Market Whales and Their Recent Bets on APO Options

Deep-pocketed investors have adopted a bearish approach towards Apollo Global Management APO, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in APO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 86 extraordinary options activities for Apollo Global Management. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 22% leaning bullish and 67% bearish. Among these notable options, 4 are puts, totaling $803,797, and 82 are calls, amounting to $22,596,648.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $27.5 to $210.0 for Apollo Global Management during the past quarter.

Volume & Open Interest Trends

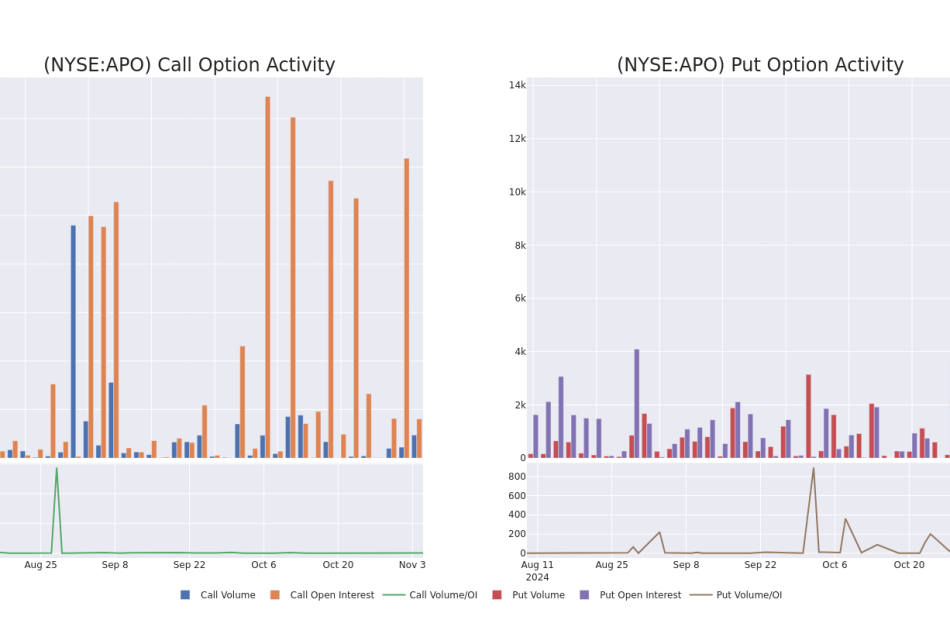

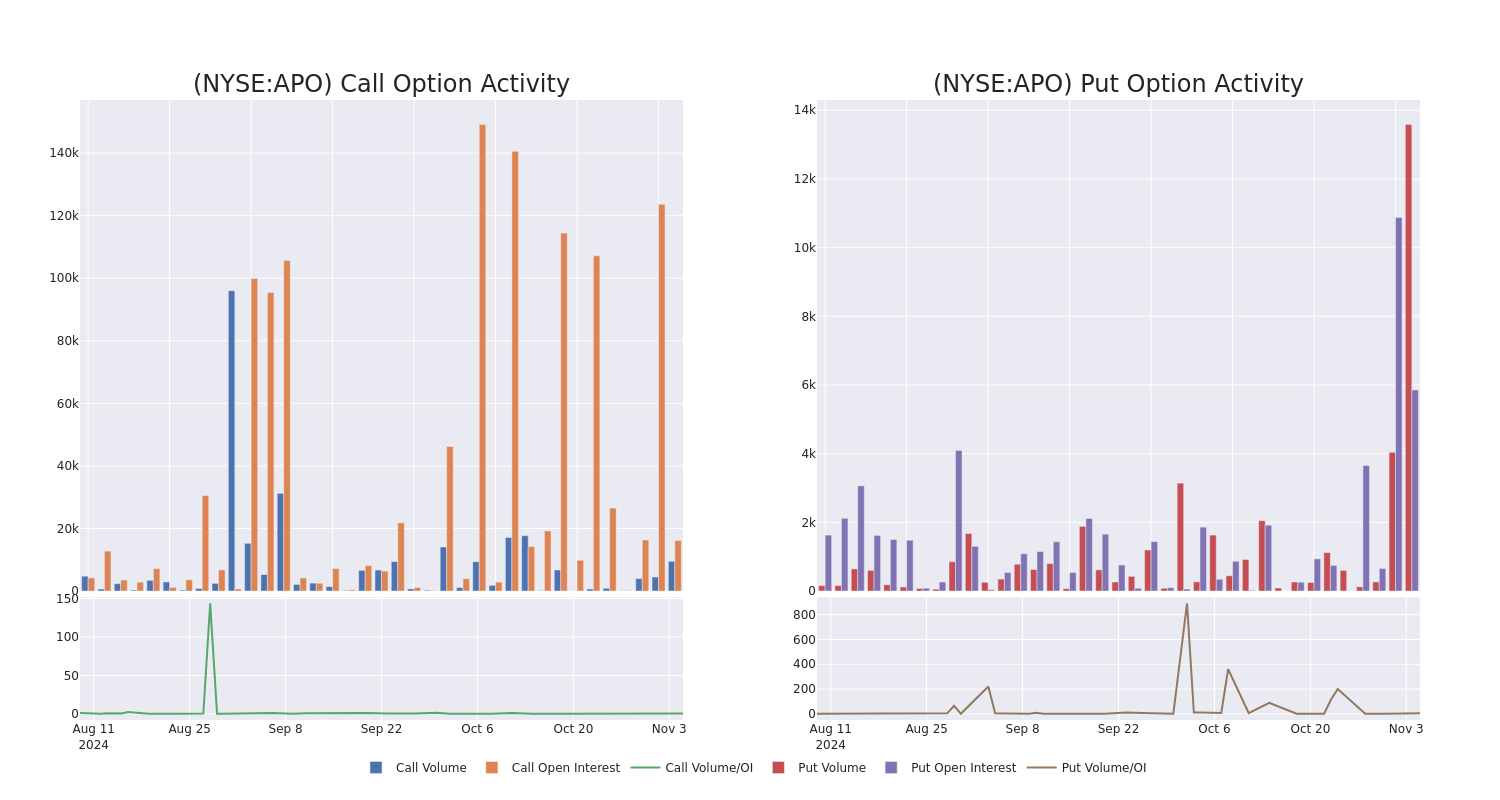

In today’s trading context, the average open interest for options of Apollo Global Management stands at 5981.95, with a total volume reaching 139,340.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Apollo Global Management, situated within the strike price corridor from $27.5 to $210.0, throughout the last 30 days.

Apollo Global Management 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APO | CALL | TRADE | BEARISH | 01/16/26 | $17.3 | $16.3 | $16.5 | $185.00 | $4.9M | 91.5K | 9.1K |

| APO | CALL | TRADE | BULLISH | 01/16/26 | $17.5 | $14.5 | $16.3 | $185.00 | $4.5M | 91.5K | 224 |

| APO | CALL | TRADE | BEARISH | 01/16/26 | $16.6 | $16.1 | $16.2 | $185.00 | $4.3M | 91.5K | 6.0K |

| APO | CALL | TRADE | BEARISH | 11/15/24 | $24.8 | $24.0 | $24.0 | $140.00 | $945.6K | 4.7K | 525 |

| APO | CALL | SWEEP | BULLISH | 01/17/25 | $112.0 | $110.0 | $110.0 | $52.50 | $594.0K | 727 | 100 |

About Apollo Global Management

Apollo Global Management Inc is an alternative investment manager. It serves various sectors such as chemicals, manufacturing and industrial, natural resources, consumer and retail, consumer services, business services, financial services, leisure, and media and telecom and technology. The company operates in three business segments that are Asset Management, Retirement Services, and Principal Investing. It generates maximum revenue from the Retirement Services segment.

Following our analysis of the options activities associated with Apollo Global Management, we pivot to a closer look at the company’s own performance.

Apollo Global Management’s Current Market Status

- Trading volume stands at 5,669,419, with APO’s price up by 10.42%, positioned at $164.82.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 92 days.

Expert Opinions on Apollo Global Management

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $158.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Apollo Global Management, targeting a price of $174.

* Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Apollo Global Management with a target price of $150.

* An analyst from Deutsche Bank persists with their Buy rating on Apollo Global Management, maintaining a target price of $155.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Apollo Global Management with a target price of $137.

* An analyst from TD Cowen has decided to maintain their Buy rating on Apollo Global Management, which currently sits at a price target of $178.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Apollo Global Management, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SURGE ENERGY INC. ANNOUNCES THIRD QUARTER FINANCIAL AND OPERATING RESULTS; LATEST OPERATIONAL RESULTS; AND 2025 CAPITAL AND OPERATING BUDGET

CALGARY, AB, Nov. 6, 2024 /CNW/ – Surge Energy Inc. (“Surge” or the “Company”) SGY is pleased to announce financial and operating results for the quarter ended September 30, 2024, as well as the Company’s 2025 capital and operating budget as approved by Surge’s board of directors (the “Board”).

