Will a Nursing Home Drain Our $500k in Savings and Trust Fund?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Can a nursing home seize your savings? What if your money is in a trust or a Roth IRA? For married and single retirees alike, these are important questions with nuanced answers.

First for the good news: A nursing home cannot simply take your retirement accounts or savings. Short of legal action due to an unpaid bill, you can distribute your assets as you see fit. However, you will have to plan ahead to optimize your end-of-life finances, particularly because in some cases its possible the government could seize assets post-death to pay for nursing home expenses.

Long-term care, especially stays in nursing homes, can be costly. Options for covering these costs include paying out of pocket, private insurance and Medicaid. Your assets, even if they’re in a Roth IRA or certain types of trusts, can potentially impact your eligibility for the latter. If you need help planning for your long-term care needs, consider working with a financial advisor.

Long-term care, which can include everything from homemaker services and help from a home health aide to nursing home care, is expensive. In fact, the median monthly cost of a private room in an American nursing home is estimated to be $9,584 in 2023, according to GenWorth, an insurance company that offers long-term care coverage. Those costs are expected to increase to nearly $13,000 per month by 2033.

That’s well beyond what most people can afford from their retirement income, and many times what Social Security pays. That’s why it’s important to plan ahead, says Alec F. Root, a chartered financial analyst (CFA) with DBR & Co.

“As with estate planning in general, it is helpful to have these conversations sooner rather than later, especially before one’s health changes and potentially impacts their ability to properly insure themselves,” he told SmartAsset. “Five to 10 years prior to retirement is generally a good time to discuss this subject. A strong estate plan will detail the terms of late-life care, while a good financial plan will account for nursing home care and final expenses.”

Medicare won’t cover the costs of a nursing home or other facilities. Instead, generally, the best way to afford long-term care may be through dedicated long-term care insurance. The earlier you purchase this coverage the less expensive this will be. For a healthy 55-year-old, you can expect to pay between $950 and $1,500 per year for this coverage, according to the American Association of Long-Term Care Planning. At 65, those averages jump to between $1,700 and $2,700 per year. So prepare ahead of time.

Sealed Air Reports Q3 2024 Results

Third Quarter 2024 Highlights and Financial Results

- Shifted operating structure into two distinct verticals, Food and Protective, and announced both vertical presidents with strong commercial packaging expertise

- Volume growth in Food driven by strong end-market demand and competitive wins

- Protective industrial and fulfillment portfolios continue to be weak

- Cost take-out on track to generate $90 million of incremental cost savings for full-year 2024

- Net leverage ratio reduced to 3.7x with maintained focus on deleveraging the balance sheet

- Updating our financial outlook for 2024

CHARLOTTE, N.C., Nov. 7, 2024 /PRNewswire/ — Sealed Air Corporation SEE announced third quarter 2024 financial results and business updates.

“With the shift into two verticals, Food and Protective, and the onboarding of new leadership, we have positioned Sealed Air for long-term success,” said Patrick Kivits, Sealed Air’s CEO. “Over the coming months, we are focused on operationalizing each vertical and finalizing the long-term growth strategy for each business. In parallel, we are stepping up our cost take-out initiatives to right-size each business and improve profitability until our transformation takes hold.”

“While our third quarter results were ahead of expectation, the strength of our Food business continues to be offset by continued softness in our Protective portfolio. As a result, we are maintaining the midpoint of our Sales and Adjusted EBITDA guidance,” said Dustin Semach, Sealed Air’s President and CFO. “We continue to improve underlying cash generation fundamentals, optimize our debt and tax rate, and as a result, we are raising our guidance for Free Cash Flow and Adjusted EPS for the year.”

|

($ millions, except per share data) |

||||

|

GAAP Results |

Third Quarter |

|||

|

2024 |

2023 |

Reported △% |

Constant Currency △% |

|

|

Net Sales |

$1,345.1 |

$1,381.8 |

(2.7) % |

(2.3) % |

|

Net Earnings |

$88.7 |

$57 .6 |

54.0 % |

|

|

Diluted EPS |

$0.61 |

$0.40 |

52.5 % |

|

|

Cash Flow from Operations (YTD) |

$483.8 |

$192.5 |

151.3 % |

|

|

Non-GAAP Results |

Third Quarter |

|||

|

2024 |

2023 |

Reported △% |

||

|

Adjusted EBITDA |

$276.0 |

$284.7 |

(3.1) % |

|

|

Adjusted Net Earnings |

$115.7 |

$111.5 |

3.8 % |

|

|

Adjusted Diluted EPS |

$0.79 |

$0.77 |

2.6 % |

|

|

Free Cash Flow (YTD) |

$322.7 |

$182.5(1) |

76.8 % |

|

|

(1) 2023 excludes the impact of a $175 million tax deposit to resolve certain U.S. tax matters. |

|

Unless otherwise stated, all results compare third quarter 2024 results to third quarter 2023 results from continuing operations. Year-over-year financial discussions present operating results from continuing operations as reported. |

Third Quarter 2024 Financial Highlights

Net sales of $1.35 billion decreased 3% as reported, with APAC increasing 4% and the Americas and EMEA regions both decreasing 4%. Net sales decreased $32 million, or 2%, on a constant dollar basis. Price had an unfavorable impact of $26 million, or 2%. Volumes decreased by $6 million, or less than 1%.

Income tax expense was $31 million, resulting in an effective tax rate of 25.7% in the quarter. This compares to an income tax expense of $20 million in the prior year, or an effective tax rate of 26.1%. The Adjusted Tax Rate was 24.0% in the quarter, as compared to 25.7% in the prior year.

Net earnings were $89 million, or $0.61 per diluted share, as compared to net earnings of $58 million, or $0.40 per diluted share in the prior year. The current year results were unfavorably impacted by $33 million of Special Items expense, including $16 million of restructuring and other associated costs related to the cost take-out to grow program (“CTO2Grow Program”) and $8 million related to the amortization of Liquibox intangible assets. The prior year results were unfavorably impacted by $72 million of Special Items expense, including $51 million related to business closure activity. Adjusted earnings per diluted share increased to $0.79, from $0.77 in the prior year, primarily due to lower interest and tax expense, partially offset by lower Adjusted EBITDA.

Adjusted EBITDA was $276 million, or 20.5% of net sales, as compared to $285 million, or 20.6% in the prior year. The decrease in Adjusted EBITDA was primarily due to lower volumes and unfavorable net price realization in Protective, partially offset by lower operating costs driven by productivity benefits as a result of the CTO2Grow Program.

Business Segment Highlights

Third quarter net sales in Food were $898 million, an increase of approximately 1% as reported. Currency fluctuations had an unfavorable impact of $5 million, or less than 1%. On a constant dollar basis, net sales increased $9 million, or 1%. Volumes increased $21 million, or 2%, with growth in all regions driven by strength in end-market demand and competitive share gains. Price had an unfavorable impact of $12 million, or 1%. Adjusted EBITDA of $206 million, or 22.9% of net sales, increased 6% from $194 million, or 21.7% of net sales. The increase in Adjusted EBITDA was driven by higher volumes, favorable net price realization and lower operating costs driven by productivity benefits, including our CTO2Grow Program.

Third quarter net sales in Protective were $447 million, a decrease of 8% as reported. Currency fluctuations had an unfavorable impact of less than $1 million. On a constant dollar basis, net sales decreased $41 million, or 8%. Volumes decreased $28 million, or 6%, resulting from continued weakness in our industrial and fulfillment portfolios. Price had an unfavorable impact of $13 million, or 3%. Adjusted EBITDA of $75 million, or 16.9% of net sales, decreased 21% from $95 million, or 19.5% of net sales. The decrease in Adjusted EBITDA was primarily attributable to lower volumes and unfavorable net price realization, partially offset by lower operating costs driven by productivity benefits, including our CTO2Grow Program.

Cash Flow and Net Debt

Cash flow from operating activities during the first nine months of 2024 was a source of $484 million, as compared to a source of $193 million during the prior year period, which included a $175 million tax deposit.

Capital expenditures in the first nine months of 2024 were $161 million, as compared to $185 million during the prior year period. Free Cash Flow, defined as net cash from operating activities less capital expenditures, was a source of $323 million for the first nine months of 2024, as compared to a source of $8 million during the prior year period. Excluding the $175 million tax deposit, Free Cash Flow was a source of $183 million for the first nine months of 2023.

Dividend payments for the first nine months of both 2024 and 2023 were $89 million.

