Alexandria Real Estate Equities, Inc. Enables the Discovery, Development and Delivery of New Innovative Medicines That Are Key to Addressing Significant Unmet Medical Need

Alexandria to lead mission-critical panel on immunology and inflammation as a cornerstone of treating human disease tomorrow at the 2024 Galien Forum USA at the Alexandria Center® for Life Science – New York City

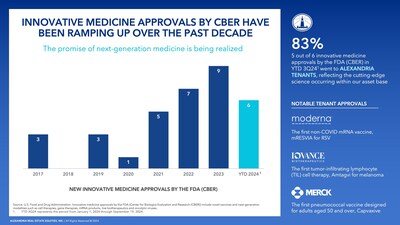

PASADENA, Calif., Nov. 6, 2024 /PRNewswire/ — Alexandria Real Estate Equities, Inc. ARE, the first, preeminent, longest-tenured and pioneering owner, operator and developer of collaborative mega campuses in AAA life science innovation cluster locations, continues to leverage its position at the vanguard and heart of the $5 trillion secularly growing life science industry to foster the development of new therapies and cures for the 10,000 diseases known to humankind, of which less than 10% are currently addressable with treatments. With $4.5 trillion in U.S. healthcare spending in 2022, the majority of which is attributed to hospital and physician services, the opportunity to reduce the economic burden on the country and better manage disease for patients through the development of new innovative medicines remains immense. Driven by decades of scientific discovery, the U.S. Food and Drug Administration (FDA) this year has approved 38 novel small molecule and biologic therapies, as well as six new innovative medicines, which include novel vaccines and next-generation modalities such as cell, gene and mRNA-based therapies. Alexandria tenants are responsible for five of these six innovative medicines, reflecting the cutting-edge science taking place within the company’s Labspace® facilities and the high quality of the company’s client base. Innovative medicines continue to gain momentum with a 286% increase in approvals by the FDA in this class between the 2017–2020 and 2021–YTD 2024 periods.

“As innovative medicine approvals by the FDA have ramped up over the past several years, the promise of next-generation medicine is being realized in key areas of unmet need, including oncology, neurodegenerative and psychiatric disorders and diseases of the immune system, which means expanded treatment options and enhanced quality of life for patients,” said Joel S. Marcus, executive chairman and founder of Alexandria Real Estate Equities, Inc. and Alexandria Venture Investments. “Innovation in medicine is the only effective path to solving the over 90% of diseases that currently have no treatments and to reducing long-term costs associated with the healthcare system. New medicines delivered to patients and early detection of costly diseases, like Alzheimer’s or cancer, mean fewer visits to the hospital and fewer treatments over the long term. At Alexandria, we are working to ensure that the life science industry can maintain its collaborative science-driven advantage as one of the world’s most innovative, impactful and critical industries, and one that is vastly improving health and well-being.”

Alexandria has a remarkable track record of partnering with trailblazing life science companies to enable the development of life-changing and lifesaving treatments and cures. Since 2013, Alexandria tenants have developed or commercialized half the novel FDA-approved therapies, and so far in 2024, they have been responsible for over 80% of the FDA approvals for innovative medicines. Many of these approvals are first-of-their-kind medicines. Notably, Moderna, with which Alexandria began its strategic relationship in 2012, received approval for a respiratory syncytial virus (RSV) vaccine. Moderna’s novel RSV vaccine validates the potential of its paradigm-shifting mRNA technology to address multiple diseases, and it is also the first mRNA vaccine to be approved for a disease other than COVID-19. Included among the Alexandria tenants harnessing the immune system to treat cancer is Iovance Biotherapeutics, which received FDA approval for the first tumor-infiltrating lymphocyte cell therapy to treat advanced melanoma. Alexandria has been providing mission-critical real estate to Iovance in the San Francisco Bay Area since early 2022.

The field of immunology and inflammation has emerged as fundamental to how we approach a wide array of human diseases. Recent breakthroughs in our understanding of the immune system are leading to revolutionary therapies and opening new frontiers in medical science. Moreover, immunology is predicted to become the second-largest area of biopharmaceutical spend by 2028, behind oncology, and the global immunology market is expected to more than double from nearly $103 billion in 2024 to $257 billion by 2032.