Select financial and operating information is outlined below and should be read in conjunction with the Company’s unaudited interim financial statements and management’s discussion and analysis for the three and nine months ended September 30, 2024, available at www.sedarplus.ca and on Surge’s website at www.surgeenergy.ca.

MESSAGE TO SHAREHOLDERS

Surge has a high quality, light and medium gravity crude oil asset and opportunity base, with an internally estimated drilling inventory that supports more than 10 years of drilling1 – in two of the top four crude oil plays in North America2 (based on per well payout economics). Surge’s management (“Management”) and Board operate and manage the Company to maximize free cash flow available for shareholder returns, primarily through a sustainable base dividend and share buybacks, which have historically been shown to deliver superior returns to investors over time3.

Q3 2024 FINANCIAL AND OPERATIONAL HIGHLIGHTS

During Q3/24, Surge completed the strategic repositioning of the Company’s debt capital structure with the closing of a $175 million, 5 year term, senior unsecured note financing (“Senior Unsecured Notes”). Concurrently, Surge repaid the Company’s $126 million second-lien secured term facility, as well as all amounts drawn under Surge’s first-lien revolving credit facility. The Company further strengthened Surge’s financial position with an increase of $40 million to its first-lien revolving credit facility, which now stands undrawn at $250 million.

With the completion of the Senior Unsecured Note financing, substantially all of the Company’s net debt4 has now been termed out through late 2028 (Surge’s existing $48 million aggregate principal amount of convertible debentures), and late 2029 (the $175 million Senior Unsecured Notes).

As at September 30, 2024, Surge had $11.5 million of cash on hand, in addition to its undrawn $250 million first-lien revolving credit facility, as a result of these strategic debt capital transactions.

During Q3/24, Surge delivered adjusted funds flow (“AFF”)4 of $72.7 million and cash flow from operating activities of $73.4 million.

Seasonally, Q3/24 represents a higher capital expenditure period for the Company due to increased drilling activity following the conclusion of spring breakup (and the removal of associated road bans) within Surge’s operating areas. On this basis, in Q3/24, Surge spent $51.4 million on property, plant, and equipment expenditures, drilling 27 gross (24.2 net) wells in its Sparky and SE Saskatchewan core areas.

Even with the increased post-breakup drilling activity in Q3/24, the Company generated free cash flow (“FCF”)4 of $21.3 million, representing 29 percent of AFF generated in Q3/24.

In Q3/24, Surge returned $12.7 million to its shareholders by way of the Company’s annual base cash dividend of $0.52 per share (paid monthly), which represents 17 percent of AFF generated during the quarter.

Surge returned an additional $4.0 million to shareholders in Q3/24, through the Company’s active normal course issuer bid (“NCIB”), repurchasing 621,700 shares during the quarter.

On a combined basis, Surge provided direct returns of approximately $17 million to the Company’s shareholders in Q3/24 through the base dividend and the NCIB share repurchases. This represents approximately 23 percent of AFF returned to shareholders in the quarter.

In Q3/24, the Company continued to validate and expand Surge’s large, new Sparky crude oil discovery at Hope Valley, drilling 3.0 gross (3.0 net) additional wells at the property. Surge now estimates over 80 multi-lateral drilling locations1 at Hope Valley. The Company is encouraged by the repeatability of its ongoing drilling results at Hope Valley as it moves into the full development phase of this new Sparky discovery.

Highlights from the Company’s Q3 2024 financial and operating results include:

- Increasing average daily production to 23,795 boepd (87 percent liquids) during Q3/24, as compared to 23,618 boepd (87 percent liquids) in Q2/24. Q3 was the first full quarter following the non-core asset sales of approximately 1,100 boepd that closed in late Q2/24, as announced on May 29, 2024;

- Drilling 27 gross (24.2 net) wells, with activity focused in the Company’s Sparky and SE Saskatchewan core areas;

- Reducing net operating expenses4 by $1.50 per boe (seven percent) to $18.81 per boe in Q3/24, as compared to $20.31 per boe in Q2/24;

- Providing additional term and reduced interest expense costs with the successful closing of Surge’s $175 million Senior Unsecured Note financing. The Senior Unsecured Notes bear interest at a rate of 8.5% per annum and mature on September 5, 2029;

- Repaying in full the Company’s $126 million second-lien term facility;

- Distributing $12.7 million to Surge’s shareholders by way of the Company’s $0.52 per share per annum base dividend (paid monthly); and

- Returning an additional $4.0 million to shareholders by way of the Company’s NCIB share repurchase program.

FINANCIAL AND OPERATING HIGHLIGHTS

|

FINANCIAL AND OPERATING HIGHLIGHTS |

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||

|

($000s except per share and per boe) |

2024 |

2023 |

% Change |

2024 |

2023 |

% Change |

|

Financial highlights |

||||||

|

Oil sales |

158,463 |

177,440 |

(11) % |

477,213 |

479,634 |

(1) % |

|

NGL sales |

3,333 |

3,173 |

5 % |

10,840 |

9,433 |

15 % |

|

Natural gas sales |

395 |

3,862 |

(90) % |

5,478 |

12,855 |

(57) % |

|

Total oil, natural gas, and NGL revenue |

162,191 |

184,475 |

(12) % |

493,531 |

501,922 |

(2) % |

|

Cash flow from operating activities |

73,420 |

71,315 |

3 % |

213,809 |

186,429 |

15 % |

|

Per share – basic ($) |

0.73 |

0.72 |

1 % |

2.12 |

1.90 |

12 % |

|

Per share diluted ($) |

0.72 |

0.71 |

1 % |

2.08 |

1.85 |

12 % |

|

Adjusted funds flowa |

72,710 |

86,874 |

(16) % |

218,002 |

214,845 |

1 % |

|

Per share – basic ($)a |

0.72 |

0.87 |

(17) % |

2.16 |

2.19 |

(1) % |

|

Per share diluted ($) |

0.71 |

0.86 |

(17) % |

2.13 |

2.13 |

— % |

|

Net income (loss)c |

17,263 |

16,583 |

4 % |

(51,060) |

45,427 |

nm |

|

Per share basic ($) |

0.17 |

0.17 |

— % |

(0.51) |

0.46 |

nm |

|

Per share diluted ($)d |

0.17 |

0.16 |

6 % |

(0.51) |

0.45 |

nm |

|

Expenditures on property, plant and equipment |

51,361 |

43,945 |

17 % |

136,826 |

120,267 |

14 % |

|

Net acquisitions and dispositions |

(20) |

231 |

nmb |

(33,521) |

(2,143) |

nm |

|

Net capital expenditures |

51,341 |

44,176 |

16 % |

103,305 |

118,124 |

(13) % |

|

Net debta, end of period |

247,314 |

286,295 |

(14) % |

247,314 |

286,295 |

(14) % |

|

Operating highlights |

||||||

|

Production: |

||||||

|

Oil (bbls per day) |

19,988 |

20,188 |

(1) % |

20,078 |

20,330 |

(1) % |

|

NGLs (bbls per day) |

779 |

659 |

18 % |

832 |

669 |

24 % |

|

Natural gas (mcf per day) |

18,168 |

19,564 |

(7) % |

19,167 |

19,396 |

(1) % |

|

Total (boe per day) (6:1) |

23,795 |

24,108 |

(1) % |

24,105 |

24,232 |

(1) % |

|

Average realized price (excluding hedges): |

||||||

|

Oil ($ per bbl) |

86.17 |

95.53 |

(10) % |

86.74 |

86.42 |

— % |

|

NGL ($ per bbl) |

46.50 |

52.34 |

(11) % |

47.57 |

51.63 |

(8) % |

|

Natural gas ($ per mcf) |

0.24 |

2.15 |

(89) % |

1.04 |

2.43 |

(57) % |

|

Netback ($ per boe) |

||||||

|

Petroleum and natural gas revenue |

74.09 |

83.17 |

(11) % |

74.72 |

75.87 |

(2) % |

|

Realized loss on commodity and FX contracts |

(0.10) |

(0.69) |

(86) % |

(0.49) |

(0.83) |

(41) % |

|

Royalties |

(14.88) |

(15.05) |

(1) % |

(13.66) |

(13.34) |

2 % |

|

Net operating expensesa |

(18.81) |

(20.82) |

(10) % |

(20.33) |

(21.56) |

(6) % |

|

Transportation expenses |

(1.39) |

(1.31) |

6 % |

(1.26) |

(1.56) |

(19) % |

|

Operating netbacka |

38.91 |

45.30 |

(14) % |

38.98 |

38.58 |

1 % |

|

G&A expense |

(2.35) |

(2.13) |

10 % |

(2.34) |

(2.13) |

10 % |

|

Interest expense |

(3.34) |

(4.01) |

(17) % |

(3.64) |

(3.96) |

(8) % |

|

Adjusted funds flowa |

33.22 |

39.16 |

(15) % |

33.00 |

32.49 |

2 % |

|

Common shares outstanding, end of period |

101,426 |

100,314 |

1 % |

101,426 |

100,314 |

1 % |

|

Weighted average basic shares outstanding |

101,066 |

99,384 |

2 % |

100,728 |

98,277 |

2 % |

|

Stock based compensation dilutiond |

1,471 |

1,589 |

(7) % |

1,843 |

2,459 |

(25) % |

|

Weighted average diluted shares outstanding |

102,537 |

100,973 |

2 % |

102,571 |

100,736 |

2 % |

|

a This is a non-GAAP and other financial measure which is defined in Non-GAAP and Other Financial Measures. |

||||||

|

b The Company views this change calculation as not meaningful, or “nm”. |

||||||

|

c The nine months ended September 30, 2024 includes a non-cash impairment charge of $96.5 million. |

||||||

|

d Dilution is not reflected in the calculation of net loss for the nine months ended September 30, 2024. |

||||||

OPERATIONS UPDATE: CONTINUED DRILLING SUCCESS IN SPARKY AND SE SASKATCHEWAN CORE AREAS

Surge continued the Company’s 2024 drilling program in Q3/24, with two rigs drilling in the Sparky core area and one rig in the SE Saskatchewan core area. Surge remains on track to meet the Company’s 2024 production exit rate target of 24,000 boepd.

