Dogwood Therapeutics Announces Third Quarter 2024 Financial Results

– Dogwood Therapeutics, Inc. (Nasdaq: “DWTX”) formed in October by combination of Virios Therapeutics, Inc. and Pharmagesic (Holdings) Inc., 100% parent company of Wex Pharmaceuticals, Inc. (the “Combination”) –

– Expanded pipeline with multiple programs in large markets with high unmet need –

– Strategic financing results in combined working capital of approximately $23 million to fund operations and advance Phase 2b Halneuron® development through 2025 –

– Top-line results from Long-COVID Phase 2a study expected in mid-November 2024 –

– NaV 1.7 inhibition pain treatment, Halneuron®, Phase 2b study for chemotherapy-induced neuropathic pain expected interim readout 2H 2025 –

ATLANTA, Nov. 07, 2024 (GLOBE NEWSWIRE) — Dogwood Therapeutics, Inc. DWTX (the “Company”), a development-stage biotechnology company developing new medicines to treat pain and fatigue-related disorders, today announced financial results for the third quarter ended September 30, 2024 and provided a business update.

“The formation of Dogwood Therapeutics last month represents a transformational expansion of our pipeline with the addition of Halneuron®, a non-opioid, novel NaV 1.7 modulator to treat neuropathic pain associated with chemotherapy, purposefully complementing our promising development assets IMC-1 and IMC-2,” said Greg Duncan, Chief Executive Officer of Dogwood Therapeutics. “The concurrent strategic financing to be provided by an affiliate of CK Life Sciences Int’l., (Holdings) Inc. (“CKLS”), former owner of Pharmagesic (Holdings) Inc., provides us with operating capital through 2025. We see this as a win-win for legacy Virios shareholders and CKLS, with both short-term and medium-term value creation opportunities associated with forthcoming data from the Bateman-Horne Center (“BHC”) managed IMC-2 Phase 2 Long-COVID trial, and the Halneuron® Phase 2b interim data projected for the second half of next year.”

Key Highlights

- Dogwood’s expanded pipeline includes three late-stage assets: Halneuron®, currently in Phase 2b development for chemotherapy-induced neuropathic pain (“CINP”); IMC-1, poised for Phase 3 development as a treatment for fibromyalgia (“FM”); and IMC-2, currently in Phase 2 development to treat Long-COVID (“LC”) sequelae.

- In connection with the Combination, the Company announced that it raised $19.5 million in committed debt financing by an affiliate of CKLS in two tranches with $16.5 million funded as of October 7, 2024 and an additional $3.0 million to be funded in 1Q 2025, subject to certain conditions. This financing is expected to fund research and operations through several key milestones, including the release of results from the Halneuron® Phase 2b interim analysis assessment expected in 2H 2025.

- Top-line results from the ongoing BHC IMC-2 LC Phase 2a study, assessing two doses of the combination of valacyclovir + celecoxib versus placebo, are expected by mid-November 2024.

Dogwood Therapeutics Proprietary Pipeline Includes:

- Halneuron® is in Phase 2b development as a non-opioid, NaV 1.7 inhibitor to treat the neuropathic pain associated with chemotherapy treatment. Halneuron® has been granted fast track designation from the Food and Drug Administration (“FDA”) for the treatment of CINP.

Next milestone: Interim data from the ongoing Phase 2b CINP study are expected in 2H 2025.

- IMC-2 (valacyclovir + celecoxib) is in Phase 2a development as a combination antiviral treatment for LC.

Next milestone: Topline data from an investigator led, double blind controlled proof of concept study, assessing two doses of IMC-2 vs placebo, are expected in mid-November 2024.

- IMC-1 (famciclovir + celecoxib) is ready for Phase 3 development as a combination antiviral treatment for FM. IMC-1 has been granted fast track designation by the FDA for the treatment of FM.

Dogwood is exploring partnerships for IMC-1 to execute the Phase 3 FM program agreed upon by the FDA.

Third Quarter 2024 Financial Results

Research and development expenses increased by $0.2 million for the third quarter of 2024 compared to the third quarter of 2023. The quarter-over-quarter change was primarily due to increases in expenses associated with the grant to BHC for the second proof-of-concept study in LC of $0.3 million offset by a decrease in regulatory expenses of $0.1 million.

