Insights into Shoe Carnival's Upcoming Earnings

Shoe Carnival SCVL is gearing up to announce its quarterly earnings on Thursday, 2024-11-21. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Shoe Carnival will report an earnings per share (EPS) of $0.65.

Anticipation surrounds Shoe Carnival’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

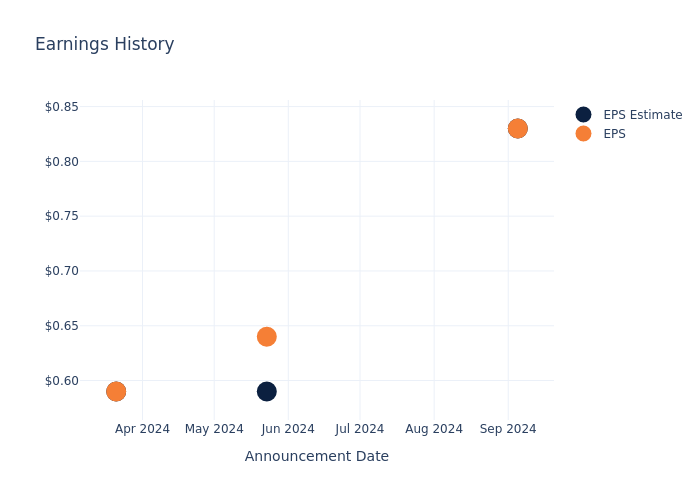

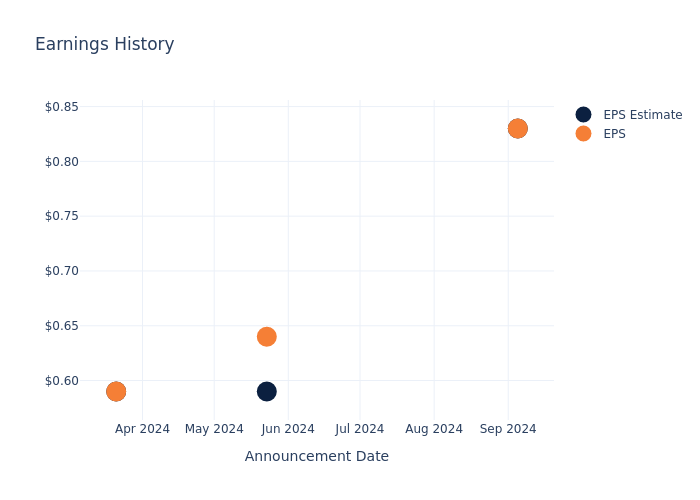

Historical Earnings Performance

In the previous earnings release, the company missed EPS by $0.00, leading to a 1.13% drop in the share price the following trading session.

Here’s a look at Shoe Carnival’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.83 | 0.59 | 0.59 | 1.01 |

| EPS Actual | 0.83 | 0.64 | 0.59 | 0.80 |

| Price Change % | -1.0% | 2.0% | 2.0% | 8.0% |

Performance of Shoe Carnival Shares

Shares of Shoe Carnival were trading at $33.67 as of November 19. Over the last 52-week period, shares are up 42.29%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Shoe Carnival

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Shoe Carnival.

With 1 analyst ratings, Shoe Carnival has a consensus rating of Buy. The average one-year price target is $51.0, indicating a potential 51.47% upside.

Peer Ratings Comparison

The analysis below examines the analyst ratings and average 1-year price targets of Guess and Caleres, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Guess is maintaining an Buy status according to analysts, with an average 1-year price target of $28.0, indicating a potential 16.84% downside.

- Analysts currently favor an Neutral trajectory for Caleres, with an average 1-year price target of $37.5, suggesting a potential 11.38% upside.

Summary of Peers Analysis

The peer analysis summary outlines pivotal metrics for Guess and Caleres, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Shoe Carnival | Buy | 12.93% | $119.94M | 3.71% |

| Guess | Buy | 10.24% | $319.94M | -2.04% |

| Caleres | Neutral | -1.76% | $310.88M | 4.91% |

Key Takeaway:

Shoe Carnival ranks highest in revenue growth among its peers. It has the lowest gross profit margin. Its return on equity is in the middle compared to its peers.