Total debt was $4.5 billion as of September 30, 2024 and $4.7 billion as of December 31, 2023. Net Debt, defined as total debt less cash and cash equivalents, was $4.1 billion as of September 30, 2024 and $4.3 billion as of December 31, 2023. As of September 30, 2024, SEE had approximately $1.4 billion of available liquidity comprised of $386 million of cash and $1.0 billion of available and unused lines of credit under our committed credit facilities. The net leverage ratio, defined as net debt divided by last twelve months Adjusted EBITDA, decreased to 3.7x as of September 30, 2024 as compared to 3.9x as of December 31, 2023.

Updated 2024 Full Year Outlook

|

Net Sales |

$5.375 to $5.425 billion |

|

Adjusted EBITDA |

$1.09 to $1.11 billion |

|

Adjusted EPS |

$3.00 to $3.10 |

|

Free Cash Flow |

$350 to $450 million |

Adjusted EBITDA, Adjusted EPS and Free Cash Flow are non-GAAP financial measures. We have not provided guidance for the most directly comparable GAAP financial measures, as they are not available without unreasonable effort due to the high variability, complexity and low visibility of certain Special Items.

Conference Call Information

Sealed Air Corporation will host a conference call and webcast on Thursday, November 7, 2024 at 10:00 a.m. (ET) to discuss our Third Quarter 2024 Results. The conference call will be webcast live on the Investors homepage at www.sealedair.com/investors. A replay of the webcast will also be available thereafter. A slide presentation, which includes supplemental information relating to the Company’s third quarter earnings will be made available through the “Presentations & Events” section of the Company’s Investor Relations website at https://ir.sealedair.com/events-and-presentations prior to the call.

About Sealed Air

Sealed Air Corporation SEE, is a leading global provider of packaging solutions that integrate sustainable, high-performance materials, automation, equipment and services. Sealed Air designs, manufactures and delivers packaging solutions that preserve food, protect goods and automate packaging processes. We deliver our packaging solutions to an array of end markets including fresh proteins, foods, fluids and liquids, medical and life science, e-commerce retail, logistics and omnichannel fulfillment operations, and industrials. Our globally recognized solution brands include CRYOVAC® brand food packaging, LIQUIBOX® brand liquids systems, SEALED AIR® brand protective packaging, AUTOBAG® brand automated packaging systems, and BUBBLE WRAP® brand packaging. In 2023, Sealed Air generated $5.5 billion in sales and has approximately 17,000 employees who serve customers in 115 countries/territories.

Website Information

We routinely post important information for investors on our website, www.sealedair.com, in the Investors section. We use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document.

Non-GAAP Information

In this press release, we include certain non-GAAP financial measures, including Net Debt, Adjusted Net Earnings and Adjusted EPS, net sales on an “organic” and a “constant dollar” basis, Free Cash Flow, Adjusted EBITDA, Adjusted EBITDA Margin, net leverage ratio and Adjusted Tax Rate. Management uses non-GAAP financial measures to assess operating and financial performance, set budgets, provide guidance and compare with peers’ performance. We believe such non-GAAP financial measures are useful to investors. Non-GAAP financial measures should not be considered in isolation from or as a substitute for GAAP information. See the attached supplementary information for reconciliations of non-GAAP financial measures to their most directly comparable GAAP financial measures. Information reconciling forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures is not presented because it is not available without unreasonable effort. The reconciling information that is not available includes forward-looking ranges of certain Special Items with high variability, complexity and low visibility. We are unable to address the probable significance of such unavailable information, which could have a potential significant impact on our future GAAP financial results.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by such words as “anticipate,” “believe,” “plan,” “assume,” “could,” “should,” “estimate,” “expect,” “intend,” “potential,” “seek,” “predict,” “may,” “will” or the negative of these terms and similar expressions. All statements contained in this press release, other than statements of historical facts, such as those regarding our growth initiatives, business strategies, operating plans, business outlook, restructuring activities and market conditions, are forward-looking statements. These statements are neither promises nor guarantees, but involve known and unknown risks and uncertainties that may cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. These risks include important factors discussed in the “Risk Factors” section in Part I of our most recent Annual Report on Form 10-K, as updated by our other filings with the Securities and Exchange Commission.

Any forward-looking statements made by us in this press release are based solely on management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements, we disclaim any obligation to do so even if subsequent events cause our views to change, except as may be required by applicable law.

Company Contacts

Investors

Brian Sullivan

brian.c.sullivan@sealedair.com

704.503.8841

Louise Lagache

louise.lagache@sealedair.com

Media

Amanda Hoggarth

amanda.hoggarth@sealedair.com

|

Sealed Air Corporation Condensed Consolidated Statements of Operations (Unaudited)

|

||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||

|

(In USD millions, except per share data) |

2024 |

2023 |

2024 |

2023 |

||||

|

Net sales |

$ 1,345.1 |

$ 1,381.8 |

$ 4,019.8 |

$ 4,111.4 |

||||

|

Cost of sales |

943.6 |

968.5 |

2,801.5 |

2,875.0 |

||||

|

Gross profit |

401.5 |

413.3 |

1,218.3 |

1,236.4 |

||||

|

Selling, general and administrative expenses |

187.1 |

181.8 |

563.8 |

582.6 |

||||

|

Loss on disposal of businesses and property and equipment, net |

(5.4) |

(48.7) |

(5.8) |

(55.2) |

||||

|

Amortization expense of intangible assets |

15.9 |

15.4 |

47.0 |

46.0 |

||||

|

Restructuring charges |

6.8 |

9.8 |

24.8 |

9.2 |

||||

|

Operating profit |

186.3 |

157.6 |

576.9 |

543.4 |

||||

|

Interest expense, net |

(60.5) |

(70.1) |

(188.9) |

(196.6) |

||||

|

Other expense, net |

(6.4) |

(9.6) |

(14.0) |

(33.0) |

||||

|

Earnings before income tax provision |

119.4 |

77.9 |

374.0 |

313.8 |

||||

|

Income tax provision |

30.7 |

20.3 |

104.1 |

99.4 |

||||

|

Net earnings from continuing operations |

88.7 |

57.6 |

269.9 |

214.4 |

||||

|

Gain (Loss) on sale of discontinued operations, net of tax |

3.0 |

(1.0) |

2.1 |

3.2 |

||||

|

Net earnings |

$ 91.7 |

$ 56.6 |

$ 272.0 |

$ 217.6 |

||||

|

Basic: |

||||||||

|

Continuing operations |

$ 0.61 |

$ 0.40 |

$ 1.86 |

$ 1.49 |

||||

|

Discontinued operations |

0.02 |

(0.01) |

0.01 |

0.02 |

||||

|

Net earnings per common share – basic |

$ 0.63 |

$ 0.39 |

$ 1.87 |

$ 1.51 |

||||

|

Weighted average common shares outstanding – basic |

145.8 |

144.5 |

145.5 |

144.3 |

||||

|

Diluted: |

||||||||

|

Continuing operations |

$ 0.61 |

$ 0.40 |

$ 1.85 |

$ 1.48 |

||||

|

Discontinued operations |

0.02 |

(0.01) |

0.02 |

0.02 |

||||

|

Net earnings per common share – diluted |

$ 0.63 |

$ 0.39 |

$ 1.87 |

$ 1.50 |

||||

|

Weighted average common shares outstanding – diluted |

146.1 |

144.9 |

145.8 |

144.8 |

||||

|

Sealed Air Corporation Condensed Consolidated Balance Sheets (Unaudited)