In light of the paramount importance of this burgeoning field, Alexandria is leading a mission-critical panel titled “Immunology & Inflammation – A Cornerstone of Treating Human Disease” tomorrow, November 7, 2024, at the 2024 Galien Forum USA at the Alexandria Center® for Life Science – New York City. Co-moderated by Mr. Marcus and Lynne Zydowsky, PhD, chief of science of Alexandria, the pivotal discussion will feature pioneers in immunology who will delve into the latest advances, current challenges and future opportunities for harnessing the immune system to combat chronic and inflammatory disorders. Alexandria’s panel will also explore how immunological and anti-inflammatory approaches are reshaping our understanding of disease mechanisms and opening new opportunities for treatment. These latest developments — from engineered cell therapies to novel immunomodulatory drugs — hold the promise to transform the treatment landscape for millions of patients worldwide.

About Alexandria Real Estate Equities, Inc.

Alexandria Real Estate Equities, Inc. ARE, an S&P 500® company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. As the pioneer of the life science real estate niche with our founding in 1994, Alexandria is the preeminent and longest-tenured owner, operator and developer of collaborative mega campuses in AAA life science innovation cluster locations, including Greater Boston, the San Francisco Bay Area, San Diego, Seattle, Maryland, Research Triangle and New York City. As of September 30, 2024, Alexandria has a total market capitalization of $33.1 billion and an asset base in North America that includes 41.8 million RSF of operating properties, 5.3 million RSF of Class A/A+ properties undergoing construction, and one committed near-term project expected to commence construction in the next two years. Alexandria has a longstanding and proven track record of developing Class A/A+ properties clustered in mega campuses that provide our innovative tenants with highly dynamic and collaborative environments that enhance their ability to successfully recruit and retain world-class talent and inspire productivity, efficiency, creativity and success. Alexandria also provides strategic capital to transformative life science companies through our venture capital platform. We believe our unique business model and diligent underwriting ensure a high-quality and diverse tenant base that results in higher occupancy levels, longer lease terms, higher rental income, higher returns and greater long-term asset value. For more information on Alexandria, please visit www.are.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding Alexandria’s impact on the life science industry, on its tenants’ business and pursuit of novel treatment and cures and on human health and well-being. These forward-looking statements are based on Alexandria’s present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by Alexandria’s forward-looking statements as a result of a variety of factors, including, without limitation, the risks and uncertainties detailed in its filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this press release, and Alexandria assumes no obligation to update this information. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in Alexandria’s forward-looking statements, and risks and uncertainties to Alexandria’s business in general, please refer to Alexandria’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and any subsequently filed quarterly reports on Form 10-Q.

CONTACT: Joel S. Marcus, Executive Chairman & Founder, (626) 578-9693, jmarcus@are.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-enables-the-discovery-development-and-delivery-of-new-innovative-medicines-that-are-key-to-addressing-significant-unmet-medical-need-302296686.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-enables-the-discovery-development-and-delivery-of-new-innovative-medicines-that-are-key-to-addressing-significant-unmet-medical-need-302296686.html

SOURCE Alexandria Real Estate Equities, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Beer Institute Releases September 2024 Domestic Tax Paid Estimate

WASHINGTON, Nov. 06, 2024 (GLOBE NEWSWIRE) — Today, the Beer Institute published an unofficial estimate of domestic tax paid shipments by beer brewers for September 2024:

The September 2024 estimate is 12,000,000 barrels, a decrease of 8.3% compared to September 2023 removals of 13,081,553.

| Domestic Tax Paid – TTB | ||||

| (31 Gallon Barrels) | ||||

| Month | 2023 | 2024 | Percent Change | Volume Change |

| January | 11,208,167 | 11,508,721 | 2.7% | 300,554 |

| February | 11,043,282 | 12,100,525 | 9.6% | 1,057,243 |

| March | 14,730,269 | 12,374,224 | -16.0% | -2,356,045 |

| April | 12,859,240 | 12,445,223 | -3.2% | -414,017 |

| May | 12,771,963 | 13,518,871 | 5.8% | 746,908 |

| June | 15,155,437 | 14,177,623 | -6.5% | -977,814 |

| July | 13,268,213 | 12,681,783 | -4.4% | -586,430 |

| August | 14,096,274 | 12,948,763 | -8.1% | -1,147,511 |

| September | 13,081,553 | 12,000,000 | -8.3% | -1,081,553 |

| YTD | 118,214,398 | 113,755,733 | -3.8% | -4,458,665 |

The October 2024 domestic tax paid estimate is scheduled to be released on December 5, 2024.