All You Need to Know About Shoe Carnival

Shoe Carnival Inc is a family footwear retailer that offers a broad assortment of dress, casual and athletic footwear for men, women, and children with an emphasis on national name brands such as Nike, Skechers, Adidas, Puma, HEYDUDE, Converse, Vans, and Crocs. They operate their business as one reportable segment based on the similar nature of products sold; merchandising, distribution, and marketing processes involved; target customers; and economic characteristics of our stores and e-commerce platforms. Its bricks-first, omnichannel approach provides customers easy access to a wide assortment of branded footwear for work, athletics, daily activities, and special events via a choice of delivery channel.

Shoe Carnival’s Economic Impact: An Analysis

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Shoe Carnival’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 12.93%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Shoe Carnival’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 6.78% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Shoe Carnival’s ROE stands out, surpassing industry averages. With an impressive ROE of 3.71%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.04%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.58.

To track all earnings releases for Shoe Carnival visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sam Altman-Backed Oklo Slumps After Kerrisdale Says It’s Shorting Stock

(Bloomberg) — Shares of Oklo Inc., the nuclear fission reactor company backed by OpenAI Inc’s Sam Altman, tumbled Wednesday after Kerrisdale Capital said it is shorting the stock.

Most Read from Bloomberg

The report alleges that “virtually every aspect of Oklo’s investment case warrants skepticism,” sending the stock down as much as 10%. Shares pared much of the decline and were down about 6% in midday trading in New York.

Oklo shares have whip-sawed recently, rallying more than 20% this week through Tuesday’s close after falling 25% on Friday following its earnings release and the expiration of a lockup period that allows key investors like Peter Thiel’s venture capital firm to start selling shares.

Oklo declined to comment.

Since the company went public via a special purpose acquisition merger in May, its shares have soared more than 150%.

“In classic SPAC fashion, Oklo has sold the market on inflated unit economics while grossly underestimating the time and capital it will take to commercialize its product,” the Kerrisdale report said.

The company is among a wave of firms developing so-called small modular reactors that are expected to be built in factories and assembled on site. Advocates say the approach will make it faster and cheaper to build nuclear power plants, but the technology is unproven. Only a handful have been developed, and only in Russia and China.

Oklo has said it expects its first system to go into service in 2027, but the Kerrisdale report highlights numerous technical and regulatory hurdles that may delay that schedule. Oklo is pursuing a new technology that it said will make its design safer and cheaper than conventional reactors in use today. The company’s design doesn’t have approval from the US Nuclear Regulatory Commission, a process that typically takes years.

Wall Street is split on the company thus far. Of the four analysts covering Oklo, two have buy-equivalent ratings and two are neutral. The average price target implies about 5% return from where shares are trading.

Besides Altman and Thiel, the company has another potentially high-profile connection. Board member Chris Wright was nominated by President-elect Donald Trump to lead the Energy Department last week.

(Updates stock move and adds company comment.)

Herbert Hughes Takes Money Off The Table, Sells $100K In Byrna Technologies Stock

On November 20, a recent SEC filing unveiled that Herbert Hughes, Board Member at Byrna Technologies BYRN made an insider sell.

What Happened: Hughes’s recent move involves selling 5,000 shares of Byrna Technologies. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value is $100,376.

During Wednesday’s morning session, Byrna Technologies shares up by 0.19%, currently priced at $21.38.

Delving into Byrna Technologies’s Background

Byrna Technologies Inc is a designer, manufacturer, retailer and distributor of technological solutions for security situations that do not require the use of lethal force. The company generates its revenue from the United States, South Africa, Europe, South America, Asia and Canada.

Byrna Technologies: Delving into Financials

Revenue Growth: Over the 3 months period, Byrna Technologies showcased positive performance, achieving a revenue growth rate of 194.34% as of 31 August, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: The company excels with a remarkable gross margin of 62.4%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Byrna Technologies’s EPS is below the industry average. The company faced challenges with a current EPS of 0.05. This suggests a potential decline in earnings.