|

||||

|

(In USD millions) |

September 30, 2024 |

December 31, 2023 |

||

|

Assets |

||||

|

Current assets: |

||||

|

Cash and cash equivalents |

$ 386.0 |

$ 346.1 |

||

|

Trade receivables, net |

478.7 |

442.6 |

||

|

Income tax receivables |

19.7 |

44.9 |

||

|

Other receivables |

95.6 |

94.2 |

||

|

Advances and deposits |

67.4 |

72.8 |

||

|

Inventories, net |

807.3 |

774.3 |

||

|

Prepaid expenses and other current assets |

204.8 |

188.4 |

||

|

Total current assets |

2,059.5 |

1,963.3 |

||

|

Property and equipment, net |

1,438.0 |

1,416.4 |

||

|

Goodwill |

2,896.8 |

2,892.5 |

||

|

Identifiable intangible assets, net |

397.6 |

439.0 |

||

|

Deferred taxes |

151.8 |

130.8 |

||

|

Operating lease right-of-use-assets |

97.5 |

86.5 |

||

|

Other non-current assets |

279.9 |

272.1 |

||

|

Total assets |

$ 7,321.1 |

$ 7,200.6 |

||

|

Liabilities and Stockholders’ Equity |

||||

|

Current liabilities: |

||||

|

Short-term borrowings |

$ 139.7 |

$ 140.7 |

||

|

Current portion of long-term debt |

58.1 |

35.7 |

||

|

Current portion of operating lease liabilities |

29.1 |

29.2 |

||

|

Accounts payable |

800.9 |

764.6 |

||

|

Accrued restructuring costs |

17.9 |

23.1 |

||

|

Income tax payable |

47.5 |

28.7 |

||

|

Other current liabilities |

499.7 |

487.0 |

||

|

Total current liabilities |

1,592.9 |

1,509.0 |

||

|

Long-term debt, less current portion |

4,334.0 |

4,513.9 |

||

|

Long-term operating lease liabilities, less current portion |

75.0 |

66.7 |

||

|

Deferred taxes |

36.0 |

35.8 |

||

|

Other non-current liabilities |

512.0 |

525.7 |

||

|

Total liabilities |

6,549.9 |

6,651.1 |

||

|

Stockholders’ equity: |

||||

|

Preferred stock |

— |

— |

||

|

Common stock |

15.5 |

15.4 |

||

|

Additional paid-in capital |

1,438.3 |

1,429.5 |

||

|

Retained earnings |

680.1 |

496.5 |

||

|

Common stock in treasury |

(404.2) |

(436.4) |

||

|

Accumulated other comprehensive loss, net of taxes |

(958.5) |

(955.5) |

||

|

Total stockholders’ equity |

771.2 |

549.5 |

||

|

Total liabilities and stockholders’ equity |

$ 7,321.1 |

$ 7,200.6 |

||

|

Sealed Air Corporation Condensed Consolidated Statements of Cash Flows (Unaudited)

|

||||

|

Nine Months Ended September 30, |

||||

|

(In USD millions) |

2024 |

2023 |

||

|

Net earnings |

$ 272.0 |

$ 217.6 |

||

|

Adjustments to reconcile net earnings to net cash provided by operating activities(1) |

233.7 |

279.7 |

||

|

Changes in operating assets and liabilities: |

||||

|

Trade receivables, net |

(42.8) |

18.1 |

||

|

Inventories, net |

(56.2) |

60.2 |

||

|

Accounts payable |

36.5 |

(132.7) |

||

|

Customer advance payments |

(5.5) |

(9.8) |

||

|

Income tax receivable/payable |

44.7 |

(9.9) |

||

|

Tax deposit |

— |

(175.0) |

||

|

Other assets and liabilities |

1.4 |

(55.7) |

||

|

Net cash provided by operating activities |

$ 483.8 |

$ 192.5 |

||

|

Cash flows from investing activities: |

||||

|

Capital expenditures |

(161.1) |

(185.0) |

||

|

Proceeds related to sale of business and property and equipment, net |

0.7 |

1.9 |

||

|

Business acquired in purchase transactions, net of cash acquired |

4.2 |

(1,162.9) |

||

|

(Payments) proceeds associated with debt, equity and equity method investments |

(1.1) |

3.3 |

||

|

Settlement of foreign currency forward contracts |

(11.0) |

15.1 |

||

|

Proceeds from cross-currency swaps |

3.1 |

1.6 |

||

|

Net cash used in investing activities |

$ (165.2) |

$ (1,326.0) |

||

|

Cash flows from financing activities: |

||||

|

Net (payments) proceeds from short-term borrowings |

(1.6) |

206.6 |

||

|

Proceeds from long-term debt |

413.4 |

1,411.4 |

||

|

Payments of long-term debt |

(582.1) |

(433.2) |

||

|

Payments of debt modification/extinguishment costs and other |

(7.3) |

(14.1) |

||

|

Dividends paid on common stock |

(88.8) |

(88.9) |

||

|

Impact of tax withholding on share-based compensation |

(9.2) |

(21.3) |

||

|

Repurchases of common stock |

— |

(79.9) |

||

|

Principal payments related to financing leases |

(6.1) |

(6.4) |

||

|

Net cash (used in) provided by financing activities |

$ (281.7) |

$ 974.2 |

||

|

Effect of foreign currency exchange rate changes on cash and cash equivalents |

$ 3.0 |

$ (15.5) |

||

|

Cash and cash equivalents |

346.1 |

456.1 |

||

|

Restricted cash and cash equivalents |

— |

— |

||

|

Balance, beginning of period |

$ 346.1 |

$ 456.1 |

||

|

Net change during the period |

$ 39.9 |

$ (174.8) |

||

|

Cash and cash equivalents |

386.0 |

281.3 |

||

|

Restricted cash and cash equivalents |

— |

— |

||

|

Balance, end of period |

$ 386.0 |

$ 281.3 |

||

|

Non-GAAP Free Cash Flow: |

||||

|

Cash flow from operating activities |

$ 483.8 |

$ 192.5 |

||

|

Capital expenditures |

(161.1) |

(185.0) |

||

|

Non-GAAP Free Cash Flow |

$ 322.7 |

$ 7.5 |

||

|

Nine Months Ended September 30, |

||||

|

(In USD millions) |

2024 |

2023 |

||

|

Supplemental Cash Flow Information: |

||||

|

Interest payments |

$ 220.3 |

$ 201.7 |

||

|

Income tax payments, net of cash refunds(2) |

$ 74.9 |

$ 310.1 |

||

|

Restructuring payments including associated costs |

$ 43.5 |

$ 12.4 |

||

|

Non-cash items: |

||||

|

Transfers of shares of common stock from treasury for profit-sharing contributions |

$ 25.4 |

$ 23.9 |

||

|

____________ |

|

|

(1) |

2024 adjustments primarily consist of depreciation and amortization of $183 million, share-based compensation expense of approximately $23 million, profit sharing expense of $20 million, provision for inventory obsolescence of $17 million and loss on debt redemption and refinancing activities of $7 million. 2023 adjustments primarily consist of depreciation and amortization of $175 million, net loss associated with the disposal of businesses of $53 million, share-based compensation expense of $31 million, profit sharing expense of $19 million, provision for inventory obsolescence of $15 million, and loss on debt redemption and refinancing activities of $5 million. |

|

(2) |

2023 includes a $175 million tax deposit related to the resolution of certain U.S. tax matters that was made during the second quarter of 2023. Excluding the $175 million tax deposit, Income tax payments, net of cash refunds were $135 million for the nine months ended September 30, 2023. |

|

Sealed Air Corporation Components of Change in Net Sales by Segment (Unaudited)

|

||||||||||||

|

Three Months Ended September 30, |

||||||||||||

|

(In USD millions) |

Food |

Protective |

Total Company |

|||||||||

|

2023 Net Sales |

$ 893.4 |

64.7 % |

$ 488.4 |

35.3 % |

$ 1,381.8 |

100.0 % |

||||||

|

Price |

(12.2) |

(1.4) % |

(13.4) |

(2.7) % |

(25.6) |

(1.8) % |

||||||

|

Volume(1) |

21.3 |

2.4 % |

(27.6) |

(5.7) % |

(6.3) |

(0.5) % |

||||||

|

Total constant dollar change (non-GAAP)(2) |

9.1 |

1.0 % |

(41.0) |

(8.4) % |

(31.9) |

(2.3) % |

||||||

|

Foreign currency translation |

(4.6) |

(0.5) % |

(0.2) |

— % |

(4.8) |

(0.4) % |

||||||

|

Total change (GAAP) |

4.5 |

0.5 % |

(41.2) |

(8.4) % |

(36.7) |

(2.7) % |

||||||

|

2024 Net Sales |

$ 897.9 |

66.8 % |

$ 447.2 |

33.2 % |

$ 1,345.1 |

100.0 % |

||||||

|

Nine Months Ended September 30, |

||||||||||||

|

(In USD millions) |

Food |

Protective |

Total Company |

|||||||||

|

2023 Net Sales |

$ 2,627.1 |

63.9 % |

$ 1,484.3 |

36.1 % |

$ 4,111.4 |

100.0 % |

||||||

|

Price |

(71.1) |

(2.7) % |

(43.4) |

(2.9) % |

(114.5) |

(2.8) % |

||||||

|

Volume(1) |

93.0 |

3.5 % |

(75.5) |

(5.1) % |

17.5 |

0.4 % |

||||||

|

Total organic change (non-GAAP)(2) |

21.9 |

0.8 % |

(118.9) |

(8.0) % |

(97.0) |

(2.4) % |

||||||

|

Acquisition |

23.5 |

0.9 % |

— |

— % |

23.5 |

0.6 % |

||||||

|

Total constant dollar change (non-GAAP)(2) |

45.4 |

1.7 % |

(118.9) |

(8.0) % |

(73.5) |

(1.8) % |

||||||

|

Foreign currency translation |

(12.4) |

(0.4) % |

(5.7) |

(0.4) % |

(18.1) |

(0.4) % |

||||||

|

Total change (GAAP) |

33.0 |

1.3 % |

(124.6) |

(8.4) % |

(91.6) |

(2.2) % |

||||||

|

2024 Net Sales |

$ 2,660.1 |

66.2 % |

$ 1,359.7 |

33.8 % |

$ 4,019.8 |

100.0 % |

||||||

|

Components of Change in Net Sales by Region (Unaudited)