General and administrative expenses increased by $0.9 million for the third quarter of 2024 compared to the third quarter of 2023. The quarter-over-quarter change was primarily due to higher legal and professional fees related to the business combination in October 2024 of $1.0 million offset by lower insurance expenses associated with being a public company of $0.1 million.

Net loss for the third quarter of 2024 was $2.3 million, or $2.05 basic and diluted net loss per share, compared to a net loss of $1.2 million, or $1.62 basic and diluted net loss per share for the third quarter of 2023 (as adjusted to reflect the reverse stock split implemented on October 9, 2024).

The Company estimates that its current cash of $2.0 million at September 30, 2024 along with the $16.5 million in loan proceeds received on October 7, 2024 is not sufficient to fund operating expenses and capital requirements for at least the next 12 months. The Company will need to secure the additional $3.0 million of loan proceeds available to us under the terms of the loan agreement in February 2025 to continue to fund our operations through 2025.

About Dogwood Therapeutics

Dogwood Therapeutics DWTX is a development-stage biopharmaceutical company focused on developing new medicines to treat pain and fatigue-related disorders. The Dogwood research pipeline includes two separate mechanistic platforms with a non-opioid analgesic program and an antiviral program. The proprietary non-opioid, Nav 1.7 analgesic program is centered on lead development candidate, Halneuron® which is a voltage-gated sodium channel blocker, a mechanism known to be effective for reducing pain. Halneuron® treatment has demonstrated pain reduction of both general cancer related pain and CINP. Interim data from the forthcoming Phase 2 CINP study are expected in 2H 2025. The antiviral program includes IMC-1 and IMC-2, which are novel, proprietary, fixed dose combinations of nucleoside analog, anti-herpes antivirals and the anti-inflammatory agent, celecoxib, for the treatment of illnesses believed to be related to reactivation of previously dormant herpes viruses, including FM and LC. Top-line data from an ongoing IMC-2 Phase 2 LC study are expected in mid-November 2024. IMC-1 is poised to progress into Phase 3 development as a treatment for FM and is the focus of external partnership activities. For more information, please visit www.dwtx.com.

Follow Dogwood Therapeutics

Email Alerts: https://ir.dwtx.com/resources/email-alerts

LinkedIn: https://www.linkedin.com/company/dogwoodther/

Twitter: https://twitter.com/dogwoodther

Facebook: https://www.facebook.com/dogwoodther

Forward-Looking Statements

Statements in this press release contain “forward-looking statements,” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “suggest,” “target,” “aim,” “should,” “will,” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Dogwood’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict, including risks related to the completion, timing and results of current and future clinical studies relating to Dogwood’s product candidates. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the Amended Annual Report on Form 10-K/A for the year ended December 31, 2023 and the Company’s quarterly report on Form 10-Q for the quarterly period ended September 30, 2024, which are filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Dogwood undertakes no duty to update such information except as required under applicable law.

Contact:

IR@dwtx.com

DOGWOOD THERAPEUTICS

Selected Financial Data

(unaudited)

| Condensed Statements of Operations Data |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | $ | — | $ | — | $ | — | $ | — | ||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | 535,162 | 374,200 | 1,214,964 | 1,429,757 | ||||||||||||

| General and administrative | 1,766,010 | 900,089 | 3,470,133 | 2,879,036 | ||||||||||||

| Total operating expenses | 2,301,172 | 1,274,289 | 4,685,097 | 4,308,793 | ||||||||||||

| Loss from operations | (2,301,172 | ) | (1,274,289 | ) | (4,685,097 | ) | (4,308,793 | ) | ||||||||

| Other Income: | ||||||||||||||||

| Interest income | 20,488 | 39,215 | 63,245 | 115,951 | ||||||||||||

| Total Other income | 20,488 | 39,215 | 63,245 | 115,951 | ||||||||||||

| Net loss | $ | (2,280,684 | ) | $ | (1,235,074 | ) | $ | (4,621,852 | ) | $ | (4,192,842 | ) | ||||

| Net loss per share of common stock — basic and diluted, as adjusted | $ | (2.05 | ) | $ | (1.62 | ) | $ | (4.95 | ) | $ | (5.63 | ) | ||||

| Weighted average shares outstanding — basic and diluted, as adjusted | 1,110,317 | 763,750 | 932,872 | 774,586 | ||||||||||||

| Condensed Balance Sheet Data | September 30, | December 31, | |||||

| 2024 | 2023 | ||||||

| Cash | $ | 2,039,819 | $ | 3,316,946 | |||

| Total assets | 2,283,249 | 4,165,442 | |||||

| Total liabilities | 1,333,818 | 358,548 | |||||

| Total stockholders’ equity | 949,431 | 3,806,894 | |||||

Source: Dogwood Therapeutics, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sunlands Technology Group to Report Third Quarter 2024 Financial Results on Friday, November 22, 2024