###

The Beer Institute is a national trade association for the American brewing industry, representing brewers, beer importers and industry suppliers—an industry that supports nearly 2.4 million jobs and provides more than $409 billion to the American economy. First founded in 1862 as the U.S. Brewers Association, the Beer Institute is committed today to developing sound public policy and to the values of civic duty and personal responsibility. For additional updates from the Beer Institute, visit our website and follow us on Facebook, X, LinkedIn and Instagram.

Jeff Guittard Beer Institute 2027372337 jguittard@beerinstitute.org

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Costco Wholesale Corporation Reports October Sales Results

ISSAQUAH, Wash., Nov. 06, 2024 (GLOBE NEWSWIRE) — Costco Wholesale Corporation (“Costco” or the “Company”) COST today reported net sales of $20.03 billion for the retail month of October, the four weeks ended November 3, 2024, an increase of 7.2 percent from $18.68 billion last year.

Net sales for the first nine weeks were $44.65 billion, an increase of 8.0 percent from $41.33 billion last year.

Comparable sales were as follows:

| 4 Weeks | 9 Weeks | ||

| U.S. | 4.1% | 5.4% | |

| Canada | 8.0% | 6.7% | |

| Other International | 7.1% | 7.9% | |

| Total Company | 5.1% | 5.9% | |

| E-commerce | 19.3% | 21.2% | |

Comparable sales excluding the impacts from changes in gasoline prices and foreign exchange were as follows:

| 4 Weeks | 9 Weeks | ||

| U.S. | 5.8% | 7.7% | |

| Canada | 8.7% | 7.4% | |

| Other International | 8.4% | 9.1% | |

| Total Company | 6.5% | 7.8% | |

| E-commerce | 19.3% | 21.2% | |

October results were negatively affected by a pull forward in sales from the abnormal consumer activity associated with the hurricanes and port strikes in September. The estimated impact on October’s total and comparable sales was a little more than one percent in the U.S. and slightly less than one percent worldwide.

Additional discussion of these results is available in a pre-recorded message. It can be accessed by visiting investor.costco.com (click on “Events & Presentations”). This message will be available through 4:00 p.m. (PT) on Wednesday, November 13, 2024.

Costco currently operates 892 warehouses, including 615 in the United States and Puerto Rico, 108 in Canada, 40 in Mexico, 35 in Japan, 29 in the United Kingdom, 19 in Korea, 15 in Australia, 14 in Taiwan, seven in China, five in Spain, two in France, and one each in Iceland, New Zealand and Sweden. Costco also operates e-commerce sites in the U.S., Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia.

Certain statements contained in this document and the pre-recorded message constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking statements are statements that address activities, events, conditions or developments that the Company expects or anticipates may occur in the future. In some cases forward-looking statements can be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. These risks and uncertainties include, but are not limited to, domestic and international economic conditions, including exchange rates, inflation or deflation, the effects of competition and regulation, uncertainties in the financial markets, consumer and small business spending patterns and debt levels, breaches of security or privacy of member or business information, conditions affecting the acquisition, development, ownership or use of real estate, capital spending, actions of vendors, rising costs associated with employees (generally including health-care costs and wages), workforce interruptions, energy and certain commodities, geopolitical conditions (including tariffs), the ability to maintain effective internal control over financial reporting, regulatory and other impacts related to environmental and social matters, public-health related factors, and other risks identified from time to time in the Company’s public statements and reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and the Company does not undertake to update these statements, except as required by law. Comparable sales and comparable sales excluding impacts from changes in gasoline prices and foreign exchange are intended as supplemental information and are not a substitute for net sales presented in accordance with U.S. GAAP.

| CONTACTS: | Costco Wholesale Corporation David Sherwood, 425/313-8239 Josh Dahmen, 425/313-8254 Andrew Yoon, 425/313-6305 |

COST-Sales

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's 20% Tariff Plans Could Unleash Wave Of Spending On Big Ticket Buys In Holiday Quarter, Says Economist Justin Wolfers — 'Already Hearing Anecdata'

A leading economist warns that U.S. consumers may rush to purchase big-ticket items in the fourth quarter, anticipating President-elect Donald Trump‘s proposed 20% tariff on imports.