|

||||||||||||||||

|

Three Months Ended September 30, |

||||||||||||||||

|

(In USD millions) |

Americas |

EMEA |

APAC |

Total |

||||||||||||

|

2023 Net Sales |

$ 908.0 |

65.7 % |

$ 285.4 |

20.7 % |

$ 188.4 |

13.6 % |

$ 1,381.8 |

100.0 % |

||||||||

|

Price |

(14.0) |

(1.6) % |

(9.5) |

(3.4) % |

(2.1) |

(1.1) % |

(25.6) |

(1.8) % |

||||||||

|

Volume(1) |

(6.7) |

(0.7) % |

(7.5) |

(2.6) % |

7.9 |

4.2 % |

(6.3) |

(0.5) % |

||||||||

|

Total constant dollar change (non-GAAP)(2) |

(20.7) |

(2.3) % |

(17.0) |

(6.0) % |

5.8 |

3.1 % |

(31.9) |

(2.3) % |

||||||||

|

Foreign currency translation |

(11.3) |

(1.2) % |

4.7 |

1.7 % |

1.8 |

0.9 % |

(4.8) |

(0.4) % |

||||||||

|

Total change (GAAP) |

(32.0) |

(3.5) % |

(12.3) |

(4.3) % |

7.6 |

4.0 % |

(36.7) |

(2.7) % |

||||||||

|

2024 Net Sales |

$ 876.0 |

65.1 % |

$ 273.1 |

20.3 % |

$ 196.0 |

14.6 % |

$ 1,345.1 |

100.0 % |

||||||||

|

Nine Months Ended September 30, |

||||||||||||||||

|

(In USD millions) |

Americas |

EMEA |

APAC |

Total |

||||||||||||

|

2023 Net Sales |

$ 2,695.6 |

65.6 % |

$ 863.9 |

21.0 % |

$ 551.9 |

13.4 % |

$ 4,111.4 |

100.0 % |

||||||||

|

Price |

(76.2) |

(2.8) % |

(33.5) |

(3.9) % |

(4.8) |

(0.9) % |

(114.5) |

(2.8) % |

||||||||

|

Volume(1) |

20.6 |

0.7 % |

(15.7) |

(1.8) % |

12.6 |

2.3 % |

17.5 |

0.4 % |

||||||||

|

Total organic change (non-GAAP)(2) |

(55.6) |

(2.1) % |

(49.2) |

(5.7) % |

7.8 |

1.4 % |

(97.0) |

(2.4) % |

||||||||

|

Acquisition |

17.2 |

0.7 % |

4.0 |

0.5 % |

2.3 |

0.4 % |

23.5 |

0.6 % |

||||||||

|

Total constant dollar change (non-GAAP)(2) |

(38.4) |

(1.4) % |

(45.2) |

(5.2) % |

10.1 |

1.8 % |

(73.5) |

(1.8) % |

||||||||

|

Foreign currency translation |

(6.6) |

(0.3) % |

1.7 |

0.2 % |

(13.2) |

(2.4) % |

(18.1) |

(0.4) % |

||||||||

|

Total change (GAAP) |

(45.0) |

(1.7) % |

(43.5) |

(5.0) % |

(3.1) |

(0.6) % |

(91.6) |

(2.2) % |

||||||||

|

2024 Net Sales |

$ 2,650.6 |

65.9 % |

$ 820.4 |

20.4 % |

$ 548.8 |

13.7 % |

$ 4,019.8 |

100.0 % |

||||||||

|

____________ |

|

|

(1) |

Our volume reported above includes the net impact of changes in unit volume as well as the period-to-period change in the mix of products sold. |

|

(2) |

Total organic change is a non-GAAP financial measure which excludes acquisitions within the first twelve months after acquisition, divestiture activity from the time of the sale, and the impact of foreign currency translation. Total constant dollar change is a non-GAAP financial measure which excludes the impact of foreign currency translation. |

|

Sealed Air Corporation Segment Information Reconciliation of Net Earnings to Non-GAAP Consolidated Adjusted EBITDA (Unaudited)

|

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(In USD millions) |

2024 |

2023 |

2024 |

2023 |

||||

|

Adjusted EBITDA from continuing operations: |

||||||||

|

Food |

$ 205.9 |

$ 194.3 |

$ 600.1 |

$ 580.1 |

||||

|

Adjusted EBITDA Margin(1) |

22.9 % |

21.7 % |

22.6 % |

22.1 % |

||||

|

Protective |

75.5 |

95.0 |

246.8 |

271.3 |

||||

|

Adjusted EBITDA Margin(1) |

16.9 % |

19.5 % |

18.2 % |

18.3 % |

||||

|

Corporate |

(5.4) |

(4.6) |

(7.1) |

(19.1) |

||||

|

Non-GAAP Consolidated Adjusted EBITDA |

$ 276.0 |

$ 284.7 |

$ 839.8 |

$ 832.3 |

||||

|

Adjusted EBITDA Margin(1) |

20.5 % |

20.6 % |

20.9 % |

20.2 % |

||||

|

_________ |

||||||||

|

(1) Adjusted EBITDA divided by net sales. |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(In USD millions) |

2024 |

2023 |

2024 |

2023 |

||||

|

GAAP Net earnings from continuing operations |

$ 88.7 |

$ 57.6 |

$ 269.9 |

$ 214.4 |

||||

|

Interest expense, net |

60.5 |

70.1 |

188.9 |

196.6 |

||||

|

Income tax provision |

30.7 |

20.3 |

104.1 |

99.4 |

||||

|

Depreciation and amortization, net of adjustments(1) |

63.2 |

64.6 |

184.2 |

187.1 |

||||

|

Special Items: |

||||||||

|

Liquibox intangible amortization |

7.5 |

7.4 |

22.7 |

19.9 |

||||

|

Liquibox inventory step-up expense |

— |

— |

— |

10.8 |

||||

|

Restructuring charges |

6.8 |

9.8 |

24.8 |

9.2 |

||||

|

Other restructuring associated costs |

9.0 |

34.6 |

22.2 |

34.5 |

||||

|

Foreign currency exchange loss due to highly inflationary economies |

2.4 |

4.9 |

7.9 |

10.6 |

||||

|

Loss on debt redemption and refinancing activities |

— |

— |

6.8 |

4.9 |

||||

|

Contract terminations |

— |

15.3 |

(0.1) |

15.3 |

||||

|

Charges related to acquisition and divestiture activity |

4.1 |

2.8 |

3.2 |

24.5 |

||||

|

Other Special Items |

3.1 |

(2.7) |

5.2 |

5.1 |

||||

|

Pre-tax impact of Special items |

32.9 |

72.1 |

92.7 |

134.8 |

||||

|

Non-GAAP Consolidated Adjusted EBITDA |

$ 276.0 |

$ 284.7 |

$ 839.8 |

$ 832.3 |

||||

|

__________ |

||||||||

|

(1) Depreciation and amortization by segment are as follows: |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(In USD millions) |

2024 |

2023 |

2024 |

2023 |

||||

|

Food |

$ 47.9 |

$ 48.1 |

$ 141.1 |

$ 135.8 |

||||

|

Protective |

22.8 |

23.9 |

65.8 |

71.2 |

||||

|

Consolidated depreciation and amortization(i) |

$ 70.7 |

$ 72.0 |

$ 206.9 |

$ 207.0 |

||||

|

Liquibox intangible amortization |

(7.5) |

(7.4) |

(22.7) |

(19.9) |

||||

|

Depreciation and amortization, net of adjustments |

$ 63.2 |

$ 64.6 |

$ 184.2 |

$ 187.1 |

||||

|

____________ |

|

|

(i) |

Includes share-based incentive compensation of $8.5 million and $24.4 million for the three and nine months ended September 30, 2024, respectively, $12.1 million and $32.3 million for the three and nine months ended September 30, 2023, respectively. |

|

The calculation of the non-GAAP Adjusted Tax Rate is as follows: |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(In USD millions) |