BEIJING, Nov. 07, 2024 (GLOBE NEWSWIRE) — Sunlands Technology Group STG (“Sunlands” or the “Company”), a leader in China’s adult online education market and China’s adult personal interest learning market, today announced that it will report its third quarter 2024 unaudited financial results on Friday, November 22, 2024, before the open of U.S. markets.

Sunlands’ management team will host a conference call at 5:30 a.m. U.S. Eastern Time, (6:30 p.m. Beijing/Hong Kong time) on November 22, 2024, following the quarterly results announcement.

For participants who wish to join the call, please access the link provided below to complete online registration 30 minutes prior to the scheduled call start time. Upon registration, participants will receive details for the conference call, including dial-in numbers, a personal PIN and an e-mail with detailed instructions to join the conference call.

Registration Link:

https://register.vevent.com/register/BI723ccaebdbf44e96857bedb8c2c0c81e

Additionally, a live webcast and archive of the conference call will be available on the Investor Relations section of Sunlands’ website at https://ir.sunlands.com/.

About Sunlands

Sunlands Technology Group STG (“Sunlands” or the “Company”), formerly known as Sunlands Online Education Group, is a leader in China’s adult online education market and China’s adult personal interest learning market. With a one to many, live streaming platform, Sunlands offers online professional courses and educational content, including various interest courses, aimed at preparing students for professional certification exams, enhancing their professional skills, and catering to their personal interests, as well as various degree- or diploma-oriented post-secondary courses. Students can access its services either through PC or mobile applications. The Company’s online platform cultivates a personalized, interactive learning environment by featuring a virtual learning community and a vast library of educational content offerings that adapt to the learning habits of its students. Sunlands offers a unique approach to education research and development that organizes subject content into Learning Outcome Trees, the Company’s proprietary knowledge management system. Sunlands has a deep understanding of the educational needs of its prospective students and offers solutions that help them achieve their goals.

For investor and media inquiries, please contact:

Sunlands Technology Group

Investor Relations

Email: sl-ir@sunlands.com

SOURCE: Sunlands Technology Group

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASHFORD HOSPITALITY TRUST ANNOUNCES AMENDMENT TO STRATEGIC FINANCING IN ANTICIPATION OF PAY OFF

DALLAS, Nov. 6, 2024 /PRNewswire/ — Ashford Hospitality Trust, Inc. AHT (“Ashford Trust” or the “Company”) announced today that it has entered into an amendment to its strategic financing that will reduce the exit fee from 15.0% to 12.5% of the original loan balance through December 15, 2024, provided that the outstanding loan balance has been reduced to $50 million or less by November 15, 2024.

The strategic financing represents the Company’s only fully recourse debt obligation, and this amendment represents the latest in a series of targeted initiatives undertaken by the Company to complete repayment of that obligation. In January of this year, the Company announced its plan to pay off its strategic financing, which includes raising sufficient capital through a combination of asset sales, mortgage debt refinancings, and non-traded preferred capital raising.

“We are pleased to provide this update on the plan to pay off our strategic financing and the significant progress that we’ve made,” said Stephen Zsigray, Ashford Trust’s President and Chief Executive Officer. “Despite a difficult hotel transaction and financing market, we have carefully executed on the plan that we laid out earlier this year, and we plan to close a few additional transactions in the coming weeks that would enable us to completely pay off this financing.”

The Company has made significant progress on this plan with year-to-date asset sales of approximately $311 million and the refinancing of the Renaissance Nashville hotel, which generated approximately $17 million in excess proceeds while also unencumbering the Westin Princeton. Since the launch of its non-traded preferred capital raise, the Company has raised approximately $173 million of gross proceeds. The Company has closes on its non-traded preferred every other week and is using a portion of the proceeds raised in each close to pay down its strategic financing.

The current outstanding balance on the strategic financing is approximately $82 million, a 59% reduction from the original principal balance.

Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing predominantly in upper upscale, full-service hotels.