What Happened: “I wonder whether we are going to see a burst of spending on consumer durables in Q4, as people pull forward spending on big ticket items ahead of the tariffs. I’m already hearing anecdata of this,” economist Justin Wolfers wrote on X following Trump’s victory in the 2024 presidential election.

Wolfers’ observation comes as Trump secured a decisive win over Democrat Kamala Harris, capturing 277 electoral votes and 51% of the popular vote, according to Associated Press figures. The president-elect has promised to implement broad tariffs, including a 10% levy on all imports and higher rates on Chinese goods.

Why It Matters: Trump’s victory, marking the first non-consecutive second term since Grover Cleveland in the 1800s, sets the stage for significant economic policy shifts. Beyond tariffs, his agenda includes extending the 2017 tax cuts and exempting Social Security payments, tips, and overtime income from taxation.

The potential consumer response highlights the broader economic implications of Trump’s trade agenda. ABN Amro senior economist Rogier Quaedvlieg cautioned that “a full-scale implementation of Trump’s tariffs will increase inflation and put the U.S. in a recession.”

JPMorgan analysts estimate the proposed trade policies could push inflation up by 2.4% in a worst-case scenario, potentially triggering a surge in consumer spending before the tariffs take effect.

Read Next:

Image Via Pixabay

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

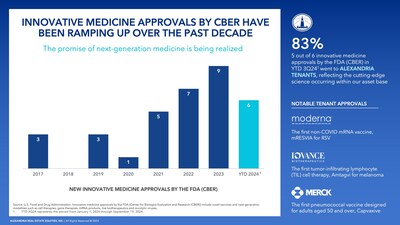

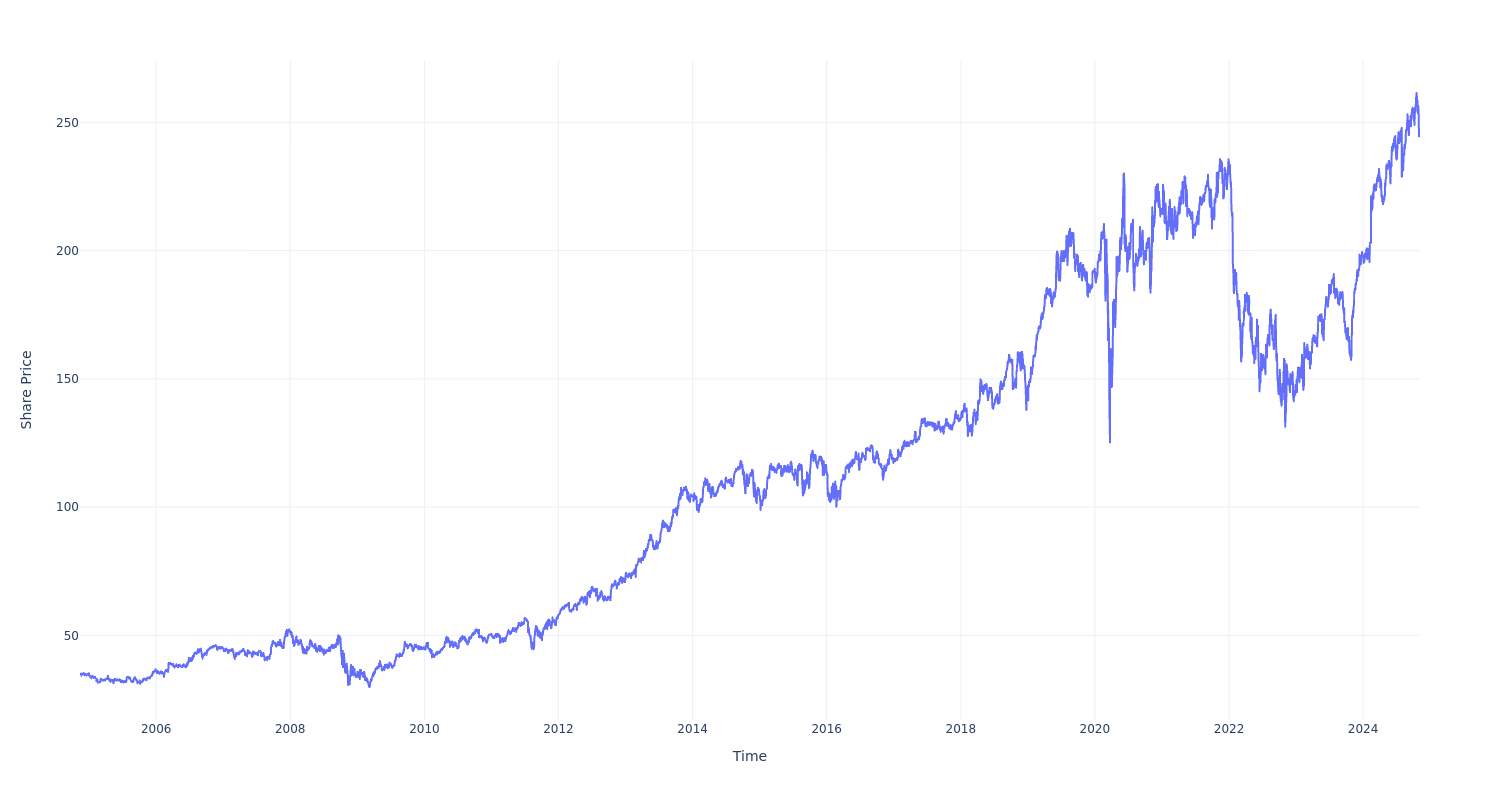

Here's How Much $100 Invested In Welltower 15 Years Ago Would Be Worth Today

Welltower WELL has outperformed the market over the past 15 years by 6.54% on an annualized basis producing an average annual return of 18.46%. Currently, Welltower has a market capitalization of $82.62 billion.

Buying $100 In WELL: If an investor had bought $100 of WELL stock 15 years ago, it would be worth $1,217.25 today based on a price of $132.68 for WELL at the time of writing.

Welltower’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LocalRestorePro Launches Expert Restoration Services in New York City and Northern New Jersey