2024 |

2023 |

2024 |

2023 |

||||

|

GAAP Earnings before income tax provision from continuing operations |

$ 119.4 |

$ 77.9 |

$ 374.0 |

$ 313.8 |

||||

|

Pre-tax impact of Special Items |

32.9 |

72.1 |

92.7 |

134.8 |

||||

|

Non-GAAP Adjusted Earnings before income tax provision |

$ 152.3 |

$ 150.0 |

$ 466.7 |

$ 448.6 |

||||

|

GAAP Income tax provision from continuing operations |

$ 30.7 |

$ 20.3 |

$ 104.1 |

$ 99.4 |

||||

|

Tax Special Items(1) |

(1.8) |

1.4 |

(8.6) |

(10.6) |

||||

|

Tax impact of Special Items |

7.7 |

16.8 |

22.0 |

25.9 |

||||

|

Non-GAAP Adjusted Income tax provision |

$ 36.6 |

$ 38.5 |

$ 117.5 |

$ 114.7 |

||||

|

GAAP Effective income tax rate |

25.7 % |

26.1 % |

27.8 % |

31.7 % |

||||

|

Non-GAAP Adjusted Tax Rate |

24.0 % |

25.7 % |

25.2 % |

25.6 % |

||||

|

____________ |

|

|

(1) |

For the three and nine months ended September 30, 2024 and September 30, 2023, Tax Special Items primarily reflect accruals for uncertain tax positions. |

|

Sealed Air Corporation Reconciliation of Net Earnings and Net Earnings Per Common Share to Non-GAAP Adjusted Net Earnings and Non-GAAP Adjusted Net Earnings Per Common Share (Unaudited)

|

||||||||||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

(In USD millions, except per share data) |

Net |

Diluted |

Net |

Diluted |

Net |

Diluted |

Net |

Diluted |

||||||||

|

GAAP net earnings and |

$ 88.7 |

$ 0.61 |

$ 57.6 |

$ 0.40 |

$ 269.9 |

$ 1.85 |

$ 214.4 |

$ 1.48 |

||||||||

|

Special Items(1) |

27.0 |

0.18 |

53.9 |

0.37 |

79.3 |

0.54 |

119.5 |

0.83 |

||||||||

|

Non-GAAP adjusted net |

$ 115.7 |

$ 0.79 |

$ 111.5 |

$ 0.77 |

$ 349.2 |

$ 2.39 |

$ 333.9 |

$ 2.31 |

||||||||

|

Weighted average number of |

146.1 |

144.9 |

145.8 |

144.8 |

||||||||||||

|

___________ |

|

(1) Special Items include items in the table below. |

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||

|

(In USD millions, except per share data) |

2024 |

2023 |

2024 |

2023 |

||||

|

Special Items: |

||||||||

|

Liquibox intangible amortization |

$ 7.5 |

$ 7.4 |

$ 22.7 |

$ 19.9 |

||||

|

Liquibox inventory step-up expense |

— |

— |

— |

10.8 |

||||

|

Restructuring charges |

6.8 |

9.8 |

24.8 |

9.2 |

||||

|

Other restructuring associated costs(i) |

9.0 |

34.6 |

22.2 |

34.5 |

||||

|

Foreign currency exchange loss due to highly inflationary economies |

2.4 |

4.9 |

7.9 |

10.6 |

||||

|

Loss on debt redemption and refinancing activities |

— |

— |

6.8 |

4.9 |

||||

|

Contract terminations(ii) |

— |

15.3 |

(0.1) |

15.3 |

||||

|

Charges related to acquisition and divestiture activity(iii) |

4.1 |

2.8 |

3.2 |

24.5 |

||||

|

Other Special Items(iv) |

3.1 |

(2.7) |

5.2 |

5.1 |

||||

|

Pre-tax impact of Special Items |

32.9 |

72.1 |

92.7 |

134.8 |

||||

|

Tax impact of Special Items and Tax Special Items |

(5.9) |

(18.2) |

(13.4) |

(15.3) |

||||

|

Net impact of Special Items |

$ 27.0 |

$ 53.9 |

$ 79.3 |

$ 119.5 |

||||

|

Weighted average number of common shares outstanding – Diluted |

146.1 |

144.9 |

145.8 |

144.8 |

||||

|

Loss per share impact from Special Items |

$ (0.18) |

$ (0.37) |

$ (0.54) |

$ (0.83) |

||||

|

____________ |

|

|

(i) |

Other restructuring associated costs for the three and nine months ended September 30, 2024 primarily relate to fees paid to third-party consultants in support of the CTO2Grow business transformation. Other restructuring associated costs for the three and nine months ended September 30, 2023 primarily consists of impairment of property and equipment and inventory obsolescence charges related to business closure activity. |

|

(ii) |

Contract terminations for the three and nine months ended September 30, 2023 primarily relates to charges associated with business closure activity. |

|

(iii) |

Charges related to acquisition and divestiture activity for the three months ended September 30, 2024 primarily consist of Liquibox related charges. Charges related to acquisition and divestiture activity for the nine months ended September 30, 2024 primarily consist of integration expenses and other Liquibox related charges, partially offset by income recognized on the final purchase price settlement related to the Liquibox acquisition. |

|

(iv) |

Other Special Items for the three and nine months ended September 30, 2024 primarily include fees related to professional services directly associated with Special Items or events that are considered one-time or infrequent. Other Special Items for the three months ended September 30, 2023 primarily relate to a gain associated with a legal settlement. Other Special Items for the nine months ended September 30, 2023 primarily relate to a one-time, non-cash cumulative translation adjustment (CTA) loss recognized due to the wind-up of one of our legal entities, partially offset by a gain associated with a legal settlement. |

|

Calculation of Net Debt (Unaudited)

|

||||

|

(In USD millions) |

September 30, 2024 |

December 31, 2023 |

||

|

Short-term borrowings |

$ 139.7 |

$ 140.7 |

||

|

Current portion of long-term debt |

58.1 |

35.7 |

||

|

Long-term debt, less current portion |

4,334.0 |

4,513.9 |

||

|

Total debt |

4,531.8 |

4,690.3 |

||

|

Less: cash and cash equivalents |

(386.0) |

(346.1) |

||

|

Non-GAAP Net Debt |

$ 4,145.8 |

$ 4,344.2 |

||

|

Net Leverage Ratio (Net Debt / Last Twelve Months Adjusted EBITDA) |

3.7x |

3.9x |

||

|

Last Twelve Months Ended |

||||

|

(In USD millions) |

September 30, 2024 |

December 31, 2023 |

||

|

GAAP Net earnings from continuing operations |

$ 394.8 |

$ 339.3 |

||

|

Interest expense, net |

255.3 |

263.0 |

||

|

Income tax provision |

95.1 |

90.4 |

||

|

Depreciation and amortization, net of adjustments |

236.7 |

239.6 |

||

|

Special Items: |

||||

|

Liquibox intangible amortization |

30.7 |

27.9 |

||

|

Liquibox inventory step-up expense |

(0.6) |

10.2 |

||

|

Restructuring charges |

31.2 |

15.6 |

||

|

Other restructuring associated costs |

22.2 |

34.5 |

||

|

Foreign currency exchange loss due to highly inflationary economies |

20.4 |

23.1 |

||

|

Loss on debt redemption and refinancing activities |

15.1 |

13.2 |

||

|

Contract terminations |

(0.8) |

14.6 |

||

|

Charges related to acquisition and divestiture activity |

7.0 |

28.3 |

||

|

CEO severance |

6.1 |

6.1 |

||

|

Other Special Items |

0.9 |

0.8 |

||

|

Pre-tax impact of Special items |

132.2 |

174.3 |

||

|

Non-GAAP Consolidated Adjusted EBITDA |

$ 1,114.1 |

$ 1,106.6 |

||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sealed-air-reports-q3-2024-results-302298176.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sealed-air-reports-q3-2024-results-302298176.html

SOURCE SEE

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NBA legend Scottie Pippen's Prophetic 'Satoshi Nakamoto Dream' Misses Bitcoin Numbers On Election Day

NBA star Scottie Pippen’s “dream encounter” with Bitcoin BTC/USD creator Satoshi Nakamoto failed to hit the bull’s eye, as the leading cryptocurrency gained but didn’t gain enough on election day.

What happened: Widely regarded as one of the greatest players in NBA history, Pippen is a known celebrity advocate of Bitcoin and actively uses his social media presence to promote the cryptocurrency.

Earlier in September, he described one of his dreams that piqued the interest of the Bitcoin community.

Pippen said that none other than the pseudonymous Satoshi appeared in his dreams and predicted that the dominant cryptocurrency would hit $84,650 on Nov. 5, the day of the elections.

However, he added that this wasn’t any financial advice.

As it turned out, Bitcoin soared on Donald Trump’s victory but missed “Satoshi’s projection”. The apex cryptocurrency’s rally was halted at a high of $76,460.

Details about Pippen’s Bitcoin or cryptocurrency holdings have been sketchy, and the iconic athlete did not immediately respond to Benzinga’s request for more information.

Why It Matters: Price predictions for Bitcoin were in full swing leading up to the election, and they are certain to continue as market expectations have only grown.