Surge’s Q3/24 drilling program consisted of a total of 27 gross (24.2 net) wells, with 12 gross (12.0 net) wells drilled in the Sparky core area and 15 gross (12.2 net) drilled in the SE Saskatchewan core area.

The development of Surge’s Hope Valley discovery continued in Q3/24 with the drilling of three multi-leg horizontal wells. These three wells were drilled each with 12 lateral legs, accessing an average of 15,000 meters of Sparky reservoir per well, utilizing the application of modern multi-lateral open hole drilling technology.

The first two wells drilled in Q3/24 are now on production, with 60 day production rates of 230 bopd and 220 bopd respectively, and the third well is currently on production in its initial clean-up stage. These production results compare favorably to the offset discovery well, which had a 60 day initial production rate of 244 bopd and a 90 day initial production rate of 236 bopd, as previously announced in Q2/24. Surge is encouraged by the repeatability of the Company’s recent drilling results1 at Hope Valley as it moves into the development phase for this asset.

Additionally, during Q3/24, the Company began construction of a multi-well battery at Hope Valley which is expected to be completed in December 2024. Following Surge’s continued success at Hope Valley, the Company has commenced a follow-up 42 square kilometer 3D seismic program to complement the Company’s existing 3D dataset. This seismic data will be utilized in Surge’s 2025 drilling program and will help to further de-risk its expanding Hope Valley inventory. The Company currently owns 32.5 net sections of land at Hope Valley, and internally estimates over 80 (net) multi-lateral Sparky drilling locations on these lands.

The Company also continued its strong operational momentum in SE Saskatchewan during Q3/24, drilling 15 gross (12.2 net) wells in this core, operated light oil area. Drilling was focused in Surge’s Steelman and Viewfield properties, targeting the Frobisher formation where 8 gross (8.0 net) wells were drilled. The first six wells of this Frobisher program are now on production, with an average IP30 rate of over 425 boepd (90% light oil).

Surge has a drilling inventory of over 250 (internally estimated) net locations1 in SE Saskatchewan, of which more than 165 are Frobisher light oil locations.

2025 CAPITAL AND OPERATING BUDGET: MAXIMIZING FREE CASH FLOW

Given the recent instability and volatility of world crude oil prices, Management has elected to utilize a US$70 WTI crude oil price assumption for the Company’s 2025 capital and operating budget.

In 2025, Surge will continue to focus on the Company’s disciplined capital allocation business strategy, with cash flow strategically allocated between focused capital projects and returns to shareholders. Surge is currently returning over $52 million annually to shareholders through the Company’s existing $0.52 per share per annum base dividend (paid monthly). Additionally, Management currently anticipates allocating the majority of the Company’s remaining excess free cash flow (“excess FCF”)4 in 2025 to share repurchases under its existing NCIB program.

Surge’s 2025 capital budget will see greater than 95 percent of the Company’s development expenditures directed towards two of the top four crude oil plays in Canada2 in its Sparky (>11,500 boepd; 85% liquids) and SE Saskatchewan (~8,500 boepd; 90% liquids) core areas, which now comprise over 83 percent of the Company’s current production.

Surge has reduced the Company’s 2025 capital spending budget by $20 million, from $190 million in 2024, to $170 million in 2025. This significant reduction in forecast capital expenditures is largely due to the Company’s successful application of modern, multilateral drilling technologies in both the Sparky and SE Saskatchewan core areas, which have provided improved capital efficiencies and increased FCF.

The reduction in Surge’s 2025 capital budget further is expected to further improve the sustainability of the Company’s dividend and shareholder returns based business model, with the $20 million reduction in year over year budgeted capital expenditures representing nearly 40 percent of Surge’s annual dividend payment of $52.7 million.

Based on Surge’s 2025 capital budget, the Company anticipates delivering average production of 23,750 boepd (87 percent liquids), while concurrently generating an anticipated $85 million of FCF at US$70 WTI crude oil pricing5.

Management and the Board closely monitor market conditions for commodity prices, Canadian oil price differentials, as well as interest and foreign exchange rates. The pace of the Company’s capital expenditures budget is strategically adjusted by Management based on market conditions.

2025 BUDGET HIGHLIGHTS

Surge’s disciplined 2025 capital and operating budget is designed to maximize FCF as follows:

- A focused $170 million exploration and development capital expenditure program;

- Forecast AFF flow of more than $277 million ($2.73 per share) at US$70 WTI crude oil pricing5;

- Forecast annual cash flow from operating activities of more than $255 million ($2.51 per share) at US$70 WTI crude oil pricing5;

- Forecast FCF of $85 million ($0.84 per share) at US$70 WTI crude oil pricing5;

- Targets the drilling of 65.0 of the Company’s most capital efficient net drilling locations; focused predominately in the Sparky and SE Saskatchewan core areas; and

- Utilizes less than 8 percent of the Company’s internally estimated drilling location inventory (i.e. over 900 net total estimated locations currently in inventory)1.

Further details relating to the 2025 budget are set forth below:

|

Guidance |

@ US $70 WTI5 |

|

Average 2025 production |

23,750 boepd (87% liquids) |

|

2025(e) Exploration and development expenditures |

$170 million |

|

2025(e) Adjusted Funds Flow |

$277 million |

|

Per share |

$2.73 per share |

|

2025(e) Cash flow from operating activities* |

$255 million |

|

Per share |

$2.51 per share |

|

2025(e) Free cash flow |

$85 million |

|

Per share |

$0.84 per share |

|

2025(e) Base dividend |

$53 million |

|

Per share |

$0.52 per share |

|

2025(e) Royalties as a % of petroleum and natural gas revenue |

19.0 % |

|

2025(e) Net operating expenses |

$19.50 – $19.95 per boe |

|

2025(e) Transportation expenses |

$1.50 – $1.75 per boe |

|

2025(e) General & administrative expenses |

$2.25 – $2.45 per boe |

|

2025(e) Interest expenses |

$2.50 – $2.75 per boe |

|

$1.3 billion in tax pools (providing an estimated 4-year tax horizon) |

|

|

* Cash flow from operating activities assumes a nil change in non-cash working capital. |

2025 DRILLING PROGRAM: FOCUSED ON THE SPARKY (MANNVILLE) AND SE SASKATCHEWAN (FROBISHER)

Surge’s 2025 capital program is focused in the Company’s Sparky and SE Saskatchewan core areas, with 100 percent of the 2025 drilling budget in these two areas. A total of approximately 65.0 net wells are planned across all core areas, with 34.0 net wells planned in the Sparky, and 31.0 net wells planned in SE Saskatchewan.

Sparky (Mannville)

Surge’s 2025 capital program in the Sparky core area (>85% liquids; 23° API average crude oil gravity) is directed to development drilling, consisting of 19 net single-leg fracked Sparky horizontal wells and 15 net multi-leg Sparky wells. In 2025, Management will be focused on the continued growth of Surge’s multi-lateral well footprint in the Mannville stack of formations, with approximately 50 percent of drilling capital directed to multi-lateral development.

SE Saskatchewan

In the Company’s SE Saskatchewan core area, Surge is currently budgeting the drilling of 31.0 net conventional Mississippian horizontal wells, with 23.0 of these wells targeting the Frobisher formation, and 8.0 wells targeting the Midale and Lodgepole formations.

Over the past number of years, the Company has endeavored to optimize reservoir contact by drilling two and three leg vertically stacked multi-lateral wells within the Frobisher formation. In 2025, 17.0 net wells of Surge’s planned 23.0 net Frobisher wells (74 percent) will be drilled as multi-lateral horizontal wells.

OUTLOOK: THE PATH TO VALUE MAXIMIZATION

Following the early repayment of Surge’s $126 million second-lien term facility, combined with the successful $175 million Senior Unsecured Note financing (together with an undrawn $250 million first-lien credit facility), the Company is now allocating substantially all excess FCF to shareholder returns through its base dividend and share buybacks.