BROOKLYN, N.Y., Nov. 6, 2024 /PRNewswire/ — LocalRestorePro, a new leader in fire, water, and mold restoration services, is excited to announce its official launch, providing residents and businesses in the Greater New York City area with reliable, expert assistance in emergency restoration. With a commitment to exceptional service, LocalRestorePro aims to be the go-to resource for anyone facing the aftermath of unexpected property damage.

LocalRestorePro specializes in emergency restoration solutions for water damage, mold remediation, and fire damage cleanup. Their certified team of professionals is equipped to handle any disaster, ensuring prompt responses and efficient recovery processes to minimize disruption to your life or business.

Residential & Commercial Restoration Services Tailored to Your Needs

LocalRestorePro offers a full suite of restoration services, including:

- Water Damage Restoration: Quick response to minimize damage and restore properties to their pre-loss condition, preventing further complications.

- Mold Remediation: Thorough inspection and safe removal of mold to protect indoor air quality and health, ensuring a safe environment for your family or employees.

- Fire Damage Restoration: Expert cleanup and restoration following fire incidents, ensuring homes and businesses are safe, secure, and restored to their original state.

- Air Duct Cleaning: Comprehensive air duct cleaning services to improve indoor air quality, reduce allergens, and enhance the efficiency of your HVAC system.

- Commercial Restoration: Specialized restoration services for businesses, ensuring minimal downtime and a quick return to operations following any disaster.

“At LocalRestorePro, we understand the stress and urgency that come with property damage,” said Isaac Blum, CEO of LocalRestorePro. “Our mission is to provide top-notch restoration services that prioritize our clients’ peace of mind and satisfaction. We’re dedicated to helping our community recover quickly and efficiently.”

24/7 Emergency Services Available

LocalRestorePro is proud to offer 24/7 emergency restoration services. Their dedicated team is ready to respond quickly to any crisis, ensuring that clients receive the help they need, whenever they need it. The company works closely with clients and their insurance providers to streamline the claims process, making recovery as seamless as possible, allowing you to focus on what matters most.