Forward-Looking Statements

Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Additionally, statements regarding the following subjects are forward-looking by their nature: our business and investment strategy; anticipated or expected purchases, sales or dispositions of assets; our projected operating results; completion of any pending transactions; our plan to pay off strategic financing; our ability to restructure existing property-level indebtedness; our ability to secure additional financing to enable us to operate our business; our understanding of our competition; projected capital expenditures; the impact of technology on our operations and business; the risk that the notice and noncompliance with NYSE continued listing standards may impact the Company’s results of operations, business operations and reputation and the trading prices and volatility of the Company’s common stock; and the Company’s ability to regain compliance with the NYSE continued listing standards. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. These and other risk factors are more fully discussed in the Company’s filings with the SEC.

The forward-looking statements included in this press release are only made as of the date of this press release. Investors should not place undue reliance on these forward-looking statements. We will not publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise except to the extent required by law.

![]() View original content:https://www.prnewswire.com/news-releases/ashford-hospitality-trust-announces-amendment-to-strategic-financing-in-anticipation-of-pay-off-302297475.html

View original content:https://www.prnewswire.com/news-releases/ashford-hospitality-trust-announces-amendment-to-strategic-financing-in-anticipation-of-pay-off-302297475.html

SOURCE Ashford Hospitality Trust, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Calls Trump's Return To White House A 'Huge Win For The Stock Market'

In the wake of the recent U.S. presidential election, Jim Cramer has connected the surge in the stock market to the election of President-elect Donald Trump and his anticipated pro-business policies.

What Happened: Cramer noted that the conclusion of the election brought relief to traders who are now gearing up for a Trump administration, CNBC reported on Thursday.

“The fact that we already know the winner is a huge win for the stock market in itself, which makes it a magnet for new money. This election, with its vicious maelstrom of hate and fear, is finally over,” he said.

Tesla Inc. TSLA saw a remarkable rally, closing up 14.75%. Cramer pointed out that Elon Musk, a vocal Trump supporter, might benefit from Trump’s tendency to reward allies. Tech giants like Alphabet Inc. GOOGL GOOG and Amazon.com Inc. AMZN, previously burdened by antitrust issues, also saw gains. Cramer mentioned that cybersecurity stocks surged amid expectations of increased hacking under Trump’s presidency.

Cramer acknowledged the market’s record highs during the Joe Biden administration and speculated on future market movements with Trump, who has a keen interest in Wall Street.

“Who knows how high they can go with a president-elect who always told me that the Dow Jones Industrial Average was his version of the Nielsen ratings.”

Why It Matters: The market rally following Trump’s election victory reflects a shift in investor sentiment. The Dow Jones index jumped over 1,500 points, reaching a record high. The CNN Money Fear and Greed index moved to a “Neutral” zone, indicating improved market sentiment.

The anticipation of favorable tax policies under Trump’s administration has further fueled the rally. Additionally, a look back at Trump’s first term provides insights into how various S&P 500 sectors might perform under his leadership. While past performance doesn’t guarantee future results, it offers valuable clues for investors navigating the new administration.

Price Action: According to Benzinga Pro, SPDR S&P 500 ETF Trust SPY closed 2.49% higher on Wednesday while at the time of writing, both Dow Jones Futures and S&P 500 Futures were trading 0.15% higer.

Read Next:

Image via Flickr

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fathom Holdings Promotes Joanne Zach to Chief Financial Officer

CARY, N.C., Nov. 6, 2024 /PRNewswire/ — Fathom Holdings, Inc. FTHM (“Fathom”; or the “Company“), a national, technology-driven, end-to-end real estate services platform integrating residential brokerage, mortgage, title, and SaaS offerings for brokerages and agents, today announced the promotion of Joanne Zach to Chief Financial Officer (CFO). Joanne has served as Fathom’s Senior Vice President of Finance since February 2021, bringing over 25 years of diverse finance experience in both public and private sectors.

As Senior Vice President, Joanne has spent the past three years working closely under CEO Marco Fregenal’s leadership. Together, they have collaborated on strategic planning and financial decisions, allowing her to gain valuable insights from his expertise and mentorship. This experience has equipped her with a deep understanding of Fathom’s financial strategy and operational goals, as well as strong relationships across the Company’s divisions. With this transition, Fregenal can now focus fully on leading the Company as CEO, while Joanne steps into the CFO role. Joanne brings a wealth of senior finance experience from organizations of various sizes, spanning life sciences to manufacturing, and has played pivotal roles in IPOs and capital raises. Before joining Fathom, she began her career in public accounting as an auditor at Arthur Andersen and later advanced to senior finance leadership positions. Joanne holds a CPA license and a bachelor’s degree in accounting from Fairfield University.