Surge has a high quality, light and medium gravity crude oil asset and opportunity base, with an internally estimated drilling inventory that supports more than 10 years of drilling1 – in two of the top four crude oil plays in North America2 (based on per well payout economics). Surge’s Management and Board operate and manage the Company to maximize FCF available for shareholder returns, primarily through a sustainable base dividend and share buybacks, which have historically been shown to deliver superior returns to investors over time3.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements. The use of any of the words “anticipate”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “should”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

More particularly, this press release contains statements concerning: Surge’s expectation it will meet the Company’s 2024 production exit rate target; the anticipated completion date of the construction of a multi-well battery at Hope Valley; the anticipated use of the seismic data obtained from its 3D seismic program in Surge’s 2025 drilling program and the expectations such data will help to further de-risk its expanding Hope Valley inventory; Surge’s expectations and estimates with respect to its 2025 capital and operating budget; Surge’s 2025 guidance; Surge’s continued focus through 2025 on its disciplined capital allocation strategy; the anticipation that a majority of the Company’s remaining free cash flow in 2025 will be used for share repurchases under its NCIB program; the expectation that the reduction in Surge’s 2025 capital budget will improve the sustainability of the Company’s dividend and shareholder returns based business model; Management’s focus on the continued growth of Surge’s multi-lateral well footprint in the Mannville stack and the commitment to development drilling in the Sparky area; Surge’s planned 2025 drilling program; Surge’s expectations regarding crude oil prices and WCS differentials; Surge’s identification of potential drilling locations, including in Hope Valley; and the Company’s ability to de-risk future drilling locations in Hope Valley.

The forward-looking statements are based on certain key expectations and assumptions made by Surge, including expectations and assumptions around the performance of existing wells and success obtained in drilling new wells; Surge’s pricing assumptions of US$70 WTI, US$13.50 WCS differential, US$3.50 EDM differential, $0.725 CAD/USD FX and $2.50 AECO; anticipated operating, transportation and general and administrative costs and expenses; the application of regulatory and royalty regimes; prevailing economic conditions; development and completion activities; the performance of new wells; the successful implementation of waterflood programs; the availability of and performance of facilities and pipelines; the geological characteristics of Surge’s properties; the successful application of drilling, completion and seismic technology; the determination of decommissioning liabilities; prevailing weather conditions; licensing requirements; the impact of completed facilities on operating costs; the availability and costs of capital, labour and services; and the creditworthiness of industry partners.

Although Surge believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Surge can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the condition of the global economy, including trade, public health and other geopolitical risks (including the Russian invasion of Ukraine and continued conflict in the Middle East); risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; inability of Surge to fund its future capital requirements and business plan; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks); commodity price and exchange rate fluctuations and constraint in the availability of services, adverse weather or break-up conditions; uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures; risks related to decommissioning liabilities including as a result of changes to laws or regulations, reserves estimates, costs and technology; failure to obtain the continued support of the lenders under Surge’s current credit facilities; potential decrease in the available lending limits under Surge’s credit facilities as a result of the syndicate’s interpretation of the Company’s reserves, commodity prices and decommissioning obligations; or the inability to obtain consent of lenders to increase or maintain the credit facilities. Certain risks are set out in more detail in Surge’s annual information form dated March 6, 2024 and in Surge’s interim management discussion and analysis for the period ended September 30, 2024, both of which have been filed on SEDAR+ and can be accessed at www.sedarplus.ca.

The forward-looking statements contained in this press release are made as of the date hereof and Surge undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws.

Oil and Gas Advisories

The term “boe” means barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet of natural gas. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. “Boe/d” and “boepd” mean barrel of oil equivalent per day. Bbl means barrel of oil and “bopd” means barrels of oil per day. NGLs means natural gas liquids.

This press release contains certain oil and gas metrics and defined terms which do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar metrics/terms presented by other issuers and may differ by definition and application.

“Internally estimated” means an estimate that is derived by Surge’s internal Qualified Reserve Evaluators (“QRE’s”) and prepared in accordance with National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities and the COGE Handbook. All internal estimates contained in this new release have been prepared effective as of January 1, 2024.

Drilling Inventory

Unbooked locations are internal estimates based on prospective acreage and assumptions as to the number of wells that can be drilled per section based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources. Unbooked locations have been identified by Surge’s internal certified Engineers and Geologists as an estimation of our multi-year drilling activities based on evaluation of applicable geologic, seismic, engineering, production and reserves information. There is no certainty that the Company will drill any or all unbooked drilling locations and if drilled, there is no certainty that such locations will result in additional oil and gas reserves, resources or production. The drilling locations on which the Company actually drills wells will ultimately depend upon the availability of capital, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained and other factors. While certain unbooked drilling locations have been de-risked by drilling existing wells in close proximity to such unbooked drilling locations, the majority of other unbooked drilling locations are farther away from existing wells where Management has less information about the characteristics of the reservoir and therefore, there is more uncertainty whether wells will be drilled in such locations and if drilled, there is more uncertainty that such wells will result in additional oil and gas reserves, resources or production.

Assuming a January 1, 2024 reference date (and net of the May 29, 2024 non-core dispositions, announced May 30, 2024), the Company will have over >1,000 gross (>900 net) drilling locations identified herein; of these, >530 gross (>490 net) are unbooked locations. Of the 424 net booked locations identified herein, 339 net are Proved locations and 85 net are Probable locations based on Sproule’s 2023 year-end reserves and excluding the sold non-core properties. Assuming an average number of net wells drilled per year of 75, Surge’s >900 net locations provide >12 years of drilling.

Surge’s internally used type curves were constructed using a representative, factual and balanced analog data set, as of January 1, 2024. All locations were risked appropriately, and Estimated Ultimate Recovery (“EUR”) was measured against Discovered Petroleum Initially In Place (“DPIIP”) estimates to ensure a reasonable recovery factor was being achieved based on the respective spacing assumption. Other assumptions, such as capital, operating expenses, wellhead offsets, land encumbrances, working interests and NGL yields were all reviewed, updated and accounted for on a well-by-well basis by Surge’s QRE’s. All type curves fully comply with Part 5.8 of the Companion Policy 51 – 101CP.

Assuming a September 30, 2024 reference date, the Company will have over >80 gross (>80 net) Hope Valley area drilling locations identified herein; of these, >70 gross (>70 net) are unbooked locations. Of the 9 net booked locations identified herein, 6 net are Proved locations and 3 net are Probable locations based on Sproule’s 2023 year-end reserves.

Surge’s internal Hope Valley type curve profile of 172 bopd (IP30), 170 bopd (IP90) and 175 mbbl (175 mboe) EUR reserves per well, with assumed $2.5 MM per well capital, has a payout of <12 months @ US$70/bbl WTI (C$76/bbl WCS) and a ~168% IRR.

Assuming a December 31, 2024 reference date, the Company will have over >300 gross (>250 net) SE Saskatchewan & Manitoba area drilling locations identified herein; of these, >125 gross (>100 net) are unbooked locations. Of the 153 net booked locations identified herein, 122 net are Proved locations and 31 net are Probable locations based on Sproule’s 2023 year-end reserves.

Assuming a December 31, 2024 reference date, the Company will have over >200 gross (>165 net) Frobisher drilling locations identified herein; of these, >100 gross (>75 net) are unbooked locations. Of the 88 net booked locations identified herein, 68 net are Proved locations and 19 net are Probable locations based on Sproule’s 2023 year-end reserves.

Surge’s internal Frobisher type curve profile of 173 bopd (IP30), 143 bopd (IP90) and 84 mbbl (84 mboe) EUR reserves per well, with assumed $1.25 MM per well capital, has a payout of < 7 months @ US$70/bbl WTI (C$89/bbl LSB) and a >300% IRR.

Non-GAAP and Other Financial Measures

This press release includes references to non-GAAP and other financial measures used by the Company to evaluate its financial performance, financial position or cash flow. These specified financial measures include non-GAAP financial measures and non-GAAP ratios and are not defined by IFRS, and therefore are referred to as non-GAAP and other financial measures. Certain secondary financial measures in this press release – namely “adjusted funds flow”, “adjusted funds flow per share”, “adjusted funds flow per boe”, “net debt”, “free cash flow”, “excess free cash flow”, “net operating expenses”, “net operating expenses per boe”, “operating netback”, and “operating netback per boe” are not prescribed by GAAP. These non-GAAP and other financial measures are included because Management uses the information to analyze business performance, cash flow generated from the business, leverage and liquidity, resulting from the Company’s principal business activities and it may be useful to investors on the same basis. None of these measures are used to enhance the Company’s reported financial performance or position. The non-GAAP and other financial measures do not have a standardized meaning prescribed by IFRS and therefore are unlikely to be comparable to similar measures presented by other issuers. They are common in the reports of other companies but may differ by definition and application. All non-GAAP and other financial measures used in this document are defined below, and as applicable, reconciliations to the most directly comparable GAAP measure for the period ended September 30, 2024, have been provided to demonstrate the calculation of these measures:

Adjusted Funds Flow & Adjusted Funds Flow Per Share

Adjusted funds flow is a non-GAAP financial measure. The Company adjusts cash flow from operating activities in calculating adjusted funds flow for changes in non-cash working capital, decommissioning expenditures, and cash settled transaction and other costs. Management believes the timing of collection, payment or incurrence of these items involves a high degree of discretion and as such, may not be useful for evaluating Surge’s cash flows.