A potential Trump win being the bull case, global investment bank Standard Chartered had earlier projected Bitcoin to shoot to $125,000. Brokerage firm Bernstein projected the leading cryptocurrency to hit $80,000 to $90,000 by the end of Q4 should Trump emerge victorious.

Price Action: At the time of writing, Bitcoin was exchanging hands at $74,605.01 down 0.14% in the last 24 hours, according to data from Benzinga Pro.

Photo courtesy: Unsplash

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

5 Things to Know Before the Stock Market Opens

News of the day for Nov. 7, 2024

Kent Nishimura / Bloomberg via Getty Images

Fed Chair Jerome Powell in Washington, D.C., in October.

Stock futures were marginally higher early Thursday following a strong day for markets after the Donald Trump election win.

Trump Media, Tesla and bitcoin gave back some gains; Fed watchers are anticipating a quarter-point interest rate cut today, with comments from Fed Chair Jerome Powell to follow; Lyft (LYFT) shares surged higher after the ride-hailing app reported strong earnings and lifted its outlook; Qualcomm (QCOM) shares moved higher after posting strong revenue gains while Arm Holdings (ARM) declined on a lower-than-expected sales forecast; Zillow (Z) shares jump edon improved revenue and narrower losses for the real-estate site.

Here’s what investors need to know today.

After surging on the electoral victory of Republican Donald Trump on Wednesday, stock futures built on those gains in early trading on Thursday. The Dow Jones, S&P 500 and Nasdaq were each up around 0.2% in futures trading, coming after each made jumps of 2.5% or more in the prior session.

Futures for the smaller-company focused Russell 2000, which moved higher by 5.8% in trading Wednesday, moved higher in early trading. Shares of Trump Media (DJT) were plunging by nearly 14%, while Tesla (TSLA) shares ticked lower. Treasury yields remained little changed after surging on the election results, while bitcoin (BTCUSD) traded lower by about 1% to trade around $74,800.

Investors will be eyeing today’s interest rate decision from the Federal Open Market Committee (FOMC), which is expected to include lower interest rates by a quarter-percentage point at a 2 p.m. announcement. The move would follow a more aggressive rate cut in September and bring the federal funds rate down to a level of 4.5% to 4.75%. With inflation cooling and the job market showing signs of weakness, officials have projected that the Federal Reserve could enact a series of rate cuts over the coming year. A news conference from Fed Chair Jerome Powell at 2:30 p.m. is likely to provide more insight into the central bank’s plans.

Shares of ride hailing app Lyft (LYFT) jumped more than 20% in premarket trading after it reported better-than-expected quarterly results and raised its outlook. The company posted a third-quarter revenue increase of 32% year-over-year to $1.5 billion, ahead of the analyst consensus from Visible Alpha. Lyft reported a net loss of $12.4 million, or 3 cents per share, narrower than the loss of $17.08 million and 5 cents per share that analysts were expecting. With active riders hitting an all-time high of 24.4 million, Lyft projected fourth-quarter gross bookings of $4.28 billion to $4.35 billion, above the analyst consensus of $4.24 billion.

The Bull Market in US Stocks Is Just Starting, Evercore Says

(Bloomberg) — The US stocks rally is nowhere near done, according to Evercore ISI strategists, who see Donald Trump’s plans to slice through red tape propelling the S&P 500 Index (^GSPC) another 11% through the middle of next year.

Most Read from Bloomberg

History shows the bull market is “still an infant,” Julian Emanuel wrote in a note. “This market will be driven higher by the policy prospect of deregulation in DC,” he said, setting a price target for the index of 6,600 points by end-June 2025.

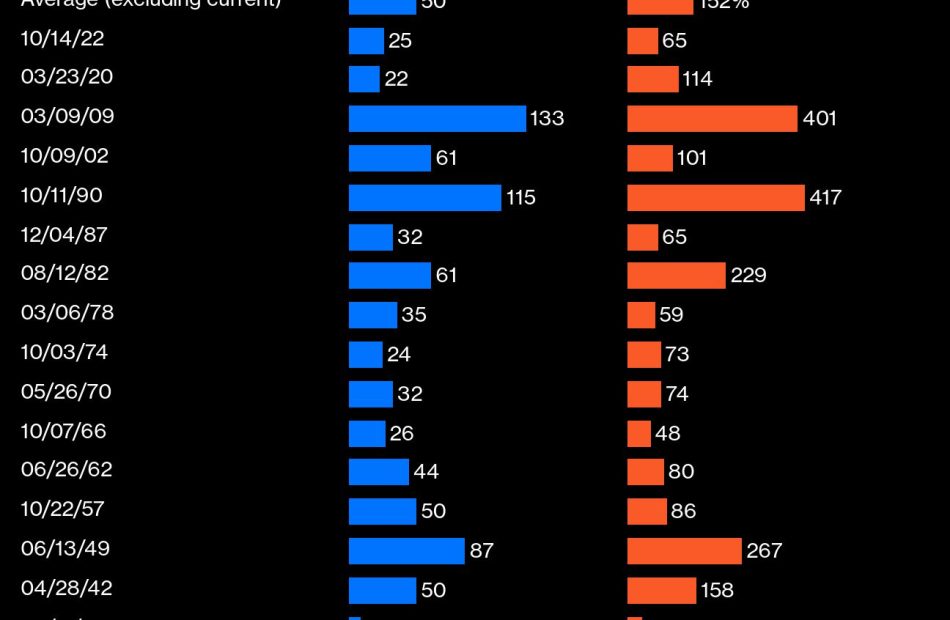

In the past 100 years, the benchmark gauge has averaged a 152% gain over 50 months during bull markets, research by Emanuel’s team shows. In the latest case, the index has rallied 65% since hitting a low in October 2022, with technology heavyweights driving the bulk of the advance.

And though stock valuations already look lofty, “expensive has a history of getting more expensive and lasting longer with greater gains,” Emanuel said.

The S&P 500 surged to a record on Wednesday after Trump’s presidential win as his plans for loser regulation and lower corporate taxes were seen boosting company earnings. The Russell 2000 Index (^RUT) of small-cap stocks hit a three-year high on speculation those firms will benefit more from Trump’s protectionist stance.

Seasonal trends into the year end also bode well for stocks more broadly. The S&P 500 has gained an average 4.1% in the fourth quarter in the past 20 years, according to data compiled by Bloomberg.

Morgan Stanley’s Michael Wilson — among the most notable bearish voices on US stocks last year — said this week that the benchmark can keep climbing into the final stretch of the year.

—With assistance from Cristin Flanagan.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Galaxy Announces Third Quarter 2024 Financial Results

Subsequent to quarter-end, Galaxy executed a non-binding term sheet with a U.S.-based hyperscaler to host high-performance computing at its Helios campus in West Texas.

NEW YORK, Nov. 7, 2024 /CNW/ – Galaxy Digital Holdings Ltd. GLXY (the “Company” or “GDH Ltd.”) today released financial results for the three months and nine months ended September 30, 2024, for both itself and Galaxy Digital Holdings LP (the “Partnership” or “GDH LP”). In this press release, a reference to “Galaxy”, “we”, “our” and similar words refer to GDH Ltd., its subsidiaries and affiliates including GDH LP, or any one of them, as the context requires.

Corporate and Business Updates

Financial Highlights: In the third quarter, Galaxy reported a net loss of $54 million, representing a significant narrowing of our net loss from the second quarter. We generated operating revenue growth of over 30% quarter-over-quarter (“QoQ”), despite industry spot trading volumes declining 15% and ether declining 24% in the quarter. For the nine months ended September 30, 2024, Galaxy reported net income of $191 million, driven by strong operating performance and positive digital asset markets. Galaxy’s equity capital was $2.1 billion as of September 30, 2024.

Helios: Subsequent to quarter-end, Galaxy executed a non-binding term sheet with a U.S.-based hyperscaler to host high-performance computing at its Helios campus in West Texas. The term sheet includes options to allocate all of Helios’ 800 megawatts of currently approved power capacity to HPC hosting and support. The consummation of the transaction is subject to execution of definitive documents, customary due diligence and approvals of the parties.