“Joanne’s promotion to CFO is an exciting step for Fathom,” said Fregenal. “Over the past three years, Joanne has consistently demonstrated the strategic acumen and commitment that Fathom’s growth demands. Her ability to drive financial efficiency and continuous improvement is a testament to her leadership. As Fathom advances in an evolving market, I am confident that Joanne will continue to strengthen our financial framework for long-term success.”

Joanne Zach shared her enthusiasm, stating, “I am honored and dedicated to take on this new role at Fathom. Working with Marco and the talented Fathom team, I look forward to building on the strong foundation we’ve created together. I am excited to further enhance our financial strategies and leverage our technology to drive Fathom’s growth, innovation, and value creation for our clients, agents, partners, employees, and shareholders.”

About Fathom Holdings Inc.

Fathom Holdings Inc. is a national, technology-driven, real estate services platform integrating residential brokerage, mortgage, title, and SaaS offerings to brokerages and agents by leveraging its proprietary cloud-based software, intelliAgent. The Company’s brands include Fathom Realty, Encompass Lending, intelliAgent, LiveBy, Real Results, and Verus Title. For more information, visit www.FathomInc.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains “forward-looking statements” that involve risks and uncertainties which we expect will or may occur in the future and may impact our business, financial condition and results of operations. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including: risks associated with general economic conditions, including rising interest rates; its ability to generate positive operational cash flow; risks associated with the Company’s ability to continue achieving significant growth; its ability to continue its growth trajectory while achieving profitability over time; risks related to ongoing and future litigation; and other risks as set forth in the Risk Factors section of the Company’s most recent Form 10-K as filed with the SEC and supplemented from time to time in other Company filings made with the SEC. Copies of Fathom’s Form 10-K and other SEC filings are available on the SEC’s website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Investor Contact:

Matt Glover and Clay Liolios

Gateway Group, Inc.

949-574-3860

FTHM@gateway-grp.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fathom-holdings-promotes-joanne-zach-to-chief-financial-officer-302297074.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fathom-holdings-promotes-joanne-zach-to-chief-financial-officer-302297074.html

SOURCE Fathom Holdings Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Did S&P 500 Stock Sectors Perform During Trump's First Term? Could This Time Be Different?

With Donald Trump clinching a second term in the 2024 U.S. presidential election, markets are turning their attention to his potential impact on the economy and markets.

While past performance doesn’t guarantee future results, it can still provide valuable insights for investors looking for clues about what to expect from the new administration.

Here’s a detailed look at how the 11 S&P 500 sectors fared during Trump’s first term.

Although Trump wasn’t sworn in as president until January 2017, financial markets began reacting to his potential policies immediately after his election.

Trump’s first term, which spanned from Nov. 8, 2016 — the day he won against Hillary Clinton — to Nov. 3, 2020 – when he lost versus Joe Biden — brought varied performances across S&P 500 sectors.

Technology and consumer discretionary sectors led the rally, while energy was the clear laggard, with the only negative return among sectors over those four years.

Tech stocks were buoyed by the spectacular rise of Magnificent Seven giants. An equally weighted basket of Microsoft Corp. MSFT, Apple Inc. AAPL, NVIDIA Corp. NVDA, Alphabet Inc. GOOG GOOGL, Amazon.com Inc. AMZN, Meta Platforms Inc. META and Tesla, Inc. TSLA delivered a remarkable 380% return from November 2016 to November 2020. That return is nearly double the performance of the Magnificent Seven during Biden’s term.

Regarding the energy sector’s poor performance, that wasn’t solely a result of the COVID-19 pandemic-driven oil price collapse.

Despite Trump’s pro-fossil-fuel policies, energy stocks faced persistent headwinds throughout his term, even before 2020, with the global shift toward renewables putting continuous pressure on traditional oil and gas investments.

Surprisingly to many, solar stocks — tracked by the Invesco Solar ETF TAN — were among the top-performing industries during Trump’s first presidency, soaring by an impressive 267% between November 2016 and November 2020.