Debt Management: Byrna Technologies’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.06.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 194.0, Byrna Technologies’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 6.63 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 146.15 reflects market recognition of Byrna Technologies’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Important Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Byrna Technologies’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

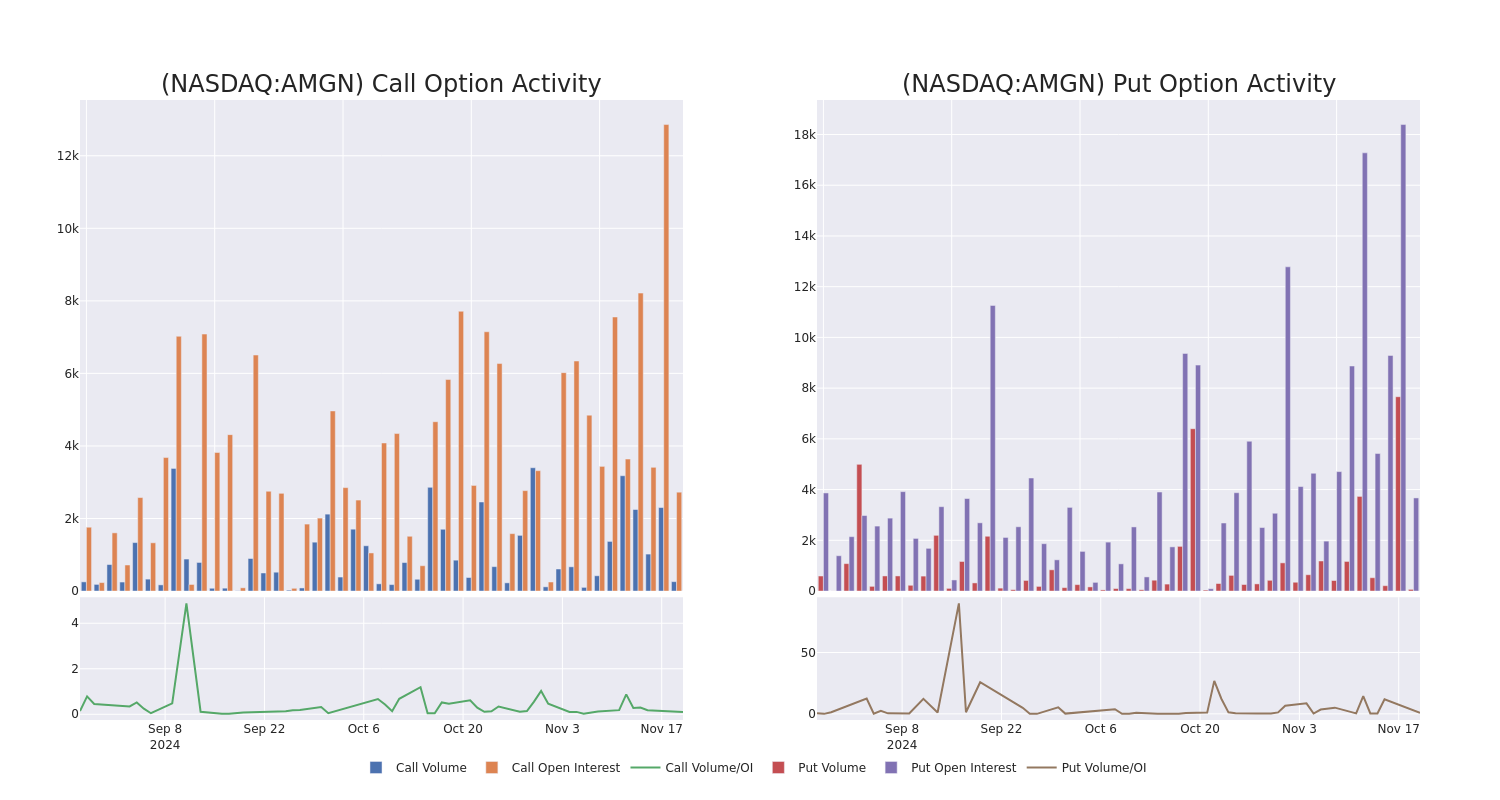

Decoding Amgen's Options Activity: What's the Big Picture?