US Listing and Reorganization: Galaxy continues to work on completing its proposed reorganization and domestication to become a Delaware-incorporated company and subsequently list on the Nasdaq, upon completion of ongoing SEC review and subject to stock exchange, shareholder and applicable regulatory approvals of such transactions. On July 26, 2024, Galaxy filed an amendment to its registration statement responding to SEC comments, which is under review.

|

Select GDH LP Financial Metrics |

Q3 2024 |

Q2 2024 |

Q/Q % Change |

Q3 YTD |

|

Equity Capital |

$2,081M |

$2,129M |

(2) % |

— |

|

Liquidity |

$1,506M |

$1,312M |

15 % |

— |

|

Cash & Net Stablecoins1 |

$475M |

$409M |

16 % |

— |

|

Net Digital Assets Excluding Stablecoins2 |

$562M |

$485M |

16 % |

— |

|

Spot Bitcoin and Ethereum ETFs |

$469M |

$418M |

12 % |

— |

|

Net Income (loss) |

($54M) |

($177M) |

N.M.3 |

$191M |

|

Book Value Per Share in CAD4 |

$8.24 CAD |

$8.45 CAD |

(2) % |

— |

|

Note: Throughout this document, totals may not sum due to rounding. Quarter-over-quarter and year-over-year percentage change calculations are based on unrounded results. |

|

|

(1) |

Includes Cash Equivalents. |

|

(2) |

Refer to page 16 of this release for a breakout of our net digital assets position; Excludes non-current net digital assets. |

|

(3) |

Abbreviation for “Not Meaningful”. |

|

(4) |

Calculated as equity capital divided by outstanding Class A and Class B Units multiplied by the end of period foreign exchange rate. |

Galaxy Global Markets

Galaxy Global Markets (“GGM”) offers institutional-grade expertise and access to a broad range of digital asset products, including digital asset spot and derivatives trading, financing, M&A advisory, and equity and debt capital markets services. GGM operates in two discrete business units – Trading and Investment Banking.

Trading reported counterparty trading revenue of $54 million in the third quarter, a 117% increase quarter-over-quarter (“QoQ”), despite a 20% decrease in trading volumes, primarily driven by increased revenue from derivatives and lending activity. Galaxy’s average loan book size expanded to $863 million, a 23% increase QoQ driven by increased demand from both new and existing counterparties, who relied on our lending desk to provide them with margin-based financing. Galaxy continues to onboard new counterparties, including large traditional asset managers and hedge funds, and ended the third quarter with 1,280 total trading counterparties.

Investment Banking successfully closed one deal subsequent to quarter-end, serving as the exclusive financial advisor to an existing client on a small buyside acquisition. Galaxy is executing against a pipeline of mandates representing $2.4 billion in potential deal value.

|

Key Performance Indicators |

Q3 2024 |

Q2 2024 |

Q/Q % Change |

Q3 YTD |

|

Counterparty Trading Revenue |

$54M |

$25M |

117 % |

$146M |

|

Loan Book Size (Average) |

$863M |

$699M |

23 % |

$742M |

|

Total Trading Counterparties |

1,280 |

1,212 |

6 % |

— |

|

Active Trading Counterparties |

296 |

294 |

1 % |

— |

|

Investment Banking Deals Closed |

0 |

2 |

(100) % |

3 |

|

Pipeline |

21 |

19 |

11 % |

— |

|

Deal Value of Pipeline |

$2.4B |

$2.1B |

14 % |

— |

____

KEY TERMS

Counterparty Trading Revenue: revenue from counterparty-facing activities from our Derivatives, Credit, Over-the-Counter Trading, and Quantitative Trading businesses, net of associated funding charges.

Loan Book Size (Average): average market value of all open loans, unfunded arrangements to finance delayed trading/settlement (for example over weekends), and uncommitted credit facilities in the period. As of September 30, 2024, unfunded, uncommitted facilities accounted for approximately $156M of total Loan Book Size (Average).

Active Trading Counterparties: counterparties with whom we have traded within the past 12 months and who are still onboarded with Galaxy’s trading business.

Pipeline: the number of open engagements and transactions the Investment Banking team has in market.

Deal Value of Pipeline: the theoretical aggregate deal value associated with the Investment Banking pipeline.

Galaxy Asset Management

Galaxy Asset Management (“GAM”) provides investors access to the digital asset ecosystem via a diverse suite of institutional-grade investment vehicles that span passive, active, and venture strategies.

GAM management and performance fees were $8.1 million in the third quarter, representing a 44% decrease QoQ, primarily driven by the nearing completion of an opportunistic mandate to unwind portfolios on behalf of the FTX estate. GAM reported assets under management (“AUM”) of approximately $4.6 billion, a 2% increase QoQ, driven primarily by net inflows into GAM’s passive and active ETF strategies, which were offset by net market depreciation. In the quarter, GAM, in partnership with State Street Global Advisors, announced the launch of three actively managed digital asset and disruptive technology focused ETFs that offer investors exposure to digital asset and disruptive technology equities, spot cryptocurrencies, derivatives, cash, and cash-like instruments DECO HECO, TEKX).

|

Key Performance Indicators |

Q3 2024 |

Q2 2024 |

Q/Q % Change |

Q3 YTD |

|

Management and Performance Fees |

$8.1M |

$14.5M |

(44) % |

$40.5M |

|

Total AUM1 |

$4,608M |

$4,503M |

2 % |

— |

|

Passive AUM |

$2,466M |

$2,392M |

3 % |

— |

|

Active AUM2 |

$647M |

$629M |

3 % |

— |

|

Venture AUM |

$1,495M |

$1,482M |

1 % |

— |

|

(1) In Galaxy’s monthly AUM disclosures, the “funds” line item consists of AUM held in GAM’s Passive, Active, and Venture funds, excluding opportunistic assets. Total AUM for Q2 2024 was updated from what was previously reported as AUM for quarterly close vehicles are reported as of the most recent information available for the applicable period. |

|

(2) Includes opportunistic AUM. “Opportunistic” AUM are near-term or mid-term engagements to unwind portfolios managed by GAM. Opportunistic AUM was $429M as of September 30, 2024 and $520M as of June 30, 2024. |

____

KEY TERMS

Assets Under Management: all figures are unaudited. AUM is inclusive of sub-advised funds, committed capital closed-end vehicles, seed investments by affiliates, affiliated and unaffiliated separately managed accounts, engagements to unwind portfolios, and fund of fund products. Changes in AUM are generally the result of performance, contributions, withdrawals, liquidations and opportunistic mandate wins.

- AUM for committed capital closed-end vehicles that have completed their investment period is reported as NAV (Net Asset Value) plus unfunded commitment.

- AUM for quarterly close vehicles is reported as of the most recent quarter available for the applicable period.

- AUM for affiliated separately managed accounts is reported as NAV as of the most recently available estimate for the applicable period.

Passive Strategies: single- and multi-asset private funds, as well as a suite of regulated spot digital asset exchange-traded funds offered through partnerships with asset managers globally.

Active Strategies: Galaxy’s Liquid Crypto Fund, the management of certain opportunistic mandates, and a suite of actively managed and regulated digital asset and disruptive technology exchange-traded funds offered through a partnership with State Street Global Advisors.

Venture Strategies: organized around two investment themes: Interactive Ventures and Crypto Ventures. Galaxy Interactive invests at the intersection of content, technology, and social commerce, managing client capital across three funds. GAM’s Crypto Ventures sleeve includes Galaxy’s inaugural crypto venture fund, which is focused on investing in early-stage companies across crypto protocols, software infrastructure, and financialized applications, as well as two global, multi-manager venture funds and a subset of Galaxy’s balance sheet venture investments.

Galaxy Digital Infrastructure Solutions

Galaxy Digital Infrastructure Solutions (“GDIS“) consists of proprietary and hosted bitcoin mining services, GK8 self-custody technology solutions, and blockchain infrastructure.

Subsequent to quarter-end, Galaxy executed a non-binding term sheet with a U.S.-based hyperscaler to host high-performance computing at its Helios campus in West Texas. The term sheet includes options to allocate all of Helios’ 800 megawatts of currently approved power capacity to HPC hosting and support. The consummation of the transaction is subject to execution of definitive documents, customary due diligence and approvals of the parties.

Mining

Mining revenue was $18.5 million for the third quarter, relative to expenses, net of curtailment credits, of $10.0 million, resulting in a 46% direct mining profit margin. Mining revenue and cost to mine were impacted by the Bitcoin halving, elevated mining difficulty and seasonal curtailment. Galaxy initiated fiber construction at Helios and, beyond the current approved capacity of 800MW, expects approval on a portion of the 1.7 gigawatts currently under study in the first half of 2025.

|

Key Performance Indicators |

Q3 2024 |

Q2 2024 |

Q/Q % Change |

Q3 YTD |

|

Mining Revenue |

$18.5M |

$24.1M |

(23) % |

$72.8M |

|

Proprietary Mining Revenue |

$11.4M |

$16.3M |

(30) % |

$47.9M |

|

Hosted Revenue |

$7.0M |

$7.8M |

(10) % |

$24.9M |

|

Total Hashrate Under Management |

6.2 EH/s |

5.6 EH/s |

11 % |

— |

|

Proprietary Mining Hashrate |

3.5 EH/s |

2.9 EH/s |

21 % |

— |

|

Hosted Mining Hashrate |

2.7 EH/s |

2.6 EH/s |

4 % |

— |

|

Number of Proprietary BTC Mined |

176 |

242 |

(27) % |

790 |

|

Average Marginal Cost to Mine |

<$38.0K |

<$22.5K |

N.M. |

<$23.0K |

Blockchain Infrastructure and GK8

Blockchain Infrastructure and GK8 continue to build and invest in the technology that powers the digital assets ecosystem. Blockchain Infrastructure expanded its Assets Under Stake by 58% QoQ to $3.4 billion as of September 30th, with Galaxy maintaining its position as one of the largest validators globally on the Solana network. Blockchain rewards, net of staking costs, were $10.7 million in the third quarter, up 26% QoQ. GK8 added one new client in the quarter.

|

Key Performance Indicators |

Q3 2024 |

Q2 2024 |

Q/Q % Change |

Q3 YTD |

|

Assets Under Stake |

$3,394M |

$2,144M |

58 % |

$3,394M |

|

GK8 Total Client Count |

23 |

22 |

5 % |

— |

____

KEY TERMS

Hashrate Under Management: the total combined hashrate of active proprietary and hosted mining capacity managed by Galaxy.