Below is a table and chart showing the performance of S&P 500 sectors under Trump’s first term.

| Sector ETF | Performance Nov. 8, 2016 – Nov. 3, 2020 |

|---|---|

| Technology Select Sector SPDR Fund XLK | +138.56% |

| Consumer Discretionary Select Sector SPDR Fund XLY | +86.70% |

| Health Care Select Sector SPDR Fund XLV | +53.58% |

| Materials Select Sector SPDR Fund XLB | +40.29% |

| Industrial Select Sector SPDR Fund XLI | +37.81% |

| Utilities Select Sector SPDR Fund XLU | +31.52% |

| Financial Select Sector SPDR Fund XLF | +24.31% |

| Consumer Staples Select Sector SPDR Fund XLP | +21.99% |

| Communication Services Select Sector SPDR Fund XLC | +20.20% |

| Real Estate Select Sector SPDR Fund XLRE | +15.84% |

| Energy Select Sector SPDR Fund XLE | -57.40% |

In the first three months following Trump’s 2016 election, financials stocks saw significant gains.

The Financial Select Sector SPDR Fund (XLF) rose by 17.2% between Nov. 8, 2016, and Jan. 10, 2017, outpacing all other sectors. The rally was driven by anticipation of deregulation and tax cuts, which boosted investor confidence in banks and other financial stocks.

Conversely, consumer staples and utilities — traditionally defensive sectors — were the weakest performers in that initial period, with losses of 2.39% and 2.3%, respectively.

| Sector | Return (Nov. 8, 2016 – Jan. 10, 2017) |

|---|---|

| Financials (XLF) | +17.21% |

| Industrials (XLI) | +8.07% |

| Materials (XLB) | +7.15% |

| Energy (XLE) | +6.91% |

| Consumer Discretionary (XLY) | +6.00% |

| Health Care (XLV) | +4.58% |

| Technology (XLK) | +4.20% |

| Real Estate (XLRE) | +0.42% |

| Utilities (XLU) | -2.30% |

| Consumer Staples (XLP) | -2.39% |

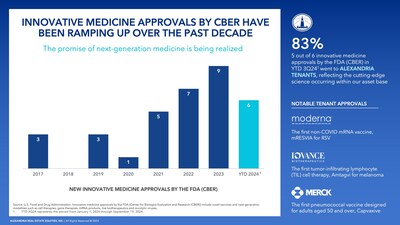

On November 6, 2024, the day after Trump’s re-election was confirmed, market activity showed a familiar pattern with financials and industrials posting the strongest gains.

Financials climbed by 5.6%, followed by energy and industrial, each more than 3.5%, suggesting renewed optimism for deregulation and potential infrastructure investment as investors previously had in the first three months following his election in 2016.

| S&P 500 Sector ETF | % Change (Nov. 6, 2024) |

|---|---|

| Financials (XLF) | +5.7% |

| Energy (XLE) | +3.8% |

| Industrials (XLI) | +3.6% |

| Consumer Discretionary (XLY) | +2.6% |

| Technology (XLK) | +2.4% |

| Communications (XLC) | +1.9% |

| Materials (XLB) | +1.3% |

| Health Care (XLV) | +0.0% |

| Utilities (XLU) | -1.1% |

| Consumer Staples (XLP) | -1.6% |

| Real Estate (XLRE) | -3.4% |

Trump’s return to the White House could bring back some familiar market dynamics, but the economic and geopolitical landscape in 2024 is notably different from 2016.

Investors should be prepared for a mix of potential tailwinds and headwinds that may shape sector performance in unique ways.

Trump’s expected emphasis on tax cuts, deregulation and support for traditional energy sources could once again boost sectors like financials, industrials and consumer discretionary. Financial stocks, in particular, might benefit from any renewed push to ease regulatory restrictions, while industrials could get a lift from a possible infrastructure spending package.

As in his first term, Trump’s focus on “America First” policies could support domestic manufacturing and sectors tied to infrastructure, including industrials and materials.

Trump’s pro-fossil-fuel stance could give the energy sector some breathing room. Traditional energy companies may benefit if there’s a shift in focus back toward oil and gas, though this will depend on global energy market dynamics.

Global trade dynamics have shifted significantly since Trump’s first term, with ongoing tensions between the U.S. and China.

If Trump reintroduces tariffs on Chinese imports, it could impact tech and industrials sectors, which rely on international supply chains and components.