Helping Clients in NYC, Northern NJ, and Southwestern CT

LocalRestorePro serves New York City, including Northern New Jersey (Hoboken, Jersey City, Fort Lee, Newark) and Southwestern Connecticut (Stamford, Norwalk, Greenwich, Darien), as well as NYC’s boroughs and surrounding suburbs (Westchester, Rockland, Nassau, Suffolk). These areas are characterized by a mix of urban and suburban lifestyles, and the company is committed to providing restoration expertise to their rich tapestry of residents and businesses.

Get Your Free Consultation Today!

LocalRestorePro invites homeowners and businesses in the New York City area to reach out for a free consultation. Visit the LocalRestorePro website at www.localrestorepro.com

or call at (646) 603-1414 to learn more about services and how LocalRestorePro can help you restore your property after a disaster.

About LocalRestorePro

LocalRestorePro is a leading provider of restoration services specializing in fire, water, and mold damage recovery. With a focus on customer satisfaction, their certified professionals utilize advanced techniques and technologies to ensure properties are restored efficiently and effectively, providing peace of mind to clients throughout the restoration process.

For more information (press and media inquiries only), contact:

Isaac Blum, CEO

LocalRestorePro

Email: 385862@email4pr.com

Phone: (646) 603-1414

Website: www.localrestorepro.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/localrestorepro-launches-expert-restoration-services-in-new-york-city-and-northern-new-jersey-302296696.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/localrestorepro-launches-expert-restoration-services-in-new-york-city-and-northern-new-jersey-302296696.html

SOURCE LocalRestorePro.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

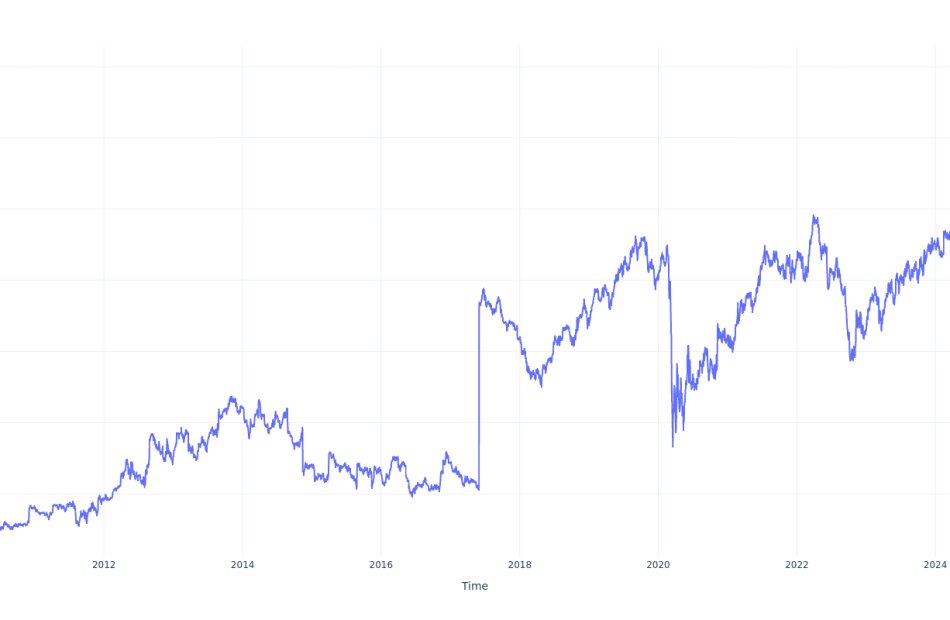

Here's How Much $100 Invested In Ecolab 20 Years Ago Would Be Worth Today

Ecolab ECL has outperformed the market over the past 20 years by 1.92% on an annualized basis producing an average annual return of 10.26%. Currently, Ecolab has a market capitalization of $69.77 billion.

Buying $100 In ECL: If an investor had bought $100 of ECL stock 20 years ago, it would be worth $704.81 today based on a price of $246.39 for ECL at the time of writing.