Proprietary Mining Hashrate: the hashrate attributed to Galaxy owned and operated mining machines.

Hosted Mining Hashrate: the hashrate attributed to third-party machines operated by Galaxy for a client.

Number of Proprietary BTC Mined: the total amount of bitcoin mined from proprietary mining operations.

Average Marginal Cost to Mine: the average marginal cost of production for each bitcoin generated during the period. The calculation excludes depreciation, mark-to-market on power contracts, and corporate overhead.

Assets Under Stake: all figures are unaudited. AUS reflects the total notional value of assets bonded to Galaxy validators, based on prices as of the end of the specified period. This includes certain Galaxy balance sheet assets, Galaxy affiliate assets, and third-party assets.

GK8 Total Client Count: the total number of clients contracted to use GK8’s technology solutions.

Summary of Operating Expenses

|

Operating expenses |

Q3 2024 |

Q2 2024 |

Q/Q % Change |

Q3 YTD |

|

Compensation and compensation related |

$40M |

$43M |

(7) % |

$125M |

|

Equity based compensation |

$13M |

$12M |

8 % |

$42M |

|

General and administrative |

$48M |

$45M |

7 % |

$143M |

|

Mining costs |

$10M |

$10M |

— % |

$36M |

|

Trading, commission and custody expenses |

$6M |

$6M |

— % |

$19M |

|

Technology |

$8M |

$7M |

14 % |

$21M |

|

Depreciation and amortization |

$16M |

$14M |

14 % |

$40M |

|

Other |

$8M |

$9M |

(11) % |

$27M |

|

Professional fees |

$11M |

$14M |

(21) % |

$38M |

|

Staking costs |

$39M |

$30M |

30 % |

$70M |

|

Interest |

$29M |

$21M |

38 % |

$70M |

|

Notes interest expense |

$7M |

$7M |

— % |

$21M |

|

Note: Quarter-over-quarter percentage change calculations are based on unrounded results. |

Overview of Third Quarter Operating Expenses:

- Compensation and compensation related expenses of $40 million decreased by approximately $3 million QoQ, primarily driven by adjustments to cash bonus accrual.

- Equity based compensation of $13 million was roughly flat QoQ.

- General and administrative expenses increased by approximately $3 million from the second quarter of 2024, driven primarily by $2 million of higher depreciation and amortization costs, reflecting the additional depreciation from new mining machines and electrical infrastructure that were energized during the prior quarter.

- Professional fees of $11 million decreased by approximately $3 million QoQ, primarily driven by $2 million of lower legal expense.

- Staking costs increased by approximately $9 million QoQ, reflecting the continued expansion of Galaxy’s validation services including the acquisition of the assets of CryptoManufaktur in July 2024. Despite the increase in staking costs, Galaxy’s blockchain rewards, net of staking costs, increased by 26% QoQ.

- Interest expense increased approximately $8 million QoQ, reflecting our ability to source non-dilutive wholesale financing to help fund our counterparty trading business, where our revenue increased by approximately $29 million QoQ.

Net Digital Assets Position Summary

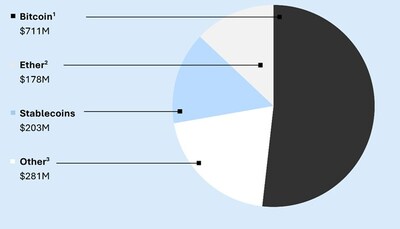

Net digital assets includes all digital assets categorized as assets, less all digital assets categorized as liabilities on the statement of financial position and is included in the Company’s liquidity measure. Net digital assets as of September 30, 2024 is as follows:

|

(1) Includes associated tokens such as wBTC. In addition to digital assets, net, the Partnership also held interests in investment vehicles designed to hold BTC, including bitcoin futures ETFs, Galaxy sponsored BTC funds, Mt. Gox Investment Fund LP, and Xapo Holdings Limited, net of associated investment liabilities. |

|

(2) Includes associated tokens such as wETH and stETH. In addition to digital assets, net, the Partnership also held interests in investment vehicles designed to hold ETH, including spot ETFs and Galaxy sponsored ETH funds. |

|

(3) Includes $8.2 million net SOL and $45.9 million net TIA digital assets, net. In addition to digital assets, net, the Partnership also held interests in investment vehicles designed to hold digital assets, including the Galaxy sponsored Galaxy Digital Crypto Vol Fund LLC (includes $93.0 million SOL and $23.1 million of AVAX) and Ripple Lab Inc. |

GDH Ltd.’s Financial Highlights

As the only significant asset of GDH Ltd. is its minority interest in GDH LP, its results are driven by the results of GDH LP. GDH Ltd. accounts for its investment in this associate (GDH LP) using the equity method. The investment, initially recorded at cost, is increased or decreased to recognize GDH Ltd.’s share of the earnings and losses of GDH LP. The net comprehensive income (loss) of GDH Ltd. was $(16.4) million for the three months ended September 30, 2024 and $44.1 million for the nine months ended September 30, 2024.

Earnings Conference Call

An investor conference call will be held today, November 7, 2024, at 8:30 AM Eastern Time. A live webcast with the ability to ask questions will be available at: https://investor.galaxy.com/. The conference call can also be accessed by investors in the United States or Canada by dialing 1-800-715-9871, or 1-646-307-1963 (outside the U.S. and Canada) using the Conference ID: 9649375. A replay of the webcast will be available and can be accessed in the same manner as the live webcast on the Company’s Investor Relations website.

About Galaxy Digital Holdings Ltd. GLXY (“GDH Ltd.”) and Galaxy Digital Holdings LP (“GDH LP”)

Galaxy GLXY is a digital asset and blockchain leader providing access to the growing digital economy. We serve a diversified client base, including institutions, startups, and qualified individuals. Since 2018, Galaxy has been building a holistic financial platform spanning three complementary operating businesses: Global Markets, Asset Management, and Digital Infrastructure Solutions. Our offerings include, amongst others, trading, lending, strategic advisory services, institutional-grade investment solutions, proprietary bitcoin mining and hosting services, network validator services, and the development of enterprise self-custodial technology. The company is headquartered in New York City, with global offices across North America, Europe, and Asia. Additional information about Galaxy’s businesses and products is available on www.galaxy.com.

This press release should be read in conjunction with (i) GDH LP’s Management Discussion and Analysis and Consolidated Financial Statements for the three and nine months ended September 30, 2024 and (ii) GDH Ltd.’s Management Discussion and Analysis and Consolidated Financial Statements for the three and nine months ended September 30, 2024 (together, the “Consolidated Financial Statements” and “MD&As”), which have been filed on SEDAR at www.sedarplus.ca.

Disclaimers and Additional Information

The TSX has not approved or disapproved of the information contained herein. The Ontario Securities Commission has not passed upon the merits of the disclosure record of Galaxy.

This press release is not an offer to buy or sell, nor is it a solicitation of an offer to buy or sell, interests in any Galaxy sponsored fund or any advisory services or any other security or to participate in any advisory services or trading strategy. If any offer and sale of securities in a Galaxy sponsored fund is made, it will be pursuant to the confidential offering memorandum of the fund (the Offering Memorandum or fund prospectus (“Prospectus”)). Any decision to make an investment in any Galaxy sponsored fund should be made after reviewing such Offering Memorandum or Prospectus, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment.

The finalization of the transactions contemplated by the non-binding term sheet with Helios are contingent upon the successful negotiation and execution of definitive agreements, satisfactory completion of due diligence, and receipt of all necessary consents and approvals. There can be no assurance that a definitive agreement will be entered into or that the proposed transaction will be consummated.

No Offer or Solicitation