Last but not least, even if Trump policies seem to prioritize fossil fuels, the private sector’s commitment to renewables could still drive growth in solar and clean energy stocks.

Read Now:

Photo: Image created using Shutterstock images

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Steam's Built-In Game Recording Now Available To All Users: What You Need To Know

Valve Corporation has rolled out a new game recording feature on Steam, allowing players to easily capture, replay, and share gameplay directly from their PC or Steam Deck.

This built-in system, which has moved from beta testing to a full release, offers users streamlined tools to document and save their gaming moments without relying on external software, according to a blog post.

New Recording Features On Steam

The game recording tool introduces a “Background Recording” mode, which automatically saves gameplay footage to the user’s chosen storage drive while respecting set duration and storage limits.

See Also: How Steam Reached 38 Million Concurrent Players — A New Milestone

For players who want more control, an “on-demand” option enables manual start and stop functionality, letting them record specific gameplay segments.

Another feature, called “Timeline,” adds event markers to gameplay recordings, allowing users to quickly find key moments. For games with “Timeline-enhanced” capabilities, markers will automatically appear whenever significant events, such as Steam achievements or screenshots, occur. This makes it easier for players to organize and edit their gameplay clips before sharing them.

With this update, Steam Deck users now have a native option to record and share gameplay directly from the handheld device.

This addition aligns with Valve’s aim to position the Steam Deck as a versatile platform, providing users with more of the same features they might expect on a traditional gaming console.

Read Next:

Image credits: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alexandria Real Estate Equities, Inc. Enables the Discovery, Development and Delivery of New Innovative Medicines That Are Key to Addressing Significant Unmet Medical Need

Alexandria to lead mission-critical panel on immunology and inflammation as a cornerstone of treating human disease tomorrow at the 2024 Galien Forum USA at the Alexandria Center® for Life Science – New York City

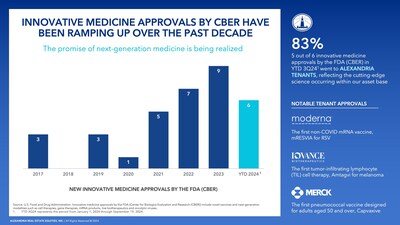

PASADENA, Calif., Nov. 6, 2024 /PRNewswire/ — Alexandria Real Estate Equities, Inc. ARE, the first, preeminent, longest-tenured and pioneering owner, operator and developer of collaborative mega campuses in AAA life science innovation cluster locations, continues to leverage its position at the vanguard and heart of the $5 trillion secularly growing life science industry to foster the development of new therapies and cures for the 10,000 diseases known to humankind, of which less than 10% are currently addressable with treatments. With $4.5 trillion in U.S. healthcare spending in 2022, the majority of which is attributed to hospital and physician services, the opportunity to reduce the economic burden on the country and better manage disease for patients through the development of new innovative medicines remains immense. Driven by decades of scientific discovery, the U.S. Food and Drug Administration (FDA) this year has approved 38 novel small molecule and biologic therapies, as well as six new innovative medicines, which include novel vaccines and next-generation modalities such as cell, gene and mRNA-based therapies. Alexandria tenants are responsible for five of these six innovative medicines, reflecting the cutting-edge science taking place within the company’s Labspace® facilities and the high quality of the company’s client base. Innovative medicines continue to gain momentum with a 286% increase in approvals by the FDA in this class between the 2017–2020 and 2021–YTD 2024 periods.

“As innovative medicine approvals by the FDA have ramped up over the past several years, the promise of next-generation medicine is being realized in key areas of unmet need, including oncology, neurodegenerative and psychiatric disorders and diseases of the immune system, which means expanded treatment options and enhanced quality of life for patients,” said Joel S. Marcus, executive chairman and founder of Alexandria Real Estate Equities, Inc. and Alexandria Venture Investments. “Innovation in medicine is the only effective path to solving the over 90% of diseases that currently have no treatments and to reducing long-term costs associated with the healthcare system. New medicines delivered to patients and early detection of costly diseases, like Alzheimer’s or cancer, mean fewer visits to the hospital and fewer treatments over the long term. At Alexandria, we are working to ensure that the life science industry can maintain its collaborative science-driven advantage as one of the world’s most innovative, impactful and critical industries, and one that is vastly improving health and well-being.”

