, providing resource management services to residential, commercial, municipal, and industrial customers. The company’s reportable segments on Geographical basis include Eastern, Western and Mid-Atlantic regions through the Resource solution segment. It generates maximum revenue from the Western region segment. The company services include Recycling, Collection, Organics, Energy, Landfills, Special Waste as well as Professional Services.

Casella Waste Sys’s Economic Impact: An Analysis

Revenue Growth: Over the 3 months period, Casella Waste Sys showcased positive performance, achieving a revenue growth rate of 16.7% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Key Insights into Profitability Metrics:

-

Gross Margin: With a low gross margin of 35.11%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Casella Waste Sys’s EPS reflects a decline, falling below the industry average with a current EPS of 0.1.

Debt Management: With a below-average debt-to-equity ratio of 0.76, Casella Waste Sys adopts a prudent financial strategy, indicating a balanced approach to debt management.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 971.91 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 4.19 is above industry norms, reflecting an elevated valuation for Casella Waste Sys’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Casella Waste Sys’s EV/EBITDA ratio stands at 24.52, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

The Insider’s Guide to Important Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Casella Waste Sys’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.