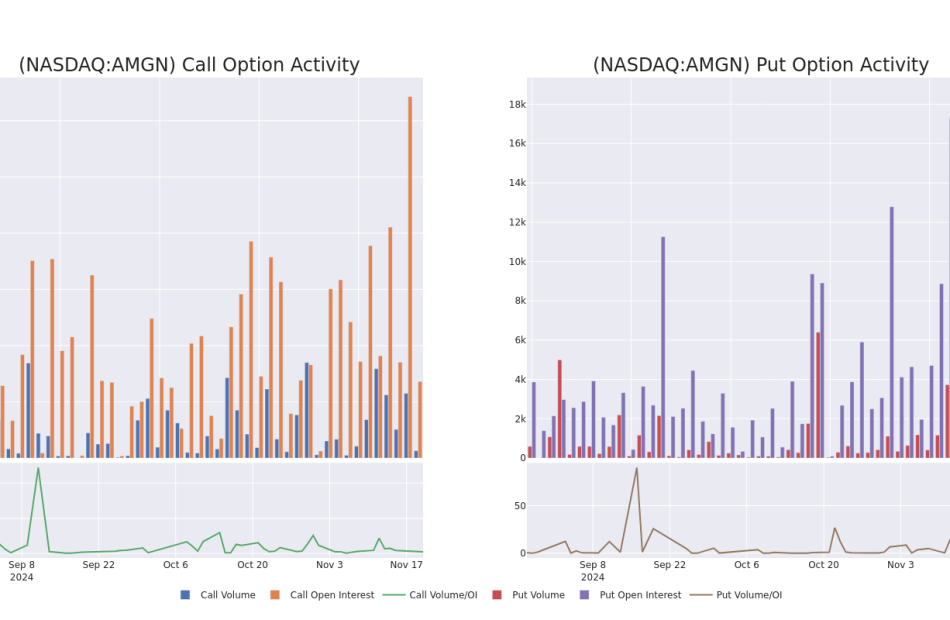

Financial giants have made a conspicuous bullish move on Amgen. Our analysis of options history for Amgen AMGN revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $172,165, and 4 were calls, valued at $144,495.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $280.0 and $350.0 for Amgen, spanning the last three months.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Amgen stands at 1066.0, with a total volume reaching 267.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amgen, situated within the strike price corridor from $280.0 to $350.0, throughout the last 30 days.

Amgen Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | TRADE | BULLISH | 12/20/24 | $22.0 | $21.4 | $21.55 | $292.50 | $60.3K | 70 | 51 |

| AMGN | PUT | SWEEP | BEARISH | 12/20/24 | $21.8 | $21.4 | $21.5 | $292.50 | $45.1K | 70 | 51 |

| AMGN | CALL | SWEEP | BEARISH | 12/20/24 | $18.0 | $17.4 | $17.44 | $282.50 | $43.7K | 703 | 113 |

| AMGN | CALL | SWEEP | BULLISH | 01/17/25 | $20.5 | $19.85 | $20.5 | $280.00 | $40.9K | 1.7K | 7 |

| AMGN | PUT | TRADE | NEUTRAL | 01/17/25 | $56.1 | $53.95 | $55.05 | $335.00 | $38.5K | 310 | 7 |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm’s therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Following our analysis of the options activities associated with Amgen, we pivot to a closer look at the company’s own performance.

Where Is Amgen Standing Right Now?

- With a trading volume of 2,464,150, the price of AMGN is up by 1.67%, reaching $284.63.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 76 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Amgen options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