Alexandria has a remarkable track record of partnering with trailblazing life science companies to enable the development of life-changing and lifesaving treatments and cures. Since 2013, Alexandria tenants have developed or commercialized half the novel FDA-approved therapies, and so far in 2024, they have been responsible for over 80% of the FDA approvals for innovative medicines. Many of these approvals are first-of-their-kind medicines. Notably, Moderna, with which Alexandria began its strategic relationship in 2012, received approval for a respiratory syncytial virus (RSV) vaccine. Moderna’s novel RSV vaccine validates the potential of its paradigm-shifting mRNA technology to address multiple diseases, and it is also the first mRNA vaccine to be approved for a disease other than COVID-19. Included among the Alexandria tenants harnessing the immune system to treat cancer is Iovance Biotherapeutics, which received FDA approval for the first tumor-infiltrating lymphocyte cell therapy to treat advanced melanoma. Alexandria has been providing mission-critical real estate to Iovance in the San Francisco Bay Area since early 2022.

The field of immunology and inflammation has emerged as fundamental to how we approach a wide array of human diseases. Recent breakthroughs in our understanding of the immune system are leading to revolutionary therapies and opening new frontiers in medical science. Moreover, immunology is predicted to become the second-largest area of biopharmaceutical spend by 2028, behind oncology, and the global immunology market is expected to more than double from nearly $103 billion in 2024 to $257 billion by 2032.

In light of the paramount importance of this burgeoning field, Alexandria is leading a mission-critical panel titled “Immunology & Inflammation – A Cornerstone of Treating Human Disease” tomorrow, November 7, 2024, at the 2024 Galien Forum USA at the Alexandria Center® for Life Science – New York City. Co-moderated by Mr. Marcus and Lynne Zydowsky, PhD, chief of science of Alexandria, the pivotal discussion will feature pioneers in immunology who will delve into the latest advances, current challenges and future opportunities for harnessing the immune system to combat chronic and inflammatory disorders. Alexandria’s panel will also explore how immunological and anti-inflammatory approaches are reshaping our understanding of disease mechanisms and opening new opportunities for treatment. These latest developments — from engineered cell therapies to novel immunomodulatory drugs — hold the promise to transform the treatment landscape for millions of patients worldwide.

About Alexandria Real Estate Equities, Inc.

Alexandria Real Estate Equities, Inc. ARE, an S&P 500® company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. As the pioneer of the life science real estate niche with our founding in 1994, Alexandria is the preeminent and longest-tenured owner, operator and developer of collaborative mega campuses in AAA life science innovation cluster locations, including Greater Boston, the San Francisco Bay Area, San Diego, Seattle, Maryland, Research Triangle and New York City. As of September 30, 2024, Alexandria has a total market capitalization of $33.1 billion and an asset base in North America that includes 41.8 million RSF of operating properties, 5.3 million RSF of Class A/A+ properties undergoing construction, and one committed near-term project expected to commence construction in the next two years. Alexandria has a longstanding and proven track record of developing Class A/A+ properties clustered in mega campuses that provide our innovative tenants with highly dynamic and collaborative environments that enhance their ability to successfully recruit and retain world-class talent and inspire productivity, efficiency, creativity and success. Alexandria also provides strategic capital to transformative life science companies through our venture capital platform. We believe our unique business model and diligent underwriting ensure a high-quality and diverse tenant base that results in higher occupancy levels, longer lease terms, higher rental income, higher returns and greater long-term asset value. For more information on Alexandria, please visit www.are.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding Alexandria’s impact on the life science industry, on its tenants’ business and pursuit of novel treatment and cures and on human health and well-being. These forward-looking statements are based on Alexandria’s present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by Alexandria’s forward-looking statements as a result of a variety of factors, including, without limitation, the risks and uncertainties detailed in its filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this press release, and Alexandria assumes no obligation to update this information. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in Alexandria’s forward-looking statements, and risks and uncertainties to Alexandria’s business in general, please refer to Alexandria’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and any subsequently filed quarterly reports on Form 10-Q.

CONTACT: Joel S. Marcus, Executive Chairman & Founder, (626) 578-9693, jmarcus@are.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-enables-the-discovery-development-and-delivery-of-new-innovative-medicines-that-are-key-to-addressing-significant-unmet-medical-need-302296686.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-enables-the-discovery-development-and-delivery-of-new-innovative-medicines-that-are-key-to-addressing-significant-unmet-medical-need-302296686.html

SOURCE Alexandria Real Estate Equities, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.