Changes in non-cash working capital are a result of the timing of cash flows related to accounts receivable and accounts payable, which Management believes reduces comparability between periods. Management views decommissioning expenditures predominately as a discretionary allocation of capital, with flexibility to determine the size and timing of decommissioning programs to achieve greater capital efficiencies and as such, costs may vary between periods. Transaction and other costs represent expenditures associated with property acquisitions and dispositions, debt restructuring and employee severance costs, which Management believes do not reflect the ongoing cash flows of the business, and as such, reduces comparability. Each of these expenditures, due to their nature, are not considered principal business activities and vary between periods, which Management believes reduces comparability.

Adjusted funds flow per share is a non-GAAP ratio, calculated using the same weighted average basic and diluted shares used in calculating income (loss) per share.

The following table reconciles cash flow from operating activities to adjusted funds flow and adjusted funds flow per share:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||

|

($000s except per share) |

2024 |

2023 |

2024 |

2023 |

|

Cash flow from operating activities |

73,420 |

71,315 |

213,809 |

186,429 |

|

Change in non-cash working capital |

(10,357) |

12,644 |

(12,494) |

20,611 |

|

Decommissioning expenditures |

4,016 |

2,695 |

9,640 |

7,305 |

|

Cash settled transaction and other costs |

5,631 |

220 |

7,047 |

500 |

|

Adjusted funds flow |

72,710 |

86,874 |

218,002 |

214,845 |

|

Per share – basic ($) |

0.72 |

0.87 |

2.16 |

2.19 |

Free Cash Flow & Excess Free Cash Flow

Free cash flow and excess free cash flow are non-GAAP financial measures. During the period, Management changed the composition of free cash flow and excess free cash flow. This change was made as a result of Management’s assessment that decommissioning expenditures and cash settled transaction and other costs are not considered principal business activities and vary between periods, which Management believes reduces comparability. Management believes the timing of collection, payment or incurrence of these items involves a high degree of discretion and as such, may not be useful for evaluating Surge’s cash flows. Prior period calculations of free cash flow and excess free cash flow have been restated in the table below to reflect this change.

Free cash flow is calculated as cash flow from operating activities, adjusted for changes in non-cash working capital, decommissioning expenditures, and cash settled transaction and other costs, less expenditures on property, plant and equipment. Excess free cash flow is calculated as cash flow from operating activities, adjusted for changes in non-cash working capital, decommissioning expenditures, and cash settled transaction and other costs, less expenditures on property, plant and equipment, and dividends paid. Management uses free cash flow and excess free cash flow to determine the amount of funds available to the Company for future capital allocation decisions.

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||

|

($000s except per share) |

2024 |

2023 |

2024 |

2023 |

|

Cash flow from operating activities |

73,420 |

71,315 |

213,809 |

186,429 |

|

Change in non-cash working capital |

(10,357) |

12,644 |

(12,494) |

20,611 |

|

Decommissioning expenditures |

4,016 |

2,695 |

9,640 |

7,305 |

|

Cash settled transaction and other costs |

5,631 |

220 |

7,047 |

500 |

|

Adjusted funds flow |

72,710 |

86,874 |

218,002 |

214,845 |

|

Less: expenditures on property, plant and equipment |

(51,361) |

(43,945) |

(136,826) |

(120,267) |

|

Free cash flow |

21,349 |

42,929 |

81,176 |

94,578 |

|

Less: dividends paid |

(12,741) |

(11,889) |

(36,870) |

(34,785) |

|

Excess free cash flow |

8,608 |

31,040 |

44,306 |

59,793 |

Net Debt

Net debt is a non-GAAP financial measure, calculated as bank debt, senior unsecured notes, term debt, plus the liability component of the convertible debentures plus current assets, less current liabilities, however, excluding the fair value of financial contracts, decommissioning obligations, and lease and other obligations. There is no comparable measure in accordance with IFRS for net debt. This metric is used by Management to analyze the level of debt in the Company including the impact of working capital, which varies with the timing of settlement of these balances.

|

($000s) |

As at September 30, 2024 |

As at June 30, 2024 |

As at September 30, 2023 |

|

Cash |

11,500 |

— |

— |

|

Accounts receivable |

53,193 |

56,960 |

74,624 |

|

Prepaid expenses and deposits |

4,215 |

5,803 |

3,050 |

|

Accounts payable and accrued liabilities |

(93,094) |

(90,791) |

(83,978) |

|

Dividends payable |

(4,395) |

(4,018) |

(4,013) |

|

Bank debt |

— |

(33,010) |

(11,900) |

|

Senior unsecured notes |

(170,642) |

— |

— |

|

Term debt |

(9,094) |

(131,044) |

(230,624) |

|

Convertible debentures |

(38,997) |

(38,607) |

(33,454) |

|

Net Debt |

(247,314) |

(234,707) |

(286,295) |

Net Operating Expenses & Net Operating Expenses per boe

Net operating expenses is a non-GAAP financial measure, determined by deducting processing income, primarily generated by processing third party volumes at processing facilities where the Company has an ownership interest. It is common in the industry to earn third party processing revenue on facilities where the entity has a working interest in the infrastructure asset. Under IFRS, this source of funds is required to be reported as revenue. However, the Company’s principal business is not that of a midstream entity whose activities are dedicated to earning processing and other infrastructure payments. Where the Company has excess capacity at one of its facilities, it will look to process third party volumes as a means to reduce the cost of operating/owning the facility. As such, third party processing revenue is netted against operating costs when analyzed by Management. Net operating expenses per boe is a non-GAAP ratio, calculated as net operating expenses divided by total barrels of oil equivalent produced during a specific period of time.

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||

|

($000s) |

2024 |

2023 |

2024 |

2023 |

|

Operating expenses |

43,242 |

47,988 |

141,075 |

148,654 |

|

Less: processing income |

(2,054) |

(1,812) |

(6,812) |

(6,046) |

|

Net operating expenses |

41,188 |

46,176 |

134,263 |

142,608 |

|

Net operating expenses ($ per boe) |

18.81 |

20.82 |

20.33 |

21.56 |

Operating Netback, Operating Netback per boe & Adjusted Funds Flow per boe

Operating netback is a non-GAAP financial measure, calculated as petroleum and natural gas revenue and processing and other income, less royalties, realized gain (loss) on commodity and FX contracts, operating expenses, and transportation expenses. Operating netback per boe is a non-GAAP ratio, calculated as operating netback divided by total barrels of oil equivalent produced during a specific period of time. There is no comparable measure in accordance with IFRS. This metric is used by Management to evaluate the Company’s ability to generate cash margin on a unit of production basis.

Adjusted funds flow per boe is a non-GAAP ratio, calculated as adjusted funds flow divided by total barrels of oil equivalent produced during a specific period of time.

Operating netback & adjusted funds flow are calculated on a per unit basis as follows:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||

|

($000s) |

2024 |

2023 |

2024 |

2023 |

|

Petroleum and natural gas revenue |

162,191 |

184,475 |

493,531 |

501,922 |

|

Processing and other income |

2,054 |

1,812 |

6,812 |

6,046 |

|

Royalties |

(32,581) |

(33,384) |

(90,226) |

(88,278) |

|

Realized loss on commodity and FX contracts |

(217) |

(1,535) |

(3,229) |

(5,515) |

|

Operating expenses |

(43,242) |

(47,988) |

(141,075) |

(148,654) |

|

Transportation expenses |

(3,035) |

(2,902) |

(8,328) |

(10,344) |

|

Operating netback |

85,170 |

100,478 |

257,485 |

255,177 |

|

G&A expense |

(5,154) |

(4,716) |

(15,437) |

(14,117) |

|

Interest expense |

(7,306) |

(8,888) |

(24,046) |

(26,215) |

|

Adjusted funds flow |

72,710 |

86,874 |

218,002 |

214,845 |

|

Barrels of oil equivalent (boe) |

2,189,137 |

2,217,941 |

6,604,665 |

6,615,403 |

|

Operating netback ($ per boe) |

38.91 |

45.30 |

38.98 |

38.58 |

|

Adjusted funds flow ($ per boe) |

33.22 |

39.16 |

33.00 |

32.49 |

For more information about Surge, please visit our website at www.surgeenergy.ca:

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility of the accuracy of this release.

|

1 |

See Drilling Inventory. |

|||||||

|

2 |

As per Peters Oil & Gas Plays Update from January 16, 2024: North American Oil and Natural Gas Plays – Half Cycle Payout Period. Note: Sparky is represented as “Conventional Heavy Oil Hz” by Peters. |

|||||||

|

3 |

Hartford Funds, ‘The Power of Dividends: Past, Present, and Future’. |

|||||||

|

4 |

This is a non-GAAP and other financial measure which is defined under Non-GAAP and Other Financial Measures. |

|||||||

|

5 |

Pricing assumptions: US$70 WTI, US$13.50 WCS differential, US$3.50 EDM differential, $0.725 CAD/USD FX and $2.50 AECO. |

|||||||

SOURCE Surge Energy Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/06/c7508.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/06/c7508.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Humana

Investors with a lot of money to spend have taken a bearish stance on Humana HUM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with HUM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 26 uncommon options trades for Humana.