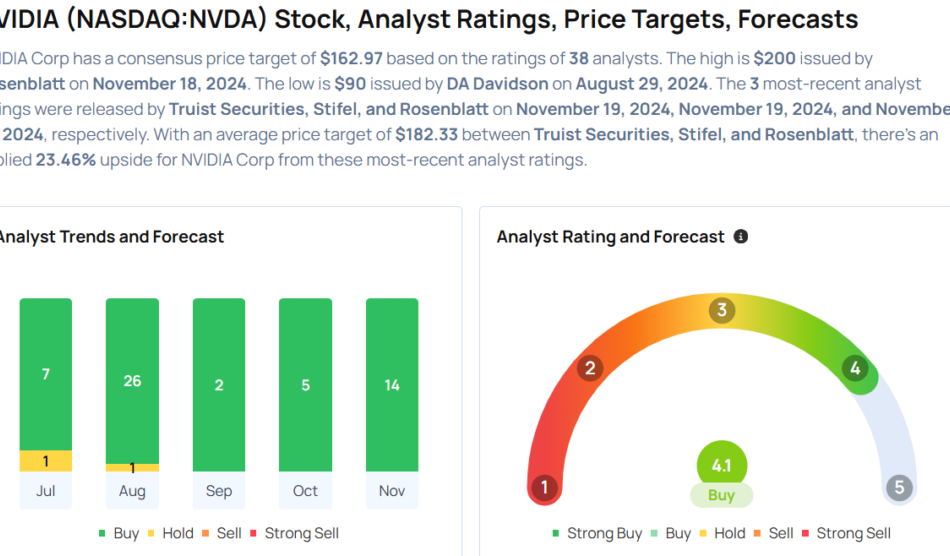

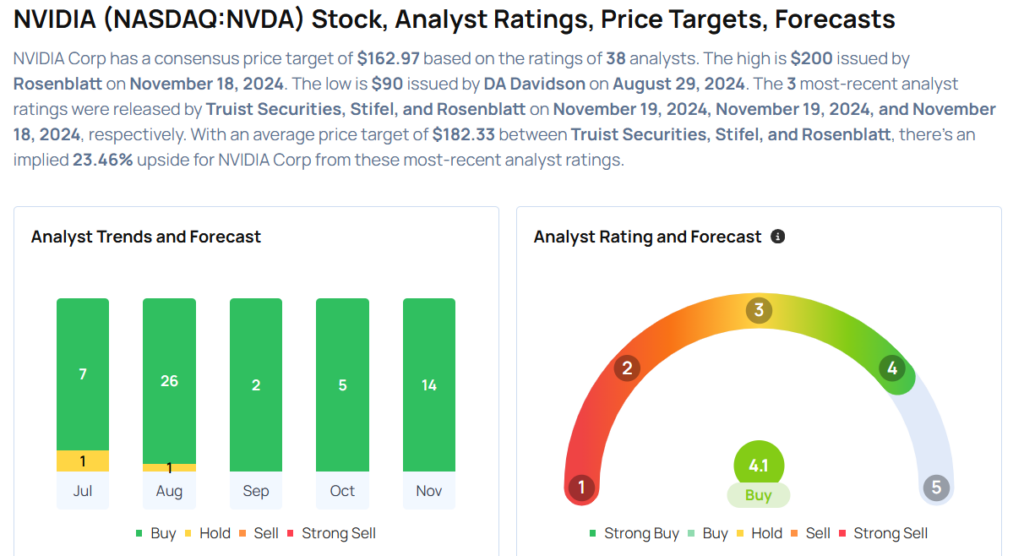

Nvidia Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

NVIDIA Corporation NVDA will release earnings results for its third quarter, after the closing bell on Wednesday, Nov. 20.

Analysts expect the Santa Clara, California-based bank to report quarterly earnings at 75 cents per share, up from 40 cents per share in the year-ago period. Nvidia projects to report revenue of $33.14 billion for the recent quarter, compared to $18.12 billion a year earlier, according to data from Benzinga Pro.

On Monday, Nvidia announced it partnered with Alphabet Inc GOOG GOOGL Google Quantum AI to accelerate the development of next-generation quantum computing devices.

Nvidia shares gained 3.8% to close at $145.41 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Truist Securities analyst William Stein maintained a Buy rating and raised the price target from $148 to $167 on Nov. 19. This analyst has an accuracy rate of 87%.

- Stifel analyst Ruben Roy maintained a Buy rating and raised the price target from $165 to $180 on Nov. 19. This analyst has an accuracy rate of 86%.

- Wedbush analyst Matt Bryson maintained an Outperform rating and raised the price target from $138 to $160 on Nov. 14. This analyst has an accuracy rate of 82%.