Ecolab’s Performance Over Last 20 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Maplebear

Investors with a lot of money to spend have taken a bullish stance on Maplebear CART.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CART, it often means somebody knows something is about to happen.

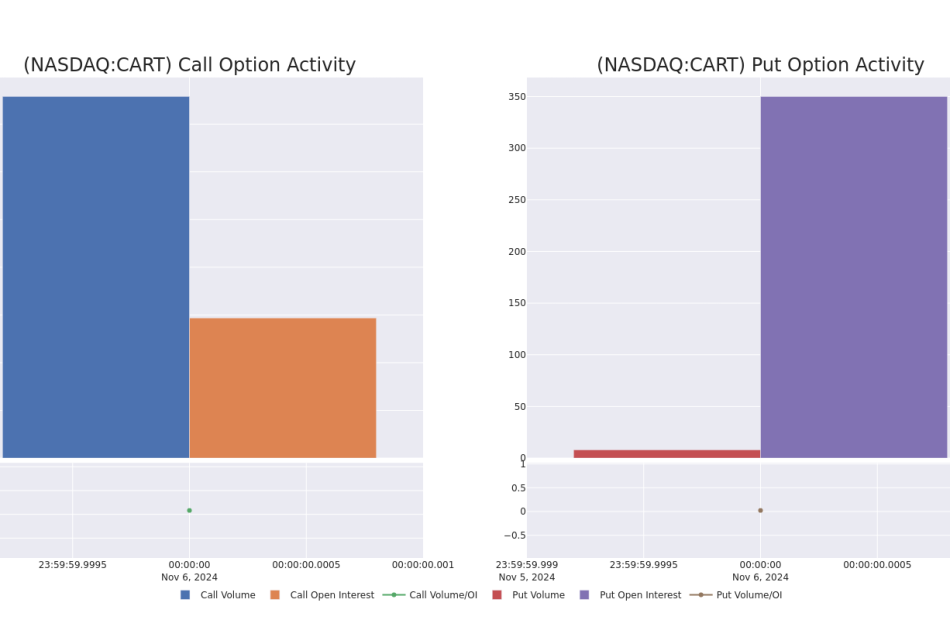

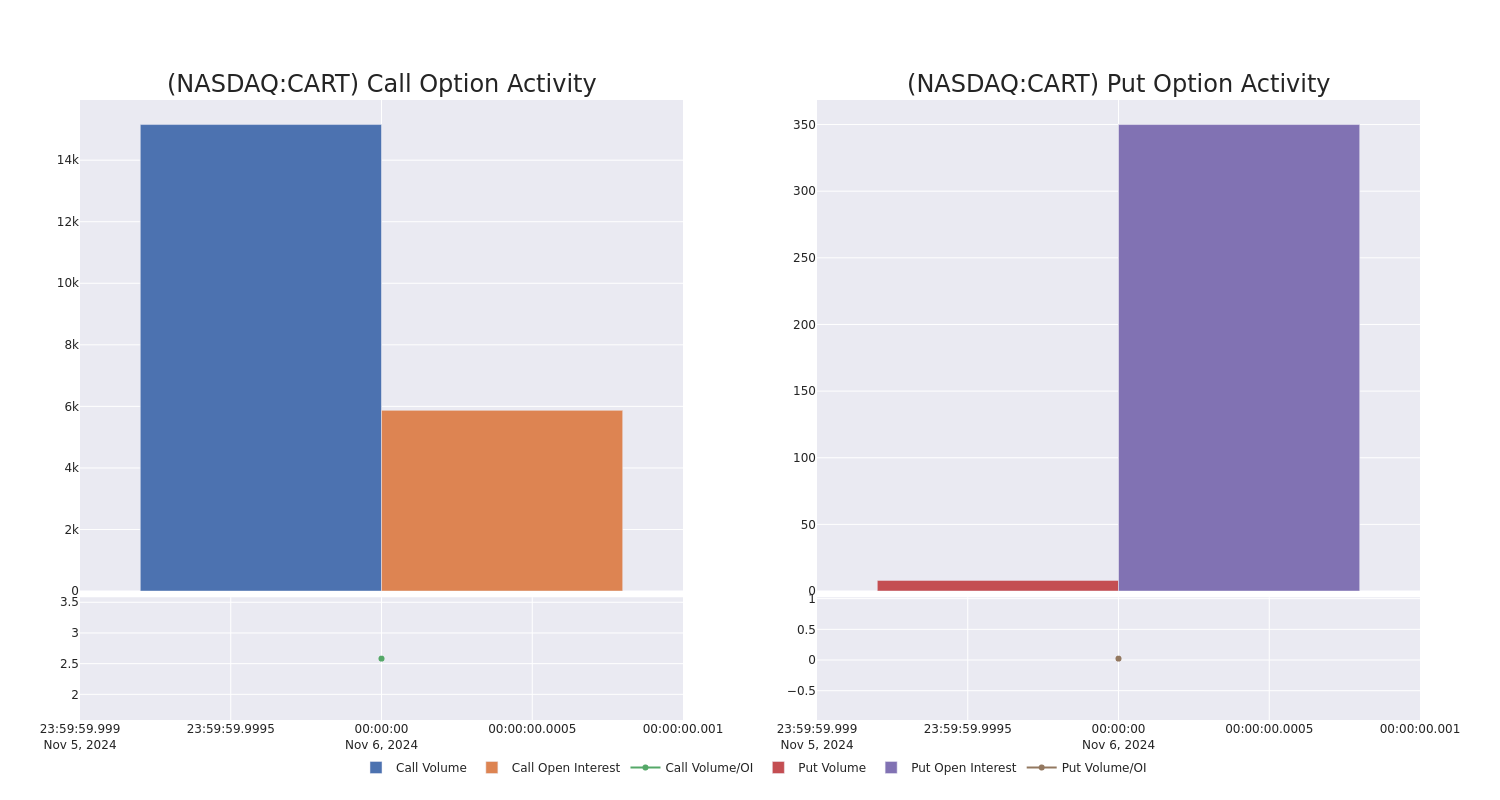

Today, Benzinga’s options scanner spotted 15 options trades for Maplebear.

This isn’t normal.

The overall sentiment of these big-money traders is split between 86% bullish and 6%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $99,298, and 14, calls, for a total amount of $1,405,775.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $50.0 for Maplebear during the past quarter.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Maplebear’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Maplebear’s whale trades within a strike price range from $45.0 to $50.0 in the last 30 days.

Maplebear Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CART | CALL | SWEEP | BULLISH | 06/20/25 | $6.4 | $6.2 | $6.4 | $50.00 | $160.0K | 2.9K | 2.4K |

| CART | CALL | SWEEP | BULLISH | 06/20/25 | $6.4 | $6.0 | $6.4 | $50.00 | $160.0K | 2.9K | 2.2K |

| CART | CALL | SWEEP | BULLISH | 06/20/25 | $6.3 | $6.2 | $6.3 | $50.00 | $157.5K | 2.9K | 1.8K |

| CART | CALL | SWEEP | BULLISH | 06/20/25 | $6.2 | $5.9 | $6.2 | $50.00 | $155.0K | 2.9K | 1.4K |

| CART | CALL | SWEEP | BULLISH | 06/20/25 | $6.2 | $5.9 | $6.2 | $50.00 | $155.0K | 2.9K | 620 |

About Maplebear

Maplebear (Instacart) operates a leading grocery delivery platform in the United States and Canada. The firm partners with various regional and national grocers, which offer their selection of food and other goods to customers through Instacart’s ubiquitous platform. Once an item is ordered through Instacart’s site, the item is picked and delivered to the customer’s home by one of the platform’s 600,000 shoppers, who are classified as independent contractors. Instacart earns fees based on average order value and leverages its platform’s high usage to sell advertising, mainly to consumer-packaged goods companies. Instacart currently has nearly 8 million monthly active users (or orderers) on its platform.

Where Is Maplebear Standing Right Now?

- With a trading volume of 603,342, the price of CART is up by 4.21%, reaching $47.51.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 6 days from now.

Expert Opinions on Maplebear

In the last month, 3 experts released ratings on this stock with an average target price of $51.666666666666664.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Jefferies downgraded its action to Hold with a price target of $45.

* An analyst from Stifel has decided to maintain their Buy rating on Maplebear, which currently sits at a price target of $55.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Maplebear with a target price of $55.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Maplebear options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.