This isn’t normal.

The overall sentiment of these big-money traders is split between 26% bullish and 57%, bearish.

Out of all of the special options we uncovered, 10 are puts, for a total amount of $1,769,622, and 16 are calls, for a total amount of $1,255,541.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $110.0 to $400.0 for Humana during the past quarter.

Volume & Open Interest Development

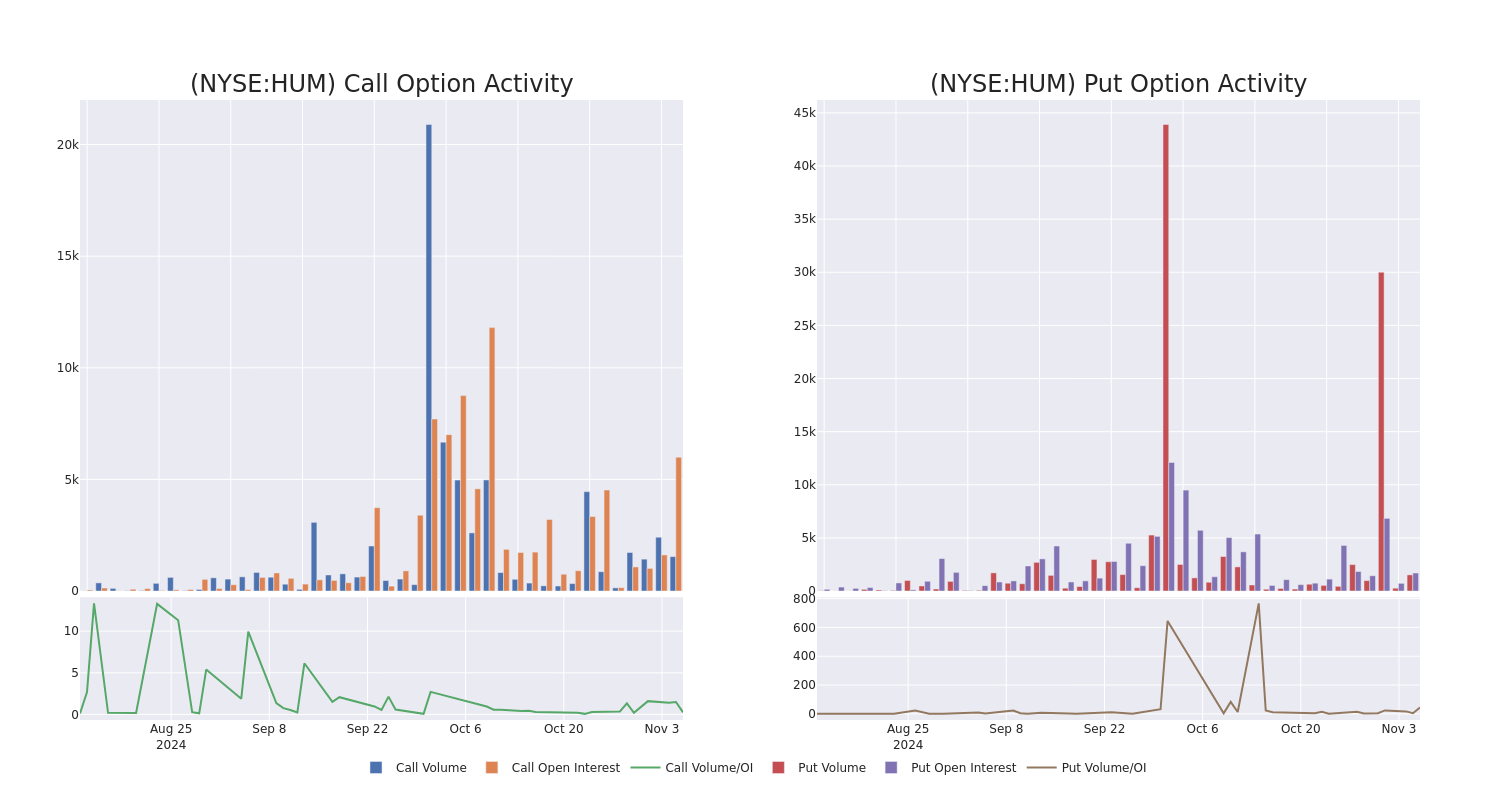

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Humana’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Humana’s whale trades within a strike price range from $110.0 to $400.0 in the last 30 days.

Humana Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HUM | PUT | TRADE | BEARISH | 01/17/25 | $15.7 | $13.4 | $16.0 | $275.00 | $1.2M | 22 | 841 |

| HUM | CALL | TRADE | BEARISH | 01/15/27 | $82.9 | $75.0 | $76.89 | $250.00 | $384.4K | 92 | 53 |

| HUM | CALL | SWEEP | BEARISH | 11/08/24 | $18.1 | $15.0 | $15.0 | $270.00 | $150.0K | 396 | 220 |

| HUM | CALL | SWEEP | BEARISH | 06/20/25 | $6.7 | $6.2 | $6.6 | $400.00 | $110.7K | 758 | 168 |

| HUM | CALL | SWEEP | BEARISH | 11/08/24 | $13.5 | $12.5 | $12.5 | $270.00 | $96.2K | 396 | 311 |

About Humana

Humana is one of the largest private health insurers in the us with a focus on administering Medicare Advantage plans. The firm has built a niche specializing in government-sponsored programs, with nearly all its medical membership stemming from individual and group Medicare Advantage, Medicaid, and the military’s Tricare program. The firm is also a leader in stand-alone prescription drug plans for seniors enrolled in traditional fee-for-service Medicare. Beyond medical insurance, the company provides other healthcare services, including primary-care services, at-home services, and pharmacy benefit management.

Having examined the options trading patterns of Humana, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Humana

- Currently trading with a volume of 800,538, the HUM’s price is up by 1.69%, now at $259.87.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 78 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Humana, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SANDRIDGE ENERGY, INC. ANNOUNCES FINANCIAL AND OPERATING RESULTS FOR THE THREE AND NINE-MONTH PERIODS ENDED SEPTEMBER 30, 2024 AND DECLARES $0.11 PER SHARE CASH DIVIDEND

OKLAHOMA CITY, Nov. 6, 2024 /PRNewswire/ — SandRidge Energy, Inc. (the “Company” or “SandRidge”) SD today announced financial and operational results for the three and nine-month periods ended September 30, 2024.

Recent Highlights

- On November 5, 2024, the Board of Directors declared a $0.11 per share cash dividend payable on November 29, 2024 to shareholders of record on November 15, 2024

- On August 30, 2024, the Company closed on its previously announced acquisition of certain producing oil and natural gas properties and interest in 11 drilling spacing units (“DSUs”) in the Cherokee play of the Western Anadarko Basin

- Completions of the four drilled uncompleted (“DUC”) wells associated with the Western Anadarko Basin transaction are underway with the first well generating an initial 30-day production rate of ~1,000 Boe per day (~70 % oil)

- Production in September, the first month reflecting contributions from recently-acquired assets(1), averaged ~19 MBoe/d (18% oil, 52% liquids), which is a 27% increase versus 2Q24

- Third quarter net income was $25.5 million, or $0.69 per basic share. Adjusted net income(2) was $7.1 million, or $0.19 per basic share

- Adjusted EBITDA(2) of $17.7 million for the three-month period ended September 30, 2024

- Adjusted G&A(2) of $1.6 million, or $1.02 per Boe for the three-month period ended September 30, 2024

- As of September 30, 2024, the Company had $94.1 million of cash and cash equivalents, including restricted cash

- Generated $34.4 million of free cash flow(2) for the nine-month period ended September 30, 2024. Free cash flow represents a conversion rate of approximately 76% relative to adjusted EBITDA for the nine months ended September 30, 2024.