- Raymond James analyst Srini Pajjuri maintained a Strong Buy rating and increased the price target from $140 to $170 on Nov. 14. This analyst has an accuracy rate of 80%.

- Susquehanna analyst Christopher Rolland maintained a Positive rating and boosted the price target from $160 to $180 on Nov. 14. This analyst has an accuracy rate of 72%.

Considering buying NVDA stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Qualcomm stock falls after new autos, PC targets fail to wow investors

Qualcomm (QCOM) stock fell as much as 6% on Wednesday, a day after the company provided new financial targets for its non-smartphone business at its first Investor Day in three years.

Qualcomm, which gets the majority of its revenue from both designing and licensing handset chips, has been expanding into semiconductors that go into cars, personal computers and other devices.

The company now expects those businesses to generate a combined $22 billion in sales by 2029.

Eight billion dollars of that will come from Qualcomm’s automotive segment, where it already has partnerships with the likes of BMW to increase computing functionality in vehicles and push toward more autonomous driving.

Qualcomm forecast that $14 billion will come from its Internet of Things segment, which includes extended reality devices and industrial functions. It also includes PCs, expected to account for $4 billion. The company’s Snapdragon X Elite chips power Microsoft’s latest generation Surface laptops, which feature the GenAI Copilot assistant.

“Everybody that buys an X Elite is extremely happy with it,” Qualcomm CEO Cristiano Amon said in an interview following the Investor Day in New York.

“From all of our OEMs (original equipment manufacturers) and Microsoft, the current response is exceeding everybody’s expectation.” Amon called the $4 billion target for the PC business “high confidence.”

Some analysts, however, said the road there may not be smooth.

“While management is optimistic about AI PC opportunities, Windows-on-ARM skepticism and intense competition (from both x86 and ARM SoC suppliers) could limit QCOM’s opportunity,” Raymond James’ Srini Pajuri wrote in a note to clients. He has a hold-equivalent “market perform” rating on the stock.

Bank of America’s Tal Liani rates Qualcomm a “buy,’ and “came away incrementally positive on Qualcomm’s long-term positioning and the diversification outside of handsets.”

But Liani pointed out that not only is the company entering markets with emerging tech, but that it also needs to grab market share.

“These markets need to develop to support Qualcomm’s long-term targets, of which the pace and magnitude is uncertain,” he wrote.

Qualcomm’s biggest business remains smartphones, and its ramped-up diversification comes as Apple is working on migrating away from Qualcomm modems. As for the Android-based business, Amon said he’s projecting mid-single-digit growth, what he calls a “conservative assumption.”

That means the company expects to end the decade with its revenue about evenly split between handsets at 50% and autos and Internet of Things combined for the other 50%.

Target Margins And Inventory Issues Raise Analyst Caution After Weak Q3 Performance

Target Corporation TGT shares are trading lower on Wednesday after it reported weak third-quarter results and slashed FY24 outlook.

The company reported third-quarter adjusted earnings per share of $1.85, missing the street view of $2.30.

For FY24, the company now forecasts adjusted EPS between $8.30 and $8.90, down from the previous guidance of $9.00 to $9.70. The revised FY24 EPS outlook is also below the consensus estimate of $9.55.

Here are the analyst’s take on the earnings performance:

JP Morgan analyst Christopher Horvers reiterated the Neutral rating on Target Corporation.

The analyst notes that margins were a key factor in the stock’s reaction, as they are crucial to assessing the likelihood of meeting the 2025 operating margin estimate of 6.0%. While shrink (loss of inventory) helped, the analyst cautioned that higher fulfillment costs and excess inventory hurt margins, lowering the outlook.

For the fourth quarter, the analyst sees flat comparable sales, with a 40-basis-point headwind from the calendar shift, resulting in an operating margin of 4%-5% and earnings per share of $1.85-$2.45, below the Street’s expectation.

Also Read: Netflix Faces Class-Action Lawsuit Over Streaming Crashes During Jake Paul, Mike Tyson Fight

BofA Securities analyst Robert F. Ohmes reiterated the Buy rating on the company, with a price forecast of $195.