Financial Results & Update

Profitability

|

Dollars in thousands (except per share data) |

3Q24 |

2Q24 |

Change |

3Q23 |

Change |

|

Net income |

$ 25,484 |

$ 8,794 |

$ 16,690 |

$ 18,670 |

$ 6,814 |

|

Net Income per share |

$ 0.69 |

$ 0.24 |

$ 0.45 |

$ 0.51 |

$ 0.18 |

|

Net cash provided by operating activities |

$ 20,847 |

$ 11,412 |

$ 9,435 |

$ 25,507 |

$ (4,660) |

|

Adjusted net income(2) |

$ 7,057 |

$ 6,353 |

$ 704 |

$ 16,236 |

$ (9,179) |

|

Adjusted net income per share(2) |

$ 0.19 |

$ 0.17 |

$ 0.02 |

$ 0.44 |

$ (0.25) |

|

Adjusted operating cash flow(2) |

$ 19,073 |

$ 15,384 |

$ 3,689 |

$ 25,041 |

$ (5,968) |

|

Adjusted EBITDA(2) |

$ 17,742 |

$ 12,934 |

$ 4,808 |

$ 22,587 |

$ (4,845) |

|

Free cash flow(2) |

$ 10,861 |

$ 8,967 |

$ 1,894 |

$ 24,155 |

$ (13,294) |

Operational Results & Update

Production, Revenue & Realized Prices

|

3Q24(1) |

2Q24 |

Change |

3Q23 |

Change |

|

|

Production |

|||||

|

MBoe |

1,563 |

1,363 |

200 |

1,586 |

(23) |

|

MBoed |

17.0 |

15.0 |

2.0 |

17.2 |

(0.2) |

|

Oil as percentage of production |

15 % |

14 % |

1 % |

17 % |

(2) % |

|

Natural gas as percentage of production |

50 % |

54 % |

(4) % |

55 % |

(5) % |

|

NGLs as percentage of production |

35 % |

32 % |

3 % |

28 % |

7 % |

|

Revenues |

|||||

|

Oil, natural gas and NGL revenues |

$30,057 |

$25,977 |

$4,080 |

$38,149 |

$(8,092) |

|

Oil as percentage of revenues |

56 % |

57 % |

(1) % |

56 % |

— % |

|

Natural gas as percentage of revenues |

15 % |

11 % |

4 % |

19 % |

(4) % |

|

NGLs as percentage of revenues |

29 % |

32 % |

(3) % |

25 % |

4 % |

|

Realized Prices |

|||||

|

Realized oil price per barrel |

$73.07 |

$79.54 |

$(6.47) |

$79.83 |

$(6.76) |

|

Realized natural gas price per Mcf |

$0.92 |

$0.66 |

$0.26 |

$1.36 |

$(0.44) |

|

Realized NGL price per barrel |

$16.25 |

$18.99 |

$(2.74) |

$21.89 |

$(5.64) |

|

Realized price per Boe |

$19.23 |

$19.06 |

$0.17 |

$24.04 |

$(4.81) |

Operating Costs

During the third quarter of 2024, lease operating expense (“LOE”) was $9.1 million or $5.82 per Boe which is a 9% reduction versus the prior quarter on a per Boe basis, despite incremental LOE associated with the Western Anadarko Basin acquisition. The Company continues to focus on its operating costs and on safely maximizing the value of its asset base through prudent expenditure programs, cost management efforts, and continuous pursuit of efficiency in the field.

Production Optimization Program

The Company remains focused on optimizing its stable, low-decline legacy production. SandRidge continuously evaluates the potential for high-return projects that further enhance its asset base. Such projects include, but are not limited to, workovers, artificial lift improvements and conversions from less efficient systems, recompletions of “behind pipe” pay in vertical section of existing wells, and the restimulation of existing intervals and previously bypassed unstimulated intervals in existing wells. When evaluating these and other options, the Company ensures that all projects meet high rate of return thresholds and remains capital disciplined as the commodity price landscape changes.

Liquidity & Capital Structure

As of September 30, 2024, the Company had $94.1 million of cash and cash equivalents, including restricted cash, diversified across multiple significant, well-capitalized financial institutions. The Company has no outstanding term or revolving debt obligations.

Dividend Program

|

Dollars in thousands |

Total |

3Q24 |

2Q24 |

1Q24 |

4Q23 |

3Q23 |

2Q23 |

|

Special dividends(3) |

$ 130,206 |

$ — |

$ — |

$ 55,868 |

$ — |

$ — |

$ 74,338 |

|

Quarterly dividends(3) |

$ 19,752 |

$ 4,112 |

$ 4,103 |

$ 4,097 |

$ 3,721 |

$ 3,719 |

$ — |

|

Total dividends(3) |

$ 149,958 |

$ 4,112 |

$ 4,103 |

$ 59,965 |

$ 3,721 |

$ 3,719 |

$ 74,338 |

|

Total |

3Q24 |

2Q24 |

1Q24 |

4Q23 |

3Q23 |

2Q23 |

|

|

Special dividends per share |

$ 3.50 |

$ — |

$ — |

$ 1.50 |

$ — |

$ — |

$ 2.00 |

|

Quarterly dividends per share |

$ 0.53 |

$ 0.11 |

$ 0.11 |

$ 0.11 |

$ 0.10 |

$ 0.10 |

$ — |

|

Total dividends per share |

$ 4.03 |

$ 0.11 |

$ 0.11 |

$ 1.61 |

$ 0.10 |

$ 0.10 |

$ 2.00 |

On November 5, 2024, the Board of Directors declared a $0.11 per share cash dividend payable on November 29, 2024 to shareholders of record on November 15, 2024.

Acquisitions

On August 30, 2024, the Company closed on its previously announced acquisition of certain producing oil and natural gas properties in the Cherokee play of the Western Anadarko Basin for $123.8 million, before customary post-closing adjustments.

The acquisition included 44 producing wells, 4 drilled uncompleted (“DUC”) wells which are being completed in the fourth quarter, and leasehold interest in 11 drilling and spacing units (“DSUs”) focused in Ellis and Roger Mills counties in Oklahoma. The Company is preparing to initiate a drilling program on the DSUs and expects to realize high rates of returns associated with the projects.

The oily PDP production and new development associated with the acquisition is projected to meaningfully increase SandRidge’s EBITDA and cash flow on a pro forma basis, while maintaining its planned quarterly dividend.(2)

Outlook

We remain committed to growing the cash value and generation capability of our asset base in a safe, responsible and efficient manner, while prudently allocating capital to high-return, organic growth projects. These standalone projects include (1) Development in the Cherokee Shale Play, which includes completions of four drilled uncompleted (“DUC”) wells, and initiating a drilling program, (2) production optimization program through artificial lift conversions to more efficient and cost-effective systems and high-graded heel completion projects in the NW Stack and (3) opportunistic leasing that could bolster future development and complement the recently acquired Cherokee assets. Our legacy non-Cherokee leasehold remains approximately 99% held by production, which cost-effectively maintains our development option over a reasonable tenor. These legacy non-Cherokee assets have higher relative gas content for which prices are not yet at optimal levels to resume development or material reactivations. We will continue to monitor forward-looking commodity prices, project results, costs and other factors that could influence returns and adjust capital allocations accordingly. These and other factors will continue to shape our development decisions for the remainder of the year and beyond.

We also remain vigilant in evaluating further merger and acquisition opportunities, with consideration of our strong balance sheet and commitment to our capital return program.

Environmental, Social, & Governance (“ESG”)

SandRidge maintains its Environmental, Social, and Governance (“ESG”) commitment, to include no routine flaring of produced natural gas and transporting over 95% of its produced water via pipeline instead of truck. Additionally, SandRidge maintains an emphasis on the safety and training of our workforce. The Company has personnel dedicated to the close monitoring of our safety standards and daily operations.

Conference Call Information

The Company will host a conference call to discuss these results on Thursday, November 7, 2024 at 1:00 pm CT. The conference call can be accessed by registering online in advance at https://registrations.events/direct/Q4I2315049 at which time registrants will receive dial-in information as well as a conference ID. At the time of the call, participants will dial in using the participant number and conference ID provided upon registration. The Company’s latest presentation is available on the Company’s website at investors.sandridgeenergy.com.

A live audio webcast of the conference call will also be available via SandRidge’s website, investors.sandridgeenergy.com, under Presentation & Events. The webcast will be archived for replay on the Company’s website for at least 30 days.

Contact Information

Investor Relations

SandRidge Energy, Inc.

1 E. Sheridan Ave. Suite 500

Oklahoma City, OK 73104

investors@sandridgeenergy.com

About SandRidge Energy, Inc.

SandRidge Energy, Inc. SD is an independent oil and gas company engaged in the production, development, and acquisition of oil and gas properties. Its primary areas of operations are the Mid-Continent and Western Anadarko regions in Oklahoma, Texas, and Kansas. Further information can be found at sandridgeenergy.com.