The analyst notes that Target’s fiscal third-quarter earnings release raises several questions. They highlight the CEO’s comments about the “unique challenges” faced by the retailer, expressing uncertainty about the specific cost pressures encountered in the third quarter and how much of this can normalize in 2025.

Ohmes is also cautious about the impact of digital growth on gross margin in the fourth quarter and 2025, following the pressures seen in the third quarter.

Additionally, the increase in general liability expenses raises questions, and the analyst is curious about whether shrink (inventory loss) provided a tailwind during the quarter and if it aligned with initial expectations. Finally, Ohmes is concerned about the shift in store-originated comps to a negative -1.9% in the third quarter, reversing the +0.7% growth seen in the second quarter.

Price Action: TGT shares are trading lower by 21.2% to $122.88 at last check Wednesday.

Image via Unsplash

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cover is bringing high-end customizable prefab homes to all of Southern California

In 2024, this homebuilder obtained a permit faster than 99.8% of other permits, and built a 2 bed 2 bath home in just 3 weeks. Now they’re expanding their operations to over 200 new cities.

LOS ANGELES, Nov. 20, 2024 /PRNewswire/ — After years of focused technology development and production, Cover is announcing its biggest service area expansion yet: Cover is now serving all of Southern California, from San Luis Obispo to San Diego—including Los Angeles, Orange, Riverside, San Bernardino, Ventura, and Santa Barbara counties.

Cover’s approach has been to do a few things and do them extraordinarily well. For seven years, they’ve been building in Los Angeles only, iterating and perfecting their product and building process. It’s working, and that’s clear. Just last month, they permitted their most recent Backyard Home in just 28 days. That’s faster than 99.8% of Los Angeles ADU projects. Earlier this year they also installed a two-bed, two-bath custom Backyard Home in just 3 weeks. All without a crane or heavy equipment.

Cover builds homes using their patented panelized building technology with impressive architect-grade quality, at record speeds. Recently, the company moved into an 80,000 square foot pilot factory in Gardena, Los Angeles County. This quadrupled the size of their previous operation, with a new production capacity of 100 homes a year.

“California faces a housing crisis with a shortfall of over 3 million homes. At California’s current home building rate, it’ll take decades to build enough homes to meet the demand. We have to do something differently.” said Alexis Rivas, Cofounder & CEO of Cover. “That’s why Cover developed technology to build homes on production lines, more like cars.”

“This expansion marks a huge step forward in our mission to make better homes for everyone,” said Mr. Rivas. “We’re excited to now bring our proven process and exceptional homes to homeowners across Southern California.”

Now, all Southern California residents working with Cover can expect full-service project management from designs and permits, through turnkey delivery.

State-Approved for Speed and Simplicity: Cover’s building system exceeds California’s stringent building codes, ensuring a safe home and streamlined permitting process in cities throughout Southern California. Their pre-engineered Lego-like panels can be arranged into custom layouts.

A Dedicated Team, All Under One Roof: Cover eliminates the inefficiencies of coordinating with architects, engineers, general contractors, and subcontractors. Instead, Cover is the one point of contact, with in-house architects, mechanical and structural engineers, construction professionals, and an installation team that work closely together to deliver a complete home.

Built Locally in Southern California: The panels are manufactured in Cover’s Gardena, Los Angeles factory and then transported to their final destination on a standard truck. No crane or heavy machinery needed.

Residents all over Southern California can now enter their address in Cover’s online tool and get started building with Cover.

About Cover:

Cover is a technology company founded in 2014 that designs, permits, manufactures, and installs custom architect-grade homes. Cover’s mission is to make thoughtfully designed and well-built homes for everyone. Using proprietary design software and a precision manufactured building system, Cover delivers exceptional design, functionality, and energy performance, in a fraction of the time of conventional construction. Cover builds out of its 80,000 square foot headquarters and factory located in Gardena, Los Angeles County California and currently serves Southern California.

For more information, please email Cover at hello@buildcover.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/cover-is-bringing-high-end-customizable-prefab-homes-to-all-of-southern-california-302311380.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cover-is-bringing-high-end-customizable-prefab-homes-to-all-of-southern-california-302311380.html

SOURCE Cover Technologies, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.