-Tables to Follow-

|

_____________________________________________ |

||

|

(1) |

July and August production and revenue contribution from recently-acquired Western Anadarko Basin assets were reported as a negative adjustment to the gross purchase price as a result of a transaction effective date of July 1, 2024. |

|

|

(2) |

See “Non-GAAP Financial Measures” section at the end of this press release for non-GAAP financial measures definitions. |

|

|

(3) |

Includes dividends payable on unvested restricted stock awards. |

|

Operational and Financial Statistics

Information regarding the Company’s production, pricing, costs and earnings is presented below (unaudited):

|

Three Months Ended September 30, |

Nine Months Ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Production – Total |

|||||||

|

Oil (MBbl) |

231 |

267 |

624 |

816 |

|||

|

Natural Gas (MMcf) |

4,729 |

5,276 |

13,979 |

15,373 |

|||

|

NGL (MBbl) |

544 |

440 |

1,348 |

1,301 |

|||

|

Oil equivalent (MBoe) |

1,563 |

1,586 |

4,302 |

4,679 |

|||

|

Daily production (MBoed) |

17.0 |

17.2 |

15.7 |

17.1 |

|||

|

Average price per unit |

|||||||

|

Realized oil price per barrel – as reported |

$ 73.07 |

$ 79.83 |

$ 75.66 |

$ 73.88 |

|||

|

Realized impact of derivatives per barrel |

0.64 |

— |

0.23 |

— |

|||

|

Net realized price per barrel |

$ 73.71 |

$ 79.83 |

$ 75.89 |

$ 73.88 |

|||

|

Realized natural gas price per Mcf – as reported |

$ 0.92 |

$ 1.36 |

$ 0.95 |

$ 1.78 |

|||

|

Realized impact of derivatives per Mcf |

— |

— |

— |

0.38 |

|||

|

Net realized price per Mcf |

$ 0.92 |

$ 1.36 |

$ 0.95 |

$ 2.16 |

|||

|

Realized NGL price per barrel – as reported |

$ 16.25 |

$ 21.89 |

$ 19.15 |

$ 20.77 |

|||

|

Realized impact of derivatives per barrel |

0.09 |

— |

0.04 |

— |

|||

|

Net realized price per barrel |

$ 16.34 |

$ 21.89 |

$ 19.19 |

$ 20.77 |

|||

|

Realized price per Boe – as reported |

$ 19.23 |

$ 24.04 |

$ 20.07 |

$ 24.52 |

|||

|

Net realized price per Boe – including impact of derivatives |

$ 19.36 |

$ 24.04 |

$ 20.11 |

$ 25.77 |

|||

|

Average cost per Boe |

|||||||

|

Lease operating |

$ 5.82 |

$ 7.22 |

$ 6.68 |

$ 6.83 |

|||

|

Production, ad valorem, and other taxes |

$ 1.16 |

$ 1.28 |

$ 1.29 |

$ 1.82 |

|||

|

Depletion (1) |

$ 5.34 |

$ 2.66 |

$ 3.90 |

$ 2.44 |

|||

|

Earnings per share |

|||||||

|

Earnings per share applicable to common stockholders |

|||||||

|

Basic |

$ 0.69 |

$ 0.51 |

$ 1.22 |

$ 1.60 |

|||

|

Diluted |

$ 0.69 |

$ 0.50 |

$ 1.22 |

$ 1.59 |

|||

|

Adjusted net income per share available to common stockholders |

|||||||

|

Basic |

$ 0.19 |

$ 0.44 |

$ 0.59 |

$ 1.52 |

|||

|

Diluted |

$ 0.19 |

$ 0.44 |

$ 0.59 |

$ 1.51 |

|||

|

Weighted average number of shares outstanding (in thousands) |

|||||||

|

Basic |

37,134 |

36,969 |

37,087 |

36,906 |

|||

|

Diluted |

37,180 |

37,161 |

37,150 |

37,123 |

|||

|

(1) Includes accretion of asset retirement obligation. |

Capital Expenditures

The table below presents actual results of the Company’s capital expenditures for the nine months ended September 30, 2024 (unaudited):

|

Nine Months Ended |

|

|

September 30, 2024 |

|

|

(In thousands) |

|

|

Drilling, completion, and capital workovers |

$ 6,562 |

|

Leasehold and geophysical |

6,893 |

|

Capital expenditures (on an accrual basis) |

$ 13,455 |

|

(excluding acquisitions and plugging and abandonment) |

Capitalization

The Company’s capital structure as of September 30, 2024 and December 31, 2023 is presented below:

|

September 30, 2024 |

December 31, 2023 |

||

|

(In thousands) |

|||

|

Cash, cash equivalents and restricted cash |

$ 94,081 |

$ 253,944 |

|

|

Long-term debt |

$ — |

$ — |

|

|

Total debt |

— |

— |

|

|

Stockholders’ equity |

|||

|

Common stock |

37 |

37 |

|

|

Additional paid-in capital |

1,004,264 |

1,071,021 |

|

|

Accumulated deficit |

(557,544) |

(602,947) |

|

|

Total SandRidge Energy, Inc. stockholders’ equity |

446,757 |

468,111 |

|

|

Total capitalization |

$ 446,757 |

$ 468,111 |

|

|

SandRidge Energy, Inc. and Subsidiaries Condensed Consolidated Income Statements (Unaudited) (In thousands, except per share amounts) |

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenues |

|||||||

|

Oil, natural gas and NGL |

$ 30,057 |

$ 38,149 |

$ 86,317 |

$ 114,715 |

|||

|

Total revenues |

30,057 |

38,149 |

86,317 |

114,715 |

|||

|

Expenses |

|||||||

|

Lease operating expenses |

9,104 |

11,450 |

28,734 |

31,946 |

|||

|

Production, ad valorem, and other taxes |

1,813 |

2,031 |

5,550 |

8,522 |

|||

|

Depreciation and depletion — oil and natural gas |

8,345 |

4,217 |

16,771 |

11,415 |

|||

|

Depreciation and amortization — other |

1,605 |

1,637 |

4,947 |

4,870 |

|||

|

General and administrative |

2,304 |

2,619 |

8,686 |

8,004 |

|||

|

Restructuring expenses |

260 |

42 |

341 |

343 |

|||

|

Employee termination benefits |

— |

— |

— |

19 |

|||

|

(Gain) loss on derivative contracts |

(1,866) |

— |

(1,866) |

(1,447) |

|||

|

Other operating (income) expense, net |

— |

(31) |

24 |

(152) |

|||

|

Total expenses |

21,565 |

21,965 |

63,187 |

63,520 |

|||

|

Income from operations |

8,492 |

16,184 |

23,130 |

51,195 |

|||

|

Other income (expense) |

|||||||

|

Interest income (expense), net |

1,553 |

2,455 |

6,742 |

7,782 |

|||

|

Other income (expense), net |

— |

31 |

92 |

88 |

|||

|

Total other income (expense) |

1,553 |

2,486 |

6,834 |

7,870 |

|||

|

Income (loss) before income taxes |

10,045 |

18,670 |

29,964 |

59,065 |

|||

|

Income tax (benefit) expense |

(15,439) |

— |

(15,439) |

— |

|||

|

Net income (loss) |

$ 25,484 |

$ 18,670 |

$ 45,403 |

$ 59,065 |

|||

|

Net income (loss) per share |

|||||||

|

Basic |

$ 0.69 |

$ 0.51 |

$ 1.22 |

$ 1.60 |

|||

|

Diluted |

$ 0.69 |

$ 0.50 |

$ 1.22 |

$ 1.59 |

|||

|

Weighted average number of common shares outstanding |

|||||||

|

Basic |

37,134 |

36,969 |

37,087 |

36,906 |

|||

|

Diluted |

37,180 |

37,161 |

37,150 |

37,123 |

|||

|

SandRidge Energy, Inc. and Subsidiaries Condensed Consolidated Balance Sheets (Unaudited) (In thousands) |

|||

|

September 30, 2024 |

December 31, 2023 |

||

|

ASSETS |

|||

|

Current assets |

|||

|

Cash and cash equivalents |

$ 92,697 |

$ 252,407 |

|

|

Restricted cash – other |

1,384 |

1,537 |

|

|

Accounts receivable, net |

28,506 |

22,166 |

|

|

Derivative contracts |

1,284 |

— |

|

|

Prepaid expenses |

886 |

430 |

|

|

Other current assets |

814 |

1,314 |

|

|

Total current assets |

125,571 |

277,854 |

|

|

Oil and natural gas properties, using full cost method of accounting |

|||

|

Proved |

1,677,882 |

1,538,724 |

|

|

Unproved |

17,487 |

11,197 |

|

|

Less: accumulated depreciation, depletion and impairment |

(1,406,957) |

(1,393,801) |

|

|

288,412 |

156,120 |

||

|

Other property, plant and equipment, net |

81,694 |

86,493 |

|

|

Derivative contracts |

383 |

— |

|

|

Other assets |

3,172 |

3,130 |

|

|

Deferred tax assets, net of valuation allowance |

66,008 |

50,569 |

|

|

Total assets |

$ 565,240 |

$ 574,166 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|||

|

Current liabilities |

|||

|

Accounts payable and accrued expenses |

$ 48,479 |

$ 38,828 |

|

|

Asset retirement obligations |

9,668 |

9,851 |

|

|

Other current liabilities |

608 |

645 |

|

|

Total current liabilities |

58,755 |

49,324 |

|

|

Asset retirement obligations |

57,775 |

54,553 |

|

|

Other long-term obligations |

1,953 |

2,178 |

|

|

Total liabilities |

118,483 |

106,055 |

|

|

Stockholders’ Equity |

|||

|